Free Car Rental Invoice Template for Easy Use

Managing financial transactions efficiently is crucial for any business. Having a structured document to capture all essential details of services provided can streamline administrative tasks. It helps ensure clarity between you and your clients while also maintaining accurate records for accounting purposes.

In this guide, we will explore how to create an effective and professional document for your business dealings. By using a carefully designed layout, you can avoid errors, save time, and improve customer satisfaction. With the right approach, managing these documents becomes a simple and straightforward process.

Understanding the key components of such a document is essential. It’s not just about listing charges; it’s about providing transparency and fostering trust. From including service dates to payment details, each aspect contributes to a well-rounded financial record. Whether you’re new to this or looking to improve your current method, the following information will be invaluable in helping you set up an efficient system.

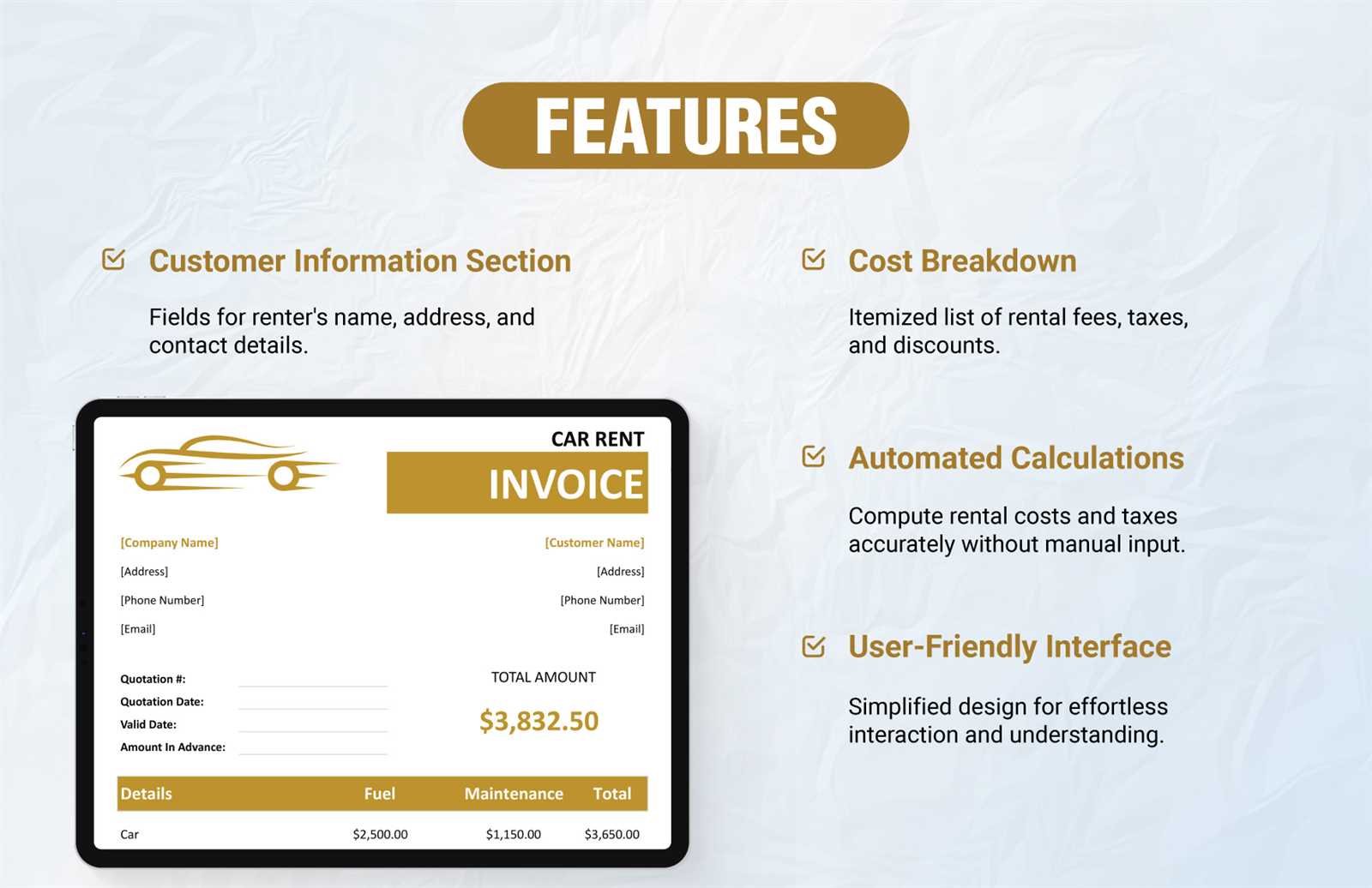

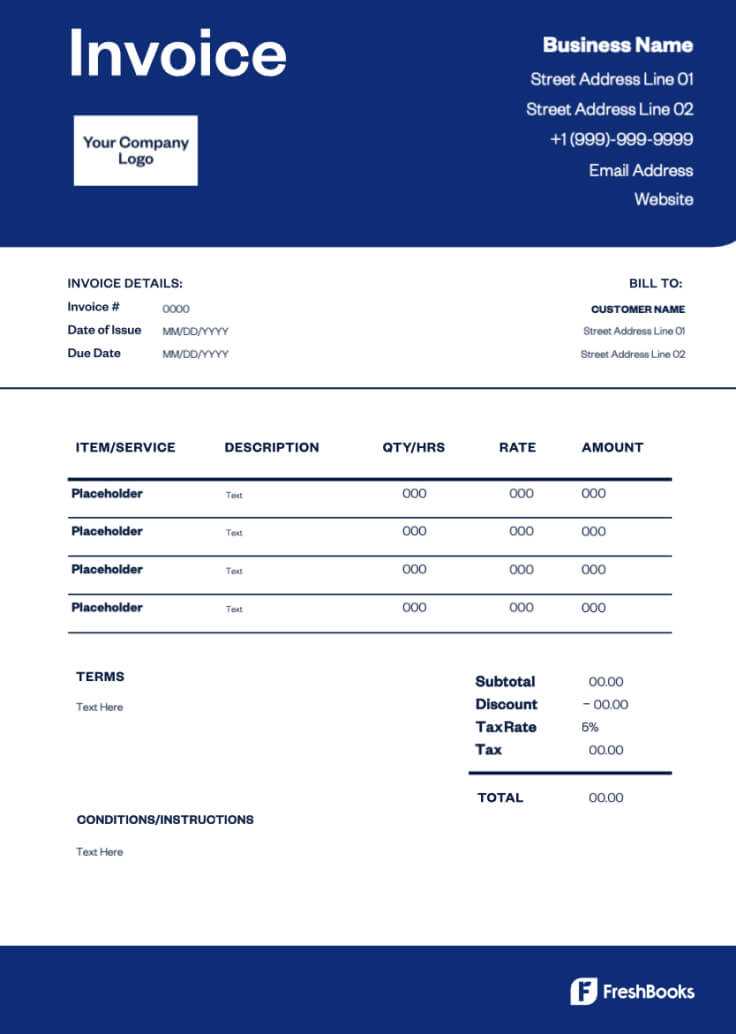

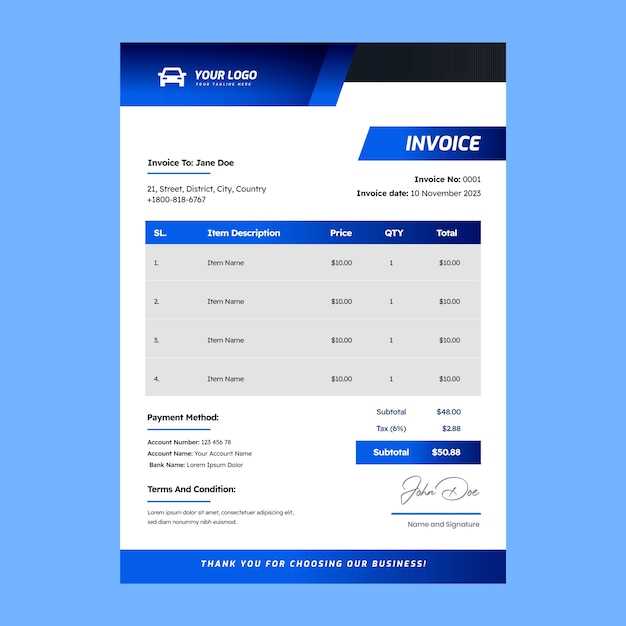

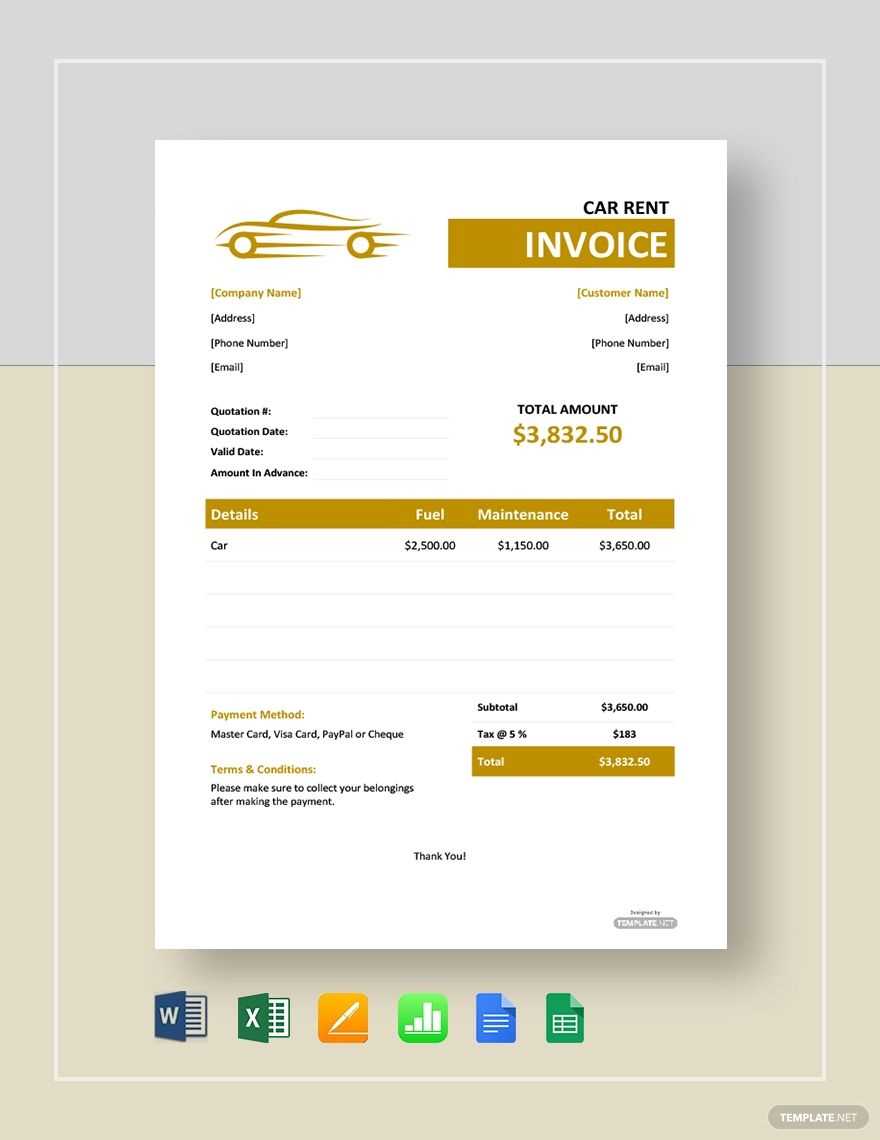

Free Car Rental Invoice Template Overview

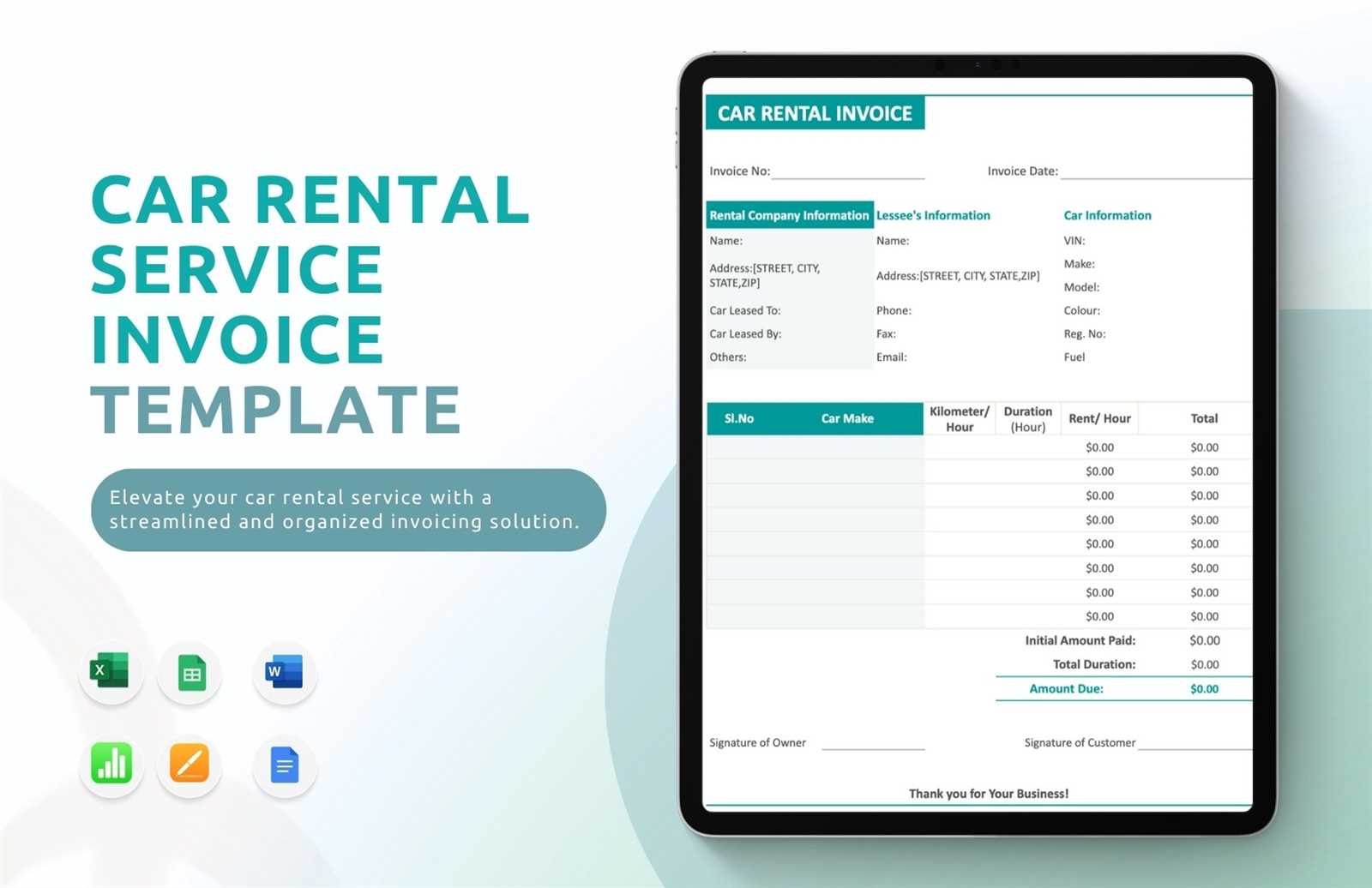

For any business that involves leasing or providing vehicles for temporary use, having a standardized document to record each transaction is essential. Such a document helps ensure all relevant details are clearly communicated and accounted for, minimizing confusion and enhancing professionalism. Using a ready-made document structure can save you time and effort in creating one from scratch, while also helping maintain consistency across all dealings.

