Free Car Rental Invoice Template Download

When managing a vehicle hire business, having a reliable way to document transactions is essential. A well-structured financial record helps maintain transparency, ensures clarity for both clients and service providers, and streamlines business operations. By using a structured format, businesses can easily track charges, payments, and services rendered, making administrative tasks much smoother.

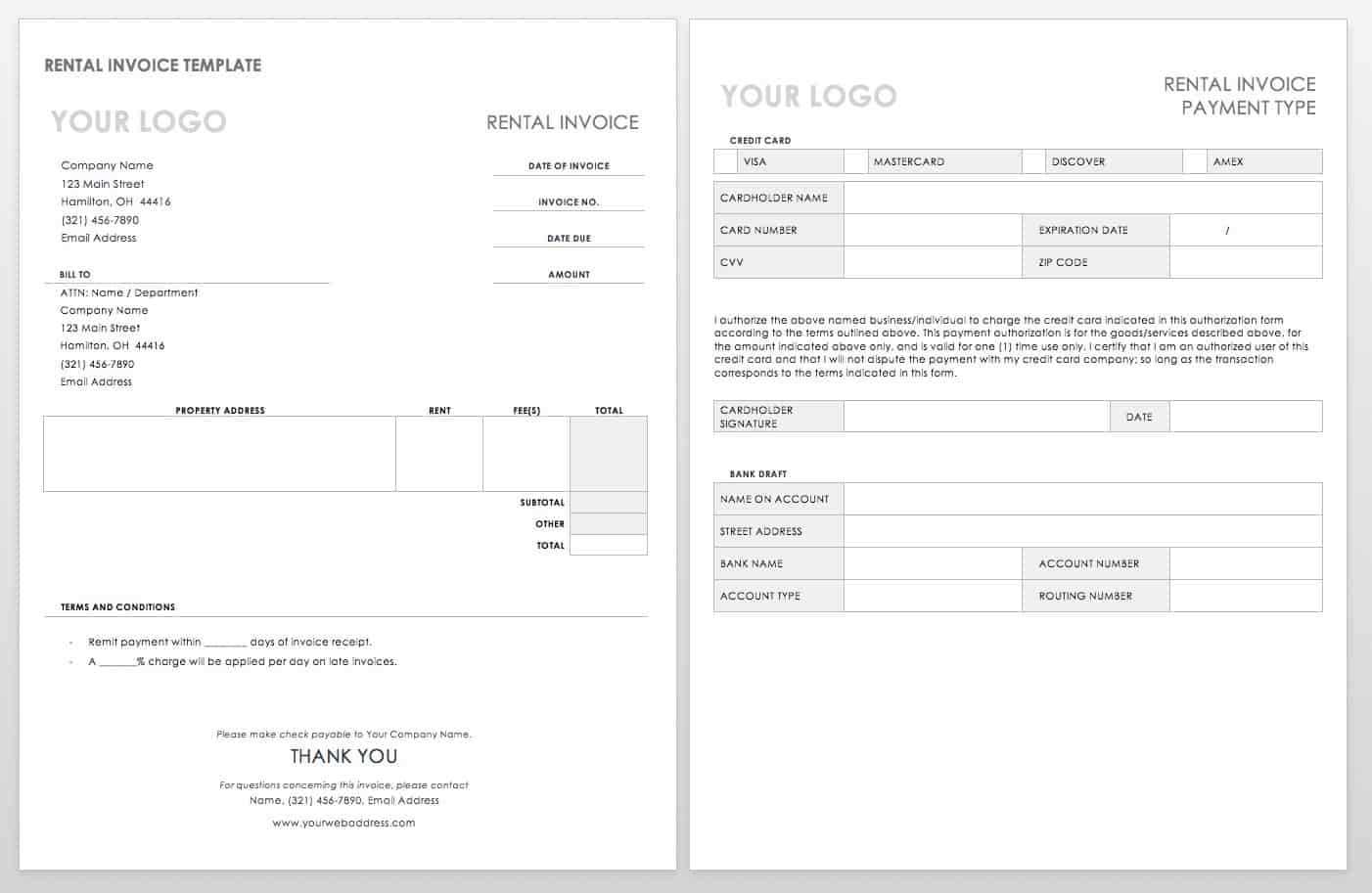

Customizable billing formats allow for the inclusion of necessary details like service dates, fees, and client information. This can be adapted to various business needs and adjusted for different types of services. The ease of modifying these documents ensures that each transaction is accurately recorded and presented.

