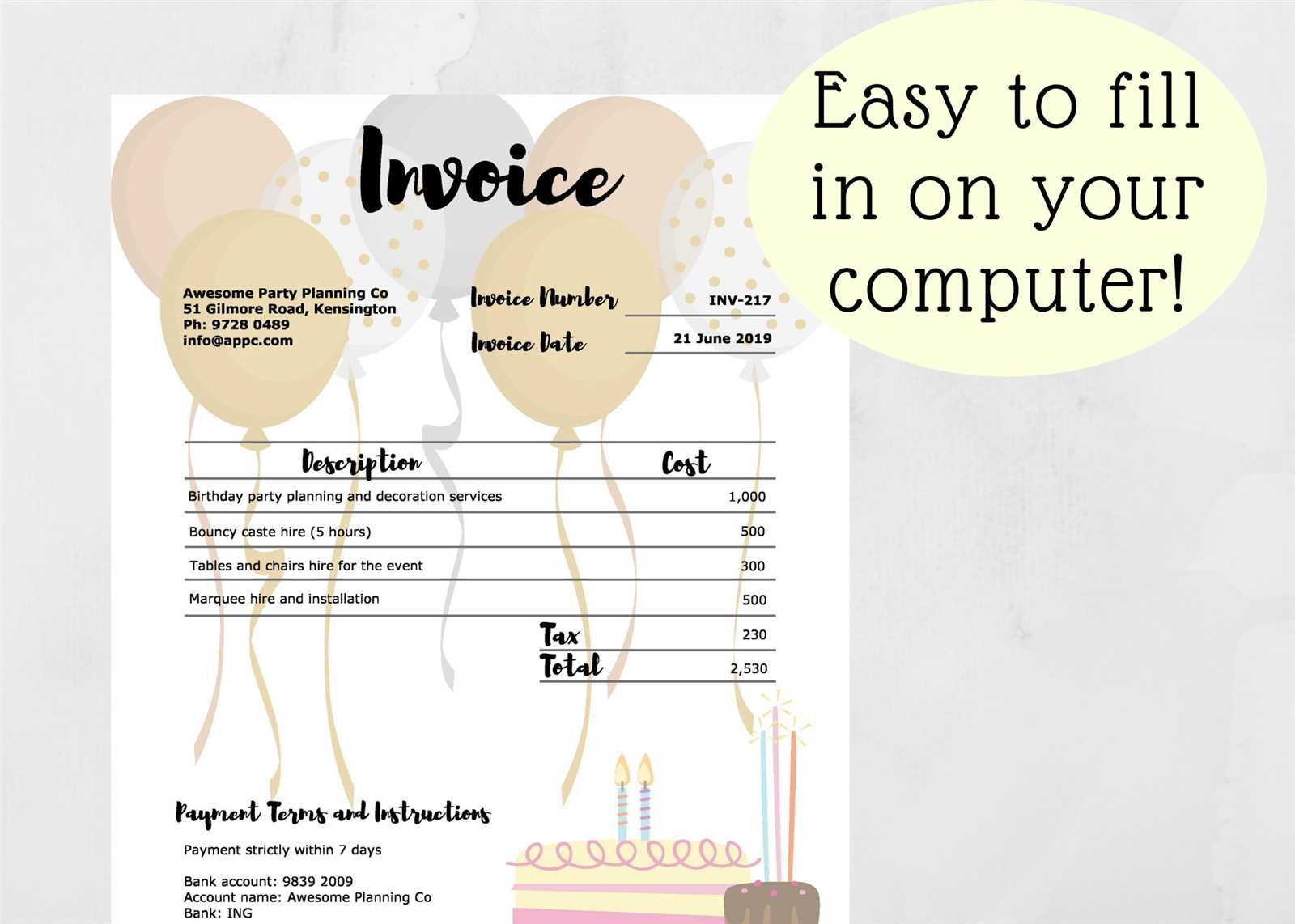

Free Birthday Party Invoice Template for Easy Event Billing

When hosting an event or providing services for a celebration, it’s crucial to have a clear and professional way to handle financial transactions. A well-structured document helps ensure both you and your clients are on the same page, avoiding confusion and misunderstandings. This essential tool not only outlines the agreed-upon costs but also provides a transparent breakdown of services rendered.

By using a pre-designed structure, you can simplify the billing process and maintain consistency across all your events. Customizable and easy to use, this solution allows for flexibility while ensuring that all key details are captured, from service descriptions to payment terms. Whether you’re managing a small gathering or a larger scale event, having a proper document is essential for smooth financial management.

Streamlining your billing process ensures that you stay organized, professional, and efficient, leaving more time to focus on the creative aspects of your work. With just a few adjustments, you can tailor your billing document to reflect your unique business needs, providing clients with an experience that is both hassle-free and clear.