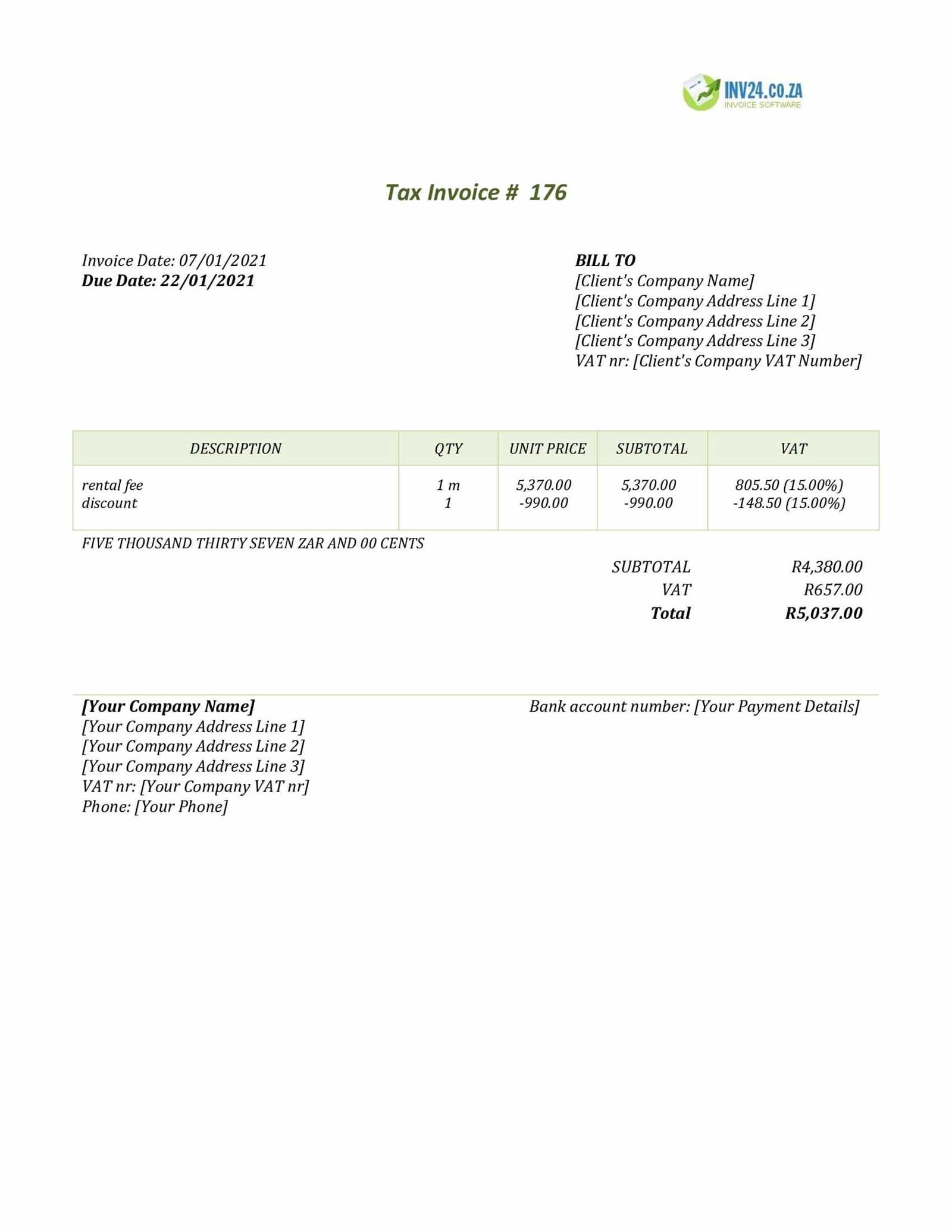

These documents typically include several important sections that provide a comprehensive summary of the transaction, which might include:

- Client’s information

- Service period and duration

- Amount due and any applicable taxes

- Terms and conditions of the service

By utilizing a well-organized structure, you ensure that all essential information is captured accurately. This approach also makes it easier to process payments, track outstanding balances, and offer clear communication with your customers. Whether you are handling one-off transactions or long-term leases, having a standardized approach simplifies your workflow and ensures consistency in all your dealings.

Why Use an Invoice Template

Having a standardized document format for recording transactions is crucial for businesses of all sizes. It provides a streamlined approach to documenting services rendered and ensures that all the necessary details are included in a clear, consistent manner. This not only helps maintain professionalism but also reduces the risk of errors that can occur when creating documents from scratch each time.

By using a pre-designed structure, you can focus on filling in specific information without worrying about formatting or layout. This saves time and effort, allowing you to process transactions more quickly. Additionally, a consistent format helps clients easily understand the charges and terms, fostering transparency and trust.

Furthermore, using a ready-made structure allows for better record-keeping and organization. You can store and access past transactions efficiently, making it easier to track payments and manage financial data. Whether for a single transaction or recurring services, adopting a standardized approach can enhance both your workflow and customer experience.

Benefits of Free Invoice Templates

Utilizing a pre-designed document format offers several advantages for businesses. One of the primary benefits is cost savings. Rather than investing in specialized software or hiring a designer to create custom documents, you can access high-quality, ready-to-use formats without spending any money. This is particularly helpful for small businesses or startups looking to streamline operations while keeping expenses low.

Another significant advantage is time efficiency. With a standardized structure, you no longer need to spend time designing and formatting documents from scratch. Simply fill in the relevant details, and you have a professional-looking record ready for your clients. This allows you to focus on other aspects of your business, such as customer service or marketing.

Moreover, using a ready-made structure ensures consistency across all transactions. Every document you create will have the same professional appearance, helping to build trust and credibility with clients. It also simplifies record-keeping, as all your financial documents will follow the same format, making it easier to track payments and maintain accurate records over time.