Utilizing digital options further enhances efficiency, allowing for fast generation, easy editing, and seamless sharing. With the right approach, you can simplify your accounting processes while maintaining professionalism in all transactions. This tool is indispensable for businesses looking to stay organized and reduce time spent on administrative tasks.

Car Rental Invoice Template Free Download

When running a vehicle hire business, having a clear and organized method to document each transaction is crucial. It not only ensures accurate billing but also helps maintain a professional relationship with clients. By using customizable formats, businesses can easily capture all essential details of the transaction, such as services provided, charges, and payment terms.

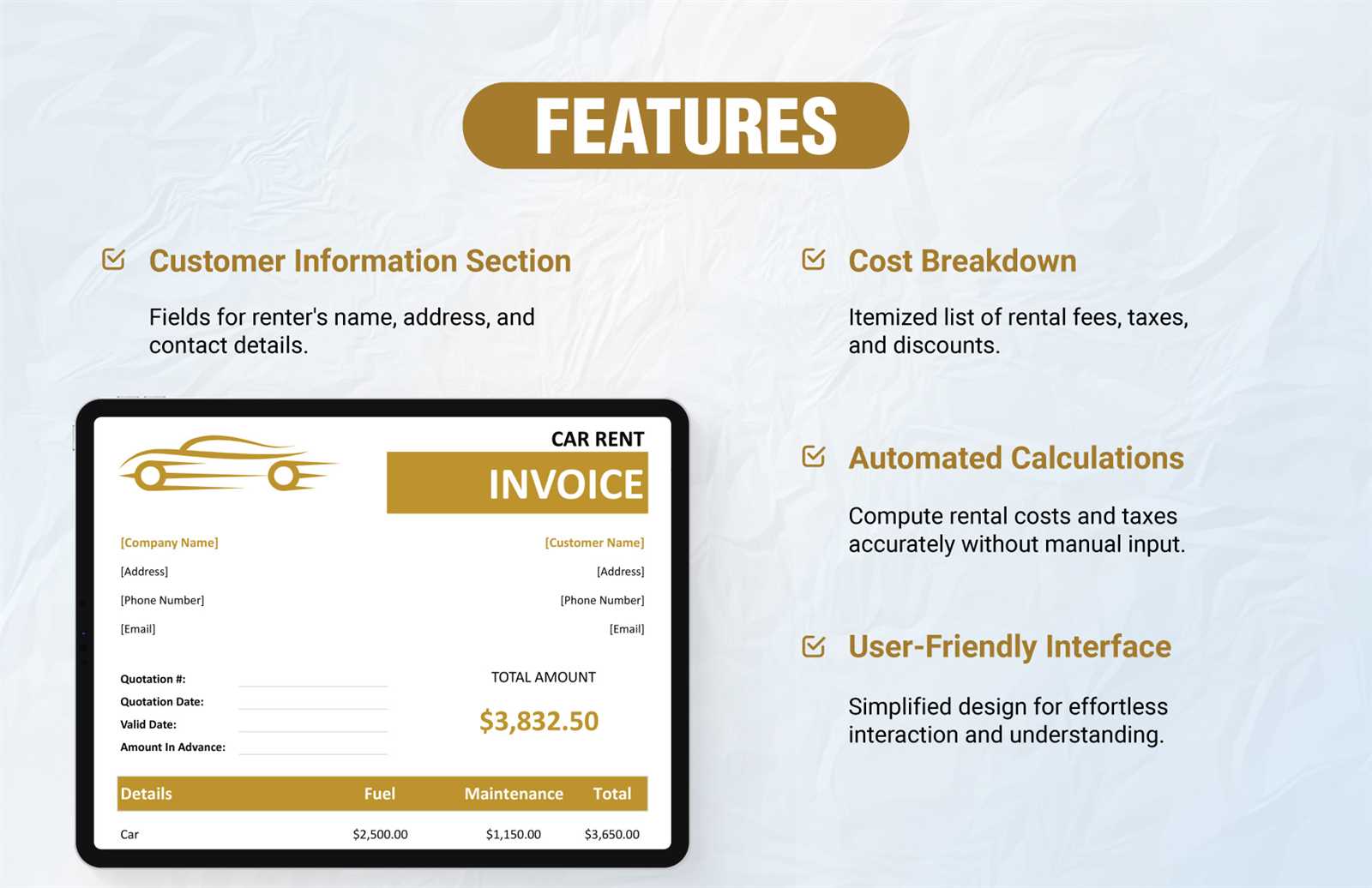

Key Features of an Effective Billing Format

To streamline your business operations, it’s important to choose a format that offers flexibility while covering all necessary details. The right document should include:

- Client information, including contact details

- Details of the vehicle or services provided

- Accurate date range for the service

- Breakdown of charges, including any additional fees

- Clear payment instructions and due dates

Advantages of Using a Digital Billing Format

Digital versions of these documents provide numerous benefits, making the billing process faster and more efficient. Some advantages include:

- Easy to edit and customize for each transaction

- Quick sharing options with clients via email or online platforms

- Automated calculations to reduce human error

- Ability to store records securely and access them at any time

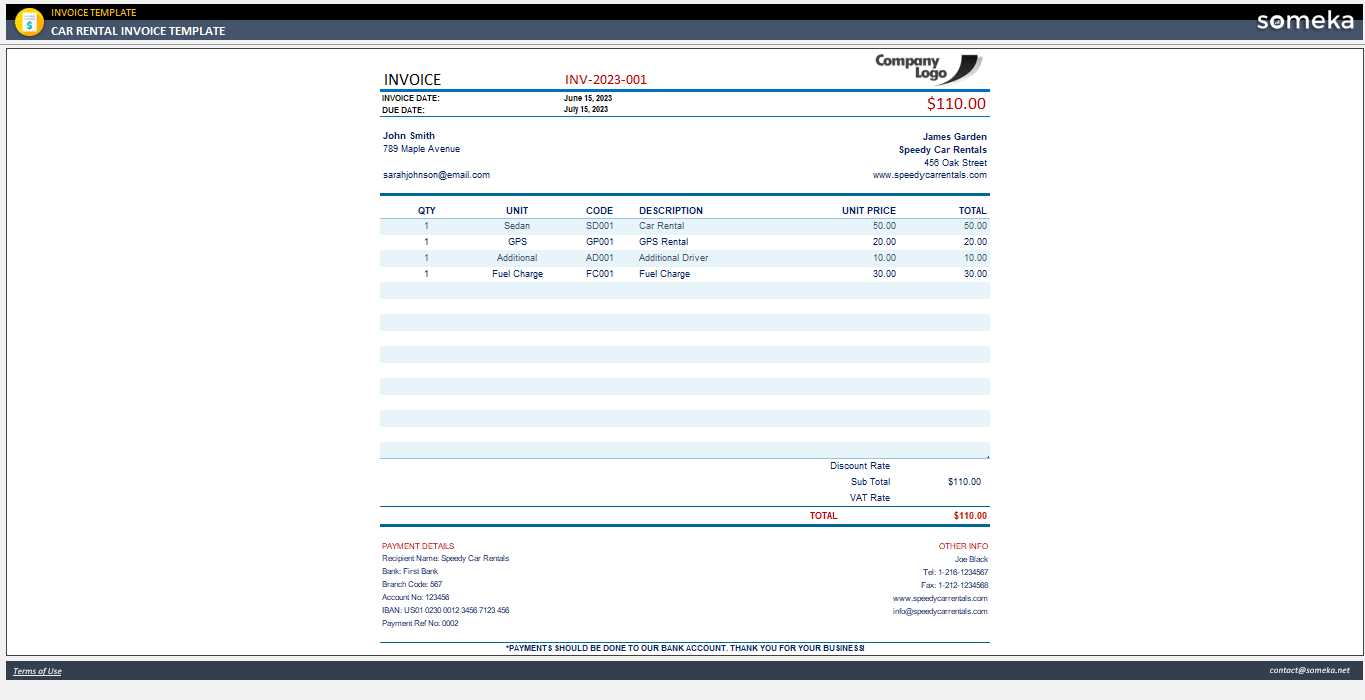

How to Use a Car Rental Invoice

Properly documenting transactions is essential for maintaining an organized business. Using a structured form to record the details of each agreement ensures transparency and helps both the service provider and the client keep track of their financial obligations. Understanding how to effectively use such a document can improve business efficiency and reduce errors in financial reporting.