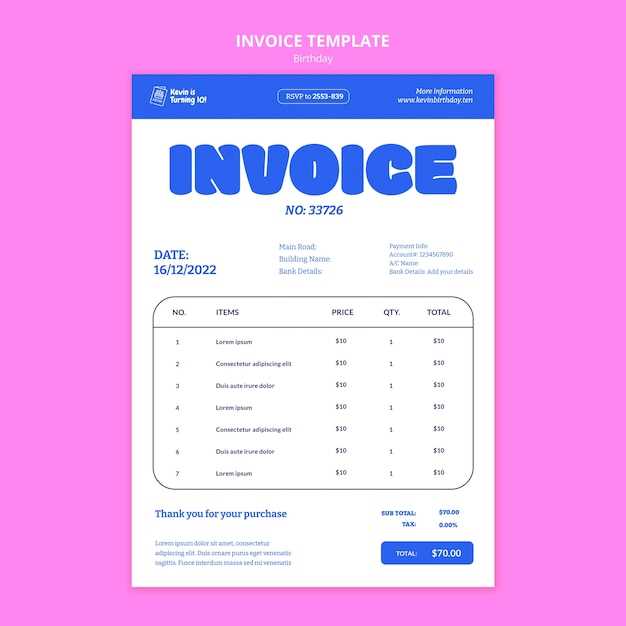

Event Billing Document Overview

For any event organizer, providing clients with a structured and professional record of services and costs is essential. Such a document ensures transparency and helps maintain a smooth financial process between the service provider and the client. With clear pricing, descriptions, and payment terms, this tool offers both parties a reliable reference for the event’s financial aspects.

The document should be simple yet detailed enough to include all necessary information, such as a list of services, the total amount due, and payment deadlines. It serves as both a summary and a formal request for payment, ensuring that both the event provider and client have a mutual understanding of the agreed-upon terms.

Key Elements of a Well-Structured Document

Customization is one of the most important aspects when creating a billing document. It should reflect your specific services, pricing structure, and business style. A well-designed record should include fields for personal details, service breakdowns, payment instructions, and any other relevant terms to ensure clarity.

Why It’s Important to Use a Professional Format

Using a standardized format can save time and reduce the chances of errors. When you use a professionally crafted document, it not only adds credibility but also helps you maintain consistency across multiple events. Clients appreciate clarity and having a document that looks professional can contribute to better communication and stronger relationships.

Why Use an Event Billing Document

Having a pre-designed structure for managing financial transactions in event planning simplifies the process and ensures consistency. With a reliable format, you can avoid mistakes, save time, and present a professional image to clients. Using a standardized format provides clarity, accuracy, and helps in keeping your records organized, which is essential for both the service provider and the client.

Benefits of Using a Structured Format

- Time-Saving: A ready-made document saves you the effort of creating a new one from scratch for every event.

- Consistency: Consistent documentation across all events helps build a trustworthy reputation with your clients.

- Professionalism: A clean and polished layout reflects well on your business and instills confidence in your clients.

- Easy Customization: You can easily adjust fields and details to match the specifics of each event.

- Accuracy: Predefined sections ensure all necessary details are included, reducing the risk of omitting important information.

How It Helps You Stay Organized

By using a pre-structured form, you can easily track payments, monitor due dates, and manage finances across multiple events. The structure allows you to quickly reference previous transactions and keep a clear record of your earnings. This streamlined approach ensures that you never miss a payment or important detail, keeping your operations efficient and professional.

