Business Forms Invoice Templates for Streamlined Billing

Efficient management of financial transactions is essential for any company, regardless of its size or industry. A well-organized method for requesting payment not only helps ensure timely receipt of funds but also maintains a professional image. Creating accurate, clear, and consistent documents for billing can significantly reduce errors and improve cash flow.

Standardized billing documents play a crucial role in making this process smoother and more reliable. These documents provide a structured way to outline charges, terms, and necessary details that both you and your clients can refer to when managing payments. By using ready-made solutions, companies can save valuable time and minimize the risk of miscommunication.

Whether you are a freelancer or run a large organization, having access to pre-designed solutions for creating payment requests can make your operations more efficient. Customizable options allow for flexibility, ensuring that the final product reflects your brand identity while still maintaining all the legal and business essentials required for smooth transactions.

Business Forms Invoice Templates

Having a structured approach to billing is vital for smooth financial transactions. When you need to request payments, it’s important to have a standardized method that ensures clarity and consistency. Using pre-designed documents that outline charges, payment terms, and contact information can streamline the process, making it more efficient and reducing the likelihood of errors.

Ready-made solutions can be tailored to meet your specific needs, offering flexibility while maintaining professional standards. These documents allow you to focus on the core aspects of your business rather than spending time on manual creation each time you need to issue a payment request. With customizable options, it’s easy to align the design and details with your brand’s identity.

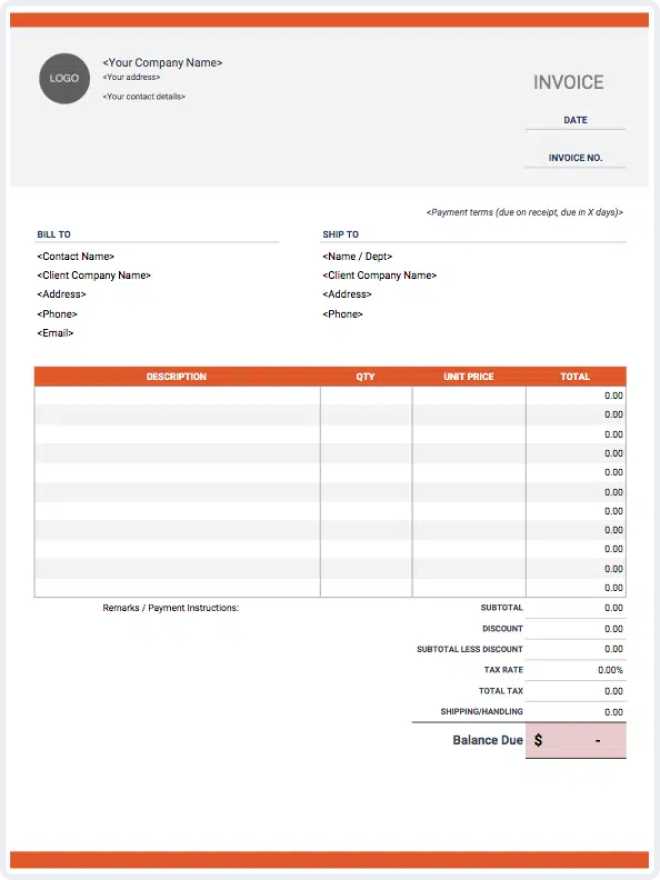

Customization options often include space for logos, company details, and personalized payment instructions, ensuring the document reflects your unique requirements. Using such resources can help maintain a high level of professionalism and ensure that all necessary information is included for clients to process payments smoothly.

Ready-to-use billing solutions also offer the advantage of adhering to local regulations, including legal requirements for payment terms, tax details, and contact information. This ensures that all necessary components are covered, reducing the chances of disputes or delays due to missing information.

Why Use Invoice Templates for Your Business

Using pre-designed documents to request payment provides numerous advantages that help improve efficiency and accuracy. These ready-made solutions save time and ensure that all necessary details are included in each payment request, reducing the risk of mistakes. When your financial documents are well-organized, clients can easily process payments without confusion, leading to faster and more reliable transactions.

One of the key reasons to adopt these pre-designed documents is the ability to maintain consistency across all your billing communications. When you use the same structure and format each time, you build a professional image and establish clear expectations with your clients. These standardized tools can be easily modified to suit different needs, such as varying amounts or specific payment terms, without starting from scratch.

Here’s a comparison of the benefits:

| Benefit | Without Pre-designed Documents | With Pre-designed Documents |

|---|---|---|

| Time Efficiency | Requires creating each request from scratch | Simply fill in the details and send |

| Professional Appearance | Inconsistent and potentially error-prone | Consistent, polished, and brand-aligned |

| Legal Compliance | May miss important legal or tax details | Includes all necessary fields and legal requirements |

| Error Reduction | Higher risk of mistakes | Pre-defined fields reduce the chance of errors |

By relying on these efficient resources, you can streamline your financial processes and focus more on growing your company rather than getting bogged down in administrative tasks.

Key Features of Effective Invoice Forms

When creating a document to request payment, it’s essential to include certain elements that ensure clarity, accuracy, and professionalism. A well-designed document should provide all necessary details in a structured manner, making it easy for both the sender and recipient to understand the terms of the transaction. This will help avoid confusion and speed up the payment process.

