Blank Cleaning Invoice Template for Efficient Billing

Managing financial transactions is crucial for any business, especially for service providers who need to track their work and receive timely payments. Having a professional and organized method to document services rendered can make all the difference in maintaining smooth operations and ensuring customer satisfaction.

Using a well-structured document for billing purposes not only saves time but also enhances professionalism. A customizable document that includes all necessary details allows for clear communication with clients and streamlines the payment process. By adopting an easy-to-use format, service providers can focus on their work while leaving the paperwork to a reliable system.

Adopting an organized approach to financial records can improve cash flow and reduce errors in the payment process. A consistent format helps maintain transparency and avoids misunderstandings with clients, ensuring that both parties are on the same page throughout the transaction.

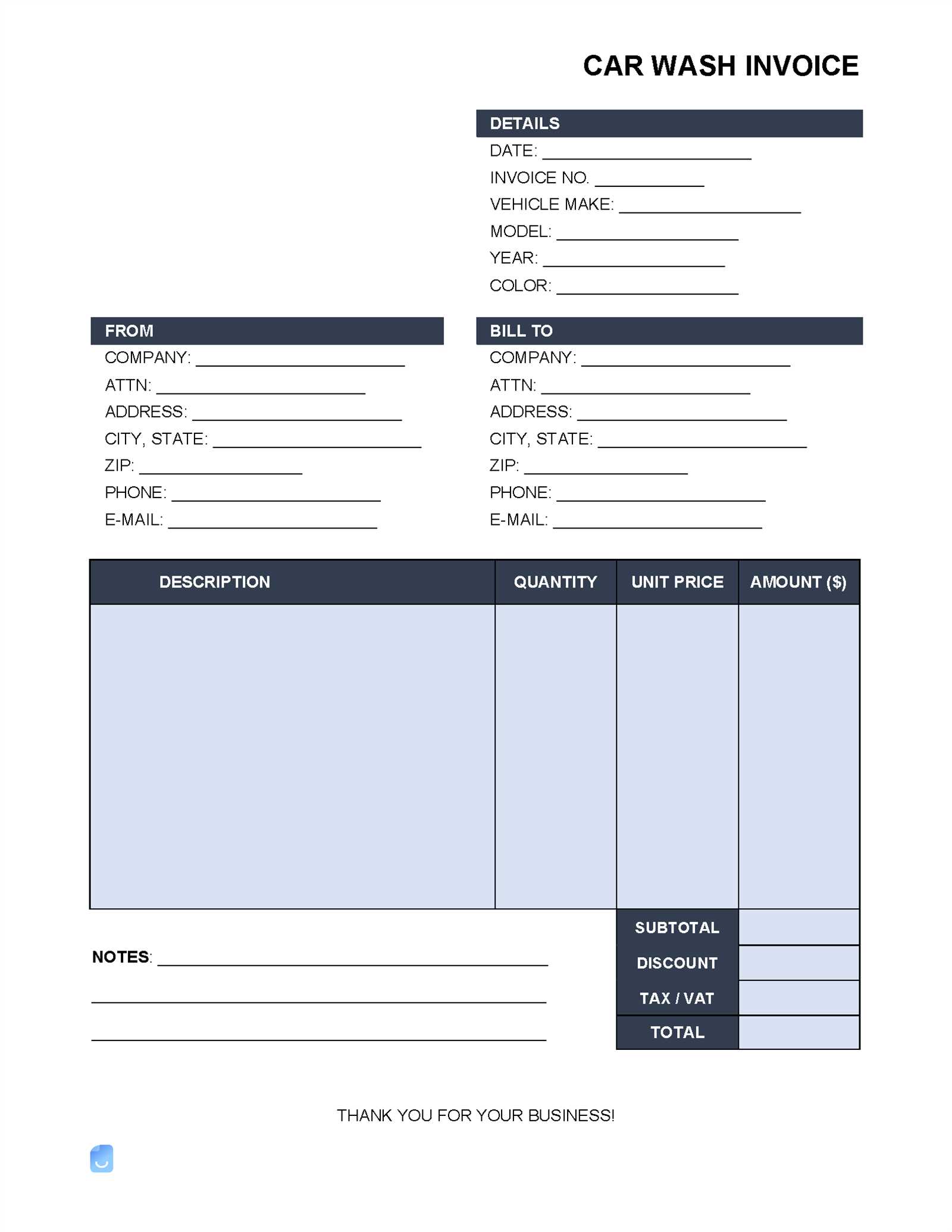

Blank Cleaning Invoice Template for Business

For businesses that provide regular services, having a clear and consistent method to document payments is essential for maintaining organization and professionalism. An effective tool for this purpose ensures all the necessary information is presented in a concise and easy-to-understand format. With the right structure, businesses can focus more on their work while simplifying the billing process.

By using a standardized document, companies can streamline their financial management and avoid mistakes that could lead to delayed payments or confusion. The right structure helps maintain transparency with clients, fostering trust and improving customer relations.

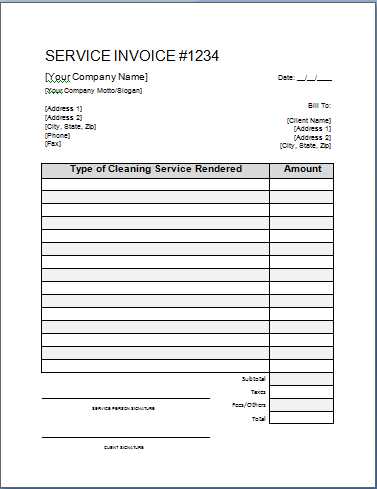

The following elements are critical when setting up such a document:

- Client Details: Include the name, address, and contact information of the customer receiving the service.

