Blank Trucking Invoice Template for Easy and Accurate Billing

Managing financial transactions in the transportation industry can be complex, especially when it comes to creating clear and professional documentation for each service provided. Proper invoicing is essential for maintaining smooth cash flow and ensuring timely payments from clients. A well-organized billing document helps both service providers and customers keep track of services rendered and amounts due, reducing confusion and minimizing errors.

For those in the logistics and freight business, having an easy-to-use and customizable format for generating payment requests can significantly streamline operations. By using a structured layout, service providers can focus on the quality of their work rather than spending time on creating repetitive paperwork. This approach not only enhances professionalism but also improves efficiency across the entire billing process.

With the right resources, anyone can create accurate, professional documentation quickly and easily. Whether you’re a small business owner or managing a large fleet, a reliable system for generating financial documents is crucial for success. In this article, we’ll explore how adopting a versatile, ready-to-use format can make the billing process simpler and more effective.

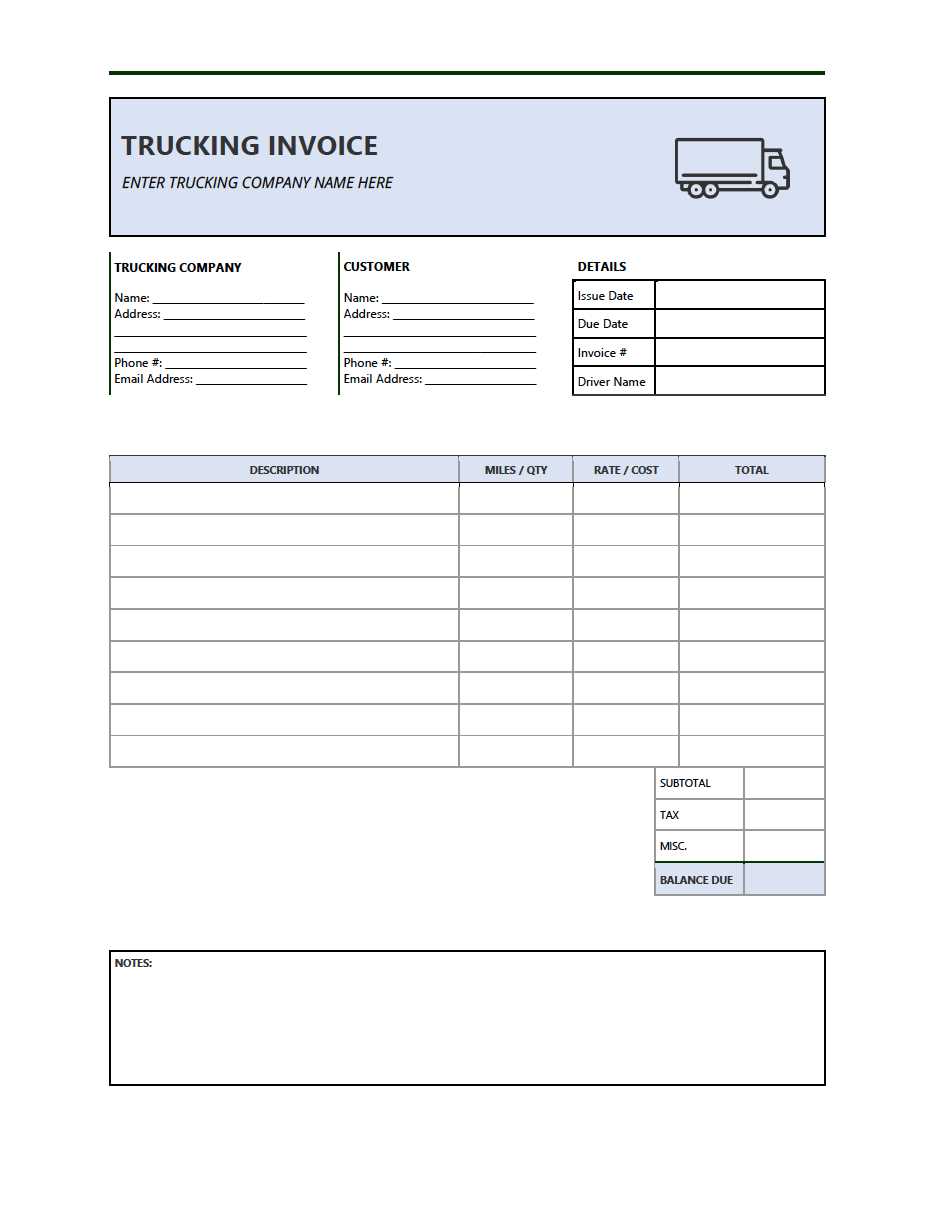

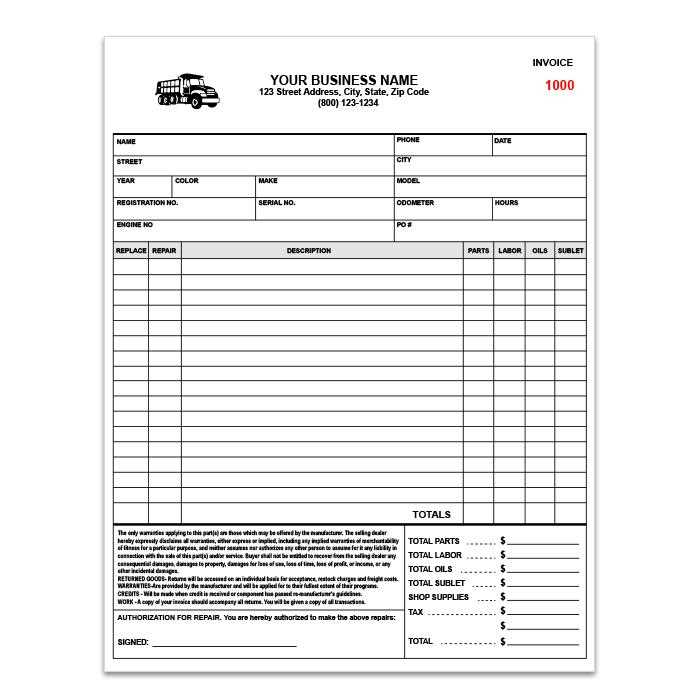

Blank Trucking Invoice Template Overview

In the transportation and logistics industry, having a standardized format for financial documentation is essential for maintaining organized records and ensuring seamless payment processing. A well-designed document layout allows service providers to efficiently request payments while presenting a professional appearance to clients. Such a format includes all the necessary fields to outline services provided, payment terms, and other essential details, making it easy for both parties to review and approve the charges.

Key Features of an Effective Document Layout

For any business involved in freight and delivery, a clear structure that highlights critical information is crucial. These documents typically feature sections for the client’s details, service descriptions, rates, and payment deadlines. Additionally, customizable areas for tax information, discounts, and extra charges can be added as needed. A well-organized design ensures that nothing is overlooked and that all necessary data is presented in a way that’s easy to understand.

Advantages of Using a Ready-to-Use Document Format

One of the major advantages of using a pre-structured document format is the time saved in creating payment requests. Instead of manually drafting each document, businesses can simply input the relevant data into a pre-made structure, significantly reducing administrative workload. Furthermore, using a consistent format helps build trust with clients, as they will quickly recognize the document’s professionalism. The ability to easily modify these files for different situations also allows for greater flexibility, accommodating a variety of billing needs.

How to Create a Trucking Invoice

Creating an accurate and professional billing document for transportation services is crucial for ensuring that payment requests are clear, transparent, and easy to process. The key to an effective payment request lies in including all necessary details in a well-structured format. Whether you’re an independent contractor or a fleet operator, following a step-by-step approach to generating these documents can save time and reduce the risk of errors.

Steps to Follow When Generating a Billing Document

To create a proper payment request, it’s important to include all the critical information your client will need to review and approve the charges. Here are the basic elements to include:

- Service Provider Information: Include your name, business name, address, phone number, and email address for easy communication.

- Client Details: Add the client’s name, company name (if applicable), and contact information.

