Ultimate Billing Invoice Template for Easy Payment Management

When running a business, keeping track of financial transactions is essential for maintaining smooth operations and ensuring timely compensation. One of the most effective ways to streamline this process is by using a well-structured document that facilitates clear communication between service providers and clients.

Customizable payment documents allow businesses to present professional records of amounts due, services rendered, and payment terms. These documents help to avoid confusion, reduce errors, and enhance trust with customers, ensuring that both parties are aligned on the details of the transaction.

By leveraging the right tools, organizations can not only save time but also improve the accuracy and consistency of their financial records. Whether you’re a freelancer, small business owner, or part of a larger enterprise, having access to efficient solutions for generating clear, organized payment requests is a critical step toward maintaining financial health and professionalism.

Billing Invoice Template Essentials

Creating professional documents to request payment is a crucial part of managing any business. These documents help establish clear terms for the work completed, the amount due, and the timeline for payment. For the process to be effective, certain elements must be included to ensure accuracy and avoid confusion between service providers and clients.

To create a document that serves its purpose, it’s important to include the following essentials:

- Business Information: Clearly display the name, address, and contact details of your business, along with any relevant identification numbers or licenses.

- Client Information: Include the client’s full name or company name, along with their contact information to ensure the document reaches the correct person.

- Description of Services or Products: Provide a detailed breakdown of the work completed, items sold, or services rendered. This helps the client understand exactly what they are paying for.

- Payment Amount: Clearly state the total amount due, including any applicable taxes or additional fees, to avoid ambiguity.

- Payment Terms: Specify the deadline for payment, accepted payment methods, and any late fees that may apply if payment is delayed.

- Unique Identifier: Assign a unique reference number to each document for easy tracking and record-keeping.

Including these core elements ensures that your documents are clear, professional, and legally sound. This structure also makes it easier for clients to process payments promptly and without confusion, reducing the chances of disputes and delays.

How to Create a Simple Invoice

Creating a straightforward document for payment requests doesn’t have to be complicated. A well-organized payment record can help streamline transactions, ensure clarity, and avoid misunderstandings. By following a few simple steps, you can create an effective document that captures all necessary details while remaining easy to understand.

Here’s a step-by-step guide to help you create a simple and clear payment request:

- Start with Your Information: Begin by including your business name, address, phone number, and email address. This makes it clear who is issuing the document.

- Add Client Details: Include the recipient’s name, company name (if applicable), and contact information. This ensures that the document reaches the correct person.

- Include a Unique Identifier: Assign a reference number to the document for easy tracking. This number will help you or your client refer to the specific transaction in the future.

- List Services or Products: Provide a detailed description of the goods or services provided. Be specific to avoid confusion. Include the quantity, unit price, and any relevant details for each item or service.

- Clearly State the Total Amount Due: Add up all costs, taxes, and additional fees to show the total amount owed. Ensure this figure is prominently displayed so it is easy to find.

- Set Payment Terms: Specify when the payment is due and the acceptable payment methods. If there are any late fees or discounts for early payment, mention those as well.

- Include Your Payment Details: Provide your bank account information, PayPal address, or any other method you prefer for receiving payments.

By following these steps, you can create a simple yet professional document that ensures both parties are clear on the terms of the transaction. A well-structured payment request not only speeds up the process but also reinforces professionalism and trust between you and your clients.

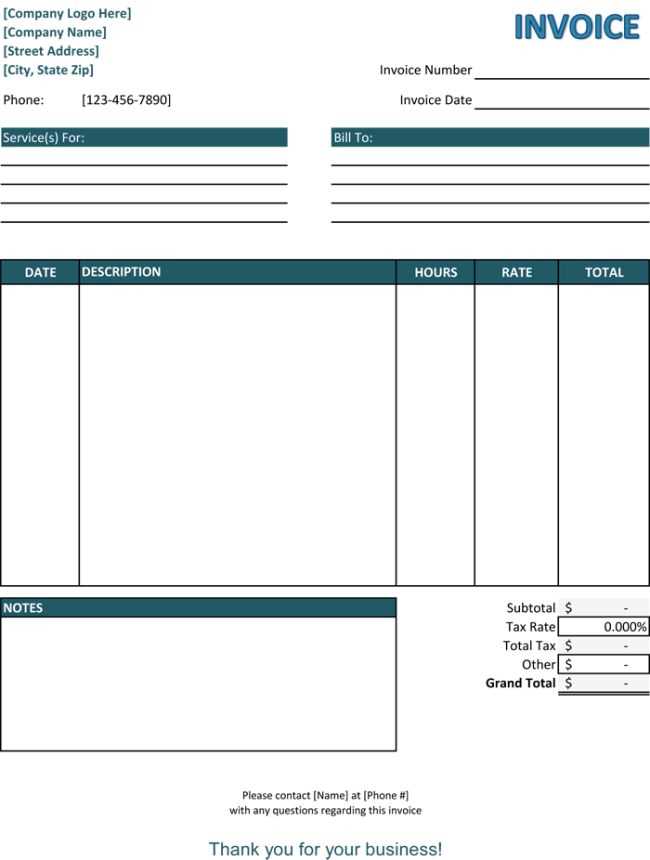

Key Elements of an Invoice Template

To ensure that a payment request is both professional and effective, certain components must be included. These core elements help make the document clear, organized, and legally sound. Each part of the document plays a specific role in ensuring that both parties understand the terms of the transaction and that there is no confusion regarding the amount due or the details of the services or goods provided.

