Blank Invoice Template for Microsoft to Simplify Your Billing Process

Managing financial transactions can be a time-consuming task for any business, but having the right tools can make all the difference. With the right kind of pre-designed documents, you can quickly create professional-looking records for every transaction. This method saves time, reduces errors, and ensures that your communications with clients remain clear and consistent.

Ready-made solutions offer users the flexibility to customize their records according to specific business needs. Whether you’re a freelancer, small business owner, or part of a larger enterprise, these resources help you stay organized and efficient. By utilizing these structured formats, you can focus more on growth and less on administrative tasks.

In this guide, we’ll explore how to use these resources effectively, how to make them your own, and why they are an essential part of maintaining smooth financial operations. Embrace the convenience of pre-designed options and make billing easier than ever before.

Blank Invoice Template for Microsoft

Creating professional financial documents doesn’t have to be complicated or time-consuming. With pre-made options available in software tools, generating detailed transaction records becomes a simple and efficient task. These pre-structured files offer a perfect starting point for businesses of all sizes, enabling you to create documents that look polished and are fully customizable to meet your specific needs.

Why Choose Pre-Formatted Documents

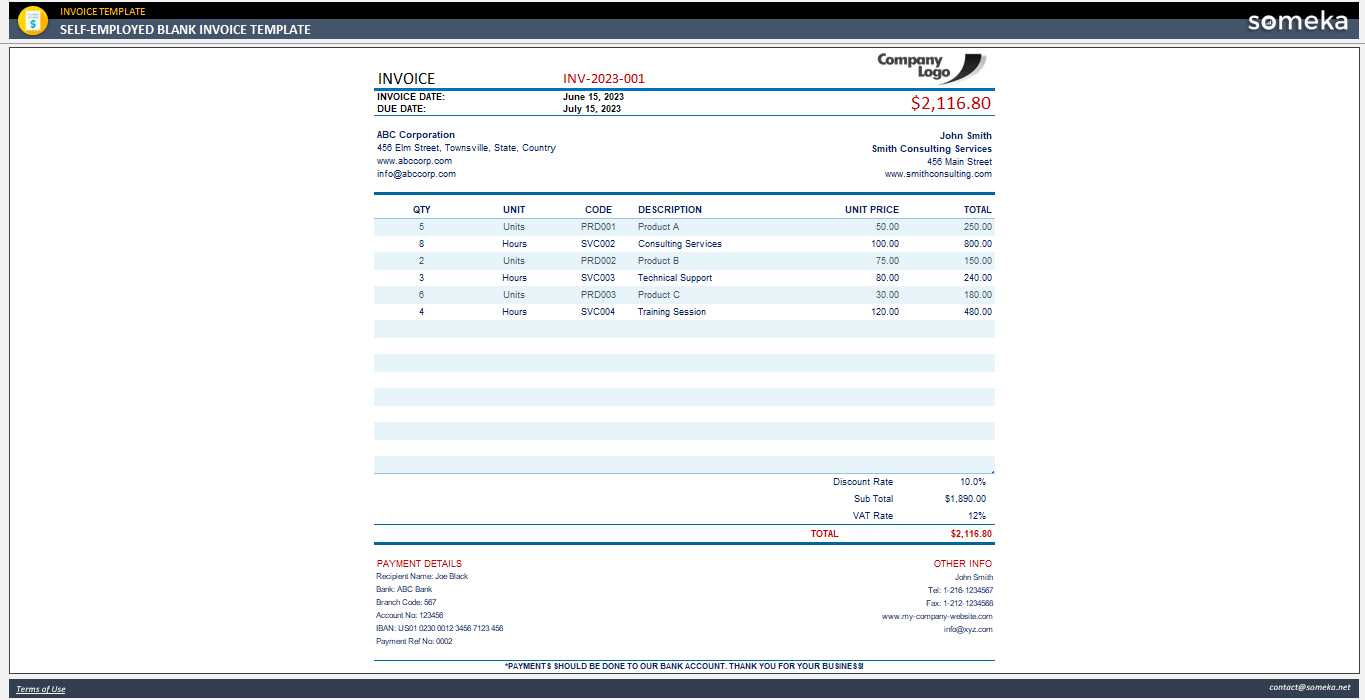

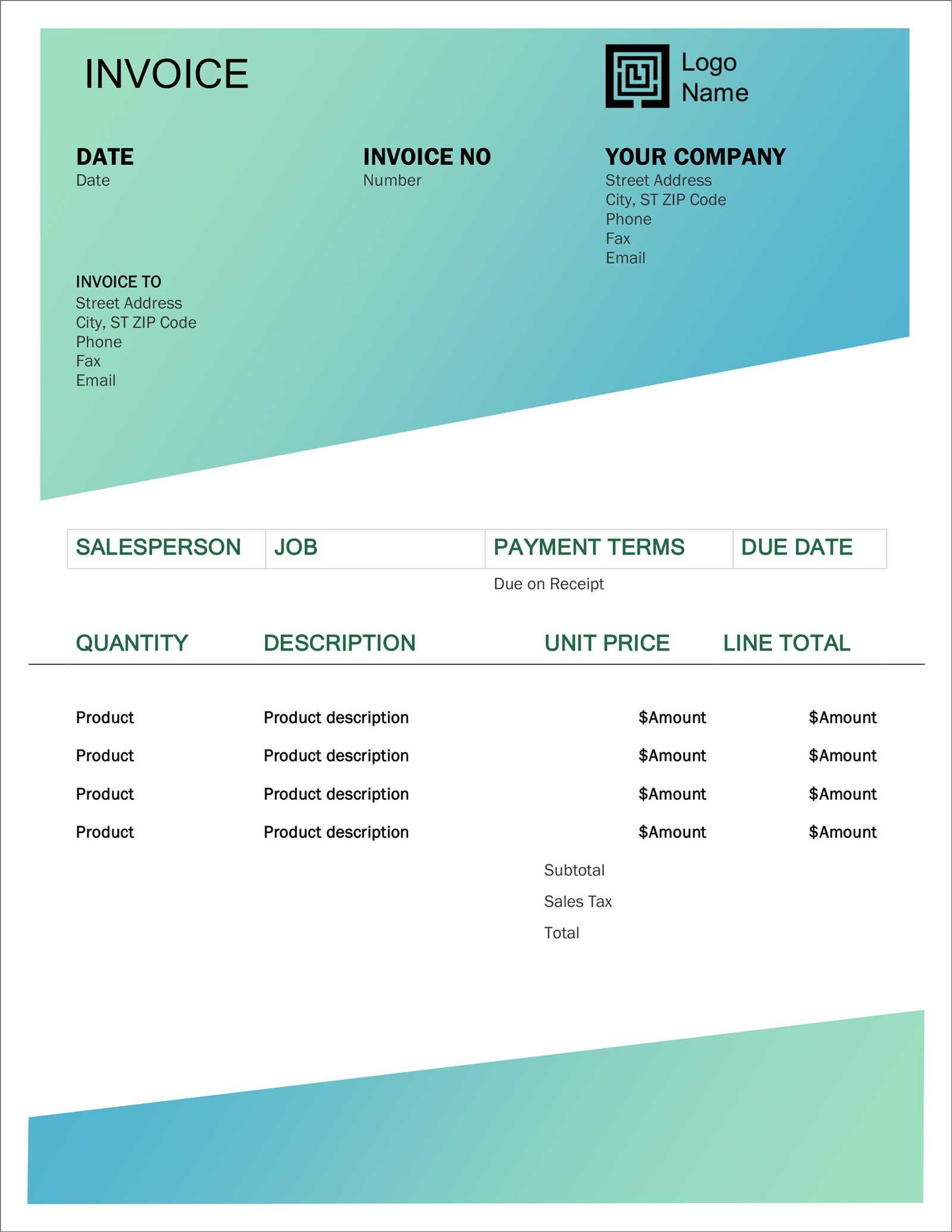

