Complete Guide to Booking.com Invoice Template

When managing rental properties or accommodations, one of the key tasks is creating clear and accurate financial records. These documents are essential for maintaining transparency with guests, handling payments, and ensuring compliance with tax regulations. Having a well-organized system for generating these records can save time and reduce the risk of errors.

With the right tools, creating these financial statements can be a straightforward process. A standardized document helps you include all necessary information, such as guest details, charges, taxes, and payment methods. This is crucial for both personal record-keeping and professional transactions.

In this guide, we’ll walk you through how to create and manage these billing documents efficiently. Whether you’re a host, property manager, or accountant, understanding the process can streamline your workflow and improve the accuracy of your financial reporting.

Booking.com Invoice Template Overview

Creating clear and organized financial records for each booking is an essential part of managing accommodations. These documents provide both hosts and guests with a clear breakdown of charges, helping to avoid confusion and ensuring that all payments are properly documented. A well-structured document makes it easier for property managers to track earnings and handle accounting tasks efficiently.

Key Features of a Standard Billing Document

A comprehensive document typically includes several key sections to ensure transparency and accuracy. These elements help organize payment details and facilitate clear communication between parties. Common components include:

- Guest Information: Name, contact details, and booking dates.

- Charges and Fees: Detailed list of services, taxes, and any additional costs.

- Payment Status: Amount paid, payment method, and outstanding balance if applicable.

- Property Information: Name, address, and contact details of the accommodation.

Why Use a Structured Document for Bookings?

Having a consistent format for financial records can help minimize errors and ensure that all necessary information is included. A pre-designed document makes it easier to generate accurate bills quickly, which is especially important when managing multiple bookings at once. Furthermore, using an organized structure makes it simple to keep track of past transactions for tax purposes or future reference.

Why Use a Booking.com Invoice Template

Maintaining accurate financial records is crucial when managing bookings and accommodations. Using a standardized document for each transaction not only simplifies the process but also ensures consistency and professionalism. This approach helps hosts stay organized and make sure they don’t overlook any necessary details, whether for guests or for accounting purposes.

One of the main advantages of having a pre-designed format is efficiency. By utilizing a ready-made structure, property managers can quickly generate the necessary paperwork without having to manually format each document. This saves valuable time and reduces the chances of errors in calculating charges or missing essential information.

Moreover, these documents serve as a professional tool for managing payments, keeping both the host and guest informed about the transaction details. With a clear, easy-to-read format, the financial breakdown is transparent, which can help resolve any disputes quickly and avoid confusion over billing issues.

How to Download the Template

Obtaining the right document for managing financial records is a simple process that can be completed in just a few steps. These documents are often made available through official platforms or third-party providers, ensuring that hosts have easy access to standardized formats that meet their needs.

Follow these steps to download the document structure:

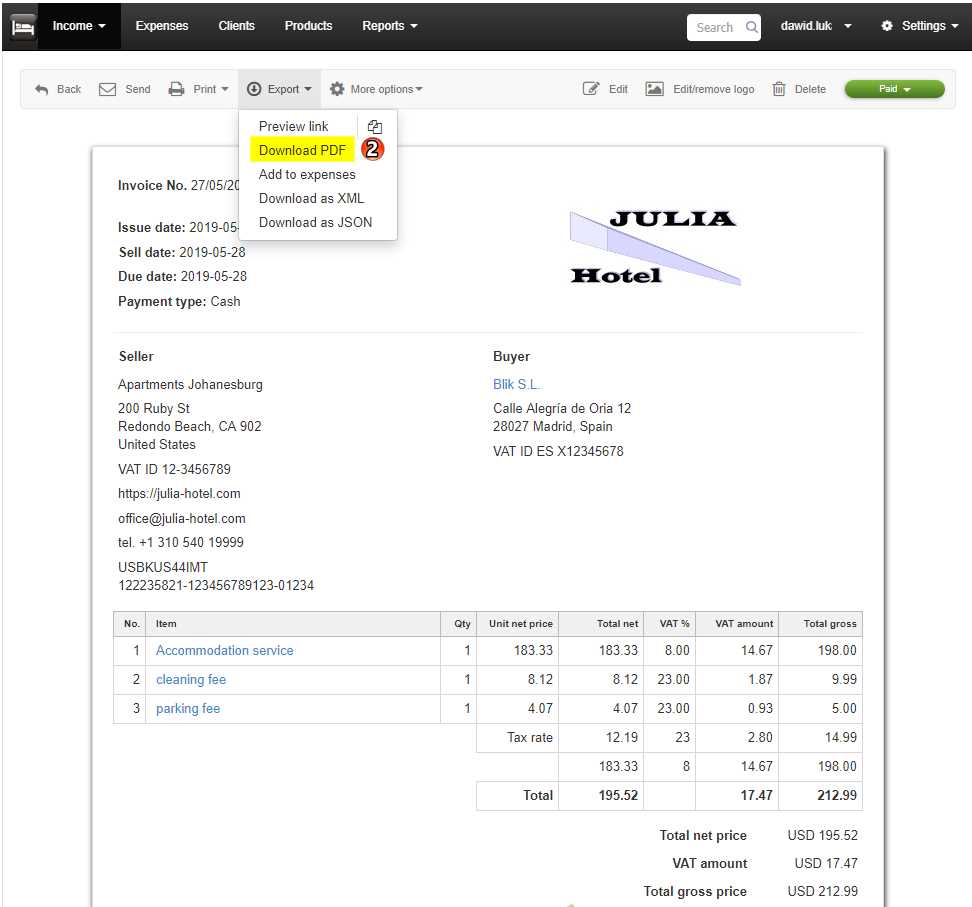

- Visit the Official Website: Go to the relevant platform or service where the document is hosted.

- Locate the Download Section: Find the section dedicated to billing or payment documents. This may be under account settings or support resources.

- Select the Format: Choose the format that best suits your needs, such as a PDF or Excel file, based on your preferred method of editing.

- Click to Download: Click the download button to save the file to your device. Ensure you have enough space on your storage.

- Open and Review: Once downloaded, open the file to confirm that it’s the correct document. Review its layout and details to ensure it matches your expectations.

With these simple steps, you will be ready to start generating and customizing your financial records with ease and accuracy.

