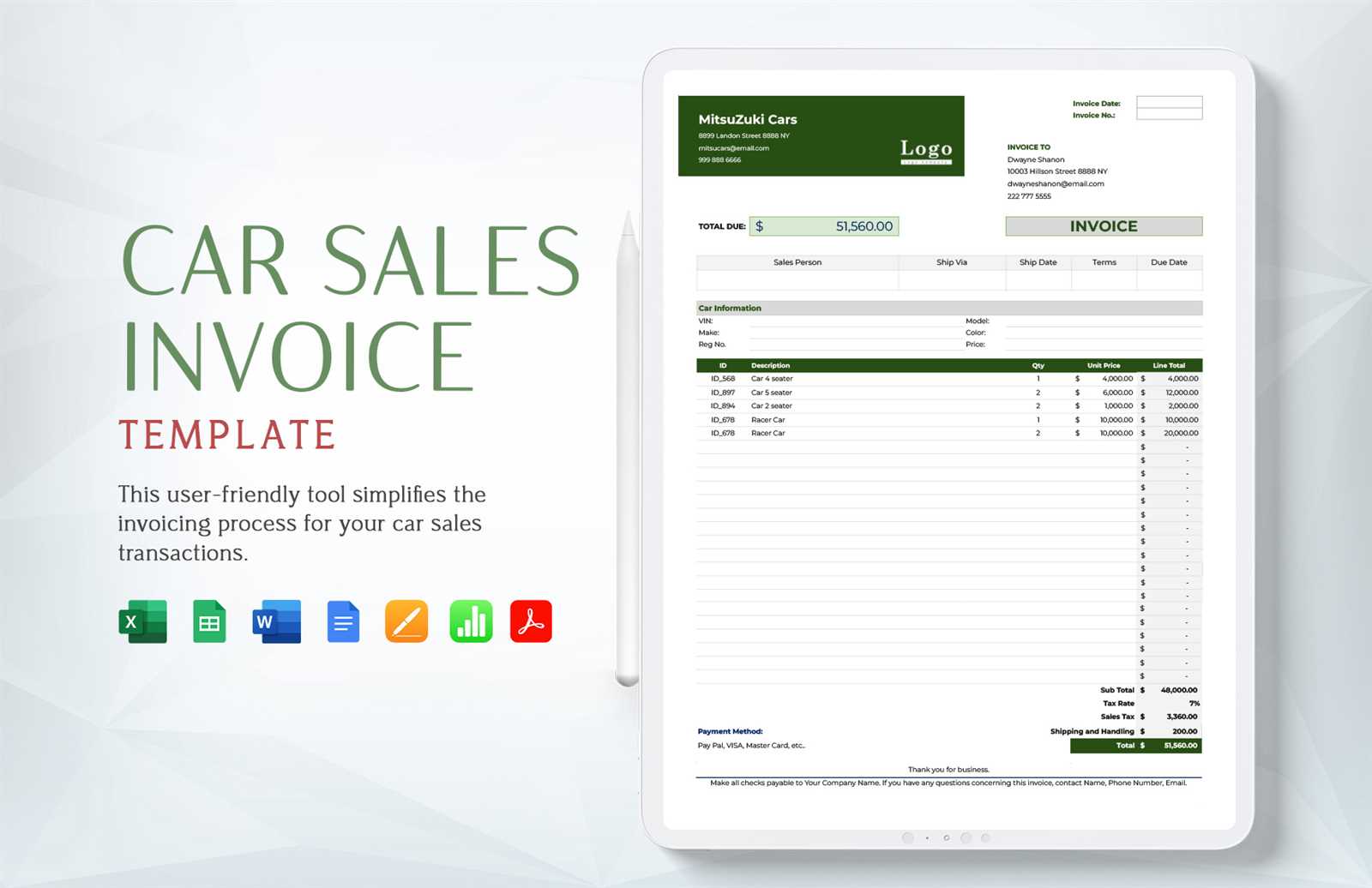

Car Sale Invoice Template for Smooth and Professional Transactions

When completing a vehicle transfer, having the right documentation is crucial to ensure both parties are protected and all details are accurately recorded. This document serves as proof of the exchange, detailing the specifics of the deal, including the buyer, seller, vehicle information, and agreed-upon terms.