- Service Description: Clearly outline the services provided, with enough detail to avoid confusion.

- Amount Due: List the cost for each service provided, along with any applicable taxes or discounts.

- Payment Terms: Specify payment due dates and any penalties for late payments.

- Unique Reference Number: This helps in tracking and organizing records effectively.

Having all this information in a uniform layout ensures both parties understand the terms and expectations, making the payment process straightforward and efficient.

Why Use a Cleaning Invoice Template

Having a structured document for billing is essential for any service-oriented business. It simplifies the process of tracking payments and ensures that all important information is presented clearly. A well-organized approach can help businesses avoid confusion and delays, ultimately leading to more efficient financial management.

Utilizing a pre-designed format makes it easier to include all necessary details without overlooking important elements. It helps businesses maintain a professional appearance and ensures consistency across all transactions. Furthermore, it can significantly reduce the time spent creating documents from scratch, allowing service providers to focus more on delivering quality work.

Key Benefits of Using a Structured Document

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed formats speed up the creation process, reducing administrative work. |

| Consistency | Standardized formats ensure uniformity across all billing records, enhancing professionalism. |

| Clear Communication | A well-organized document clearly outlines the services provided and the payment expectations, reducing misunderstandings. |

| Improved Cash Flow | Proper documentation helps ensure timely payments, improving business cash flow management. |

Why Consistency Matters

By using a uniform structure, businesses can ensure that clients always receive the same type of document, which helps build trust and makes payment expectations clear. This consistency also makes it easier to track records for future reference and financial audits.

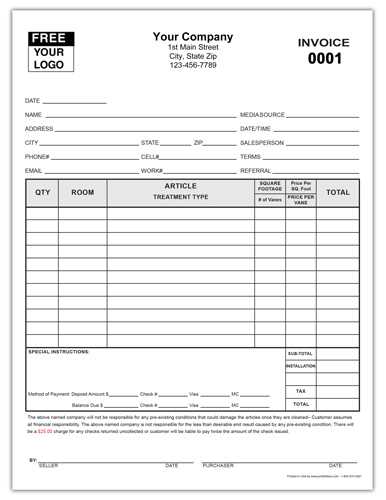

Key Features of a Cleaning Invoice

When creating a document to request payment for services rendered, it is crucial to include all the necessary information in a clear and organized manner. A well-designed billing document serves not only as a request for payment but also as a professional record that helps both parties keep track of the transaction. Ensuring all relevant details are present can prevent misunderstandings and ensure timely payments.

The most important aspects of such a document include:

- Client Information: The name, address, and contact details of the customer receiving the service should be clearly stated to ensure accurate billing.

- Service Details: A detailed description of the services provided, including dates, frequency, and any special requests, should be included to avoid confusion.

- Amount Due: The cost for each service, along with any applicable taxes or discounts, must be clearly outlined to ensure transparency.

- Payment Terms: Clear payment terms, such as the due date and acceptable payment methods, should be specified to prevent delays in settling the amount owed.

- Unique Reference Number: A reference number makes it easier to track the document for future reference or in case of disputes.

Including these key features in your document helps maintain clarity and professionalism, ensuring both parties are on the same page throughout the transaction. A complete and accurate document will contribute to smooth and effective business operations.

