BMW Invoice Template for Easy and Professional Billing

Managing financial transactions in any automotive business requires precision and professionalism. Having a well-structured document that outlines services rendered and payment details is essential for smooth operations. Whether you’re running a small repair shop or a dealership, using a standardized method for creating payment records can save time and reduce errors.

Creating a clear, organized statement for your clients is not only beneficial for maintaining transparency but also helps ensure timely payments. With the right tools, it’s possible to generate professional records quickly, which can enhance your business’s efficiency. This is especially important when dealing with numerous clients and varying service offerings.

In this article, we will explore how you can simplify the billing process by using customizable forms that fit your business needs. These resources offer flexibility and allow you to focus on what really matters–providing excellent service and growing your business.

BMW Invoice Template Guide

Creating professional billing documents is an essential part of maintaining a well-organized business. These records ensure that clients understand the services they received and the amount due, providing both transparency and a clear record for accounting. A standardized approach to generating payment documents can streamline operations and improve your overall business efficiency.

This guide will walk you through the process of crafting an effective billing document for your automotive services, covering everything from required fields to customization tips. By the end, you will have a better understanding of how to structure your documents to meet both client expectations and legal requirements.

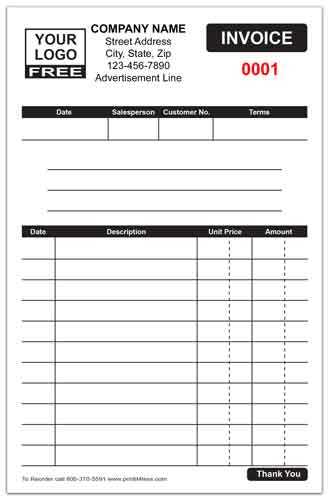

Key Components of a Billing Record

To create an effective and comprehensive document, certain pieces of information must always be included. Here are the essential sections:

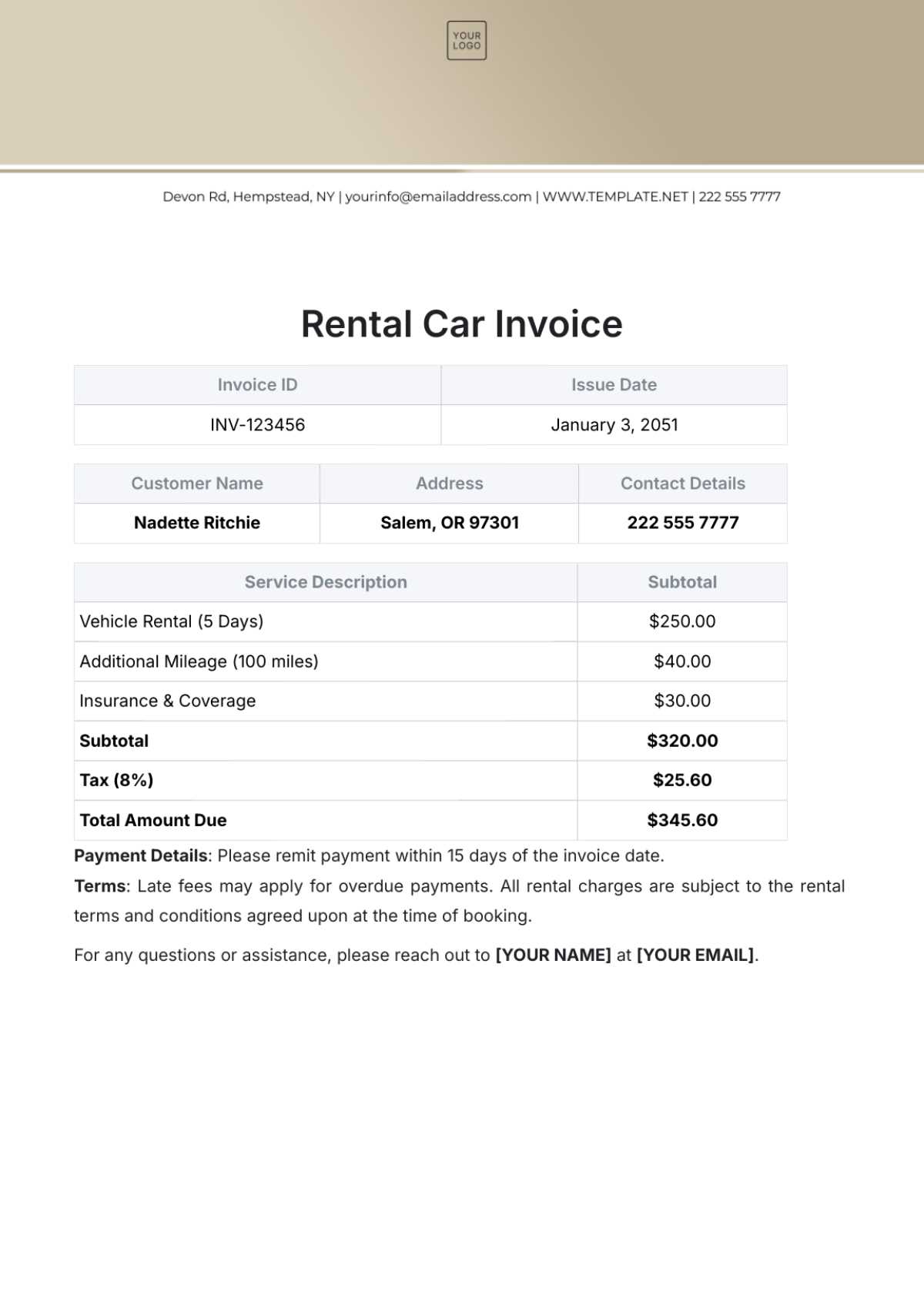

- Business Details: Include your business name, contact information, and logo.

- Client Information: Provide the client’s name, address, and contact details.

- Transaction Date: Clearly state the date the services were completed or the product delivered.

- Itemized List of Services: Break down the services rendered or goods sold, including prices for each.

- Total Amount Due: Include the total sum owed, with tax and discounts clearly displayed if applicable.

- Payment Terms: Specify the due date and accepted payment methods.

Customization Options for Your Documents

While there are general guidelines to follow, customization can add a personal touch and make the document more suited to your business needs. Consider the following options:

- Logo and Branding: Add your business logo to make the document appear more professional and recognizable.

- Payment Instructions: If you use specific payment gateways or want to provide clients with multiple payment options, make sure to include this information.

- Discounts and Offers: If you offer promotions, such as discounts on repeat services, clearly outline them on the record.

- Terms and Conditions: For added clarity, include any relevant business terms such as return policies, warranties, or service guarantees.

By incorporating these elements, you can ensure that your payment records are clear, professional, and tailored to your specific business needs. This approach will not only help you stay organized but also build trust with your clients, improving your business relationships and increasing the likelihood of timely payments.

Why Use an Invoice Template

Having a standardized document for billing purposes is crucial for any business, especially when dealing with multiple transactions and clients. Using a pre-designed format simplifies the process, saving time and ensuring consistency across all transactions. Whether you’re offering services or selling products, a well-structured record helps maintain professionalism and transparency.

Without a consistent format, businesses risk errors, confusion, and delays in payments. A predefined structure eliminates the guesswork, allowing you to focus on providing quality service rather than worrying about formatting or forgetting key information. With the right tools, your financial records become clearer, easier to manage, and more effective for both you and your clients.

Key Benefits of Using a Standardized Billing Document:

- Time-Saving: Quickly generate accurate records without needing to start from scratch each time.

- Professional Appearance: Enhance your business image with clean, organized documents that inspire trust.

- Consistency: Ensure that every transaction includes all necessary details in a uniform layout.

- Reduced Errors: Minimize the risk of missing vital information, such as payment terms or client details.

- Efficiency in Tracking: Easily track payments, outstanding balances, and client histories with minimal effort.

Ultimately, using a structured format not only simplifies the billing process but also boosts client confidence, ensuring that your business operates smoothly and professionally at all times.

Key Features of BMW Invoice Templates

For any automotive business, an effective billing document must have certain essential characteristics that make it functional and professional. These key elements ensure clarity, ease of use, and flexibility, helping businesses maintain accuracy in their financial records. Whether you’re managing a car dealership, repair shop, or service center, a well-structured document can streamline your operations and improve customer experience.

Essential Information to Include

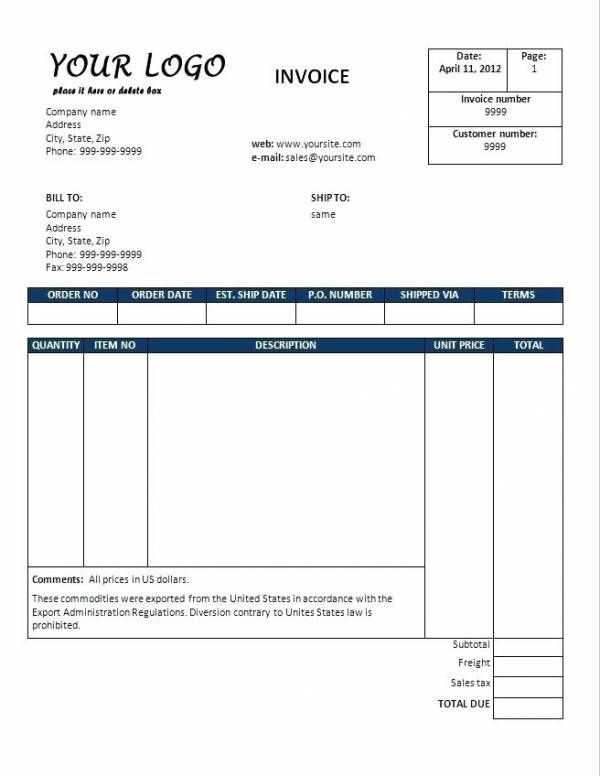

Every properly designed billing document should contain specific fields to ensure it serves its purpose. The most important features include:

- Business Contact Information: Clearly display your business name, address, phone number, and email for easy communication.

