Canada Customs Invoice Template Excel for Easy Documentation

Managing paperwork for international shipping can be a complex and time-consuming task, especially when it comes to ensuring that all necessary details are accurately recorded. For businesses and individuals involved in cross-border trade, the need for precise and streamlined documentation is critical. A well-organized document helps to avoid delays, ensures compliance with regulations, and accelerates the process of getting goods to their destination.

One of the most effective ways to handle these formalities is by using digital tools that allow for easy customization and quick updates. With the right resources, you can create a document that meets all requirements while also simplifying the data-entry process. By leveraging widely available software, you can tailor these documents to your specific needs, making international transactions smoother and more efficient.

In this guide, we will explore how to create a document that covers all essential details for your shipments, ensuring that you stay on top of the paperwork while saving time and reducing errors. From setting up your document structure to adding key information, we’ll walk through the steps that will help you manage your global trade more effectively.

Canada Customs Invoice Template Excel Guide

When it comes to completing the necessary documentation for international shipments, efficiency and accuracy are key. Creating a structured document that includes all required details not only saves time but also minimizes the risk of mistakes that could lead to shipping delays or customs issues. The goal is to create a clear, comprehensive form that can be easily updated and customized for different transactions.

Using a digital format that allows for easy editing and data management makes the process much smoother. This type of tool helps users ensure that all required information is present and properly formatted. By following a few simple steps, you can quickly build a document that meets the necessary regulations and streamlines your shipping procedures.

Steps to Set Up Your Document

Start by defining the key sections that should appear in your document. These typically include product descriptions, values, origin information, and shipping details. Ensuring that each section is properly labeled and formatted will help you avoid errors later. It’s important to create a layout that is both functional and adaptable to changes in the shipping process.

Customization Tips for Different Shipments

Customizing the layout of your document can make it more efficient for specific shipment needs. For example, adding fields for special instructions or customizing the currency options based on the destination country can help speed up the process. By adjusting the structure to fit the unique requirements of each shipment, you can make documentation handling faster and more accurate.

Understanding Canada Customs Invoice Requirements

When engaging in international trade, it is essential to meet specific documentation standards to ensure smooth processing of goods across borders. Having the right paperwork helps customs authorities assess the legitimacy of a shipment and determines the applicable taxes, duties, or other charges. Adhering to the required format and including the correct details prevents delays and ensures compliance with regulations.

Each shipment type may require different information, but certain basic fields are common to all international shipping documents. These typically include product descriptions, origin, value, and destination details. It is crucial that all information is accurate, as discrepancies can lead to shipping delays or additional scrutiny from border authorities.

Key Information to Include

The most important fields that must appear in your shipping documents include:

| Field | Description |

|---|---|

| Product Description | Clear description of the items being shipped, including quantity and specifications. |

| Value | The commercial value of the goods, which may influence duties and taxes. |

| Country of Origin | The country where the goods were produced or manufactured. |

| Destination | The final destination of the shipment, which helps calculate applicable tariffs. |

Additional Documentation Requirements

In some cases, you may need to include additional documents such as certificates of origin, permits, or specific declarations based on the type of goods being shipped. For instance, if shipping perishable goods or chemicals, extra certifications may be required to comply with safety regulations. Always ensure that these supplementary documents are clearly referenced and attached to avoid confusion during the processing of your shipment.

Why Use an Excel Template for Customs Invoices

Using a structured digital document for managing shipping paperwork can drastically improve efficiency and accuracy. With the ability to easily edit, store, and organize data, digital documents allow businesses to streamline their operations and reduce the likelihood of errors. This method also provides flexibility, enabling users to quickly make adjustments as needed based on changing shipment details or regulations.

One of the main advantages of digital documents is that they can be customized to fit specific needs, whether for different types of goods, varying international destinations, or multiple transactions at once. The ease of use and the ability to implement formulas for calculations makes this approach an excellent choice for managing complex shipping details.

