Top Billings Invoice Templates for Efficient and Professional Invoicing

Creating clear and professional documents for payment requests is essential for smooth financial transactions. These documents not only help businesses ensure timely payments but also establish credibility with clients. Whether you are a freelancer, small business owner, or part of a larger organization, using the right kind of formatted document can save time and reduce errors.

By choosing an appropriate layout, you can simplify the process of requesting funds while maintaining a polished appearance. A well-designed form ensures that all necessary information is included, such as contact details, payment terms, and itemized costs. This increases the likelihood of a prompt response and reduces the chances of confusion between you and your client.

In this guide, we will explore various options for structuring these essential documents, highlighting key features to look for and offering practical advice on how to customize them for different business needs. With the right approach, you can optimize your payment process and keep your cash flow running smoothly.

Understanding Billings Invoice Templates

When it comes to requesting payment from clients, clarity and consistency are key. Structured documents that outline the terms of the transaction help both parties stay organized and ensure that all necessary details are captured. These documents play an essential role in professional exchanges, serving as a record of the services or products provided, along with the agreed-upon payment amount and due date.

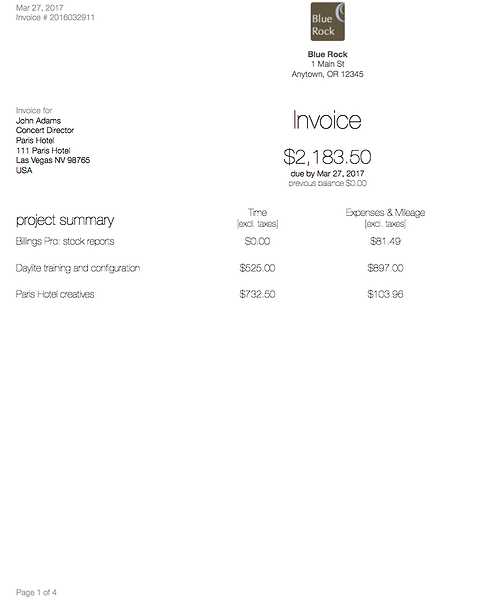

While there are many ways to create such documents, using pre-designed layouts can greatly simplify the process. These structured formats include all the important sections, from contact information to payment instructions, allowing you to focus on the content rather than the format. By choosing the right layout, businesses can ensure that they present a polished image and avoid common mistakes that could delay payment or cause confusion.

Understanding how to effectively use these ready-made designs is crucial. They can be easily customized to fit your brand, industry, or specific needs, making them adaptable for any type of transaction. Whether you are sending a simple request for a one-time payment or managing recurring charges, these documents provide a reliable and professional solution.

What is a Billing Invoice Template?

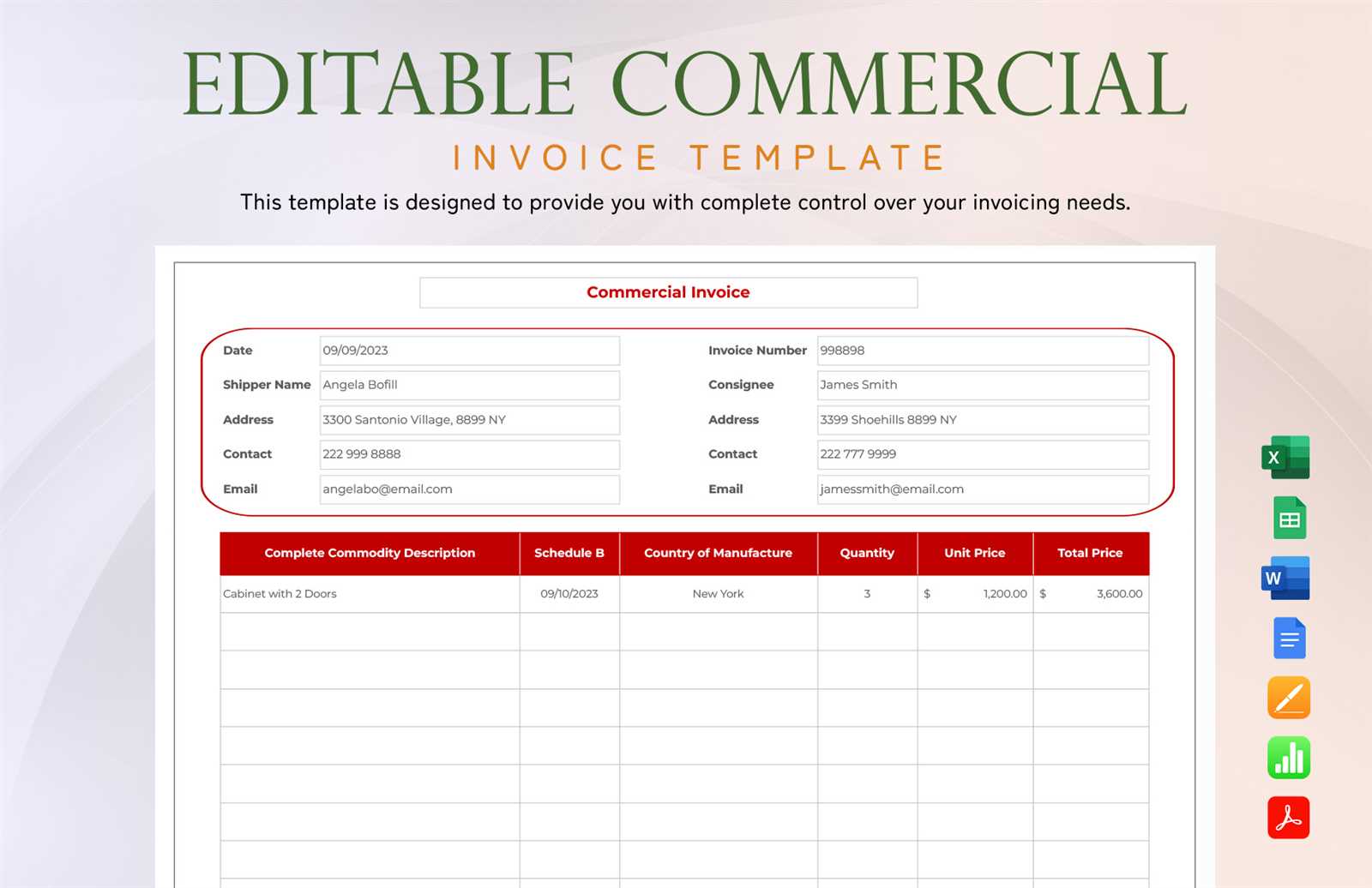

A payment request document is a formal way to ask for funds in exchange for goods or services provided. It contains key details that help both the service provider and the client keep track of the transaction. These documents are structured in a way that ensures all important information, such as the amount due, payment terms, and descriptions of the offered services or products, is clearly presented.

A pre-designed layout for such a document offers a convenient framework that can be filled with specific details. Instead of creating a new one from scratch every time, businesses can use a standard format that includes all necessary sections, such as contact information, itemized costs, and deadlines for payment. This helps reduce errors and speeds up the billing process.

In essence, these ready-made structures provide a streamlined way to create accurate and professional payment requests. They can be customized according to the unique needs of the business or industry, making them an essential tool for anyone who needs to send out payment requests on a regular basis.

