Canadian Invoice Template with GST for Accurate Billing

For any business owner, managing payments and ensuring accurate financial records is crucial. Proper documentation helps avoid confusion and ensures tax compliance. Whether you’re a freelancer or run a larger enterprise, having a reliable system for charging clients is essential to maintaining smooth operations. A professional billing format plays a key role in this process, making transactions clearer and simpler for both parties.

When it comes to preparing statements for goods and services, it’s important to factor in all necessary charges, including government-mandated fees. Including these elements correctly can save you time and prevent costly errors. By using a well-designed system for financial records, you can easily track payments and ensure that your business meets all legal requirements.

Having the right tools in place can improve your workflow and enhance customer experience. A customizable system tailored to your specific needs provides the flexibility to meet different client demands while remaining compliant with local regulations. This approach reduces the likelihood of mistakes and supports long-term business growth.

Understanding GST in Canadian Invoices

In business transactions, accurate financial documentation is crucial, especially when it comes to the tax obligations imposed by the government. The application of certain charges on products or services ensures that businesses comply with tax laws while maintaining transparent records. Understanding how to properly incorporate these mandatory fees into your billing process is essential for any entrepreneur.

One of the most important aspects of business transactions is correctly calculating the applicable taxes on sales. These charges are typically a percentage of the total price and must be clearly identified on the final record. Failure to include or incorrectly calculate this amount can lead to compliance issues and financial penalties. In this section, we will explore how to apply these taxes effectively to your financial documents.

The tax is usually represented as a percentage of the total value of the transaction. Below is an example of how different elements are presented in a billing document:

| Description | Amount | Tax Applied | Total Amount |

|---|---|---|---|

| Product A | $100.00 | $5.00 | $105.00 |

| Service B | $50.00 | $2.50 | $52.50 |

| Total | $150.00 | $7.50 | $157.50 |

This simple breakdown helps both the business and the customer understand the total cost, including the tax. The tax amount is added to the base price, ensuring that all calculations are clear and transparent. By following this approach, business owners can keep their records accurate and comply with the legal tax requirements in their region.

Why You Need a Canadian Invoice Template

Maintaining accurate and professional records is essential for any business, large or small. One of the most important documents in managing transactions is the formal billing record, which serves as proof of the exchange between buyer and seller. Without a standardized format, businesses risk confusion, errors, and potential disputes with clients. A well-structured system ensures consistency, improves clarity, and helps you stay organized.

By utilizing a pre-designed document structure, you can streamline your financial processes and focus more on your business operations. A customizable layout allows you to include all necessary details, such as charges, taxes, and payment terms, while maintaining a professional appearance. Here are some of the key reasons why using such a system is beneficial:

- Clarity and Professionalism: Having a clear and consistent format presents your business as organized and trustworthy, which can improve customer relations.

- Time-Saving: Pre-designed formats save you time by eliminating the need to create documents from scratch for every transaction.

- Accuracy: A standardized structure reduces the risk of missing important details, ensuring that all required information is included each time.

- Legal Compliance: A pre-designed document helps ensure that all legal requirements, such as the inclusion of mandatory taxes, are met.

- Tax Tracking: Clear financial records make it easier to track sales, payments, and taxes for accurate reporting during tax season.

Ultimately, using an efficient billing method saves you time and resources, while also preventing costly mistakes. A consistent and organized document format improves both your internal processes and your overall customer experience. It’s a simple tool that brings significant advantages to your business operations.

How GST Affects Your Billing Process

When conducting transactions, it’s essential to include all necessary charges to ensure transparency and compliance with tax laws. One of the most important factors in any billing process is the application of sales taxes, which can vary depending on your location and the nature of your goods or services. These charges are not optional and must be accurately accounted for in each transaction, affecting both the way you structure your documents and the way you calculate totals.

Impact on Calculation and Formatting

The inclusion of sales tax means that your pricing and total amounts will need to reflect the additional percentage applied to the base price. This affects the overall format of your financial records, requiring you to break down the total amount clearly to avoid confusion. Here’s how it influences your billing process:

- Additional Line Items: You must include a line for the tax charge to ensure transparency and clarity for your clients.

- Precise Calculations: It’s crucial to apply the correct percentage to each item or service sold to avoid errors.

- Clear Breakdown: The total amount should be clearly separated into product/service price, tax applied, and final total.

Ensuring Compliance

Failure to correctly apply these charges can result in legal consequences, including fines or audits. Therefore, staying informed about the tax rate that applies to your business and ensuring it’s properly incorporated into your records is vital. Here are key steps to follow:

- Verify Applicable Rates: Ensure you are using the correct tax rate for the goods or services you’re providing.

- Consistent Updates: Keep your billing process updated to reflect any changes in tax regulations.

- Track and Report: Maintain accurate records of all transactions for easy reporting during tax filings.

By correctly accounting for this sales charge in your billing documents, you not only comply with regulations but also create clear, professional records for your clients, fostering trust and reducing the likelihood of disputes.

