Free Billing Invoice Template for Word to Streamline Your Invoicing Process

Managing financial transactions effectively requires clear and organized documents that ensure both parties are on the same page. For businesses and freelancers alike, having a well-structured document to outline services, products, and payment terms is essential for smooth operations and timely payments. With the right tools, creating these documents can be quick and easy, saving time and reducing errors.

One of the most efficient ways to prepare such documents is by using a customizable format that allows you to adjust details according to each transaction. These formats offer flexibility, ensuring that all necessary information is included while maintaining a professional appearance. Whether you’re a small business owner or an independent contractor, this approach helps you maintain consistency in your financial communications.

In this guide, you’ll learn how to set up and personalize your payment documents with simple tools, ensuring that your records are not only accurate but also professionally presented. From adding business details to calculating totals, the process is straightforward and manageable for anyone looking to streamline their financial workflows.

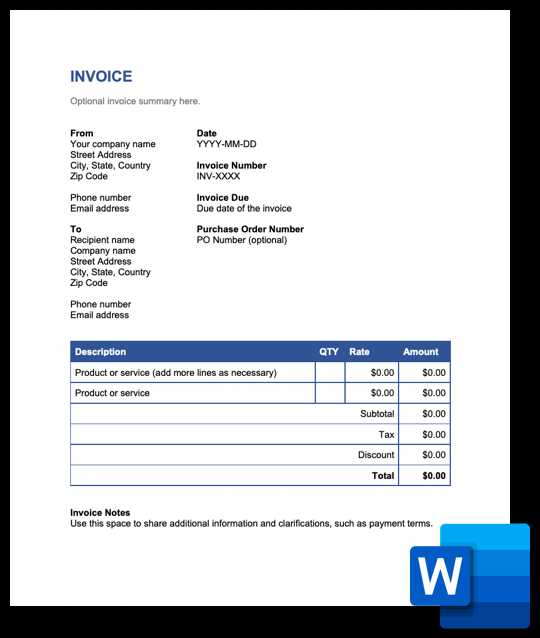

How to Create a Billing Document in Word

Creating a professional document for tracking payments is a crucial part of any business. Using simple software tools, you can create a clear, concise record that outlines all transaction details. With a little customization, this document can be tailored to meet your specific needs and reflect your brand’s identity. Here’s how to get started.

Step 1: Start with a Blank Document

The first step is to open a blank document in your preferred text editor. This gives you full control over the layout and content, allowing you to format it exactly as needed. Once you’ve opened the document, you can begin adding the essential sections.

Step 2: Add Key Information

Your document should include the following details to ensure it covers everything necessary:

- Your business name and contact details – Clearly display your company name, address, phone number, and email.

- Client details – Include the recipient’s name, address, and contact information.

- Unique transaction number – Assign a number to each document for easy tracking.

- Date of transaction – The date when the work was completed or the goods were delivered.

- Description of services or products – List the items or services provided, including quantities and rates.

- Total amount due – Calculate the total payment, including taxes or additional fees.

Step 3: Organize the Information with Tables

Using tables helps organize the data neatly, making it easier for both you and the recipient to read. Arrange the description, quantity, price per unit, and total cost in separate columns. This layout adds clarity and structure to your document.

Step 4: Customize the Document

To give your document a more professional appearance, you can add your business logo, choose a suitable font, and adjust the overall design. You may also want to include terms of payment, such as due date, late fees, and accepted payment methods.

Step 5: Save and Share

Once the document is complete, save it in an easily accessible format and share it with your client. It’s also a good idea to keep a copy for your own records, ensuring you have everything documented

Why Choose Word for Invoicing?

When it comes to creating professional financial documents, choosing the right software can significantly impact the quality and efficiency of your work. While there are many options available, one of the most popular choices for managing payment records is a simple text editing program. This tool offers flexibility, ease of use, and customization that meets the needs of most businesses, regardless of size.

Benefits of Using a Text Editor for Payment Records

There are several reasons why many businesses prefer to use this particular software for creating payment-related documents. Its accessibility, familiarity, and extensive features make it an ideal choice for anyone looking to prepare accurate and visually appealing documents. Below are some key advantages:

| Feature | Benefit |

|---|---|

| Easy to use | No learning curve for those familiar with basic text editing software. |

| Customizable design | Allows for personalized layouts, logos, and fonts to match your business branding. |

| Cost-effective | Most text editing programs are included in standard office software packages, reducing extra costs. |

| Compatibility | Documents can be easily shared, edited, and opened on most devices and platforms. |

| Standard formatting tools | Offers built-in features like tables, grids, and alignment options for organizing data efficiently. |

How Flexibility Can Improve Your Documents

Text editing software allows you to create clear, easy-to-read documents without being limited by pre-made templates. You have the freedom to design your layout exactly how you want it, add custom branding elements, and adjust any details according to each transaction. This level of flexibility ensures that each document can be tailored to your needs and preferences, which is especially important for businesses with unique invoicing requirements.

