Blank Self Employed Printable Invoice Template for Easy Billing

Managing payments is a crucial task for anyone running their own business, and having the right tools can make this process much smoother. A well-designed billing document helps ensure that transactions are clear, professional, and accurate, which fosters trust with clients. Whether you’re working on a one-time project or a long-term contract, knowing how to create and use a proper payment record is essential for staying organized and getting paid on time.

Many professionals turn to ready-made solutions that allow for quick adjustments to match their business needs. These customizable forms are simple to personalize, ensuring that all the necessary details are included without the hassle of creating a document from scratch. With the right format, you can easily fill in client names, services provided, and payment terms, making the entire process more efficient and reducing the risk of errors.

In this guide, we will explore the best options for those looking for straightforward billing solutions, highlighting the key elements to include and the benefits of using pre-designed formats. By the end, you’ll be equipped with the knowledge to create polished, professional payment records in no time.

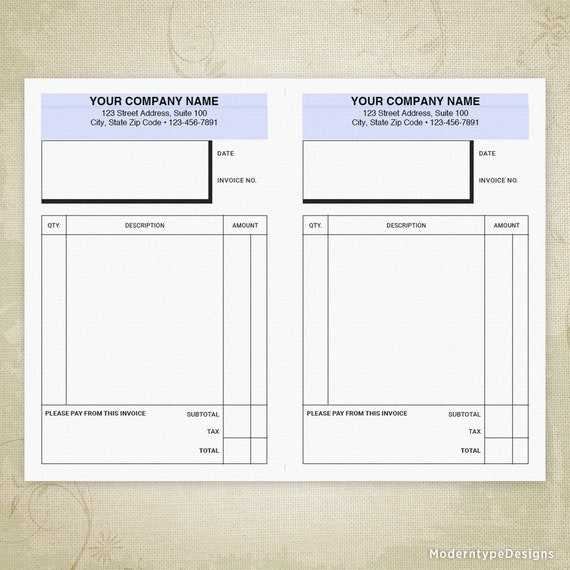

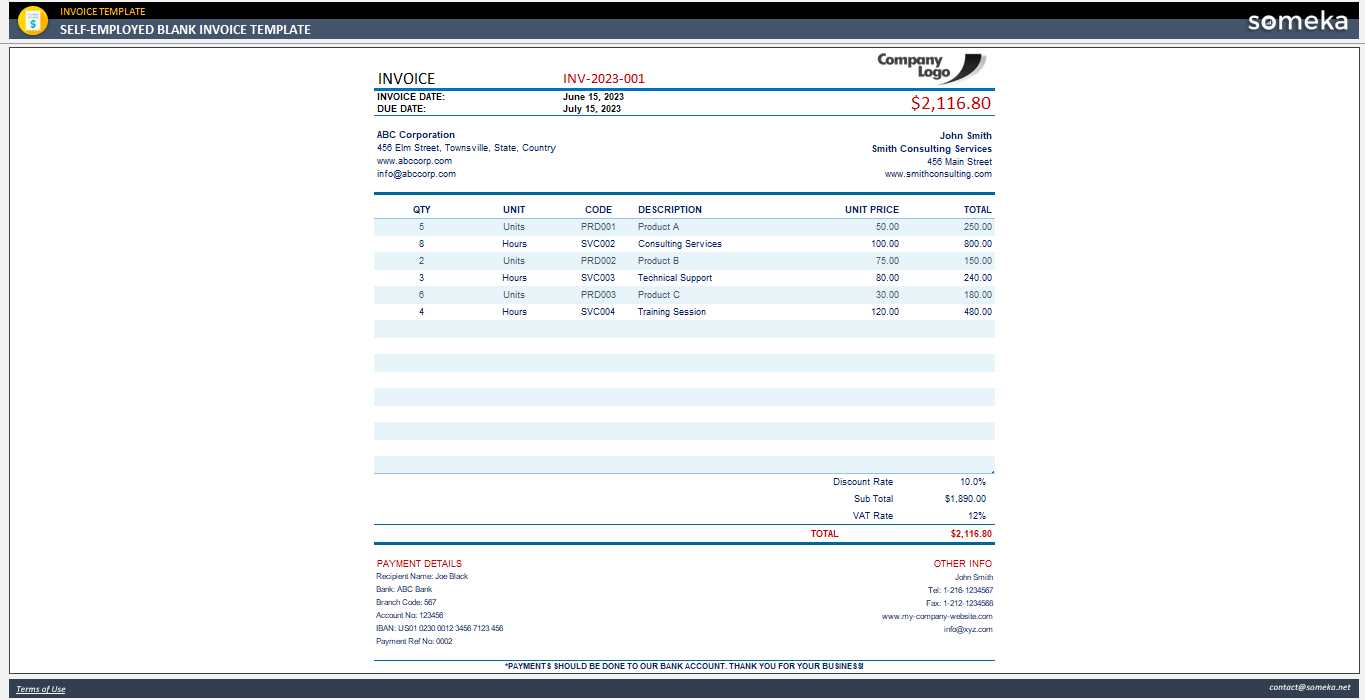

Blank Self Employed Printable Invoice Template

For independent professionals, having a standardized document to request payment for services is essential. A well-organized billing record not only provides clarity to clients but also ensures you have a formal way to track income and expenses. Using an adaptable, ready-made form helps streamline the process, allowing you to focus more on your work and less on administrative tasks.

The main advantage of using such a document is the simplicity it offers. With predefined sections for the key details–like the payer’s information, service description, payment due date, and total amount–you can quickly create a document that meets legal and business requirements. Whether you’re a freelancer, contractor, or consultant, this approach eliminates the need to design a new record for every transaction.

Choosing the right form depends on the type of services you offer and the complexity of your business. Many professionals opt for flexible options that allow them to easily modify content, ensuring the format fits different clients and projects. This way, each bill is tailored to the specific situation, helping to maintain professionalism while simplifying the entire billing process.

