Blank Billing Invoice Template for Easy Customization and Use

Creating clear and professional payment records is crucial for maintaining a smooth business operation. A well-structured document helps to ensure transparency, accuracy, and efficiency in financial transactions. Whether you are a freelancer, small business owner, or part of a larger enterprise, having a standardized form for billing is essential for both tracking payments and fostering positive relationships with clients.

Customized forms allow businesses to streamline their accounting tasks and maintain consistency across different transactions. By using editable formats, you can ensure all necessary details are included, from the amount due to the terms of payment. Additionally, this approach helps in reducing errors that may arise from manual documentation, ultimately saving time and effort.

With the right structure, these documents can serve multiple purposes, from providing clients with an easy-to-read summary of their charges to assisting in managing your accounts effectively. The ability to tailor these forms to fit specific business needs adds flexibility and ensures that your payment documentation is aligned with your professional standards.

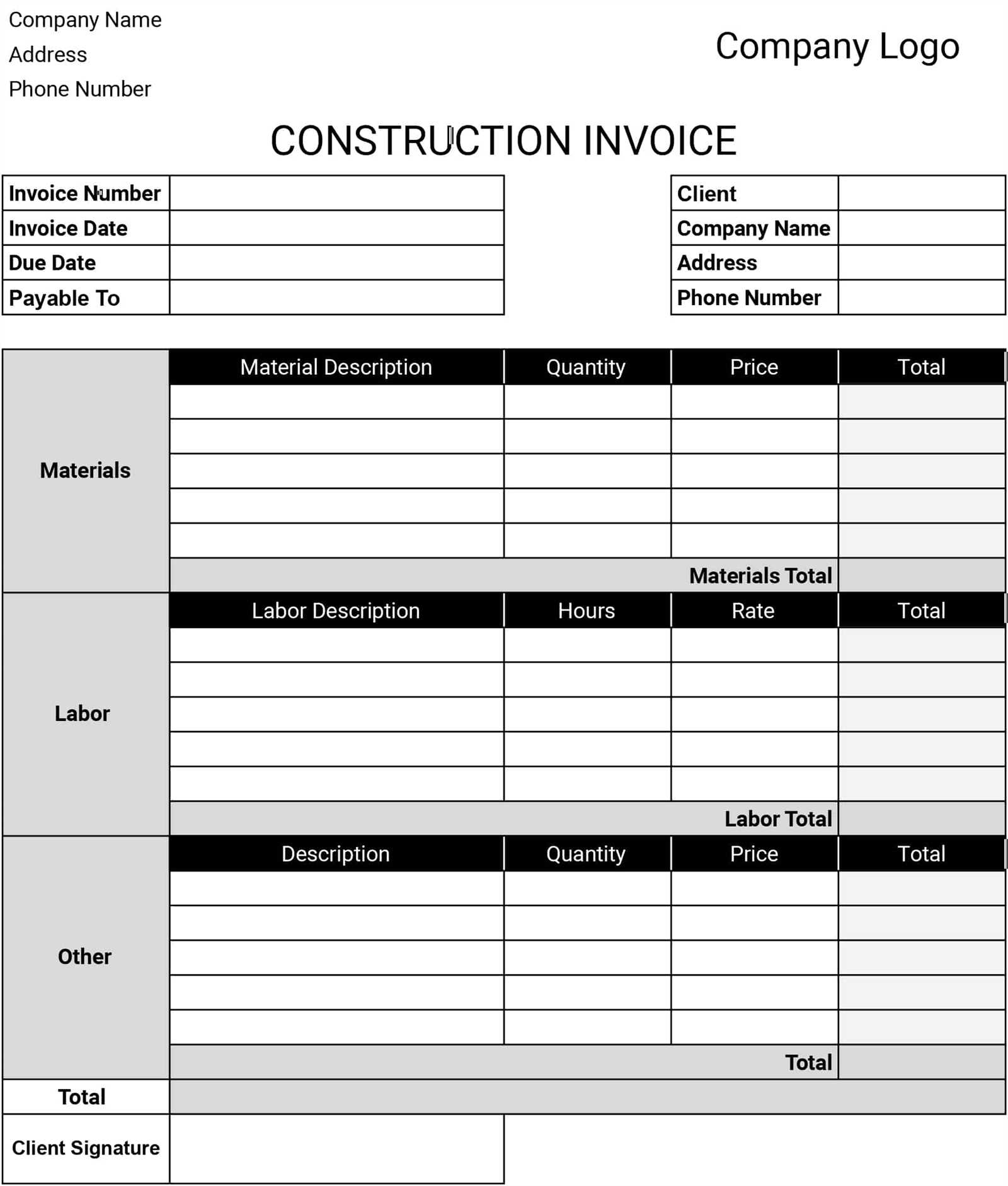

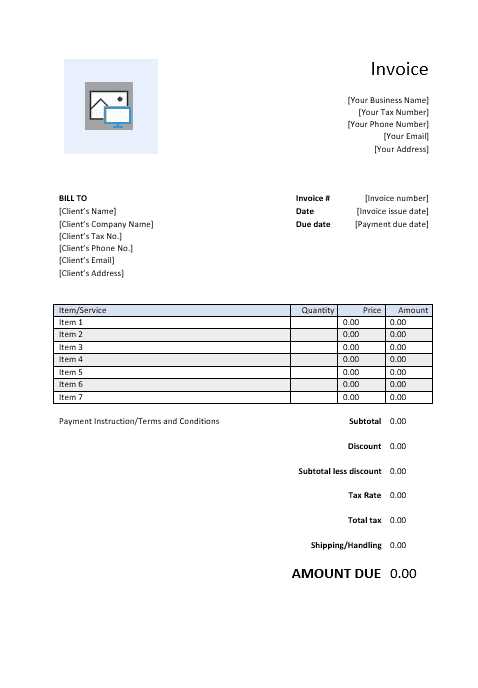

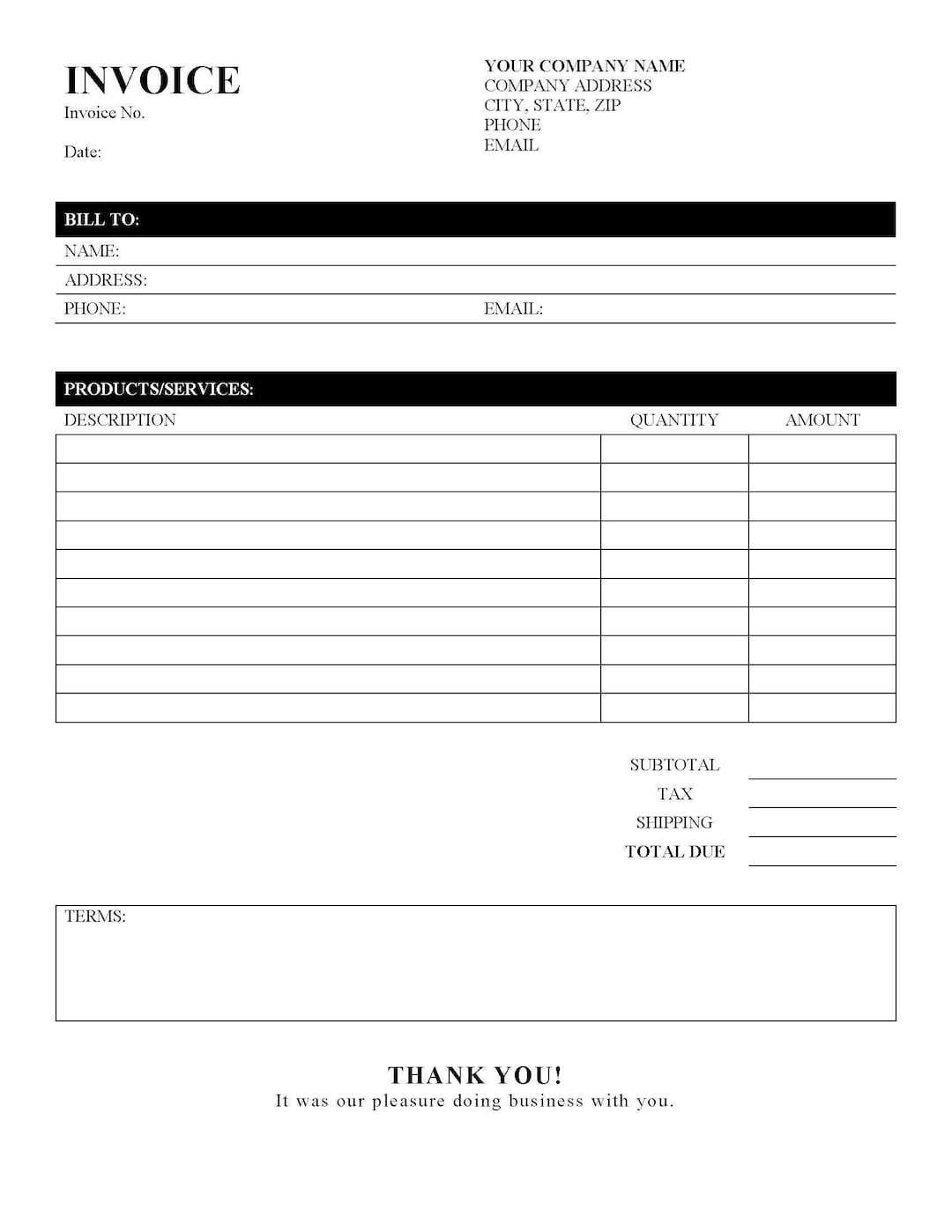

Essential Features of Billing Invoices

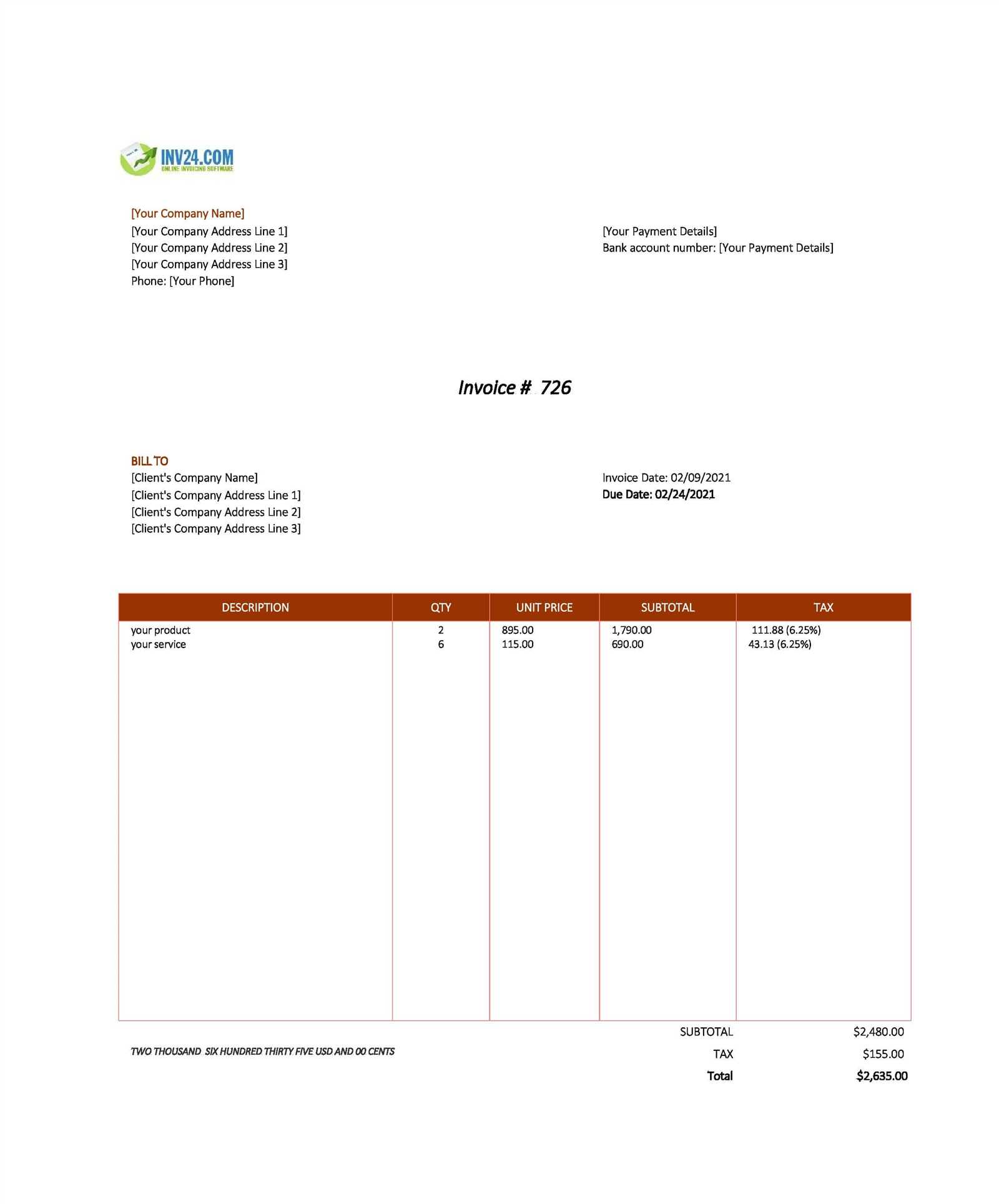

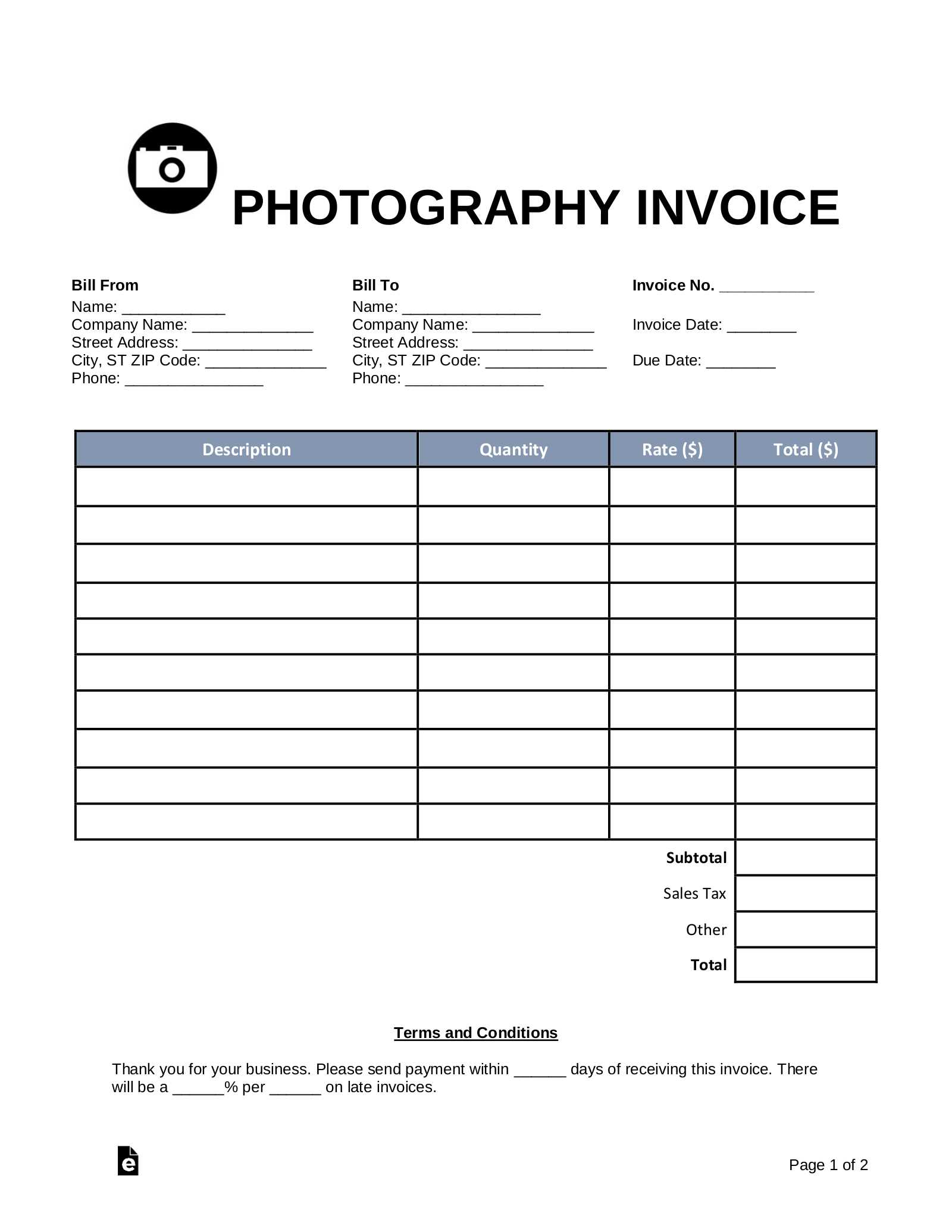

When creating a document to request payment from clients, it is important to ensure that all necessary details are included. A properly designed payment record not only clarifies the terms of the transaction but also enhances professionalism and trust. The following features are essential to ensure your records are complete and effective.

Clear Identification Information

One of the most important aspects of any payment record is the ability to clearly identify both the sender and the recipient. This includes the name, contact details, and addresses of both parties involved. Including a unique reference number for each document is also crucial for tracking and organizing records efficiently.

Detailed Payment Information