Key Features of an Event Billing Document

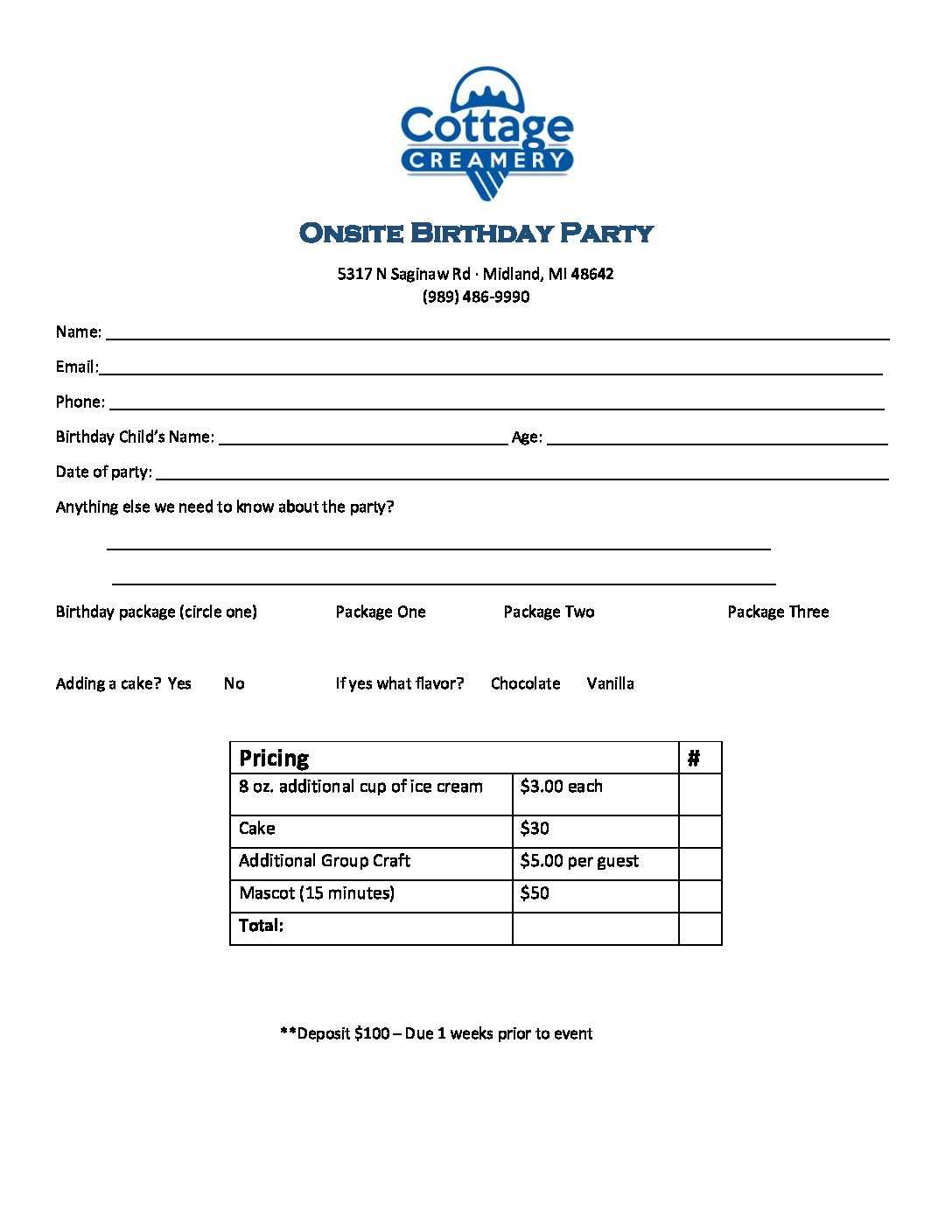

When preparing a document for services rendered at any celebration, it is essential to include specific elements that ensure clarity, accuracy, and professionalism. A well-organized document outlines all necessary details, making it easy for both the service provider and client to understand the financial aspects of the event. By including the right information, you can help prevent misunderstandings and ensure smooth transactions.

Essential Elements to Include

- Client Information: Clearly state the client’s name, contact details, and event specifics to avoid confusion.

- Service Breakdown: List all services provided, including descriptions and corresponding prices, to ensure transparency.

- Total Amount Due: Provide a clear and accurate total to be paid, reflecting any applicable taxes, fees, or discounts.

- Payment Terms: Specify the due date, payment methods, and any late fees for overdue payments.

- Unique Reference Number: Assign a unique code or number to each document for easy tracking and reference.

Why These Features Matter

Each of these key elements plays a critical role in maintaining a professional and efficient billing process. The service breakdown helps clients understand exactly what they are paying for, while clear payment terms set expectations for both parties. Additionally, including a reference number ensures easy organization and quick access to records, should any issues arise in the future.

How to Customize Your Document

Tailoring your billing document to reflect your unique business needs is essential for providing a personalized experience for your clients. Customization allows you to adjust various sections of the document to fit the specifics of each event, ensuring that all relevant information is clearly presented. This approach not only enhances professionalism but also improves the overall efficiency of your billing process.

There are several key elements you can modify to make the document align with your services and branding. Here are some of the most important aspects to consider when customizing your financial document:

| Section | Customization Options |

|---|---|

| Client Information | Include the client’s name, address, and contact details to personalize the document. |

| Service Details | Adjust the descriptions and pricing to match the specific services offered for each event. |

| Payment Terms | Modify payment methods, due dates, and late fees according to your business policies. |

| Logo and Branding | Add your company logo, colors, and fonts to maintain brand consistency. |

| Notes Section | Include any additional information, such as special terms or client requests, to personalize the document further. |

By customizing these key sections, you ensure that each billing document is both relevant and professional. This level of detail also demonstrates your attention to customer needs, helping to build trust and improve client satisfaction.