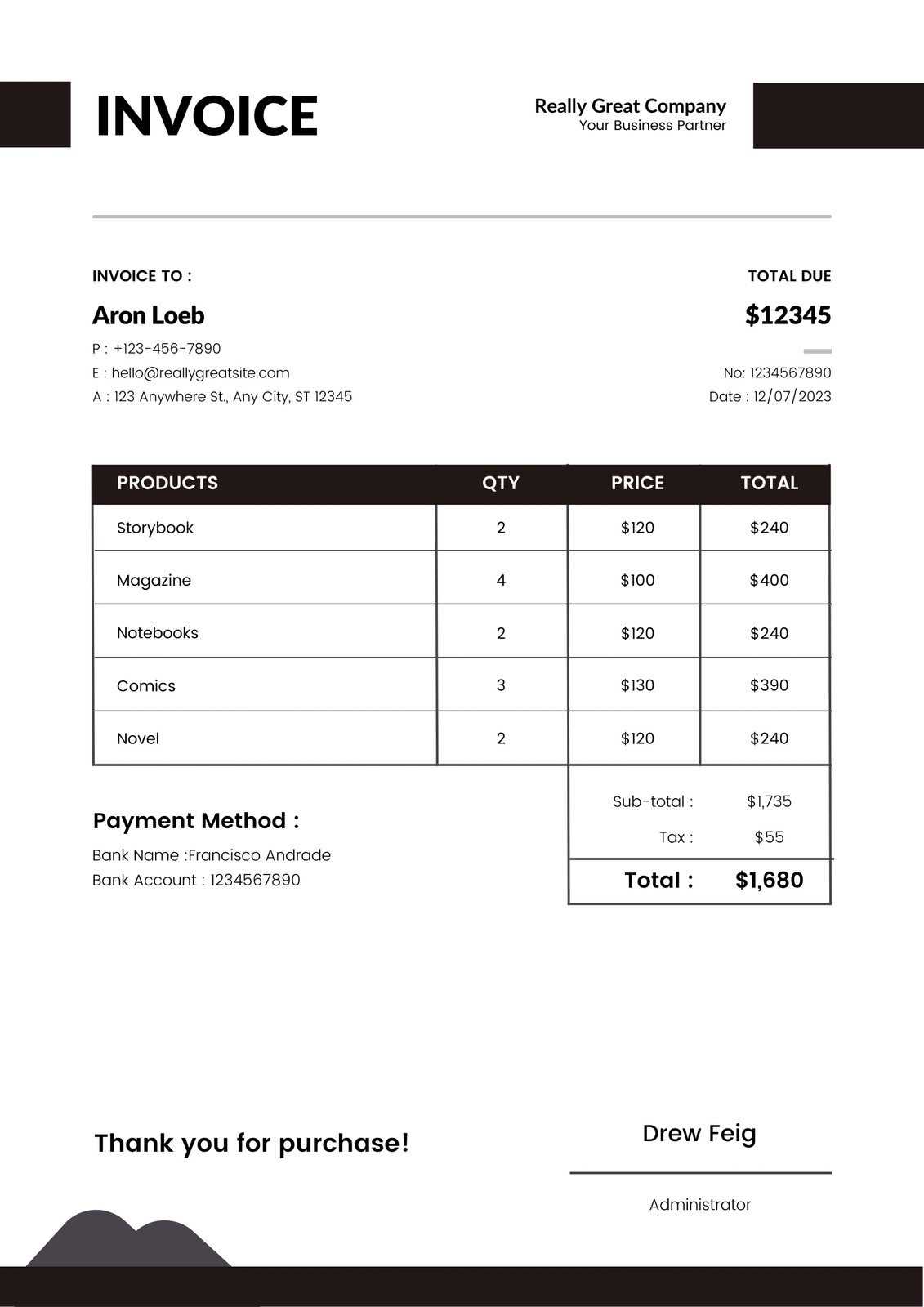

Some of the most important aspects to include are clear identification of both parties, detailed descriptions of the products or services provided, accurate pricing information, and specified payment terms. These elements create a solid foundation for any transaction and ensure that all essential information is covered.

Here’s a list of key features that contribute to the effectiveness of such documents:

| Feature | Description |

|---|---|

| Clear Contact Information | Include both your and your client’s full names, addresses, and contact details for easy communication. |

| Itemized List of Services | Break down each product or service with quantities, rates, and descriptions to avoid confusion. |

| Precise Payment Terms | Clearly state the due date, payment methods, and any penalties for late payments. |

| Legal Compliance | Ensure the document meets local legal requirements, such as tax details or invoice numbers. |

| Professional Layout | Use a clean, organized design that reflects your company’s brand and ensures readability. |

By incorporating these key features, you create a document that serves its purpose efficiently while maintaining professionalism. A well-structured payment request not only helps to expedite transactions but also fosters trust and credibility with clients.

How to Customize Your Invoice Template

Personalizing your payment request document allows you to align it with your brand identity while ensuring it meets your unique business needs. Customization offers flexibility in how the document appears, what information it includes, and how it reflects your company’s style. By adjusting key elements, you can create a more professional and functional tool that suits your specific requirements.

Adjust Layout and Design

The layout and design of your document play a significant role in making it visually appealing and easy to read. You can modify sections such as the header, footer, and the arrangement of information to suit your preferences. Incorporating your logo, choosing brand-specific colors, and using consistent fonts helps establish a recognizable identity for your company.

Personalize Content and Fields

To ensure the document is relevant to your specific transactions, personalize the fields and content. This includes adding your company name, contact details, and payment instructions. You can also modify the descriptions of products or services to better reflect the items or services your company offers. Tailoring these details will make the document more specific to each client interaction, improving clarity and accuracy.

Types of Business Invoice Templates Available

There are various types of payment request documents that cater to different needs and industries. Each type is designed to provide a specific format and structure, ensuring that all relevant details are included while also aligning with the particular requirements of a transaction. Depending on the nature of your work, you can select from a variety of options to suit the type of goods or services you offer.

