Car Shop Invoice Template for Easy and Professional Billing

Efficient billing is essential for any business, especially in industries that require clear financial documentation for goods and services rendered. Whether you’re running a small independent business or managing a larger operation, having a reliable system in place can save you time and prevent costly mistakes. Using well-structured documents for transactions ensures transparency and fosters trust with your clients.

Professional and organized billing is not just about tracking payments but also about enhancing your overall customer experience. With the right tools, you can automate many aspects of the process, making it quicker and less prone to errors. Whether it’s for repairs, parts sales, or service charges, a properly formatted record can help you maintain accurate financial records and avoid confusion down the road.

In this guide, you’ll learn how to create and manage customized documents tailored to your specific needs, from basic details to advanced features. These documents can be personalized to match your business style and branding, ensuring every transaction reflects your professionalism and attention to detail.

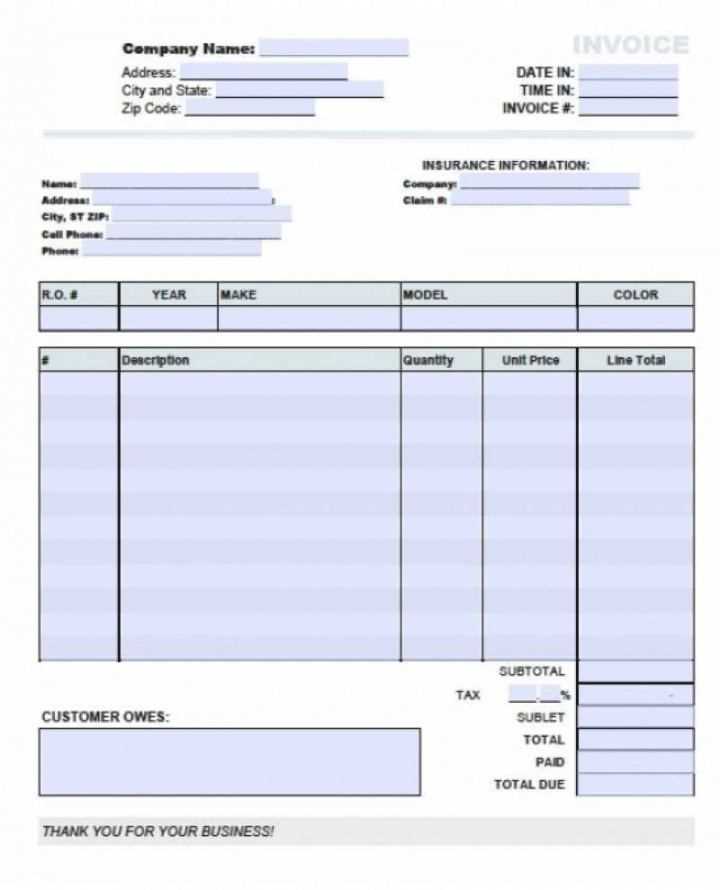

Car Shop Invoice Template Overview

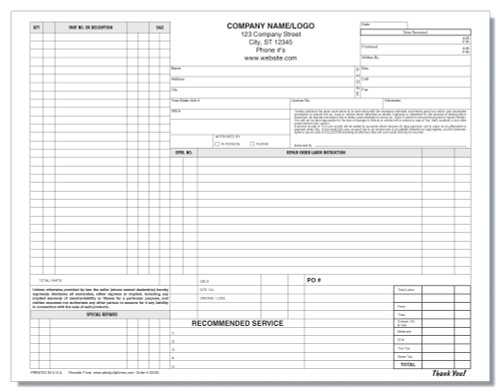

In any automotive business, clear and accurate documentation is crucial to ensure proper record-keeping and smooth financial transactions. A well-organized document helps outline the charges for services rendered or goods sold, ensuring both the business and customer are on the same page. These records not only serve as proof of the transaction but also play a role in managing payments, taxes, and future accounting processes.

Using a structured document allows businesses to streamline their operations, maintain professional communication, and minimize errors that could lead to disputes or confusion. A properly formatted document is key for maintaining consistency and ensuring that all necessary details are included. Whether you’re working with a simple repair service or handling parts sales, the right structure helps facilitate a seamless experience for both you and your clients.

Key Features of an Effective Document

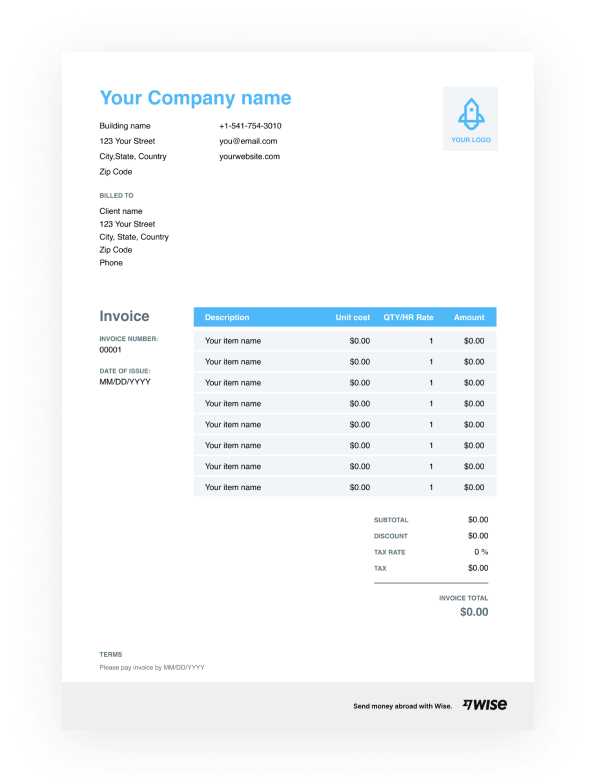

- Clarity and Simplicity: Ensures both parties understand the charges and services listed.

- Comprehensive Details: Includes essential information such as date, items or services provided, costs, and payment terms.

- Customizability: Allows you to add your business name, logo, and any additional fields specific to your needs.