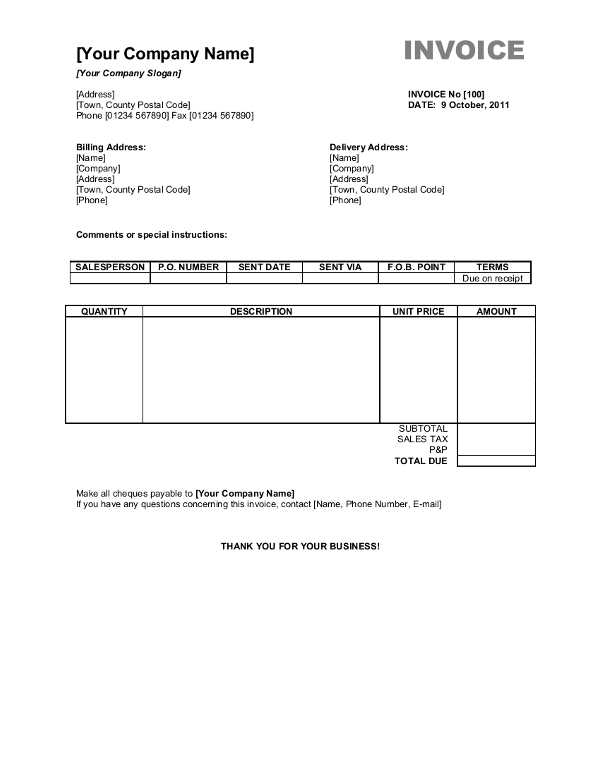

Essential Elements of a Canadian Invoice

When it comes to formal billing, certain details must always be included to ensure the document is both clear and legally compliant. These key components not only make the document more professional but also ensure that all the required information is present for both the seller and buyer. Whether you’re selling products or offering services, these essential elements help facilitate smooth transactions and maintain organized records.

Each record should be designed to highlight critical information that provides clarity regarding the sale. This includes everything from business details to the calculation of applicable fees. Below are the key components that should be included:

- Business Information: Clearly state your business name, address, phone number, and any other contact details. This helps the customer identify the source of the transaction.

- Customer Information: Include the name and address of the customer receiving the goods or services, ensuring there is no ambiguity regarding who the document pertains to.

- Unique Reference Number: Assign a unique identifier to each document for easy reference and tracking. This number ensures that all transactions are properly logged and can be easily located if needed.

- Itemized List of Products/Services: Provide a detailed list of what has been sold, including the quantity, description, unit price, and total cost for each item or service.

- Tax Information: Clearly indicate any applicable taxes, along with the rate applied. This allows customers to see exactly how much they are paying in taxes.

- Total Amount: The total amount due should be displayed prominently, including all charges and applicable taxes.

- Payment Terms: Specify the terms for payment, including the due date and any discounts or penalties for early or late payment.

- Method of Payment: Include the accepted methods of payment, such as credit card, bank transfer, or online payment system.

By ensuring that all these elements are present and clearly formatted, you create a professional, transparent document that is easy for both you and your customers to understand. Clear communication is key to building trust and ensuring a smooth billing process.

Creating Customizable Invoices for Canadian Businesses

For businesses of any size, having the flexibility to create and adapt billing documents is essential for maintaining accurate records and ensuring smooth transactions with clients. A flexible billing system allows entrepreneurs to tailor their documents to suit their specific needs, whether they are offering one-time services or recurring products. Customizable records are important for creating a professional image and making the billing process more efficient.

Having a customizable billing format means you can modify different elements such as the layout, line items, and tax calculations. This flexibility allows businesses to adjust the document to reflect unique pricing structures, discounts, or additional fees while ensuring full compliance with local tax laws. Below are some key factors to consider when creating a tailored document:

Key Elements of Customization

- Company Branding: Customizing the look and feel of your document with your logo, color scheme, and fonts creates a consistent brand identity for your business.

- Product/Service Descriptions: Make sure that the descriptions of products or services are clear and accurate, and leave room for adjustments as your offerings change.

- Tax Breakdown: The ability to adjust tax rates based on location and service type is essential for compliance with tax regulations.

- Payment Terms and Notes: Custom fields allow you to add specific payment instructions, due dates, or special client notes, providing a personalized touch.