Benefits of Using Invoice Templates

Using a pre-designed format for payment requests offers numerous advantages that can significantly improve the billing process. By having a structured approach, businesses can ensure consistency and professionalism in every transaction, which fosters trust with clients and partners. These formats provide a clear and organized way to present financial details, reducing the likelihood of misunderstandings or disputes.

One of the key benefits is time efficiency. Instead of creating a new document from scratch for each transaction, a ready-made layout allows you to quickly fill in the required information and send it to clients. This saves valuable time that can be better spent on other business tasks. Moreover, these pre-built forms often come with fields that help ensure all critical details are included, further reducing the chances of errors or omissions.

Another significant advantage is professional appearance. A well-designed, consistent format enhances your business’s image and reflects attention to detail, which can positively impact client relationships. Additionally, using standardized documents can help with organization, as all payment requests are stored in a uniform format, making it easier to track outstanding payments and monitor cash flow.

Choosing the Right Template for Your Business

Selecting the appropriate format for payment requests is crucial to ensure smooth and efficient transactions. The right design not only reflects your business’s professionalism but also simplifies the process of managing finances. With a variety of options available, it’s important to choose a layout that aligns with your industry, business size, and client expectations.

Key Factors to Consider

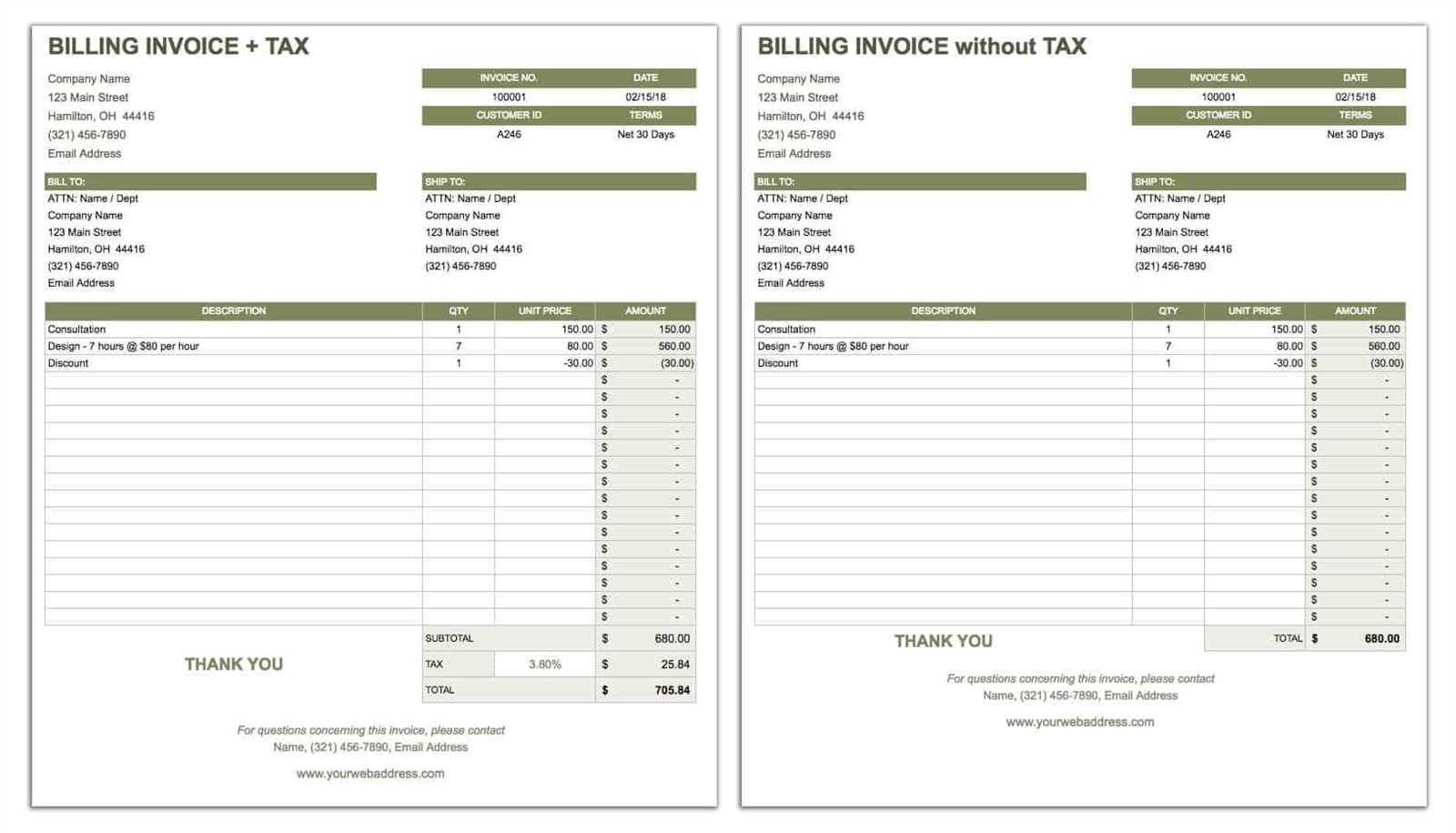

When evaluating a pre-designed layout, there are several important factors to keep in mind. For example, the complexity of the format should match the nature of your business. A simple, straightforward design may be sufficient for small businesses or freelancers, while larger companies might require a more detailed format with additional sections for taxes, discounts, or payment terms.

| Factor | Small Business | Large Business |

|---|---|---|

| Design Complexity | Simple and clean | Detailed with multiple sections |

| Customization Needs | Minimal customization | Advanced customization options |

| Additional Fields | Basic details (e.g., amount, service) | Taxes, discounts, payment terms, etc. |

Industry-Specific Considerations

Another key consideration is the type of bus

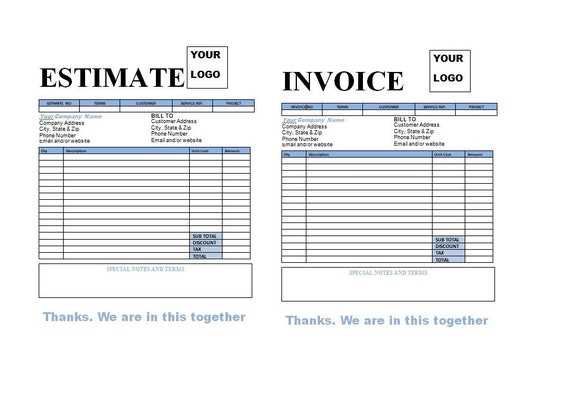

How to Customize Billing Templates

Customizing a pre-designed format for payment requests allows businesses to tailor the document to their specific needs, ensuring that it reflects their brand and meets the requirements of their clients. With the right adjustments, you can create a professional-looking document that communicates all necessary details clearly while maintaining consistency with your business’s identity.