Key Features of Payment Document Templates

When it comes to preparing financial records, having a well-structured and professional document is essential for both clarity and efficiency. Ready-to-use formats can simplify the process by offering a consistent framework for organizing important details. These documents are designed to be adaptable to different needs, making them an ideal choice for businesses and freelancers who want to streamline their administrative tasks.

Here are some of the most important features that make these ready-made formats so useful:

- Clear Section Layout – Well-organized documents typically include distinct sections for key information, such as contact details, transaction summary, payment terms, and totals. This ensures that no important data is overlooked.

- Pre-designed Fields – These formats come with pre-set fields for essential information such as item descriptions, quantities, rates, and totals, allowing for faster and more accurate data entry.

- Easy Customization – You can easily adjust the layout to match your business’s branding, such as adding logos, choosing fonts, or adjusting colors to align with your company’s identity.

- Professional Appearance – These documents are designed to look polished and formal, which helps to create a positive impression with clients and customers.

- Consistency – By using a standardized format, you ensure that all your financial records look similar, helping to maintain a professional and organized image.

- Automated Calculations – Some formats come with built-in functions that automatically calculate totals, taxes, and discounts, reducing the risk of human error.

- Legal and Tax Compliance – Many pre-designed formats are structured to include necessary legal details, such as tax rates, due dates, and payment terms, ensuring compliance with local regulations.

- Compatibility – These formats can typically be opened, edited, and shared across different devices and software platforms, making them versatile and easy to work with.

By using these key features, businesses can save time, reduce errors, and create documents that look both professional and polished, all while meeting the unique needs of each transaction.

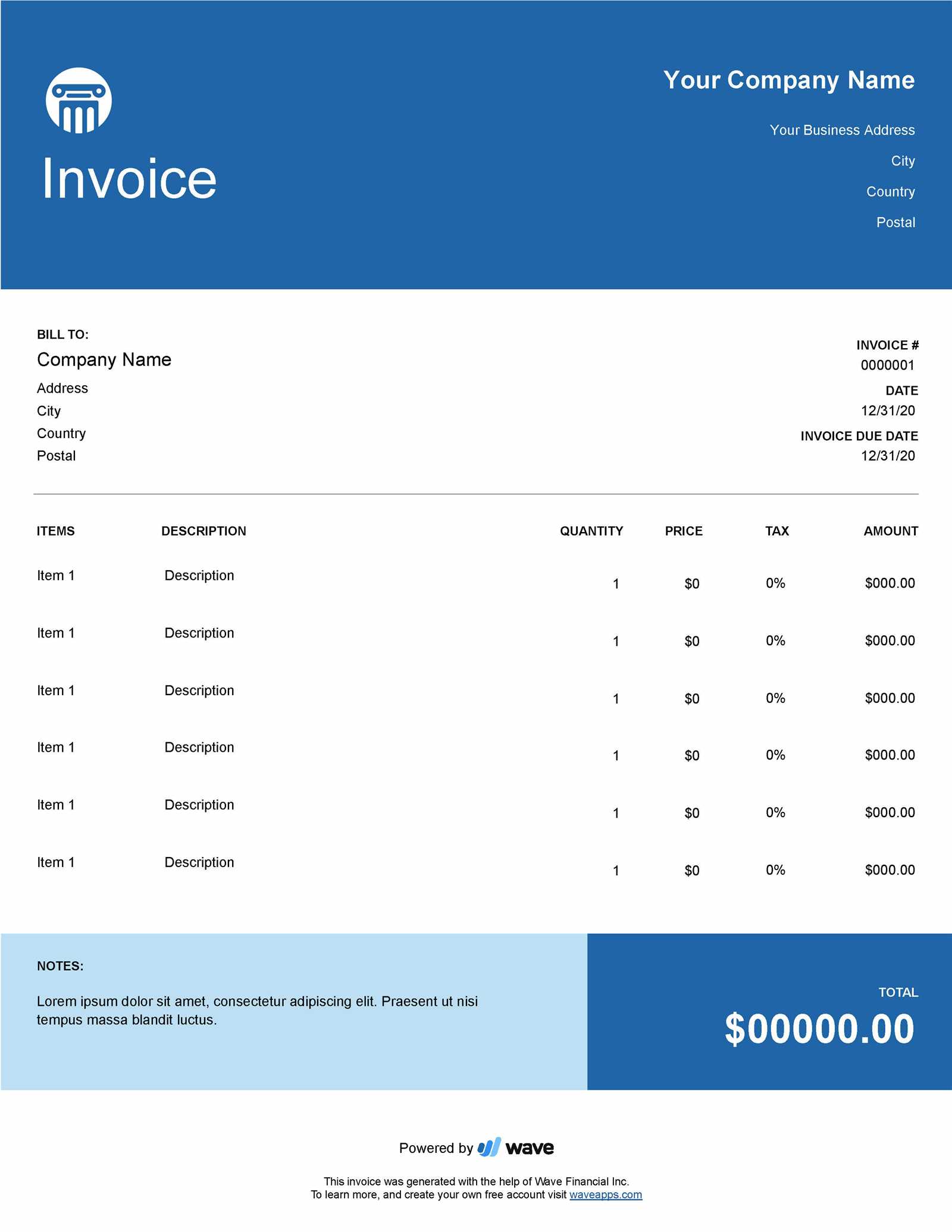

Customizing Your Payment Document Layout

Personalizing your financial documents allows you to tailor them to fit your business needs while ensuring that all necessary information is presented clearly. Customizing the structure of these documents not only improves professionalism but also helps establish a consistent and recognizable brand identity. By adjusting key elements like design, content placement, and formatting, you can create a document that reflects your company’s style and values.

