How to Create a Professional Care Invoice Template

Managing payments for healthcare services can be complex, but having a well-structured document to outline charges and ensure timely compensation can make the process much easier. Whether you’re providing personal assistance, medical care, or other types of support, it’s crucial to have a clear and professional way to request payment for services rendered.

In this guide, we will explore how to craft a customizable document that helps you itemize fees, specify payment terms, and maintain accurate financial records. A well-designed billing sheet not only aids in ensuring you are paid promptly but also builds trust with your clients, offering a transparent approach to billing.

Efficiently managing payments is essential for any caregiving professional. By utilizing a carefully designed payment request form, you can save time and reduce errors, allowing you to focus more on providing quality care. The right format can also help avoid misunderstandings and ensure that clients know exactly what they are being charged for.

What is a Billing Document for Health Services

A billing document for health-related services is a crucial tool used by providers to request payment from clients for the assistance or care they have received. It serves as a formal record that outlines the services rendered, their respective costs, and the terms for payment. By creating an itemized request for payment, caregivers and healthcare professionals can ensure clarity and accuracy in financial transactions.

Key Features of a Billing Document

- Service Details: A detailed list of the tasks performed or care provided, including the dates and hours spent.

- Costs and Charges: Clear breakdown of the fees for each service, including any additional charges or discounts.

- Payment Terms: Information about the payment due date, accepted payment methods, and any penalties for late payments.

- Client Information: Essential details such as the client’s name, contact information, and billing address.

- Professional Information: Contact details of the service provider, including their name, business name (if applicable), and license or registration number.

Why is it Important?

Having a well-structured billing document ensures that all parties involved have a clear understanding of what is expected. It prevents confusion, disputes, and delays in payment, while also helping caregivers maintain professional standards. Moreover, it acts as a record for both clients and providers, aiding in accounting and ensuring compliance with legal requirements.

Benefits of Using a Billing Document for Health Services

Utilizing a structured payment request document offers numerous advantages for both caregivers and their clients. It provides a clear and organized way to track services provided, ensure prompt payment, and avoid misunderstandings. With an easy-to-use format, professionals can enhance their administrative efficiency while maintaining transparency and professionalism in their transactions.

Improved Accuracy and Transparency

- Detailed Breakdown: A well-organized document allows for a precise listing of services, ensuring that clients understand exactly what they are being charged for.

- Clear Payment Terms: It outlines payment expectations, including deadlines, late fees, and payment methods, which helps avoid confusion.

- Reduced Errors: By using a standardized format, caregivers can minimize mistakes in calculations or omissions that could delay payment or create disputes.

Time and Cost Savings

- Faster Payments: Clients are more likely to pay promptly when the billing process is clear and straightforward, leading to quicker cash flow for caregivers.

- Less Administrative Work: Standardized documents reduce the time spent on creating custom invoices for every client, freeing up time for other important tasks.

- Minimized Follow-Up: With clearly defined terms and charges, caregivers spend less time chasing payments or answering billing questions from clients.

Key Elements of a Billing Document for Health Services

A well-constructed payment request for health services includes several important components that ensure clarity and transparency for both the provider and the client. Each section serves a specific purpose, from detailing the services performed to specifying the amount due. Understanding the key elements of such a document is essential for both caregivers and clients to maintain smooth financial transactions.