- Client Details: Include the client’s name, contact info, and address to personalize the document.

- Detailed Service Breakdown: Provide a list of services rendered, with clear descriptions and associated prices for each item.

- Total Amount Due: Clearly highlight the total amount owed, including taxes and any additional charges.

- Payment Terms: Specify the due date, accepted payment methods, and any late fee policies if applicable.

Customization Options and Flexibility

While the core structure remains the same, being able to customize your documents to fit your business needs is essential. Some features to consider include:

- Branding: Include your company logo, colors, and any other branding elements to make the document look professional and consistent with your business identity.

- Payment Instructions: Add clear instructions on how clients can make payments, such as bank details, online payment links, or accepted methods.

- Discounts and Promotions: If offering special deals, you can easily highlight any discounts applied to the services.

- Legal Information: Include terms and conditions, warranties, or service agreements relevant to your business and jurisdiction.

By including these elements, you ensure that your billing documents are not only functional but also convey a professional image to your clients, improving both efficiency and customer satisfaction.

How to Customize a BMW Invoice

Customizing your billing documents allows you to align them with your specific business needs and brand identity. A personalized format can enhance your professionalism, making transactions smoother for both you and your clients. Customization is particularly important in the automotive industry, where different services and products require tailored documentation.

Steps to Personalize Your Billing Document

To customize your billing document, you need to focus on key areas such as design, content, and structure. Here are the essential steps:

- Logo and Branding: Add your company’s logo at the top of the document to make it easily identifiable and consistent with your other marketing materials.

- Contact Information: Make sure your business address, phone number, and email are clearly visible. This makes it easy for your clients to reach out with questions or concerns.

- Itemized Services: Provide a clear breakdown of services rendered or products sold. This should include descriptions, unit prices, and quantities.

- Payment Terms: Include the payment due date, any late fees, and accepted payment methods to ensure there’s no confusion about how and when to pay.

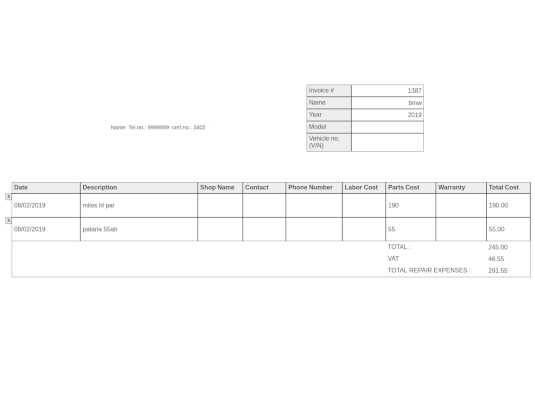

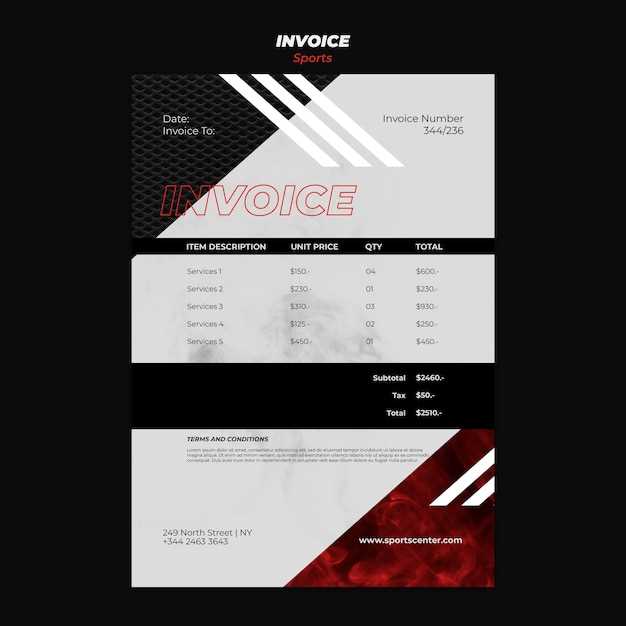

Example of a Custom Billing Document

Below is an example of how to structure your customized document:

| Service/Product | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Oil Change | Full synthetic oil change with filter replacement | $50 | 1 | $50 |

| Brake Pads | Front brake pads replacement | $120 | 2 | $240 |

| Total | $290 |

By customizing your document with relevant details and keeping it organized, you ensure that all necessary information is communicated clearly to your clients. This not only helps in preventing disputes but also enhances the customer experience by making transactions straightforward and professional.

