Blank Invoice Template for Services

Creating clear and accurate billing records is essential for any business. Whether you’re a freelancer, small business owner, or part of a larger organization, a well-structured document helps streamline payment processes and ensures transparency with clients. Having a reliable way to generate these records saves both time and effort, making it easier to focus on delivering quality work.

In this guide, we’ll explore how to design and customize a simple yet effective billing form that meets your needs. With the right tools, you can quickly create professional documents that reflect your brand and maintain consistency in your financial dealings. We will cover key elements, design tips, and practical advice on making your billing process as smooth as possible.

Efficiency is the key. By using a pre-made structure, you can avoid starting from scratch every time you need to bill a customer. This approach not only simplifies the creation process but also ensures all necessary details are included each time, reducing the chances of missing important information.

Blank Invoice Template for Services

Having a standard structure for billing helps ensure that all necessary information is captured and organized. This method simplifies the process of generating documents when it’s time to request payment, while also presenting a professional image to clients. A well-designed structure ensures that nothing is overlooked and can be used repeatedly for each transaction.

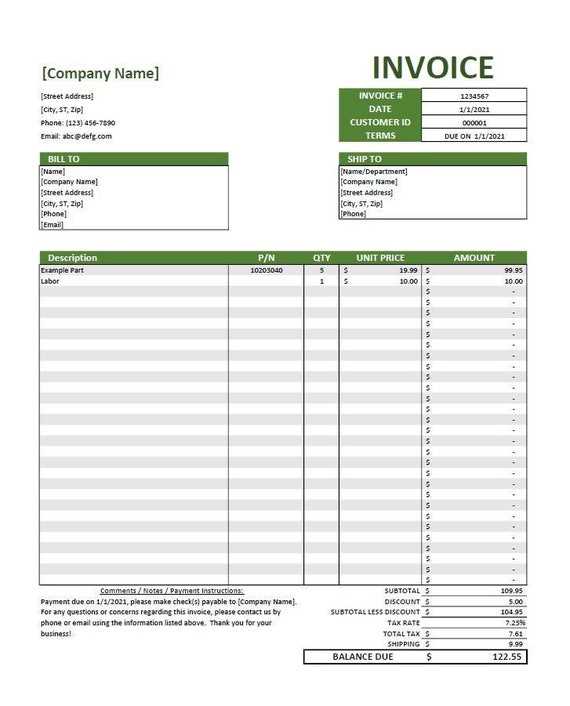

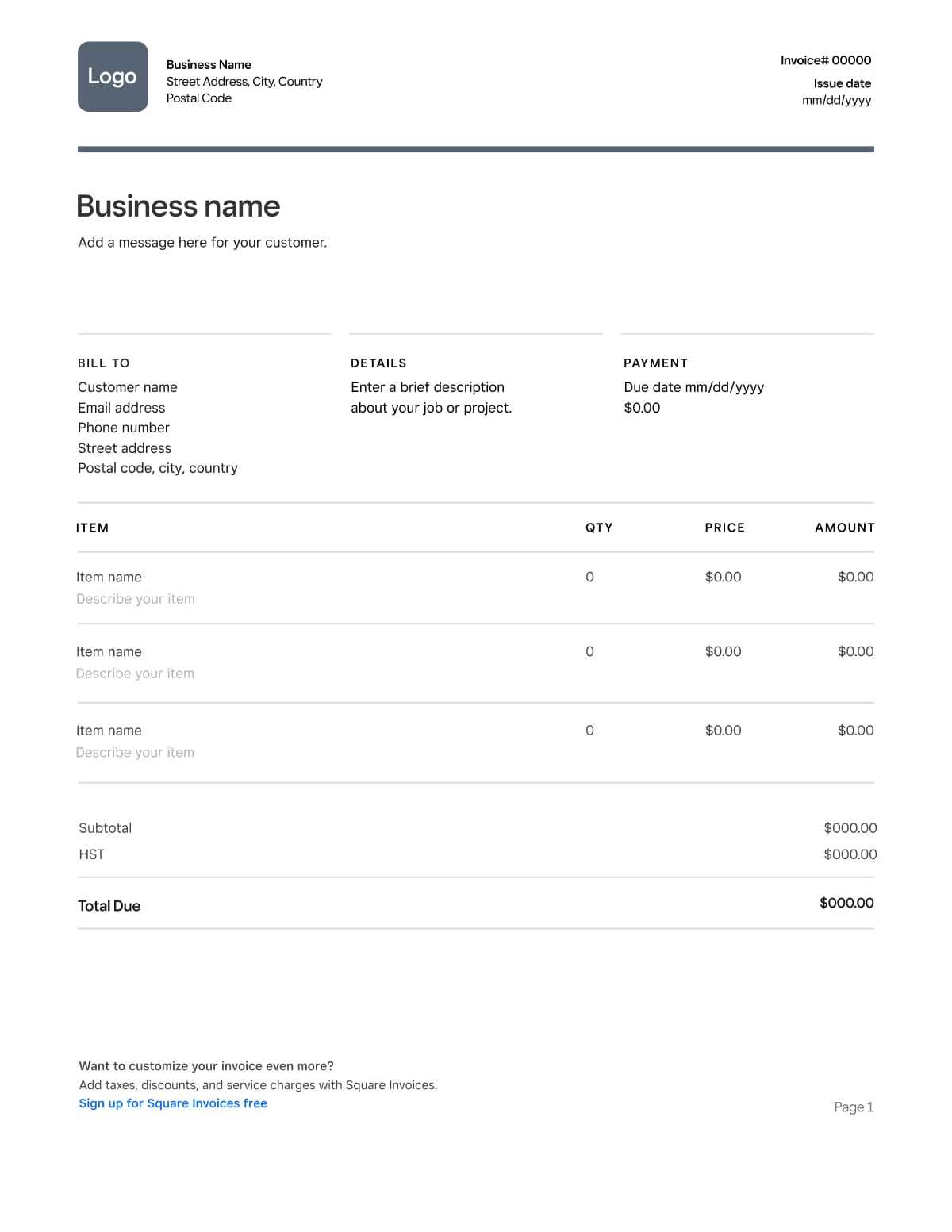

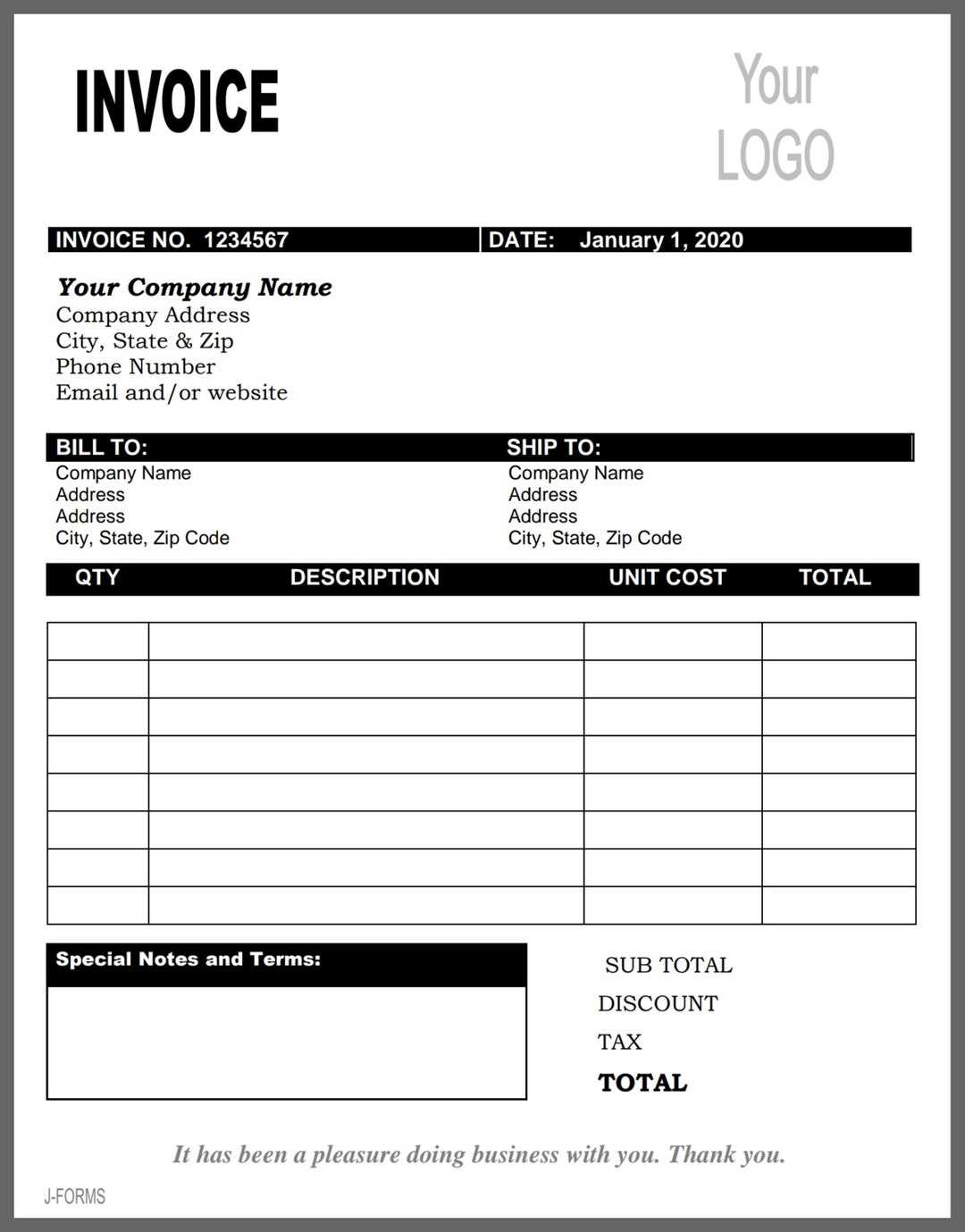

Key Components of a Billing Document

When creating your document, it’s important to include the following elements to ensure clarity and accuracy:

- Client Details: Name, address, and contact information.

- Work Description: A clear list of tasks or goods provided.

- Amount Due: A breakdown of costs and any applicable taxes.

- Payment Terms: Due date and payment instructions.

- Unique Identifier: A reference number for tracking purposes.

Customizing Your Document

Depending on your needs, the structure can be adapted. If you offer multiple types of work, you can create different sections for each category. Additionally, adding your company logo, colors, and a personalized note can make the document feel more cohesive with your brand. The more customizable the structure is, the more professional it will appear to clients.

