Broker Invoice Template for Easy Billing and Professional Invoices

For businesses that require regular payments for services rendered, maintaining a streamlined process is crucial. One of the most effective ways to ensure accuracy and professionalism is through the use of a standardized billing document. This tool helps in clearly outlining the details of transactions, ensuring that all necessary information is provided to clients in a clear and concise manner.

Creating such a document from scratch can be time-consuming and prone to errors. By using a pre-designed structure, professionals can save valuable time and avoid common mistakes. A well-crafted document not only simplifies the payment process but also fosters trust and credibility with clients, ensuring smooth financial transactions.

In this article, we will explore the essential components of an effective billing document, how to customize it according to your specific needs, and where to find quality resources to help you get started. Whether you’re a freelancer, contractor, or any other service provider, implementing a reliable billing method is key to maintaining professional relationships and ensuring timely payments.

Broker Invoice Template Overview

Having a standardized billing document is essential for any business or professional who needs to request payment for services. This kind of tool is designed to provide a clear and concise breakdown of services rendered, fees, and other relevant details. It helps ensure transparency, reduces errors, and makes the payment process much more efficient. A well-structured document serves as both a request for payment and a record of the transaction.

When creating such a document, it’s important to focus on clarity, completeness, and ease of understanding. This allows your clients to quickly review the charges and make payments without unnecessary confusion. A good document not only serves its immediate purpose but also reinforces your professionalism and attention to detail.

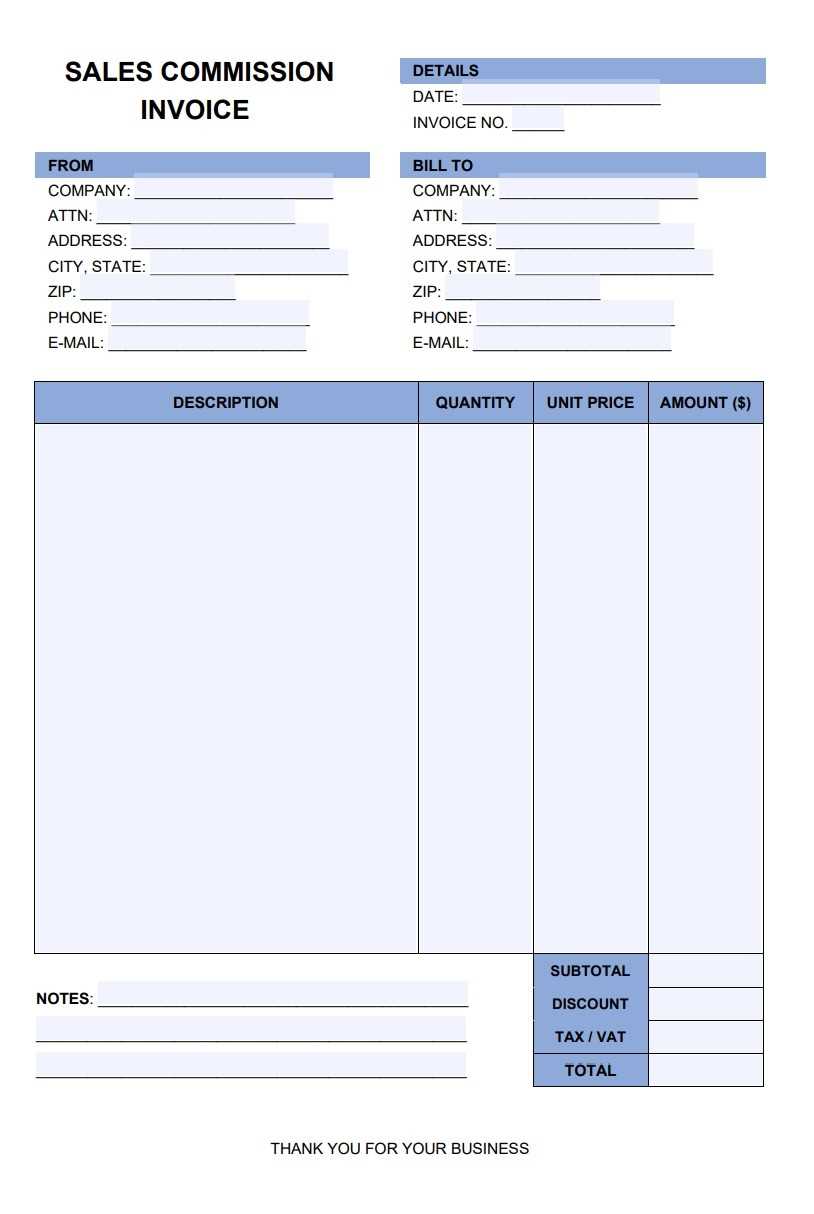

Key Features of a Well-Designed Billing Document

- Clear Itemization: List all services or goods provided, with clear descriptions and corresponding costs.

- Payment Terms: Specify due dates, accepted payment methods, and any late fees that may apply.

- Contact Information: Ensure your contact details are easily accessible for client inquiries.

- Unique Identifiers: Include a reference number or code to track the transaction more effectively.

Benefits of Using a Pre-Formatted Document

- Saves Time: Reduces the need to create a new document from scratch each time.

- Consistency: Ensures all important details are included every time you request payment.

- Professionalism: Using a polished, well-structured document demonstrates your attention to detail.

By using a ready-made structure, professionals can focus on their work without worrying about administrative tasks like document formatting. Whether you’re a consultant, real estate agent, or another service provider, employing a structured method for requesting payments can make all the difference in maintaining positive client relationships and ensuring timely payments.

Why Use a Broker Invoice Template

Using a structured document for billing purposes provides numerous benefits, particularly for professionals who handle multiple transactions or clients. A ready-made format ensures that all necessary details are included in a consistent manner, reducing the chances of missing critical information and helping to maintain a professional appearance. With a standardized form, the time spent on each billing request is minimized, making the entire process more efficient and less prone to errors.

Having a reliable framework in place allows for faster processing of payments, helping to avoid delays that can impact cash flow. Additionally, it simplifies tracking and record-keeping, ensuring that past transactions are easily accessible when needed. This is especially valuable for businesses that need to keep a clear and organized history of all financial interactions.