- Professional Design: Enhances your credibility and reinforces your business brand.

Benefits of Using Pre-built Documents

- Time Efficiency: Pre-built formats help you generate documents quickly without reinventing the wheel.

- Accuracy: Ensures all necessary information is included and avoids mistakes.

- Legal Compliance: Guarantees that all critical elements are covered, which can help with tax filings and audits.

- Cost-Effective: Using a free or affordable pre-made version helps you avoid the need for expensive software or custom designs.

Why You Need an Invoice Template

In any business, having a structured document to track transactions is essential for maintaining order and professionalism. Without a clear, consistent method for recording sales, services, and payments, it becomes difficult to keep accurate financial records, which can lead to confusion, missed payments, or even disputes with clients. A ready-to-use format offers a straightforward way to ensure every detail is covered, streamlining the entire process and reducing the risk of errors.

Utilizing a well-organized document also helps establish a formal relationship with customers, as it reflects a business’s attention to detail and commitment to transparency. Whether you’re handling a one-time service or managing ongoing client relationships, having a reliable system for documenting transactions fosters trust and reinforces your professionalism.

Moreover, using such a format can save significant time and effort. By relying on a pre-designed structure, businesses can quickly generate consistent records without starting from scratch each time. This efficiency not only simplifies day-to-day operations but also frees up resources to focus on other important aspects of running the business.

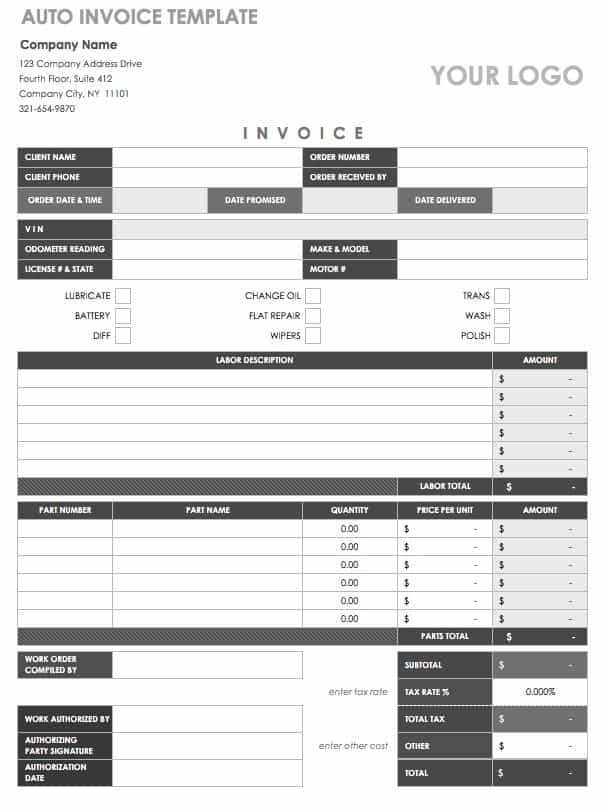

Key Elements of a Car Shop Invoice

To ensure clarity and professionalism in any financial transaction, certain details must always be included in a document outlining services or goods provided. These critical components serve to avoid confusion, establish expectations, and ensure both parties have a clear understanding of the exchange. A properly structured record not only facilitates payments but also supports future accounting and tax processes.

Here are the key elements that should be included to create a comprehensive and effective document:

- Business Information: The name, address, phone number, and email of the company issuing the document. This helps identify the business and provides the recipient with contact information in case of questions or disputes.

- Client Details: The recipient’s name, address, and contact information. Having this ensures the transaction is correctly attributed and can help in case of follow-up or reminders.

- Document Date: The date the transaction occurred or when the document was generated. This serves as a reference point for payment deadlines and record-keeping.

- Unique Identification Number: A unique reference number for the document that helps in tracking and organizing records for future reference.

- Description of Products or Services: A detailed breakdown of the items or services provided, including quantities, unit prices, and total costs. This helps clarify what the customer is being charged for.

- Amount Due: The total amount owed for the transaction, including any applicable taxes, fees, or discounts. This ensures the customer knows exactly what they need to pay.

- Payment Terms: The conditions for payment, including the due date, accepted payment methods, and any late fees that may apply if payment is not made on time.

- Tax Information: The breakdown of any taxes applied to the total cost, including tax rates and amounts, to ensure transparency and compliance with tax laws.

- Business Logo and Branding: Including your company’s logo and branding elements helps reinforce the business identity and adds a professional touch to the document.

These essential elements contribute to a clear, organized, and professional document that both the business and the client can refer to with confidence. By ensuring all these details are included, you can avoid potential misunderstandings and ensure a smooth

