Bonsai Invoice Template for Effortless Billing and Customization

Managing payments and keeping track of financial transactions is a crucial aspect of running any business. Whether you’re a freelancer or a small business owner, having a streamlined system for generating and managing bills can save valuable time and improve cash flow. The right tools allow you to focus on your work while ensuring that your clients are billed correctly and promptly.

By utilizing specialized billing documents, you can create professional-looking statements that reflect your business standards. These tools are designed to simplify the process, offering easy customization, automatic calculations, and clear formatting. With the right setup, you can ensure a smooth invoicing process that meets both your needs and your clients’ expectations.

In this guide, we’ll explore a user-friendly solution that makes creating, sending, and managing financial documents easier than ever. Whether you’re new to using billing software or looking to optimize your current method, you’ll find valuable insights and tips for making the most of this system.

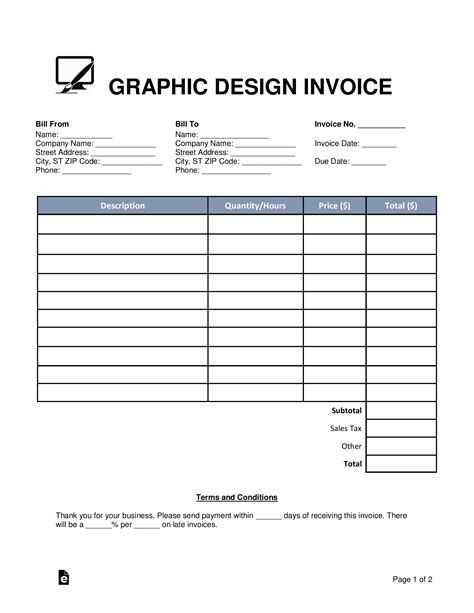

Billing Document Overview

Effective financial management begins with clear and professional documents for requesting payment. These documents not only help to formalize transactions but also ensure that both parties are on the same page regarding the terms of the agreement. A well-designed solution for creating and managing these records can significantly enhance efficiency, reduce errors, and improve the overall client experience.

The tool discussed here offers a simple yet powerful way to generate these essential records. It is designed with freelancers, contractors, and small business owners in mind, allowing them to easily customize, track, and send accurate requests for payment. With a variety of pre-set fields and automatic calculations, it makes the billing process faster and more reliable.

By utilizing this method, users can streamline their workflow, save time on administrative tasks, and focus more on their core work. Whether you’re looking to add taxes, discounts, or set recurring payment schedules, this solution offers a flexible approach to meet your unique needs.

Why Choose This Billing Solution

When it comes to managing your business’s financial records, efficiency and professionalism are key. Choosing the right tool to create and send payment requests can make a significant difference in how smoothly your operations run. A flexible and user-friendly system allows you to focus on your work while ensuring that your clients receive accurate and timely statements. Here’s why this solution is a top choice for freelancers and small business owners alike:

- Time-saving automation: Automatically calculates totals, taxes, and discounts, eliminating manual errors and saving you valuable time.

- Customization options: Tailor the document to match your brand with editable fields, personalized logos, and color schemes, ensuring a professional look every time.

- Streamlined workflow: Easily track payments, set up recurring billing, and send reminders without extra effort, keeping you organized and on top of your finances.

- Legal compliance: The system ensures that all required fields are included, helping you stay compliant with legal requirements in your region.

- User-friendly design: The simple interface allows anyone, regardless of technical skill, to create and manage professional payment requests.

These features work together to create a seamless and efficient experience, allowing you to focus on your business without worrying about the complexities of financial documentation.

How to Customize Your Billing Document

Personalizing your payment request is essential to reflect your brand identity and make a lasting impression on your clients. Customization allows you to adjust various elements, from visual design to functional details, ensuring the document suits your business needs and style. The following steps will guide you through the process of creating a professional and unique request for payment.

Step 1: Set Up Your Branding

- Add your logo: Upload your logo to make your request more recognizable and consistent with your brand image.

- Choose your color scheme: Customize the colors to match your company’s branding, creating a cohesive and professional look.

- Font selection: Pick fonts that align with your business tone, whether formal or casual, ensuring readability and style.

Step 2: Customize the Content

- Client details: Input client name, address, and contact information to ensure accuracy in each transaction.

- Item descriptions: Include clear and concise descriptions of the products or services provided to avoid any confusion.

- Payment terms: Set payment deadlines, late fees, and any other important terms relevant to your agreement.

By adjusting these elements, you can create a document that not only reflects your brand but also meets your business’s specific requirements. With a few simple customizations, you’ll be able to send professional, consistent, and personalized payment requests every time.

