Blank Invoice Template for Microsoft Word

Designing a professional billing document doesn’t have to be a complicated task. With the right tools, you can quickly create a customized record of services or products offered, ensuring clarity for both you and your clients. Whether you’re a freelancer, small business owner, or a large enterprise, having a reliable format for generating these documents is essential for smooth operations and maintaining professionalism.

In this guide, we’ll explore how to efficiently generate such documents using widely available software. The aim is to simplify the process while ensuring that all necessary details are included for proper communication with clients. With a few simple steps, you can produce consistent and error-free records every time.

Customization is key, as it allows the user to tailor the document to their specific needs. Whether it’s adjusting fonts, adding logos, or modifying sections, the process remains user-friendly and adaptable. In the following sections, we’ll discuss the advantages of using a flexible document creation tool and how to make the most of it for your business needs.

Blank Invoice Template for Microsoft Word

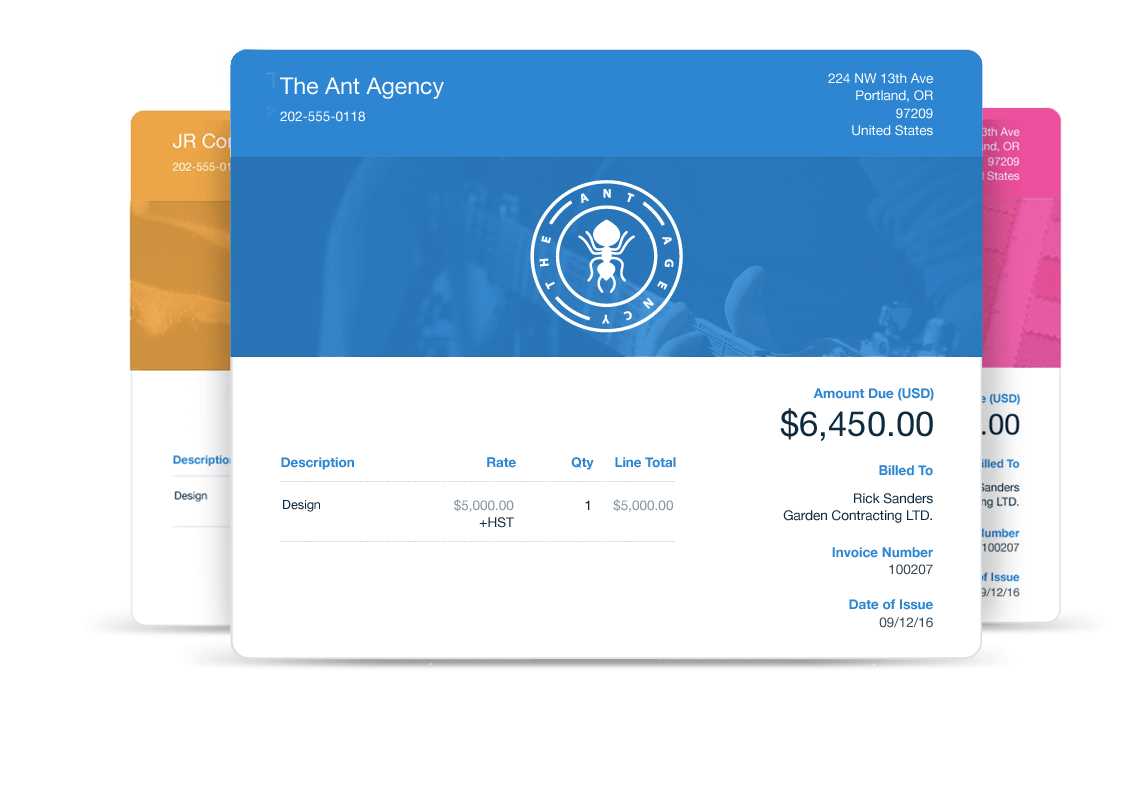

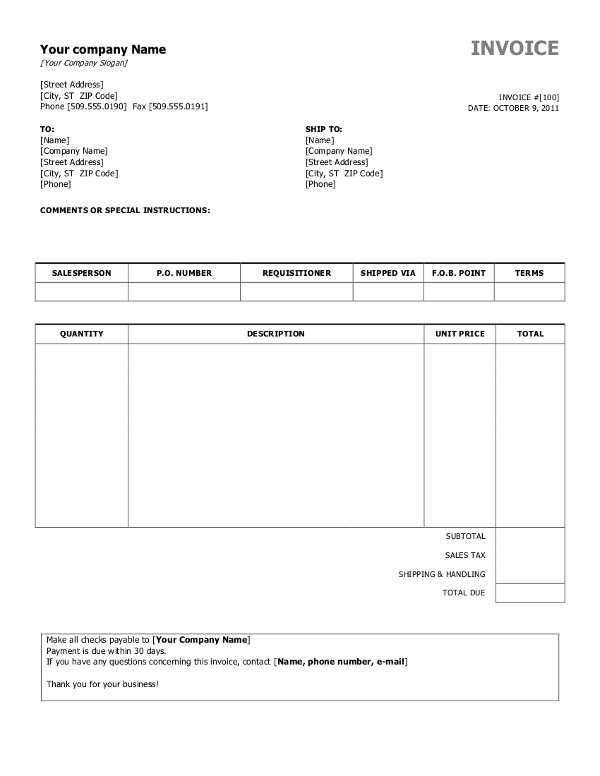

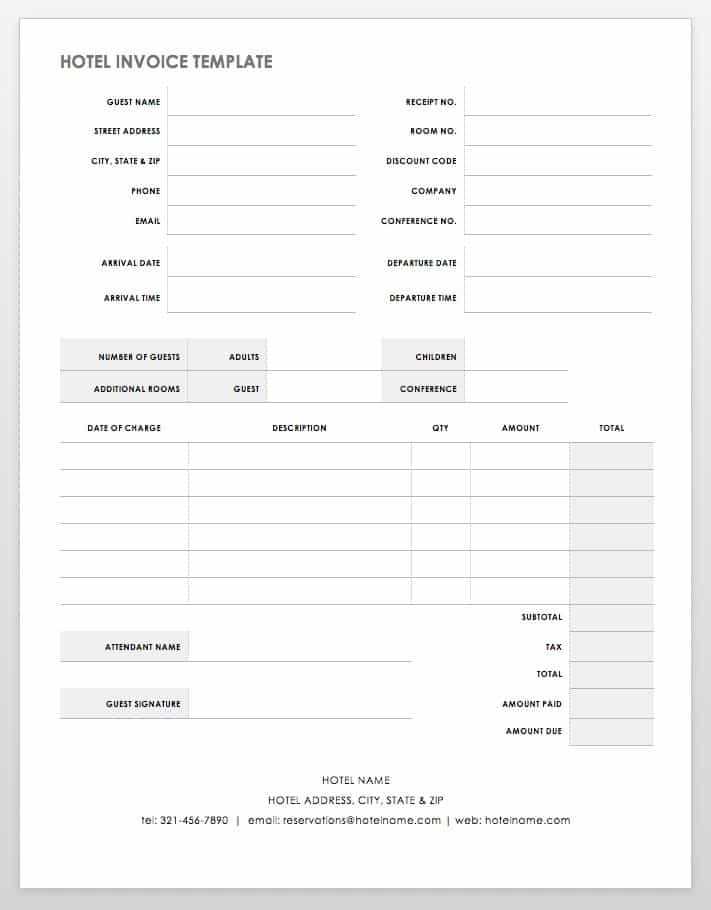

When creating a document to request payment for services or products, having a simple, ready-made structure can save significant time. A pre-designed structure allows you to quickly input the necessary details, such as customer information, dates, and pricing, without the need to build the layout from scratch. Using a convenient format ensures that each document looks professional and contains all the key sections for accurate communication with clients.