Key Advantages of Using a Standardized Billing Form

- Consistency: A standardized approach guarantees that every billing document contains all essential information, such as service descriptions, amounts, and payment instructions.

- Time Efficiency: With a pre-designed structure, you can quickly generate documents without needing to start from scratch each time.

- Professional Appearance: A well-crafted document improves the perception of your business, showcasing attention to detail and reliability.

- Better Organization: A uniform approach makes it easier to store and retrieve past documents for reference or auditing purposes.

How a Structured Document Helps in Daily Operations

| Benefit | Impact on Business |

|---|---|

| Consistency | Helps maintain clarity across all client communications, reducing misunderstandings. |

| Time Efficiency | Speeds up the billing process, allowing more focus on core activities. |

| Professionalism | Builds trust with clients and ensures a positive reputation. |

| Better Organization | Facilitates easy access to past records for future reference or financial reviews. |

Ultimately, adopting a structured approach to billing not only improves internal operations but also enhances client satisfaction. By streamlining the way you request payments, you can ensure smooth financial transactions and maintain positive relationships with your clients.

Key Features of Broker Invoices

For any business requesting payment for services, a properly structured billing document must include certain essential elements. These features ensure that all necessary information is conveyed clearly, helping both the service provider and the client understand the details of the transaction. A well-designed document minimizes confusion and promotes timely payments, making it an important part of any financial process.

The most effective billing documents are those that include specific, easy-to-understand details about the work performed, the amount owed, payment terms, and other crucial information. By incorporating these key components, you ensure that your requests for payment are both professional and efficient.

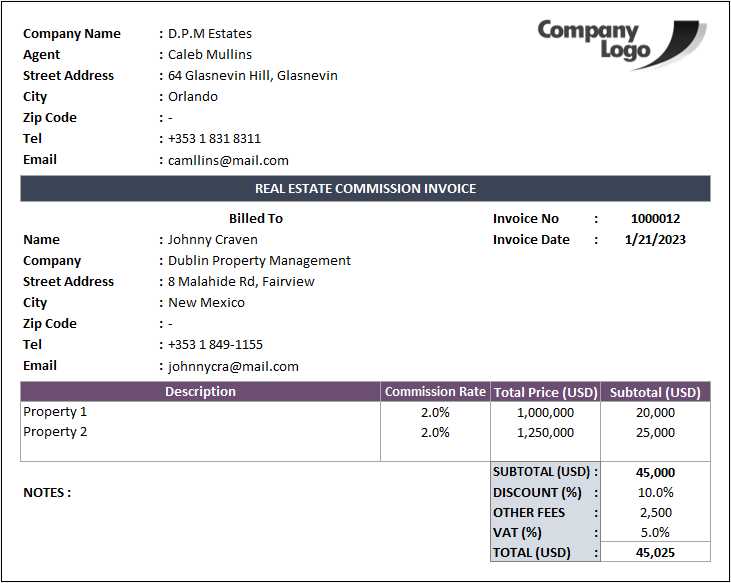

Essential Components to Include

- Service Description: A clear breakdown of the work performed or items provided, including the quantity, unit price, and any relevant details.

- Total Amount Due: The final amount owed by the client, after applying any discounts or additional charges.

- Payment Terms: Detailed instructions on payment deadlines, methods, and any penalties for late payments.

- Unique Reference Number: A tracking number or code for the specific transaction, aiding in organization and future references.

- Contact Information: Your name, business name, phone number, and email address, making it easy for clients to reach you if they have any questions.

- Legal Information: Any necessary disclaimers, tax details, or regulatory requirements that apply to the transaction.

Why These Features Matter

- Clarity: Clear descriptions and itemized lists reduce the likelihood of misunderstandings between you and your clients.

- Professionalism: A detailed, structured request for payment reinforces your credibility and trustworthiness.

- Timeliness: Including payment terms helps encourage clients to pay on time, improving your cash flow.

- Organization: Having reference numbers and organized details helps keep records in order and simplifies tracking of payments.

By including these key features in your billing requests, you ensure a smoother payment process and foster a more professional relationship with your clients.

