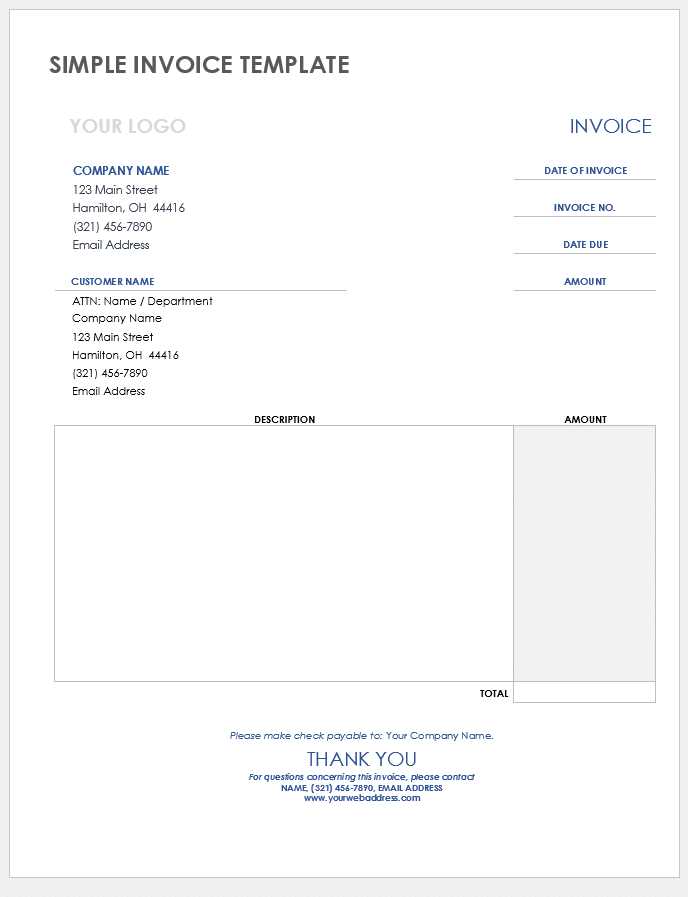

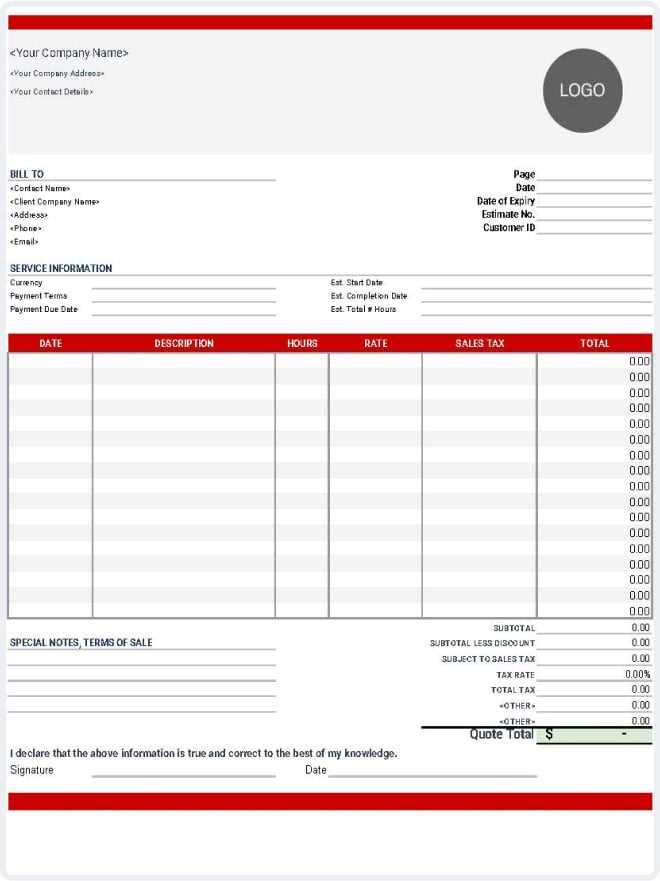

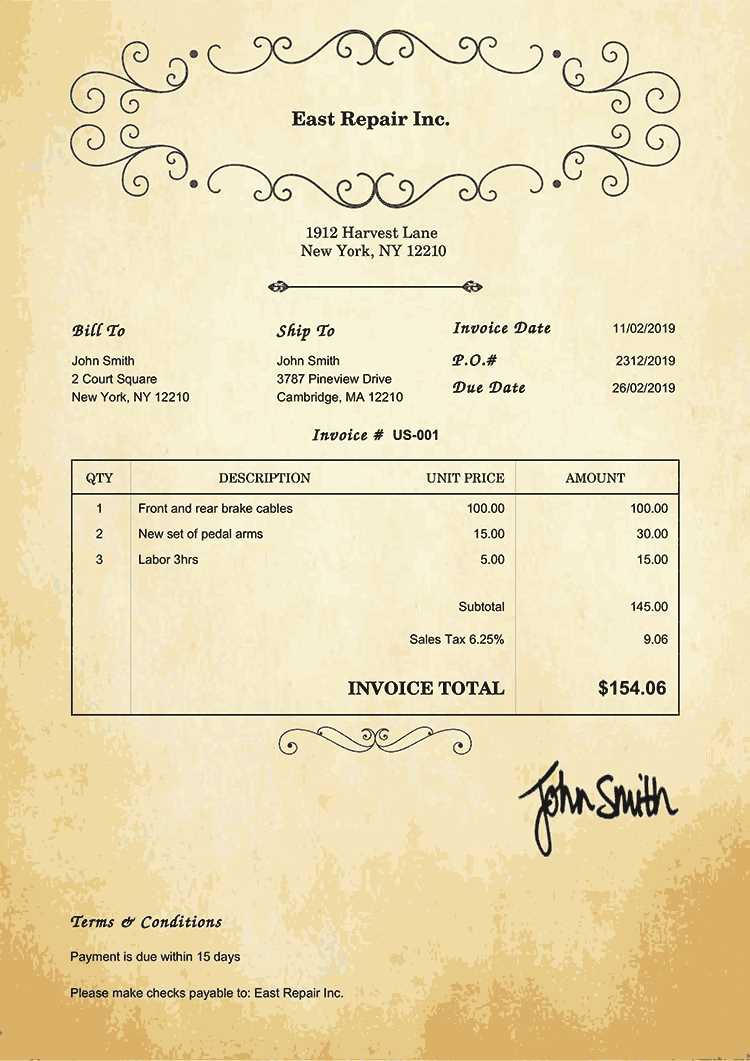

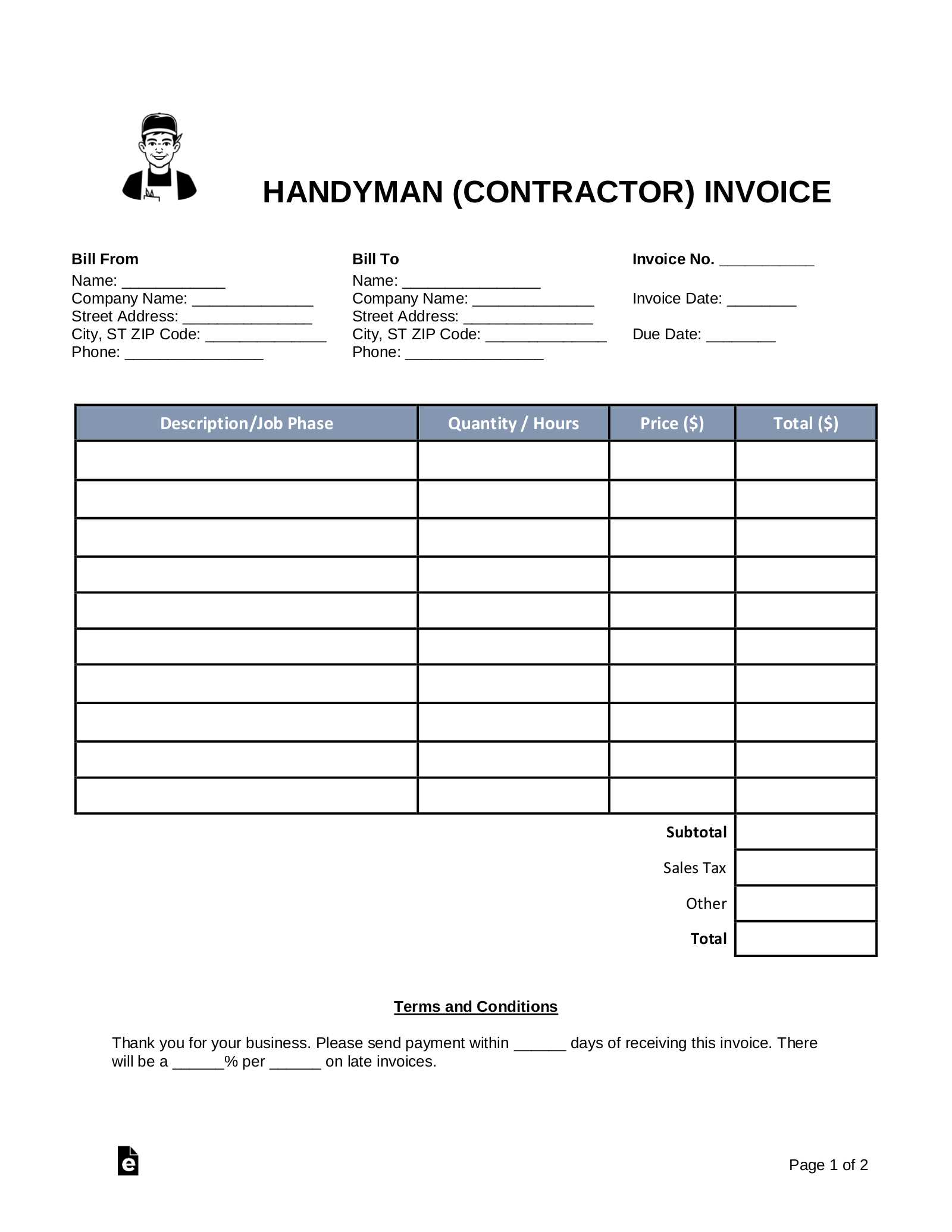

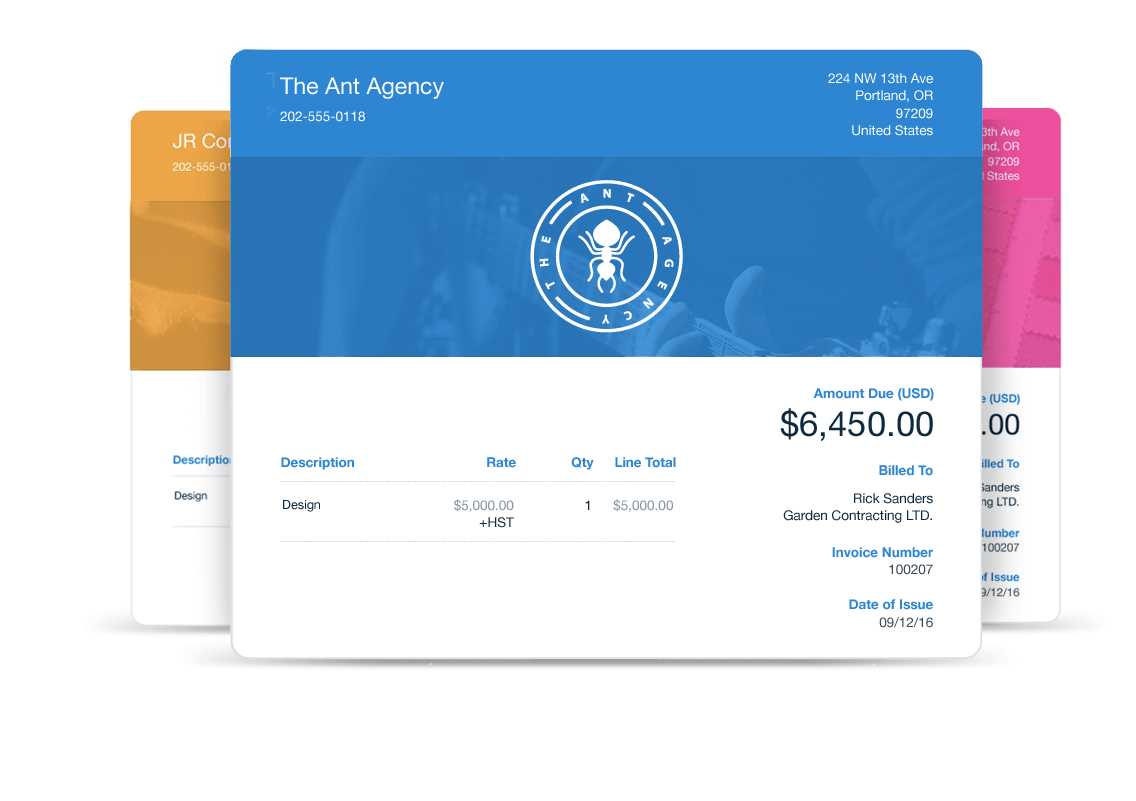

Free Billing Invoice Templates for Quick Customization

Creating well-structured financial documents is essential for maintaining smooth business operations. Whether you’re managing a small enterprise or handling personal projects, having the right tools can save you time and reduce errors. With the availability of customizable resources, designing accurate and professional records has never been easier.

