Download Blank Invoice Template DOC for Easy Customization

Managing financial transactions requires precision and clarity. For any business or freelancer, having a reliable and adaptable tool to create payment requests is essential. This article explores how to easily generate clean, customizable billing documents that meet professional standards and legal requirements.

Whether you’re just starting out or have been managing accounts for years, the ability to quickly generate a clear and accurate request for payment can streamline your workflow. Customizable formats allow users to adapt to different business needs, ensuring that all necessary information is included and presented correctly.

In the following sections, we’ll walk through various options available to help you create these documents, along with tips on formatting, essential elements, and best practices to ensure your requests are always on point. Whether you’re working in a corporate setting, freelancing, or running a small business, the right document format can make all the difference.

Blank Invoice Template DOC Overview

Creating effective billing documents is crucial for any business transaction. The right structure ensures that all essential details are included and presented clearly, making the process smoother for both the sender and the recipient. With a flexible, customizable format, generating these documents becomes easy and efficient. In this section, we’ll explore the advantages of using a ready-made, editable format for your financial requests.

Why Choose a Customizable Format?

Having a ready-to-use format allows for quick adjustments based on your specific needs. Whether you’re a freelancer, a small business owner, or part of a larger organization, the ability to modify a document to fit various clients and services is a significant benefit. Key reasons to use an editable structure include:

- Flexibility to adjust for different business types and transaction details.

- Time-saving as you don’t have to create new documents from scratch.

- Professionalism with a clean, consistent design that instills confidence in your clients.

- Ease of customization to quickly input details like dates, amounts, and services rendered.

What to Expect from the Structure

The format typically includes fields for all necessary information, such as payment terms, service descriptions, and contact details. These sections can be easily filled in for each new transaction, ensuring accuracy every time. Common elements you can expect to find include:

- Sender and recipient information

- Unique identification or reference number

- Detailed description of services or goods provided

- Total amount due and payment methods

- Terms and conditions or payment due date

Overall, using a pre-structured, editable document for payment requests helps maintain consistency while saving valuable time, allowing businesses to focus more on what matters most–building relationships and growing their operations.

Why Choose a Blank Invoice Template

When managing financial transactions, having a pre-designed structure for your billing needs offers numerous benefits. Instead of creating a new document from scratch for each request, using a versatile and customizable layout can streamline the process while maintaining professionalism. This section outlines the reasons why a ready-made structure is an invaluable tool for businesses of all sizes.

Key Benefits of Using a Pre-Formatted Document

Opting for an adaptable framework for your billing needs provides several advantages that can make managing payments more efficient and organized. Some of the key reasons to consider this approach include:

- Efficiency: Save time by quickly filling in details without starting from zero each time.

- Consistency: Ensure that all documents have a uniform layout, making them easy to recognize and understand.

- Professional Appearance: Present a polished, well-structured request that reflects positively on your business.

- Customization: Tailor the document to fit specific client needs or services, ensuring flexibility for different scenarios.

- Compliance: Easily include all the necessary legal and financial information, helping to meet industry requirements.

How It Helps in Various Business Settings

Whether you’re a freelancer, small business owner, or part of a large company, having a customizable document is a valuable tool. The ability to adjust details quickly and efficiently can benefit businesses by:

- Speeding up the billing cycle for faster payments.

- Reducing errors and omissions with a structured format.

- Improving client trust with clear and concise payment requests.

- Allowing easy tracking and referencing of past transactions for record-keeping.

Overall, choosing a customizable layout for your billing needs is a practical solution that offers both time-saving benefits and professional results.

How to Customize Your Invoice DOC

Personalizing your billing document is an essential step to ensure that it meets your specific needs and reflects your business identity. Customization allows you to add unique elements such as branding, payment terms, and detailed descriptions of services, making the document more professional and tailored to each transaction. In this section, we will guide you through the process of adjusting a ready-made structure to suit your requirements.

