Free Blank Work Invoice Template for Easy Billing

In any business or freelance profession, keeping accurate records of services rendered is crucial for both organization and financial tracking. Having a clear, structured document that outlines the work completed and the amount due is essential for smooth transactions. This can help avoid misunderstandings with clients and ensure timely payments.

Whether you’re a freelancer, contractor, or small business owner, knowing how to craft an efficient and well-organized document is a key aspect of your billing process. A well-designed layout allows you to present your charges clearly, making it easier for clients to understand and process payments quickly. Understanding the components of a billing form and customizing it for your needs can significantly enhance the professionalism of your financial communications.

Customizing your billing forms to suit your unique services and industry is important, as it reflects your attention to detail and commitment to providing transparent transactions. From client information to payment terms, the right document can help streamline your accounting process, save time, and reduce errors.

Why Use a Blank Work Invoice Template

Having a pre-designed document for billing simplifies the process of requesting payments from clients. Instead of starting from scratch each time, a ready-made structure allows you to quickly input relevant details and issue the document with a professional appearance. This can save valuable time and ensure consistency across all your transactions.

Using such a format helps eliminate errors that might arise when manually creating new records. The layout typically includes all the necessary sections, ensuring that no critical information is overlooked. By adopting this approach, you ensure clarity for both you and your clients, reducing confusion and improving the overall payment experience.

Moreover, customizing a standard design to suit your business’s unique needs gives you flexibility while maintaining a consistent and organized approach to billing. This can enhance your credibility and show clients that you are a professional who values accuracy and efficiency in every transaction.

Benefits of Customizable Invoice Templates

Having the ability to modify your billing documents provides significant advantages, especially when dealing with a variety of clients or different types of services. A flexible structure allows you to easily adapt to specific business needs, ensuring that each document reflects the unique terms and conditions of each transaction.

Personalization for Your Brand

Customizing your billing forms helps maintain consistency with your brand image. You can incorporate your company logo, color scheme, and fonts, which makes the documents look professional and cohesive with other marketing materials. This level of personalization enhances your business’s credibility and strengthens your brand identity.

Efficiency and Accuracy

- Quickly update pricing and service details for each new client

- Easily add or remove sections based on the nature of the transaction

- Minimize the risk of mistakes by automating repetitive sections like tax rates or payment terms

By using a customizable format, you streamline your billing process, making it faster and more accurate each time. It reduces the manual effort needed to adjust the structure of the document and ensures all important information is included without the need for constant re-entry.