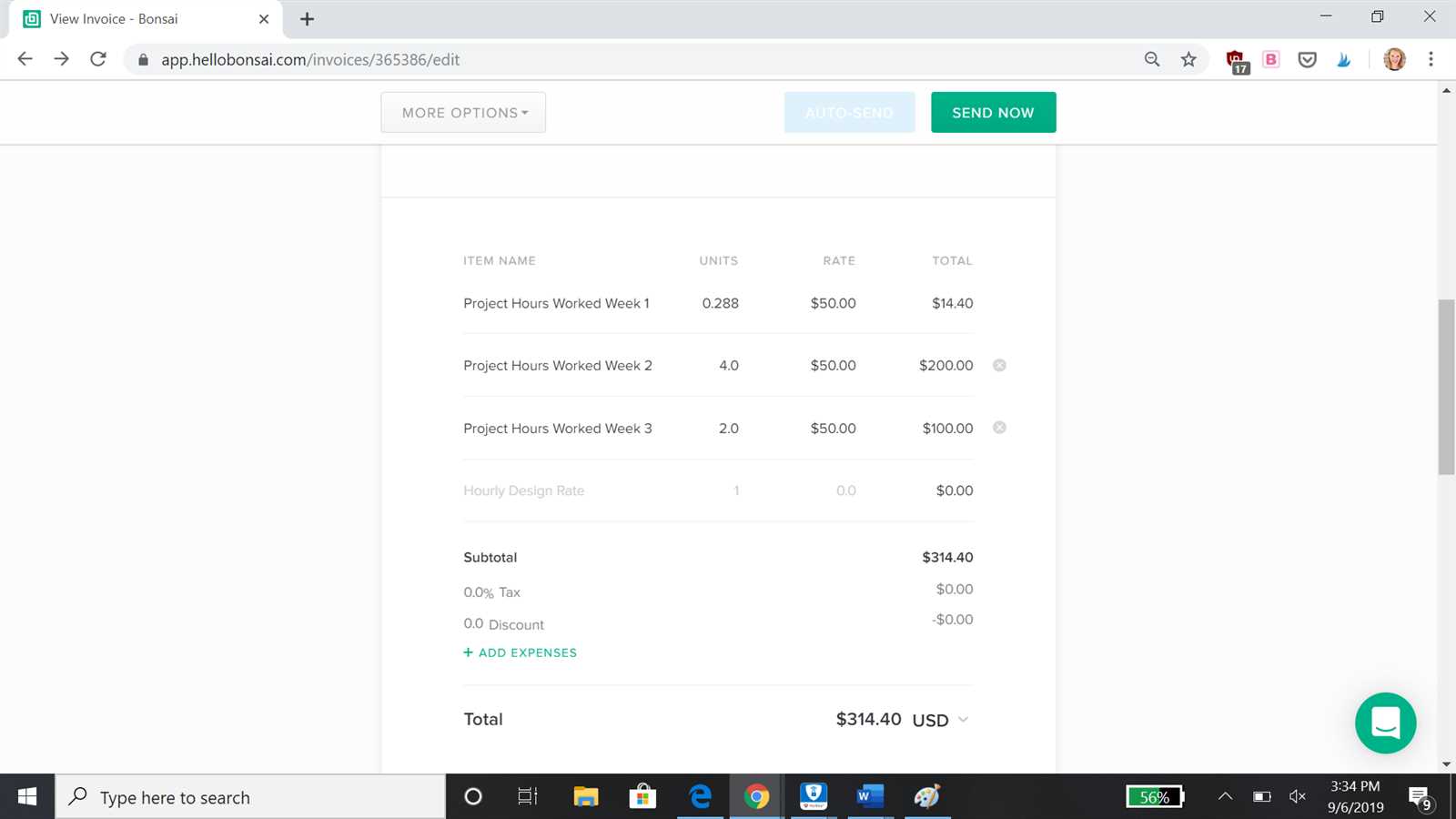

Step-by-Step Guide to Using Your Billing Tool

Creating and sending professional payment requests doesn’t have to be a complicated task. With the right tool, you can streamline the entire process, from setting up your documents to tracking payments. This step-by-step guide will walk you through the essentials, helping you get the most out of the platform and ensuring that your financial records are accurate and well-organized.

Follow these simple instructions to get started and make the most of the available features:

- Step 1: Create an Account

– Begin by signing up for an account on the platform. Enter your basic business information and set up your profile.

