How to Use Business Central Invoice Template for Streamlined Billing

Efficient financial management is key to maintaining smooth operations in any business. One of the most effective ways to simplify this process is through the use of predefined documents that help manage transactions with customers. These documents ensure accuracy, consistency, and speed, which ultimately saves time and reduces the risk of errors. Having a reliable framework in place allows businesses to focus more on growth and less on administrative tasks.

Customizable solutions provide flexibility, enabling businesses to adapt the structure of these documents according to their specific needs. By creating a uniform system for issuing payments, businesses can maintain a professional image while ensuring all necessary information is included in every transaction. With the right setup, this process can be automated, making routine tasks even more efficient.

Using such systems effectively can not only improve day-to-day operations but also enhance customer relationships by providing clear, easy-to-understand statements. In this article, we will explore how to optimize these tools for your needs and achieve better financial organization.

Understanding Business Central Invoice Templates

In today’s competitive market, businesses need efficient methods to manage financial transactions and maintain accurate records. One such method is through the use of pre-designed documents that streamline the billing process. These documents help standardize the way businesses handle payment requests, ensuring that all necessary information is included and organized in a clear, consistent format. The ability to customize and automate this process is key to reducing errors and improving workflow.

With the right setup, businesses can create a framework that supports various transaction types while remaining adaptable to specific needs. This approach not only saves time but also enhances the overall professionalism of the business, providing customers with a seamless experience. These systems ensure that every document issued contains the correct details, such as pricing, tax rates, and payment terms, in a format that is easy for both parties to understand.

| Feature | Description |

|---|---|

| Customization | Ability to tailor document structure and design based on business needs. |

| Automation | Automatic generation of documents based on preset criteria, reducing manual input. |

| Standardization | Ensures consistency across all transaction records, improving accuracy and professionalism. |

| Tax and Discount Calculation | Automatic inclusion of tax rates and discounts for precise billing. |

| Record Keeping | Helps maintain an organized, easily accessible record of all transactions. |

By understanding how

Why Use Business Central for Invoicing

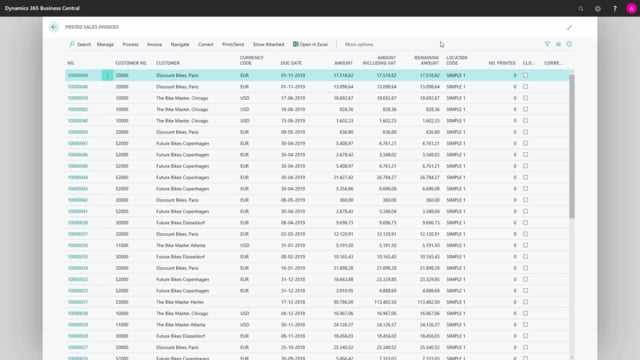

Managing financial transactions efficiently is essential for any organization, and having a reliable system to generate payment requests plays a critical role in this process. Using a comprehensive solution not only simplifies creating these documents but also ensures that every detail is captured accurately, from customer information to pricing and terms. The right system can automate many aspects of this task, reducing manual errors and saving valuable time.

Automation and Accuracy

Automation is one of the major benefits of using a specialized system. By setting up predefined parameters, businesses can ensure that all documents are created consistently without the need for constant input. This greatly reduces the risk of human error and ensures that each transaction is recorded accurately. Whether it’s calculating taxes, applying discounts, or including payment terms, automation makes the entire process smoother and more reliable.

Flexibility and Customization

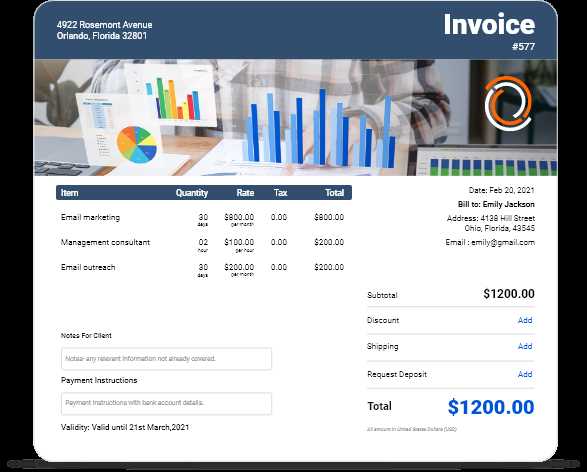

Another key advantage is the flexibility and customization options available. Businesses can tailor the structure and content of their documents to fit specific needs or industries. This ensures that all required fields are included and presented in a clear, professional manner. Customization options allow for the inclusion of logos, branding elements, and other company-specific information, providing a cohesive and polished look for all financial communications.

| Benefit | Description |

|---|---|

| Time Savings | Automating repetitive tasks reduces the time spent creating documents and minimizes errors. |

| Consistency | Predefined settings ensure every document follows the same format and includes all necessary details. |

| Customization | Flexibility to adapt document appearance and content to match company requirements and industry standards. |

| Improved Accuracy | Automatic calculations and validation reduce the likelihood of manual errors, ensuring correct billing. |

| Streamlined Workflow | Integration with other systems streamlines the overall workflow, saving effort and time on document management. |

Using a compr

Key Features of Invoice Templates in Business Central

When managing financial transactions, having an organized and efficient method for generating and issuing documents is essential. A well-designed system can help streamline the process, ensuring consistency and accuracy in every transaction. The core features of a structured framework for document creation offer businesses the tools to customize, automate, and optimize their billing operations with ease.