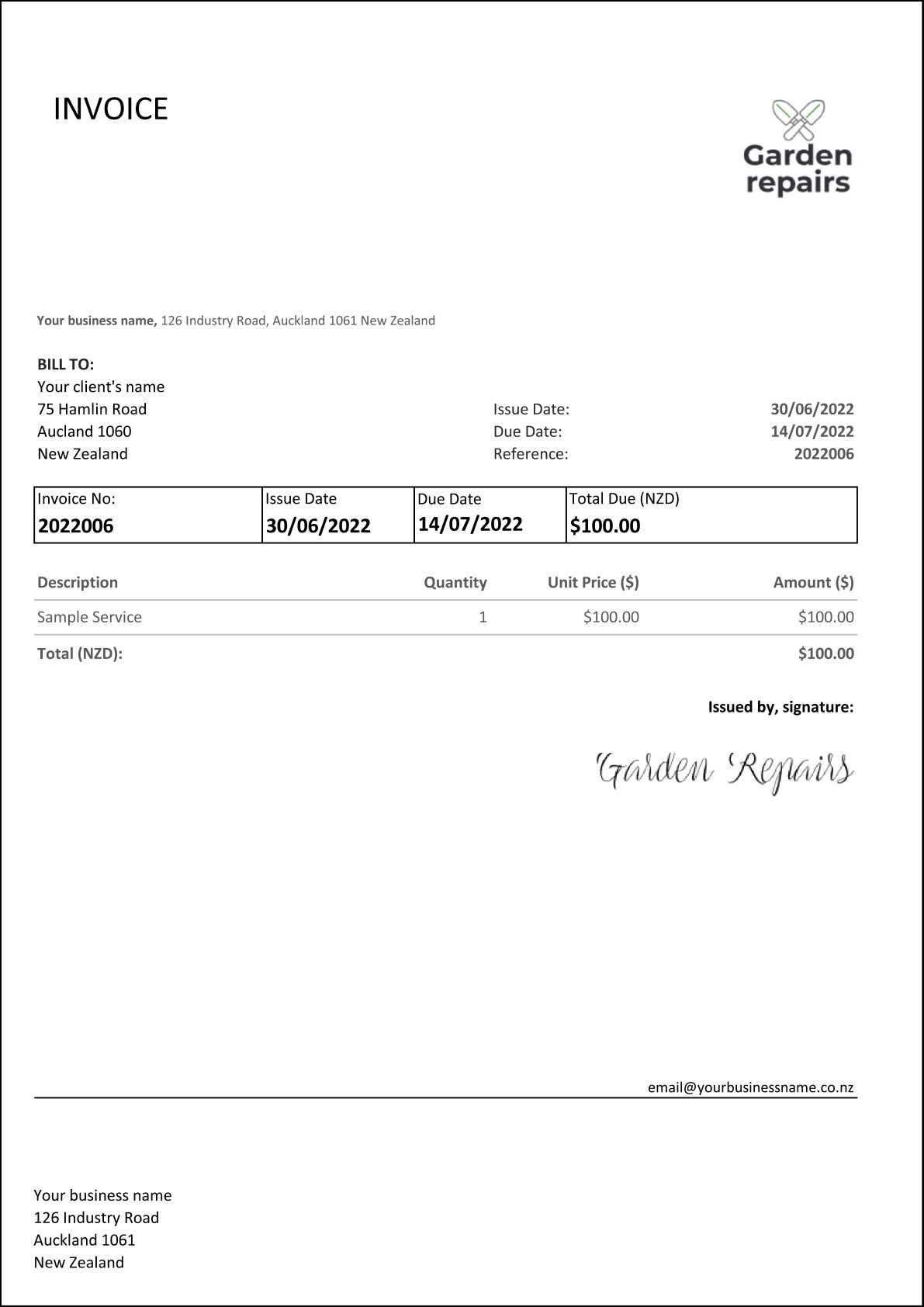

How to Create a Work Invoice

Creating a payment request document involves gathering essential details about the services you’ve provided and presenting them in a clear, professional format. The process typically begins with including the necessary information, such as your business details, the client’s information, and a breakdown of the charges. Organizing these elements in a structured manner ensures clarity and prevents misunderstandings.

Here is a simple guide to structuring your document:

| Section | Description |

|---|---|

| Business Information | Include your name, company name, address, and contact details. |

| Client Information | Provide the name, address, and contact details of the client. |

| Transaction Details | List the services provided, including descriptions, quantity, rate, and total cost. |

| Payment Terms | State the payment methods, due date, and any late fees if applicable. |

Once all details are gathered, the next step is to arrange them in an easy-to-read format, ensuring that each section is clearly labeled. This layout helps clients quickly understand the charges and how to proceed with payment. With the right document, you can easily communicate your professionalism and enhance the client’s experience.

Essential Information on Work Invoices

To ensure smooth transactions and avoid confusion, it is important to include key details in every payment request document. Each section should contain specific information that both the service provider and the client can easily reference. Clear communication through these essential elements helps in the timely processing of payments and minimizes potential disputes.

Client and Business Information are the first pieces of crucial data. Always include your name or business name, address, and contact details, as well as the same for your client. This ensures that both parties can be easily identified and reached in case of any issues.

Service Description is another critical component. It is important to list the services provided in detail, including dates, hours worked (if applicable), and specific tasks completed. A well-written description prevents any ambiguity and helps both parties agree on the scope of the work done.

Payment Terms should outline when the payment is due, the accepted methods of payment, and any applicable late fees. This ensures that clients are aware of the financial expectations and can plan accordingly.

Design Tips for Professional Invoices

Creating a visually appealing and well-organized document is essential for making a strong professional impression. A clear and polished design ensures that your client easily understands the details of the payment request. Focusing on layout, typography, and visual hierarchy can elevate the document’s readability and help convey professionalism.

Maintain a Clean Layout

A clutter-free design is key to a professional-looking document. Use adequate spacing between sections to allow the information to breathe and prevent the page from feeling overcrowded. A simple grid layout with well-defined sections will make the document easy to navigate. Avoid excessive borders or patterns that can distract from the core content.

Use Readable Fonts and Consistent Formatting

The typography you choose plays a significant role in readability. Stick to easy-to-read fonts like Arial or Helvetica for the body text and use bold or larger font sizes for headers. Consistency is important–ensure that font sizes, weights, and colors are uniform throughout the document to create a cohesive appearance.

Free Resources for Downloading Templates

There are many online platforms offering free resources to help you create professional billing documents. These sites provide ready-made structures that you can customize to suit your business needs. Whether you’re looking for simple layouts or more complex designs, these resources make it easy to download, personalize, and start using them immediately.

