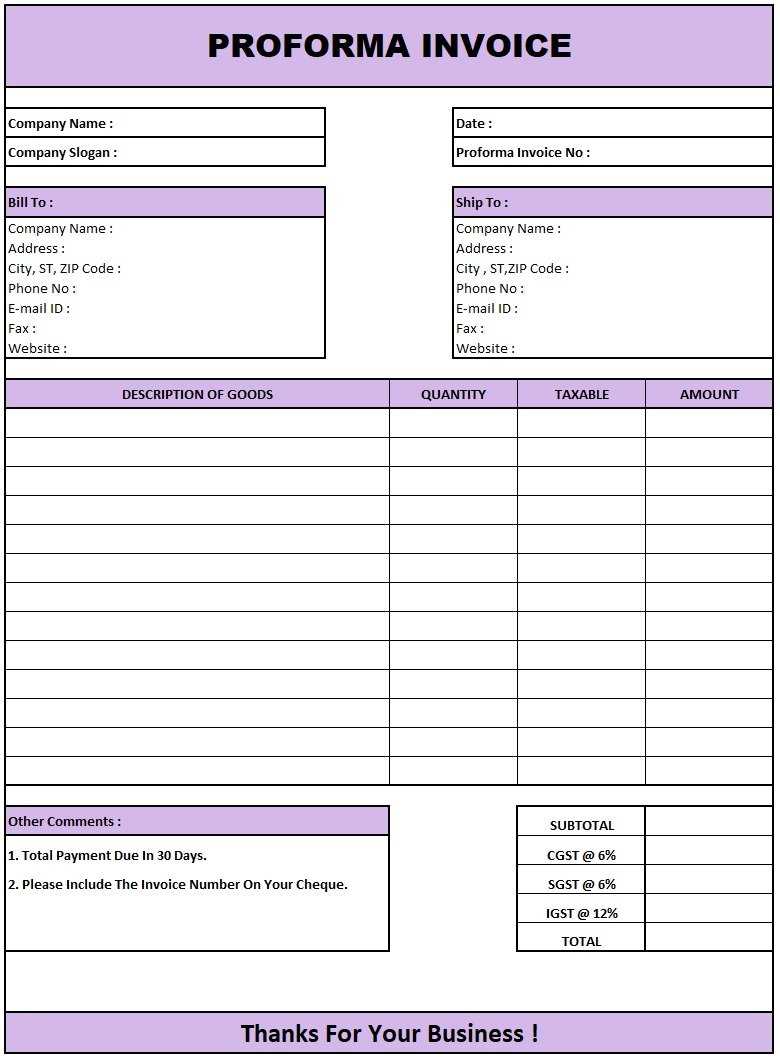

Blank Proforma Invoice Template for Easy Use

In business transactions, clear communication and professional presentation are key elements to ensure smooth operations. One of the most important documents used in the early stages of a deal is a preliminary sales record. This document serves as an outline of the goods or services being provided, detailing quantities, prices, and terms before finalizing the deal.

Using a well-organized document not only saves time but also minimizes the risk of misunderstandings between parties. When customized to fit your specific needs, it becomes a versatile tool that can be adjusted for various business dealings. A simple, customizable form can help streamline your workflow and enhance the professional appearance of your documents.

Having a ready-made format that can be easily filled in with relevant details ensures that no critical information is missed. With just a few adjustments, this document can be tailored to meet the requirements of any industry or client. By adopting this approach, businesses can avoid errors and focus on maintaining strong relationships with their customers.

