How to Create a Professional Billing Invoice Email Template

Effective communication with clients is crucial when it comes to requesting payments for services rendered or products delivered. The way you present your request can influence the speed and clarity of the transaction. A well-structured message can ensure that both parties are on the same page, reducing confusion and enhancing professionalism.

Clarity and professionalism are essential in ensuring that the recipient understands the nature of the communication and the details involved. By using a consistent format and tone, you can create a smoother process for both you and your clients. Additionally, having a reliable structure allows you to focus on the specific details, such as amounts, due dates, and payment methods, without worrying about formatting or language barriers.

In this article, we will explore how to craft clear and concise payment requests that encourage prompt action. Whether you are a freelancer, a small business owner, or part of a larger organization, the approach you take in sending these messages can play a significant role in maintaining healthy cash flow and positive client relationships.

Billing Invoice Email Template Guide

Creating a clear and professional payment request is key to maintaining a strong relationship with clients and ensuring prompt settlements. A well-crafted communication ensures that all essential details are covered, leaving no room for misunderstandings. With the right structure, you can streamline the process and present the necessary information in a way that’s easy for the recipient to understand and act on.

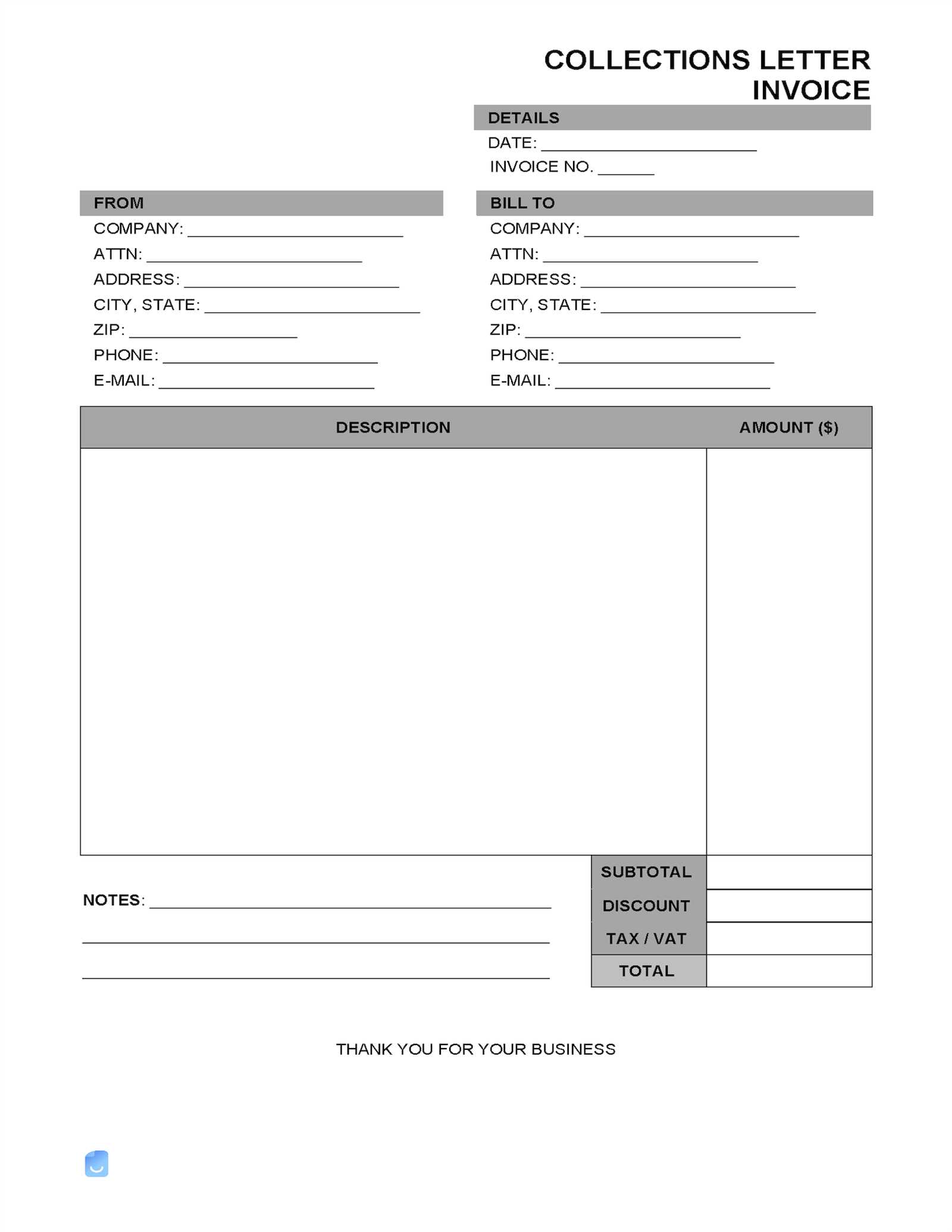

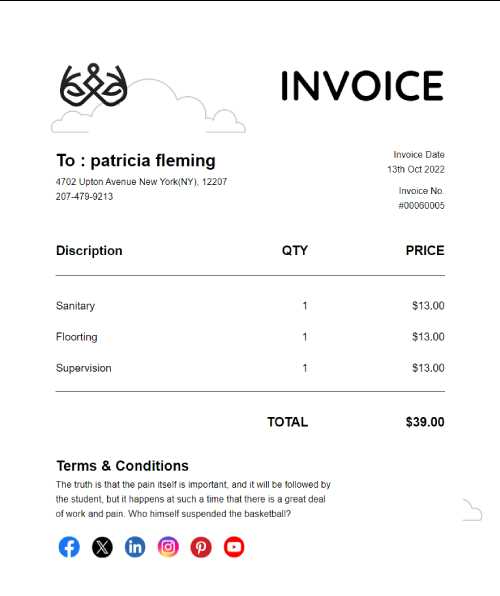

Here is a basic guide to help you structure a well-organized message:

| Section | Description |

|---|---|

| Subject Line | Keep it simple and to the point, ensuring the recipient knows exactly what the message is about (e.g., “Payment Due for Services Rendered”). |

| Greeting | Begin with a polite and professional greeting. Address the recipient by name to make the message feel personalized. |

| Details of Payment | Provide a concise breakdown of what the payment covers, including relevant dates, amounts, and descriptions of the goods or services. |

| Due Date | Clearly state the date by which payment is expected. If applicable, mention any late fees or consequences for delayed payments. |

| Payment Methods | Offer clear instructions on how to make the payment, including acceptable methods (e.g., bank transfer, online payment link, check, etc.). |

| Closing | Close with a polite thank you, and provide your contact information in case the recipient has any questions or concerns. |

Following this structure will ensure that all relevant details are included and presented clearly. A well-organized request not only improves the likelihood of timely payment but also helps in maintaining a professional image with your clients.

Importance of a Clear Invoice Email

Clear and concise communication plays a crucial role in ensuring smooth transactions between businesses and clients. When requesting payments, it’s essential that the recipient fully understands the terms, amounts, and deadlines involved. A well-structured message not only fosters professionalism but also reduces the chances of misunderstandings or delayed payments.

Here are several reasons why clarity is so important when sending payment requests:

- Reduces Confusion: A well-organized message ensures that the recipient clearly understands what they owe and when it’s due. This prevents any ambiguity about the payment details.

- Builds Professionalism: A clean, well-structured communication reflects professionalism and helps maintain a positive relationship with clients.

- Speeds Up the Process: When clients can easily find all the necessary information, they are more likely to process the payment promptly.

- Minimizes Disputes: Including precise details about the services provided, charges, and terms leaves little room for arguments or confusion over the amount due.

- Enhances Client Experience: A clear, easy-to-read request improves the overall client experience, leading to better customer satisfaction.

Incorporating these elements into your payment requests not only improves the likelihood of timely payment but also reinforces your business’s reputation for transparency and reliability.

How to Personalize Your Invoice Email

Personalizing a payment request helps create a more engaging and professional interaction with your clients. By tailoring your communication to reflect the individual needs of each recipient, you can build stronger relationships and increase the likelihood of timely payments. Personalization makes the message feel more thoughtful and less like a generic transaction.

Here are some ways to personalize your payment request messages:

- Use the Client’s Name: Always address the recipient by their first name to make the message feel more personal and less automated.

- Reference Previous Work or Services: Mention specific details about the project or services provided. This not only adds a personal touch but also helps the client recall the work you’ve done for them.

- Offer Customized Payment Terms: If appropriate, offer tailored payment options or deadlines based on your previous conversations or the client’s payment history.

- Use a Friendly Tone: While professionalism is important, a friendly and approachable tone can make the request feel less transactional and more like a natural part of your ongoing relationship.

- Include a Thank You: Always thank the client for their business, acknowledging their trust in your services. This simple gesture reinforces a positive, long-term business relationship.

By taking the time to personalize your requests, you not only improve your chances of prompt payment but also demonstrate your commitment to providing excellent customer service and fostering good business relationships.

Best Practices for Writing Invoice Emails

Crafting a clear and professional payment request is essential to ensuring that clients understand the details of the transaction and respond promptly. Following best practices when drafting these communications can help maintain your credibility, improve client relationships, and reduce confusion. Proper structure, tone, and content are key to a successful payment request.

Structure and Clarity

The layout of your message is crucial in making sure the recipient can easily find all the necessary information. A well-structured request helps the client understand what is expected without having to search for specific details. Include the following key components:

- Subject Line: Be direct and clear (e.g., “Payment Request for Services Provided”).

- Salutation: Address the recipient by name for a personal touch.

- Clear Breakdown: Provide a simple, concise breakdown of the charges, including the amount due, the services rendered, and the due date.