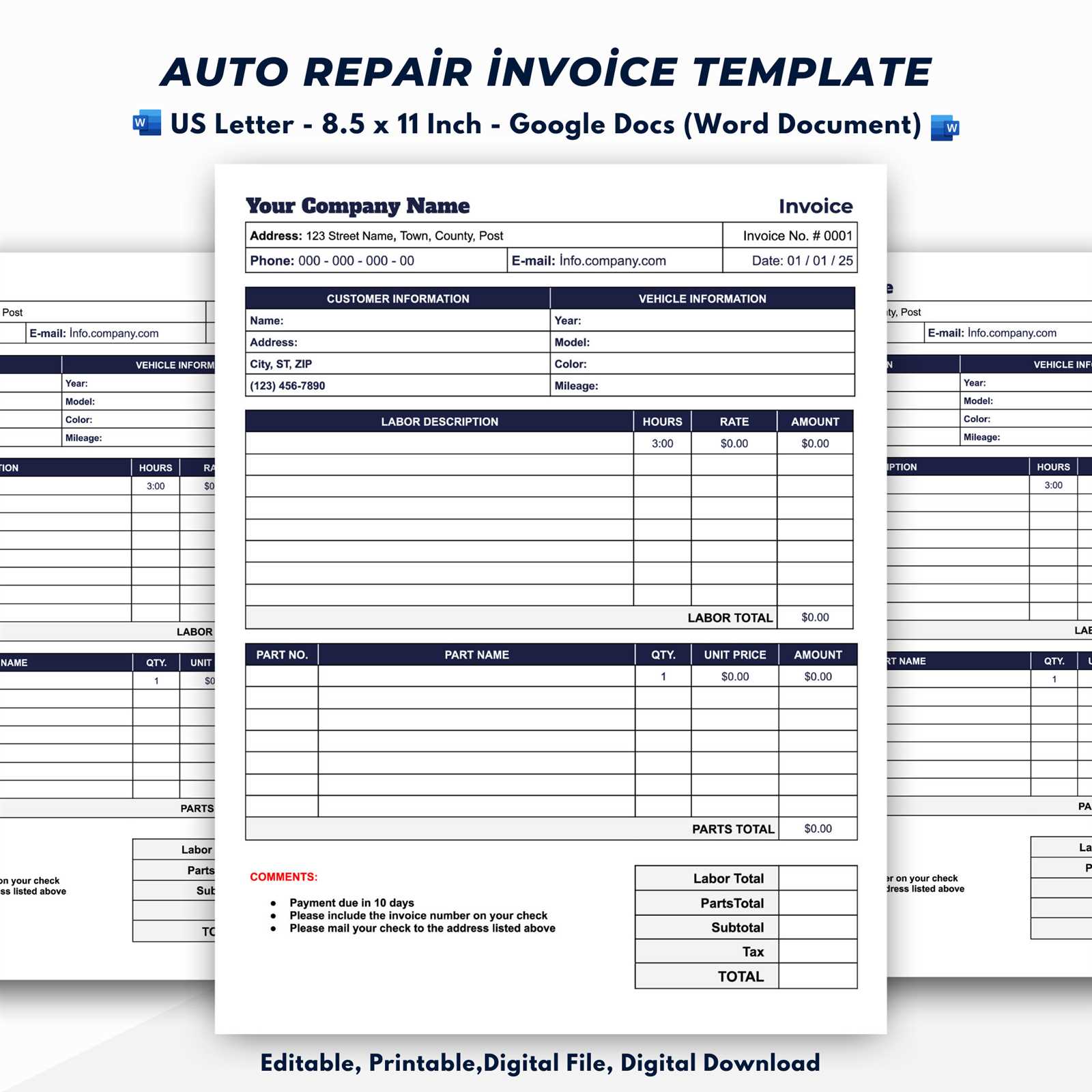

How to Create Your Own Template

Designing your own structured document for tracking transactions can be a straightforward process with the right approach. Whether you’re looking to reflect your business’s unique branding or include specific details tailored to your operations, creating a custom format ensures that all necessary information is presented clearly and consistently. A personalized document helps maintain professionalism and makes it easier to manage your financial records effectively.

Follow these steps to create a customized format that meets your business needs:

Step-by-Step Guide

- Choose the Right Platform: Select a tool or software that allows you to create and modify documents easily, such as a word processor, spreadsheet software, or specialized billing software.

- Set Up the Layout: Decide on a layout that is easy to read and visually appealing. Keep the design simple but professional, ensuring that all sections are clearly separated and easy to navigate.

- Include Essential Details: Make sure to include all the key elements: business and client information, transaction date, item descriptions, total costs, payment terms, and any other relevant data.

- Add Custom Branding: Incorporate your company’s logo, colors, and fonts to make the document reflect your business identity.

- Define Payment Terms: Clearly state the payment methods you accept, any applicable taxes, discounts, or additional charges, as well as the payment due date.

- Save for Future Use: Once you’ve created the document, save it in a reusable format, such as a template, so you can quickly fill in the details for future transactions.

Best Practices for Customization

- Consistency: Keep the layout and structure consistent across all documents to help customers quickly recognize your records.

- Simplicity: Avoid clutter. Use clear fonts, appropriate spacing, and keep the information concise.

- Flexibility: Make sure your document can be easily updated or modified to fit different transaction types or customer needs.

By following these steps, you can create a functional and professional document that reflects your business’s operations while ensuring accurate, organized records for both you and your clients.

Benefits of Using a Pre-made Invoice

Utilizing a pre-designed document for financial transactions can provide significant advantages for any business. Rather than spending time creating a record from scratch, a ready-made option allows you to focus on other important tasks while ensuring that all necessary details are included. These pre-designed documents are often carefully crafted to meet legal and industry standards, which can help streamline your operations and avoid costly mistakes.

By using a pre-made format, you can increase efficiency, reduce errors, and maintain consistency across your financial records. This method ensures that your documentation is professional and complies with essential business practices without requiring significant time or resources to create custom solutions.

Key Advantages

- Time-Saving: Pre-designed documents eliminate the need for you to start from scratch, allowing you to quickly generate records for every transaction.

- Consistency: Using a standard format for all transactions ensures that each document looks professional and contains the same key elements, reducing confusion.

- Professional Appearance: A polished, ready-made document enhances your business’s reputation and reinforces the impression of a well-organized operation.

- Accuracy: Pre-made options are typically well-structured and include all required fields, reducing the chances of missing important details that could lead to mistakes or disputes.

Legal and Tax Benefits

- Compliance: Pre-designed documents are often created with legal and tax guidelines in mind, helping to ensure that your records comply with local regulations.

- Audit Readiness: Using standardized formats helps you maintain accurate, easily accessible records, which can be invaluable in case of audits or financial reviews.

Incorporating a pre-made solution into your workflow not only saves time but also contributes to more reliable, professional, and legally compliant documentation. Whether you’re a small business owner or managing a larger operation, this approach can simplify financial management and improve overall efficiency.

Customizing Your Car Shop Invoice

Personalizing your financial records not only helps reinforce your business’s identity but also ensures that all the details are presented in a way that works best for you and your customers. Customizing a standard document gives you the flexibility to highlight specific services, adjust layouts, and add branding elements, making it a reflection of your business operations and values. Whether it’s including a logo, adjusting the color scheme, or modifying the content, customizing ensures the document meets both practical and professional needs.