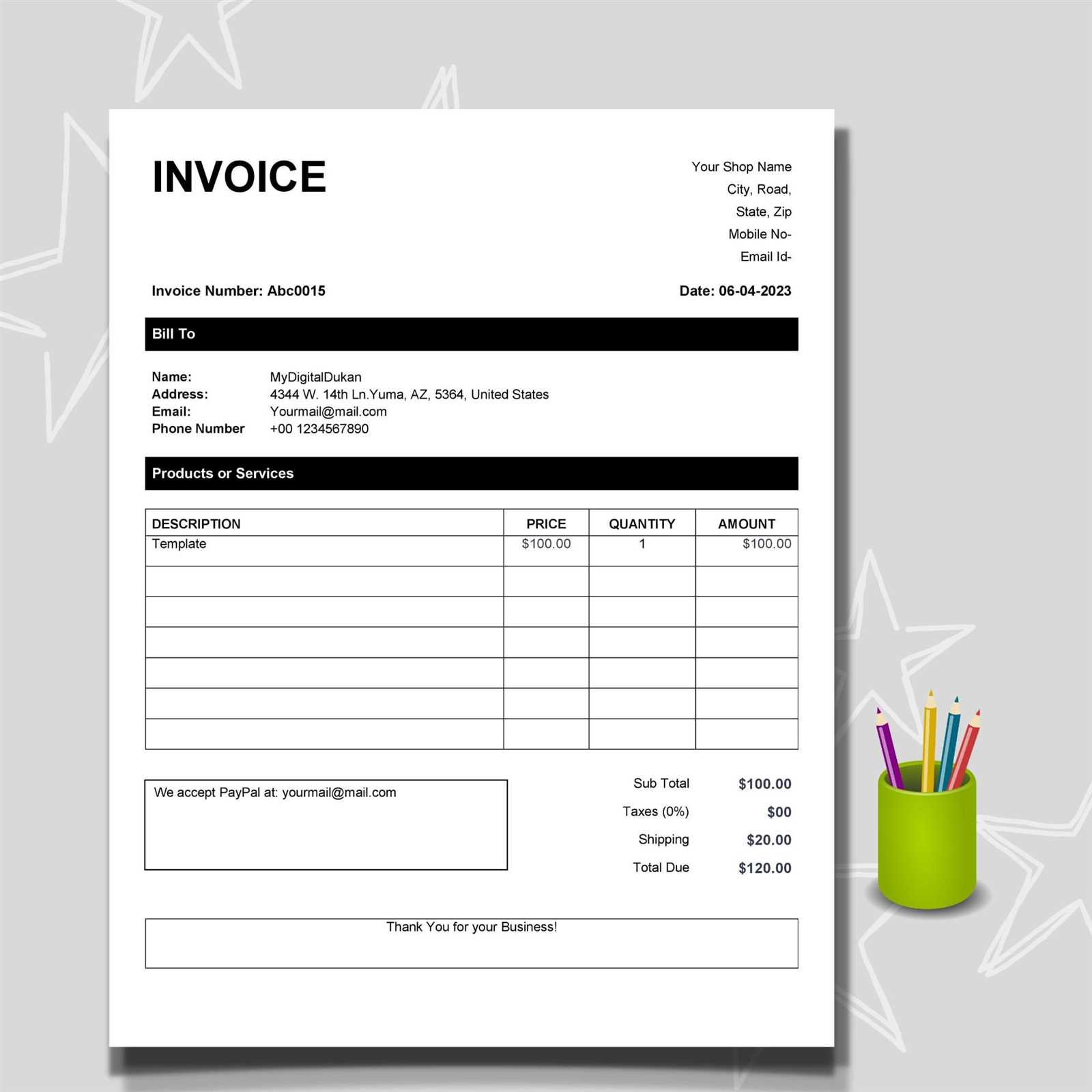

Editing Key Fields and Sections

The first step in customization is to fill in the necessary details that vary from one transaction to another. This includes basic information such as:

- Company Name and Contact Information: Include your business name, address, and other contact details.

- Client Information: Add the recipient’s name, address, and contact details.

- Description of Services: Provide a clear breakdown of the products or services being billed for.

- Payment Terms: Specify the due date, any late fees, or payment instructions.

Advanced Customization Tips

Beyond the basics, there are additional ways to make your billing documents stand out and fit your brand’s style. Consider the following enhancements:

- Branding Elements: Add your company logo, brand colors, and fonts to align with your corporate identity.

- Custom Fields: Create custom sections to capture additional information relevant to your business or specific project.

- Discounts and Taxes: Include any applicable discounts, taxes, or special payment terms based on the transaction.

- Footer and Notes: Add any important notes, such as return policies, warranty information, or payment instructions.

By following these steps and tips, you can ensure that your billing documents are not only functional but also professional and aligned with your business’s needs.

Key Benefits of Using a Template

Using a pre-designed format for your billing needs offers significant advantages that can simplify your workflow and improve the overall efficiency of your financial transactions. A well-structured document saves time and reduces the risk of errors while ensuring that you maintain a consistent and professional approach to payment requests. In this section, we’ll explore the key reasons why adopting a standardized layout is beneficial for any business.

Efficiency and Time-Saving

One of the most noticeable benefits is the amount of time saved when generating payment documents. With a pre-made format, you don’t have to start from scratch each time. Instead, you can simply input the unique details for each transaction, allowing you to create a professional request in minutes. This is especially helpful for businesses with high-volume transactions, where speed is essential. Key points include:

- Quick setup: Pre-filled fields and organized sections make the process faster.

- Reduced manual work: Automatic layout and formatting save you from tedious adjustments.

- Consistent results: Each document follows the same structure, eliminating the need for reformatting every time.

Improved Professionalism and Accuracy

Another important benefit of using a pre-structured document is that it ensures you meet all the necessary professional and legal standards. A properly designed format includes all required fields, reducing the chances of missing important details such as client information, payment terms, and itemized charges. This can greatly enhance the credibility of your business. Consider the following advantages:

- Professional Appearance: A clean, well-organized document fosters trust and instills confidence in clients.

- Accuracy: Predefined sections help reduce errors, ensuring that every necessary detail is included and correctly placed.

- Legal Compliance: Templates often include important fields that align with industry standards or regulations, preventing legal issues.

Incorporating a ready-made layout into your process not only makes administrative tasks easier but also enhances your business’s overall image and reduces the risk of mistakes, all while saving valuable time.