Here are the key elements that should be included in every payment request document:

- Header with Your Business Information: At the top, include your business name, address, contact number, and email. This ensures the recipient knows who the document is from and how to reach you if necessary.

- Client Information: Add the recipient’s name or company name, along with their address and contact information. This helps avoid confusion about who is responsible for the payment.

- Unique Document Reference: Every document should have a unique identifier or number. This number makes it easier to track and reference the document in the future.

- Description of Goods or Services: Provide a detailed list of what has been delivered or completed. Include the quantity, price per unit, and any other relevant details that clarify what the payment is for.

- Subtotal and Taxes: Clearly show the cost of each item or service, and calculate any applicable taxes or additional charges. This breakdown helps prevent misunderstandings.

- Total Amount Due: The final amount to be paid should be displayed prominently. Make sure this figure includes all costs, taxes, and fees.

- Payment Terms: Specify the due date for payment, any discounts for early payment, and penalties for late payments. This ensures both parties understand when the money is expected and the consequences for delays.

- Accepted Payment Methods: Include the payment options you accept (bank transfer, credit card, PayPal, etc.), making it easier for the client to settle the amount.

Including these essential components ensures that the payment request is clear, accurate, and legally binding. A well-structured document makes it easier for clients to process payments promptly and avoids any potential disputes.

Benefits of Using Invoice Templates

Utilizing pre-designed documents for payment requests offers significant advantages for businesses of all sizes. These ready-made solutions simplify the invoicing process, ensuring that important details are consistently included, saving both time and effort. Whether you’re a freelancer or a large enterprise, relying on structured formats brings several key benefits that can improve both efficiency and professionalism.

Time Efficiency and Consistency

One of the primary benefits of using ready-to-use payment request forms is the time saved in generating accurate records. By filling in standard fields, you avoid the need to manually draft each document from scratch. This consistency ensures that every document you send out has the necessary elements, such as contact details, terms, and payment breakdowns, reducing the risk of missing crucial information.

Professionalism and Accuracy

Using a structured document enhances the overall presentation of your business, conveying professionalism to clients and partners. A well-organized request not only reduces errors but also increases trust. Clients are more likely to pay promptly when they receive clear and accurate payment details. Additionally, pre-designed formats help maintain accuracy by including essential fields, reducing the chance of mistakes such as incorrect totals or missing payment instructions.

Financial Clarity is another key advantage. These documents often come with built-in sections for taxes, discounts, and subtotals, which helps both businesses and clients keep track of the financial details clearly. By having all the necessary fields in place, it becomes easier to manage and reconcile transactions.

In conclusion, using structured formats for payment requests streamlines business operations, boosts credibility, and ensures that both parties involved are clear on the terms. These tools not only save time but also reduce errors, leading to smoother, more efficient transactions.