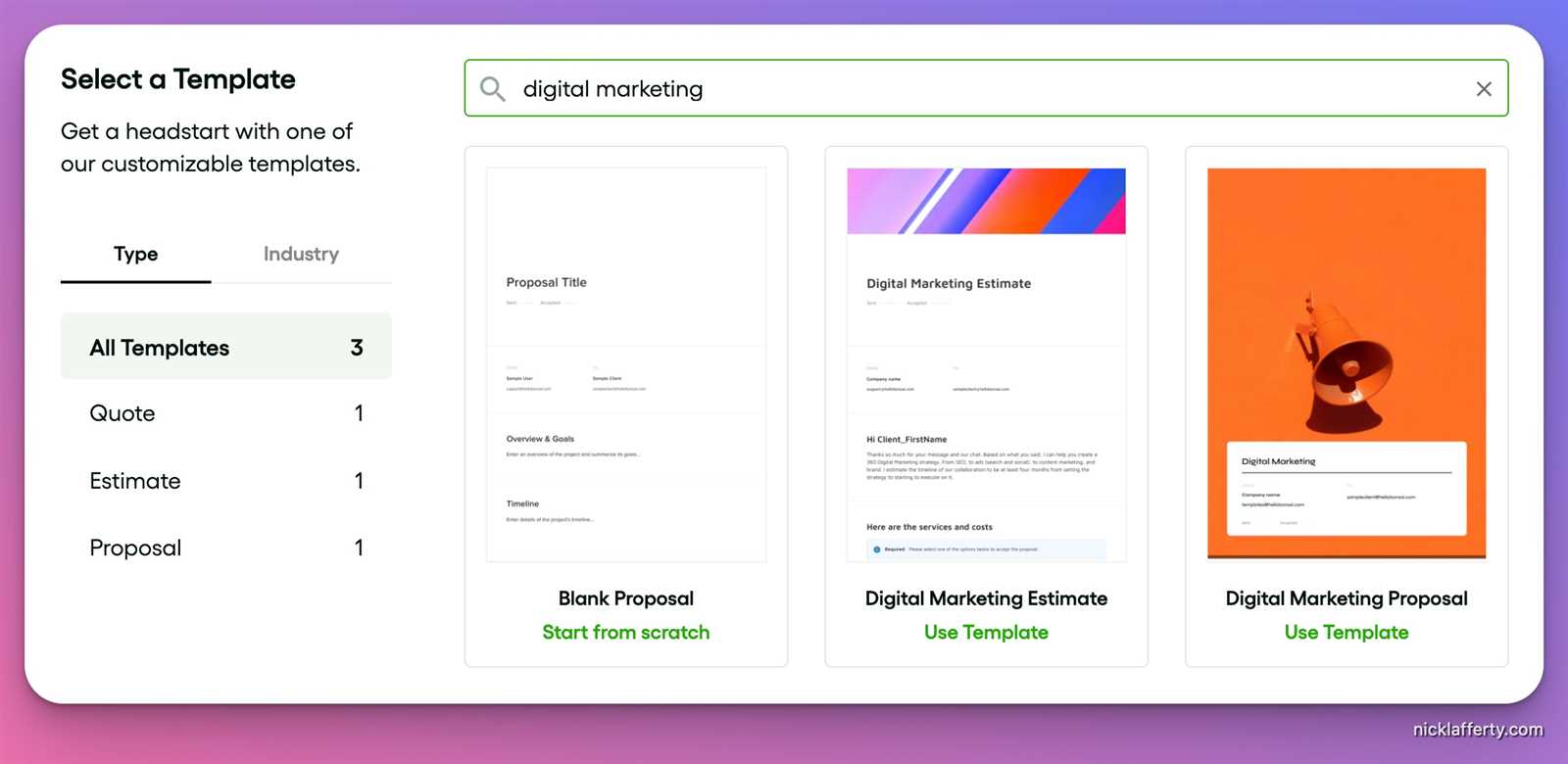

- Step 2: Select Your Document Type

– Choose the type of document you need to create, whether it’s a one-time payment request, a recurring charge, or a detailed estimate.

- Step 3: Enter Client and Service Details

– Fill in the necessary information, such as the client’s name, contact details, and a description of the services or products provided. Ensure all fields are accurate to avoid any mistakes.

- Step 4: Customize the Layout

– Adjust the design of your document to suit your branding by adding logos, changing colors, and selecting preferred fonts.

- Step 5: Set Payment Terms

– Define the payment schedule, including due dates, late fees, or discounts, depending on the terms of your agreement.

- Step 6: Review and Send

– Before finalizing, double-check all details for accuracy. Once you’re confident everything is correct, send the request to your client via email or download it for later use.

Benefits of Using This Tool for Billing

Managing financial transactions effectively is crucial for any business, and having the right tool can make the process much easier and more efficient. By using an all-in-one solution for generating payment requests, you can automate key aspects of the billing process, reduce errors, and maintain a professional appearance in every transaction. Below are some of the key advantages of adopting this platform for your billing needs:

Streamlined Workflow

- Time-saving automation: Automates calculations, including totals, taxes, and discounts, saving you time on manual entry and reducing the risk of mistakes.

- Easy-to-use interface: User-friendly design ensures that you can create and manage documents without any technical expertise.