Time-Saving Benefits

By using a well-organized digital document, much of the manual effort involved in creating and updating paperwork is eliminated. Fields for product descriptions, values, and origin information can be pre-configured, reducing the time spent on repetitive tasks. Furthermore, calculations for taxes, duties, or shipping fees can be automated, minimizing the risk of human error.

Flexibility and Customization

A digital document offers endless customization options. Whether you need to include additional columns for specific details or adjust formatting for particular requirements, digital documents are easy to adapt. The flexibility to modify and update these files quickly ensures that you can handle shipments of all sizes and types with minimal effort.

How to Customize Your Canada Invoice Template

Personalizing your shipping document to fit specific needs is a simple yet effective way to streamline your international transactions. Customizing the layout allows you to capture all the necessary details in a way that best suits your business or shipment type. Whether you’re handling small shipments or large bulk orders, tailoring your document ensures that all required information is accurately included and easily accessible.

Here are some steps you can take to modify your shipping documentation for a more efficient process:

- Adjust Layout and Structure: Organize the document into clear sections such as item descriptions, shipping details, and value assessments. A well-structured document makes it easier to input data and track shipments.

- Add Fields for Specific Information: If your goods require special handling or have unique regulations, include additional fields for notes, serial numbers, or licensing information.

- Automate Calculations: Add formulas for currency conversions, tax calculations, or shipping fees to save time and avoid manual errors.

Customizing your document can help reduce time spent on paperwork and ensure all necessary details are included before submission. Tailor it to fit your product range and shipping needs by following these steps:

- Start with a Clean Layout: Begin with a basic framework that includes all standard fields such as product name, quantity, value, and origin.

- Expand with Additional Information: Add extra rows or columns for any specific data your business requires, such as special product features, compliance codes, or export documentation.

- Ensure Compliance: Make sure that your customization still adheres to the required standards and regulations for international shipments.

By personalizing your shipping document, you can improve accuracy and efficiency, ultimately speeding up the process and reducing potential errors in future transactions.

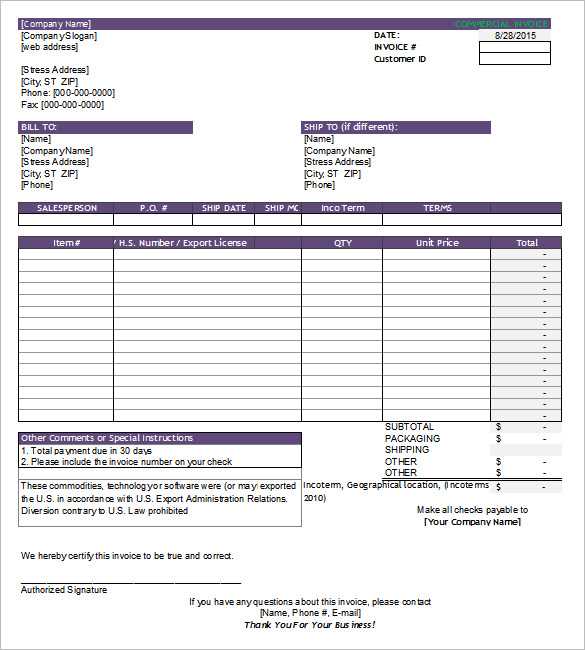

Essential Fields in a Canada Customs Invoice

To ensure smooth processing of goods during international transactions, it’s crucial to include specific details in your shipping documentation. These fields help customs authorities assess the value, origin, and compliance of the goods being shipped. A comprehensive document provides clarity and transparency, reducing the risk of errors, delays, or potential legal issues. Knowing what information to include will make the documentation process faster and more efficient.

Here are the core sections that must be included in your shipping document:

Key Information to Include

- Product Description: A clear, detailed description of each item being shipped, including any specific characteristics such as size, model, or material.

- Quantity: The exact number of units for each product being sent. This helps in determining the total value of the shipment and the applicable duties or taxes.

- Value of Goods: The total value of each item and the overall shipment, which plays a role in calculating duties and taxes.