- Unique Reference Number: Assign a unique ID to each document to help track transactions.

- Service Descriptions: Provide a clear breakdown of the services provided, including dates, duration, and specific tasks performed.

- Rate and Charges: Include the agreed-upon rate for services and any additional charges, such as fuel surcharges or special fees.

- Payment Terms: State when the payment is due and any penalties for late payments.

- Tax Information: If applicable, add any tax rates that need to be applied to the charges.

Choosing the Right Tools for Document Creation

While you can create these documents manually, using digital tools and software makes the process faster and more reliable. Many online platforms offer customizable forms that can be adapted to your specific business needs. Some benefits of using these tools include:

- Faster document generation with pre-filled fields

- Ability to save and reuse past documents for future use

- Automatic calculations for taxes and additional charges

Once you’ve included all the necessary details, review the document for accuracy, and send it to your client through email or print for physical delivery. This process will ensure timely and accurate payments, while helping you maintain a professional relationship with your clients.

Why Use a Blank Invoice Template

Using a pre-designed layout for generating payment requests can significantly improve efficiency and reduce the chances of mistakes. Such a ready-to-use structure provides a consistent format that ensures all necessary details are included without the need to create each document from scratch. This approach not only saves valuable time but also helps maintain a professional appearance in your financial communications with clients.

Time-Saving and Efficiency

When managing multiple clients or projects, the process of manually creating each billing document can quickly become time-consuming. With a pre-made layout, you can simply input the relevant details–such as the client’s name, services rendered, and payment terms–into the existing structure. This eliminates the need to repeatedly start from a blank page and allows you to focus on other important tasks.

Consistency and Professionalism

Having a uniform format for all payment requests ensures that your documents always appear polished and well-organized. Consistency in your billing process can help strengthen your brand image and build trust with clients, as they will recognize the professionalism of your financial communications. A standardized format also reduces the risk of leaving out key information, ensuring that every document is complete and easy to understand.

By incorporating a ready-to-use layout, you can streamline your billing process, avoid errors, and present a polished, professional image to clients, ultimately leading to smoother transactions and better business relationships.

Benefits of Customizable Invoice Formats

Customizable billing formats offer significant advantages, allowing businesses to tailor payment requests according to specific needs. The flexibility to adjust various sections of the document ensures that all essential details are included while maintaining a professional appearance. Whether it’s adjusting the layout, adding new fields, or modifying the design, customization makes it easier to cater to the unique requirements of each client or service.

One of the main benefits is the ability to adapt to changing business needs. For example, you can easily modify the format to accommodate different types of services, pricing structures, or payment terms. This ensures that all aspects of your transactions are accurately reflected, regardless of variations in your business model or client preferences.

Additionally, a customizable layout helps create a consistent brand identity. By adjusting the design, fonts, colors, and logo placement, you can ensure that every document aligns with your company’s visual style. This not only enhances professionalism but also helps reinforce brand recognition with clients.