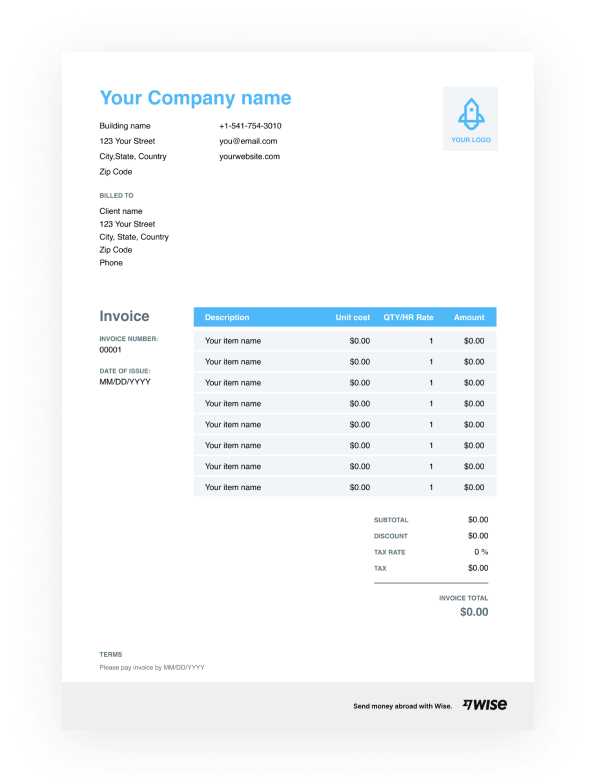

Example of a Customizable Billing Document

The following table illustrates how different elements of a billing record can be customized for a specific transaction:

| Description | Unit Price | Quantity | Subtotal | Tax | Total |

|---|---|---|---|---|---|

| Consulting Services | $150.00 | 2 | $300.00 | $15.00 | $315.00 |

| Web Development | $500.00 | 1 | $500.00 | $25.00 | $525.00 |

| Total | $800.00 | $40.00 | |||

As seen in the example, a customizable format can easily accommodate different items, pricing, and taxes, making the process simpler and more accurate for both the business and its customers. The flexibility of such systems ensures you can stay organized, while also keeping your business’s financial records up to date and professional-looking.

Creating Customizable Invoices for Canadian Businesses

For businesses of any size, having the flexibility to create and adapt billing documents is essential for maintaining accurate records and ensuring smooth transactions with clients. A flexible billing system allows entrepreneurs to tailor their documents to suit their specific needs, whether they are offering one-time services or recurring products. Customizable records are important for creating a professional image and making the billing process more efficient.

Having a customizable billing format means you can modify different elements such as the layout, line items, and tax calculations. This flexibility allows businesses to adjust the document to reflect unique pricing structures, discounts, or additional fees while ensuring full compliance with local tax laws. Below are some key factors to consider when creating a tailored document:

Key Elements of Customization

- Company Branding: Customizing the look and feel of your document with your logo, color scheme, and fonts creates a consistent brand identity for your business.

- Product/Service Descriptions: Make sure that the descriptions of products or services are clear and accurate, and leave room for adjustments as your offerings change.

- Tax Breakdown: The ability to adjust tax rates based on location and service type is essential for compliance with tax regulations.

- Payment Terms and Notes: Custom fields allow you to add specific payment instructions, due dates, or special client notes, providing a personalized touch.

Example of a Customizable Billing Document

The following table illustrates how different elements of a billing record can be customized for a specific transaction:

| Description | Unit Price | Quantity | Subtotal | Tax | Total |

|---|---|---|---|---|---|

| Consulting Services | $150.00 | 2 | $300.00 | $15.00 | $315.00 |

| Web Development | $500.00 | 1 | $500.00 | $25.00 | $525.00 |

| Total | $800.00 | $40.00 | |||

As seen in the example, a customizable format can easily accommodate different items, pricing, and taxes, making the process simpler and more accurate for both the business and its customers. The flexibility of such systems ensures you can stay organized, while also keeping your business’s financial records up to date and professional-looking.

How to Calculate GST on Your Invoice

Accurately calculating the appropriate sales tax is a critical part of any business transaction. This charge is typically calculated as a percentage of the base price of products or services sold, and it must be clearly reflected in the final document. Understanding how to apply this tax correctly ensures that both you and your customers are clear on the total cost and helps you stay compliant with tax regulations.

To determine the correct amount, it’s important to follow a simple process. The calculation involves multiplying the total value of the items or services by the applicable rate. Here’s a step-by-step guide to help you with the process:

Step-by-Step Guide to Calculating Sales Tax

- Determine the Base Price: Identify the total price of the goods or services before tax is applied.

