Blank Construction Invoice Template for Easy Billing

Efficient billing is an essential part of managing any project, especially in the field of construction. Whether you’re working as a contractor or managing a team, having a clear and accurate way to request payment is crucial. A well-structured document ensures that both parties are on the same page regarding services rendered and payment expectations.

There are several ways to format these important papers, but using an organized and customizable format can save time and prevent misunderstandings. This format should be easy to adapt, ensuring that all necessary details, such as labor costs, materials, and additional fees, are clearly presented. In addition, it should align with industry standards to facilitate smoother transactions and prompt payments.

By understanding the key components of a professional billing document and how to create it effectively, you can enhance your business operations and maintain positive client relationships. The right approach helps you avoid errors and ensures that your financial records are well-organized for future reference.

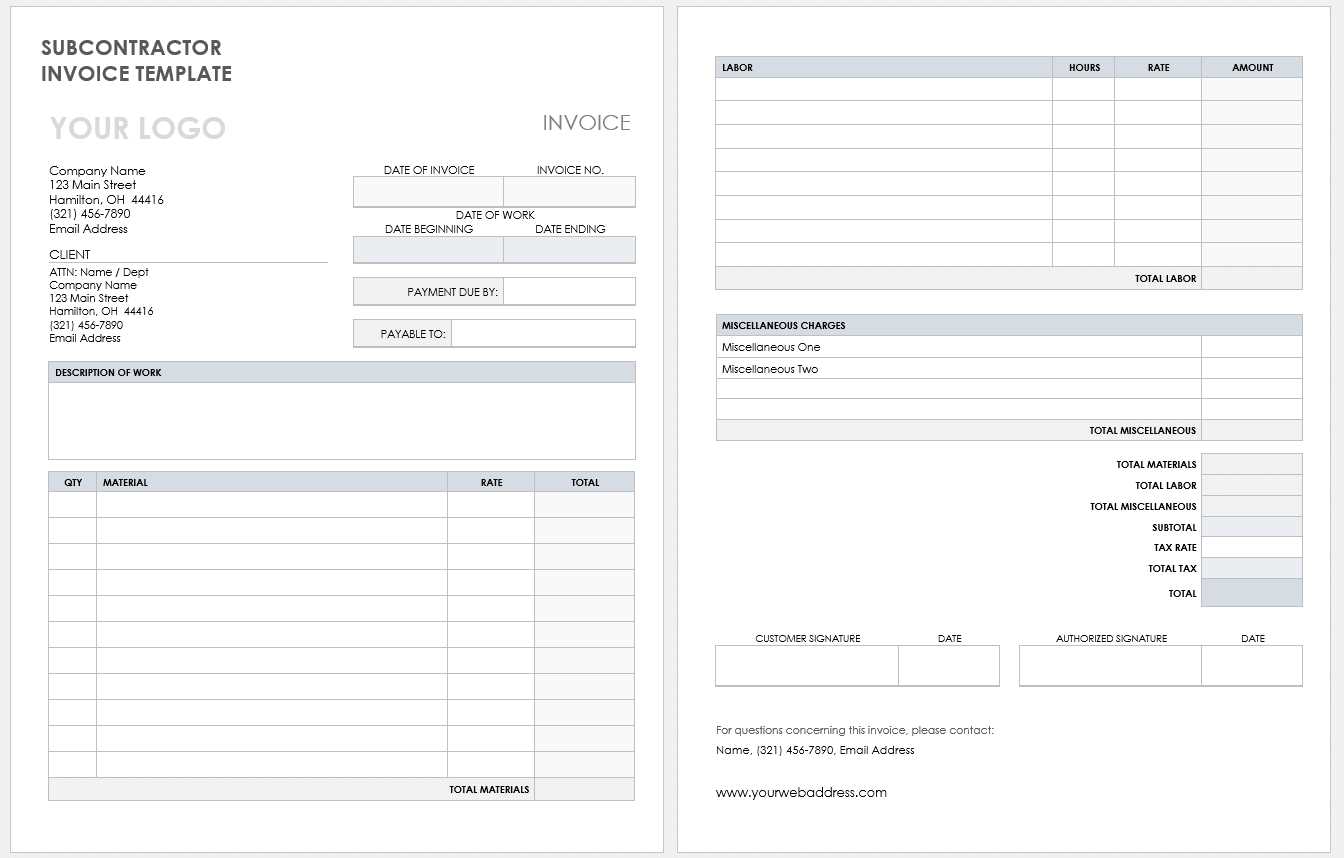

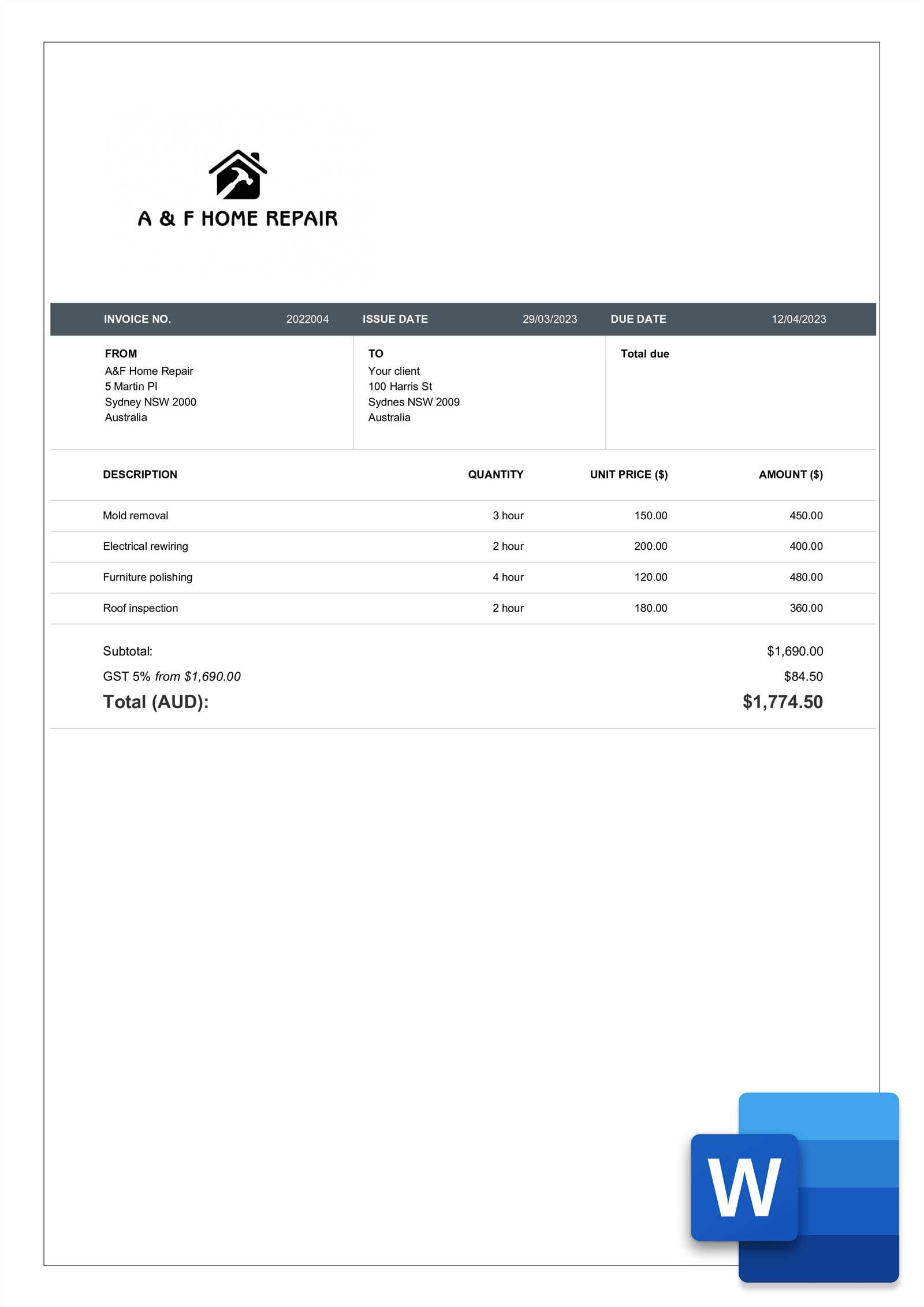

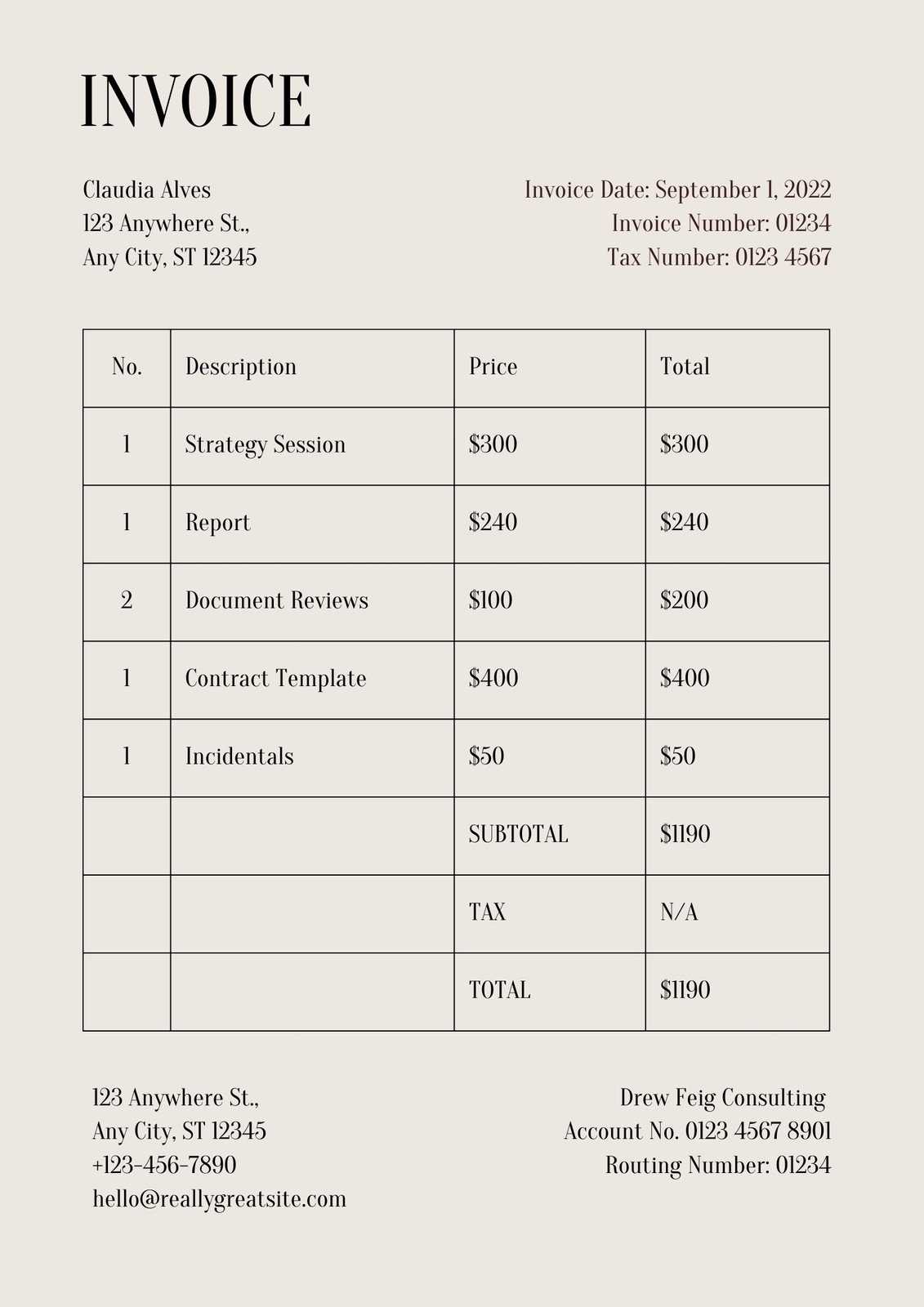

Blank Construction Invoice Template