Using pre-designed forms can save valuable time while ensuring accuracy. They provide a clean, professional layout with all the necessary fields to capture important details like dates, amounts, and client information. Whether you’re managing payments for products or services, these resources streamline the billing process by eliminating the need to start from scratch every time you need a new record.

How to Access and Customize Your Document

Accessing these ready-made files is simple, especially for those already using popular software platforms. Once downloaded, customizing the document is easy – simply adjust the fields to reflect your company’s branding, update pricing, and input transaction details. The flexibility to modify each section ensures that the final document is tailored to your business, whether you’re a freelancer or running a larger company.

Embrace the convenience of using pre-structured files to maintain consistency across all your transactions. With just a few clicks, you can generate polished records every time, allowing you to focus on what matters most – growing your business.

How to Use a Blank Invoice Template

Generating professional records for transactions is an essential part of any business. With the right pre-made structure, the process becomes quick and efficient. Instead of creating a new document each time, you can simply fill in the required details and have a polished result in minutes. Here’s how to effectively use such a resource to streamline your billing process.

Step-by-Step Guide

Follow these simple steps to create accurate and professional documents:

- Open the Document – Start by opening the file in the software of your choice. This will typically be a word processor or spreadsheet program.

- Enter Business Details – Update the header section with your company name, logo, and contact information. This helps maintain consistency and ensures clients can reach you if needed.