It is vital to include all the relevant details about the services or products provided. This includes a description, quantity, price per unit, and total cost. Itemization helps clients easily understand what they are being charged for and reduces the likelihood of disputes over costs. Additionally, specifying the payment terms and due date ensures clarity on when the payment is expected.

Finally, offering an easy method for making payments, such as providing bank account details or online payment links, can expedite the process and improve the overall customer experience. These features are critical for a well-organized financial system.

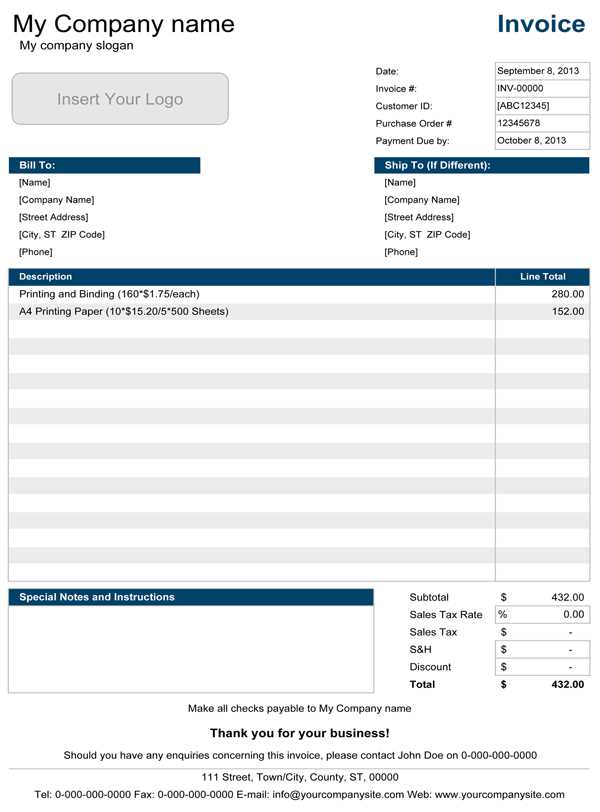

How to Use a Blank Template

Utilizing an editable document for payment requests is an efficient way to standardize financial transactions. By starting with a pre-designed form, you can quickly fill in the necessary details without having to recreate the structure from scratch. This approach not only saves time but also ensures that all required information is consistently included, leading to clearer communication and fewer mistakes.