Free vs Premium Invoice Templates

When selecting a format for your business transactions, you have the option to choose between free and premium designs. Both types offer distinct advantages, but understanding the differences can help you make an informed decision based on your specific needs. While free options can serve the basic requirements, premium formats often provide more advanced features and greater customization possibilities.

Advantages of Free Billing Documents

Free billing documents are a great starting point for small businesses or individuals just beginning to manage financial records. They offer simplicity and accessibility without the need for an initial investment. Key benefits include:

- Cost-Effective: No upfront cost, making them an excellent choice for startups or businesses with limited budgets.

- Easy to Use: Most free options come with basic functionality and can be used quickly with minimal setup.

- Quick Access: Many free formats are readily available online for immediate download, allowing for fast implementation.

Benefits of Premium Billing Documents

Premium formats, on the other hand, provide more advanced features that can cater to the specific needs of established businesses. These options come with added benefits, such as:

- Customization: Premium designs allow for more in-depth personalization, enabling you to tailor the document to fit your branding and business style.

- Advanced Features: These options often include additional fields, more detailed reporting, integration with accounting software, and automated payment reminders.

- Professional Appearance: Premium documents are designed with a polished, professional look that enhances your business image and instills confidence in clients.

- Customer Support: Premium users often have access to customer support for troubleshooting or assistance with customization.

Choosing between free and premium options depends on the size and needs of your business. Free templates can be a good starting point for smaller operations, but as your business grows, investing in a premium option might offer the functionality and professionalism needed to streamline operations and improve client satisfaction.

Common Mistakes in BMW Invoices

Even with the best intentions, mistakes in billing documents are not uncommon. Errors can cause confusion, delay payments, and damage professional relationships. It’s important to be aware of the most frequent mistakes that occur when creating these records, so you can avoid them and ensure smooth, efficient transactions with clients.

Frequent Errors to Watch Out For

Here are some common mistakes that businesses often make when preparing billing documents:

- Missing or Incorrect Client Details: Failing to include accurate customer information, such as names, addresses, or contact details, can cause confusion and delays in payments.

- Inaccurate or Incomplete Service Descriptions: Not providing enough detail about the services rendered, or listing incorrect descriptions, can lead to misunderstandings about what the client is being charged for.

- Failure to Include Payment Terms: Omitting clear payment instructions, such as due dates and accepted payment methods, can result in late payments or disputes.

- Incorrect Tax Calculation: Errors in applying the correct sales tax or VAT rates can cause discrepancies and may even violate local tax regulations.

- Not Including the Total Amount Clearly: Failing to clearly highlight the total amount due, including taxes and discounts, can lead to confusion about the actual payment owed.

- Overlooking the Date of Issue: Not stating the date of the transaction or the date the document is issued can create confusion when tracking payment deadlines.

- Unclear Formatting: Poorly structured documents with hard-to-read fonts or misaligned information can make it difficult for clients to understand the details, leading to payment delays.

How to Avoid These Mistakes

To avoid these common errors, consider the following tips:

- Double-check Client Information: Always verify your client’s details before issuing the document to ensure accuracy.

- Provide Clear Descriptions: Make sure each service or product is described accurately and in detail to prevent misunderstandings.

- Include Clear Payment Instructions: Specify the due date, payment methods, and any late fees to eliminate confusion regarding payment expectations.

- Review Tax Calculations:

Step-by-Step Invoice Creation Process

Creating a clear and accurate billing document is crucial for maintaining a professional relationship with your clients. A well-organized record ensures that both parties understand the services provided, the amount due, and the terms of payment. The following step-by-step process outlines the key actions required to generate an effective and efficient record of your transaction.

1. Gather Necessary Information

Before creating the document, gather all relevant details about the transaction. This includes:

- Client’s full name and contact details

- A description of the services provided or products sold

- The price for each service or product

- Applicable taxes and discounts

- Payment due date and methods

2. Choose a Format

Decide whether you want to use a physical or digital format for your document. Digital records are easier to manage and share, but ensure you use a reliable software or platform that supports customization for your specific needs.

3. Create a Detailed Breakdown

List each service or product provided, including a description, unit price, quantity, and the total cost for each item. This breakdown helps clients understand exactly what they are being charged for and reduces the likelihood of misunderstandings.