Having a reliable and structured document to request payments is essential for any business in the building sector. It should allow you to outline all charges in a clear and professional manner, ensuring clients understand what they are paying for and why. This document serves as a formal request for compensation, detailing the work completed, materials used, and agreed-upon costs.

Key Features of an Effective Billing Document

When designing this essential paper, certain elements must always be included to ensure clarity and professionalism:

- Client Information: Name, address, and contact details of the client receiving the bill.

- Service Details: A description of the work or services provided, including dates and locations.

- Costs: Breakdown of charges for labor, materials, and additional services.

- Payment Terms: Clear instructions on how and when payments should be made.

- Due Date: The specific date by which the payment should be completed.

Advantages of Using a Structured Billing Format

Using a predefined format for these documents offers several advantages:

- Consistency: Standardized paperwork ensures consistency across all projects and clients.

- Time-Saving: Pre-made formats eliminate the need to create documents from scratch for every project.

- Clarity: Clear presentation of costs and services helps avoid misunderstandings and disputes.

- Professionalism: Well-organized paperwork enhances your business reputation and trustworthiness.

Why Use a Construction Invoice Template

Using a standardized document to request payments for services or work performed is crucial for ensuring clear communication between service providers and clients. A well-structured format helps avoid confusion, reduces the risk of errors, and ensures that all necessary details are included, making it easier to track payments and maintain accurate financial records.

By relying on a pre-made format, businesses can save valuable time, focusing on their core activities rather than spending hours creating documents from scratch. Additionally, these formats promote consistency across all projects, ensuring that clients receive the same professional presentation for each job completed, regardless of size or complexity.

Furthermore, using a reliable format can streamline the payment process, minimizing delays and ensuring that clients know exactly what they are being charged for. It also reduces the likelihood of misunderstandings, as all terms and conditions are clearly outlined, helping both parties stay aligned on expectations and responsibilities.