Here are some areas you can focus on when tailoring a document to suit your needs:

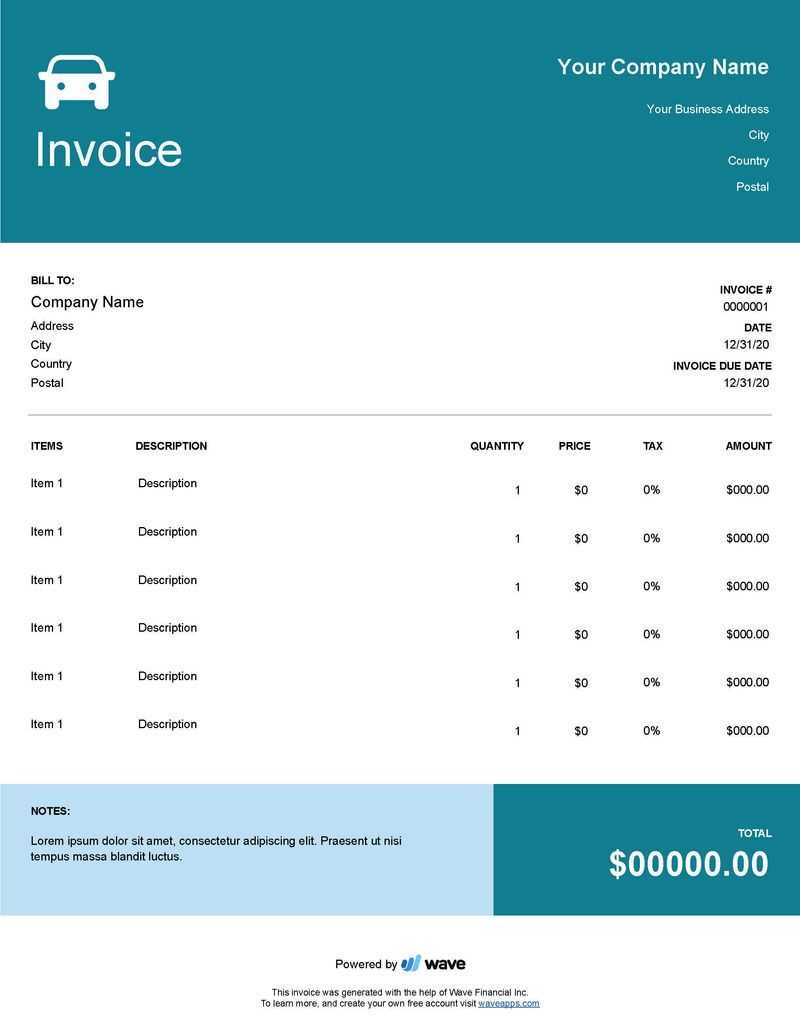

| Customizable Element | What to Consider |

|---|---|

| Logo and Branding | Include your business logo, colors, and fonts to give the document a consistent brand identity. |

| Field Layout | Adjust the positioning of sections like service descriptions, payment terms, and tax information to prioritize the most important details. |

| Additional Information | Add custom fields such as customer reference numbers, specific service categories, or discount codes relevant to your business model. |

| Payment Terms | Tailor the payment methods and deadlines to reflect the standard practices within your business or industry. |

| Itemized Breakdown | Offer a more detailed breakdown of charges, including hourly rates for services or multiple items if needed. |

By customizing these elements, you not only make the document more functional for your specific business needs but also present a more polished and professional appearance to your clients. Personalization helps establish trust and adds a layer of professionalism that can set you apart in a competitive market.

Choosing the Right Invoice Software

Selecting the right software to manage your financial records is crucial for streamlining your business operations and ensuring accuracy. With so many options available, it’s important to choose a platform that meets your specific needs, whether you’re looking for simplicity, customization, or advanced features. The right software can save you time, reduce errors, and help you maintain professional, organized documentation for each transaction.

Factors to Consider

- User-Friendly Interface: Choose software that is easy to navigate, even for those who may not be tech-savvy. A clean, intuitive layout will help speed up the process of creating and managing documents.

- Customization Options: Look for platforms that allow you to personalize fields, logos, and other design elements, so your records reflect your brand and unique business requirements.

- Integration with Other Tools: Consider whether the software integrates with your accounting, payment, or CRM systems. This can save time by syncing data across platforms and automating various processes.

- Automation Features: Software that offers automation–such as recurring transactions, payment reminders, or tax calculations–can help simplify routine tasks and improve efficiency.

- Security and Compliance: Ensure the software complies with relevant laws and regulations and provides data protection features to safeguard sensitive customer and business information.

Popular Invoice Software Options

- QuickBooks: A popular choice for small and medium-sized businesses, offering a range of features for invoicing, accounting, and tax management.

- FreshBooks: Known for its user-friendly interface, FreshBooks is ideal for freelancers and small business owners looking for simple yet effective billing solutions.

- Zoho Invoice: Offers advanced customization options, recurring billing, and integration with other Zoho business apps, making it a great choice for growing businesses.