Crafting this record may seem daunting, but with a well-structured form, the process becomes much easier. It not only helps in confirming the transaction but also serves as a reference in case any issues arise after the exchange. Whether you’re selling privately or through a dealership, having a clear, professional record is a necessary step for both legal protection and smooth ownership transfer.

Car Sale Invoice Template Overview

When transferring ownership of a vehicle, having a clear, formal document is essential for both the buyer and seller. This document serves as a detailed record of the transaction, outlining the agreed terms and providing evidence of the exchange. It helps prevent misunderstandings and ensures that all necessary information is recorded accurately for both parties involved.

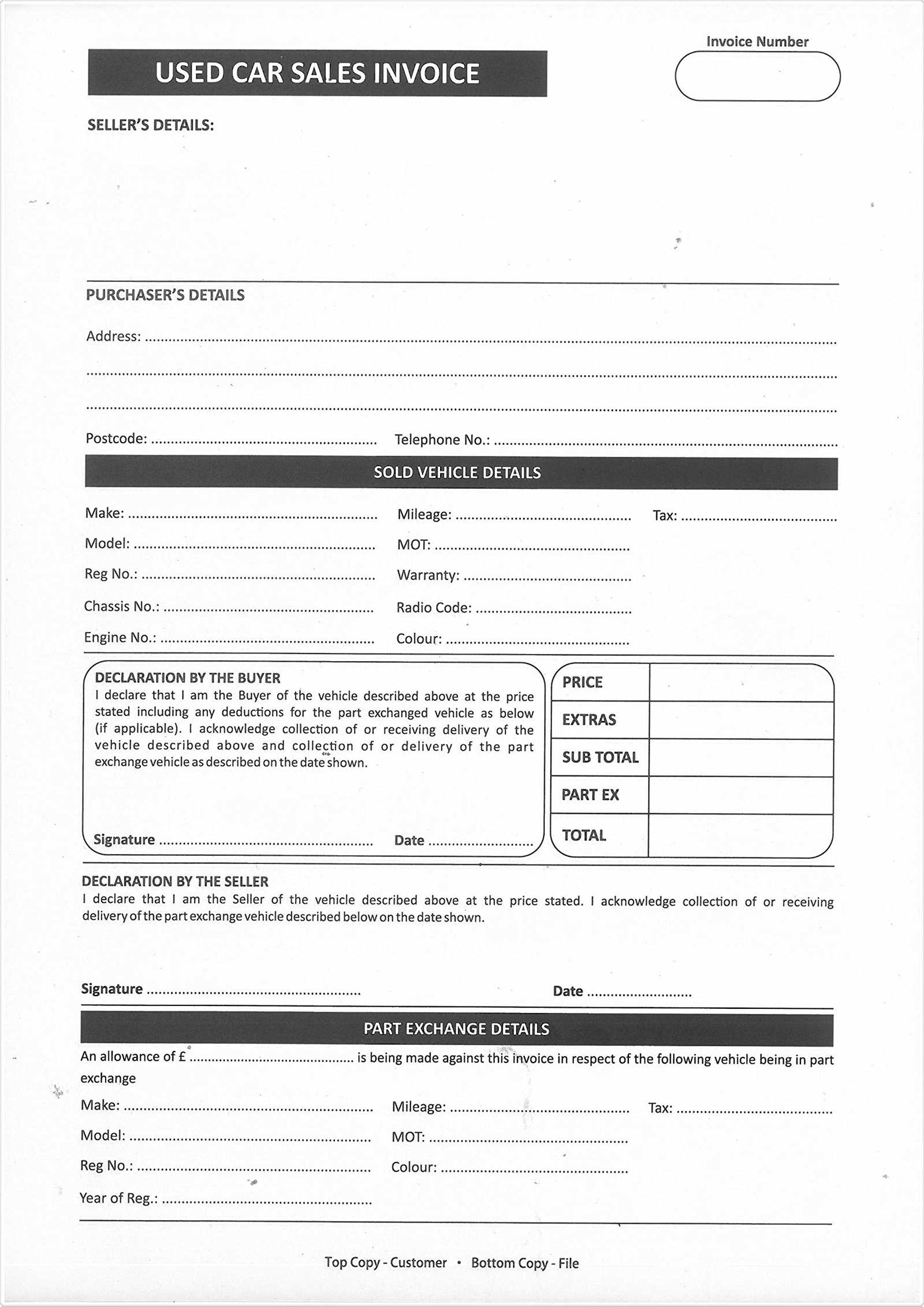

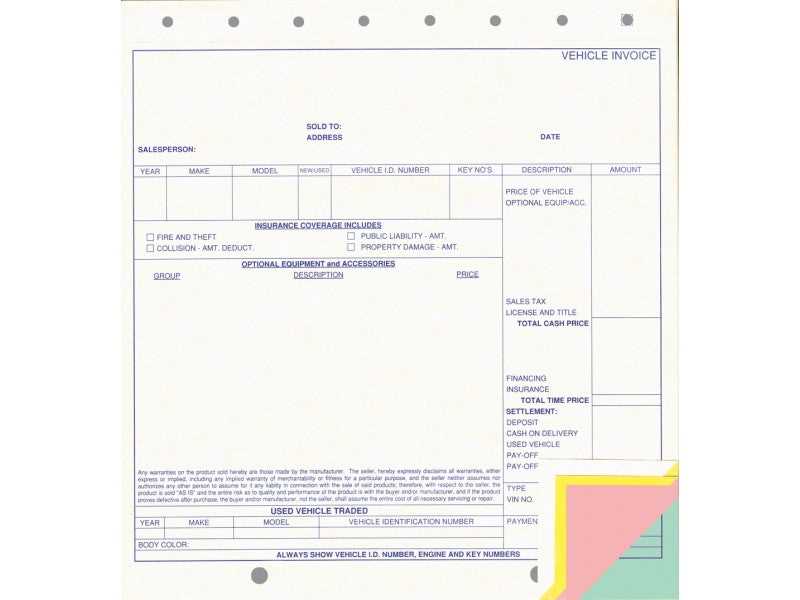

The document typically includes important details such as the buyer and seller’s contact information, vehicle specifications, price, payment method, and date of transfer. By using a structured form, individuals can avoid missing crucial data and streamline the transaction process. A properly created document can also serve as a reference in case of any future disputes or inquiries regarding the transfer.

Having a standardized version of this document can simplify the process for both private sellers and dealerships. It ensures that nothing is overlooked and that the transfer is legally recognized. With the right layout, anyone can quickly fill in the required fields, making the exchange smooth and efficient.

Why You Need a Car Sale Invoice

Documenting a vehicle transfer is a critical step in ensuring both parties are protected during the transaction. Without a formal record, misunderstandings or disputes can arise, especially if questions come up about the terms of the deal or the vehicle’s condition. A properly documented agreement safeguards both the buyer and the seller, making it clear that the transaction has been completed as agreed upon.

Legal Protection and Security

Having an official document provides legal protection for both parties involved. It serves as proof that the transaction has occurred and outlines the terms agreed upon. This is especially important in case of any future legal disputes, as it helps verify the details of the exchange and the agreed price.

Clear Communication and Transparency

A formal document helps to ensure that all relevant information is clearly communicated between the buyer and the seller. Details such as the vehicle’s make, model, VIN, and agreed price are all clearly outlined, leaving no room for confusion. This level of transparency helps avoid any potential disagreements after the transaction has been completed.

Key Elements of a Car Sale Invoice

When creating a formal record for a vehicle transfer, it’s essential to include specific information that clearly outlines the details of the transaction. A well-organized document ensures that both the buyer and seller have a complete understanding of the terms, leaving no room for confusion or dispute. Below are the key components that should be present in any properly structured transaction record.