Essential Information for Accurate Billing

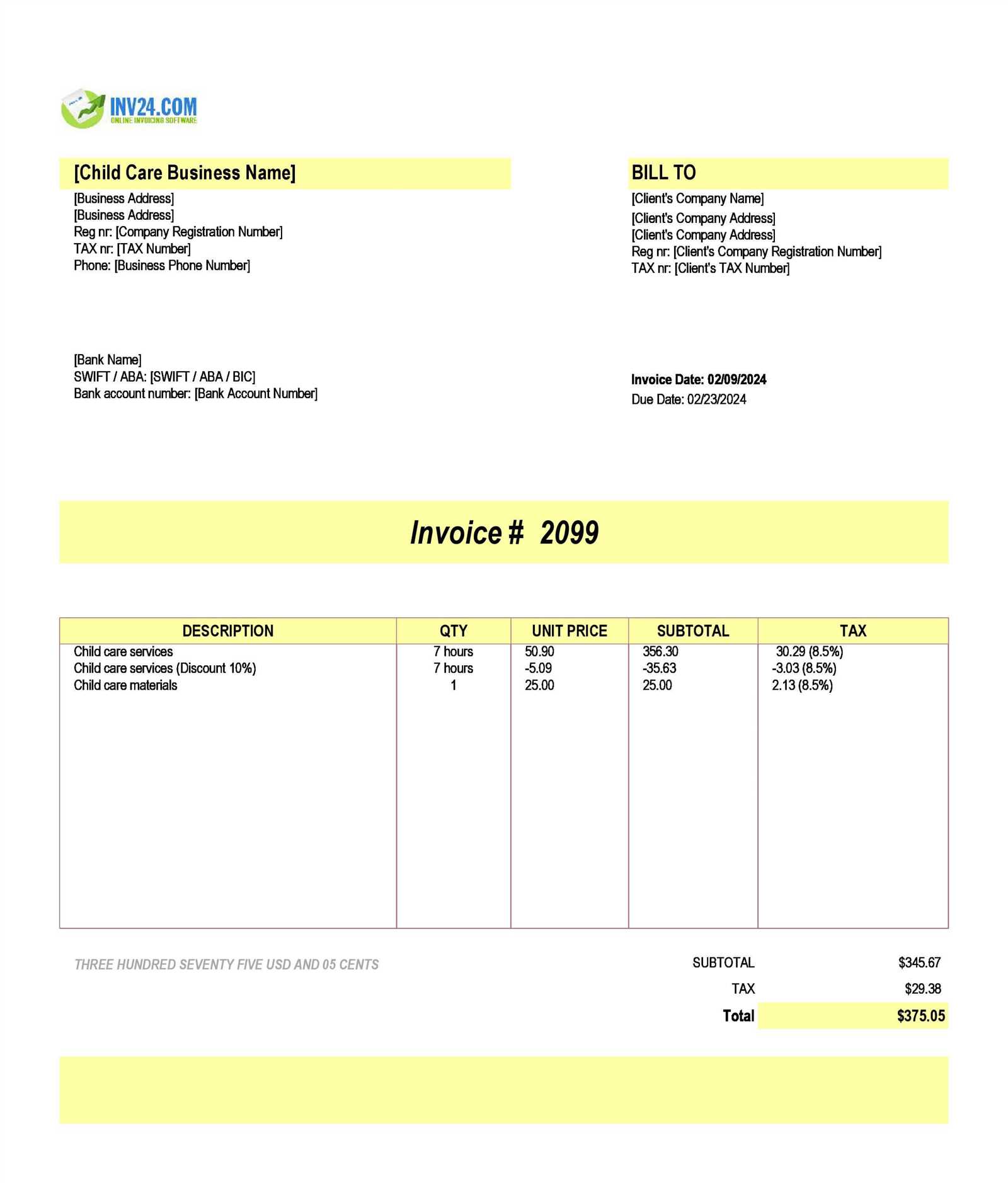

The following table outlines the most critical components that should be included in a payment request form:

| Element | Description |

|---|---|

| Provider Details | Information about the caregiver or healthcare service provider, including name, contact details, and any necessary identification numbers or certifications. |

| Client Information | Details of the person receiving care, such as their name, address, phone number, and email for communication. |

| Service Description | A detailed list of services provided, including the type of care, hours worked, and dates of service. |

| Pricing Breakdown | Clear explanation of the charges for each service, as well as any additional fees or discounts applied. |

| Payment Terms | Details about when payment is due, acceptable payment methods, and any late fees or penalties. |

| Invoice Number | A unique identifier for each document to help track and reference the payment request. |

Why These Elements Matter

Each element in a billing document plays an important role in preventing misunderstandings and ensuring that all parties are on the same page. By including accurate provider and client information, clearly listing the services rendered, and specifying payment expectations, both caregivers and clients can reduce the chances of delays or disputes in the payment process.

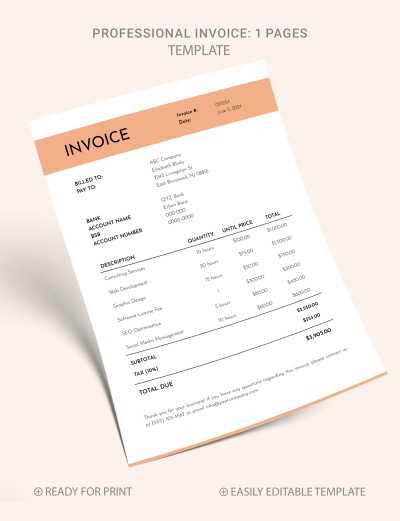

How to Design a Billing Document for Health Services

Designing an effective payment request form is essential for ensuring smooth transactions between healthcare providers and clients. A well-designed document not only presents all necessary information clearly but also reflects professionalism. The design should be simple yet detailed, making it easy for both parties to understand the charges and terms associated with the services rendered.

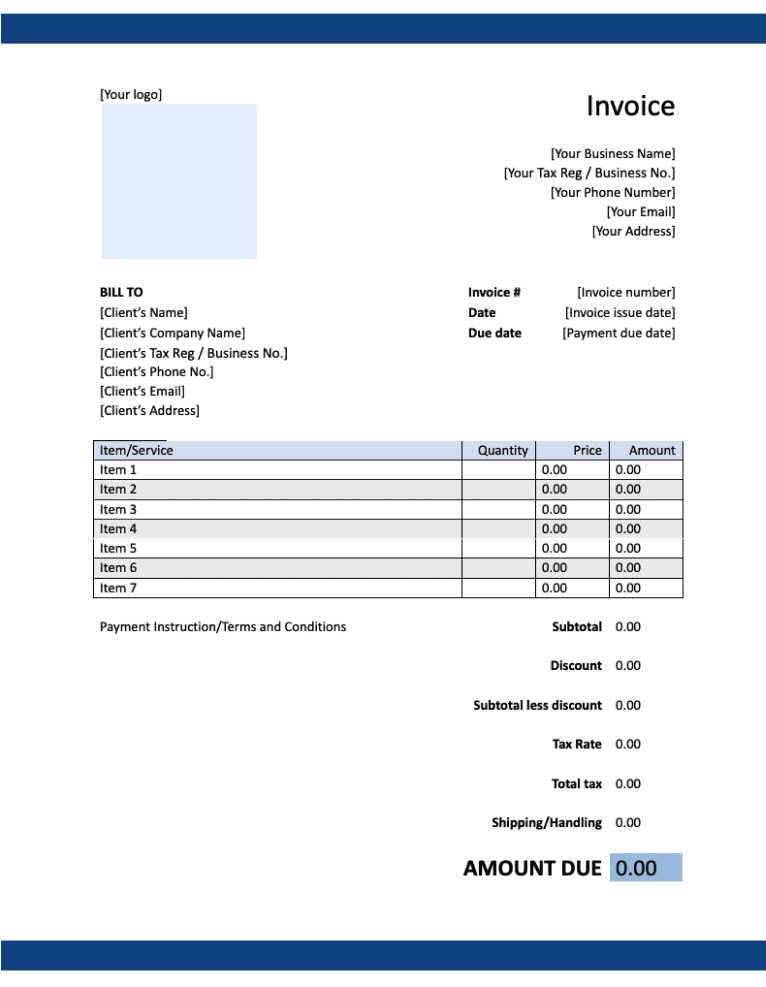

Steps to Create a Professional Payment Request

Follow these basic steps to create a functional and clear document:

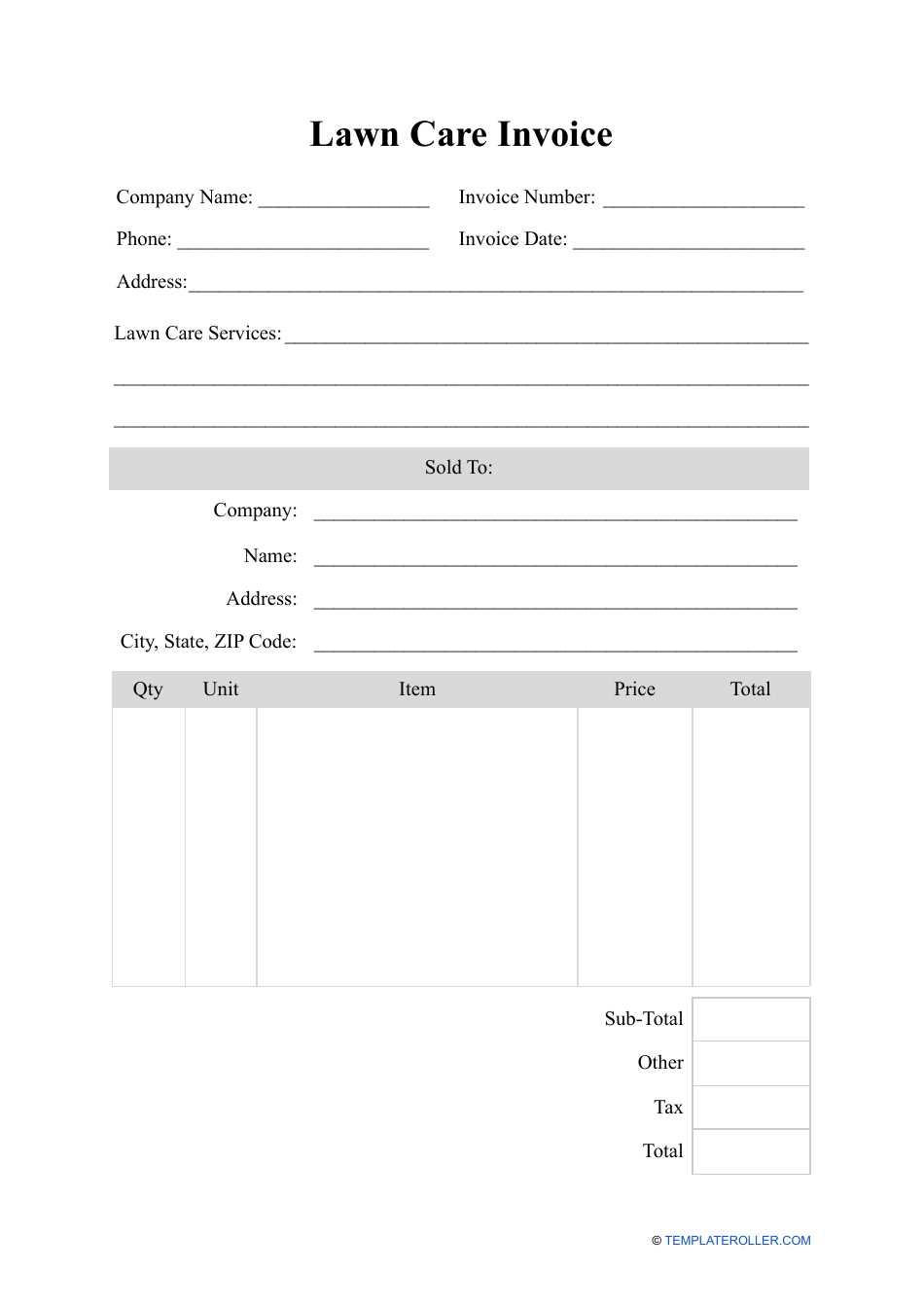

- Start with a Header: Include your business name, logo (if applicable), and contact information at the top of the document. This ensures that the client can quickly reach out if they have questions.

- Provide Client Details: Add the name, address, and contact information of the client to personalize the document and avoid confusion with other clients.

