Bridal Makeup Invoice Template for Easy Billing

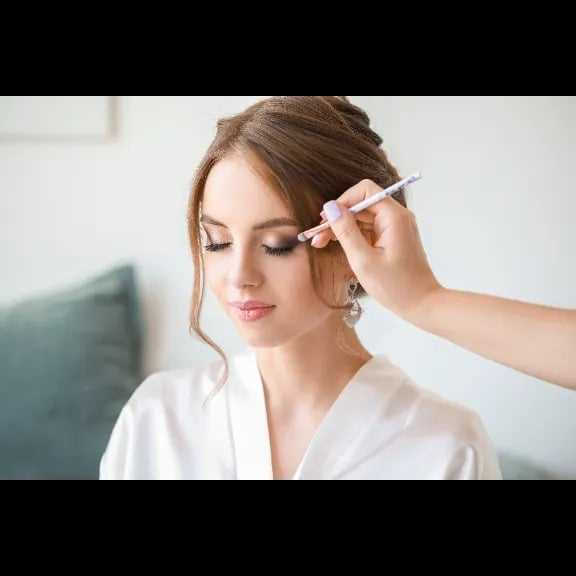

When providing professional services for weddings, clear and organized billing is essential. Having a structured way to present charges not only improves communication with clients but also ensures timely payments and accurate financial tracking. A well-crafted document helps create a professional image and reinforces trust with customers.

Customized billing forms can streamline the payment process and ensure all necessary details are captured. These documents typically include the services rendered, payment terms, and contact information, offering a simple and effective method to keep track of financial transactions.

Whether you’re just starting or have been in business for years, having a reliable system in place is key. By using easy-to-fill forms, you can focus on providing high-quality services while maintaining financial order with minimal effort.

Bridal Makeup Invoice Template Overview

For professionals in the wedding industry, having a structured document to outline charges and services is crucial. It serves as an official record of the work completed and the agreed-upon payments, helping both parties stay organized and avoid misunderstandings. These documents offer a simple yet effective way to track transactions and maintain clear communication with clients.

Customized billing forms are essential for any service-based business, as they ensure all necessary details are captured accurately. A well-organized document should include sections for client information, services rendered, payment terms, and any additional notes. This allows for transparency and helps clients easily understand what they are being charged for.

Having such a document not only enhances professionalism but also improves workflow efficiency. By utilizing pre-made or easily customizable forms, wedding service providers can save time, reduce errors, and ensure that every transaction is documented properly.

Why You Need an Invoice Template

Having a standardized document for billing is essential for any service provider, especially when dealing with numerous clients and transactions. It helps ensure that both parties have a clear understanding of the financial aspects of their agreement. Without a proper system in place, it can be easy to overlook important details, leading to confusion or missed payments.

Benefits of Using a Structured Billing Form

- Organization: A consistent format helps keep all your transactions in order and ensures that nothing is forgotten.

- Professionalism: Clients will appreciate the clear, polished appearance of a well-designed document, which enhances your business reputation.

- Time Efficiency: Customizable forms save time by eliminating the need to create a new document for each client from scratch.

- Clarity: Clear and detailed billing documents help avoid misunderstandings about charges, scope of work, and payment terms.

Common Challenges Without a Billing System

- Lost revenue due to missed or delayed payments.

- Confusion regarding what is included in the cost or the terms of payment.

- Difficulty tracking outstanding payments and managing financial records.

Using a well-organized billing system ensures that these issues are minimized and helps keep your business running smoothly.

Key Features of a Bridal Makeup Invoice

For any service-based business, having a document that clearly outlines the details of a transaction is essential for smooth operations. A well-structured billing record not only communicates the cost but also serves as a reference for both the provider and the client. The key to a useful document lies in its ability to include the right elements, ensuring clarity and transparency.

Essential Information to Include

- Client Information: Names, addresses, and contact details help ensure that the document is clearly associated with the correct customer.

- Service Description: A detailed list of the services provided, including any specific requests, will help avoid confusion about what was charged.

