Customizable Boutique Invoice Template for Your Business

For any small business, having clear and well-organized documents for transactions is essential. These documents serve as proof of agreements, help maintain financial clarity, and ensure timely payments. Whether you’re offering services or selling products, providing an easy-to-understand statement for your clients is key to a smooth business operation.

Customizing your billing records to suit your brand and specific needs can set you apart from the competition. By tailoring these records to your unique business model, you not only improve the client experience but also reinforce your professional image. A well-designed form can make a lasting impression on your customers and create trust in your business processes.

Choosing the right format for your transactions can greatly impact efficiency. A thoughtful approach to organizing the necessary details, such as amounts, services, and payment terms, ensures a straightforward and transparent process. When done right, it allows for seamless communication and fosters positive client relationships.

Why a Boutique Invoice Template Matters

For any business, maintaining a structured approach to financial documentation is crucial. The format used to present charges, payments, and other transaction details directly impacts the clarity and professionalism of the business. A well-organized document ensures that both the business owner and the client understand the terms and amounts involved, preventing misunderstandings and fostering trust.

When creating billing records, it’s important to consider several key factors:

- Clarity: A clean, easy-to-read structure helps customers understand exactly what they are being charged for and the due dates.

- Professionalism: A polished design signals competence and helps your business make a positive impression on clients.

- Consistency: Using the same format for each transaction provides a sense of reliability and ensures all essential details are always included.

In addition to these practical aspects, personalized financial documents help reflect the uniqueness of your business, adding a special touch that resonates with clients. When businesses tailor their paperwork to align with their brand identity, it creates an enhanced experience for the customer, promoting loyalty and satisfaction.

Having a standard approach to managing financial transactions also streamlines operations. It simplifies the tracking of payments and aids in record-keeping, allowing business owners to maintain better control over their financial processes. With the right structure, businesses can improve their workflow, minimize errors, and maintain efficient communication with clients.

Streamlining Billing for Small Businesses

For small businesses, simplifying the billing process can lead to significant time savings and reduce the risk of errors. Efficient management of financial documents ensures that payments are tracked accurately, clients receive clear statements, and cash flow is consistent. Streamlining this aspect of business operations is essential for growth and operational efficiency.

Adopting a clear, standardized approach to creating and sending financial documents eliminates unnecessary steps and minimizes the chances of missing key details. By automating certain tasks, like calculations or the inclusion of specific terms, businesses can speed up the process while maintaining accuracy and professionalism.

Additionally, using consistent formats for all transactions creates a reliable system that both business owners and clients can trust. A simple, structured format allows for easy referencing and ensures that all necessary components–such as payment dates, amounts, and descriptions–are included every time. This level of consistency helps businesses avoid confusion, streamline communication, and improve overall operational efficiency.

