Car Wash Invoice Template for Easy Billing and Customization

Managing payments and ensuring smooth transactions is an essential part of running any service-based business. For those in the vehicle care industry, creating clear, professional billing documents is crucial for maintaining financial organization and customer trust. These documents not only serve as a formal request for payment but also reflect the professionalism of the business.

By using well-structured billing forms, service providers can avoid misunderstandings and ensure their clients understand exactly what they’re paying for. A well-crafted document will include key details such as services rendered, pricing, payment terms, and any applicable taxes, making it easier for both businesses and customers to keep track of transactions.

In this guide, we’ll explore how to create an effective billing document, highlighting the components that should always be included, as well as tips for customizing it to suit the specific needs of your business. Whether you’re just starting out or looking to improve your current process, having the right system in place is essential for success.

Car Wash Invoice Template Guide

Creating an effective billing document is essential for any business that offers specialized vehicle services. A well-designed document helps streamline financial transactions, ensuring clarity between the service provider and the customer. This guide will walk you through the process of creating a comprehensive and professional billing record that can be tailored to fit the unique needs of your business.

Key Components to Include

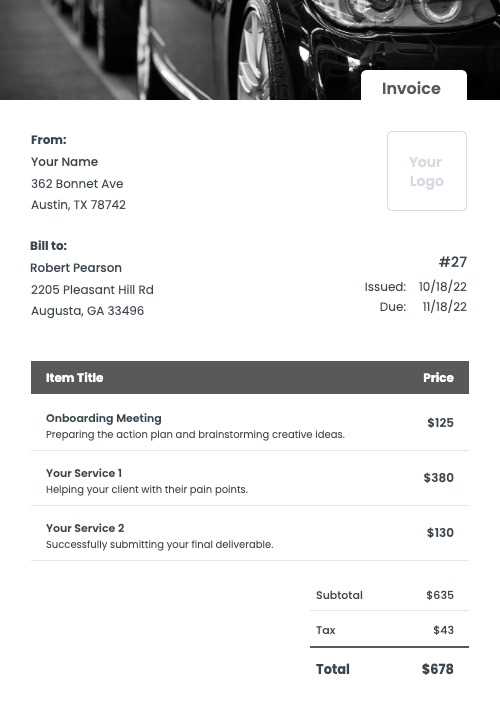

To ensure your document is both functional and professional, there are several critical elements to include. At a minimum, the document should list the client’s name, a detailed breakdown of the services provided, the associated costs, and the total amount due. It is also important to specify payment terms, such as due dates and accepted payment methods. Accurate details will help prevent any potential misunderstandings with customers and facilitate smooth transactions.

Customizing for Your Business

While there are general guidelines to follow, customization is key to making the document work best for your specific needs. You can adjust the layout and content to reflect your company’s branding or include any additional information that might be relevant, such as promotional discounts or membership programs. Tailoring your document not only improves your business’s professional image but also ensures that all relevant details are communicated clearly to your clients.

Why Use an Invoice Template

Having a standardized billing document is essential for any service-based business. It helps ensure consistency, reduces errors, and speeds up the payment process. By using a pre-designed format, service providers can focus on delivering excellent customer experiences while maintaining an organized and professional approach to financial transactions.

Utilizing a ready-made structure allows businesses to easily input client details and service information, ensuring nothing is overlooked. Automation of this process saves time and reduces the likelihood of mistakes, such as incorrect pricing or missing items. Furthermore, a well-organized record helps establish trust with clients, showing that your business is reliable and transparent with its pricing and services.

In addition to practical benefits, using a customizable format gives you the flexibility to align the document with your brand’s identity. Personalizing your billing record ensures it reflects the professionalism of your business, while offering the necessary space for all relevant information, like payment terms and service descriptions.

Benefits of Professional Invoices

Using professionally designed billing records can greatly enhance the efficiency and credibility of any business. By ensuring that each transaction is documented clearly and accurately, businesses can foster better client relationships, improve financial tracking, and present themselves as trustworthy and reliable. These benefits go beyond simply requesting payment–they establish a positive business image that clients can rely on.