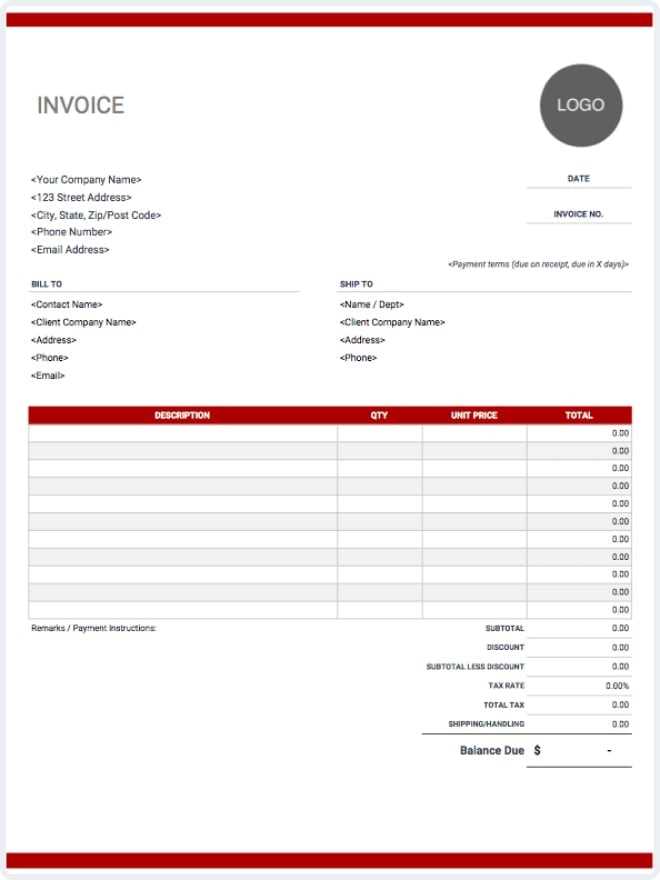

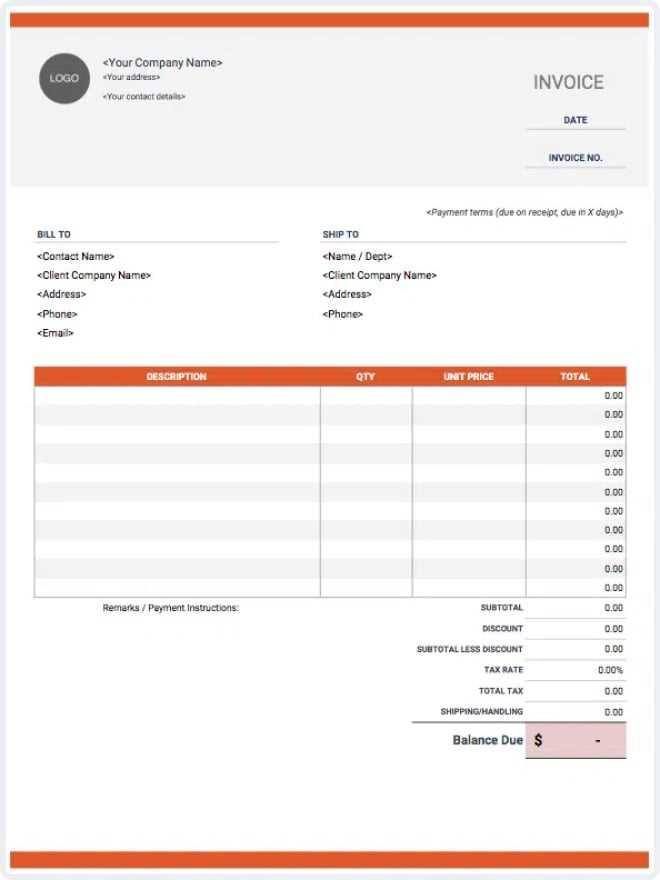

How to Customize Your Template

Adjusting a pre-designed document to suit your specific business needs is a straightforward process. By modifying certain fields and sections, you can tailor it to better reflect your services, terms, and branding. Customization ensures that every document you produce is aligned with your business identity and the specific requirements of each transaction.

Steps for Customization

Follow these simple steps to personalize your document:

- Insert your business details: Ensure that your company name, address, phone number, and email are clearly listed at the top of the document.

- Adjust the payment terms: Customize the payment methods, due dates, and any late fees or discounts that apply to your services.

- Add relevant service details: Include specific information about the services provided, such as duration, pricing, and any additional charges or taxes.

- Branding: Incorporate your logo, company colors, or fonts to give the document a professional look that matches your business identity.

Additional Tips for Customization

- Ensure clarity: Use clear, concise language to describe terms and pricing, avoiding unnecessary jargon that might confuse clients.

- Save for future use: After customizing your document, save it in an editable format so you can easily adjust details for future transactions.

- Double-check for errors: Before sending the document to clients, review it carefully for any mistakes in pricing, dates, or client details.

By following these steps, you can create a professional and consistent document that accurately reflects your business and maintains clear communication with clients.