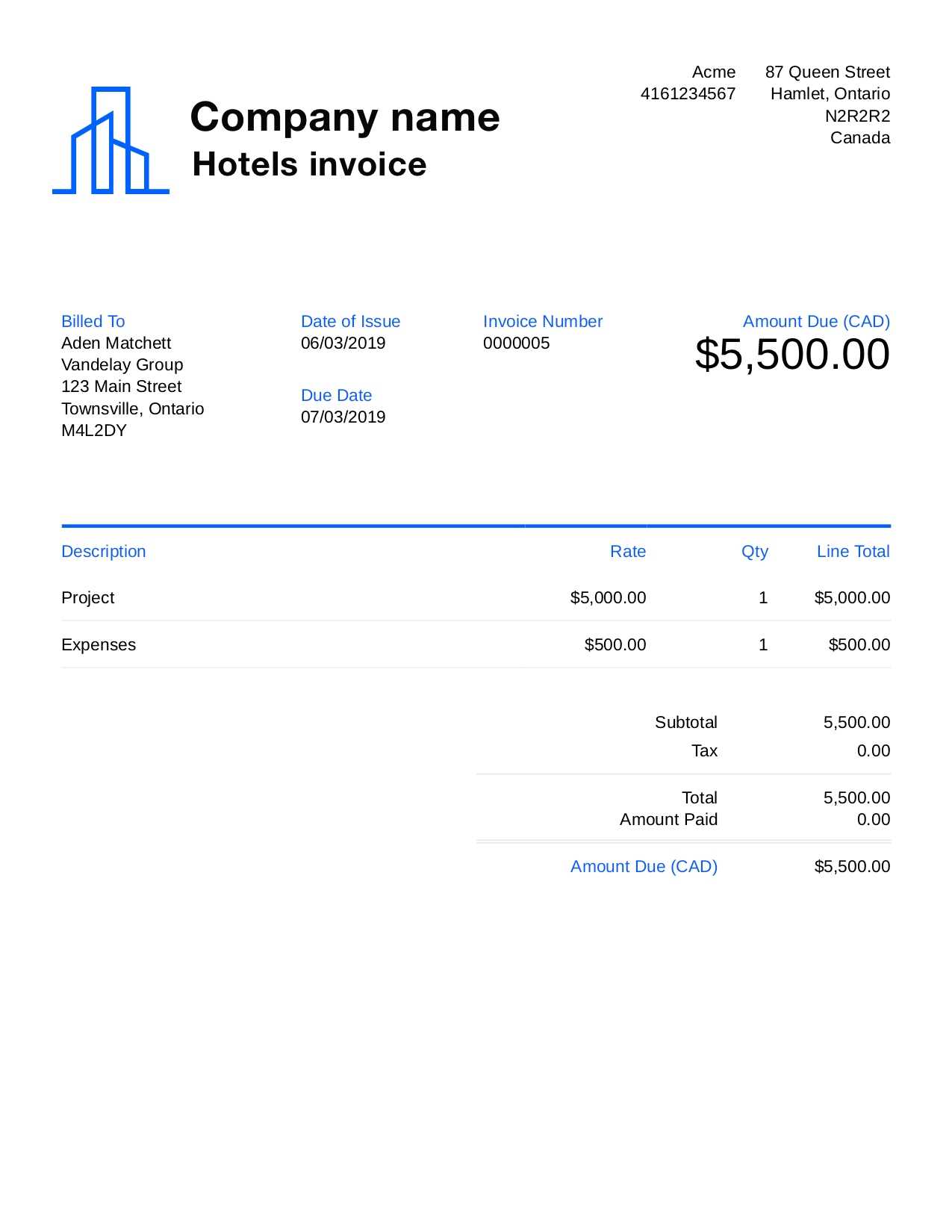

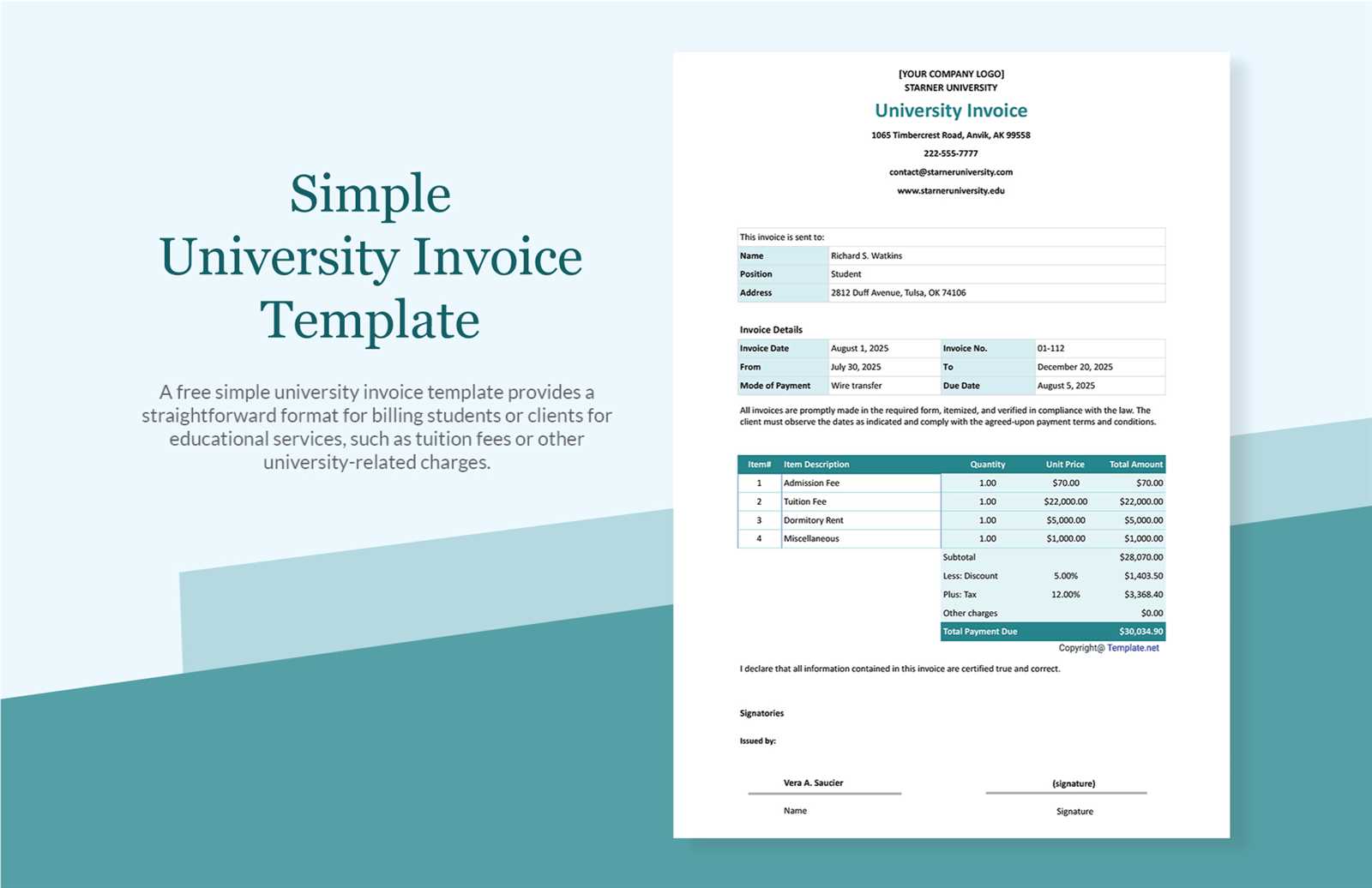

Essential Features of an Invoice Template

When creating a document for billing purposes, it’s crucial to include specific details that ensure clarity, accuracy, and professionalism. A well-structured document not only communicates the necessary information but also helps maintain a smooth financial transaction between businesses and their clients.

Key components that should be included are:

- Business information: Clearly display the company name, address, and contact details to ensure easy identification.

- Client details: Include the name and contact information of the recipient to prevent any confusion.

