Boat Repair Invoice Template for Easy Billing and Record Keeping

When providing services to clients in the maritime industry, having a clear and organized document for billing is essential. A well-structured financial record ensures that both parties are on the same page regarding the cost of work completed. By using a professional document, you can easily outline all relevant details, ensuring transparency and reducing misunderstandings.

Accurate documentation of work done not only helps with payment collection but also assists in keeping a record for future reference. Whether for minor fixes or larger overhauls, it’s important to have a reliable way to communicate charges, parts used, and labor costs. Such a document is not just a tool for the current transaction but also a means of building trust and fostering long-term client relationships.

Organizing your billing process with the right format can save time, enhance clarity, and make payments more seamless. In this section, we’ll explore how to create an efficient and professional document that works best for your specific needs. With the right approach, the process becomes straightforward and much easier to manage over time.

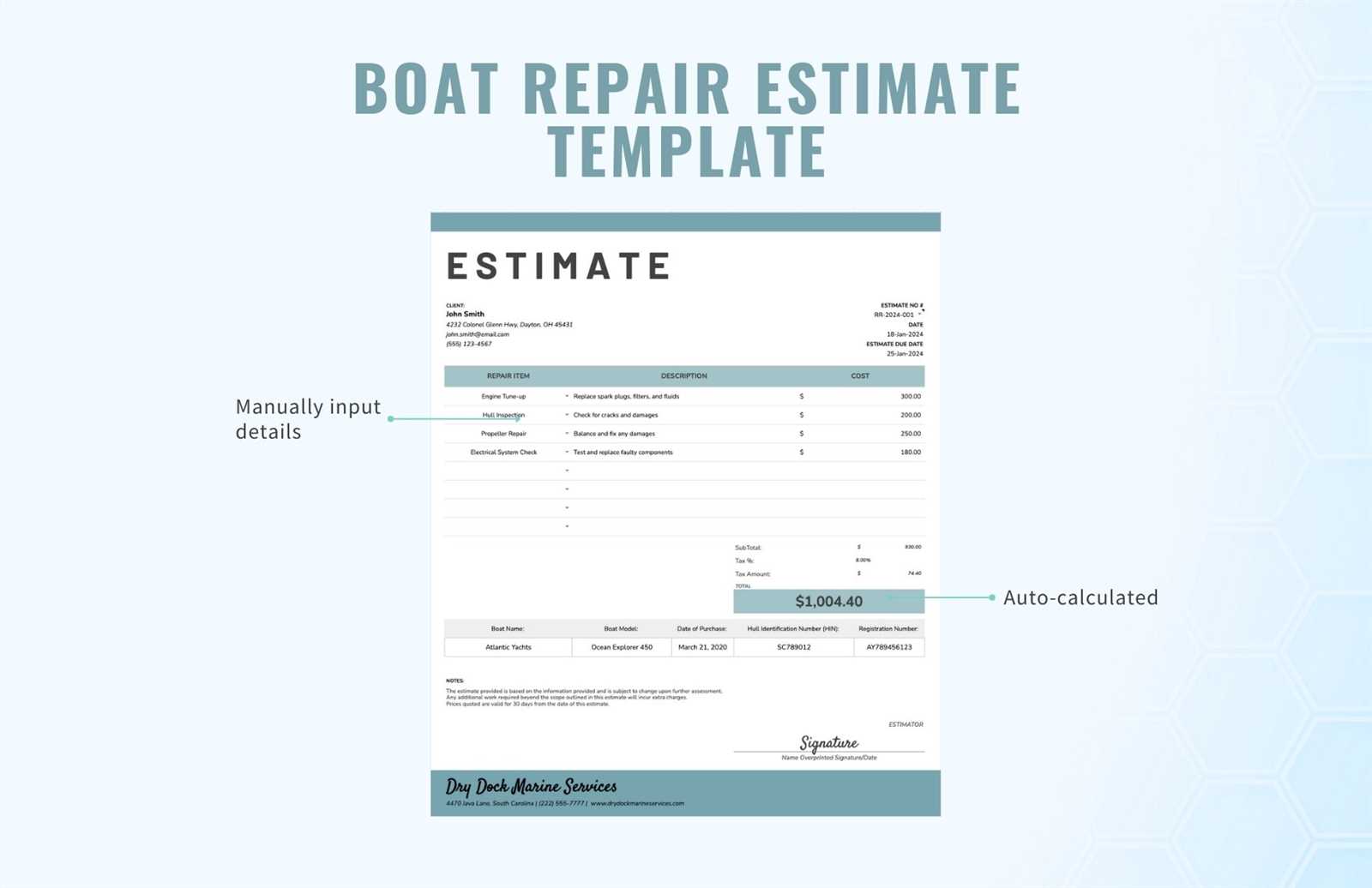

Boat Repair Invoice Template Overview

For any business offering marine services, a well-organized billing document is essential for smooth transactions. This document serves as a clear record of work completed, costs incurred, and payment expectations, helping both service providers and customers stay aligned. Whether the job involves parts replacement, maintenance, or extensive servicing, having a comprehensive financial statement is key to efficient operations.

Creating a professional billing document is not just about listing costs. It involves presenting all relevant details, such as labor hours, materials used, and agreed-upon rates, in an easy-to-understand format. This ensures that clients are fully aware of what they are being charged for and can review the work done with full transparency.

The primary goal of such a document is to make the payment process simple and straightforward. A well-constructed statement provides a clear breakdown of all costs, eliminates confusion, and establishes trust between service providers and their clients. Additionally, it serves as an important tool for record-keeping, allowing businesses to track past jobs, payments, and outstanding balances.

Why You Need an Invoice Template

In any service-based business, having a structured and consistent method for documenting charges is essential for smooth operations. Without a standardized approach, tracking transactions can become chaotic, leading to confusion, errors, and missed payments. A well-organized document allows you to clearly communicate all costs involved and ensures that both the service provider and the client are on the same page.

Using a pre-designed structure can help streamline the billing process. It saves time by reducing the need to create new documents from scratch for each job. Furthermore, it ensures consistency in how information is presented, which can enhance professionalism and prevent misunderstandings.

| Benefit | Description |

|---|---|

| Efficiency | Quickly generate accurate documents for each service provided. |

| Clarity | Ensure all costs and details are outlined in a straightforward format. |

| Consistency | Maintain uniformity in how charges and services are documented. |