Many websites offer free downloads in various formats, such as Word, Excel, or PDF, ensuring that you can choose the one that fits your preferred method of editing. Some platforms also provide a variety of styles and industries, allowing you to select the most relevant option for your specific line of work.

How to Fill Out an Invoice Template

Filling out a billing document requires careful attention to detail to ensure that all necessary information is included. By following a structured approach, you can quickly complete the form and provide your client with clear, accurate details. Each section of the document serves a specific purpose, and understanding what to include in each part is key to making the process smooth and efficient.

Key Sections to Complete

- Business Information: Include your business name, address, phone number, and email address.

- Client Information: List the client’s name, business name (if applicable), and contact details.

- Services Provided: Clearly describe each service rendered, including the date of service and any other relevant details.

- Payment Terms: Specify the total amount due, payment methods accepted, and any late fees or discounts.

- Due Date: Include the date by which the payment must be made.

Additional Considerations

- Ensure that all numbers are accurate and formatted correctly.

- Double-check that the document is clear and free of any typos.

- Consider adding a personalized message or thank-you note for a more professional touch.

By systematically filling out each section and reviewing the document before submission, you can avoid errors and ensure that your client has all the information they need to complete the payment process.

Common Mistakes in Work Invoices

Even minor mistakes in payment request documents can lead to misunderstandings, delayed payments, or disputes. It’s important to be aware of common errors to ensure that each document is clear, accurate, and professional. By recognizing and avoiding these issues, you can streamline the billing process and maintain good relationships with your clients.

Typical Errors to Watch Out For

Here are some frequent mistakes that often occur in billing documents:

| Error | Impact |

|---|---|

| Incorrect Contact Information | Can cause delays in communication and payment. |

| Missing or Incorrect Dates | Can lead to confusion about when services were provided or when payments are due. |

| Unclear Service Descriptions | May result in disputes over what was delivered or agreed upon. |

| Failure to Include Payment Terms | Can cause clients to delay payments or misunderstand payment expectations. |

How to Avoid These Errors

To prevent these issues, double-check all the details before sending the document. Verify that your client’s contact information is correct, ensure that the service descriptions are clear, and confirm that the payment terms are explicitly stated. Keeping a checklist of common mistakes to watch out for can help you avoid errors and present a more professional document every time.

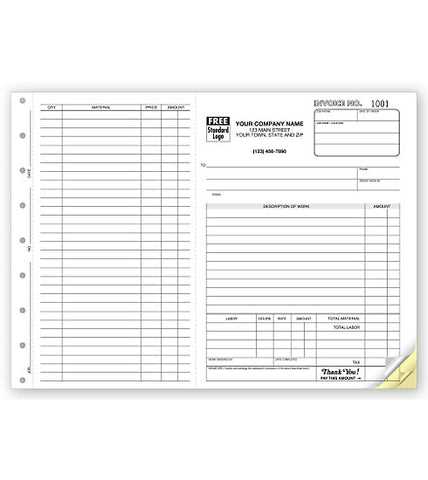

Invoice Templates for Different Industries

Each industry has unique billing needs that require specific structures and formats. Customizing the layout and information included in a payment request document based on your field can help streamline the process and ensure that all necessary details are covered. From creative services to retail, each sector benefits from a tailored approach to billing.

Creative and Freelance Services

For professionals in creative fields like design, writing, or photography, a payment request document should emphasize the scope of services provided, hourly or project rates, and any licensing or usage fees. Providing a clear breakdown of the work done is essential, as clients in these fields may require more detailed descriptions of the services rendered.

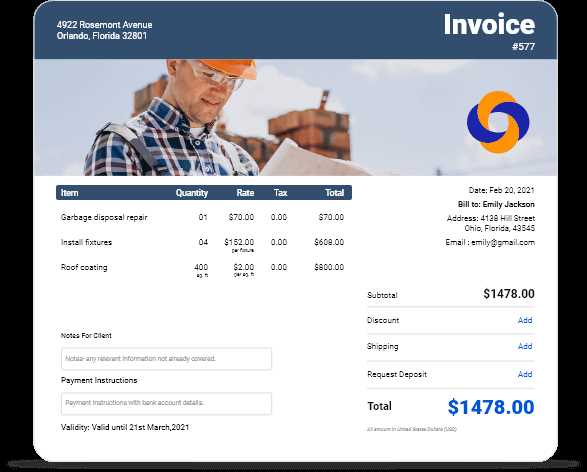

Retail and Product-Based Businesses

In industries dealing with physical goods, billing documents often need to include inventory numbers, product descriptions, unit prices, and total costs for each item purchased. Clear distinction between taxes, shipping fees, and discounts is also essential for a transparent and professional presentation.