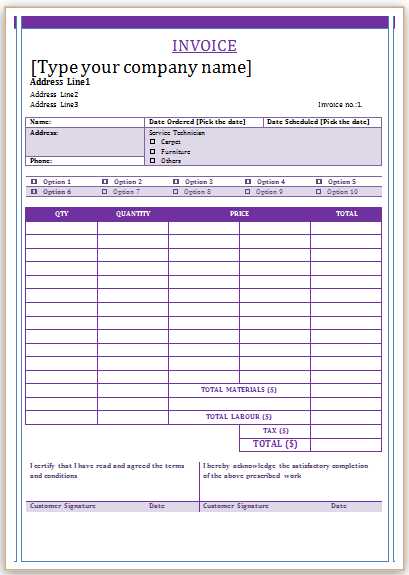

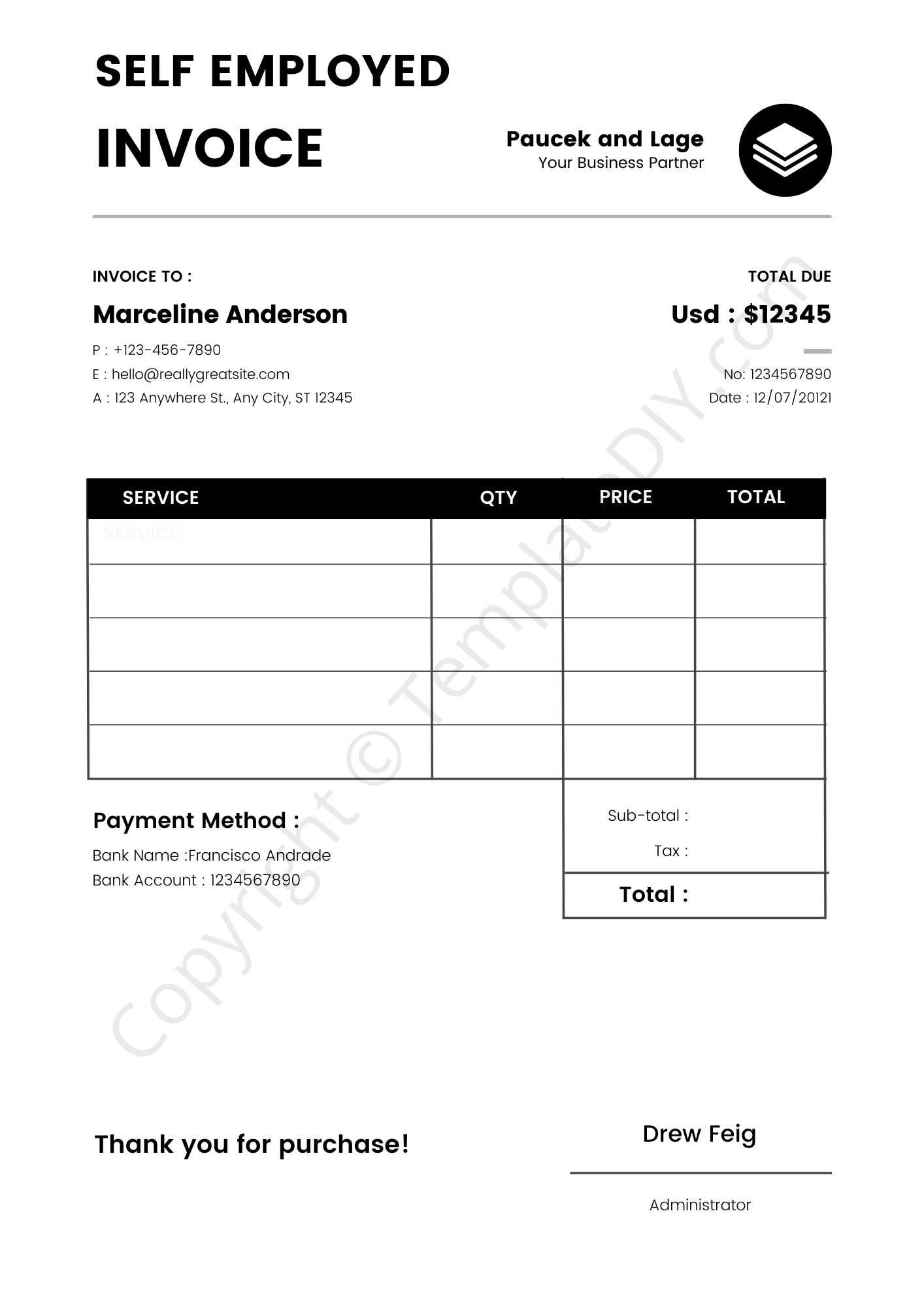

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your business needs and ensure it reflects your brand’s professionalism. A personalized format helps you maintain consistency across all transactions while presenting the necessary details in a way that is clear and effective. By adjusting certain elements, you can make your document more functional and aligned with your company’s identity.

Here are some key areas you can modify to suit your business:

1. Adjusting the Layout and Design

- Logo and Branding: Add your business logo and choose fonts and colors that align with your brand identity.

- Header Customization: Include a custom header with your company name, contact details, and any relevant licenses or certification numbers.

- Footer Details: Place important information such as your website, payment terms, or legal disclaimers at the bottom of the document.

2. Modifying Content Fields

- Service Description: Tailor the section to accurately describe the services provided, adjusting for specifics like duration, frequency, or special requests.

- Pricing Structure: Adapt the pricing format to reflect your business model, whether it’s hourly rates, flat fees, or packages.

- Payment Instructions: Customize the payment terms and methods based on your preferred approach, such as credit card, bank transfer, or cash payments.

By making these adjustments, you can create a billing document that not only meets your business needs but also strengthens your professional image and ensures clarity for your clients.

Benefits of Professional Invoicing

Adopting a professional approach to billing is essential for any business. Using a structured document that clearly outlines payment details not only ensures accurate transactions but also builds trust with clients. A well-crafted bill reflects the seriousness and reliability of your business, helping to establish long-term relationships and avoid misunderstandings.

There are several key advantages to maintaining a professional billing process:

- Clarity and Transparency: A clear format provides all the necessary details about the services rendered, leaving no room for confusion. Both you and your client can easily track the terms and payment expectations.

- Time Efficiency: A standardized billing document reduces the time spent creating new ones from scratch, allowing you to focus more on delivering services.

- Legal Protection: A well-documented payment request serves as a legal record of the transaction, which can be helpful in case of disputes or audits.

- Enhanced Professionalism: Sending a polished, professionally formatted document gives your business a more credible and trustworthy image, which can attract more clients.

- Improved Cash Flow: Clear and consistent billing encourages timely payments, helping to maintain steady cash flow for your business.

In summary, adopting professional invoicing practices can streamline your financial operations and significantly enhance your business’s reputation. It’s an essential tool for maintaining smooth transactions and fostering trust with your clients.