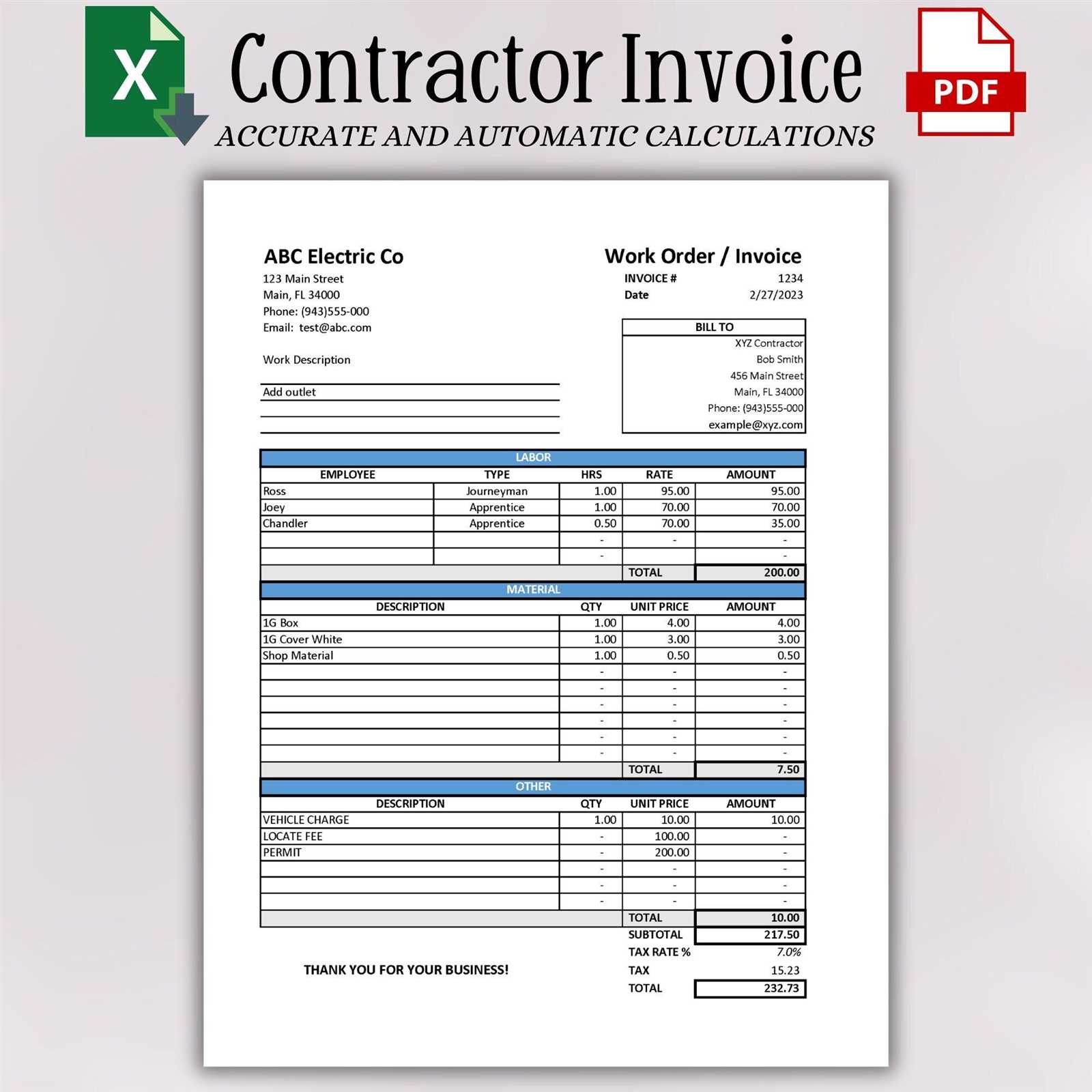

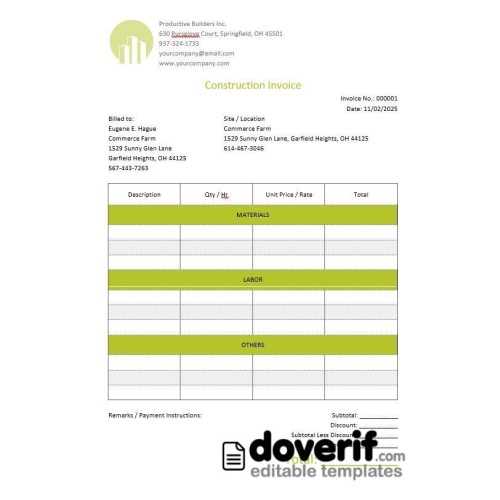

Key Components of a Construction Invoice

For an effective and professional document requesting payment, certain elements must be clearly presented. A comprehensive layout helps both the service provider and client understand exactly what is being charged and why, making the billing process smoother and more transparent. These critical components ensure that there is no confusion regarding costs, services, or expectations.

Essential Information to Include

When creating a payment request, it’s important to include the following key details:

- Service Provider’s Details: Your company name, address, and contact information for easy communication.