Why Use an Invoice Template

For any professional providing services or products, requesting payment in a clear and organized manner is key to maintaining smooth business operations. Using a structured document to outline payment terms not only simplifies the billing process but also helps build credibility with clients. By relying on a pre-designed format, you ensure that all essential details are consistently included, saving time and reducing the risk of errors.

Time Efficiency

Creating a billing statement from scratch for every transaction can be time-consuming. By using a pre-made form, you can avoid the hassle of designing a new record each time you need to request payment. The process becomes as simple as filling in the relevant details, allowing you to focus more on your work and less on administrative tasks.

Consistency and Professionalism

- Having a uniform format for all billing statements helps create a professional image for your business.

- A standardized form ensures that all necessary information is included, reducing confusion and potential disputes.

- It reflects a well-organized approach, which can increase trust and reliability in the eyes of clients.

Using a consistent format for each transaction also minimizes the chances of overlooking key details, such as payment due dates or specific service descriptions. This approach not only streamlines your work but also enhances the overall experience for your clients, helping to ensure timely payments and long-term business relationships.

Benefits of Printable Invoice Formats

Using a ready-made document for requesting payments offers several advantages that can make the billing process more efficient and professional. These formats are designed to streamline the collection of essential details, ensuring that all necessary information is included without the need for constant editing or redesign. Whether you’re managing a small business or handling freelance projects, relying on such a format can save time and reduce errors.

Enhanced Organization

One of the main benefits of using a ready-to-use payment record is the level of organization it brings. Each field is clearly labeled, making it easy to fill in details such as client names, service descriptions, and amounts owed. This structure helps ensure that nothing is missed, which reduces confusion and simplifies accounting tasks.

Convenience and Flexibility

- Ready-to-fill forms allow you to quickly generate a professional document with minimal effort.

- These formats can be easily customized to suit your business needs, whether it’s for hourly services, project-based work, or product sales.

- You can print them for physical delivery or send them digitally to clients, offering flexibility in communication.

Having a convenient document format at hand means you can issue payment requests without delay, helping to keep cash flow steady and reducing the risk of missing payments. The flexibility to personalize these forms ensures they fit a variety of business models, making them a valuable tool for many professionals.

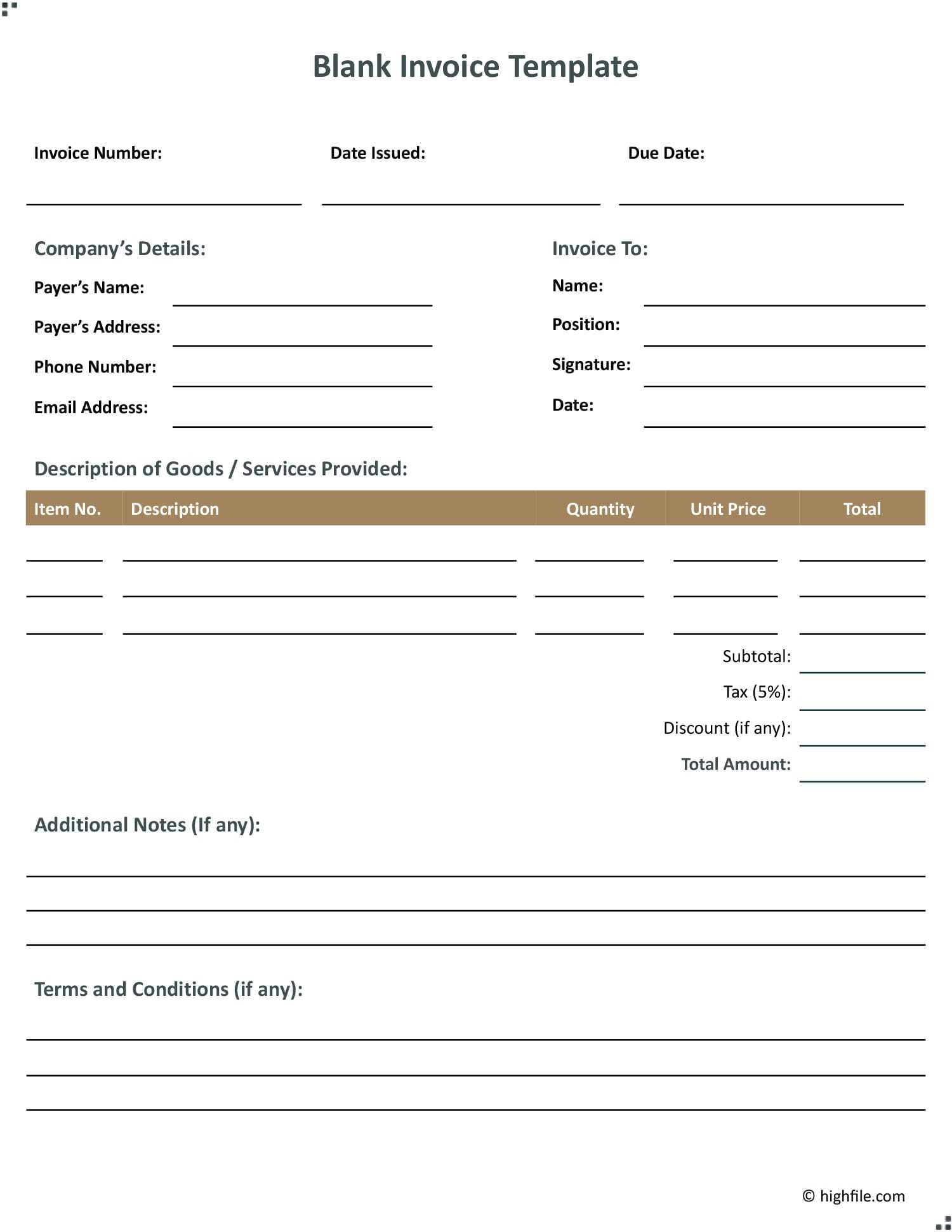

How to Customize Your Invoice Template

Customizing a billing record allows you to tailor it to your specific needs, ensuring that it reflects your business style and meets any legal or contractual requirements. Adjusting the design and content to fit your unique services can make the document more professional and easier for clients to understand. The flexibility to modify different sections helps you stay organized and ensures all important details are included.