Streamlining the process is key when dealing with payments and transactions. By using well-designed forms, you can quickly generate documents that meet your needs without spending excessive time on manual formatting. These resources often include pre-set fields and simple instructions that guide you through the process.

Personalizing these documents according to your specific requirements ensures they reflect your brand or personal style. Additionally, the ability to easily modify details like pricing, dates, and client information makes them flexible and adaptable for various situations. With numerous options available, you can select the ideal solution for your needs.

Why Use Free Invoice Templates

Having ready-to-use resources for creating essential financial documents can significantly improve efficiency in managing payments and client transactions. These pre-designed tools help you focus on content rather than spending time formatting or designing from scratch. For businesses, freelancers, and personal use, these documents offer a quick and professional solution to managing financial records.

Key Benefits of Using Pre-Designed Forms

Using customizable forms allows for easy adaptation to different needs without requiring advanced design skills. They come with pre-structured fields, saving time while ensuring consistency. Additionally, many options are available without any cost, making them a budget-friendly solution for anyone looking to streamline administrative tasks.

| Benefit | Details |

|---|---|

| Time-Saving | Pre-designed fields allow for quick input without needing to format from scratch. |

| Cost-Effective | No need for paid software or services to create high-quality documents. |

| Customization | Easily adjust the document layout, colors, and details to suit your style. |

| Professional Appearance | Templates are designed to meet industry standards for appearance and structure. |

How to Get the Most Out of Ready-Made Resources

By choosing the right document, you can save time while ensuring accuracy and professionalism. Whether you’re managing recurring payments or one-time transactions, these tools offer the flexibility to adjust according to specific needs. Leveraging these resources allows you to focus more on growing your business rather than spending time on document creation.

Understanding the Importance of Invoices

Proper documentation of financial transactions is crucial for maintaining transparency and accuracy in business operations. Whether for a one-time service or ongoing agreements, having a clear record of exchanges ensures that both parties are on the same page. These documents not only track payments but also serve as legal proof of transactions and agreements made between clients and service providers.

They play a vital role in managing cash flow and are essential for bookkeeping and tax reporting. Well-organized records help businesses monitor their finances, manage overdue payments, and track revenue. Without this formal record, it becomes challenging to resolve disputes or prove the completion of a service. Furthermore, the clear structure provided by these documents enhances professionalism and builds trust between companies and their clients.

Benefits of Customizable Billing Templates

Having the ability to adjust and personalize financial documents according to specific needs provides significant advantages. Customization allows individuals and businesses to align their records with their unique branding, terms, and transaction details, making them more relevant and professional. These editable resources simplify the process of generating accurate documents while offering flexibility in how they are presented.

Flexibility for Different Business Needs

Customized resources provide flexibility, allowing you to adapt documents for various types of transactions, whether it’s a simple service fee or a complex contract. You can easily modify fields such as payment terms, tax rates, and item descriptions to meet the specific requirements of each situation. This versatility helps businesses save time while ensuring that every document is tailored to the client’s needs.

Enhancing Professional Appearance

Personalized financial documents reflect a higher level of professionalism and attention to detail. By incorporating your brand’s colors, logo, and specific design elements, you can create a cohesive and polished look that enhances your business’s image. A well-designed document leaves a lasting impression, contributing to stronger client relationships and boosting trust in your business.

How to Choose the Right Template

Selecting the most suitable document for your financial transactions is key to ensuring both efficiency and accuracy. It’s important to consider factors such as the type of service, the frequency of use, and the level of customization needed. A well-chosen form can help streamline your administrative tasks, ensuring consistency and professionalism in your records.