Step-by-Step Guide for Customization

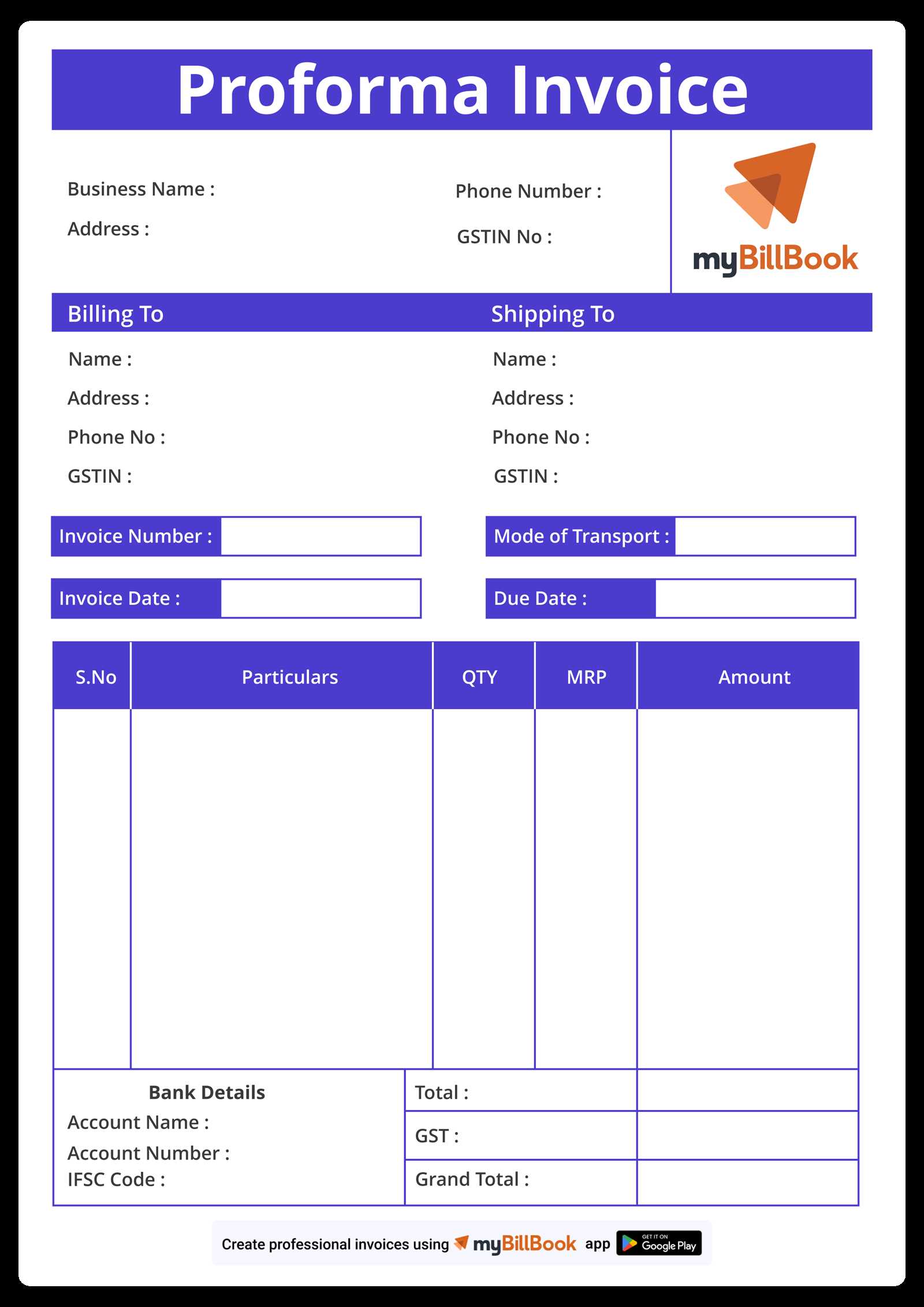

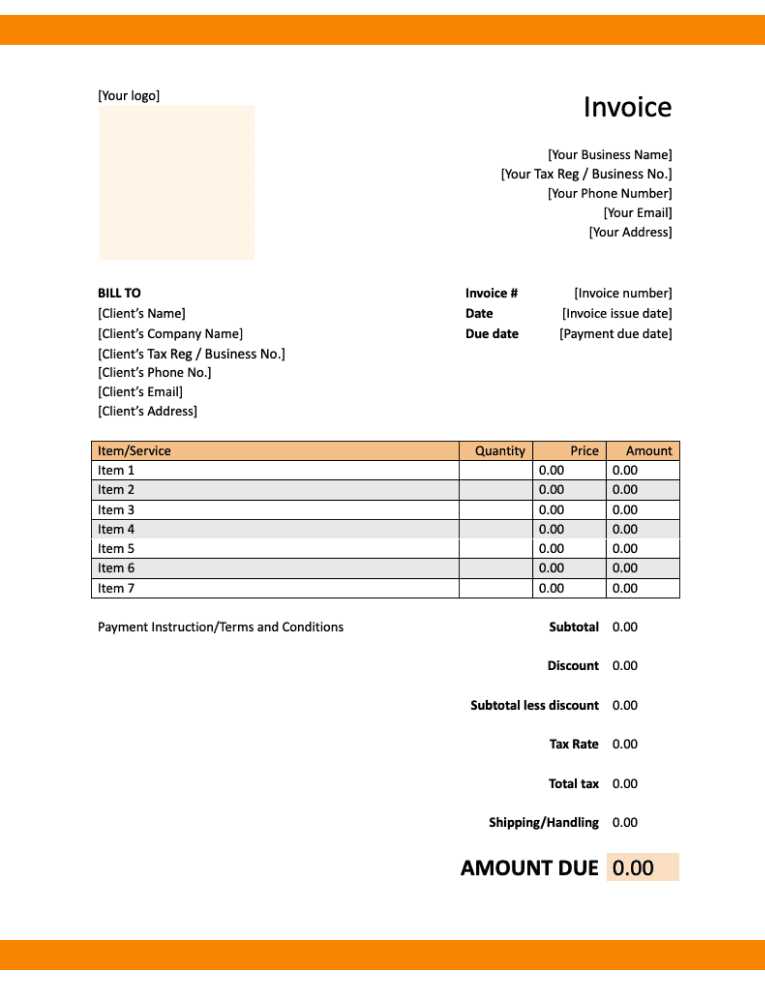

Customizing your billing document is an important step to ensure that all relevant information is included and presented in a clear, professional manner. Whether you need to adjust the layout, add specific details, or modify the content, the process can be easily accomplished with a few simple steps. This guide will walk you through the customization process, making it easier to tailor the document to your needs.