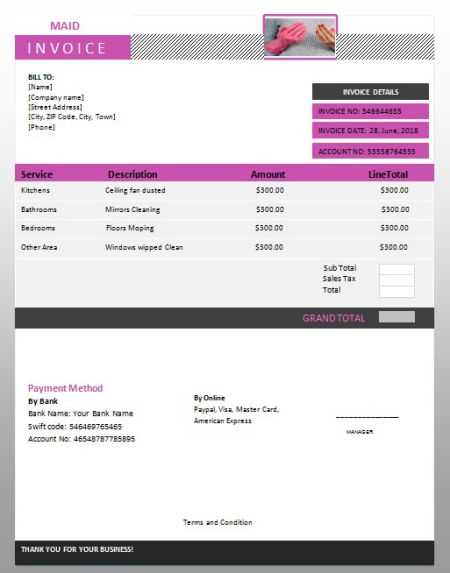

Steps to Create a Cleaning Invoice

Creating an organized billing document is an essential task for any service-oriented business. A structured approach ensures that all the necessary details are included, helping both the service provider and the client understand the terms and expectations. By following a few simple steps, you can create an effective and professional payment request every time.

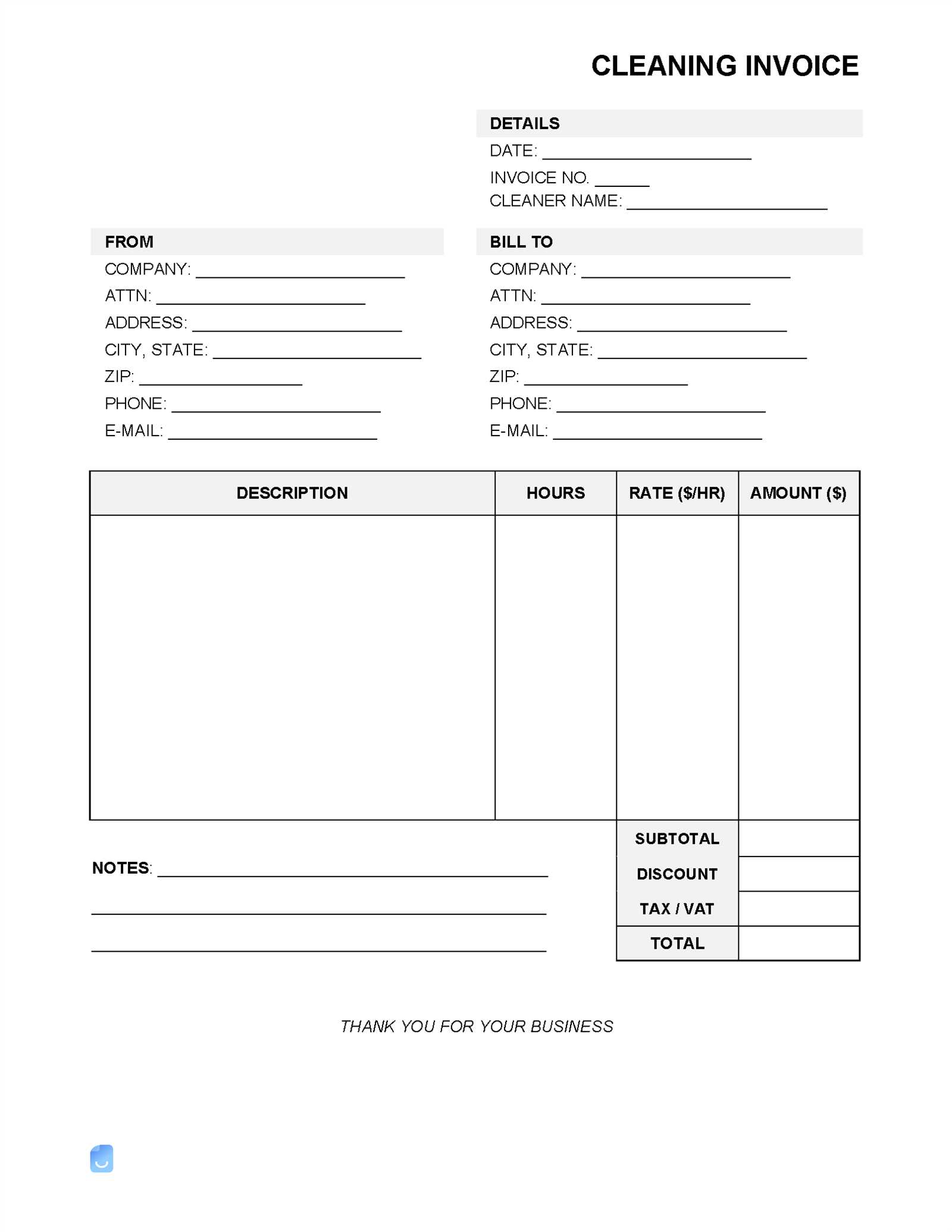

1. Include Essential Client and Service Details

The first step is to gather all relevant information for the client and the services provided. Be sure to include:

- Client’s Full Name and Contact Information: Include the customer’s name, address, phone number, and email for proper identification.

- Service Description: Detail the services provided, including dates, times, and any specific tasks performed during the session.

- Unique Reference Number: Assign a unique identifier to help track and organize your documents for future reference.

2. Specify Payment Terms and Amount Due

After providing the necessary service details, the next step is to clearly outline the payment expectations. This includes:

- Itemized Costs: List the cost of each service provided and any additional charges, such as taxes or fees.