- Input Transaction Information – Fill in key details such as the client’s name, the products or services provided, and the amounts. Ensure that all quantities and prices are accurate.

- Adjust Dates – Modify the document to reflect the correct date of the transaction. This is especially important for record-keeping and payment tracking.

- Customize Payment Terms – Adjust the payment terms and due date to reflect your business practices. You can include notes such as late fees or discounts for early payment.

- Save and Send – After reviewing the completed document, save it in your preferred file format (PDF is a popular choice) and send it to the client via email or a file-sharing platform.

Additional Tips

- Keep it Clear – Make sure all fields are legible and easy to understand. Avoid overloading the document with unnecessary details.

- Consistency – Use the same structure for every transaction to ensure your records are uniform and easy to manage over time.

- Regular Updates – Periodically check the document for any outdated information or fields that need adjustment based on changing business needs.

By following these steps, you can quickly create professional and accurate transaction records that are tailored to your business and easily understood by clients.

Benefits of Microsoft Invoice Templates

Using pre-designed documents for financial transactions offers several advantages that can make the billing process easier and more efficient. These structured formats are specifically designed to help businesses manage their records, ensuring that every transaction is accurately documented and presented in a professional manner.

Time-Saving Convenience

One of the primary benefits of using ready-made forms is the amount of time saved. Instead of creating a new record from scratch, you can simply input the necessary details, such as client information, transaction amounts, and dates. This significantly reduces the time spent on administrative tasks and allows you to focus on growing your business.

Consistency and Professionalism

Consistency in financial documents is crucial for maintaining professionalism. By using a pre-designed structure, all your records will follow the same format, making them easier to read and understand for clients. The polished appearance also boosts your business’s credibility, ensuring your clients trust the documents you send.

Ease of Customization

Although these resources come with a set structure, they are fully customizable to suit the specific needs of your business. You can adjust sections for taxes, payment terms, and even branding elements such as logos and fonts. This flexibility ensures the document aligns with your company’s unique requirements while maintaining a professional look.

Accuracy and Error Reduction

With clearly defined fields and a set structure, the chances of making errors are minimized. The consistent format ensures you don’t miss any important details, such as itemized costs or contact information, reducing the likelihood of mistakes that could lead to confusion or delayed payments.

In summary, using pre-designed documents can save time, increase professionalism, and ensure accuracy in your business’s financial transactions. By leveraging these resources, you can streamline your billing process while keeping your records organized and error-free.

Customizing Your Invoice Template in Microsoft

Once you have selected a pre-designed document for your business, personalizing it to fit your specific needs is a simple process. Customizing the structure allows you to reflect your company’s branding, update transaction details, and adjust the layout to ensure every record is clear and professional. This step ensures that the document you send to clients is not only functional but also aligns with your company’s identity.

Steps to Personalize Your Document

Follow these easy steps to make the document truly your own:

- Edit Header Information – Start by adding your company name, logo, and contact details at the top of the page. This ensures your clients know where the document originated from and how to reach you.

- Modify Client Information – Enter your client’s name, address, and contact details in the designated sections to make the record specific to that transaction.

- Adjust Line Items – Customize the sections where products or services are listed. You can change descriptions, quantities, and pricing to reflect the specific items involved in the current transaction.

- Include Payment Terms – Modify the terms and due date based on your agreement with the client. You can also add additional notes, such as late fees or discounts, if applicable.

- Update Formatting and Design – Customize fonts, colors, and layout to match your branding. This can help create a more cohesive look for all your business communications.

Tips for Effective Customization

- Keep it Simple – Avoid cluttering the document with unnecessary elements. A clean and simple layout is more professional and easier for clients to understand.

- Ensure Accuracy – Double-check all fields for accuracy before sending. Small mistakes in numbers or dates can cause confusion and delays in payment.

- Use Consistent Branding – Make sure that all your documents use the same colors, fonts, and logos to maintain a consistent look across all business communications.

By taking a few simple steps to personalize the document, you can ensure that each record reflects your business’s identity and meets your specific needs, while still maintaining a professional appearance.

Where to Find Free Invoice Templates

For businesses looking to simplify the process of creating financial records, free pre-made documents can be a valuable resource. These files are widely available across the internet, and many reputable sources offer them at no cost. Finding a reliable place to download these resources can save you time and help ensure your documents are both professional and easy to use.

Popular Online Resources

There are numerous platforms where you can download free structured files for your business needs. Some of the most well-known sources include:

- Office.com – Offers a wide variety of pre-made documents for businesses, including those for billing and payments. Many of these files are free and customizable.

- Google Docs – A cloud-based platform that provides several free document templates that can be edited and shared with ease.

- Canva – Known for its design tools, Canva also offers customizable billing templates that can be tailored to your business’s style.