Benefits of Professional Billing Documents

Using a polished and well-structured billing document offers numerous advantages for both the service provider and the client. A professionally designed document helps establish credibility, ensures accuracy, and promotes clear communication. By presenting your financial statements in an organized and standardized format, you create a more efficient process for tracking payments and maintaining business relationships.

Credibility and Trust are two significant benefits of using a professionally formatted document. When clients receive a clean, clear, and well-organized record, they are more likely to trust you and feel confident in your services. A well-crafted document reflects positively on your business, giving the impression of competence and reliability.

Accuracy is crucial in any financial transaction. A detailed, professionally designed document ensures that all aspects of the service, payment terms, and totals are correctly represented, reducing the risk of errors or misunderstandings. By providing clear breakdowns of costs, both you and your client are fully aligned on the agreed terms.

Moreover, organization is another key advantage. With a proper system in place for managing financial records, you can easily track payments, monitor overdue amounts, and maintain accurate accounting for your business. A professional billing system allows you to stay on top of your finances and ensures that you never miss a detail.

Essential Details to Include in a Billing Document

For any financial record related to event services, it is crucial to include specific details that ensure both the client and provider are on the same page regarding the terms and payment expectations. These elements help avoid confusion and make the transaction transparent. Whether you are providing a list of services or specifying payment terms, a comprehensive document should cover all key aspects of the service provided.

Here are the essential details that should be included in your billing record to ensure accuracy and clarity:

| Detail | Description |

|---|---|

| Client Information | Include the client’s name, address, phone number, and email to ensure the document is properly personalized. |

| Service Breakdown | List each service or product provided, along with a brief description and corresponding price for transparency. |

| Payment Terms | Specify payment methods (credit card, bank transfer, etc.), the due date, and any late fees or penalties for overdue payments. |

| Total Amount | Provide a clear summary of the total amount due, including taxes, discounts, or any additional charges. |

| Unique Reference Number | Assign a reference number for tracking and organizational purposes, especially for larger businesses or repeat clients. |

By including these details, you ensure the billing document is comprehensive, professional, and easy to understand. These elements not only facilitate smooth financial transactions but also help maintain transparency and trust between you and your clients.

Free vs Paid Billing Documents

When choosing a document structure for tracking event-related services and payments, you may encounter both free and paid options. Each comes with its own set of advantages and limitations, and the right choice for you depends on your specific needs, budget, and the level of customization you require. While free formats can be a great starting point, paid options often provide additional features and flexibility that might better suit more complex requirements.

Advantages of Free Options

Free structures are often accessible and easy to use, offering a simple solution for individuals or small businesses just starting out. They can be quickly downloaded, and most basic designs allow for basic customization. Free formats are generally suitable for straightforward events with minimal complexity.

Benefits of Paid Solutions

Paid options provide enhanced functionality, offering additional features like better customization, integrated payment systems, and the ability to handle multiple clients or recurring billing. These formats are designed with businesses in mind, providing a higher level of professionalism and efficiency in managing financial records.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic fields for editing | Highly customizable, with branding and flexible layouts |

| Ease of Use | Simple and straightforward, good for beginners | More complex but with advanced features for experienced users |

| Support | Limited or no support | Access to customer support and troubleshooting assistance |

| Features | Basic templates with few features | Includes automatic calculations, payment tracking, and recurring billing |

| Integration | Minimal integration with other tools | Seamless integration with accounting and payment systems |

Ultimately, whether you choose a free or paid document depends on the scale and complexity of your event management process. For simple occasions, a free option may be sufficient, but as your business grows or if you require more advanced features, investing in a paid option can save you time and improve the overall professionalism of your operations.

Best Tools for Creating Billing Documents

Choosing the right tool for creating financial records is essential for streamlining your process and maintaining professionalism. Several software solutions are available that can help you generate, manage, and track your billing documents with ease. Whether you prefer simple, free tools or need advanced features for more complex transactions, there are options to suit every need.

Top Tools for Creating Billing Records

- Wave – A free, user-friendly platform that offers invoicing, accounting, and receipt scanning features, perfect for small businesses.

- FreshBooks – A popular choice for entrepreneurs, offering easy-to-use templates and automatic payment tracking.

- Zoho Invoice – A highly customizable tool that allows for personalized templates and integrated payment options, ideal for growing businesses.

- QuickBooks – Well-known accounting software that includes advanced billing featu

Common Mistakes in Event Billing Documents

While creating a financial document for services rendered, there are several common pitfalls that can lead to confusion or errors. Small mistakes, such as missing information or incorrect calculations, can cause unnecessary delays and create misunderstandings with clients. Being aware of these potential issues and avoiding them can help maintain professionalism and ensure smooth transactions.