What is an Invoice Template

A billing document is a standardized format used by businesses to request payment from clients. It includes essential information regarding the work completed or goods delivered, payment amounts, and terms. By using a consistent structure, businesses can easily manage financial transactions and ensure that nothing is overlooked.

This structure serves as a useful tool for maintaining clarity in transactions and ensuring professionalism. It helps both the business and client understand the details of the agreement, reducing confusion and making the payment process more efficient. It typically includes sections for the client’s contact information, a breakdown of the services or products provided, and the total amount due.

Efficiency is key when using such a structure. It allows business owners to save time by filling in standard details quickly rather than drafting a new document from scratch each time a payment request is made. Customizable forms ensure that the document can be adapted to specific needs while retaining consistency in layout and information.

Benefits of Using a Blank Template

Using a pre-designed structure to request payment offers numerous advantages, particularly for business owners looking to save time and ensure accuracy. By having a ready-to-use format, you can eliminate errors and reduce the effort required to create a new document from scratch every time. This method helps streamline financial operations and improves consistency across transactions.

Some key benefits include:

| Advantage | Explanation |

|---|---|

| Time-saving | Pre-designed formats reduce the time needed to generate each document, allowing you to focus on other important tasks. |

| Consistency | Using the same layout for all requests ensures that important details are always included, creating a professional image for your business. |

| Customizability | The structure can be tailored to suit specific needs, including personalized branding or adjustments for different types of work. |

| Accuracy | By following a proven format, you can reduce the chances of missing critical information or making calculation mistakes. |

By incorporating this simple tool into your workflow, you can enhance the efficiency of your financial transactions and ensure that your business stays organized and professional in its dealings with clients.