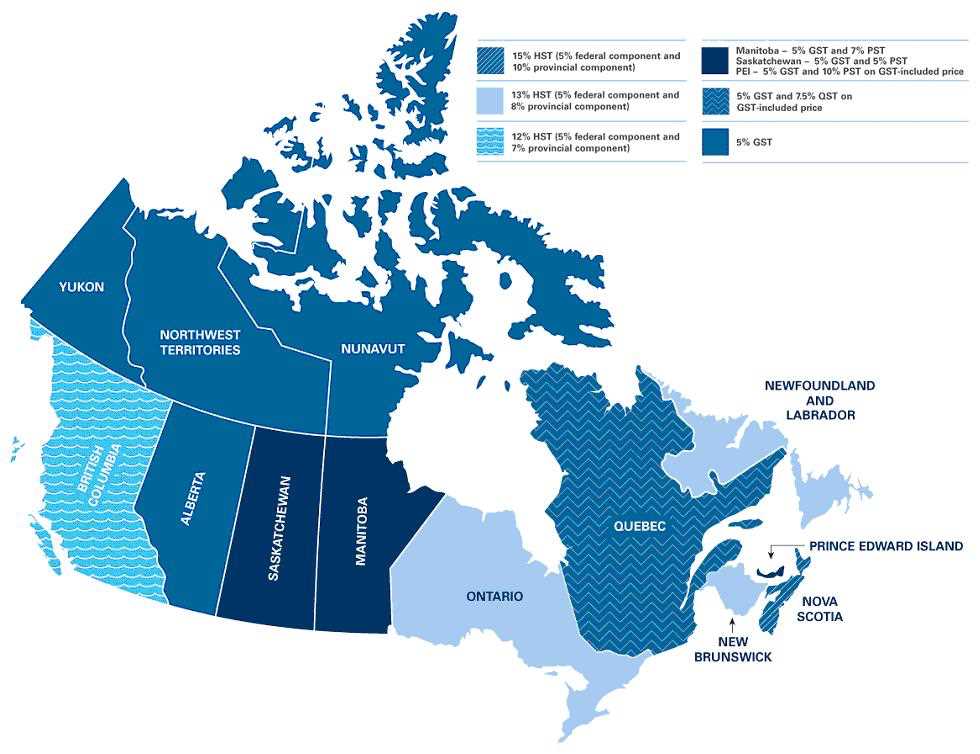

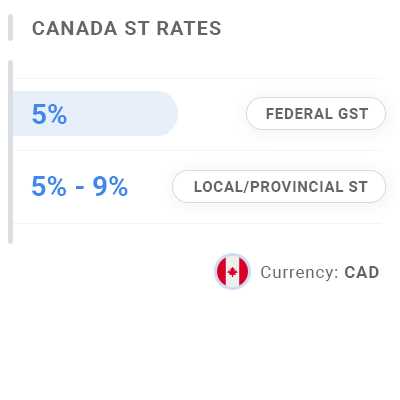

- Find the Applicable Tax Rate: Know the sales tax rate that applies to your goods or services. This rate may vary depending on the region or product category.

- Calculate the Tax Amount: Multiply the base price by the sales tax rate. For example, if the rate is 5% (0.05) and the price is $100, the tax would be $100 x 0.05 = $5.00.

- Add the Tax to the Base Price: Once you’ve calculated the tax amount, add it to the original price to get the total cost. For example, $100 + $5 = $105.

Here’s an example calculation:

- Base Price: $200.00

- Tax Rate: 5% (0.05)

- Tax Amount: $200 x 0.05 = $10.00

- Total Amount: $200 + $10 = $210.00

By following these steps, you can easily calculate the correct sales tax for any transaction. It is important to remember that some items or services may be exempt from this charge or have a different rate, so always ensure you’re using the correct tax rate for your specific situation.