Improved Clarity and Organization

A well-structured billing record provides both the client and the business with a clear breakdown of services rendered and amounts due. The benefits include:

- Clear itemization of all services provided, preventing any confusion over pricing or service details.

- Consistency across all transactions, reducing the chances of miscommunication or missed charges.

- Easy tracking of payments, which simplifies accounting and helps avoid errors in financial reporting.

Enhanced Professional Image

Using a polished and formal billing document shows clients that your business is organized and professional. This contributes to a stronger relationship with customers, leading to:

- Increased trust, as clients feel more confident when they receive clear and professional documentation.

- Faster payment processing, as clients are more likely to pay promptly when they receive a clear and professional record.

- Better customer retention as clients appreciate businesses that demonstrate attention to detail.

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific business needs and brand identity. A personalized approach ensures that the document aligns with the services you offer, the payment methods you accept, and your company’s overall professional image. By adjusting key elements, you can make your records more effective and client-friendly, while also maintaining consistency across your operations.

Personalizing Key Details

Start by adding your company’s logo, contact information, and a unique branding style. This not only makes the document look more professional but also reinforces your business’s identity. Other details you may want to include are:

- Service descriptions tailored to what your business offers.

- Payment terms that reflect your standard policies.

- Tax rates and additional fees for clarity and compliance.

Adjusting the Layout and Design

The layout and design of your billing document should reflect the nature of your business and the preferences of your clients. You can adjust font sizes, colors, and section organization to make the document both aesthetically pleasing and easy to read. Customizing the design can also include making the document simple and straightforward or adding more detailed sections if needed. A clean, organized layout not only improves readability but also shows attention to detail, which can positively influence how clients perceive your business.

Key Elements of a Billing Document

A well-structured billing document should clearly communicate all relevant information related to the transaction. To avoid confusion and ensure both parties are on the same page, it’s essential to include certain key components. These elements not only help with accuracy but also demonstrate professionalism, which builds trust with your clients.

The essential elements of a comprehensive billing document include:

- Business Information: Your company’s name, address, phone number, and email address should be easily visible. This allows customers to contact you with any questions or concerns regarding the payment.

- Client Details: Including the customer’s name, contact information, and address ensures the document is personalized and accurately linked to the correct party.

- Service Description: Each service rendered should be itemized with clear descriptions, dates, and pricing. This prevents any ambiguity about what the customer is being charged for.

- Pricing Breakdown: Including individual service costs, taxes, and any additional charges ensures transparency in the total amount due.

- Payment Terms: Specify payment due dates, acceptable methods of payment, and any late fees or discounts for early payment to set clear expectations for both parties.

Choosing the Right Template for Your Business

Selecting the right structure for your billing documents is essential for streamlining your business operations. A well-suited design can help you maintain organization, ensure accuracy, and improve customer satisfaction. The right choice will depend on your business size, service offerings, and branding needs.

When choosing a suitable format, consider the following factors:

- Business Type: Make sure the structure aligns with the nature of your services. For instance, a detailed breakdown might be necessary for complex services, while simpler formats work better for basic offerings.

- Customization Options: Look for a structure that allows you to easily modify sections, whether it’s for adding discounts, taxes, or adjusting pricing. Flexibility is key for long-term use.

- Brand Alignment: Ensure that the design complements your company’s brand identity. A consistent look across all customer-facing documents reinforces your professionalism.

- Ease of Use: Choose a layout that is simple for both you and your clients to navigate. An easy-to-read structure reduces errors and enhances the customer experience.

By considering these factors, you can select a format that not only meets your operational needs but also helps to present your business in a polished, professional manner.

Free Billing Document Templates

There are many resources available online for obtaining free, customizable billing formats. These templates can help you streamline your payment process, reduce administrative workload, and maintain professionalism. Using a pre-designed structure allows you to quickly generate accurate documents without the need to design them from scratch.

Here are some key benefits of using free billing document formats:

- Cost-Effective: Free formats eliminate the need for expensive software or professional design services, making it an affordable option for businesses of any size.

- Customization: Many free options offer a high level of flexibility, allowing you to modify details such as branding, service descriptions, and payment terms.