These preformatted documents are easy to customize, allowing you to add specific details relevant to your business. Whether you’re invoicing for one-time projects or recurring services, having a well-organized structure helps maintain consistency across all communications. Below is an example of how a typical layout might be structured:

| Section | Details |

|---|---|

| Client Information | Name, Address, Contact |

| Service/Product | Description of items or services provided |

| Quantity | Amount of goods or services delivered |

| Rate | Price per unit or service |

| Total | Calculated sum based on quantity and rate |

| Payment Terms | Due date, late fees, payment methods |

This structure ensures that all the essential information is included, minimizing the risk of errors and disputes. Additionally, customization options such as the ability to adjust fonts, colors, or branding elements help reinforce your company’s identity, making each document uniquely yours.

What is an Invoice Template

An invoicing document is a formal record used to request payment for goods or services provided. It typically includes important information such as the client’s details, a description of the products or services delivered, payment terms, and the total amount due. Having a standard format for creating these records simplifies the process, ensuring that all necessary elements are included consistently.

A pre-designed structure helps streamline the creation of these documents, allowing you to focus on the specifics rather than worrying about layout or formatting. By using a structured format, you can ensure that your documents are clear, professional, and ready to be sent out with minimal effort. This approach saves time and reduces the chances of overlooking important details.

Why Use Word for Invoices

Using a widely accessible software program to create billing documents offers several benefits. It provides a familiar interface, easy customization, and flexibility in formatting, all while ensuring the document remains professional and clear. Many users are comfortable with this software, making it a go-to option for quick and effective document creation.

Familiar Interface

The ease of use is one of the main reasons this program is preferred for creating business documents. Most people are already familiar with its layout, which means less time spent learning new software or struggling with complex tools. You can focus on inputting the necessary information, knowing that the interface is intuitive.

Customization Options

This software allows for extensive customization, from adjusting fonts and colors to adding logos and changing the layout. You can easily adapt the document to suit your business’s branding, making each one unique and aligned with your company’s professional image.

| Feature | Benefit |

|---|---|

| Easy Editing | Quick updates to any detail without complications |

| Template Availability | Multiple pre-made options available for faster document creation |

| File Compatibility | Documents can be saved in various formats for easy sharing |

Additionally, the ability to save documents in multiple formats such as PDF ensures that your files are easily shareable and compatible with any platform. This combination of simplicity and versatility makes it a practical choice for creating billing documents of all kinds.

Key Features of an Invoice Template

Creating a professional billing document requires including specific sections that ensure clarity and organization. A well-structured record allows for easy tracking of services, payments, and due dates. When choosing or designing a layout for such documents, several key features should be present to make the process straightforward and the result polished.

Essential Sections

Every document should contain essential details such as the service or product description, pricing, and payment terms. Including the recipient’s information and your business details is also crucial for proper communication. A clear and organized layout ensures that these sections are easy to navigate and understand.

Customization and Flexibility

The ability to adjust the document to suit the needs of your business is another important feature. This can include changing fonts, adding your company logo, or modifying the structure to fit different types of transactions. Having these options allows you to maintain consistency across your communications while tailoring each record to its specific context.