- Client Information: Full name, address, and contact details of the recipient of the bill.

- Project Details: A description of the work done, including locations, dates, and specific tasks completed.

- Itemized Charges: Clear breakdown of the costs, such as labor, materials, and additional fees, to avoid confusion.

- Total Amount Due: The total sum owed, including any taxes, discounts, or adjustments.

Additional Considerations

Including the following can make the document more comprehensive:

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees or discounts for early payments.

- Invoice Number: A unique identifier for easy tracking and record-keeping.

- Legal Disclaimers: Any necessary terms and conditions related to the service agreement.

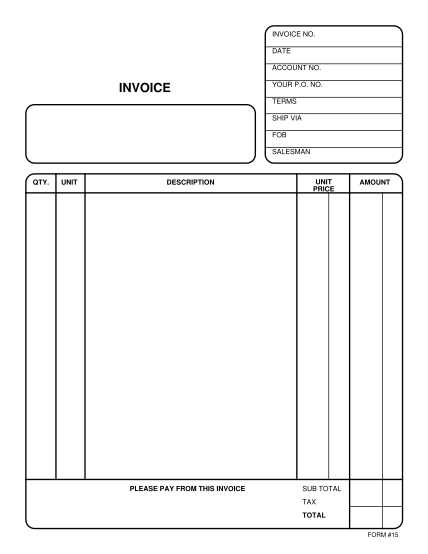

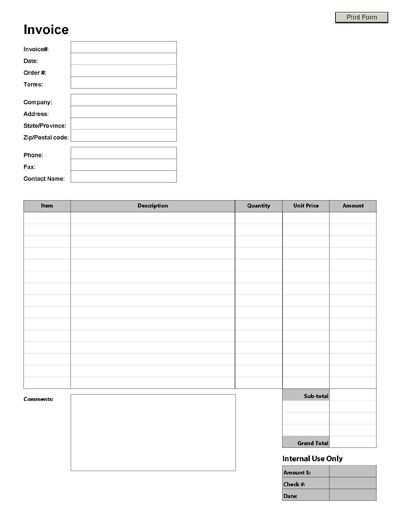

How to Customize Your Invoice Template

Customizing a payment request document allows you to tailor it to your specific business needs, ensuring that it aligns with your branding and presents the necessary details clearly. Personalizing the structure and appearance can enhance professionalism and improve client relationships by reflecting your company’s identity and communication style. Making adjustments to suit the type of services you provide can also streamline the billing process.

Steps to Personalize Your Payment Request

To effectively customize your document, consider the following steps:

- Choose a Clear Layout: Select a design that is easy to read and understand, with ample space for all required details.

- Branding Elements: Add your company logo, color scheme, and business name at the top for a professional touch.

- Adjust the Service Description: Modify the section that outlines services provided to reflect the specifics of your business or project.

- Modify Payment Terms: Ensure payment deadlines, late fees, and acceptable methods are appropriate for your business practices.

- Include Custom Fields: Add any fields that may be relevant to your business, such as job numbers, project stages, or discount options.

Design and Functional Considerations

Beyond content, consider the document’s design and functionality:

- Make It Professional: Use readable fonts and clear headings for easy navigation.

- Ensure Compatibility: Choose a format that works well with both print and digital devices for easy sharing and archiving.

- Optimize for Digital Use: If sending electronically, ensure the document is editable or can be filled out online to simplify the process for clients.

Benefits of Using Digital Invoices

Transitioning from paper-based billing methods to digital formats offers numerous advantages for both businesses and clients. By using electronic documents, you can streamline your operations, reduce errors, and improve efficiency in the billing process. Digital documents are more easily managed, organized, and tracked, allowing for faster payments and better record-keeping.

Key Advantages of Digital Billing

Switching to electronic billing can provide several benefits that improve business operations:

| Benefit | Description |

|---|---|

| Time Efficiency | Digital formats allow for quick creation, customization, and delivery of payment requests, speeding up the overall process. |

| Reduced Costs | Eliminates the need for paper, printing, and postage, reducing overhead expenses. |

| Easy Tracking | Digital records are easily stored, sorted, and accessed, making it simple to track outstanding payments and past transactions. |

| Increased Accuracy | Automatic calculations and digital checks help eliminate errors that may occur with manual billing methods. |

| Faster Payments | Clients can receive, review, and pay electronically, speeding up the payment cycle. |

Environmental and Practical Considerations

In addition to the business and financial advantages, digital billing helps reduce your environmental impact. By reducing paper usage, you contribute to sustainability efforts, aligning your business with modern eco-conscious practices. Moreover, digital documents can be accessed from anywhere, allowing you to manage your financial processes on-the-go.

Common Mistakes to Avoid in Invoices

While creating billing documents may seem straightforward, there are several common errors that can cause confusion and delays in payment. Mistakes in these documents can lead to misunderstandings, disputes, and even non-payment. Ensuring accuracy and clarity is essential to maintaining a smooth payment process and building trust with your clients.