Step-by-Step Process

To get started with a pre-made form, follow these simple steps:

| Step | Description |

|---|---|

| 1 | Download the document and open it in your preferred editing software. |

| 2 | Fill in the details such as client name, services provided, and amount due. |

| 3 | Ensure that payment terms and deadlines are clearly stated. |

| 4 | Double-check for accuracy, including contact information and totals. |

| 5 | Save and send the completed document to your client via email or print it out. |

Benefits of Using an Editable Form

Using a pre-designed form offers several advantages. It minimizes errors, ensures all necessary information is included, and creates a professional appearance. By customizing a ready-made document, you save time on repetitive tasks while maintaining accuracy and consistency across your transactions.

Benefits of Customizable Invoice Formats

Using a flexible document for payment requests allows businesses to adapt their records to specific needs, ensuring that all required details are present while maintaining a professional appearance. Customizable formats offer significant advantages, particularly for businesses looking to streamline their financial processes and present a cohesive brand image.

One of the key benefits of these adaptable forms is efficiency. With a personalized layout, you can eliminate unnecessary sections and focus on the information that matters most for each transaction. This not only saves time but also reduces the risk of errors, ensuring that every detail is accurate and relevant.

Another advantage is branding. Customizing the design allows you to incorporate your company’s logo, colors, and font choices, creating a consistent and professional look across all financial documents. This helps strengthen your business identity and enhances your credibility with clients.

Finally, a customizable form offers flexibility. Whether you need to add extra fields, modify payment terms, or change the layout, an editable document allows you to tailor it to the specific needs of each client or project. This adaptability ensures that your records always meet your business requirements, no matter how they evolve.

Creating Professional Invoices Quickly

Generating high-quality payment records efficiently is essential for any business. With the right approach and tools, you can produce clear, organized, and professional documents in a matter of minutes. Streamlining this process not only saves time but also ensures accuracy, improving your overall financial management.

Here are some tips for creating effective documents quickly:

- Use Pre-Designed Layouts: Start with a professional structure that includes all necessary sections, like payment details and client information.

- Fill in the Details: Customize each form with specific transaction data, such as service descriptions, pricing, and deadlines.

- Automate Where Possible: Leverage software that auto-fills repetitive fields like client name, address, or previous transaction details.

- Ensure Consistency: Stick to a consistent format for easy recognition and clarity, which is especially important for recurring transactions.

By following these steps, you can quickly create polished documents without sacrificing professionalism, helping you maintain smooth financial operations.

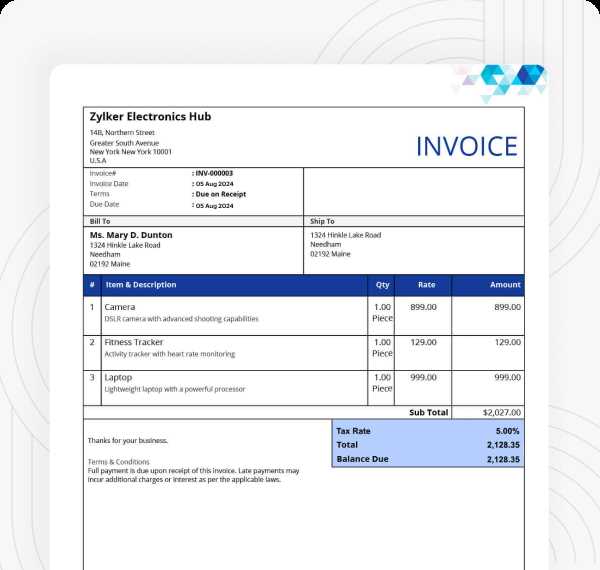

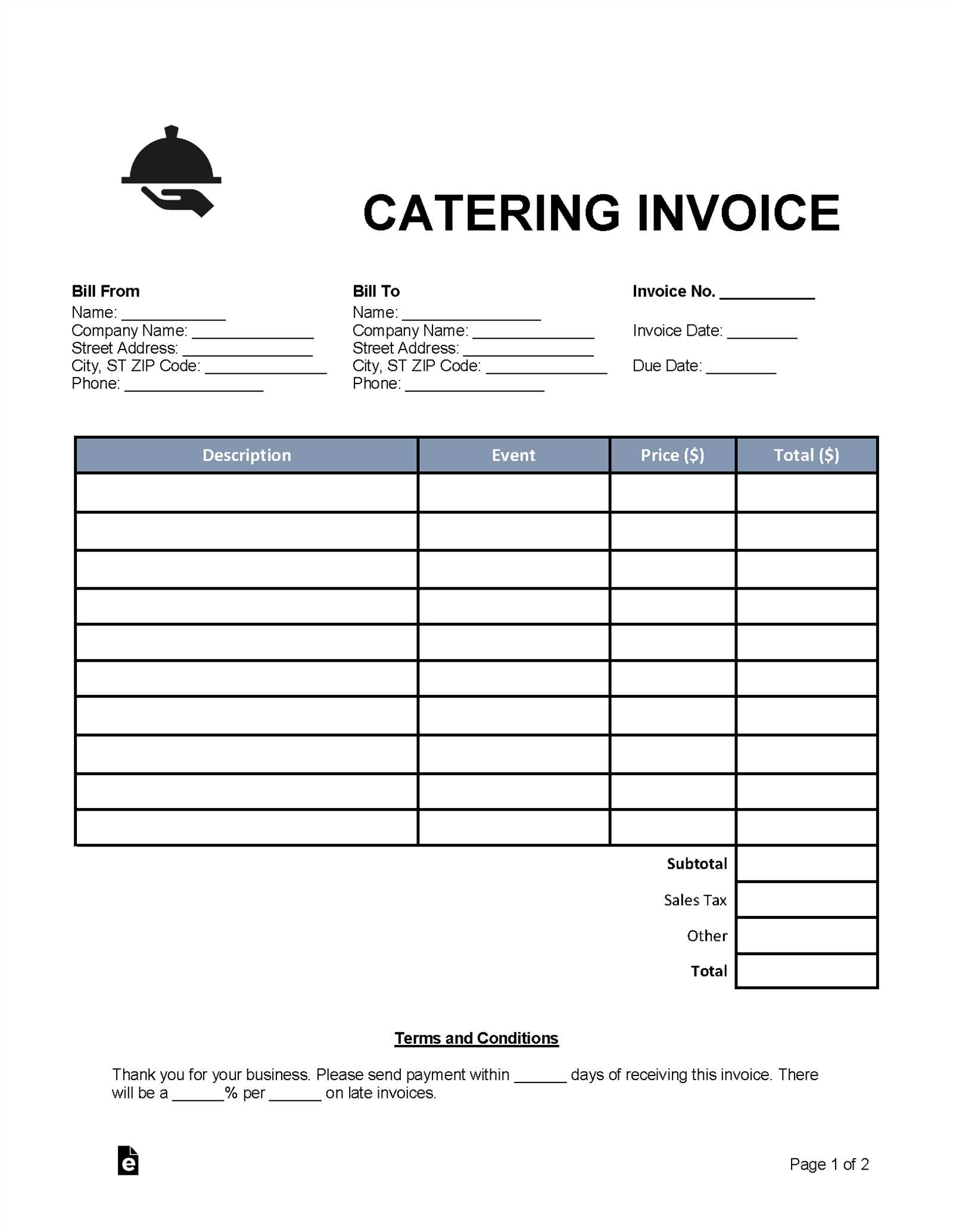

Key Components of a Billing Invoice

Creating a well-organized document for payment requests is crucial for ensuring clarity and avoiding confusion. A professional record should contain all necessary information that outlines the transaction details, terms, and payment instructions. Below are the essential components that every document should include to ensure it is complete and easy to understand.