One of the most frequent mistakes is failing to include all necessary details. Missing key information, such as the client’s contact details, specific services provided, or payment terms, can make the document unclear and lead to confusion. Always ensure that all relevant fields are filled out accurately.

Another common issue is incorrect pricing or calculations. Double-checking the service fees, taxes, discounts, and total amounts is crucial. Even a small mistake in the math can lead to discrepancies, affecting both your client and your business. Accuracy is essential to maintain trust and avoid payment disputes.

- Omitting Payment Terms: Not specifying payment methods, deadlines, or late fees can cause delays in receiving payments.

- Unclear Descriptions: Vague descriptions of services or products can leave clients unsure about what they are being charged for.

- Failure to Include a Reference Number: Without a unique reference or document number, it can become difficult to track the billing record or refer to it later.

- Incorrect Formatting: A cluttered or difficult-to-read layout can create confusion and look unprofessional, making it harder for clients to understand the charges.

By avoiding these common mistakes, you can ensure that your financial documents are accurate, clear, and professional, leading to better relationships with your clients and smoother business operations.

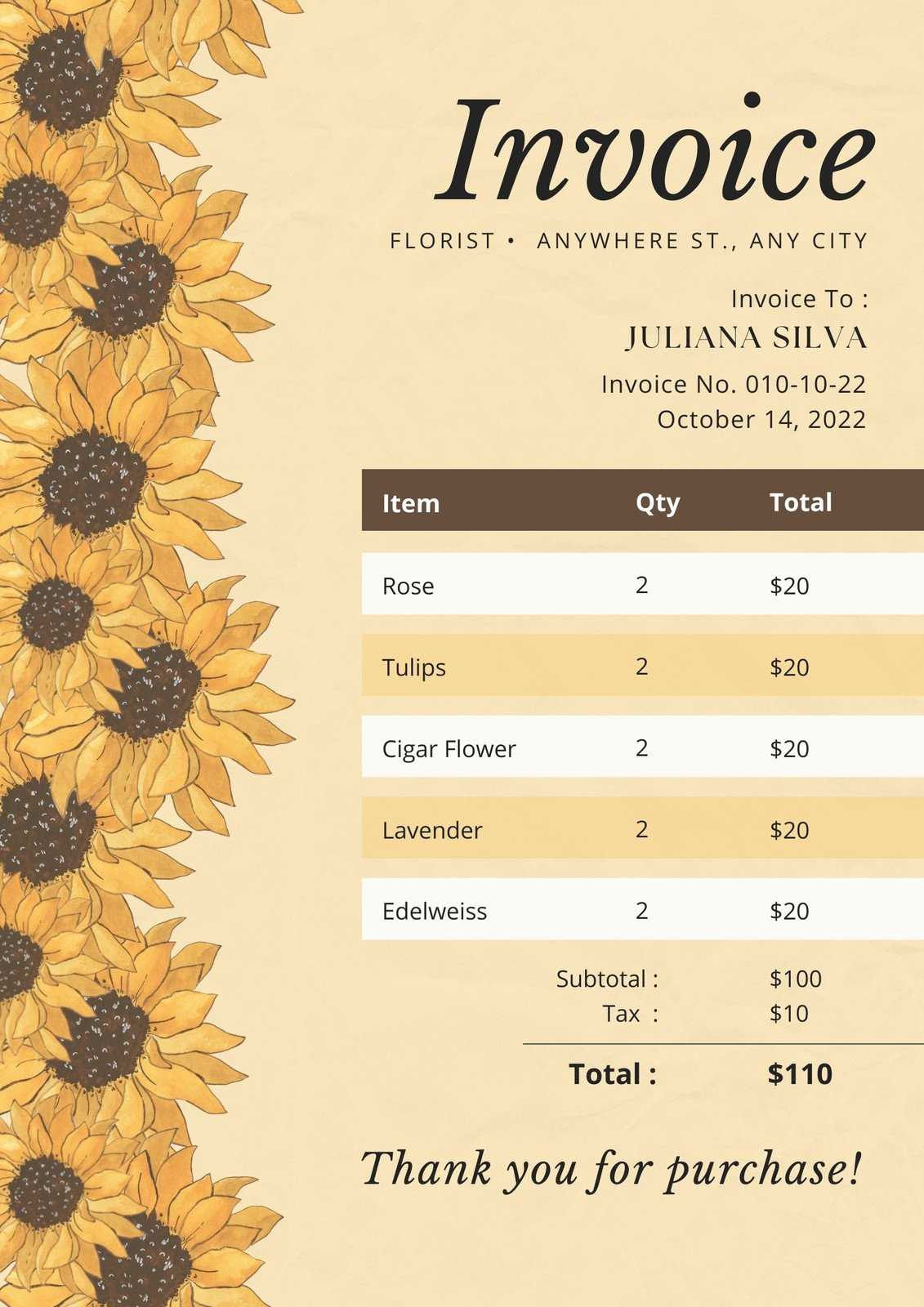

How to Add Discounts and Taxes

When preparing a financial record for services rendered, it is important to account for any applicable discounts or taxes that may affect the final amount due. These adjustments help ensure that the document reflects the accurate total and complies with any legal or business requirements. Properly adding discounts and taxes can also enhance transparency and improve the client’s understanding of the charges.