Frequent Errors to Watch Out For

Here are some of the most common mistakes to avoid when preparing your billing documents:

- Incorrect Client Information: Always double-check that the client’s name, address, and contact details are accurate. Any mistake here can delay communication and payments.

- Missing Payment Terms: Ensure the payment deadline, acceptable methods, and late fees are clearly stated. Without this information, it can be difficult for clients to understand when payment is due.

- Omitted or Unclear Service Descriptions: Failing to provide a detailed description of services or work performed can lead to confusion about what the client is paying for.

- Unorganized Cost Breakdown: Always provide a clear, itemized list of charges, including labor, materials, and additional fees, to avoid misunderstandings about pricing.

- Incorrect or Missing Invoice Number: Without a unique identifier, it’s harder to track and reference specific transactions, which can lead to administrative confusion.

- Errors in Calculations: Double-check your numbers. Simple arithmetic errors can cause discrepancies between the total amount due and the actual charges.

- Failure to Include Legal Terms: If applicable, make sure any terms or conditions related to the agreement or project are included. This helps avoid disputes later on.

How to Avoid These Mistakes

To minimize these errors, take the time to carefully review each document before sending it. Using a standardized format and a reliable software solution can help reduce human errors and streamline the process. Additionally, consider setting up a system for tracking payments and keeping records to ensure you stay on top of outstanding balances.

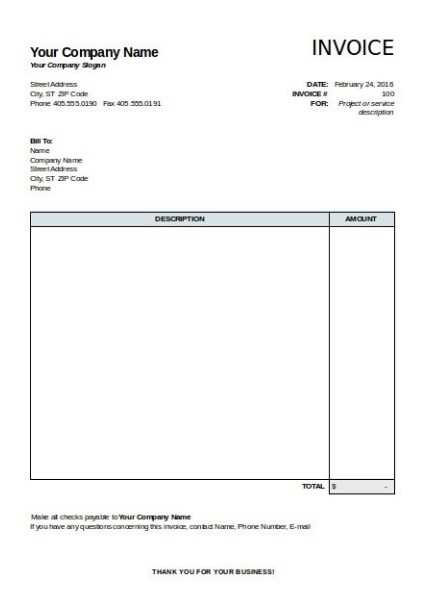

Steps to Create a Construction Invoice

Creating a professional payment request requires careful attention to detail. By following a structured process, you can ensure that all necessary information is included, helping both you and your client understand the terms clearly. Properly drafted documents not only improve the payment process but also enhance your professional image.

Follow these simple steps to create a comprehensive and accurate billing document:

- Start with Your Business Information: Include your company name, address, phone number, and email at the top of the document. This allows your client to easily contact you with any questions or concerns.

- Include Client Details: Add the client’s name, address, and contact information so they can quickly identify which project the request is associated with.

- Assign a Unique Identification Number: Generate a unique number for each payment request. This helps both you and your client easily track and reference the document.

- Provide a Detailed Description of Services: List all the work completed, including dates and any specific materials used. Be as detailed as necessary to avoid confusion.

- Break Down the Costs: List each individual charge separately (e.g., labor, materials, travel expenses), along with the corresponding price. This allows clients to understand exactly what they are paying for.

- Specify the Total Amount Due: Clearly state the total amount owed, including taxes and any discounts or adjustments that may apply.

- Set Payment Terms: Define the payment due date, acceptable methods of payment, and any penalties or discounts related to the payment schedule.

- Provide Payment Instructions: Include clear details on how the client can make the payment, including bank account information or online payment methods if applicable.

- Review and Send: Double-check the document for any errors, and ensure everything is accurate before sending it to the client. Once finalized, send it promptly to avoid delays.

Understanding Payment Terms in Invoices

Payment terms are a critical component of any billing document. They set the expectations for when and how a client is expected to settle their balance. Clear and well-defined terms help avoid misunderstandings, ensure timely payments, and maintain a professional relationship with clients. By establishing transparent payment guidelines, you protect your business and provide clarity for your clients.

Common Payment Terms Explained

Here are some of the most commonly used payment terms in billing documents, along with their meanings:

| Payment Term | Description |

|---|---|

| Due on Receipt | Payment is expected immediately upon receiving the document. No credit is extended. |

| Net 30 | Full payment is due 30 days after the document is issued. It is a common term for businesses offering short-term credit. |

| Net 60 | Payment is due 60 days after the document is issued, allowing the client more time to settle the balance. |

| Early Payment Discount | A discount offered if the client pays before the due date. For example, “2% 10 days” means the client can receive a 2% discount if payment is made within 10 days. |

| Late Fee | An additional charge added if payment is not received by the due date. This fee encourages timely payment and compensates for any delays. |

Why Payment Terms Matter

Establishing clear payment terms helps prevent delays and protects your business’s cash flow. Clients will appreciate knowing exactly when payment is expected and how much they need to pay. By defining these terms upfront, you can reduce the likelihood of disputes and ensure a smoother transaction process.