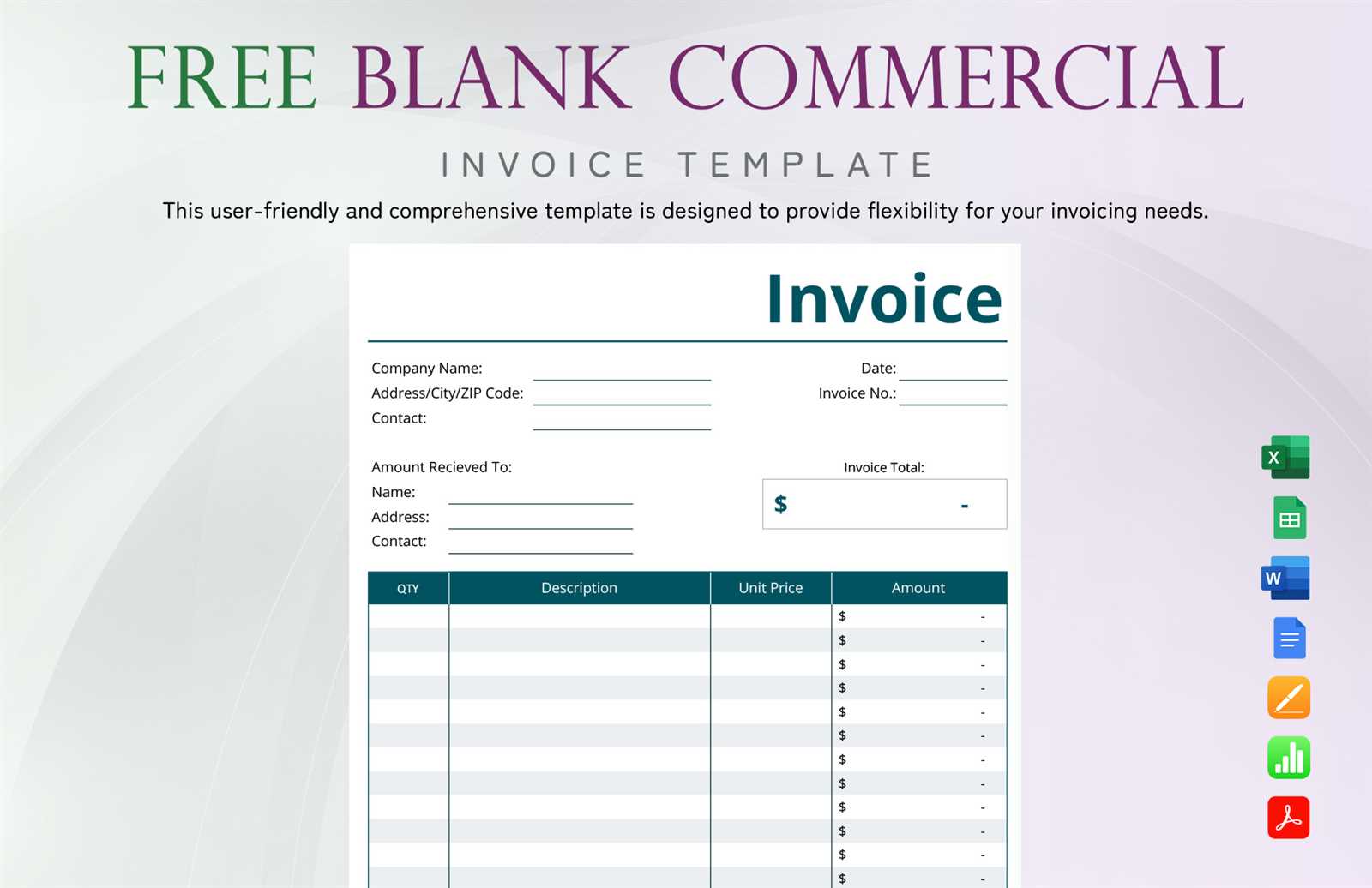

Where to Find Free Invoice Templates

There are several places where you can find customizable documents for billing purposes at no cost. Whether you’re a freelancer, a small business owner, or just someone in need of a quick solution, there are plenty of online resources offering various formats to suit your needs. These options provide a wide range of designs and features that can help you create professional and accurate billing statements without spending any money.

Here are some of the most common platforms and tools that offer free templates:

- Microsoft Office Templates – A reliable resource for various types of business documents. Microsoft offers several pre-designed options for creating professional bills that can be easily edited in Word or Excel.

- Google Docs & Sheets – These cloud-based tools offer free customizable designs for invoices and similar documents. The added benefit is real-time collaboration and easy sharing with clients or team members.

- Template Websites – Dedicated websites like Template.net or Vertex42 specialize in offering a broad selection of customizable forms for different business needs. They often have free versions alongside premium options.

- Canva – Known for its user-friendly design tools, Canva also provides numerous free templates for making business documents. Its drag-and-drop interface makes customization simple and fast.

- Zoho Invoice – A free tool tailored specifically for creating professional bills. Zoho also includes features for managing payments and client details, making it a complete solution for small businesses.

These options offer a variety of layouts and styles to ensure that you can find one that matches your specific requirements. Most are easy to download, modify, and print or email directly to clients, making them ideal for both personal and professional use.

Understanding Invoice Structure and Layout

A well-organized billing document ensures clear communication between the provider and the client. The structure of this type of document typically follows a specific order to make it easy to understand and process. By adhering to a logical layout, both parties can quickly identify the key details, such as payment terms, amounts due, and contact information.