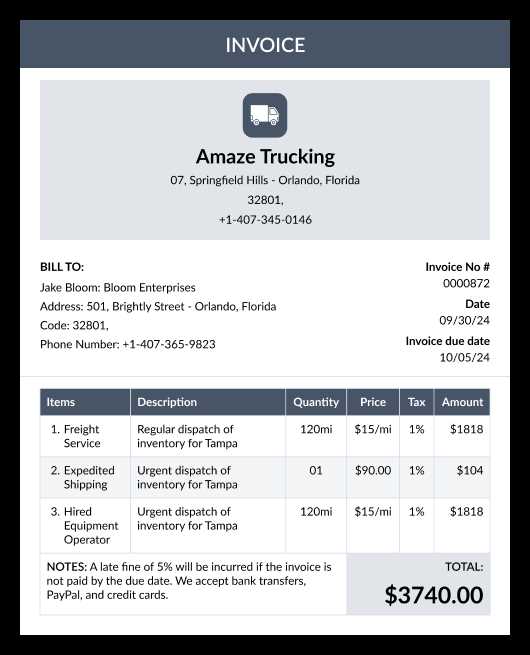

Essential Information for Trucking Invoices

Creating a comprehensive payment request requires including key details that help both the service provider and the client clearly understand the transaction. Each document must outline the services rendered, associated charges, and payment terms. Including the correct information ensures smooth processing and avoids confusion, helping to build a transparent and professional relationship with your clients.

Key Components to Include

For a payment request to be complete and effective, the following elements are crucial:

- Service Provider Information: Include your name, business name, and contact details, such as phone number and email address, for easy communication.

- Client Information: Add the recipient’s name, company name, and relevant contact details.

- Unique Reference Number: Assign a specific ID to each document for easy tracking and future reference.

- Details of Services Rendered: Provide a clear description of the services provided, including dates, duration, and any special conditions or requirements.

- Pricing and Charges: Clearly outline the rate per service, additional costs (such as fuel surcharges), and any applicable discounts.

- Payment Terms: State when payment is due and whether there are any penalties for late payments.

Additional Information to Consider

Other valuable details to include can range from tax rates to special instructions. For instance, you might need to specify a deposit or partial payment upfront, or add a breakdown of fuel charges and toll fees. Having these details laid out helps avoid misunderstandings and ensures that the client can easily verify the charges before proceeding with payment.