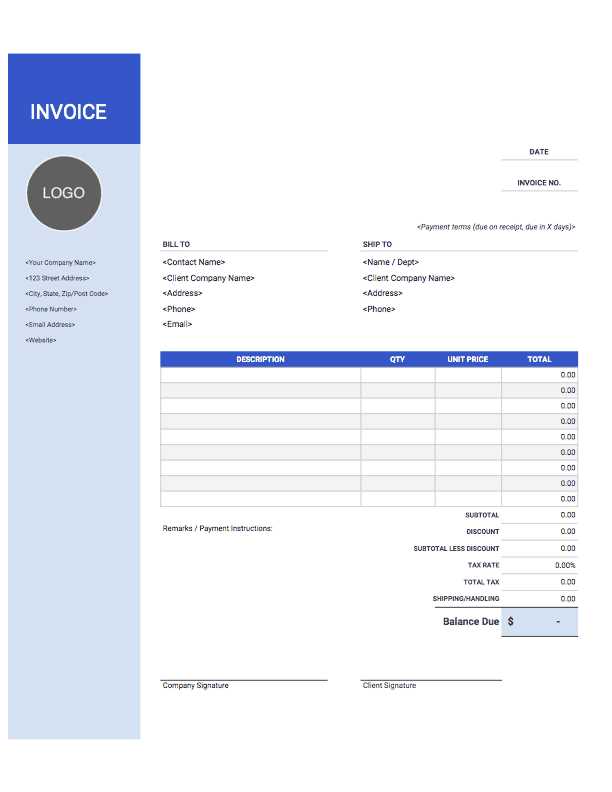

How to Customize Your Template

Customizing a billing document is essential for ensuring it reflects your business’s identity and meets your specific needs. By modifying the structure, design, and content, you can create a document that is both professional and tailored to your services. This flexibility helps maintain consistency in your communications while providing a clear and organized format for your clients.

Start by adjusting the basic layout of the document. You can change the font style and size to match your branding. Adding your company logo or adjusting the header and footer can also personalize the document and make it stand out. Ensure that all key details such as payment terms, service descriptions, and totals are clearly visible and well-organized.

Additionally, you can include or remove sections based on the specific needs of each transaction. For example, if you often bill for recurring services, you can add a section for subscription terms or payment schedules. This ability to customize ensures that each document is relevant to the job at hand and easily understood by both parties involved.

Best Practices for Invoice Creation

Creating a clear, professional billing document is crucial for maintaining smooth financial transactions with clients. Following best practices ensures that the document is easy to understand, contains all necessary details, and minimizes the chance of errors or misunderstandings. Adhering to a consistent format helps build trust and makes the payment process more efficient.

Include Clear Payment Terms

One of the most important aspects of a billing document is specifying payment terms. Clearly state the due date, accepted payment methods, and any late fees that may apply. This removes ambiguity and ensures that both parties understand their responsibilities. Also, make sure to detail any discounts or special offers to avoid confusion later on.

Maintain Consistency in Layout

Using a consistent layout across all documents is key for professionalism. Keep sections organized with ample spacing, and use bold or underlined text to highlight important details such as the total amount due or the due date. Consistency in presentation reflects a well-run business and helps clients easily navigate the document.

Benefits of Using a Blank Template

Using a pre-designed format for creating billing documents provides several key advantages that help save time and improve accuracy. With a standard structure in place, you can quickly generate professional records while ensuring consistency across all transactions. Here are some of the top benefits of using a ready-made structure:

- Time Efficiency: A pre-formatted layout reduces the time spent designing from scratch, allowing you to focus on entering specific details.

- Consistency: Using the same structure for each document helps maintain a professional appearance and ensures all necessary elements are included every time.

- Easy Customization: These formats are flexible, allowing you to quickly adjust sections, fonts, and layouts to suit your business’s unique needs.

- Reduced Errors: A structured design minimizes the risk of forgetting important details, such as payment terms, client contact information, or item descriptions.

- Professional Appearance: Pre-designed formats often include clean, organized layouts that convey a sense of professionalism to clients.

By using a standard layout, you can ensure that every document you create looks polished and is easy for clients to understand, helping streamline your billing process.

