Caregiver Invoice Template for Simple and Efficient Billing

Managing payments for personal support services can be a challenging task without the right tools in place. Having a structured system for documenting hours worked and services provided is essential for both the provider and the recipient. A well-organized billing system ensures clarity, accuracy, and timely compensation, reducing misunderstandings and improving the overall experience for all parties involved.

Creating a clear and professional record of services rendered is crucial in establishing trust and transparency. It not only helps with tracking payments but also ensures that the provider is fairly compensated for their time and expertise. A well-designed document can simplify the entire billing process, making it easy to customize according to specific needs and preferences.

By using a structured approach, the process of generating payment records becomes more efficient and reliable. Whether you’re managing care for a single client or handling multiple accounts, a standardized method of documenting services can save time and effort, while also helping to avoid errors and delays. Having a reliable system in place is key to maintaining smooth operations.

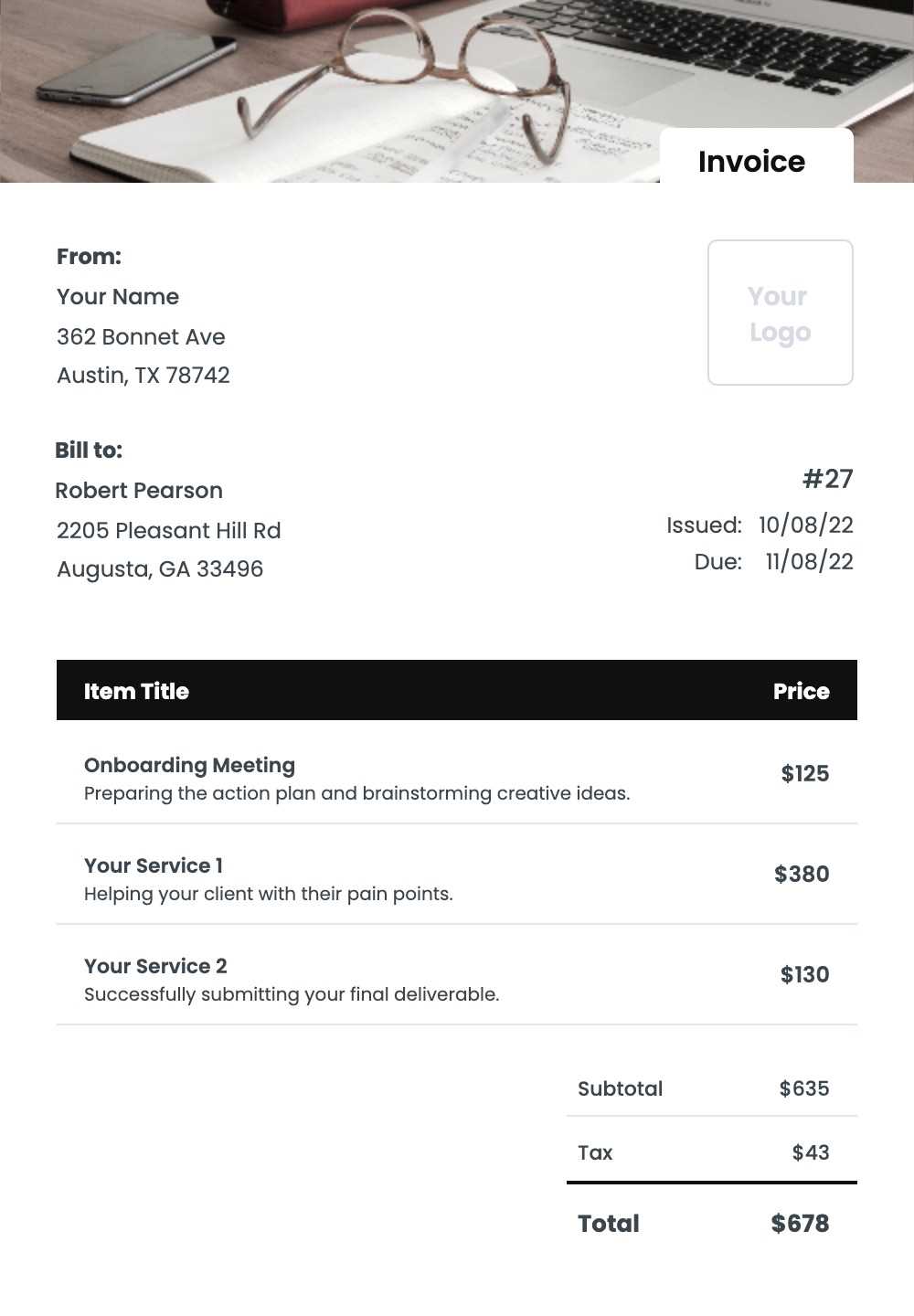

Caregiver Invoice Template Guide

Creating clear and professional billing records is essential for anyone providing personal assistance or home care services. A structured document helps both the service provider and the client keep track of hours worked, tasks completed, and the amount due. By having a reliable format for recording charges, providers can ensure that their efforts are properly compensated while avoiding confusion or delays in payment.

In this guide, we will walk you through the steps of creating a document that suits your needs. The key is to make the process as simple and efficient as possible while including all necessary details. By customizing a billing sheet, you can address your specific services, rates, and any additional terms that apply to each client. This ensures consistency and professionalism in all your transactions.

Focusing on the essential elements of an accurate billing record will help streamline your administrative tasks. A clear, easy-to-understand format makes it simple to review hours, services, and amounts due at a glance. Whether you’re a small business or a solo provider, setting up an effective system for tracking payments is one of the most important steps to ensure smooth operations and maintain a solid working relationship with your clients.

Why You Need an Invoice Template