- Time-Saving: With pre-made designs, you can quickly create a professional-looking document without spending time on formatting and layout.

- Variety of Options: There are numerous free designs available, offering different styles, layouts, and functionalities to match your specific needs.

By choosing the right free option, you can create effective and professional billing documents that help improve your financial management and client interactions.

How to Include Service Details

Including accurate and detailed information about the services provided is essential for creating clear and transparent billing documents. By properly outlining the work completed, you ensure that your clients understand exactly what they are paying for, which helps avoid any confusion or disputes. A well-structured description also reflects the professionalism of your business.

Here’s how to effectively incorporate service details into your document:

- Provide a Clear Description: List each service with a short, precise description. This ensures the client knows exactly what they are being charged for, whether it’s a basic task or a more specialized service.

- Include Service Dates: Always include the date(s) the service was provided. This adds clarity and helps with record-keeping for both you and your client.

- Specify Quantities and Rates: If applicable, detail the amount of each service performed (e.g., hours worked or units used) along with the rate for each item. This helps break down the total cost.

- Itemized Costs: Break down the total cost by each service offered, listing individual prices. This transparency ensures the client understands how the final amount was calculated.

- Optional Add-Ons: If there are any additional services or products offered during the transaction, be sure to include them as separate line items, clearly marked as optional or additional.

By carefully outlining these details, you enhance communication with your clients and establish a clear record of the services rendered, improving both customer satisfaction and your business’s financial accuracy.

Adding Taxes and Fees to Invoices

Incorporating taxes and additional charges into your billing documents is an essential part of ensuring financial accuracy and compliance with local regulations. It’s important to clearly outline these charges to maintain transparency with your clients and avoid misunderstandings. Properly documenting taxes and fees also helps keep your business organized when it comes to accounting and tax reporting.

Here’s how to effectively add taxes and fees to your billing records:

- Specify Tax Rates: Clearly state the tax percentage applied to each service. Ensure that the rate corresponds with the local tax laws in your area or the client’s location if applicable.

- Itemize Additional Fees: If you charge extra for specific services, such as rush fees or premium options, list them separately. This helps your clients understand what they are being charged for beyond the base service.

- Explain Charges Clearly: When adding taxes or additional fees, provide a brief explanation so the client knows exactly why they are being charged extra.

- Include Subtotals: Before adding taxes or fees, provide a subtotal for the services rendered. Then, show the tax or fee amount as a separate line item. Finally, display the total amount due, which should include the service charges, taxes, and any additional fees.

By clearly outlining taxes and additional fees in your records, you demonstrate professionalism and transparency. This reduces the risk of disputes and ensures a smooth transaction process with your clients.

Best Practices for Invoice Design

Creating a visually appealing and easy-to-read billing document is crucial for ensuring clarity and professionalism. A well-designed document not only improves communication but also strengthens your brand’s image. By following some basic design principles, you can make sure that your billing records are both functional and aesthetically pleasing.

Here are some best practices to follow when designing your billing documents:

- Keep It Simple: A clean, uncluttered layout ensures that all key information is easy to locate. Avoid overloading the document with excessive text or complex designs that may distract from the important details.

- Use Clear Headings and Subheadings: Organize the document with clear section titles for easy navigation. This helps both you and your client quickly find information such as service descriptions, payment terms, and totals.

- Consistent Fonts and Colors: Stick to a simple font style and use colors that align with your brand. Consistency in typography and colors helps reinforce your business’s identity and makes the document look more professional.

- Ensure Readability: Use a font size large enough for comfortable reading, particularly for important details like total amounts due and payment instructions. Clear spacing between lines and sections also contributes to a more organized look.

Additionally, organizing financial information in a structured table can significantly improve the clarity of the billing record. A table helps break down the details in an easily digestible format:

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Basic Service | 1 | $50 | $50 |

| Additional Service | 2 | $30 | $60 |

| Total | $110 | ||

By following these simple design practices, you can create a more effective and professional billing document that improves both organization and client satisfaction.

How to Track Payments with Invoices

Effectively tracking payments is a crucial part of maintaining healthy cash flow and ensuring your business operations run smoothly. Properly documenting each transaction allows you to monitor outstanding balances, manage overdue payments, and keep accurate records for accounting purposes. A well-organized system for tracking payments helps you stay on top of finances and provides a clear overview of your revenue stream.