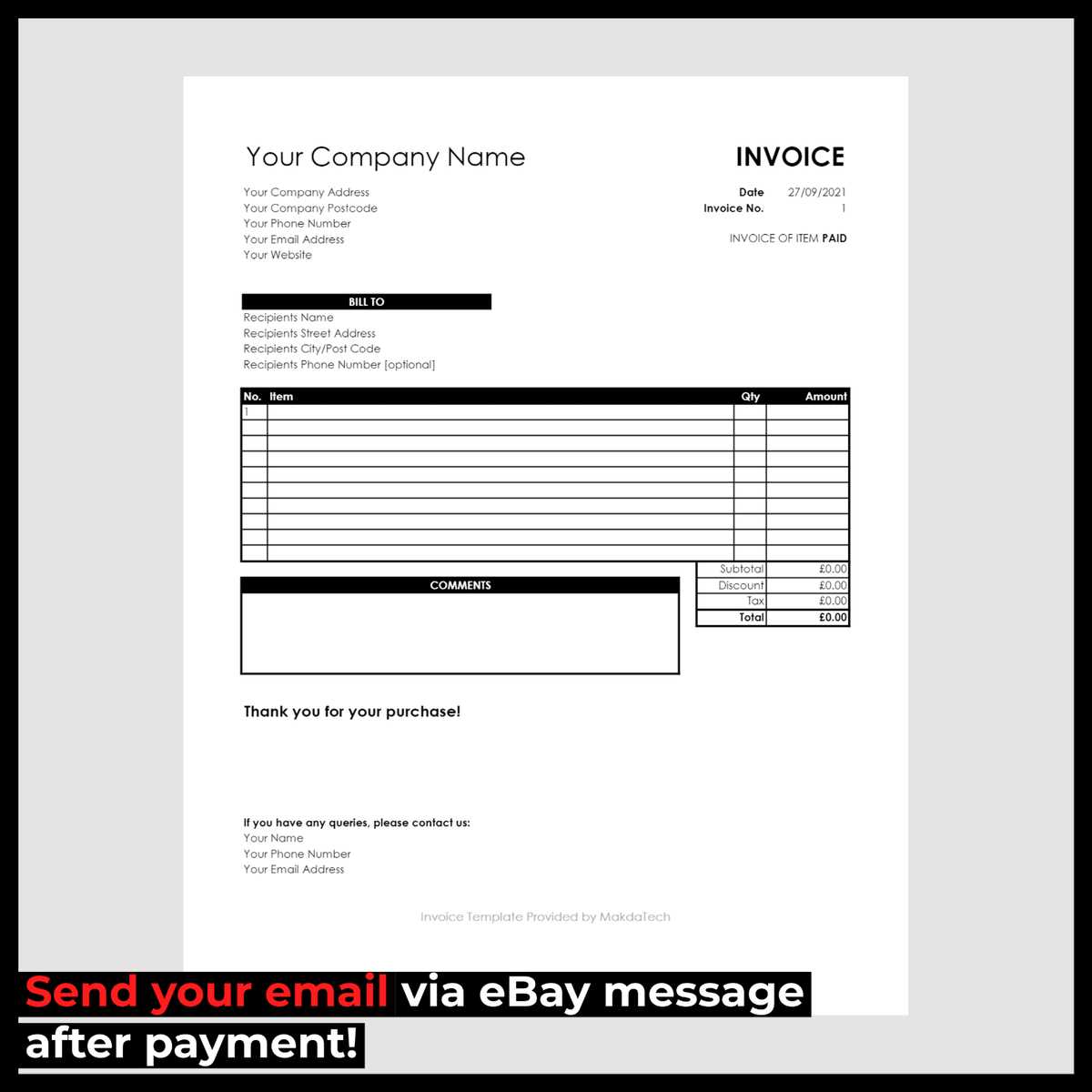

Free Templates Available for Download

There are numerous pre-designed formats available online that can be easily downloaded and customized for your business needs. These free resources offer a convenient way to quickly create professional billing documents without the need for advanced design skills or expensive software. Whether you’re a freelancer, small business owner, or entrepreneur, using a downloadable layout can save time and ensure that your documents are structured properly.

Where to Find Free Downloads

Many websites offer free access to a variety of structured layouts that can be customized to suit different types of transactions. Some popular sources include business resource platforms, online document libraries, and template marketplaces. These sites typically offer downloadable files in multiple formats, making it easy to select one that works best for your needs.

Why Choose Free Resources

Cost-effective: Free downloadable formats eliminate the need to invest in paid software or services.

Easy Customization: Once downloaded, these documents are ready for quick customization, allowing you to add your business details and specific transaction information.

Time-saving: Using a ready-made layout speeds up the creation process, helping you focus on the content instead of design.

By utilizing these free resources, you can ensure that your documents are both professional and aligned with your branding, all without spending a dime.