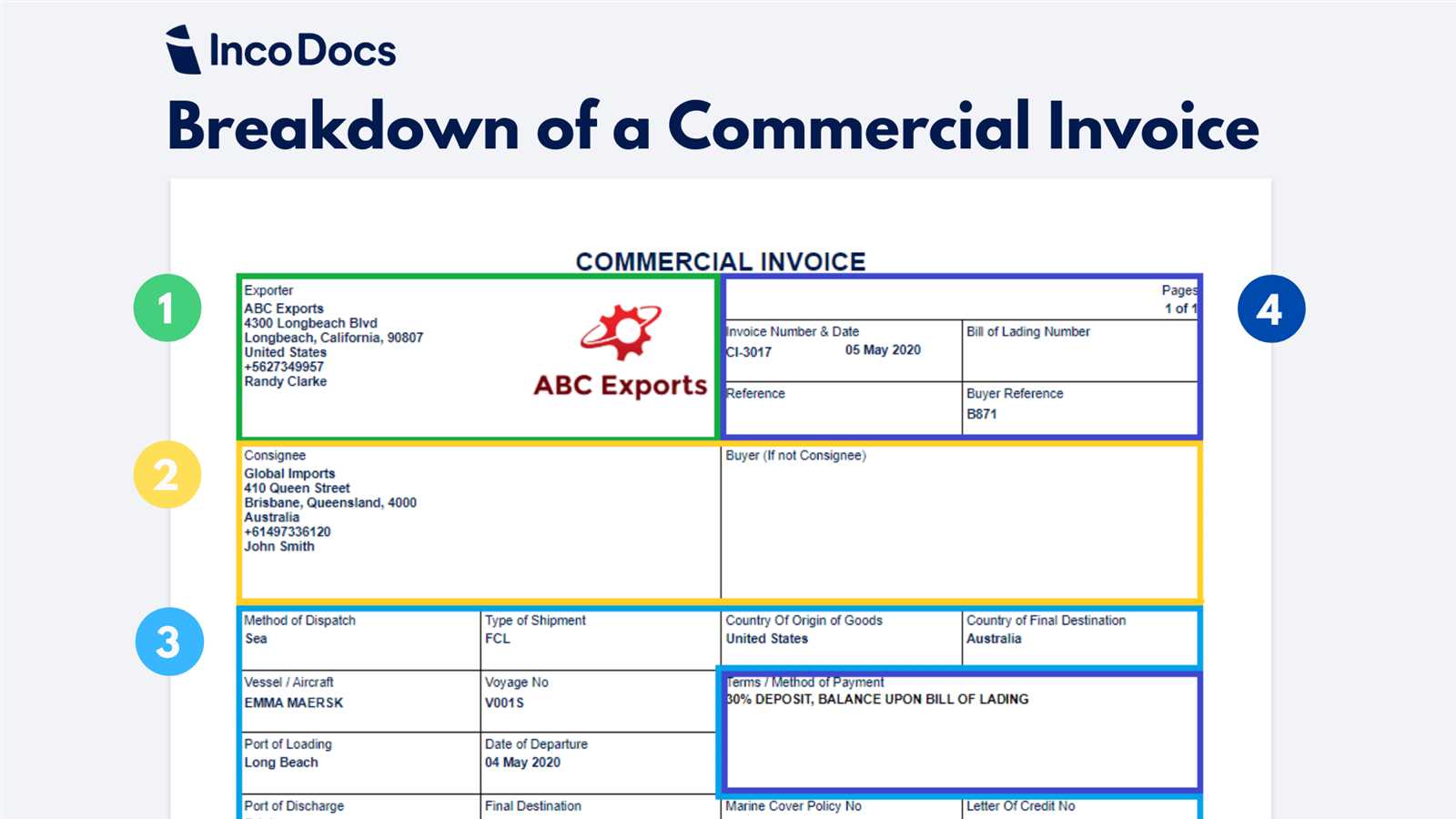

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific needs, making it more efficient and professional. By adjusting the format, design, and content, you ensure that the document reflects your brand identity while providing clients with all the essential information in a clear and concise manner. Customization also helps you include any specific details or requirements relevant to your industry or business type.

Personalizing your request for payment is not only about adding your logo or changing the layout; it’s also about ensuring that the key details are accurate and presented in a way that makes sense for both you and your clients. This can lead to faster payments and fewer misunderstandings.

Steps to Personalize Your Billing Document

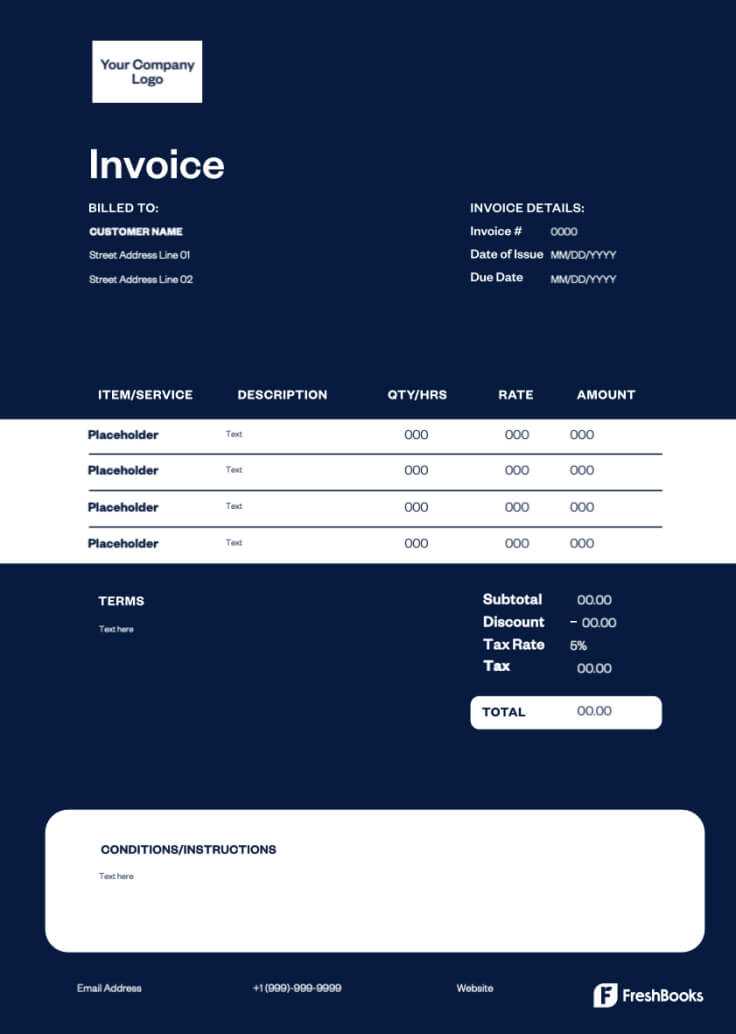

- Add Your Branding: Include your company’s logo, colors, and fonts to maintain a consistent look across all client communications.

- Adjust the Layout: Choose a format that is easy to follow and visually appealing. Ensure there is enough space for all necessary information.

- Include Specific Details: If your business has special terms or conditions (such as payment methods, discounts, or late fees), make sure these are clearly stated.

- Modify the Language: Adapt the tone to match your relationship with the client–whether formal or more relaxed–and adjust wording to suit the services you offer.

- Set Payment Terms: Clearly define payment due dates, late fees, and any other terms that might apply to avoid confusion later.

Tools to Help You Customize

- Pre-built Software: Many online tools offer ready-made options that allow you to easily personalize your billing document.

- Word Processing Programs: Use programs like Microsoft Word or Google Docs to adjust formatting, insert logos, and modify text.

- Design Tools: If you want to make your document stand out visually, consider using design software like Canva or Adobe InDesign for more creative control.

Customizing your billing document helps you maintain a professional image while ensuring that clients have all the necessary information to process payments quickly. Whether you choose a simple approach or a more elaborate design, the key is to keep things clear, organized, and consistent.