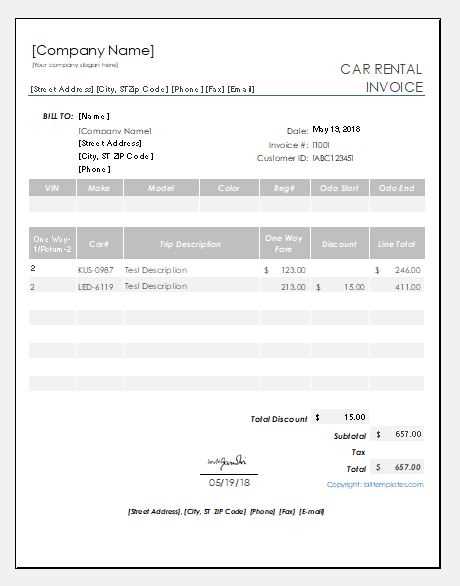

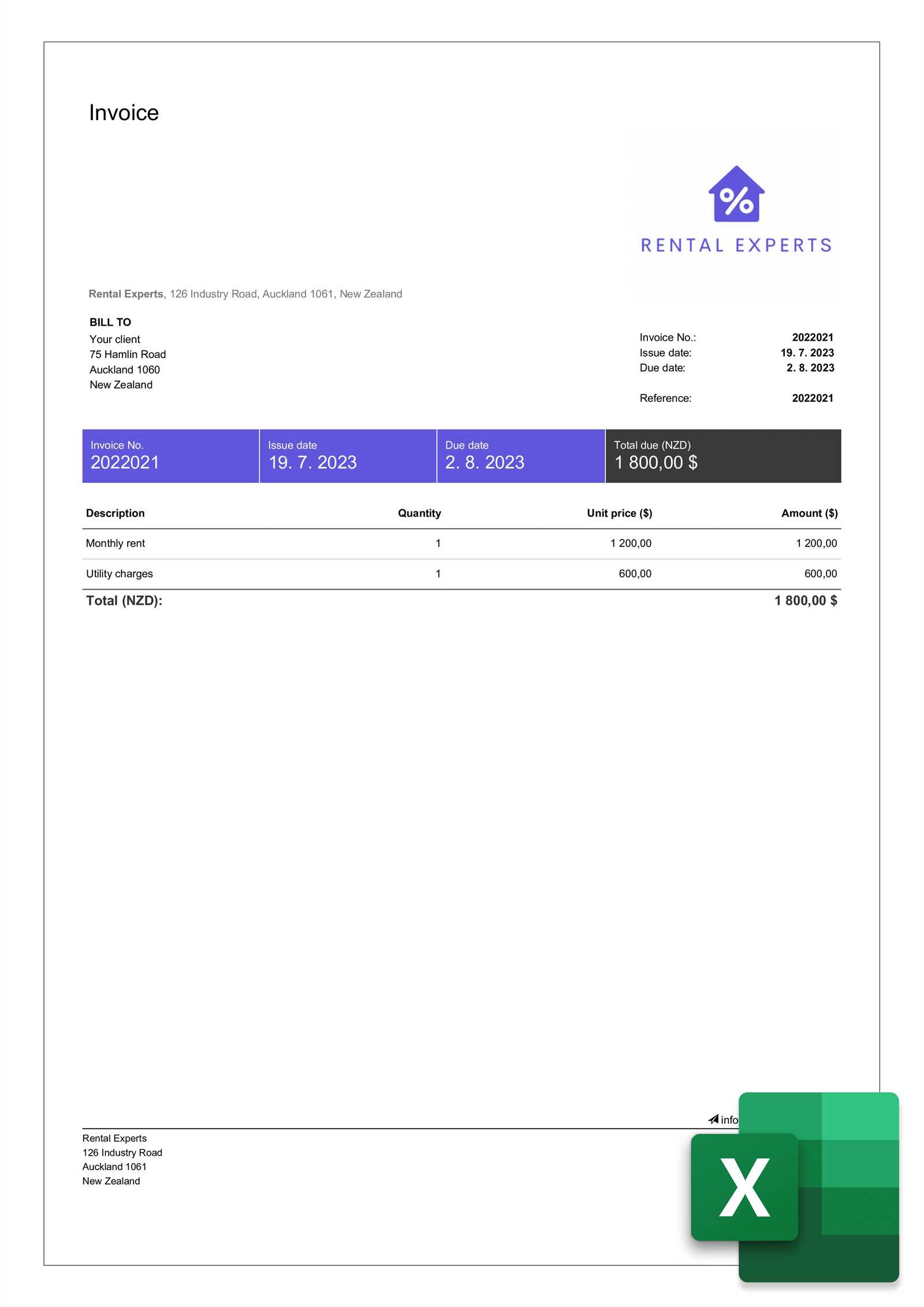

Essential Information for Rental Invoices

When preparing a document to record a transaction for services provided, it’s important to include all the necessary details that ensure clarity and transparency for both parties. A well-structured record not only helps avoid misunderstandings but also provides a clear summary of the agreement, ensuring both parties are on the same page regarding the terms and conditions.

Each document should include key elements that cover the following:

- Service Provider Details: Include your business name, contact information, and any other relevant details to help the client identify the source of the document.

- Client Information: Clearly mention the client’s name, address, and contact details to ensure proper identification.

- Dates of Service: Specify the period when the service was provided, including both the start and end dates.

- Pricing Breakdown: List the charges for the services rendered, including any additional fees or taxes, to ensure the total amount due is clear.

- Payment Terms: Outline the payment due date, accepted payment methods, and any late fee policies.

- Terms and Conditions: If applicable, include the terms under which the service was provided, such as cancellation policies or additional fees for extended use.

Including these elements ensures a smooth transaction process and helps maintain a professional standard for your business. It also serves as a useful reference in case any questions or disputes arise later on.

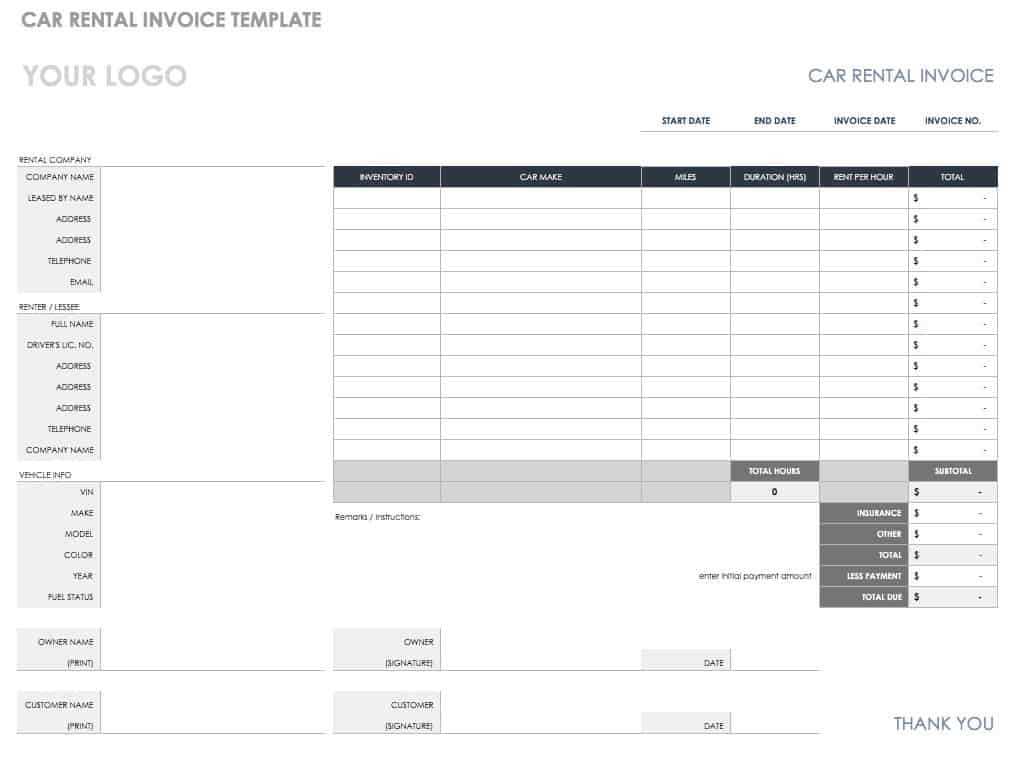

Key Elements of a Professional Invoice

A professional record of services provided is essential for establishing trust and ensuring smooth financial transactions between a business and its clients. Such a document should be clear, well-organized, and easy to understand. The following elements are crucial for maintaining professionalism and ensuring that all necessary information is included for both parties.

Core components that make a document look professional and complete include:

- Header with Company Information: Clearly display your business name, logo, contact details, and registration number at the top of the document for easy identification.

- Unique Reference Number: Each document should have a unique number for tracking purposes, which helps in organizing and referring to past transactions.

- Client Information: Include the client’s full name, address, and contact details to ensure the document is attributed to the correct recipient.

- Detailed Service Description: Clearly state what was provided, including the dates, duration, and any relevant terms, ensuring that both parties are in agreement regarding the scope of the service.

- Payment Breakdown: List all amounts, including unit prices, total charges, taxes, and any additional fees, so the client has a full understanding of the amount due.

- Payment Instructions: Specify the due date, acceptable payment methods, and any penalties for late payments, ensuring there are no misunderstandings regarding payment terms.

- Terms and Conditions: Include any policies related to refunds, cancellations, or other relevant rules that may impact the transaction, keeping both parties informed.

By including these key components, you not only provide your clients with a clear and professional record but also enhance the efficiency of your business operations, making the process of managing transactions straightforward and reliable.