Step-by-Step Guide for Using Billing Forms

To make the most out of a billing document, it’s important to follow a clear procedure. Here’s a step-by-step guide:

- Fill in Client Details: Ensure the name, address, and contact details of the customer are correctly recorded.

- Document Service Information: List the specific services provided, including dates, vehicle specifics, and any additional items or services.

- Breakdown of Charges: Provide a detailed breakdown of all costs, including base rates, taxes, and extra fees.

- Payment Terms: Clearly indicate the payment due date, any late fees, and the total amount due.

Why Accuracy is Important

Accurate records help avoid misunderstandings between the service provider and the client. By carefully reviewing the document before finalizing it, you ensure that all details are correct, which helps in maintaining a professional relationship and reducing potential disputes. A well-prepared financial document is also crucial for tax reporting and future reference.

Benefits of Downloading an Invoice Template

Using pre-designed forms for billing offers several advantages, especially when it comes to efficiency and professionalism. Instead of creating a document from scratch, you can utilize a ready-made format that is structured to capture all the necessary details. This reduces the time spent on administrative tasks and helps ensure consistency in every transaction.

Time-Saving Advantages

One of the most significant benefits is the time saved by using a pre-structured document. Instead of designing and formatting each bill individually, you can simply input the required information. This helps you focus more on delivering services and managing your business, rather than getting bogged down in paperwork.

Consistency and Accuracy

By using a standardized format, you ensure that all essential details are included and presented clearly. This consistency not only improves professionalism but also reduces the risk of missing critical information, such as tax rates or payment terms. Accuracy in these documents is vital for avoiding errors and ensuring proper financial management.

Customizing Your Billing Document

Personalizing your financial records is essential for reflecting your brand and ensuring that all relevant details are clearly communicated to your clients. Customization allows you to adjust the layout, add specific terms, and include your business logo or contact information. This ensures that every document aligns with your company’s identity and provides a professional appearance.

Incorporating Your Business Branding

Including your logo, business name, and contact details on every document strengthens your brand’s visibility and professionalism. This small but effective touch ensures that your clients always know how to reach you and reinforces your company’s image. Furthermore, having consistent branding across all documents helps build trust and credibility with your customers.

Adjusting for Specific Client Needs

Every client may have different requirements or preferences, and customizing the format can help meet those needs. You can include additional fields for special discounts, payment plans, or notes on services provided. By tailoring the document to each situation, you improve communication and make the experience more personalized for your clients.

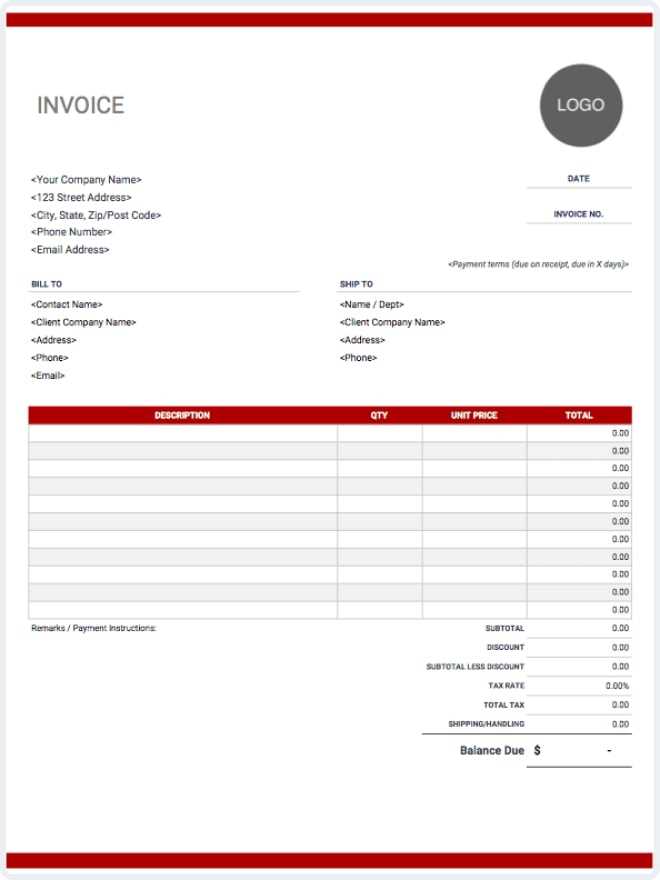

Essential Elements of a Billing Document

To ensure that your financial records are both accurate and professional, certain key elements must be included in each document. These elements not only help clarify the transaction for both parties but also make the document easy to read and understand. Below are the most important components to include when preparing your billing record:

| Element | Description |

|---|---|

| Client Information | Include the client’s full name, address, and contact details to ensure clear identification. |

| Service Details | Describe the service provided, including dates, hours, and specifics about the goods or services involved. |

| Cost Breakdown | Provide a clear list of charges, including base rates, taxes, and any additional fees. |

| Payment Terms | Specify the total amount due, the payment method, and the due date. |

| Additional Notes | Include any other relevant details, such as special discounts, payment plans, or comments. |

Free Templates vs Paid Options

When it comes to choosing a document format for your business, you have the option of using either no-cost solutions or investing in premium versions. Both choices offer distinct advantages, depending on your needs and the complexity of your operations. The decision ultimately comes down to factors such as customization, functionality, and long-term benefits.

Free options are often a good starting point for businesses with simple needs. They provide basic functionality and allow you to create professional documents without any upfront cost. However, they may lack advanced features and flexibility, especially if you need to customize them to match your brand or include specific details for different clients.

On the other hand, paid versions offer a broader range of tools and customization options. These solutions often include advanced features, such as automated calculations, detailed reporting, and the ability to integrate with other business software. Paid options may also provide better customer support and ongoing updates, making them more suitable for businesses that require more sophisticated functionality and scalability.

How to Edit Your Billing Document

Customizing your financial documents is a straightforward process that allows you to adjust the details of each transaction to suit your needs. Whether you’re correcting information, adding specific terms, or personalizing the layout, having the ability to make quick edits helps ensure that each document is accurate and up-to-date.

Step-by-Step Guide to Editing

Here’s how you can easily make changes to your billing record:

- Open the Document: Start by opening the file using the appropriate software (e.g., word processor, spreadsheet tool, or invoicing platform).

- Edit Client Information: Modify client details such as name, address, or contact information as needed.

- Update Service Details: Adjust the description of the service provided, including dates, vehicle specifics, or any additional services rendered.

- Adjust Costs: Update the pricing, taxes, and any fees to reflect the correct amounts.

- Save Changes: Once you’ve made the necessary changes, save the document to keep the most current version.

Why Regular Edits are Important

Regularly updating your documents ensures that all information is accurate and reflects any changes in your business or client needs. This can help prevent errors, improve client satisfaction, and make the overall billing process smoother. Having an editable version of your records also simplifies adjustments if discrepancies arise in the future.

Best Software for Document Customization

Choosing the right software for creating and customizing your financial records can greatly enhance efficiency and professionalism. The right tool not only streamlines the document creation process but also offers a range of customization options to match your business needs. Whether you are looking for advanced features or simple designs, various software solutions cater to different preferences.

Top Software for Beginners

For those who are just starting or need a straightforward solution, some software offers easy-to-use tools for creating basic documents. These options often come with pre-designed layouts, customizable fields, and simple editing features. Some of the best options include:

- Microsoft Word: Offers easy editing and customizable layouts for creating professional-looking documents.

- Google Docs: A free and accessible option with templates that can be easily customized and shared online.

- Zoho Writer: Cloud-based tool with customizable features and easy integration with other business applications.

Advanced Software for Professionals

For businesses that require more advanced functionalities, such as automated calculations, integration with accounting systems, and detailed reporting, the following software solutions are highly recommended:

- QuickBooks: Popular accounting software with robust billing and document creation tools, ideal for businesses of all sizes.

- FreshBooks: A user-friendly platform that provides detailed customization and integrates easily with payment systems.

- Wave: Offers a free solution with advanced features, including invoicing, payment processing, and financial reporting.