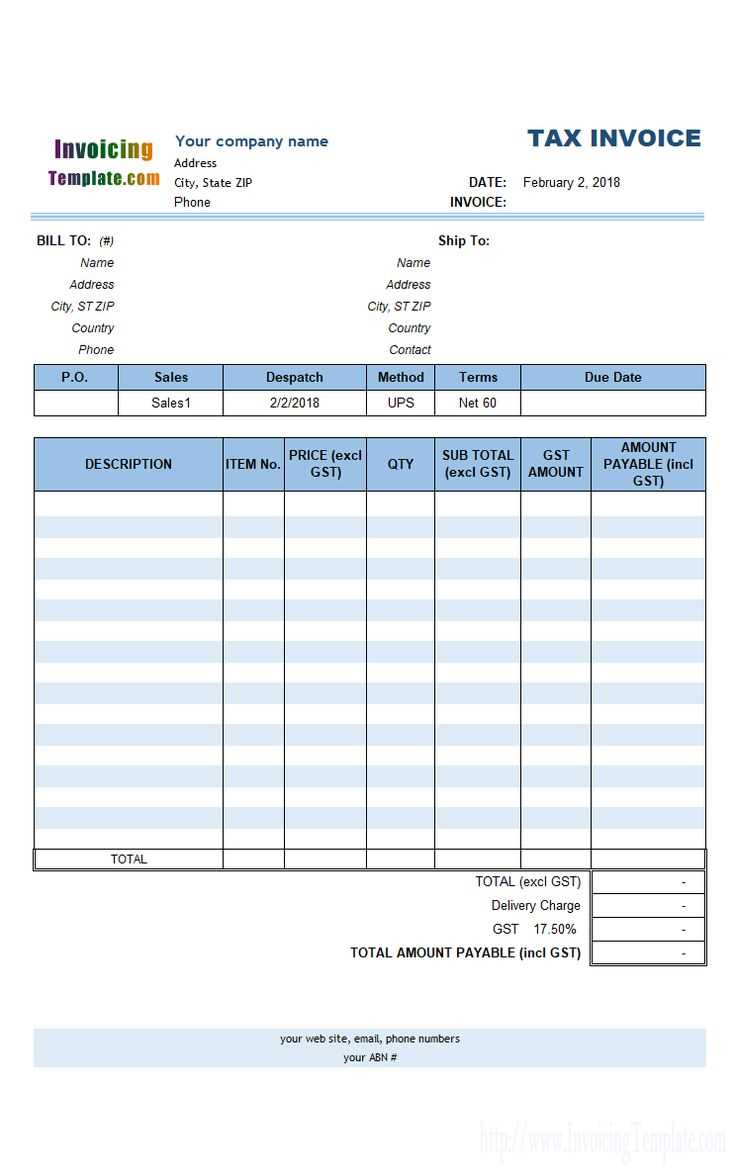

Key Features of a Good Invoice Template

A well-designed billing document is essential for creating a professional image and maintaining organized financial records. The right structure ensures clarity, accuracy, and compliance with tax regulations, which ultimately builds trust with clients and simplifies the process of tracking payments. The core features of an effective billing document allow businesses to customize each record while keeping all essential information easily accessible.

When creating a billing document, certain elements are non-negotiable. These include clear descriptions, correct calculations, and an intuitive layout that allows for quick access to all necessary information. Here are some key features to look for in a well-structured record:

Essential Components of a Well-Designed Billing Record

- Clear Business Details: Include your company name, logo, contact information, and any relevant business numbers (such as tax ID) to ensure your client knows exactly who they are dealing with.

- Client Information: Make sure the customer’s name, address, and contact details are included to avoid confusion or errors in delivery and billing.

- Unique Reference Number: Each document should have a unique identifier for easy reference and tracking. This number helps in organizing records and managing follow-up actions.

- Accurate Itemization: List all goods or services provided, including unit price, quantity, and total amount for each item. This clarity helps your customer understand the breakdown of charges.

- Tax Information: Clearly show the tax applied, including the rate and the total tax amount. This ensures transparency and legal compliance.

- Total Due: Display the final amount to be paid, including any taxes, fees, or additional charges, so the client knows exactly what is expected.

- Payment Terms: Include the due date, payment methods accepted, and any late payment penalties to set clear expectations with your clients.

Example of a Properly Structured Billing Record

The following table illustrates how a well-structured billing document may look in practice:

| Description | Unit Price | Quantity | Subtotal | Tax | Total |

|---|---|---|---|---|---|

| Web Design Services | $500.00 | 1 | $500.00 | $25.00 | $525.00 |

| Domain Registration | $15.00 | 1 | $15.00 | $0.75 | $15.75 |

| Total | $515.00 | $25.75 | |||

As shown, each element is broken down clearly, with the final total calculated at the end. A well-organized layout like this makes it easy for both the business and the client to track and manage the transaction, ensuring there is no confusion about charges or payment terms.

Choosing the Right Billing Document Format

When running a business, selecting the right structure for your financial records is essential. The proper format not only ensures that your transactions are documented clearly but also helps in streamlining your administrative tasks. A well-organized document facilitates accurate tracking of sales, taxes, and payments, while also presenting a professional image to your clients.

Choosing the ideal structure involves considering various factors that will affect your workflow and the clarity of your records. Here are some key points to keep in mind when selecting the right format for your business needs:

Factors to Consider When Selecting a Billing Format

- Customization Options: The ability to tailor the structure to your business type, adding fields such as product descriptions, quantities, and discounts, is essential for meeting specific needs.

- Tax Compliance: Ensure the format you choose allows for easy calculation and inclusion of required taxes. The document should clearly break down the tax amount, making it transparent for both you and your clients.

- Ease of Use: Choose a format that is simple to navigate and use. The document should be intuitive so you can quickly input details and generate accurate records without unnecessary effort.

- Professional Appearance: A clean and well-organized format enhances the professional image of your business. The document should reflect your brand’s identity and make a good impression on clients.

- Legal Requirements: Ensure that the structure you choose complies with all relevant local regulations. This includes the inclusion of necessary business information, tax rates, and any other required legal elements.

- Automated Features: Look for options that offer automated features like calculation of totals, tax, and due dates, which can save time and reduce the risk of errors.

Types of Formats to Consider

- Pre-designed Digital Formats: These are ready-made structures that can be filled out quickly, offering flexibility and ease of use for most businesses.

- Customizable Excel or Spreadsheet Formats: Ideal for businesses that need more control over how data is displayed and calculated. This format allows for complex pricing structures and tax calculations.

- Online Billing Software: Many businesses opt for cloud-based tools that not only offer customizable formats but also allow for the storage of past transactions and integration with payment systems.

Choosing the right format for your billing documents depends on your specific business needs, the complexity of your sales process, and the level of customization required. By carefully evaluating these factors, you can select a structure that will help you maintain clear, accurate, and professional records for your business.