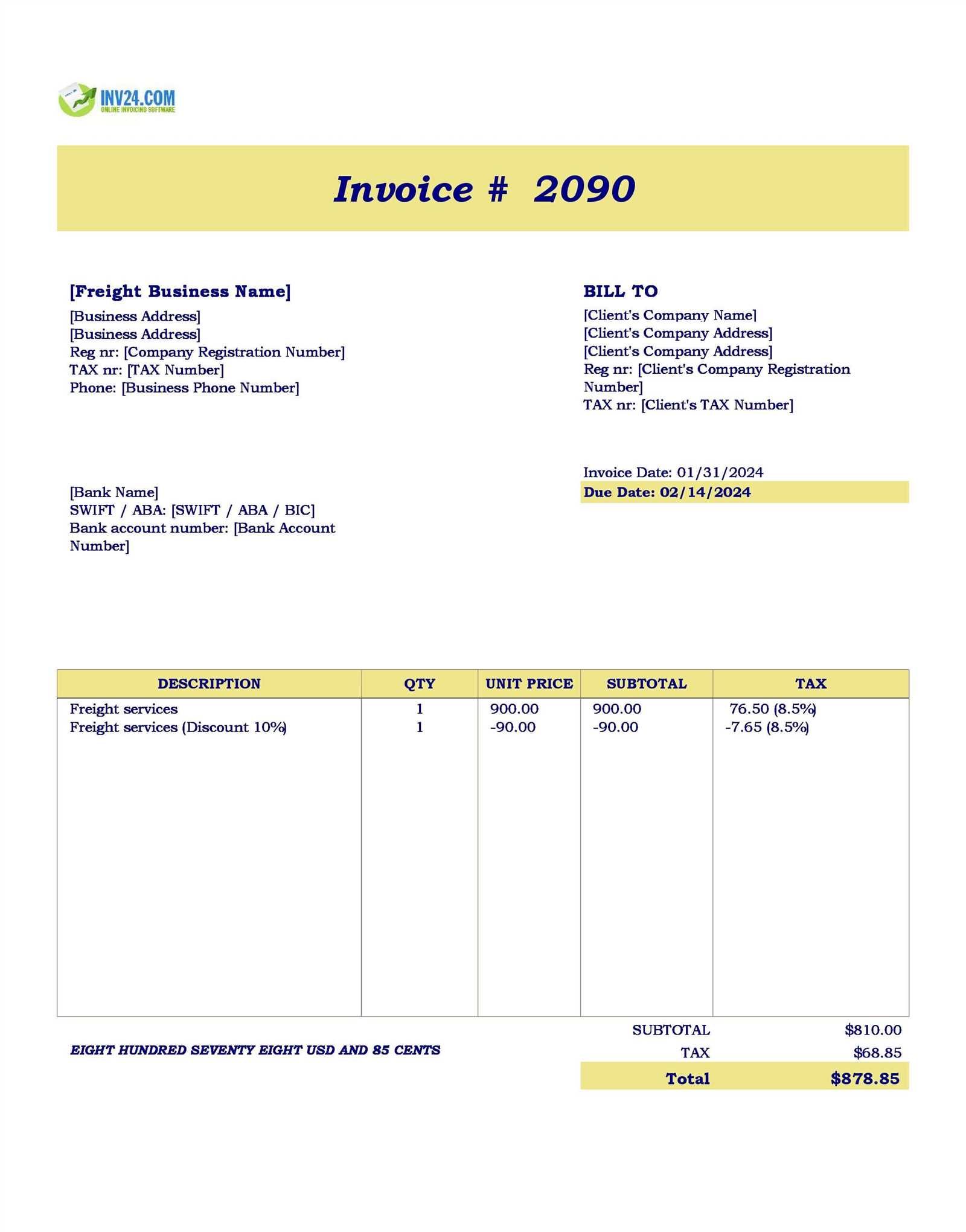

Free Blank Invoice Templates for Truckers

For service providers in the transportation industry, having access to a ready-to-use and customizable document layout is essential for simplifying the billing process. Fortunately, there are numerous free resources available that allow you to generate professional payment requests without having to design them from scratch. These free formats are ideal for truck drivers, logistics companies, or anyone in the freight sector looking to save time while maintaining a polished and accurate billing process.

Where to Find Free Billing Document Formats

Several online platforms offer free downloadable resources that can be easily customized for your specific business needs. Some of the best sources for these formats include:

- Online Invoice Generators: Websites like Invoice Simple and FreshBooks offer free basic versions of their billing tools with customizable fields and professional layouts.

- Microsoft Office Templates: Microsoft Word and Excel provide free downloadable formats that can be customized for different service types, including transportation.

- Google Docs and Sheets: Google offers free, easy-to-edit documents that can be accessed from any device, making them perfect for those who need flexibility on the go.

Advantages of Using Free Resources

Using a free, customizable format offers several advantages. Here are just a few:

- Cost-Effective: These resources save you money, as they are typically available at no charge.

- Time-Saving: Pre-designed structures allow you to quickly input your information without starting from scratch.

- Professional Results: These formats help ensure your payment requests appear well-organized and clear, contributing to a positive business image.

By leveraging these free tools, you can streamline your billing process, reduce administrative work, and ensure that your transactions are handled efficiently and professionally.

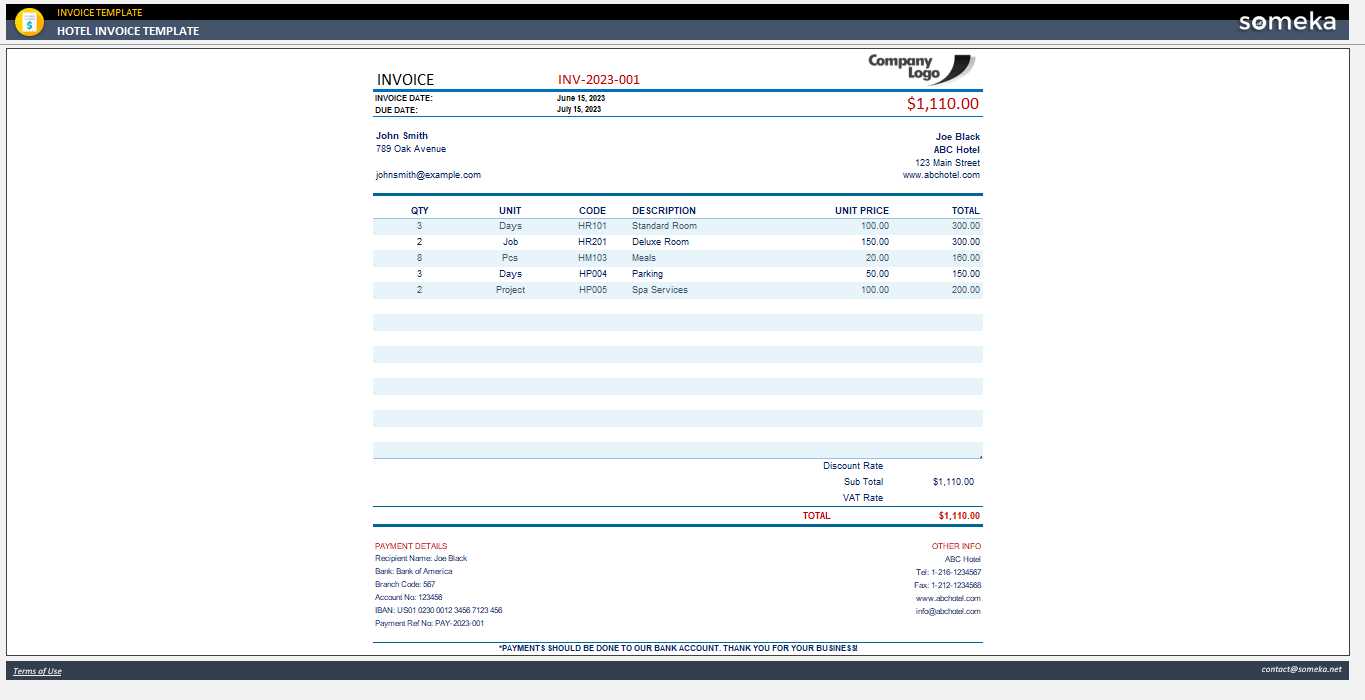

Choosing the Right Invoice Template

Selecting the right document format is crucial for ensuring that your payment requests are clear, professional, and aligned with your business needs. A well-chosen layout not only saves time but also helps maintain consistency and accuracy in your financial communications. The right structure can make your billing process smoother and more efficient, reducing the risk of errors and confusion for both you and your clients.

Factors to Consider When Choosing a Format

When deciding on the best format for your payment requests, there are several key aspects to take into account:

- Business Type: The complexity of the services you provide may determine how detailed the document needs to be. For simple services, a basic structure may suffice, while more complex services may require additional fields for extra charges or specific details.