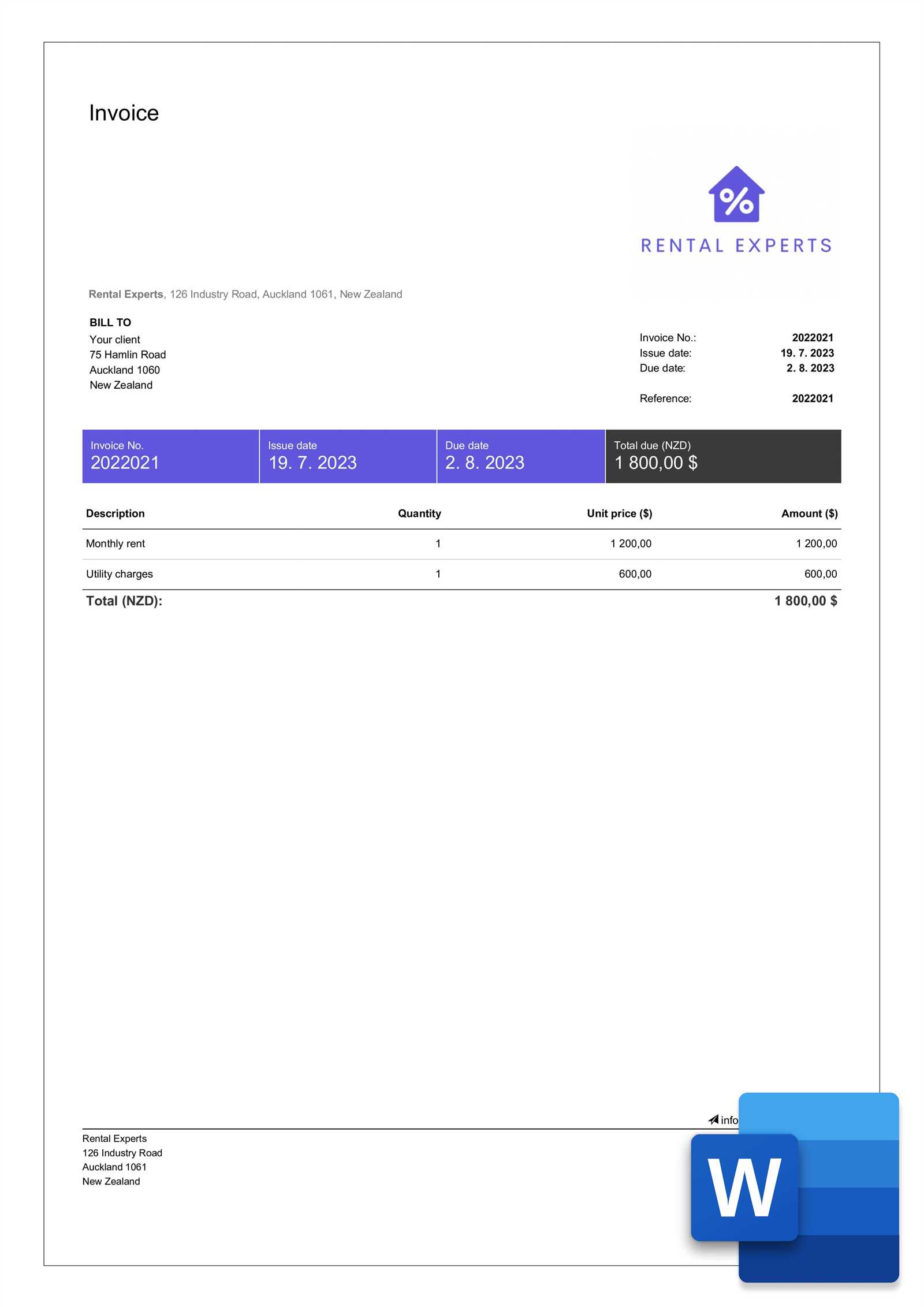

1. Open the File and Review the Layout

The first step is to open the downloaded document in your preferred program (Excel, Word, or PDF reader). Take a moment to review the layout and check if it fits your requirements. Ensure that sections such as guest details, payment information, and accommodation details are included in the right format.

2. Modify Key Sections

Now you can start adjusting the content. Here are the most important areas to modify:

- Guest Information: Update the name, contact details, and booking dates for each guest.

- Charges and Fees: Adjust the charges based on the services provided, including the nightly rate, taxes, and any additional fees.

- Payment Details: Ensure the payment status is correct, including amounts paid, any remaining balance, and payment methods.

- Property Details: Verify that the accommodation’s name, address, and contact information are accurate and up to date.

Once you’ve made the necessary changes, take a moment to double-check the document for accuracy. Ensuring all details are correct is key to providing guests with a clear financial record and avoiding any future confusion.

3. Save and Export the Document

After making your adjustments, save the document to your preferred location on your device. If you need to share it with guests or colleagues, consider exporting it to a PDF for easy viewing and printing. This format ensures that the document’s layout and content remain intact when shared.

With these simple steps, you’ll be able to easily customize your billing documents, making them a perfect fit for your needs while maintaining a professional appearance.

Essential Information to Include in the Invoice

When creating a financial record for a booking, it is important to ensure that all necessary details are included to maintain clarity and transparency. A well-organized document should provide both the host and the guest with clear information about the charges, payment status, and other essential elements related to the transaction. This helps avoid confusion and ensures compliance with tax and business regulations.

Below are the key details that should always be included in the document:

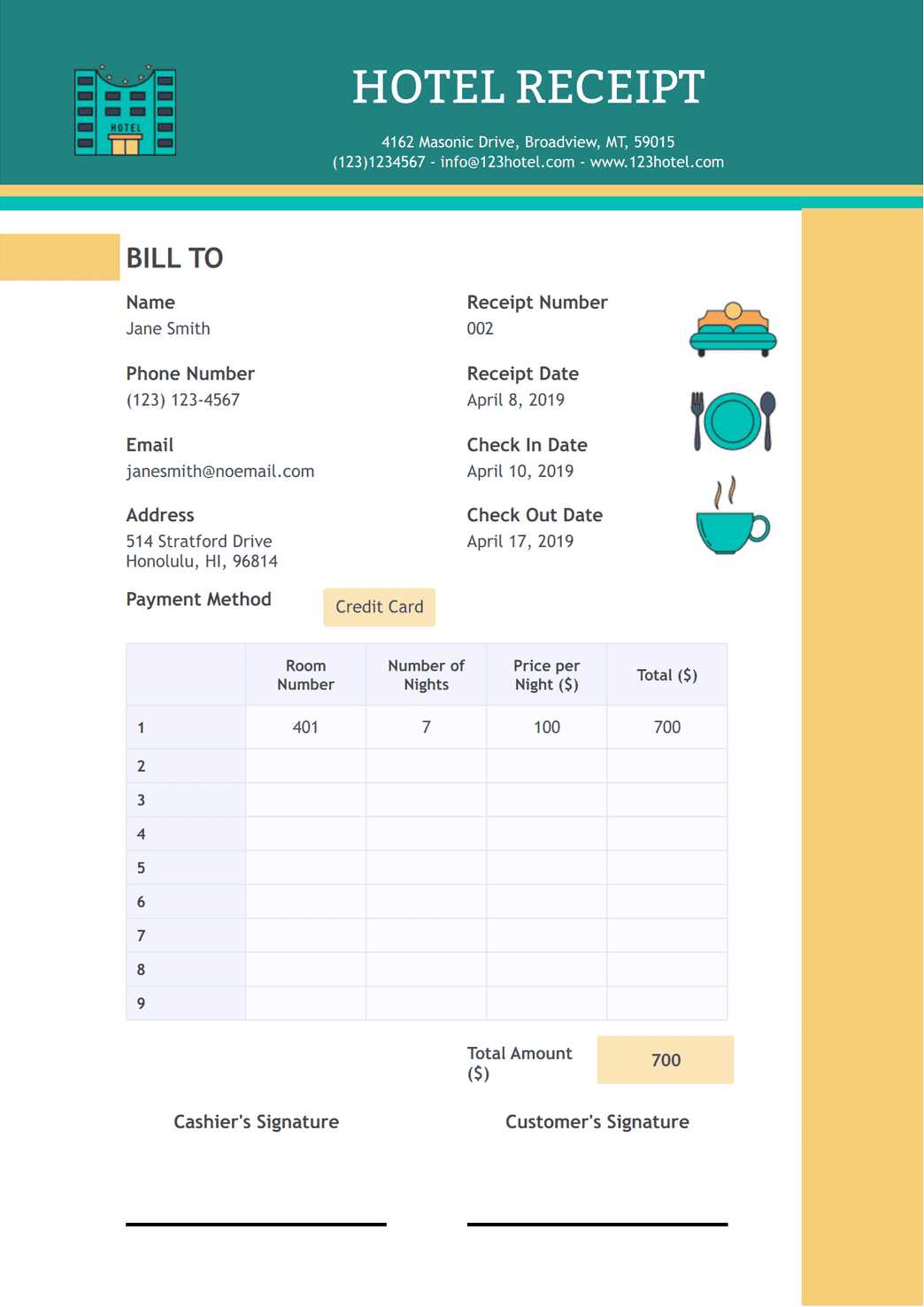

- Guest Information: The full name, contact details, and check-in/check-out dates of the guest.

- Booking Reference Number: A unique identifier for the booking, which makes it easy to track and reference the transaction.

- Accommodation Details: The name and address of the property, along with any relevant contact information for the host.

- Charges and Fees: A detailed breakdown of the costs, including room rates, cleaning fees, taxes, and any additional charges. This should be clearly listed to avoid any ambiguity.

- Payment Status: Information about the payment made, including the total amount, payment method, and whether there is any remaining balance or outstanding payment.

- Invoice Date: The date on which the document was generated, which is important for accounting purposes.

- Cancellation or Refund Policy: If applicable, include any details regarding cancellation or refund terms relevant to the booking.

Including all of this information ensures that the document serves as an accurate and comprehensive financial record, benefiting both parties and facilitating smooth transactions.

How to Edit the Template in Excel

Editing a financial record in Excel allows you to easily adjust details, update figures, and customize the layout according to your needs. Excel offers a range of tools that help automate calculations, ensuring that your document remains accurate and professional. Below is a simple guide to help you modify the document using Excel effectively.

1. Open the Document in Excel

The first step is to open the downloaded file in Microsoft Excel. If the document is in a different format, such as CSV or PDF, you may need to convert it to an Excel-compatible format before proceeding. Once opened, you will see the document’s structure, including rows for guest details, charges, and payment status.

2. Review and Modify Data

Next, you can begin editing the content in the relevant cells. Below is a sample table with key sections that may require adjustments:

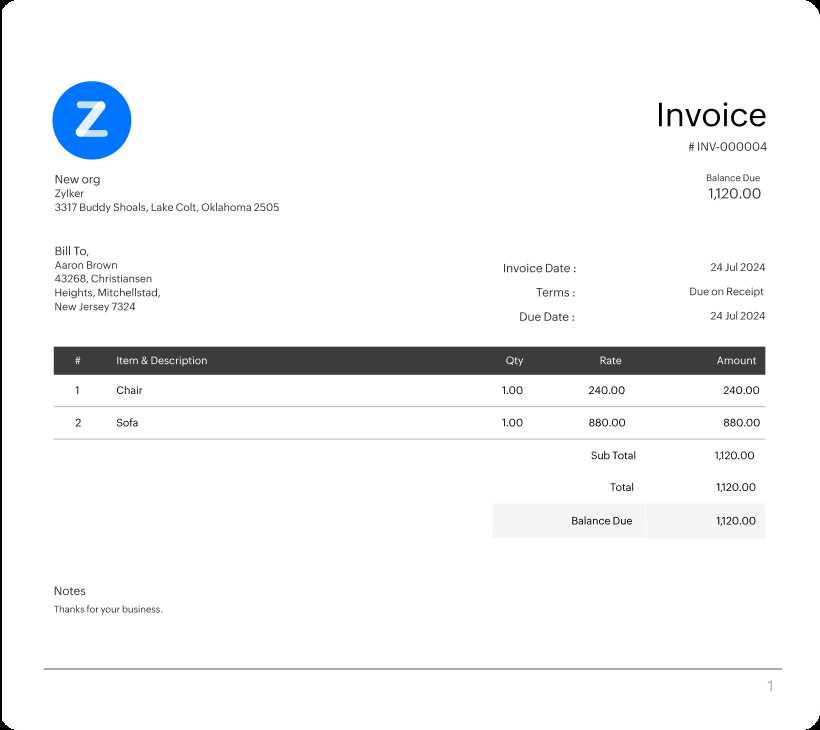

| Item | Details | Amount |

|---|---|---|

| Guest Name | John Doe | |

| Accommodation | Luxury Suite | $200 per night |

| Taxes | Sales Tax | $20 |

| Total Amount | $220 |

Make sure to update details like the guest name, booking dates, service charges, and total amount. If needed, you can add or remove rows to match the structure of your specific document.

3. Automate Calculations

Excel allows you to use formulas to automatically calculate totals, taxes, or any other values based on the data entered. For example, you can use the SUM function to calculate the total amount of charges by adding the room rate, taxes, and any other additional fees. To do this, click on the cell where the total should appear and enter the formula:

=SUM(C2:C4) (This assumes the amounts are in column C from rows 2 to 4).

4. Save Your Changes

Once all the necessary changes have been made, save the document. If you need to send it to a guest or colleague, you may want to export it as a PDF to preserve the layout and ensure it is easily readable by others.

By following these steps, you can easily customize the financial document in Excel to suit your needs, making sure that it remains both accurate and professional.

Invoice Format Explained

Understanding the structure of a billing document is essential for ensuring that all required information is presented clearly and professionally. The format typically consists of several key sections that provide a breakdown of charges, guest information, and payment details. Each section plays a specific role in ensuring the document is complete and easy to understand for both hosts and guests.