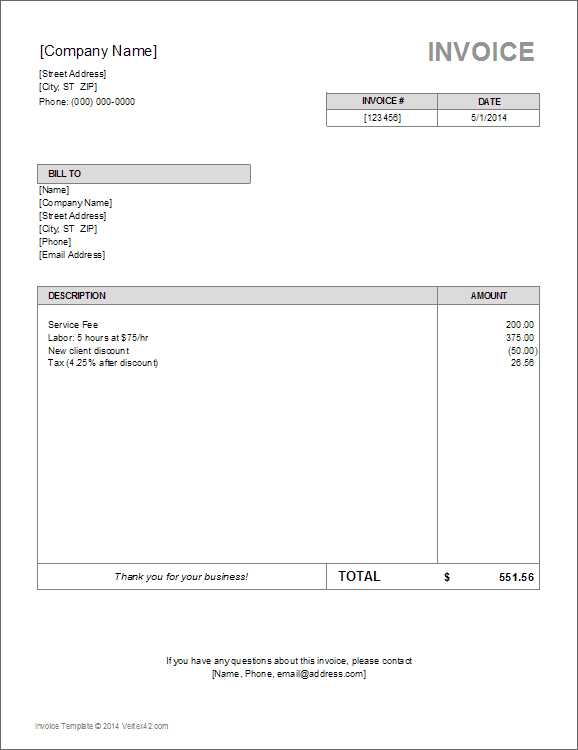

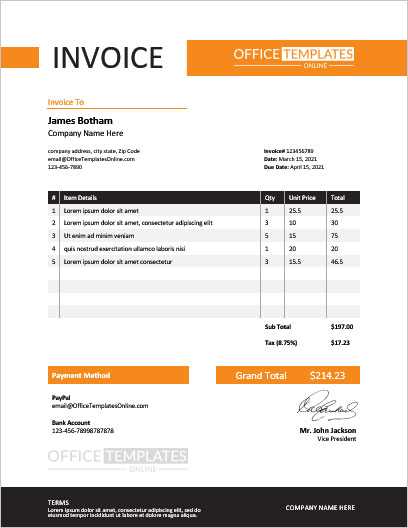

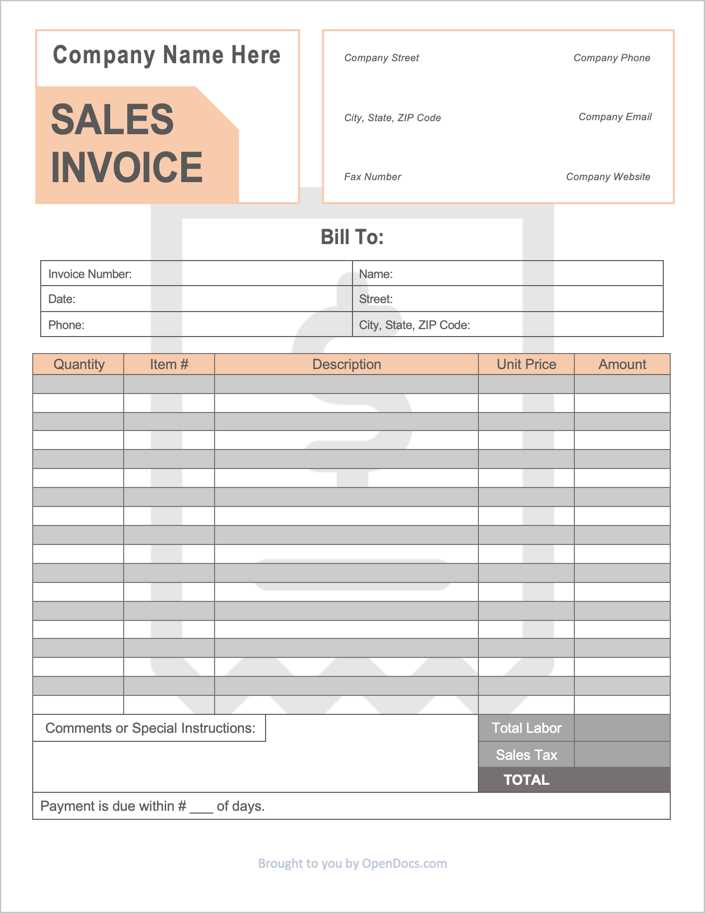

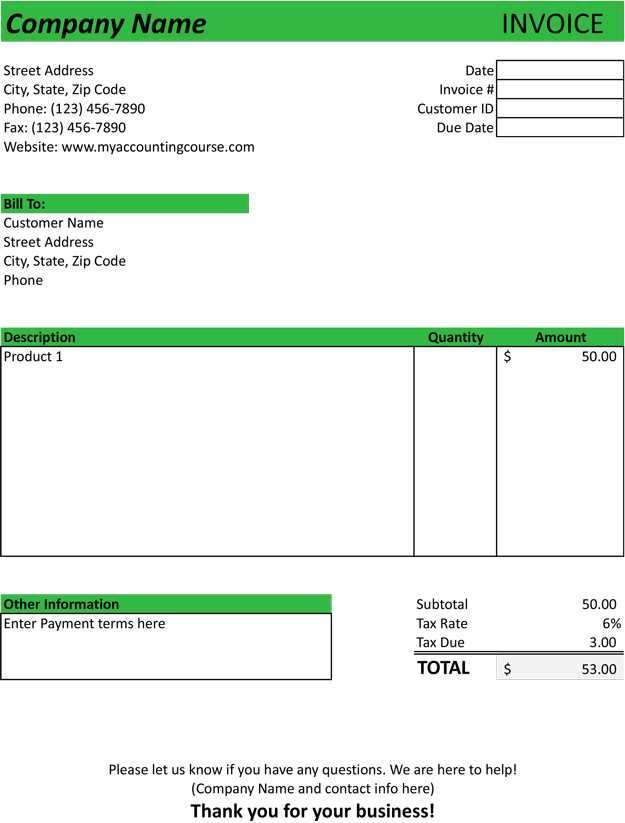

Basic Billing Document: This is the most straightforward format, typically used for standard transactions. It includes essential details like payment terms, amounts, and due dates without any frills. Ideal for one-off transactions or small-scale operations, this type is simple and quick to customize.