Choosing the Right Layout

One of the first steps in customizing your document is selecting the layout that best suits your business type. Depending on the complexity of your transactions, you may prefer a simpler format or a more detailed one. Ensure that the layout is easy to navigate and that all important information, such as transaction details, totals, and payment instructions, is prominently displayed. Key areas to focus on include:

- Header section – This is where your business name, logo, and contact details should go. It’s important to make this section visually clear and easy to find.

- Client details – Make sure the recipient’s information is easily identifiable and separate from other sections of the document.

- Itemized list – Organize the list of products or services in a table format for better readability.

Adjusting Content and Design Elements

Once the layout is set, you can begin personalizing the content. This includes adjusting text for clarity and modifying design elements to align with your brand’s visual identity. Here are some tips:

- Fonts and colors – Choose fonts that are legible and professional. Match the colors with your branding for a cohesive look.

- Logos and imagery – Adding your company’s logo or other relevant images can help make the document uniquely yours.

- Payment terms – Clearly state payment terms such as due dates, late fees, and accepted payment methods. This helps avoid misunderstandings.

Customizing your payment document not only improves its appearance but also enhances its effectiveness in communicating the necessary details to your clients, fostering clear and professional business relationships.

How to Add Your Business Logo

Including your company logo in financial documents is an effective way to reinforce your brand identity and add a professional touch. A logo serves as a visual representation of your business and helps your documents stand out, making them more recognizable to your clients. Adding your logo to payment records is a simple process that can enhance the overall presentation of your paperwork.

Step 1: Prepare Your Logo Image

Before adding the logo, ensure that the image file is high-quality and appropriately sized for the document. It’s best to use a PNG or JPEG file format, as these are widely supported and provide clear visuals. Resize the logo so that it is not too large or too small, ensuring it fits well within the document without overpowering other content.

Step 2: Insert the Logo into Your Document

Once your logo image is ready, follow these simple steps to insert it into your document:

- Open your document and place your cursor where you would like the logo to appear, usually at the top of the page.

- Navigate to the “Insert” tab in your text editor and select the “Image” option.

- Choose the logo file from your computer and click “Insert” to place it in the document.

- Resize or adjust the logo’s position as needed by clicking and dragging the image or using alignment tools.

By following these steps, you can easily incorporate your business logo into your documents, giving them a more polished and professional look. This not only enhances your branding but also ensures that all your communication materials are consistent and easily recognizable by clients.

Formatting Tips for Professional Payment Documents

Creating a clean and visually appealing document is key to ensuring that your financial records are taken seriously and easily understood. A well-formatted document reflects professionalism and helps communicate important details clearly. The way you organize and present the information can make a significant difference in how your document is received by clients or customers.

Here are some formatting tips to help you create professional-looking documents:

- Use a Consistent Layout – Stick to a uniform structure throughout the document. Group similar sections together, such as the header, transaction details, and payment terms, to make the document easier to follow.

- Keep the Font Simple and Clear – Choose legible, professional fonts like Arial, Helvetica, or Times New Roman. Avoid decorative fonts that might make the document hard to read. Keep the font size consistent, with slightly larger text for headings and section titles.

- Align Text Properly – Ensure that all text is properly aligned. For example, business and client details should be left-aligned, while totals and other important figures can be right-aligned for better readability.

- Utilize Tables for Clarity – Organize items, services, or products in a table format. This helps break up large blocks of text and makes it easier to read through itemized charges. Make sure the columns are evenly spaced, and use bold text for headings to highlight important categories like quantity, description, and total cost.

- Leave Sufficient White Space – Don’t overcrowd your document with text. Adequate white space between sections and around the edges of the page creates a more polished and approachable design.

- Highlight Key Information – Use bold or italics to draw attention to important figures, such as the total amount due or payment terms. This helps ensure that your client or customer sees the most critical details at a glance.

- Proofread for Consistency – Before finalizing your document, proofread it for consistency in spelling, formatting, and style. Consistency helps maintain professionalism and ensures that your documents are error-free.

By following these formatting guidelines, you can create clear, well-structured documents that not only look professional but also ensure that the information is easy to understand and act upon.