When customizing your payment request form, it’s important to focus on key sections that must be accurate and clear. Below is a simple guide on what to adjust for a personalized look:

| Section | How to Customize |

|---|---|

| Header | Include your business name, logo, and contact information to make the document professional and identifiable. |

| Client Details | Ensure your client’s name, address, and contact information are correctly filled in for clear communication. |

| Service Description | Detail the services or products provided, including dates, quantities, and descriptions to avoid confusion. |

| Payment Terms | Clearly state the payment due date, any late fees, and accepted methods of payment to avoid misunderstandings. |

| Total Amount | Break down costs clearly, showing any discounts or taxes to ensure transparency. |

By adjusting these sections, you create a personalized and professional payment request that suits your specific business needs. This not only helps you maintain clarity and accuracy but also builds trust with your clients through well-organized communication.

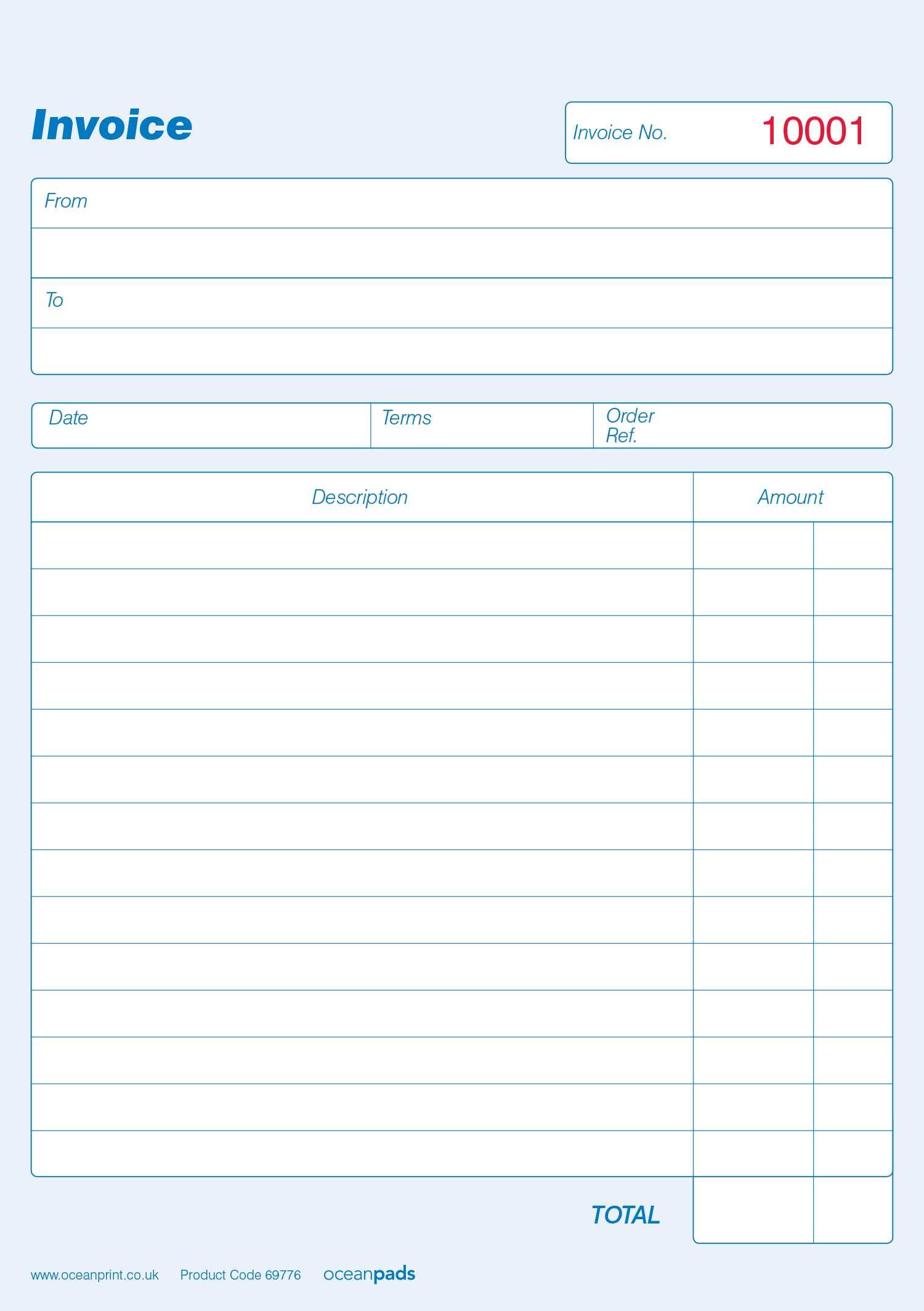

Essential Information for an Invoice

When creating a billing document, it’s important to include key details that ensure clarity and transparency for both you and your client. A well-structured record not only helps prevent misunderstandings but also makes it easier to track payments and maintain proper financial records. Certain information is critical for every transaction, regardless of the type of service or product provided.

Below are the essential elements that should always be included in your billing record:

- Business and Client Details: Clearly list your business name, address, and contact information, as well as the client’s name, address, and contact details. This helps to avoid confusion and ensures both parties can easily reach each other if necessary.

- Unique Reference Number: Each document should have a unique number or identifier. This helps in tracking and organizing payments, making it easier to refer back to past transactions.

- Service or Product Description: Provide a detailed description of what was offered, including the type of service, quantity, and any additional specifications. This ensures both parties are on the same page regarding what has been delivered.

- Payment Terms: Include the agreed-upon payment terms, such as the due date, late fees, and acceptable payment methods. This reduces confusion and sets expectations for timely payment.

- Total Amount Due: Clearly list the amount to be paid, including any taxes, discounts, or additional charges. This ensures there are no surprises for the client and helps avoid disputes over the final cost.

Incorporating these key elements into your payment request form makes it more professional, transparent, and easy to process. Whether you’re dealing with a one-time project or an ongoing contract, these details will help ensure that both you and your client have a clear understanding of the terms and amounts involved.