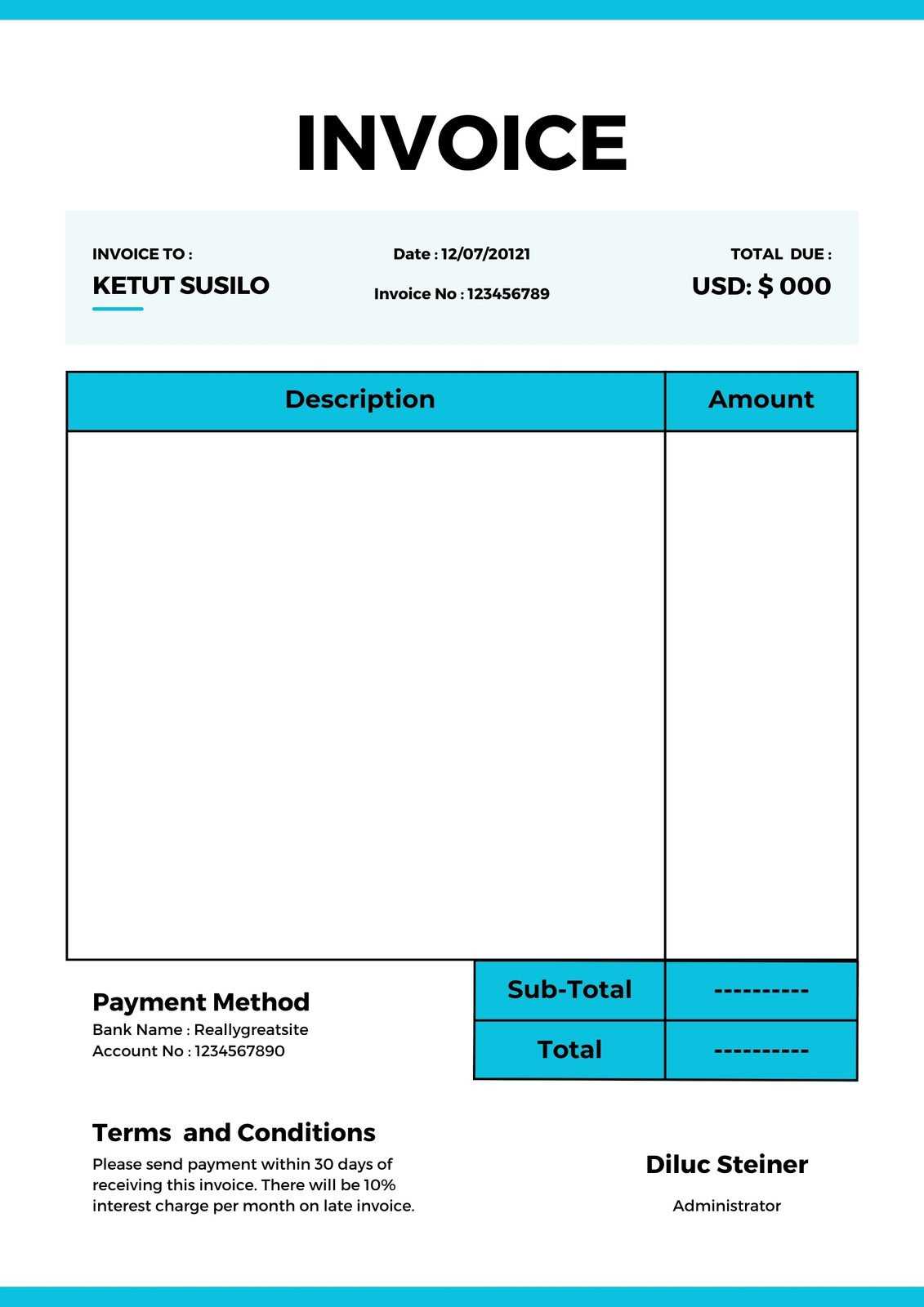

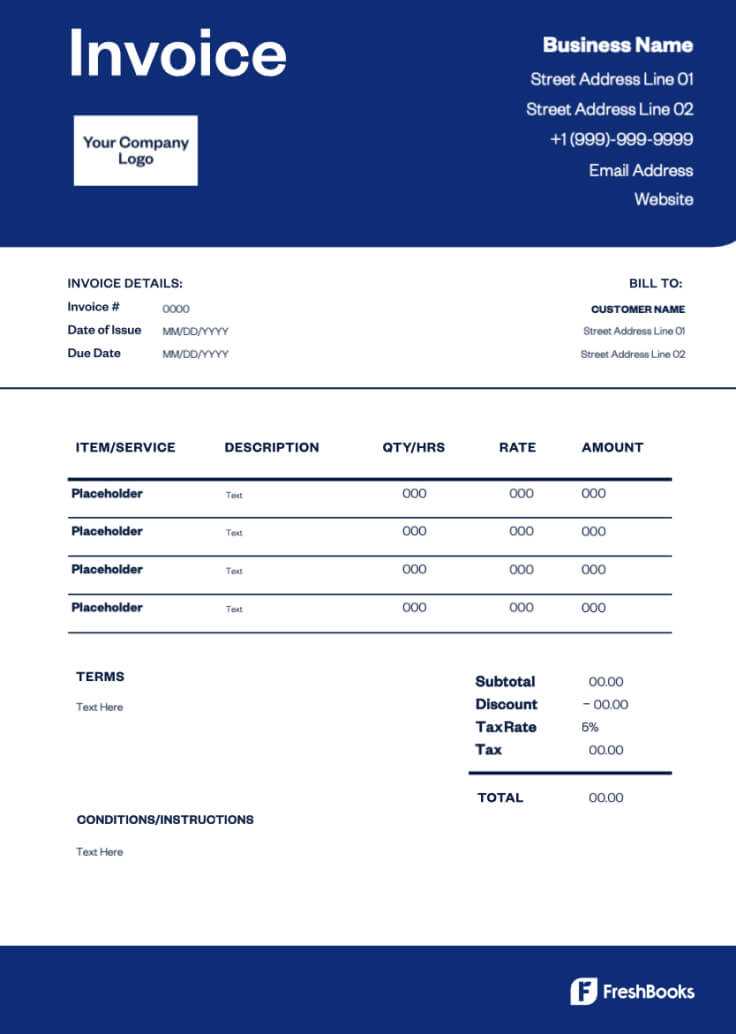

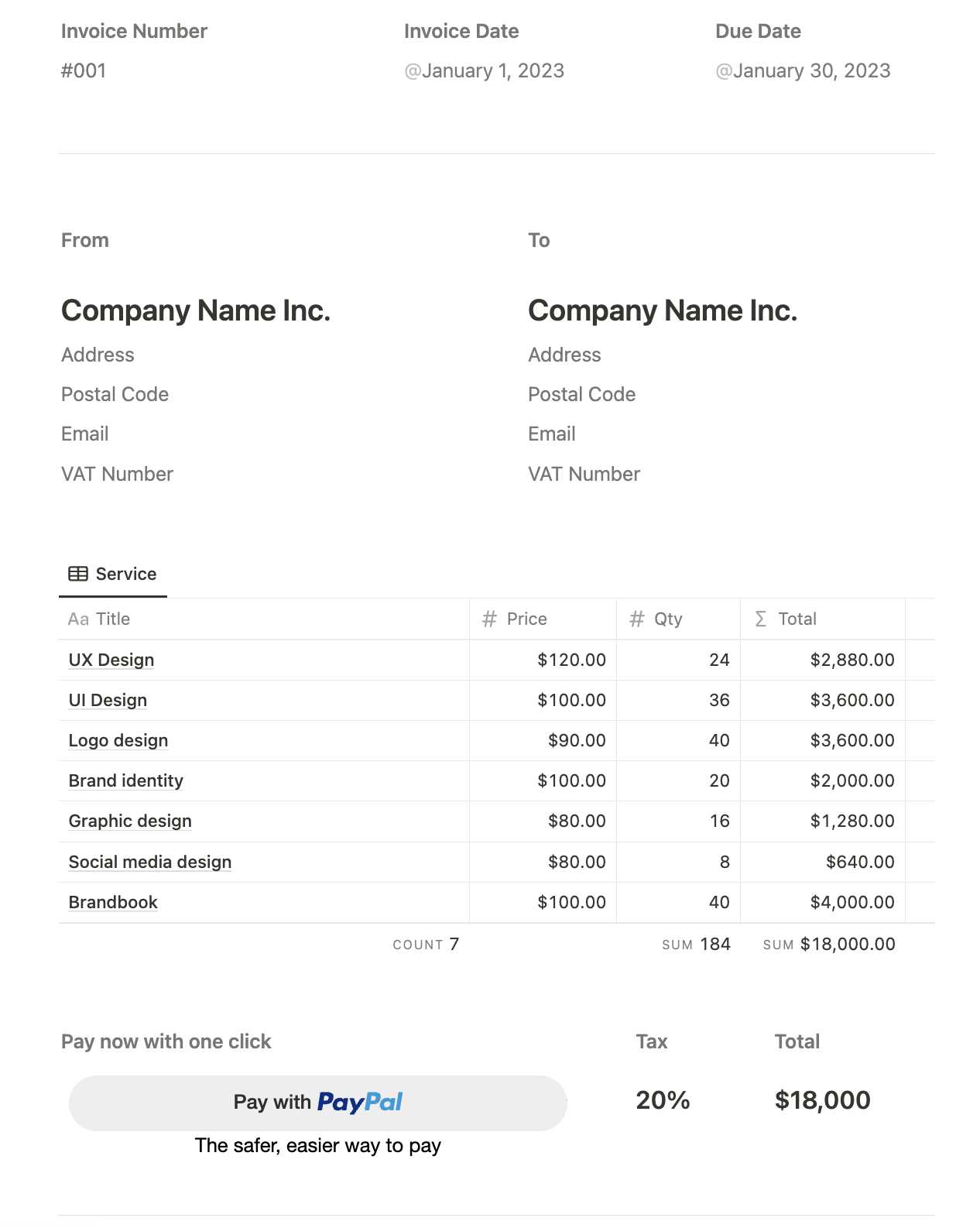

One of the first steps in customization is adding your business logo, contact information, and branding colors. This will help create a cohesive visual identity and make your request stand out. Additionally, adjusting the layout to fit your specific business needs–whether adding extra fields for detailed service descriptions, taxes, or payment terms–can make the document more useful and complete.

Key Customization Options

- Logo and Branding: Incorporating your logo and using brand colors creates a professional and consistent appearance.

- Payment Terms: Customize the payment due dates, late fees, or installment options to suit your specific policies.

- Additional Information: Add any other relevant fields, such as project milestones, discounts, or special instructions.

- Currency and Taxes: Adjust for different currencies, tax rates, or international payment terms if working globally.

By following these steps, you can ensure that your payment request documents are not only functional but also reflect the unique needs of your business while fostering a professional relationship with your clients.

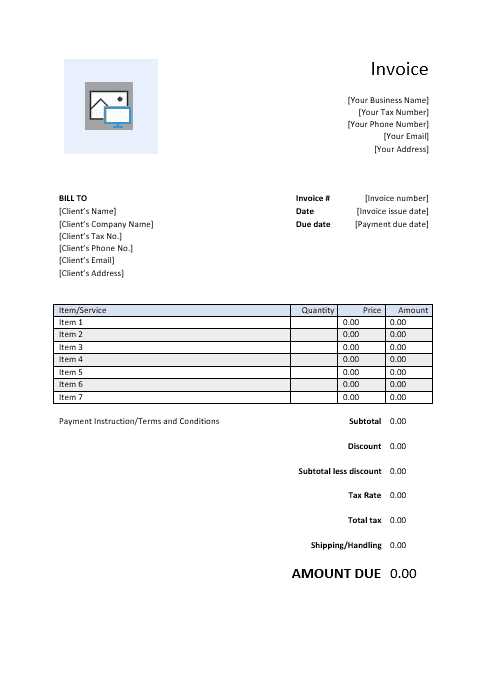

Essential Elements in an Invoice

Creating a clear and professional payment request requires including all the essential information to ensure both the client and the business are on the same page. A well-structured document should outline the transaction details, making it easy for the recipient to understand the payment amount, due date, and any other relevant terms. By including these key elements, you reduce the chances of confusion or delays in processing the payment.

Below are the most important sections that should always be present in any payment request document:

| Element | Description |

|---|---|

| Contact Information | Both the sender and recipient’s names, addresses, and phone numbers for clear communication. |

| Invoice Number | A unique identifier to track the document for future reference and accounting purposes. |

| Transaction Date | The date the payment request is issued, which helps establish the timeline for payment due dates. |

| Details of Goods/Services | A description of the items or services provided, including quantities, rates, and individual costs. |

| Total Amount Due | The total sum that needs to be paid, after including any applicable taxes or discounts. |

| Payment Terms | Details such as due date, late fees, and accepted payment methods, ensuring clarity around payment expectations. |

Including these elements not only makes the document more professional but also ensures that it serves its primary function–facilitating a smooth financial transaction between the business and the client.

Free vs Paid Invoice Templates

When it comes to choosing a pre-designed format for payment requests, businesses often face a decision between free and paid options. Both have their advantages and limitations, depending on the specific needs of the company. While free layouts can offer basic functionality, premium designs tend to provide more advanced features and customization options. Understanding the key differences between the two can help you make the right choice for your business.