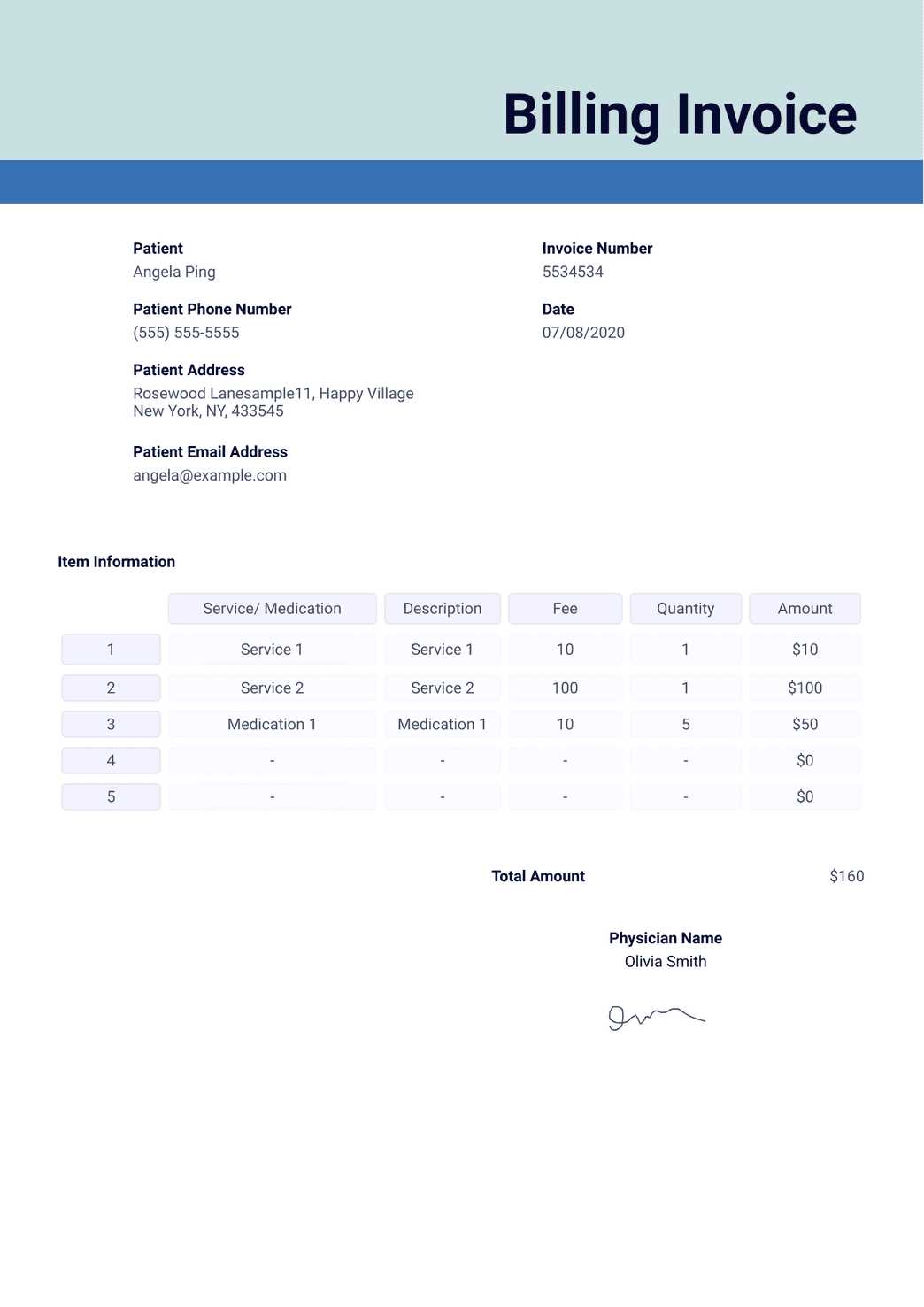

Using Tables to Organize Payment Details

Tables are an essential tool for organizing and presenting financial information clearly and efficiently. By structuring data in a table format, you can easily break down complex details into readable sections. This method enhances the overall clarity of your document, allowing both you and your clients to quickly find the information you need, such as quantities, prices, and total amounts. Using tables not only improves readability but also adds a professional touch to your paperwork.

Benefits of Using Tables for Payment Records

There are several advantages to using tables when organizing financial details. Here are a few key benefits:

- Improved Clarity – Tables help break down information into organized columns and rows, making it easier for your client to review the details quickly.

- Professional Appearance – A table structure looks neat and formal, enhancing the credibility of your document.

- Easy Data Comparison – By aligning information such as quantity, description, and price in a structured way, clients can easily compare values without confusion.

- Space Efficiency – Using tables ensures that all relevant data fits into a compact and readable layout, maximizing space without clutter.

How to Structure Your Table

To ensure your table is both functional and professional, consider the following points when creating the layout:

- Columns – Use separate columns for different types of information, such as item number, description, quantity, price per unit, and total cost.

- Row Organization – Each row should represent a single item or service, with corresponding details in each column.

- Bold Headers – Make sure the column headers (e.g., “Description,” “Unit Price,” “Total”) are bolded to differentiate them from the data.

