Business Invoice Template for Open Office Free Download and Customization

For any organization, having well-organized documents to track payments and transactions is essential. The process of designing these records can be streamlined with simple tools that offer customization options. With the right structure in place, generating professional-looking documents becomes effortless and efficient.

These documents serve not only as a means of communication with clients but also as an official record of services rendered or goods provided. A clean and clear format ensures that both parties are on the same page and minimizes any potential confusion. By using accessible tools, individuals can create documents that look polished while saving valuable time.

Customization options allow users to adjust every detail, from logos to payment terms, ensuring that each document reflects the company’s branding and policies. This approach helps maintain consistency and professionalism across all communications.

Efficiency and organization go hand in hand, and having a reliable method to generate necessary documents ensures that your company’s workflow stays smooth. With a little preparation, these records can be easily adjusted and reused, making them a vital asset for any small to medium-sized enterprise.

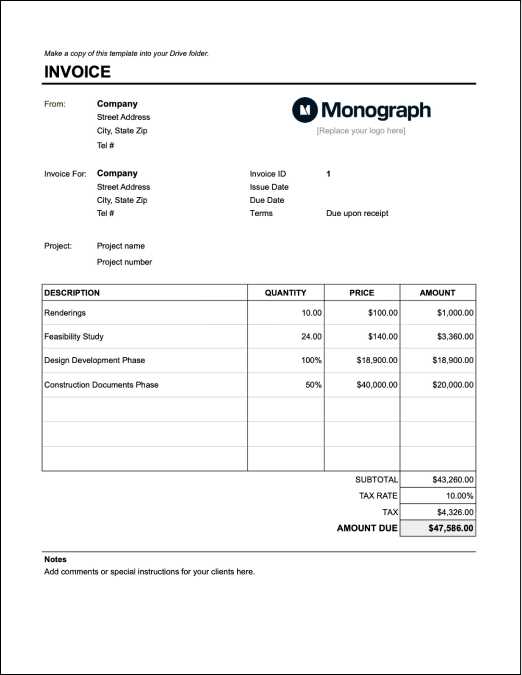

Business Invoice Template for Open Office

Having a ready-to-use document for recording transactions can save time and enhance professionalism. With the right structure, creating these documents becomes much easier, enabling users to quickly generate accurate and clear records for clients and suppliers. By utilizing a simple tool, you can customize each document according to your specific needs.

Key Features of the Document Format

- Easy-to-use structure

- Customizable fields for your branding

- Pre-formatted sections for payment terms

- Option to include logos and contact details

- Pre-set calculations for totals and taxes

With these features, users can quickly adapt the document to their preferences. Whether you need a minimalist style or a more detailed approach, the format allows flexibility without compromising clarity.

Steps to Create a Record for Transactions

- Download the file and open it in your editing software.

- Fill in your company’s information, including name, logo, and contact details.

- Adjust the sections to match the specific nature of the transaction.

- Double-check the calculations to ensure accuracy.

- Save and share the document as needed.

By following these steps, creating a document that looks polished and professional can be done in just a few minutes. Customizing these files ensures that they meet your specific requirements, making them useful for a variety of situations.

How to Create an Invoice in Open Office

Creating a well-structured record to document financial transactions is a straightforward process with the right tools. With an intuitive editing program, you can easily design a professional document that reflects your company’s branding and clearly presents key details, such as amounts due and payment terms. This task becomes quicker and more efficient once you know how to use the available features effectively.

Step 1: Start by opening the software and selecting a blank file or an existing layout. If you’re starting fresh, set up the document with a header that includes your company’s name, logo, and contact details. You can adjust the font, size, and alignment to match your preferred style.

Step 2: Add sections for customer details, such as their name, address, and contact information. You can easily format these fields to ensure a clean and organized look. Consider including a reference number for easy tracking.

Step 3: Create the main section to list the items or services provided. For each entry, include a description, quantity, unit price, and total amount. Use simple calculations to ensure the totals are accurate, and check that the final sum reflects the total owed.

Step 4: Include payment terms, such as due date and methods of payment. You may also wish to add any additional notes or policies specific to your business.

Step 5: Once all the information is added and reviewed for accuracy, save the document. You can then print or email the completed form to your client, ensuring all details are clear and professional.