- Payment Terms: Clearly outlining when payment is due, as well as accepted methods, makes it easier for the client to know how and when to pay.

- Unique Reference Number: Including a unique reference number for each transaction helps you easily track payments and manage your financial records.

- Subtotal and Total: It’s important to clearly break down the cost of services, taxes, and any additional fees, providing a final total that is easily understood.

Design Considerations

- Simple Layout: A clean, easy-to-read layout improves the document’s professionalism and ensures clients can quickly find the information they need.

- Branding: Adding a logo or business name helps reinforce your brand and adds to the document’s credibility.

- Customization: The ability to customize sections such as payment terms or service details can make the document more tailored to the specific needs of each client.

Incorporating these features into your billing records helps ensure professionalism and builds trust with your clients, while also simplifying the financial management process for your business.

How to Customize Your Invoice Template

Customizing your billing form allows you to personalize it according to your specific business needs and preferences. Tailoring the document ensures that all necessary details are included while maintaining a professional appearance. The right adjustments can also make the process more efficient and client-friendly, reflecting your brand’s identity.

To make your document more effective, you can modify several key elements to match the scope of your services and the nature of your clients. Here are some steps to follow when customizing your form:

| Customization Aspect | How to Modify |

|---|---|

| Client Information | Add fields for the client’s full name, address, and contact details. |

| Service Description | Include a section for detailing each service performed, including optional add-ons or special requests. |

| Payment Terms | Specify the payment method, due date, and any late payment fees if applicable. |

| Branding | Incorporate your company logo, colors, and font to create a cohesive and professional appearance. |

| Additional Notes | Leave space for extra details such as a thank-you message or terms and conditions. |

By adjusting these sections, you can ensure that the billing form meets your specific requirements and provides clear information to your clients. Customization not only enhances your document’s functionality but also helps reinforce your business identity, making your services stand out to customers.

Steps to Create a Bridal Makeup Invoice

Creating a billing document for your services is an essential step in maintaining professionalism and ensuring a smooth financial transaction with your clients. Following a clear process helps ensure that you include all necessary details and that the final document is organized and easy to understand. Below are the key steps to create an effective billing record.

1. Gather Client Information

Start by collecting the client’s full name, address, phone number, and email. This ensures that the document is correctly attributed to the right person and allows for easy communication if necessary.

2. List the Services Provided

Clearly describe each service you performed, including any special requests or customizations. Break down the tasks in a way that both you and your client can easily understand what was delivered.

3. Include the Pricing Breakdown

List the cost for each service individually, including any additional fees, taxes, or discounts applied. This makes the charges transparent and avoids confusion about the total amount due.

4. Specify Payment Terms

Clearly state when the payment is due and what methods are accepted. You may also include any late fees or penalties for delayed payments to ensure that both parties are on the same page.

5. Add a Unique Reference Number

Assigning a unique identifier to each document helps you easily track and manage your transactions. It also makes it easier to reference specific records in future communications.

6. Review and Send

Before finalizing the document, review it for any errors or missing information. Once everything looks correct, send the document to your client via your preferred delivery method (email, physical mail, etc.).

By following these simple steps, you can create a professional, accurate billing document that reflects your services and ensures timely payments.

Common Mistakes to Avoid in Invoices

Creating a billing document requires attention to detail, and even small errors can lead to confusion, delays, or missed payments. Avoiding common mistakes ensures that both you and your clients have a clear understanding of the charges and terms. Here are some of the most frequent errors that should be prevented when preparing a financial record.

- Incomplete Client Information: Missing or incorrect details, such as the client’s name, address, or contact information, can lead to confusion and delays in communication.

- Unclear Service Descriptions: Failing to provide a detailed breakdown of the services rendered can cause misunderstandings regarding what is being charged. Always list the specific tasks completed.

- Missing Payment Terms: Not specifying the payment due date, acceptable methods of payment, or late fees can lead to uncertainty and slow payment processing.

- Incorrect Pricing: Errors in pricing or leaving out additional fees like taxes or travel charges can cause discrepancies and damage your reputation for professionalism.