- Sender and Recipient Information: Include the name, address, and contact details of both parties involved. This ensures the document is properly attributed and easy to reference.

- Unique Reference Number: Assign a unique identification number to each document for easy tracking and future reference.

- Description of Services or Goods: Clearly list the services or products provided, including quantities, rates, and itemized costs.

- Total Amount Due: Specify the total amount that needs to be paid, ensuring it includes all applicable taxes, fees, and discounts.

- Payment Terms: Clearly outline the due date for payment and any terms related to late fees or early payment discounts.

- Payment Methods: Provide clear instructions for how the client can make the payment, such as bank details, online payment links, or accepted credit cards.

By including these key components, you can create a clear and professional document that leaves no room for misunderstandings, streamlining the payment process for both parties.

Free Templates for Small Businesses

For small businesses, managing finances effectively is key to success. Using ready-made forms for financial records can help simplify the process, saving time and effort while maintaining a professional approach. Free resources are particularly valuable for small businesses looking to streamline their operations without additional costs.

Why Free Options Work for Small Businesses

Free forms provide a cost-effective solution for startups and small enterprises that may not have the budget for paid software. These forms can be easily customized to fit the specific needs of your business, allowing you to maintain a professional appearance while ensuring all necessary details are included. Additionally, free resources often come in various formats, such as PDF or Word, giving you flexibility in how you manage your financial records.

Where to Find Free Resources

There are many online platforms that offer free downloadable forms that cater to different types of transactions. These resources often come with clear instructions, making it easy for even new business owners to start using them right away. Be sure to check for customization options and ensure the form includes all the necessary sections relevant to your services or products.

Common Mistakes to Avoid in Invoices

Creating clear and accurate financial records is essential for smooth business operations. However, mistakes in these documents can lead to confusion, delayed payments, or even disputes. Understanding and avoiding common errors is crucial for maintaining professionalism and ensuring timely compensation for your services or products.

Missing or Incorrect Information

One of the most frequent mistakes is failing to include all the necessary details. This can include leaving out client contact information, payment terms, or service descriptions. Inaccurate details, such as incorrect pricing or missing quantities, can also cause confusion and delay the payment process. Always double-check all the fields to ensure everything is accurate and clear.

Poor Organization or Formatting

A poorly organized document can make it difficult for the recipient to understand the charges and payment terms. Failing to list items in a clear and itemized manner, or neglecting to highlight the total amount due, can lead to misunderstandings. Ensure your document is well-structured, with a clear breakdown of charges and an easily identifiable total to make it simple for your clients to process the payment.