Essential Payment Tracking Information

To track payments accurately, your billing documents should include key details that allow for easy reference and follow-up. These include:

- Payment Due Date: Clearly stating the due date helps both you and your client understand the timeline for payment. This can also serve as a reminder for clients who may have missed the deadline.

- Payment Method: Indicate the method of payment (e.g., cash, credit card, bank transfer) on the document. This helps keep track of how payments were made and provides a reference for your accounting system.

- Paid Amount: If a partial payment has been made, ensure that the amount received is recorded. This ensures that the remaining balance is clear to both parties.

- Balance Due: Always show the outstanding amount due, if applicable. This makes it easy to follow up on unpaid balances and maintain accurate financial records.

Using Digital Tools for Payment Tracking

Digital tools and accounting software can greatly simplify the process of tracking payments. These tools allow you to create records, monitor due dates, and receive payment notifications all in one place. With automated reminders, you can follow up with clients who haven’t paid by the due date, reducing the risk of missed payments.

By including all relevant payment details in your billing documents and using the right tools for tracking, you can stay on top of your financial management and ensure timely payments.

Common Mistakes to Avoid in Billing Documents

Creating a billing document that is clear, accurate, and professional is essential for smooth financial transactions. However, certain mistakes can easily undermine the effectiveness of your document, leading to confusion, delays, or even disputes. By being aware of common errors, you can ensure your records remain reliable and foster positive client relationships.

1. Missing or Incorrect Client Information

One of the most common mistakes is failing to include accurate client details or making errors in their contact information. This can lead to confusion and payment delays. Always double-check:

- Client’s full name or business name.

- Accurate address, email, and phone number.

- Correct payment information, especially if there are multiple points of contact.

Incorrect or missing details can make it difficult to reach the client, and in some cases, lead to delayed payments or lost communication.

2. Not Including All Relevant Charges

Omitting additional charges such as taxes, optional services, or discounts can result in confusion or underpayment. Always ensure that all services provided are listed with clear descriptions and associated costs. If any taxes or additional fees apply, clearly show them as separate line items to avoid misunderstandings. In addition:

- List any discounts or promotional offers if applicable.

- Ensure that rates, such as hourly or per-unit prices, are clearly stated.

- Provide clear explanations for any fees that may be seen as additional charges.

3. Lack of Payment Terms and Due Dates

Failing to specify payment terms or due dates can lead to delayed payments and client confusion. Always state clearly:

- The exact due date for the payment.

- The acceptable payment methods (e.g., bank transfer, credit card, etc.).

- Any penalties for late payments, if applicable.

Without these details, clients may feel uncertain about when or how to pay, which can result in missed payments or unnecessary follow-ups.

By avoiding these common mistakes, you can ensure that your billing documents are clear, comprehensive, and easy to process, ultimately contributing to a more efficient and professional business operation.

Understanding Numbering System for Billing Documents

A clear and consistent numbering system is vital for keeping your financial records organized and ensuring that transactions are tracked efficiently. A well-structured numbering system allows you to easily reference specific documents, helps prevent errors, and simplifies your accounting processes. It also helps you maintain a clear chronological order of all transactions.

Why Numbering Matters

Numbering your billing documents properly not only provides structure but also serves multiple purposes:

- Tracking Payments: Unique numbers allow you to quickly locate a specific transaction, making it easier to follow up on payments and resolve any discrepancies.

- Legal and Tax Purposes: In many jurisdictions, numbering your billing documents in a sequential order is a requirement for tax and legal compliance. It ensures that all transactions are accounted for.

- Professionalism and Organization: A well-organized numbering system demonstrates professionalism and instills confidence in your clients, making the transaction process smoother.

How to Structure Your Numbering System

When setting up a numbering system for your documents, consider the following elements:

- Sequential Numbers: Use a simple sequential numbering method (e.g., 001, 002, 003) to ensure that each document has a unique identifier. This helps you avoid duplicates and makes the record-keeping process easier to manage.