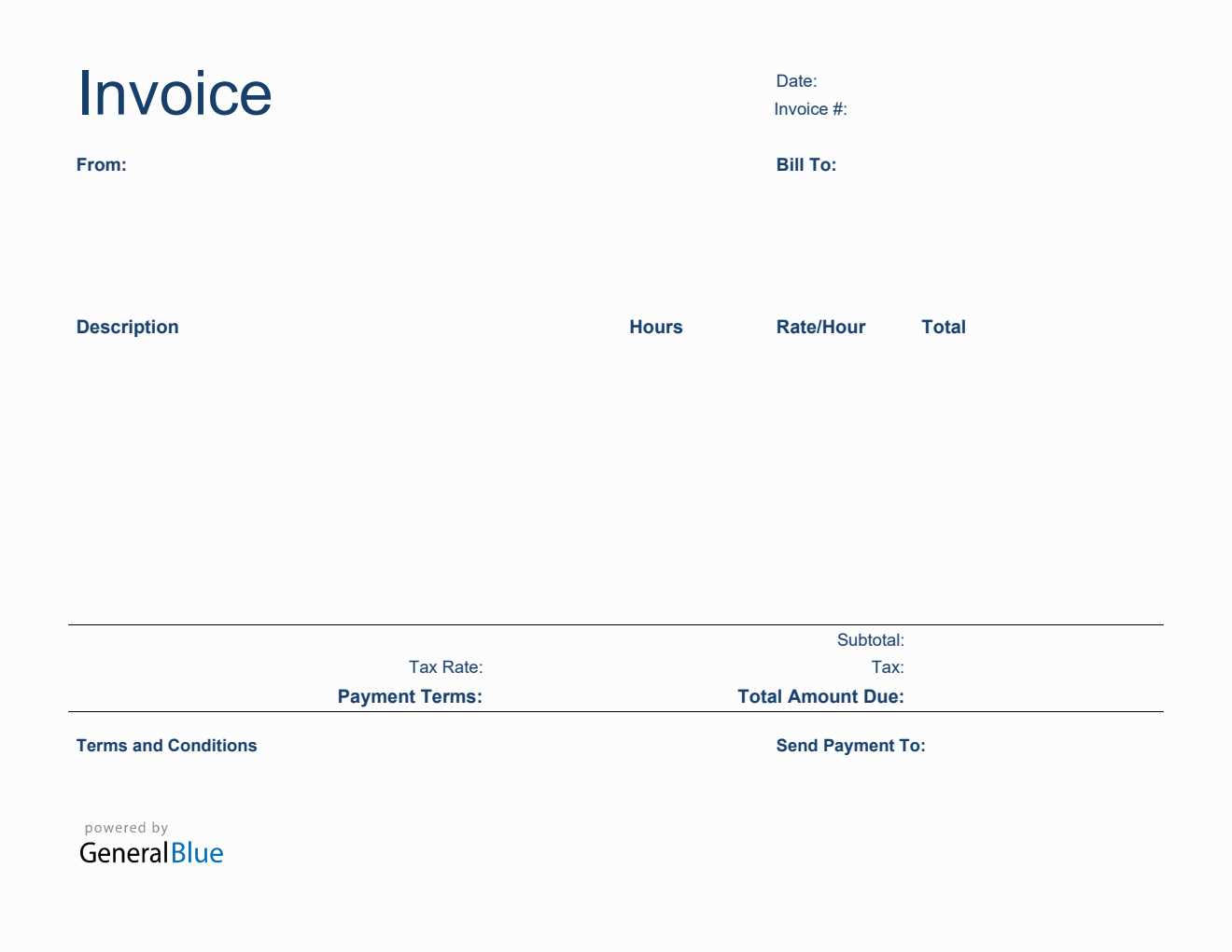

Choosing the Right Template for Freelancers

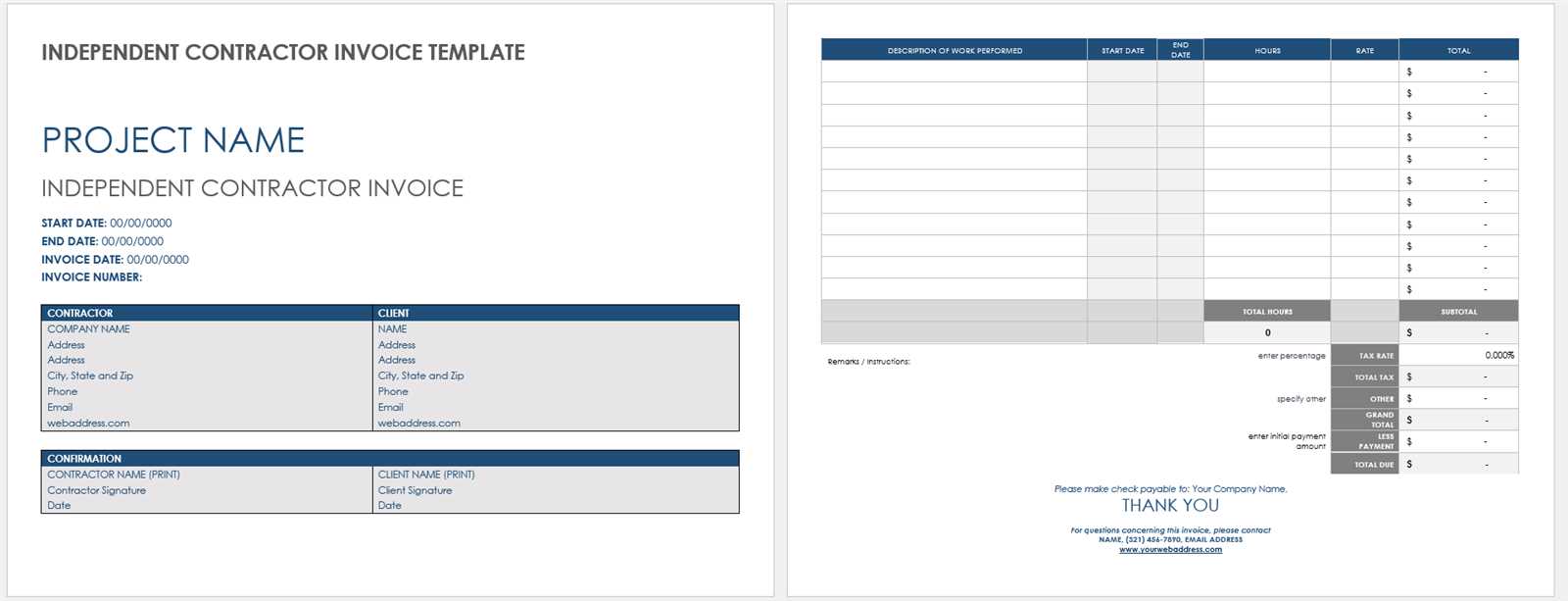

When selecting a billing format for your freelance business, it’s important to find one that suits your specific needs and workflow. The right document should be simple yet comprehensive, allowing you to efficiently communicate payment details to clients while maintaining a professional appearance. There are various factors to consider when choosing the most suitable solution for your freelance work.

Firstly, consider the type of services you offer. If you charge by the hour, a template that allows for detailed time tracking and hourly rates is essential. For project-based work, a format that includes sections for milestones and agreed-upon project fees may be more appropriate. Flexibility is key, as it ensures you can adapt the format to different types of projects and clients.

Another important consideration is customization. Look for an option that allows you to easily modify the layout and content. This can include adding your logo, adjusting color schemes to match your brand, and customizing text fields to suit your particular business terms. A customizable format ensures that your billing document aligns with your personal style and enhances your professional image.

Finally, consider the ease of use. The template should be user-friendly, requiring minimal effort to fill in details. It should also be compatible with the tools you use, such as word processors, spreadsheets, or online invoicing software, to make the process even more efficient. With the right format, you can streamline your administrative tasks and focus on what you do best–delivering high-quality services to your clients.

Top Features of Invoice Templates

When choosing a payment request document, it’s important to focus on the features that enhance its usability and professionalism. A good document format should not only make it easy to fill in details but also ensure that every essential element is included to avoid confusion and promote timely payments. Below are some of the key features to look for when selecting a billing record.

Clarity and Simplicity

The most important feature of any payment record is clarity. A well-designed format should be easy to read and understand. Key sections such as the payment due date, service description, and total amount due should be clearly labeled and easy to locate. This helps ensure that both you and your client can quickly reference important details without searching through the document.

Customizability and Flexibility

Every freelancer or small business has unique needs, so it’s essential to choose a document format that can be easily customized. The ability to add your business logo, adjust fonts, or include custom terms allows you to maintain a professional and branded appearance. Flexibility also extends to the structure of the form–whether you need space for hourly rates, project-based pricing, or additional charges, a customizable layout ensures your document adapts to various situations.

Additionally, including fields for client information, payment methods, and even a space for notes or terms ensures that you can tailor each record for different projects and clients. This makes the billing process more efficient and less repetitive.

Automated Calculations

Many modern document formats include automated fields for calculating totals, taxes, and discounts. This feature saves time and reduces the risk of human error, ensuring that the final amount due is accurate every time. Whether you’re working with complex pricing or simple fees, having these calculations done automatically provides added convenience and ensures the integrity of your payment request.

How to Save Time with Templates