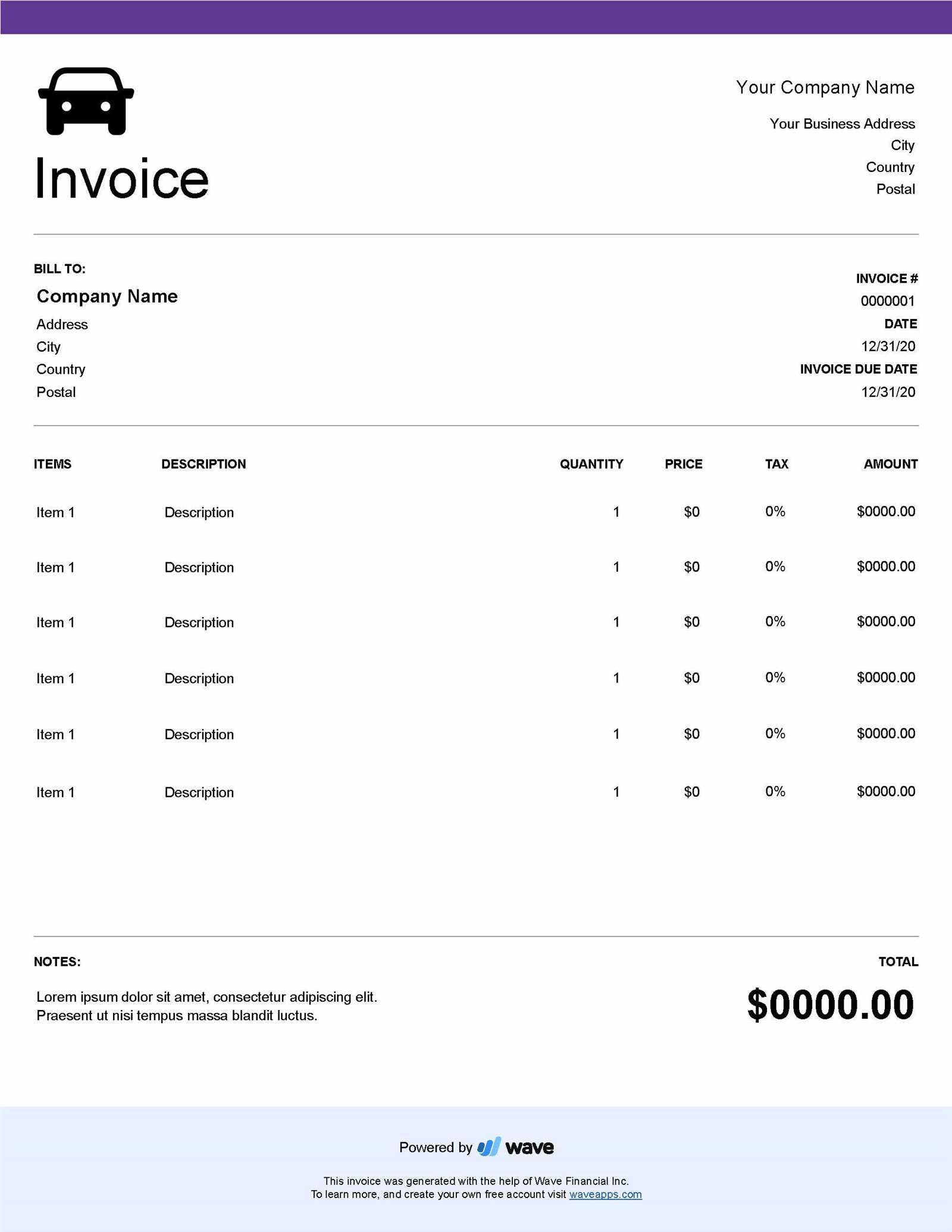

- Wave: A free invoicing and accounting software that is particularly appealing to small businesses and startups.

Choosing the right software can dramatically improve your efficiency and accuracy. Whether you’re managing a handful of clients or overseeing multiple transactions every day, the right platform will help you stay organized, professional, and compliant with industry standards.

Invoice Formatting Tips for Professionals

Creating clear, consistent, and professional financial documents is key to maintaining a trustworthy relationship with clients. A well-formatted record not only ensures accuracy but also reflects the professionalism of your business. The way you present your records can impact customer perception, making it essential to focus on clarity, structure, and design. Below are some formatting tips that will help you craft professional, easy-to-read documents.

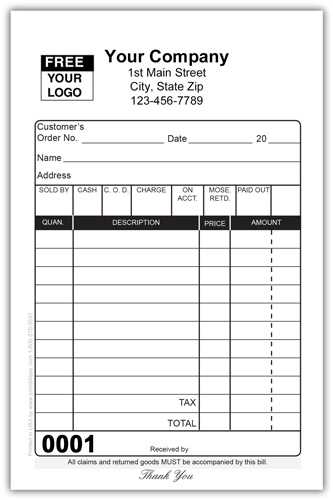

Essential Formatting Principles

- Clean Layout: Use plenty of white space to make your document easy to read. A cluttered page can confuse the reader and detract from important information.

- Consistent Font Style and Size: Stick to one or two easy-to-read fonts, and maintain consistency throughout the document. A common choice is using sans-serif fonts for better legibility.

- Clear Sectioning: Break the document into clearly defined sections–such as business information, customer details, transaction items, and payment terms. This helps the reader quickly locate important details.

- Highlight Important Details: Bold or underline key information like totals, payment deadlines, or special instructions. This helps prevent any important information from being overlooked.

- Proper Alignment: Ensure that numbers and amounts are aligned correctly, especially in columns. This makes financial calculations easier to follow and reduces the chance of errors.

Professional Design Tips

- Use Branding Elements: Incorporate your business logo, colors, and fonts to create a professional and consistent look that aligns with your brand identity.

- Include Clear Header and Footer: Place your company name, logo, and contact information in the header. In the footer, include any legal disclaimers or payment terms, making sure they’re easy to find.

- Avoid Over-Designing: While it’s important to incorporate your brand, avoid making the document too busy or colorful. Keep it professional and easy on the eyes.

- Use Tables for Itemization: Organize product or service details into a table with columns for descriptions, quantities, unit prices, and totals. This makes it much easier for clients to understand what they’re being charged for.

By following these formatting tips, you can ensure that your financial documents are not only functional but also visually appealing and professional. Clear formatting leads t

Essential Information to Include on Invoices

For any business, it’s crucial to ensure that your financial documents are comprehensive and clear. Including all necessary details not only promotes transparency but also helps both parties stay organized and avoid misunderstandings. Every well-structured document should contain specific information to ensure smooth transactions, accurate record-keeping, and compliance with regulations. Below are the essential elements you must always include when preparing such records.

Key Details to Include

- Business Information: Include the name, address, phone number, and email of your company. This allows customers to contact you easily if there are any questions or issues with the transaction.