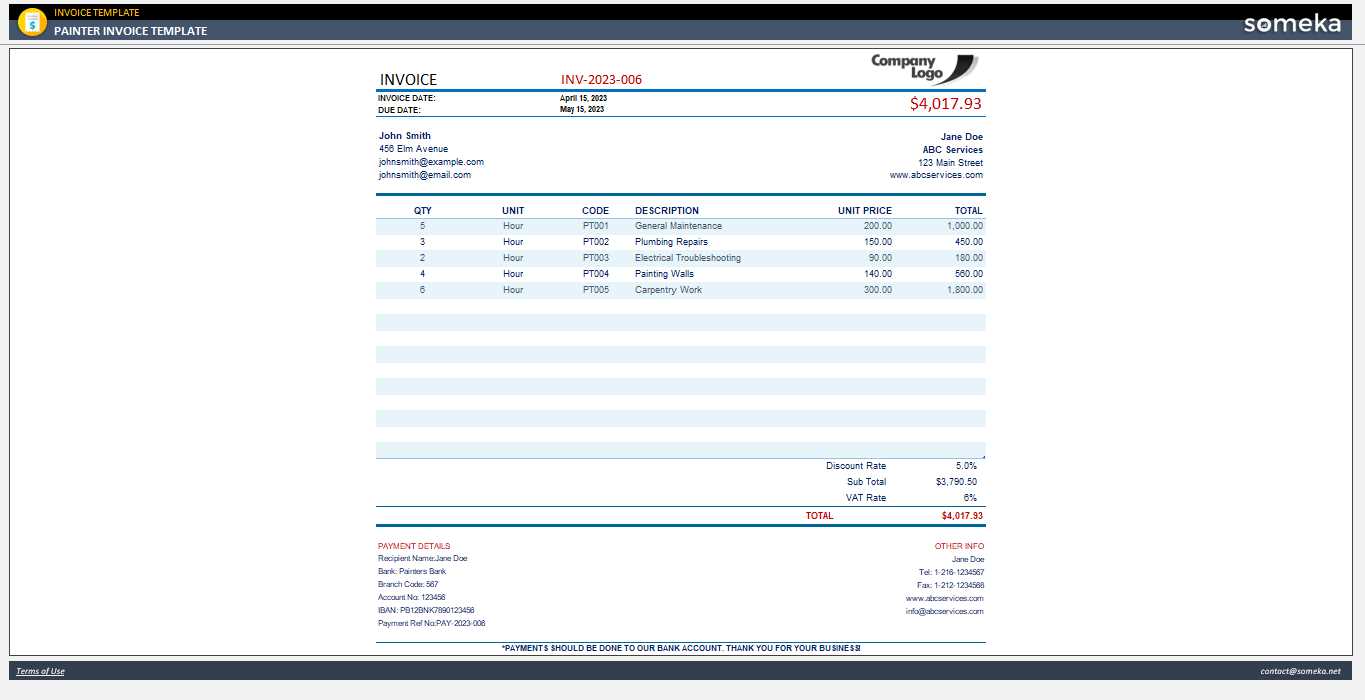

Steps to Fill Out an Invoice

Creating a clear and accurate record for services provided is essential for effective communication and smooth transactions. The process of filling out such a document is simple when you follow a systematic approach. Below are the key steps to ensure every necessary detail is included and the document is completed correctly.

Step-by-Step Guide

Follow these steps to properly complete your document:

- Enter Your Business Information: Start by including your company’s name, address, and contact details. This makes it clear who is issuing the document and helps your client reach out if needed.

- Provide Client Details: Include the recipient’s name, address, and contact details to ensure the document is linked to the correct individual or business.

- Assign a Unique Reference Number: Add a unique reference number for tracking purposes. This helps both you and your client reference the transaction in the future.

- Detail the Services Provided: Describe the service offered, including dates, duration, and any other pertinent details that help clarify what was delivered.

- Break Down Charges: Clearly list the individual charges, taxes, and any additional fees, so your client understands exactly what they are being billed for.

- Specify Payment Terms: Include information on when the payment is due, the accepted methods, and any penalties or discounts for early or late payments.

- Review and Double-Check: Before finalizing the document, review all the information for accuracy, ensuring no mistakes in prices, dates, or contact information.

Finalizing the Document

- Save a Copy: Once the document is complete, save it in an easily accessible format for both you and your client.

- Send the Document: Share the completed document with your client via email, mail, or another method, based on what’s most convenient for both parties.

By following these simple steps, you can ensure that your document is comprehensive, professional, and free from errors, facilitating smooth financial transactions and clear communication with your clients.

Common Mistakes to Avoid

When creating a document to record transactions, it’s essential to be mindful of certain common errors that can lead to confusion or disputes. Even small mistakes can cause delays in payment or damage professional relationships. By being aware of these common pitfalls, you can ensure that your document remains clear, accurate, and effective.

Key Mistakes to Watch Out For

- Incorrect or Missing Contact Information: Ensure that both your business and the client’s details are accurate. Mistakes in phone numbers, addresses, or email addresses can delay communication and payment processing.

- Failure to Include Payment Terms: Not specifying when payment is due or how it should be made can lead to misunderstandings. Always clarify the due date, accepted payment methods, and any late fees or discounts.

- Ambiguous Service Descriptions: Failing to clearly define what services were provided can lead to confusion or disputes. Be specific about what was delivered, including dates, quantities, and pricing.

- Not Including a Unique Reference Number: Omitting a unique reference number can make it difficult to track the transaction. This number is vital for both record-keeping and easy reference in case of future inquiries.

- Overlooking Taxes or Additional Fees: Neglecting to include applicable taxes or extra charges can create issues when the client reviews the document. Ensure that all costs are clearly listed, with taxes or additional fees itemized separately.

Final Checks Before Sending

- Review for Accuracy: Double-check all fields for errors, including spelling, numbers, and dates. Even small mistakes can undermine the professionalism of your document.

- Ensure Proper Formatting: A clean, well-organized document reflects positively on your business. Ensure consistent fonts, headings, and spacing to improve readability.

By taking the time to avoid these mistakes, you can create a professional and clear document that helps maintain positive client relationships and ensures smooth financial transactions.

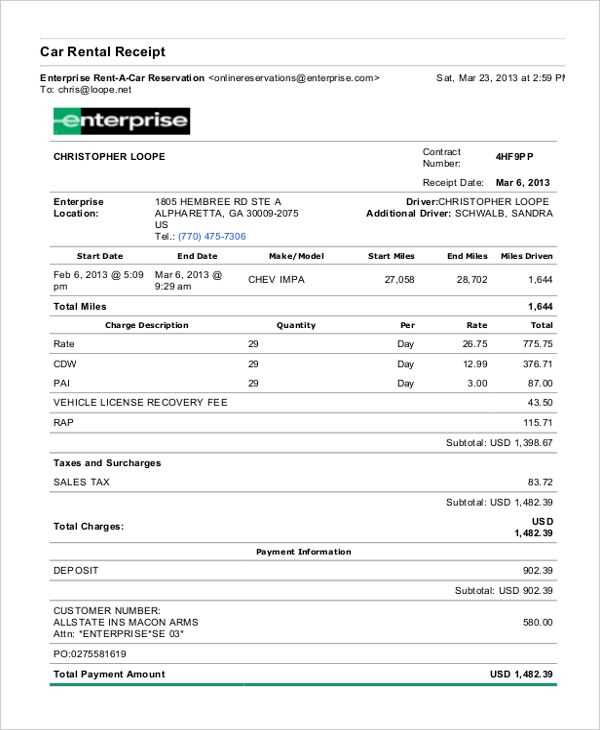

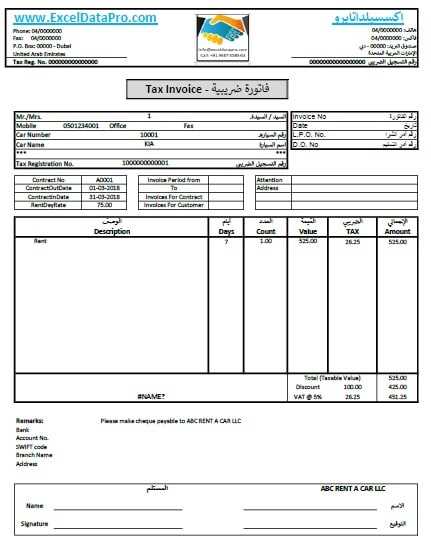

How to Add Taxes to Your Invoice

Incorporating taxes into a financial document is an essential part of the billing process. Accurately adding tax ensures that both you and your client are in compliance with local tax regulations. It also ensures clarity regarding the total amount due and helps avoid confusion or disputes. Below are the steps to properly calculate and include taxes in your billing document.

Steps to Follow:

- Identify the Applicable Tax Rate: Research and confirm the correct tax rate for your region and the type of service provided. Tax rates vary based on location and service category, so it’s essential to use the correct one.

- Calculate the Taxable Amount: Determine the total amount for the service being provided before tax. This is the base amount on which the tax will be calculated.

- Apply the Tax Rate: Multiply the taxable amount by the tax rate to determine how much tax should be added. For example, if the taxable amount is $100 and the tax rate is 10%, the tax would be $10.