Choosing the Right Invoice Format

When it comes to billing, selecting the appropriate format for your payment request is essential to ensure clarity and professionalism. The right structure not only makes it easier for your client to understand the charges but also reflects your attention to detail. Different industries and business models may require varying formats to effectively communicate pricing and terms.

Consider Your Industry Needs

Each sector has unique requirements when it comes to billing documents. For example, a service-based business may need to include detailed descriptions of services rendered, while a product-based business might focus on itemized lists with quantities and prices. Understanding your industry’s specific needs will help you choose the best format for a clear and comprehensive document.

Think About Your Client’s Preferences

In some cases, your clients may prefer a more detailed breakdown of charges, while others might appreciate a simpler, high-level summary. By considering your client’s preferences and providing a format that is easy for them to read and process, you increase the likelihood of prompt payments and a smooth transaction.

Best Software for Invoice Creation

Creating professional billing documents has become easier with the advent of specialized software tools. These programs help automate the process, ensuring accuracy and saving valuable time. Whether you’re a freelancer or a business owner, using the right software can simplify your administrative tasks and ensure that your payment requests are well-organized and error-free.

Top Software Options for Efficient Billing

- QuickBooks: Known for its user-friendly interface and comprehensive features, QuickBooks allows users to create and manage detailed billing documents, track payments, and integrate with accounting software.

- FreshBooks: Ideal for small businesses and freelancers, FreshBooks offers customizable billing layouts, easy time tracking, and automated reminders for late payments.

- Zoho Invoice: A cloud-based solution with a wide variety of design options, Zoho Invoice makes it easy to send invoices, track payments, and create reports with minimal effort.

- Wave: This free software is perfect for small businesses, offering simple tools to create, send, and manage billing documents without the need for an advanced subscription.

Factors to Consider When Choosing Software

- Ease of Use: Choose a tool that has an intuitive interface to avoid a steep learning curve.

- Customization: Look for software that offers flexible design options to match your branding or preferred format.

- Integration: Consider tools that integrate with your existing accounting, payment processing, and CRM systems for seamless workflows.

- Cost: Evaluate pricing plans to ensure the software fits within your budget, especially if you’re just starting your business.

How to Track Payments with Invoices

Tracking payments is a crucial part of managing your finances, and a well-structured payment request document can help you keep everything organized. By including specific details and setting up a tracking system, you can easily monitor which payments have been made, which are overdue, and which are still pending. Proper tracking ensures a smoother workflow and reduces the risk of missed payments.

Key Information to Include for Payment Tracking

To effectively track payments, it’s important to ensure your document contains specific details that make it easy to monitor each transaction:

- Unique Invoice Number: Assigning a unique number to each document helps you reference specific transactions and keep your records in order.

- Payment Due Date: Clearly stating when the payment is due helps both you and your client stay on the same page regarding deadlines.

- Amount Due: Ensure that the total amount is clearly stated, including taxes, discounts, and any other relevant charges.

- Payment Status: Including a section where you can mark the payment status (e.g., Paid, Pending, Overdue) will help you track progress at a glance.

Methods to Track Payments

There are various methods you can use to keep track of your payments:

- Manual Tracking: This involves keeping a record in a spreadsheet or ledger, manually updating the status after each payment is received.

- Automated Tools: Using accounting software or specialized tracking systems can automate the process, sending reminders for overdue payments and updating the status as soon as a payment is made.

- Cloud-Based Platforms: Cloud-based invoicing platforms often include payment tracking features, allowing you to view your payment history and update the status in real-time.

Invoice Templates for Small Businesses

For small businesses, creating professional payment request documents can be a challenge, especially when trying to balance simplicity and comprehensive details. Using a well-designed document format helps ensure that all essential information is included while presenting a polished, professional image to clients. These documents play a key role in maintaining cash flow and ensuring that payments are received on time.

Streamlining the Billing Process is essential for small business owners. By using the right structure, you can simplify the creation process and save valuable time. This approach also minimizes the risk of mistakes, ensuring that your clients always receive clear, accurate documents.

Small business owners should look for customizable formats that allow for flexibility, such as adjusting the design to match their brand or adding specific fields to meet their needs. The key is finding a solution that is both functional and easy to use, enabling efficient billing without excessive effort.