Service/Product Description Unit Price Quantity Total Full Car Detailing Exterior and interior cleaning, waxing, and polishing $150 1 $150 Brake Replacement Front and rear brake pads replacement $200 2 $400 Total $550 4. Add Payment Terms

Clearly outline the payment terms, including the total amount due, due date, and accepted methods of payment. Also, specify if there are any late fees or discounts for early payment.

5. Review and Finalize

Before sending the document, review it carefully to ensure all details are accurate and complete. Double-check the client’s information, service descriptions, prices, and payment terms. Once verified, send the document to the client via email or other preferred method.

Following this step-by-step proce

Choosing the Right Format for Your Invoice

When creating a billing document, selecting the appropriate format is essential for both clarity and ease of use. The right structure ensures that all necessary information is presented in a way that is easy to understand for both you and your clients. Whether you prefer a digital or physical format, your choice will impact how efficiently you manage transactions and how professional your records appear.

Digital vs. Paper Billing Documents

There are two main formats to choose from: digital and physical. Each has its advantages depending on the nature of your business and client preferences. Here’s a breakdown:

- Digital Documents: Digital records are widely used due to their convenience, speed, and environmental benefits. They are easy to store, share, and track, and allow for quick updates. Emailing a PDF or using specialized software also enables you to include interactive features, such as payment links and online payment options.

- Paper Documents: While less common today, paper records may still be preferred by some clients or required for legal reasons. Physical documents are useful for businesses that operate in areas with limited internet access or when dealing with clients who prefer traditional methods of record-keeping.

Factors to Consider When Choosing a Format

Choosing between digital and physical formats depends on several factors, such as:

- Client Preferences: Some clients may prefer receiving paper documents, while others prefer digital formats for easier processing.

- Business Operations: If your business requires frequent updates or large volumes of transactions, digital records may be the more efficient option.

- Legal or Regulatory Requirements: Certain industries may have regulations that require physical copies or specific formats for official records.

- Convenience: Digital formats allow for faster distribution and payment processing, while physical documents may require manual filing and postage.

Ultimately, selecting the right format comes down to the unique needs of your business and your clients. Digital records are often the preferred choice for their convenience and scalability, but paper documents may still have a place depending on your specific circumstances. Whichever format you choose, ensure that it meets both your operational needs and your clients’ expectations.

Essential Information for BMW Invoices

Creating a comprehensive and professional billing document requires careful attention to detail. Including all necessary information ensures that your clients understand exactly what they are being charged for and helps prevent any misunderstandings or disputes. Whether you are providing services or selling products, it’s crucial to cover the key elements that will make your document clear, accurate, and legally sound.

Here are the essential details that should be included in every billing document:

- Business Information: Always include your company’s name, address, contact number, and email. This helps clients reach you easily if they have questions regarding the charges.

- Client Information: Ensure that your client’s full name, company (if applicable), address, and contact information are clearly listed. This will prevent any confusion about who the charges are for.

- Unique Document Number: Every billing document should have a unique reference number. This helps both you and your client track payments and identify the document in case of any future issues.

- Detailed Breakdown of Products/Services: Provide a clear and itemized list of all products or services provided, along with a description, quantity, and price for each item. This helps clients see exactly what they are being billed for and ensures transparency.

- Payment Terms and Due Date: Clearly state the total amount due, the payment deadline, and any specific payment methods accepted. If there are any penalties for late payments or discounts for early payment, include these details as well.

- Taxes and Additional Fees: Indicate any applicable taxes (such as VAT or sales tax) and other fees that might apply to the total cost. This ensures that your client is aware of the full payment amount required.

- Payment Instructions: Specify how your client should pay. This can include bank account details, online payment links, or instructions for paying via credit card or another method.

By including these key elements, you ensure that your documents are complete, professional, and easy for your clients to understand. This reduces the chance of payment delays and improves the overall client experience.

How to Include Payment Terms Effectively

Clearly outlining payment terms in your billing documents is crucial for ensuring smooth transactions and preventing misunderstandings. When both you and your client understand the expectations regarding payment schedules, methods, and penalties, it reduces the chance of delayed payments and strengthens your professional relationship. Properly defining payment terms also helps to maintain consistency and provides a clear framework for both parties to follow.

Key Elements of Payment Terms

To include payment terms effectively, focus on these essential components:

- Due Date: Always specify the exact date by which payment must be made. Using clear language, such as “Payment due by [date],” helps avoid confusion and ensures that both parties are on the same page regarding deadlines.

- Accepted Payment Methods: Indicate all available payment methods, such as credit card, bank transfer, online payment platforms, or checks. The more options you provide, the easier it is for clients to make timely payments.

- Late Fees or Penalties: If you charge a fee for late payments, clearly state the amount or percentage that will be added to the total after the due date has passed. This encourages timely payment and discourages delays.