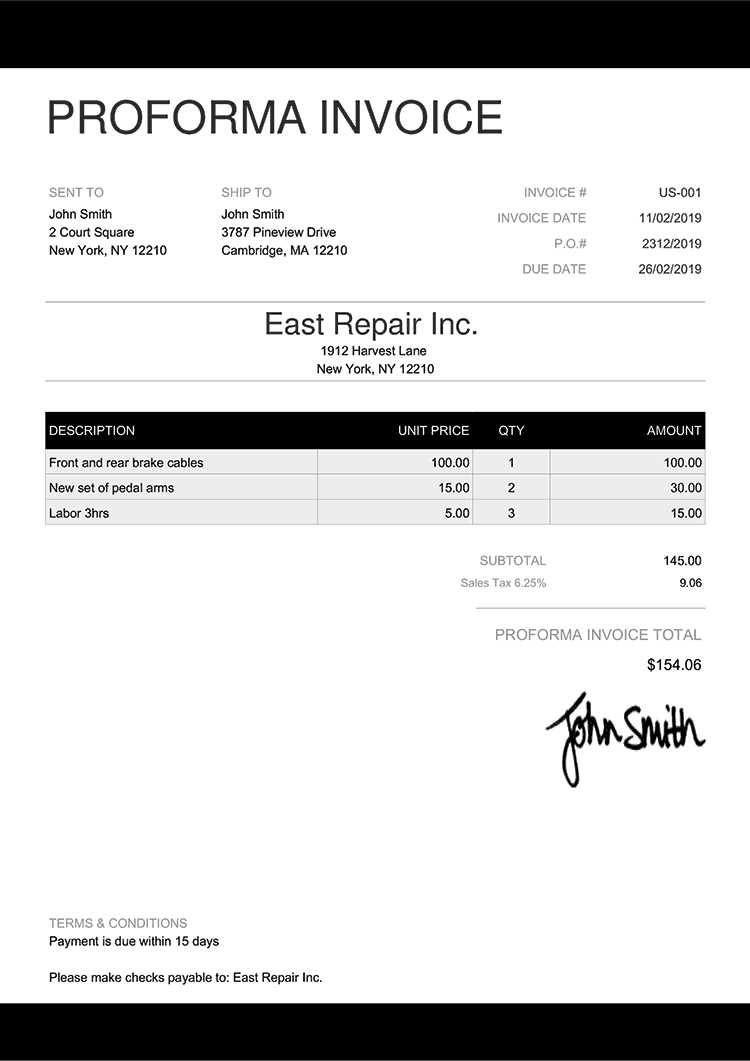

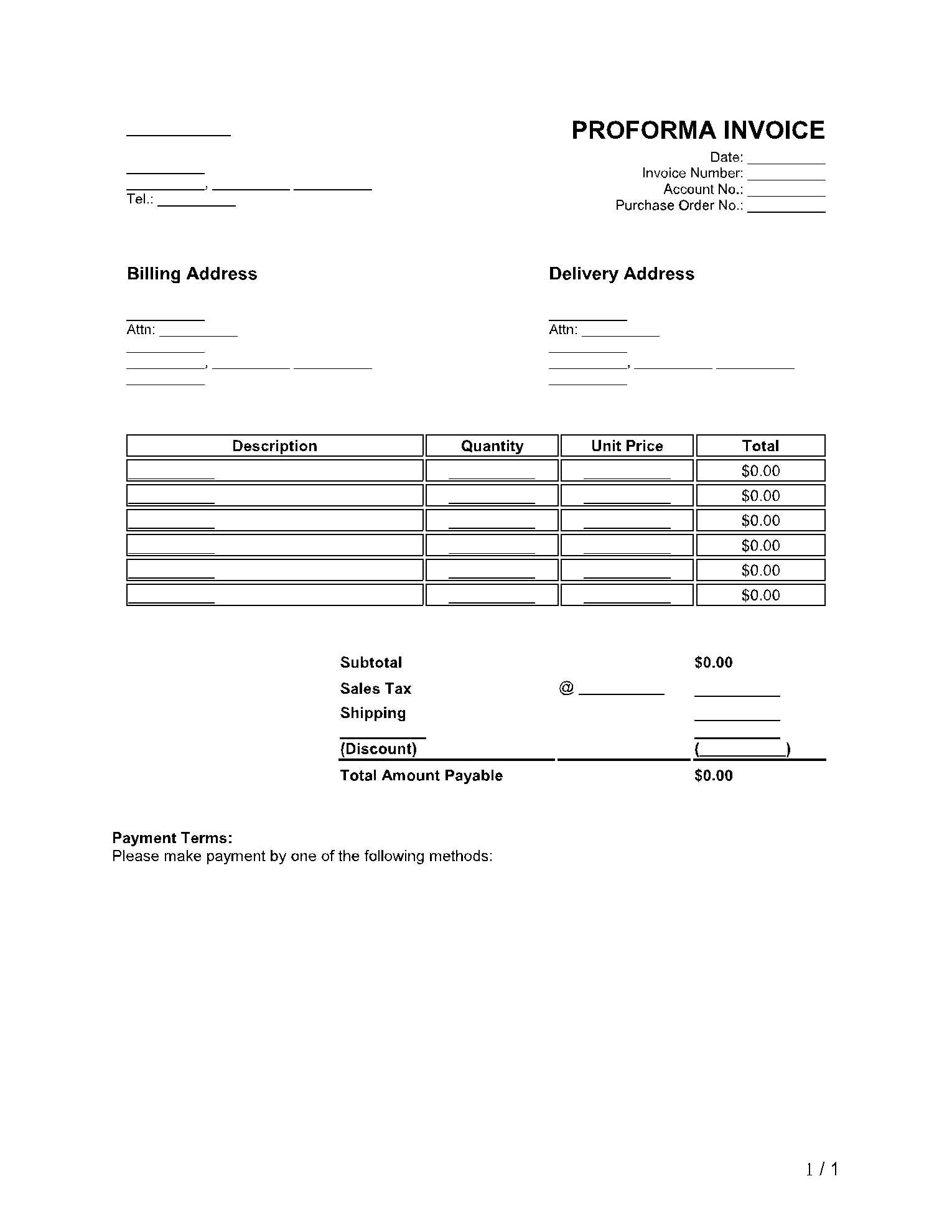

Blank Proforma Invoice Template Overview

In the business world, having a structured document to outline the terms of a transaction before it becomes official is essential for clarity and organization. This document acts as a preliminary agreement, summarizing the details of goods or services being provided and their associated costs. It serves as a formal notification to the recipient about the nature of the exchange, often used in international trade or situations where a final agreement has yet to be reached.

Having an easily customizable form to fill in all the necessary information ensures that important details, such as pricing, descriptions, and payment terms, are clearly communicated. This way, businesses can provide a professional and accurate record without wasting time on creating one from scratch each time. Whether you are dealing with a client or preparing for internal use, this document helps set clear expectations and avoids any potential confusion.

Customizability is one of the key benefits of such documents, as it allows businesses to tailor each form to their specific needs, making it a versatile tool for a range of situations. By utilizing a consistent format, companies can easily track and manage transactions, ensuring smooth operations and maintaining a high standard of professionalism.

What is a Proforma Invoice?

In business, certain documents are used to outline the terms of a potential transaction before a final agreement is made. These preliminary papers provide essential details about goods or services, including their descriptions, quantities, and agreed prices. They act as an initial agreement between the seller and buyer, often prepared before a formal contract or final sales document is issued.

Purpose of a Preliminary Document

The main purpose of this document is to provide the recipient with a clear understanding of what is being offered, along with the costs and payment terms. This helps both parties assess the transaction and avoid confusion later on. It is often used for international trade, large orders, or situations where the buyer needs to verify the transaction details before proceeding with payment.

Key Features

- Detailed Description: A full breakdown of products or services being offered, including quantity, unit price, and any special terms.

- Estimated Pricing: Although it is not a final bill, it outlines expected charges, helping both parties prepare for the actual transaction.

- Payment Terms: Clear instructions regarding when payment is due, the accepted methods, and any discounts or penalties.

- Validity: Often includes a time limit for acceptance, ensuring that the offer is valid for a specific period before being adjusted or withdrawn.

Overall, this type of document plays an important role in establishing trust and clarity between the buyer and seller, setting the stage for a smooth final agreement.

Benefits of Using a Blank Template

Utilizing a pre-structured document that can be easily customized offers several advantages for businesses. Such a document serves as a reliable starting point, ensuring that all necessary details are included and reducing the chances of missing important information. By having a set format, companies can save time and maintain consistency across all transactions, whether they are dealing with new or repeat clients.

Time and Efficiency

One of the biggest advantages of using a pre-made form is the time saved in preparation. Rather than starting from scratch each time, businesses can simply fill in the relevant details, ensuring that the process is faster and more efficient. This leads to a quicker turnaround, allowing for more transactions to be processed in a shorter amount of time.

Consistency and Professionalism

Having a uniform document helps maintain a high level of professionalism. Clients and partners will appreciate the consistency of receiving well-organized records, which can enhance the business’s reputation. A properly structured document ensures that all key information is presented in a clear, accessible format, which is essential for establishing trust and credibility.

Customizability is another significant benefit, as the format can be adjusted to meet specific needs, whether for different industries, clients, or types of transactions. This flexibility makes it a versatile tool for businesses of all sizes and sectors.