Top Features of Open Office Invoice Templates

When creating a professional document for tracking payments and transactions, having the right features in your editing tool is essential. A well-designed layout ensures that all important details are presented clearly and accurately. The following features make creating such documents both easy and efficient, allowing you to generate high-quality records quickly.

Key Characteristics

- Customizable Fields: Adapt the layout to include your branding, logo, and personalized sections.

- Pre-set Calculations: Automatically calculate totals, taxes, and discounts, reducing the chances of errors.

- Professional Layout: Neatly organized sections that ensure all necessary information is displayed in a logical order.

- Flexible Design: Modify fonts, colors, and alignment to suit your style and company identity.

- Ease of Use: User-friendly interface that allows even beginners to create a polished document.

Benefits of Using the Layout

- Time-Saving: Ready-to-use fields and structures speed up the creation process.

- Accuracy: Pre-formatted sections ensure that all relevant details are included without missing any critical information.

- Consistency: Maintain a uniform style across all your records to present a professional image to clients and partners.

These features combine to streamline the process of generating essential documents while ensuring that each one meets the necessary standards of clarity and professionalism.

Free Templates for Small Business Invoices

For small companies, having access to free and customizable documents is a practical way to streamline financial tracking. These ready-to-use files allow businesses to efficiently create professional records without the need for expensive software or specialized skills. Whether you are handling a few clients or many, a well-structured document can save time and reduce errors.

Advantages of Using Free Files

- No Cost: Many resources are available at no charge, providing a cost-effective solution for small companies.

- Easy to Customize: These files can be easily adjusted to suit the unique needs of each company, including branding and formatting preferences.

- Quick Setup: With pre-designed structures, you can start using them immediately without the need for extensive setup or design work.

- Accessibility: Files can be opened and edited on a wide variety of devices and software, making them versatile for different users.

How to Find Free Resources

- Online Libraries: Several websites offer downloadable resources for various document needs.

- Software Tools: Many free editing tools, such as word processors, provide built-in options that can be easily adapted.

- Community Sharing: Open forums and business networks often share free resources tailored to specific industries.

By using these free options, companies can maintain professional standards while staying within budget. The ability to adjust and reuse these resources ensures that each document reflects the business’s needs and maintains consistency over time.

Customizing Your Open Office Invoice Template

Tailoring your document to fit the unique needs of your company is essential for creating a personalized and professional appearance. Adjusting elements like layout, fonts, and fields allows you to showcase your brand and ensure all necessary details are included. Customization can help make your records clearer, more functional, and visually appealing to clients.

Key Customization Options

- Adding Your Brand Elements: Insert your company logo, business name, and contact details in the header to enhance brand visibility.

- Modifying Font and Style: Adjust fonts, sizes, and colors to match your brand’s identity and ensure readability.

- Creating Custom Fields: Add extra fields for additional details, such as project references or custom payment terms.

- Rearranging Sections: Rearrange or remove sections that aren’t necessary, making the document more relevant to your specific business needs.

- Including Tax and Discount Information: Ensure the document reflects any taxes or discounts by customizing calculation fields for accuracy.

Additional Tips for Customization

- Use Clear Labels: Label each section clearly to prevent confusion, particularly when dealing with amounts or payment terms.

- Choose Professional Colors: Use subtle color schemes that align with your company’s branding without overwhelming the recipient.

- Ensure Consistent Alignment: Make sure all text and numbers align neatly to create a polished, organized appearance.

By customizing your document to match your company’s branding and functional needs, you can create a professional and consistent way to manage transactions with clients.

Benefits of Using Open Office for Invoices

Using free and versatile software for creating payment records offers several advantages, especially for individuals or small companies. The ability to quickly create and modify documents without relying on costly applications ensures that resources are used efficiently while maintaining a professional standard.

Cost Efficiency

- No License Fees: With no cost to use, this software is ideal for those looking to avoid expensive subscriptions or purchases.

- Free Updates: Unlike paid alternatives, users receive regular updates and improvements without any extra charges.

Flexibility and Customization

- Adaptable Layout: Customize the design of each document to meet specific needs, from adding custom fields to adjusting the format.