Start by identifying your specific needs. If you require a document for simple one-time transactions, a straightforward design may suffice. For ongoing relationships, however, you might need a more comprehensive structure that includes sections for recurring charges, payment terms, and service details. Additionally, look for formats that allow easy customization so you can tailor them to your business or personal preferences.

Free vs Paid Invoice Templates

When selecting resources for creating financial documents, one of the key considerations is whether to go with free or paid options. Each has its advantages and potential drawbacks depending on your needs and the complexity of the tasks at hand. Understanding the differences between these two choices can help you make a more informed decision.

Advantages of Free Resources

Free document creation tools are widely available and can be an excellent choice for individuals or small businesses with limited budgets. They provide a cost-effective way to create professional-looking forms without investing in expensive software or services. However, they may have some limitations in terms of customization and additional features.

- Cost-effective and accessible

- Quick and easy to use

- Basic customization options

- Often available on multiple platforms

Benefits of Paid Solutions

Paid resources, on the other hand, often provide more advanced features and greater flexibility. These options can offer premium designs, a broader range of customization tools, and additional support. Businesses with higher demands may find the investment worthwhile, as these tools can help maintain a consistent brand image and streamline administrative processes.

- Advanced customization and design options

- Support for complex document needs

- Frequent updates and improvements

- Higher levels of customer service and support

Top Websites for Free Templates

There are numerous online platforms that offer a wide variety of pre-designed documents for different purposes. These websites allow users to easily access and download resources without the need for costly subscriptions or software. Whether you’re looking for simple or more sophisticated designs, these platforms offer a range of options to suit your needs.

Popular Platforms for Downloadable Documents

Many websites provide free access to well-structured forms that can be customized for personal or business use. These sites are perfect for those who need a professional-looking document without spending time on design or layout. The options range from basic to more intricate layouts, giving users flexibility in their choices.

- Canva – Offers an extensive selection of editable resources, ideal for quick and visually appealing document creation.

- Microsoft Office Templates – A reliable source for professionally designed files, available directly from Microsoft.

- Google Docs – Provides simple and easily customizable options that can be accessed and edited in the cloud.

- Template.net – A site with a wide variety of document styles, including customizable forms for all types of needs.

Key Features of These Platforms

What sets these platforms apart is their ease of use and the variety of features they offer. From drag-and-drop design tools to pre-populated fields, these resources allow for fast and hassle-free document creation. Many of these websites also include cloud storage options, making it simple to access and share your work from anywhere.

- Easy customization for personal and business needs

- Accessible from multiple devices with cloud integration

- Wide range of document styles to choose from

- User-friendly design tools with no experience required

Best Formats for Billing Invoices

Choosing the right format for your financial documents is crucial for ensuring clarity and professionalism. The layout should be easy to read, well-structured, and suitable for the type of transaction being recorded. Selecting the appropriate design ensures that all essential details are included and presented in a way that is simple for both you and your clients to understand.

Standardized formats are often used to ensure consistency and legal compliance. These typically include key elements such as contact information, a breakdown of services or goods provided, payment terms, and totals. A clean, organized format reduces the likelihood of errors and helps to maintain a professional image. Additionally, using digital formats allows for quick sharing and easy access, making the process more efficient and streamlined.

Depending on your specific needs, formats can vary from basic layouts with minimal details to more comprehensive ones that include fields for taxes, discounts, and multiple payment options. Regardless of the complexity, the key is to find a design that best suits your business while maintaining clarity and transparency for your clients.

How to Personalize Your Invoice

Customizing your financial documents is an important step in making them reflect your brand and the specific needs of each transaction. Personalizing a document adds a professional touch, fosters trust, and ensures that all relevant details are tailored to both your business and your client. Whether it’s through adjusting the design, layout, or content, the goal is to create a document that is both functional and representative of your business identity.

Key Elements to Customize

There are several aspects of a document that can be personalized to suit different situations. By adjusting these elements, you can create a document that is not only professional but also aligned with your brand’s image and client expectations.

- Logo and Brand Colors: Include your logo and use your brand’s colors to enhance the document’s appearance and strengthen your brand identity.

- Payment Terms: Specify your preferred payment methods, due dates, and any discounts or late fees to clarify your terms.

- Contact Information: Make sure to include accurate and up-to-date contact details for both parties, making it easy for clients to reach you if needed.

- Notes and Personal Messages: Adding a personal touch, such as a thank-you note or a reminder, can help build a positive relationship with your client.