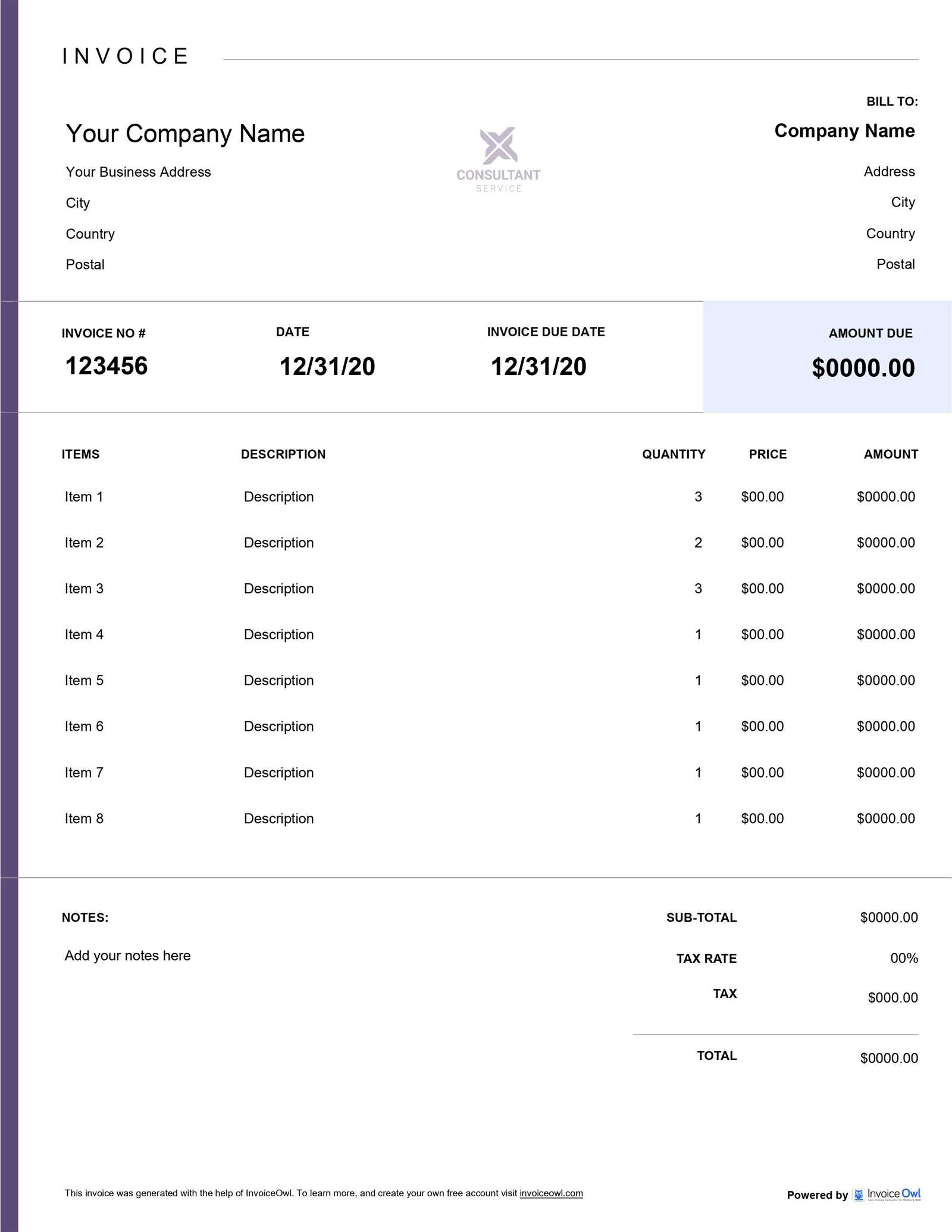

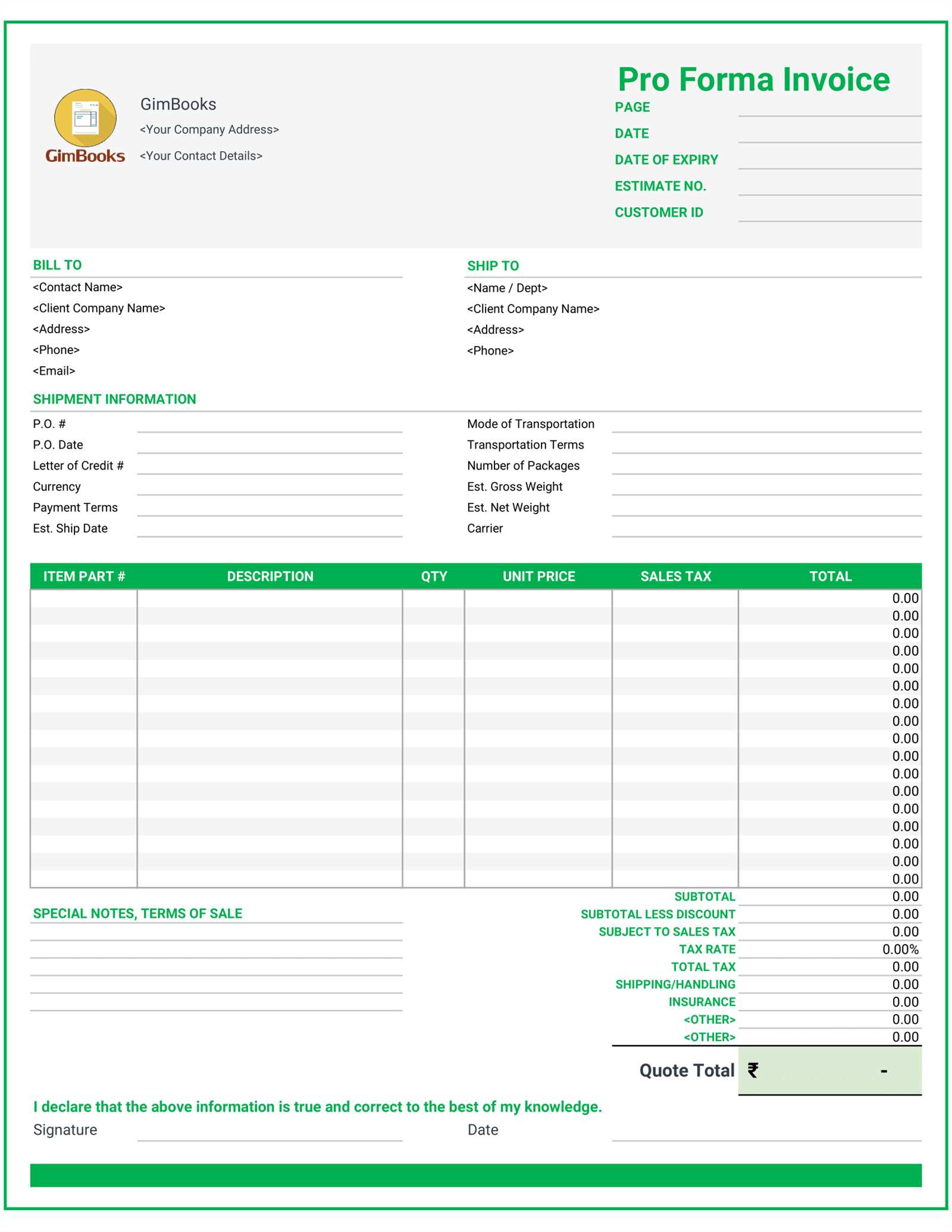

How to Customize Your Template

Adapting a pre-designed form to meet specific business needs is an essential step in creating documents that are both functional and professional. Customization allows businesses to modify the structure, content, and details according to their requirements, ensuring accuracy and relevance for each transaction. By following a few simple steps, you can make sure that every document you use is perfectly suited for its intended purpose.

Steps for Customization

To begin, you need to identify the key fields that require personalization. Common sections to customize include company name, client details, item descriptions, pricing, and payment terms. By adjusting these sections, the form can be tailored to reflect the specifics of each deal, ensuring it meets legal, financial, and operational needs.