- Template.net – A site offering a range of business-related files, including free ones that cater to different industries and needs.

Tips for Choosing the Right Source

When looking for free documents, it’s important to select reputable sources to avoid issues such as poor quality or hidden fees. Be sure to:

- Check Customization Options – Ensure the document is flexible enough to meet your specific needs, from adding your branding to adjusting pricing details.

- Review User Feedback – Look at reviews or ratings from other users to gauge the quality and usability of the files before downloading.

- Ensure Compatibility – Verify that the document format works with the software you plan to use, whether that’s a word processor or a spreadsheet program.

How to Create Professional Invoices Quickly

Generating professional billing records doesn’t have to be a time-consuming process. With the right tools and a structured approach, you can create accurate and polished documents in just a few steps. Whether you’re running a small business, freelancing, or managing a larger company, the ability to quickly produce well-organized financial records is essential for maintaining smooth operations and keeping clients satisfied.

The key to fast and efficient document creation lies in utilizing pre-made designs that can be easily customized. By filling in the required details–such as client information, transaction amounts, and payment terms–you can generate a professional-looking document in just a few minutes. Here are some tips to help you streamline the process:

- Start with a Pre-Designed Format – Using a ready-made layout eliminates the need to design from scratch. Choose a document that suits your needs and simply add the necessary details.

- Customize for Branding – Update the document with your company’s logo, name, and contact details to ensure consistency and professionalism.

- Use Clear and Concise Descriptions – List your products or services clearly, and provide simple descriptions with corresponding prices and quantities. This minimizes confusion for your clients.

- Set Payment Terms – Clearly outline the payment due date and any applicable late fees or discounts. This helps set expectations with clients upfront.

- Double-Check for Accuracy – Quickly review all fields before sending to ensure there are no errors in client information, pricing, or dates.

By following these simple steps, you can efficiently produce accurate and professional documents that help you maintain a streamlined and organized billing process.

Adjusting Invoice Template for Different Currencies

When doing business internationally or with clients in different regions, it’s essential to ensure that your financial documents reflect the appropriate currency. Whether you’re dealing with different exchange rates or simply need to show payments in various denominations, adjusting your documents for multiple currencies is an important step for accuracy and professionalism.

Customizing your document for different currencies involves more than just changing the currency symbol. Here are key steps to ensure that your records are correctly formatted and meet your client’s expectations:

- Select the Correct Currency Symbol – Each currency has a unique symbol (e.g., $, €, £). Make sure the correct symbol is used throughout your document to avoid confusion.

- Update the Amounts – Adjust the pricing for each item listed to match the correct currency value. Keep in mind that exchange rates fluctuate, so it’s important to use the current rate if needed.

- Include Exchange Rates – If you’re working with multiple currencies, it can be helpful to include the exchange rate used to convert the amounts. This adds transparency and can help prevent misunderstandings.

- Adjust Payment Terms – Make sure the payment terms, including due dates and late fees, are relevant to the currency being used. Some regions may have different norms for payment schedules.

- Consider Tax Adjustments – Different countries may have different tax rates or VAT policies. Be sure to adjust your document to reflect the correct tax rate for the client’s region.

By taking these steps, you can easily adapt your financial documents for clients in any location, ensuring smooth transactions and professional communication regardless of currency differences.

How to Add Tax Information to Templates

When creating financial records, including tax details is an essential step for both legal compliance and clarity. Whether you’re required to charge sales tax, VAT, or another type of tax, it’s important to ensure that this information is clearly displayed in your documents. Adding tax information correctly ensures that your clients are aware of any additional charges and that your records are accurate for accounting purposes.

Steps to Add Tax Information

Follow these steps to easily incorporate tax details into your documents:

- Identify the Tax Rate – Determine the correct tax rate based on your location and the client’s region. This will vary depending on the product or service, as well as the applicable laws.