- Recurring billing: Set up automated recurring charges for clients, ensuring you don’t have to manually generate requests each month.

Professional and Customizable Documents

- Custom branding: Personalize documents with your logo, business name, and brand colors, providing a consistent and professional appearance for every payment request.

- Accurate and detailed records: Provide clear itemized lists, payment terms, and due dates, ensuring transparency and clarity for your clients.

- Client-friendly format: Documents are well-organized and easy for clients to read, improving communication and minimizing confusion.

Using this tool not only simplifies the entire payment process but also he

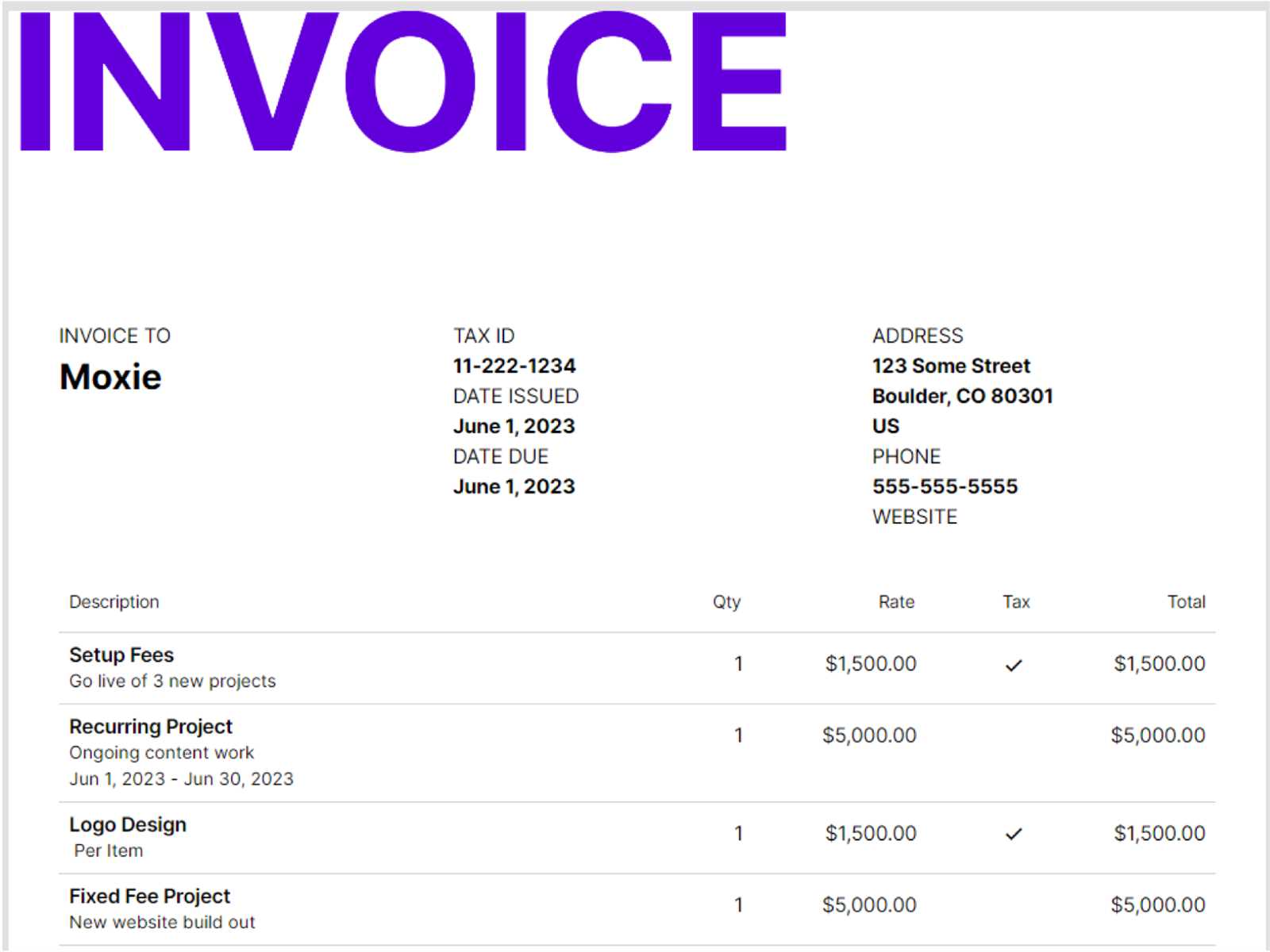

Creating Professional Payment Requests

Presenting clear, well-organized, and professional payment requests is key to maintaining trust and professionalism in any business relationship. Using the right tools to generate these documents allows you to deliver a polished, consistent appearance every time, making a positive impression on your clients. With the right setup, you can easily create comprehensive and visually appealing records that reflect your brand’s professionalism.