| Professionalism | Present a polished and credible image to clients. |

| Record Keeping | Track past transactions and manage accounts efficiently. |

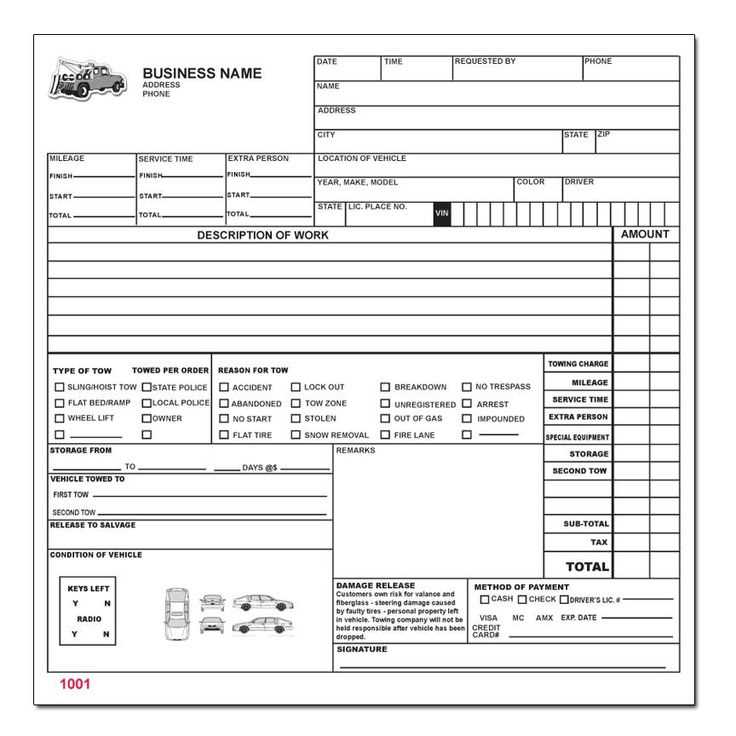

Key Features of a Boat Invoice

When creating a financial document for services rendered, certain elements are crucial to ensure clarity and professionalism. A well-structured record should provide all the necessary details to facilitate understanding and payment processing. These key components not only make the document easy to read but also help maintain accuracy and prevent disputes.

Essential Information

To make sure the document covers all the necessary points, it should include client and business details, such as names, contact information, and service dates. These data points ensure that both parties can easily reference the transaction and resolve any potential issues that may arise later. Additionally, the document must clearly list the cost breakdown for labor, parts, and any other charges associated with the service provided.

Professional Presentation

In addition to accuracy, professional formatting is a must. The layout should be clean and organized, ensuring that the customer can quickly understand the charges and terms. This not only fosters trust but also demonstrates a level of attention to detail and quality in your work. By maintaining a consistent and formal approach to financial documents, you help reinforce a strong and reliable brand image.

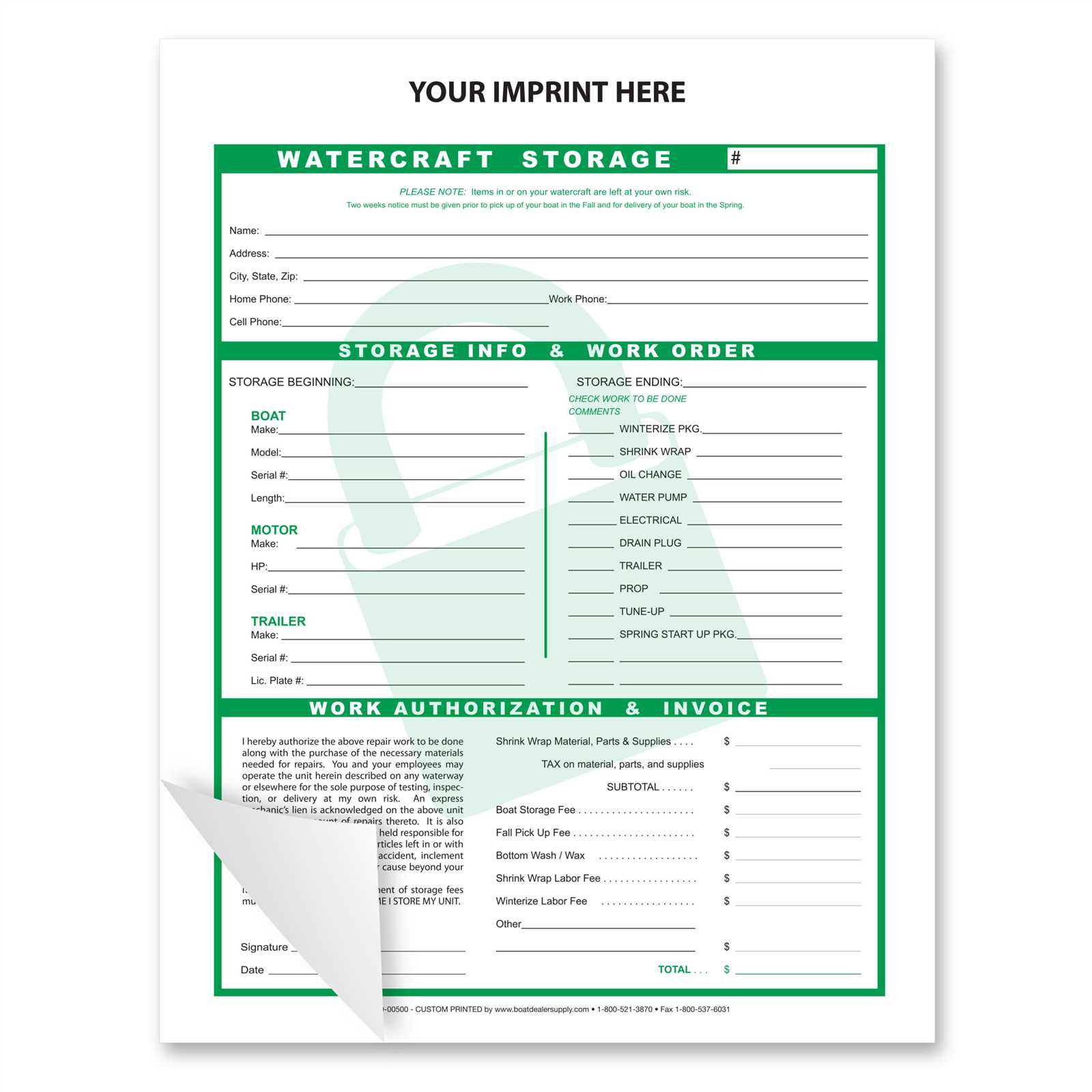

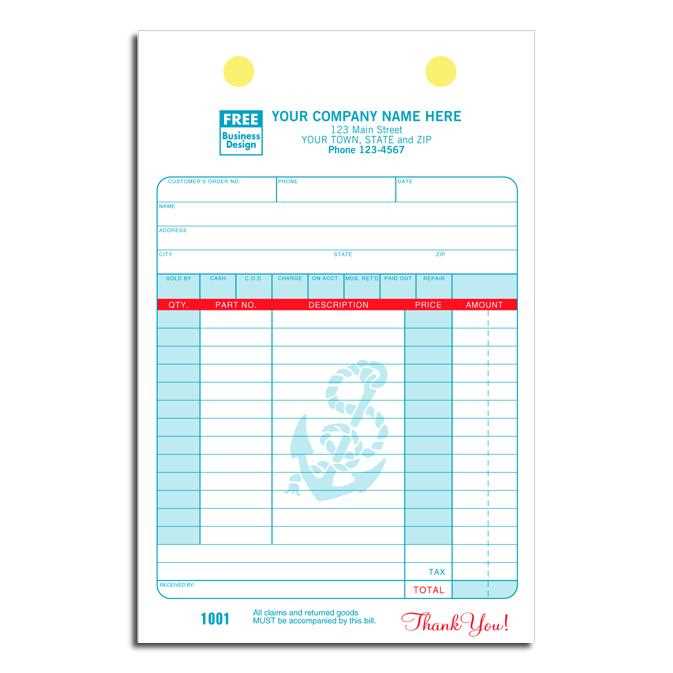

How to Customize the Template

Adapting a standard document to suit your specific needs is an essential step in streamlining the billing process. By customizing the format, you can ensure that all relevant information is clearly presented and tailored to your business requirements. Whether you’re adjusting the layout, adding specific fields, or incorporating unique branding elements, personalization can make the document more efficient and professional.