- Discounts for Early Payment: Offering a discount for early payments can incentivize clients to pay before the due date. For example, “2% discount if paid within 10 days.” This approach can improve cash flow and reduce outstanding receivables.

- Payment Installments: If you allow clients to pay in installments, provide details on the schedule, including the amounts due and the dates for each payment. This helps clients manage their finances and ensures you receive payments on time.

Best Practices for Payment Terms

Here are some tips to effectively incorporate payment terms into your billing documents:

- Be Clear and Concise: Avoid using complex language or jargon that might confuse clients. Keep the payment terms simple and easy to understand.

- Highlight Key Information: Ensure that the due date, payment methods, and any penalties for late payment are clearly visible. Bold or underline these details to make them stand out.

- Maintain Consistency: Always use the same terms across all documents to ensure clarity and consistency. This helps build trust with your clients and simplifies your accounting processes.

- Be Professional: While payment terms may seem straightforward, presenting them professionally reflects positively on your business and shows that you value both your time and your clients’ time.

By including clear and detailed payment terms, you establish expectations upfront and reduce the likelihood of payment-related issues. Properly defined terms are key to maintaining a healthy cash flow and fostering positive client relationships.

Best Software for Creating BMW Invoices

When it comes to generating professional billing documents, the right software can make all the difference. The best tools streamline the process, allowing you to create accurate and visually appealing records in just a few minutes. With various options available, choosing the right software depends on your specific business needs, whether you’re looking for simplicity, advanced features, or integration with other tools.

Top Software Solutions for Billing Documents

Here are some of the best software tools for creating detailed and efficient billing records:

- QuickBooks: One of the most popular accounting software solutions, QuickBooks allows users to easily create and customize billing documents. It also integrates with other accounting features, such as tracking expenses and managing invoices, making it a great option for businesses of all sizes.

- FreshBooks: FreshBooks is an intuitive and user-friendly platform designed for small businesses. It offers easy-to-use features for creating billing documents, managing clients, and tracking payments. You can also set up automated reminders for overdue payments.

- Zoho Invoice: Zoho Invoice is an excellent choice for businesses looking for a customizable billing solution. It allows users to create professional documents with a variety of templates, track payments, and automate recurring billing. It’s especially useful for freelancers and small businesses.

- Wave: Wave is a free accounting software that includes tools for generating billing records. It offers a simple interface for creating detailed documents, and it also provides features for tracking income, expenses, and financial reports, making it an excellent option for small businesses and freelancers.

- Invoicely: Invoicely is a cloud-based invoicing platform that allows businesses to create and send billing records with ease. With a variety of templates, you can quickly generate customized documents. It also offers features for time tracking, payment processing, and multi-currency support.

Factors to Consider When Choosing Software

When selecting the right software for your billing needs, consider the following factors:

- Ease of Use: Choose software that is user-friendly and doesn’t require extensive training. The interface should be intuitive, making it simple to create and send records.

- Customization Options: Look for software that allows you to tailor billing documents to suit your business’s needs. The ability to add your logo, modify fields, and choose different templates is essential.

- Automation Features: Automated reminders, recurring payments, and automatic payment tracking can save time and reduce manual errors. This is especially useful for businesses with regular clients.

- Enhances Credibility: A polished and well-structured document reflects positively on your business and signals that you take your operations seriously. Clients are more likely to trust a business that provides clear and accurate billing information.

- Promotes Timely Payments: Clear payment terms and detailed breakdowns help clients understand the amount due and the payment schedule. This reduces confusion and encourages quicker payment processing.

- Reduces Disputes: A well-organized document with all necessary details prevents misunderstandings and disputes about charges, deadlines, and terms. It provides both parties with a clear reference point.

- Improves Cash Flow: By presenting professional documents, you make it easier for clients to make payments on time, which can help ensure a steady cash flow for your business.

- Legal Protection: A properly formatted and detailed document can serve as legal protection in case of disputes. Having a record of agreed-upon terms and payments is valuable for resolving issues efficiently.

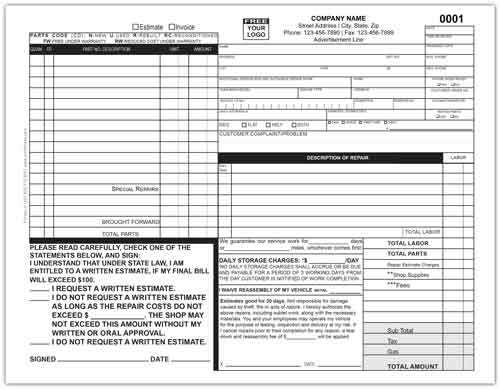

- Maintenance Services: For routine tasks such as oil changes, tire rotations, or fluid checks, create a simple breakdown with a list of services provided and associated costs. Include the date of service and estimated time for completion.