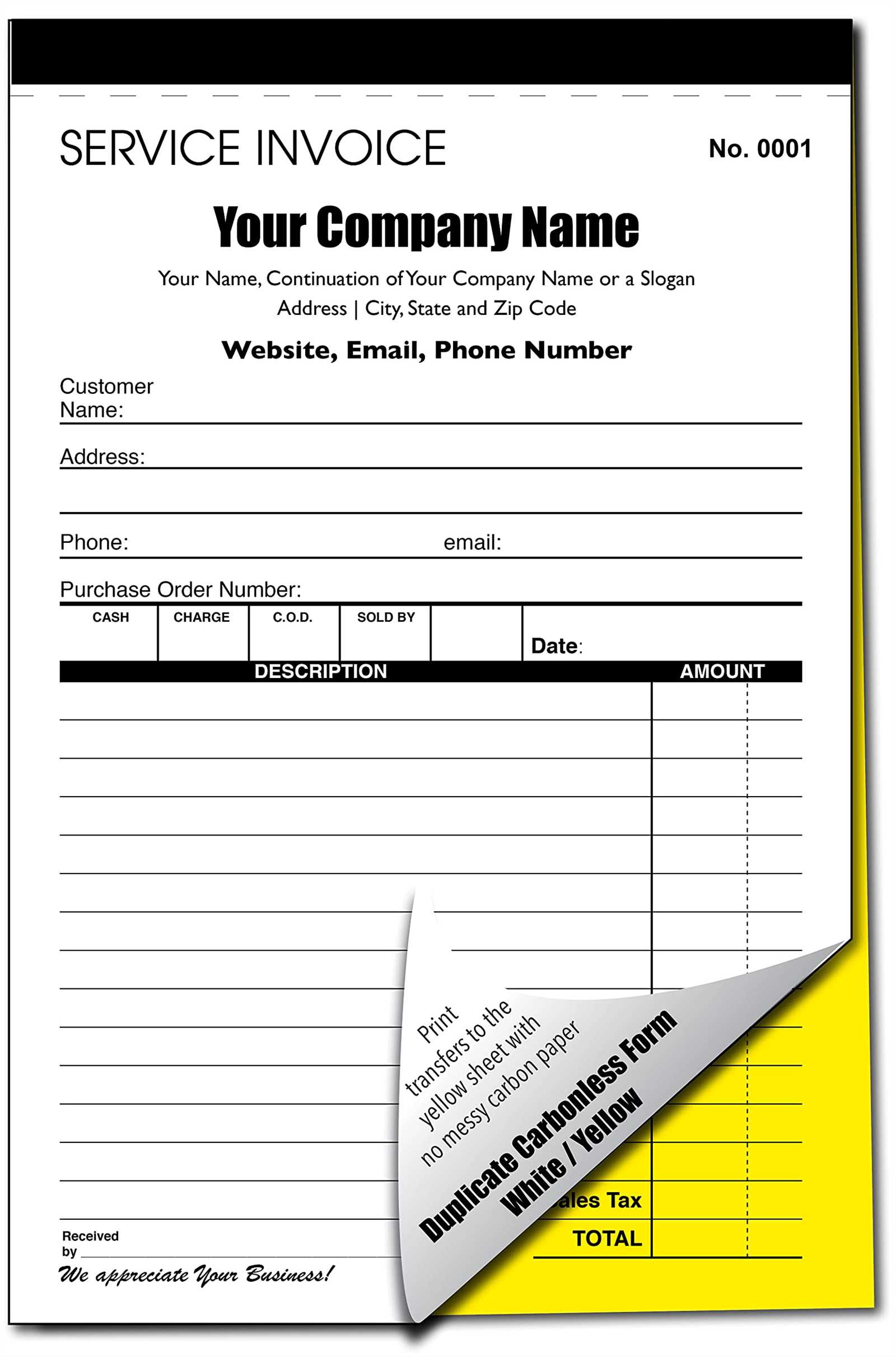

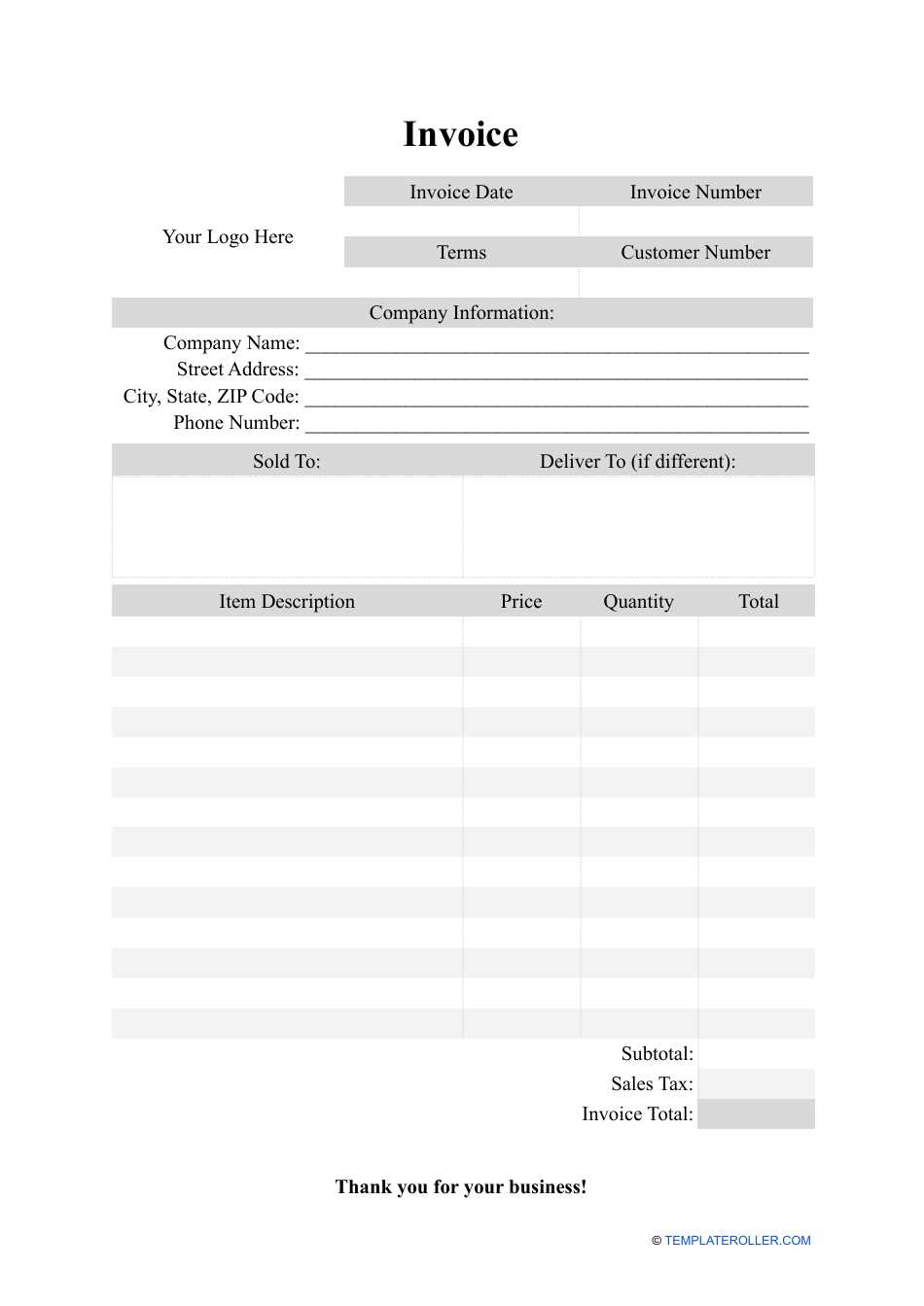

How to Customize Your Invoice

Tailoring your payment request form to reflect your business’s unique needs is essential for creating a professional and personalized experience for your clients. Customization allows you to adjust various elements of the document to align with your branding, highlight specific information, and ensure that all necessary details are included. This process can make your documents not only functional but also visually appealing and in line with your business identity.

Personalizing the Design

One of the first steps in customization is adjusting the design elements. You can include your company logo, change fonts, or use your brand colors to make the form easily recognizable. Personalizing these aspects creates a cohesive look across all your business materials and enhances the professionalism of the request.