Adjusting the Layout

Start by adjusting the layout to suit your workflow. You can modify the section placement, font size, and overall structure to improve readability. This ensures that key details, such as service descriptions and pricing, stand out clearly. Be mindful of spacing and alignment to maintain a clean, organized appearance.

Incorporating Branding and Personal Details

Incorporating your business logo, colors, and contact information into the document is a great way to enhance its professionalism. Adding custom fields for any additional terms, like warranties or payment instructions, can further align the document with your service offerings. Personalizing the content ensures that the document reflects your brand while providing all necessary details for the customer.

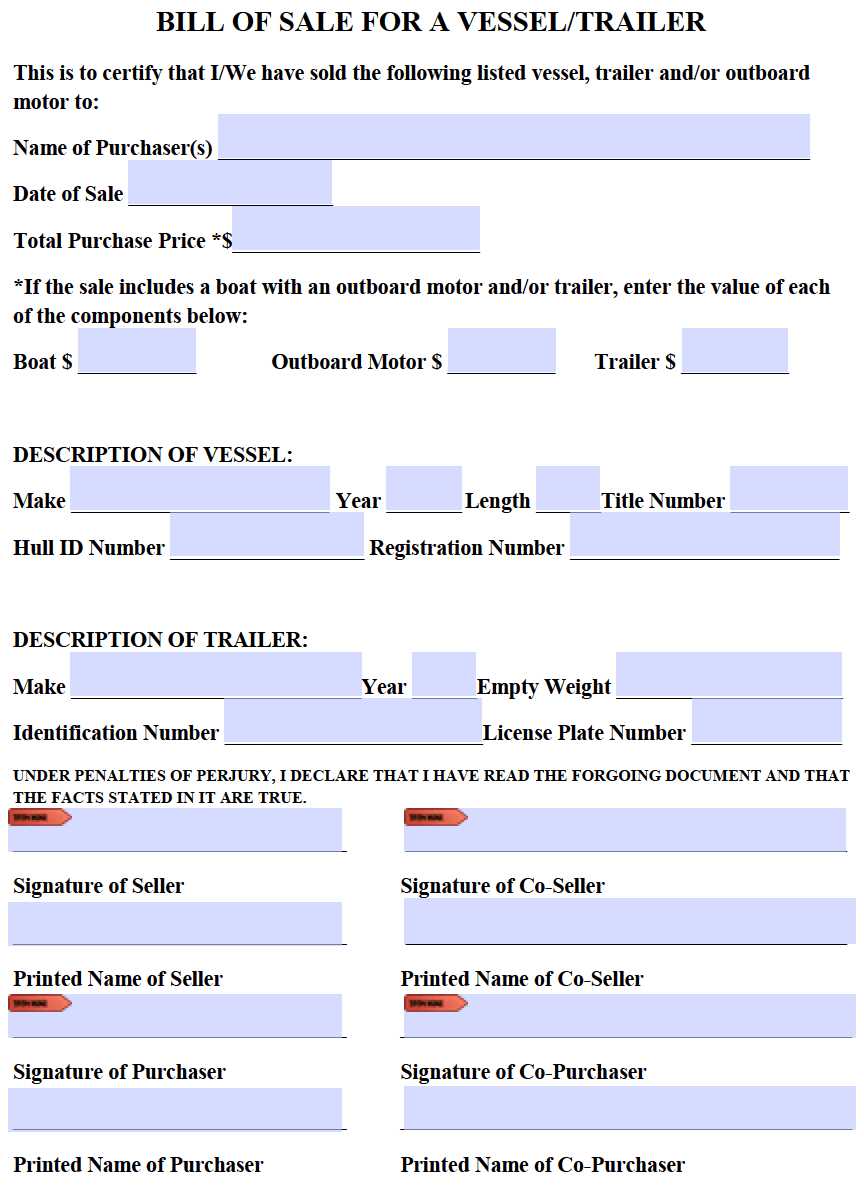

Step-by-Step Guide to Filling Out the Invoice

Completing a financial record correctly is crucial for maintaining accuracy and ensuring smooth transactions. By following a systematic approach, you can ensure that all necessary information is included and clearly communicated to the client. This step-by-step guide will walk you through the process of filling out your document, from start to finish, ensuring that nothing is overlooked.

Step 1: Enter Client Information

Begin by entering the client’s full name, address, and contact details. This ensures that both parties can easily reach each other in case of any questions or issues. Make sure the information is accurate to avoid any delays in processing payments.

Step 2: List the Services and Charges

Next, clearly describe the work performed, including the labor involved and the materials used. Break down the charges for each component, providing a detailed explanation to help the client understand what they are being charged for. Be specific and transparent about pricing to avoid confusion.

Step 3: Include Payment Terms

Finally, include the agreed-upon payment terms, such as the due date and accepted payment methods. Adding information about late fees or discounts for early payment can help manage expectations and encourage timely settlements.

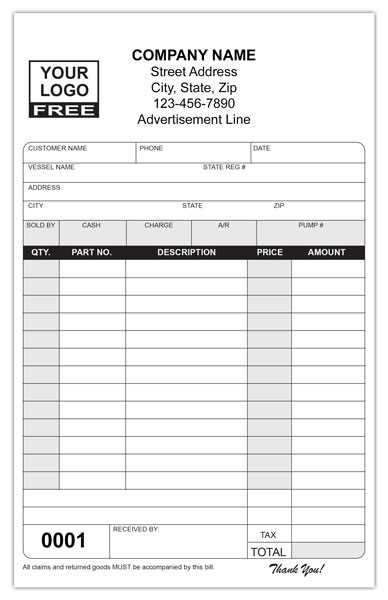

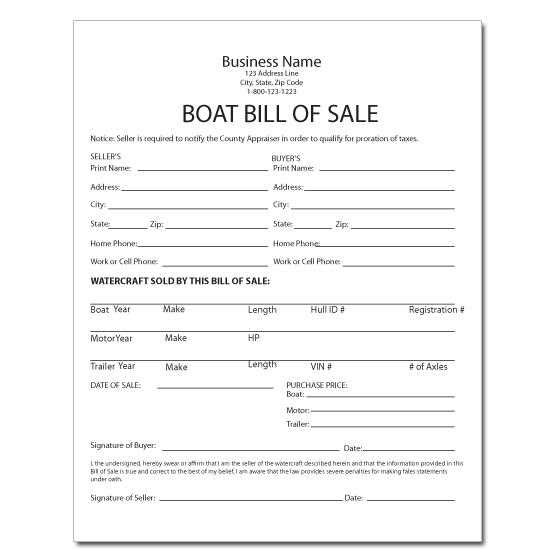

Essential Information to Include

For a financial document to be effective, it must include certain key details that ensure clarity and prevent misunderstandings. These pieces of information not only help with accurate billing but also serve to maintain transparency between the service provider and the client. Including all necessary data will help both parties stay on the same page and make the payment process seamless.

Client and business details are crucial to identify the parties involved. Always include the full name, address, and contact information for both the service provider and the customer. This ensures that the document can be easily referenced or corrected if needed.

Breakdown of services and costs is another essential element. Clearly list the work performed, including the time spent, materials used, and their individual costs. This transparency helps avoid confusion and builds trust with your client. Additionally, it’s important to include any applicable taxes, discounts, or additional charges that may apply to the final amount.