Having a standardized method for documenting services and tracking payments is crucial for anyone in a service-based profession. Whether you’re providing personal care, assistance, or support, using a consistent format helps ensure accuracy and avoids potential misunderstandings. A well-structured record simplifies the process of billing clients and ensures both parties are on the same page regarding payment expectations.

Benefits of Using a Standardized Record

Clarity and Professionalism: A clear, uniform document demonstrates professionalism and helps maintain a transparent relationship with clients. When both the provider and the recipient can easily reference hours worked, services provided, and amounts due, it builds trust and reduces the chances of disputes.

Efficient Payment Tracking

Streamlined Payments: With a pre-designed structure, tracking payments becomes straightforward. It allows you to keep a record of all transactions, making it easier to follow up on overdue payments and stay organized. Having a reliable document also simplifies tax reporting and financial management, making it easier to manage your business or personal finances in the long run.

How to Customize Your Invoice

Personalizing your billing record is an essential step in ensuring it accurately reflects the services you provide and meets your clients’ expectations. By adjusting key elements such as payment terms, service descriptions, and rates, you can create a document that suits your specific business needs and enhances your professionalism. Customization not only makes the record easier to understand but also helps you stand out as a reliable and organized service provider.

Adjusting Service Descriptions and Rates

Start by clearly defining the services you offer. Whether you’re providing hourly care, specific tasks, or packages, be sure to list each service in a way that is easy to follow. Additionally, ensure that the corresponding rates are clearly stated. Customizing the pricing structure, including discounts or premium charges, will make it easier for your clients to understand how much they owe for each service rendered.

Including Terms and Additional Details

Payment Terms: Adding clear payment terms, such as due dates or late fees, helps prevent misunderstandings. You may also want to include contact information, payment methods, and other important details that can make the payment process more convenient. Tailoring your record with this type of information ensures that your clients know exactly what to expect and when.

Essential Information for Caregiver Invoices

When creating a billing document for personal assistance or support services, it’s important to include all the necessary details to ensure transparency and avoid confusion. A complete and accurate record helps both the provider and the client understand the terms of the agreement, hours worked, and payment due. Below are the key elements that should be included in any well-structured document.