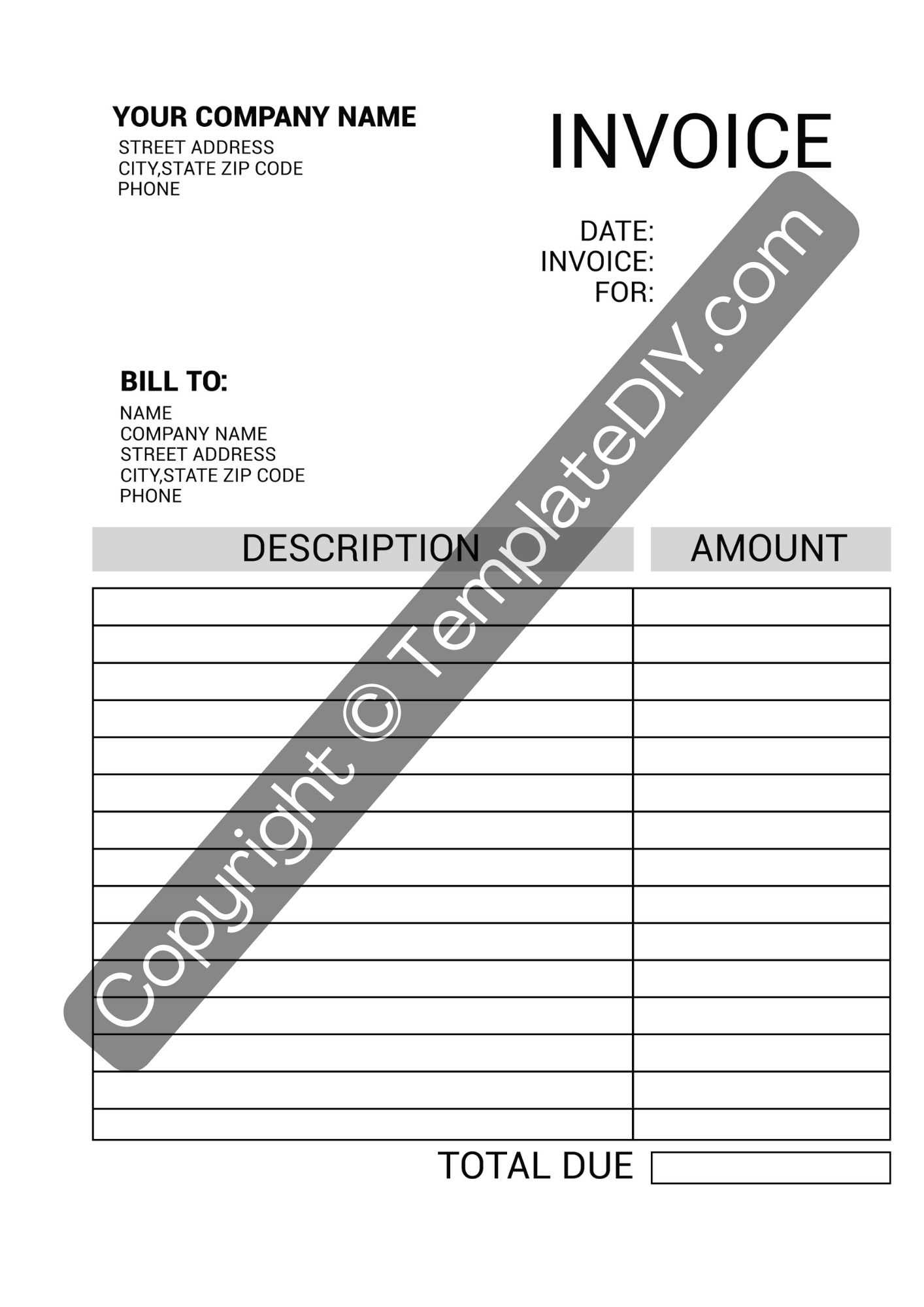

Customizing Your Invoice for Business Needs

Adapting payment request documents to fit the specific requirements of your business can make a significant difference in both the efficiency of your operations and the clarity of communication with clients. Customization allows you to align the document with your brand identity, highlight key information, and incorporate any particular details relevant to your industry or services.

To make your document more effective, consider these customization options:

| Customization Option | Purpose |

|---|---|

| Branding Elements | Incorporating your logo, business colors, and fonts gives the document a professional, branded look. |

| Payment Terms | Modify the payment terms based on client agreements, offering flexible options such as discounts for early payment or extended deadlines for large projects. |

| Detailed Service Descriptions | Customizing service or product descriptions makes it easier for clients to understand exactly what they are being charged for. |

| Multiple Payment Methods | Adjust the payment options section to include various payment methods that suit both your preferences and those of your clients. |

| Tax or Discount Application | Customize fields to accommodate specific taxes or discounts that apply to certain transactions, ensuring the final amount is correct. |

By tailoring these elements to fit your business’s specific needs, you create a document that is not only functional but also reinforces your brand identity and ensures accuracy in every transaction. Customization also improves the client experience, making it easier for them to process payments quickly and efficiently.

How to Choose the Right Template

Selecting the right structure for your payment request is essential for ensuring clarity, efficiency, and professionalism. The design and functionality of the document should align with your business needs, the nature of your services, and the preferences of your clients. A well-chosen format not only helps you maintain consistency but also enhances the overall client experience, making the payment process smoother and more transparent.

Here are key factors to consider when choosing the right format for your business:

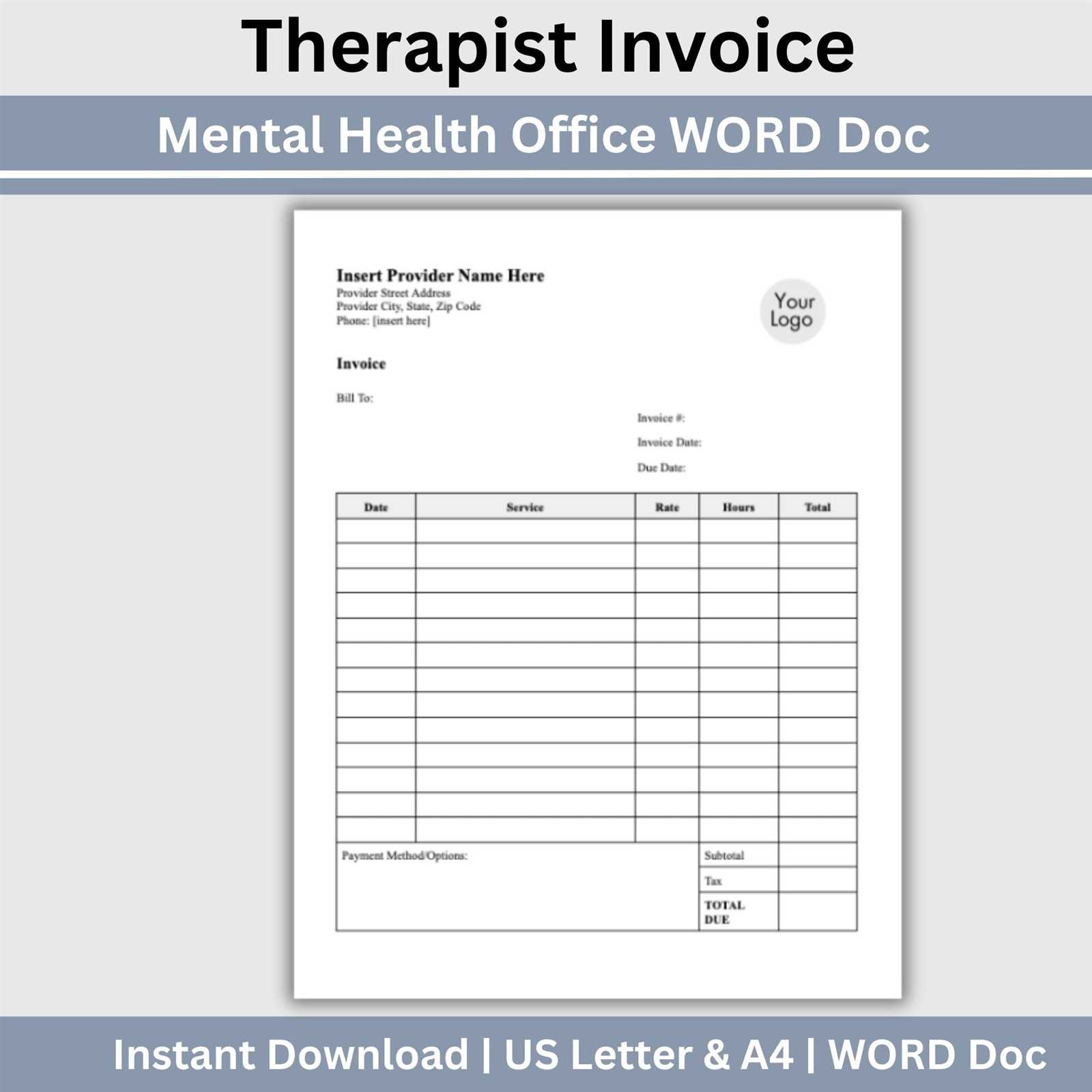

- Industry-Specific Requirements: Different industries may require different details on their payment requests. For example, a consultant may need a more detailed description of services, while a product seller may focus more on quantities and prices. Choose a format that reflects the nature of your work.

- Ease of Use: Ensure that the structure is user-friendly and easy to fill out. Look for a layout that allows for quick customization and doesn’t require complicated formatting.

- Customization Flexibility: Opt for a format that allows you to add or remove sections as needed. For instance, if you sometimes offer discounts or charge for shipping, you should be able to easily include these options without cluttering the document.

- Professional Design: Choose a clean, polished design that reflects your business’s brand identity. The layout should be clear, with an easy-to-read font, well-organized sections, and enough white space to avoid a cluttered look.

- Compatibility with Your Software: Make sure the document structure works well with your existing tools and software. If you use accounting software, choose a format that can easily integrate or import/export data.

By keeping these factors in mind, you can select a structure that not only meets the functional needs of your business but also strengthens your brand image and improves the client’s experience. The right format helps to create a professional, consistent, and efficient payment process.