Why a Professional Document Matters

Having a well-structured and polished financial record is crucial for any business. A professional document not only reflects the credibility of your business but also ensures clear communication with clients, reducing the likelihood of misunderstandings. The appearance and accuracy of these records contribute to building trust and fostering positive relationships with customers.

| Reason | Impact |

|---|---|

| Professionalism | A clean and organized document reinforces the perception of your business as reliable and competent. |

| Clarity | Clear and precise information reduces the risk of confusion and ensures both parties are on the same page regarding terms and payment. |

| Legal Protection | Accurate and well-detailed records help protect both the business and the client in case of any disputes. |

| Efficient Payments | A professional document provides all necessary details, making it easier for clients to process payments on time. |

Choosing the Right Billing Format

Selecting the right structure for your financial documents is an essential task that can significantly affect how your business communicates with clients. The layout and design of these documents should be clear, professional, and suited to the nature of the transaction. Whether you need a simple or more detailed approach, choosing the appropriate format will ensure smooth processing and greater accuracy.

| Factor | Consideration |

|---|---|

| Business Type | Choose a layout that aligns with the services you offer, ensuring all necessary information is clearly presented. |

| Customization Needs | Look for a format that allows easy edits and personalization to match your branding or specific transaction details. |

| Client Expectations | Consider what your clients expect in terms of document clarity and detail, and choose a structure that meets those needs. |

| Legal and Tax Requirements | Ensure the structure includes all legally required fields, such as tax rates, terms of service, and payment due dates. |

Common Mistakes on Billing Documents

Errors in financial records can lead to confusion, delayed payments, and even damage to client relationships. It’s essential to double-check details to ensure the accuracy of the document. Even small mistakes can create unnecessary issues, such as incorrect charges or misunderstandings about payment terms. Understanding the most common mistakes can help prevent them and ensure smoother transactions.

Frequent Errors to Watch Out For

- Incorrect Client Information: Ensuring the name, contact details, and address are accurate is crucial to prevent communication issues.

- Missing or Incorrect Dates: Failure to include accurate service dates or payment due dates can lead to confusion about when payment is expected.

- Unclear Descriptions of Services: Vague or missing descriptions of services rendered can result in disputes over what was provided and what should be paid for.

- Calculation Errors: Simple math mistakes, such as adding taxes or calculating totals incorrectly, can cause discrepancies between what’s charged and what is owed.

How to Avoid These Mistakes

To minimize errors, ensure that all the information is double-checked before sending out any financial record. Utilize software that can automatically calculate totals, taxes, and fees. Also, standardize your document format to avoid inconsistencies and make the process faster and more efficient.

How to Save Time with Pre-Formatted Documents

Utilizing pre-designed structures for financial documents can significantly reduce the time spent on each transaction. By adopting a standardized approach, you eliminate the need to start from scratch every time. This allows you to focus on more important tasks while ensuring that your documents remain professional and accurate. The efficiency gained from using pre-set designs helps streamline your workflow and reduce errors.

Advantages of Using Pre-Formatted Documents

- Quick Setup: With a structured layout, you can quickly fill in the relevant details without worrying about formatting each section.

- Consistency: Using the same format for every document ensures uniformity, making your records easier to manage and review.

- Accuracy: Pre-set designs often include essential fields, reducing the chance of missing crucial information or making mistakes.

- Time Efficiency: Save time by reusing the same structure, allowing for faster processing and distribution of documents.

Features to Look for in Pre-Formatted Documents

| Feature | Benefit |

|---|---|

| Editable Fields | Ensure that all sections can be customized to fit specific transaction details. |

| Automatic Calculations | Automatically calculate totals, taxes, and other essential figures to avoid manual errors. |

| Professional Design | Make a positive impression with a clean, organized look that enhances the document’s credibility. |

| Compatibility | Ensure the design works well with the software you already use for ease of integration and efficiency. |

Understanding Tax Calculation on Financial Documents

Accurately calculating taxes on financial records is essential for both businesses and clients. Ensuring the correct tax rate is applied not only helps to comply with legal requirements but also maintains transparency and trust. Without proper tax calculations, the document may become inaccurate, leading to potential disputes or penalties. Understanding the basics of tax inclusion and how to apply the correct rates can streamline your financial transactions and ensure compliance.

Basic Principles of Tax Calculation

- Sales Tax: This is typically a percentage of the total amount charged and must be calculated based on local laws. Ensure the right tax rate is applied depending on the location of the transaction.

- Taxable Amount: Tax is often calculated on the subtotal before any discounts or additional fees are added. It’s important to ensure that only the appropriate amounts are taxed.

- Exemptions: Some goods or services might be exempt from tax. Make sure to exclude these items from the taxable total to avoid errors.

Steps to Accurately Calculate Tax

- Identify the Tax Rate: Verify the local tax rate applicable to your service or product category. Rates can vary by region, so it’s important to check current tax laws.

- Calculate Taxable Amount: Determine which items or services are subject to tax, and calculate the subtotal for those items only.