- Country of Origin: The country where the goods were manufactured or produced. This is essential for determining applicable trade regulations and tariffs.

- Shipping Information: The destination address, along with any relevant shipping details, such as the shipping method, delivery terms, and estimated arrival time.

Additional Fields for Accuracy

- HS Codes: The Harmonized System code for each product, which helps classify the goods for tariff and trade purposes.

- Special Instructions: Any specific handling, storage, or regulatory requirements for the shipment, such as perishable goods or hazardous materials.

- Export Documentation: Reference numbers for permits, licenses, or certificates if needed, to ensure compliance with export regulations.

By including these key fields, you ensure that your shipping documentation meets all necessary requirements and avoids unnecessary complications during the shipping process.

Steps to Fill Out Your Customs Invoice

Properly completing shipping documentation is essential for smooth international transactions. Accurate and detailed paperwork helps ensure that shipments comply with regulations, prevents delays, and reduces the likelihood of extra charges. Following a clear step-by-step process allows you to gather and input the necessary information efficiently and without error.

Below are the steps you need to follow to fill out your shipping document correctly:

Step-by-Step Process

- Start with Basic Information: Begin by entering the sender’s and recipient’s details. Include names, addresses, contact information, and any other relevant identifiers.

- Describe the Goods: Clearly list each item being shipped. Provide specific descriptions, including the type of goods, brand, and any distinguishing features such as size or color.

- Enter Quantity and Value: For each product, specify the quantity and unit price. Multiply these to calculate the total value for each item and for the entire shipment.

- Specify the Country of Origin: Indicate where each item was produced or manufactured. This helps determine the applicable tariffs and taxes for the shipment.

- Fill in Shipping Information: Provide the destination address, shipping method, and expected delivery date. This ensures that the goods reach the correct location on time.

Additional Details for Accuracy

- HS Code: Include the relevant Harmonized System code for each item. This code helps customs authorities classify the goods for tariff and trade purposes.

- Special Handling Instructions: If applicable, add any instructions for handling specific goods, such as fragile or perishable items.

- Provide Export Documentation: Include any necessary export permits, certificates of origin, or licenses that may be required based on the nature of the shipment.

By following these steps and providing accurate details, you ensure that your shipping document meets all necessary requirements, facilitating a smooth customs process and timely delivery of goods.

Benefits of Using Excel for Customs Documentation

Using digital tools to manage international shipping paperwork offers a wide range of advantages that can improve efficiency and reduce errors. One of the most effective tools for this purpose is spreadsheet software, which provides users with the ability to organize, track, and modify documentation in real-time. By leveraging its capabilities, businesses can streamline the entire process, ensuring that all necessary information is properly recorded and accessible when needed.

Here are some key benefits of using spreadsheet software for handling shipping documentation:

- Easy Customization: The ability to tailor documents to fit specific needs is one of the biggest advantages. You can create personalized layouts, add new fields, or modify existing ones based on your shipment’s requirements.

- Data Accuracy: Built-in formulas allow you to automatically calculate values such as total cost, taxes, or shipping fees. This reduces the risk of manual errors and ensures consistency across all documents.

- Time Efficiency: With digital documentation, you can quickly enter and update information without needing to manually retype data. This significantly reduces the amount of time spent preparing paperwork for each shipment.

- Organized Record-Keeping: Spreadsheets allow for easy organization and storage of records, enabling you to access past documents quickly when needed. You can also sort and filter data for better management of multiple shipments.

- Automated Calculations: Spreadsheet programs can automatically compute complex calculations, such as total value, duty rates, or currency conversions. This removes the burden of doing these tasks manually and ensures accuracy.

- Instant Updates: When shipping regulations or pricing changes occur, it’s easy to modify your document with a few clicks. This flexibility makes it easier to stay compliant with changing requirements without having to recreate documents from scratch.

By utilizing spreadsheet software for shipping paperwork, businesses can not only save time but also reduce administrative costs and improve overall accuracy in international trade operations.