Suggested Custom Fields

| Field | Customization Tips |

|---|---|

| Company Details | Ensure accurate contact info, including your company address and registration number. |

| Client Information | Personalize by adding the customer’s full name, address, and contact details. |

| Items/Services | Include detailed descriptions, unit prices, quantities, and any discounts offered. |

| Payment Terms | Specify due dates, accepted payment methods, and any applicable penalties or discounts for early payment. |

Once you’ve adjusted the fields, make sure to save your customized version. This can then be reused, minimizing the effort needed for future transactions while maintaining a consistent format across all communications.

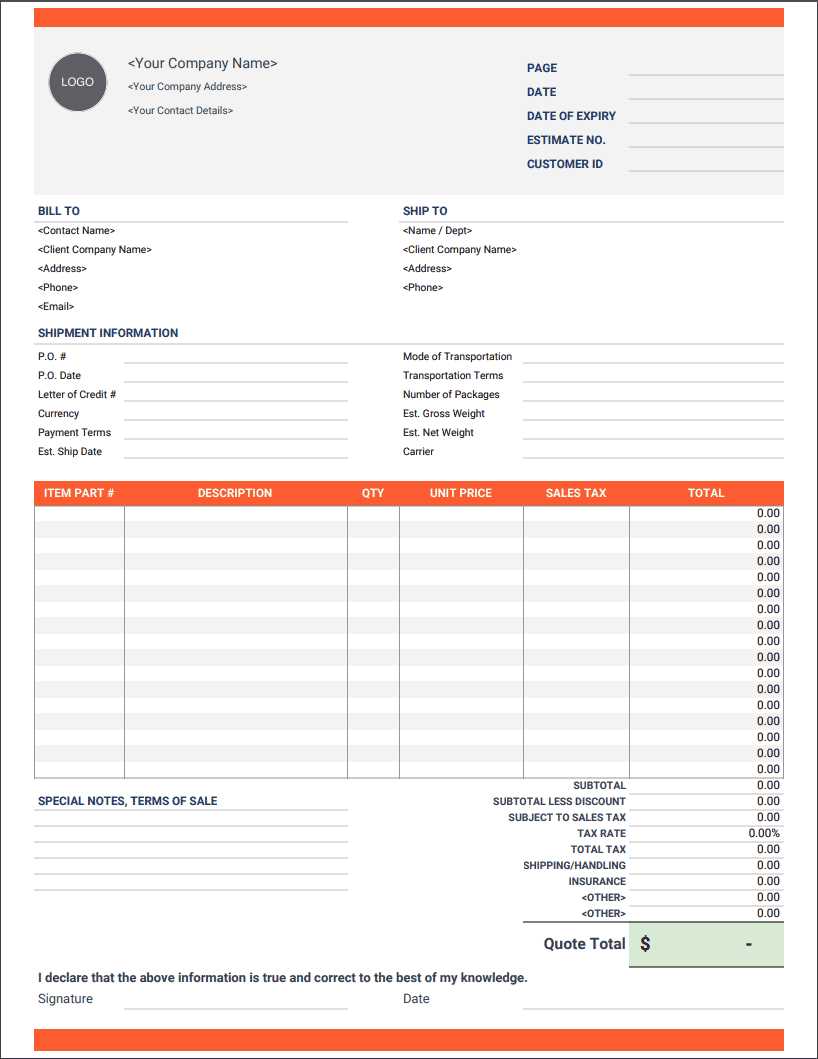

Key Elements of a Proforma Invoice

When creating a document to outline the terms of a potential transaction, there are several essential components that must be included to ensure clarity and accuracy. These elements help both parties understand the scope of the agreement, including the goods or services being exchanged, their pricing, and payment terms. A well-structured document sets the foundation for a smooth transaction, minimizing the risk of misunderstandings or disputes.

Essential Components

- Document Title: Clearly indicate that the document is a preliminary agreement, often labeled as a “sales estimate” or “proposed agreement.”

- Company Information: Include the name, address, and contact details of both the seller and the buyer, ensuring that all parties are clearly identified.

- Detailed Description of Goods/Services: List the items or services being offered, along with specifications such as model numbers, quantities, and any relevant details.

- Pricing Information: Provide a breakdown of the costs, including unit price, total price, and any discounts or additional charges that apply.

- Payment Terms: Clearly outline the payment schedule, methods of payment, and any deadlines or penalties for late payment.

- Delivery Details: Specify expected delivery dates, shipping costs, and any special terms related to delivery or handling.

- Validity Period: Indicate how long the offer is valid, ensuring that both parties are aware of the time constraints before the terms change.

- Legal Terms: Include any relevant legal disclaimers, terms of agreement, or conditions related to the transaction.

By ensuring all these elements are included, businesses can provide a clear and transparent understanding of the terms before finalizing any sales or agreements, which benefits both the seller and the buyer.

Common Mistakes to Avoid

Creating a well-structured document for transactions is essential, but there are several common mistakes that can undermine its effectiveness. These errors can lead to confusion, disputes, or delays in finalizing agreements. Avoiding these pitfalls ensures that both parties have a clear understanding of the terms and prevents unnecessary complications.

1. Missing or Incorrect Information

One of the most frequent mistakes is omitting critical details or including inaccurate information. This can include missing client details, incorrect pricing, or incomplete descriptions of products or services. It’s important to double-check all fields to ensure that the document accurately reflects the agreed-upon terms.

2. Lack of Clarity in Terms

Another common error is vague or unclear payment and delivery terms. Failing to specify due dates, payment methods, and shipping details can lead to misunderstandings. Be sure to include precise deadlines, accepted payment options, and any relevant terms or conditions to avoid confusion down the line.

3. Overlooking Legal Aspects

Legal disclaimers or conditions are sometimes neglected, especially when the document is used for international transactions. Ensure that all necessary legal clauses are included, such as tax rates, liability disclaimers, or return policies, depending on the nature of the transaction. This helps protect both parties in case of disputes.

4. Using Inconsistent Formats

Maintaining a consistent structure throughout your documents is essential for professionalism. Inconsistent formatting, such as varying fonts, sizes, or alignment, can make the document appear unprofessional and harder to read. Stick to a clear and uniform design to make it easier for clients to follow the information.

By avoiding these common mistakes, businesses can create documents that are not only professional but also clear and effective, reducing the risk of errors and misunderstandings in the transaction process.

Why Choose a Blank Template

Opting for a pre-structured document that can be customized according to specific needs offers several key advantages for businesses. It provides a flexible framework, allowing companies to easily tailor the content to match the specifics of each transaction. This not only saves time but also ensures that all the necessary information is presented clearly and consistently, regardless of the situation.

Advantages of Using a Customizable Format

By choosing a customizable form, businesses gain the ability to adjust key sections like pricing, delivery details, and payment terms. This adaptability makes it suitable for a wide range of industries and scenarios, from small transactions to complex international agreements.

Efficiency and Professionalism

Using a standardized structure eliminates the need to start from scratch each time, which speeds up the process. In addition, a professionally designed and consistent format enhances the overall appearance and reliability of the document, contributing to a positive impression among clients and partners.