Common GST Mistakes to Avoid in Invoices

Accurate tax calculations are critical for both business compliance and customer transparency. Mistakes in applying sales tax to transactions can lead to confusion, customer dissatisfaction, or even legal consequences. Common errors often stem from miscalculating the tax rate, omitting important details, or misinterpreting tax-exempt items. It’s essential to be mindful of these mistakes to ensure your records are correct and your business operations remain smooth.

Here are some of the most frequent errors businesses make when applying sales tax to transactions:

Common Mistakes to Avoid

- Incorrect Tax Rate: One of the most common mistakes is applying the wrong tax rate. Be sure to verify the correct rate based on your location, product type, and whether the product or service is taxable.

- Failing to Include Tax: Sometimes, businesses forget to include the tax amount entirely, which can lead to discrepancies in payment and potential issues with tax authorities.

- Incorrectly Calculating Tax on Discounts: If discounts or promotions are applied, ensure that the sales tax is calculated on the discounted amount, not the original price.

- Omitting Tax Information: Failing to clearly list the tax amount on the document can confuse clients, leading to delays in payment and misunderstandings.

- Not Adjusting for Exemptions: Certain goods and services may be exempt from the charge. Make sure to correctly identify any tax-exempt products or services and adjust the total accordingly.

- Not Updating for Changes in Tax Rates: Tax rates can change due to government regulations. Regularly updating your calculations and systems is crucial for ongoing compliance.

Example of Correct Tax Application

The table below demonstrates how the tax should be calculated correctly on a transaction:

| Description | Unit Price | Quantity | Subtotal | Tax (5%) | Total |

|---|---|---|---|---|---|

| Consulting Services | $200.00 | 1 | $200.00 | $10.00 | $210.00 |

| Software License | $150.00 | 2 | $300.00 | $15.00 | $315.00 |

| Total | $500.00 | $25.00 | |||

As shown, the tax is applied correctly to both the individual items and the total amount. Always ensure that tax is clearly calculated and included, and avoid these common errors to maintain transparency and avoid potential issues down the line.

How to Include GST in Multiple Products

When selling multiple items, ensuring that the correct tax is applied to each product is essential for both business compliance and customer clarity. Calculating tax for each product individually, rather than just on the total sum, provides greater transparency and accuracy. This process involves applying the tax rate to each item based on its price, then adding the individual taxes together to get the overall tax amount.

Here’s a step-by-step guide on how to calculate and include sales tax for multiple products, ensuring everything is accurate and in compliance with the law:

Steps to Apply Sales Tax on Multiple Products

- Identify the Tax Rate: Confirm the applicable sales tax rate for your products. This can vary based on the region, the type of product, or the services offered.

- Calculate Tax Per Product: For each item, multiply the price by the sales tax rate. Ensure that this is done individually for every item sold.

- Sum the Tax Amounts: Once you’ve calculated the tax for each product, add these amounts together to get the total tax for the entire transaction.

- Display the Tax Clearly: Make sure to list the sales tax for each product, as well as the total amount of tax applied, on your record to ensure clarity and transparency for the customer.

Example: Calculating Sales Tax for Multiple Products

The following table demonstrates how the tax is calculated for multiple items in a single transaction:

| Description | Unit Price | Quantity | Subtotal | Tax (5%) | Total |

|---|---|---|---|---|---|

| Wireless Headphones | $100.00 | 2 | $200.00 | $10.00 | $210.00 |

| Bluetooth Speaker | $50.00 | 1 | $50.00 | $2.50 | $52.50 |

| Total | $250.00 | $12.50 | |||

In this example, the tax is calculated individually for each item based on its price. After calculating the tax for each product, the total sales tax is added together. This clear and transparent process ensures both you and your customers understand the breakdown of costs, and helps you maintain accurate financial records.

GST Compliance for Canadian Entrepreneurs

For entrepreneurs, maintaining compliance with tax regulations is crucial to avoid fines, audits, and other legal issues. Sales tax rules can be complex, but understanding the requirements and staying updated ensures smooth business operations. Entrepreneurs must be proactive in correctly applying taxes, keeping accurate records, and submitting the necessary documents on time. Failure to comply can result in financial penalties and damage to your business reputation.

One of the key aspects of tax compliance is understanding when and how to apply sales tax. Not all products or services are subject to tax, and rates can vary based on the nature of the business and location. By following the correct processes, entrepreneurs can avoid common mistakes and maintain transparency with their clients.

Steps for Ensuring Compliance

- Register for a Sales Tax Number: If your business’s annual revenue exceeds the threshold for registration, you must obtain a tax number from the appropriate authorities. This allows you to charge, collect, and remit tax correctly.

- Accurately Apply the Tax Rate: Ensure that the correct tax rate is applied to each transaction. Different regions may have different rates, and certain products or services may be exempt from taxation.