- Prefix or Suffix: You may choose to add a prefix or suffix to the number for additional context, such as the year or client code (e.g., 2024-001 or ABC-001), which can be helpful for categorizing or sorting documents.

- Consistency: Stick to a consistent format across all documents. This will make it easier to search for and retrieve past transactions when needed.

By implementing a clear and systematic numbering approach, you ensure that your billing documents remain organized, accurate, and easily accessible. This also facilitates better communication and smoother financial tracking for your business.

How to Send Billing Documents to Clients

Sending billing documents to clients is a crucial step in the payment process. The way you deliver these records not only impacts how quickly you receive payments, but also influences your professionalism and client relationships. There are several methods available, each with its own advantages, and choosing the right one can help ensure that the transaction is completed smoothly and efficiently.

Methods of Sending Billing Records

There are various ways to deliver your billing documents, and the choice depends on your preferences, client needs, and the nature of your business. The most common methods include:

- Email: Sending documents via email is one of the quickest and most efficient methods. You can attach the billing record as a PDF or another file format that your client can easily access. Ensure that the subject line clearly indicates it’s a payment document to avoid confusion.

- Postal Mail: For clients who prefer physical copies or for larger businesses that require paper documentation, sending documents by mail may still be necessary. Be sure to use a reliable postal service to avoid delays.

- Online Platforms: Some businesses use online invoicing platforms or payment systems that automatically send billing records and allow clients to pay directly. These platforms often include tracking features to monitor when the document has been viewed and paid.

Best Practices for Sending Billing Documents

Regardless of the method you choose, it’s important to follow certain best practices when sending billing documents to clients:

- Be Clear and Concise: Ensure that the subject and body of your message are clear and to the point. Mention the amount due, the due date, and any payment instructions directly in the communication.

- Confirm Delivery: If you’re sending the document through email, request a read receipt or follow up to confirm that the client has received it. For postal mail, consider using a service that provides tracking.

- Follow Up: If the payment is not received by the due date, follow up promptly with a polite reminder. If you’re using an online system, many platforms have automated reminder features to help you stay on top of overdue payments.

By choosing the right method and maintaining clear communication with your clients, you can streamline the billing process and reduce the chances of payment delays.

Maintaining Billing Records for Tax Purposes

Keeping accurate and organized records of all your financial transactions is essential for both business management and tax compliance. Proper documentation allows you to calculate taxable income, track deductible expenses, and ensure that your business remains in good standing with tax authorities. A systematic approach to maintaining records helps minimize the risk of errors during tax preparation and makes the auditing process smoother if required.

Here are a few key practices to follow when managing your financial records for tax purposes:

- Keep Detailed Records: Store all relevant documents, including receipts, transaction records, and payment confirmations. Detailed records help verify income and expenses in case of audits or tax filings.

- Organize by Date: Sort your documents chronologically to make it easier to track the flow of payments and identify any gaps in records. Using monthly or quarterly categories will also help streamline the process during tax season.

- Track Taxes Separately: If applicable, keep a separate record of all taxes paid and collected. This includes sales taxes, service taxes, or any other relevant fees that may impact your taxable income or expenses.

- Use Digital Tools: Leverage accounting software or digital record-keeping platforms to automate the process of tracking and organizing your financial documents. These tools help reduce errors and ensure your records are always up-to-date.

Having organized billing records ensures that you can easily access the necessary information when filing taxes, providing peace of mind and minimizing the risk of non-compliance. Additionally, well-maintained records can also serve as a valuable tool for evaluating your business’s financial health.

Billing Documents for Different Business Models

Every business model has unique needs when it comes to generating financial records. Whether you run a service-based business, a product-oriented enterprise, or a hybrid model, it’s essential to customize your billing documents to reflect your specific services, pricing structure, and payment terms. Tailoring your documents ensures accuracy, improves customer satisfaction, and streamlines financial management.

1. Service-Based Businesses

For businesses that provide services, the billing document should focus on clearly detailing the services provided, the duration or scope of the service, and the corresponding fees. These businesses often deal with hourly rates, project-based pricing, or recurring services, so it’s crucial to list the following:

- Service Description: Include a detailed explanation of the services rendered, ensuring that the client understands exactly what they are being charged for.