- Provider and Client Information: Always include the full names, contact details, and addresses of both parties. This ensures that there is no ambiguity about who is providing the services and who is receiving them.

- Dates of Service: Clearly state the dates during which services were provided. This could be specific dates or a range, depending on the billing frequency.

- Detailed Service Descriptions: List the services provided with enough detail to avoid confusion. For example, include the number of hours worked or specific tasks completed.

- Rates and Charges: Break down the cost for each service, indicating any hourly or flat rates. If there are additional charges, such as for transportation or special tasks, make sure these are clearly listed.

- Total Amount Due: Include the total amount owed, which combines all services and any applicable taxes or additional fees.

- Payment Terms: Specify the payment due date, accepted payment methods, and any penalties for late payments.

By including these essential elements, the billing process becomes more efficient, reducing the likelihood of disputes and ensuring that both parties are on the same page regarding payments and services rendered.

Understanding Caregiving Service Rates

When providing personal assistance services, setting clear and fair rates is crucial for both the provider and the client. The cost for services can vary depending on several factors, such as the level of care required, the duration of the services, and any specialized tasks involved. Having a transparent pricing structure ensures that both parties are aware of what to expect and helps avoid misunderstandings.

Factors Affecting Service Rates: The rates you charge may depend on various elements, such as the complexity of the services, the number of hours worked, and any additional needs the client may have. For example, providing medical support or intensive personal care often commands a higher rate than general companionship or housekeeping services.

Hourly vs Flat Rates: Some providers opt for hourly rates, while others may prefer a flat fee for specific services or packages. It’s important to choose the pricing model that best suits your services and your clients’ preferences. An hourly rate can be useful for flexible, short-term care, while flat rates might be more suitable for longer-term arrangements or regular visits.

By clearly defining and communicating your rates, you ensure that both you and your clients are aligned on expectations, leading to a more efficient and transparent payment process.