Adding discounts is straightforward but requires careful attention to detail. A discount can be applied as a fixed amount or as a percentage of the total. When specifying a discount, make sure to clearly label it and include a brief description of the reason (e.g., promotional offer or loyalty reward). This ensures that the client knows exactly how the discount is being applied and what it represents.

Incorporating taxes involves calculating the applicable tax rate and adding it to the total. Be sure to check local tax laws to determine the correct percentage, as it may vary depending on your location or type of service. You can add taxes as a separate line item, clearly labeled, so clients can easily identify the tax amount.

- For Discounts: Include the discount amount and state whether it’s a fixed sum or percentage. Example: “10% discount for early booking” or “$20 off for returning customers.”

- For Taxes: Clearly display the tax rate and apply it to the subtotal. Example: “Sales tax (8%) on services rendered: $X.”

- Final Total: After applying any discounts and taxes, ensure that the final amount is clearly indicated, showing how it was calculated from the original price.

Transparency is key when applying discounts and taxes. Including a breakdown of these adjustments helps build trust and ensures that there are no surprises when the client reviews the final amount. Accurate documentation also keeps your business compliant with tax regulations and fosters positive relationships with your clients.

Choosing the Right Format for Your Billing Document

When creating a financial record for services provided, selecting the correct format is crucial to ensure that all necessary details are clearly presented. The format you choose can affect the document’s readability, ease of use, and professionalism. Whether you prefer a simple, straightforward approach or require something more detailed with advanced features, your choice of format should align with your business needs and client expectations.

Types of Formats to Consider

- Basic Text Formats: Simple documents created in word processors or spreadsheets. These are easy to use and customizable but may lack design elements that enhance professionalism.

- PDF Documents: A popular choice for formal records, as they maintain their format across different devices. PDF files are easy to share, print, and store.

- Cloud-Based Tools: Online platforms that allow you to create and store your records digitally. These tools often offer features like automatic calculations, templates, and easy sharing options.

- Accounting Software: Specialized software that integrates billing with other business functions, such as inventory management or payroll. These tools are suitable for businesses with more complex needs.

Factors to Consider When Choosing the Right Format

- Ease of Use: Choose a format that suits your technical abilities and is simple to update or modify as needed.

- Customization Options: Consider whether the format allows you to add branding elements, such as your logo, company colors, or personalized fields.

- Legal Compliance: Ensure that the format you choose meets any industry or local legal requirements for record-keeping and tax purposes.

- Access and Sharing: Think about how you intend to share the document with clients. Some formats may be easier to email, print, or upload to a client portal.

Choosing the right format not only makes your billing process more efficient but also contributes to creating a professional image for your business. Consider your specific needs and client preferences to find the most suitable solution.

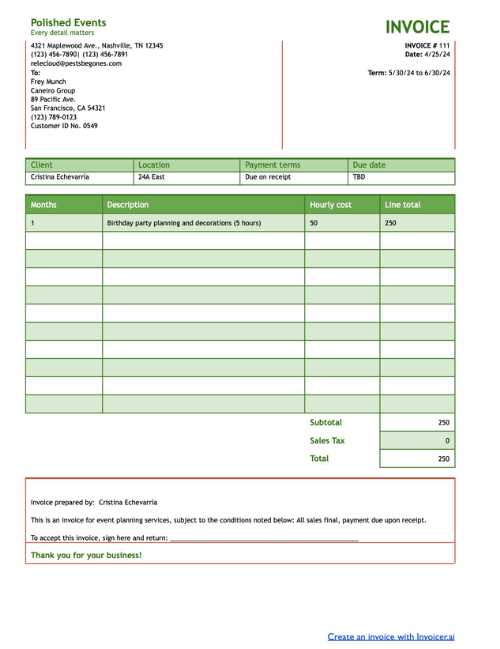

Invoice Document for Event Planners

For event planners, having a professional and well-organized document to track services provided and payments due is essential. This document serves as a formal record of the services rendered, the total cost, payment terms, and any other relevant details that ensure clarity for both the client and the provider. A well-structured billing document can help event planners manage their finances effectively while maintaining a high level of professionalism.