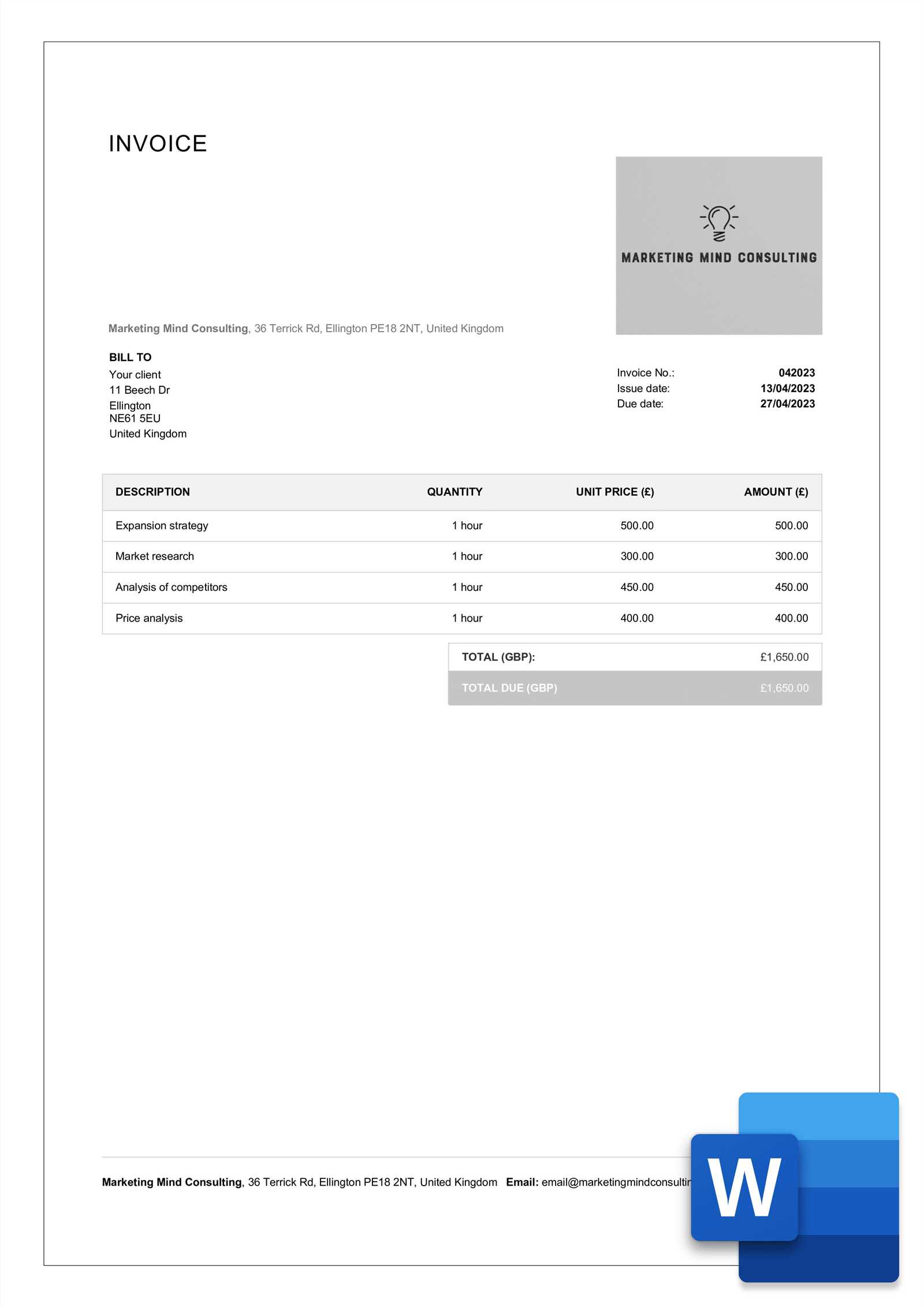

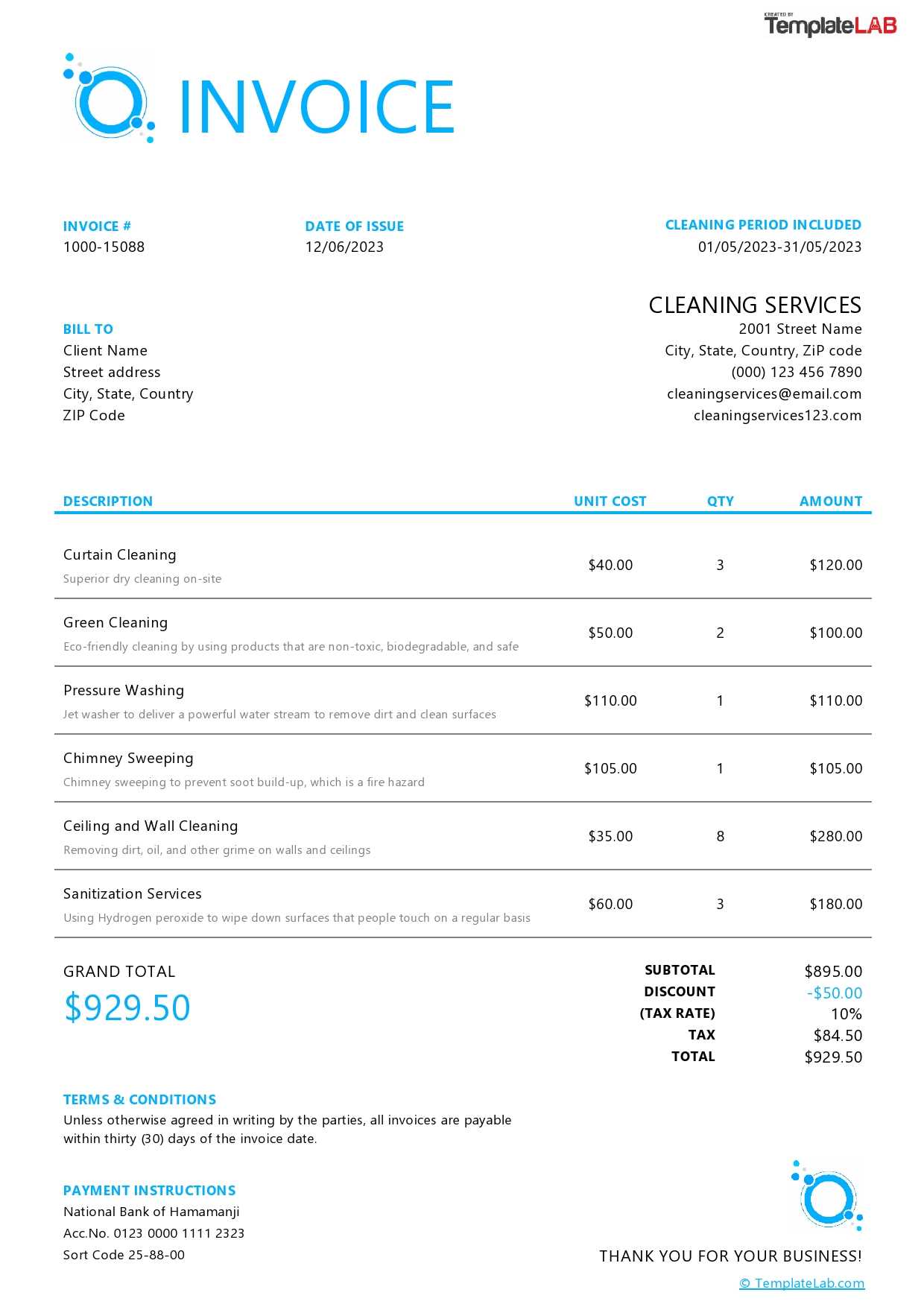

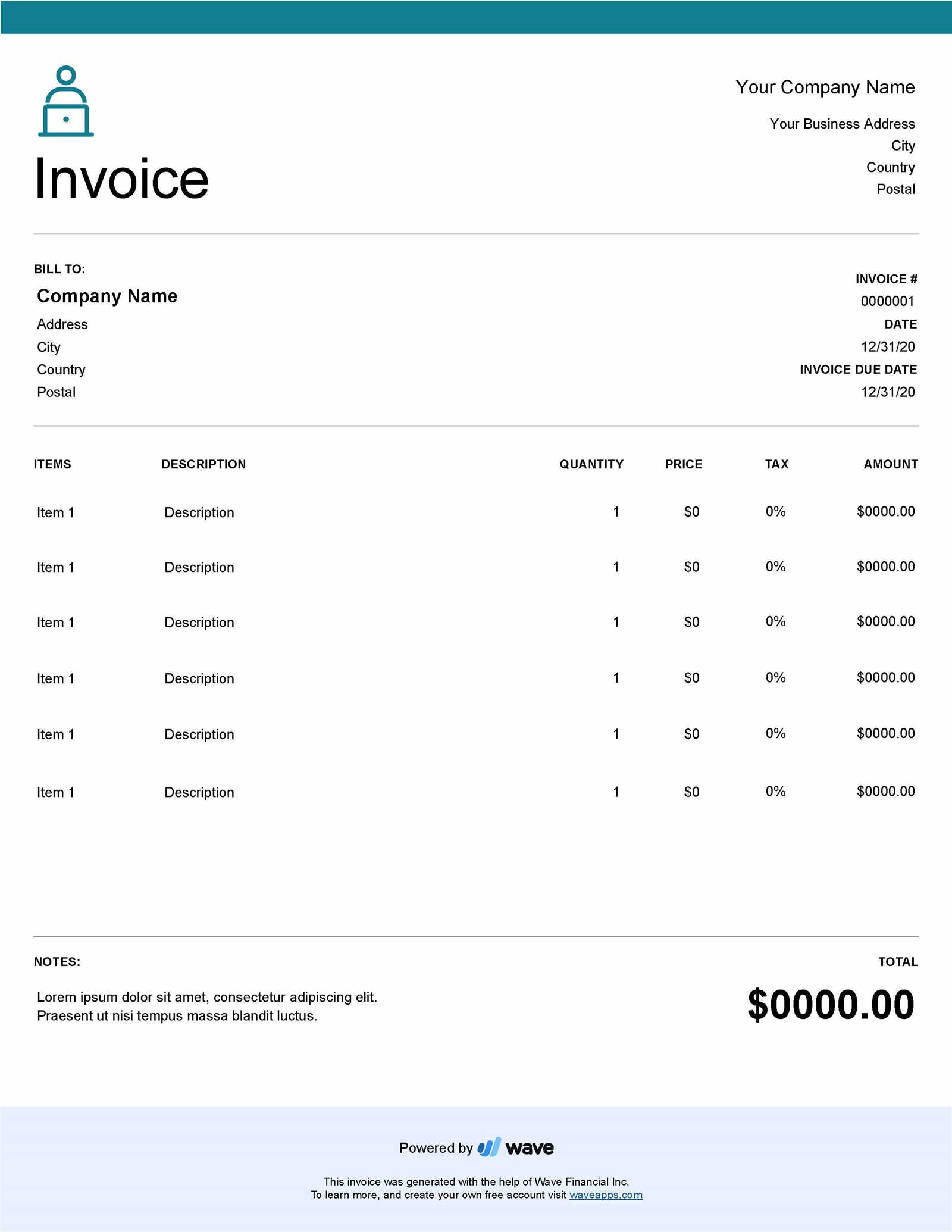

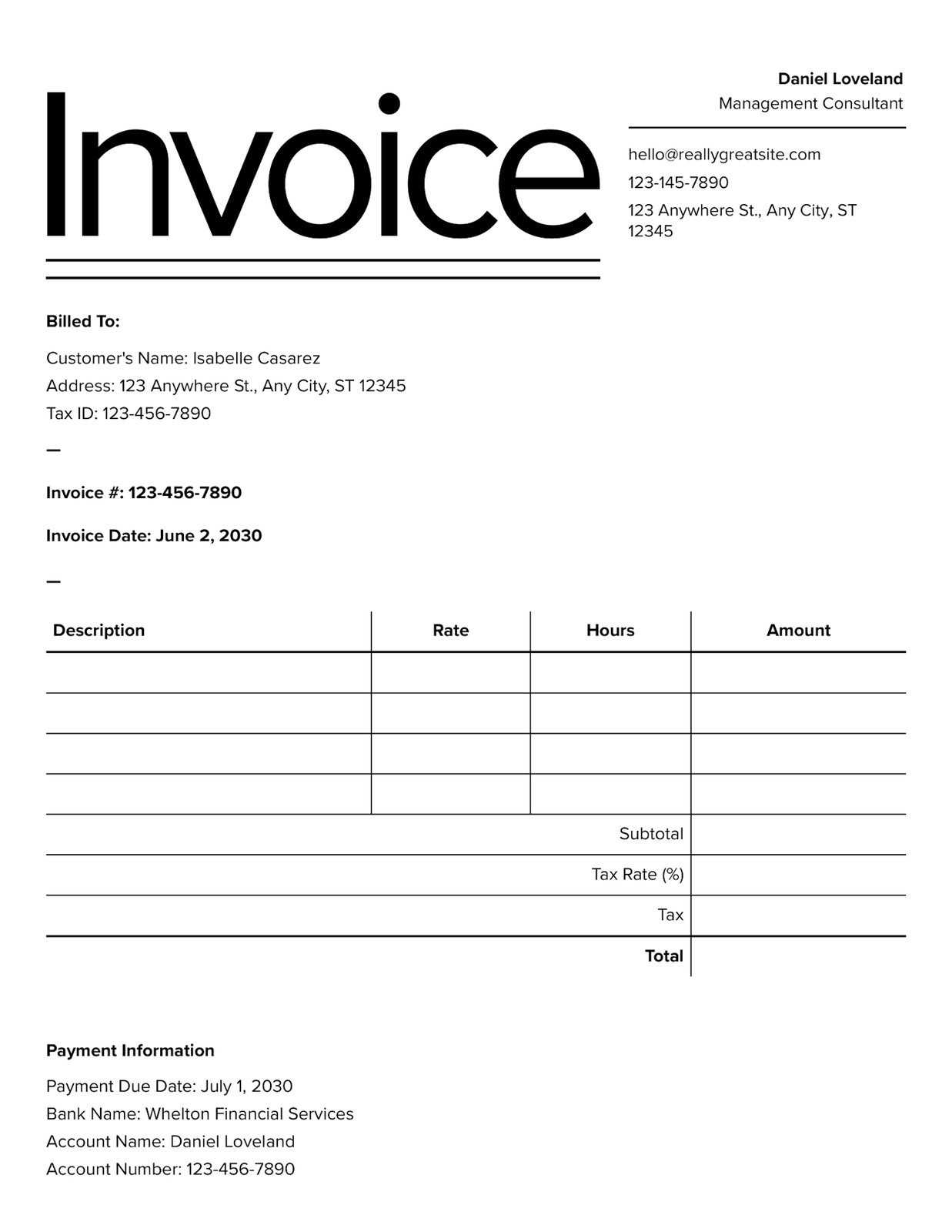

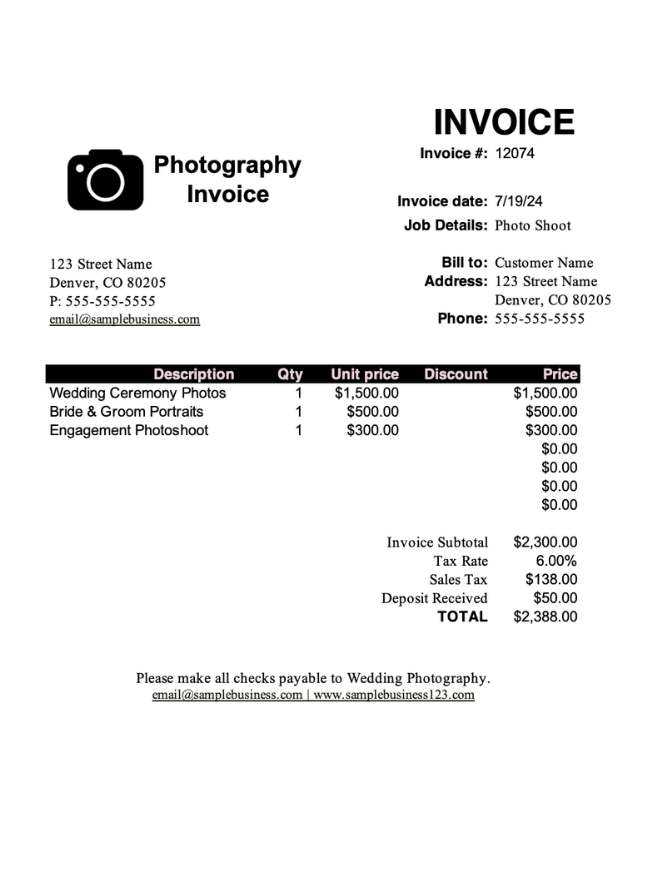

Detailed Service Invoice: Used by professionals and service providers, this version includes itemized lists of services provided, hourly rates, and the total time spent. This format helps clients understand the specifics of the services rendered, making it ideal for contractors, consultants, or freelancers.