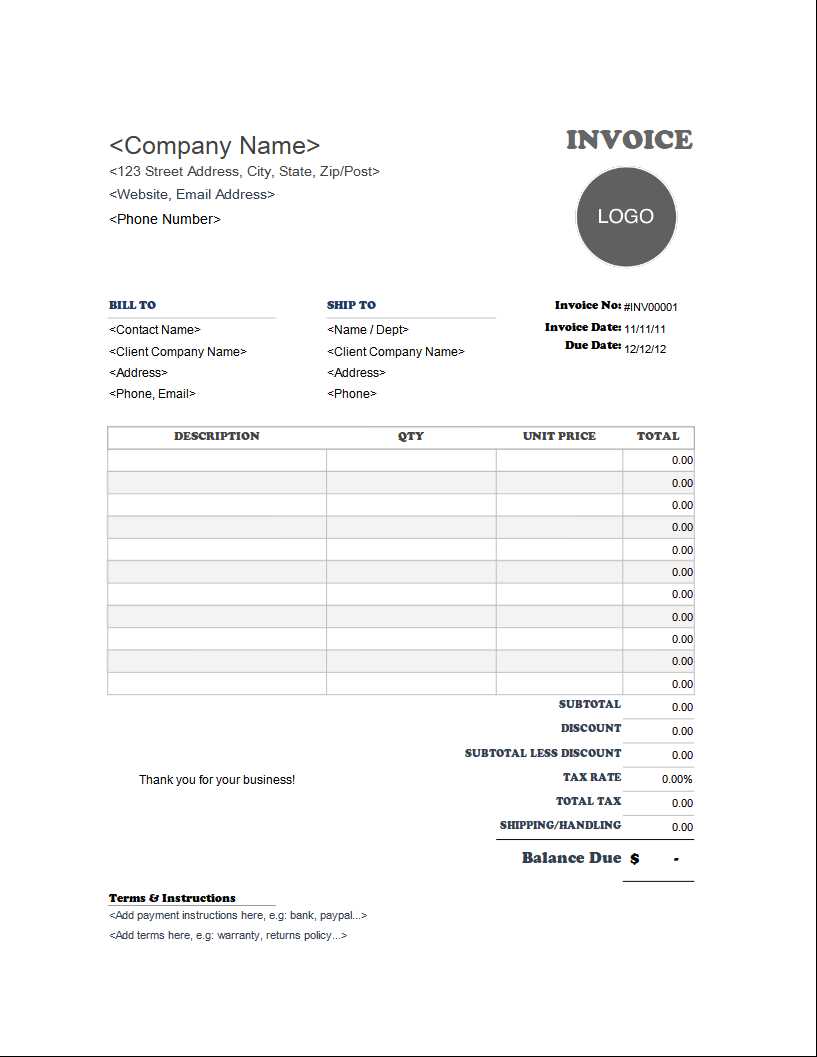

- Include a Tax Section – Create a designated section within your document for taxes. This is typically placed after the subtotal and before the total amount due. Label it clearly as “Tax” or “Sales Tax” for easy identification.

- Calculate the Tax Amount – Multiply the subtotal by the applicable tax rate to calculate the tax amount. Make sure this calculation is correct, as errors can lead to payment discrepancies.

- Display the Total – After adding the tax, update the total amount due to include both the subtotal and tax amount. Ensure this final total is clearly marked to avoid confusion.

- Provide Tax ID Information – In some cases, it may be necessary to include your business’s tax ID number or VAT registration number. This helps your clients verify your legitimacy and ensures compliance with tax laws.

Tips for Accurate Tax Management

- Stay Updated – Tax rates can change, so it’s important to regularly check for any updates that may affect your billing calculations.

- Be Transparent – Clearly explain the tax breakdown on the document, especially if you are applying different rates to various products or services.

- Automate Calculations – If possible, use software tools that can automatically calculate and add taxes to your records, minimizing the risk of errors.

By following these simple steps, you can ensure that your documents are fully tax-compliant and provide clients with the transparency they need regarding addi

Save Time with Pre-designed Invoice Templates

Creating financial documents from scratch can be time-consuming, especially when you need to maintain consistency and professionalism across multiple records. Using pre-made structures can help streamline the process, allowing you to generate accurate and polished documents quickly. These ready-made resources are designed to save you time while ensuring that all essential information is included and correctly formatted.

Efficiency at Your Fingertips

Pre-designed layouts eliminate the need to start from scratch for every new transaction. Instead of spending time adjusting margins, fonts, and headings, you can focus solely on filling in the relevant details. Here are a few ways pre-made formats help you save time:

- Ready-to-Use Format – No need to create a new structure each time. Simply open the pre-designed document, and add your specific transaction details.

- Quick Customization – With fields already laid out, you can easily update your business name, client information, and product details with just a few clicks.

- Consistency Across Documents – Using the same format for every transaction ensures a uniform appearance, reducing the time spent on adjustments for each record.

Focus on What Matters Most

By automating the layout process with pre-made structures, you can focus on the more important aspects of your business, such as managing clients, refining your products, and improving customer service. Saving time on administrative tasks means more time for growth and innovation in your business.

In conclusion, using pre-designed files helps you maintain a professional appearance while saving valuable time. It’s an efficient solution that allows you to streamline your financial processes without sacrificing quality or accuracy.

Formatting Tips for Clear Invoices

Clear and well-organized records are essential for effective communication with clients and smooth payment processing. The layout and structure of your documents play a crucial role in ensuring that all the necessary details are easy to find and understand. Proper formatting helps avoid confusion and makes it easier for clients to review and process payments.