Buyer and Seller Information

One of the most important elements is the contact details of both the buyer and the seller. This typically includes their full names, addresses, phone numbers, and email addresses. This information serves as a point of reference for both parties and can be useful in case of any follow-up or issues related to the exchange.

Transaction Details

The document must also contain specific information about the transaction itself. This includes the agreed purchase price, payment method (such as cash, check, or financing), and any applicable taxes or fees. Additionally, the date of transfer and any warranties or conditions of the deal should be clearly outlined to ensure that both parties are fully aware of the terms before finalizing the exchange.

How to Create a Car Sale Invoice

Creating an official document for a vehicle exchange doesn’t need to be complicated. With the right structure and clear information, anyone can produce a document that reflects the terms of the transaction. The key is to ensure that all relevant details are included and properly formatted to prevent confusion later. Follow these steps to create a formal record of the transfer.

Step 1: Collect Necessary Information

Before starting the document, gather all the essential details. You will need the buyer’s and seller’s contact information, vehicle details, and the agreed-upon price. Make sure you have the vehicle’s identification number (VIN), make, model, year, and mileage to include in the document.

Step 2: Use a Structured Format

A well-organized document will clearly present all the information, making it easy to understand for both parties. You can either create your own layout or use an online template. Below is an example of how the information should be structured in the document:

| Item | Details |

|---|---|

| Buyer’s Full Name | John Doe |

| Seller’s Full Name | Jane Smith |

| Vehicle Identification Number (VIN) | 1HGBH41JXMN109186 |

| Make, Model, Year | Toyota Camry, 2015 |

| Odometer Reading | 72,000 miles |

| Sale Price | $12,500 |

| Payment Method | Bank Transfer |

| Transaction Date | March 20, 2024 |

Once all the necessary details are filled in, review the document to ensure accuracy. The final step is to both sign the document to confirm the agreement and make it legally binding.