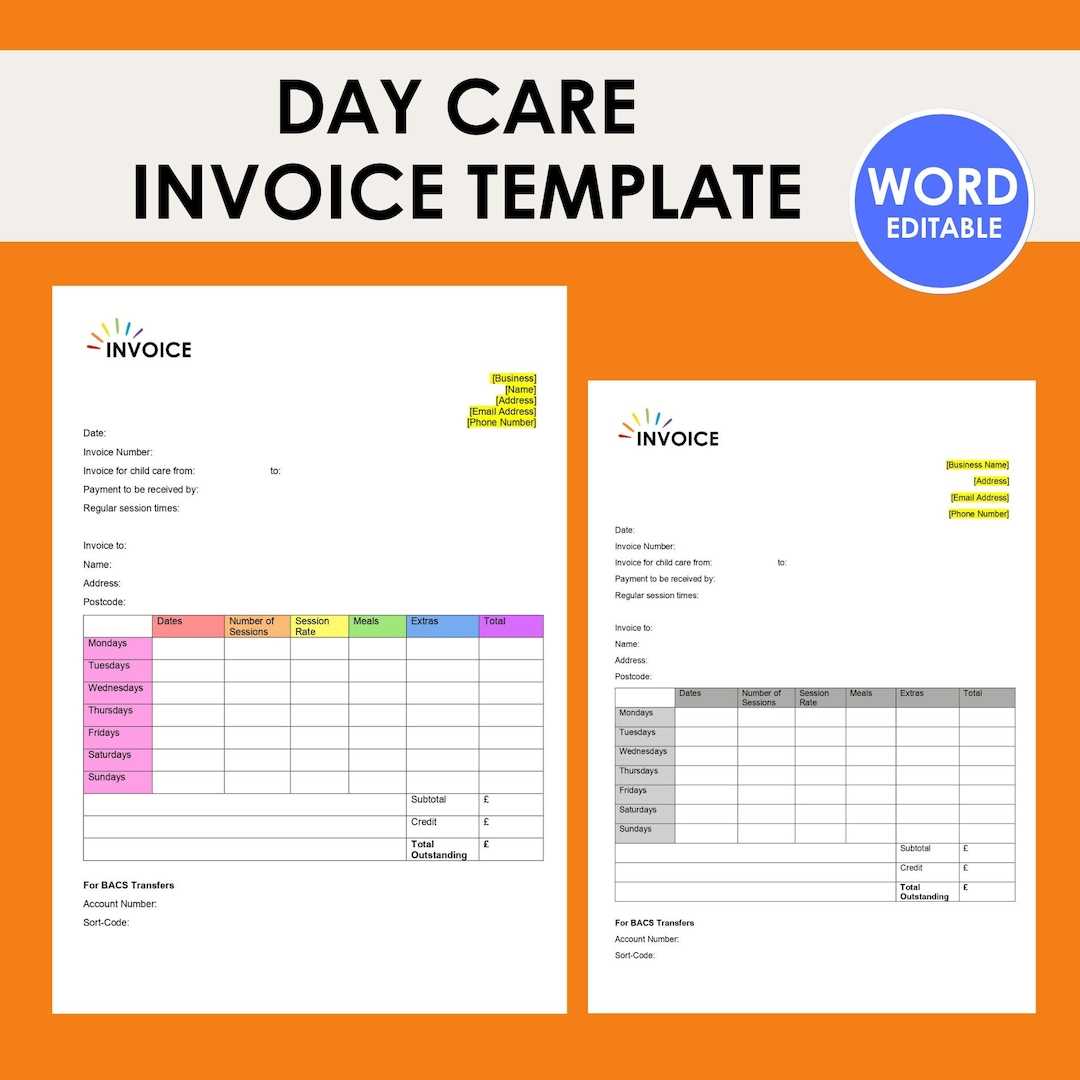

- List Services Provided: Break down the services rendered, including dates, hours worked, and detailed descriptions of the care or assistance provided. Use a table format for easy readability.

- Specify Charges: Clearly list the cost for each service. If there are additional fees (e.g., travel, supplies), include them separately for full transparency.

- Set Payment Terms: State the payment deadline, acceptable payment methods, and any late fees or discounts that apply. Make sure this is easy to locate on the document.

- Add Unique Reference Number: Assign a unique number to each document to keep track of transactions and simplify record-keeping.

Design Tips for Better Clarity

- Keep it Simple: Use a clean, professional layout with clear headings and sections. Avoid clutter to ensure important information stands out.

- Choose Readable Fonts: Use easy-to-read fonts and a standard size for all text. Make headings bold to draw attention to key sections.

- Use a Grid or Table: For services and charges, a table format helps organize information neatly, making it easier for clients to understand and verify their payments.

- Highlight Important Information: Use bold or colored text to emphasize payment terms or overdue fees, ensuring they catch the client’s attention.

By following these steps and tips, you can create a document that is not only functional but also professional and user-friendly, ensuring a smooth and transparent billing process for both parties involved.

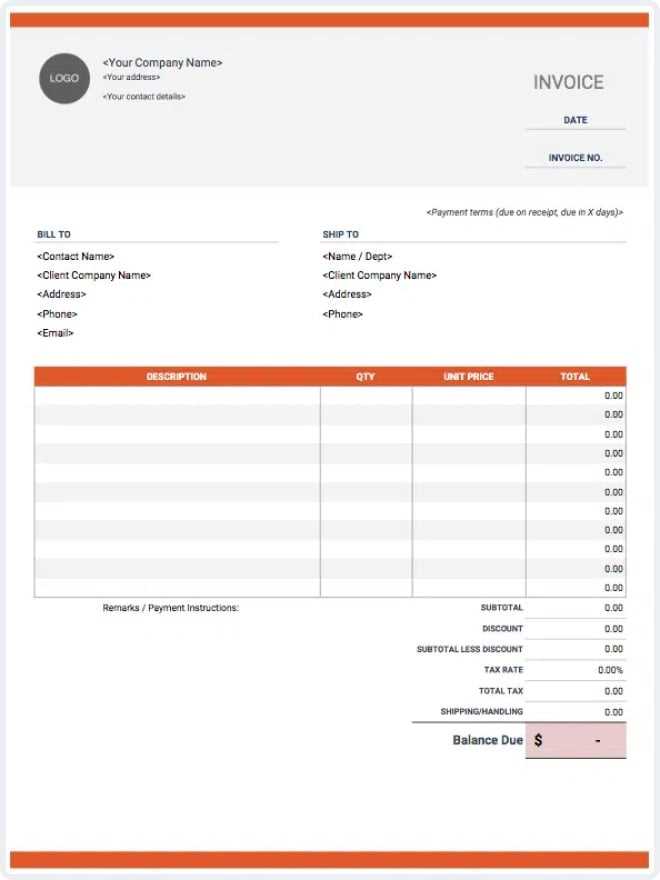

Choosing the Right Billing Document Format

Selecting the right format for a payment request is crucial to ensure that all necessary information is included and presented clearly. The proper layout can streamline the billing process, reduce confusion, and help avoid errors. It’s important to consider both functionality and appearance when deciding on a format, as it must be professional, easy to use, and customizable to fit your needs.

Factors to Consider When Choosing a Format

- Customization Options: Choose a design that allows you to add or modify sections easily, such as service descriptions, pricing, and payment terms, to fit your specific requirements.

- Ease of Use: Select a format that is simple to fill out and doesn’t require complex steps. A user-friendly layout will save time for both you and your clients.

- Professional Appearance: Opt for a clean and polished design that represents your services in a professional manner, fostering trust and credibility with your clients.

- Flexibility for Different Services: Ensure the format can accommodate various types of services, from hourly care to one-time tasks, with the ability to add new categories or remove unnecessary sections.

- Compatibility: Choose a format that is compatible with the tools you use, whether it’s a word processor, spreadsheet software, or accounting system.

Types of Formats Available

- Pre-designed Formats: These are ready-made, easy-to-use options that only require basic customization. Ideal for those who need a quick solution.

- Customizable Digital Formats: These formats are highly adaptable, allowing you to create a unique design that suits your style and specific billing needs.

- Printable Formats: If you prefer physical records, select a design that works well when printed, maintaining clarity and professionalism even in hard copy.

By carefully considering these factors, you can select the right format that not only suits your billing needs but also enhances your professionalism and efficiency when managing client payments.