How to Add Your Business Details

Including your business details in any document is essential for establishing professionalism and ensuring clear communication. It allows your clients to easily identify your company and contact you if needed. By adding specific information in the appropriate sections of the document, you create a consistent and reliable point of reference for all your transactions.

Essential Information to Include

When adding your business details, make sure to include the following key elements:

- Company Name: Clearly state the name of your business at the top of the document to make it easily identifiable.

- Address: Provide a physical location or office address where clients can send payments or reach you.

- Phone Number: A contact number for immediate queries or follow-ups.

- Email Address: Include an email address for digital communication and billing inquiries.

- Website: If available, include your business website for easy access to more information about your products or services.

Formatting Tips for Clarity

Ensure that your business information is prominently displayed, typically in the header or footer. It should be easy for clients to find, so they can refer to it quickly when needed. You can also use bold or larger font sizes for your company name to make it stand out. Aligning the details in a clean and organized way will make the document look polished and professional.

By including these details, you enhance the legitimacy of your documents and provide your clients with all the necessary information for a smooth transaction process.

Adjusting Layout for Needs

Customizing the structure of your billing document is essential to meet the specific needs of your business and clients. A flexible layout allows you to add, remove, or rearrange sections to ensure the document fits each transaction. Whether you are handling a one-time payment or a recurring subscription, modifying the structure helps you present the information in the clearest way possible.

Begin by evaluating the information you need to include for each transaction. You may want to highlight certain details, such as the due date or itemized charges, to make them more prominent. Adjusting the layout allows you to emphasize the most important sections, ensuring both you and your clients can quickly reference key data.

Formatting Tips: Align headings and content neatly to ensure readability. Use bullet points or tables to organize information like product or service descriptions, making the document easy to scan. Adjusting font sizes or using bold text can help differentiate between section titles and transaction details. Make sure to leave sufficient space between sections for clarity and an overall professional look.

By tailoring the structure, you can improve the flow and presentation of your documents, making them more effective in communicating the necessary details while maintaining a polished appearance.

How to Save Your Document as PDF

Saving your document as a PDF is a crucial step in ensuring that it maintains its formatting and is easily shareable with clients. The PDF format preserves the layout, fonts, and structure, making it a reliable choice for professional documents. This process can be done quickly, ensuring that your work remains consistent and accessible across all devices and operating systems.

Steps to Save as PDF

Follow these simple steps to save your document as a PDF:

- Step 1: Once you have completed your document, click on the “File” menu located at the top of the application.

- Step 2: Select the “Save As” option from the dropdown menu.

- Step 3: Choose a location on your computer where you would like to save the file.

- Step 4: In the “Save as type” dropdown, select “PDF” from the list of available formats.

- Step 5: Click “Save” to finalize the process.

Advantages of Using PDF Format

- Universal Compatibility: PDF files can be opened on nearly any device, without the risk of formatting errors.

- Security: PDFs offer options to add password protection or restrict editing, ensuring the integrity of your document.

- Professional Appearance: The PDF format retains your document’s design and layout exactly as intended, making it look polished when shared with clients.

By saving your document as a PDF, you ensure that your clients will receive a consistent and professional version, regardless of the software they use to view it.

Common Mistakes in Document Creation

Creating billing documents can be a simple process, but there are several common errors that many make. These mistakes can lead to confusion, delayed payments, and even strained client relationships. By being aware of these pitfalls, you can ensure your documents are clear, professional, and accurate, streamlining your financial transactions.