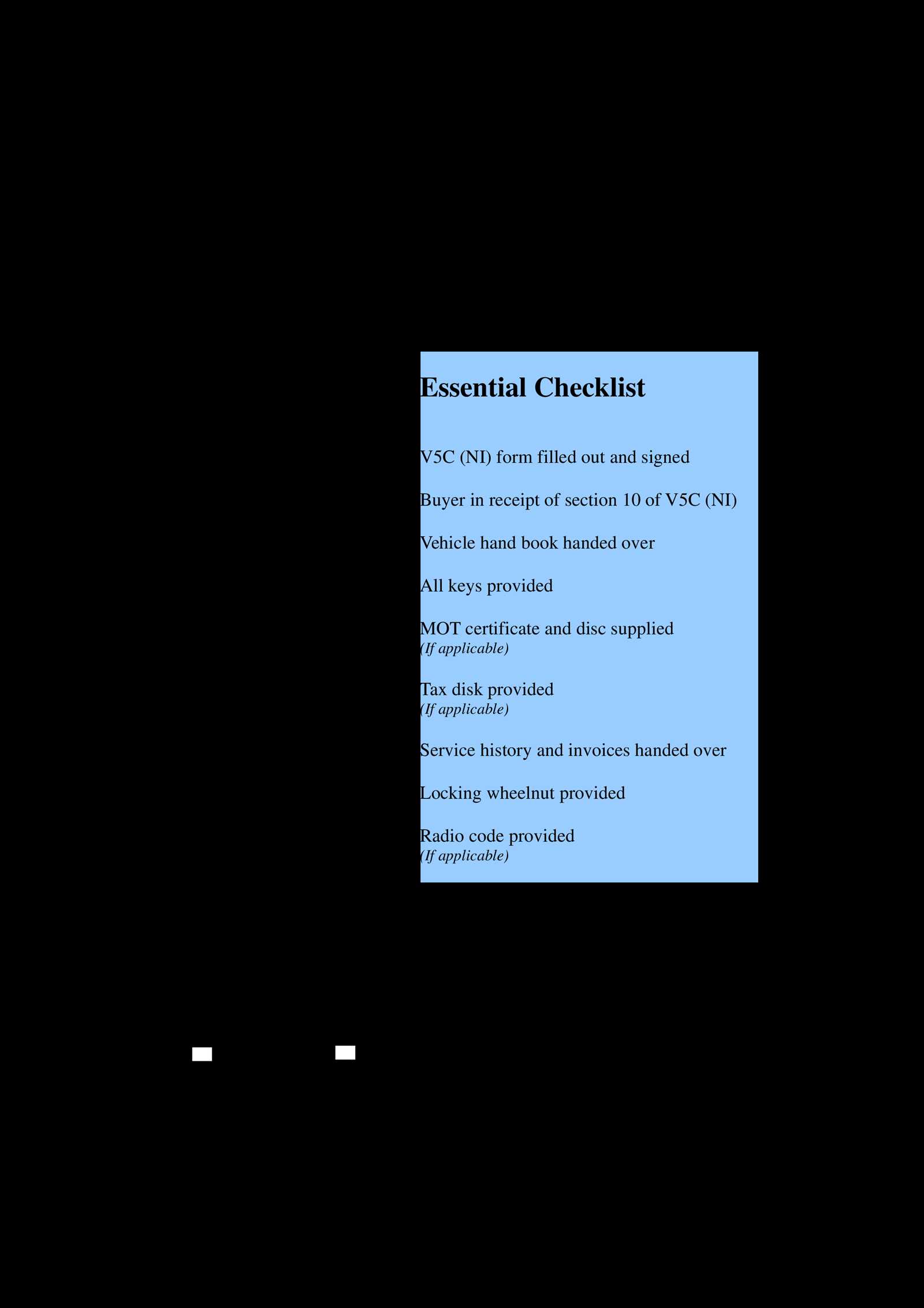

Essential Information to Include in the Invoice

To ensure that a vehicle transfer is legally sound and clear for both parties, it’s crucial to include specific details in the documentation. These elements not only make the transaction transparent but also help to avoid misunderstandings or disputes later on. Below is a list of essential information that must be included in any formal record of the exchange.

| Required Information | Description |

|---|---|

| Buyer’s Full Name and Contact Details | Include the complete name, address, phone number, and email of the buyer for reference. |

| Seller’s Full Name and Contact Details | List the seller’s name, address, phone number, and email to ensure both parties are identified. |

| Vehicle Identification Number (VIN) | Clearly state the unique VIN, which helps to uniquely identify the vehicle being transferred. |

| Make, Model, Year, and Mileage | Provide details about the vehicle’s make, model, production year, and current mileage. |

| Purchase Price | State the agreed-upon amount for the vehicle, along with any additional costs like taxes or fees. |

| Payment Method | Indicate the method of payment (e.g., cash, bank transfer, financing), along with any payment terms. |

| Transaction Date | Record the exact date the transaction occurred to formalize the transfer of ownership. |

| Signatures | Both the buyer and seller must sign the document to confirm their agreement and make it legally binding. |

By including all of these details, both parties can ensure that the transaction is documented clearly, accurately, and legally. This reduces the potential for future issues and provides proof of the exchange if needed.

Customizing Your Car Sale Invoice

Personalizing a formal document for a vehicle transfer allows you to tailor it to the specific needs of the transaction. Customization ensures that all relevant details are covered while reflecting the nature of the exchange. By adjusting the structure or adding additional fields, you can make sure the document fits your unique situation, whether it’s a private sale or through a dealership.

Customization can also help in including specific clauses or terms that may be important to either party, such as warranties or return policies. This added flexibility ensures that both buyer and seller are clear on the conditions of the deal.

| Customizable Section | Purpose |

|---|---|

| Additional Terms and Conditions | Include special terms like warranties, return policies, or payment arrangements. |

| Payment Schedule | For installment payments, outline the amounts, dates, and method of payment. |

| Delivery/Collection Details | Specify delivery or pickup arrangements, including dates and locations if applicable. |

| Custom Clauses | Add any other clauses necessary for specific transactions, like as-is conditions or repairs. |

By customizing the document, you make sure that all aspects of the deal are captured in a way that benefits both parties and prevents any potential confusion or conflicts down the line.