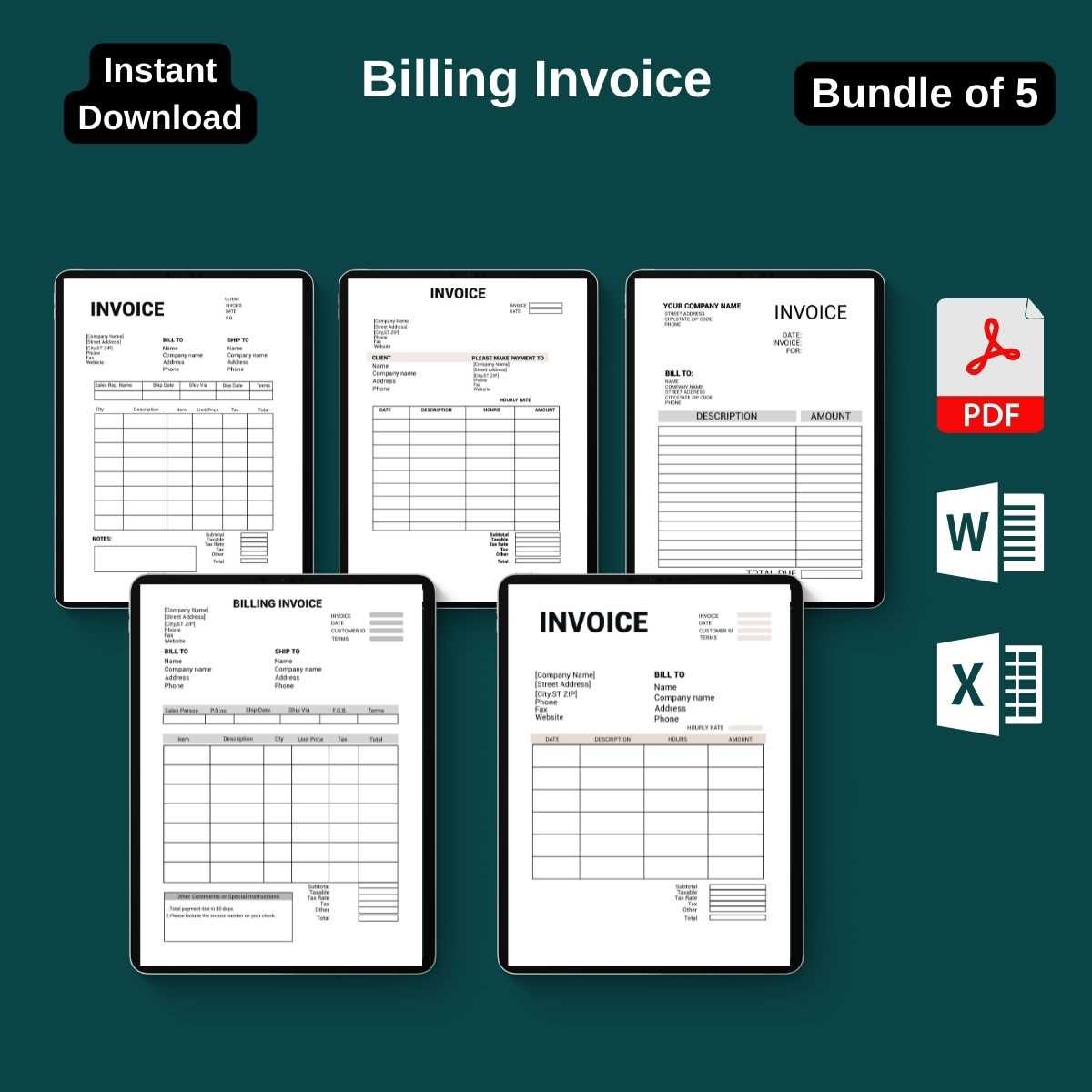

Free Billing Invoice Templates Online

There are many free resources available online that provide ready-made structures for payment requests. These free tools allow small business owners, freelancers, and entrepreneurs to create professional documents without the need for expensive software or custom design. With a variety of formats and styles to choose from, you can easily find an option that fits your specific business needs.

Advantages of Using Free Online Resources

One of the main benefits of using free online tools is the cost savings. Instead of paying for software or hiring a designer, you can access high-quality, customizable documents at no charge. Additionally, these resources often include user-friendly features that make it simple to fill in details like client information, payment terms, and descriptions of services or products.

Where to Find Free Templates

Many reputable websites offer downloadable documents that are easy to customize. Some popular platforms include:

- Google Docs: Offers free, editable payment request formats that can be easily shared and updated in real time.

- Microsoft Office: Provides a variety of free downloadable designs through their templates section, compatible with Word and Excel.

- Online Accounting Software: Many accounting platforms such as Wave and Zoho offer free document generation tools that include customizable fields for payments.

- Independent Template Providers: Websites like Invoice Generator or Invoiced provide free, simple-to-use forms that can be customized without creating an account.

By utilizing these free resources, you can save time and money while still delivering professional, well-structured documents that enhance your business’s credibility and improve the payment process.

Invoice Formatting Tips for Clarity

When creating a payment request document, clarity is key to ensuring that both you and your client are on the same page. A well-organized structure helps prevent confusion, reduces errors, and speeds up the payment process. Proper formatting allows important details to stand out, making it easier for the recipient to review and process the information quickly.

Here are some useful tips for formatting your document to improve readability and clarity:

- Use Clear, Legible Fonts: Choose a simple, professional font like Arial or Times New Roman. Ensure the text size is large enough to be easily readable–usually between 10 and 12 points.

- Organize Information with Sections: Break the document into clearly defined sections, such as contact details, description of services, totals, and payment terms. Use headings to distinguish each section and make it easy to locate key information.

- Highlight Key Figures: Make the total amount due stand out by using bold text or a larger font size. This ensures that the recipient can quickly identify the most important detail of the document.

- Include Sufficient White Space: Avoid clutter by leaving enough space between different sections and rows. Proper spacing makes the document feel less overwhelming and easier to read.

- Use Tables for Itemization: For a detailed breakdown of goods or services provided, use a table to neatly organize each item. Include columns for quantity, description, price, and subtotal to make it clear how the total amount is calculated.

- Be Consistent with Alignment: Ensure that text, numbers, and tables are consistently aligned. For instance, right-align numerical values for easy comparison, and keep text left-aligned for clarity.

By following these simple formatting tips, you can create a document that is not only professional but also easy for your clients to understand. A well-organized payment request reduces the chance of disputes and ensures faster processing, improving the overall client experience.

Common Mistakes in Billing Invoices

When creating payment request documents, even small errors can lead to confusion, delays, or disputes. Many businesses fall into the trap of overlooking essential details or making formatting mistakes that can cause unnecessary complications. Identifying and avoiding these common mistakes is crucial for maintaining professionalism and ensuring timely payments.

Here are some frequent mistakes to watch out for when preparing your payment requests:

- Incorrect or Missing Contact Information: Failing to include your business name, address, or contact details can make it difficult for clients to reach you with questions or payments. Always ensure your information is clearly displayed.

- Omitting Important Payment Terms: Not specifying payment due dates, late fees, or accepted methods can lead to confusion. Clients may assume they have more time to pay or might not know how to submit payment.

- Errors in Pricing or Calculations: Even a small miscalculation can cause frustration. Double-check your math to ensure that the amounts listed match the work completed or products delivered, including taxes and discounts.

- Lack of a Unique Reference Number: Not including a reference number makes it harder to track the payment or link it to a specific project or service. Always include a unique identifier to make tracking easier.

- Unclear Descriptions of Goods or Services: Vague or incomplete descriptions can create confusion about what the client is being charged for. Be specific and detailed about each item or service included in the document.

- Not Aligning with Client Expectations: If you agreed on specific terms or rates with the client, make sure the payment request accurately reflects these. Any discrepancies can cause dissatisfaction or delay payments.