Key Elements of a Well-Formatted Document

To create clear and professional documents, pay attention to the following essential elements:

- Consistent Fonts – Use readable fonts such as Arial or Times New Roman and ensure consistent font sizes throughout the document for clarity.

- Clear Headings – Organize your document with distinct headings like “Client Details,” “Payment Terms,” and “Total Amount Due” to guide the reader’s eye.

- Proper Spacing – Adequate spacing between sections and line items helps improve readability and prevents the document from feeling overcrowded.

- Bold Important Information – Bold key pieces of information, such as the total amount due, payment due date, or any special instructions.

Example Layout

Here is an example of how a well-organized document could be structured:

| Section | Details |

|---|---|

| Client Information | Client Name, Address, Contact |

| Products/Services | Description, Quantity, Unit Price |

| Subtotal | Sum of all items before tax |

| Tax | Applicable tax rate and amount |

| Total Amount Due | Total after tax |

| Payment Terms | Due Date, Late Fees |

By following these formatting tips, you can create clear, professional documents that are easy for your clients to understand and act on, reducing the chances of

Invoice Template for Small Businesses

For small businesses, having a professional and efficient way to manage billing and payments is essential. Using a well-structured document can simplify the process of tracking transactions, ensuring that both your business and clients have clear records of payments and services rendered. A good billing document can help small businesses maintain professionalism while saving time on administrative tasks.

Here’s how a well-organized record can be structured for a small business, ensuring that all essential details are easily accessible:

| Section | Description |

|---|---|

| Business Information | Your business name, address, and contact details |

| Client Information | Client’s name, address, and phone number |

| Transaction Date | Date when the service or product was delivered |

| Details of Services/Products | Description of what was provided, including quantities and prices |

| Subtotal | Cost of services/products before taxes |

| Taxes | Any applicable taxes, such as sales tax or VAT |

| Total Due | The final amount after adding taxes |

| Payment Terms | Due date for payment, any discounts or late fees |

For small businesses, using a well-organized document not only enhances your company’s credibility but also ensures that clients understand the payment breakdown. These clear records can help avoid misunderstandings and ensure timely payments, which are critical to the financial health of your business.

Step-by-Step Guide to Using Templates

Creating professional documents for your business can be time-consuming, but with the right tools, it becomes an easy and efficient process. By using pre-designed formats, you can quickly generate polished records without needing to start from scratch every time. This step-by-step guide will walk you through the process of using ready-made documents to ensure consistency and save valuable time.

Step 1: Choose the Right Document

The first step is selecting a structure that suits your needs. Consider the type of transaction you are processing–whether it’s a sale, service, or product exchange–and make sure the format you choose includes all necessary fields, such as client details, item descriptions, prices, and payment terms.

Step 2: Customize the Content

Once you’ve selected a format, it’s time to personalize it. Follow these steps:

- Add Your Business Information – Input your company’s name, address, and contact details at the top of the document to ensure that clients know who they are dealing with.

- Enter Client Details – Include the name, address, and contact information for the client or customer you are dealing with. This helps keep things clear and organized.

- Describe the Products or Services – List each product or service you’ve provided, along with the quantity and price. Be sure to provide clear descriptions so there’s no confusion.

Step 3: Finalize and Review

After entering all the relevant information, double-check for any errors or omissions. Make sure all the numbers are correct and that the format looks clean and professional. It’s also important to ensure that the payment terms and due dates are clearly specified. Once everything is reviewed, save the document, and it’s ready to be sent to your client.

By following these simple steps, you can quickly generate professional documents that are consistent, accurate, and efficient. Whether you’re sending a billing statement or a receipt, using pre-made formats will help you stay organized and save time on administrative tasks.

Key Fields to Include in Your Invoice

Creating a comprehensive and professional financial record requires more than just listing services or products. It’s essential to include all the necessary fields that ensure clarity, accuracy, and proper tracking of transactions. Including key information helps both you and your clients stay organized and ensures that payments are processed without confusion or delays.

Essential Information to Include

Here are the crucial sections that should always appear in your document:

- Business Details – Your company’s name, address, phone number, and email should be clearly visible at the top. This helps clients easily identify the source of the document and provides a way to contact you if needed.

- Client Information – Include the client’s full name, business name (if applicable), address, and contact details. This ensures the document is personalized and directs it to the correct recipient.

- Unique Reference Number – Assign a unique number to each document to keep track of transactions. This helps with record-keeping and makes it easier to reference in case of disputes or future correspondence.

- Description of Goods or Services – List all items or services provided with a brief description, quantity, unit price, and total cost for each item. This transparency avoids misunderstandings.

- Subtotal and Taxes – Include the subtotal before taxes, the applicable tax rate, and the total tax amount. This clarifies how much of the total cost is due to tax charges.