- List the Tax Separately: When adding tax to the document, be sure to list it as a separate line item. This provides clarity for the client and shows exactly how much is being charged for taxes.

- Include the Total Amount Due: Once you’ve added the tax amount, update the total amount due. This total should reflect both the original amount and the tax added, ensuring that your client knows the exact payment expected.

Things to Keep in Mind:

- Tax Exemptions: If certain services or clients are tax-exempt, be sure to note this on the document and adjust the calculations accordingly.

- Tax Regulation Compliance: Stay updated on any changes to tax laws in your region, as incorrect tax calculations can lead to penalties or delays in payments.

By following these steps and ensuring the accuracy of your calculations, you can confidently add

Tracking Payments with Your Template

Effective management of payments is a crucial part of maintaining a smooth business operation. Keeping track of when clients make payments and how much is paid ensures that there are no misunderstandings and helps to maintain proper financial records. Using a structured approach in your billing document makes tracking payments easy and organized.

Steps for Payment Tracking

- Include Payment Status Fields: Add a dedicated section in your document to indicate whether the payment has been made, is pending, or is overdue. This helps both you and your client stay on top of the financial status.

- List Payment Dates: Record the exact date each payment is received. If you are offering installment payments, ensure that you note each payment’s date as well as the total amount received.

- Specify Payment Methods: Clearly specify how payments are being made, whether through bank transfer, credit card, cash, or other methods. This will help track the payment’s origin and assist in any future reconciliation.

- Track Outstanding Balances: If there’s an outstanding balance after a partial payment, include a column or field to reflect the remaining amount. This makes it easy to see what is still owed.

- Update Regularly: After each payment, update the document promptly to reflect the current payment status. Keeping accurate, up-to-date records reduces confusion and ensures that everything is on track.

Best Practices for Payment Management

- Use Clear and Consistent Notations: Make sure payment statuses are easy to identify, using terms like “Paid”, “Pending”, and “Overdue” for clarity.

- Send Regular Reminders: If a payment is due or overdue, send polite reminders with a summary of the outstanding balance and payment details to encourage prompt payment.

- Maintain Backup Records: Keep additional records of payment confirmations (e.g., receipts, bank statements) to verify each transaction and avoid future disputes.

By following these steps and maintaining clear records, you can efficiently track payments, ensuring both parties are aligned on financial matters and making future transactions smoother.

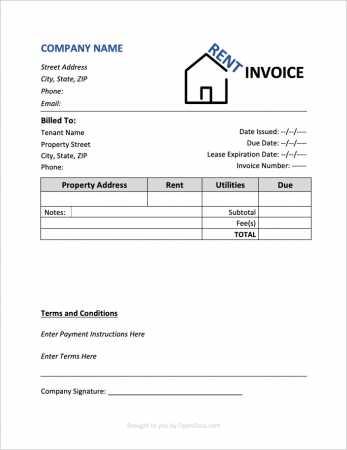

Including Rental Terms on Your Invoice

Clearly stating the terms and conditions associated with the service provided is essential for maintaining transparency and avoiding any future misunderstandings. When creating your billing document, outlining the specific rules, agreements, and obligations between you and the client is vital to ensure both parties are aligned on what was agreed upon. This helps prevent disputes and ensures that expectations are clear.

Essential Terms to Include:

- Service Duration: Clearly indicate the start and end dates for the service. This helps to avoid any confusion regarding the length of time the service was provided.

- Payment Schedule: Specify when payments are due, including any due dates for full payment or installments. Mention any late fees that might apply if payment is delayed.

- Cancellation Policy: Define the conditions under which the service can be canceled. Include details such as timeframes for cancellations and any associated fees.

- Damage or Loss Policy: Outline responsibilities for any damages or losses that might occur during the service period. Specify who will be held liable and what charges, if any, may be incurred.

- Additional Charges: Include any potential additional charges that may apply, such as extra fees for extended use, cleaning, or fuel surcharges. These should be clearly listed to avoid unexpected costs for the client.

Why It’s Important:

- Clarity and Transparency: By including these terms, both you and your client are clear on expectations, reducing the risk of confusion.

- Legal Protection: In case of any disputes or issues, having clear terms in writing can help protect both parties legally, ensuring that both sides are accountable for their obligations.

- Professionalism: Including detailed terms shows professionalism and can enhance your reputation as a business that takes contracts and agreements seriously.

Including these rental conditions on your billing document not only helps with clear commu

Free Templates vs Paid Templates

When choosing a structure for your business documents, one of the first decisions you will face is whether to use a no-cost option or invest in a premium one. Both choices come with their own set of advantages and drawbacks, and understanding the differences can help you make a more informed decision based on your needs. The key is determining what features you require and what level of customization and support you are seeking.

Advantages of No-Cost Options:

- Cost-Effective: The primary advantage of using a free option is the lack of upfront cost. You can access ready-made designs without spending any money.

- Quick Setup: No-cost options are typically easy to download and start using right away. There is minimal setup required, making it ideal for those on a tight schedule.

- Basic Features: Many free options include all the basic elements necessary for creating a standard business document, such as dates, amounts, and customer information fields.

Drawbacks of No-Cost Options:

- Limited Customization: Free choices may lack advanced features or customization options. If you need a specific design or functionality, the options could be restrictive.

- Lack of Support: Most no-cost designs come without customer service or technical support. If you run into issues or need assistance, you may be left on your own.

- Basic Design: Free options often feature simpler designs, which may not convey the professional image you want for your business.

Advantages of Premium Options:

- Advanced Customization: Paid designs typically allow for greater flexibility in terms of layout, color schemes, and content placement, enabling you to create a unique and personalized document.

- Professional Appearance: Premium options tend to have more polished and sophisticated designs, which can enhance your business’s professional image.

- Ongoing Support: With a paid service, you can often access customer support to assist with any issues, making it easier to resolve problems quickly.

Drawbacks of Premium Options:

- Higher Cost: The primary downside of premium options is the expense. You’ll need to budget for the purchase or subscription fee.

- Longer Setup: Customization and additional features may require more time to set u

Tips for Streamlining Invoice Process

Optimizing the process of managing financial documents can save you significant time and effort, ensuring that all transactions are tracked efficiently. By implementing simple strategies and utilizing the right tools, you can minimize errors and delays, leading to smoother operations. Here are some key practices to enhance your billing workflow and make the process more efficient.

Automate Repetitive Tasks

Automation is one of the most effective ways to streamline your process. By using software or online tools, you can automate common tasks such as calculating totals, taxes, and due dates. This reduces human error and speeds up the process significantly. Additionally, recurring bills can be set to generate automatically, saving you time each month.

- Set Up Automatic Reminders: Ensure that clients are reminded before payment due dates.

- Auto-Generate Documents: Use tools that automatically create documents based on your input, saving you time.

Organize Your Data Efficiently

- Centralize Data: Use a single location or software to store all customer and transaction details.

- Use Clear Naming Conventions: Develop a simple system for naming your documents and files for quick identification.

Stay Consistent: Maintain consistency in terms of formatting, terminology, and processes. Having a standardized way of creating and managing documents not only simplifies the process for you but also ensures that clients are familiar with the format, making it easier for them to understand and process.

By implementing these strategies, you can reduce administrative overhead, minimize mistakes, and improve overall efficiency, making the financial management of your business a seamless experience.

How to Save and Print Your Document

Once your financial record is ready, it’s important to ensure that it is saved properly for future reference and printed in a clear and professional format. Storing the document in a safe, organized way makes it easy to access whenever needed, while ensuring that the printed version maintains its quality. Here are some simple steps to save and print your document effectively.