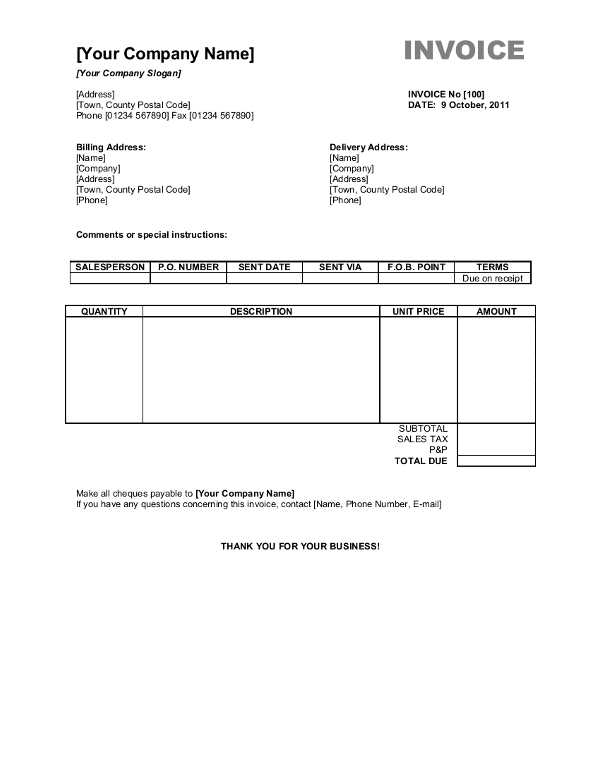

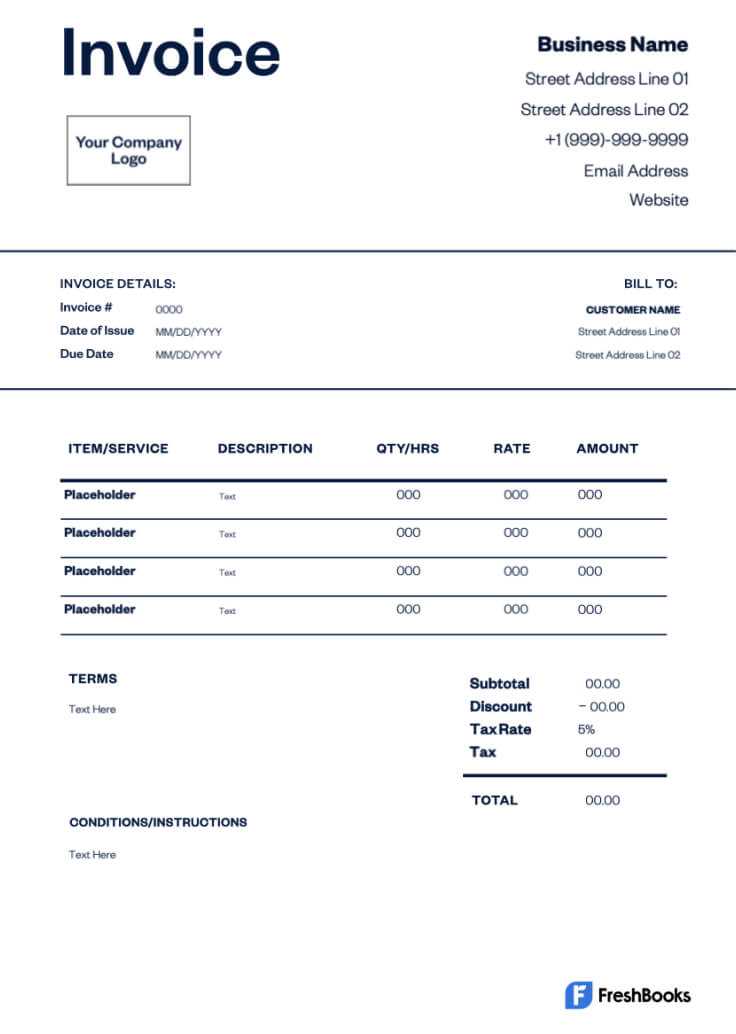

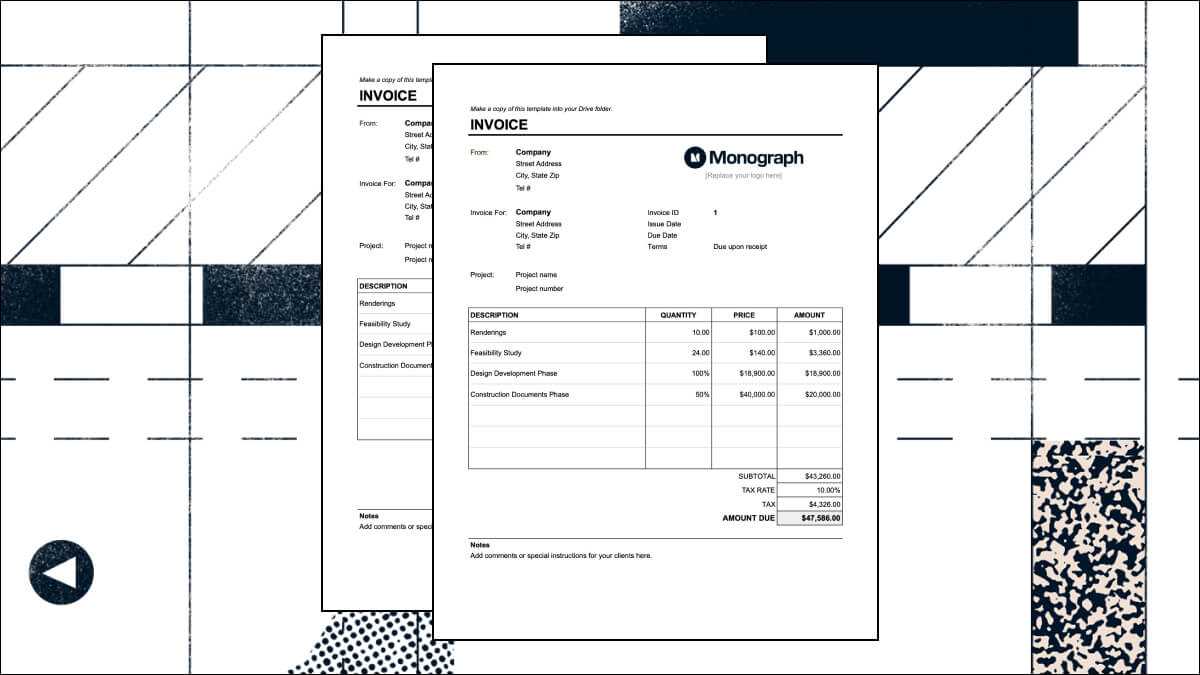

Free Excel Templates for Canada Customs Invoices

Accessing pre-made digital documents can save valuable time when preparing shipping paperwork for international transactions. Free resources are available online that offer customizable and ready-to-use layouts, making it easier to create the necessary documents without starting from scratch. These templates typically include all the essential fields required for efficient shipping, helping businesses streamline the process and avoid mistakes.

Here are some key reasons why using free digital resources can be beneficial for managing shipping documentation:

Why Choose Free Resources?

- Cost-Effective: Many free templates are available without the need for a paid subscription or one-time purchase, making them an excellent option for small businesses or individuals with a limited budget.

- Pre-Formatted for Efficiency: These documents are often pre-designed to meet standard shipping requirements, saving you time spent on formatting or organizing the document structure.

- Easy Customization: While the basic structure is already in place, these documents can be easily tailored to suit your specific needs, including adding or removing fields as necessary.

Where to Find Free Digital Resources

Many websites offer downloadable versions of ready-to-use shipping documents. Popular options include online business tool platforms, free resource websites, and forums where business owners share templates they’ve created for common use. Additionally, spreadsheet programs may offer built-in templates for international shipping that you can quickly adjust and implement.