- Customer Details: Clearly list the recipient’s name, address, and contact information. This ensures that the transaction is properly attributed to the correct individual or company.

- Document Number: Every record should have a unique reference number for easy tracking and future reference.

- Date of Transaction: The date when the service was rendered or the goods were delivered. This helps clarify the timeline of the transaction.

- Description of Goods/Services: A detailed breakdown of the items or services provided, including quantities, unit prices, and a brief description of what was delivered.

- Total Amount Due: The sum of all charges, including any applicable taxes, fees, and discounts, making it clear what the customer needs to pay.

- Payment Terms: Specify the terms of payment, such as due date, payment methods accepted, and any late fees that may apply if the payment is delayed.

Additional Considerations

- Tax Information: Include the relevant tax rates and amounts applied to the transaction to ensure clarity and compliance with tax laws.

- Discounts or Promotions: If applicable, include any discounts or promotional offers that apply to the total cost, helping customers understand the final price.

- Terms and Conditions: Outline any specific terms, warranties, or disclaimers that apply to the service or product provided, ensuring that both parties are clear on the agreement.

By including these key details, you create a clear, professional document that serves as a reliable record of the transaction. This transparency not only helps with customer relations but also ensures that your business stays compliant with legal and financial regulations.

How to Automate Invoice Generation

Automating the process of creating financial records can save businesses valuable time and reduce the chances of errors. With the right tools, you can streamline your workflow, automatically generate detailed documents, and ensure consistency across all transactions. Automation not only improves efficiency but also allows you to focus on other important aspects of your business while maintaining an accurate and organized record-keeping system.

Steps to Automate the Process

- Choose the Right Software: Select a platform that supports automatic record generation, such as cloud-based accounting or billing software. Many options offer customizable features and integrate with other tools for seamless automation.

- Set Up Client and Product Information: Input your client details and the products or services you regularly offer into the system. This will allow the software to auto-fill relevant fields for each new transaction.

- Configure Recurring Billing: If your business offers subscription-based services or regular billing, set up recurring payments in your chosen software. This will automatically generate and send records at specified intervals.

- Automate Calculations: Ensure the software is configured to calculate totals, taxes, and discounts based on the information entered. This reduces the risk of manual errors and speeds up the process.

- Integrate Payment Gateways: Link the software to your payment processor or gateway. This allows for immediate tracking of payments and, in many cases, automatic updating of records once payment is received.

- Set Up Automatic Reminders: Many software tools can send automated reminders for upcoming payments or overdue balances, helping you stay on top of collections without having to manually reach out to clients.

Benefits of Automation

- Time Savings: Automation significantly reduces the time spent on manual data entry and calculations, allowing you to focus on other tasks.

- Consistency and Accuracy: Automated systems ensure uniformity in your documents and reduce the chances of human error, providing accurate records every time.

- Faster Payments: With automated reminders and easy payment options, you can expedite the payment process, improving cash flow and reducing late payments.

- Improved Record Keeping: Automated systems store all records in one place, making it easier to track and retrieve past transactions when needed.

By implementing automated processes, you can create a more efficient, organized, and reliable billing system. Automation not only sa

Common Mistakes to Avoid in Invoices

Creating accurate and clear financial records is essential for any business, but there are several common mistakes that can undermine the effectiveness of these documents. Failing to include key details, making calculation errors, or presenting the information in a confusing way can lead to misunderstandings, delayed payments, and even legal issues. Below are some of the most frequent mistakes businesses make when preparing such records, along with tips on how to avoid them.

Key Mistakes and How to Avoid Them

| Mistake | How to Avoid It |

|---|---|

| Missing Contact Information | Ensure that both your company and the customer’s contact details are listed clearly, including names, addresses, phone numbers, and email addresses. |

| Incorrect or Missing Dates | Always include the correct date of issue and the date the goods or services were provided. Double-check the timeline for accuracy. |

| Ambiguous Descriptions | Provide clear, concise descriptions for all goods or services. Include details such as quantity, unit price, and specific service provided to avoid confusion. |

| Omitting Payment Terms | Clearly state payment due dates, accepted payment methods, and any late fees or discounts for early payments. |

| Calculation Errors | Double-check all totals, taxes, and discounts. Use automated tools if possible to avoid mistakes in calculations. |

| Failure to Include a Unique Reference Number | Assign a unique reference number to each document. This makes tracking transactions easier and helps prevent confusion in case of disputes. |

| Unprofessional Layout | Maintain a clean, organized layout. Use consistent fonts, headers, and clear sectioning to make the document easy to read. |

Avoiding these common mistakes will not only help you create more accur

How to Add Taxes to Your Invoice

Including taxes in your financial documents is essential to ensure that both you and your clients are clear on the total amount due. Whether it’s a sales tax, VAT, or another type of levy, it’s important to calculate and present taxes correctly to maintain transparency and compliance with local tax laws. In this section, we’ll walk through the steps you should take to accurately add taxes to your records and avoid any confusion during the payment process.

Steps to Properly Add Taxes

- Determine the Applicable Tax Rate: Research the correct tax rate for the product or service you provide based on your location or the client’s location. This may differ depending on local laws and industry-specific regulations.

- Calculate the Taxable Amount: Determine which portion of the total amount is taxable. Some products or services may be exempt from taxes, so be sure to calculate taxes only on taxable items.

- Apply the Tax Rate: Multiply the taxable amount by the appropriate tax rate to calculate the total tax amount. For example, if the tax rate is 10% and the taxable amount is $100, the tax would be $10.

- List Tax Separately: Clearly show the tax amount as a separate line item on your document. This helps your client understand the exact breakdown of charges, including how much is attributed to taxes.

- Include Tax Identification Information: If required by local tax authorities, include your tax identification number or business registration number on the document. This can help your clients with their own accounting and make the transaction more official.