- Totals Row – Include a row at the bottom of the table to sum up the total amount due, including taxes or additional fees if applicable.

By using tables, you create a more organized and user-friendly document that clearly presents all the necessary details. This method ensures that no information is overlooked and that your document maintains a professional, polished appearance.

Including Payment Terms in Your Document

Clearly stating the terms of payment in your financial records is essential for maintaining transparency and ensuring that both parties understand their obligations. By outlining the payment expectations in advance, you help avoid confusion and set the stage for a smooth transaction. Including specific payment terms not only protects your business but also fosters a professional relationship with your clients.

Here are key elements to include when specifying payment terms:

- Due Date – Indicate the exact date by which payment should be made. This helps your client understand the timeline and avoid delays.

- Accepted Payment Methods – Clearly state which payment methods are acceptable (e.g., bank transfer, credit card, PayPal). This ensures that there are no misunderstandings about how payments can be processed.

- Late Fees – Specify any penalties or interest charges for late payments. This encourages timely payment and sets clear consequences for overdue amounts.

- Early Payment Discounts – If applicable, offer incentives for early settlement of the amount due. For example, a 5% discount if the payment is made within 10 days.

- Partial Payments – If you allow for installment payments, make sure to outline the schedule and amount due for each installment.

- Payment Instructions – Provide clear instructions on how to make the payment. This may include bank account details, online payment links, or specific steps for credit card payments.

By clearly defining payment terms in your documents, you set clear expectations and reduce the risk of disputes. It also demonstrates professionalism, showing your clients that you value clarity and organization in all business dealings.

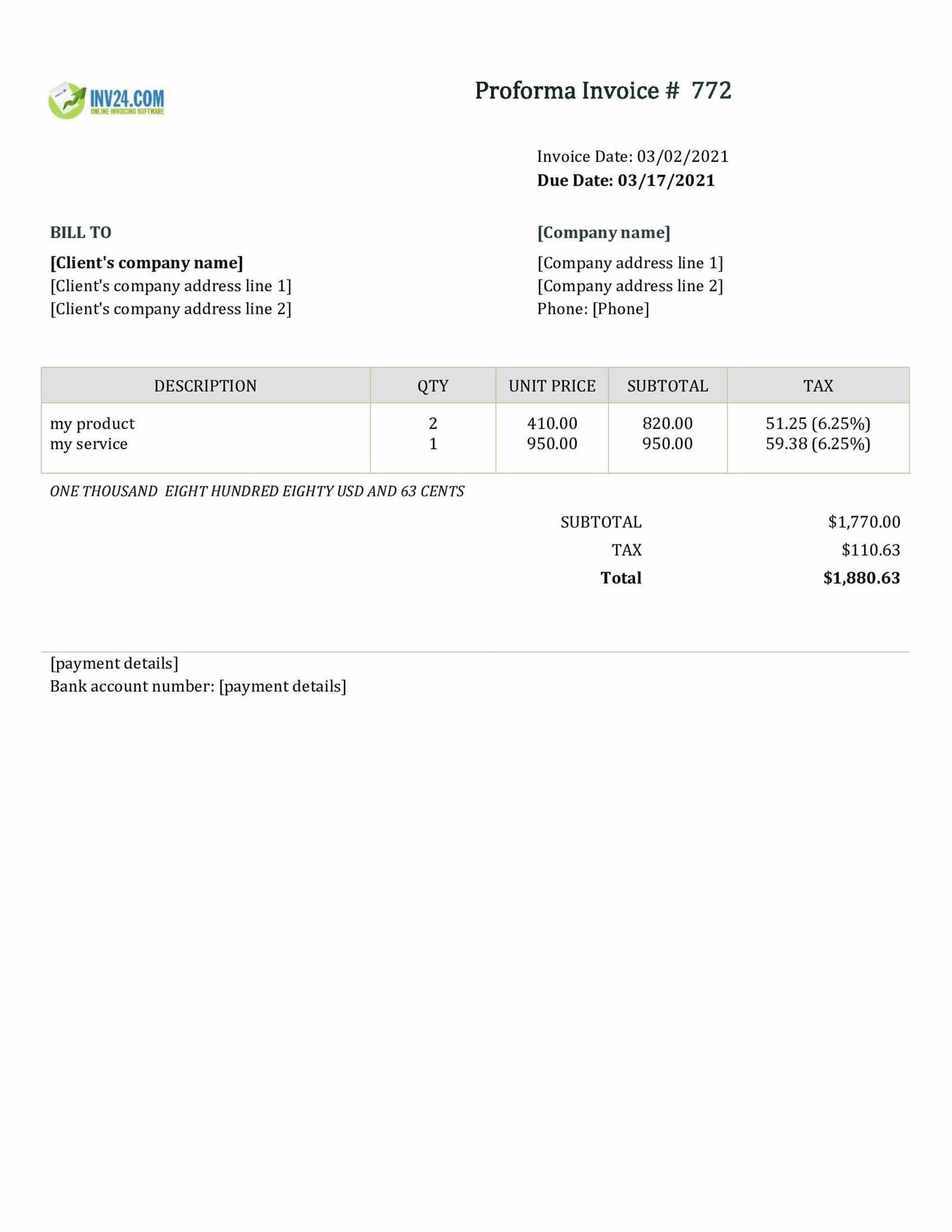

How to Calculate Taxes on Payment Records

Adding taxes to your payment documents is a critical step to ensure that you are complying with local tax regulations and properly collecting the amount due. Whether you need to apply sales tax, value-added tax (VAT), or any other form of tax, calculating the correct amount is essential for transparency and accuracy in your financial dealings.