By using free, pre-made digital documents, you can significantly simplify the process of managing international shipments while maintaining accuracy and compliance.

Common Mistakes to Avoid with Customs Invoices

Filling out international shipping documentation requires careful attention to detail. Mistakes in the paperwork can result in delays, extra charges, or even rejection of the shipment by authorities. It’s essential to be aware of common errors that can occur during the process and take proactive steps to avoid them. By understanding these pitfalls, you can ensure that your documentation is accurate, complete, and compliant with regulations.

Here are some common mistakes to watch out for when preparing your shipping documents:

- Incomplete or Missing Information: Failing to include essential details such as product descriptions, quantities, or the country of origin can lead to delays. Make sure every required field is filled out accurately.

- Incorrect Values: Providing incorrect or inflated values for goods is a serious error that can cause complications with customs clearance. Always double-check the value of each item and ensure that it reflects the correct market price.

- Missing Signatures or Dates: Some shipping documents require a signature or a specific date to validate the contents. Neglecting to include these can make the document invalid and delay the shipment.

- Not Updating for Regulatory Changes: Shipping requirements and regulations can change frequently. Failing to stay updated with the latest rules may result in incomplete or non-compliant paperwork.

- Omitting HS Codes: The Harmonized System (HS) code is crucial for classifying goods and determining applicable tariffs. Ensure that you include the correct HS code for each item to avoid classification errors.

- Not Including Supporting Documents: Some goods may require additional paperwork, such as certificates of origin, permits, or licenses. Failing to provide these documents can delay the approval process or lead to penalties.

By being mindful of these common mistakes, you can help ensure that your shipping documentation is complete, accurate, and processed smoothly, reducing the risk of delays and additional costs.

How to Save Time with Excel Templates

Managing international shipments can be a time-consuming task, especially when dealing with paperwork. However, using digital solutions to streamline document creation can save significant time and reduce the risk of errors. By utilizing pre-designed documents, businesses can speed up the process of filling out and organizing required details, ensuring faster processing and fewer administrative delays.

One of the most effective ways to save time is by using digital document structures that already include all necessary fields and formatting. These customizable tools allow users to quickly enter data, automate calculations, and organize information with minimal effort. Here’s how these resources can help you save time:

- Pre-filled Fields: Most digital solutions come with pre-defined fields for essential information such as product description, value, and quantity. By simply filling in the blanks, you can complete a document in a fraction of the time compared to starting from scratch.

- Automated Calculations: Many digital tools include built-in formulas that automatically calculate totals, taxes, and shipping fees. This reduces the time spent manually calculating numbers and minimizes the risk of mistakes.

- Reusable Format: Once you’ve customized your document for your needs, you can save and reuse the format for future shipments. This eliminates the need to redesign your documents for each transaction, saving valuable time on every order.

- Quick Data Entry: Digital documents allow for faster data entry through copy-pasting or importing data directly from other sources, reducing the time spent inputting details by hand.

- Easy Modifications: If any details change, such as item descriptions or shipping rates, you can easily update the document in just a few clicks rather than starting over. This flexibility makes document preparation faster and more efficient.

By leveraging digital solutions and reusable layouts, you can significantly reduce the time spent on administrative tasks, allowing more focus on other areas of your business. These tools not only save time but also ensure accuracy and consistency in every document you create.

Excel Formulas for Canada Invoice Calculations

When preparing shipping documentation, calculating totals, taxes, and other fees manually can be time-consuming and prone to errors. However, digital tools like spreadsheet software offer powerful features that automate these calculations, saving time and improving accuracy. By using simple formulas, you can instantly calculate product values, apply taxes, and determine final costs without the need for manual intervention.

Here are some essential formulas and functions you can use to streamline calculations in your shipping documents:

Common Formulas for Accurate Calculations

- SUM: This basic formula adds up a range of numbers, making it ideal for calculating the total cost of a shipment. For example, you can sum up the prices of individual items to get the total value.