- Total Due – Clearly state the final amount that needs to be paid, including any taxes and discounts applied. This is the amount the client will need to pay by the due date.

- Payment Terms – Specify the due date, any late payment fees, and acceptable payment methods. This helps set expectations and encourages timely payments.

Additional Information to Consider

While the above sections are essential, you may also want to include:

- Payment Instructions – Provide clear instructions on how the client can make a payment (bank transfer, online payment link, etc.).

- Discounts or Special Offers – If applicable, include any discounts or special offers that

Invoice Template for Freelancers and Contractors

For freelancers and independent contractors, managing payments efficiently is crucial for maintaining a steady cash flow and building trust with clients. Having a well-structured document is essential for clearly outlining the services provided, payment terms, and other important details. A professional-looking document helps ensure that your clients understand the breakdown of charges, the timeline for payment, and the agreed-upon terms.

Important Sections for Freelancers and Contractors

When creating a document for your freelance or contracting business, it’s important to include the following key sections:

- Your Business Details – Always include your full name or business name, contact information, and any relevant identification numbers (such as tax ID or business registration number) at the top of the document. This ensures your client knows who the payment is going to and how to contact you.

- Client Information – Include your client’s name, company name (if applicable), address, and contact details. This helps personalize the document and makes it clear who the payment is intended for.

- Service Description – Clearly detail the services or work that was provided. Include dates, hours worked, and any milestones or deliverables. Providing a clear description ensures there are no misunderstandings about the work performed.

- Amount and Rates – List the rate for your services (hourly or flat fee) and break down the costs for the client. If multiple services were provided, ensure each one has a separate line with the corresponding charge.

- Payment Terms – Specify when payment is due, whether it’s immediately or within a specific number of days. It’s also important to include any late payment fees or discounts for early payment if applicable.

- Total Due – Clearly display the total amount due at the bottom, so the client can easily see how much they owe.

Additional Considerations

As a freelancer or contractor, you may want to include a few extra details to make the document more comprehensive and professional:

- Deposit Information – If you require an upfront deposit or partial payment, be sure to mention this at the top of the document or in the payment terms section.

- Notes or Comments – Adding a short note thanking your client for their business or providing further instructions can make your document feel more personalized.

- Reimbursement of Expenses – If you have incurred expenses related to the project (such as travel or materials), list these separately so they can be reimbursed by your client

How to Send Invoices Directly from Microsoft

Sending professional documents directly from your preferred software is a convenient and time-saving way to manage transactions. Rather than printing or manually emailing your records, you can streamline the process and ensure quick delivery to your clients. By using the built-in tools available in popular office software, you can create and send detailed records in just a few simple steps.

Step 1: Create the Document

The first step is to create your financial record using the features available within your software. Start by opening a blank document or selecting a pre-designed layout that matches your needs. Once open, input all the necessary details, such as your business and client information, services provided, payment terms, and total due. Customizing this document to include your specific branding or logo can further enhance the professional look.

Step 2: Save and Prepare for Sending

Once your document is finalized, save it in a format that’s easy to share. Common formats like PDF are ideal because they maintain the document’s layout and prevent any unwanted changes. If you’re using office software that integrates with cloud storage, you can save the document directly to your cloud account for easy access across devices.

Step 3: Send the Document

To send the document to your client, use the built-in email functionality of the office software. You can attach the saved document directly to an email and customize the message as needed. Additionally, you may be able to use integrated email services to send the document straight from the program without needing to open a separate email client. Be sure to include the recipient’s correct email address and a professional message indicating the purpose of the email.

Using these simple steps, you can easily create and send professional financial records without leaving your office software, saving you time and ensuring that the process is smooth for both you and your clients.

Common Invoice Mistakes to Avoid

When preparing billing documents, accuracy is crucial. Even small mistakes can lead to delays in payments, confusion, or even lost business. To ensure smooth transactions and maintain professionalism, it’s important to be aware of common errors that can occur when creating financial records. Below are some common mistakes to watch out for and tips on how to avoid them.

Common Mistakes to Avoid

- Incorrect Client Information – Always double-check the name, address, and contact details of the recipient. Incorrect client information can delay payment and cause confusion.

- Missing or Wrong Dates – The date of the transaction or service delivery and the due date are crucial. Ensure these dates are accurate to avoid misunderstandings about payment timelines.

- Inaccurate Descriptions of Products or Services – Providing unclear or incorrect descriptions of what was delivered can cause disputes. Be specific about what was provided, including quantities, unit prices, and any special terms.

- Failure to Include Payment Terms – Clearly state the payment terms, including the due date and accepted payment methods. If you offer early payment discounts or late fees, be sure to mention these as well.