- Failure to Include Reference Number: Not including a unique identifier for each transaction makes tracking payments and resolving disputes more difficult.

- Forgetting to Proofread: Spelling or grammatical errors can make your document look unprofessional and may cause confusion. Always double-check before sending it out.

By being mindful of these common mistakes, you can ensure that your billing documents are clear, accurate, and professional, leading to smoother transactions and improved client relationships.

Essential Information to Include in Invoices

For any service or product-based transaction, having a well-detailed document is vital for maintaining clarity and ensuring timely payments. A complete and accurate document outlines all necessary details to prevent misunderstandings and disputes. Here are the key elements that should always be included in your financial documents to make them clear and professional.

- Client Details: Always include the full name, address, and contact information of the client. This helps to correctly associate the document with the customer.

- Your Business Information: Provide your business name, address, phone number, email, and any relevant business identifiers such as tax ID numbers. This promotes credibility and ensures your clients know how to reach you.

- Unique Document Number: Assign a unique reference number to each document for tracking purposes. This simplifies organizing and locating past transactions.

- Service/Products Provided: A detailed description of the services rendered or goods delivered, including any specific requests, helps the client understand what they are being billed for.

- Pricing Breakdown: Clearly list the cost for each service or item, including any taxes or additional charges. This transparency helps avoid confusion.

- Payment Terms: Specify when the payment is due, the accepted payment methods, and any penalties for late payments. This ensures both parties are aware of expectations.

- Subtotal and Total: Clearly display the subtotal, any applicable taxes, and the final total amount owed. This allows the client to easily see the breakdown of costs.

- Due Date: Include a clear due date for payment to avoid any misunderstandings and help ensure timely payment.

Including these essential elements in your billing documents will help you maintain a professional image and foster better communication with your clients, leading to smoother financial transactions.

Best Practices for Professional Invoicing

Creating a billing document that reflects professionalism and clarity is essential for maintaining a positive business relationship with clients. Following best practices helps ensure that your records are accurate, easy to understand, and encourage prompt payments. By adhering to these guidelines, you can streamline your financial processes and present a polished image of your business.

1. Maintain Consistency in Format

Using a consistent layout for all your billing documents makes it easier for both you and your clients to navigate through the information. Whether you’re using a digital or physical format, keeping the style uniform enhances professionalism and helps clients quickly familiarize themselves with the structure of your records.

2. Ensure Clarity and Transparency

All details should be clearly outlined, including the specific services rendered, the associated costs, and any additional fees or discounts. Avoid using ambiguous terms and ensure that the client understands exactly what they are being billed for. This minimizes confusion and prevents disputes.

3. Be Prompt in Sending Documents

Send your billing records as soon as the service is completed or a product is delivered. Timely invoicing helps you maintain a steady cash flow and shows professionalism. If a client is unsure about the charges, sending the document quickly allows them to raise any concerns in a timely manner.

4. Include a Payment Deadline

Clearly state when payment is due, as this helps avoid unnecessary delays. Having a deadline encourages clients to prioritize their payments, and it also sets expectations on when you should follow up if payment isn’t received on time.

5. Use Professional Language

The language you use in your billing document should be formal and polite, maintaining a professional tone throughout. This enhances your business image and reassures clients that they are dealing with a credible professional.

6. Offer Multiple Payment Options

To make it easier for clients to pay, consider providing multiple payment options, such as bank transfers, credit cards, or digital wallets. The more flexible you are, the quicker clients will settle their payments.

7. Review for Accuracy

Before sending out your billing documents, always double-check for errors. Ensure that all client information, service descriptions, and amounts are accurate. This prevents delays caused by corrections and shows attention to detail.

By implementing these best practices, you can ensure that your billing process is efficient, professional, and effective in managing financial transactions with clients.

Free Bridal Makeup Invoice Templates

For professionals in any creative field, having access to free, customizable billing documents can be a time-saver and help maintain a professional image. These documents allow for easy tracking of payments and ensure that clients understand exactly what services they are being charged for. Free options are available online and can be adapted to suit individual business needs, streamlining the payment process without the need for expensive software or services.