- Multiplication for Item Totals: Use the formula = Quantity * Unit Price to calculate the total value for each product in your shipment.

- Percentage for Tax or Fees: To calculate taxes or other percentage-based fees, use the formula = Total Value * Tax Rate. This will quickly determine how much tax should be applied to the overall shipment.

- Subtotal Calculation: To find the subtotal for all items before taxes and fees, simply use the SUM function for the range of item totals.

Example Table for Invoice Calculations

| Item | Quantity | Unit Price | Total (Quantity x Unit Price) | Tax (10%) | Grand Total |

|---|---|---|---|---|---|

| Product A | 5 | $50 | =5*50 | =D2*0.10 | =D2+E2 |

| Product B | 3 | $30 | =3*30 | =D3*0.10 | =D3+E3 |

| Total | =SUM(D2:D3) | =SUM(E2:E3) | =SUM(F2:F3) |

By utilizing these formulas, you can ensure accurate and efficient calculations, minimizing errors and reducing the time spent on document preparat

Tracking Shipments with Custom Invoice Templates

Efficiently tracking shipments is crucial for maintaining transparency and ensuring that deliveries arrive on time. By using personalized documentation, businesses can organize and monitor the progress of their shipments from dispatch to delivery. Custom forms not only allow for the inclusion of necessary shipping details, but they also provide a structured way to track each stage of the shipping process, making it easier to identify potential issues or delays.

When you customize your shipping documentation, you can incorporate fields specifically designed to track the movement of goods throughout their journey. These forms can include tracking numbers, shipment dates, delivery statuses, and even notes for any special handling requirements. By utilizing such personalized records, you can stay informed about the progress of each shipment and address any challenges that arise quickly.

Additionally, having a clear system in place for tracking shipments helps keep all relevant parties informed, from the sender to the recipient, improving communication and customer satisfaction. Whether you are shipping domestically or internationally, maintaining accurate tracking information on your shipping forms allows for smoother logistics management and quicker problem resolution.

Updating Your Template for New Regulations

As international trade regulations and industry standards evolve, it’s essential to ensure that your shipping documents remain compliant with the latest rules. Keeping your documentation up-to-date not only helps avoid costly penalties but also ensures that shipments pass through customs smoothly and efficiently. Adjusting your forms for new regulatory changes is a crucial step in maintaining compliance and optimizing the shipping process.

Regularly reviewing and modifying your documentation structure is important for staying current with changes in tariffs, taxes, reporting requirements, and specific shipping rules. This might involve adding new fields, removing outdated ones, or adjusting formats to align with current practices. By doing so, you reduce the risk of errors and delays, making the shipping process more efficient for both you and your clients.

Adapting your forms to meet new regulations requires a proactive approach. Monitoring changes in relevant regulations and integrating them into your shipping documents is the best way to avoid disruptions in your business operations. This ensures that your shipments are always compliant, regardless of any updates to the regulatory environment.

Canada Customs Invoice Template vs PDF Forms

When preparing shipping documentation for international transactions, businesses often have the option to choose between digital forms or static document formats. While both methods serve the same purpose–ensuring proper documentation for shipments–each has distinct advantages and drawbacks depending on the needs of the user. One popular choice is using flexible, customizable formats that allow for easy updates and data entry, while another involves using fixed, non-editable files like PDFs. Understanding the differences between these two options can help businesses determine which approach is best for their shipping needs.

Flexibility of Digital Formats

Using digital solutions like spreadsheets or editable documents provides a high level of flexibility. These formats allow for easy customization, automatic data calculations, and real-time updates, making them ideal for businesses that need to adjust documents quickly. For example, fields for taxes, product values, or shipping charges can be modified without the need to manually recreate the entire document, saving time and reducing errors. Additionally, businesses can save and reuse the same format for multiple shipments, maintaining consistency across all transactions.