Recurring Payment Request: This type is perfect for subscription-based services or long-term contracts. It includes a set payment schedule and ensures that clients are reminded of upcoming dues, whether monthly, quarterly, or annually. Customizable fields allow for easy updates for different clients and payment cycles.

Pro-forma Invoice: Typically used before finalizing a transaction, this type provides an estimate or pre-billing request, outlining expected costs. This allows both parties to agree on pricing before services are rendered or goods are delivered.

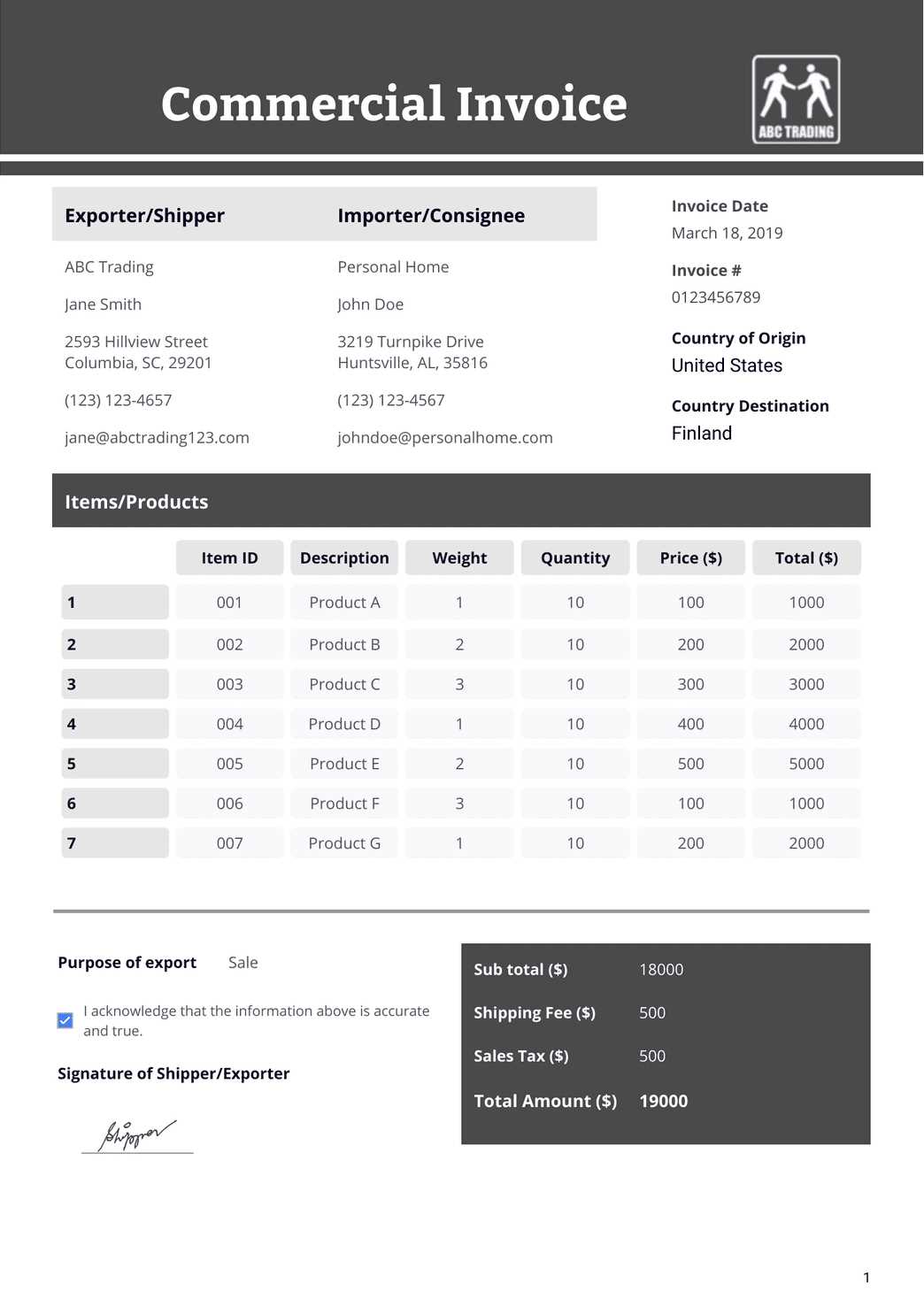

Commercial Invoice: Commonly used for international trade, this document contains more specific details related to shipping, customs, and taxes. It’s essential when dealing with cross-border transactions, ensuring that all required customs documentation is included for the goods being shipped.

Best Practices for Creating Invoices

Creating accurate and professional payment requests is essential for ensuring timely payments and maintaining strong client relationships. By following a few key practices, you can streamline the billing process, reduce errors, and present your company in a reliable, organized manner. Clear communication and attention to detail in your financial documents will help avoid misunderstandings and ensure that all necessary information is conveyed effectively.

One of the best practices is to always include complete contact information, both for your company and your client. This ensures that there are no delays in communication if there’s any issue with the payment. Additionally, make sure to provide a unique reference number for each request to make tracking easier for both parties.

Another important aspect is to itemize your charges clearly. Avoid vague descriptions–be specific about the services or products provided, including quantities, rates, and any additional fees. This transparency helps clients understand what they are paying for and reduces the likelihood of disputes.

Clearly state payment terms, such as due dates, acceptable payment methods, and any penalties for late payments. This helps set expectations upfront and encourages timely settlement. It’s also wise to review local laws and regulations to ensure that all required legal information, such as tax rates or business registration numbers, is included when necessary.

Benefits of Digital Invoice Templates

Digital payment request documents offer a wide range of advantages over their paper counterparts. These electronic solutions make the billing process more efficient, streamlined, and environmentally friendly. By utilizing digital formats, businesses can save time, reduce errors, and ensure that payment requests are processed faster and more securely.

Time and Cost Efficiency

One of the primary benefits of digital payment requests is the time saved in creating and sending them. With pre-designed solutions, all the necessary fields can be filled in quickly, reducing the time spent on each document. Additionally, sending documents electronically eliminates the need for printing, postage, and manual handling, leading to cost savings for businesses.