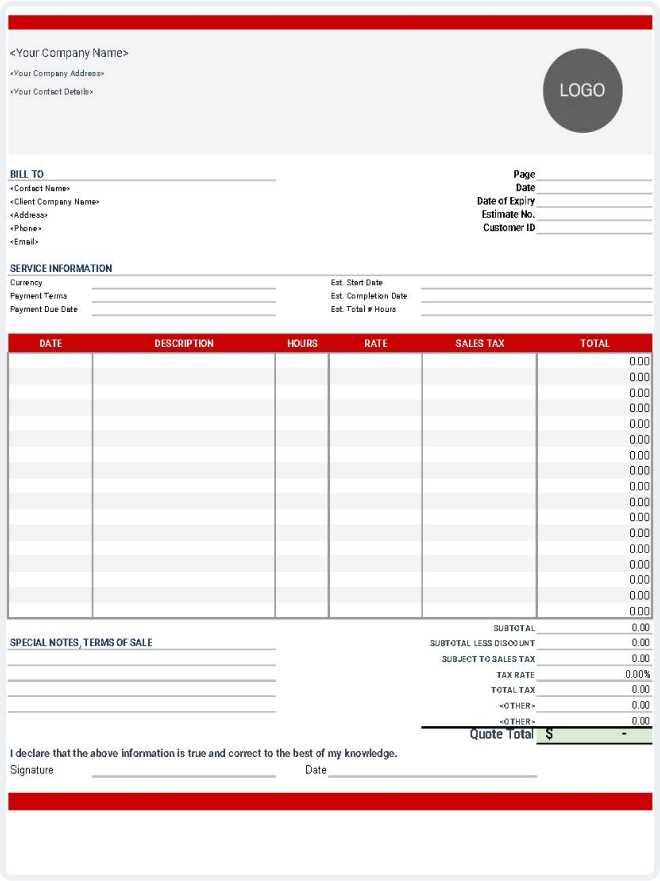

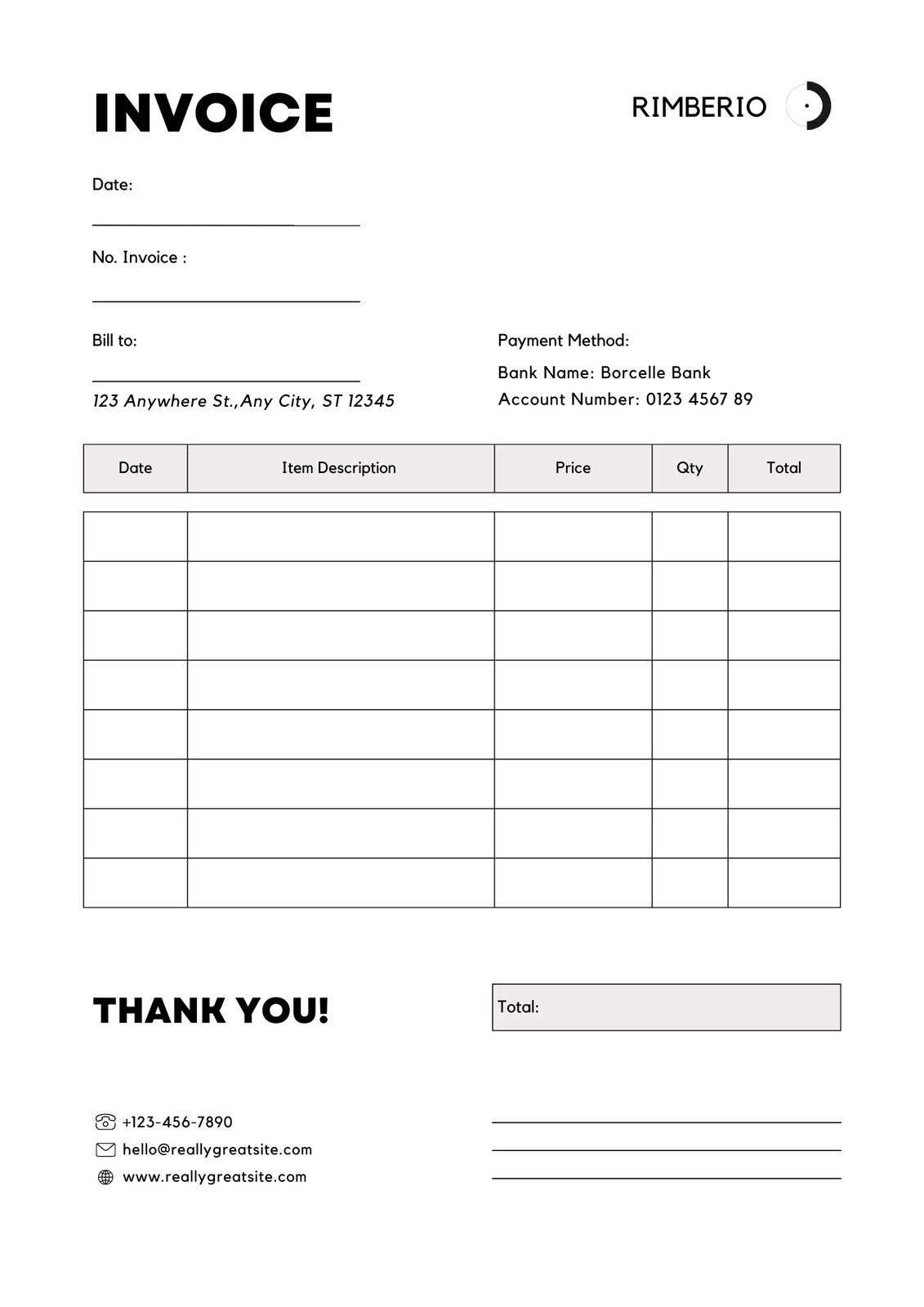

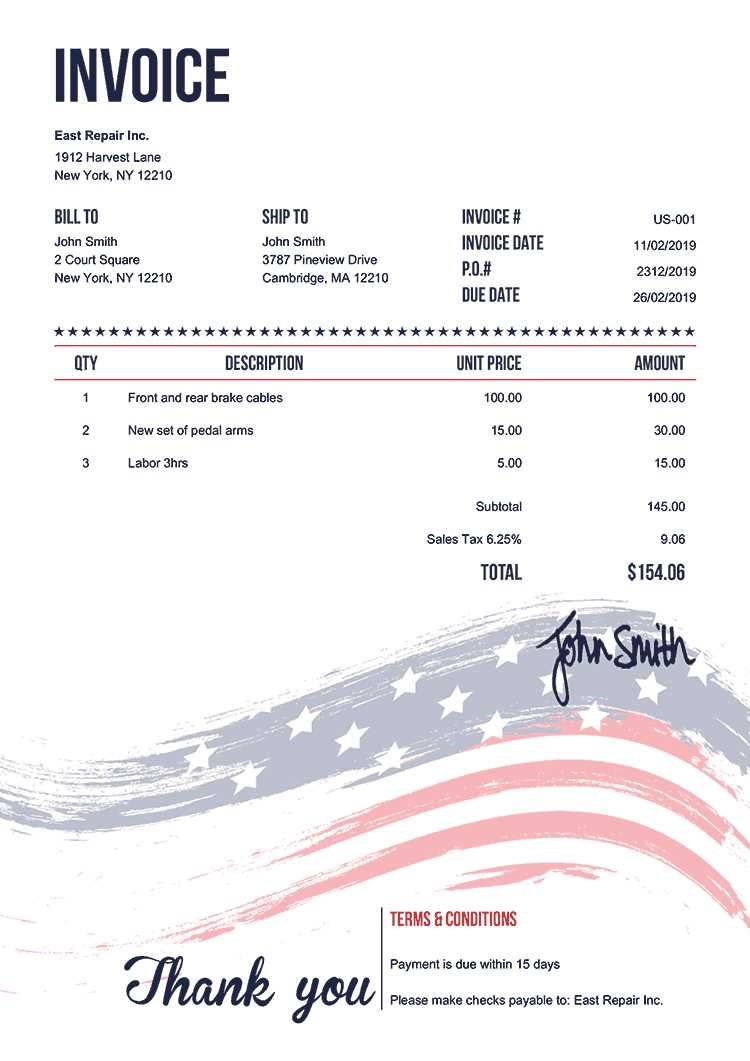

How to Design an Invoice Template

Designing a professional payment record layout involves balancing clarity, organization, and customization. A well-crafted structure ensures that all necessary details are easy to read and understand, while also reflecting your brand’s identity. Here’s a step-by-step guide to creating a functional and aesthetically pleasing document for payment requests.

- Choose a Clean Layout: Start with a simple and clear design. Avoid cluttering the document with too much information or overly complex graphics. Keep it clean to ensure all sections are easily distinguishable.

- Include Essential Sections: Make sure your design contains all the key elements, such as contact information, transaction details, and payment terms. It’s important that these sections are easy to locate.

- Use Clear Typography: Choose easy-to-read fonts and maintain consistency throughout the document. The text should be legible, with different font sizes used to differentiate headings and body content.

- Highlight Important Information: Key details like the total amount due and payment due date should stand out. Use bold or larger fonts to emphasize these areas.

- Incorporate Your Brand: Personalize the design by including your logo, color scheme, and other brand elements. This not only makes your document look professional but also helps reinforce your brand identity.

- Ensure Flexibility: Design the layout to be easily customizable, allowing you to modify it according to each specific transaction, whether for different clients or services.

By following these guidelines, you can create an organized and professional document that streamlines your payment process and improves client satisfaction.

Understanding Invoice Numbering Systems

Properly organizing financial records is essential for businesses, and one of the most important aspects of this process is the use of a unique numbering system. A well-structured numbering approach not only helps you keep track of each transaction but also ensures clarity and avoids confusion. It provides a systematic way to reference specific records and facilitates easy retrieval for future audits or client inquiries.