- Apply the Tax Rate: Multiply the taxable amount by the tax rate to calculate the total tax due.

- Include the Tax in the Total: Add the calculated tax to the subtotal to determine the final amount to be paid.

Printable vs Digital Billing Documents

When managing financial transactions, businesses often face the decision between providing physical or electronic records. Each format has its own set of benefits and limitations, depending on the needs of both the business and the customer. While printed documents offer a tangible copy, digital formats provide more convenience and speed. Understanding the advantages of both can help in choosing the most appropriate option for your specific situation.

Advantages of Printable Documents

- Physical Proof: Printed records provide a hard copy that can be stored in files, useful for manual accounting or for customers who prefer a physical document.

- Ease of Distribution: Physical copies can be handed directly to clients or sent via postal services without requiring an internet connection.

- Compliance with Traditional Processes: Some clients or regions still require physical documentation for legal or business reasons, ensuring a smooth transaction.

Advantages of Digital Records

- Efficiency: Digital documents can be created, edited, and sent instantly, saving both time and effort compared to manual processes.

- Eco-Friendly: Using digital formats reduces paper usage, helping to lower environmental impact and contribute to sustainability.

- Accessibility: Electronic records can be accessed anywhere, anytime, and on any device with an internet connection, offering greater convenience.

- Easy Integration: Digital records can be directly integrated into accounting software or cloud storage, allowing for smoother bookkeeping and data management.

Adding Your Branding to the Template

Incorporating your company’s identity into business documents is an essential step in maintaining professionalism and consistency across all communications. Personalizing documents with your logo, color scheme, and other brand elements helps reinforce your company’s image and makes your documents instantly recognizable to clients. Whether you’re issuing receipts or other transaction records, branding is an important detail that can leave a lasting impression.

Here are a few key elements to consider when customizing your business documents:

| Branding Element | Description |

|---|---|

| Logo | Place your company’s logo at the top of the document to make it easily identifiable and enhance your brand’s visibility. |

| Color Scheme | Use your brand’s official colors to highlight headings, borders, and other key elements to create a cohesive look. |

| Typography | Utilize your company’s fonts to maintain consistency with your other marketing materials, ensuring a professional appearance. |

| Contact Information | Include your business address, phone number, email, and website to make it easy for clients to reach you and reinforce your credibility. |

By ensuring these elements are included, you not only enhance the professionalism of your documents but also create a stronger connection between your company and your clients. Customizing your documents with your branding makes them not just functional, but also a reflection of your business identity.

Where to Find Free Invoice Templates

If you’re looking to create professional documents without the hassle of starting from scratch, there are several places online where you can access customizable options. These resources offer pre-designed forms that you can adjust to fit your specific needs, saving time and ensuring accuracy in your billing process.

Here are some common sources for obtaining ready-to-use forms:

- Online Document Libraries: Many websites provide a collection of editable documents that can be accessed for free. They often cover a wide range of business needs, from billing to contracts, and can be customized in various formats such as Word or PDF.

- Spreadsheet Software: Tools like Microsoft Excel and Google Sheets often include built-in templates for creating billing documents. These platforms offer flexible templates that can be modified to suit your business requirements.

- Business Software Platforms: Several online platforms specialize in business management tools, offering free access to a variety of forms, including those needed for transaction records. These services may allow you to generate and customize documents with ease.

- Freelancer Websites: Some freelancing platforms also provide free resources, where designers and business professionals share editable documents that anyone can use for personal or business purposes.

By exploring these options, you can find the right solutions that fit your workflow and professional needs, ensuring that you can produce well-organized documents without any hassle.