- Failure to Include Taxes or Additional Fees: Forgetting to include applicable taxes, shipping fees, or other charges can lead to underpayment. Be sure to account for all costs when calculating the total amount due.

Avoiding these common mistakes can significantly improve the clarity and professionalism of your payment documents. Ensuring accuracy and transparency not only reduces the risk of delays but also builds trust with your clients, making future transactions smoother.

How to Automate Your Invoicing Process

Automating the payment request process can save significant time and reduce the risk of errors, allowing you to focus on other aspects of your business. By using automated tools and systems, you can streamline the creation, sending, and tracking of payment requests, ensuring that they are sent on time and with all necessary information. This not only improves efficiency but also helps maintain a professional appearance and consistency in your financial dealings.

Steps to Automate Your Payment Requests

Here are the essential steps you can take to set up an automated invoicing system for your business:

| Step | Description |

|---|---|

| Choose the Right Software | Select an automation tool or software that suits your business needs. Many accounting platforms, such as QuickBooks, FreshBooks, and Zoho, offer automated document generation and tracking features. |

| Set Up Recurring Billing | For clients with regular payment schedules, set up recurring billing within the software. This ensures that documents are automatically generated and sent at predetermined intervals, such as weekly, monthly, or annually. |

| Customize Payment Details | Configure the software to automatically include your business details, payment terms, and specific service descriptions to save time and maintain consistency in each document. |

| Integrate Payment Gateways | Link your payment processor to the software. This allows clients to pay directly from the payment request document, making the process smoother for both parties. |

| Enable Automatic Reminders | Set up automatic reminders for unpaid requests. Many tools can send email reminders to clients before or after the due date to encourage timely payments. |

Benefits of Automation

Automating the payment request process offers several key benefits:

- Time-Saving: By automating the creation and sending of documents, you can eliminate the need for manual entry and follow-ups, saving hours each month.

- Accuracy: Automation reduces human error, ensuring that every payment request is consistent, complete, and accurate.

- Professionalism: An automated system ensures that all documents are generated according to your standards, reinforcing a professional image with every transaction.

- Better Cash Flow Management: Automation ensures timely sending and reminders, improving the chances of on-time payments and reducing late fees.

By setting up automation for your payment requests, you can streamline your entire payment process, reduce administrative overhead, and increase financial efficiency.

Using Invoice Templates for Freelancers

Freelancers often juggle multiple clients and projects, making it essential to maintain an organized and efficient system for requesting payments. Utilizing pre-designed documents for payment requests allows freelancers to streamline their billing process, ensuring timely and accurate payments. With minimal effort, you can create a professional-looking document that outlines your services, rates, and payment terms, helping you maintain a consistent cash flow and a polished image with clients.

Why Freelancers Benefit from Using Pre-made Structures

For freelancers, managing finances can be a challenging task, especially when handling multiple clients with varying needs. Pre-made payment request documents offer several advantages:

- Time Efficiency: Instead of creating a new document from scratch every time, freelancers can simply fill in the relevant details, saving time on administrative work.

- Professional Appearance: A consistent and polished document helps build trust with clients, making your business appear more professional and reliable.

- Consistency: Using the same format for all clients ensures that you don’t overlook important details like payment terms, descriptions of services, or deadlines.

- Customizability: Pre-made formats can be easily customized to fit the needs of individual clients or projects, ensuring accuracy while maintaining flexibility.

Key Elements to Include for Freelancers

When selecting a document structure, freelancers should ensure that it includes the following essential elements:

- Client Information: Include your client’s name, business name (if applicable), and contact details to ensure clarity and proper identification.

- Project Breakdown: Clearly outline the work completed or services provided, with specific details on each task to avoid confusion about what is being billed.

- Payment Terms: Include details on when the payment is due, the preferred payment method, and any late fees or discounts that may apply.

- Invoice Number: Assigning a unique number to each document helps you track payments and maintain records efficiently.

By using pre-designed structures for payment requests, freelancers can focus more on their work and less on the administrative side of things, ensuring that they receive timely compensation while maintaining professionalism with every client.

Importance of Accurate Invoice Details

Providing precise and comprehensive information in payment request documents is crucial for maintaining smooth business transactions and fostering trust with clients. When all the necessary details are clearly outlined, it ensures that both parties have a shared understanding of the terms, reducing the likelihood of misunderstandings or disputes. Accurate documentation also simplifies the process of tracking payments and handling any discrepancies that may arise.

Here are some key reasons why having accurate details in your payment request documents is essential:

- Prevents Payment Delays: Clear and correct information ensures that clients can quickly process payments without needing clarification. Errors or omissions can lead to delays, as clients may need to reach out for clarification.

- Avoids Disputes: Providing exact descriptions of services, rates, and any terms helps avoid disagreements about what was delivered and how much is owed. When clients understand the specifics of the transaction, the likelihood of disputes decreases.

- Ensures Legal Compliance: Accurate details, including tax information and official contact information, are vital for staying compliant with local and international laws, particularly for businesses dealing with large transactions or operating across borders.

- Improves Financial Management: Keeping precise records of payment requests makes it easier to track income, manage cash flow, and prepare for tax season. Well-documented transactions can also simplify financial audits.