Free vs Paid Car Sale Invoice Templates

When creating a formal document for a vehicle transfer, individuals often face the choice between using a free or paid version of a pre-designed form. Both options have their advantages, but understanding the differences can help you make the right decision for your needs. Free forms may be suitable for simple transactions, while paid options can offer additional features, customization, and support for more complex deals.

Free options are typically basic and easy to access, making them ideal for quick, straightforward transactions. However, they may lack the flexibility and extra features that more tailored forms provide. Paid forms, on the other hand, often come with more sophisticated layouts, additional fields, and customer support, offering a higher level of professionalism and customization for those looking for a more polished document.

Ultimately, the choice depends on the complexity of the transaction and the level of detail required. For smaller or informal deals, a free form might be sufficient. However, for larger transactions or those requiring more specific terms, investing in a paid option may be worth the additional cost for its added value and convenience.

Common Mistakes in Car Sale Invoices

When preparing a formal document for a vehicle exchange, it’s easy to overlook key details or make errors that can lead to confusion or even legal issues. While the purpose of this document is to clearly outline the terms of the transaction, mistakes in the document can cause unnecessary complications for both the buyer and the seller. Being aware of the most common mistakes can help prevent these issues and ensure that the exchange is properly documented.

One frequent error is missing or incorrect vehicle information. The vehicle identification number (VIN), make, model, and mileage are crucial details that should never be omitted or misrepresented. Failing to accurately record this information can create confusion or make it difficult to verify the transaction in the future.

Another common mistake is inaccurate payment details. If the agreed-upon price, payment method, or terms of payment are unclear or incorrect, it can lead to disputes later on. It’s important to be thorough and precise in this section, ensuring that both parties understand how and when the payment will be made.

Additionally, not including a date of transfer is a mistake that can invalidate the document or make it difficult to prove the terms of the agreement. A proper date marks the official moment of ownership transfer and is essential for record-keeping and legal purposes.

By avoiding these mistakes and double-checking the document for accuracy, both parties can ensure that the transaction is smooth and transparent, protecting their interests and reducing the risk of future disputes.

How to Format Your Invoice Correctly

Proper formatting of a vehicle transaction document is essential to ensure clarity and professionalism. A well-organized form helps both parties easily navigate through the key details of the exchange, minimizing the chances of confusion or mistakes. The structure should be clean, logical, and consistent to convey the necessary information in an easily understandable manner.

Start by using clear headings and subheadings to separate different sections of the document. This makes it simple to find specific details such as the buyer’s and seller’s information, vehicle details, payment terms, and transaction date. Consistency in font style and size is also crucial for readability and a polished appearance.

| Section | Formatting Tips |

|---|---|

| Buyer and Seller Information | Use separate columns for names, addresses, phone numbers, and email addresses. Ensure the text is aligned for easy reading. |

| Vehicle Details | Provide the VIN, make, model, year, and mileage in a clear, concise list format to avoid clutter. |

| Price and Payment Terms | Break down the price, including any taxes or additional fees. Specify the method of payment and payment schedule if applicable. |

| Signatures | Leave enough space for both parties to sign and date the document. This confirms the agreement and makes it legally binding. |

By organizing the content in a logical, structured way, you ensure that all essential details are easy to locate, and the document looks professional. This not only helps avoid misunderstandings but also adds a level of credibility to the transaction.

Car Sale Invoice vs Bill of Sale

When it comes to transferring ownership of a vehicle, two documents often come up: the formal transaction record and the bill of transfer. While both serve to document the exchange, they differ in purpose, content, and legal implications. Understanding these differences can help ensure that both the buyer and seller are clear on what each document provides and when to use them.

Purpose and Function

The formal transaction document typically serves as a receipt for the buyer, confirming that the transaction has taken place and the agreed-upon price has been paid. It often includes payment details, taxes, and sometimes additional clauses such as warranties. In contrast, the bill of transfer is primarily used as proof of ownership change. It officially marks the date the vehicle’s ownership has been transferred and may not include detailed payment information.