Free Broker Invoice Templates Available

For professionals looking to streamline their billing process, there are many free resources available online that offer ready-made structures for creating billing documents. These resources are designed to help save time and ensure accuracy, especially for those who may not have the time or expertise to design their own documents from scratch. By using these free options, you can focus more on your core services while maintaining a professional approach to client payments.

Many of these free documents are fully customizable, allowing you to adjust the format, content, and layout to match your specific needs. Whether you’re a freelancer, consultant, or small business owner, having access to a well-designed, cost-free option can make a significant difference in the way you handle financial transactions.

Where to Find Free Resources

- Online Invoice Generators: Many websites offer free tools that allow you to create customized billing documents online. These platforms usually provide basic layouts that are easy to adjust.

- Document Sharing Sites: Platforms like Google Docs or Microsoft Office offer downloadable files for free that can be easily edited and customized.

- Business Websites: Many professional service-oriented sites offer free templates for download, with options tailored to different industries and needs.

Advantages of Using Free Billing Documents

- Cost-effective: You don’t need to spend money on software or professional services to create a functional billing document.

- Time-saving: Ready-made designs allow you to focus on your work, while minimizing time spent on administrative tasks.

- Easy Customization: Many free resources provide flexible formats that can be adjusted to suit your specific needs.

- Professional Appearance: Even though they are free, these options are designed to help maintain a polished, professional image when dealing with clients.

Taking advantage of free resources for creating your billing documents can significantly improve efficiency and reduce the burden of paperwork. With customizable options available, there’s no need to start from scratch every time you need to request payment.

Essential Information for Broker Invoices

When requesting payment for services, it’s crucial to include all the relevant details in the billing document to avoid confusion and ensure a smooth transaction. A well-structured request provides clarity and sets clear expectations for both parties. This ensures that clients understand exactly what they are being charged for, the payment terms, and any additional instructions needed to complete the transaction.

Including the right information not only helps in securing timely payments but also serves as a formal record of the business interaction. Missing any key details could lead to disputes or delayed payments, which is why it’s important to get the basics right every time you prepare a request for payment.

Key Elements to Include in Your Billing Document

- Contact Details: Ensure that both your business information and your client’s details are correctly listed, including names, addresses, and phone numbers.

- Clear Service Descriptions: Break down the services provided with specific details, quantities, and rates for each item or task.

- Payment Terms: Clearly state the amount due, payment methods, deadlines, and any penalties for late payments.

- Transaction Reference: Include a unique identifier or reference number to track the transaction for future reference or record-keeping.

- Tax Information: If applicable, include tax rates and amounts, ensuring that your client understands any additional charges required by law.

Why These Details Matter

- Transparency: Clear information helps avoid misunderstandings, ensuring both parties are on the same page about the terms and amounts involved.

- Legality: Including tax details and other legal requirements ensures compliance with financial regulations and helps maintain proper records.

- Professionalism: Including all necessary information demonstrates that you are organized and serious about your business dealings.

By ensuring that your document contains all the essential elements, you make the payment process easier for your clients and help protect yourself from potential disputes. This approach is essential for maintaining a positive relationship and ensuring timely financial transactions.

Steps to Create a Broker Invoice

Creating a billing document from scratch requires attention to detail and a clear understanding of the information that needs to be included. By following a step-by-step approach, you can ensure that the request for payment is accurate, professional, and easy for your client to understand. A well-organized document not only helps in avoiding errors but also accelerates the payment process by clearly outlining all necessary details.

To help you get started, here are the essential steps involved in creating an effective payment request. These steps will guide you through the process and ensure that nothing is overlooked.

Step 1: Gather All Necessary Information

- Your Business Details: Include your name, address, contact number, email address, and any business identification number if required.

- Client Information: Ensure the client’s name, address, and contact details are accurate.