Key Features of a Customizable Framework

| Feature | Benefit |

|---|---|

| Easy Adjustability | Modify fields such as pricing, item details, and payment terms according to specific needs. |

| Consistent Layout | Maintain a professional look that is uniform across all transactions, helping build trust with clients. |

| Time-Saving | Reduce the time spent on document creation by utilizing a pre-designed framework that only needs minimal adjustments. |

| Clear Communication | Ensure that all essential details are included, making it easier for clients to understand the terms of the transaction. |

Choosing a customizable form allows businesses to create professional documents with minimal effort while ensuring accuracy and clarity in every transaction.

Where to Find Free Templates

Finding a ready-to-use structure for business documents can be a time-saver, especially when you’re looking for an efficient way to outline transaction details. There are many resources available online that offer free, customizable forms, allowing you to quickly download and tailor them to your specific needs. Whether you’re looking for a simple or more detailed structure, these resources provide a variety of options to suit your business requirements.

Top Sources for Free Resources

Many platforms offer free downloads, enabling businesses to access high-quality, customizable forms. Some popular websites include:

| Platform | Key Features |

|---|---|

| Microsoft Office Templates | Offers a wide range of professional designs for various industries, customizable in Microsoft Word or Excel. |

| Google Docs/Sheets | Provides free online resources with editable documents that can be easily shared or exported to other formats. |

| Template.net | Includes both free and premium options, with a large selection of business-related forms ready to use. |

| Canva | Free customizable designs with an easy-to-use drag-and-drop interface, perfect for creating visually appealing documents. |

Additional Tips

When using free resources, ensure that the document aligns with your specific needs. Look for websites that offer customization options, so you can adjust fields, layout, and branding to reflect your business accurately. Many platforms also provide sample forms, which can help guide you in structuring your own document.

By exploring these platforms, businesses can find free resources that are easily adaptable and help streamline document creation while maintaining professionalism and accuracy.

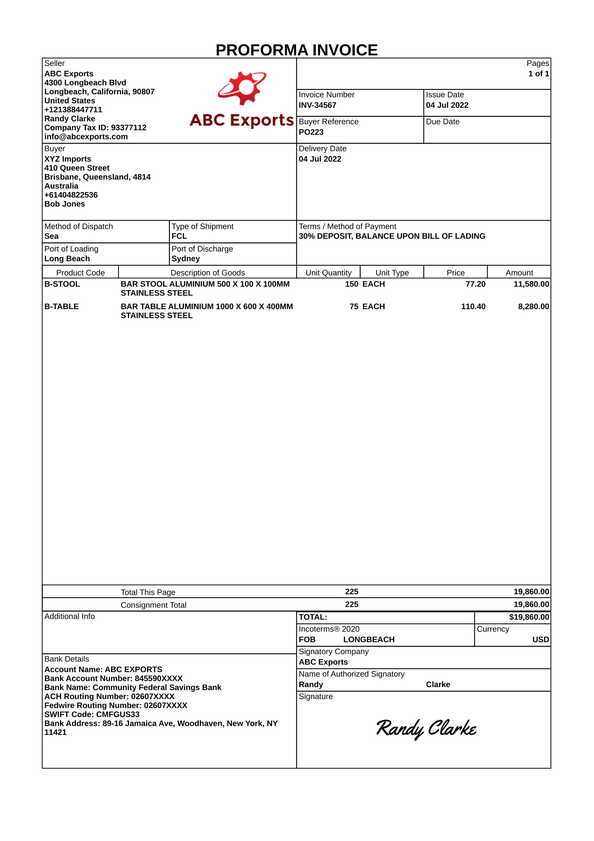

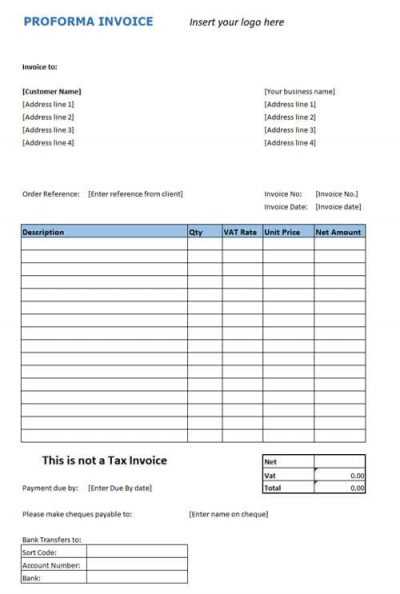

Steps to Fill Out a Proforma Invoice

When creating a preliminary document for a transaction, it’s important to ensure all necessary details are included for clarity and accuracy. Properly filling out each section of the form helps outline the terms of the potential sale, making it easier for both parties to understand the agreement. The following steps guide you through the process of completing the document, ensuring that it reflects the agreed-upon terms and conditions.

1. Include Business Information

Begin by entering your company’s name, address, and contact details at the top of the document. Also, make sure to include the recipient’s information, including their name, business address, and contact details. This section ensures that both parties are clearly identified for communication and reference.

2. Add Description of Goods or Services

Next, provide a detailed list of the items or services being offered. Include relevant specifications, such as model numbers, quantities, and descriptions. For services, outline the scope of work and any special conditions or terms. This section ensures that both parties agree on exactly what is being exchanged.

3. Enter Pricing and Payment Information

Clearly outline the cost for each item or service. Include unit prices, total costs, and any applicable discounts or additional charges. Specify the total amount due and note any taxes or fees that apply. Additionally, include payment terms such as the accepted methods, due date, and any late payment penalties.

4. Specify Delivery or Completion Terms

If applicable, specify the delivery date, shipping details, and any related costs. For services, include expected completion timelines and any delivery or performance milestones. This helps set expectations for both parties in terms of timing and logistics.

5. Legal Terms and Conditions

Include any legal disclaimers or conditions that apply to the transaction, such as liability clauses, warranties, or return policies. This section provides protection for both parties and ensures that

Legal Considerations for Proforma Invoices

When preparing preliminary documents for a transaction, it’s essential to consider the legal implications and ensure that the information provided is clear, accurate, and in line with applicable laws. These documents, while not legally binding in the same way as formal contracts, still carry weight in terms of confirming the terms and conditions of a potential deal. It’s important to understand how these documents interact with legal frameworks and what precautions businesses should take to protect their interests.

1. Accuracy of Information

One of the key legal considerations is ensuring that all details in the document are accurate. Incorrect information, such as pricing, quantities, or descriptions, can lead to disputes or confusion later on. The accuracy of the details can affect negotiations and may even impact legal claims or future agreements.

2. Clarity of Terms

Clearly outline the terms of the transaction, such as payment schedules, delivery expectations, and potential penalties. Ambiguous language can lead to misunderstandings or even legal disputes. By specifying these details upfront, you reduce the risk of conflicts and create a clearer path for both parties to follow.

3. Binding Nature

While these preliminary documents are not legally binding contracts, they may serve as evidence in legal proceedings if a dispute arises. It’s essential to note that the terms outlined in such documents are often seen as a basis for further negotiations or agreements, but they should not be interpreted as final contracts unless explicitly stated. Businesses should be cautious not to treat them as final and irrevocable agreements.