- Wide Compatibility: The software supports a range of file formats, making it easy to export and share your work across different platforms.

Ease of Use

- User-Friendly Interface: The simple and intuitive interface makes it accessible for both beginners and advanced users.

- Quick Setup: You can start creating documents right away, with little learning curve or setup time involved.

These advantages make this free software an ideal solution for anyone seeking an effective and economical way to handle financial documentation. The ability to quickly create, edit, and distribute documents helps maintain a streamlined and organized approach to managing payments and transactions.

Common Mistakes in Invoice Creation

Creating accurate payment documents is crucial for maintaining a professional image and ensuring smooth transactions. However, mistakes can easily occur, leading to confusion, delays, or misunderstandings. Recognizing and avoiding common errors can save time and help maintain clear communication with clients.

Missing Essential Details

- Omitting Contact Information: Forgetting to include your business name, phone number, or address can make it difficult for clients to reach you.

- Leaving Out Payment Terms: Not specifying when the payment is due or the accepted payment methods can cause confusion.

- Not Including Unique Identifiers: Failure to add unique reference numbers or order IDs may make it harder for clients to track or manage payments.

Incorrect Amounts or Calculations

- Mathematical Errors: Mistakes in calculating totals, taxes, or discounts can result in incorrect amounts being requested.

- Not Including Taxes: Forgetting to apply the appropriate tax rates can lead to discrepancies between what is owed and what is paid.

- Incorrect Currency or Formatting: Using the wrong currency symbol or inconsistent formatting can cause confusion, especially in international transactions.

By paying attention to these common issues and ensuring that all required information is accurate and clear, you can prevent delays and maintain trust with your clients.

Step-by-Step Guide to Invoice Design

Creating a clear and professional payment document is essential for ensuring smooth financial transactions. A well-structured document helps clients easily understand the charges and terms, improving the overall experience. This guide will walk you through the key steps to design an effective document that suits your business needs.

Step 1: Choose the Right Layout

- Simple and Clean Design: Keep the layout straightforward and easy to navigate, with a clear hierarchy of information.

- Branding Elements: Include your company’s logo, colors, and fonts to make the document uniquely yours.

Step 2: Include Key Information

- Contact Details: Ensure that your business name, address, and phone number are prominently displayed.

- Client Information: Include the client’s name, address, and contact information for clear communication.

- Detailed Breakdown: List the products or services provided with descriptions, quantities, and individual prices.

Following these steps will help ensure that your document looks professional and includes all the necessary details, allowing your clients to easily understand the terms of the transaction.

How to Add Your Logo to Invoices

Incorporating your company’s logo into payment documents adds a professional touch and helps maintain brand consistency. This simple design step not only enhances the visual appeal but also makes it easier for clients to identify your business. Here’s how you can easily add your logo to your financial documents.

Step 1: Prepare Your Logo Image

Ensure that your logo is in a suitable format such as PNG, JPEG, or SVG. The image should be high quality and appropriately sized to fit into the header area of the document without overwhelming the layout.

Step 2: Insert the Logo into the Document

To insert your logo, follow these basic steps:

| Step | Action |

|---|---|

| 1 | Open your document editing software. |

| 2 | Navigate to the header section where you want the logo to appear. |

| 3 | Select the option to insert an image or graphic. |

| 4 | Upload your logo from your device or cloud storage. |

| 5 | Adjust the size and position to ensure it fits properly without cluttering the space. |

By following these simple steps, you can easily add your logo and strengthen your brand presence on every document you send to clients.

Best Practices for Professional Invoices

Creating clear and effective financial documents is essential for ensuring smooth transactions with clients. A professional appearance and well-organized content can foster trust and encourage prompt payments. Here are some key practices to follow when designing your payment requests.

Key Elements of a Professional Document

When crafting payment requests, it’s important to include essential information that is easy to read and understand. Below are the main elements every document should have:

| Element | Explanation |

|---|---|

| Header with Company Name | Include your business name and contact details at the top for easy identification. |

| Clear Payment Terms | State your payment deadlines, methods, and any late fees. |

| Detailed List of Services or Products | Provide a breakdown of what was delivered, along with corresponding prices for clarity. |

| Unique Identifier | Assign a unique number to each document for record-keeping and tracking purposes. |

| Professional Formatting | Ensure the document is clean and well-organized with readable fonts and consistent alignment. |

By including these key elements and maintaining a clean, organized structure, you’ll create a professional financial request that clients will find easy to process and respond to promptly.