Finally, payment terms should be explicitly stated, including the due date, accepted payment methods, and any late fees. Setting clear expectations around payment will encourage timely settlements and protect both parties from disputes.

Formatting Tips for Professional Invoices

The appearance of a financial document plays a crucial role in how it is perceived by clients. A clean, organized layout not only ensures readability but also reflects the professionalism of your business. Proper formatting can help clients easily understand the details of the charges and streamline the payment process.

Clear and consistent organization is key. Use headings and sections to break down the document into easily digestible parts. Group similar information together, such as contact details, itemized services, and pricing, to create a logical flow. This helps clients quickly locate the information they need without confusion.

Typography and spacing should also be considered. Choose legible fonts and maintain appropriate spacing between sections to avoid a cluttered look. A well-spaced document with clearly defined text will make it easier for clients to read and ensure that all important details stand out.

Lastly, use professional colors and design elements to reinforce your brand identity. While it’s important to keep the document simple, incorporating subtle branding elements such as your company logo or brand colors can add a personal touch without compromising on clarity.

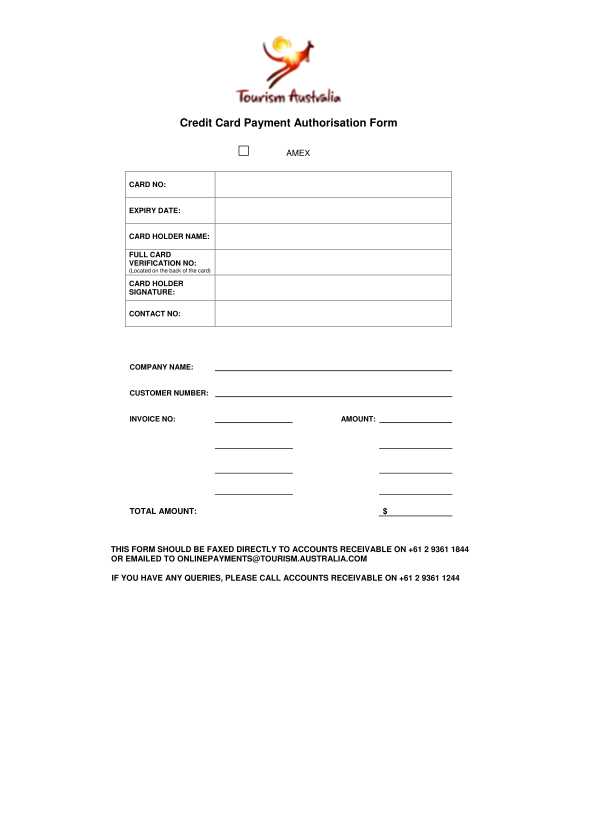

Understanding Payment Terms in Boat Repairs

Setting clear payment terms is essential to ensure that both the service provider and the client are aligned on expectations. Payment terms define how and when the client is required to settle their bill and can have a significant impact on cash flow and customer satisfaction. It’s important to be specific about deadlines, accepted payment methods, and any additional charges that may apply.

Here are some common payment terms to consider when drafting your financial document:

- Due Date: Specify when the payment is expected. Common options include “due upon receipt” or “net 30,” meaning payment is due within 30 days of the document issue date.

- Accepted Payment Methods: Clearly list all the ways the client can pay, such as credit cards, bank transfers, checks, or online payment systems.

- Late Fees: Include information about any penalties that will apply if the payment is not made by the due date. This could be a flat fee or a percentage of the total amount due.

- Deposits or Partial Payments: If you require a deposit before starting the work or an installment plan, make sure to specify the amount and timing of each payment.

Clear payment terms help prevent confusion and ensure that both parties are on the same page about the financial aspects of the service. It’s also a good practice to reinforce these terms in your communication before and after the work is completed.

How to Track Repair Costs Accurately

Accurately tracking the costs associated with services performed is crucial for both maintaining profitability and ensuring fair billing. By keeping detailed records of all expenses, including materials, labor, and overhead, you can provide precise pricing and avoid discrepancies with clients. Proper tracking also helps in managing budgets, forecasting future costs, and ensuring that no financial aspects are overlooked.

To track costs effectively, start by breaking down the expenses into clear categories, such as labor, parts, and miscellaneous charges. Keep detailed logs of hours worked, the cost of materials, and any additional charges incurred during the project. It’s also essential to keep receipts and invoices for all purchased items, which can be cross-referenced with your records to ensure accuracy.

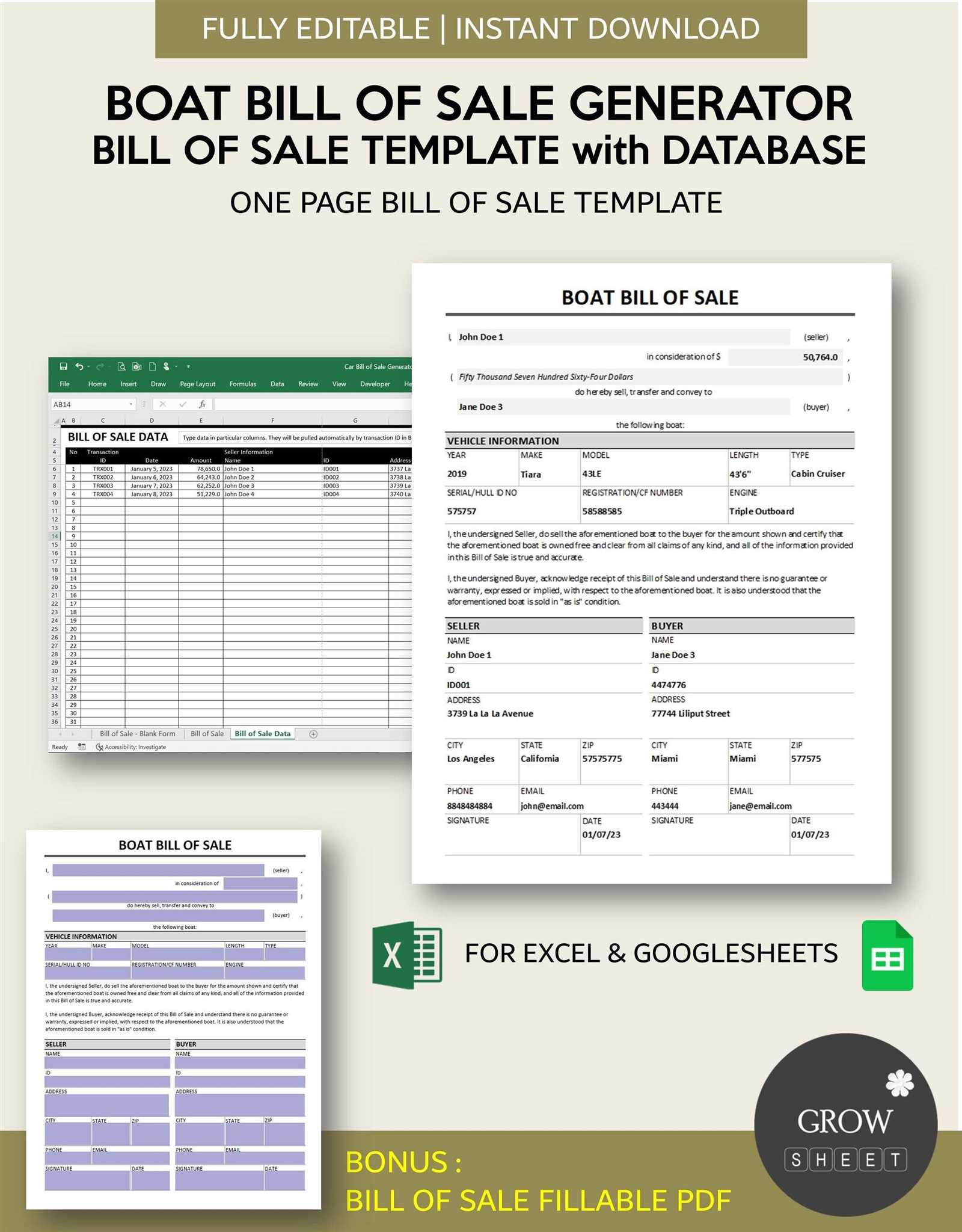

Using digital tools, such as accounting software or spreadsheets, can make tracking much easier. These tools allow you to categorize and update costs in real-time, providing you with up-to-date information on your financial standing. Regularly review and reconcile your records to ensure that all expenses are accounted for and that nothing is left out.