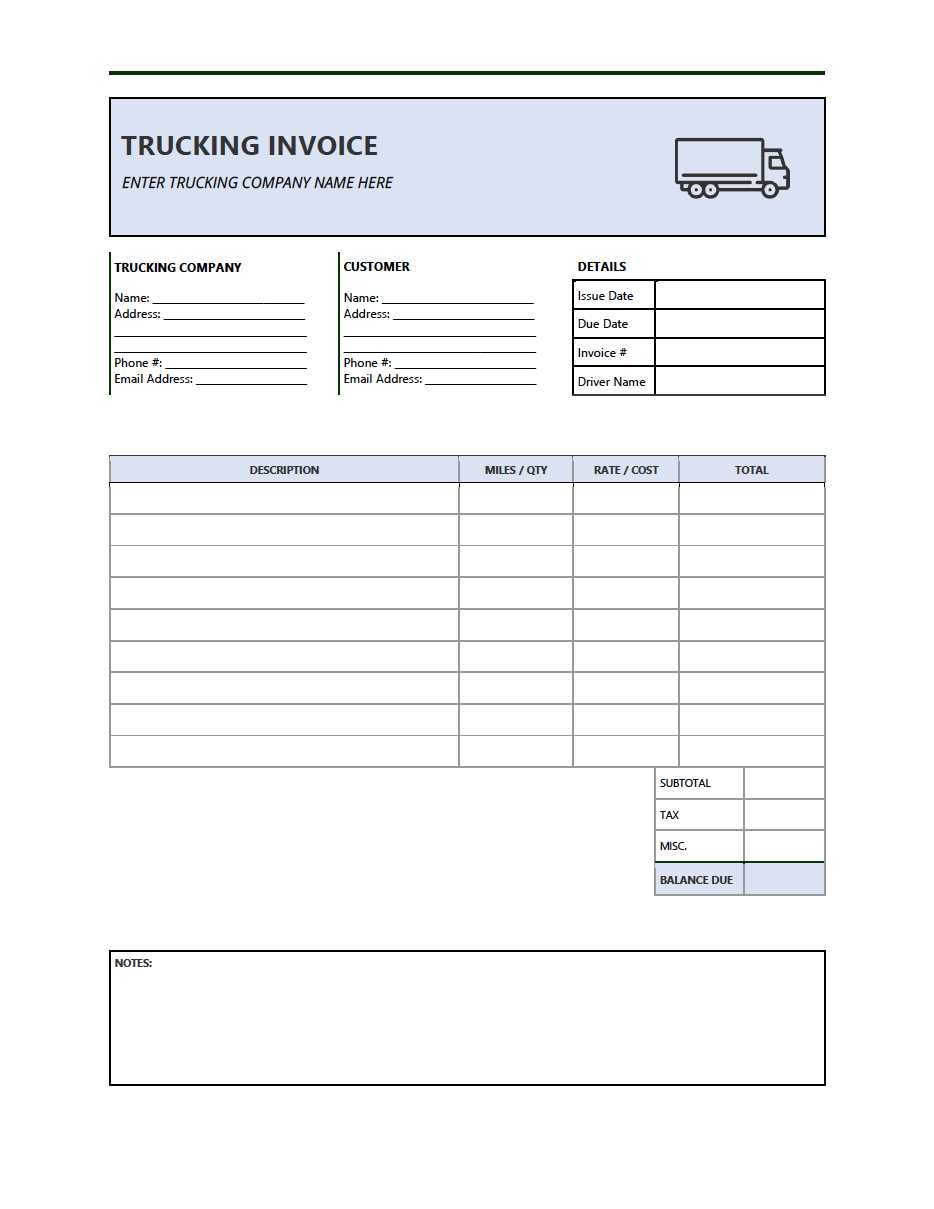

- Transaction Details: List all services or goods provided, including dates, descriptions, quantities, and individual costs.

Step 2: Choose a Layout and Design

- Simple and Clear Format: Choose a format that is easy to follow, ensuring each section is clearly separated for readability.

- Professional Appearance: Use a consistent font, style, and color scheme that aligns with your business branding.

- Space for All Information: Ensure there is enough room to include all transaction details without overcrowding the document.

Step 3: Include Payment Terms

- Due Date: Clearly state the date by which payment is expected.

- Accepted Payment Methods: Specify the methods available for payment, such as bank transfer, check, or online payment systems.

- Late Payment Fees: If applicable, mention any penalties for late payments and the terms under which they apply.

Step 4: Add Additional Information

- Tax Information: Include any relevant tax rates or VAT details if necessary.

- Reference Numbers: Add a unique reference number or code to help both you and your client track the transaction.

- Additional Notes: If required, include any disclaimers, terms and conditions, or special instructions related to the payment.

Step 5: Review and Finalize

- Double-Check Accuracy: Review the document for any errors, such as incorrect amounts, client details, or missing information.

- Ensure Consistency: Verify that all sections are clearly formatted and the document is professional in appearance.

- Save and Send: Once finalized, save your document and send it to your client in a preferred format, such as PDF or via email.

Following these simple steps ensures that you create a clear, accurate, and professional payment request, helping you maintain strong relationships with clients and get paid on time.

Common Mistakes in Broker Invoicing

When preparing a billing document, small errors can lead to confusion, delayed payments, or even disputes. These mistakes, although often overlooked, can have a significant impact on both the service provider and the client. Avoiding these common errors is essential to maintaining professionalism, ensuring timely payments, and fostering positive relationships with clients.

By paying attention to the key details and following a systematic approach, you can reduce the risk of making costly mistakes in your billing process. Below are some of the most common errors that can occur when preparing a request for payment, and tips on how to avoid them.

Common Errors to Avoid

- Incorrect Client Information: One of the most frequent mistakes is entering the wrong contact details or company information. Always double-check the client’s name, address, and other relevant details to ensure accuracy.

- Missing Service Descriptions: Failing to clearly describe the services or products provided can lead to confusion and disputes. Ensure each item is listed with sufficient detail, including quantities, rates, and dates.

- Unclear Payment Terms: Vague payment terms or missing due dates can cause delays in payment. Clearly specify when payment is due and how it should be made, including accepted payment methods and any late fees.

- Mathematical Errors: Simple math errors, such as incorrect totals or tax calculations, can be a major issue. Always double-check the numbers to ensure that the amounts are accurate.

- Lack of a Unique Reference Number: Without a reference number, both you and your client may find it difficult to track the transaction in the future. Include a unique identifier for each billing document.

- Omitting Tax Details: If applicable, failing to include the correct tax rates or VAT information can lead to compliance issues. Make sure to list taxes separately and clearly state the rates applied.

- Not Including Contact Information: Always include your business contact information–email, phone number, and website–so clients can easily reach you if they have any questions or concerns.

How to Avoid These Mistakes

- Double-Check All Information: Always review the document before sending it to ensure accuracy in all fields, including client details, services, pricing, and payment terms.

- Use Automation Tools: Consider using digital tools or software to help automate the creation of your billing documents. These tools often reduce the risk of errors, especially in calculations and formatting.

- Standardize Your Documents: By using a consistent format and layout, you reduce the likelihood of missing important details and create a more professional presentation.

- Seek Feedback: Before finalizing your payment request, it may be helpful to ask a colleague or another professional to review it for any potential mistakes.

By being aware of these common mistakes and taking steps to avoid them, you ensure that your requests for payment are clear, professional, and accurate, which ultimately leads to faster paym

Legal Requirements for Broker Invoices

When creating a billing document, it is essential to comply with various legal requirements to ensure that the transaction is transparent and enforceable. Legal guidelines govern the information that must be included, as well as the format in which it must be presented. Failing to meet these requirements can lead to issues such as delayed payments, disputes, or legal complications.

Different countries and regions have specific rules and regulations regarding the information that should appear in financial documents. Ensuring compliance with these legal standards is necessary for maintaining your business’s integrity and avoiding legal risks.

Key Legal Elements to Include

| Legal Requirement | Details |

|---|---|

| Business Identification | Your business name, registration number, and tax identification number (TIN) must be included to comply with tax regulations. |

| Client Information | Full client name and address should be listed to ensure the payment request is properly addressed. |

| Clear Payment Terms | The document must specify the payment due date, acceptable methods of payment, and any applicable late fees or penalties. |

| Tax Information | Details on taxes, such as VAT, must be clearly stated, including the rate applied and the amount calculated. |

| Unique Reference Number | A unique reference or transaction number must be included to ensure that the payment request can be tracked and referenced in the future. |

Why These Legal Requirements Matter

- Tax Compliance: Ensuring that tax rates and other mandatory details are included helps you remain compliant with tax authorities and avoids penalties.