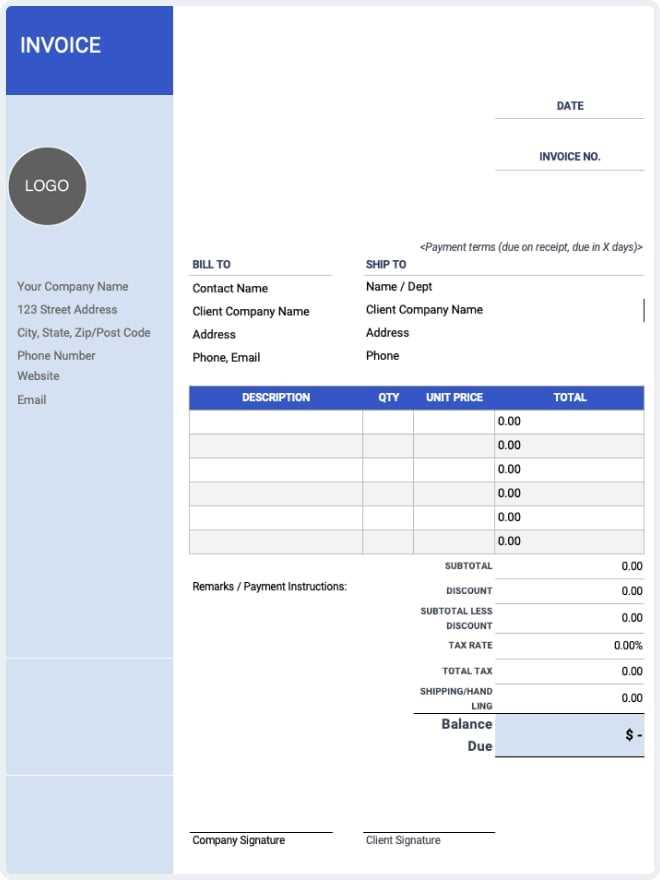

Customizing Your Billing Document Format

Customizing your payment request form allows you to tailor it to your specific needs and reflect your professional identity. A well-customized document not only makes the billing process more efficient but also enhances your brand’s image. By adjusting certain elements, you can ensure the document meets both legal requirements and client expectations, while maintaining clarity and ease of use.

Key Customization Options

Here are several aspects you can modify to make your document more effective:

| Element | Customization Tips |

|---|---|

| Header Section | Include your business name, logo, and contact information. Personalize it with your brand colors and font to make it recognizable. |

| Client Information | Customize fields to capture necessary client details, such as name, address, phone number, and email for easy follow-up. |

| Service Descriptions | Modify the service list to suit the specific care or assistance you provide, with the option to add extra rows for new tasks or remove those that are irrelevant. |

| Pricing Breakdown | Set up pricing categories, such as hourly rates, fixed charges, or additional costs for specialized services or supplies. |

| Payment Terms | Clearly define your payment expectations, including due dates, accepted payment methods, and any late fees. Customize this section to match your policy. |

| Footer Section | Include space for additional notes, legal disclaimers, or terms and conditions, ensuring clients understand your payment and service policies. |

Tools for Customization

- Word Processors: Use programs like Microsoft Word or Google Docs for easy text adjustments, inserting logos, and altering layouts.

- Spreadsheet Software: Excel or Google Sheets offers flexibility for organizing services, prices, and client details with built-in calculation functions.

- Invoice Software: Specialized software can help automate many aspects of billing, including customization and record-keeping, and often provides templates that can be further tailored.

By customizing your document, you ensure it not only serves its functional purpose but also aligns with your branding and business practices, offering a professional appearance that builds trust with your clients.

Free vs Paid Billing Document Formats

When choosing a format for your payment requests, you’ll encounter both free and paid options. Each type has its advantages and disadvantages depending on your specific needs, business model, and the level of customization required. While free formats may seem like an attractive option for those just starting, paid solutions often offer more features and greater flexibility for businesses looking to streamline their billing process.

Free options are generally basic, providing the essential structure needed to create a payment request. These formats are suitable for smaller operations or those with limited resources. However, they may lack advanced features like automated calculations, detailed customization, or integration with accounting systems.

On the other hand, paid solutions usually offer a wider range of tools and customization options, including the ability to add logos, incorporate advanced payment terms, and integrate with other software tools such as accounting or payment processing platforms. These premium options often come with customer support and regular updates, ensuring that you have access to the latest features and fixes.

Ultimately, the choice between free and paid formats depends on the complexity of your needs. For simple and straightforward billing, a free option may suffice, but for businesses looking to scale or automate their billing process, a paid solution might be the better long-term investment.

How to Save Time with Pre-Designed Billing Formats

Using pre-designed formats for payment requests can drastically reduce the time spent on administrative tasks. Instead of creating a new document from scratch for every client or service, a reusable format allows you to simply fill in the details, ensuring consistency and speeding up the process. This approach eliminates the need for repetitive formatting and allows you to focus more on providing services.

Time-Saving Benefits of Pre-Made Formats

- Consistency: Pre-designed formats maintain the same structure across all documents, reducing the time spent on formatting and ensuring all necessary details are included.

- Reduced Manual Input: With pre-set fields and sections, you only need to input new information for each client or service, rather than recreating the document each time.

- Fewer Errors: Using a consistent format minimizes the risk of missing important sections or making formatting errors, saving time on revisions and corrections.

- Quick Customization: Templates can be easily customized for specific services or clients without starting from scratch, allowing you to make minor adjustments quickly.

How to Maximize Efficiency

- Use Automated Features: Choose formats that offer automated calculations or built-in fields, so you don’t need to manually calculate totals or tax rates.

- Store Client Information: Keep a database of client details so you can quickly fill in their information, reducing the time spent on re-entering contact data.

- Save Frequently Used Services: Store a list of common services and their costs so you can easily insert them into each document without retyping.

By using pre-designed formats effectively, you can streamline your billing process, reduce administrative work, and increase the time you have to focus on your core tasks.

Common Mistakes in Billing Documents

When creating payment request documents, it’s easy to overlook certain details that can lead to confusion or delays in payment. Simple errors in formatting, pricing, or communication can cause misunderstandings with clients and ultimately slow down the payment process. Understanding these common mistakes is key to avoiding them and ensuring that your financial transactions remain smooth and professional.

Some of the most frequent errors include failing to include clear descriptions of services, not specifying payment terms, or leaving out important contact information. These oversights may seem small but can lead to unnecessary follow-up or disputes that could have been easily avoided with a more thorough approach.