There are various approaches to numbering, but the key is to ensure consistency and simplicity. The system you choose should be easy to understand and scalable as your business grows. Below are some common methods for structuring your reference numbers:

- Sequential Numbering: This is the simplest and most common method, where each new record is assigned the next consecutive number. This system is easy to implement and ensures no numbers are skipped.

- Year-Based Numbering: Some businesses prefer to include the year in the reference number, such as “2024-001”, to easily identify when a transaction occurred. This can be particularly useful for organizing records by year.

- Client-Specific Numbering: In some cases, businesses may choose to include client identifiers in the reference number, such as “C001-001”. This can be useful when you work with multiple clients, making it easier to identify records related to specific customers.

By understanding and implementing a logical numbering system, you can maintain better organization and reduce the chances of errors when handling transactions.

Automating Your Invoice Process

Streamlining financial documentation is essential for improving efficiency and reducing errors. Automating the process of generating and managing payment records not only saves time but also ensures consistency and accuracy. With the right tools in place, businesses can simplify their accounting tasks and reduce the manual effort required for creating and sending transaction details.

- Use of Accounting Software: Modern accounting software offers automation features that allow you to generate payment records with minimal effort. These programs can be set to create and send documents automatically based on predefined templates and client information.

- Recurring Billing Setup: For businesses with regular clients, automation can include setting up recurring payments. Once configured, the system will automatically generate new records at specified intervals, reducing administrative workload.

- Integration with Payment Systems: Automating the payment collection process is also beneficial. By integrating your financial documentation system with online payment platforms, you can generate documents upon receiving payments and automatically update your records.

- Notifications and Reminders: Automating reminders for outstanding payments can help ensure timely collections. Many systems allow you to send automated reminders based on due dates, reducing the chances of overdue payments.

By automating the workflow, businesses can not only improve operational efficiency but also create a seamless experience for clients, ensuring timely processing and reducing the chances of errors or missed payments.

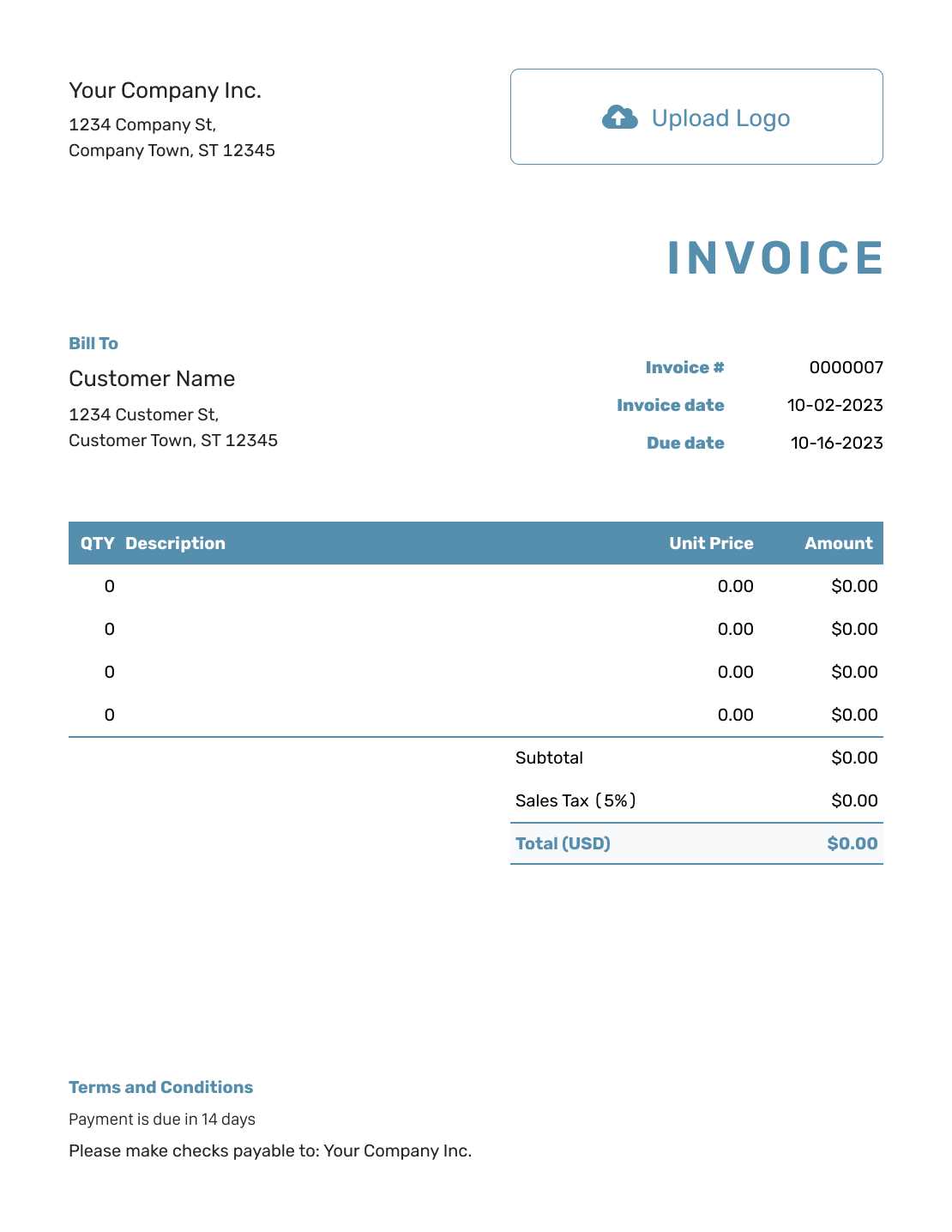

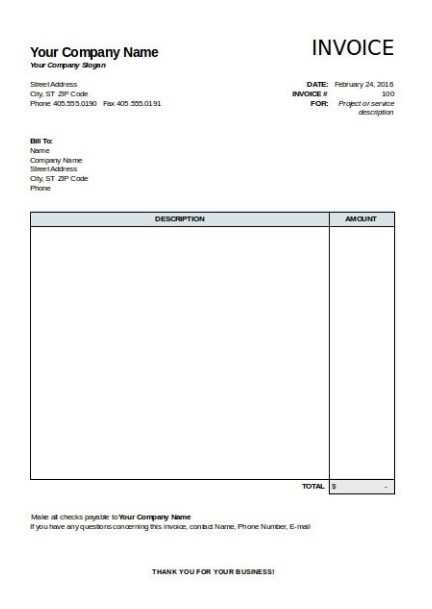

Why Choose a Blank Invoice Template

Using a simple and customizable document structure allows businesses to have complete control over the content, layout, and design of their transaction records. This approach offers flexibility, enabling you to tailor the document to suit the specific needs of your clients and business requirements. Instead of relying on fixed formats, this option allows for easy adjustments and ensures that all necessary details are included clearly and concisely.