Follow these simple steps to craft a clear and professional request for payment:

- Accurate client information: Ensure that the recipient’s name, address, and contact details are correctly listed.

- Clear breakdown of services: List each service or product provided, along with its corresponding price, so the client can easily understand what they are being charged for.

- Professional design: Use a clean layout, easy-to-read fonts, and a color scheme that aligns with your branding, ensuring the document is both functional and visually appealing.

Here’s an example of a well-organized payment document structure:

Item Description Quantity Unit Price Total Consulting Service 5 hours $50 $250 Design Work 3 hours $75 Time-Saving Features of the Billing Tool

Managing financial records and sending payment requests can be time-consuming, but the right tool can help you significantly speed up the process. With automated features and streamlined processes, you can eliminate repetitive tasks and focus on what really matters–growing your business. Below are some of the time-saving functionalities that make this tool a powerful asset for anyone handling financial transactions.

- Automated Calculations: No more manual calculations for totals, taxes, and discounts. The system automatically computes everything based on the information you provide, ensuring accuracy and saving you valuable time.

- Pre-set Templates: Use ready-made, customizable formats to quickly generate professional documents without starting from scratch. Just input the details, and the document is ready to send.

- Recurring Payments: Set up recurring billing for clients with just a few clicks. Once configured, the system automatically generates and sends the payment request at regular intervals, reducing your workload significantly.

- Client Management: Store all client information in one place. When creating a new payment request, you can quickly pull up the details for any existing client, eliminating the need to re-enter information.

- Payment Tracking: The tool automatically tracks payments and notifies you when an amount has been paid or is overdue, helping you stay on top of your finances without needing to manually monitor every transaction.

These time-saving features help simplify the billing process and reduce the administrative burden, allowing you to focus more on your core business activities while maintaining a professional and organized approach to financial management.

Integrating Your Billing System with Your Workflow

Efficiency in business processes is crucial for managing time and resources effectively. One of the most powerful ways to streamline operations is by integrating your payment request system directly into your existing workflow. This integration allows for seamless data transfer, automated tasks, and a more cohesive experience across all your business tools, saving you time and reducing manual work.

Here are a few ways to integrate the billing tool into your daily operations:

- Connect with Your CRM: Sync client information directly from your customer relationship management (CRM) system to avoid manual data entry and ensure accuracy across all platforms.