Advantages of Using Free Billing Documents

Utilizing a free billing template offers several benefits. It saves time, provides a professional structure, and ensures that important details are not overlooked. These pre-made designs often include the essential elements, such as client information, service breakdowns, and pricing, which makes creating a document quick and efficient.

Where to Find Free Billing Documents

Numerous websites offer downloadable and customizable free templates that can be used for any service-based business. Some popular platforms include:

- Microsoft Office Templates: Offers various free formats that can be tailored to your specific needs, from simple documents to more complex designs.

- Google Docs: Provides editable billing formats that can be easily modified in a collaborative environment.

- Online Invoice Generators: Websites like Invoice Generator or Zoho Invoice offer free templates with easy customization options and immediate download capabilities.

- Canva: Known for its design templates, Canva also offers free and customizable invoice layouts that are visually appealing and professional.

Customization Options

Although free templates are readily available, it’s important to personalize them to reflect your business’s branding. You can adjust the color scheme, fonts, and layout to match your style, ensuring consistency with other marketing materials like business cards or websites. This small touch can add a professional flair and further enhance your business image.

By using free customizable billing documents, you can easily maintain organization and professionalism in your financial dealings, making the entire process smoother for both you and your clients.

Design Tips for Attractive Invoices

Creating an appealing and well-organized financial document is essential for leaving a lasting impression on clients. A clean, professional design not only makes the document easy to read but also enhances your business’s image. Here are some key design tips to ensure your financial records stand out while maintaining clarity and functionality.

1. Use a Clear Layout

A well-structured document ensures that all important information is easily accessible. Avoid clutter by using a clear layout with adequate spacing between sections. Group related information, such as contact details, service breakdowns, and payment terms, to create a logical flow that guides the reader through the document effortlessly.

2. Incorporate Your Brand Identity

Including your business’s logo, color scheme, and fonts reinforces your brand identity and helps make the document look professional. Consistency across all business materials–including financial documents–builds trust and recognition. Consider using the same design elements from your website or marketing materials to ensure uniformity.

3. Prioritize Readability

Choose a font that is easy to read, even on small screens or when printed. Sans-serif fonts like Arial or Helvetica are great choices for clear legibility. Avoid using more than two or three fonts in the document to maintain a cohesive and clean look.

4. Keep it Simple and Clean

While it’s tempting to add decorative elements, simplicity is key. An overly busy design can distract from the important information. Stick to a minimalistic approach, using subtle lines or icons to highlight key sections without overwhelming the reader.

5. Use Color Thoughtfully

Color can help emphasize key details, like the total amount due or the due date. However, use colors sparingly. A few well-placed accents can guide the reader’s eye, but too many colors can make the document look unprofessional. Stick to a simple color palette that complements your branding.

6. Add a Personal Touch

Consider including a short message of gratitude or a note of appreciation for your client’s business. This small gesture can help build stronger relationships and encourage repeat business. Just a line or two can make a big difference in how clients perceive your service.

By following these design tips, you can create visually appealing financial documents that not only look professional but also help facilitate a smooth transaction process. A well-crafted design reflects your attention to detail and enhances your business’s reputation.

How to Send Your Makeup Invoice

After completing a project, it’s essential to send the payment request efficiently and professionally. How you deliver your financial document can impact the client’s experience and, ultimately, the speed of payment. Whether you’re sending it digitally or via physical mail, ensuring that the process is smooth and clear will reflect positively on your business.

1. Choose the Right Delivery Method

There are multiple ways to send your payment request, and choosing the right method depends on your client’s preferences and the nature of your business. Common options include:

- Email: Fast, secure, and convenient for most clients. Simply attach the completed document to the email or use an online invoicing service that allows direct sending.

- Online Payment Systems: Platforms like PayPal, Stripe, or Square allow you to send an automated request that includes a payment link for ease of processing.

- Postal Mail: For clients who prefer physical documents, sending a hard copy might be the preferred method. Ensure the document is printed clearly and neatly, and send it with tracking for peace of mind.