- Payment Method: Specify the methods by which the client can make the payment, such as bank transfer, credit card, or other options.

- Due Date: State the payment deadline to ensure the client is aware of when the payment is expected.

By following these steps, you will create a comprehensive and professional document that accurately reflects the services provided and makes the payment process straightforward for both parties.

Essential Information for Cleaning Invoices

For any service-based business, providing a clear and comprehensive document for payment is crucial. The more precise and organized the details, the easier it will be for both the service provider and the customer to understand the terms of the transaction. Ensuring that all necessary components are included helps avoid confusion and delays in payments.

1. Client and Service Information

Start by including basic yet vital details that ensure the document is specific to both the provider and the customer. These include:

- Client Name and Address: Accurate client information allows for easy identification and ensures proper record-keeping.

- Description of Services Rendered: Clearly outline what services were provided, including any special requests or specific tasks completed during the service period.

- Dates of Service: Include the exact date or date range when the service was performed for accurate documentation.

2. Payment and Terms Details

Next, specify the payment-related elements to avoid any misunderstandings. Essential points include:

- Total Amount Due: The cost for each service should be listed, along with any taxes or additional fees that may apply.

- Due Date: Clearly state the payment due date to ensure timely payment and reduce the chances of delays.

- Payment Instructions: Provide clear details on how the client can make the payment, such as bank transfer, online payment, or cash.

Including these key pieces of information in your document will ensure a smooth transaction process, reduce confusion, and enhance your business’s professionalism.

Choosing the Right Format for Invoices

Selecting the appropriate structure for your billing document is an essential step in ensuring smooth business operations. The format not only impacts the clarity and professionalism of your request for payment but also affects how easily both you and your clients can track and manage the transaction details. The right format can simplify the billing process and promote timely payments.

1. Digital vs. Paper Documents

One of the first decisions to make is whether to issue your payment requests in a physical or digital format. Each has its own set of advantages:

- Digital Documents: Easy to send via email or online payment platforms, helping save time and reduce paperwork. It’s also simpler to store and organize electronically.

- Paper Documents: May be preferred by some clients for their tangible nature, providing a hard copy of the transaction for their records. However, it requires physical mailing, which can add delays and costs.

2. Key Features of an Effective Format

No matter which format you choose, there are several essential features your billing document should include to ensure efficiency:

- Clear Layout: The document should have an organized structure, with sections for client details, service descriptions, and payment terms clearly marked for easy navigation.

- Easy Customization: Ensure the format is flexible enough to allow for adjustments, such as adding or removing services, changing prices, or adjusting payment terms based on individual client needs.

- Consistency: Choose a format that you can use across all transactions to maintain consistency in your communications and records.

Ultimately, the right format will depend on the preferences of your clients, the nature of your business, and the ease with which you can manage your payment processes. Whether you choose a digital or paper format, ensure that it is clear, professional, and easy to customize for each transaction.

Free Templates vs Paid Options

When creating a billing document, businesses often face the choice between using free resources or opting for paid solutions. Both options come with their own set of advantages and limitations. The decision largely depends on the specific needs of your business, the level of customization required, and the resources you are willing to allocate for creating professional documents.

Free options are an attractive choice for small businesses or individuals looking to minimize expenses. They are often easy to access and can be used right away without any initial investment. However, free resources may come with certain restrictions, such as limited design features, fewer customization options, or lack of professional polish.

Paid options, on the other hand, offer more advanced features and customization, often allowing you to tailor your documents to match your brand identity and business needs. These resources may also include customer support and updates, ensuring you have access to the latest features and compliance changes. While they come with a cost, the investment can save you time and effort in the long run and improve the overall professionalism of your documents.

Ultimately, the choice between free and paid options comes down to the specific requirements of your business and the level of detail you wish to include in your billing process. If you need a simple and quick solution, free options may suffice. However, for businesses aiming for a higher level of customization and professional quality, paid options may provide better value in the long term.