- Customization Options: Choose a structure that allows you to adjust fields as necessary, such as adding discounts, taxes, or additional fees, depending on the nature of each transaction.

- Professional Appearance: A clean, organized design reflects well on your business. Make sure the format is easy to read and visually appealing to create a strong impression with clients.

- Ease of Use: Opt for a format that is simple to fill out and edit. You don’t want a layout that complicates the process or wastes time. The more intuitive the structure, the more efficient the billing process will be.

How to Test and Finalize Your Choice

Before settling on a final format, it’s important to test it out by creating a few mock documents. This will give you a sense of how the layout works in practice and help you identify any potential issues, such as missing sections or unclear fields. Once you’ve selected the best option, ensure that you have a system for consistently using the format across all your transactions to maintain uniformity.

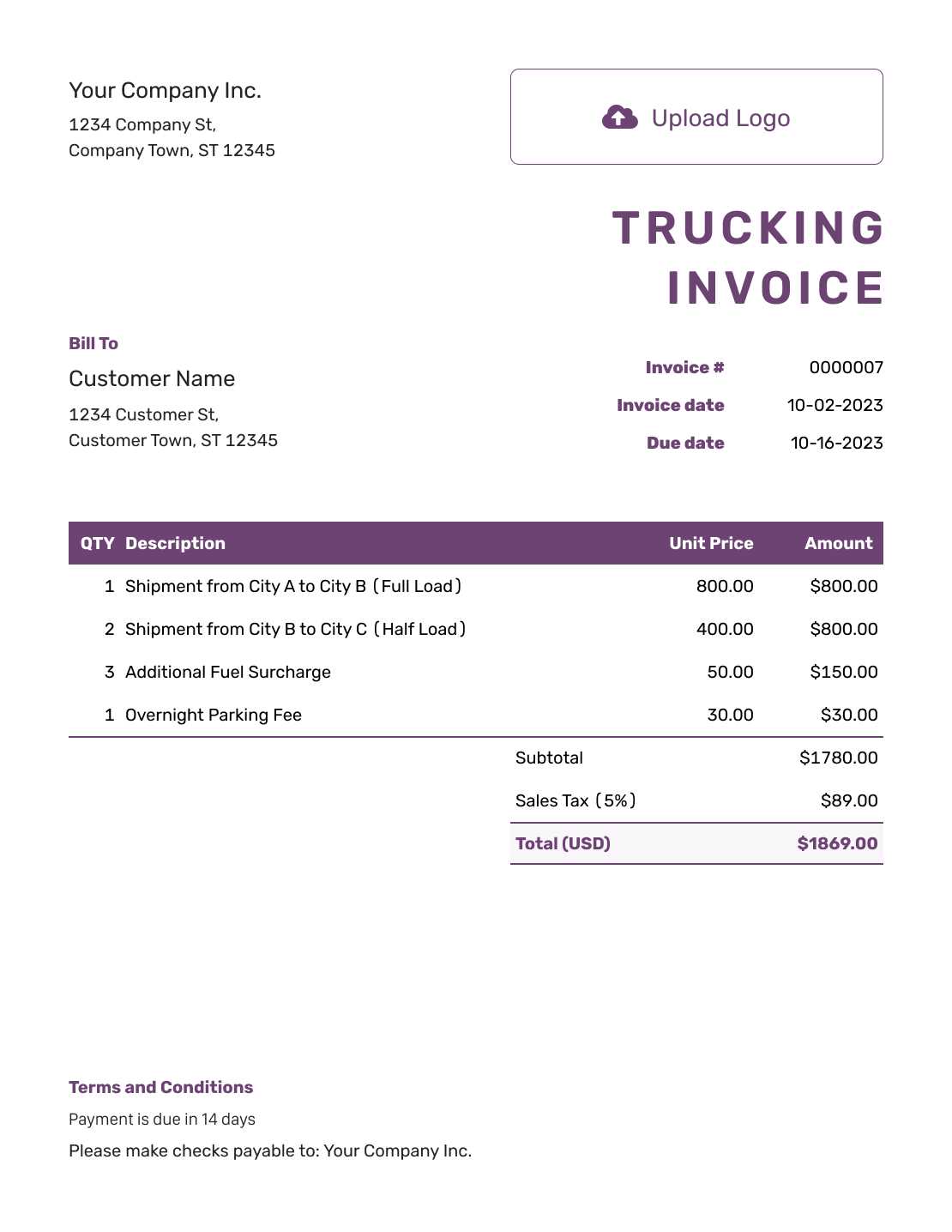

How to Customize a Trucking Invoice

Customizing your billing document allows you to tailor it to your specific business needs, ensuring that all necessary details are included and presented in a clear, professional manner. Whether you need to adjust the layout, add new sections, or update payment terms, the ability to personalize your document is a powerful tool for streamlining your billing process. Customization ensures that every transaction reflects the unique aspects of your services and helps maintain consistency across all communications.

Key Areas to Modify

When personalizing your payment requests, there are several sections that may need adjustment depending on your business requirements:

- Company Branding: Add your company logo, address, and contact details at the top of the document to reinforce your brand identity and make your communications more professional.

- Client Information: Ensure that the client’s name, company, and contact information are correctly entered for each transaction.

- Service Descriptions: Modify the service descriptions section to reflect the specific nature of the work completed. This may include adjusting the language or adding specific details related to each job.

- Pricing and Charges: Update rates, additional fees, or discounts as needed for each client or project. This section should be flexible to account for different pricing structures or extra costs.

- Payment Terms: Customize payment due dates, late fees, or any other conditions that are unique to each contract or client agreement.