Key Sections of a Standard Document

A typical document follows a consistent format, which helps in organizing all the relevant details in an easy-to-read manner. Here are the main sections that should be included:

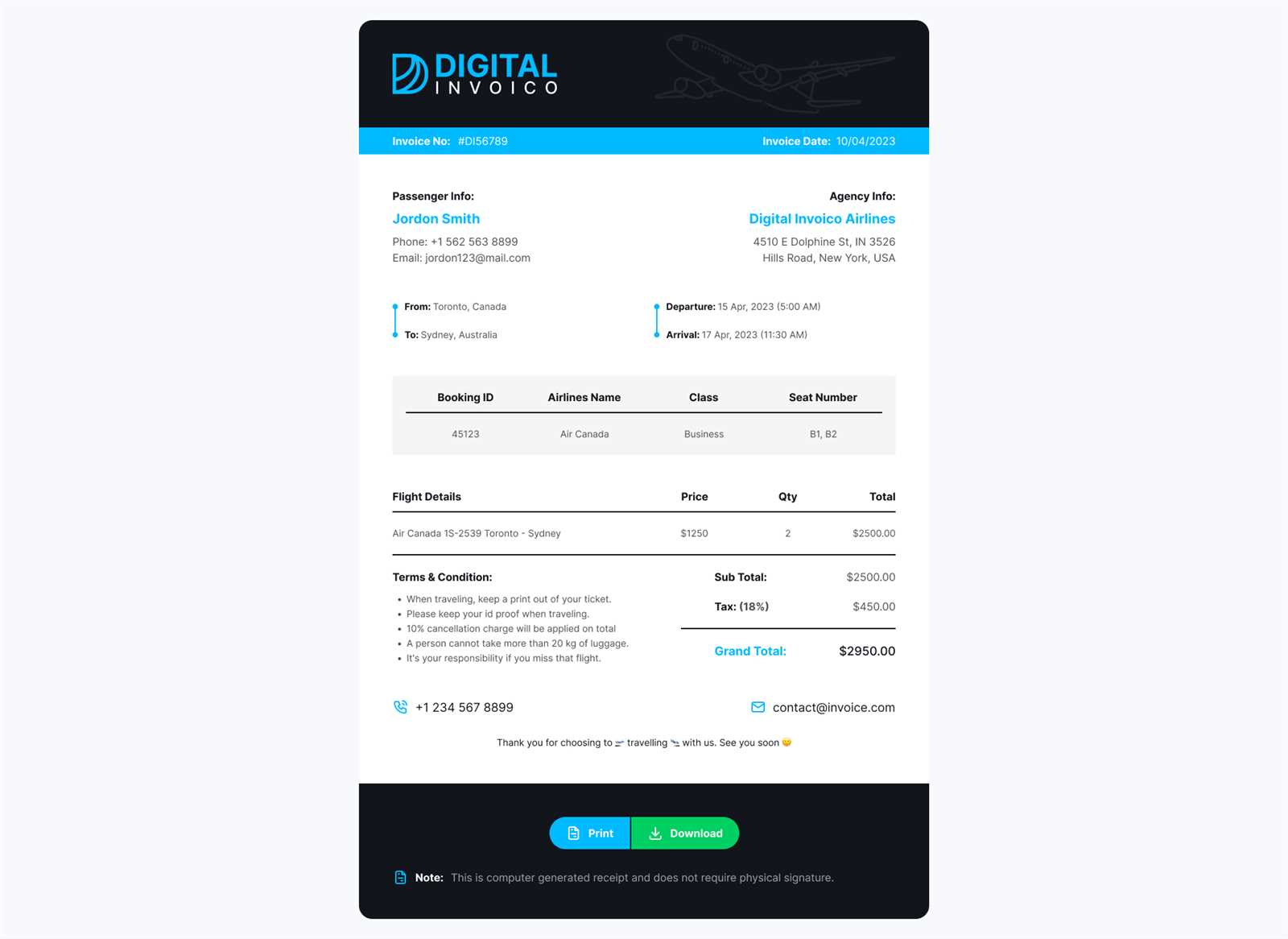

- Header Information: This includes the name of the property, its contact information, and sometimes the property’s logo or branding. It may also include a unique reference number for the booking.

- Guest Details: This section contains the name of the guest, their contact information, and the dates of their stay. It is important to ensure the correct details are entered to avoid any confusion.

- Charges Breakdown: A detailed list of the charges for the booking, including room rates, taxes, additional services, and fees. Each item should be clearly itemized with its corresponding amount.

- Payment Information: This part shows the amount that has been paid, the payment method, and whether there is an outstanding balance. If payment was made by credit card or other methods, those details are included here.

- Footer Information: Additional information such as terms and conditions, cancellation policies, or refund procedures may be included in this section.

Why the Format is Important

A clear, structured format helps avoid misunderstandings and provides both the guest and host with a professional and organized financial record. It ensures that all aspects of the transaction are accounted for and makes it easier to track payments and resolve any disputes that may arise. Whether it’s for personal record-keeping or tax purposes, using a consistent format is essential for smooth operations.

Common Mistakes to Avoid

When preparing a financial document for a booking, it’s crucial to avoid common errors that can lead to confusion or even disputes. A small mistake in the details can affect the accuracy of the transaction record, potentially causing issues for both the host and the guest. Being aware of these pitfalls can help ensure the document remains professional and error-free.

Here are some of the most frequent mistakes to watch out for:

- Incorrect Guest Information: Failing to properly enter the guest’s name, contact details, or booking dates can cause confusion, especially if the guest contacts you in the future about their stay.

- Missing or Incorrect Charges: Omitting certain charges (such as taxes or additional services) or entering incorrect amounts can lead to disputes. Always double-check that all charges are clearly listed and accurate.

- Not Updating Payment Status: Failing to mark whether the full amount has been paid or if there is any outstanding balance can create misunderstandings. Ensure the payment status reflects the actual situation.

- Overlooking Currency Conversions: If the booking involves international guests, make sure to include the correct currency conversion rates and adjust the amounts accordingly. This ensures clarity, especially for payments made in different currencies.

- Errors in Tax Calculations: Tax calculations can be complex, especially in different jurisdictions. Double-check the tax rates and ensure they are correctly applied to avoid potential legal issues.

- Not Including Terms and Policies: Sometimes hosts forget to add cancellation policies, refund terms, or other important clauses that are necessary for transparency. These should always be clearly stated to prevent misunderstandings.

By avoiding these common mistakes, you ensure that your financial records are accurate, complete, and professional, making the transaction smoother for everyone involved.

How to Generate Invoices on Booking.com

Generating a financial document for a reservation on a booking platform is an essential part of managing your business. Most platforms offer a simple process for creating these documents, which can be easily accessed from your account. The system typically allows you to download and review the document to ensure all details are accurate before sending it to the guest or using it for your records.