Key Sections of an Event Planner Billing Document

An effective billing document for event planners should contain several important elements to ensure accuracy and transparency. Below are the essential sections that should be included:

Section Description Client Information Include the client’s name, contact information, and event details to personalize the document. Service Breakdown Provide a detailed list of all services provided (e.g., event coordination, decoration, catering), along with their corresponding prices. Payment Terms Specify payment methods, deadlines, and any late fees for overdue payments. Discounts and Taxes Include any applicable discounts or taxes, and clearly explain how they affect the total amount. Total Amount Due Provide a clear, final amount owed, including a breakdown of services, taxes, discounts, and any additional fees. Why a Professional Billing Document Matters for Event Planners

Using a professional document not only helps in maintaining organization but also enhances client trust. A detailed and transparent billing record ensures that both the event planner and the client are aligned on the cost and payment expectations. This can help avoid any misunderstandings or disputes and provide a clear reference for both parties.

Additionally, such documents are crucial for keeping accurate records for accounting purposes, making tax season much easier, and improving cash flow management. By using a professional, customized billing document, event planners can streamline their financial processes and focus more on creating memorable experiences for their clients.

How to Track Payments Effectively

Effectively tracking payments is essential for managing cash flow, staying organized, and maintaining positive relationships with clients. Whether you’re managing a small business or handling individual transactions, a systematic approach to recording and following up on payments ensures that you are paid on time and avoid disputes. Tracking payments accurately also helps you assess the financial health of your business and plan for future growth.

Key Strategies for Tracking Payments

To track payments efficiently, you should consider using a structured system that allows you to easily monitor all transactions. Below are some important strategies for keeping track of payments:

Strategy Description Use a Payment Management System Implementing a digital system or software helps automate tracking and provides real-time updates on the status of payments. Many tools can link directly with your accounting software. Create Clear Payment Terms Ensure clients are aware of when payments are due, accepted payment methods, and any late fees. This clarity can reduce the chance of missed or delayed payments. Maintain Detailed Records Keep thorough records of all transactions, including the amount, date, and method of payment. This allows you to quickly reference past transactions and stay organized. Send Payment Reminders Set up automated reminders or manually follow up with clients before and after payment deadlines to ensure timely payments. Track Partial Payments For clients making partial payments, keep a clear record of the amount paid, remaining balance, and due dates for any further payments. Benefits of Effective Payment Tracking

By implementing these strategies, you can enjoy a variety of benefits that will improve the overall financial health of your business:

- Improved Cash Flow: Timely payments ensure that you have enough funds available to cover expenses and reinvest in your business.

- Better Financial Planning: Accurate paymen

Simple Tips for Clear Billing Documents

Clear and straightforward billing documents are essential for smooth transactions and ensuring both you and your clients are on the same page. A well-organized record reduces confusion, avoids payment delays, and enhances your professionalism. Below are some simple tips that can help you create transparent and easy-to-understand billing records for your services.

1. Use a Clean, Organized Layout: A cluttered or difficult-to-read document can confuse clients and lead to misunderstandings. Make sure to organize the document into sections (such as service details, payment terms, and total amount due) with clear headings for easy navigation.

2. Include All Necessary Details: Ensure you include essential information such as the client’s name, the specific services provided, dates, and payment terms. This transparency helps clients understand what they are paying for and when payment is expected.

3. Clearly List Prices and Fees: Avoid ambiguity by listing prices for each service separately. If applicable, break down taxes, discounts, or additional fees so that the total amount is easily understandable. Always double-check for any discrepancies.

4. Use Consistent Terminology: Be consistent with the terms you use throughout the document. For instance, if you refer to the “total amount due,” avoid switching to terms like “balance” or “final payment” unless necessary. This consistency prevents confusion and ensures clarity.

5. Provide a Clear Payment Due Date: Specify the exact date when payment is due and any penalties for late payments. This helps set expectations and avoid delays in receiving funds.

6. Include Contact Information: Always provide a way for clients to reach you in case they have questions or concerns about the document. This could include your email, phone number, or business address.

By following these simple guidelines, you can create billing documents that are easy to understand, professional, and effective in ensuring prompt payment.

How to Send Billing Documents to Clients

Sending clear and professional billing documents to clients is an important part of maintaining smooth business operations. The method you use to send these records can impact the client’s experience, affect the speed of payment, and contribute to your overall professionalism. It’s essential to choose a method that’s both efficient and convenient for both you and the client.

1. Use Email for Quick Delivery: One of the most common and efficient ways to send billing records is via email. This allows you to deliver the document instantly and ensures that the client has a record of the transaction. When sending by email, attach the billing document as a PDF to preserve formatting and make it easy for the client to open and print.