Adding Specific Information

In addition to the general sections, you can also add custom fields that reflect the specific nature of your work. For example, if you provide multiple services, you might want to include a section that breaks down each type of service. You can also add extra notes for payment terms, special instructions, or discounts to cater to each client’s unique needs.

Key Customization Features:

- Branding: Incorporate your logo, colors, and fonts for consistency.

- Details: Modify sections to suit different types of transactions or clients.

- Terms: Add personalized payment terms or reminders for overdue balances.

- Notes: Include additional messages or disclaimers tailored to specific customers.

Customizing your document in these ways ensures that it’s not only practical but also reflects the

Essential Elements of a Service Invoice

To ensure that your payment request is both clear and professional, it’s important to include all the necessary components. A well-structured document provides both you and your client with the information needed to complete the transaction without confusion. Each section should be carefully designed to convey the details of the work done, the cost, and payment instructions.

Key Information to Include

There are several crucial elements that every payment document should have to be considered complete and legally sound:

- Client Information: This includes the name, address, and contact details of the client you’re working with.

- Work Description: A detailed breakdown of the work performed, including dates, services rendered, or products delivered.

- Amount Due: The total amount owed, including any taxes or additional fees.

- Payment Terms: This specifies the due date and any penalties or late fees for overdue payments.

- Unique Identifier: Each request should have a unique reference number for tracking and record-keeping purposes.

Formatting Tips

Formatting is crucial for readability. Use headings, bold text, and consistent alignment to make the document easy to navigate. Ensure that all numbers are clear and that the breakdown of costs is easy to follow. The clearer the layout, the less likely any mistakes will be made during payment processing.

Additional Considerations: You might also want to include a personal note or a thank you message to reinforce your professional relationship with the client. Offering options for payment, such as bank transfer details or online payment links, can also simplify the process for the client.

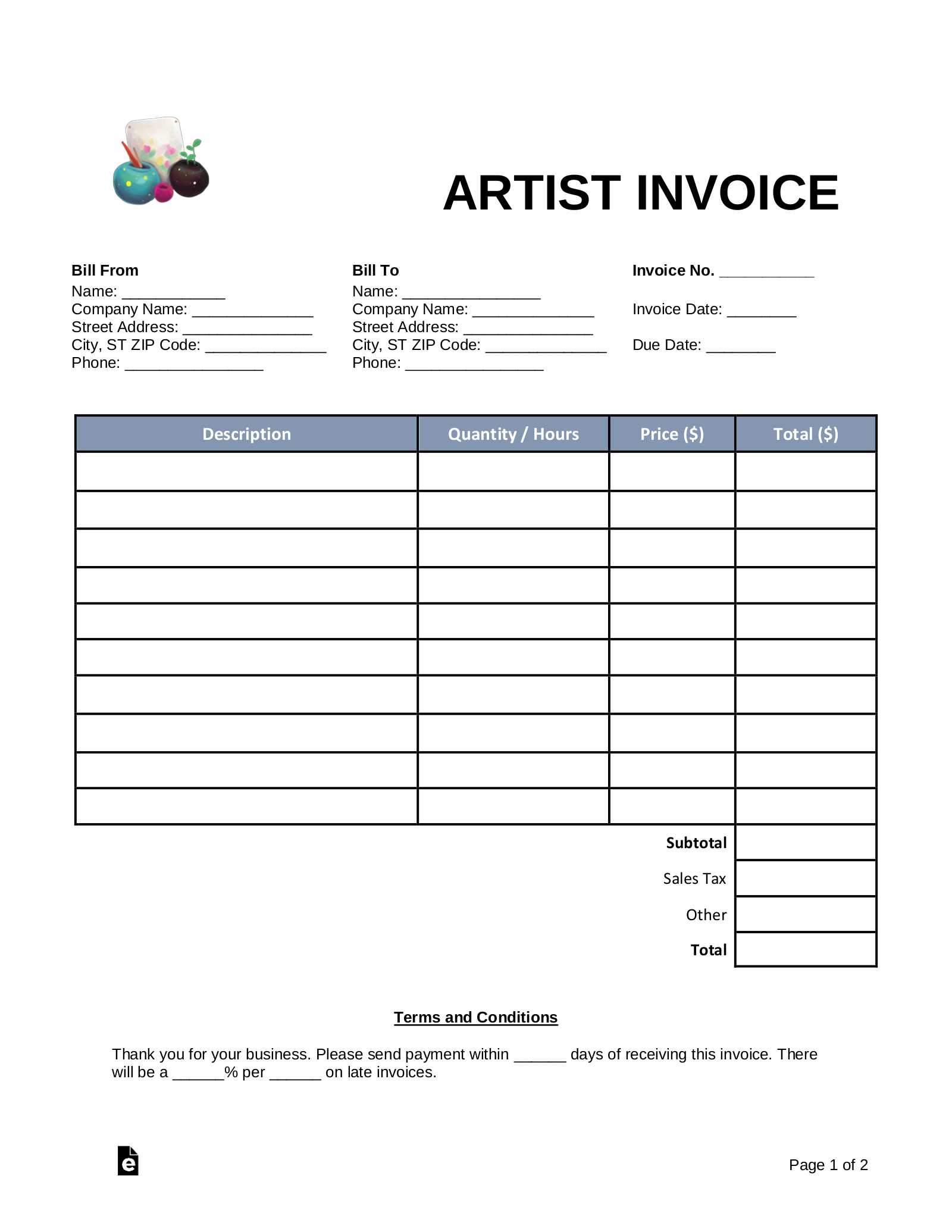

Free Invoice Templates Available Online

For businesses looking to streamline their payment processes, there are numerous free options available online that provide ready-to-use structures for requesting payment. These resources offer a convenient way to save time and ensure that your billing documents are formatted correctly, without the need to create a new form from scratch. Whether you need a simple design or a more detailed one, these free resources can be customized to fit your specific needs.

Where to Find Free Resources

Several platforms offer free downloadable and editable options. These sites typically allow you to choose from a variety of designs and formats, making it easy to find one that fits your business style. Some popular websites include:

- Google Docs: Offers customizable documents with various layouts for easy editing and sharing.

- Microsoft Office Templates: A range of free formats available for quick download and modification.

- Template Websites: Sites like Template.net and Canva offer free, editable options that are easy to personalize.

Benefits of Using Free Options

Using free resources can significantly reduce the time and effort spent on creating payment documents. These templates are designed to be user-friendly, ensuring that even those with minimal experience can generate professional-looking records. Additionally, they provide a consistent format, which enhances your business’s credibility and professionalism.

Common Mistakes to Avoid in Invoices

When creating payment requests, even small errors can lead to confusion, delayed payments, or potential disputes with clients. It’s essential to ensure that every detail is correct and clearly presented to avoid misunderstandings. By understanding the common mistakes and taking steps to prevent them, businesses can ensure smoother transactions and maintain professional relationships with their clients.