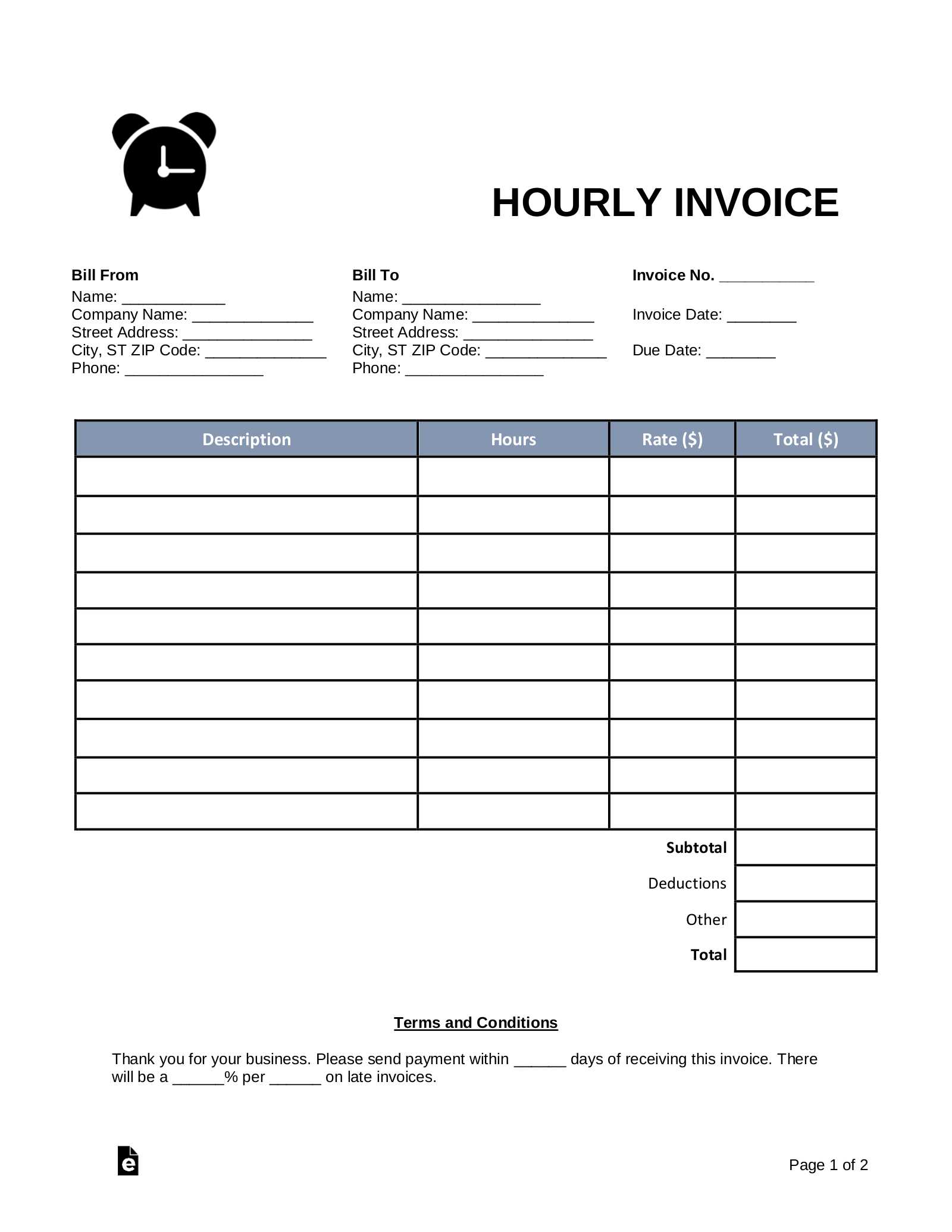

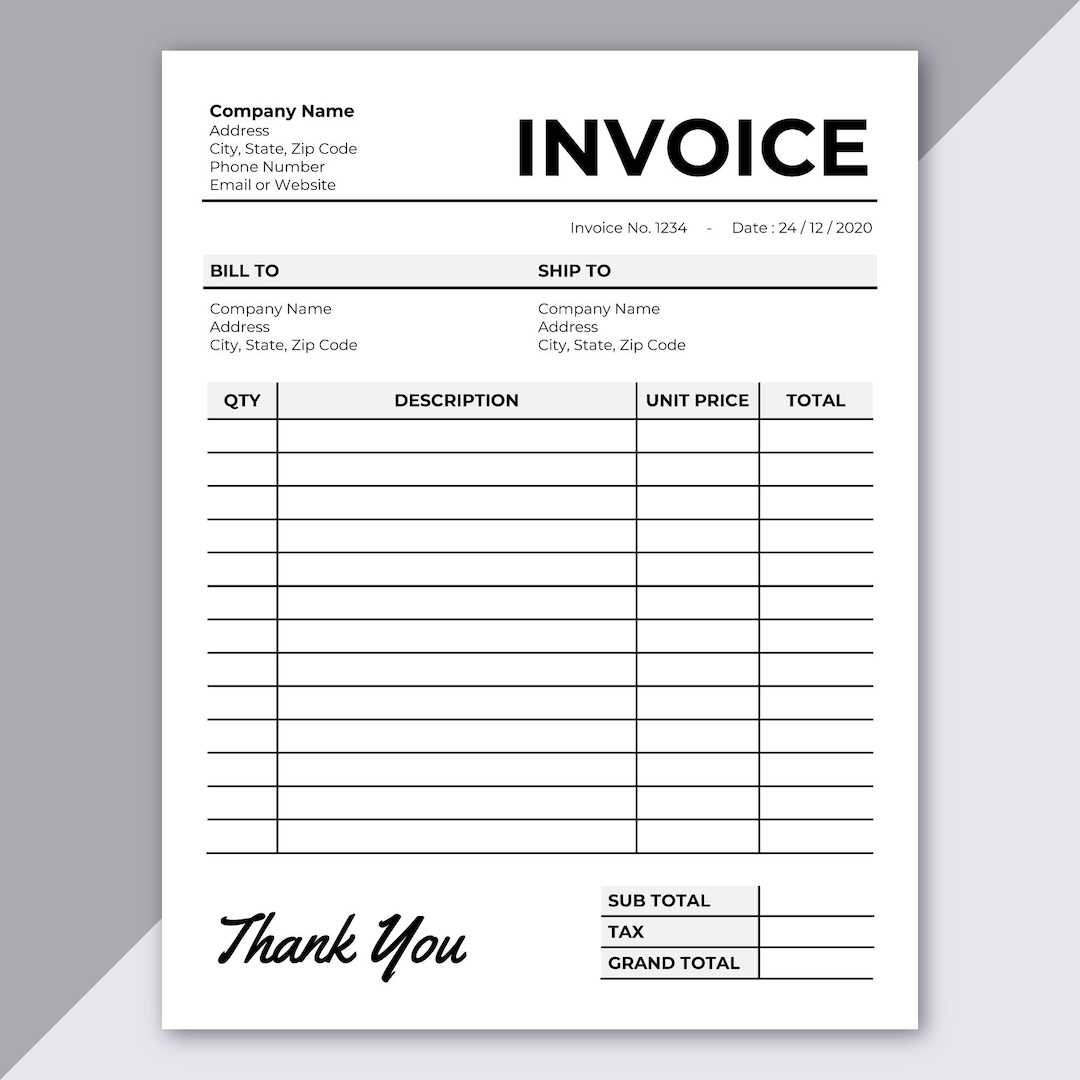

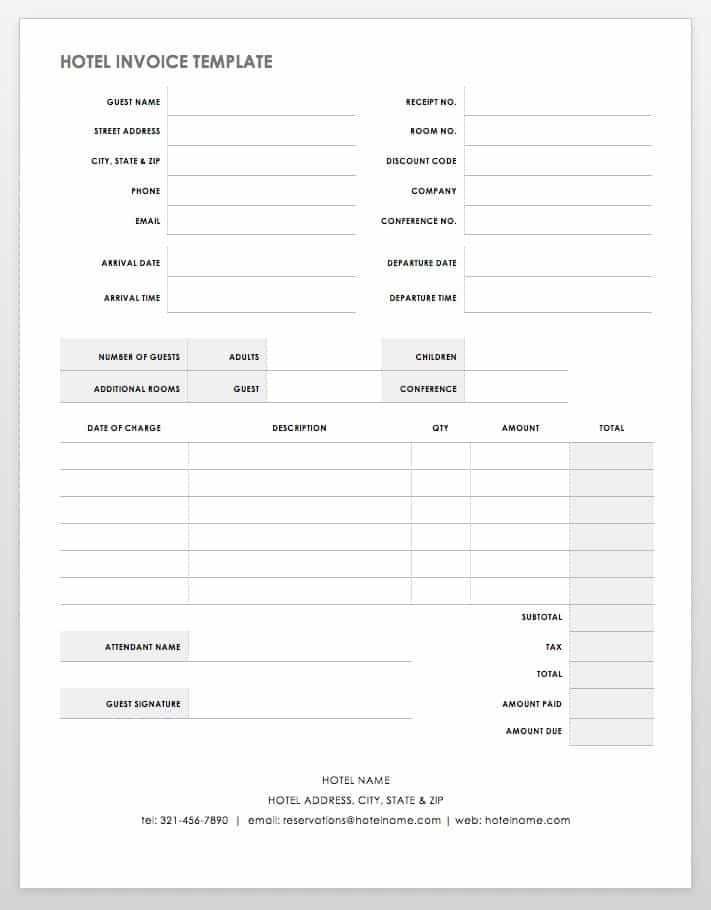

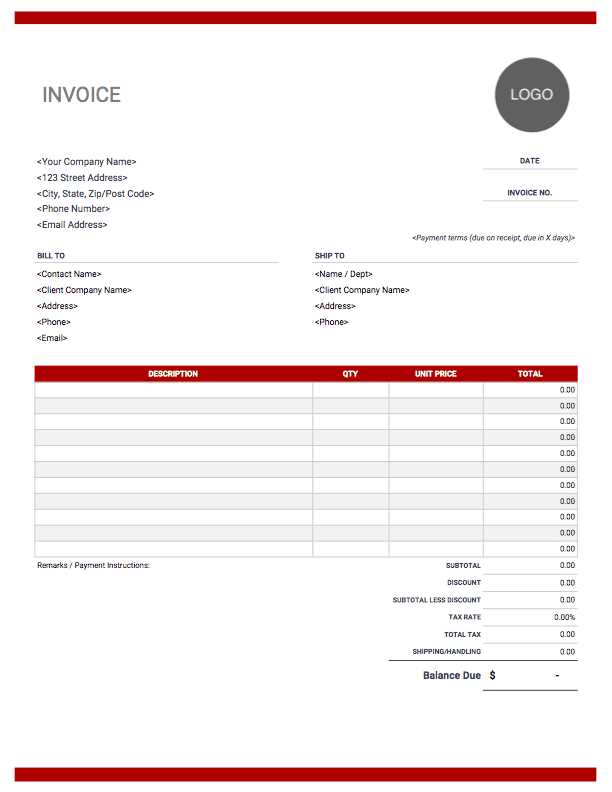

The following components are essential to creating an effective billing document:

- Header Section – This part usually includes the name of the business or individual sending the bill, along with contact details such as address, phone number, and email. It might also feature a logo for added professionalism.

- Recipient Information – The details of the person or company being billed should be listed clearly. This includes the name, address, and any other relevant contact information.

- Document Number and Date – Each bill should have a unique reference number and a date of issue to help track payments and correspondence.

- Description of Goods or Services – This section breaks down the items or services provided, often with individual prices for each entry, quantities, and a total amount per item.

- Pricing Breakdown – A detailed list of the charges, including any applicable taxes, discounts, or fees, along with the final total that the recipient needs to pay.