4. Jurisdiction and Applicable Laws

It’s important to include any relevant jurisdiction and applicable laws that may govern the transaction. This is especially crucial for international transactions, where laws vary across countries. Specifying which legal framework will apply in the case of a dispute can help avoid complications and ensure both parties understand their rights and obligations.

5. Protection Against Fraud

Make sure that all parties involved are legitimate, and the terms are agreed upon transparently. Fraudulent activity can occur if false information is included, so it’s important to verify the identity and intentions of those you are entering into an agreement with. Protecting against fraud also means ensuring that the document is free of any misleading or deceptive language.

6. Retaining Records

It is crucial to retain a copy of all such documents for record-keeping and potential future legal purposes. These documents may be necessary for tax reporting, audits, or dispute resolution. Keeping accurate and organized records ensures that you can refer back to the terms and details should any legal questions arise.

By taking these legal considerations into account, businesses can ensure that they are better protected when using such documents and can avoid potential disputes or legal challenges in the future. Clear, accurate, and legally sound documentation forms the foundation of trustworthy business transactions.

How to Save and Share Your Invoice

Once your document has been completed, the next important step is to ensure that it is saved securely and shared with the relevant parties. Whether it’s for internal records, client communication, or legal purposes, proper saving and sharing methods help ensure that the document remains accessible and protected. Below, we outline the best practices for storing and distributing such documents to ensure efficiency and security.

1. Saving the Document

To prevent any data loss, it’s essential to save the file in a secure and accessible format. The most commonly used file types are PDF, Word, or Excel, as they preserve the structure and format of the document. Here are some tips for saving the file properly:

| File Format | Pros |

|---|---|

| Universal compatibility, fixed formatting, high security | |

| Word | Easy to edit, can be converted to PDF |

| Excel | Ideal for calculations and detailed data |

It is also recommended to organize the saved files into a dedicated folder on your computer or cloud storage, making it easier to locate and manage them when necessary. Always make sure to include the relevant document name, client name, and date to make it easy to identify the file later on.

2. Sharing the Document

Sharing your completed document is just as important as saving it. Here are the most common methods for sharing the document securely:

- Email: The most common method for sending documents, especially for businesses, is via email. Ensure you attach the correct file and include a clear subject line.

- Cloud Storage: Sharing via cloud services (like Google Drive, Dropbox, or OneDrive) ensures easy access for both parties. Simply upload the file and share the link.

- Secure File Transfer: If the document contains sensitive information, consider using secure file transfer protocols or services that offer encryption to protect the data.

Always confirm that the recipient has received the document and can open it correctly. In cases where the recipient might have limited access to certain tools, offering alternative formats like Word or Excel can be helpful. Additionally, always ensure that sensitive data, such as payment terms or financial details, is securely transmitted using encryption when possible.

By following these simple steps, you can easily save and share your document, ensuring that it remains accessible for future reference while also maintaining security and professionalism in your communications.

Template Formats: Excel vs Word

When choosing the best format for your document, it’s important to consider the specific features and needs of the task at hand. The choice between using a spreadsheet format like Excel or a word processing format like Word can greatly affect how easily you can manage, edit, and present your information. Both formats offer distinct advantages depending on the nature of the content and how you plan to use or share the document.

Excel Format

Excel is ideal for documents that require detailed data manipulation, such as calculations, inventory tracking, or maintaining large lists. This format is especially useful when you need to handle numbers and data in an organized way, providing built-in functions to assist with calculations. Key benefits of using Excel include:

- Data Organization: Excel allows for easy organization of rows and columns, making it suitable for data-heavy documents.

- Formulas and Functions: You can automate calculations and apply formulas to assist with financial or numerical data.

- Customization: Offers greater flexibility for creating complex structures, such as adding columns for multiple data points.

Word Format

Microsoft Word, on the other hand, is better suited for documents that are primarily text-based, where layout and formatting are important. It allows you to present information in a more visually appealing and structured way, such as in a formal letter or report. Some benefits of using Word include:

- Text Formatting: Word provides rich text formatting options, making it easier to add headers, bullet points, and other stylistic features.

- Ease of Use: Word is simple to use and does not require a strong understanding of formulas or functions, making it more user-friendly for non-technical tasks.

- Document Presentation: If the document needs to be presented in a formal or professional way, Word offers more options for styling the layout and content.

Comparison Table

| Feature | Excel | Word |

|---|---|---|

| Best For | Data-heavy, numerical tasks | Text-based, structured documents |

| Customization | Advanced calculations, formulas, data organization | Text formatting, layout design |

| Ease of Use | Requires knowledge of Excel functions | Easy to use for basic documents |

| Presentation Quality | Less focus on presentation | High-quality presentation options |

Ultimately, the choice between Excel and Word depends on the specific requirements of your document. For detailed, data-centric content with calculations, Excel is a more suitable option. For text-focused content that needs to be visually appealing and easy to read, Word provides greater flexibility in presentation. Choose the f

Understanding Numbering System for Documents

A well-structured numbering system is essential for managing business documents efficiently, ensuring smooth tracking, organization, and reference. The numbering format plays a key role in creating a logical flow and helps both businesses and clients stay organized. It aids in preventing confusion, ensuring that each record is unique, and simplifies the retrieval of information when necessary.

Why Numbering Matters

The numbering of documents serves multiple purposes beyond just identification. Here are some key reasons why implementing a consistent numbering system is crucial:

- Organization: A well-defined numbering scheme helps you maintain an orderly system for all your records, making it easier to locate and reference past documents.

- Unique Identification: Each number acts as a unique identifier, ensuring that there is no overlap or confusion between different records.

- Tracking: Numbering allows businesses to track the status of transactions and manage payments and deliveries with greater ease.

Common Numbering Systems

There are several common methods for numbering documents, each serving specific needs based on the scale and structure of the business. Below are some popular numbering formats:

- Sequential Numbering: This is the simplest and most common method, where each new record gets the next available number, such as 001, 002, 003, and so on.

- Date-Based Numbering: Some businesses prefer to incorporate the date into the numbering system, such as using the year or month to create numbers like 2023-001, 2023-002, etc.

- Custom Alphanumeric Codes: For larger businesses or specific industries, combining letters with numbers, such as INV-001, INV-002, might help categorize and distinguish between different types of documents.

Choosing the right numbering system depends on your specific business needs, scale, and the level of organization required. A clear and consistent approach ensures better record-keeping and minimizes errors in managing your business documentation.

Tips for Efficient Document Management

Efficiently managing business records, especially financial documents, is essential for smooth operations and better decision-making. A streamlined process helps businesses track transactions, maintain accurate records, and stay on top of deadlines. With proper organization and attention to detail, you can avoid errors and save time on administrative tasks. Here are some tips to improve your document management system:

Organize and Categorize Records

One of the first steps to efficient management is organizing your documents in a way that makes sense for your business. Categorizing documents by type, date, or client can help you quickly locate information when needed. Here are some suggestions:

- Use Folders: Create clear folders (physical or digital) to store related documents. For example, set up folders for each client or project to group all relevant paperwork together.