Key Differences in Content

While both documents contain the names of the buyer and seller, vehicle details, and the transaction date, the key difference lies in the information they emphasize. A formal transaction record focuses on payment terms, including methods and any applicable fees. On the other hand, the bill of transfer is more focused on transferring legal ownership, often including language that confirms the vehicle is being sold “as-is” and with no warranties unless otherwise stated.

In summary, a formal transaction record and a bill of transfer are both important, but they serve different roles in the vehicle transfer process. The formal transaction document is crucial for confirming payment details, while the bill of transfer is essential for legal ownership change.

Legal Requirements for Car Sale Invoices

When completing a vehicle transaction, it is essential to meet legal requirements to ensure the agreement is valid and enforceable. Certain elements must be included in the documentation to comply with local laws and regulations. Failing to include these required details can lead to complications, including disputes over ownership or payment, and potential legal consequences. Understanding the legal obligations is vital for both the buyer and the seller to avoid future problems.

Required Information

Different regions may have specific laws regarding what must be included in the transaction document. However, there are general requirements that apply in most cases. Key details such as the buyer’s and seller’s information, vehicle specifications, payment terms, and the transfer date must always be documented. These details provide a clear record of the transaction and protect both parties involved.

| Legal Element | Description |

|---|---|

| Buyer and Seller Information | Names, addresses, and contact details of both parties involved in the transaction. |

| Vehicle Information | Vehicle identification number (VIN), make, model, year, and current mileage. |

| Payment Details | Amount paid, method of payment, and any applicable taxes or fees. |

| Transfer Date | The exact date when the vehicle’s ownership is officially transferred from seller to buyer. |

| Signatures | Both parties must sign to confirm agreement, making the document legally binding. |

Additional Legal Considerations

In some jurisdictions, additional legal requirements may apply. For example, certain states or countries may require specific forms to be filed with a local motor vehicle department or tax authority to complete the transaction. Additionally, some regions require the buyer to receive a specific document indicating that the vehicle is free of liens or other encumbrances. Always check local laws to ensure full compliance with all legal obligations.

How to Handle Taxes on Car Sales

When transferring ownership of a vehicle, handling taxes is an important part of the process. The taxation involved in such transactions can vary depending on local laws, the price of the vehicle, and other factors such as whether it’s a private sale or through a dealership. Properly managing tax obligations ensures compliance with the law and prevents any issues down the line for both the buyer and seller.

In many regions, a sales tax is levied on the exchange, based on the agreed price of the vehicle or its fair market value. It’s important to determine whether the tax is the responsibility of the buyer or the seller, as some areas may require the seller to collect and remit the tax, while others place the burden on the buyer to pay it directly to the government. This responsibility should be clearly noted in the documentation.

Some jurisdictions may also have additional fees or exemptions based on certain criteria. For example, if the buyer is a non-profit organization or the vehicle is being transferred between family members, tax exemptions or reductions might apply. To ensure accuracy, it is recommended to check with local tax authorities to confirm the applicable tax rates and regulations for your specific situation.

When preparing the transaction document, be sure to clearly itemize the amount of tax collected, including any applicable fees. This transparency helps avoid confusion and provides a record of the transaction that can be referenced in case of audits or disputes.

Automating Car Sale Invoice Generation

Automating the creation of formal transaction records can greatly simplify the process for both buyers and sellers, saving time and reducing errors. By using software or online tools, it’s possible to streamline the generation of documents, ensuring that all the necessary details are included and formatted correctly. Automation can also help ensure that important fields, like payment details and vehicle information, are never missed, making the process more efficient and accurate.

Automated systems allow users to enter basic information, such as the vehicle’s details, the parties involved, and the agreed price, and then generate a fully formatted document. This removes the need for manual entry, reducing the chances of mistakes and inconsistencies. Additionally, some systems can automatically calculate applicable taxes or fees, further simplifying the transaction.

| Benefit of Automation | Description |

|---|---|

| Time Savings | Automated systems generate documents quickly, reducing the time spent creating each record manually. |

| Accuracy | Automation helps ensure that all required fields are correctly filled out, reducing the chance of errors. |

| Consistency | Automated templates maintain a consistent format and structure for all transaction records. |

| Tax Calculation | Some systems automatically calculate taxes and fees based on location and transaction details. |

| Record Keeping | Automated tools often allow users to store and retrieve documents easily for future reference. |

By adopting automated solutions, both buyers and sellers can enjoy a smoother, more efficient transaction process while ensuring that all necessary details are captured accurately and consistently. This approach reduces the administrative burden and ensures compliance with any legal requirements.