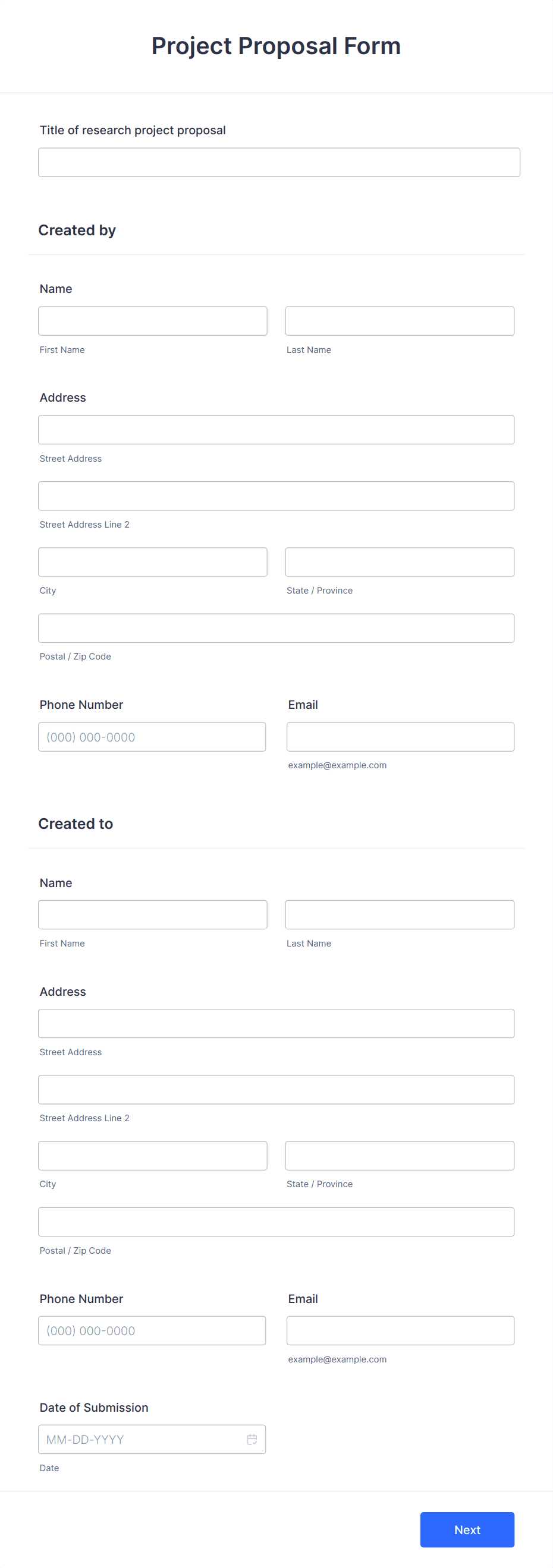

Step-by-Step Invoice Creation Process

Creating a clear and accurate billing document is essential for tracking services provided and ensuring timely payment. By following a simple process, you can generate a professional and reliable record that includes all necessary information. Below is a step-by-step guide to help you build an effective billing statement from start to finish.

- Step 1: Gather Client Information

Collect all relevant details, including the client’s full name, address, and contact information. Having accurate client information ensures that your record is personalized and complete. - Step 2: List the Services Rendered

Include a detailed description of the services provided. Break down tasks clearly and specify the time spent on each one, whether it’s by hour or task. This transparency helps avoid confusion later. - Step 3: Specify Rates and Charges

Clearly state the pricing for each service or hourly rate. Include any additional charges for extra services, such as travel expenses, special needs, or overtime. Be specific to avoid ambiguity. - Step 4: Calculate the Total Amount

Add up the costs for all services, taxes, and any other fees to calculate the total amount due. This will provide a clear picture of what the client needs to pay. - Step 5: Add Payment Terms

Include payment due dates, acceptable methods of payment, and any late fees or penalties. Clearly outlining payment terms helps ensure both parties understand when and how payment should be made. - Step 6: Review for Accuracy

Before sending the document, double-check all details for accuracy. Make sure all services are listed, rates are correct, and the total amount is accurate. This helps prevent mistakes and delays in payment.

By following these steps, you ensure that your billing records are comprehensive, accurate, and easy to understand. This process helps maintain professionalism and promotes timely payment for services rendered.

Best Practices for Accurate Billing

Ensuring the accuracy of your billing records is essential for maintaining professionalism and ensuring timely payments. Mistakes in billing can lead to confusion, delays, and frustration for both you and your clients. By following best practices, you can minimize errors and streamline the entire process, making it easier to track services rendered and payments due.

- Always Include Detailed Service Descriptions: Clearly outline the services you provided, including the number of hours worked or specific tasks completed. This reduces any ambiguity and ensures both parties are on the same page.

- Use Consistent and Clear Rates: Set and maintain consistent pricing for your services. Whether it’s an hourly rate or a flat fee, make sure the rates are clearly displayed and easy to understand.

- Track Time Accurately: Record the exact time spent on each task, and avoid estimations. Using a time tracking tool can help ensure that the hours billed reflect the actual time worked.

- Double-Check Calculations: Always verify your math before finalizing the document. A simple arithmetic mistake can lead to disputes or delayed payments.

- Specify Payment Terms Clearly: Clearly state the due date, accepted payment methods, and any late fees or interest. This helps prevent misunderstandings and sets clear expectations for both parties.

- Keep Records Organized: Maintain a systematic and organized method for storing all billing records. This will help you track unpaid balances, and previous transactions, and manage future payments effectively.

By following these best practices, you can ensure that your billing process runs smoothly, minimizes errors, and promotes positive client relationships.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s important to ensure that every detail is accurate and clear. Small mistakes can lead to confusion, delayed payments, or even disputes between the provider and the client. By being mindful of common errors, you can create a more professional and effective document that promotes smooth transactions.

- Missing or Incorrect Contact Information: Failing to include accurate details for both parties, such as names, addresses, and phone numbers, can lead to delays or misunderstandings.