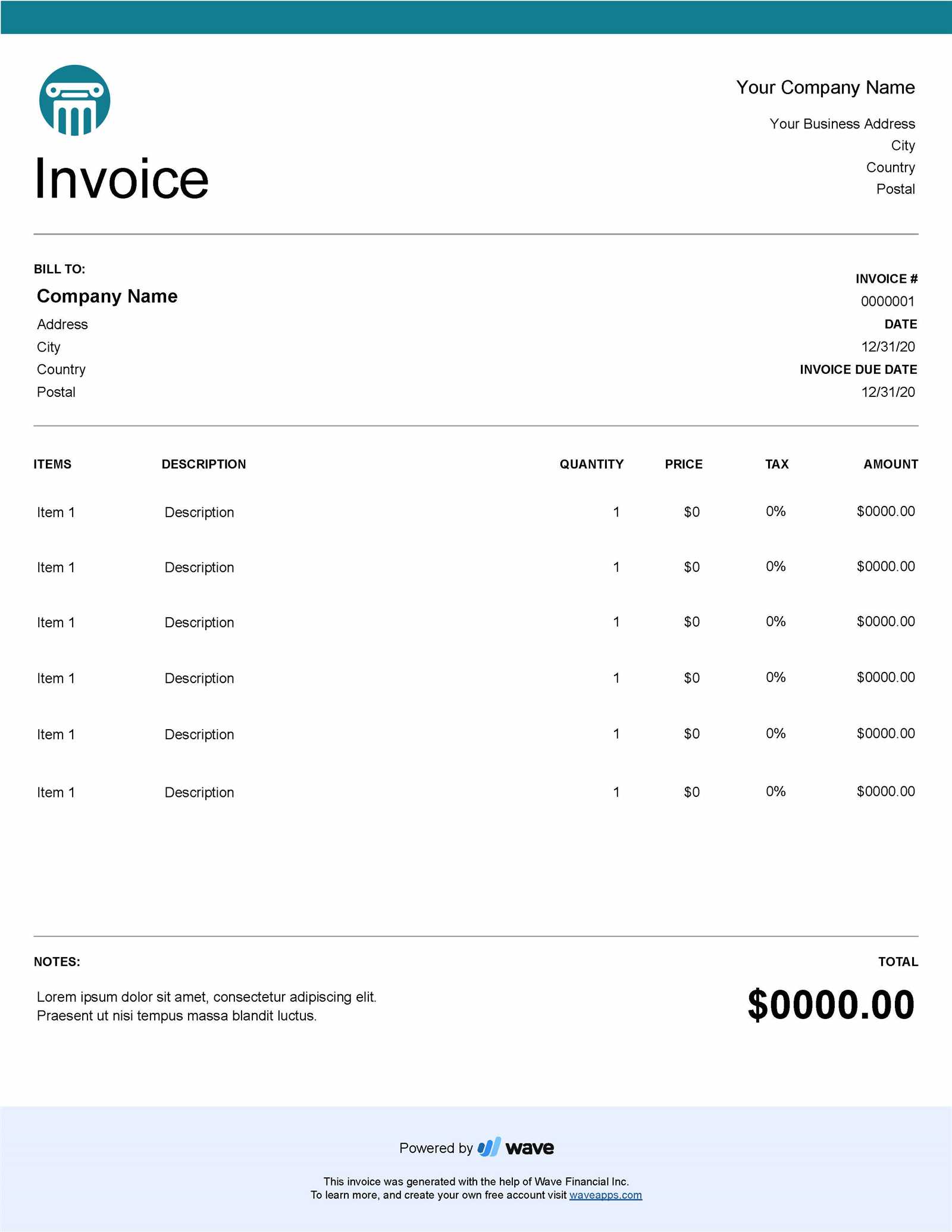

Free options are typically simple and easy to use, making them a good choice for small businesses or freelancers just starting out. They often come with basic fields, allowing you to input essential details like client information, amounts due, and payment terms. However, free designs may lack advanced features such as additional sections for taxes, discounts, or recurring billing. They can also be less customizable in terms of branding and design aesthetics.

Paid versions, on the other hand, offer greater flexibility and more sophisticated features. These layouts usually include more comprehensive fields, allowing you to tailor documents to your specific industry or business needs. Additionally, paid formats often come with support for multiple currencies, automated calculations, and professional design elements. For businesses that require more control over branding and functionality, investing in a premium option can save time and reduce the risk of errors.

How to Create an Invoice from Scratch

Creating a payment request document from scratch might seem daunting at first, but with the right structure, it can be a straightforward process. By focusing on the key elements that need to be included and organizing the information logically, you can craft a professional document that meets your business needs. This approach not only saves time but also ensures accuracy and consistency in all your transactions.

Step 1: Gather the Necessary Information

Before you start designing the document, collect all relevant details, such as the recipient’s name, address, and contact information, as well as a description of the goods or services provided. Make sure to also include the agreed-upon payment amount, any taxes or discounts, and the payment due date. Having all the details ready will help you avoid missing any crucial information while creating the document.

Step 2: Organize the Layout

Next, you need to structure the document in a clear and logical format. Start by adding your business details at the top, such as your logo, name, and contact information. Then, include a unique identification number for the transaction, followed by the recipient’s information. The body of the document should list the items or services provided, along with individual prices and any applicable taxes or discounts. Finally, conclude with the total amount due, payment terms, and the due date.

Tip: To enhance professionalism, keep the design simple and organized. Use clear headings, bullet points for itemized lists, and consistent fonts throughout the document.

Once you’ve structured the document and included all necessary information, review it carefully before sending it to your client. This ensures that all details are accurate and that the payment process goes smoothly.