- Transaction details: Each charge should be clearly listed with descriptions, quantities, and unit prices.

- Payment terms: Clearly outline the due date, payment method, and any late fees to avoid misunderstandings.

- Unique reference number: Each document should have a unique identifier for tracking purposes.

- Total amount: A final sum that adds up all charges and taxes, providing a clear view of the full payment due.

Incorporating these elements ensures that all necessary information is provided, making it easier for both parties to understand the transaction. Additionally, using a clean and readable format improves the overall customer experience, reflecting the professionalism of the business.

How to Customize Your Billing Document

Customizing your financial records is an important step in creating a unique experience for your clients while reinforcing your brand identity. Tailoring these documents allows you to present information in a way that reflects your business’s personality, which can build stronger relationships with your customers. A personalized design can make your communication more professional and memorable.

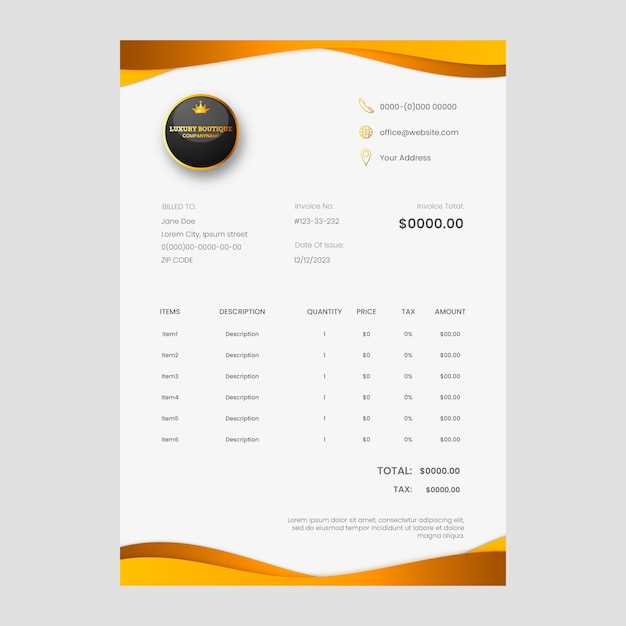

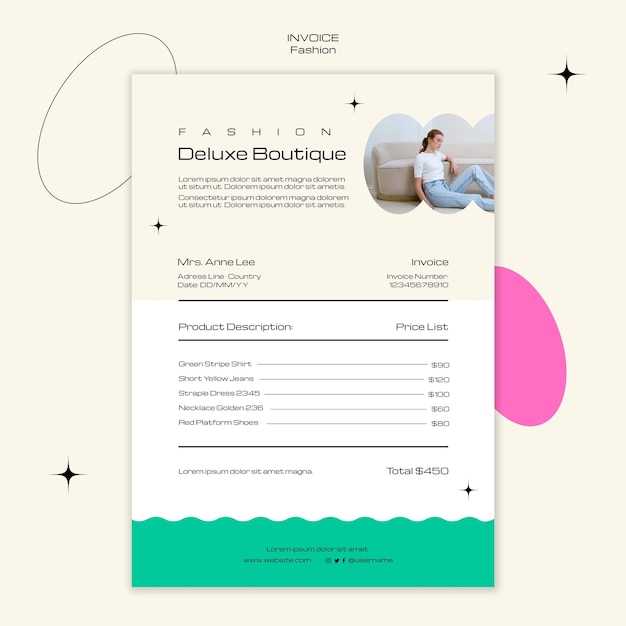

Choosing the Right Design

Start by selecting a design that aligns with your business’s image. If your brand is minimalist, opt for a clean, simple layout with plenty of white space. For a more creative or upscale business, you may want to incorporate your logo, custom colors, or elegant fonts. Whatever style you choose, ensure it is clear and easy to read for your clients.

Adding Custom Elements

Personalization goes beyond just aesthetics; it’s also about including relevant business information and adjusting the content to meet your needs. Some businesses might want to add a personal note or offer promotional discounts, while others may prefer to include specific payment instructions or client reference numbers. Customizing these details makes the process smoother for both parties involved and ensures that no essential information is overlooked.

Choosing the Right Billing Format

Selecting the proper format for your financial documents is crucial to ensure clarity, ease of use, and professionalism. The layout you choose should not only present information effectively but also align with your business needs and customer expectations. A good format can streamline your accounting processes and help maintain clear communication between you and your clients.