Missing or Incorrect Information

One of the most common issues is leaving out important details, such as the client’s contact information, the description of the work completed, or the total amount due. It’s essential to double-check that all sections are filled out correctly and thoroughly. This includes ensuring that:

- The client’s name, address, and contact information are accurate.

- Descriptions of the work or products are clear and specific.

- The payment terms, including due dates and penalties, are explicitly stated.

Calculation Errors

Another frequent mistake is incorrect calculations. Whether it’s the total amount due, taxes, or discounts, ensuring that all numbers are correct is crucial. Always double-check the math to avoid errors that could lead to overcharging or undercharging clients. Using automated tools can help reduce the chances of making these types of mistakes.

By paying attention to these common mistakes, you can create clear, professional, and accurate documents that facilitate timely payments and maintain positive client relationships.

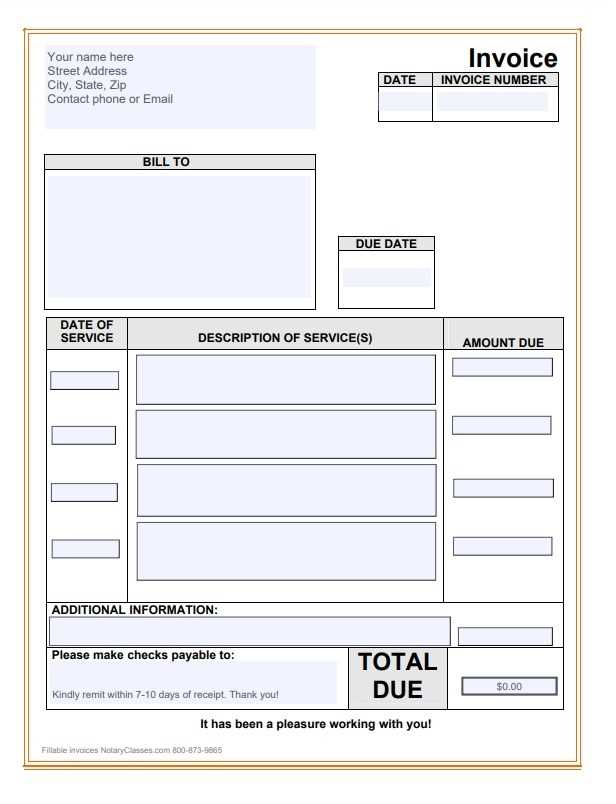

How to Format Your Invoice Properly

Proper formatting is essential when creating a payment request document, as it ensures clarity and professionalism. A well-organized document helps clients quickly find the information they need, such as the total amount due, payment terms, and the services provided. The right format not only looks professional but also contributes to smoother transactions and reduces the chance of confusion.

Key Sections to Include

The structure of your payment request should include several key elements to ensure that all necessary information is clearly presented:

- Header: Start with your business name, contact information, and the document’s unique reference number.

- Client Details: Include the client’s name, address, and contact information.

- Description of Work: List the services or products provided, including dates, quantities, and rates.

- Amounts: Clearly show the total due, along with taxes, discounts, and any additional charges.

- Payment Terms: Specify the due date, payment methods, and any late fees if applicable.

Formatting Tips for Clarity

Formatting should focus on readability. Here are a few tips for organizing your payment request:

- Use headings: Separate sections with bold or underlined headings to make it easier for clients to navigate the document.

- Align the text: Align text consistently, especially amounts and dates, to enhance visual appeal.

- Keep it simple: Avoid cluttering the document with unnecessary information or overly complex design elem

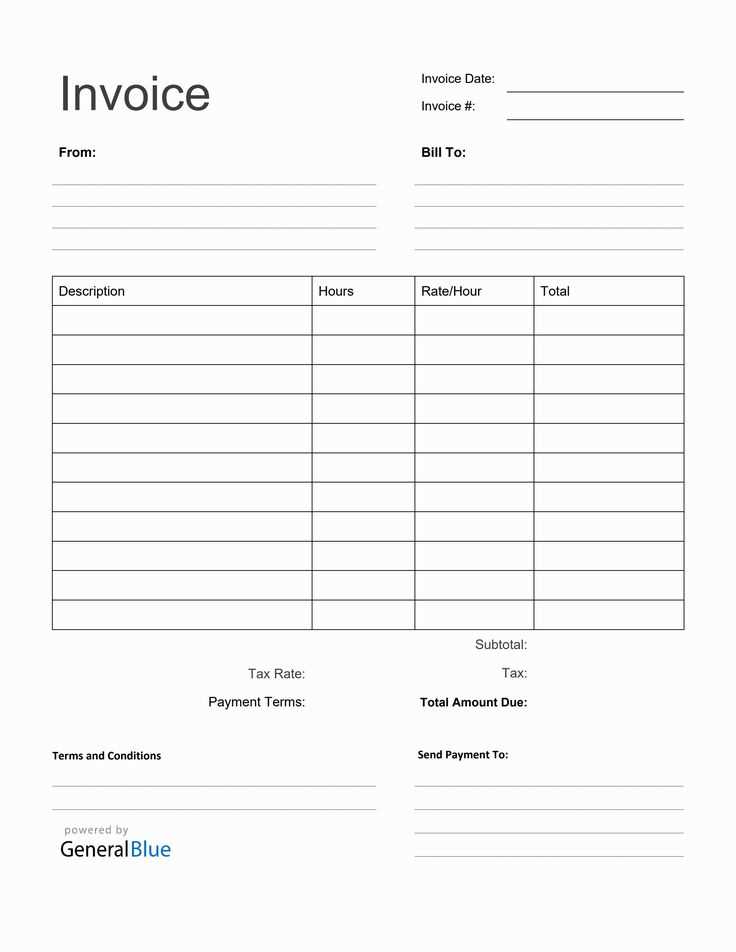

Choosing the Right Template for Your Business

When selecting a document structure for billing, it’s important to choose one that aligns with the specific needs of your business. The right design can help streamline your payment collection process, ensuring accuracy and clarity while maintaining a professional appearance. Tailoring the format to your industry, brand, and the type of work you provide will result in a more effective and efficient way of managing financial transactions.