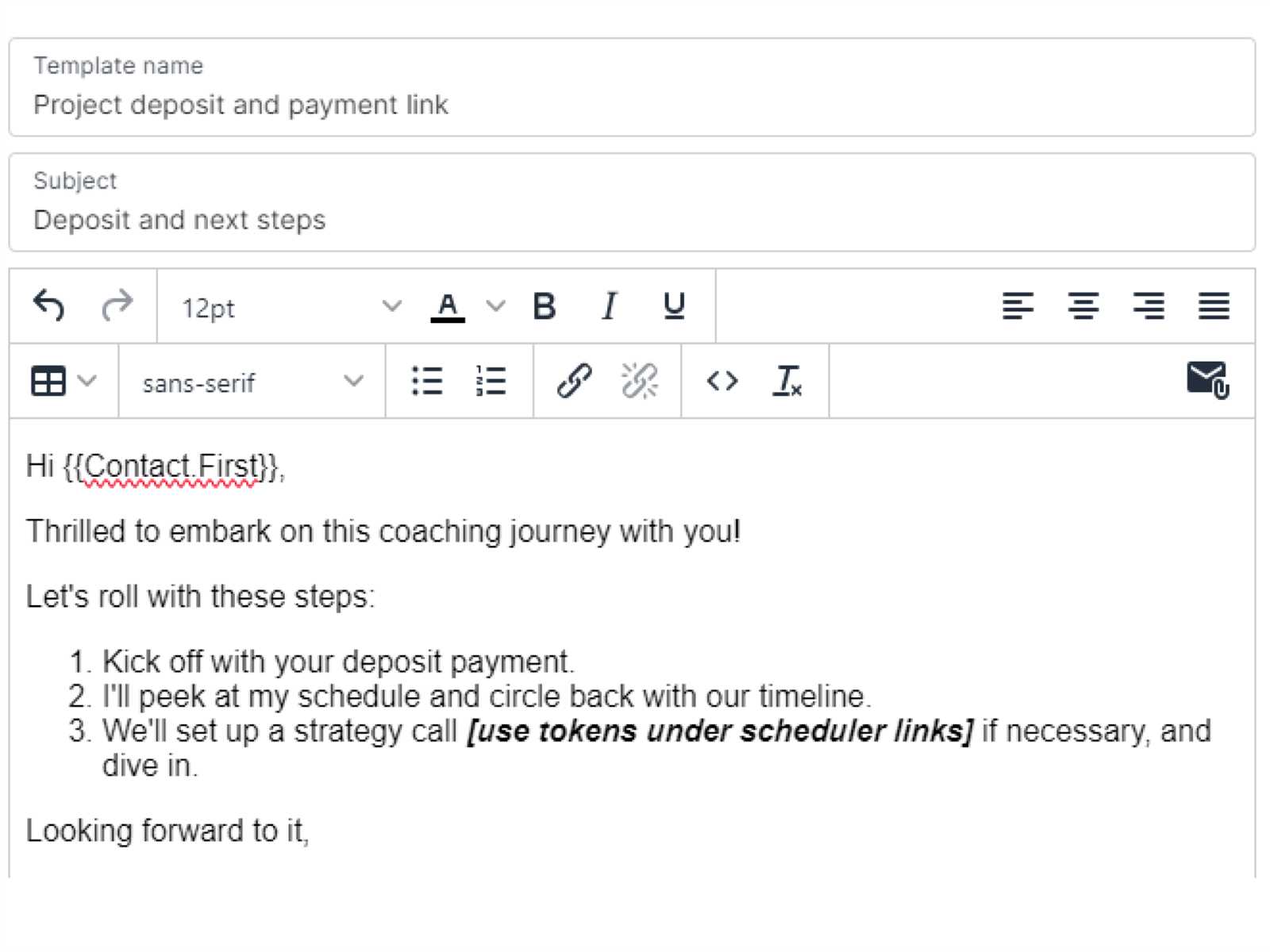

- Automate Payment Reminders: Set up automated notifications that remind clients of upcoming payments or overdue balances, so you don’t have to manually follow up.

- Link to Accounting Software: Integrate with accounting platforms to automatically record transactions, saving time on bookkeeping and reducing errors in financial reporting.

- Recurring Payment Setup: For clients with regular billing cycles, automate the creation and sending of repeated payment requests, reducing the need to manually create new documents each time.

- Track Payment Status: Automatically sync with your payment processor to track when payments are made or overdue, allowing you to easily monitor your cash flow.

By integrating your payment management tool with other systems, you can create a more cohesive, efficient workflow. This minimizes the need for manual entry and ensures that you have accurate, up-to-date financial records without adding extra work to your plate.

How This Tool Streamlines Payments

Efficient payment management is key to maintaining a steady cash flow and healthy business relationships. By automating and simplifying the process of generating and sending requests for payment, this tool eliminates unnecessary steps and ensures that payments are processed quickly and accurately. Here’s how it helps streamline your payment process:

- Automatic Payment Reminders: The system can automatically send reminders to clients about upcoming or overdue payments, ensuring you don’t have to manually follow up and reducing the risk of late payments.

- Quick Payment Tracking: As soon as a client makes a payment, it’s automatically recorded, allowing you to easily track outstanding balances and monitor cash flow.

- Multiple Payment Methods: Clients can pay through various methods, including credit cards, bank transfers, or payment platforms, making it convenient for them and ensuring faster processing.

- Clear Payment Terms: Each request clearly states the payment terms, due dates, and any late fees, reducing confusion and promoting timely payments.