- Payment Terms and Due Date – Clear instructions on how and when the payment should be made. This might include accepted payment methods, late fees, or any special terms.

- Footer – Often contains additional notes, terms, or a thank-you message. It may also include legal disclaimers or information about the service or product warranty.

Ensuring that each of these sections is well-organized and easy to read helps avoid misunderstandings and improves the professionalism of the document. A clean, structured layout also streamlines the payment process and facilitates efficient record-keeping for both parties.

How to Edit Blank Invoice in Word

Editing a standard billing document in Word is straightforward and can be done in just a few simple steps. By modifying a pre-designed file, you can quickly tailor the details to fit your specific needs, whether you are invoicing a client or requesting payment for a service. With Microsoft Word’s editing tools, you can personalize the content, adjust the layout, and ensure all necessary information is included.

Follow these steps to edit a billing form in Word:

- Open the Document – Start by opening the Word file that contains the layout you want to modify. You can either download one from an online resource or use a pre-existing file on your computer.

- Modify the Header – Update the business name, address, and other contact information. If necessary, you can also insert a logo or change fonts to match your branding style.

- Edit the Recipient Details – Replace the placeholder name and contact information with the recipient’s details. Be sure to include all relevant address and contact fields to ensure proper delivery.

- Adjust the Itemized List – Change the descriptions, quantities, and prices for the products or services rendered. You can also add or remove rows depending on how many items are included in the transaction.

- Update Payment Terms – Modify the due date, payment method, and any other special terms that apply to the agreement. Be sure that the terms are clear and concise to avoid confusion.

- Review and Save – Once all the necessary fields are filled out, carefully review the document for accuracy. Save the file in your preferred format, such as Word or PDF, for sharing or printing.

By following these steps, you can easily edit a pre-made billing document in Word to create a professional and accurate statement. Customizing the details ensures that each document reflects the specific transaction and meets your business needs.

Common Mistakes to Avoid in Invoices

Creating a clear and professional billing document is essential for ensuring timely payments and maintaining good relationships with clients. However, small errors in these documents can lead to confusion, delays, or even payment disputes. To avoid these issues, it’s important to be mindful of the most common mistakes that can occur when preparing such documents.

Here are some common mistakes to avoid when drafting a payment request:

- Missing or Incorrect Contact Information – Ensure that both your contact details and the recipient’s are correct. An incorrect address, email, or phone number can delay communication and payment processing.

- Unclear Item Descriptions – Vague descriptions of products or services can lead to misunderstandings. Be specific and detailed about what is being billed, including quantities, rates, and any relevant reference numbers.

- Omitting Payment Terms – Always clearly state the payment due date, accepted payment methods, and any late fees. Without this information, clients may not know when to pay or how to submit their payment.

- Not Including a Unique Reference Number – Every billing document should have a unique identifier or number. This helps keep track of transactions, making it easier for both parties to reference specific payments or resolve disputes.

- Mathematical Errors – Simple mistakes in adding up totals or calculating taxes can cause serious issues. Double-check your calculations to ensure accuracy and avoid confusion over the final amount due.

- Failure to Proofread – Spelling and grammar errors can undermine the professionalism of your document. Always proofread the document before sending it to ensure everything is correct and clear.

- Not Including a Thank-You Note or Closing Statement – A polite closing message or a simple “thank you” can go a long way in maintaining positive relationships with clients. It leaves a good impression and promotes goodwill.

Avoiding these common mistakes will help ensure that your billing documents are clear, accurate, and professional, which in turn can streamline the payment process and reduce the likelihood of misunderstandings.

Tips for Professional Invoice Design

A well-designed billing document not only conveys important financial information but also reflects your professionalism and attention to detail. The way you present a request for payment can influence how seriously clients take your business. With a clean, organized design, you can make the process smoother for both you and the recipient. Here are some key tips to enhance the design of your payment request documents.

1. Keep It Simple and Clean

A cluttered design can be overwhelming and may lead to confusion. Focus on a clear, minimalist layout with plenty of white space to make the document easy to read. Avoid unnecessary graphics or elements that don’t contribute to the essential information.

2. Use Consistent Branding

Your document should reflect your brand’s identity. Use the same colors, fonts, and logo that appear on your website or business card to create a cohesive look. This reinforces your brand image and adds professionalism to your communication.

3. Prioritize Readability

Ensure that the text is legible by using clear fonts like Arial, Helvetica, or Times New Roman. Keep the font size between 10 and 12 points for the body text, and use bold for section headings. Avoid using too many different fonts or styles, as this can make the document look disorganized.

4. Organize Information Logically

Structure the content so that key details are easy to find. Start with your contact information at the top, followed by the recipient’s details, the list of items or services, pricing, and payment terms. A logical flow allows the recipient to quickly understand the document’s content.

5. Include Clear Payment Instructions

Make sure the payment terms, due date, and accepted payment methods are clearly highlighted. Clients should be able to identify how and when to make the payment without having to search for this information. Consider using bullet points or a bold section to make payment details stand out.

6. Use Professional Colors

Colors can influence perception. Stick to neutral or professional tones like navy, grey, or black, as these convey seriousness and trust. If you choose to use brighter colors, make sure they complement your brand’s color scheme and do not distract from the key information.

7. Leave Room for Notes

Sometimes you may need to add special instructions or thank the client for their business. Include a space at the bottom of the document for a brief note. This adds a personal touch and shows you care about your client relationships.

By following these tips, you can create a visually appealing, easy-to-understand payment request document that strengthens your professionalism and encourages prompt payments.