- Unclear Service Descriptions: Vague descriptions of the services provided can cause confusion. Be specific and detailed, listing the exact tasks performed and the time spent on each one.

- Inconsistent Rates: Changing rates without prior agreement can create issues. Ensure that rates are consistent and clearly stated on the document to avoid disputes.

- Incorrect Calculations: Mistakes in adding up totals or applying the wrong rates can lead to overcharging or undercharging. Always double-check your numbers before finalizing the document.

- Omitting Payment Terms: Without clear payment terms, including due dates and accepted payment methods, clients may be unsure about when and how to pay, leading to delays.

- Not Including a Unique Identification Number: Including a reference or invoice number helps keep records organized and ensures that payments are correctly matched with the corresponding document.

By avoiding these common mistakes, you can create a more accurate, professional, and efficient billing process that helps foster positive relationships with clients and ensures timely payments.

How to Format Your Caregiver Invoice

Proper formatting of a billing document is crucial for clarity and professionalism. A well-organized and easy-to-read record helps both parties quickly understand the details of the services provided and the amount due. The following guidelines will help you structure your billing statement in a clear and efficient manner, ensuring all essential information is included and easy to find.

1. Include Your Business Information

Start by adding your full name or business name, address, phone number, and email address. If you have a website or social media accounts for your business, you may want to include those as well. This provides the client with all the necessary contact details in case they need to reach you.

2. Client’s Information

Next, include the client’s name, address, and contact information. This ensures that the record is personalized and clearly identifies the recipient of the services.

Break Down Services: Organize your list of services into a clear and detailed format. You can either use bullet points or a table to show each task performed. Be specific about the hours worked or the specific services provided, such as cleaning, personal assistance, or other activities. Make sure to separate each service so the client can easily see what was done and how much each task costs.

Include Rates and Charges: Clearly list the rates for each service, whether it’s hourly or per task. If you apply a flat fee for certain tasks, make sure this is clearly indicated. Including a breakdown of costs helps prevent confusion and ensures transparency.

Total Amount Due: Always include a clearly labeled section showing the total amount due. This section should summarize the cost of all services provided, taxes, and any additional fees or charges. Make it easy for the client to see the total without having to calculate anything themselves.

By following these formatting guidelines, your billing document will be both professional and easy to read, ensuring smooth communication and prompt payment.

Tracking Payments and Due Dates

Maintaining accurate records of payments and due dates is essential for ensuring timely collection of funds and for keeping track of outstanding balances. A well-organized system will help you manage your financial transactions effectively and reduce the risk of missed payments or confusion over due dates. Below is a simple way to track payments and manage due dates using a table format.

| Service Date | Amount Due | Due Date | Amount Paid | Payment Date | Balance Remaining |

|---|---|---|---|---|---|

| 01/10/2024 | $150.00 | 01/17/2024 | $150.00 | 01/15/2024 | $0.00 |

| 01/17/2024 | $100.00 | 01/24/2024 | $50.00 | 01/20/2024 | $50.00 |

| 01/24/2024 | $120.00 | 01/31/2024 | $0.00 | Pending | $120.00 |

This table format allows you to easily track the service dates, amounts due, and payments made. By updating this regularly, you can quickly identify outstanding balances and ensure that all payments are made on time. Additionally, this system helps prevent any confusion or misunderstandings between you and your clients about what has been paid and what remains due.

Legal Considerations for Caregiver Invoices

When creating billing documents for services rendered, it is important to be aware of legal requirements and regulations that may affect the process. Ensuring that your documents comply with the law can help prevent disputes, maintain professionalism, and protect both the service provider and the client. Below are key legal factors to consider when preparing billing statements.

1. Contractual Agreements

Before providing services, it is essential to have a clear agreement with the client. This agreement should outline the terms of payment, including rates, services provided, and expected timelines. Having a contract in place helps set clear expectations and reduces the risk of legal issues related to payment disputes.