Tax Calculation Example

| Description | Amount |

|---|---|

| Product/Service Total | $200 |

| Sales Tax (10%) | $20 |

| Total Due | $220 |

By following these steps, you can ensure that taxes are properly calculated and clearly presented to your clients, avoiding misunderstandings and maintaining compliance with tax laws. Always check with a tax professional to confirm that you are applying the correct rates and following all legal requirements f

Invoice Payment Terms Explained

Setting clear and precise payment terms is essential for maintaining smooth financial transactions between businesses and clients. These terms outline when and how payment should be made, helping to avoid confusion and ensure that both parties are on the same page regarding due dates, late fees, and accepted payment methods. Understanding the various options for payment terms can improve cash flow and foster better business relationships.

Common Payment Terms to Include

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due 30 days after the date the document is issued. This is one of the most common payment terms used in business-to-business transactions. |

| Due on Receipt | Payment is expected immediately upon receiving the document. This is typically used for one-time or urgent transactions. |

| Net 60 or Net 90 | Payment is due 60 or 90 days after the issue date. This option may be used for long-term projects or higher-value transactions where the client needs more time to arrange payment. |

| COD (Cash on Delivery) | Payment is due when goods are delivered, often used for deliveries that involve physical goods or services where payment is collected at the time of delivery. |

| Installment Payments | Payment is divided into multiple smaller payments made over a set period. This is common for larger purchases or services that are paid for in phases. |

Why Payment Terms Matter

- Clarifies Expectations: Clear payment terms help both the client and the business know exactly when and how much is due, reducing the risk of missed payments.

- Improves Cash Flow: By setting appropriate payment deadlines, businesses can maintain better cash flow and plan for expenses without worrying about overdue payments.

- Prevents Disputes: When the terms are explicitly stated, there is less room for confusion, ensuring that both parties are aware of the financial expectations.

- Fosters Professionalism: Well-defined payment terms present a professional image and demonstrate that you are organized and reliable.

Understanding and clearly communicating payment terms is vital for the smooth operation of any business. By selecting the most ap

Tracking Payments with Invoice Templates

Effectively monitoring payments is a key component of maintaining a healthy cash flow and staying organized in any business. By using standardized records, businesses can keep track of outstanding balances, payment statuses, and overdue amounts with ease. Whether you are handling one-time transactions or recurring payments, having a structured way to monitor and follow up on payments can save time and reduce the risk of missed or forgotten payments.

Steps to Track Payments Effectively

- Include a Payment Status Field: Always include a section where you can indicate the payment status, such as “Paid,” “Pending,” or “Overdue.” This makes it easier to track which payments have been completed and which still need attention.

- Set Up Payment Due Dates: Clearly list the due date for each transaction, allowing you to easily identify when payments are overdue and follow up accordingly.

- Use Payment Reference Numbers: If you are dealing with multiple clients or transactions, use unique reference numbers to help track each payment. This will also help with record-keeping and prevent confusion.

- Track Partial Payments: If a customer makes a partial payment, make sure to update the record to reflect the remaining balance. This ensures that both you and the client are clear on what is owed.

- Send Payment Reminders: Use automated reminders or manual follow-ups for payments that are approaching or past their due date. Sending reminders can help prevent late payments and maintain good customer relationships.

Benefits of Using Structured Records for Payment Tracking

- Improved Organization: Having a standardized system allows you to quickly access records and check the status of any transaction, reducing the risk of errors or missed payments.

- Better Cash Flow Management: By keeping track of which payments are pending or overdue, you can better predict when funds will come in and plan your finances accordingly.

- Efficient Follow-Ups: A clear payment history allows you to send timely reminders and address any overdue payments without having to search through multiple documents.

- Enhanced Professionalism: Structured payment tracking shows clients that you are organized and diligent, which can help build trust and encourage prompt payments.

By adopting a consistent approach to payment tracking, businesses can ensure t

Creating a Consistent Invoicing System

Establishing a reliable and consistent method for generating financial documents is crucial for any business. A well-organized system ensures that every transaction is recorded accurately, payments are tracked effectively, and clients know exactly what to expect. By standardizing the process of generating these documents, you can improve efficiency, reduce errors, and maintain professionalism in every interaction with clients.

Steps to Build a Reliable Billing System

- Standardize Document Format: Ensure that all records follow a consistent format. This includes having specific sections for client information, services/products provided, total amount due, and payment terms. A uniform format reduces confusion and makes it easier to review past transactions.

- Automate Where Possible: Consider using billing software or online tools that can automatically generate financial documents based on predefined templates. This saves time and reduces the chances of manual errors.

- Set Clear Payment Terms: Define the payment due date and any penalties for late payments. By having clear and consistent payment terms, you set expectations from the start, reducing disputes and misunderstandings.

- Keep a Record of All Transactions: Maintain a log of all completed transactions, including the status of payments. Whether they are paid, pending, or overdue, tracking payment status is crucial for maintaining accurate financial records.

- Regularly Review and Update Your System: Regularly evaluate the effectiveness of your billing system and make adjustments if needed. As your business grows, your invoicing needs may change, and it’s important to adapt accordingly.

Benefits of a Consistent Billing System

- Improved Cash Flow Management: A structured approach ensures that payments are received on time and helps identify overdue balances more easily.

- Increased Efficiency: By standardizing the process, you save time on creating and sending documents, which frees you up to focus on other aspects of your business.

- Better Client Relationships: A professional, consistent billing system demonstrates reliability and helps build trust with clients, encouraging timely payments and long-term partnerships.

- Reduced Errors: Standardizing the process and automating certain steps minimizes the chances of mistakes that can occur with inconsistent methods.

By creating and adhering to a consistent system for generating and managing financial documents, businesses can streamline their administrative processes, improve client satisfaction, and maintain better control over their finances. Consistency in billing is not only a time-saver but also a

Legal Considerations for Car Shop Invoices

When creating financial documents for business transactions, it’s crucial to understand the legal requirements that apply. These documents serve as an official record of the sale and may be used for tax, accounting, or legal purposes. Ensuring that all the necessary elements are included and that the document complies with relevant laws can help protect your business and prevent potential legal issues down the line. Understanding these legal considerations is vital for maintaining transparency and avoiding disputes with clients or tax authorities.