Why DOC Format is Ideal for Invoices

The DOC format is widely recognized as a reliable and versatile option for creating professional billing documents. Its popularity is driven by its user-friendly features and compatibility with various platforms and devices. This format provides an easy way to design, edit, and share payment requests while maintaining a polished, professional appearance.

Here are several reasons why the DOC format is ideal for these types of documents:

- Easy to Edit and Customize – DOC files are highly flexible, allowing you to modify text, fonts, layout, and structure quickly. This makes it simple to tailor the content to your specific needs, whether you are sending a recurring request or one-off billing.

- Widely Accessible – Almost everyone has access to a word processor like Microsoft Word or Google Docs, making it easy for both senders and recipients to open and read the document. Even those without specialized software can often view and edit DOC files with free alternatives.

- Professional Appearance – Documents in DOC format can be formatted to look clean and organized, ensuring that all essential information is clear and easy to understand. With the ability to use custom fonts, logos, and headers, you can create a polished look that aligns with your brand.

- Versatility for Different Needs – The DOC format allows for the inclusion of tables, lists, and other elements, which makes it ideal for breaking down charges, adding tax calculations, or listing services in a neat, structured way.

- Simple to Save and Share – DOC files are easy to save, print, or email. You can quickly send them to clients as email attachments or upload them to cloud storage for easy access, making sharing efficient and hassle-free.

- Conversion Options – One of the key advantages of DOC files is that they can be easily converted into other formats, such as PDF, for secure sharing. This flexibility allows you to adapt to your client’s preferred method of receiving documents.

Given these advantages, the DOC format stands out as an excellent choice for creating and managing payment requests, ensuring smooth communication and efficient transactions between businesses and clients.

Using Invoices for Freelancers and Small Business

For freelancers and small business owners, creating clear and accurate billing documents is essential to maintaining cash flow and professionalism. These documents serve as a formal request for payment and help keep financial records organized. Whether you’re a consultant, designer, or service provider, using well-structured billing statements ensures that you get paid on time while maintaining positive client relationships.

Here’s why freelancers and small business owners should prioritize using billing documents and how to effectively implement them:

- Clear Record Keeping – By generating a billing statement for each transaction, you create an organized record of all payments. This is crucial for tracking income, filing taxes, and managing your financial history.

- Professionalism – Sending a detailed request for payment shows your clients that you take your work seriously. It conveys that your business operates with the same level of professionalism as larger companies, helping to build trust and credibility.

- Legal Protection – A properly structured document can serve as a legally binding agreement that outlines the terms of your services, including rates, payment schedules, and deadlines. This can protect you in case of disputes over payment or scope of work.

- Payment Clarity – Including clear itemization of services, rates, and totals reduces the chances of misunderstandings. Clients will have a full understanding of what they are paying for, which can result in faster payment and fewer questions.

- Time-Saving – Using pre-designed files or digital tools to generate these documents speeds up the billing process. You won’t need to manually create a new form each time, and many software options allow you to save and reuse client information for future transactions.

- Easy Tracking and Follow-Up – With a unique reference number for each document, it’s easier to track outstanding payments. You can set reminders to follow up on overdue balances, ensuring that you don’t miss out on due funds.

Whether you’re invoicing a client for the first time or managing a steady stream of work, using these documents is vital for maintaining organized financial practices. By implementing this straightforward yet essential tool, freelancers and small businesses can streamline their operations and improve cash flow management.

Legal Requirements for Invoices

When issuing a formal payment request, certain legal elements must be included to ensure that the document complies with tax regulations and serves as a valid financial record. These requirements vary by country and jurisdiction, but there are key elements that are universally recognized. Understanding these legal necessities helps prevent issues during audits, disputes, or tax filings.

Here are the essential legal components that should be included in any billing document:

- Unique Identification Number – Each document should have a unique reference number to track payments and transactions. This is crucial for record-keeping and provides an easy way to reference specific requests for payment.

- Business Information – The sender’s full business name, address, and tax identification number must be clearly displayed. This helps verify the legitimacy of the business and enables tax authorities to associate the payment with the correct entity.

- Recipient’s Information – The name and contact details of the individual or business receiving the bill must be included. This ensures that the right person or entity is billed and can be used to resolve disputes if needed.

- Detailed Description of Goods or Services – A clear and itemized list of the products or services provided must be included. Each entry should specify the quantity, rate, and total for transparency.

- Tax Information – If applicable, the tax rate and amount should be clearly stated. This includes both sales tax or VAT, depending on the local tax laws. Some countries also require the inclusion of tax registration numbers.

- Total Amount Due – The final amount owed must be clearly stated, including any applicable taxes, discounts, or fees. This ensures there is no ambiguity regarding the payment expected.

- Payment Terms – The document should specify the payment due date, acceptable methods of payment, and any penalties for late payments. This helps ensure clarity regarding the terms and protects both parties.

- Issue Date and Due Date – Including both the date the document is issued and the due date for payment is critical. This helps establish timelines and avoids confusion about when payment is expected.

Failing to include these key elements can lead to delays in payment, confusion, or even legal complications. By ensuring compliance with these legal requirements, businesses can protect themselves while maintaining professional and accurate financial records.

How to Save and Share Invoice Templates

Once you’ve customized your billing document, it’s important to save and share it in a way that preserves its integrity and ensures easy access for future use. Whether you’re sending it to clients or keeping it for your records, choosing the right format and method for distribution is essential for smooth business operations. There are a variety of options for saving and sharing your payment request documents, depending on your preferences and the tools you’re using.