Digital vs Paper Car Sale Invoices

When completing a vehicle transaction, the choice between digital and paper documentation is an important consideration. Both methods serve the same purpose–recording the terms of the exchange–but they offer different advantages and drawbacks. Understanding the benefits of each can help you decide which method is best suited for your needs, whether you prioritize convenience, legal requirements, or long-term storage.

Advantages of Digital Documentation

Digital records provide a fast and convenient way to generate, share, and store documents. With digital tools, you can quickly create a transaction record, and send it via email or other online platforms. This eliminates the need for physical copies, reducing paper waste and the risk of documents being lost or damaged. Additionally, digital records are often easier to store and retrieve, especially when using cloud-based services that allow for quick access and backup.

Benefits of Paper Documentation

On the other hand, paper documentation has its own set of benefits. Many buyers and sellers still prefer physical records, especially for legal or personal reasons. In certain jurisdictions, paper documents may be required for registration or tax purposes, or they may be easier to present during certain types of transactions. Paper records also offer a sense of permanence and can be stored in a physical file for easy reference.

Ultimately, the choice between digital and paper records will depend on factors such as convenience, legal requirements, and personal preferences. Both methods can serve as valid and legally binding proof of the transaction, as long as the required details are included and properly documented.

How to Send a Car Sale Invoice

Once the formal document for the vehicle transaction is prepared, the next step is to ensure it is sent to the appropriate party. Whether it’s for the buyer or for legal purposes, sending the document properly is crucial for confirming the details of the exchange. There are various ways to send this record, each with its own benefits, depending on your preferences and the requirements of the parties involved.

The most common method is through digital means, such as email or secure online platforms, which ensures quick and efficient delivery. Another option is to send a physical copy via postal mail, which may be necessary in some situations, particularly for legal or official records. The choice will depend on the urgency, the parties’ preferences, and any legal requirements.

| Method | Advantages |

|---|---|

| Fast, easy to track, and allows for quick updates or follow-ups. | |

| Postal Mail | Provides a physical copy, which may be required for legal or registration purposes. |

| Secure Online Platforms | Offers a safe and encrypted way to send documents, often with built-in tracking. |

| Fax | Still useful for some legal processes, although less common in modern transactions. |

Regardless of the method chosen, ensure that the document is clearly legible and all essential details are included. It’s also a good practice to request confirmation of receipt, particularly for important or high-value transactions, to guarantee both parties have a copy for their records.

Benefits of Using an Invoice Template

Using a pre-designed document format for formal transaction records offers several advantages that can make the process more efficient and reliable. Templates help streamline the creation of these documents by providing a consistent structure, ensuring that all necessary details are included without missing any critical information. This can save time and reduce errors, especially for those who are unfamiliar with creating such documents from scratch.

Efficiency and Time Savings

One of the most significant benefits of using a pre-made document structure is the speed at which you can generate a record. Instead of manually formatting each section or worrying about layout, a template provides a ready-to-use design. This allows you to focus on entering relevant details, making the entire process faster and more efficient. Whether you are handling a single transaction or multiple records, templates save valuable time.

Consistency and Professionalism

Templates also promote consistency. By using the same structure each time, you ensure that all important information is included, and that it’s presented in a clear, professional manner. This not only helps maintain a high level of organization, but it also makes the transaction records look more legitimate and reliable, which is especially important for legal or financial purposes. Having a professional-looking document enhances trust and clarity for both parties involved in the exchange.

Additionally, templates are often customizable, allowing you to add specific details or make adjustments based on your unique requirements. This ensures flexibility while still maintaining a consistent and structured approach.