Tools for Customization

There are various tools available to help you customize your payment documents, ranging from simple word processors to dedicated invoicing software. Many online platforms offer drag-and-drop customization, while spreadsheet tools like Excel or Google Sheets allow you to adjust fields and formulas. The key is to choose a tool that offers enough flexibility to meet your needs while being easy to use.

Common Mistakes to Avoid on Invoices

When preparing financial documents for clients, it’s important to ensure that all the necessary information is accurate and clearly presented. Small errors can lead to delays in payment, misunderstandings, or even lost revenue. By being aware of common mistakes, you can take the necessary precautions to avoid them and ensure that your payment requests are processed smoothly and efficiently.

1. Missing or Incorrect Client Details

One of the most basic yet important errors is failing to include the correct client information. This includes the client’s name, address, and contact details. Always double-check these fields to avoid sending a document with outdated or incorrect information, which could lead to confusion or payment issues. Inaccurate details may also delay processing or even result in the payment being sent to the wrong recipient.

2. Lack of Clear Payment Terms

Another common mistake is not specifying payment terms clearly. Without clear instructions on when the payment is due and any applicable late fees, clients may delay payments or misunderstand when they should make the payment. Always outline payment deadlines, methods, and penalties for overdue payments to ensure both parties are on the same page.

3. Not Itemizing Charges

Failing to provide a detailed breakdown of charges can create confusion. Clients may question the total amount if it’s not clear how it was calculated. Always itemize services, rates, taxes, and any additional costs so the client can easily verify the charges. This transparency helps prevent disputes and ensures that clients understand what they’re paying for.

4. Forgetting to Include a Unique Reference Number

Each financial document should have a unique reference or invoice number for tracking purposes. This is essential for maintaining accurate records, both for you and your clients. Without it, clients may struggle to identify or reference a specific payment, which could lead to delays or confusion.

5. Incorrect Calculations

Mathematical errors in your calculations, whether for rates, taxes, or discounts, can result in incorrect totals. Always double-check your numbers to ensure accuracy. Most invoicing software or tools come with built-in calculation features that can help eliminate errors, but it’s still important to review the final document before sending it out.

By being mindful of these common mistakes, you can create more effective and reliable payment requests, ensuring a smoother transaction process for both you and your clients.

Best Practices for Trucking Invoices

To ensure smooth business operations and timely payments, it’s important to follow best practices when creating financial documents. A well-structured and accurate payment request not only fosters professionalism but also reduces the chances of disputes, delays, or confusion. By adhering to these guidelines, you can streamline the billing process and build strong, lasting relationships with your clients.

1. Be Clear and Detailed

Clarity is key when preparing a billing document. Always provide a detailed breakdown of the services provided, including dates, locations, and specific tasks completed. Additionally, make sure the charges are itemized, including any additional costs such as fuel surcharges, taxes, or tolls. Clear communication about rates and services helps clients understand exactly what they’re paying for, reducing the likelihood of questions or misunderstandings.

2. Use Professional Design and Layout

The appearance of your document is a reflection of your business, so it’s important to use a clean and professional layout. Ensure that the document is easy to read, with clear headings and organized sections. Consistent use of fonts, spacing, and alignment contributes to a polished look that enhances your credibility. Include your company’s logo, contact information, and payment instructions prominently to help clients recognize your business quickly.

3. Set Clear Payment Terms

Clearly outline the payment terms on every document. Include the due date, accepted payment methods, and any penalties for late payments. Setting expectations early on helps avoid confusion and ensures that clients understand their responsibilities. If necessary, break down the payment schedule into stages, such as deposits or partial payments, to keep things transparent and manageable for both parties.

4. Double-Check for Accuracy

Before sending any billing document, always double-check for errors in details, calculations, and amounts. A simple mistake–whether it’s a wrong client name or an incorrect rate–can cause unnecessary delays and may even harm your reputation. Make sure all client information is accurate, the payment terms are correct, and the totals are properly calculated.

5. Follow Up Promptly

Once your document is sent, keep track of its status. If you haven’t received payment by the due date, follow up promptly with a polite reminder. Timely follow-ups can help maintain a steady cash flow and remind clients of their obligations without appearing overly aggressive.

By implementing these best practices, you not only ensure that your payment documents are accurate and professional, but you also foster trust with your clients, ultimately contributing to smoother transactions and long-term success.

How to Organize Trucking Payments

Efficiently managing payments is crucial for maintaining cash flow and ensuring the financial stability of any business. In the transportation industry, keeping track of payments can be especially complex due to varying client needs, service types, and schedules. By implementing a clear system for organizing payments, you can streamline your financial operations, avoid delays, and keep your business running smoothly.

1. Set Clear Payment Terms

Establishing clear and consistent payment terms for all your clients is the first step toward organizing payments. Specify due dates, accepted payment methods, and any late fees or discounts for early payments. Having this information outlined in advance ensures both parties know what to expect and reduces confusion when it comes time to settle the balance.

2. Use a Centralized Tracking System

Maintaining an organized system for tracking payment statuses is essential. Whether you use accounting software, spreadsheets, or a manual ledger, make sure to record every payment, outstanding balance, and due date. This centralized system will allow you to easily monitor which clients have paid, which invoices are overdue, and which payments are pending. Additionally, tracking payments in one place ensures that nothing falls through the cracks.

3. Send Timely Reminders

To ensure timely payments, send reminders to clients before and after the due date. A reminder sent a few days before the payment is due can prompt clients to prepare funds in advance, while a follow-up reminder after the due date can help speed up the process for overdue payments. By staying proactive with communication, you can maintain a steady cash flow and reduce the risk of overdue accounts.