2. Taxes and Compliance

Depending on your location and the nature of the services you provide, certain taxes may apply to the amount charged. Be sure to research the tax laws relevant to your region and include any applicable taxes in your billing document. Failure to do so could result in penalties or fines from tax authorities. Additionally, make sure that your billing practices align with industry regulations to ensure compliance with local laws.

Record-Keeping: Proper record-keeping is essential for legal protection. Maintain copies of all signed contracts, billing statements, and correspondence with clients. These documents will serve as proof in case of any future disputes.

Dispute Resolution: In the event of a disagreement regarding payments or services, clearly outline a method for resolving disputes in your agreement. This may include mediation, arbitration, or any other legal means to resolve issues without resorting to litigation.

By understanding and incorporating legal considerations into your billing process, you ensure that both parties are protected and that transactions are completed in accordance with the law.

How to Handle Discounts and Adjustments

In any billing process, offering discounts or making adjustments is a common practice to accommodate various circumstances. Whether it’s a discount for loyal clients, a promotional offer, or an adjustment for overcharging or undercharging, properly documenting these changes ensures transparency and prevents confusion. Below is a simple way to handle discounts and adjustments in your records.

| Service Date | Original Amount | Discount/Adjustment | Adjusted Amount | Total Amount Due |

|---|---|---|---|---|

| 01/10/2024 | $200.00 | – $20.00 | $180.00 | $180.00 |

| 01/17/2024 | $150.00 | – $15.00 | $135.00 | $135.00 |

| 01/24/2024 | $250.00 | + $10.00 | $260.00 | $260.00 |

Discounts: When applying discounts, clearly indicate the amount or percentage being reduced from the original cost. Specify if it’s a seasonal promotion, loyalty discount, or any other offer. Transparency in this process will help clients understand the rationale behind the adjusted amount.

Adjustments: If an error was made in previous billing (e.g., overcharging or missing a service), make sure to clearly outline the adjustment and the reason for the change. Adjustments should be documented and agreed upon by both parties to ensure that there are no misunderstandings.

By carefully handling and documenting discounts and adjustments, you maintain clarity and professionalism, ensuring that clients understand their final amounts and feel confident in the billing process.

Incorporating Time Tracking into Invoices

When offering services based on the time spent, accurate time tracking is crucial to ensure both parties agree on the total charge. Incorporating time tracking into your billing records helps establish transparency and fairness, preventing disputes over hours worked. It’s essential to provide detailed information to your clients about how time is calculated and the breakdown of hours spent on different tasks.

How to Track Time Effectively

To incorporate time tracking into your billing, follow these simple steps:

- Record Time Regularly: Use a reliable method to track time, such as digital timesheets, a mobile app, or even a manual log. Be sure to record the start and end times for each task.

- Break Down Tasks: For more clarity, divide the time spent into categories, such as “consultation,” “service provision,” or “travel time.” This way, clients can see how their payment is distributed.

- Track Overtime: If applicable, be sure to track overtime separately. Specify hourly rates for regular and overtime hours to avoid confusion.

Example of Time-Related Billing

Here’s how you might present time-tracked data in your bill:

| Date | Task Description | Hours Worked | Hourly Rate | Total |

|---|---|---|---|---|

| 01/10/2024 | Client consultation | 2 hours | $40/hr | $80.00 |

| 01/12/2024 | Service provision | 5 hours | $40/hr | $200.00 |

| 01/14/2024 | Travel time | 1 hour | $40/hr | $40.00 |

Summarizing Time on the Bill: Ensure that all time-related services are clearly outlined with the date, task, hours worked, and the total amount for each segment. This approach helps maintain clear communication with clients and prevents misunderstandings regarding the final amount.