2. Include a Personal Message: When emailing, it’s important to include a short, polite message with the attachment. A simple note thanking the client for their business and reminding them of the payment terms can help keep the relationship positive and professional.

3. Utilize Online Payment Platforms: Many online tools and platforms offer the ability to create and send billing records directly to clients, often with the option for clients to pay instantly. This method can streamline the process, reduce errors, and make the payment experience smoother for both parties.

4. Consider Traditional Mail: If you are dealing with clients who prefer hard copies or who do not have reliable access to email, sending a physical copy of the billing document by postal mail is an option. Ensure that the document is well-organized and that you include a return envelope if applicable.

5. Use Client Portals: For businesses that manage multiple clients, a client portal can be an excellent way to send and track billing documents. These portals often allow for secure, organized document delivery, making it easier for both you and the client to manage invoices and payments over time.

6. Follow Up with Reminders: After sending the billing document, if the payment isn’t made by the due date, it’s important to send a gentle reminder. This can be done through a follow-up email or phone call. Keep your tone polite and professional to maintain a positive client relationship.

By carefully selecting the right method for sending your billing documents and keeping communication clear, you make it easier for your clients to make payments on time while also showc

Legal Requirements for Event Billing Records

When creating billing records for services rendered, it is essential to ensure that they meet the legal requirements set forth by local and national regulations. A legally compliant billing document not only helps avoid disputes but also ensures that both the service provider and client are protected. These documents must include certain details to be considered valid and enforceable in the event of a tax audit, payment dispute, or legal inquiry.

Essential Legal Elements in Billing Records

The following key components are typically required to make your financial documents legally compliant:

- Accurate Identification: The document must clearly state the names and addresses of both the service provider and the client. This ensures that the correct parties are identified in any future legal processes.

- Unique Identification Number: Each billing document should have a unique reference number or invoice number. This helps track and organize transactions, especially in case of an audit.

- Itemized List of Services: A clear breakdown of the services provided, including dates and prices, is crucial. This transparency helps avoid misunderstandings about what was delivered and what the client is being charged for.

- Taxes and Fees: Depending on the jurisdiction, certain taxes or regulatory fees may apply. Ensure that these are clearly stated and itemized, including the applicable tax rates.

- Payment Terms: Clear terms for payment deadlines, late fees, and any other conditions related to payment should be included. These terms are vital to protecting your business from payment delays or non-payment.

Additional Considerations for Compliance

- Legal Jurisdiction: Include information about the jurisdiction under which the agreement falls. This is important in case of disputes over payment or contract enforcement.

- Payment Methods: Clearly list accepted payment methods (e.g., bank transfer, credit card, check) to avoid confusion or payment delays.

- Client Approval: In some cases, a signature or client approval may be required to confirm agreement with the services and terms outlined in the document.

It is always a good idea to consult with a legal professional or accountant to ensure that your billing documents meet the specific legal requirements for your industry and location. By keeping your records compliant, you avoid unnecessary legal risks and help maintain a professional reputation in your field.

Creating a Personalized Billing Document for Clients

Creating a personalized billing record is an excellent way to show clients that you value their business and are dedicated to providing a tailored experience. A customized document not only reflects your professionalism but also helps build stronger client relationships. When you personalize your financial records, you make them more engaging, clear, and aligned with the specific services provided, making it easier for clients to understand what they are being charged for.

1. Include Client’s Name and Details: The first step in personalization is addressing the client by name. Include all relevant details such as their address, contact information, and the specific services they requested. This helps create a sense of personal connection and ensures there’s no confusion about who the billing document is intended for.

2. Tailor Descriptions of Services: Avoid generic descriptions. Instead, describe each service in detail, highlighting the specific work done for the client. This not only adds clarity but also shows that you’ve taken the time to reflect on their individual needs.

3. Reflect the Client’s Preferences: If a client has specific preferences or requirements–such as certain payment methods, project timelines, or customized pricing–ensure these are clearly indicated. Personalization in billing records shows that you are attentive to their needs and flexible in your approach.

4. Customize the Format and Design: Consider adding personal touches to the layout or design of the document, such as your company’s branding, colors, or logo. A visually appealing and consistent format reinforces professionalism and makes the document feel more personal.

5. Include a Thank You Note: A brief, genuine note of thanks for their business adds a personal touch that fosters goodwill. A simple “Thank you for your business” or a short, customized message can go a long way in building a positive client relationship.

By personalizing your financial documents, you not only improve the client experience but also reinforce your professionalism and dedication to quality service. A personalized approach helps build trust, ensuring that your clients feel valued and respected throughout the entire process.