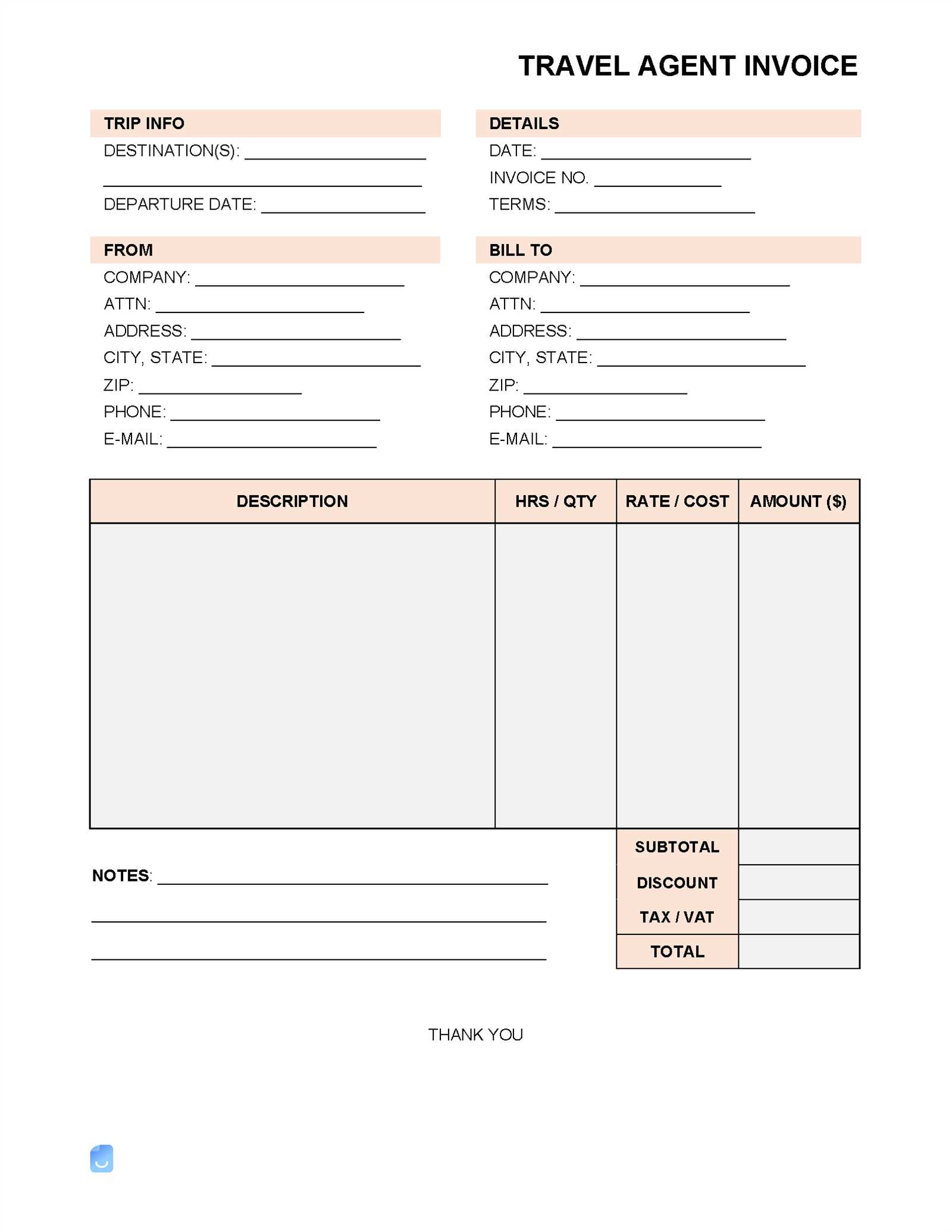

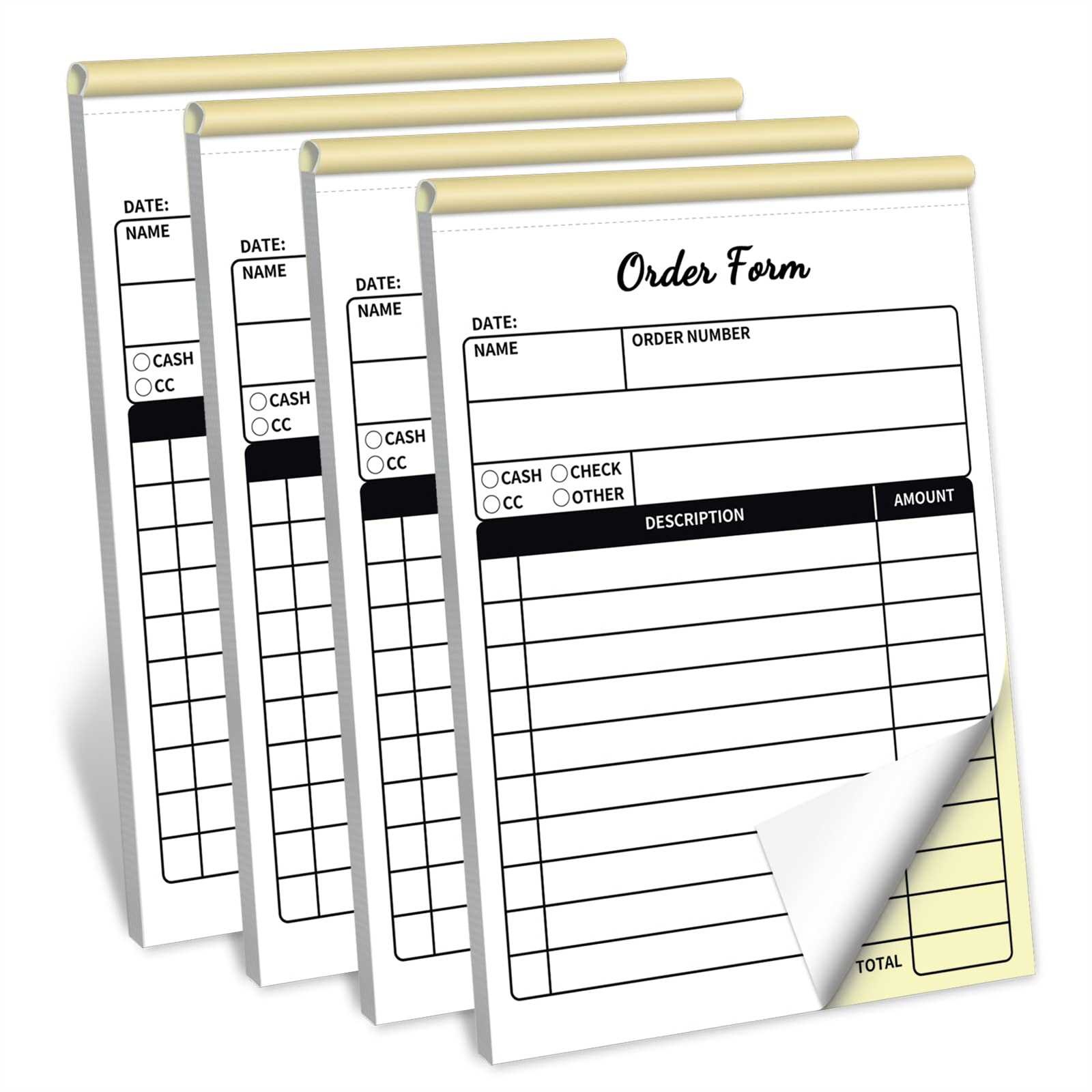

Simple vs. Detailed Formats

Depending on the nature of your business, you may opt for a simple or detailed approach to your financial documents. A simple format is ideal for straightforward transactions, with minimal items or services listed. On the other hand, a detailed structure may be necessary for businesses offering multiple services or products, where each item needs to be broken down individually to provide transparency and prevent misunderstandings.

Digital vs. Paper Formats

Digital formats are increasingly popular due to their convenience and ability to integrate with accounting software. They allow for quicker processing, easy storage, and the ability to send documents instantly. However, some clients may prefer a traditional paper format, especially for larger transactions or formal business relationships. Choosing between digital and paper formats should depend on your clients’ preferences and the scale of your operations.

Tips for Professional Billing Document Design

Creating a polished and professional look for your billing documents is essential to make a positive impression on your clients. A well-designed statement not only reflects your business’s quality but also ensures that all the necessary details are easily accessible. The design should be clear, organized, and align with your brand identity.

Focus on clarity–a clean, readable layout is key. Use a simple, consistent font and ensure the text size is large enough for easy reading. Avoid clutter by leaving sufficient white space around sections. This makes the document feel less overwhelming and helps clients quickly find relevant information, such as payment due dates and amounts.

Incorporate your branding elements to enhance the design. Your logo, brand colors, and fonts should be reflected in the document’s style, ensuring consistency across all your communications. A well-branded document reinforces professionalism and helps clients recognize your business immediately.

Finally, ensure all critical components are clearly highlighted, such as the total amount due, payment instructions, and due dates. Using bold or slightly larger text for these sections can help guide the client’s attention and prevent any confusion regarding payment details.

Benefits of Digital Billing Documents