Using a pre-designed billing document can significantly reduce the amount of time spent on administrative tasks. Rather than starting from scratch for each transaction, you can quickly fill in the necessary details, streamlining the process and allowing you to focus on your core work. This time-saving approach is especially valuable for busy professionals managing multiple clients or projects.

One way to save time is by selecting a format that suits your business model. Whether you charge by the hour, by project, or based on specific services, a flexible solution can be easily adjusted to fit your needs without requiring major changes each time. For instance, including predefined sections for rates, terms, and client information ensures that you don’t need to repeat the same steps for every new billing record.

Additionally, templates with pre-set calculations allow you to automatically compute totals, taxes, and discounts, eliminating the need to manually crunch numbers. This reduces the risk of errors and speeds up the process, especially when working with large volumes of transactions or complex pricing structures.

By using an efficient, ready-made document format, you can reduce the time spent on creating bills and focus more on providing quality services, improving your productivity and ensuring timely payments without unnecessary delays.

Creating Professional Invoices Easily

Creating a polished payment request doesn’t need to be time-consuming or complicated. With the right approach, you can produce professional documents quickly and efficiently, ensuring that all necessary details are accurately communicated to your clients. This process can be simplified by using a clear, structured format that includes all the essential components for a smooth transaction.

Key Elements for a Professional Look

When designing your payment request, focus on including the following elements to maintain professionalism and clarity:

- Clear Business Information: Include your business name, logo, and contact details at the top of the document, so clients can easily identify it as an official record.

- Client Details: Accurately fill in your client’s name and contact information to ensure there are no mix-ups, especially when dealing with multiple clients.

- Well-Defined Service Breakdown: Be specific about the services provided, including quantities, hours worked, or project deliverables, to avoid confusion.

- Payment Terms: Clearly state when payment is due and outline accepted methods, such as bank transfer, credit card, or online payments, for transparency.

Quick and Easy Customization

By using a format that is easy to customize, you can quickly adjust for each client or project without needing to start from scratch. Here are a few ways to streamline the customization process:

- Pre-fill repetitive fields, such as your business details, payment terms, and tax rates, to save time on each new document.

- Ensure the document is adaptable for various projects or hourly rates by allowing space for flexible pricing adjustments.

- Personalize each document with a professional touch, such as adding a unique reference number or personalized message for the client.

With these elements and an efficient format in place, creating polished payment requests becomes a simple task. This approach ensures that every document you send reflects a professional image, while keeping the process fast and stress-free.

Free Printable Invoice Templates for Self-Employed

For independent professionals, having access to free and ready-to-use billing documents can be a game-changer. These no-cost options allow you to quickly create professional payment requests without the need for expensive software or hiring a designer. Whether you’re a freelancer, contractor, or consultant, using a pre-made solution can save both time and effort while ensuring you get paid on time.