- Enhances Professionalism: Consistently accurate and thorough documents reflect professionalism and attention to detail, which can improve client relationships and encourage timely payments.

By ensuring that all the details in your payment request documents are accurate, you not only streamline your own processes but also help establish a stronger, more reliable reputation with your clients. This ultimately leads to a more efficient and effective financial system for your business.

Integrating Invoice Templates with Accounting Software

Integrating payment request documents with accounting software can significantly streamline your business operations. By syncing your payment structures with automated financial tools, you ensure seamless data transfer, reduce the risk of errors, and save time on administrative tasks. This integration allows for real-time updates, making it easier to track payments, manage client records, and generate financial reports with minimal effort.

Here are the key benefits of connecting your payment request system with accounting software:

- Automatic Data Syncing: Integration ensures that client and payment details are automatically updated across all systems, reducing manual data entry and the chances of errors. When you send a document, it’s instantly reflected in your accounting software.

- Improved Efficiency: By eliminating the need to manually input data into both your payment request forms and accounting software, you speed up the billing process and minimize the administrative workload.

- Real-Time Tracking: Linking your payment requests with accounting software allows for real-time tracking of payments and outstanding balances, ensuring you have up-to-date information on your cash flow at all times.

- Financial Reporting: With integration, all the data from your requests is captured in the software, making it easier to generate comprehensive reports. This helps in analyzing revenue, managing taxes, and preparing for audits.

- Better Client Management: Integration keeps client records up to date across both platforms. You can track client interactions, payment history, and outstanding balances, improving overall client relationship management.

Many popular accounting platforms, such as QuickBooks, FreshBooks, and Xero, offer built-in options to connect with various document creation tools. Whether you choose a cloud-based system or a desktop application, integrating your payment request process with accounting software can save you time, reduce errors, and improve your business’s financial accuracy.

Best Practices for Invoice Management

Effective management of payment request documents is essential for ensuring smooth financial operations and maintaining positive relationships with clients. By following best practices, businesses can improve their cash flow, reduce administrative errors, and ensure that all transactions are properly tracked. Proper management also plays a crucial role in maintaining a professional image and fostering trust with clients.

Key Practices for Efficient Management

Here are some of the best practices to follow for managing your payment request documents:

- Maintain Clear and Consistent Formats: Use a consistent layout and structure for all your payment request documents. This helps both you and your clients easily understand the details of the transaction and reduces the chance of confusion.

- Track All Payments: Keep detailed records of each payment, including the date it was received, the method of payment, and any relevant references. This will help you quickly identify any outstanding balances and ensure timely follow-ups.

- Set Clear Payment Terms: Clearly state payment due dates, accepted payment methods, and any late fees in every document. This sets clear expectations for your clients and reduces the chances of missed or delayed payments.

- Send Documents Promptly: Send your payment request as soon as possible after delivering goods or services. Timely documentation increases the chances of faster payment and shows professionalism.

- Follow Up on Outstanding Payments: Regularly follow up on unpaid balances. A polite reminder before or after the due date can encourage clients to process payments promptly.

- Use Digital Tools for Tracking: Leverage software tools to keep track of your payment requests, payments, and overdue balances. Many tools can help automate reminders and provide you with detailed reports to stay on top of your finances.

Benefits of Proper Management

Following these best practices provides several key benefits for businesses:

- Improved Cash Flow: Efficient management ensures that payments are collected on time, contributing to better cash flow and financial stability.

- Reduced Errors: Consistent tracking and accurate documentation reduce the chances of mistakes, which can lead to payment disputes or delays.

- Better Client Relations: Professional, well-organized payment processes help build trust with clients, enhancing relationships and encouraging repeat business.

- Time Savings: Automation and organization can significantly reduce the time spent on manual administrative tasks, freeing up more time for core business activities.

By adopting these best practices, businesses can streamline their financial operations, improve efficiency, and maintain healthy relationships with clients, leading to a more successful and well-managed operation.

How to Handle Invoice Disputes

Disputes over payment requests are an unfortunate but common part of doing business. Whether due to unclear terms, discrepancies in amounts, or misunderstandings about services rendered, these disagreements can disrupt cash flow and damage client relationships. However, by addressing disputes promptly and professionally, you can resolve issues effectively and maintain positive business connections.

Steps to Resolve Payment Disputes

Here are the key steps to follow when dealing with payment disputes:

| Step | Description |

|---|---|

| Review the Dispute | Carefully examine the disputed document to understand the client’s concerns. Ensure that all details, such as rates, dates, and services, are accurate and clearly stated. It’s essential to have all facts in hand before responding. |

| Communicate with the Client | Reach out to the client directly to discuss the issue. Open, respectful communication is crucial. Listen to their concerns and try to understand their perspective. Keep the conversation professional and focused on finding a solution. |

| Offer a Solution | Once you have a clear understanding of the dispute, propose a reasonable solution. This might include revising the payment request, offering a partial refund, or explaining any misunderstandings. If the dispute is due to an error on your part, acknowledge it and take corrective action. |

| Document the Agreement | After reaching a resolution, make sure to document the agreement in writing. This could include a revised payment request or a confirmation email outlining the terms of the settlement. Both parties should have a record of the terms for future reference. |

| Follow Up | After the dispute is resolved, follow up with the client to ensure that the payment is made promptly. A friendly reminder can help prevent further delays and demonstrate professionalism. |

Tips for Preventing Future Disputes

While disputes are sometimes inevitable, taking proactive steps can minimize the risk of future issues:

- Be Transparent:

Tracking Payments with Billing Invoices

Efficient tracking of payments is crucial for maintaining smooth financial operations and ensuring that all amounts owed are collected on time. By keeping accurate records and monitoring payment statuses, businesses can stay on top of their finances and prevent late payments from affecting cash flow. Organizing and tracking payment requests helps in identifying outstanding balances, following up with clients, and maintaining a steady revenue stream.