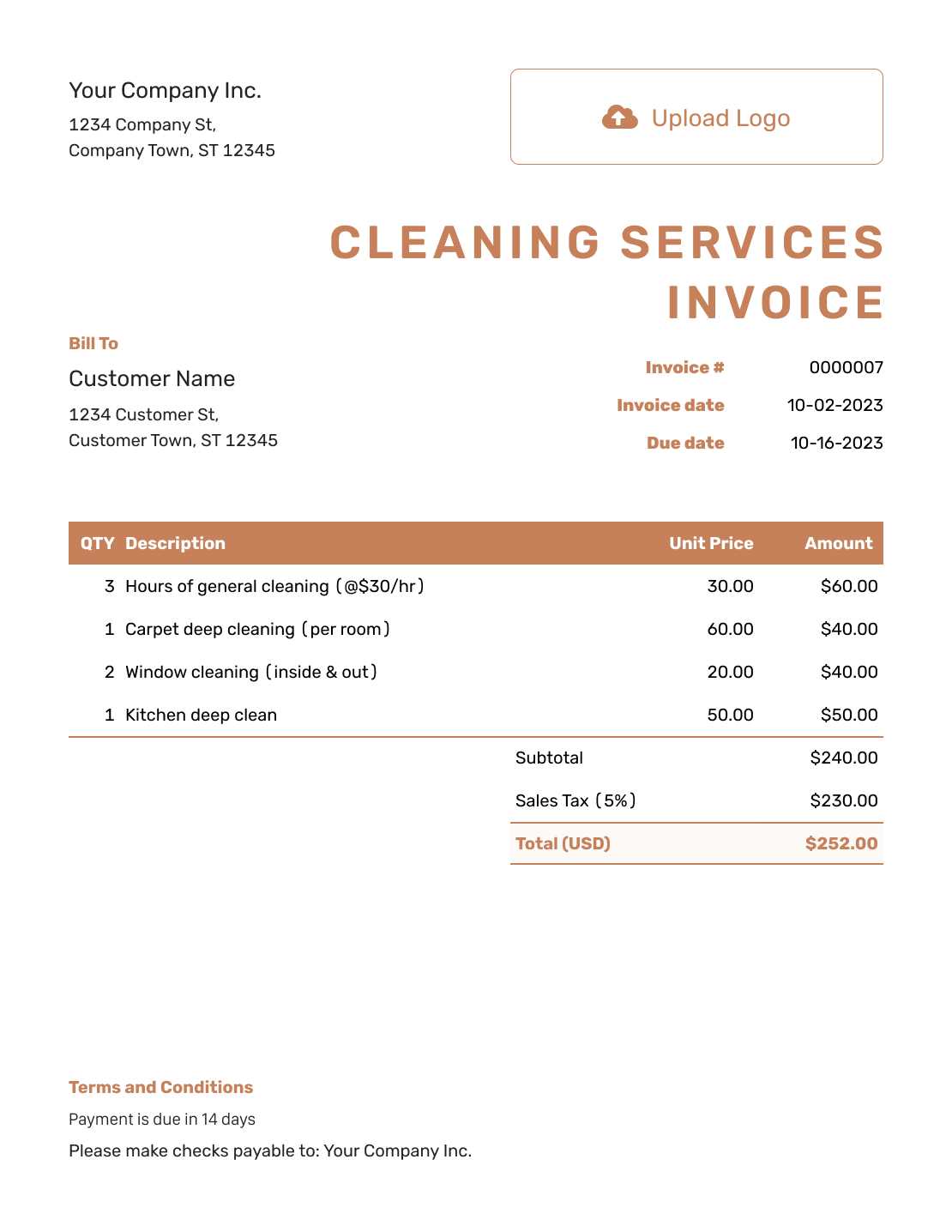

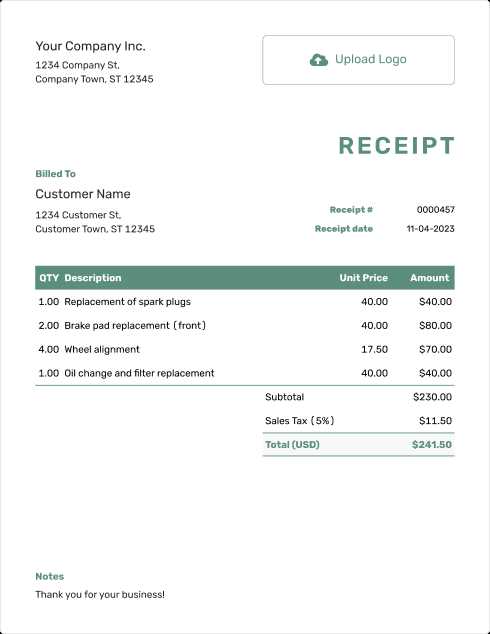

How to Add Tax and Discounts

In any billing document, calculating taxes and applying discounts accurately is essential to ensure transparency and fairness in the payment process. Adding these elements correctly not only helps businesses stay compliant with tax regulations but also provides clients with a clear breakdown of their charges. Whether it’s a standard sales tax or a special promotional discount, knowing how to properly integrate these adjustments is crucial for effective billing.

1. Adding Tax

When applying tax to the total amount, you should ensure that the correct tax rate is used based on the location of the service or product. Here’s how to do it:

- Identify the tax rate: Determine the applicable sales tax rate based on the jurisdiction in which the service was provided.

- Calculate the tax amount: Multiply the total cost of the services by the tax rate to determine the tax amount.

- Add the tax to the total: Include the tax amount in the final total, making sure it is clearly indicated as a separate line item for the client to see.

2. Applying Discounts

Discounts can be a great way to incentivize clients, especially for repeat business or special promotions. When adding a discount:

- Decide on the discount type: Choose whether the discount will be a fixed amount or a percentage of the total.

- Apply the discount: Subtract the discount from the total amount before tax to calculate the new pre-tax total.

- Clearly display the discount: Ensure that the discount is listed separately from other charges, so the client can see the original price, the discount applied, and the new amount due.

By properly applying taxes and discounts, you ensure that your billing process remains clear, accurate, and professional, while also helping to build trust with your clients.

Using Invoices for Better Record-Keeping

Effective record-keeping is vital for managing finances, tracking business performance, and staying organized. By properly documenting each transaction, businesses can gain better control over their operations and ensure compliance with financial regulations. A well-structured billing document serves as an important tool for keeping accurate records of sales, payments, and outstanding balances.

Maintaining a thorough and organized system allows businesses to quickly reference past transactions, making it easier to resolve disputes, handle audits, and plan for future growth. Furthermore, invoices provide a clear and consistent format for tracking payments, ensuring that no important details are overlooked.