Here’s a simple guide to help you calculate taxes on your documents:

Step 1: Determine the Tax Rate

The first step is to know the applicable tax rate for your products or services. Tax rates vary by location, industry, and sometimes the type of goods or services being provided. Ensure that you are using the correct rate for the relevant jurisdiction. You may need to consult with a tax professional or use an official government source to verify the rate.

Step 2: Calculate the Taxable Amount

The taxable amount is the portion of the total cost that will be subject to tax. If you are selling a product or service with multiple items, you will need to calculate the subtotal of the taxable amount first, excluding any discounts or exemptions that may apply.

- Example: If the total amount before tax is $500 and the tax rate is 10%, the taxable amount is $500.

- If there are any discounts, subtract them from the total before applying the tax.

Step 3: Apply the Tax Rate

To calculate the tax, multiply the taxable amount by the tax rate (expressed as a percentage). If your tax rate is 10%, you would multiply the taxable amount by 0.10 to find the amount of tax to add.

- Example: If the taxable amount is $500 and the tax rate is 10%, the tax would be $500 × 0.10 = $50.

Step 4: Add Tax to the Total

Once you’ve calculated the tax, add it to the original total amount. This gives you the final amount due, which should be clearly stated in the document.

- Example: If the subtotal is $500 and the tax is $50, the total amount due would be $500 + $50 = $550.

Step 5: Display the Tax Information Clearly

Make sure to display the tax amount separately from the subtotal in your payment document. This helps your client see exactly how much tax they are being charged, increasing tra

Creating a Payment Document Numbering System

Establishing a clear and consistent numbering system for your financial records is an essential step for organizing your transactions. A well-designed numbering system helps both you and your clients track and reference payments easily. It also ensures that your documents remain in sequential order, making it easier to maintain accurate records and comply with accounting or tax regulations.

Why a Numbering System is Important

A good numbering system offers several benefits, including:

- Easy Tracking – It allows you to quickly locate and reference specific records, reducing the chance of mistakes or confusion.

- Improved Organization – A structured system keeps your documents in a logical order, which is essential for filing and future reference.

- Professionalism – A well-organized document numbering system can enhance the overall professionalism of your business, making it easier for clients and customers to follow your records.

- Legal Compliance – In some regions, keeping a sequential record of transactions is a legal requirement. A numbering system helps ensure you comply with these regulations.

How to Create an Effective Numbering System

Here are a few tips to create a simple yet effective numbering system:

- Start with a Clear Prefix – If you have different types of financial documents, use prefixes to differentiate between them. For example, “A” for sales or “R” for refunds.

- Use Sequential Numbers – Use a consistent, increasing number for each new record. This could start from “001” and go up, ensuring that there are no duplicates.

- Include Dates or Year Codes – Consider adding the year or a specific date range in the numbering. For example, “2024-001” or “04-24-001.” This helps to easily identify when the record was created and adds a layer of organization.

- Keep it Simple – While it’s important to have a system, make sure the numbering is simple and not overly complicated. A clean and straightforward approach will be easier to manage.

By implementing a clear numbering system, you’ll keep your payment records organized, professional, and easy to track, which is essential for smooth business operations and clear communication with your clients.

Ensuring Legal Compliance in Your Payment Records

Maintaining legal compliance in your financial documentation is crucial for avoiding disputes, penalties, or legal issues. Different regions and industries have specific laws that govern how payments should be recorded and what information must be included. Ensuring that your records meet these requirements helps protect your business, ensures transparency, and builds trust with your clients.

Key Elements for Legal Compliance

When creating financial documents, it’s essential to include the following information to ensure compliance:

- Business Information – Include your full legal business name, address, and contact information. In many jurisdictions, this is a legal requirement.

- Client Information – Clearly state the client’s name and contact details, including their address, to establish a proper record of the transaction.

- Transaction Date – Always include the date of the transaction or when the payment is due. Some jurisdictions require this for accurate recordkeeping and tax reporting.

- Detailed Descriptions – Include a clear description of the products or services provided. In some regions, the lack of detailed information can lead to questions or disputes about the nature of the transaction.

- Tax Information – If applicable, include the correct sales tax or VAT information, as well as the tax rate applied. Ensure this is in line with the tax laws of your country or region.