Steps to Customize Your Document

Personalizing your document doesn’t have to be complicated. With the right tools, you can easily adjust the layout, colors, and content to meet your needs. Follow these simple steps to make your document truly yours:

- Choose a document layout that fits your style.

- Upload your logo and apply your brand colors to key sections.

- Fill in essential details such as service description, prices, and payment terms.

- Review the document for accuracy and ensure all required fields are complete.

- Save your work and send it digitally or print it out for use.

Common Mistakes in Billing Invoices

Even though creating financial documents may seem straightforward, it’s easy to make mistakes that can lead to confusion or delays in payment. These errors can stem from simple oversights or miscalculations, and they often result in frustration for both the sender and the recipient. Understanding the most common mistakes and how to avoid them can help you ensure a smooth and efficient transaction process.

Incorrect or Missing Information

One of the most frequent mistakes is leaving out essential details or inputting incorrect information. Missing data such as a client’s name, a description of services, or the correct payment terms can cause confusion and delay processing. Additionally, failing to double-check the accuracy of dates, amounts, and contact details can lead to misunderstandings.

- Incomplete Client Details: Ensure all necessary information, such as name, address, and contact information, is included.

- Incorrect Payment Amounts: Double-check that the amounts listed are correct, including taxes, discounts, and total charges.

- Missing Payment Terms: Clearly state payment due dates, penalties for late payments, and accepted payment methods.

Failure to Maintain Consistency

Another common issue is inconsistency across documents. Using different formats or naming conventions can confuse clients and make your records appear unprofessional. Keeping a standardized approach to how each document is structured can save time and prevent errors.

- Inconsistent Formatting: Use consistent fonts, colors, and layout styles for a clean and professional look.

- Different Terminology: Stick to familiar terms for services, charges, and terms to avoid confusion.

How to Create Professional Invoices

Creating well-structured and professional financial documents is essential for maintaining a trustworthy image in any business transaction. A polished document not only reflects your professionalism but also ensures clarity for both parties involved. With the right approach, you can craft a document that is clear, concise, and effective in communicating the necessary details.

To achieve a professional look, it is important to focus on key elements such as layout, accuracy, and consistency. These components help present your information in a way that is easy to read and understand. Below are some tips on creating an impactful financial document:

Key Elements of a Professional Document

Make sure that your document includes the following essential information:

| Element | Description |

|---|---|

| Client Information | Include the client’s name, address, and contact details to ensure proper communication. |

| Document Number | Assign a unique identifier to each document for easy tracking and reference. |

| Services or Goods | Clearly describe the products or services provided, including quantities and unit prices. |

| Payment Terms | Specify payment due dates, late fees, and accepted payment methods. |

| Total Amount | Provide a clear breakdown of the total cost, including taxes and discounts if applicable. |

By ensuring these key components are present, you can create a clear and professional financial document that leaves a lasting positive impression on your clients.

Time-Saving Tips with Templates

When managing financial documents, time is often of the essence. Instead of starting from scratch with each new record, using pre-designed structures can help you streamline the process. By utilizing customizable structures, you can save valuable time while ensuring consistency and accuracy in your documentation.

Streamlining Your Process

One of the best ways to save time is by using ready-made structures that only require minimal adjustments. These documents can be pre-filled with standard fields and formats, leaving you with just the task of inputting specific details related to each transaction.

- Pre-set Fields: Use documents that already have the key fields, such as client name, date, and payment terms, so you don’t have to re-enter the same information each time.

- Standard Layout: Utilize consistent layouts to ensure all required details are included, saving time on design and reducing errors.

- Quick Customization: Opt for formats that allow for easy customization, letting you adjust the details with minimal effort.

Automating Recurring Tasks

For businesses that frequently handle similar transactions, setting up recurring structures can save even more time. Many systems allow you to create a base format and replicate it for future use, minimizing the need for manual input. This not only speeds up the process but also ensures that your documentation remains consistent.

- Recurring Documents: Set up recurring entries for regular clients or services to quickly generate similar documents for future use.

- Automated Calculations: Use structures that can automatically calculate totals, taxes, or discounts, reducing manual calculations.

How to Add Taxes to Invoices

In many business transactions, taxes are an important component that needs to be clearly stated in financial documents. Properly calculating and including taxes ensures that both the seller and buyer are on the same page regarding the total cost. It is essential to account for the appropriate tax rates based on location, product or service type, and any exemptions that may apply.