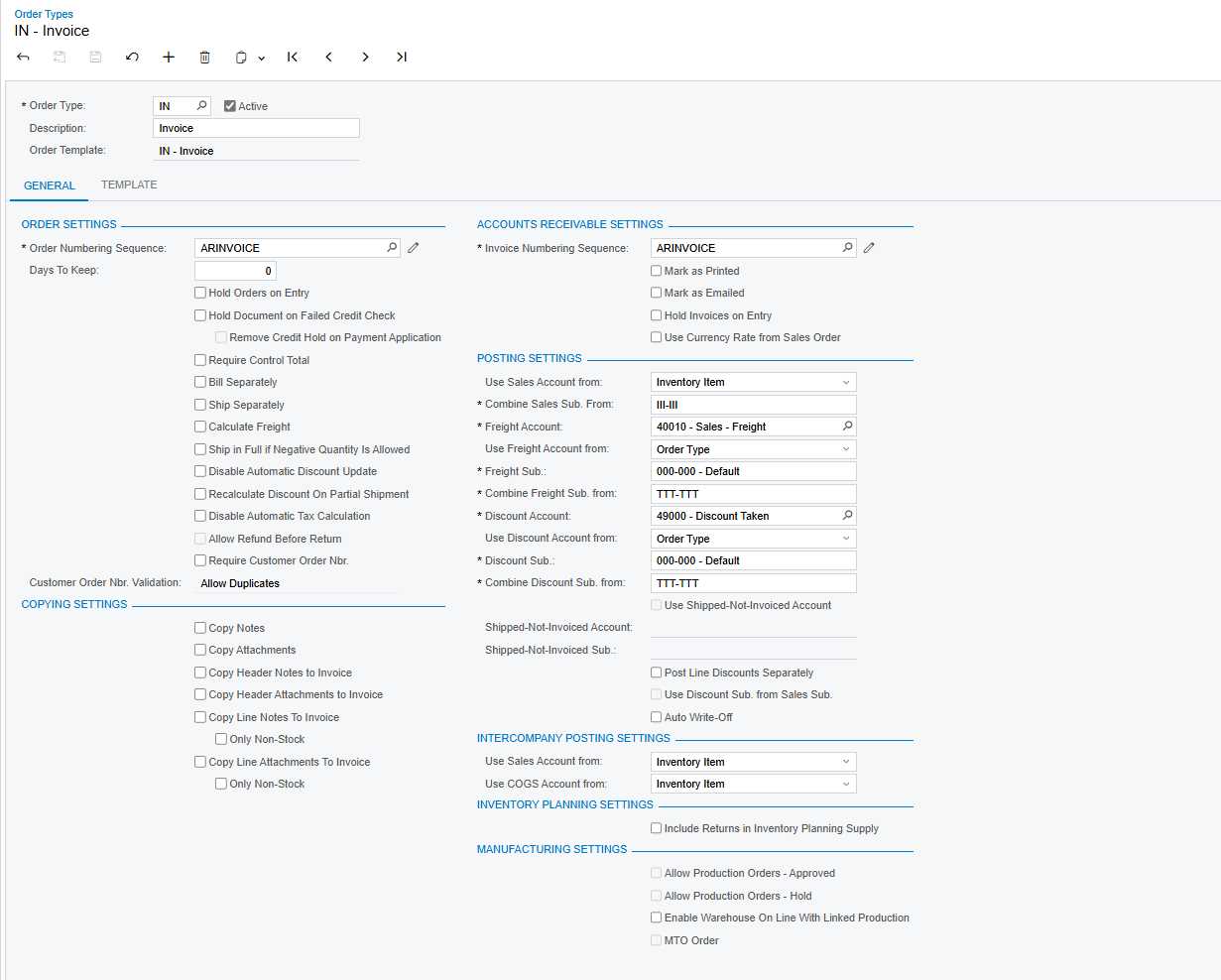

Best Software for Invoice Generation

Choosing the right software for creating payment requests can significantly streamline your business’s financial operations. The right tool not only helps you generate professional documents quickly but also ensures accuracy and consistency in every transaction. With numerous options available, selecting the best software depends on your business size, needs, and desired features.

Key Features to Look For

- Ease of Use: The software should have an intuitive interface that allows you to generate documents quickly without a steep learning curve.

- Customization: Look for software that allows you to add your branding, adjust fields, and tailor the layout to your specific business needs.

- Automated Calculations: Automatic tax calculations, discounts, and totals reduce manual errors and save time.

- Recurring Billing: For businesses with repeat clients, the ability to set up automated recurring invoices can simplify operations.

- Payment Integration: Integration with payment gateways lets clients pay directly from the document, speeding up the process.

- Tracking and Reporting: Good software should include features to track outstanding payments and generate financial reports.

Top Software for Creating Payment Requests

- FreshBooks: Popular among small businesses and freelancers, this software offers an easy-to-use interface with invoicing, time tracking, and expense management features.

- QuickBooks: Ideal for businesses that need more comprehensive accounting tools, QuickBooks allows seamless invoicing along with payroll, tax filing, and reporting functions.

- Zoho Invoice: A versatile tool for creating professional-looking payment documents, Zoho Invoice supports multi-currency billing and integrates with various payment gateways.

- Wave: Free and user-friendly, Wave provides basic invoicing features along with accounting and receipt scanning, making it a great choice for small businesses.

- Invoicely: Known for its simplicity and flexibility, Invoicely offers both free and premium versions that cater to small businesses and large enterprises alike.

Choosing the right software will depend on your specific needs, whether you’re looking for advanced features or a simple solution to generate documents quickly. No matter the size of your business, investing in the right tool can save time, reduce errors, and improve your overall fin

Common Mistakes to Avoid in Invoicing

While creating and sending payment requests may seem straightforward, there are several common pitfalls that can lead to confusion, delays, and potential disputes. Mistakes in the documentation can affect your cash flow and harm your business relationships. By understanding these common errors, you can take the necessary steps to avoid them and ensure smooth and timely payments.

1. Missing Key Information

One of the most frequent mistakes is failing to include all the necessary details. Leaving out important data, such as the recipient’s name, payment due date, or transaction number, can lead to confusion and delays. Always ensure that the document includes clear and complete information, such as itemized charges, payment instructions, and your contact details.

2. Incorrect Payment Terms

Setting unclear or incorrect payment terms can create misunderstandings. Whether it’s an ambiguous due date, unclear late fees, or missing tax details, this can lead to delayed or partial payments. Be specific about when the payment is due and outline the penalties for late payments if applicable.

3. Not Keeping Consistent Formatting

Inconsistent design or formatting can make the document appear unprofessional and difficult to read. Ensure that your document follows a uniform structure, with clearly defined sections for the recipient’s details, payment terms, and breakdown of charges. A clean, consistent layout fosters trust and makes the document easier to navigate.

4. Overcomplicating the Document

While it’s important to include all necessary details, overloading the document with too much information can overwhelm the recipient. Keep the payment request straightforward and focus on the essential elements. Avoid unnecessary jargon or complex terms that could confuse the client.

5. Forgetting to Follow Up

Even if a payment request is accurate and clear, failing to follow up can lead to delays. Make it a habit to send reminders or track payments regularly to ensure that you receive timely compensation. Setting automated reminders or scheduling follow-ups can help you stay on top of your receivables.

By avoiding these common mistakes, you can streamline the payment process, maintain a professional image, and foster positive relationships with your clients.

How to Automate Your Invoicing Process

Automating your payment request system can save you significant time and effort while ensuring consistency and accuracy in every transaction. By eliminating manual steps and using automation tools, you can streamline the process, reduce errors, and improve your overall cash flow management. This is particularly beneficial for businesses with regular clients or large volumes of transactions.

Step 1: Choose the Right Software

The first step in automating your payment request system is selecting software that offers automation features. Many modern accounting or invoicing platforms allow you to set up recurring billing, automatic calculations, and even integrate with payment systems. Look for tools that can generate and send documents automatically based on predefined parameters, such as subscription dates, payment cycles, or project completion milestones.

Step 2: Set Up Recurring Payments and Reminders

For businesses that work with repeat clients or have ongoing services, setting up recurring payments is a key feature to automate. This allows you to automatically generate payment requests on a regular basis without needing to create each one manually. Additionally, setting up reminders for upcoming payments or overdue balances ensures that you never miss a follow-up and clients are consistently reminded of their obligations.

Tip: Make sure your automated system can send customizable notifications and reminders to clients. This ensures that each communication is aligned with your business’s tone and payment policies.

By automating your payment requests, you free up valuable time for other business tasks, reduce the risk of human error, and ensure that clients are always aware of their payment responsibilities.

Invoice Templates for Small Businesses

For small businesses, having an efficient and professional system for creating payment requests is essential. Using a pre-designed format not only saves time but also helps maintain consistency and ensures that all necessary information is included in each transaction. With the right layout, even small businesses can present themselves as organized and trustworthy, fostering better relationships with clients.

When selecting a format for your payment requests, it’s important to consider the specific needs of your business. A small business may not require complex features, but having a simple yet professional design is crucial. Below are some key features and types of formats that can benefit small businesses:

Key Features for Small Business Payment Requests

- Simplicity: Choose a layout that is easy to fill in and does not overwhelm the recipient with too much information.

- Customization: Ensure that the design allows you to add your business logo, branding, and specific details related to the products or services you offer.

- Clear Payment Terms: Include clear due dates, payment methods, and any late fees or discounts for early payments.

- Itemized List: If applicable, include a breakdown of the goods or services provided, with quantities and individual prices for clarity.

- Automated Calculations: Many formats allow for automatic summing of totals, taxes, and discounts, saving time and reducing human error.

Recommended Formats for Small Businesses

- Basic Layout: A simple, no-frills design that lists key details like service description, amounts, and due dates. Ideal for freelancers or businesses offering a single product or service.