Switching to digital financial records offers numerous advantages for businesses of all sizes. These electronic documents provide greater efficiency, easier management, and a more environmentally friendly option compared to traditional paper-based methods. With digital solutions, businesses can streamline their processes and ensure faster, more reliable transactions with clients.

Here are some key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | Digital documents can be generated and sent instantly, reducing the time spent on paperwork and mailing. |

| Reduced Errors | Automation and digital formatting help minimize the risk of mistakes, such as incorrect calculations or missing details. |

| Easy Tracking | Storing and managing digital records makes it easy to track payments, monitor overdue amounts, and search for past transactions. |

| Cost Savings | Eliminating paper, ink, and postage expenses lowers overall operational costs for the business. |

| Environmental Impact | Using digital files reduces paper waste, making it a more sustainable choice for eco-conscious businesses. |

By adopting digital formats for your billing records, you can enhance operational efficiency, improve client communication, and contribute to a greener future.

Automating Billing for Better Efficiency

Automation can drastically improve the efficiency of your billing process by reducing manual tasks, minimizing human error, and speeding up transactions. With the right tools, you can generate, send, and track financial documents automatically, saving valuable time and allowing your team to focus on other important tasks. Automation ensures that your process runs smoothly and consistently, providing a more streamlined experience for both your business and clients.

Time Savings and Accuracy

One of the primary benefits of automation is the time saved by eliminating repetitive tasks. Instead of manually entering data for each transaction, automated systems can pull information from your customer database and generate documents in seconds. This not only saves you time but also reduces the likelihood of mistakes, ensuring that details such as amounts and dates are consistently accurate.

Improved Cash Flow Management

Automating your billing process can also enhance cash flow management. By setting up recurring billing schedules or sending out reminders automatically, you ensure timely payments and reduce delays. Clients are less likely to forget or overlook payment deadlines when reminders are sent consistently, leading to a more predictable cash flow and better financial planning.