- Legal Protection: A correctly formatted document can serve as legal proof of the agreement between the service provider and the client.

- Transparency: Clear payment terms and detailed descriptions protect both parties and reduce the chances of disputes.

- Business Reputation: Adhering to legal requirements shows professionalism and a commitment to following industry standards.

By following the necessary legal guidelines when preparing a billing document, you ensure that the transaction is legitimate, transparent, and enforceable. This helps maintain trust with your clients and safeguards your business from potential legal issues.

Using Digital Tools for Broker Invoices

In today’s fast-paced business environment, digital tools offer significant advantages for creating, managing, and sending billing documents. These tools not only help streamline the process but also reduce human error, save time, and improve the overall efficiency of the payment collection process. With the right digital tools, you can create professional-looking documents in just a few minutes, manage your finances more effectively, and keep track of all transactions in one place.

By leveraging digital platforms, businesses can automate various aspects of the billing process, from calculation of totals and taxes to sending reminders for late payments. These tools also offer a range of customization options to ensure that your documents meet your specific needs, all while maintaining a high standard of professionalism.

Benefits of Using Digital Tools

- Increased Efficiency: With pre-built templates and automation features, digital tools speed up the process of creating and sending payment requests, allowing you to focus more on your core business activities.

- Accuracy: Automation reduces the risk of errors in calculations, such as totals, tax rates, or service charges, ensuring that your documents are correct every time.

- Customization: Many digital tools allow you to adjust layouts, add your logo, change fonts, and incorporate specific terms, ensuring that your documents reflect your branding and business style.

- Record Keeping: Digital tools provide a secure way to store and organize all your billing documents. This makes it easier to track payments, manage client records, and retrieve past documents when needed.

- Environmental Impact: By reducing the need for paper-based billing systems, digital tools contribute to a more sustainable business practice.

Popular Digital Tools for Billing

- Accounting Software: Platforms like QuickBooks and Xero provide full-featured solutions for creating and managing billing documents, as well as tracking expenses, generating reports, and handling taxes.

- Online Payment Systems: Tools like PayPal and Stripe allow you to send payment requests and accept payments online, streamlining the entire payment process.

- Dedicated Billing Platforms: Tools like FreshBooks and Wave offer easy-to-use interfaces for generating customizable billing documents, tracking time, and sending automatic reminders for overdue payments.

Using these digital solutions, businesses can improve accuracy, reduce administrative burdens, and enhance the overall experience for their clients. Whether you need to generate a simple request for payment or manage multiple transactions at once, digital tools provide a reliable and efficient way to handle all your billing needs.

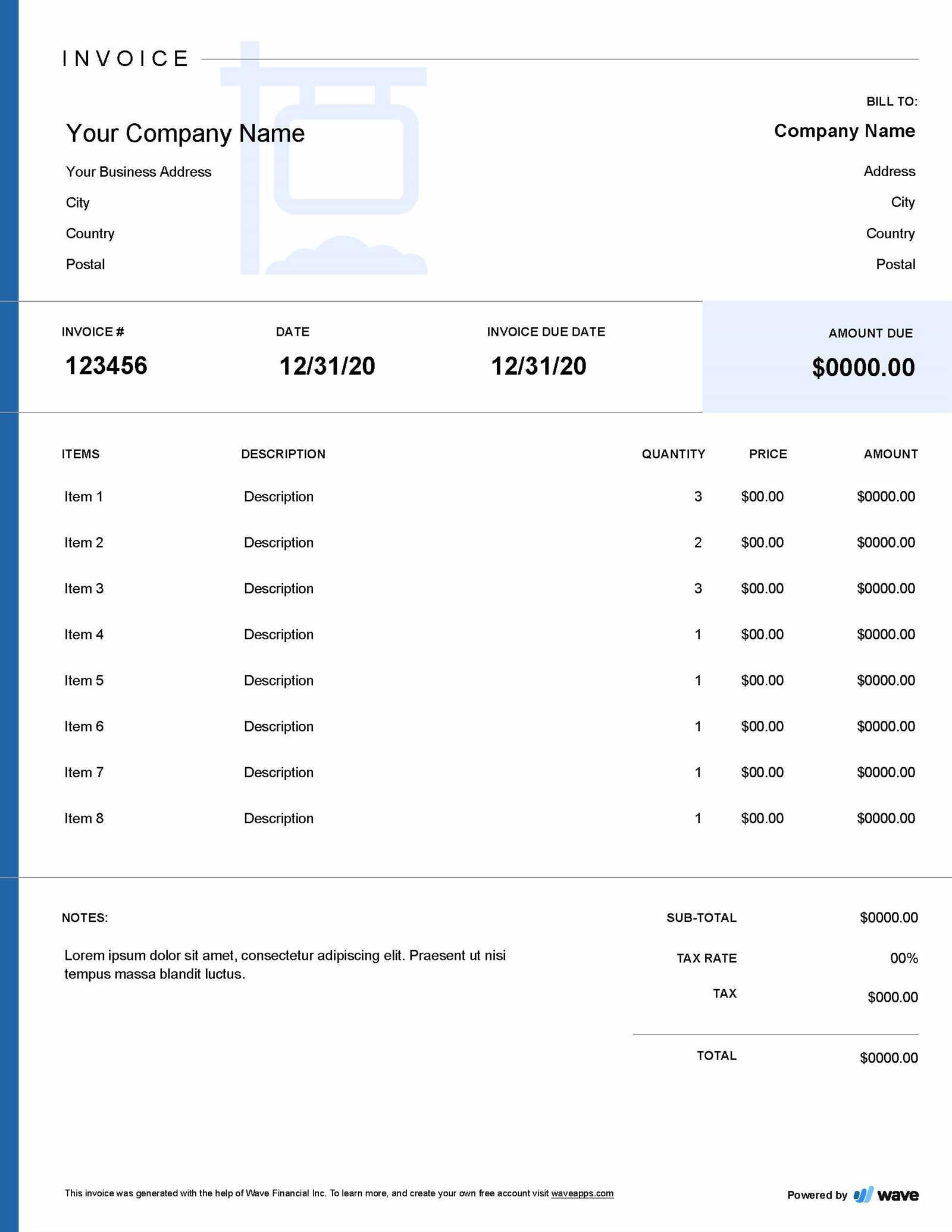

Best Practices for Invoice Formatting

When preparing a request for payment, the format and layout of the document play a crucial role in ensuring clarity and professionalism. A well-organized and easy-to-read document makes it simpler for clients to understand the details, leading to faster payments and fewer misunderstandings. Following best practices in formatting helps establish trust and portrays your business as efficient and attentive to detail.