- Label Clearly: Label each document with a descriptive title that includes key details like date, client, or service type, so it’s easy to search and identify later.

- Set Up Subfolders: In the case of large projects or multiple clients, consider using subfolders to organize documents by specific categories such as payments, receipts, or contracts.

Automate and Use Software Tools

Manual record-keeping can be time-consuming and prone to errors. Automating your document management system with specialized software can save you time and help you stay organized. Here’s how:

- Use Accounting Software: Tools like QuickBooks or FreshBooks allow you to generate and store records digitally, track payments, and keep everything in one place.

- Set Reminders: Set up automated reminders to follow up on outstanding payments, review due dates, or remind clients of upcoming invoices.

- Store Documents in the Cloud: Cloud-based services like Google Drive or Dropbox make it easy to store, share, and access documents from any location, keeping everything backed up and secure.

Regularly Review and Update

Another key part of effective management is conducting regular reviews to ensure that your records are up-to-date. This can help prevent any errors from compounding over time. Consider these practices:

- Audit Documents Periodically: Schedule regular audits to check for any discrepancies or missing files and ensure that your system remains organized.

- Update Client and Transaction Records: Make sure client details and transaction history are current and accurate to prevent confusion when processing future documents.

By following these tips, you can ensure that your record-keeping system is efficient, organized, and easy to maintain. Proper document management is crucial for maintaining a smooth workflow and avoiding unnecessary stress when handling business finances.

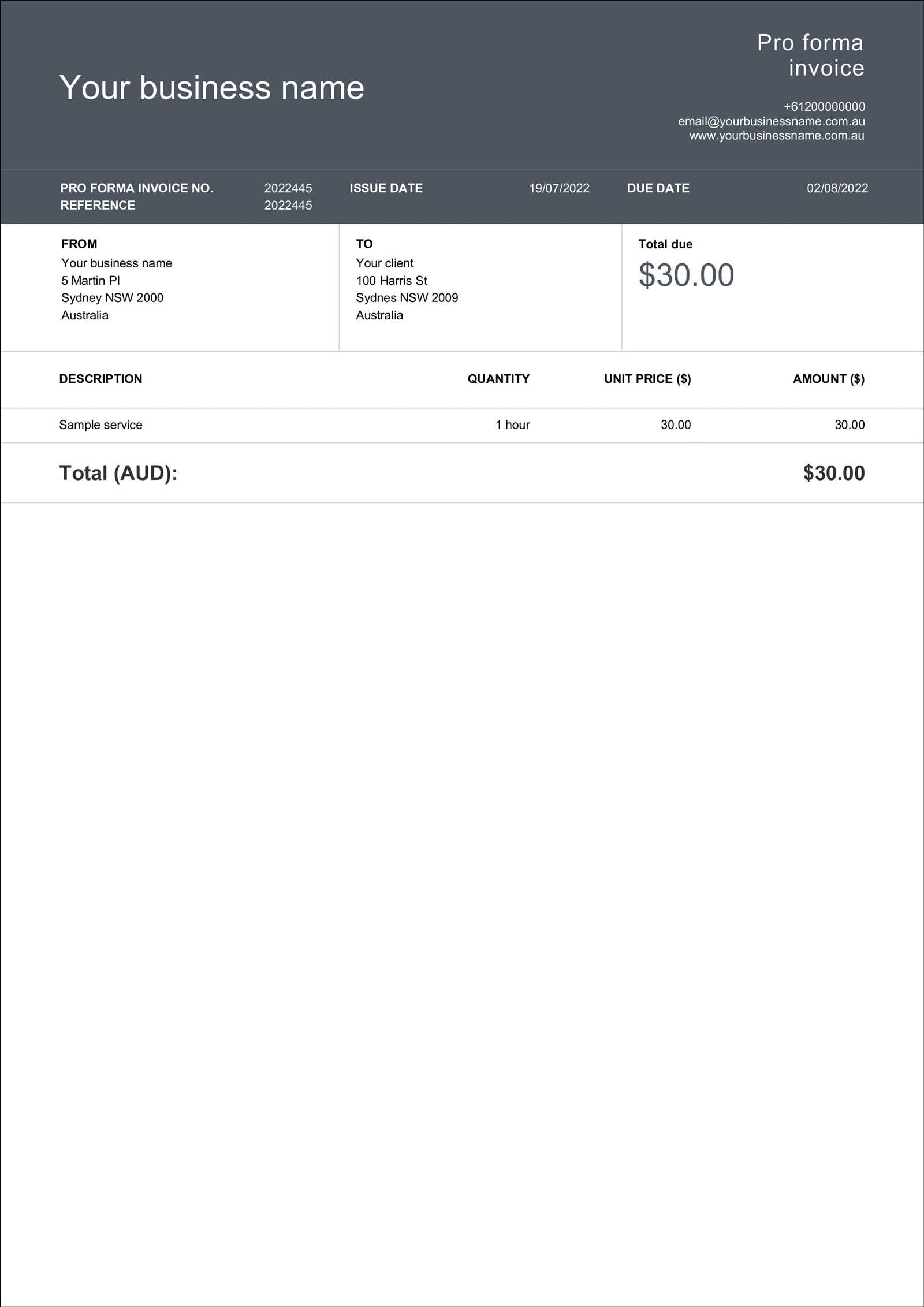

Proforma Document vs Commercial Document

Understanding the difference between various business documents is crucial for smooth transactions. While both proforma and commercial documents serve similar purposes in the business world, they have distinct roles in the sales process. These documents outline the terms of a transaction, but they differ in terms of their function, usage, and legal standing. Below, we’ll explore the key differences between these two essential documents.

Purpose and Function

While both documents may appear similar at first glance, they serve different purposes. The main distinction lies in their role within the transaction process:

- Proforma Document: This document is typically issued before the actual sale takes place. It provides an estimate or a preliminary outline of the products or services to be provided, including their prices and conditions. However, it is not a legally binding document and does not trigger the transfer of goods or services.

- Commercial Document: In contrast, this document is issued after the sale and serves as a legal confirmation of the transaction. It includes detailed information about the sale, such as quantities, prices, and terms, and it serves as the actual request for payment.

Legal Implications

The legal standing of these documents also differs significantly:

- Proforma Document: As a preliminary document, it does not hold any legal weight in terms of payment or transfer of ownership. It’s mainly used for informational purposes, helping the buyer understand the expected costs and logistics.

- Commercial Document: This document is legally binding and represents a formal agreement between the buyer and seller. It triggers the payment process and often serves as the foundation for accounting and customs procedures.

While both documents are important in their respective stages of the transaction process, understanding their distinct roles helps businesses manage sales efficiently and accurately. One is used for initial agreements and projections, while the other formalizes the exchange of goods or services and acts as the basis for payment and legal action if necessary.