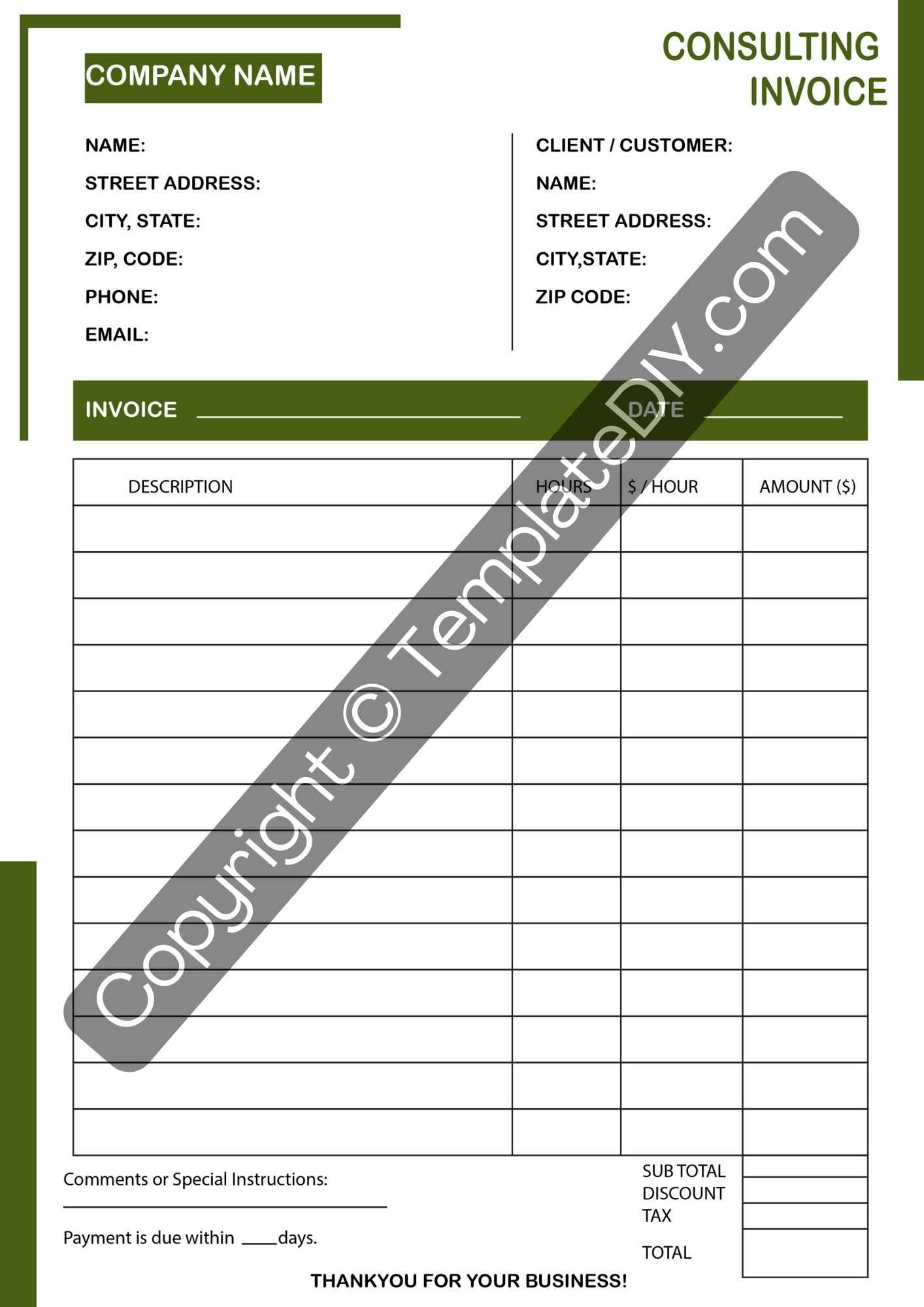

Consider Your Business Type

Different businesses have different requirements when it comes to billing documents. Here are a few considerations to keep in mind:

- Freelancers: A simple, straightforward structure may work best, focusing on hours worked, rates, and the total amount due.

- Retailers: If you are selling products, including itemized lists with prices, quantities, and descriptions is important.

- Consultants: For those offering professional advice, including a section for consultation hours, service descriptions, and hourly rates is useful.

Brand Consistency and Professionalism

The appearance of your document should reflect your brand’s identity. Whether you use colors, logos, or specific fonts, ensure that your billing documents are consistent with your other marketing materials. This consistency helps build trust with clients and reinforces your business’s professional image. Look for designs that are clean, well-organized, and align with the level of formality your business represents.

Ultimately, the best document structure for your business should be easy to customize, simple to read, and tailored to your specific needs. A well-chosen format will improve your financial operations and present your business in the best light possible.

Why Professional Invoices Matter

A well-crafted billing document plays a crucial role in the financial transactions between businesses and their clients. Not only does it act as a formal request for payment, but it also helps establish your brand’s credibility and fosters trust. A professional document conveys attention to detail, ensures clarity in the payment process, and contributes to the smooth flow of your business operations.

Establishes Trust and Credibility

By using a polished and clear payment document, you demonstrate to your clients that you are organized, reliable, and serious about your business. This can help build long-term relationships and encourage repeat business. Here’s why it matters:

- Professional appearance: A well-designed document looks more credible and trustworthy to clients.

- Consistency: Regularly using the same format reinforces your brand’s professionalism and creates a sense of continuity in client interactions.

- Clarity: A clear, well-organized document makes it easier for clients to understand the details and fulfill payment without confusion.

Reduces Payment Delays

One of the most significant benefits of a properly formatted document is that it can help reduce payment delays. When your payment request is clear and professional, clients are less likely to dispute the charges or misunderstand the terms. Furthermore, a well-drafted document can include all necessary payment information, deadlines, and penalties for late payment, ensuring that clients understand their obligations.

In conclusion, maintaining a professional approach to billing not only helps with the timely collection of payments but also elevates your business’s reputation in the eyes of your clients.

Saving Time with Invoice Templates

Streamlining administrative tasks is essential for running an efficient business, and having a pre-designed structure for billing can significantly reduce the time spent on financial paperwork. Instead of creating a new document from scratch for every transaction, using a ready-made format allows you to focus on the essential details and make updates quickly. This approach not only saves valuable time but also ensures consistency in your billing process.

By using a pre-set design, you eliminate the need to manually input repetitive information, such as business details or payment terms. Instead, you can customize specific sections for each client, speeding up the process while maintaining accuracy and professionalism. This time-saving practice can be especially beneficial for businesses with frequent transactions or a large number of clients.

In the long run, using ready-made formats helps you stay organized, reduces errors, and allows you to handle other aspects of your business more efficiently, giving you more time to focus on growth and client relationships.

Tracking Payments with an Invoice

Properly tracking payments is crucial for maintaining healthy cash flow and ensuring financial stability in your business. A well-structured payment request not only helps clients understand the amount due but also provides a clear record for you to monitor outstanding amounts. By keeping detailed records of every transaction, you can easily track which payments have been made and which are still pending.

Organizing Payment Details

Incorporating essential details into your payment request document allows you to easily monitor the payment status. Some key elements include:

- Due date: Clearly stating the deadline helps you keep track of payment timelines and follow up if necessary.

- Amount due: Listing the exact amount ensures that both you and the client are aligned on what is owed.

- Payment methods: Including the available payment options makes it easier to see which method was used, streamlining the payment tracking process.

Efficient Follow-ups

Having a systematic way to track payments makes it easier to follow up with clients who have not yet paid. With a clear record of when payments were due and how much is outstanding, you can quickly identify late payments and send reminders or take further action as needed. This proactive approach ensures that your business stays on top of its finances.