- Hourly or Flat Rates: Specify the rate being charged, whether it’s hourly, per project, or as part of a subscription model.

- Payment Terms: State the due date and any applicable late fees or discounts for early payment.

2. Product-Based Businesses

For businesses that sell products, the billing record should include product details, quantities, prices, and any additional shipping or handling fees. Key elements for this model include:

- Product Listings: Include a description of each product, including quantities and unit prices, so the customer can easily identify what they are being charged for.

- Discounts and Promotions: If applicable, highlight any discounts, offers, or promotional pricing that applies to the purchase.

- Shipping and Handling Fees: Clearly state any shipping or handling charges, as these are often additional to the product price.

Customizing billing documents according to your business model ensures transparency with clients, reduces the risk of errors, and improves the overall client experience.

Tools to Create Billing Documents

In today’s digital age, generating accurate and professional billing records has become easier than ever. A variety of tools are available that allow business owners to create customized, error-free documents quickly. These tools range from basic templates to advanced software solutions, all designed to simplify the billing process, improve efficiency, and ensure compliance with business requirements.

1. Online Billing Software

Online platforms provide robust features for creating, managing, and sending financial documents. These tools often offer templates and automation features that save time and reduce human error. Some benefits include:

- Automated Calculations: Automatically calculate totals, taxes, and discounts, reducing manual errors.

- Recurring Billing: Set up subscription-based billing for regular clients.

- Customization: Tailor document formats with your business branding, including logos, colors, and fonts.

2. Spreadsheet Software

For those who prefer a more hands-on approach, spreadsheet programs like Microsoft Excel or Google Sheets are widely used for creating billing records. With a little setup, you can customize your own formulae to track services, rates, taxes, and totals. Some advantages of using spreadsheets include:

- Full Customization: Design your documents from scratch, adding or removing fields as needed.

- Data Organization: Easily store and organize historical billing data for reference.

- Cost-Effective: Many spreadsheet programs are free or come with existing software packages.

Comparison of Popular Tools

| Tool | Features | Best For |

|---|---|---|

| FreshBooks | Automated billing, client management, expense tracking | Small businesses and freelancers |

| Wave | Free invoicing, receipt scanning, accounting features | Startups and small businesses on a budget |

| Microsoft Excel | Custom templates, formulas, data management | Businesses that want full control over design |

| Zoho Invoice | Customizable templates, multi-currency support | Businesses with global clients |

Choosing the right tool depends on your business needs, budget, and level of customization required. Whether you use a

How to Handle Billing Disputes

Disputes over billing can arise for various reasons, such as misunderstandings about charges, discrepancies in services rendered, or errors in documentation. Handling these situations efficiently and professionally is crucial for maintaining good customer relationships and protecting your business’s reputation. By following clear communication strategies and staying organized, you can resolve these disputes quickly and fairly.

1. Review the Billing Details

When a dispute arises, the first step is to carefully review the details of the transaction. Make sure that the information on the billing document is accurate, including the services or products provided, the pricing, and the payment terms. Compare the disputed items with any agreements, contracts, or correspondence with the client to verify the accuracy of the charges.

- Verify the Dates: Ensure that the dates of service and payment terms are correct.

- Check for Errors: Double-check for any mathematical errors or missed discounts that might have caused the issue.

- Review Communication: Look back at any previous communications or agreements to ensure that expectations were clearly set.

2. Communicate Clearly with the Client

Once you’ve reviewed the details, reach out to the client promptly to address the dispute. Open, respectful communication is key to resolving any issue. Follow these best practices for effective communication:

- Stay Professional: Approach the conversation with a calm and professional tone, focusing on finding a solution.

- Be Transparent: If there is an error on your part, acknowledge it and explain the steps you will take to correct it.

- Offer Solutions: If the dispute is due to a misunderstanding or minor discrepancy, offer to adjust the charges, provide a discount, or issue a refund if necessary.

By being proactive and addressing disputes early, you can often resolve them amicably without further escalation. Effective handling of billing conflicts not only ensures smoother transactions but also helps build trust and loyalty with your clients.