1. Accessing the Reservation Details

To begin, log in to your account on the platform where the booking was made. Navigate to the section where you can view your reservations or bookings. Once you find the specific reservation, you will usually see an option to generate a financial document. This document will contain key information, such as the guest’s name, stay dates, room rates, and any additional charges or fees.

2. Reviewing and Downloading the Document

After selecting the reservation, check the document’s details for accuracy. Ensure that all charges, taxes, and payment statuses are correctly reflected. If everything looks good, you can download the file in your preferred format, often as a PDF or Excel sheet. This can then be saved for your records or sent to the guest as a receipt or proof of payment.

By following these simple steps, you can efficiently generate and manage financial records for each booking, streamlining your administrative tasks and maintaining accurate documentation.

Booking.com Invoices for Tax Purposes

Maintaining accurate financial records is crucial for meeting tax obligations, especially when managing rental properties or accommodations. The financial documents associated with each booking serve as an essential tool for tracking income, expenses, and applicable taxes. These records help ensure compliance with local tax laws and provide a clear overview of your earnings for tax reporting purposes.

For tax purposes, here are the key elements that need to be carefully tracked and included in the financial document:

- Total Income: Ensure that the total income from each booking is clearly indicated. This includes the base price of the accommodation and any additional charges such as cleaning fees, extra services, or amenities.

- Tax Breakdown: Make sure to include the taxes applied to the total amount. Different jurisdictions may have varying tax rates, so it’s important that each transaction reflects the correct tax rate based on the location.

- Payment Method: Document the method of payment used (credit card, bank transfer, etc.). This can be important for reconciling payments and demonstrating the flow of funds in your business.

- Dates of Stay: Clearly show the dates the guest stayed at your property, as this information is crucial for calculating income on a monthly or yearly basis.

- Refunds and Cancellations: If a refund or cancellation has occurred, it should be properly documented in the financial record, showing the amount refunded and the reason for the cancellation.

By keeping track of these elements, you’ll have the necessary documentation to file taxes correctly and avoid potential issues with tax authorities. Additionally, maintaining organized financial records can make tax season less stressful, providing you with all the information you need in one place.

Automating Your Invoice Process

Managing financial records can be time-consuming, especially when dealing with multiple bookings. Automating the process of generating and sending receipts can save time and reduce the risk of errors. By using the right tools and systems, you can streamline your workflow and ensure that each transaction is recorded accurately and promptly without the need for manual input every time.

Here are some ways to automate your financial document generation process:

- Use an Automated Booking Platform: Many booking platforms offer built-in features to automatically generate financial records once a reservation is confirmed or completed. This ensures that every transaction is tracked and documented without the need for manual creation.

- Integrate with Accounting Software: Connect your booking system to accounting software like QuickBooks, Xero, or FreshBooks. This integration allows automatic data transfer, creating financial records directly in your accounting system, making tax reporting and financial management easier.

- Set Up Automatic Email Reminders: You can configure your system to automatically send receipts or payment confirmations to guests after a transaction is completed. This reduces the need for you to manually email each guest, saving you time.

- Leverage Batch Processing: If you have a high volume of bookings, some systems allow you to generate multiple documents at once, creating a batch of receipts or payment summaries. This can significantly speed up the process and ensure that all records are updated in real time.

- Automate Payment Reconciliation: Use automated payment reconciliation tools to match payments with corresponding bookings. This ensures that all payments are correctly attributed, reducing discrepancies in your financial records.

Automating your financial record generation not only saves time but also helps ensure accuracy and consistency in your transactions. With the right tools in place, you can simplify your workflow and focus more on running your business rather than administrative tasks.

Best Practices for Invoice Accuracy

Ensuring the accuracy of financial documents is essential for maintaining trust with guests and managing your business effectively. Small errors in amounts, dates, or guest details can lead to confusion, disputes, and even financial discrepancies. By following a few best practices, you can minimize the risk of mistakes and ensure that your documents are clear, professional, and correct every time.

Here are some key best practices for ensuring accuracy in your financial documents:

- Double-Check Guest Details: Always verify that the guest’s name, contact information, and stay dates are correctly entered. Mistakes here can lead to confusion and potentially even payment issues later on.

- Review Charges and Fees: Carefully list all charges, including room rates, extra services, and taxes. Ensure that the amounts are correct and that there are no omissions. A detailed breakdown helps guests understand the charges and reduces the chance of misunderstandings.

- Keep Tax Calculations Accurate: Pay special attention to tax rates, especially if you’re dealing with international guests. Ensure that the applicable taxes are calculated correctly based on local regulations and the guest’s location.

- Update Payment Information: Make sure that payments are properly recorded. If the guest has made a partial payment or if there is a balance due, this must be reflected accurately. Avoid any confusion by clearly stating whether the payment has been completed or if further action is needed.

- Use Templates with Pre-filled Fields: Using pre-filled fields for common details (such as property information, contact details, and payment terms) can minimize errors, as it reduces the need for manual entry each time a new document is created.

- Check for Consistent Formatting: Use consistent formatting for all financial documents. This includes uniform font sizes, clear itemization of charges, and standard date formats. Consistency enhances professionalism and readability, reducing the chance of errors.

- Implement a Review Process: Before sending the final document, it’s always a good idea to have a second person review it. This extra set of eyes can help catch errors that you may have missed during your initial review.

By incorporating these best practices, you can reduce the chances of errors and ensure that each financial record is accurate, helping to maintain transparency with your guests and making financial management more efficient.

Understanding Commission Fees

When hosting accommodations on an online platform, it’s important to understand the commission structure and how these fees affect your earnings. The platform typically charges a commission based on the total amount of the booking, which is deducted before you receive the payment. This fee helps the platform cover its operational costs, including marketing, customer support, and other services provided to hosts and guests. Understanding how these fees work is essential for calculating your net income and managing your pricing strategy effectively.

How Commission Fees Are Calculated

Commission fees are generally calculated as a percentage of the total booking amount. This amount may vary depending on factors such as the type of property, location, and the terms of the agreement with the platform. Below are key points to consider when calculating the commission fees:

- Percentage Rate: The platform usually charges a fixed percentage, often ranging from 10% to 20%, of the booking value. This rate may differ based on the service level, promotional offers, or partnership agreements.

- Inclusions: The commission is typically applied to the total amount paid by the guest, which includes room rates, additional fees, taxes, and extra services. Be sure to account for these elements when calculating the fee.

- Exclusions: In some cases, certain charges, such as refundable deposits or taxes collected on behalf of the government, may not be subject to commission fees. Always check the platform’s terms for specific details.

Impact on Your Earnings

Understanding the impact of commission fees on your overall revenue is crucial for setting competitive and profitable pricing. Since these fees are deducted from your total earnings, it’s important to factor them into your pricing strategy. Here’s how you can manage this:

- Adjusting Prices: To maintain profitability, you may need to increase your room rates slightly to compensate for the commission fees. Ensure that your prices remain competitive within the market.