Common Mistakes to Avoid in Invoices

Creating accurate and clear financial documents is essential for smooth business transactions. However, several common mistakes can undermine the professionalism of your documents, potentially leading to misunderstandings, delayed payments, or disputes with clients. Avoiding these errors is key to maintaining transparency and ensuring timely payment.

Omitting essential details is one of the most frequent mistakes. Failing to include important information such as the client’s name, payment terms, or a detailed breakdown of charges can cause confusion and delay payment. Always ensure that all necessary details are clearly visible and easy to understand.

Not specifying due dates can lead to unnecessary delays in payments. If the due date is not clearly stated, clients may not know when payment is expected, resulting in late payments. It’s important to define a clear deadline and include it prominently on the document.

Incorrect pricing or calculations is another common issue. Simple errors in adding up charges or applying incorrect rates can result in discrepancies that confuse or frustrate the client. Always double-check your calculations before finalizing the document to ensure everything adds up correctly.

Failure to include payment methods can make it difficult for clients to settle their accounts. Be sure to specify all accepted payment options to give clients clear instructions on how to pay. Without this information, clients may delay payments or struggle to follow through.

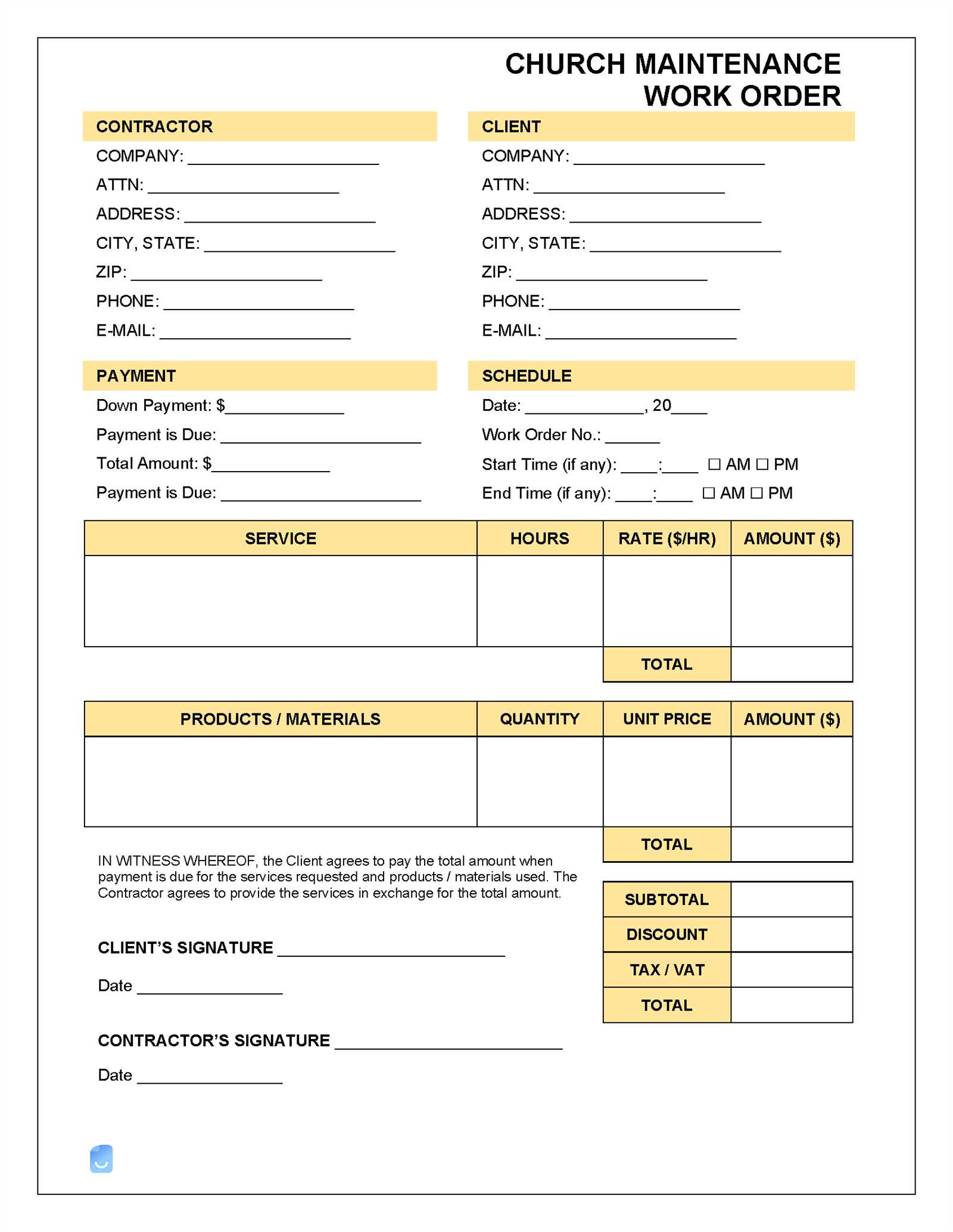

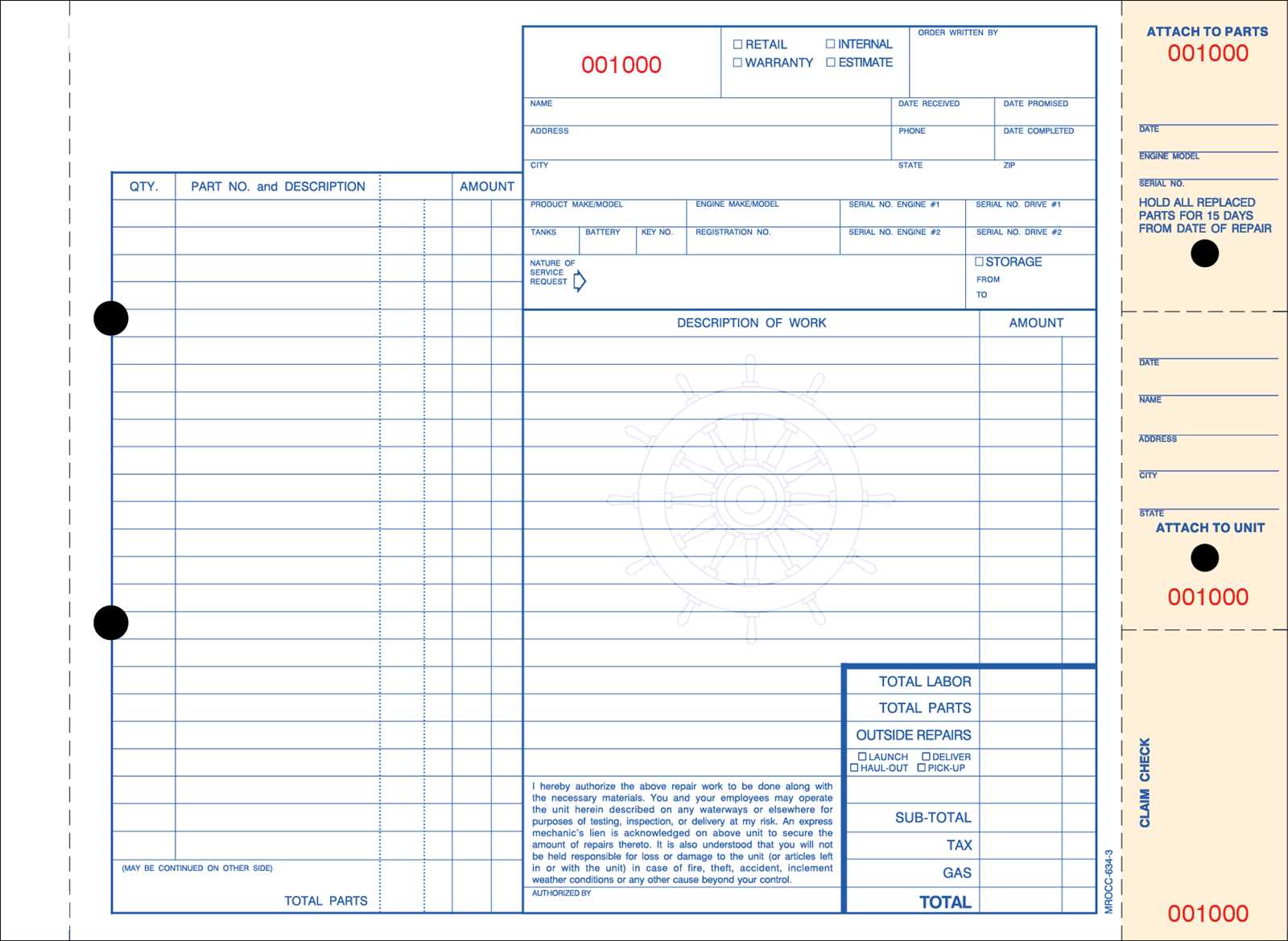

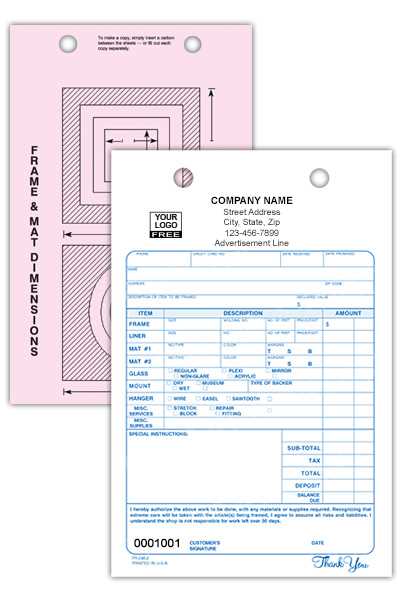

How to Handle Multiple Repair Services

When multiple tasks or services are performed on a single project, it’s important to document each aspect clearly to ensure transparency and accurate billing. By breaking down the overall work into distinct sections, clients can see the exact services provided and their associated costs. This not only helps avoid confusion but also builds trust with your customers.

Itemize each service separately to provide clarity. For each distinct task, list the work done, materials used, and the associated cost. This detailed breakdown makes it easy for clients to understand the scope of the work performed and ensures that nothing is overlooked or misunderstood.

Group similar tasks together when appropriate. If multiple services are related or part of a larger job, you can group them into categories. This will help streamline the document while still providing the necessary level of detail. For example, categorizing labor, materials, and miscellaneous charges separately will help keep the overall structure organized and professional.

Use clear descriptions for each task performed. A simple description of what was done will help clients understand the specific services provided. Avoid using technical jargon unless your client is familiar with it, and always ensure the descriptions are easy to read and comprehend.

Lastly, adjust pricing based on the complexity or time required for each service. For example, more complicated tasks may require higher rates, and this should be reflected in your breakdown. By being transparent and fair in your pricing, you can help clients feel confident in the value they’re receiving.