- Not Adding a Unique Reference Number – Each document should have a unique identifier to make tracking easier. Without a reference number, it may be difficult for both you and the client to locate or reference the transaction in the future.

- Incorrect or Missing Tax Calculations – Always ensure that any applicable taxes are correctly calculated and listed. Failing to include the correct tax information can lead to complications and potential legal issues.

- Unclear Total Amount Due – Clearly highlight the total amount due, including any taxes and discounts. This prevents confusion and ensures your client knows the exact amount to pay.

- Not Following Up – Even if everything on your document is correct, it’s important to follow up with your clients if payment is not received by the due date. Regular communication ensures timely payment and reinforces your professionalism.

Avoiding these mistakes will help streamline your financial processes and reduce the chances of misunderstandings. By taking the time to review and double-check your billing documents, you’ll create a more efficient and reliable system that reflects positively on your business.

How to Update Your Invoice Template Regularly

Keeping your financial documents up to date is essential for maintaining professionalism and staying compliant with changing laws or business practices. Regular updates ensure that your records reflect accurate information, meet client expectations, and comply with any new tax regulations or payment policies. By periodically reviewing and adjusting your documents, you can avoid potential errors and improve the overall quality of your billing process.

Why Regular Updates Are Important

Updating your billing forms on a regular basis helps you stay organized and ensures that they reflect the latest details about your business. This might include:

- Changes in Pricing or Services – As your business evolves, the services you offer or the rates you charge may change. Keeping your records aligned with your current offerings ensures accuracy and avoids confusion.

- Tax and Legal Requirements – Tax laws and invoicing requirements can change over time. Make sure your documents reflect the most recent tax rates, invoice format regulations, and other legal stipulations.

- Updated Contact Information – If you move offices, change your phone number, or update your email address, it’s crucial to modify your contact details in all your business documents.

- Payment Terms and Methods – Offering new payment methods, like mobile payments or online gateways, should be reflected in your records. Adjust payment terms as needed, especially if you change your policies on late fees or early payment discounts.

How to Make the Process Efficient

Regular updates don’t have to be time-consuming. Follow these steps to make the process smooth:

- Create a Schedule – Set a reminder to review and update your financial documents at least once a quarter or whenever you implement a significant change in your business.

- Use Editable Formats – Save your documents in editable formats (such as Word or Excel) so you can quickly make changes without starting from scratch.

- Standardize Your Layout – Keep a consistent structure across all your records. This will make it easier to update them and ensure uniformity in all your transactions.

- Backup Your Changes – Keep a backup of each version of your documents. This way, if you need to revert to an older version, you can do so easily.

By regularly updating your billing forms, you’ll maintain accuracy, professionalism, and compliance, ensuring smooth financial transactions with your clients and partners.

Invoice Template vs Custom Designed Invoices

When managing your billing process, choosing between ready-made documents and custom-designed ones can significantly impact your workflow and professionalism. While both approaches have their benefits, understanding the key differences can help you decide which method is best suited to your business needs. Whether you prefer the convenience of pre-designed options or the personal touch of a custom layout, it’s important to know what each offers.

Advantages of Using Pre-designed Documents

Pre-designed billing forms are templates that offer a quick and easy way to create accurate and professional records. These are especially helpful for small businesses or freelancers who need a straightforward solution for regular billing.

- Time Efficiency – Pre-designed formats are ready to use, allowing you to fill in necessary details and send the document without spending time on design work.

- Consistency – These ready-made documents ensure that all your billing forms follow a consistent structure, maintaining uniformity across your business operations.

- Cost-Effective – Most pre-designed formats are free or low-cost, which can be a significant advantage for small businesses with limited budgets.

- Ease of Use – With minimal customization needed, these forms are easy to use even for those with limited technical skills.

Advantages of Custom-Designed Billing Forms

Custom designs offer greater flexibility and the ability to tailor your records to your specific business needs. This approach is ideal for companies looking to stand out or provide a more personalized experience for their clients.

- Branding Opportunities – A custom-designed record allows you to incorporate your brand colors, logo, and fonts, creating a more professional and cohesive appearance that aligns with your overall brand image.

- Tailored to Your Needs – Custom designs can include specific fields and formats that match your business model, making it easier to track services, expenses, or other key data points.

- Unique Appeal – A personalized layout can leave a lasting impression on clients, enhancing your credibility and fostering trust.

- Flexibility – With a custom design, you have complete control over the structure, allowing you to make changes as your business evolves or new needs arise.

Ultimately, the choice between using pre-designed formats or creating your own depends on your business size, budget, and branding priorities. Pre-designed forms offer simplicity and speed, while custom options provide greater control and a polished, professional look tailored to your unique business identity.