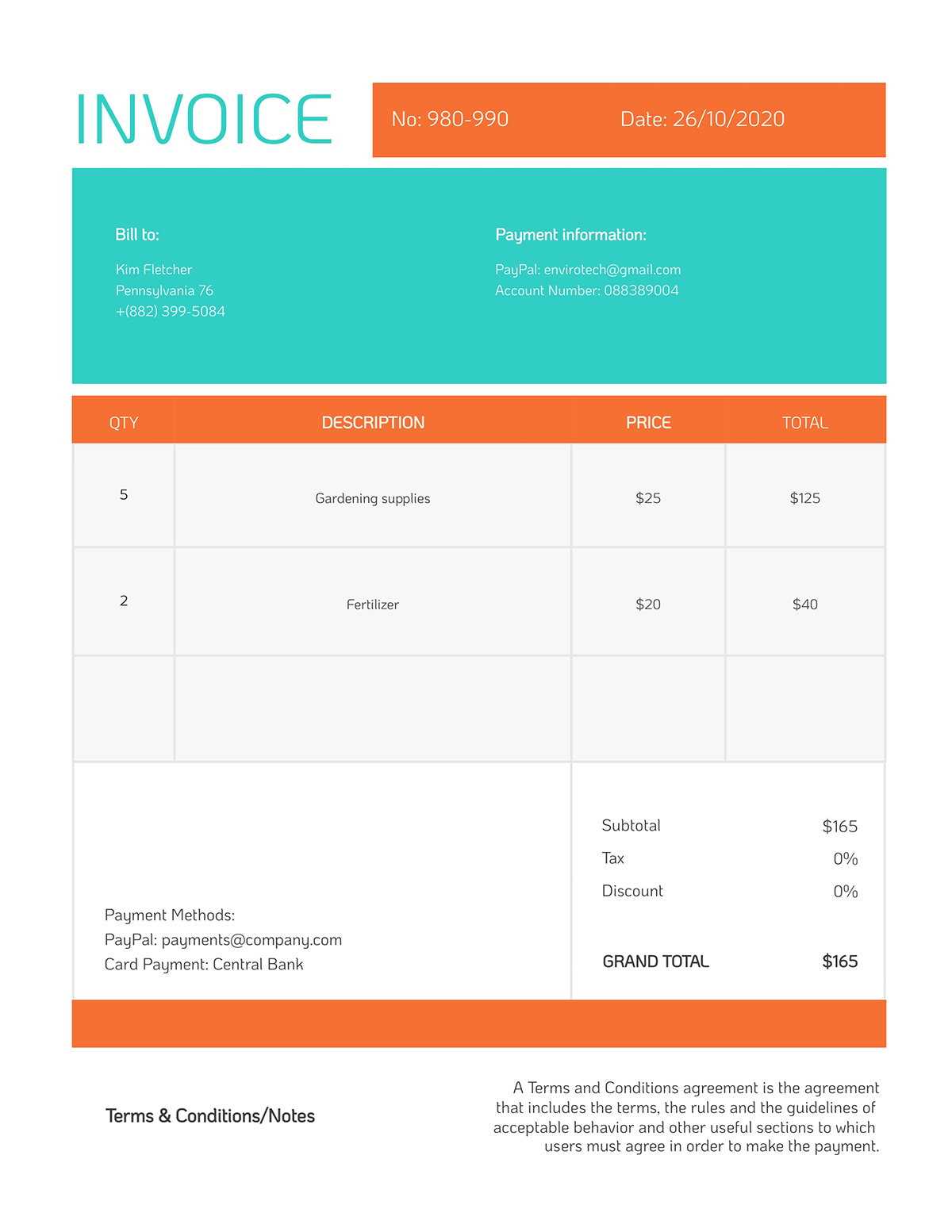

How to Include Payment Terms on Billing Documents

Clearly stating payment terms on your financial documents is essential for maintaining transparency and avoiding misunderstandings with clients. Well-defined payment expectations ensure that both parties are on the same page regarding due dates, fees, and methods of payment. Including this information helps clients know when and how to make payments, which can lead to smoother transactions and improved cash flow.

Key Elements to Include

To ensure clarity, consider the following elements when specifying payment terms:

- Due Date: Specify the exact date by which payment is expected. This ensures the client knows the deadline and avoids any confusion.

- Late Fees: If applicable, mention any penalties for late payments, such as a fixed fee or a percentage of the total amount due.

- Accepted Payment Methods: List the available payment options, such as bank transfer, credit card, or online payment platforms, so clients know how to pay.

- Discounts for Early Payment: If you offer discounts for early settlement, make sure to clearly state the terms, including the percentage discount and the due date.

- Currency: Indicate the currency in which payments should be made to avoid any confusion in international transactions.

How to Format Payment Terms

Make sure the payment terms are placed in a prominent area of the document, such as the footer or a dedicated section near the total amount due. Using bold text or underlining can help highlight this important information. Keep the language simple and concise to avoid any ambiguity. A clear and easy-to-understand statement of terms helps ensure both you and your clients have aligned expectations.

Common Mistakes to Avoid with Billing Documents

Even minor errors in your financial documents can lead to confusion, delays, or disputes with clients. It’s crucial to avoid common mistakes that can hinder the clarity and professionalism of your transactions. Ensuring that all necessary details are accurate and well-presented will help maintain smooth business operations and foster positive relationships with your clients.

Here are some of the most common mistakes to avoid:

| Mistake | Consequence |

|---|---|

| Missing Payment Details | Failure to include payment methods, due dates, or late fees can lead to confusion and delayed payments. |

| Incorrect Information | Errors in customer names, billing amounts, or item descriptions can lead to disputes and frustration. |

| Unclear Terms | Vague or overly complex payment terms may confuse clients and result in delayed or incorrect payments. |

| Lack of Professional Design | A cluttered or unprofessional document can create a negative impression and damage your reputation. |

| Not Including Due Dates | Without a clear due date, clients may procrastinate, leading to delayed payments and cash flow issues. |

By being mindful of these common pitfalls and taking the time to ensure accuracy and clarity, you can avoid complications and ensure that your transactions are as smooth and professional as possible.