- Repairs and Diagnostics: When dealing with repairs or diagnostic services, provide a detailed description of the work performed, including labor hours, parts replaced, and the cost of each. Be sure to itemize the components and any additional diagnostics required for transparency.

- Parts and Accessories: If clients purchase parts or accessories, list each item individually along with part numbers, descriptions, and prices. Ensure that any warranties or guarantees for the parts are clearly outlined to avoid confusion.

- Custom Services: For specialized or custom services, such as custom modifications, upgrades, or performance tuning, it’s essential to include a detailed breakdown of the scope of work, specific parts used, and any unique pricing based on customization.

- Labor Rates: If your business offers a variety of services with different labor requirements, include a section that clearly states hourly rates based on the type of service performed.

- Time Estimates: For services that require more than one visit or extensive labor, provide estimated timeframes for completion, especially if there are any delays or scheduling changes.

- Discounts and Offers: If your business offers seasonal discounts or package deals, highlight these in the document to ensure clients are aware of any potential savings.

- Choose the Right Format: Select a format that aligns with your business model and the type of transactions you handle. Whether you’re providing products, services, or a mix of both, choose a layout that allows you to include all necessary information clearly and concisely.

- Customize for Branding: Ensure that the document reflects your business identity. Add your company’s logo, brand colors, and contact information to create a personalized and professional document that clients can easily recognize.

- Fill in Client Details: Input the client’s name, address, and other relevant contact information. This ensures that the document is specific to the transaction and helps prevent errors in billing.

- Itemize Services or Products: Clearly break down the items or services provided, along with their corresponding prices, quantities, and any applicable taxes or fees. This transparency helps your client understand exactly what they are being charged for.

- Specify Payment Terms: Clearly state the payment due date, accepted payment methods, and any penalties for late payments or discounts for early settlement. These terms help manage expectations and ensure that payments are received on time.

- Send and Track: Once completed, send the billing document to your client via email, mail, or your preferred method. Keep a copy for your records and use tracking features (if available) to monitor payment statuses.

- Maintain Consistency: Use the same layout and format for all of your billing documents to ensure consistency. This helps maintain professionalism and makes it easier to track multiple transactions.

- Automate Where Possible: If your software or platform allows it, automate the creation and sending of documents for recurring clients. This can save time and reduce manual errors.

- Double-Check for Accuracy: Before sending any billing documents, review the details thoroughly. Check for correct pricing, client information, and payment terms to avoid any confusion or disputes.

- Automate Record Generation: Use software that allows you to automate the creation of documents for recurring clients or regular services. This reduces the time spent on manual entry and ensures consistency across all records.

- Organize by Categories: Group your billing records based on specific criteria, such as service type, client, or date range. This makes it easier to locate and manage individual records when needed.

- Track Payment Statuses: Keep track of payments received and those pending. Using a system that shows real-time payment updates ensures you don’t miss any overdue balances and helps maintain a healthy cash flow.

- Use Cloud-Based Storage: Cloud-based storage solutions allow for secure, easily accessible records from anywhere. You can organize documents into folders and maintain a backup for every transaction, making retrieval fast and simple.

- Set Payment Reminders: Set automated reminders for clients who have upcoming or overdue payments. This can be particularly helpful in preventing late payments and reducing the manual effort involved in follow-up communications.

- Use Accounting Software: Modern accounting platforms often include built-in payment tracking features. These tools automatically record payments made, update balances, and flag overdue accounts. This eliminates the need for manual entry and minimizes human error.

- Create a Payment Schedule: Set clear payment terms, including due dates and acceptable payment methods. Record each client’s payment schedule so you know when to expect payments and can follow up promptly if they are late.

- Manual Payment Logs: If you’re not using accounting software, you can maintain a manual log or spreadsheet where you record every payment received. Include details like payment date, amount, payment method, and the invoice or service related to the payment.

- Automated Payment Reminders: Many software solutions allow you to set automated reminders for clients. These reminders can notify clients when a payment is due or if it’s overdue, helping ensure timely payments.

- Check Bank Statements Regularly: Regularly monitor your business bank account to verify that payments have been deposited. Cross-reference payments with your logs to confirm accuracy and detect any discrepancies early.

- Be Consistent: Whether you use software or manual methods, ensure you track all payments consistently. Keeping a consistent system will help you easily identify which payments have been made and which are still outstanding.

- Send Detailed Payment Receipts: After receiving a payment, send a clear and detailed receipt to your clients. This reinforces transparency and provides a record for both you and the client.

- Monitor Overdue Accounts: Regularly review accounts with overdue payments and reach out to clients with reminders or payment plans if necessary. Act promptly to avoid extended delays.