Choosing a flexible format for your transaction records provides numerous advantages, including:

| Benefit | Description |

|---|---|

| Customization | Modify the structure to match your brand and meet client-specific needs. This customization ensures consistency across your documents. |

| Clarity | The clean format helps highlight important details like due dates, amounts, and service descriptions, reducing the chances of confusion or mistakes. |

| Time-Saving | Once you have a basic structure set up, creating new records becomes faster and more efficient, especially with reusable fields and pre-set sections. |

| Scalability | As your business grows, you can easily adjust the design and content to accommodate additional services, clients, or changes in your financial processes. |

By choosing a customizable layout, you can create professional, clear, and adaptable records that fit seamlessly into your business’s workflow.

Tracking Payments with Invoice Templates

Effectively managing payments is crucial for maintaining smooth financial operations in any business. Using a well-structured document format allows you to track incoming payments, monitor outstanding amounts, and ensure that all transactions are accounted for. These records serve as a clear reference to ensure that no payments are overlooked and that clients receive accurate and up-to-date billing details.

Key Features for Payment Tracking

- Payment Status Tracking: Including fields for the payment status (e.g., paid, pending, overdue) helps quickly identify which transactions are completed and which need follow-up.

- Due Dates: Displaying due dates clearly on the document helps both you and your clients stay on top of payment deadlines, reducing the likelihood of missed payments.

- Payment Method Details: Including information about how payments were made (e.g., bank transfer, credit card, etc.) provides transparency and simplifies reconciliation.

- Itemized Charges: Breaking down services or products into individual charges ensures that both parties are clear about what is being paid for and helps avoid misunderstandings.

Benefits of Tracking Payments Efficiently

- Improved Cash Flow Management: By keeping track of all payments and due dates, businesses can better manage their cash flow, ensuring timely operations and financial stability.

- Reduced Administrative Errors: Tracking payments using an organized system reduces the chances of human error when managing finances, ensuring that all transactions are properly recorded.

- Streamlined Client Communication: When payment records are clear and well-documented, it becomes easier to communicate with clients regarding any discrepancies or outstanding balances.

By using a structured format to track payments, businesses can enhance their financial processes, ensure accurate record-keeping, and maintain strong client relationships.

Incorporating Your Brand into Invoices

Incorporating your company’s identity into essential financial documents not only creates a professional appearance but also helps reinforce your brand’s presence with every transaction. Customizing these records with your logo, color scheme, and unique design elements transforms a simple document into an extension of your business’s image and values.

Why Branding Matters

Including your brand elements on financial statements can have a significant impact on your company’s credibility and recognition. By presenting a cohesive and branded look, you ensure that clients associate your services with a polished and consistent image.

How to Integrate Your Brand

- Logo Placement: Position your company logo at the top of the document where it’s immediately visible, ensuring clients can easily identify your business.

- Color Scheme: Use your brand’s primary colors for headings, borders, or accents to make the document feel aligned with your overall aesthetic.

- Font Style: Choose fonts that reflect your company’s personality, whether it’s modern, professional, or friendly, and use them consistently across all financial documents.

- Custom Design Elements: Include branded icons, symbols, or watermarks that subtly reflect your company’s theme without overwhelming the main content.

Customizing financial documents is an easy and effective way to reinforce your brand identity while maintaining a professional and trustworthy image in all client interactions.

Legal Considerations for Invoices

When creating essential financial documents for your business, it’s crucial to ensure that all necessary legal elements are included. These documents not only serve as records of transactions but also play a role in protecting both parties in case of disputes. Adhering to the legal requirements is vital for maintaining compliance and avoiding potential legal issues.

Key Legal Elements to Include

- Payment Terms: Clearly outline the payment due dates, late fees, and any interest charges that may apply to overdue amounts.

- Tax Information: Ensure that any relevant tax information is correctly stated, including the applicable tax rate and your business’s tax identification number.

- Business Information: Include the full name of your business, your contact details, and any required registration numbers or business licenses.

- Client Details: Make sure the recipient’s full name or company name, along with their contact information, is properly listed.

- Description of Services or Products: Provide a clear breakdown of the services rendered or goods sold to ensure transparency and avoid misunderstandings.

Importance of Legal Compliance

Failing to include all legally required details can result in disputes, fines, or a lack of enforceability in the case of non-payment. Additionally, some jurisdictions may have specific rules regarding the format or content of financial documents. Ensuring compliance with local and international laws will safeguard your business and foster trust with your clients.

How to Send an Invoice Effectively

Sending financial documents promptly and professionally is a crucial step in ensuring timely payments and maintaining strong client relationships. The method you choose for delivery, along with the clarity and professionalism of your document, can significantly impact how quickly your payment is processed. It’s important to follow best practices when distributing these documents to avoid delays and ensure that your clients understand their obligations.

Firstly, always ensure that the document contains all necessary details–such as the amount due, due date, and services rendered–to avoid confusion or disputes. Send the document via reliable and professional channels, such as email or through a secure client portal. For email, attaching the document as a PDF ensures that it is both easy to access and retains its formatting. Additionally, using a clear subject line with the document’s purpose (e.g., “Payment Request for [Service/Product]”) can make it easier for the recipient to identify and prioritize your request.

Follow up appropriately if the payment is not received on time. A friendly reminder email or call is often enough to prompt payment, but make sure to stay polite and professional to maintain a positive relationship with your clients. Setting up automated reminders through an invoicing system can also help streamline this process and reduce manual effort. By establishing clear expectations and maintaining professionalism in your communication, you increase the likelihood of prompt and efficient payment.

Enhancing Client Communication with Invoices

Effective communication with clients is essential for maintaining strong business relationships and ensuring that both parties are on the same page regarding expectations and payments. Financial documents not only serve as a request for payment but also as a means to convey professionalism, transparency, and clarity. By crafting well-designed documents and delivering them appropriately, you can foster trust and keep your communication clear and efficient.

Here are some ways to improve communication through these documents:

- Clarity of Information: Include clear and concise details, such as the amount due, payment terms, and due date. Avoid ambiguity to prevent confusion and reduce the chances of disputes.

- Consistency: Ensure that your documents maintain consistent formatting and language, making them easy for clients to understand and reference when necessary.

- Personalized Touch: Consider including personalized notes, such as a brief message thanking your clients for their business. This shows that you value their partnership.

- Timeliness: Send documents promptly and keep clients informed of upcoming due dates. Late or overlooked requests for payment can lead to misunderstandings and delay the payment process.

By using these strategies, you can improve the overall client experience and strengthen your relationships. Transparent and well-crafted financial documents reflect your professionalism and commitment to providing excellent service, leading to more positive interactions and timely payments.