- Issue Correctly Structured Billing Records: Provide clear, itemized records that show the tax amount for each item, the overall total, and any applicable exemptions. This transparency helps your customers understand the charges and prevents confusion.

- Keep Detailed Records: Maintain detailed and accurate records of all transactions, including taxes charged, invoices issued, and payments received. This documentation will be essential for filing tax returns and in case of any future audits.

- Submit Returns on Time: Be aware of the filing deadlines for your tax returns and ensure that your payments are made promptly. Late payments or missed filings can result in penalties and interest charges.

Consequences of Non-Compliance

Failure to adhere to tax regulations can result in significant financial and legal consequences. Some of the potential risks include:

- Penalties and Fines: Late filings, underreporting of taxes, or failing to collect the proper amount can result in fines and penalties.

- Audits: Non-compliance increases the likelihood of an audit, which can be time-consuming and costly for your business.

- Loss of Reputation: Being found in violation of tax rules can harm your business’s credibility, making it difficult to build or maintain client relationships.

By staying informed and maintaining diligent record-keeping practices, entrepreneurs can ensure they meet all necessary requirements and avoid any legal issues. Compliance not only protects your business but also fosters trust with your clients and enhances your reputation in the marketplace.

Why Automation Saves Time in Billing

In today’s fast-paced business environment, efficiency is key to staying competitive. Manual processes, such as creating financial documents or calculating taxes, can consume valuable time that could be better spent on other critical aspects of running a business. Automating the billing process allows entrepreneurs to save significant time and reduce the risk of human error. By using automated tools, businesses can streamline repetitive tasks, improve accuracy, and ensure faster document generation.

Automation not only speeds up the process but also helps with consistency. Once set up, automated systems apply the same rules to each transaction, ensuring that every document is formatted correctly and that the correct charges are applied. This consistency leads to fewer mistakes, a smoother workflow, and ultimately, more time available for growth and customer service.

Benefits of Automation in Billing

- Reduced Manual Effort: Once the initial setup is done, generating and sending billing documents becomes a matter of a few clicks, eliminating the need for repeated manual entries.

- Minimized Errors: Automation eliminates common human mistakes, such as incorrect calculations, missing fields, or overlooked tax rates, which can lead to disputes or delays in payment.

- Consistency and Standardization: Automated systems ensure that every document follows the same format, making it easier for clients to understand and reducing confusion.

- Faster Processing: Generating documents manually can take up to several hours, but automated systems can complete the task in a fraction of that time, improving your cash flow.

- Easy Updates: With automation, it’s easy to apply changes in pricing, tax rates, or policies across all documents in a matter of minutes.

How Automation Works

Below is an example of how automation can speed up the billing process by reducing manual input and streamlining task execution:

| Manual Process | Automated Process |

|---|---|

| Manually entering customer details for each transaction | Customer details are automatically populated from a database |

| Calculating taxes for each product separately | Automated tax calculations applied based on predefined rules |

| Creating and formatting each document individually | Documents are generated and formatted automatically in bulk |

| Sending documents via email or printing them | Documents are automatically sent via email to customers |

As shown, automation handles several time-consuming tasks, freeing up resources and allowing businesses to focus on areas that drive growth. With automated systems in place, entrepreneurs can ensure that the billing process is quick, efficient, and accurate.

Top Software Tools for Generating Billing Documents

Generating professional billing documents is essential for any business, and using the right software tools can make this process faster and more efficient. Whether you’re managing a small business or handling a large number of transactions, having the right tool can help you automate calculations, streamline document creation, and ensure consistency. These tools offer a wide range of features, from customizable layouts to automatic tax calculations, saving you valuable time and reducing the chance of errors.

Here are some of the top software tools that can help businesses generate accurate and professional billing documents:

Best Tools for Creating Billing Documents

- QuickBooks: Known for its comprehensive accounting features, QuickBooks allows businesses to generate and send professional billing documents, track payments, and manage accounting records in one place. It also offers tax calculation features and customization options.

- FreshBooks: FreshBooks is a user-friendly tool that simplifies billing for small business owners and freelancers. It offers customizable billing documents, automatic payment reminders, and a time-tracking feature that is particularly helpful for service-based businesses.

- Zoho Invoice: Zoho Invoice offers a wide variety of features, including automated billing, customizable document templates, and seamless integration with other Zoho apps. It also supports multi-currency and multi-language capabilities, making it ideal for international businesses.

- Wave: Wave is a free tool that is perfect for small businesses and freelancers looking for basic but effective billing document creation. It supports automatic tax calculations, recurring billing, and the ability to track payments directly within the system.

- Bill.com: Bill.com is a comprehensive tool that specializes in automating invoicing, payments, and approvals. It integrates well with accounting software, offering easy billing creation, payment tracking, and even features for managing approvals and approvals workflows.