2. Include Clear Payment Instructions

When sending your financial document, it’s important to provide clear and concise instructions on how the client can settle the payment. This can include:

- Payment methods: Clearly state the available methods, such as bank transfer, credit card, or online payment systems.

- Due date: Be sure to specify the payment due date. If your client misses the deadline, having it in writing helps prevent confusion.

- Late fees: If applicable, inform the client about any penalties for overdue payments. This encourages timely payment and maintains your business’s professionalism.

3. Follow Up Professionally

If the payment isn’t made by the due date, send a polite reminder. Maintain a professional tone and offer assistance if there are any issues with the payment process. A timely follow-up can help prevent delayed payments without damaging the client relationship.

By following these steps, you ensure a seamless payment process and reinforce your commitment to professionalism. Sending payment requests effectively reflects your attention to detail and keeps your business running smoothly.

Tracking Payments with Your Invoice

Keeping track of payments is crucial for maintaining smooth cash flow and ensuring timely transactions. A well-organized payment tracking system helps you stay on top of received and pending payments, making it easier to follow up with clients if needed. Here are some best practices to effectively track payments using your financial documents.

1. Include a Payment Status Section

Adding a payment status section to your financial document can help you easily monitor which payments have been made and which are still outstanding. This section could include:

- Paid: Mark the payment as received, including the date it was paid.

- Pending: Indicate if payment is expected by a specific date.

- Overdue: Highlight payments that have not been made by the due date.

2. Use Unique Identifiers

Assigning a unique reference number to each transaction or payment request can make it easier to track payments. When clients reference this number, you can quickly identify their payment history and avoid confusion. Some systems even allow clients to enter the reference number when making their payment, simplifying the tracking process.

3. Record Payment Method and Amount

For every payment you receive, it’s important to note the method used (such as bank transfer, credit card, or digital payment platforms) and the exact amount. This record will serve as a reference in case any discrepancies arise or if you need to confirm payments during financial audits.

4. Utilize Payment Tracking Software

If you handle a large number of transactions, using payment tracking software or tools can streamline the process. These systems can automatically update the payment status, send reminders for overdue payments, and provide you with detailed reports for better financial management.

5. Send Payment Reminders

If a payment becomes overdue, sending a polite reminder is essential to maintain professionalism. You can include the payment status in your follow-up message, along with any necessary details regarding payment options and deadlines. Keeping communication clear and timely ensures that clients stay on track.

By incorporating these tracking methods, you will enhance your ability to manage payments effectively and maintain a professional relationship with your clients. Having a clear payment tracking system in place reduces confusion and ensures timely revenue for your business.

Legal Considerations for Makeup Invoices

When creating a payment request, it’s important to ensure that it complies with legal requirements to avoid future disputes or misunderstandings. Understanding the legal aspects of payment documentation not only helps protect your business but also builds trust with your clients. Below are key legal considerations to keep in mind when issuing a financial document.

1. Include Clear Terms and Conditions

Every financial document should clearly outline the terms and conditions of the transaction. This includes:

- Payment due date: Specify when the payment is due to avoid any confusion regarding deadlines.

- Late fees: If you charge late fees, ensure that they are clearly mentioned in the document.

- Refund policy: If applicable, include details on the conditions under which a refund can be requested.

2. Provide Accurate Business Information

For legal purposes, your business name, address, and contact information must be clearly displayed on the financial document. Additionally, if your business is registered for VAT or another tax system, ensure the relevant tax information is included.

3. Taxation Compliance

Complying with tax regulations is essential. Make sure you include any applicable tax charges, such as VAT, sales tax, or service tax, depending on your jurisdiction. This ensures that both you and your client are meeting legal obligations. Failure to include taxes could lead to penalties or disputes down the line.

4. Use Unique Identifiers for Transactions

Each payment request should have a unique reference or transaction number. This makes it easier to track payments and ensures that both you and the client can reference the same document if issues arise. It also helps in complying with record-keeping laws and tax reporting regulations.