- Link to Your Financial Reports: Connect payment tracking to your financial reporting tools so you can track income, expenses, and profits in real-time. This ensures that your business has up-to-date financial data at all times.

Why Professional Invoices Matter

When it comes to business transactions, clear and well-organized documentation is key to ensuring that both you and your clients are on the same page. A professionally crafted billing record not only helps in securing timely payments but also strengthens your brand image and fosters trust. Whether you’re providing a service or selling a product, how you present your financial documents can have a lasting impact on your business relationships.

Benefits of Using Professional Billing Documents

Here are some important reasons why using professional billing records is crucial for your business:

Key Elements of a Professional Billing Document

To create an effective and professional document, certain elements should always be included. Here is a breakdown of the key components:

Element Description Client Information Include the client’s name, company, and contact details to ensure that the document is correctly attributed. Detailed Breakdown List each product or service, its price, quantity, and total cost to provide transparency about what the client is being charged for. Payment Terms Clearly state the payment due date, accepted methods, and any penalties for late payments or discounts for early settlement. Unique Reference Number A unique document number ensures that both parties can track the transaction easily, especially for accounting and future reference. By ensuring that all these elements are present and organized, your billing documents will not only be effective but will also enhance your professional image, making a significant impact on your business’s success.

Customizing for Different BMW Services

When offering a range of services, especially in specialized industries like automotive care, it is essential to tailor your billing documents to reflect the specific services provided. Customization helps ensure clarity, professionalism, and accuracy, and it provides clients with a detailed breakdown of the charges based on the services they have received. Whether it’s maintenance, repairs, or parts replacement, each type of service may require a unique approach to documenting the work and corresponding fees.

Tailoring Billing Documents for Various Services

Each service type has its own requirements and should be reflected accordingly in the document. Here are some examples of how to customize the format for different services:

Additional Considerations for Customization

In addition to service-specific details, consider the following when customizing your billing documents:

By customizing billing records to reflect the specifics of each service offered, you enhance the clarity and professionalism of your business. This approach not only ensures accurate payment but also builds trust with your clients, demonstrating that you understand their unique needs and provide tailored solutions.

How to Use BMW Invoice Templates for Business

Using pre-designed billing documents can save time, reduce errors, and improve efficiency in any business. These ready-to-use formats provide a consistent way of detailing transactions, allowing businesses to maintain professional standards while simplifying their financial documentation process. By leveraging customizable options, businesses can tailor their documents to fit the specific needs of their clients and services.

Steps to Utilize Billing Documents for Your Business

Here’s a step-by-step guide on how to make the most of these customizable documents for your business:

Best Practices for Using Billing Documents

To maximize the effectiveness of these tools, here are some best practices to follow:

Additional Features to Look for in Billing Software

While customizing your documents, you may want to look for additional features that can enhance your business operations:

Managing Multiple Billing Records Efficiently

When handling numerous transactions over a period of time, managing a large volume of billing records can quickly become overwhelming. However, with the right systems in place, businesses can streamline their processes and ensure that all transactions are organized and tracked efficiently. By using the appropriate tools and practices, you can maintain accuracy, reduce errors, and save valuable time when managing multiple documents.

Key Strategies for Efficient Management

Here are some effective ways to manage multiple billing records without sacrificing accuracy or professionalism:

Useful Tools for Managing Multiple Records

There are various tools and software available to help businesses handle multiple records efficiently. Here are some useful features to consider when choosing the best system for your needs:

Feature Description Batch Processing The ability to generate and send multiple billing records at once, saving time and reducing manual effort when handling large volumes. Client Management Centralized client information helps you track past and present transactions, ensuring that each document is accurate and up to date. Real-Time Payment Tracking Automated systems that allow you to track whether a payment has been made and send reminders as needed. Integration with Accounting Software Link your system to accounting software to easily sync financial data and reduce the risk of errors in your records. By using these tools and strategies, managing multiple billing records becomes a more organized and efficient process, allowing you to focus more on growing your business rather than spending time on manual administrative tasks.

How to Track Payment for Billing Records

Keeping track of payments for services rendered or products sold is a crucial part of managing a business’s financial health. Properly tracking payments ensures that you stay on top of outstanding balances, avoid financial discrepancies, and can follow up with clients when necessary. Whether you manage a few transactions or hundreds, having a system to track payments is essential to maintaining good cash flow and client relationships.

Effective Methods for Payment Tracking

Here are some methods and tools you can use to track payments for your business efficiently:

Best Practices for Payment Tracking

To further enhance the efficiency and accuracy of your payment tracking process, consider these best practices:

By adopting these methods and practices, you can efficiently track payments, manage cash flow, and reduce the risk of missing payments. A reliable tracking system helps maintain your business’s financial health and builds trust with clients, ensuring smooth financial operations.