Here are some strategies to help you track payments effectively:

- Use a Unique Identifier for Each Request: Assigning a unique reference number or code to each payment request makes it easier to track and reference specific transactions. This number helps both you and your client keep track of payments and any related correspondence.

- Include Detailed Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any applicable late fees. This ensures that both you and your client have a shared understanding of the payment expectations, reducing confusion.

- Track Payment Status Regularly: Set aside time each week or month to review your outstanding balances. Keeping a consistent schedule for monitoring your records ensures you don’t overlook any overdue payments.

- Record Partial Payments: If your clients make partial payments, update your records to reflect the remaining balance. This provides both you and your clients with clear information about what has been paid and what is still due.

- Use Software Tools for Automation: Many accounting and management tools allow you to track payments automatically. These platforms can alert you when payments are due or overdue, saving you time and effort in manual tracking.

- Send Payment Reminders: If a payment is overdue, sending a polite reminder can prompt clients to settle the balance. Be sure to follow up regularly, especially for larger amounts, to avoid delays in payment processing.

By keeping detailed records of each payment and regularly checking the status of your transactions, you can ensure a steady cash flow and prevent financial confusion. Effective payment tracking also builds a strong reputation for your business, as clients appreciate the transparency and professionalism in managing their accounts.

Legal Considerations for Invoice Creation

Creating payment request documents is not just a financial necessity but also a legal obligation. It’s important to ensure that these documents comply with local and international laws to avoid potential disputes, fines, or complications. Accurate and legally sound documentation helps to establish clear agreements between businesses and clients, reducing the risk of misunderstanding and ensuring that both parties are protected.

Here are key legal aspects to consider when creating payment requests:

- Correct Information: Ensure that the document includes all required information, such as the names and contact details of both the business and the client, a description of the goods or services provided, and the agreed-upon price. Accurate and detailed records are essential for avoiding disputes and ensuring compliance with contractual obligations.

- Compliance with Tax Laws: Depending on your location, tax regulations may require specific tax details to be included in the document, such as tax identification numbers or applicable VAT rates. Failure to include these details can lead to fines or penalties.

- Payment Terms and Deadlines: Clearly state the payment due date, along with the accepted methods of payment. It’s also important to specify the consequences of late payments, such as late fees or interest charges, to ensure both parties are aware of the terms.

- Legal Language: Use clear and precise language to avoid ambiguity in the terms of the payment request. Ambiguous wording can lead to legal complications or misunderstandings between parties.

- Record-Keeping Requirements: Most jurisdictions require businesses to retain records of transactions for a specified number of years. Be sure to keep copies of all payment request documents, along with proof of payment, for future reference or in case of an audit.

- Jurisdiction and Governing Law: If you’re working with clients from different regions, consider including a clause specifying the governing law and jurisdiction in case of disputes. This will clarify which laws apply and where any legal action will take place.

By ensuring that your payment request documents meet legal requirements, you protect both your business and your clients, preventing legal disputes and maintaining a professional and compliant approach to business transactions.

How to Maintain Professional Invoicing Standards

Maintaining high standards in payment request documentation is essential for presenting a professional image to clients and ensuring smooth financial operations. Professionalism in this area not only helps in receiving timely payments but also strengthens business relationships and establishes credibility. By adhering to clear, consistent practices, businesses can enhance their reputation and avoid confusion or disputes.

Here are some strategies to ensure your payment documentation remains professional:

- Use Clear and Concise Language: Avoid jargon or ambiguous terms. The language used should be easy to understand, ensuring that both you and your client are on the same page regarding payment terms and amounts.

- Maintain Consistency in Format: Use a standardized format for all payment request documents. This includes consistent fonts, colors, and layout. A well-organized format conveys professionalism and makes it easier for clients to process the details of the transaction.

- Ensure Accurate and Detailed Information: Include all relevant details, such as item descriptions, quantities, unit prices, and any applicable taxes or discounts. Mistakes or omissions can lead to misunderstandings and delayed payments.

- Follow Up Promptly: After sending a payment request, ensure you follow up in a timely manner if the payment is not received by the due date. A polite and professional reminder can go a long way in maintaining a positive relationship with clients.

- Include Payment Terms and Conditions: Always outline clear payment terms, including due dates, accepted payment methods, and any late fees or interest charges. This sets expectations upfront and reduces the likelihood of disputes.

- Adopt Digital Solutions: Use accounting or invoicing software to streamline the creation, sending, and tracking of payment requests. Digital tools not only save time but also help you maintain a professional appearance with templates, automatic calculations, and organized records.

By following these best practices, businesses can maintain high standards in their financial communications, which ultimately leads to faster payments, fewer misunderstandings, and stronger relationships with clients.