Common Errors to Avoid

Here are some of the most frequent mistakes made when preparing billing records:

| Mistake | Impact | Solution |

|---|---|---|

| Missing or incorrect contact details | Clients may be unable to reach you for follow-up questions or payments. | Ensure your business name, address, phone number, and email are correct and clearly displayed. |

| Not specifying payment terms | Clients may be unclear about when payment is due, leading to delays. | Always include the due date and any late payment policies clearly on the document. |

| Unclear or missing item descriptions | Clients may be confused about what they are being charged for, causing disputes. | Provide detailed, itemized descriptions of products or services offered, with quantities and unit prices. |

| Incorrect calculations | Errors in totals can lead to financial discrepancies and distrust. | Double-check all calculations before finalizing the document. |

| Not including a unique reference number | It may be difficult to track or differentiate between different records. | Assign each document a unique reference number for easy identification and tracking. |

Tips for Ensuring Accuracy

To avoid these common mistakes, always take the time to review the document before sending it. Use simple language, double-check the details, and make sure all relevant information is included. A well-prepared document reflects your professionalism and can help build trust with your clients.

How to Track Payments in Word

Tracking payments is an essential part of managing financial transactions and ensuring that all amounts due are received on time. Using a document editor to monitor payments can be an efficient way to stay organized and avoid confusion. By including payment status information directly in your documents, you can easily track whether an amount has been settled or remains outstanding.

Here are a few steps you can follow to effectively track payments in your documents:

- Step 1: Include a payment status section – Add a clear “Payment Status” section within the document to update whether payment has been made or is pending. This section should be easy to update as payments are received.

- Step 2: Utilize a payment table – Create a table with columns such as “Date Paid,” “Amount Paid,” and “Remaining Balance.” This will allow you to visually track the progress of each payment.

- Step 3: Add reference numbers – When tracking payments, include unique transaction or reference numbers to associate each payment with the corresponding document or service provided.

By regularly updating these sections, you can maintain accurate records of all transactions and easily monitor outstanding balances. This approach will help ensure a smooth payment process and reduce the chances of missing any critical payments.

Templates for Different Business Types

Every business has its own unique needs when it comes to managing financial records. Whether you’re in retail, consulting, or another field, customizing your documentation for your specific business type ensures accuracy and professionalism. Various industries have different requirements for what should be included in financial documents, from itemized lists to service details. Tailoring these documents helps streamline your processes and build trust with your clients.

Here are some examples of how different business sectors can benefit from specialized document formats:

- Retail businesses: For businesses selling goods, including a detailed list of products, quantities, and individual pricing is crucial. A clear subtotal and tax breakdown are also essential for these types of transactions.

- Freelancers and consultants: Service-based businesses often require documents that focus on labor hours, project milestones, and rates. These types of documents should clearly show the scope of work, deadlines, and payment schedules.

- Professional services: For industries like law or accounting, documents may need to include hourly rates, retainer fees, and legal terms, along with a comprehensive breakdown of services rendered.

- Manufacturing and wholesale: Companies in manufacturing or wholesale sectors typically need documents that list bulk product quantities, unit costs, shipping details, and discounts for larger orders.

By choosing the right format for your business, you can provide clarity for both yourself and your clients, making transactions smoother and more transparent.

Using Templates for Multiple Clients

Managing multiple clients requires efficiency and consistency when handling financial records. By utilizing a standardized format for your documents, you can ensure that each client receives a professional and clear summary of their transactions. This approach not only saves time but also reduces errors, making the billing process smoother and more reliable across different projects or services.

Customizing for Each Client

While a basic document format remains the same, it’s important to customize the content to suit each client’s specific needs. You can adjust fields such as service descriptions, quantities, pricing, and due dates. Having a reusable framework allows you to quickly tailor each document without recreating it from scratch.

Benefits of Standardized Documents

- Consistency: Using a uniform document layout ensures that all clients receive a similar style, which increases professionalism.

- Efficiency: Reduces the amount of time spent on repetitive tasks, as you can easily modify existing documents rather than creating new ones for each client.

- Organization: Helps keep client records organized and easily accessible, making it simpler to track payments, balances, and transaction history.

By leveraging a consistent structure for all client documents, businesses can manage billing and financial communications more effectively, ensuring a higher level of client satisfaction.

Why Keep Documents Professional

Maintaining a professional appearance in all financial correspondence is crucial for establishing credibility and trust with clients. Whether it’s a bill, statement, or any other record of transaction, the way these documents are presented can reflect directly on the business. A well-organized, clear, and visually appealing format helps convey professionalism and ensures that clients take your business seriously.