How to Protect Your Invoices Legally

Ensuring that your payment request documents are legally protected is crucial to avoid any potential disputes or complications. Proper legal safeguards help ensure that both parties are clear about terms and obligations, and that you have the right protections in place if a client fails to make a payment. Understanding the essential elements to include and how to safeguard the information is key to ensuring smooth transactions and protecting your business interests.

Key Legal Protections for Your Documents

Here are a few important steps to take when protecting your payment request documents:

- Include Clear Payment Terms: Specify when the payment is due, the acceptable payment methods, and any penalties for late payments. This ensures both parties understand the expectations and consequences.

- Legal Jurisdiction: Make sure to include a clause that indicates which legal jurisdiction applies in case of disputes. This will determine where and how any legal matters will be handled.

- Recordkeeping and Copies: Always keep detailed records of the payment requests and any communication with clients regarding payments. This documentation can be invaluable in case you need to take legal action.

- Use Digital Signatures: A digital signature is a secure and legally recognized way to confirm that both parties agree to the terms outlined in the payment request. This provides an added layer of authenticity.

How to Handle Disputes

In case of non-payment or disputes, having a clear process for addressing issues can help protect your rights:

- Include a Dispute Resolution Clause: A dispute resolution clause outlines how conflicts will be resolved, often specifying methods such as mediation or arbitration, which can help avoid lengthy court proceedings.

- Invoice Tracking: Keep track of when payments are made, as well as any overdue amounts, and ensure that both parties have clear access to this information in case a dispute arises.

- Seek Legal Advice: If necessary, consult with a legal professional to ensure your terms and documents are legally sound and compliant with your local laws.

How to Personalize Your Work Invoices

Customizing your payment request documents not only helps enhance your brand’s image but also makes the documents more professional and easier for clients to understand. Personalization can include everything from adding your logo to adjusting the layout or language to reflect your business style. A well-designed document leaves a lasting impression and can foster positive relationships with your clients, making your communications more memorable and trustworthy.

Key Elements to Personalize

Here are some essential components to consider when customizing your payment requests:

- Logo and Business Name: Include your company logo and business name prominently at the top of the document. This gives the payment request a professional appearance and ensures clients immediately recognize your business.

- Color Scheme and Fonts: Use your brand colors and fonts to make the document align with your overall branding. This can help establish consistency across all your business materials.

- Personalized Message: Add a personal touch by including a message or thank you note that reflects your brand’s voice, whether formal or casual. This can help build rapport with clients.

Creating a Customized Layout

To make the document stand out, it’s important to design it in a way that is clear and visually appealing. Below is an example of a simple layout you can personalize:

| Field | Example |

|---|---|

| Header Section | Include your business name, logo, and contact information at the top. |

| Client Information | List the client’s name, address, and any other relevant details. |

| Details of Service | Clearly describe the services provided, including rates, quantities, and total cost. |

| Terms and Conditions | Include payment terms, such as due date and accepted payment methods. |

By personalizing these sections, you can create a payment request that is not only functional but also reflects the professionalism and personality of your business.

Incorporating Taxes and Discounts on Invoices

Accurately reflecting taxes and discounts in your billing documents is essential for clarity and professionalism. It ensures both you and your clients are on the same page regarding the final amount due. Whether you’re offering promotional discounts or complying with local tax laws, it’s important to calculate and present these details clearly. Properly accounting for these elements can also help maintain compliance with financial regulations and avoid potential misunderstandings.

Including Taxes

Taxes can vary greatly depending on your location and the nature of the services or goods provided. It’s crucial to include the correct tax rates and specify the tax amount applied. You should also clearly indicate whether the tax is already included in the total or if it’s an additional charge. This transparency helps to avoid confusion and ensures that the client understands the final cost breakdown.

- Clearly state the tax rate applied (e.g., 10%, 15%) and the amount.

- If the tax is included in the price, explicitly mention it, e.g., “Price includes tax.”

- For tax-exempt transactions, indicate that no tax is applied.

Applying Discounts

Discounts are often used to incentivize early payments, bulk purchases, or loyal customers. Be sure to clearly state any discount applied, including the percentage or amount, and how it affects the total price. It’s also useful to note the conditions under which the discount is offered, such as a limited-time offer or specific client eligibility.

- List the type of discount (percentage or fixed amount) and the total value.

- Indicate any discount expiration date or terms that apply.

- Clearly show the new total after the discount is applied.

Incorporating taxes and discounts properly not only demonstrates professionalism but also ensures the accuracy of your billing process, making your financial dealings smoother and more transparent for both parties involved.