- Payment Terms – Specify the due date, any discounts for early payments, and penalties for late payments. This transparency can prevent legal misunderstandings and help enforce the terms of the agreement.

- Legal Disclaimer – In some cases, adding a legal disclaimer or terms and conditions regarding your goods or services is necessary to protect your business legally.

How to Stay Updated on Legal Requirements

Tax and business laws can change frequently, so it’s important to stay informed about the regulations that affect your industry. Here are some steps you can take to ensure ongoing legal compliance:

- Consult a Legal Professional – Regularly consulting with a lawyer or accountant can help ensure that your documents meet legal standards.

- Monitor Local Laws – Keep an eye on changes in tax law, business regulations, and any sector-specific rules that may affect your financial documentation.

- U

Common Mistakes to Avoid When Creating Payment Documents

When preparing financial documents, attention to detail is essential. Even small errors can lead to confusion, delayed payments, or legal complications. By understanding and avoiding common mistakes, you can ensure that your records are clear, accurate, and professionally presented. Below are some of the most frequent errors businesses make when documenting transactions and how to prevent them.

1. Failing to Include Complete Information

One of the most common mistakes is leaving out essential details in your records. Missing information can cause confusion and delay the payment process. Be sure to include the following:

- Business and Client Details – Always include your full business name, address, and contact information, as well as your client’s details.

- Clear Descriptions – Ensure that each item or service is clearly described with the necessary specifications, quantity, and unit price.

- Payment Terms – Always specify the payment due date, late fees, and any other terms agreed upon with the client.

2. Using Incorrect or Missing Tax Rates

Incorrect tax rates or the absence of tax information can lead to legal and financial issues. Double-check that you are applying the correct tax rate for your product or service and ensure that tax is calculated and displayed clearly in your document.

- Tip: Verify tax rates based on your location or the location of your client, as tax laws vary widely depending on the region.

- Tip: Always indicate the tax amount separately from the subtotal for better clarity.

3. Not Using a Consistent Numbering System

Another common mistake is using inconsistent or confusing numbering for financial records. This can make it difficult to track payments and may cause issues in your record-keeping.

- Tip: Use a sequential numbering system and avoid duplicating numbers. This way, each record is unique and easy to reference.

- Tip: Consider including the date or year in your numbering system for added organization.

4. Leaving Out Payment Methods

Failing to specify acceptable payment methods can lead to delays in receiving payments. Be sure to clearly list how payments can be made (e.g., bank transfer, credit card, online platforms) and include any relevant account or payment links.

- Tip: If you offer multiple payment options, include clear instructions for each method to avoid confusion.

5. Overlooking Proofreading

Small typos or

Free Resources for Payment Document Templates

When it comes to creating professional payment documents, there are numerous free resources available that can save you time and effort. These tools offer customizable layouts, making it easy to adapt them to your business’s specific needs. By using these free resources, you can ensure that your documents are not only clear and professional but also legally compliant and organized.

Here are some of the best free resources for creating payment records:

- Google Docs – Google offers free document templates for various business needs, including payment records. The templates are fully customizable, and you can access them online from any device, making it easy to create and manage your documents from anywhere.

- Microsoft Office Online – Microsoft provides free online versions of their popular software, including a selection of basic document templates. You can use their online tools to create, edit, and save your records in real-time.

- Canva – Known for its user-friendly design tools, Canva offers free templates for payment documents. With drag-and-drop functionality, you can easily customize the layout, add logos, and adjust text to suit your brand.

- Zoho Invoice – While primarily a paid service, Zoho offers a free tier with basic features for creating and managing payment documents. It’s a great tool for small businesses looking for a simple solution without the cost.

- Template.net – This website offers a wide variety of free templates for business documents. You can download customizable records in various formats, including PDF and Excel, making it easy to adjust them according to your needs.

- Smartsheet – Known for its collaborative tools, Smartsheet offers free document templates designed for invoicing and financial record-keeping. You can use their easy-to-navigate sheets to track payments and manage client information.

By leveraging these free resources, you can create professional documents that help keep your transactions organized, transparent, and compliant with industry standards–all without the need for expensive software or services.

How to Save and Share Your Payment Document

Once you’ve created a professional payment document, the next steps are saving it properly and sharing it with your clients. Organizing your records efficiently and ensuring they are easily accessible when needed is essential for smooth business operations. Fortunately, there are several ways to save and share these documents to ensure they reach your client securely and on time.

Saving Your Payment Document

To ensure your document is secure and accessible, consider these methods for saving:

- Save as a PDF – Converting your document into a PDF format ensures that it maintains its formatting across different devices and platforms. This makes it easier for both you and your client to access and view the document correctly.

- Use Cloud Storage – Cloud storage solutions like Google Drive, Dropbox, or OneDrive offer convenient ways to store your documents online. This ensures they are backed up and easily accessible from any device, anywhere.

- Save Locally – If you prefer to keep documents on your computer, save them in a dedicated folder for easy access. Organize your files by date or client to make searching and retrieving documents simple.