Free billing records can be easily customized to fit your unique needs. Many platforms offer downloadable formats that are simple to adjust, enabling you to add your logo, business details, and specific terms. With the right document in hand, you can easily update client names, service descriptions, and amounts due, creating a seamless and efficient billing process.

In addition to being cost-effective, these free documents can be a great way to maintain a professional image. With clear sections for payment terms, due dates, and itemized services, a well-organized payment request enhances your credibility and helps avoid confusion or delays in payments.

For anyone looking to streamline their billing process, free, customizable formats are an excellent solution. They provide the perfect balance of simplicity, professionalism, and ease of use, ensuring that you can focus on your business while maintaining control over your finances.

Best Tools to Edit Invoice Templates

When it comes to creating professional payment requests, having the right tools can make a significant difference. Whether you’re looking for flexibility, ease of use, or advanced features, the right software allows you to customize your billing forms to perfectly match your business needs. Here are some of the top tools available for editing and personalizing your billing documents.

Top Editing Tools for Customizing Your Billing Records

These tools offer a range of features that help you create, edit, and manage payment requests efficiently:

- Microsoft Word: Ideal for users who prefer a more traditional, word processing approach. Word offers simple editing options and flexibility for creating professional documents from scratch or using pre-designed formats.

- Google Docs: A free, cloud-based option that allows for easy collaboration and access from anywhere. It’s perfect for freelancers who need to create and edit records on the go, with the added benefit of real-time sharing with clients.

- Canva: Known for its easy-to-use design tools, Canva provides customizable templates with visually appealing layouts. Great for those who want to create invoices that stand out with professional design elements.

- Wave: A free online accounting software that includes an intuitive invoicing feature. Wave offers a variety of pre-built, customizable layouts and integrates easily with your business accounts for streamlined billing.

- Zoho Invoice: A cloud-based solution specifically designed for creating and managing invoices. Zoho Invoice offers robust customization features, including the ability to add logos, adjust layout, and track payment status in real-time.

Features to Look for in an Editing Tool

When selecting a tool for editing your billing documents, keep an eye out for these key features to make your workflow smoother:

- Customizable Layouts: Ensure the tool allows you to adjust fields such as service descriptions, rates, and totals.

- Automated Calculations: A tool with automated calculations for totals, taxes, and discounts saves you time and reduces errors.

- Branding Options: Look for tools that allow you to add your logo, color scheme, and contact details to maintain a professional image.

- Cloud Integration: Tools that store documents in the cloud allow you to access and edit your records from anywhere, providing convenience and flexibility.

- Client Information: Ensure that your client’s name, address, and contact details are correct. Mistakes here can delay communication or cause confusion when processing the payment.

- Service Descriptions: Clearly define the services rendered or products provided. Be specific about quantities, rates, and dates to avoid misunderstandings.

- Payment Terms: Verify that payment terms, such as due dates and accepted methods, are correctly stated. Any ambiguity can lead to delayed or missed payments.

- Amounts and Calculations: Double-check all figures, including totals, taxes, and any discounts applied. Small calculation errors can lead to significant discrepancies over time.

- Specify the Tax Rate: Clearly state the tax rate being applied to the total amount. This should be indicated as a percentage and should match the applicable rate for the product or service provided in your location or the client’s location, depending on the tax laws.

- Breakdown of Tax Amount: Provide a detailed breakdown of the tax amount. If multiple taxes are involved (such as federal, state, or local), list each tax separately and show how much is being charged for each one.

- Indicate Taxable Amount: Show the amount of the service or product that is subject to tax before applying the tax rate. This is particularly useful if only part of the total amount is taxable.

- Provide Your Tax ID Number: Depending on your region or business structure, you may need to include your tax identification number (TIN) or VAT number on your billing document to ensure that your tax filings are correctly linked to your business.

- Payment Status Section: Clearly mark whether the payment is “Paid,” “Pending,” or “Overdue.” Some templates allow you to add dates for when payments were made or are due, making it easier to track progress.

- Outstanding Balance: Always show the remaining balance due after partial payments. This helps both you and your client stay on top of what still needs to be paid.

- Payment Method: Include a field to indicate how the payment was made (e.g., bank transfer, check, or credit card). This can serve as a helpful reference if there are any discrepancies later on.

- Due Date Reminder: Mention the due date prominently, and use additional formatting (like highlighting or bold text) to draw attention to overdue balances.

- Professionalism: Properly issued payment records create a professional image and give clients confidence in your business practices.

- Legal Protection: These records serve as a legal reference in case of payment disputes, helping you prove the agreed-upon terms and amounts.

- Cash Flow Management: Clear and accurate documents help businesses track payments, plan for expenses, and manage cash flow more effectively.

- Tax Compliance: Properly documented transactions ensure that all income is recorded, making it easier to file taxes and stay compliant with tax regulations.

- Microsoft Office Templates: Microsoft offers a wide range of free options for creating formal payment documents that you can customize in Word or Excel. These templates are versatile and easy to use for businesses of all sizes.

- Google Docs and Sheets: Google provides free, editable document templates that you can access directly from your Google account. These options are great for people who prefer cloud-based solutions and real-time collaboration.

- Canva: Canva provides free templates with customizable designs for various types of professional documents. Their user-friendly drag-and-drop interface makes it easy to create visually appealing payment requests without any design experience.

- Zoho Invoice: Zoho offers a free plan that includes access to a range of customizable billing templates. It also includes features like automatic tax calculation and payment reminders.

- Freelancer Websites: Websites like Upwork and Fiverr often provide free downloadable payment forms, as well as tips on how to customize them to match your business branding.

- Online Marketplaces: Platforms such as Etsy sometimes offer free downloadable documents created by independent designers, which can be a good option if you’re looking for something unique or creative.

- Incorrect Client Information: Failing to include the correct name, address, or contact details of the client can cause delays in payment or legal complications. Always double-check the client’s information to ensure accuracy.

- Missing or Incorrect Dates: Not including the correct issue and due dates can lead to confusion over payment timelines. Make sure the dates are clear and accurate to avoid misunderstandings.