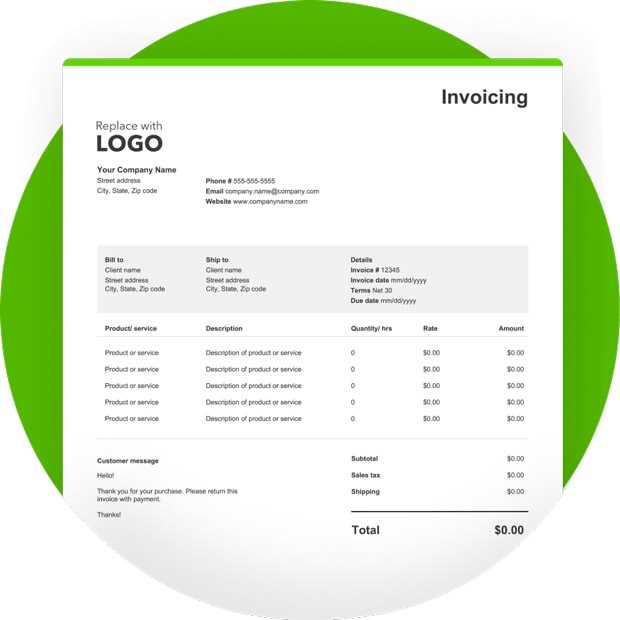

Choosing the Right Invoice Software

Selecting the right software for creating and managing billing documents is crucial for maintaining an organized, efficient financial system. With the right tool, you can automate many aspects of the billing process, reduce errors, and ensure timely payments. The right software should meet your specific needs, be easy to use, and integrate well with your other business systems.

Key Features to Look For

When choosing billing software, consider the following features to ensure it suits your needs:

- Customization Options: Look for software that allows you to tailor your documents to fit your brand, with customizable fields, logos, and layouts.

- Automation: Choose software that offers automated features, such as recurring billing, reminders for overdue payments, and automatic tax calculations.

- Integration: Ensure the software integrates with your accounting, project management, or CRM tools to streamline your business operations.

- Ease of Use: The software should have an intuitive interface that allows you to create and manage documents without needing extensive technical knowledge.

- Security: Ensure the software provides robust security features to protect sensitive financial information and client data.

- Support and Updates: Choose software that offers ongoing support, frequent updates, and access to troubleshooting resources.

Popular Options on the Market

There are several well-regarded options available, each with unique features tailored to different business needs. Some of the top-rated choices include:

- FreshBooks: Known for its user-friendly interface and extensive features for small businesses.

- QuickBooks: Offers a comprehensive suite of accounting tools, including invoicing, expense tracking, and payroll management.

- Zoho Invoice: Provides customizable templates, recurring billing, and integrates seamlessly with other Zoho tools.

- Wave: A free option with powerful features for small businesses, including invoicing, accounting, and receipt scanning.

By evaluating the features and comparing different software options, you can select the best one that will help you create professional documents efficiently and manage your business finances smoothly.

Legal Requirements for Construction Invoices

When creating billing documents for any type of work, it is essential to ensure they comply with local and national legal requirements. These regulations are in place to protect both the service provider and the client, ensuring transparency, proper documentation, and accountability. Adhering to these legal guidelines helps prevent disputes and ensures that payments are processed smoothly and without complications.

In order to meet legal standards, there are several critical elements that must be included in your billing statements. These include:

- Company Information: Your business name, address, and contact details must be clearly visible. In many jurisdictions, it’s also necessary to provide your tax identification number.

- Client Information: Ensure that the full name, address, and contact information of your client are listed accurately. This ensures that both parties are correctly identified in the transaction.

- Detailed Service Description: A clear and comprehensive breakdown of the work performed, including dates, services provided, and materials used. This helps ensure transparency and reduces the risk of misunderstandings.

- Tax Information: Including the applicable tax rates and amounts is often legally required. Many regions require specific sales tax or VAT information to be disclosed.

- Payment Terms: Specify the due date for payment and any penalties for late payments. Some jurisdictions also require specific clauses regarding payment disputes and interest charges for overdue payments.

- Invoice Number: Assigning a unique identification number to each document is a common legal requirement for tracking purposes. This is important for record-keeping and tax reporting.

- Signature or Digital Authorization: Depending on the region and project size, a signed agreement or digital confirmation may be required to verify the agreement between both parties.

Understanding and adhering to these requirements ensures your billing process is both professional and legally compliant. It’s advisable to consult with legal professionals or local authorities to ensure full compliance with the regulations applicable to your business operations.