Steps to Include Taxes

To add taxes to your financial document, follow these simple steps to ensure accuracy:

- Identify the Tax Rate: Determine the appropriate tax rate based on the location of the business and the type of product or service being provided. This may vary by state, country, or industry.

- Calculate the Tax Amount: Multiply the subtotal (before tax) by the tax rate to calculate the amount owed in taxes. Be sure to check whether the tax rate is inclusive or exclusive of the total amount.

- List the Tax Separately: Clearly display the tax amount as a separate line item in the document so that the client can see the breakdown of the charges.

Different Tax Types

Depending on your location and the nature of the transaction, you may need to apply different types of taxes. Some common types include:

- Sales Tax: A tax on the sale of goods and services, often applied at the point of sale.

- Value-Added Tax (VAT): A consumption tax added at each stage of production or distribution.

- Service Tax: A tax on services rather than goods, applicable in specific industries.

Always make sure to check local regulations to ensure compliance with the correct tax laws and rates for your transactions.

Ensuring Legal Compliance with Invoices

In business transactions, it is crucial to follow the legal requirements that govern financial documentation. Whether you’re a small business owner or a large corporation, adhering to local laws and industry standards is essential for avoiding legal issues. Ensuring that your records are accurate, complete, and comply with tax regulations helps build trust with clients and protects your business from potential disputes or fines.

Key Legal Considerations

When creating financial documents, there are several important elements that must be included to meet legal standards:

- Proper Identification: Include both your business details and the client’s information, such as full names, addresses, and tax identification numbers (if applicable).

- Clear Payment Terms: Clearly state the payment due date, any penalties for late payments, and the accepted methods of payment.

- Tax Information: Ensure that applicable taxes are calculated correctly, displayed separately, and compliant with local regulations.

Regulations to Follow

Depending on your location and the nature of your business, there may be specific laws governing the content and format of financial documents. Some general regulations to be aware of include:

- Tax Compliance: Make sure you follow the correct tax rates, including VAT or sales tax, depending on the region.

- Record-Keeping: Many jurisdictions require businesses to maintain financial records for a specific period, typically ranging from 5 to 10 years.

- Electronic vs Paper Records: Understand whether electronic documentation is legally acceptable in your jurisdiction or if paper records are required for certain types of transactions.

By taking the time to understand and apply these legal requirements, you ensure that your transactions are compliant with the law, minimizing the risk of penalties or disputes in the future.

How to Send Invoices Efficiently

Efficiently sending financial documents is crucial for smooth business operations. It ensures timely payments, helps maintain a professional relationship with clients, and simplifies record-keeping. The method you use to send these documents can impact both your workflow and the speed at which you receive payments.

Steps to Streamline the Sending Process

Here are several steps you can take to ensure that sending financial documents is both quick and organized:

- Use Digital Platforms: Leverage email or specialized invoicing software to send documents instantly, avoiding delays associated with physical mail.

- Personalize with Client Details: Always include personalized information, such as the client’s name and the specific services or products provided, to ensure clarity and reduce confusion.

- Automate Regular Payments: Set up recurring invoices for clients with regular payments to save time and avoid manual entry for each transaction.

- Verify All Information: Before sending, double-check that all fields are correct, including amounts, dates, and tax calculations, to avoid the need for corrections later.

Efficient Delivery Methods

Choosing the right delivery method is essential for efficiency. Here are the most effective options:

- Email: One of the quickest and most convenient ways to send financial documents, especially with attached PDFs or links to online payment systems.

- Online Payment Platforms: Some platforms allow you to send invoices directly through their interface, offering built-in tracking and payment features.

- Automation Software: Many businesses use automated systems to send financial documents on a set schedule, ensuring that nothing is missed and reducing manual labor.

By applying these practices, you can ensure that your financial communications are timely, professional, and efficient, ultimately enhancing both your workflow and client relationships.

Invoice Tracking and Record Keeping

Efficiently managing financial records is crucial for any business. Keeping track of payments and maintaining organized records ensures that you can easily verify transactions, avoid errors, and comply with legal requirements. A well-structured system for tracking and storing these documents also supports better decision-making and faster issue resolution.

Why Tracking and Record Keeping Matter

Proper tracking and record-keeping offer several key benefits, such as:

- Accurate Financial Overview: Helps you monitor the financial health of your business, making it easier to track income and expenses.