- Unclear or Missing Payment Terms: Not specifying how payments should be made (e.g., bank transfer, check, or credit card) can leave clients unsure about how to proceed. Always list your preferred payment methods and due dates clearly.

- Omitting Tax Information: Failing to include tax rates or tax-exempt status can result in issues with compliance or disputes over amounts owed. Be sure to include the applicable tax rates and specify whether taxes are included or additional.

- Vague Item Descriptions: If the products or services are not described clearly, clients might question what they are being charged for. Provide specific and detailed descriptions of each item or service provided to avoid confusion.

- Wrong Calculation of Totals: Miscalculating totals or taxes can lead to payment delays or customer dissatisfaction. Double-check all calculations to ensure they are accurate before sending the document.

- Not Including an Invoice Number: An invoice number is essential for organization and tracking. Without it, it can be difficult for clients to reference or for your business to track payments correctly.

- Review Before Sending: Always take a few extra minutes to review the document for any mistakes before sending it to your client. A second glance can catch errors you may have missed the first time.

- Use Software or Tools: Utilizing automated tools or online platforms can reduce the likelihood of human error. Many software solutions offer pre-built templates and auto-calculation features that ensure accuracy.

- Standardize Your Process: Establishing a clear, consistent process for creating and sending payment requests can reduce mistakes. Use the same format and layout for every document to keep things organized.

- Hourly Rate Breakdown: Ensure to specify the number of hours worked and the rate for each hour to make the calculation transparent.

- Project Milestones: If you’re working on a long-term project, it’s helpful to list milestones and associated payments.

- Reimbursable Expenses: For certain consulting services, clients may need to reimburse travel or material costs, which should be listed separately.

- Product Descriptions and Quantities: Always list each product separately, including quantities and individual prices.

- Shipping Fees: If applicable, include the shipping costs as a separate line item.

- Tax Information: Specify the applicable taxes for each product or service sold, ensuring the total amount due is accurate.

Ensuring Accuracy in Your Invoices

Accuracy is critical when creating payment requests. An incorrect bill can lead to confusion, delayed payments, or even damage to your professional reputation. To ensure your billing documents are error-free, attention to detail and a systematic approach are essential. Implementing the right checks can help prevent common mistakes and streamline the payment process.

Key Elements to Double-Check

Before sending any billing document, review the following areas carefully:

Tools to Help Ensure Precision

Using automated tools and software can reduce the risk of errors and save time. Many billing solutions offer built-in calculators, pre-set templates, and automatic tax adjustments that minimize manual work and ensure consistency across all documents. These tools are designed to help freelancers and small business owners create accurate, error-free documents with minimal effort.

By carefully reviewing your documents and utilizing the right tools, you can ensure that every payment request is precise, professional, and clear, helping you maintain a positive relationship with your clients and ensuring timely payments.

How to Include Tax Information on Invoices

Including accurate tax details in your payment request documents is essential for compliance with local regulations and for maintaining transparency with clients. Properly detailing tax amounts not only ensures you meet legal obligations but also helps your clients understand the full breakdown of the charges. Whether you’re applying sales tax, VAT, or other taxes, it’s important to present this information clearly and accurately.

To include tax information properly, follow these steps:

By presenting tax details clearly, you help clients understand the charges and avoid confusion when processing payments. It also reduces the risk of errors in future tax reporting, ensuring that your business remains compliant with local tax regulations.

Tracking Payments with Invoice Templates

Efficiently tracking payments is crucial for managing cash flow and ensuring that your business remains financially healthy. A well-organized payment request document can help you keep track of amounts due, amounts received, and any outstanding balances. By incorporating tracking features into your billing process, you can avoid confusion and reduce the risk of missed payments.

Many pre-designed payment request forms include sections specifically for marking payment status. These sections allow you to indicate whether the payment has been made, is pending, or is overdue. This simple feature helps you monitor each transaction and ensures you have a clear overview of what’s been paid and what’s still outstanding.

Key Features to Track Payments Effectively

Here are some important tracking elements to include in your payment requests to stay organized:

Using Software to Simplify Payment Tracking

For more advanced tracking, consider using accounting software or online platforms that integrate payment tracking directly into the process. These systems often provide automatic updates, such as reminders when a payment is due or overdue, and they can sync directly with your bank account to update payment statuses in real-time.

By incorporating these features into your billing documents, you can effectively track payments and maintain a clear financial record. Whether you’re using a simple form or advanced software, having a structured way to track payments ensures that you never lose track of your income and can quickly resolve any payment-related issues.

Why Invoices Are Important for Business

In the world of business, having a clear and formal record of financial transactions is essential for maintaining organization, transparency, and accountability. Properly documented requests for payment serve as proof of the services rendered or products delivered, helping both businesses and clients keep track of their financial dealings. Without these detailed records, it becomes difficult to manage cash flow, maintain accurate books, and avoid disputes with customers or clients.

For any business, issuing well-structured documents is not only about getting paid but also about fostering professionalism and trust with clients. These records are legal documents that help establish the terms of payment, including amounts due, payment methods, and due dates. This transparency makes it easier to resolve any potential conflicts, as everything is clearly outlined in writing.

Benefits of Using Payment Requests in Business

Here are several key advantages of having a formal payment request process in place:

Key Information to Include in Your Payment Requests

To ensure that your records are comprehensive and useful, make sure they include the following essential details:

| Key Information | Why It Matters |

|---|---|

| Client Information | Ensures that the right person or company is billed and helps track who made the payment. |

| Itemized List of Services or Products | Provides clarity on what is being charged for, which helps prevent confusion and disputes. |

| Amount Due | Indicates the exact amount the client owes, ensuring there are no misunderstandings. |

| Payment Terms | Clearly states when the payment is due and the accepted payment methods, reducing delays. |

By consistently issuing clear and professional records for each transaction, businesses can protect their income, streamline oper

Where to Find Free Invoice Templates

For businesses looking to create payment requests without spending money on software or design services, there are plenty of free resources available online. These resources offer customizable formats that suit various business needs, from freelancers to small enterprises. By using free tools and templates, you can save time and money while still producing professional, clear, and organized documents.