Ultimately, using a detailed and well-organized payment request not only helps you track payments but also provides transparency and improves communication with clients, fostering trust and encouraging timely payments.

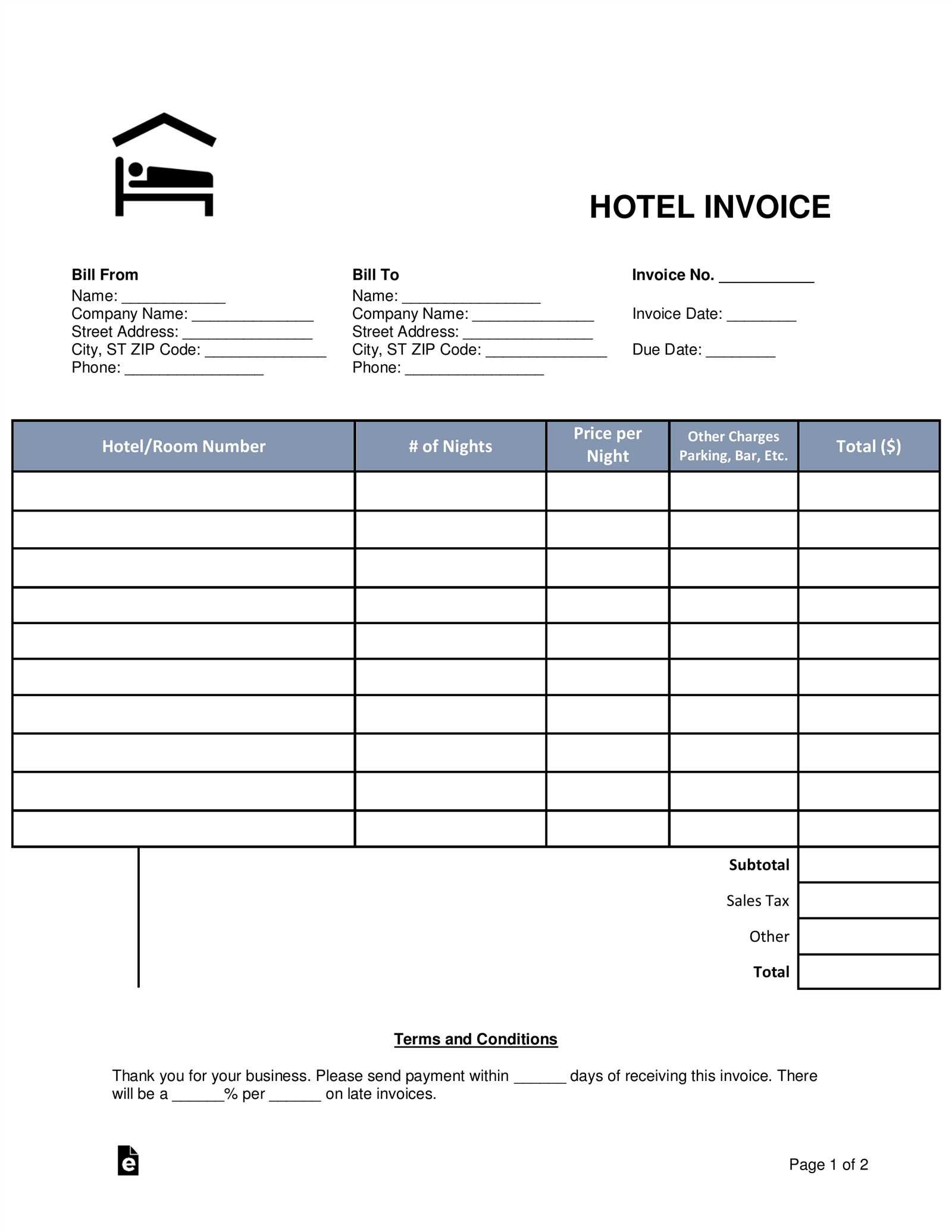

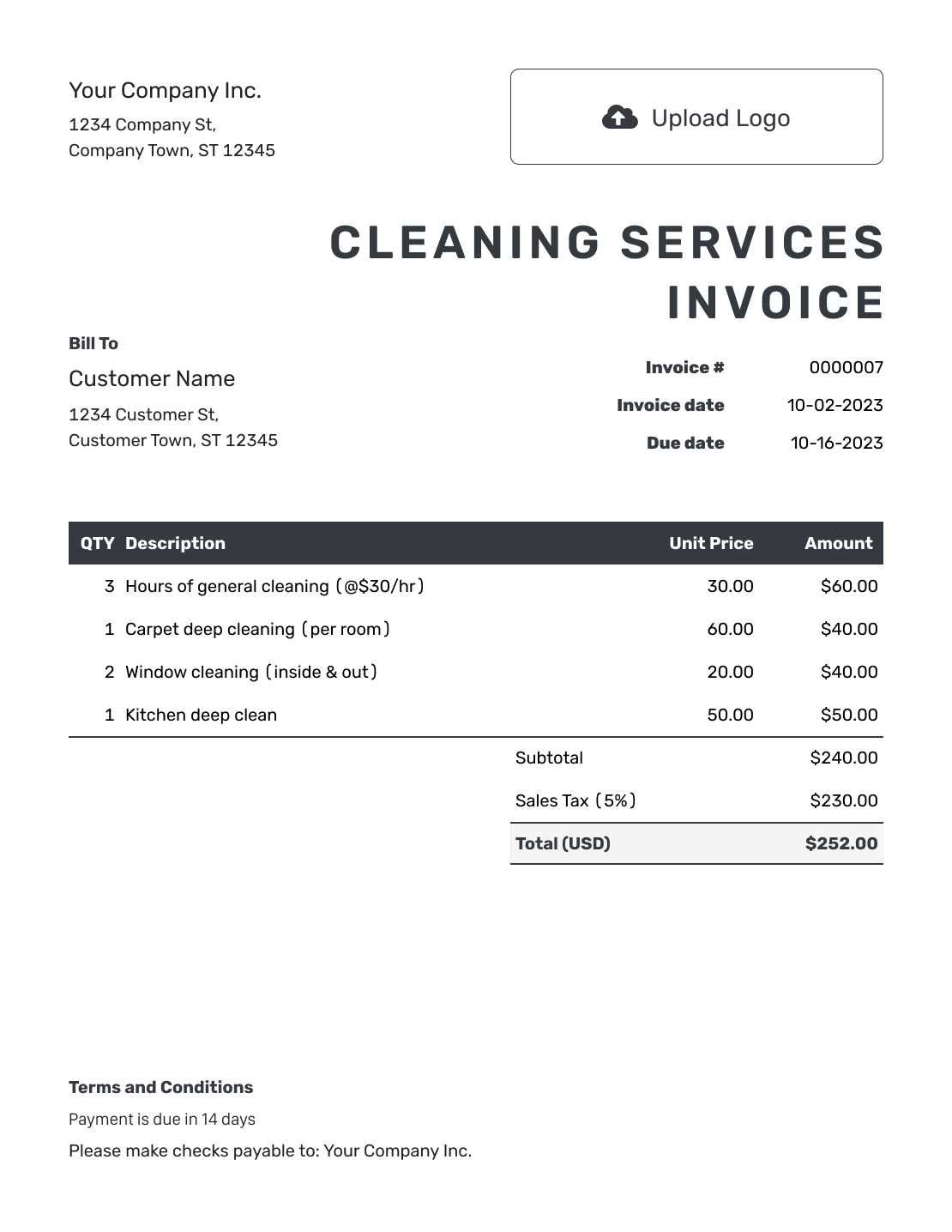

How to Include Tax Details

When requesting payment for goods or services, it’s important to include all necessary tax information to ensure compliance and clarity for both parties. Including tax details not only helps your clients understand the total cost but also helps you maintain accurate financial records. Properly detailing taxes can prevent misunderstandings and disputes, ensuring that all charges are transparent.

Key Tax Information to Include

When including tax information in a payment request, there are several essential details to ensure that everything is clear and compliant:

- Tax rate: Clearly specify the percentage of tax being applied, whether it is a flat rate or a tiered structure.

- Tax amount: Display the exact amount of tax being charged on the total sum. This should be calculated based on the applicable tax rate.

- Tax identification number: If required by law, include your business’s tax ID number to ensure that the document is officially recognized.

- Breakdown of charges: Provide a breakdown of taxable and non-taxable items, ensuring that clients understand how the tax is calculated.

Why It’s Important

Including tax details is essential for both legal and financial reasons. It ensures that you are abiding by tax laws and allows your clients to accurately account for taxes in their own records. Additionally, it helps avoid errors during audits or tax filing, providing a clear and organized structure to your financial documentation.

By properly detailing tax information, you make your payment requests transparent and professional, ensuring smooth transactions and reducing the risk of confusion or delays.

Invoice Design Tips for Businesses

Creating a professional and clear document for requesting payments can significantly enhance the perception of your business. A well-designed payment request reflects your company’s attention to detail and ensures that all important information is easy to understand. A thoughtfully structured format also helps streamline the payment process, reducing confusion and improving client relationships.

Key Design Elements to Consider

When designing your payment request, consider the following tips to ensure clarity and professionalism:

Design Aspect Tip Branding Incorporate your logo, business name, and color scheme to maintain brand consistency and make your document look official. Legibility Choose clear, readable fonts and appropriate font sizes. Avoid clutter and ensure that the information stands out. Structure Organize the document in sections–client details, payment breakdown, and terms. Use headings and bullet points to improve readability. Whitespace Make sure there is adequate space between sections and text. This helps to create a clean layout and makes the document easier to navigate. Professionalism Ensure the overall design reflects the professionalism of your business. Avoid using overly decorative elements or distracting colors. Using a Consist

Legal Considerations for Invoices

When issuing a document requesting payment, it’s crucial to ensure that it complies with legal requirements. Properly formatted records not only help businesses maintain professional standards but also protect them in case of disputes. Understanding the legal aspects of these documents can prevent issues related to late payments, misunderstandings, or even legal actions.

Important Legal Elements to Include

To make sure your payment requests meet legal standards, include the following key details:

- Business Information: Always include your full business name, address, and contact details. This ensures that your client can easily reach you if necessary.

- Client Information: List the client’s name and contact details. This will help identify the recipient of the payment request.

- Unique Identification Number: Assign a unique number to each document. This helps track payments and serves as an official reference in case of disputes.

- Clear Payment Terms: Specify the amount due, due date, and any applicable payment terms, such as late fees or discounts for early payment. This establishes expectations and avoids confusion.