- Legal Compliance: Keeps you prepared for audits or tax filings by ensuring all relevant data is well-documented.

- Efficient Payment Management: Enables you to quickly identify outstanding payments, ensuring faster follow-ups and timely collections.

- Easy Dispute Resolution: If discrepancies arise, having clear records makes it easier to resolve issues with clients or suppliers.

Best Practices for Tracking Financial Documents

To stay organized and streamline your financial management, consider these best practices:

- Use Software Solutions: Accounting software or cloud-based tools offer automated tracking, real-time updates, and secure storage for all documents.

- Assign Unique Identifiers: Each document should have a unique number or code to make it easy to reference and retrieve when needed.

- Regularly Update Your Records: Consistently track payments, update documents, and record any changes to maintain up-to-date financial data.

- Back Up Digital Records: Protect your records from loss by storing them securely in multiple locations, such as cloud services or external hard drives.

By adopting a structured approach to tracking and keeping financial records, you ensure that your business remains organized, compliant, and prepared for any financial task that may arise.

Using Templates for Recurring Payments

Managing regular payments can become a tedious task without a structured system in place. For businesses that deal with subscriptions or repeat transactions, leveraging pre-designed documents simplifies the process, saves time, and ensures consistency. These ready-made solutions can help automate much of the administrative burden, allowing for more focus on business growth.

Benefits of Using Pre-Designed Solutions for Recurring Charges

By adopting automated systems for recurring payments, businesses can enjoy several advantages:

- Consistency: Predefined formats ensure that every transaction follows the same structure, maintaining a professional and uniform appearance.

- Time-Saving: With reusable documents, you can easily create new records for each transaction without needing to start from scratch each time.

- Reduced Errors: By filling in standard fields automatically, you reduce the chances of missing crucial details or making mistakes that can cause payment delays.

- Better Tracking: Automatically generated entries help you keep track of all recurring payments, making it easier to follow up on overdue amounts and manage financial records.

How to Set Up Recurring Payment Systems Using Pre-Designed Documents

Here are some tips for efficiently implementing recurring payment structures using automated systems:

- Standardize Payment Information: Include essential details such as client name, payment frequency, amounts, and payment due dates to create clear records.

- Use Automation Software: Many digital platforms integrate with payment gateways to automatically generate and send your pre-designed documents, reducing manual effort.

- Maintain Clear Communication: Ensure your clients are aware of the payment structure and when to expect charges, fostering transparency and trust.

- Monitor Transactions Regularly: Even with automated systems, make it a practice to periodically review records and ensure that payments are processed as scheduled.

By using pre-designed documents to manage recurring payments, businesses can streamline operations, reduce the potential for mistakes, and offer a more professional service to their clients.

How to Automate Billing with Templates

Automating routine financial tasks can significantly improve efficiency, especially for businesses that handle recurring charges or have numerous clients. By utilizing standardized documents, you can streamline the process, reduce the risk of errors, and free up valuable time. This automation allows businesses to generate consistent, accurate records with minimal manual intervention.

Steps to Set Up Automation

Here are some key steps to successfully automate your financial records using pre-built formats:

- Select the Right Tool: Choose a software solution that integrates with payment platforms and allows you to create automated documents based on pre-set data.

- Standardize Payment Information: Set up consistent fields, such as client names, due dates, amounts, and other payment details, to ensure every record contains the necessary information.

- Set Up Recurring Payment Schedules: Define the frequency of payments (e.g., weekly, monthly) and automate the generation of new documents on those schedules.

- Link to Payment Gateways: Integrate your automated system with payment processors to automatically generate and send records to clients as soon as payments are processed.

- Monitor and Adjust Regularly: Even though automation handles much of the work, it’s important to review generated records periodically to ensure accuracy and compliance.

Benefits of Automation

Automating with pre-structured formats offers several advantages:

- Efficiency: By reducing manual data entry, you save time and resources that would otherwise be spent on repetitive tasks.

- Consistency: Standardized formats ensure that every financial record follows the same structure, improving clarity and professionalism.

- Fewer Errors: Automation reduces the risk of mistakes, such as missed entries or incorrect amounts, which can lead to client disputes or payment delays.

- Easy Updates: It’s simple to update the format or structure of automated documents across your system without having to adjust each one individually.

By setting up an automated system for generating financial records, you can save time,