Here are some popular places to find no-cost options for creating billing records:

Online Platforms with Free Templates

Several websites provide a variety of free formats that you can easily download and use:

Freelancer Communities and Websites

Freelancer-focused platforms also offer a variety of resources to help create well-designed billing documents:

By taking advantage of these free resources, businesses can access high-quality payment formats, making it easier to maintain professional relationships with clients and stay organized. Whether you prefer a basic design or a more creative approach, these free tools can help you manage your finances efficiently and effectively.

Common Mistakes to Avoid on Invoices

When creating formal payment requests, it’s easy to overlook small details that can lead to confusion, delays, or disputes. Even minor errors can result in clients questioning the charges or misinterpreting payment terms. To ensure smooth transactions and professional relationships, it’s crucial to avoid common pitfalls when preparing your billing documents.

Typical Errors to Watch Out For

Best Practices to Avoid Mistakes

By avoiding these common mistakes, you can ensure that your billing process runs smoothly, maintain professionalism, and foster better relationships with your clients. Accurate and clear payment requests not only help in getting paid on time but als

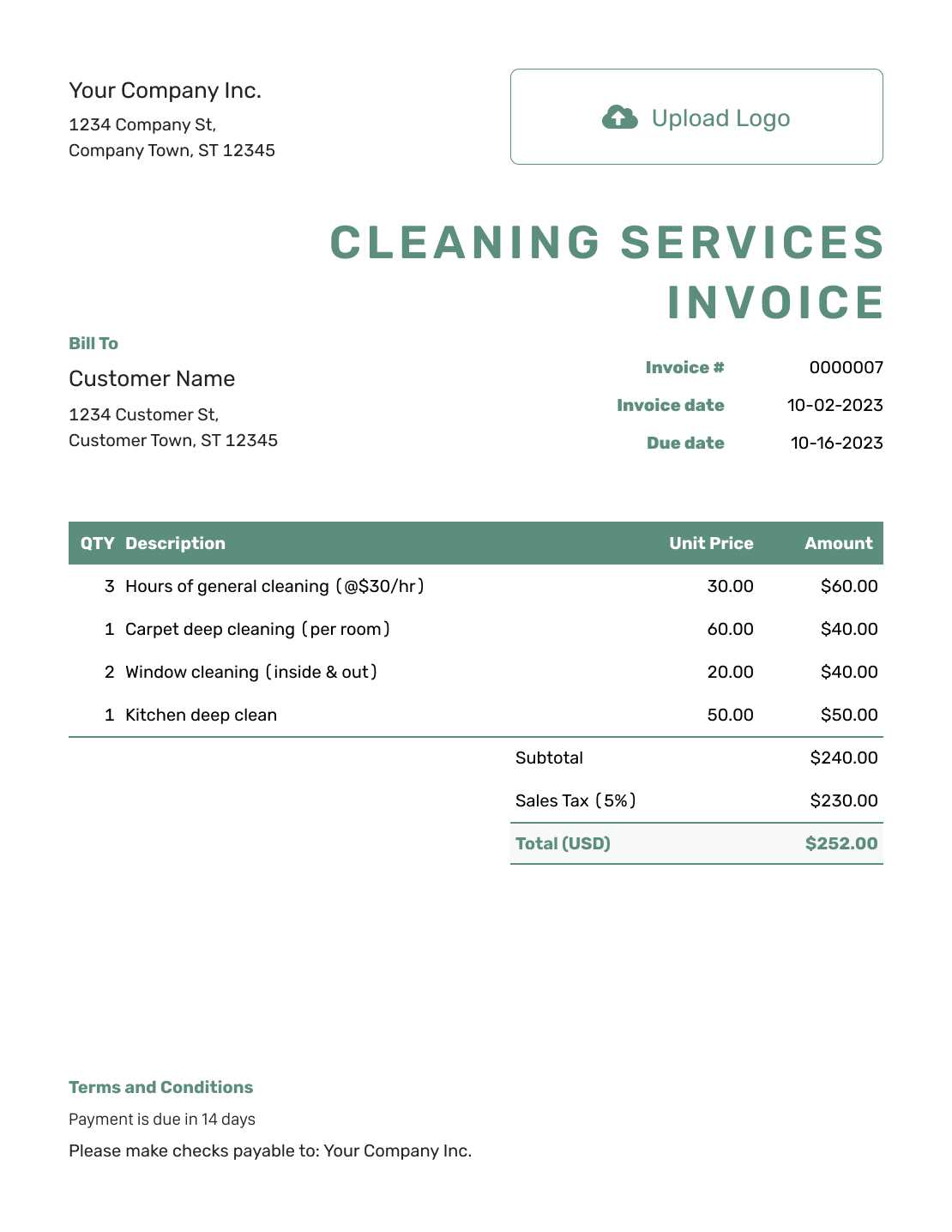

Printable Invoice Templates for Different Industries

Every business has its own specific requirements when it comes to creating formal payment requests. While the core elements of a billing document remain the same, certain industries may need to highlight unique details or structure their records differently. Customizing the layout and content according to your field can make your documents more professional and easier for clients to understand. Whether you’re in consulting, retail, or construction, using the right format can streamline the process and help you maintain a high level of professionalism.

Here are some industry-specific features to consider when creating billing statements:

Consulting and Freelance Services

For consultants or freelancers, payment requests often need to reflect the hours worked, the type of work performed, and any relevant project milestones. Including details such as hourly rates, project deliverables, or even time logs can provide clarity for both parties and reduce the chance of disputes.

Retail and E-commerce

In retail and online stores, payment documents typically focus on product details, quantities, and total costs. Additionally, tax information and shipping charges are often important elements. Having a clear and detailed breakdown of each product or service makes it easier for customers to verify what they are paying for.

Construction and Trade Services

In industries like construction or trade services, payment records typically need to account for labor, materials, and specialized equipment. Including itemized costs for each phase of the project, as well as the expected completion dates, helps ensure that both parties are clear a