Adhering to a clear structure and maintaining consistency throughout your billing documents can make a significant difference in how they are perceived. The following best practices will help you create polished and effective payment requests that meet professional standards and enhance your client interactions.

Key Formatting Best Practices

- Use a Clean and Simple Layout: Avoid cluttered designs. Ensure there is plenty of white space between sections, making the document easy to scan and read.

- Clearly Highlight Important Information: Bold or highlight key details such as due dates, payment amounts, and terms to ensure they stand out to your client.

- Organize Information in Sections: Separate different types of information (e.g., service descriptions, total amount, contact details) into clearly defined sections to help guide the reader through the document.

- Include a Consistent Header: Include a header with your business name, logo, and contact information at the top of the document. This adds a professional touch and helps clients quickly identify the source of the document.

- Use a Readable Font: Choose a professional, easy-to-read font like Arial, Times New Roman, or Calibri. Avoid using too many different fonts or overly decorative styles.

- Provide Clear Payment Instructions: Ensure the payment methods, terms, and due date are clearly visible, so the client knows how and when to pay.

Additional Tips for Effective Formatting

- Number Your Documents: Assign a unique reference number to each document for easy tracking and future reference.

- Use Itemized Lists: When listing services or products, break them down into individual line items with descriptions, quantities, and individual prices. This makes the document more transparent and helps prevent disputes.

- Stay Consistent with Your Branding: Ensure that your document’s layout aligns with your business’s brand, using consistent colors, logos, and fonts throughout.

- Check for Accuracy: Always review your document before sending it to avoid errors in totals, client details, or other critical information that may cause confusion.

By following these formatting best practices, you ensure that your payment requests are clear, professional, and easy to process. A well-organized document reflects positively on your business and enhances the overall experience for your clients.

Handling Late Payments in Invoicing

Late payments are a common challenge for many businesses, and they can disrupt cash flow and hinder operational efficiency. When payments are delayed, it is important to handle the situation professionally and tactfully. Having a clear strategy in place for addressing late payments ensures that you maintain positive client relationships while also safeguarding your revenue stream.

There are several approaches to dealing with overdue payments, from sending reminders to enforcing penalties. By adopting a proactive approach, you can minimize the impact of delayed payments and encourage clients to settle their debts promptly.

Steps to Handle Late Payments Effectively

- Send a Friendly Reminder: As soon as a payment is overdue, send a polite reminder to your client. Sometimes, a simple nudge is all that’s needed to prompt a payment.

- Clarify Payment Terms: Ensure that your clients understand the payment due date and any terms that apply, such as late fees or interest charges, outlined in the original agreement.

- Offer Flexible Payment Options: If the client is facing financial difficulty, consider offering flexible payment plans or partial payments to ease the burden and avoid a prolonged delay.

- Maintain Professionalism: Always remain polite and professional in your communication, even if the payment is significantly delayed. A calm approach will help preserve the business relationship.

Implementing Late Payment Fees and Penalties

- Set Clear Terms: Clearly define your late payment policies in advance, including any fees or interest that will apply to overdue amounts. Make sure clients are aware of these terms before engaging in business.

- Calculate Fees Fairly: Ensure that the late payment fee is reasonable and aligned with industry standards. Avoid charging excessive penalties, as this may damage client trust.

- Be Transparent: If a late fee is applied, clearly state the amount and provide a breakdown of how it was calculated. Transparency in this regard helps clients understand the additional cost and minimizes disputes.

By handling late payments with professionalism and clear communication, you can maintain strong business relationships while also ensuring that your company’s cash flow remains steady. Taking the right steps early on can help prevent future delays and create a more streamlined payment process for your business.

Integrating Broker Invoices with Accounting

Integrating billing documents with your accounting system is crucial for maintaining accurate financial records and ensuring smooth business operations. By connecting payment requests with your financial management tools, you can automate data entry, reduce errors, and gain a clear view of your cash flow. This integration allows for better tracking of payments, quicker reconciliation, and improved financial reporting.

Seamlessly linking your billing processes with accounting software ensures that all transactions are recorded correctly and consistently. This integration also makes it easier to prepare tax filings and monitor the financial health of your business, saving you time and effort in the long run.

Benefits of Integration

- Automated Data Entry: Automatic transfer of payment details from your billing system to your accounting software reduces the need for manual input and minimizes the risk of mistakes.

- Real-Time Financial Tracking: Integrating the two systems ensures that your accounts are updated in real-time, giving you an accurate view of your revenue and outstanding payments at all times.

- Improved Cash Flow Management: With all financial data synced, you can easily track payments, outstanding debts, and due dates, which helps you better manage your cash flow and avoid cash shortages.

- Faster Reconciliation: Integration streamlines the reconciliation process, as accounting software automatically matches payments with recorded transactions, reducing the time spent on manual checks.

- Compliance and Reporting: Accurate integration ensures that financial records are up-to-date, making it easier to generate reports and stay compliant with tax regulations.

How to Integrate Billing Documents with Accounting Software

| Step | Description |

|---|---|

| 1. Choose Compatible Tools | Ensure that your billing system and accounting software are compatible or can be integrated through APIs or third-party software. |

| 2. Set Up Integration | Follow the setup instructions to link both systems. This may involve syncing client details, payment terms, and transaction categories between the two platforms. |

| 3. Automate Data Transfer | Enable automatic synchronization to ensure that all relevant data, such as amounts, payment dates, and client information, is transferred between the systems in real-time. |

| 4. Monitor Transactions | Regularly check that all data is syncing correctly, and ensure that there are no discrepancies between your accounting records and billing documents. |

By integrating your billing documents with your accounting system, you can enhance efficiency, minimize errors, and gain more control over your finances. This integration not only simplifies day-to-day operations but also supports long-term business growth and financial stability.