- Itemized Format: A more detailed layout that allows for multiple products or services to be listed with individual pricing and quantities. Perfect for small businesses with varied offerings.

- Recurring Billing Layout: If your business operates on a subscription or ongoing service model, a template that supports recurring billing can automate the process and save time.

- Branded Format: A design that includes your logo, business colors, and other branding elements to create a professional, cohesive look.

Invoice Templates for Freelancers

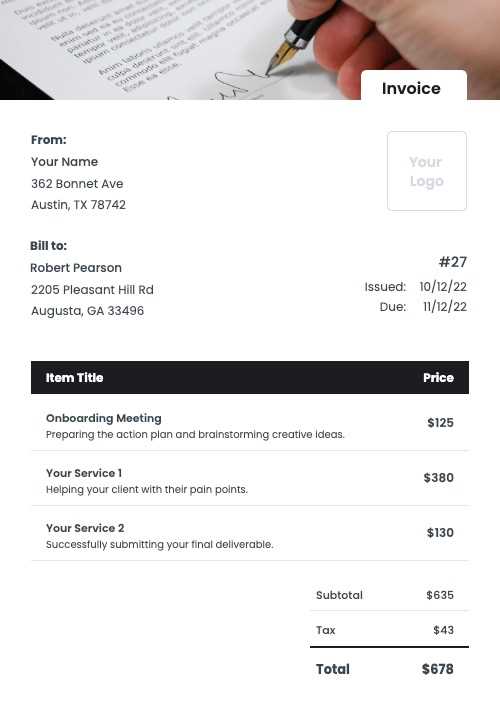

For freelancers, having a reliable and professional system to request payment is crucial for maintaining good relationships with clients and ensuring timely compensation. A well-structured payment request document not only conveys professionalism but also makes it easy for clients to understand the charges, terms, and deadlines. With the right format, freelancers can streamline their administrative tasks and focus more on their core work.

Key Elements for Freelance Payment Requests

When creating a payment request, freelancers need to focus on including essential information that ensures clarity and avoids confusion. Below are the most important sections to include:

| Element | Description |

|---|---|

| Freelancer Details | Your name, business name (if applicable), contact information, and tax identification number, if needed. |

| Client Information | The client’s name, business name (if applicable), and contact information. |

| Service Description | A clear list of services provided with specific dates, hours worked, or quantities of work completed. |

| Payment Amount | Clearly itemized charges, including the hourly rate, project rate, or other agreed-upon pricing, plus any taxes or discounts. |

| Payment Terms | Due date, acceptable payment methods, and late fees (if applicable). |

Why Freelancers Should Use a Payment Request Format

Using a consistent and professional layout not only helps in organizing payment information but also builds trust with clients. Freelancers benefit from a clear structure that minimizes misunderstandings, ensures timely payments, and provides a reference for both parties in case of disputes.

With the right design, freelancers can automate much of the process, ensuring that they spend less time on administrative tasks and more time delivering quality work to their clients.

International Invoices and Currency Formats

When conducting business internationally, it’s essential to adapt your payment requests to meet global standards and ensure that your clients can easily understand the terms of the transaction. Different countries have varying conventions for currency formatting, tax structures, and even the terminology used for payment documents. By understanding these international variations, you can prevent confusion, reduce errors, and build stronger relationships with clients around the world.

Currency Formatting Differences

Currency formats can vary significantly from one country to another. For example, the placement of the currency symbol, the use of commas or periods as thousand separators, and the number of decimal places differ based on local practices. In some regions, the currency symbol is placed before the amount (e.g., $100.00 in the U.S.), while in others, it may come after (e.g., 100,00€ in the European Union). It’s crucial to ensure that your payment documents reflect the appropriate currency format based on the client’s location to avoid confusion and errors in payments.

Tax and Legal Requirements

Different countries have different tax regulations and requirements for payment documents. For instance, some nations include value-added tax (VAT) in the price, while others list it separately. It’s important to include the correct tax rates and mention whether taxes are inclusive or exclusive in your calculations. Additionally, international clients may require specific legal language or references to tax identification numbers, especially for businesses based in the European Union, where VAT numbers are commonly used for cross-border transactions.

To ensure smooth transactions, always research the specific invoicing requirements for each country you do business with, and adjust your documents accordingly. This practice not only improves clarity but also helps you maintain compliance with local regulations.

Improving Cash Flow with Invoicing

Efficiently managing payment requests is critical for maintaining a healthy cash flow in any business. By streamlining the process and ensuring that clients are billed promptly and accurately, businesses can minimize delays and reduce the risk of overdue payments. A clear and consistent approach to requesting payment not only helps maintain steady revenue but also boosts client trust and satisfaction.

To improve cash flow, it’s important to adopt best practices for creating and managing payment requests. Below are key strategies to optimize your payment request process and ensure that cash flow remains consistent:

| Strategy | Explanation |

|---|---|

| Send Timely Requests | Always send payment requests immediately after completing the work or delivering the product. This keeps payments top of mind for your clients and speeds up processing. |

| Clear Payment Terms | Make sure your payment terms are clearly stated, including due dates, accepted payment methods, and penalties for late payments. This helps set expectations and reduces confusion. |

| Offer Multiple Payment Options | Providing different payment options (bank transfers, credit cards, online payment platforms) makes it easier for clients to settle their balances quickly. |

| Automate Recurring Billing | If you have regular clients, set up automated recurring payment requests. This eliminates the need for manual follow-ups and ensures you receive consistent payments on time. |

| Track Overdue Payments | Stay on top of outstanding payments by tracking due dates and sending timely reminders. Setting up automated reminders can help you reduce overdue balances. |

By implementing these strategies, businesses can ensure timely payments, reduce administrative burdens, and improve overall financial stability. A smooth and professional payment request system plays a key role in maintaining a healthy cash flow, which is essential for long-term business growth.

Legal Requirements for Invoices

When creating payment requests, it’s crucial to ensure that they meet all relevant legal requirements to avoid potential disputes, fines, or delays in payment. Different countries and regions have specific laws governing what must be included in a formal payment document. These requirements help establish the legitimacy of the transaction, ensure compliance with tax laws, and protect both the business and the client.

Key Legal Elements for Payment Requests

Below are the essential elements that must be included in most formal payment documents, depending on your jurisdiction:

- Business Information: Your business name, address, and contact details are required to verify the legitimacy of the request.

- Client Information: The recipient’s full name or company name, address, and contact information help identify the party being billed.

- Unique Identifier: A reference number or unique code is necessary to help track the payment and prevent confusion with other transactions.

- Description of Goods or Services: A detailed list of the products or services provided, including quantities, unit prices, and any relevant dates.

- Amount Due: The total sum to be paid, broken down clearly with taxes, fees, and any discounts applied.

- Payment Terms: This includes the due date for payment, accepted methods of payment, and any late fees or penalties for overdue balances.

- Tax Information: If applicable, tax identification numbers, VAT numbers, and tax rates must be clearly stated, especially for international transactions.

Country-Specific Legal Considerations

It’s important to note that the specific legal requirements can vary depending on the country where your business is based or where your client is located. For example:

- In the European Union, VAT must be included on all applicable transactions, and businesses are required to list their VAT numbers on payment documents.