Advantages of PDF Forms

On the other hand, PDF forms are often preferred for their consistency and security. Once filled out, PDFs offer a fixed format that ensures the document will look the same on any device, preventing potential issues with data loss or layout changes. PDFs are also less prone to unauthorized edits, providing a more secure way to share finalized documents. While they do not offer the same level of flexibility as editable formats, they are highly reliable when it comes to presenting a consistent, professional document for external purposes.

Ultimately, the choice between digital formats and PDFs depends on the specific requirements of the business. For those seeking flexibility and efficiency, digital solutions are a great choice, while PDFs provide a secure and standardized approach for finalized documents.

Best Practices for Exporting Goods from Canada

Successfully exporting goods to international markets requires careful planning and attention to detail at every step of the process. Whether you are a small business or a large corporation, following best practices ensures that shipments are completed efficiently, comply with all regulations, and reach their destinations without unnecessary delays. Proper preparation, documentation, and knowledge of the shipping process are key to smooth international transactions.

Here are some essential practices to follow when exporting goods:

- Ensure Accurate Documentation: Having the correct paperwork in place is crucial for ensuring that your shipment is processed smoothly. This includes providing complete and accurate details about the goods being shipped, their value, and any special requirements for their entry into the destination country.

- Understand Export Regulations: Familiarize yourself with the export regulations and compliance requirements of the destination country. Each country has its own rules regarding tariffs, restrictions, and documentation. Being aware of these will help avoid delays or unexpected fees.

- Choose the Right Shipping Method: Depending on the size, value, and urgency of your shipment, selecting the most appropriate shipping method is essential. Options include air freight, sea freight, and land transport. Each has its own set of advantages and considerations, including cost, transit time, and reliability.

- Proper Packaging and Labeling: Proper packaging is essential for protecting goods during transport and preventing damage. Additionally, clear labeling with accurate descriptions, weights, and handling instructions helps ensure that your shipment complies with safety regulations and reaches its destination intact.

- Work with Trusted Partners: Partnering with reliable logistics companies, freight forwarders, and carriers can make the process much easier. These partners can assist with choosing the right transport routes, ensuring proper documentation, and providing valuable insights into the best practices for international shipping.

- Track Shipments Effectively: Once your goods are dispatched, it is important to track their progress regularly. Use tracking tools to monitor the status of your shipment and stay informed about any delays or issues that might arise during transit.

By following these best practices, businesses can minimize risks and maximize the efficiency of their export operations. Planning ahead, staying informed, and maintaining good relationships with logistics partners can help ensure successful international shipments, leading to satisfied customers and fewer complications along the way.

How to Convert Your Excel Invoice to PDF

Converting your digital records to a PDF format is a simple and efficient way to ensure that your documents maintain their structure and are easily shareable. While spreadsheet documents are flexible and editable, PDFs provide a fixed layout that looks the same on any device. This is especially useful for sending finalized documents to clients or partners, ensuring that the format and data remain intact regardless of the software used to view them.

Step-by-Step Guide to Converting Documents

Converting your spreadsheet document to a PDF file is quick and easy. Here’s how you can do it:

- Step 1: Open your digital record in the spreadsheet software where it was created.

- Step 2: Go to the “File” menu and select “Save As” or “Export,” depending on your software.

- Step 3: In the file format options, choose “PDF” from the list of available formats.

- Step 4: Adjust any settings such as page orientation or scaling if necessary to ensure your document looks perfect.

- Step 5: Click “Save” or “Export,” and your document will be converted into a PDF file.

Additional Tips

- Check for Layout Issues: Before converting, double-check your layout to ensure all data is displayed correctly and nothing is cut off.

- Set Print Area: If your document spans multiple sheets or has unnecessary content, set a print area to specify which part of the document you want to save as a PDF.

- Use PDF Settings: Most software provides options to adjust the PDF quality and size, so you can choose whether to optimize it for printing or email.

Converting your documents to a PDF format provides a secure and consistent way to share finalized records with others. Once in PDF format, your documents are ready for professional presentation and safe sharing via email or online platforms.