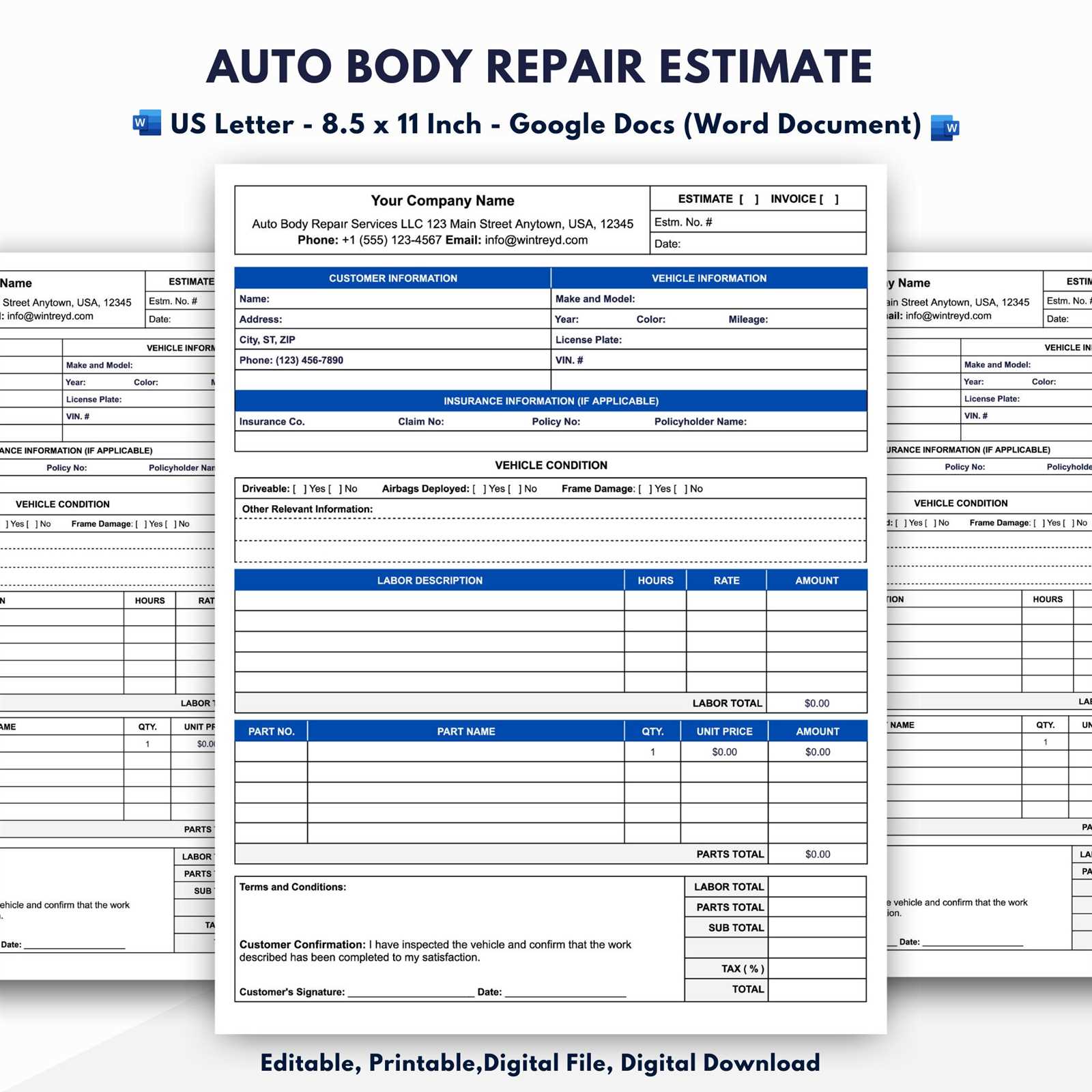

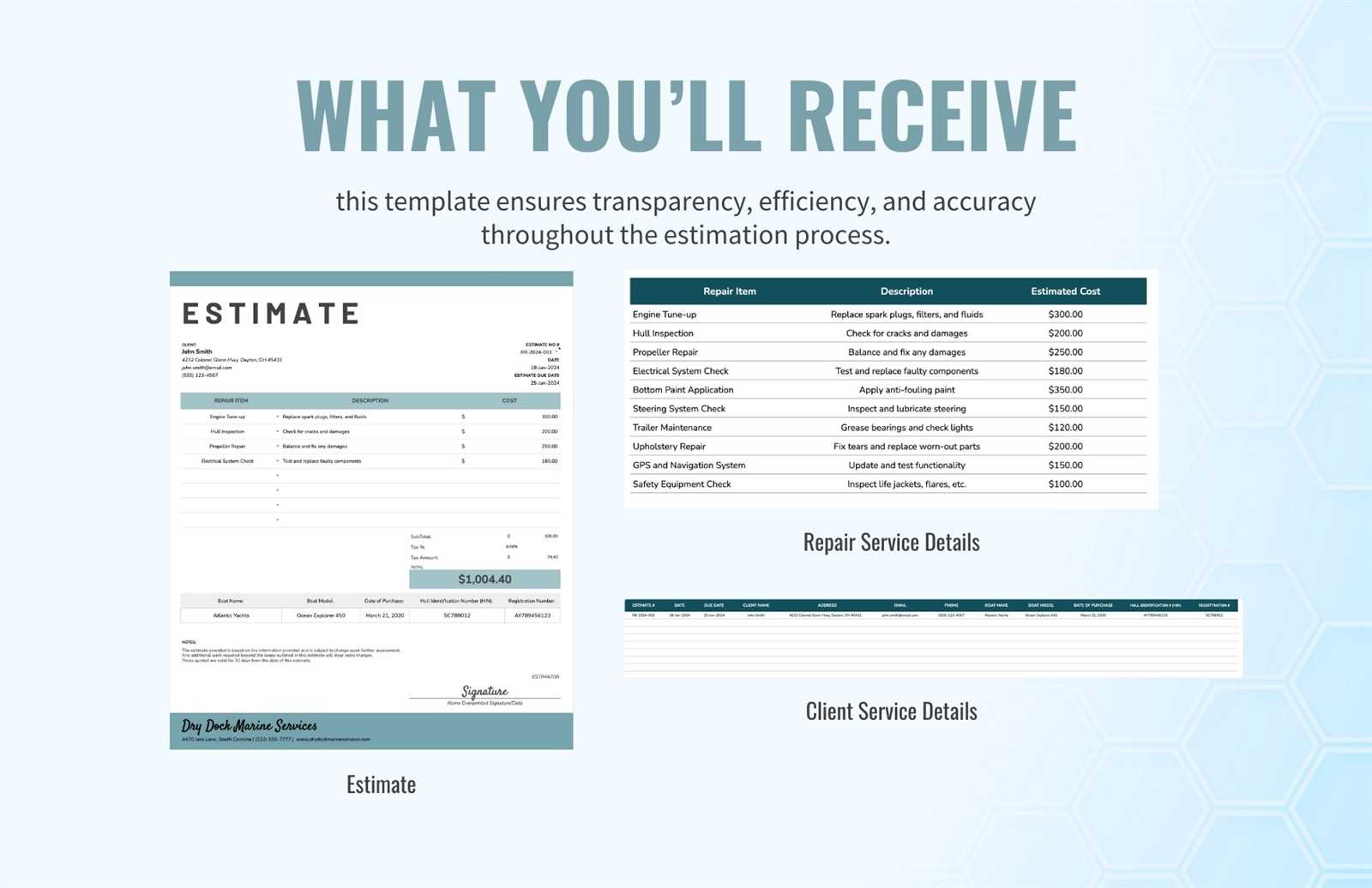

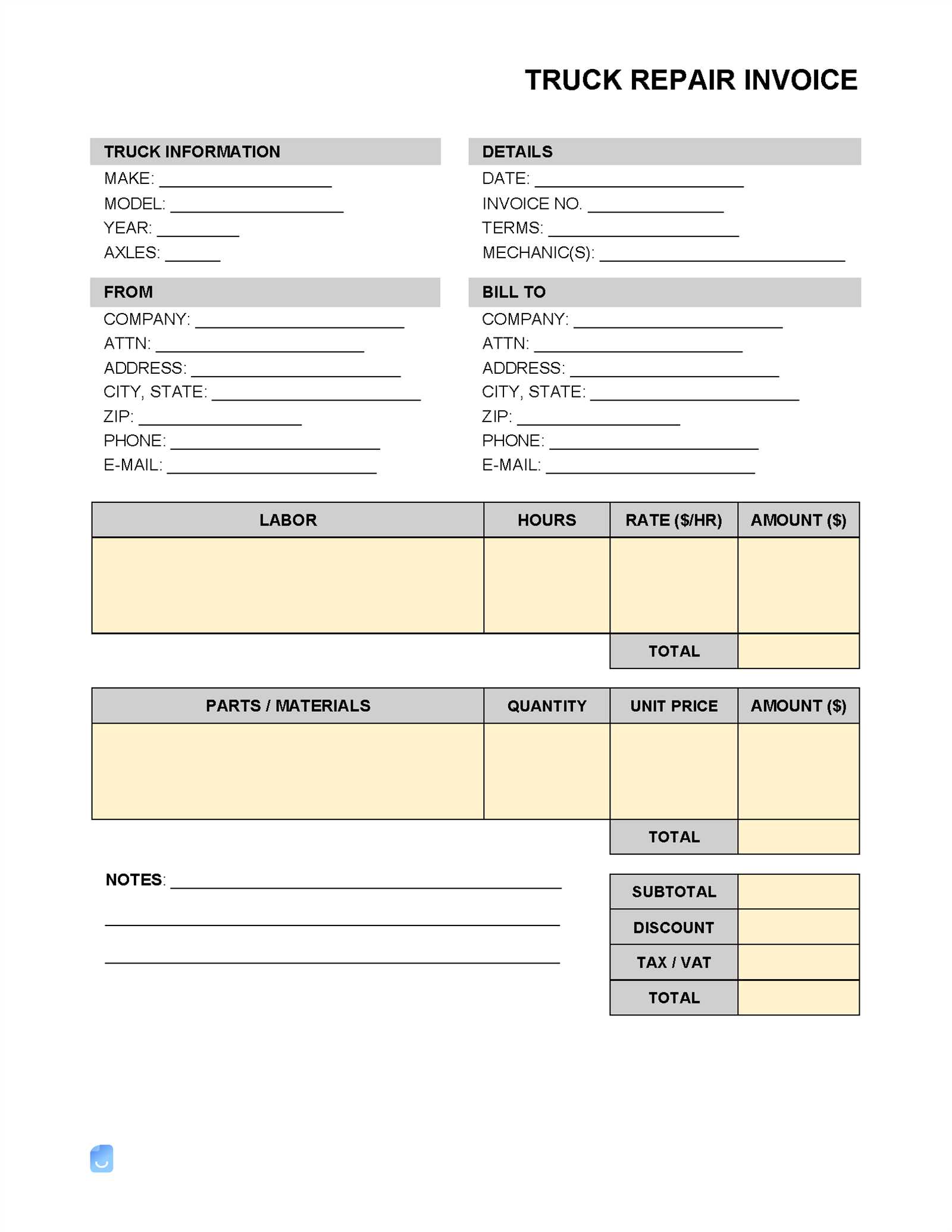

Creating Detailed Labor and Material Costs

When presenting the financial breakdown of services, providing clear and detailed information on both labor and material costs is essential. This ensures that clients understand exactly what they are being charged for and how each element of the service contributes to the overall cost. Clear documentation also helps avoid disputes and builds trust between service providers and clients.

Labor Costs

Labor costs should reflect the time and effort required to complete each task. It is crucial to provide a breakdown of how many hours were spent on each part of the service, along with the hourly rate charged for each worker involved. This transparency ensures clients can see the value of the work performed.

Material Costs

List each material or part used, along with the corresponding cost. Be specific about the type and quantity of materials to provide a clear understanding of their necessity for the project. You can also include any shipping or handling fees associated with materials, if applicable.

| Item | Description | Quantity | Unit Price | Total Cost |

|---|---|---|---|---|

| Labor | Hourly work on system inspection and maintenance | 10 hours | $50/hour | $500 |

| Part A | High-quality filter for engine system | 2 | $30 each | $60 |

| Part B | Replacement gasket for system seal | 1 | $15 | $15 |

By clearly outlining labor and material costs, you provide a thorough explanation of the financial aspects of the service. This breakdown not only ensures clarity but also helps clients feel more confident in the pricing and overall service provided.

Importance of Clear Invoice Descriptions

Providing precise and detailed descriptions in financial documents is crucial for ensuring transparency between service providers and clients. When clients can easily understand what each charge corresponds to, it minimizes confusion and helps maintain a professional relationship. Clear explanations not only help in avoiding misunderstandings but also establish trust and credibility.

Detailed descriptions allow clients to see exactly what they are being charged for, whether it’s for labor, materials, or any other services rendered. This transparency ensures that there are no hidden fees and that each service or item is accounted for accurately.

Clear language is key. Avoid using overly technical jargon or ambiguous terms that could be confusing to clients. Instead, use simple, straightforward language that conveys the necessary details without the need for further explanation. This makes it easier for clients to review the document and ensure everything is in order before making a payment.

Accurate descriptions also play a significant role in preventing disputes. When both parties have a clear understanding of the charges and the services provided, there is less room for disagreement or dissatisfaction. Additionally, it helps clients to track and reference specific tasks or materials when needed, making the payment process more efficient and less stressful for both parties.

How to Add Taxes and Discounts

Including taxes and discounts in financial documents is essential for providing a complete breakdown of the total amount due. Taxes are often a mandatory part of the cost structure, while discounts are a way to incentivize clients or provide value for repeat business. Properly calculating and clearly listing both can help avoid confusion and ensure that clients understand the final amount they owe.

To add taxes, first, calculate the applicable tax rate based on the location or service type. This amount should then be added to the total cost. Similarly, discounts should be calculated based on a percentage or fixed amount and subtracted from the total cost before the final amount is presented to the client.

| Item | Base Price | Tax Rate | Discount | Total After Tax and Discount |

|---|---|---|---|---|

| Service A | $500 | 8% | $50 | $470 |

| Material B | $100 | 8% | $10 | $88 |

| Service C | $200 | 8% | $0 | $216 |