Open Office Invoice Template vs Excel

When creating financial documents, selecting the right tool can significantly impact efficiency and professionalism. Two popular software options for generating payment requests are free spreadsheet programs and specialized document software. Both offer distinct features that cater to different user needs and preferences. In this section, we’ll compare their capabilities to help you make an informed choice.

Ease of Use

Spreadsheet software offers a flexible approach to document creation with a grid-based layout. You can manually adjust columns and rows to fit your specific needs, making it easy to adapt. However, this may require more time for users unfamiliar with formulas or advanced functions.

Document software, on the other hand, is designed with a more structured, template-driven layout. It allows users to quickly input data into pre-set sections. This streamlined process is especially helpful for those who prefer minimal customization.

Customization Options

With spreadsheet programs, users can create customized documents from scratch. Advanced formatting options, including charts and graphs, make it easy to visualize data, though it may take more time for beginners to design layouts that look professional.

While document programs offer customization, the layout options are often more restricted. These programs usually provide templates that can be adjusted, but they may not have the same flexibility as spreadsheets for creating complex designs.

Functionality and Automation

Spreadsheet software allows you to use built-in functions like sum, average, and tax calculations. This can be a big advantage when dealing with complex calculations. You can also set up automatic updates for totals and other financial information, reducing manual input errors.

Document software typically lacks the automation features found in spreadsheets. Most of the work is done manually, though some templates may include fields for basic math. However, it often requires a separate tool or additional steps for calculations beyond simple totals.

Ultimately, both options offer valuable features depending on the complexity of the financial documents and the user’s comfort with customization and formulas. Choose the one that best fits your needs for both ease of use and efficiency.

How to Save and Share Your Invoice

Once you have completed your document, saving and sharing it with clients or customers is an essential step in the process. There are several ways to ensure that the file is preserved correctly and distributed efficiently. This section will walk you through the necessary steps to save and share your document while maintaining its professional appearance.

Saving Your Document

To make sure your file is securely stored and easily accessible, follow these key steps:

- Choose the right format: Depending on your needs, save your document as a PDF for universal accessibility or as a native file format if you wish to make future edits.

- Organize your files: Save the document in a clearly labeled folder on your computer to avoid confusion later. For example, include the client’s name and the date of the document in the filename.

- Back up your files: Use cloud storage or an external drive to ensure that your document is securely backed up in case of data loss.

Sharing Your Document

Sharing your document can be done through various methods, each suited for different situations. Consider the following options:

- Email: Attach the saved document to an email for easy and direct delivery. Make sure to include a clear subject line and a polite message in the body of the email.

- Cloud services: Upload your document to a cloud platform such as Google Drive or Dropbox, and then share the link with your client. This is ideal for large files or when you need to provide ongoing access to the document.

- Printing and mailing: For more formal or legal situations, you may choose to print the document and send it by postal mail.

Choosing the right method for saving and sharing your document will depend on the urgency, the recipient’s preference, and the format requirements. Be sure to select the option that best meets your needs while ensuring professionalism and efficiency in the process.

Understanding Tax and Payment Terms in Invoices

When creating a formal request for payment, it’s essential to include specific details regarding the applicable taxes and payment deadlines. These elements help ensure clarity and avoid confusion for both parties involved. This section covers how to handle tax rates and payment terms to maintain professionalism and prevent disputes.

Tax Information

Including tax details is crucial for compliance and transparency. Here’s how to handle it effectively:

- Specify the tax rate: Clearly state the tax percentage applied to the total amount. This can vary depending on the region and the nature of the goods or services provided.

- Indicate tax exemptions: If certain goods or services are exempt from taxes, make sure to mention this to avoid any misunderstandings.

- Breakdown of costs: It’s a good practice to list the pre-tax total separately from the tax amount, as this helps recipients better understand the calculation.