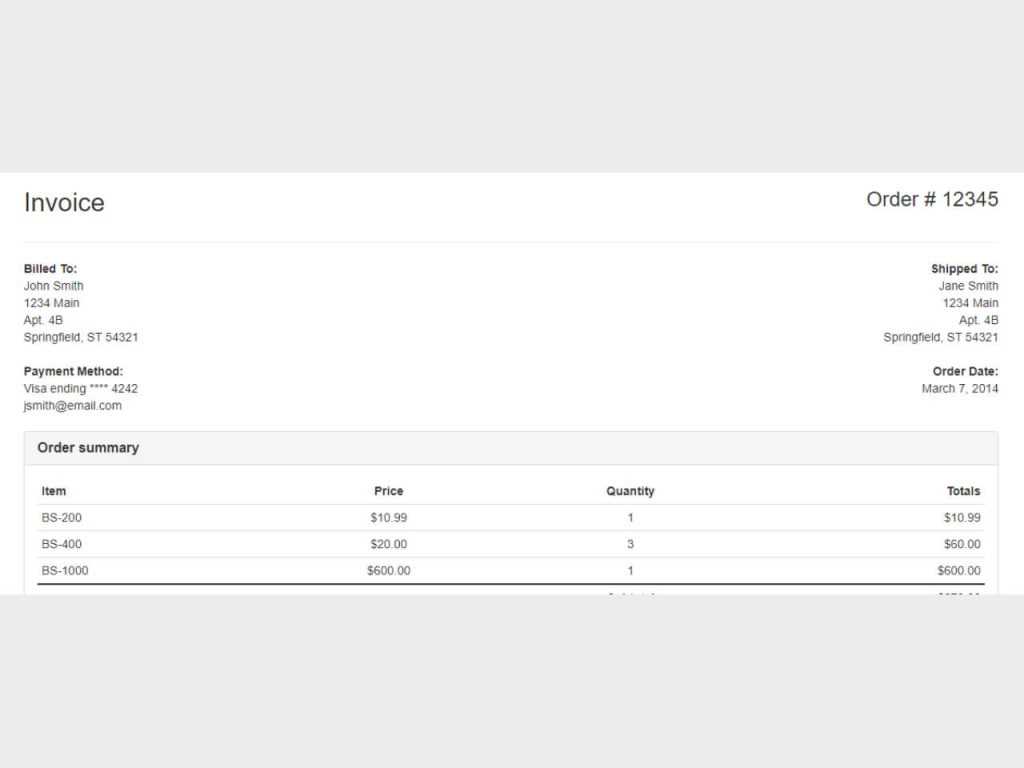

Here’s how payment details appear on the document:

Service Amount Payment Method Status Consulting $500 Credit Card Paid Design Services $350 Bank Transfer Pending Setting Up Taxes in Your Billing Document

Properly accounting for taxes in payment requests is essential for maintaining compliance and ensuring that your clients are charged accurately. By setting up taxes within your financial document system, you can automate tax calculations, saving time and reducing the chances of errors. Here’s how to set up taxes efficiently and ensure that they are applied correctly to every transaction.

- Choose Your Tax Rate: First, determine the appropriate tax rate based on your location or the client’s location. This may vary depending on the country or state in which your business operates or where your client is based.

- Apply Tax to Specific Items: You can set taxes to apply to certain products or services, or to the entire total. This ensures that you’re only charging tax on applicable items.

- Automatic Tax Calculation: Once you input the tax rate, the system will automatically calculate the tax amount for each transaction. This feature helps prevent errors and saves you from manually adding tax to each line item.

- Set Up Multiple Tax Rates: If your business operates in multiple regions or offers services that are taxed at different rates, you can configure multiple tax rates for easy switching between them.

- Display Tax Information Clearly: Make sure the tax breakdown is clearly displayed on the document, so your client can easily see the total amount of tax being charged and understand the cost breakdown.

By properly setting

Tracking Expenses with Your Billing System

Keeping track of business expenses is crucial for managing cash flow and maintaining accurate financial records. With the right tool, you can efficiently monitor and categorize expenses, ensuring that they are properly recorded and accounted for. By using an automated system to track your spending, you reduce the risk of errors and save valuable time that would otherwise be spent on manual calculations and data entry.

Here’s how you can easily track your expenses with an automated system:

- Record Every Expense: Add each expense as it occurs, including details such as the date, amount, category, and a brief description of the purchase or service. This ensures that no expense is forgotten and helps you stay organized.

- Categorize Expenses: Categorizing your expenses (e.g., office supplies, marketing, travel) helps you get a clearer picture of where your money is going and can be useful for tax reporting.

- Monitor Monthly and Yearly Totals: With automated tracking, you can easily monitor your monthly and yearly totals, allowing you to spot trends and manage your budget more effectively.

- Generate Reports: Generate detailed expense reports to assess your spending over time. These reports can help you identify areas for cost-cutting or where you may be overspending.

Here’s an example of how your expenses can be presented in a clear, organized manner:

Date Category How to Add Discounts on Your Payment Requests Offering discounts is a great way to incentivize clients to pay early or reward them for long-term business relationships. By incorporating discounts directly into your payment requests, you can ensure that the terms are clear and the process is transparent. This feature not only improves client satisfaction but also helps you maintain organized and accurate financial records.

Here’s how you can easily add discounts to your payment documents:

- Set Discount Criteria: Decide whether the discount applies to specific items, the entire total, or under certain conditions, such as early payment or bulk orders.

- Apply Discount Percentage or Amount: You can choose to apply a fixed discount amount or a percentage-based discount to the total or individual line items. This allows you to be flexible in how you offer savings.

- Automatic Calculations: Once you input the discount details, the system automatically adjusts the total, so you don’t have to manually calculate the discounted price. This reduces the chance of errors.

- Clear Discount Breakdown: Display the discount clearly on the payment document, showing both the original amount, the discount applied, and the new total. This transparency helps build trust with your clients.

For example, if a client receives a 10% discount on a service, here’s how it would appear on the payment document:

Item Description Generating Recurring Payment Requests

For businesses that offer subscription-based services or have clients with regular billing cycles, generating recurring payment requests is an essential tool for saving time and ensuring consistent cash flow. By automating the creation and sending of these requests, you can reduce manual work and avoid the risk of missing payments. This feature allows you to set up payment schedules in advance, so the system automatically generates and sends the required documents on a predefined basis.