- Tracking Commission Costs: Keep a close eye on how much you’re paying in commission fees over time. This can help you assess whether the platform is a cost-effective channel for your property.

- Evaluating Other Costs: In addition to commission fees, be sure to consider other costs associated with using the platform, such as advertising fees or payment processing charges, which may also impact your profitability.

By understanding how commission fees are structured and their impact on your earnings, you can make more informed decisions about pricing, marketing, and managing your property on the platform.

How to Save and Send Invoices

Once a financial document has been generated for a booking, it’s important to save it securely and send it to the guest in a timely manner. This not only helps keep your records organized but also ensures that your guest receives the confirmation they need for their payment or booking details. Whether you’re managing a few reservations or handling multiple transactions, having a streamlined process for saving and sending documents is essential for smooth business operations.

Here are the steps to save and send your financial documents:

- Saving Documents Securely: After generating the financial document, make sure to save it in a secure location. You can store it on your computer, a cloud storage service, or an accounting platform. Organizing documents by date or guest name will make it easier to retrieve them later if needed. It’s also a good idea to back up your files regularly to prevent loss of data.

- Choosing the Right Format: Save the document in a universally accepted format such as PDF or Excel. PDFs are preferred for their security and professional appearance, while Excel files offer more flexibility for tracking and analysis. Ensure that the document is named appropriately, including the guest name or booking reference, to avoid confusion.

- Sending the Document to the Guest: Once the document is saved, you can send it to the guest via email or through the booking platform. If sending via email, attach the document to the message and include a brief note confirming the details of the booking. If the platform offers direct messaging features, you can upload the document there as well.

- Follow-Up: After sending the document, ensure that the guest has received it and that there are no issues. If necessary, provide them with any additional information or clarifications about the charges or payment status. It’s also a good practice to keep a record of your communication with the guest for future reference.

By following these steps, you can ensure that your financial records are organized, professional, and easy to share with your guests, helping to maintain a smooth transaction process for both parties.

Booking.com Invoice Template for Hosts

For hosts managing accommodations, creating detailed and accurate financial documents is a vital part of running a successful business. These documents serve as official receipts for payments, showing the guest’s charges, taxes, and any additional fees. A clear and professional document not only helps in maintaining proper records but also builds trust with guests by providing transparency regarding the payment process.

What to Include in Your Financial Document

To ensure that your financial document is complete and accurate, make sure to include the following essential information:

- Guest Information: Always include the guest’s full name, booking dates, and contact details to clearly identify the reservation.

- Accommodation Details: Specify the room type, number of nights stayed, and any extra services or amenities used during the stay.

- Charges Breakdown: List the total price, including any base room rate, cleaning fees, taxes, and additional charges. This ensures that all costs are transparent.

- Payment Status: Clearly show whether the payment has been fully made, partially paid, or is still due. This helps in tracking any outstanding balances.

- Platform Fees: If applicable, include any service fees charged by the booking platform. This provides a clear picture of the financial structure of the reservation.

- Refunds or Adjustments: If there were any cancellations or adjustments, be sure to include those details to reflect the updated charges accurately.

How to Create a Professional Document

Creating a professional financial document for each booking is essential for maintaining organized records and providing a reliable service to your guests. Here’s how to do it:

- Choose a Clear Layout: Use a clean, easy-to-read layout with headings, bullet points, and tables to organize the information. A well-structured document looks more professional and is easier for guests to review.

- Use Consistent Branding: If you have a logo or specific branding, include it on the document to reinforce your business identity.

- Include Legal Details: Depending on your location, it may be necessary to include legal disclaimers, your business registration number, or other official details to comply with tax regulations.

- Make Use of Tools: Consider using software or online tools to generate these documents automatically, making the process faster and reducing the chance of errors.

By following these steps, hosts can create professional and accurate financial documents for each booking, ensuring that both guests and hosts are clear about the payment details and fostering trust throughout the booking process.