5. Record Keeping for Legal Purposes

It’s crucial to maintain accurate records of all financial transactions for tax reporting and legal reasons. Most countries require businesses to keep such records for a certain period. Storing these documents securely ensures that you’re prepared for any audits or legal inquiries in the future.

6. Legal Jurisdiction

If you work with clients from different regions or countries, it’s important to clarify the legal jurisdiction governing the payment agreement. This could influence the process of resolving any potential disputes regarding the transaction.

By adhering to these legal considerations, you ensure that your payment requests are not only professionally presented but also legally sound, protecting both you and your clients in any business dealings.

Invoice Formats: Digital vs Paper

When it comes to managing payment requests, businesses have two main formats to choose from: digital or paper. Both options offer distinct advantages and potential drawbacks, depending on the needs and preferences of both the service provider and the client. Understanding the benefits and limitations of each format can help you decide which one suits your business operations and client relationships best.

Digital formats, including email or online payment systems, offer speed and convenience. They allow for quick delivery, easy storage, and faster payment processing. Digital records are also more environmentally friendly and cost-effective, eliminating the need for paper, ink, and postage. However, they may require a certain level of technical expertise, and there’s always the risk of email or document errors.

On the other hand, paper formats have been traditionally used for a long time and may still hold value in certain industries. Some clients may prefer physical copies of financial documents, especially for record-keeping or personal preference. While paper invoices require more time and resources for printing and mailing, they provide a tangible document that can be physically stored and referenced.

Ultimately, the decision to use digital or paper formats comes down to convenience, client preference, and business practices. While digital formats tend to be more efficient, paper invoices can still be relevant for certain transactions or industries where physical documentation is required.

How to Use Invoices for Branding

In the business world, every touchpoint with a client is an opportunity to reinforce your brand identity. One often-overlooked but powerful way to promote your brand is through the financial documents you send to customers. Customizing these documents allows you to convey your company’s personality and professionalism while leaving a lasting impression. Here’s how you can leverage these documents for branding purposes.

1. Include Your Branding Elements

Start by incorporating your company’s logo, colors, and typography into your documents. This consistent visual identity helps customers recognize your brand immediately. You can even include a custom-designed header that highlights your unique aesthetic, making your communication feel personal and professional.

2. Clear and Professional Layout

In addition to visual elements, a clean, organized layout is crucial for reinforcing your brand’s commitment to quality. A clutter-free design with clear sections and legible fonts makes your document easier to read and enhances the customer’s experience. A well-designed document reflects positively on your business’s attention to detail.

| Branding Element | Impact on Client |

|---|---|

| Logo and Business Name | Immediate brand recognition |

| Color Scheme | Associates your brand with certain emotions and perceptions |

| Font Style | Reflects your company’s tone (e.g., modern, classic, professional) |

By taking the time to customize your financial documents with these elements, you turn every transaction into an opportunity to showcase your business’s values and commitment to quality, making your brand more memorable to clients.

How to Keep Invoice Records Organized

Maintaining well-organized financial records is essential for any business, as it ensures smooth operations, timely payments, and efficient tax management. Proper organization helps you easily access past transactions, identify trends, and avoid errors. Here are some effective strategies to keep your records tidy and accessible.

1. Use a Consistent Filing System

Whether you prefer a digital or physical system, consistency is key. Assign clear naming conventions to your documents and categorize them by client, date, or service. This makes it easier to locate specific records when needed and reduces the risk of losing important documents.

2. Automate the Process

One of the best ways to stay organized is to leverage automation tools. Use accounting software or online tools that automatically generate, send, and store your financial documents. These platforms often come with built-in organization features, such as folders, tags, and search functions that simplify record-keeping.

Benefits of Digital Organization:

- Quick access to records: Search and retrieve documents instantly.

- Cloud storage: Safely back up records online and reduce the risk of losing physical documents.

- Time-saving: Automatic sorting and categorization saves effort and ensures consistency.

By setting up a reliable system and utilizing technology, you can ensure that your financial documents remain well-organized, saving you time and stress when you need them most.