Ensuring Legal Compliance with Billing Documents

When creating financial documents for your business, it’s essential to ensure they comply with the legal standards and regulations applicable in your region or industry. Failure to include required information or to follow established rules could lead to penalties, fines, or complications in case of an audit. Understanding the key legal requirements for such documents is vital for protecting your business and maintaining good standing with authorities.

Here are some important legal considerations to keep in mind:

| Legal Requirement | Why It’s Important |

|---|---|

| Business Registration Number | Including your business registration number is often required by law and helps identify your company in legal transactions. |

| Tax Information | Accurate tax identification numbers (such as VAT or GST) are necessary to ensure compliance with tax authorities and avoid legal issues. |

| Payment Terms and Conditions | Clearly stating your payment terms helps prevent disputes and ensures that both parties are legally bound to the agreed terms. |

| Item Descriptions | Providing clear and accurate descriptions of products or services is necessary to prevent fraud or misunderstanding in case of legal action. |

| Signed Agreements | In some cases, a signed acknowledgment of the transaction is required for legal purposes, ensuring that both parties agree to the terms. |

By ensuring that your financial documents meet the necessary legal requirements, you can safeguard your business from potential issues while maintaining transparency and trust with clients and regulators alike.

How to Handle International Billing Documents

When working with clients across different countries, managing financial documents can become more complex due to varying regulations, currencies, and payment systems. It’s essential to adapt your documents to ensure they meet the specific legal and financial requirements of each region. Clear communication of terms and fees is crucial in international transactions to avoid misunderstandings and delays.

Here are some important considerations when handling international financial documents:

| Consideration | Why It’s Important |

|---|---|

| Currency | Clearly indicate the currency in which the payment is expected, especially when dealing with clients from different countries. This prevents confusion and ensures the correct amount is transferred. |

| Tax Information | Different countries have varying tax laws, so it’s important to include the relevant tax rates, such as VAT or sales tax, based on the client’s location. |

| Language | Consider providing financial documents in the client’s native language to avoid any miscommunication. In some cases, legal requirements may also dictate the language used. |

| Payment Methods | Offer international payment options, such as wire transfers or online payment platforms, that are convenient for clients from different regions. |

| International Terms | Ensure that payment terms, such as due dates and late fees, are clear and suitable for international transactions, including the time zone differences and potential delays. |

By understanding the unique challenges of international transactions and adapting your financial documents accordingly, you can ensure smoother processes and maintain strong relationships with clients worldwide.

Designing Billing Documents to Match Your Brand

Your financial documents are a reflection of your business’s identity. Just like your website or product packaging, these documents should be designed in a way that aligns with your brand’s values and aesthetics. Consistency in branding across all your communication materials, including payments and receipts, reinforces your professional image and builds trust with your clients.

Here are some key elements to consider when designing documents that match your brand:

- Logo and Branding Colors: Incorporate your company’s logo and colors to create a cohesive look. This helps clients recognize your business easily, even in a financial context.

- Typography: Use the same fonts as in your other business materials to create consistency. Make sure the fonts are legible and professional.

- Professional Layout: Ensure the design is clean and well-organized. A clutter-free layout not only looks professional but also makes the document easy to read and navigate.

- Clear Branding Message: Consider including a tagline or short message that represents your brand’s mission or values, reinforcing your brand’s identity with every document sent.

- Custom Details: Customize the document with details that reflect your business, such as your customer service contact or a personalized thank-you note to make clients feel valued.

By thoughtfully designing your financial documents to match your brand, you create a consistent and professional image that enhances your business’s credibility and strengthens your relationship with clients.

Choosing the Right Billing Software

Selecting the right software for managing your business’s financial documents is crucial to streamline your operations and ensure accuracy. The right tools can automate tasks, reduce errors, and save you valuable time. With numerous options available, it’s important to consider what features you need and how well the software integrates with your existing systems.

When choosing the right software, consider the following:

- User-Friendly Interface: Opt for software that is easy to navigate and doesn’t require extensive training. An intuitive design can significantly improve efficiency, especially if your team isn’t tech-savvy.

- Customization Options: Ensure the software allows you to personalize documents with your branding, such as logos, colors, and business details. Customization ensures that your financial documents align with your professional identity.

- Integration with Other Tools: Check if the software integrates with your accounting, CRM, or payment systems. Seamless integration will save you time and reduce the risk of mistakes.

- Automation Features: Look for software that offers automated reminders, recurring billing op

How to Track Payments with Billing Documents

Tracking payments is a key component of managing your business’s finances. By keeping a detailed record of payments received, you can ensure that accounts are settled on time, reduce administrative errors, and maintain healthy cash flow. Effective tracking methods provide clear insight into your financial status and help prevent missed payments or misunderstandings with clients.

Steps to Effectively Track Payments

Here are some essential steps to track payments accurately:

- Assign Unique Numbers: Each financial document should have a unique identifier or reference number. This makes it easier to match payments to specific transactions and avoid confusion when managing multiple clients.

- List Payment Due Dates: Clearly indicate the due date for each payment. This ensures clients are aware of deadlines and helps you monitor whether payments are made on time.

- Record Payment Status: Regularly update the status of each payment. This can be marked as “Paid,” “Pending,” or “Overdue” to quickly identify which payments have been processed and which are still outstanding.

- Monitor Payment Methods: Keep track of the payment methods used, whether they are bank transfers, checks, or credit card payments. This information can help identify trends and provide valuable insights into how clients prefer to settle their accounts.