How to Save Time on Invoicing

Time is a valuable resource, and when it comes to creating billing documents, inefficiencies can quickly add up. Streamlining the process of preparing and sending requests for payment can help save significant time and reduce administrative overhead. By adopting the right tools and practices, you can automate repetitive tasks, minimize errors, and focus more on your core business activities.

In this section, we’ll explore practical tips and strategies to help you speed up the process while maintaining accuracy and professionalism in your financial documentation.

Tips for Reducing Time Spent on Payment Requests

- Use Pre-Built Templates: Take advantage of pre-designed layouts that only require you to input specific details, such as amounts and client information. This eliminates the need to create a document from scratch every time.

- Automate Recurring Billing: If you offer subscription-based services or have regular clients, set up automatic billing cycles. This way, invoices are generated and sent on a regular schedule without manual intervention.

- Leverage Accounting Software: Many accounting platforms can generate and send billing documents automatically based on transaction data, saving you time spent on data entry and formatting.

- Use Digital Payment Platforms: Integrating payment systems like PayPal or Stripe with your billing process allows clients to pay directly through the document, eliminating follow-up calls or emails to chase payments.

- Standardize Client Information: Create client profiles within your accounting or billing software so that all necessary details–such as contact info, payment history, and terms–are stored in one place for easy access.

Additional Strategies for Efficiency

- Set Clear Payment Terms: Ensure that all payment expectations, such as due dates and penalties for late payments, are clearly outlined from the beginning. This reduces the need for follow-up inquiries and confusion.

- Use Cloud-Based Tools: Cloud software allows you to access billing data anywhere, on any device, which can significantly speed up the creation and management of financial documents, especially when working remotely.

- Track Payments Automatically: Use software that tracks payments in real-time, so you don’t have to manually check whether payments have been received or chase clients for overdue amounts.

- Batch Your Billing Tasks: Instead of creating and sending individual payment requests as they arise, set aside specific times each week to handle all your billing tasks in one go. This helps you focus and reduce distractions.

By implementing these strategies, you can drastically reduce the time spent on financial documentation. The result is a more efficient billing process that allows you to focus on growing your business while ensuring that payments are processed in a timely and professional manner.

What to Include in a Broker Invoice

Creating a comprehensive and clear payment request is essential for ensuring smooth transactions and avoiding misunderstandings. A well-structured document not only provides all necessary details for the client but also protects your business by serving as a formal record of the transaction. Knowing what to include will help you create a document that is both professional and effective in securing timely payments.

Every billing document should contain specific information to make it clear and complete. Below is a list of key components that should be included in any formal payment request.

Essential Components to Include

- Your Business Information: Include your business name, address, phone number, and email. It’s also useful to add your company logo for a more professional appearance.

- Client Information: Include the client’s full name, address, phone number, and email address. This ensures that there is no confusion about who the payment is for.

- Document Number: Assign a unique reference number to each document. This makes it easier to track and refer to specific requests in the future.

- Issue Date: Include the date the document is issued. This helps establish the timeline for payment and clarifies the due date.

- Due Date: Clearly state when the payment is due. This helps the client know when to make the payment and can prevent late payments.

- Description of Services or Products: List the services provided or products sold with clear, itemized descriptions. Include the quantity, unit price, and total amount for each line item to ensure transparency.

- Total Amount Due: Clearly display the total amount due, including any applicable taxes, shipping, or other charges. Ensure this is easily identifiable on the document.

- Payment Terms: Outline the agreed payment terms, such as early payment discounts or late payment penalties. This section helps manage expectations and encourages timely payment.

- Payment Instructions: Provide clear instructions on how the client can make the payment. Include details such as bank account information, online payment links, or alternative methods for paying.

- Notes or Additional Information: If applicable, include any relevant terms, references to previous contracts, or additional instructions that may be necessary to clarify the payment terms or the project details.

By including all the necessary details in your payment requests, you create a document that is easy to read, legally sound, and useful for both you and your client. This ensures a smooth transaction and helps maintain a positive professional relationship.

Choosing the Right Template for Your Business

Selecting the right format for your payment requests is essential to ensure clarity, consistency, and professionalism in your financial communications. A well-chosen document structure can streamline the billing process, making it easier for both you and your clients to manage transactions. The right format should reflect the nature of your business, align with your branding, and meet your specific operational needs.

When deciding which structure to use, consider factors such as the complexity of your services, your client base, and how often you send payment requests. The format should not only be functional but also easy to customize and integrate into your workflow. Whether you are a freelancer, a small business, or a larger enterprise, finding the right structure will save you time and improve your overall efficiency.

Factors to Consider When Choosing a Format

- Business Type: Different industries have different needs. For example, a service-based business might need more detailed descriptions of work performed, while a product-based business would benefit from itemized lists of goods sold.

- Client Expectations: Consider how your clients prefer to receive billing documents. Some may appreciate a simple, straightforward approach, while others may expect more formal or customized layouts.

- Customization Options: Choose a structure that allows you to easily modify or add details, such as discounts, taxes, or specific payment instructions, as per the needs of each transaction.

- Branding: The design should align with your company’s branding. Including your logo, colors, and a professional layout can help reinforce your business identity and create a cohesive look across all client communications.

- Integration with Other Systems: If you use accounting or payment software, look for a structure that can integrate seamlessly with these tools to save time and reduce errors in data entry.

Choosing Between Digital and Printable Formats

- Digital Formats: These are ideal for businesses that prioritize speed and efficiency. Digital formats allow for quick customization, emailing, and can often be integrated with payment systems to allow clients to pay directly from the document.

- Printable Formats: If you need to send physical payment requests or prefer to keep hard copies for records, printable formats may be a better option. However, they typically require manual entry and may take more time to process.

By carefully selecting the appropriate structure for your payment requests, you can create a system that suits your business needs, enhances your professionalism, and reduces time spent on administrative tasks. This thoughtful approach ensures that you remain organized and efficient while keeping your clients satisfied.