- In the United States, sales tax may need to be separately stated depending on the state, and some states require businesses to include their state tax ID numbers.

- In countries like Japan, specific language may be required for formal documentation to comply with local laws, and certain industries may have additional invoicing requirements.

By ensuring that your payment documents comply with local regulations and contain all legally required information, you help protect your business from potential legal issues and ensure smooth and timely transactions.

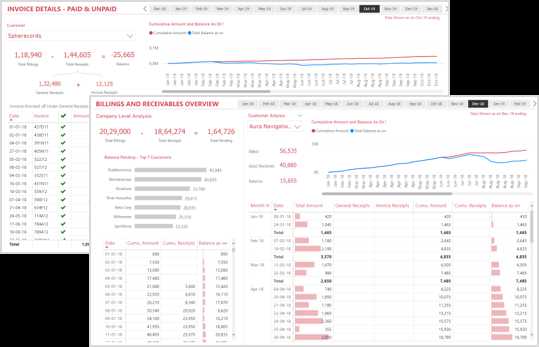

How to Track Payments from Invoices

Keeping track of payments is a critical part of managing a business’s finances. When a payment request is sent out, it’s important to monitor its status to ensure timely payment and prevent overdue balances from accumulating. By establishing a clear system for tracking outstanding payments, businesses can stay organized, improve cash flow, and reduce the risk of miscommunication with clients.

There are several strategies to help you stay on top of payments, whether you are dealing with one-time transactions or ongoing client relationships. Below are some key methods for effectively tracking the status of payments:

Methods for Tracking Payments

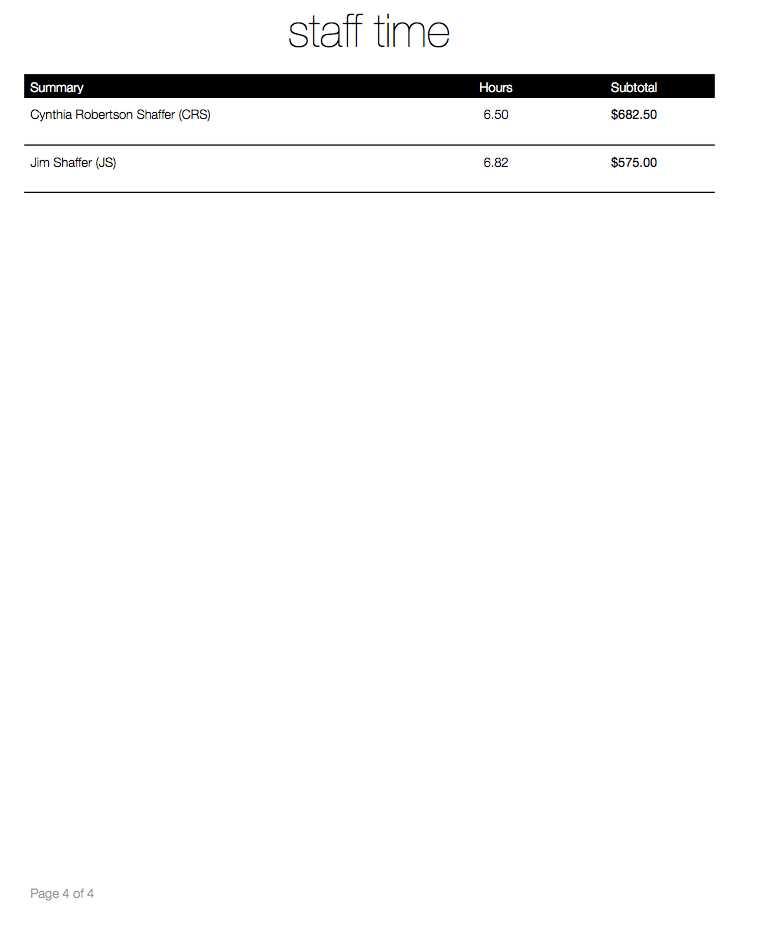

- Manual Tracking: For small businesses or freelancers, a simple spreadsheet can be an effective tool for tracking payments. Include columns for the payment request number, client name, payment amount, due date, and payment status. This approach works well for businesses with only a few clients or transactions to manage.

- Accounting Software: Specialized accounting or invoicing software can help automate the payment tracking process. These tools can send reminders, update payment statuses in real-time, and generate reports to give you an overview of your financial situation.

- Payment Reminders: Set up automated reminders for clients who have not made a payment by the due date. Friendly reminders can encourage clients to pay on time without damaging the relationship. This can be done manually or through accounting software.

- Payment Methods Tracking: If you accept multiple payment methods (bank transfer, credit card, PayPal, etc.), it’s crucial to track each one separately. Keep records of which payment methods clients used to ensure consistency and avoid confusion.

- Communication Log: Maintain a record of all communication regarding payment, including follow-up emails, phone calls, and agreements. This documentation can help resolve disputes and provide clarity if there are any delays or issues.

Automating the Process

For those looking to simplify the tracking process, automating the payment management system is highly recommended. By using tools that integrate with your payment request documents, you can automate reminders, track payment statuses, and even send receipts directly after payment is processed. This can save time, reduce manual errors, and keep your financial records up-to-date without much effort.

By implementing a robust tracking system, businesses can ensure that payments are received on time, reduce the risk of overdue accounts, and ultimately

Best Practices for Sending Invoices

Sending payment requests in a clear, professional, and timely manner is crucial for maintaining a smooth cash flow and healthy client relationships. Following best practices not only helps avoid delays but also ensures that clients have all the necessary information to process payments efficiently. Whether you’re a freelancer or a business owner, adopting the right approach can streamline the process and reduce confusion.

Here are some key best practices to follow when sending payment requests:

Key Practices for Sending Payment Requests

- Send Immediately After Service Completion: As soon as you have completed the work or delivered the product, send the payment request without delay. This keeps the transaction fresh in the client’s mind and can speed up payment processing.

- Use Clear and Professional Language: Ensure that the language you use is professional, polite, and clear. Avoid jargon and make the request as straightforward as possible to prevent confusion.

- Double-Check for Accuracy: Before sending the document, review it thoroughly for any errors in the client details, payment amounts, or service descriptions. Even small mistakes can delay payments and harm your credibility.

- Set Clear Payment Terms: Clearly outline your payment terms, including the due date, acceptable payment methods, and any penalties for late payments. This sets expectations and helps avoid future misunderstandings.

- Provide Multiple Payment Options: Offering various payment methods (bank transfer, credit card, online platforms) increases the likelihood that clients will pay on time. It also makes the process more convenient for them.

- Follow Up on Unpaid Requests: If the due date passes without payment, send a polite reminder. Most people appreciate a gentle nudge, but be sure to maintain professionalism in your tone. Automated reminders can save time and ensure consistency.

- Use Digital Platforms for Faster Delivery: Sending your payment requests digitally via email or invoicing software can speed up the process. It ensures the document reaches your client instantly and allows you to track its delivery and status.

- Attach Necessary Documentation: Include all relevant documents such as contracts, receipts, or proof of service to make it easy for your client to review and process the payment quickly.

Consistency and Professionalism

By maintaining consistency in