How to Track Payment Status for Business Documents

Managing payments efficiently is a crucial aspect of maintaining cash flow and ensuring that your business runs smoothly. Tracking payments for business documents can help you stay organized and avoid financial discrepancies. In this section, we’ll explore methods to track the status of payments, ensuring you have full visibility over your transactions.

Manual Tracking Methods

For smaller businesses or those handling a limited number of transactions, manual tracking can be an effective way to stay on top of payment statuses. Here are a few methods to consider:

- Payment Log: Keep a dedicated payment log that lists each transaction, including the amount due, payment due date, and the date the payment was received. This can be done in a simple spreadsheet or paper ledger.

- Payment Stubs or Receipts: Ensure that you issue payment receipts for each transaction and file them appropriately. This helps you have a hard copy reference for each payment made.

Automated Tracking Tools

For businesses with higher transaction volumes, automated tracking tools can provide real-time updates on payment statuses. These tools help reduce manual errors and provide better organization. Here are some tools you can use:

- Accounting Software: Many accounting platforms offer invoicing features that allow you to track payments automatically. You can easily mark payments as received, and these systems will update the status accordingly.

- Payment Gateway Integration: If you use an online payment gateway, it will typically provide automatic payment tracking and updates. These tools often send notifications when payments are made and can integrate with accounting software.

Tracking payments not only ensures your business receives timely payments but also helps you manage overdue accounts effectively. By using a combination of manual and automated methods, you can maintain a clear overview of all your financial transactions.

Advantages of Digital Business Documents

In today’s fast-paced business world, digital documents offer a range of benefits that make transactions more efficient and streamlined. Shifting from paper to digital formats for your business paperwork can improve organization, reduce errors, and increase overall productivity. This section explores the advantages of using digital forms for business transactions.

Efficiency and Speed

One of the biggest advantages of using digital documents is the significant boost in efficiency. By eliminating the need for manual processes, businesses can save time and reduce the chances of human error. Here are some key benefits:

- Instant Creation and Delivery: With digital forms, creating and sending documents is almost instantaneous. There’s no need for printing or mailing, allowing for quicker responses from clients or vendors.

- Faster Payment Processing: Digital documents can be linked to online payment platforms, making it easier for clients to pay promptly and reducing the time spent waiting for checks or manual transactions.

Cost-Effectiveness

Switching to digital business forms can help save on several expenses. The cost of printing, paper, and postage can quickly add up, but with electronic documents, these costs are significantly reduced:

- No Printing Costs: Digital documents do not require paper or ink, which eliminates the cost of printing and the environmental impact of using paper.

- Reduced Postage Fees: Sending documents digitally removes the need for traditional mailing, saving money on postage, especially when dealing with international clients.

Improved Organization and Accessibility

Storing digital documents makes organizing and retrieving them much easier than maintaining a physical filing system. Digital files can be categorized, searched, and accessed from anywhere, providing great flexibility:

- Easy Search and Retrieval: Digital documents can be indexed and searched by keywords, making it faster to find the information you need without sifting through piles of paper.

- Remote Access: With cloud-based storage, digital forms can be accessed from anywhere, allowing business owners and clients to retrieve them on the go.

Environmental Benefits

Reducing paper usage not only saves money but also helps the environment. By transitioning to digital forms, you contribute to sustainability efforts:

- Less Paper Waste: Using digital formats helps reduce the amount of paper that ends up in landfills, supporting eco-friendly practices.

- Energy Efficiency: Digital documents require less physical storage and transportation, which reduces energy consumption compared to traditional paper methods.

Overall, the shift to digital business documents offers a wide range of benefits, from time and cost savings to better organization and sustainability. Embracing these modern tools can make a significant

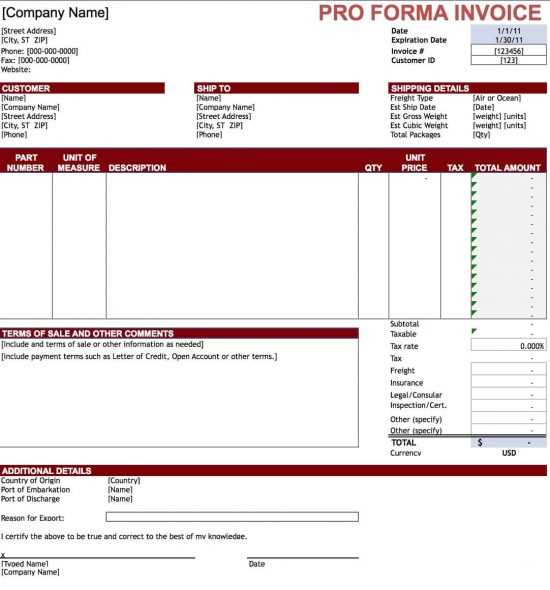

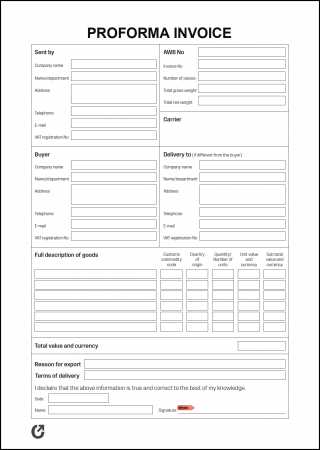

Proforma for International Trade

When engaging in international trade, businesses often need to provide preliminary documents that outline the terms of an agreement before formalizing the transaction. These documents play a crucial role in facilitating communication between buyers and sellers across borders. This section explains how such forms are used in global commerce and why they are essential for smooth international transactions.

Importance in Cross-Border Transactions

International trade involves a variety of complexities, including customs regulations, tax rules, and varying currency exchange rates. Providing a detailed document ahead of the final sale helps to avoid confusion and ensures both parties are on the same page. Some key reasons why these documents are important in global trade include:

- Clarity in Terms: It provides a clear breakdown of the goods or services to be exchanged, including the pricing, payment terms, and shipping details.

- Customs Purposes: The document serves as a preliminary declaration for customs, allowing authorities to assess taxes and duties before the shipment is processed.

- Financial Security: For buyers and sellers, it provides an early view of financial obligations, helping to mitigate risks associated with international transactions.

Essential Information Included in International Documents

In international commerce, certain details must be included to ensure the smooth processing of the transaction. These documents should contain the following essential elements:

| Details | Description |

|---|---|

| Buyer and Seller Information | Names, addresses, and contact details of both parties involved in the transaction. |

| Product/Service Description | Detailed list of the goods or services being traded, including quantities, specifications, and unit prices. |

| Shipping Terms | Information regarding the method of shipment, delivery terms (such as Incoterms), and expected arrival times. |

| Payment Terms | Details on how and when payment will be made, including any deposits or prepayments required. |

| Currency and Taxes | Currency used for the transaction and any taxes or duties applicable to the trade. |

These forms also help streamline processes with banks and customs authorities, ensuring that the transaction moves forward without delays. By clearly outlining the expectations on both sides, businesses can protect themselves and ensure successful international trade operations.