- Invoicely: Invoicely offers an easy-to-use interface with powerful features for creating billing documents, including custom templates, recurring invoices, and automatic payment reminders. It also supports integrations with payment gateways, allowing clients to pay directly through the invoice.

- Square Invoices: Square Invoices is ideal for businesses that need to generate and send documents quickly. It integrates with Square’s payment processing system and offers easy invoicing, real-time payment tracking, and customizable templates for different business needs.

Why Use These Tools?

- Time-Saving: Automating calculations, tracking payments, and sending documents automatically can significantly reduce the time spent on administrative tasks.

- Improved Accuracy: Automated systems ensure that tax rates, totals, and calculations are correct, minimizing the risk of errors.

- Professional Appearance: These tools help businesses create consistent and professional-looking documents that improve client relationships and trust.

- Customization: Many tools offer customization options for document design, ensuring that each business can create documents that reflect their branding.

- Easy Access: Many of these tools are cloud-based, allowing business owners to access their data and generate documents from anywhere with an internet connection.

Choosing the right tool depends on the specific needs of your business, including factors like the volume of transactions, the complexity of your billing processes, and your budget. By using one of these software solutions, you can streamline your workflow, improve billing accuracy, and save valuable time that can be better spent on growing your business.

Tracking Payments with Your Billing Document

Efficiently tracking payments is essential for maintaining cash flow and ensuring the financial health of your business. A well-structured document can serve as both a tool for requesting payment and a method for tracking the receipt of funds. By incorporating clear payment tracking features into your records, you can easily monitor outstanding amounts, due dates, and payment statuses, reducing the chances of missed payments and late fees.

Implementing a tracking system within your billing documents can help you stay organized and on top of your finances. Whether you prefer manual updates or an automated system, clear documentation and accurate tracking will provide you with the visibility needed to maintain positive cash flow and customer relationships.

Key Elements to Track in Your Billing Document

- Payment Status: Include a section in your document that clearly states whether the payment has been made, is pending, or is overdue. This ensures that both you and your clients are aware of the current status of the transaction.

- Due Date: Always include the payment due date to avoid confusion. This helps to ensure that your clients know when to pay and avoids delays in payment processing.

- Outstanding Amount: Clearly highlight the remaining balance, if any, so your clients know exactly how much they still owe. If the payment has already been made, indicate this to prevent any misunderstandings.

- Payment Method: Indicate how the payment was made (e.g., credit card, bank transfer, cash, etc.). This helps you track which methods are being used and simplifies reconciliation.

Example of a Payment Tracking Section

The following table shows a simple way to track payment statuses within your records:

| Description | Amount | Status | Payment Date | Payment Method |

|---|---|---|---|---|

| Product A | $200.00 | Paid | 2024-10-05 | Credit Card |

| Product B | $150.00 | Pending | 2024-10-10 | Bank Transfer |

| Total Outstanding | $150.00 |

In this example, you can easily identify which amounts have been paid and which are still pending. Tracking payments this way will help you stay organized and ensure that all transactions are accounted for, making your financ

Benefits of Using a Tax Document Template

Utilizing a structured billing document that includes tax calculations brings several advantages to businesses, especially when it comes to ensuring compliance and improving operational efficiency. A well-organized document helps maintain consistency, reduces the likelihood of errors, and streamlines the overall billing process. By using a dedicated format for generating your billing records, you can automate many time-consuming tasks and focus on more critical areas of your business.

Here are some of the key benefits of using a pre-designed document format for tax calculations:

Key Advantages of Using a Tax Document Format

- Time Efficiency: Pre-built formats allow you to quickly generate professional billing documents without having to start from scratch each time. This reduces the time spent on creating documents and ensures that all necessary fields are filled correctly.

- Tax Compliance: A well-designed document automatically calculates the correct tax amounts, helping you stay in line with local regulations. This ensures that you are charging the right amount and avoiding potential fines for miscalculation.

- Consistency and Professionalism: Using a standardized format ensures that all your documents follow the same structure, presenting a professional image to your clients. It also ensures that the necessary information is consistently included in every document.

- Automation of Repetitive Tasks: Templates often come with features such as automated date and amount fields, which can significantly reduce the manual work needed to generate each document. This minimizes the chances of human error and speeds up the billing process.

- Accurate Record-Keeping: Using a predefined format helps ensure that all necessary data, including tax amounts, totals, and due dates, are accurately recorded. This is essential for both business tracking and potential future audits.

- Customization Options: Many templates allow for easy customization, so you can tailor the document to reflect your brand or meet specific business needs. You can adjust logos, fonts, and the layout without losing the integrity of the essential components.

- Easy Tracking and Reporting: By using a consistent format, you can quickly track payments, outstanding balances, and other financial metrics. This also makes it easier to generate reports and summaries for your business’s accounting purposes.

By adopting a standardized approach to your billing system, you can improve accuracy, reduce administrative costs, and ensure compliance with tax regulations. A good document format can serve as an essential tool for maintaining smooth business operations and fostering strong customer relationships.