Here’s how you can set up recurring payment requests for your business:

- Define Billing Frequency: Choose how often the payment request should be generated, whether it’s weekly, monthly, quarterly, or annually. This helps you establish a consistent payment schedule with your clients.

- Set Start and End Dates: You can define the start date for the recurring payments and, if necessary, set an end date after a certain number of cycles or based on contract terms.

- Automatic Creation and Delivery: Once set, the system automatically generates the payment request on the selected date and sends it to the client without any manual intervention. This saves time and ensures timely billing.

- Update Amounts or Services as Needed: If there are changes to the payment amount or the services provided, you can easily update the details, and the system will apply those changes to the next cycle’s request.

- Track Payment Status: Automatically track whether the recurring payments have bee

Managing Multiple Clients with Your Billing System

When you’re juggling multiple clients, keeping track of their specific needs, payment schedules, and preferences can become a daunting task. However, with an efficient billing and client management system, you can streamline the process and ensure that each client receives personalized attention without adding extra administrative work. By organizing client data, automating tasks, and maintaining clear records, you can provide a seamless experience for both you and your clients.

Here are several ways to manage multiple clients effectively with an automated system:

- Client Profiles: Create individualized profiles for each client where you can store their contact information, payment history, and service details. This ensures that all relevant information is easily accessible when needed.

- Automate Billing Cycles: Set up recurring billing schedules for each client based on their unique payment terms. Whether they pay weekly, monthly, or per project, the system will handle the creation and delivery of payment requests automatically.

- Custom Payment Terms: Tailor payment terms for each client, including payment due dates, late fees, and discounts. This allows you to accommodate different client needs and business agreements without confusion.

- Track Outstanding Payments: The system automatically tracks which clients have paid and which are overdue. This helps you keep on top of your cash flow and ensures that no payments slip through the cracks.

- Generate Reports for Each Client: Generate detailed reports to analyze the financial status for each client, including t

Common Mistakes to Avoid in Your Billing System

When managing payment requests and financial records, it’s easy to make mistakes that can lead to confusion or delays in payments. These errors can not only disrupt your cash flow but also damage relationships with clients. Understanding the most common pitfalls and taking steps to avoid them will ensure that your financial processes run smoothly and professionally.

1. Inaccurate Billing Details

- Incorrect Client Information: Double-check client details such as contact information, billing address, and service descriptions. Missing or incorrect details can delay payments or cause misunderstandings.

- Wrong Payment Terms: Ensure that payment terms are clearly defined and accurate. Using the wrong due dates, payment methods, or discount offers can lead to confusion and delays.

- Omitting Taxes: Not including taxes or incorrectly calculating them can cause issues with compliance and client trust. Always verify the correct tax rates and include them where necessary.

2. Failing to Track Payment Status

- Overlooking Unpaid Bills: It’s crucial to track which payments are overdue. Failing to follow up on unpaid amounts can result in cash flow issues and missed opportunities for follow-up actions.

- Not Sending Reminders: If payments are due or overdue, timely reminders can help encourage clients to pay on time. Skipping this step may result in delayed payments.

- Neglecting Client Preferences: Some clients may have specific payment preferences, such as specific payment methods or schedules. Ignoring these preferences could cause unnecessary delays in payment or dissatisfaction.

3. Lack of Consistency

- Inconsistent Document F

Optimizing Your Billing Process

Streamlining your billing process is essential for ensuring smooth financial operations, reducing administrative workload, and improving client satisfaction. By automating key tasks, keeping track of payment schedules, and ensuring accuracy, you can save time and avoid common billing errors. Optimizing your approach can help you maintain a professional image and ensure timely payments, allowing you to focus on growing your business.

Here are several strategies to optimize your billing process:

- Automate Recurring Payments: Set up recurring billing cycles for clients who subscribe to ongoing services. This minimizes the need for manual entry and ensures that clients are billed consistently on schedule.

- Customize Payment Requests: Tailor each payment request to fit the specific needs of each client. By personalizing the terms and details, you create a more transparent and professional experience for your clients.

- Use Pre-Designed Layouts: Leverage well-structured formats to create clean and organized payment documents. This ensures clarity and makes it easier for your clients to understand their charges and payment terms.

- Set Payment Reminders: Send automated reminders to clients before payment is due. Timely reminders help encourage prompt payments and reduce the number of overdue accounts.

- Track Payment Status: Stay on top of which payments have been made and which are still outstanding. This helps you manage cash flow and avoid surprises, ensuring that you can follow up on overdue payments in a timely manner.

- Integrate With Accounting Software: Connect your payment system with your accounting software to seamlessly track and reconcile your finances. This integration reduces the need for manual entry and ensures accurate financial reporting.

By implementing these strategies, you can significantly enhance the efficiency of your billing workflow, reduce the risk of errors, and improve your overall business operations.