Incorporating Currency Conversions in Invoices

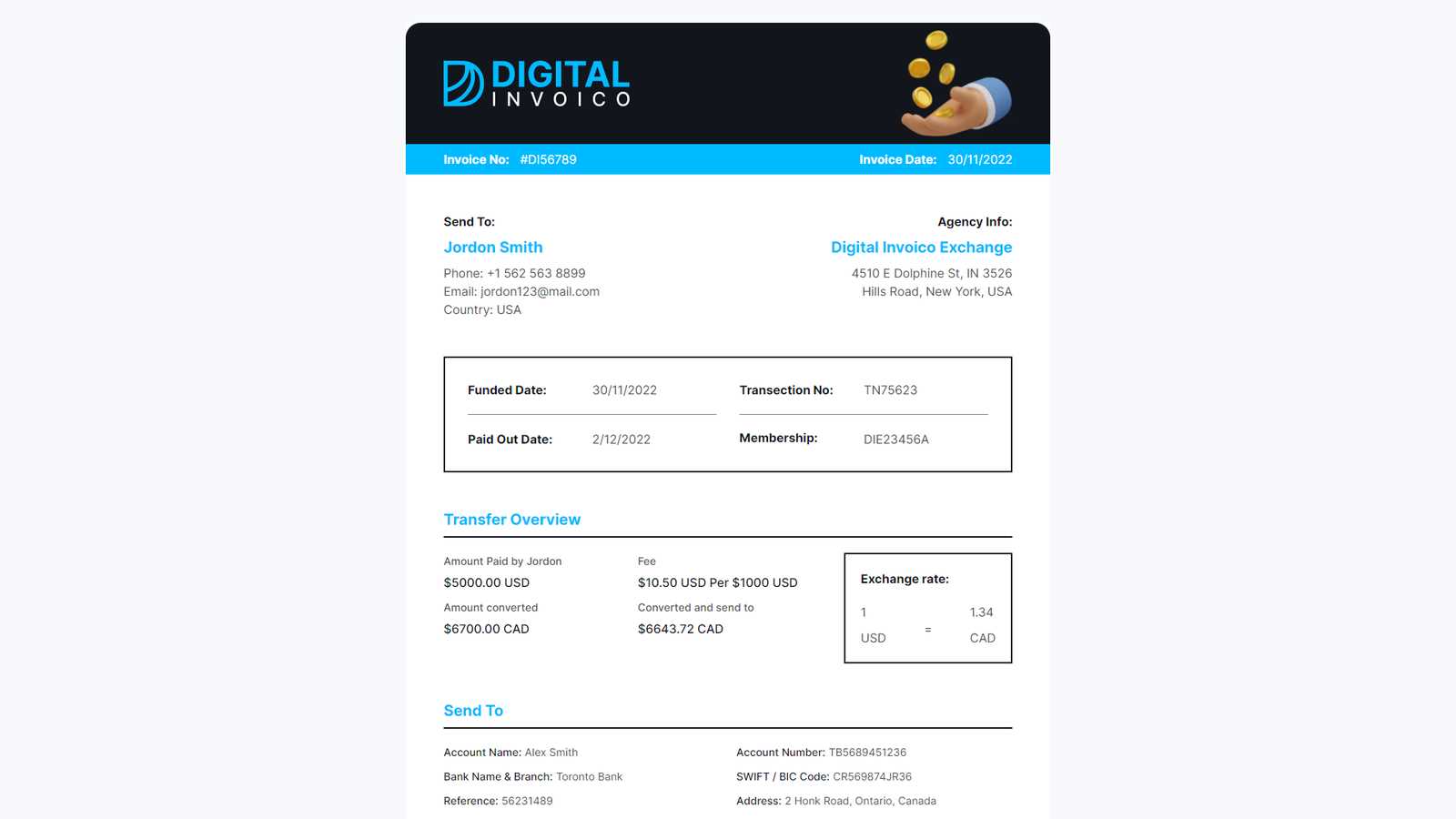

When dealing with international guests or clients, handling multiple currencies can become a complex task. To ensure transparency and ease of understanding for all parties involved, it’s essential to incorporate currency conversions accurately in financial documents. This ensures that both the host and guest are on the same page regarding the total cost of the booking, avoiding confusion or misunderstandings about payment amounts.

Why Currency Conversion Matters

Including currency conversion in your financial records is crucial for several reasons:

- Clear Communication: By displaying charges in the guest’s local currency, you make it easier for them to understand the cost of their stay. This helps avoid confusion when it comes to the final payment amount.

- Accurate Payments: When both the host and guest are using different currencies, the conversion helps ensure that the correct amount is paid. It ensures that the host receives the right amount and that the guest knows exactly how much they are being charged.

- Compliance with Local Regulations: In some countries, it may be required by law to display prices in the local currency or to include a currency conversion rate on all transactions.

How to Include Currency Conversion

To incorporate currency conversions accurately, you should follow these steps:

- Use Real-Time Exchange Rates: Always use up-to-date exchange rates when converting the price of a booking. Many online platforms or financial tools can provide real-time currency conversion data, ensuring accuracy.

- Display Both Currencies: It’s best practice to list both the original currency (such as USD) and the converted currency (such as EUR). This provides full transparency and ensures that the guest understands the total cost in their local currency.

- Specify the Conversion Date: Exchange rates fluctuate, so it’s important to specify the date when the conversion was made. This helps avoid disputes if the rate changes between the time the booking was made and the final payment.

- Include Conversion Fees: Some platforms or banks may charge conversion fees when processing payments in a different currency. Be sure to include any extra charges if applicable, so the guest is fully informed of the final amount they need to pay.

By properly incorporating currency conversions into your financial records, you create a more seamless experience for both you and your international guests. Accurate currency handling helps avoid disputes and ensures clear, effective communication regarding payment expectations.

Legal Requirements for Financial Documents

When generating financial records for transactions, it’s important to comply with the legal requirements of the country or region where the business operates. These legal guidelines ensure that all financial documents meet tax regulations and are recognized by government authorities. Whether you’re a small host or managing a larger property, understanding and adhering to these requirements is crucial for maintaining lawful business practices and avoiding potential penalties.

Key Legal Aspects to Consider

To ensure that your financial documents meet the legal standards, here are some key elements that should be included:

- Business Identification: Most jurisdictions require businesses to include their legal business name, registration number, and sometimes tax identification number on all official documents. This helps identify your business to both guests and authorities.

- Correct Currency and Amounts: Ensure that the amounts shown on the document are accurate and reflect the actual transaction. Some countries also require the use of local currency, so always verify the correct currency is listed when generating records.

- Tax Information: Depending on the location, you may be required to display tax rates or VAT (Value Added Tax) charges. It’s essential to clearly show any applicable taxes, as failing to do so could result in non-compliance with local laws.

- Transaction Dates: Most legal frameworks require the inclusion of the booking date, payment date, and the document creation date. These help provide clarity and establish a clear timeline of the transaction.

- Itemized Breakdown: It is essential to provide a detailed breakdown of all charges, including accommodation rates, extra services, fees, and taxes. This ensures transparency and helps prevent any future disputes with the guest.

Ensuring Compliance with Local Regulations

To ensure full compliance, consider the following steps:

- Review Local Laws: Laws governing business transactions and tax regulations vary from country to country. Make sure to consult with a local accountant or legal advisor to ensure that your financial documents meet the legal requirements of your region.

- Update Documents Regularly: Laws change, and so should your financial documentation practices. Stay informed about changes in tax rates, documentation standards, or any other regulations that might affect your transactions.

- Use Official Platforms or Software: Many businesses opt to use accounting software or official platforms for generating financial documents. These tools are often designed to comply with local legal standards, reducing the risk of errors or omissions.

By following these legal guidelines, you can ensure that your financial documents are accurate, professional, and compliant with local laws, helping you avoid potential legal issues while maintaining transparency with your guests.

Managing Multiple Invoices with One Template

For hosts and property managers dealing with multiple bookings, handling numerous financial documents can quickly become a complex and time-consuming task. Instead of creating separate documents for each booking, using a single, customizable document allows for a more efficient and organized way to manage multiple transactions. This approach streamlines your workflow and makes it easier to keep track of various payments, taxes, and services associated with different guests.

Benefits of Using One Document for Multiple Transactions

Here are some key reasons why managing several bookings with a single document is beneficial:

- Efficiency: Instead of generating a new document for each booking, you can input all necessary details into one file, saving time and reducing administrative effort.

- Organization: With all transactions listed in one place, you can better track payments, refunds, and any outstanding amounts, which helps maintain organized financial records.

- Easy Updates: A single template makes it simple to update information across multiple records at once, such as adjusting rates, taxes, or service charges, without needing to modify each document individually.

- Consistent Formatting: Using one document ensures that all your financial records have a consistent format, making them easier to read and review, both for you and your guests.

How to Structure Your Document for Multiple Entries

To effectively manage multiple bookings within a single document, structure it in a way that each entry is clearly separated and easy to understand. Here’s a simple example of how you can organize the information:

| Guest Name | Booking Date | Accommodation Charges | Additional Fees | Total Amount |

|---|---|---|---|---|

| John Doe | 2024-11-01 | $100 | $20 | $120 |

| Jane Smith | 2024-11-02 | $80 | $15 | $95 |

| Samuel Brown | 2024-11-05 | $120 | $30 | $150 |

By structuring your document in this way, you can easily track each booking’s details in one place. This format also allows for a quick overview of all transactions, which is especially useful for accounting or reporting purposes.

Additionally, by customizing the template with formulas in Excel or another spreadsheet tool, you can automatically calculate totals, apply taxes, or include additional services without having to manually update every entry. This incr