Frequent Errors to Avoid

- Lack of Detailed Service Descriptions: Vague or unclear descriptions can lead to confusion. Always specify what services were provided, including dates and times.

- Incorrect Pricing: Double-check the rates and quantities listed to avoid mistakes in the total amount due. Small errors can lead to disputes or delayed payments.

- Missing Payment Terms: Failure to clearly state when payment is due, or how payments should be made, can result in clients misunderstanding when to pay or how to submit payment.

- Not Including Contact Information: If clients have questions or concerns, they should easily find the provider’s contact details. Missing this information can delay responses and payments.

- Not Using Unique Document Numbers: Without a unique reference number, keeping track of multiple documents and payments can become disorganized, especially if issues arise later on.

By being mindful of these common mistakes and taking the time to carefully check each section of your payment request document, you can ensure greater clarity, avoid confusion, and maintain professional relationships with your clients.

How to Add Payment Terms in Billing Documents

Including clear payment terms in your payment request is essential for establishing expectations and ensuring timely payments. By specifying when and how you expect to be paid, you provide both you and your clients with a clear understanding of the financial arrangement. These terms help prevent misunderstandings and set a professional tone for the transaction.

Payment terms typically include details on due dates, acceptable payment methods, and any late fees or penalties. Ensuring that this section is detailed and easy to understand will reduce confusion and provide both parties with clear guidelines for processing payments.

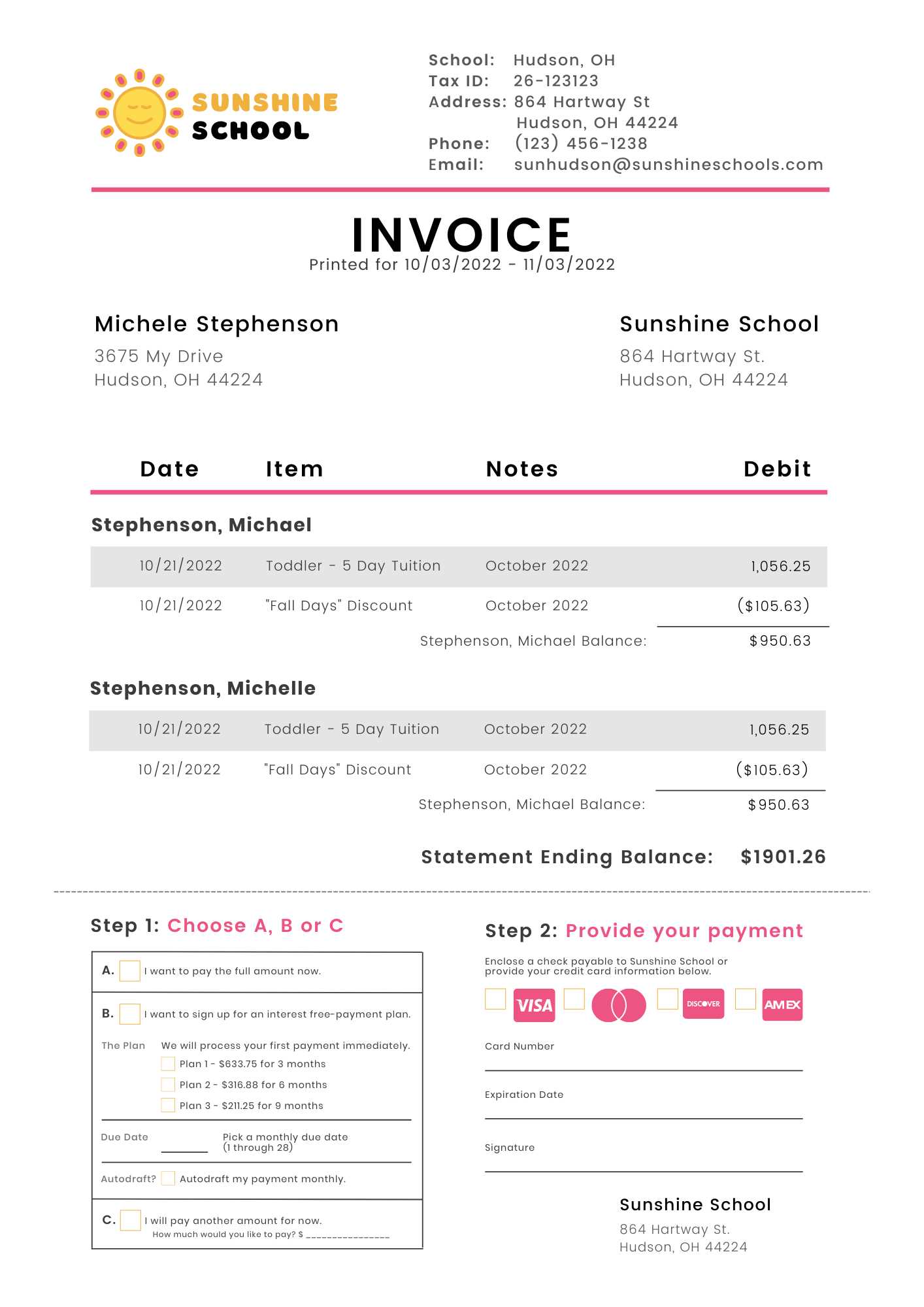

Key Payment Terms to Include

- Due Date: Clearly state when payment is expected. This could be a specific date or a number of days after the service was provided (e.g., “Due within 30 days”).

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, checks, credit cards, or online payment systems like PayPal or Stripe.

- Late Fees or Penalties: Specify if there are any additional charges for late payments, such as a percentage of the total amount due after a certain period (e.g., “Late fee of 5% after 30 days”).

- Discounts for Early Payment: If you offer discounts for prompt payments, clearly state the discount amount and the conditions under which it applies (e.g., “5% discount if paid within 7 days”).

- Payment Plan Options: If you offer flexible payment plans, outline the installment amounts, due dates, and total duration of the payment period.

How to Format Payment Terms for Clarity

- Be Specific: Use clear, precise language to avoid ambiguity. For example, instead of “payment expected soon,” use “payment due within 30 days of receipt.”

- Use Bold or Highlighting: Important terms such as due dates, late fees, and discounts should be emphasized to ensure they stand out to the reader.