Key Benefits of Using Billing Documents for Record-Keeping

Here are a few reasons why it’s essential to incorporate billing documents into your record-keeping system:

- Transparency: Billing records provide a clear breakdown of services and amounts, ensuring both parties understand the charges.

- Legal Compliance: Proper documentation ensures that businesses comply with tax regulations and other legal requirements.

- Financial Management: Billing documents make it easier to track payments, outstanding balances, and overall cash flow.

- Audit Preparedness: Organized records make audits smoother and less time-consuming by providing all the necessary documentation in one place.

How to Organize Billing Records

To optimize your record-keeping system, consider the following practices:

| Action | Purpose |

|---|---|

| Keep Copies of Each Document | Store a copy of all billing documents, whether digital or physical, for easy access and reference. |

| Organize by Date or Client | Sort documents either chronologically or by client to quickly retrieve relevant information. |

| Use Digital Tools | Consider using accounting software or cloud storage to automate and centralize your records. |

By integrating billing documents into your record-keeping system, you can streamline your financial management processes and ensure that your business remains on track for success.

What to Include in Cleaning Services Invoice

When creating a bill for professional services, it’s essential to provide a detailed and transparent breakdown of all charges. A well-structured document not only ensures that your clients understand the costs involved, but it also helps to maintain professionalism and fosters trust. Including the right details ensures that both you and your clients are on the same page, and can easily reference the document when necessary.

Each document should clearly list the services provided, the associated costs, and any additional charges. It’s also important to specify payment terms and the due date to avoid confusion later on. Here’s what you should include to ensure your document is complete and accurate:

Essential Elements to Include

- Service Description: Clearly outline each task completed, including any specific areas or items worked on.

- Cost Breakdown: List the charge for each service or item, ensuring transparency in the pricing.

- Payment Terms: Include payment methods, due dates, and any late fees if applicable.

- Client and Service Provider Information: Provide both parties’ names, addresses, and contact details for easy reference.

- Invoice Number: Assign a unique reference number to help track payments and manage your records.

- Additional Charges or Discounts: Note any extra fees for specialized services or discounts offered to the client.

Why These Elements Matter

Each of these elements plays a key role in ensuring that your document serves its purpose. A clear service description helps avoid misunderstandings, while an itemized cost breakdown shows transparency. Payment terms protect your business and encourage prompt settlement, while the unique reference number aids in organization. Lastly, ensuring all contact information is accurate makes follow-ups easier, should any issues arise.

Incorporating these elements into your billing process will enhance both clarity and professionalism, ensuring smooth transactions and strong relationships with your clients.

How to Organize Invoices for Clients

Efficient organization of billing documents is crucial for maintaining a smooth workflow, ensuring prompt payments, and keeping track of your financials. By implementing an organized system, you can easily locate any document when needed and avoid confusion or delays. This process involves categorizing and storing documents in a way that is both accessible and effective for your business operations.

It’s important to establish a clear system for grouping and sorting your documents. Whether you manage records digitally or manually, having a consistent method will help streamline the process and improve efficiency. Below are some best practices for organizing your billing records for clients.

Best Practices for Organizing Billing Records

- Keep Documents in Order: Sort records either by date or client name to quickly find relevant details.

- Use Folders or Categories: Create folders for each client or project to keep everything related in one place.

- Utilize Digital Tools: Leverage accounting software or cloud-based platforms to manage documents more easily.

- Record Payment Status: Track which bills have been paid and which are still outstanding for better follow-up management.

Organizing Documents in Practice

| Method | Benefit |

|---|---|

| Digital Filing System | Easy access and quick search capabilities for all records. |

| Physical Folder System | Organized hard copies for clients who prefer paper documentation. |

| Accounting Software | Automated organization and integration with other financial tools. |

By following these strategies and maintaining a well-organized system, you will save time, improve accuracy, and reduce the chances of missing payments or forgetting important details related to your clients.

Common Mistakes in Cleaning Invoices

When managing client billing documents, it’s important to be aware of potential errors that can cause confusion, delays, or even disputes. Small mistakes, such as incorrect details or unclear charges, can lead to frustration for both service providers and clients. Being proactive and ensuring accuracy can prevent misunderstandings and foster better business relationships.

Some of the most common mistakes in billing documents can be easily avoided by paying attention to detail. These errors can impact payment schedules, create confusion, or affect the overall professionalism of the service provided. Below are some frequent mistakes to watch out for when preparing these important documents.

Frequent Mistakes to Avoid

- Incorrect Client Information: Ensure that all client details, such as names, addresses, and contact information, are accurate to avoid miscommunication.

- Missing Service Details: Always list the exact services provided, including any special tasks or requests, to ensure transparency.

- Wrong Payment Terms: Double-check the due date, payment methods, and any late fees to avoid confusion over payment expectations.

- Omitting Taxes or Fees: Be sure to include any applicable taxes, additional fees, or discounts clearly to prevent discrepancies later on.

- Unclear Pricing: Break down costs clearly to avoid any misunderstandings about the services rendered and their charges.

How to Avoid These Errors

To avoid these common pitfalls, always double-check your documents before sending them to clients. Implementing a checklist or using reliable billing software can help ensure accuracy. Additionally, setting clear communication with clients about payment terms and service expectations can prevent many misunderstandings in the first place.

By taking care to avoid these mistakes, you will not only streamline your administrative process but also build trust and professionalism in your business.