4. Offer Multiple Payment Methods

Providing multiple payment options increases the likelihood that your clients will pay on time. Accepting payments through various methods, such as bank transfers, credit cards, or online payment systems like PayPal, gives your clients flexibility and makes the payment process easier. The more convenient it is for clients to pay, the more likely they are to settle their balances promptly.

5. Regularly Reconcile Payments

To avoid discrepancies and ensure that all payments are accounted for, it’s important to regularly reconcile your payment records. Cross-check the amounts received with your tracking system and bank statements to make sure everything matches. This will help you identify any discrepancies early on and prevent financial issues from arising down the road.

By implementing these strategies, you can organize your payments effectively, ensure that your financial records are accurate, and keep your business on track for continued success.

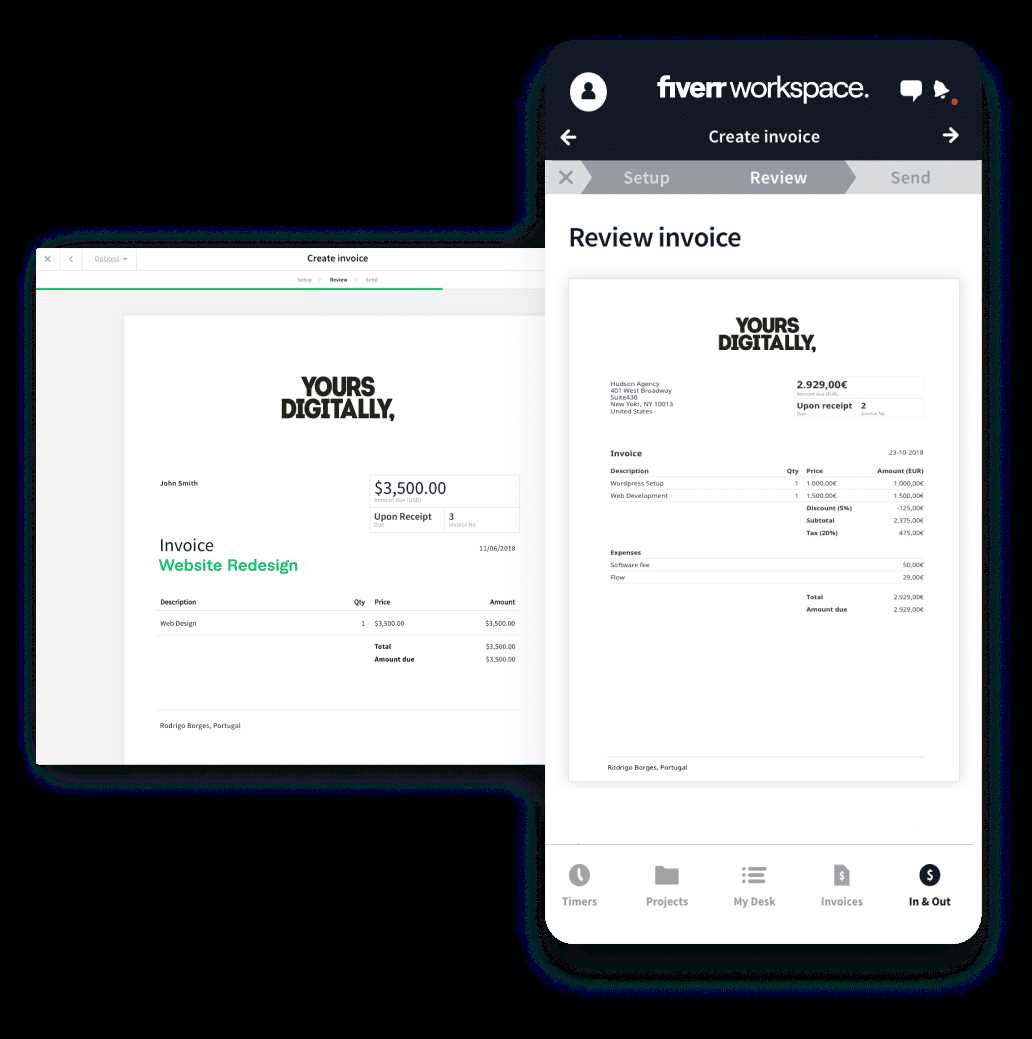

Improving Billing Efficiency with Templates

Optimizing the billing process is essential for businesses looking to streamline their operations and maintain a steady cash flow. One of the most effective ways to improve efficiency is by using pre-designed document formats that are easy to customize. These formats save time, reduce errors, and ensure consistency in all your payment requests, allowing you to focus more on growing your business and less on administrative tasks.

Benefits of Using Pre-Designed Formats

Utilizing ready-to-use structures offers several key advantages that can enhance your overall billing process:

- Time-Saving: Pre-made formats eliminate the need to start from scratch for each new transaction. Simply fill in the necessary details, and the document is ready to go.

- Consistency: Using the same layout for all financial documents ensures uniformity, making it easier for clients to read and understand your requests. This helps establish a professional image.

- Reduced Errors: With structured fields and set sections, the risk of missing crucial details or making mistakes is minimized. This reduces the chance of misunderstandings or disputes over payments.

- Customization: These formats can be tailored to your specific business needs, allowing you to add or remove sections based on the type of services provided or the preferences of individual clients.

How to Make the Most of Pre-Designed Billing Documents

To fully benefit from pre-made formats, consider the following tips:

- Regular Updates: Periodically review and update the format to reflect any changes in your pricing, payment terms, or other important information.