Saving Your Document

To keep a record of your transaction, save the file in a secure location. It is important to choose a format that can be accessed easily in the future and that will preserve the integrity of the details provided.

- Choose the Right Format: Save your document in formats like PDF or Word to ensure that formatting stays intact.

- Organize Your Files: Create folders or a naming convention to store and locate your documents quickly.

- Backup Your Files: Use cloud storage or an external drive to prevent loss of important records.

Printing Your Document

After saving your document, the next step is to print a physical copy. Ensure that the printed version is clear and professional, so it can be shared with clients or filed for your records.

- Check the Printer Settings: Set your printer to a high-quality resolution to ensure clarity.

- Preview Before Printing: Always preview the document before printing to avoid any formatting issues.

- Print on Quality Paper: Use good-quality paper to enhance the professionalism of the printed document.

By following these simple steps, you can ensure that both your digital and physical records are preserved properly, providing easy access and a professional presentation when needed.

Ensuring Legal Compliance in Financial Documents

When creating financial documents, it is essential to ensure they meet all necessary legal requirements. Compliance with local, state, or national regulations is critical for avoiding legal issues and ensuring that both businesses and customers are protected. This includes properly displaying essential information, applying the correct tax rates, and adhering to industry standards.

Key Legal Elements to Include

To ensure compliance, your financial document should include certain details that are often legally required depending on your location. These elements help establish the legitimacy of the document and protect both parties involved.

- Business Information: Clearly display your business name, address, and contact details. This is crucial for accountability.

- Customer Information: Include the name, address, and contact details of the client or customer.

- Unique Reference Number: Every document should have a unique identifier for easy tracking and reference.

- Clear Breakdown of Charges: All services, products, or fees should be itemized with precise amounts and descriptions.

- Tax Details: If applicable, taxes must be correctly calculated and included as per local tax laws.

Understanding Local Regulations

Different regions and industries may have specific rules that apply to business transactions. Understanding these regulations is important to prevent issues like tax violations or contractual disputes.

- Research Local Laws: Investigate your local jurisdiction’s rules regarding business transactions and compliance.

- Consult Legal Experts: It may be helpful to consult with legal or financial advisors to ensure you meet all requirements.

- Stay Updated: Laws and regulations can change, so it’s important to regularly review and adjust your documents as needed.

By incorporating these legal elements and staying informed about the regulations in your region, you can ensure that your documents are compliant and avoid potential legal complications.

How to Handle Refunds and Adjustments

Managing changes to payments, such as issuing refunds or making adjustments, is a vital part of maintaining strong customer relationships and ensuring transparency in business transactions. It is important to have a clear process in place for handling such requests to avoid confusion or disputes.

Steps for Processing Refunds

When a refund is necessary, it is essential to approach the situation in an organized manner. This ensures that the customer feels valued and that the financial process remains accurate.

- Verify the Request: Confirm that the refund request is legitimate, checking the terms and conditions to ensure the request complies with your policies.

- Review the Original Transaction: Check the details of the initial transaction, including the payment method and amount, to ensure accuracy before proceeding.

- Calculate the Refund Amount: Determine the exact amount to be refunded, including any applicable taxes or fees that may need adjustment.

- Issue the Refund: Process the refund via the same payment method used for the original transaction, if possible, to maintain consistency.

- Communicate Clearly: Notify the customer of the refund process, including expected timelines and any additional details they need to know.

How to Make Adjustments

Adjustments may be required when the terms of the agreement are modified after the initial transaction, such as providing discounts, correcting billing errors, or revising service charges.

- Document the Reason: Clearly note the reason for the adjustment in your records, whether it’s due to a billing error, a service change, or another valid reason.

- Update the Relevant Details: Modify the billing details to reflect the adjustment, ensuring that all changes are properly captured in the system.

- Issue a New Statement: If applicable, provide the customer with an updated statement or receipt reflecting the corrected amount.

- Confirm with the Customer: Always confirm the adjustment with the customer to ensure they are satisfied with the resolution.

By handling refunds and adjustments in a timely, transparent, and organized manner, you can maintain positive customer relationships and minimize confusion in your financial documentation.

Sharing Documents with Customers

When finalizing a transaction, it is crucial to share the corresponding payment details with your clients in a clear and professional manner. This ensures that both parties are on the same page regarding amounts owed, services rendered, and any other necessary terms. Providing this information promptly helps build trust and ensures transparency in business dealings.

Methods of Sharing Payment Documents

There are several methods for sending payment details to your customers, each with its advantages depending on the situation and customer preferences.

- Email: Sending payment records via email is one of the most common and efficient methods. You can easily attach a PDF or other file formats, ensuring the customer has a detailed record of the transaction.

- Postal Mail: For customers who prefer physical copies, mailing the document is an option. This method is slower but can be necessary for certain legal or formal reasons.

- Online Portals: If your business uses an online platform or customer portal, sharing payment documents directly through this system can be efficient. Customers can log in to view and download their documents at any time.

- SMS or Messaging Apps: In some cases, particularly for small businesses, sending payment confirmation links via text messages or messaging apps can be a quick and straightforward option for sharing necessary details.

Best Practices for Sharing Documents

To ensure the best experience for your customers and maintain a professional approach, consider these best practices:

- Timely Delivery: Always send the payment document as soon as the transaction is complete to avoid delays and confusion.

- Clear Format: Ensure the document is easy to understand, with all relevant details such as dates, amounts, and descriptions presented clearly.

- Secure Delivery: For sensitive information, use secure methods like encrypted emails or password-protected documents to protect both parties’ data.

- Confirmation: Request a confirmation from the customer that they have received and reviewed the document, either through email acknowledgment or other communication methods.

Sharing payment documents efficiently not only ensures a smooth transaction but also helps build strong, trusting relationships with your customers. By choosing the right method and following best practices, you demonstrate professionalism and commitment to clear communication.

Where to Find Free Templates Online

If you are looking for ready-made documents for your business needs, the internet offers a wide range of resources that can help you get started. Whether you need a simple design or something more detailed, there are many places where you can access these resources at no cost. These options make it easier to create professional-looking records without the need for extensive design skills or software.

Popular Websites for Downloading Documents

Numerous platforms offer downloadable resources, catering to different business requirements. Here are a few well-known sources where you can find templates:

- Google Docs: A highly accessible option that allows you to customize various types of documents, including invoices and receipts. You can find pre-made designs that can be edited online.

- Microsoft Office Templates: The official Microsoft website offers a variety of document formats for different purposes. You can easily access free versions for Word and Excel that suit your business style.

- Canva: Known for its intuitive design interface, Canva provides many document templates that you can personalize. You can adjust fonts, colors, and more to match your brand.

- Template.net: Offering a large selection of documents across multiple categories, this website features downloadable options that are perfect for creating accurate, professional records.

- Zoho: This site has a selection of business-related resources, including easy-to-edit documents that allow you to enter your specific details without hassle.

How to Make the Most of These Resources

While these sites provide ready-made options, it is important to customize the documents to ensure they meet your business requirements and look professional. Here are some tips to make the most of these free options:

- Choose the Right Format: Select a format that suits your needs. Different file types (Word, Excel, PDF) offer different levels of customization and compatibility.

- Personalize the Design: Customize fonts, logos, and colors to align with your brand’s identity.

- Ensure Clarity: Make sure all the necessary fields are included and easily understood by your customers.

- Stay Consistent: Use similar styles across all your business documents to maintain a professional image.

Using these free resources can save you time and effort, allowing you to focus on your business operations while ensuring that your documents are professional and organized. With just a few clicks, you can access and personalize various materials t