Improved Accuracy and Security

Digital documents minimize the risk of human error, such as miscalculating totals or leaving out critical details. By using software that automatically calculates totals, taxes, and discounts, you ensure accuracy in every transaction. Furthermore, electronic requests are typically more secure, with encryption features and password protections that prevent unauthorized access or tampering.

With digital solutions, tracking and archiving payment requests also becomes much easier. Storing documents in cloud systems allows for quick retrieval and organization, providing a streamlined record-keeping process that benefits both your team and clients.

How to Organize and Store Your Invoices

Proper organization and storage of payment requests are crucial for smooth financial management. Keeping accurate records helps you track payments, meet legal requirements, and maintain an efficient workflow. Whether you prefer digital or physical storage, the key is to implement a systematic approach that makes retrieval quick and easy when needed.

Digital Organization and Storage

Digital documents are highly flexible and can be easily organized using cloud-based storage or local digital systems. To maintain an orderly system, categorize documents by client, date, or project. Use clear, descriptive file names to make searching more efficient. For added security, consider encrypting files and setting up password protection to prevent unauthorized access. Cloud storage systems also offer the benefit of automatic backups, ensuring your records are safe and accessible from anywhere.

Physical Organization and Storage

If you prefer to keep hard copies of your payment requests, it’s essential to use a filing system that categorizes them by date, client, or transaction type. Store documents in clearly labeled folders or binders, and ensure they are easily accessible. For added protection, consider using fireproof file cabinets or other secure storage options to safeguard your records from damage or loss.

Consistency is key when organizing your records, whether digital or physical. By sticking to a set structure, you can quickly locate any document when needed, ensuring smooth operations and timely responses to client inquiries or audits. Additionally, regularly reviewing and updating your records will keep your storage system effective and up to date.

Common Mistakes to Avoid in Invoicing

When preparing payment requests, small mistakes can lead to significant delays or confusion. Ensuring that every detail is accurate and clearly presented is vital for maintaining professionalism and smooth financial operations. Many issues arise from simple errors, such as incomplete information or miscommunication, which can disrupt timely payments and lead to misunderstandings with clients.

Missing or Incorrect Payment Terms

One of the most common mistakes is failing to clearly specify payment terms, such as the due date or accepted methods. Without this critical information, clients may not know when or how to pay, leading to delays. Always make sure that the payment deadline, any applicable late fees, and payment options are explicitly stated. Ambiguity in payment terms can result in clients delaying their payments or questioning the charges.

Incomplete or Inaccurate Details

Another frequent error is leaving out key information, such as a client’s contact details, descriptions of products or services, or correct pricing. These missing details can lead to confusion and make it difficult for clients to process payments. Always double-check for accuracy before sending the request. Ensure that all fields are properly filled in, including tax rates, quantities, and unit prices. Inaccurate calculations or missing data may also lead to disputes or payment delays.

Consistency and attention to detail are crucial when preparing payment documents. Taking the time to carefully review every aspect of the request will not only improve your professionalism but also increase the likelihood of prompt and accurate payments. Moreover, using reliable tools to automate certain aspects of the process can help minimize human error.

Remember, a small mistake in a payment request may seem insignificant, but it can have a larger impact on cash flow and customer trust.

Free vs Paid Invoice Templates for Businesses

When it comes to creating payment requests, choosing the right document solution can significantly impact efficiency and professionalism. Many companies are faced with the decision of whether to use free or paid options, each of which comes with its own set of advantages and limitations. Understanding the differences between the two can help you make an informed choice based on your specific needs and budget.

Advantages of Free Document Solutions

Free payment request documents are a great option for small businesses or freelancers who need a simple and cost-effective way to bill clients. These solutions typically offer basic features such as customizable fields, standard layouts, and easy-to-fill-in templates. Many free versions are available online and can be downloaded quickly without any upfront costs.

However, free options often come with some restrictions. They may lack advanced features like automated calculations, branded designs, or the ability to save and track past requests. While they serve as a good starting point, free solutions might not be sufficient for businesses looking to scale or streamline their processes in the long term.

Benefits of Paid Document Solutions

On the other hand, paid payment request solutions often provide a more comprehensive set of features. These can include advanced customization options, integrations with accounting software, automated calculations, and enhanced security. Paid versions usually offer professional designs that can be tailored to fit your brand, ensuring that your documents look polished and consistent.

Paid options may also come with customer support, regular updates, and additional tools to improve workflow. These features are especially valuable for businesses with high transaction volumes or specific legal and tax requirements. Investing in a paid solution can save time and reduce errors, leading to more efficient billing practices and better client relationships.

Ultimately, the choice between free and paid options depends on the complexity of your billing needs, the scale of your operations, and your budget. For some, a simple free template might be sufficient, while others may benefit from the advanced capabilities offered by paid solutions.

Integrating Invoice Templates with Accounting Software

Integrating your payment request documents with accounting software can streamline your financial processes, making it easier to manage transactions, track payments, and maintain accurate records. By automating key aspects of the billing process, you can reduce the risk of errors and improve overall efficiency. This integration allows you to seamlessly transfer data between systems, eliminating the need for manual data entry and ensuring consistency across all financial documents.

Benefits of Integration

When payment request documents are connected to accounting tools, several advantages arise. One of the key benefits is automated data synchronization, where client details, payment amounts, and dates are automatically transferred between the systems. This reduces the time spent on repetitive tasks and ensures that records are always up to date.

Another significant benefit is enhanced reporting. With integrated systems, you can generate comprehensive reports that track outstanding payments, cash flow, and financial performance with ease. This real-time access to financial data helps businesses make better decisions and stay on top of their financial health.

Key Integration Features

Here are some of the features commonly offered by accounting software integrations with payment request documents:

| Feature | Description |

|---|---|

| Automatic Data Entry | Automatically fills in customer details and transaction information, reducing manual input. |

| Real-Time Updates | Changes made in the accounting software are instantly reflected in your payment requests and vice versa. |

| Comprehensive Reporting | Generate detailed financial reports based on payment requests and transactions for easier analysis. |

| Payment Tracking | Track payments and outstanding balances with integrated payment processing features. |

Efficiency is greatly enhanced when accounting and billing systems work together. This integration not only reduces administrative overhead but also ensures better accuracy, faster payments, and improved financial management across your operations.

Legal Requirements for Business Invoices

When creating payment requests, it is crucial to ensure that all legal requirements are met to avoid complications with tax authorities or disputes with clients. Certain information must be included in every request to comply with local laws and regulations. Failing to provide these details can lead to fines, payment delays, or legal issues down the line. Understanding these legal obligations ensures that your transactions are both professional and legally sound.