Key Legal Aspects to Consider

- Compliance with Tax Regulations: Depending on your location, you may be required to collect and report taxes on certain products or services. Ensure that your records clearly reflect the correct tax rates applied and include all necessary information for tax reporting purposes.

- Accurate Business Information: It’s essential to include accurate and complete business details on every document, such as your legal business name, address, contact information, and any relevant registration numbers. This ensures transparency and accountability.

- Clear Payment Terms: Clearly state the payment due date, applicable late fees, and any penalties for overdue payments. This not only helps manage cash flow but also provides a legal framework should any disputes arise over payment terms.

- Retention of Records: Keep accurate records of all transactions for the required length of time as mandated by local laws. This may be necessary for auditing purposes or to resolve any future disputes. In many jurisdictions, businesses are required to maintain financial documents for a certain number of years.

- Consumer Protection Laws: Be mindful of any consumer protection regulations that apply in your industry. These laws might require you to offer specific refund policies, dispute resolution processes, or other safeguards to protect customers’ rights.

How to Ensure Legal Compliance

- Consult a Legal Professional: To ensure that your business is fully compliant with all relevant laws, it’s wise to consult with a legal expert or accountant. They can help you navigate complex regulations and ensure that your documents meet all required legal standards.

- Regularly Update Your Practices: Tax laws and regulations can change frequently. Stay informed about any updates or modifications to the laws that may impact your financial documentation.

- Use Accurate Software: Consider using accounting or billing software that automatically incorporates legal requirements, such as tax rates or mandatory fields, into your documents. This can help prevent mistakes and ensure consistency in your reco

How to Handle Invoice Disputes

Disputes over payment or charges can arise in any business transaction. Whether it’s due to a misunderstanding, an error in the recorded details, or dissatisfaction with the service, handling these issues professionally and efficiently is crucial. Addressing disputes promptly and with clear communication helps maintain strong client relationships and ensures that any discrepancies are resolved fairly. Knowing how to manage these situations can prevent long-term issues and protect your business from financial strain.

Steps to Resolve Payment Disputes

- Review the Details: Before responding to a dispute, carefully review all the relevant documents and transaction history. Check for any errors or misunderstandings that may have occurred on your part, such as incorrect amounts, missing services, or misapplied discounts.

- Communicate Promptly: Address the dispute as soon as possible. Reach out to the client with a polite and professional tone, acknowledging their concerns and letting them know you are looking into the matter. Timely communication can help prevent escalation.

- Understand the Client’s Concerns: Listen carefully to the client’s side of the story. Make sure you fully understand their concerns before proposing a solution. This will show the client that you value their input and are committed to finding a fair resolution.

- Offer a Solution: If you find that there is a legitimate reason for the dispute, offer a solution that is fair to both parties. This could involve offering a discount, issuing a partial refund, or correcting an error in the original documentation.

- Document the Resolution: Once the issue is resolved, make sure to document the agreement in writing. This protects both parties and ensures there is a record of the final terms, preventing any further misunderstandings.

Best Practices for Preventing Disputes

- Be Clear and Transparent: Make sure all details on your records are clear, accurate, and transparent. This includes specifying services or goods provided, payment terms, and any additional charges. The more information you provide upfront, the less likely it is for a dispute to arise.

- Maintain Open Communication: Keep clients informed about any changes or updates regarding their transaction. Proactive communication can prevent confusion and reduce the chances of disputes later on.

- Set Clear Payment Terms: Ensure that payment deadlines, penalties for late payments, and acceptable payment methods are clearly stated and agreed upon before any services are provided. This helps manage expectations and reduces the likelihood of disagreements.

- Follow-Up Regularly: Keep track of outstanding payments and send reminders in a timely manner. Regular follow-ups show clients that you are attentive to their payment obligations and reduce the risk of delayed payments.

Handling disputes effectively requires patience, professionalism, and clear communication. By addressing issues quickly and fairly, businesses can maintain strong client relationships and avoid the negative impacts of unresolved conflicts. By following these best practices, businesses c

Best Practices for Invoice Management

Efficient management of financial documents is key to maintaining a well-organized business. It involves not only creating accurate records but also ensuring that they are processed, stored, and followed up in a timely and professional manner. By adhering to best practices, businesses can minimize errors, streamline cash flow, and ensure smooth financial operations. Proper management of these records helps prevent disputes, ensures compliance, and improves overall business efficiency.

Essential Strategies for Effective Document Management

- Maintain Accuracy: Always ensure that the details are accurate, including the amount due, payment terms, and services or products provided. Small errors can lead to confusion or disputes, so accuracy is essential.

- Automate Where Possible: Use software to automate the generation and tracking of financial records. Automation reduces the likelihood of human error, saves time, and makes it easier to maintain consistency across all documents.

- Set Clear Payment Terms: Clearly define payment expectations upfront, including deadlines, any applicable late fees, and accepted payment methods. This helps manage expectations and reduces confusion later in the process.

- Follow Up Promptly: Keep track of outstanding payments and follow up regularly. Send reminders before and after the payment due date, and ensure that any issues are addressed promptly to avoid delays in cash flow.

- Secure Storage: Store financial records in a secure, easily accessible location. Whether digital or physical, organizing documents by date, client, or category ensures quick retrieval when needed for audits or references.

Why Consistent Management Matters

- Improved Cash Flow: Timely processing and follow-up help ensure that payments are received promptly, improving overall cash flow and reducing the risk of overdue accounts.

- Reduced Errors: By standardizing your processes and using automated tools, you reduce the risk of human error, ensuring all information is consistent and accurate.

- Stronger Client Relationships: Clear, professional documentation demonstrates reliability and transparency, building trust and confidence with clients.

- Legal Compliance: Proper management of financial records ensures compliance with tax and legal regulations, reducing the risk of penalties or disputes.

By following best practices for financial document management, businesses can create a smooth, efficient workflow that minimizes errors and ensures long-term financial health. Adopting these practices promotes transparency, improves cash flow, and enhances the overall client experience.