- Automate Where Possible: If using invoicing software, take advantage of automation features that can populate client details, payment amounts, and due dates automatically based on previous transactions.

- Ensure Professionalism: Customize the format to include your company logo, brand colors, and contact information, making each document a polished representation of your business.

- Standardize Fields: Use the same terminology and structure for all documents to make them easier for clients to understand and process.

By incorporating these strategies, you can make your billing process faster, more accurate, and more professional, ultimately contributing to improved cash flow and client satisfaction.

Saving Time with Pre-Designed Invoices

Streamlining the process of creating financial documents is essential for any business looking to improve efficiency. Using pre-designed layouts can significantly reduce the time spent on administrative tasks, allowing you to focus on core business activities. These ready-made structures eliminate the need to manually create new documents from scratch, helping you quickly generate accurate and professional payment requests with minimal effort.

With a well-structured format, you can simply input the necessary details such as service descriptions, amounts, and client information. This reduces the time required for creating each document, which is especially beneficial when handling multiple transactions. The consistency of pre-made layouts ensures that each document meets the same high standard, improving both efficiency and professionalism.

By leveraging pre-designed formats, businesses can achieve faster turnaround times for billing, maintain accurate records, and minimize the risk of errors–ultimately saving time and ensuring smooth financial operations.

Automating Trucking Invoice Generation

Automating the process of creating financial documents can save businesses considerable time and effort, allowing for faster and more accurate billing. By leveraging software or tools that automatically generate payment requests based on pre-set information, businesses can eliminate the manual work involved in preparing these documents. Automation ensures that each request is consistent, professional, and error-free, while reducing the workload on administrative staff.

Advantages of Automating Payment Document Creation

Implementing automated systems for generating billing documents offers several key benefits:

- Time Efficiency: Automation speeds up the creation process, enabling you to generate payment requests in a matter of seconds rather than hours.

- Consistency: Automated systems ensure that all documents follow the same format, reducing the chances of errors and inconsistencies in your records.

- Accuracy: Automation can pull client data, service details, and rates directly from your database, minimizing human errors and ensuring that all calculations are correct.

- Customizable Features: Many automation tools allow you to set specific parameters, such as payment terms, late fees, and discount structures, ensuring that each document is tailored to the needs of your business.

How to Implement Automation

To start automating your financial document creation, follow these simple steps:

- Choose the Right Software: Select a platform or tool that integrates with your existing systems and provides features suited to your needs, such as invoicing or accounting software.

- Set Up Your Client and Service Data: Input the necessary information, including client details, rates, services, and payment terms, into the software. Many tools allow you to store this information for easy access with each new document.

- Automate the Generation Process: Set up templates and rules within the software to automatically generate documents based on the data entered. You can schedule automatic bill creation or generate them on demand as needed.

- Review and Send: While automation handles most of the work, always review the document before sending it to ensure all information is accurate and complete.

By automating the creation of financial documents, businesses can streamline operations, improve accuracy, and focus more on delivering excellent service rather than administrative tasks. The result is a more efficient workflow and timely payments.

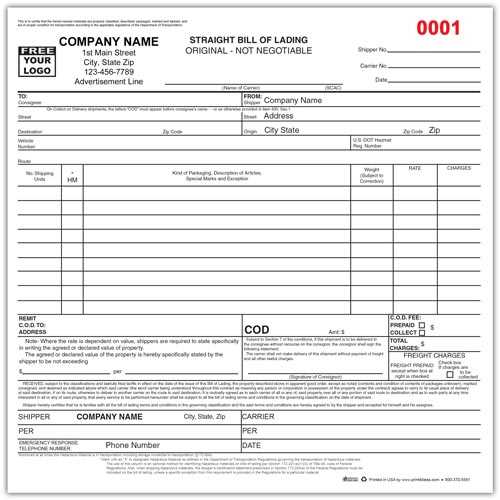

Legal Considerations in Trucking Invoices

When preparing financial documents for payment requests, it’s essential to ensure that all legal requirements are met. A properly structured document not only facilitates smooth business transactions but also protects both parties in the event of disputes. Understanding the key legal considerations for your payment documents helps avoid costly mistakes, ensures compliance, and provides clear terms that can be enforced if necessary.

1. Clear Payment Terms and Conditions

One of the most important legal aspects of any financial document is outlining the payment terms clearly. This includes specifying the due date, accepted payment methods, and any penalties for late payments. Clearly stating these terms prevents confusion and provides a legal basis for enforcing payments if the client fails to adhere to the agreed-upon schedule. Additionally, any discounts or additional fees should be explicitly mentioned to avoid disputes over charges.

2. Proper Documentation of Services Rendered

For legal protection, it’s essential to include a detailed description of the services provided. Each task, including its scope, duration, and agreed-upon rate, should be clearly outlined. This documentation acts as evidence in case of a disagreement over what was delivered. Additionally, having an itemized breakdown helps ensure transparency, allowing clients to easily understand the charges and reducing the likelihood of misunderstandings or potential legal issues.

3. Inclusion of Relevant Legal Clauses

To further protect both parties, it’s important to include any necessary legal clauses in your financial documents. This can include terms related to jurisdiction, dispute resolution, and any limitations of liability. Depending on your location and the nature of the services, these clauses can be essential in determining how any legal issues will be handled in the event of a conflict. Make sure these clauses are in line with local laws and regulations to ensure they are enforceable.

By keeping these legal considerations in mind when preparing your payment requests, you can safeguard your business interests and ensure that all financial transactions are legally sound and clear. This helps avoid costly legal battles and fosters a professional and trustworthy relationship with clients.