Payment Terms

Stating clear payment terms helps avoid delays and ensures prompt settlement. Consider the following guidelines:

- Due date: Always include a payment due date to establish a clear timeline for the transaction.

- Late fees: If applicable, state the consequences for missed payments, such as interest charges or penalties.

- Accepted payment methods: Specify the available ways to pay, such as credit cards, bank transfers, or online payment systems.

By clearly outlining both tax and payment terms, you create a transparent agreement that benefits both the issuer and the recipient, ensuring smooth transactions and reducing potential disputes.

How to Automate Invoice Calculations

Manually calculating totals and taxes for each transaction can be time-consuming and error-prone. Automating these calculations not only saves time but also ensures accuracy in your documents. By using the right tools and formulas, you can streamline this process and focus on other important tasks.

Setting Up Basic Calculations

Start by establishing a simple system that can handle basic arithmetic, such as adding up individual item costs and applying any discounts. Here’s how:

- Use a calculator or spreadsheet: Input the unit prices, quantities, and any discount percentages to get an accurate total.

- Apply formulas: Most spreadsheet software allows you to use formulas for multiplication and addition, ensuring quick and accurate calculations.

- Include a tax field: Incorporate a cell that multiplies the pre-tax total by the applicable tax rate for automatic updates when prices change.

Advanced Automation with Templates

For more complex calculations, consider using pre-built systems or templates that handle advanced tasks such as tax calculations, discounts, and totals. These can be easily customized and adapted to your specific needs:

- Tax rate adjustments: Set up formulas that adjust automatically based on the tax rates of different regions or categories.

- Dynamic totals: Ensure that any changes to quantities or unit prices instantly reflect in the total cost field, updating totals and taxes in real-time.

- Discounts and fees: Automatically apply any discounts, service charges, or handling fees to reduce errors and provide more accurate pricing.

By automating your calculations, you can reduce human error, speed up the process, and create a more efficient workflow that saves both time and resources.

Why Choose Open Office for Invoices

When creating formal documents for transactions, selecting the right software can make a significant difference in efficiency and usability. There are many tools available, but certain programs offer a unique combination of functionality, flexibility, and cost-effectiveness. Choosing the right platform can streamline your workflow and ensure professional-looking results without a hefty price tag.

Cost-Effective and Accessible

One of the most appealing features of this software is that it is completely free to use. This makes it an attractive option for individuals and small businesses looking for a reliable tool without having to invest in expensive alternatives. The software is also compatible with a variety of operating systems, allowing users to work across different devices without additional costs.

Ease of Use and Customization

Another reason to opt for this software is its user-friendly interface. Even for those with minimal technical experience, it offers straightforward navigation and a variety of options for customization. Whether you need to adjust formatting, add logos, or include specific fields, the platform allows for seamless adjustments to meet your needs. You can easily create professional documents that align with your preferences and brand identity.

Legal Considerations for Business Invoices

When creating documents for requesting payment, it’s essential to be aware of the legal requirements involved in ensuring compliance with local laws and regulations. Understanding the necessary components and the proper structure can help avoid potential disputes and ensure that both parties fulfill their obligations as agreed. This section highlights the key legal factors to keep in mind when preparing such formal requests for payment.

Required Information

Each formal request should include certain critical details to comply with legal standards and maintain clarity. These details help ensure transparency between the parties involved and prevent misunderstandings. The essential components include:

| Required Detail | Description |

|---|---|

| Full Name/Company Information | Clearly state the name of the seller and buyer, including business names if applicable. |

| Unique Identification Number | Ensure there is a unique number to identify the transaction, such as a reference or serial number. |

| Itemized List of Goods/Services | Clearly list the items or services provided, including quantities and unit prices. |

| Payment Terms | Include the due date and any other agreed-upon terms for payment, such as late fees or discounts. |

| Tax Information | Ensure any applicable taxes are included, based on local tax regulations. |

Compliance with Local Laws

Local regulations often dictate the specific requirements for official documents. It’s important to familiarize yourself with any rules related to sales, taxes, and record-keeping that apply in your jurisdiction. These rules may vary depending on your location, so it’s crucial to ensure that your formal requests meet all the necessary standards. Failing to comply with legal requirements could lead to penalties or disputes that could affect your business relationships and operations.