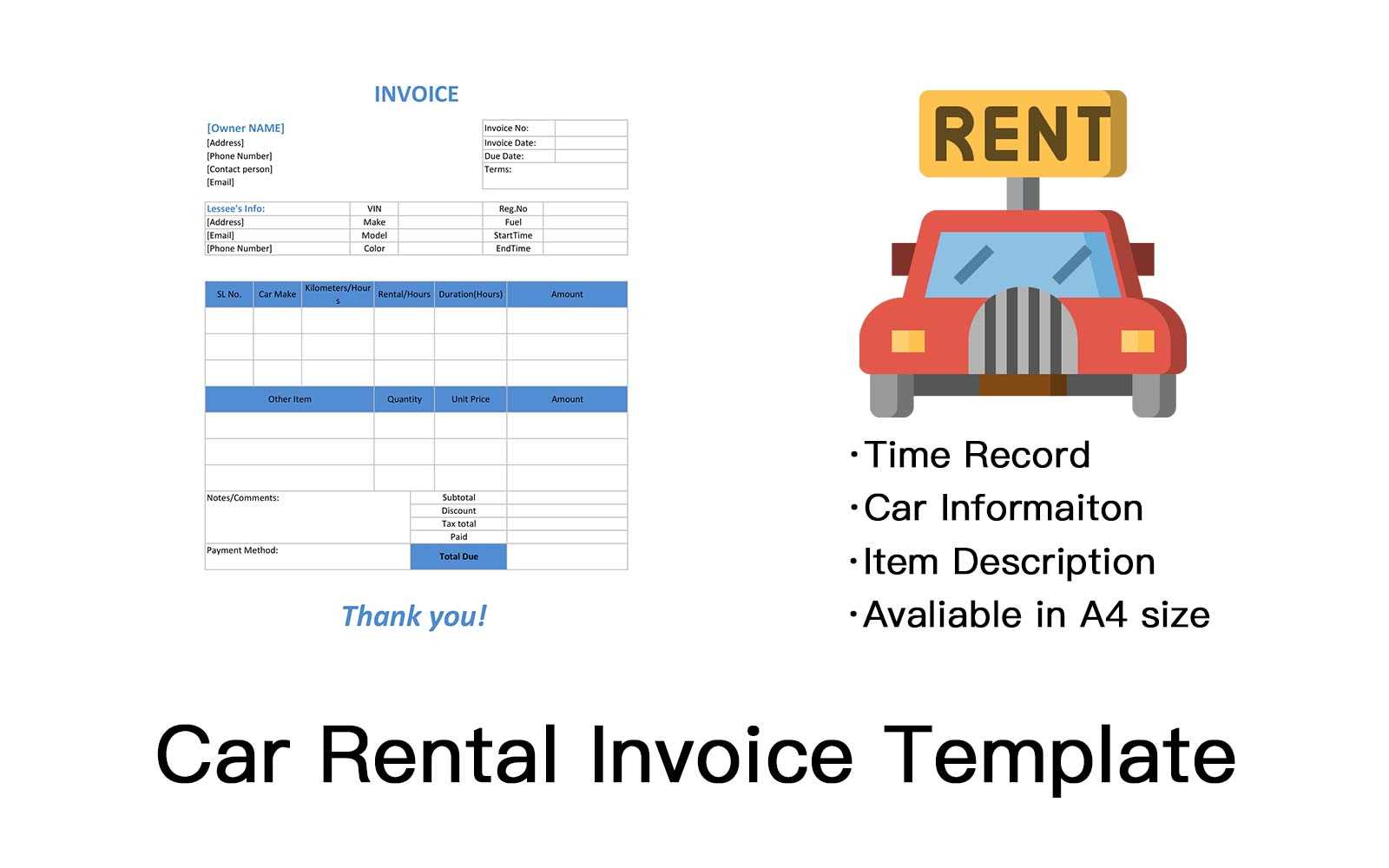

Legal Requirements for Car Rental Invoices

When generating transaction records for your clients, it’s essential to comply with legal standards that ensure transparency and protect both parties. The information required on such documents varies by region and type of service but generally includes key details that help maintain proper documentation for accounting and legal purposes.

Key Legal Elements to Include

To ensure that your records meet the necessary legal requirements, consider the following essential components:

- Business Information: Include your business name, address, and tax identification number to ensure proper identification and avoid legal complications.

- Client Details: Clearly specify the name and contact information of the individual or company being billed.

- Transaction Date: Include the date the transaction took place or when services were provided. This is critical for both legal and tax purposes.

- Description of Services: Provide a detailed breakdown of the services provided, including duration, additional costs, and any special conditions.

- Payment Terms: Clearly state the payment terms, including due dates, penalties for late payments, and applicable taxes or fees.

- Tax Information: Include any required tax information, such as sales tax or value-added tax (VAT), that applies to the transaction.

Additional Considerations

In addition to the basic requirements, some regions may have specific laws that dictate how billing records must be formatted or what additional information must be included. It’s always advisable to consult local regulations or a legal professional to ensure full compliance with your area’s laws.