How to Track Payments Efficiently

Efficiently tracking payments is crucial for maintaining a healthy cash flow and ensuring that your financial records are up-to-date. By keeping a clear record of incoming payments, you can quickly identify any outstanding balances, avoid late fees, and improve financial forecasting. The right tools and practices can streamline this process and help you stay organized.

Methods to Track Payments

There are several effective ways to track payments, depending on the size of your business and the tools you prefer. Here are some common methods:

- Accounting Software: Use specialized accounting software to automatically record payments, match them to issued documents, and generate real-time reports. Software like QuickBooks, FreshBooks, or Xero can integrate with your bank accounts to track payments effortlessly.

- Spreadsheets: For smaller operations, a simple spreadsheet can be used to manually log payments. You can create columns for payment dates, amounts, methods, and outstanding balances, making it easy to track everything in one place.

- Payment Gateways: Platforms like PayPal, Stripe, or bank transfers offer detailed payment histories, which can be accessed and tracked instantly. These platforms can help you reconcile payments directly with your records.

- Mobile Apps: Mobile payment apps such as Square or Venmo can also serve as tracking tools. These apps allow you to receive and record payments in real-time, making it easier to keep track of sales while on the go.

Best Practices for Payment Tracking

To ensure your payment tracking process remains efficient and accurate, follow these best practices:

- Consistency: Regularly update your records as payments come in. Setting aside specific times each week to reconcile your accounts will prevent any payments from slipping through the cracks.

- Clear Descriptions: When entering payment details, include as much information as possible–such as client names, payment amounts, and reference numbers–to avoid confusion later.

- Automated Reminders: Set up automated reminders for clients who have not paid by the due date. This can help prevent late payments and reduce the time spent following up manually.

- Record All Payment Methods: Track payments made by various methods (credit card, cash, bank transfer, etc.) to ensure complete and accurate financial reporting.

By implementing these strategies, you can efficiently track payments and maintain control over your finances, which is essential for the smooth operation of your business.

How to Handle Invoice Disputes

Disagreements over billing can arise for various reasons, ranging from misunderstandings about services rendered to discrepancies in amounts or payment terms. It’s important to handle such situations with professionalism and clear communication to resolve issues quickly and amicably. By following a structured approach, you can minimize disruptions and maintain strong relationships with your clients.

Steps to Resolve Disputes Effectively

When a payment dispute occurs, it’s crucial to approach the situation with a calm and methodical process. Here are key steps to follow when handling disagreements:

- Review the Document Carefully: Before taking any action, carefully review the agreement or billing document in question. Verify that all details, such as the work performed, payment terms, and amounts, are correct and clear.

- Reach Out to the Client: Contact the client as soon as possible to discuss the issue. Ensure the conversation is professional and focused on understanding their concerns. Often, a simple conversation can clear up any confusion.

- Provide Evidence: If necessary, provide supporting documents such as contracts, emails, or time logs to clarify the charges or agreements in question. Presenting clear evidence can help resolve the issue more quickly.

- Negotiate a Solution: If the dispute cannot be resolved immediately, offer to negotiate terms that are fair to both parties. This may include offering a discount, payment plan, or a revised agreement.

- Document the Agreement: Once an agreement has been reached, ensure that it is documented in writing and signed by both parties to avoid future misunderstandings.

Common Causes of Disputes

Understanding the common causes of billing disagreements can help prevent future disputes. Some of the most frequent reasons include:

| Cause | Solution |

|---|---|

| Lack of clear terms | Ensure all payment terms are explicitly stated and agreed upon before starting the work. |

| Discrepancies in services | Provide detailed descriptions of the work performed, including dates and materials used. |

| Late payments | Incl

Best Practices for Construction BillingEffective billing is essential to maintaining cash flow and ensuring that clients are satisfied with both the work completed and the payment process. By following best practices in financial documentation and communication, businesses can reduce errors, minimize disputes, and build stronger client relationships. Here are some strategies to improve your billing process and keep your business running smoothly. Key Practices for Successful BillingTo ensure that your billing process is efficient and transparent, consider the following best practices:

Maintaining Professionalism and Client Trust

Building trust with clients is crucial, and proper billing plays a significant role in that. Here are some tips for maintaining professionalism throughout the billing process:

By incorporating these best practices into your billing routine, you can improve the accuracy, professionalism, and efficiency of your financial transactions. This will not only help your busin Design Tips for a Professional InvoiceCreating a polished and professional financial document is essential for leaving a good impression on clients. The design of your billing statement can speak volumes about the quality of your services and attention to detail. A well-organized and aesthetically pleasing layout not only enhances readability but also helps maintain a sense of professionalism and trust. Here are some essential tips for designing a professional and effective billing document. Essential Elements of a Well-Designed Document

To ensure your document looks polished and clear, focus on these design elements:

Enhancing the Professional AppealTo give your document an extra touch of professionalism, consider the following:

|