Accurate time tracking benefits both you and your clients by ensuring that services are billed fairly and with full transparency. It also makes the payment process easier and more efficient, reducing the risk of d

Using Digital Tools for Invoice Creation

In today’s fast-paced world, digital tools offer an efficient and streamlined way to manage billing and financial documentation. Leveraging technology not only saves time but also ensures accuracy and professionalism in your records. By using specialized software and online platforms, you can easily generate and track your charges, making the process quicker and more organized.

Digital solutions offer several advantages over manual methods, such as pre-designed layouts, automatic calculations, and the ability to store and retrieve documents with ease. These tools allow you to create customized billing forms, manage client details, and track payments with minimal effort.

Benefits of Using Digital Tools

- Efficiency: Generate detailed records in just a few clicks, saving valuable time on administrative tasks.

- Accuracy: Automatic calculations reduce the risk of human error in adding up totals and taxes.

- Customization: Easily adjust the format and content of the documents to suit your specific needs.

- Organization: Store all your financial documents in one place, making it easy to track and manage past transactions.

Example of Digital Tool Features

Here is an example of how a digital tool might be used to generate a billing document:

| Feature | Description |

|---|---|

| Pre-designed templates | Access ready-to-use formats for various billing needs, including simple and detailed records. |

| Automated calculations | Automatically calculate totals, taxes, and discounts based on entered data. |

| Client database | Store client information for easy retrieval and quicker document creation. |

| Online access | Work from anywhere with cloud-based software, allowing you to create and manage records remotely. |

Using digital tools helps simplify the process of creating and managing financial documents, ultimately saving time and reducing the likelihood of errors. Whether you are working alone or running a business, these solutions provide an easy and effect

Providing Professional Invoices to Clients

Presenting clear, accurate, and professional billing documents is essential for maintaining strong relationships with clients. It reflects your commitment to transparency and helps build trust, ensuring that all parties are on the same page regarding payment expectations. A well-prepared document not only facilitates smooth financial transactions but also enhances your professional image.

When crafting a billing document, it’s important to include all necessary details, such as services provided, rates, payment terms, and deadlines. Professionalism goes beyond the accuracy of the figures; the overall format and clarity of the document also play a key role in ensuring client satisfaction.

To further enhance the professionalism of your billing documents, ensure that your contact details, business information, and payment options are clearly visible. This makes it easier for your clients to reach you with any questions or to process their payments promptly.

Key Considerations for Professional Documents:

- Clarity: Ensure the information is presented in an easy-to-read format, with distinct sections for each part of the charge.

- Consistency: Maintain a uniform format for all your documents, which adds credibility and makes them easier to track over time.

- Accuracy: Double-check all calculations and service details before sending the document to avoid confusion or delays.

- Timeliness: Send your billing documents promptly after services are rendered to ensure timely payment.

By following these practices, you can create professional and effective billing documents that help maintain a positive working relationship with clients, ultimately improving both your reputation and business efficiency.

Tips for Efficient Invoice Management

Efficient management of billing records is crucial for keeping financial operations smooth and organized. Properly handling these documents ensures that payments are tracked, deadlines are met, and disputes are minimized. By adopting best practices, you can streamline the process, save time, and avoid errors that could disrupt cash flow.

Here are several strategies to help you manage your financial documents more effectively:

- Automate Where Possible: Use digital tools to automatically generate and send bills. Automation helps eliminate human errors and speeds up the process.

- Organize by Categories: Create a system to categorize your records, such as by client or service type. This makes it easier to find specific documents when needed.

- Set Clear Payment Terms: Clearly outline the payment terms and due dates on your documents to avoid confusion or delays in receiving payments.

- Track Payment Status: Keep track of paid, pending, and overdue payments in a centralized system. This ensures timely follow-ups and better cash flow management.

- Keep Digital Copies: Store all documents electronically for easy access and to ensure you have backups in case of issues with physical copies.

- Regular Review: Periodically review your financial records to ensure everything is up-to-date and accurate. This helps in identifying any potential issues early on.

By implementing these tips, you can make managing financial records more efficient, reduce administrative burdens, and maintain a clear overview of your business’s financial health.