- Tax Details: If applicable, include tax rates and the total amount of tax charged. Some regions require businesses to list tax amounts separately to ensure transparency.

- Legal Notice: Depending on your jurisdiction, you may need to include specific legal disclaimers or conditions. For instance, some businesses are required to include specific payment information or penalties for non-payment.

Compliance with Local Laws

Each region or country has its own laws and regulations regarding payment documentation. Therefore, it’s important to be aware of the

How to Use Invoices for Record-Keeping

Utilizing documents that request payment is an essential practice for any business aiming to maintain organized financial records. These records serve not only as proof of transactions but also as valuable tools for monitoring income, expenses, and overall business performance. Implementing an effective record-keeping system can greatly enhance financial clarity and operational efficiency.

Organizing Financial Records

To make the most of these payment requests for tracking purposes, follow these key strategies:

- Consistent Filing: Keep all issued documents organized in a systematic manner. Whether using physical files or digital folders, maintain a consistent naming convention and categorization based on dates or client names.

- Regular Updates: Update your records frequently. Enter new transactions promptly to avoid missing any details, which can lead to discrepancies in your financial reporting.

- Tracking Payments: Monitor which requests have been paid and which remain outstanding. Use a dedicated spreadsheet or accounting software to track payment statuses, making it easier to follow up with clients when necessary.

- Summary Reports: Generate regular summary reports based on your records. Analyzing income over specific periods can help identify trends, assess profitability, and inform future business decisions.

Benefits of Organized Records

Keeping accurate records can simplify various aspects of running a business:

- Tax Preparation: Well-organized documentation makes tax filing much easier, as all necessary information will be readily available.

- Financial Analysis: Understanding your financial health through organized records allows for better budgeting and forecasting, aiding in strategic planning.

- Client Relationships: Having a clear overview of payment histories can enhance communication with clients, making it easier to resolve any disputes or questions regarding transactions.

By leveraging documents requesting payment as a tool for record-keeping, businesses can streamline their financial processes and ensure a solid foundation for growth and success.

Integrating Invoices into Your Workflow

Efficiently incorporating payment requests into your daily operations can streamline business processes, improve cash flow, and ensure timely collections. By integrating this aspect into your workflow, you can reduce the chances of errors, save time, and maintain a more organized approach to managing finances.

Automating Your Billing Process

Automation is key when it comes to maintaining consistency and accuracy. Setting up automated systems for generating and sending payment requests helps eliminate manual errors, while also speeding up the billing cycle. Consider integrating your accounting software with cloud-based tools that automatically generate and send out payment requests once certain conditions are met.

- Recurring Billing: For businesses that provide ongoing services, automating recurring billing ensures that customers are invoiced on time without manual intervention.

- Payment Reminders: Set up reminders to automatically notify clients when payment is due or overdue, reducing the need for follow-up calls or emails.

- Real-Time Tracking: Implement software that tracks the status of each transaction in real time, providing you with instant updates on payments received or pending.

Creating a Seamless Process

To ensure smooth integration, establish a clear process for handling payment requests from start to finish. This includes designing a workflow that aligns with your business model, customer expectations, and internal procedures.

- Customer Information Management: Keep detailed cust