- Provide Contact Information for Queries: Include a note with your contact details in case the client has questions or needs clarification about the payment terms.

Including well-defined pa

Best Practices for Billing in Healthcare Services

Efficient billing is crucial for healthcare providers to maintain smooth cash flow and professional relationships with clients. To ensure that your billing process is clear, accurate, and timely, it’s essential to follow best practices that improve both your internal operations and client satisfaction. By adhering to these guidelines, you can reduce errors, streamline the payment process, and enhance the overall experience for your clients.

Key Practices for Clear and Accurate Billing

- Provide Detailed Descriptions: Always include a comprehensive breakdown of services rendered, including dates, hours worked, and any specific treatments or services provided. This ensures clients understand exactly what they are paying for.

- Be Transparent with Pricing: List each charge separately, whether it’s a fixed rate or hourly fee. Avoid hidden fees to build trust and prevent confusion later on.

- Ensure Timely Delivery: Send your billing documents as soon as possible after services are provided. Prompt invoicing increases the likelihood of timely payments.

- Double-Check Client Information: Ensure that the client’s details (name, address, and contact information) are correct. Mistakes in contact details can lead to delayed payments or follow-up issues.

- Set Clear Payment Terms: Clearly state when payments are due, acceptable methods of payment, and any applicable late fees. This reduces the chances of misunderstanding and disputes.

Additional Tips for Streamlining the Process

- Use Automation: Consider using billing software to automate repetitive tasks like calculating totals, applying taxes, and sending reminders. This saves time and minimizes human error.

- Offer Multiple Payment Options: Allow clients to choose from a variety of payment methods, such as credit card, bank transfer, or online payment platforms. Offering flexibility can speed up payment processing.

- Track Payments Efficiently: Keep accurate records of all transactions and payments received. This helps you stay organized and quickly follow up on outstanding balances.

By following these best practices, healthcare providers can ensure that their billing process runs smoothly, clients remain satisfied, and payments are received in a timely manner. Consistency and professionalism in invoicing will also help strengthen the overall reputation of your practice.

Using Billing Documents for Recordkeeping

Effective recordkeeping is vital for any business, particularly in service-based industries. By maintaining accurate and organized records of all transactions, you ensure that financial data is easily accessible for reference, auditing, and tax purposes. Billing documents play a crucial role in this process, serving as both proof of service and a financial record for both you and your clients. Proper documentation helps track payments, monitor cash flow, and resolve any disputes that may arise.

Why Billing Records Matter

- Tax Compliance: Billing documents provide a clear record of earnings, which is essential for accurate tax reporting. These records support income claims and deductions during tax season.

- Financial Analysis: By reviewing past documents, you can identify trends in your revenue, assess the profitability of certain services, and make informed decisions for future business planning.

- Dispute Resolution: In case of a payment dispute, billing documents offer evidence of the agreed-upon services and terms, helping resolve conflicts efficiently and professionally.

- Organizing Cash Flow: Keeping detailed records of payments received and pending balances helps track cash flow, ensuring your business remains financially stable.

Best Practices for Using Billing Documents for Recordkeeping

- Consistent Filing: Organize your billing documents in a consistent manner, whether digitally or in physical files. Categorize them by date, client, or service type to make retrieval easier.

- Use Software for Digital Records: Digital tools and accounting software can help streamline the process, enabling you to store, search, and manage your billing documents efficiently.

- Maintain Backups: Keep backups of your records in case of data loss. For physical records, consider scanning and storing them digitally. For digital records, regularly back them up to a secure cloud or external drive.

- Review Regularly: Periodically review your billing records to ensure they are up to date and that any overdue payments are addressed promptly.

By using billing documents as part of your recordkeeping system, you can ensure that your financial data is accurate, organized, and easily accessible whenever needed, supporting both day-to-day operations and long-term business success.

How to Send a Billing Request

Once your payment request document is prepared, the next step is to send it to your client in a way that ensures clarity and prompt action. The delivery method can vary depending on the client’s preference, but it’s important to choose a method that is both professional and secure. Whether you’re sending the document via email, traditional mail, or an online payment system, each method has its own set of considerations for effectiveness and efficiency.

Best Methods for Sending Payment Requests

- Email: This is one of the fastest and most efficient ways to send a billing request. It ensures quick delivery, and you can attach the document in a PDF format for easy access. Ensure the email subject clearly identifies the purpose of the message (e.g., “Payment Request for [Service Name]”).

- Online Payment Platforms: Many businesses use payment systems like PayPal, Stripe, or QuickBooks to send and manage billing requests. These platforms can streamline the process, allowing clients to view the request and pay immediately.

- Postal Mail: For clients who prefer physical copies or when dealing with international clients, sending a printed copy through postal mail may be necessary. Ensure the address is accurate and include a return envelope for easy payment submission.

- In-Person Delivery: In some cases, particularly for local clients, delivering the billing document in person can be an effective way to ensure receipt and answer any immediate questions they may have.

Key Considerations When Sending Billing Requests

- Clear Instructions: Make sure your payment terms and methods are clearly outlined in the message. Whether you include the due date, payment options, or late fees, providing complete details will reduce confusion.

- Follow-Up: If the payment request is not responded to within the specified time, it’s important to send a polite reminder. A follow-up email or call can encourage timely payment without damaging your client relationship.

- Secure Delivery: When sending sensitive financial information, ensure the delivery method is secure. For emails, use encrypted attachments or secure payment portals to protect client data.

By carefully selecting the best method and ensuring clarity in your payment request, you can enhance the likelihood of prompt payment while maintaining a professional relationship with your clients.

Understanding Taxes in Billing Documents

When preparing a payment request, it’s crucial to understand how taxes apply to the services or products provided. Taxes can vary depending on the region, the type of service, and even the client’s status. Ensuring that your billing documents include the correct tax information not only keeps your business compliant with local laws but also helps your clients understand the final amount they are required to pay.

Types of Taxes to Consider

- Sales Tax: This is the most common type of tax added to services or products. Depending on the jurisdiction, you may be required to charge a percentage of the total service cost as sales tax. The rate varies by location, so be sure to check local tax regulations.