Here are some key steps to save and share your customized billing documents effectively:

- Save in a Versatile Format – When saving your document, consider formats that are widely accessible and easily editable. Popular formats like PDF, Word, or Excel are commonly used because they are compatible with most devices and software. PDF is ideal for sharing as it preserves the layout and design, ensuring that recipients view the document exactly as intended.

- Use Cloud Storage for Easy Access – To keep your documents accessible from any device, consider using cloud storage platforms like Google Drive, Dropbox, or OneDrive. These platforms allow you to store your files securely and access them from anywhere, which is especially useful for remote work or if you need to share them with multiple clients or team members.

- Create a Folder for Organization – Keep your billing documents organized by creating specific folders in your storage system. Organizing by client, project, or date can help you easily find past documents, streamlining the invoicing process and making it easier to follow up on unpaid balances.

- Send via Email – The most common way to share these documents is by attaching them to an email. When sending a payment request, make sure to include a brief, professional message explaining the document and the payment terms. Attach the file in the preferred format (e.g., PDF), and ensure the subject line clearly states that it’s a payment request.

- Use Accounting Software for Automated Sharing – If you use accounting or invoicing software, it may offer the ability to save and send billing documents directly from the platform. This can save time by automating the process and ensuring consistency across all your billing documents.

- Backup Your Documents Regularly – To avoid losing important records, ensure you back up your documents either on an external drive or in a secondary cloud account. Regular backups can help protect you from data loss due to accidental deletion or system failure.

By following these steps, you can efficiently save and share your payment requests, ensuring timely communication with clients while keeping your records organized and secure.

How to Automate Invoice Creation

Streamlining the process of generating billing documents can significantly save time and reduce errors. Automation tools allow businesses to create and send financial records without manual input for every transaction. By setting up a system that automatically populates fields based on customer details, transaction history, and predefined formats, you can focus more on growing your business while ensuring accuracy in your records.

Benefits of Automating Billing

- Reduces human error

- Saves time by eliminating manual data entry

- Ensures consistency in formatting and content

- Improves cash flow management with timely and accurate invoicing

- Enhances professionalism in client communication

Steps to Set Up an Automated System

- Select Automation Software: Choose a platform or tool that integrates with your accounting or customer management systems.

- Customize Your Document Layout: Set up your document’s design with necessary fields such as client information, payment terms, and item descriptions.

- Integrate with Financial Data: Link your system to automatically pull data from your sales, inventory, or CRM systems to fill out relevant fields.

- Set Triggers for Creation: Define conditions such as a completed sale or milestone to automatically trigger document generation.

- Automate Delivery: Configure your system to automatically send completed records to clients via email or other communication channels.

Comparing DOC and PDF Invoice Formats

When choosing a format for generating and sharing financial documents, two popular options are the editable and the non-editable file types. Both offer distinct advantages depending on the specific needs of the user, such as ease of customization, security, and accessibility. Understanding the key differences between these formats helps businesses make an informed decision on how to best handle their billing processes.

DOC Format

The editable format provides flexibility in modifying content at any stage, making it an ideal choice when frequent adjustments are needed. Users can easily make changes to text, numbers, and layout before finalizing the document. However, it is less secure, as the recipient can modify the file after receiving it, which could lead to potential errors or tampering.

- Advantages: Easy to edit and customize

- Drawbacks: Higher risk of document manipulation and inconsistency

- Best for: Internal use or drafts requiring constant updates

PDF Format

The non-editable format ensures that the final version of the document remains unchanged, providing a more secure and professional approach. Once generated, the content becomes locked, preventing unauthorized alterations. This is ideal for official records that need to be sent to clients or stakeholders, offering consistency and reliability.

- Advantages: Secure, fixed content, universally accessible

- Drawbacks: Not easily editable after creation

- Best for: Finalized records, official correspondence

Ultimately, the choice between these two formats depends on the intended use. For documents requiring flexibility, the editable version may be more suitable, while for finalized, secure communication, the non-editable format is often the preferred choice.

Frequently Asked Questions About Invoice Templates

When it comes to generating financial documents, many individuals and businesses have common questions regarding the format, usage, and customization of such records. Whether you’re a freelancer, a small business owner, or managing a larger company, understanding the basics of document creation can help ensure accuracy and professionalism. Below are some of the most frequently asked questions on this topic.

1. Why should I use a pre-designed format for financial documents?

Using a pre-designed structure ensures consistency and accuracy across all your records. These layouts typically include all necessary fields, such as client information, payment terms, and a breakdown of goods or services provided, saving you time and reducing the chance of forgetting important details. They also help present your financial records in a professional manner.

2. Can I customize the format to suit my business needs?

Yes, most systems allow you to modify the layout and content of the document according to your business requirements. You can change the colors, add your logo, or even adjust the fields to match specific billing practices, ensuring the document aligns with your company’s branding and communication style.

3. Are these documents legally binding?

While the layout of the document itself doesn’t determine its legal status, the content and agreement terms included can make it a legally binding record. It’s important to ensure that all necessary information, such as payment terms, due dates, and both parties’ contact details, are clearly presented and agreed upon by all parties involved.

4. Can I automate the creation of these documents?

Yes, there are various tools and software available that can automate the creation of these documents. These systems can pull in client data, transaction details, and predefined settings to generate documents quickly, ensuring that the information is accurate and reducing the time spent on manual data entry.

5. What file formats are best for sharing these documents?

The most common formats for sharing finalized documents are PDF and Word. PDF files are preferred for official communication as they are non-editable, ensuring that the content remains unchanged. However, if you need to allow for editing or collaboration, formats like Word or Excel may be more suitable.