By incorporating taxes and discounts into the pricing structure, you provide a clear understanding of how the final charges are calculated. Ensure that these adjustments are clearly marked, with both the tax and discount amounts visible, so that clients can easily see the impact on the total cost.

Invoice Template for Regular Customers

For long-term clients, it’s essential to provide a specialized financial document that reflects their continued business and loyalty. Such a document should account for previous transactions, offer personalized discounts, and ensure smooth, repeat billing without needing to re-enter basic information each time. Tailoring these documents helps maintain a strong relationship and reinforces trust.

For regular customers, including a unique identifier or reference number can simplify the tracking of their history with your business. Additionally, acknowledging their status with a discount or special pricing can further incentivize them to continue doing business with you. Personalizing the structure ensures that the client feels valued, while making the process more efficient for both parties.

Regular customers may also benefit from automated reminders for upcoming payments or discounts for early settlement. By incorporating these features, you help create an efficient, seamless experience for both the business and the customer, improving customer satisfaction and simplifying administrative work.

How to Digitize and Send Your Invoice

Converting your billing documents into a digital format allows for easier distribution, faster processing, and more efficient tracking. Whether you’re using software, a scanner, or a digital document editor, the process of digitizing your documents can streamline your business operations and reduce paper usage. Sending digital versions of your billing statements via email or through a client portal saves both time and resources while maintaining professionalism.

Steps to Digitize Your Billing Document

- Use a scanning app or scanner to convert paper documents into a digital format (PDF, JPEG, etc.).

- If you’re using software, create a document in the desired format and fill in the required information.

- Ensure the document is properly formatted and all necessary fields are included.

- Review for accuracy and make adjustments if necessary.

Sending Your Digitized Document

- Attach the finalized document to an email with a clear and concise subject line.

- If you’re using a client portal, upload the document and provide the client with access details.

- Consider setting up automated email reminders or follow-ups for outstanding balances.

Once the document is digitized and sent, ensure you track the status of the payment and follow up as needed. Digitizing your billing processes can significantly improve your workflow and customer satisfaction by offering faster and more convenient payment options.

Best Practices for Storing Repair Invoices

Properly storing financial documents is crucial for both organization and legal compliance. Whether for internal use or for potential audits, maintaining an orderly system for your transaction records can prevent confusion and ensure you’re always prepared. By utilizing digital or physical storage systems, you can easily retrieve, manage, and safeguard your documents for future reference.

Organizing Digital Records

Digital storage offers several advantages, such as accessibility and space efficiency. To manage your records effectively, follow these tips:

- Store files in a dedicated folder or cloud storage service, categorized by year, client, or service type.

- Use clear and consistent file naming conventions, such as including the client name and date of service.

- Implement regular backups to avoid data loss in case of technical issues.

Maintaining Physical Records

If you prefer or are required to keep paper copies, it’s important to create an organized filing system:

- Use labeled folders or filing cabinets to separate documents by category, date, or client.

- Consider using a secure location, such as a locked filing cabinet, to protect sensitive information.

- Ensure the documents are stored in a way that prevents deterioration, such as avoiding exposure to moisture or sunlight.

By implementing these best practices, you ensure your financial documentation remains secure, accessible, and easy to manage when needed.