Building Client Trust

When you present a well-structured document, it instills confidence in your clients. A clean, professional-looking layout suggests that your business operates with attention to detail and reliability. This trust can result in timely payments, repeat business, and long-term client relationships.

Minimizing Errors and Misunderstandings

A professional document also reduces the risk of confusion. Clear headings, organized sections, and accurate information ensure that both you and your client are on the same page. Misunderstandings about payment terms, amounts, or services rendered can be minimized with a well-organized format.

- Consistency: Having a standard structure for all records helps reinforce the professionalism of your brand.

- Accuracy: Well-designed documents allow for more precise communication of important financial details.

- Brand Image: A polished look boosts your company’s image and shows that you take your business seriously.

By keeping your documents professional, you not only ensure a positive impression but also streamline your business processes, making it easier for both you and your clients to handle financial matters effectively.

Organizing and Storing Your Financial Records

Properly organizing and storing financial records is essential for maintaining an efficient and transparent business. Effective record-keeping ensures that you can easily access past transactions, track outstanding payments, and stay compliant with tax regulations. Whether stored digitally or physically, keeping these records in an organized manner helps prevent errors, confusion, and missed deadlines.

Digital Storage Solutions

Digital storage is one of the most efficient ways to keep track of financial documents. With the right tools, you can create a system that allows for quick access and long-term preservation. Consider using cloud-based storage or dedicated software for financial management, as these solutions offer benefits like data backup, security, and easy retrieval.

- Cloud Storage: Services like Google Drive, Dropbox, or OneDrive can help store documents securely and make them accessible from anywhere.

- Financial Software: Programs like QuickBooks or FreshBooks offer automated record-keeping and easy categorization of financial documents.

- File Naming Conventions: Consistent naming conventions for your files can make it easier to locate specific records (e.g., client names, dates, or transaction types).

Physical Storage Options

If you prefer to keep physical copies, creating a well-organized filing system is crucial. Use labeled folders, binders, or filing cabinets to store your documents in an orderly fashion. Ensure that each record is categorized properly, and consider keeping a backup of critical documents in digital form for added security.

- Filing Cabinets: A dedicated filing cabinet with labeled folders for each client or transaction type can help keep everything organized.

- Indexing: Use an indexing system such as alphabetical or chronological order to easily find specific records.

- Secure Storage: Store sensitive documents in a locked, secure place to protect them from unauthorized access.

Whichever method you choose, the key is consistency. Regularly update and back up your records to ensure that they are easily accessible when needed. By staying organized, you’ll have a clear overview of your financial history and can quickly respond to client inquiries or audits.

When to Update Your Document Layout

Keeping your business forms up to date is essential for ensuring that all necessary information is captured accurately and presented professionally. Over time, your business needs may change, and so will the requirements for your records. Knowing when to update your document layout can help keep your records consistent, accurate, and in line with current business practices.

Changes in Business Information

Whenever there is a change in your business details–such as a change in address, phone number, website, or tax information–it’s crucial to update your document layout immediately. Failure to make these updates can cause confusion for clients and may result in delays or miscommunication.

- Business Address: Update the address section if you’ve moved to a new location or changed office spaces.

- Contact Information: Ensure your contact numbers and email addresses are current to avoid missed communications.

- Tax Identification Number: If there are changes in your tax ID or VAT number, make sure these are reflected in your document format.

Legal and Regulatory Changes

Occasionally, local laws or industry regulations may require adjustments to your documentation. These can include changes in tax rates, invoicing practices, or required disclosures. Regularly reviewing your documents ensures that you comply with all applicable rules and avoid any legal issues.

- Tax Rates: If there are any changes to tax rates or applicable taxes, adjust the fields that calculate totals accordingly.

- Compliance Updates: Add new legal disclaimers or clauses if required by new laws in your region.

By staying on top of updates and making changes as needed, you can ensure that your business forms always reflect the latest standards and requirements. This helps maintain professionalism and accuracy in every transaction.