- File Naming Conventions – Use a consistent naming system for your saved documents. For example, “ClientName_Date_Payment” helps you quickly identify the correct document when you need it.

Sharing Your Payment Document

After saving your document, it’s time to send it to your client. Here are some effective methods:

- Email – Sending the document via email is the most common and straightforward way to share it. Attach the document as a PDF file to ensure it is easily readable on any device.

- Cloud Links – If you use cloud storage, you can share a direct link to the document, giving your client access to view or download it. Be sure to set the appropriate permissions (view-only or editable) for added security.

- Payment Platforms – Some payment platforms (like PayPal or Stripe) allow you to upload and send payment records directly through their interface. This can streamline the payment process for clients who prefer to manage everything in one place.

- Printed Copies – If your client prefers a physical copy, you can print and mail the document. Be sure to send it through a reliable postal service to ensure timely delivery.

By following these methods, you can ensure that your payment documents are saved securely and shared in a professional manner, streamlining communication with your clients and maintaining an organized record of transactions.

Integrating Payment Records with Accounting Software

Integrating your payment records with accounting software is an essential step in streamlining your financial processes. By automating the flow of data between your documents and accounting systems, you can save time, reduce errors, and ensure more accurate financial reporting. This integration helps manage payments, track expenses, and generate financial statements with minimal manual input.

Benefits of Integration

Connecting your payment records to accounting software offers several advantages:

- Automation of Data Entry – Integration eliminates the need for manual data entry, reducing the chances of errors and saving time on bookkeeping tasks.

- Real-Time Updates – When a payment document is created or updated, accounting software can automatically adjust financial records, ensuring real-time accuracy.

- Improved Financial Reporting – Integration makes it easier to generate financial reports, including balance sheets, profit and loss statements, and tax documents, with up-to-date data.

- Better Organization – Automated syncing with your accounting system keeps everything organized in one place, making it easier to track payments and expenses.

- Tax Compliance – Accurate financial records ensure you stay compliant with tax regulations by providing detailed records of income, expenses, and taxes.

How to Integrate Payment Records with Accounting Software

There are several methods for linking your payment records to your accounting software:

- Manual Import – Some accounting software allows you to manually upload your payment documents (such as CSV or Excel files). This is a good option if you’re just starting out or don’t require a fully automated system.

- Third-Party Integrators – Many platforms offer third-party tools or apps that integrate your payment records with accounting software like QuickBooks, Xero, or FreshBooks. These tools sync your documents and accounting records seamlessly.

- API Integration – For more advanced users, accounting software APIs can directly connect to your document management system. This provides a high level of customization and automation, but it may require technical expertise.

- Cloud-Based Accounting Platforms – If you’re using cloud-based accounting software, look for platforms that offer native integrations with popular document creation tools, allowing you to link your payment documents directly with your accounting system.

By integrating your payment records with accounting software, you can streamline your financial processes, improve accuracy, and reduce the time spent on manual data entry. This approach will help you stay organized, make informed business decisions, and remain compliant with tax regulations.

How to Track Payment Transactions Efficiently

Tracking payment transactions is a crucial aspect of managing your business finances. By keeping accurate and up-to-date records, you can easily monitor outstanding amounts, ensure timely collections, and avoid any misunderstandings with clients. Implementing efficient tracking methods not only saves time but also helps maintain positive client relationships and ensures smooth cash flow management.

Methods for Effective Payment Tracking

To effectively monitor payments, consider the following methods:

- Use Dedicated Software – Accounting software and payment management systems like QuickBooks, Xero, or FreshBooks offer automatic tracking features that sync with your records. These platforms can help you monitor incoming payments, issue reminders for overdue amounts, and generate real-time financial reports.

- Set Up Payment Reminders – Many software solutions and even calendar apps allow you to set automatic payment reminders for clients. This proactive approach ensures you stay on top of due payments without having to manually track each transaction.

- Maintain a Payment Log – If you prefer a manual method, maintain a log or spreadsheet that tracks each payment. Record the date, amount, payment method, and any relevant notes. This method is simple and effective for smaller businesses or those that don’t deal with a large volume of transactions.

Organizing Payment Statuses

Organizing payment statuses can help you quickly identify which transactions are pending, completed, or overdue:

- Mark Transactions as Paid or Unpaid – A simple system of marking payments as “paid” or “unpaid” can help you keep track of what’s been settled and what’s still due. Many accounting tools also allow you to automate this process.

- Use Payment Status Codes – For more detailed tracking, consider using color-coded or numbered status codes (e.g., “1” for pending, “2” for partially paid, and “3” for fully paid). This helps you quickly assess the status of a transaction at a glance.

- Review Regularly – Schedule regular check-ins (weekly or monthly) to review your payment records. This ensures that no outstanding payments are missed and helps you address any issues promptly.

By using these methods, you can streamline your payment tracking process, reduce administrative burden, and ensure your business maintains healthy cash flow. Effective tracking helps keep financial operations running smoothly and can help you stay on top of overdue amounts without the stress of last-minute follow-ups.