The legal requirements can vary depending on your country, state, or industry. However, there are common elements that are generally required in any official billing document, regardless of location. Ensuring that these items are included helps protect both your business and your clients, as it provides clarity and transparency in every transaction.

| Required Information | Description |

|---|---|

| Unique Document Number | Each payment request should have a unique reference number to help identify and track it. |

| Seller’s and Buyer’s Details | Both parties’ names, addresses, and contact information must be clearly stated. |

| Transaction Date | The date the goods or services were provided, or the date the document was issued. |

| Itemized List | A breakdown of the goods or services provided, including quantities, prices, and descriptions. |

| Tax Information | Applicable taxes must be listed clearly, including tax rates and amounts where applicable. |

| Payment Terms | Clearly state the due date, accepted payment methods, and any penalties for late payments. |

By ensuring all of these details are included, you can avoid legal complications and ensure smooth business transactions. Regularly reviewing the legal requirements for your location and industry is important, as regulations may change over time. Compliance with these rules not only protects your business but also builds trust and credibility with your clients.

How Invoice Templates Save Time and Money

Using pre-designed billing documents can significantly reduce the time spent on creating and managing payment requests. These ready-to-use solutions streamline the process by providing a structured format that only requires you to fill in essential details, rather than starting from scratch each time. This not only saves time but also ensures that your records are consistently formatted, reducing the risk of errors.

Time Efficiency: Pre-built billing solutions allow for faster document creation. Instead of manually entering information into a blank document, you simply input the necessary details such as client names, transaction amounts, and due dates. This eliminates the need for repeated formatting, enabling you to focus on more important tasks.

Cost Savings: By reducing the time spent on administrative tasks, you can allocate more resources to growing your business or improving client relationships. Additionally, many free or low-cost solutions are available, helping small businesses save on software subscriptions or hiring additional help. In the long run, these efficiencies result in lower operational costs.

Consistency and Professionalism are also key benefits of using pre-designed solutions. Each document follows the same format, ensuring uniformity across all your payment requests. This consistency not only saves time on formatting but also reinforces your company’s professionalism and brand identity.

By automating parts of the billing process and ensuring accuracy with minimal effort, pre-designed documents are an essential tool for reducing administrative costs and improving overall productivity.

Choosing the Right Invoice Format for Your Business

Selecting the appropriate billing document layout is essential for ensuring that all necessary details are communicated clearly and professionally. The format you choose should match the nature of your transactions, the size of your operations, and your client needs. A well-designed billing document not only speeds up the payment process but also reflects the professionalism of your company.

Simple vs. Detailed Layouts

For smaller businesses or those with straightforward transactions, a simple layout is often sufficient. These basic designs typically include essential fields like client name, amount due, and payment terms. On the other hand, companies offering more complex services or products may need a detailed format. This can include itemized lists of services, additional fees, discounts, and tax information. The more complex your offerings, the more detailed the layout should be to provide transparency and avoid misunderstandings.

Custom vs. Pre-Designed Options

If you want to reinforce your brand identity, a customized format that includes your company logo, colors, and other design elements is a good choice. Custom formats allow for full flexibility in design and structure, enabling you to create a look that aligns with your business values. Alternatively, pre-designed options offer a quick solution, with ready-to-use fields and structures that are simple to implement and customize with minimal effort. These options are typically less time-consuming and are a great choice if you need a solution fast.

Choosing the right layout is about balancing ease of use with the specific needs of your business and clients. Consider factors such as transaction complexity, client expectations, and the level of personalization required when making your decision. Whether you go for simplicity or customization, ensuring that your documents are clear, professional, and easy to understand will help foster trust and efficiency in your operations.

Ensuring Professionalism with Custom Invoice Designs

Creating personalized payment requests that reflect your brand can significantly enhance your company’s image. A custom design helps establish credibility and trust, which are essential for building strong client relationships. By incorporating unique design elements such as logos, colors, and fonts, you not only ensure that your documents stand out but also convey a sense of professionalism and attention to detail.

Why Custom Designs Matter

Customizing your payment documents allows you to create a cohesive brand experience that extends beyond just the products or services you provide. Clients are more likely to view your company as established and reliable when they see a well-designed, branded document. A professional layout communicates that you take your work seriously, which can lead to faster payments and better client retention.

Elements to Include in a Custom Design

While the design can be as simple or intricate as you’d like, there are several key elements that should always be incorporated for clarity and professionalism:

| Element | Description |

|---|---|

| Logo | Include your company’s logo to reinforce your brand identity and make your documents instantly recognizable. |

| Brand Colors | Use your company’s primary colors to maintain a cohesive look across all communication materials. |

| Fonts | Choose professional fonts that are easy to read and align with your company’s overall style. |

| Consistent Layout | Maintain a clean, organized layout that ensures all necessary details are easy to find and understand. |

| Clear Call-to-Action | Always provide clear instructions on how and when to pay to avoid any confusion or delays. |

Customizing your documents ensures that each client interaction is professional and consistent with your brand’s values. By paying attention to design details, you reinforce the perception of reliability and trustworthiness, ultimately fostering stronger business relationships.

Automating Invoicing with Template Tools

Automating the billing process can greatly enhance efficiency and reduce the time spent on repetitive tasks. By utilizing tools designed to generate payment requests quickly, businesses can ensure consistent and timely invoicing without the manual effort involved in creating each document from scratch. These tools can simplify tasks like data entry, document formatting, and tracking payments, leading to faster turnaround and fewer mistakes.

With the right tools, many aspects of the billing process can be automated, allowing businesses to focus on more strategic tasks. From automatic population of customer details to sending reminders for overdue payments, the benefits are clear. Let’s explore some of the key features that make automation a powerful tool for improving your financial operations.

Key Features of Automated Billing Tools

- Automatic Data Entry: With integrated systems, customer information, transaction details, and payment terms can be automatically filled in, saving time and reducing the risk of errors.

- Recurring Billing: For businesses that charge clients on a regular basis, automated tools can set up recurring payment requests, eliminating the need to manually create each one.

- Customization Options: Even with automation, these tools allow businesses to maintain a professional and personalized appearance by customizing document layouts and branding elements.

- Payment Tracking: Automated systems can track which payments have been received and which are outstanding, helping businesses stay on top of their cash flow.

- Automatic Reminders: Automated reminders for overdue payments can be sent to clients, ensuring that nothing slips through the cracks.

- Integration with Accounting Software: Many automated tools integrate directly with accounting software, making it easy to keep records updated and generate financial reports.

Benefits of Automation

- Efficiency: Automation significantly reduces the time spent on manual tasks, allowing for faster processing of payments.

- Accuracy: Automated tools reduce human errors, ensuring that each document is consistent and accurate.

- Consistency: With automated tools, every payment request will follow the same format, reinforcing a professional image.

- Cash Flow Management: Automation helps businesses maintain better control over their cash flow by ensuring timely and accurate payment tracking.

By integrating automated billing solutions, businesses can streamline their financial processes, save valuable time, and improve overall efficiency. The result is a smoother, more reliable workflow that allows teams to focus on higher-value tasks.