Customization Options

One of the standout features is the ability to customize the design and layout of the documents. Businesses can adjust the structure to include specific fields, logos, and branding elements, ensuring each document aligns with the company’s identity. This customization not only enhances the professional appearance of the documents but also makes it easier to include relevant details such as tax rates, payment terms, and customer-specific information.

Automation and Efficiency

Another critical advantage is the automation capabilities. The system allows businesses to automate the creation of these documents based on predefined rules. This reduces the need for manual data entry, cutting down on errors and speeding up the process. By setting up templates that automatically populate necessary fields–like pricing, tax, and discount details–companies can issue accurate documents quickly and efficiently.

| Feature | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customizable Layout | Adjust the document format to include branding elements, payment details, and other business-specific information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automated Data Entry | Automatically fill fields such as pricing, tax, and terms, reducing the need for manual input and minimizing errors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Integration with Other Systems | Seamlessly integrate with accounting, CRM, and other business systems to ensure data consistency and reduce duplication. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real-time Updates | Instantly reflect changes in pricing, tax, or customer data, ensuring accuracy in every document generated. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compliance Features | Ensure that all documents meet legal and regulato

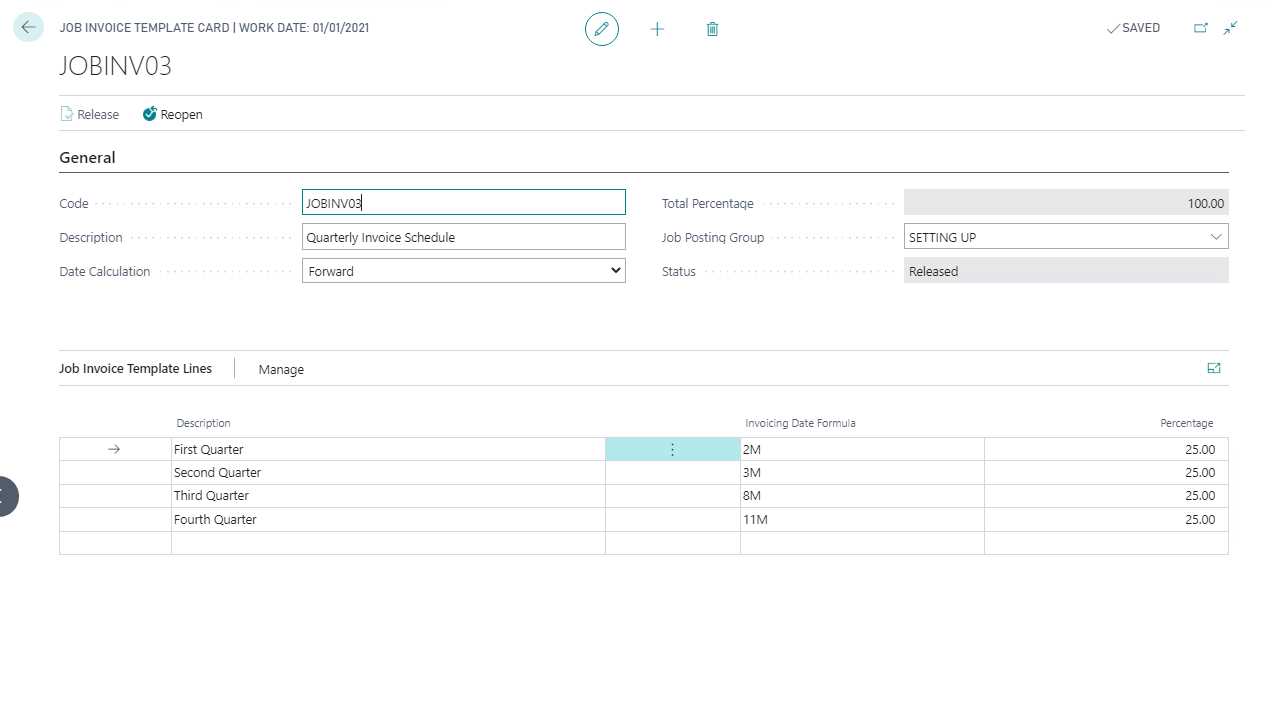

How to Create Custom Invoice TemplatesCreating tailored documents for financial transactions allows businesses to present consistent and professional communication to their clients. Customizing the structure of these documents not only ensures that all relevant information is included but also aligns the layout with the company’s branding and industry requirements. The process involves configuring fields, adding logos, and setting predefined rules to streamline the creation of each new document. Step 1: Define the Required FieldsBefore you begin designing, it’s crucial to determine which fields are necessary for every transaction. This includes details such as customer information, payment terms, product descriptions, pricing, and tax rates. By defining these fields early, you ensure that the document will capture all essential data each time it’s generated, without missing any important elements. Step 2: Customize the Layout and DesignOnce the required fields are defined, you can proceed with adjusting the layout and design of the document. This step allows you to incorporate your company’s branding, such as logos, color schemes, and fonts. Additionally, you can arrange the fields in a logical and easy-to-read order, ensuring that the document is both aesthetically pleasing and functional.

|