- Value-Added Tax (VAT): In some countries, VAT is applied instead of sales tax. It is generally included in the price of goods or services and is calculated as a percentage of the total sale amount.

- Service Tax: For specific industries or service types, a service tax might apply. This tax is charged in addition to the cost of services and can depend on the service provided or the location where it is delivered.

- Exemption Status: In some cases, clients may be exempt from paying taxes due to their status (e.g., nonprofit organizations or government entities). Be sure to identify these exemptions and apply them to the billing document if applicable.

How to Properly Include Taxes in Billing Documents

- Calculate Taxes Separately: When preparing the payment request, list the tax amount separately from the service cost. This ensures clarity and transparency for your clients.

- Provide a Clear Breakdown: Include a detailed breakdown of the taxes applied (e.g., “Sales Tax (10%) – $20”) to help your clients understand the calculation.

- Stay Up to Date on Tax Rates: Tax rates can change over time, so it’s important to stay informed about any adjustments that might affect your business.

- Include Relevant Tax Identifiers: For businesses that are required to collect taxes, including your tax identification number or VAT number in the document may be necessary for compliance.

By understanding the types of taxes applicable to your services and ensuring that your billing documents reflect these charges accurately, you help ensure smooth transactions and avoid potential legal or financial issues down the line.

Tracking Payments with Billing Documents

Effective tracking of payments is essential for maintaining cash flow and managing financial records. Keeping a record of all transactions ensures that you can monitor outstanding balances, follow up on overdue payments, and maintain accurate financial data. A well-organized system for tracking payments also helps prevent errors and minimizes confusion when reconciling accounts.

How to Track Payments Effectively

- Record Payment Dates: Note the exact date when payments are received. This will help you stay on top of overdue accounts and avoid confusion about payment timelines.

- Track Payment Methods: Keep track of the payment method used (e.g., credit card, bank transfer, check, etc.). This information is useful for reconciling financial statements and confirming payment receipt.

- Use Unique Reference Numbers: Assign a unique reference number to each payment request and link it to the corresponding payment. This makes it easier to track and identify payments in your records.

- Monitor Partial Payments: If a client makes a partial payment, make sure to update the outstanding balance accordingly. Clearly record the remaining amount due and set reminders for follow-up.

Best Tools for Tracking Payments

- Accounting Software: Programs like QuickBooks, Xero, and FreshBooks can automate payment tracking. These platforms allow you to update records in real-time, track overdue payments, and generate financial reports.

- Spreadsheets: For smaller businesses, spreadsheets can be an effective tool for manual tracking. Set up columns for client names, payment dates, amounts paid, and outstanding balances.

- Online Payment Systems: Payment platforms like PayPal or Stripe provide integrated payment tracking. These systems automatically update payment statuses and can send you notifications when a payment is received.

By implementing a robust system for tracking payments, you can ensure timely follow-ups, better cash flow management, and accurate financial reporting, all of which are essential for the success of your business.

How to Follow Up on Unpaid Billing Requests

Following up on overdue payments is a crucial part of maintaining a healthy cash flow and ensuring your business’s financial stability. While it’s important to approach this task professionally and politely, it’s also essential to take prompt action to avoid further delays. Effective follow-ups can help reinforce payment terms and remind clients of their obligations without damaging relationships.

Steps to Take When Following Up

- Send a Friendly Reminder: Start with a polite reminder shortly after the payment due date. Often, clients may simply forget, and a gentle nudge can resolve the situation quickly.

- Provide Clear Details: When following up, make sure to reference the specific service, date, and amount due. This will make it easier for your client to process the payment without confusion.

- Offer Payment Options: If the client is experiencing financial difficulty, suggest alternative payment methods or a payment plan. Flexibility can help maintain a positive relationship.

- Set a Deadline: Be clear about when you expect the payment to be made. This creates a sense of urgency and sets expectations for the client.

When to Send a Follow-Up Email

| Time Frame | Follow-Up Action |

|---|---|

| 1-7 days after due date | Send a friendly reminder with payment details |

| 7-14 days after due date | Send a more formal reminder, mention overdue status |

| 14-30 days after due date | Send a final notice with clear mention of possible late fees or further actions |

| 30+ days after due date | Consider sending a legal notice or using a collection service if payment is still not received |

Consistent and well-timed follow-ups can help prevent unpaid balances from becoming a larger issue. By maintaining professionalism and clear communication, you increase the likelihood of receiving payment without straining client relationships.

Legal Considerations in Billing Requests

When preparing billing documents for services rendered, it is essential to ensure that they comply with relevant legal requirements. Not only does this protect your business, but it also safeguards your clients’ rights and ensures that all transactions are conducted transparently and fairly. Understanding the legal framework that governs billing practices is crucial for avoiding disputes and maintaining professionalism.

Key Legal Factors to Keep in Mind

- Contractual Obligations: Ensure that your billing terms align with the terms outlined in the contract or agreement with the client. This includes the agreed-upon pricing, payment schedule, and any additional fees or terms.

- Tax Compliance: Verify that the appropriate taxes are applied based on your jurisdiction. This includes sales tax, VAT, and any other local taxes. Make sure you have the correct tax identification numbers and comply with reporting requirements.

- Late Fees and Penalties: If your payment terms include late fees or penalties for overdue payments, clearly state these in the billing document. Ensure that they are legally enforceable based on local laws and regulations.

- Data Protection and Privacy: Protect the personal and financial information of your clients. Comply with data protection laws, such as GDPR in Europe or similar regulations in your region, ensuring that sensitive information is securely handled.

Common Legal Risks and How to Mitigate Them

| Risk | Mitigation Strategy |

|---|---|

| Disputed Charges | Ensure clear communication with clients about services rendered and provide detailed breakdowns in billing documents to avoid misunderstandings. |

| Late Payments | Establish clear payment terms in contracts, specify payment deadlines, and enforce penalties for late payments as per the terms agreed upon. |

| Non-Compliance with Tax Regulations | Consult with a tax professional to ensure all taxes are accurately calculated and remitted, and that your billing documents include the required tax information. |

| Privacy Violations | Use secure platforms for storing and sending billing documents, and ensure compliance with relevant data protection laws regarding client informa |