How to Track Paid and Unpaid Invoices

Properly managing outstanding payments is essential for maintaining healthy cash flow in any business. Keeping track of which payments have been settled and which are still due helps ensure that finances stay organized and any overdue amounts are promptly followed up on. A solid system for monitoring paid and unpaid accounts is crucial for financial management and can prevent potential cash flow issues.

By keeping detailed records and using the right tools, businesses can easily track which transactions have been completed and which need attention. Here are some best practices for managing these payments effectively and ensuring you stay on top of financial obligations.

Methods to Track Payments

- Use Accounting Software: Many accounting programs allow you to track payments, generate reminders for overdue amounts, and automatically categorize completed transactions.

- Set Up Payment Reminders: Keep clients informed about due dates with automated reminders sent via email or SMS to reduce the chances of overdue payments.

- Manual Tracking: For smaller businesses, keeping a manual record in a ledger or spreadsheet is an option. Regularly update these records to ensure nothing is missed.

- Create Payment Categories: Organize payments into “Paid,” “Unpaid,” and “Overdue” sections to visualize the status of each transaction at a glance.

Tips for Efficient Follow-Up

- Timely Communication: If a payment is overdue, contact the client promptly and professionally to request the payment. Offering flexible payment terms can also help maintain good relations.

- Set Clear Payment Terms: Clearly communicate the due date, payment methods, and any penalties for late payments upfront to avoid confusion later.

- Monitor Accounts Regularly: Set aside time each week or month to review accounts and take note of any unpaid transactions that need attention.

By keeping a clear record of all transactions and actively following up on overdue payments, businesses can maintain better financial control and improve their cash flow.

Legal Considerations for Cleaning Invoices

When running a business that requires the issuance of payment requests, it’s important to be aware of the legal requirements and responsibilities that come with creating and issuing these documents. The proper preparation of these records can protect both the service provider and the client in case of disputes, miscommunications, or legal matters. Understanding what legal information needs to be included and how it must be handled is essential for compliance with local laws and regulations.

In this section, we will discuss some key legal aspects you should consider when creating and sending payment requests for your services. By following these guidelines, you can ensure that your documents are legally sound and serve as reliable evidence if any issues arise.

Key Legal Elements to Include

There are certain essential components that must be included to ensure the document is legally valid. These elements not only protect both parties but also create a formal record of the transaction.

| Element | Importance |

|---|---|

| Company Information | Ensures both parties know who is providing the service and who is responsible for receiving payment. |

| Payment Terms | Defines when payment is due, the method of payment, and any late fees that may apply for overdue balances. |

| Legal Tax Information | Required for compliance with tax laws. This may include VAT numbers or other tax-related details depending on your location. |

| Service Description | Provides a clear outline of the services rendered, including the dates and locations where they were performed. |

| Dispute Resolution Clauses | Helps avoid legal complications by outlining how disputes will be resolved, such as through arbitration or court proceedings. |

Important Legal Tips

- Consult Local Regulations: Depending on your location, there may be specific rules about how payments should be documented and what tax information must be included. Familiarize yourself with the laws applicable to your business.

- Clearly Define Your Terms: Make sure to specify payment due dates, any interest or penalties for late payments, and other contractual terms in your records to avoid any misunderstandings.

- Always Retain Copies: Keeping a copy of all issued records, including electronic versions, is crucial in case of future audits or disputes.

By adhering to legal standards and ensuring your payment documents are complete and accurate, you can safeguard your business interests and maintain a professi

Improving Cash Flow with Invoicing

Effective financial management is essential for the long-term success of any business. One of the most powerful tools at your disposal to manage cash flow is the proper creation and management of payment requests. Timely and accurate records not only ensure that your clients pay you on time but also help you track your revenue and expenses, allowing you to make informed decisions and avoid financial strain.

In this section, we will explore how leveraging payment documents can enhance your cash flow. By implementing efficient strategies and maintaining good financial practices, you can ensure your business remains financially healthy and prepared for growth.

How Timely Payment Requests Can Boost Cash Flow

Issuing clear and accurate payment requests promptly can directly affect how quickly you receive payment for your services. When clients receive well-organized and professional requests, they are more likely to pay on time. This minimizes delays and ensures that your business maintains a steady flow of income.

- Set Clear Payment Terms: Define the due date, any applicable late fees, and payment methods in your requests. This provides clarity and encourages clients to pay on time.

- Regularly Follow Up: Sending reminders before and after the payment due date helps ensure timely payments. A friendly reminder can encourage clients to act promptly.

- Offer Payment Options: Providing flexible payment methods, such as bank transfers, credit cards, or online payment systems, can make it easier for clients to settle their bills quickly.

Tracking and Managing Payments

Maintaining a thorough record of all transactions helps you understand your financial situation better. Tracking paid and unpaid amounts ensures that you stay on top of what’s owed to you and can take action if payments are delayed.

- Monitor Cash Flow: Regularly check your revenue and outstanding payments. Having an up-to-date record can help you identify any cash flow issues early on.

- Use Software for Tracking: Invest in accounting software or spreadsheets to automate the tracking of payments, reducing the risk of human error and ensuring timely follow-ups.

By implementing these strategies, you can reduce late payments, improve the efficiency of your financial operations, and enhance your cash flow. Timely and accurate payment documentation serves as the backbone of sound financial management, helping you keep your business thriving.