Using Software to Automate Tracking

For businesses handling a large volume of transactions, using billing software can help automate payment tracking. Many software solutions offer features like automatic status updates, payment reminders, and integration with accounting systems. This minimizes manual effort and ensures that payments are tracked accurately and efficiently.

By implementing these strategies and utilizing the right tools, you can ensure smooth payment processing and maintain accurate financial records for your business.

Integrating Billing Documents with Your Accounting System

Efficiently managing financial transactions requires seamless integration between your billing process and accounting system. By syncing the two, you can automate tasks, reduce manual data entry, and ensure accuracy in your financial records. This integration helps maintain up-to-date accounts, simplifies reporting, and improves overall business efficiency.

Here are the key benefits and steps for integrating billing documents with your accounting system:

- Eliminate Double Entry: Automatically syncing payments and transactions between your billing documents and accounting system reduces the need for manual data input, minimizing errors and saving time.

- Real-Time Updates: Integration ensures that financial records are updated in real-time. When a transaction is processed, your accounting system reflects it immediately, keeping everything current and accurate.

- Better Financial Reporting: Accurate and up-to-date records make generating financial reports easier and more reliable. You can track revenue, outstanding payments, and overall financial health with a few clicks.

- Automated Tax Calculations: Some systems allow automatic tax calculations based on pre-configured rules, making it easier to stay compliant with local tax regulations.

- Improved Client Communication: Syncing billing details with your accounting system enables quicker access to payment status, which can be shared with clients, reducing confusion and improving customer service.

To achieve smooth integration, you can either use specialized accounting software that includes billing management features or choose a solution that supports API integration. Many modern platforms offer easy-to-use integration tools, so even small businesses can set up an automated system with minimal technical expertise.

By integrating your billing documents with your accounting system, you can streamline your financial processes, ensuring efficiency and accuracy in every transaction.

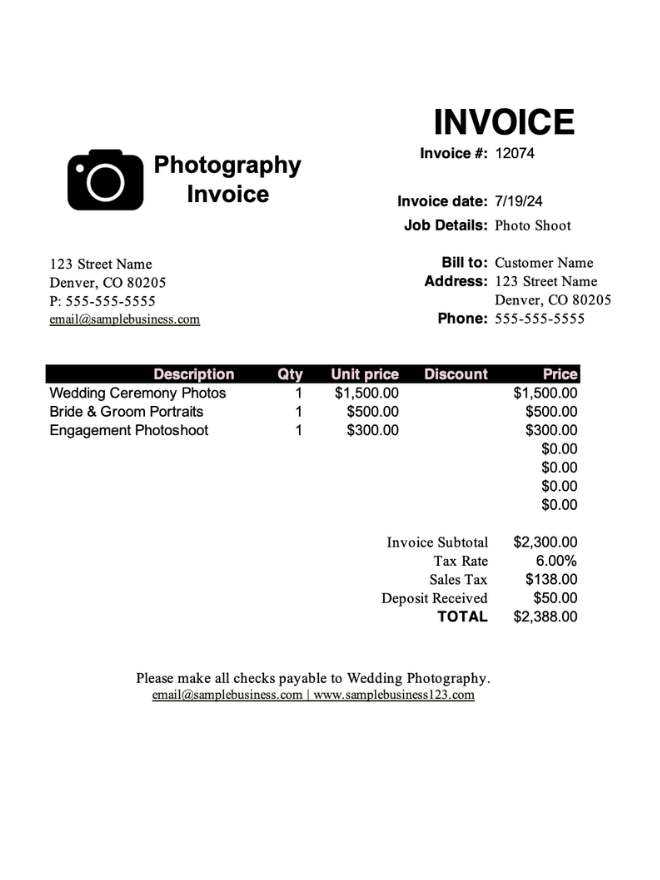

How to Create Billing Documents for Different Services

Creating accurate and professional billing documents for various services requires attention to detail and a clear understanding of what to include. Whether you are offering consulting, design, repair, or other services, each type of work may have unique requirements. A well-structured billing document ensures that both you and your clients are on the same page when it comes to services rendered and payment terms.

Follow these steps to create effective billing documents tailored to the specific services you offer:

- Define the Service Clearly: Start by specifying the exact service provided. For example, if you are a web designer, describe the scope of the project, such as “Website Design and Development” or “Website Redesign.” This ensures there is no ambiguity about the work performed.

- Include the Duration or Timeframe: For services that are billed by the hour, such as consulting or legal advice, make sure to include the total number of hours worked. If the service is project-based, state the start and end dates.

- Break Down the Cost: Itemize the charges for each part of the service. If you are providing multiple services or phases, list them separately to avoid confusion. For example, a graphic designer might charge for logo design, website graphics, and brand assets in separate line items.

- Specify Additional Charges: If applicable, include any extra costs such as materials, software, or travel expenses. Be clear about any additional fees upfront to prevent surprises later.

- Detail Payment Terms: Outline your payment terms, such as whether a deposit is required, when the full payment is due, and your preferred method of payment. It’s also helpful to mention any penalties for late payments, such as interest charges or late fees.

- Provide Contact Information: Ensure that your contact details are easy to find on the document. Include both email and phone numbers so that the client can reach you easily if they have any questions or concerns.

Customizing your billing documents according to the type of service provided will ensure that your clients understand exactly what they are being charged for and help you maintain a professional relationship. Whether it’s a one-time project or an ongoing service, providing clarity and transparency in your billing will result in smoother transactions and fewer disputes.