- Payment Instructions: Offer straightforward information on how the client can complete the transaction.

- Closing: Close politely, expressing appreciation for the client’s business.

Professional Tone and Language

While clarity is essential, the tone of your communication plays an important role in fostering positive client relations. A professional tone helps convey authority without being overly formal or impersonal. Make sure to:

- Be Courteous: Always thank your client for their business and express appreciation for their prompt payment.

- Keep it Positive: Even if you are reminding the client of overdue payments, maintain a positive, solution-focused tone.

- Avoid Jargon: Use simple and straightforward language, ensuring that the client understands your message without needing clarification.

By adhering to these best practices, you ensure that your payment requests are not only effective but also professional and client-friendly.

Key Components of an Invoice Email

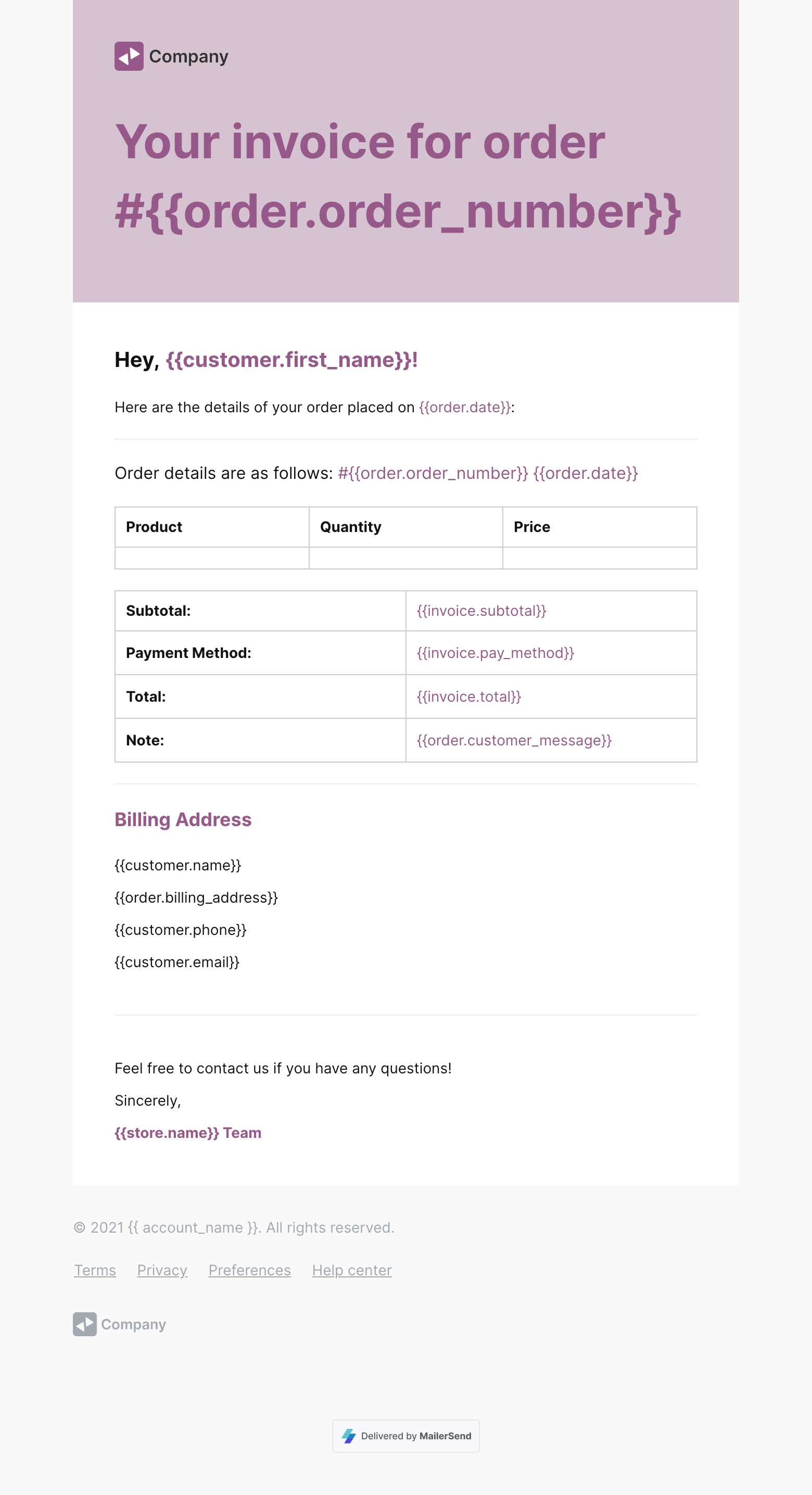

When sending a payment request, it is essential to include all necessary details in a clear and organized manner. Each part of the message should be focused on ensuring that the recipient has a complete understanding of what is being requested, along with any instructions or deadlines. A well-constructed communication is more likely to lead to prompt payment and avoid confusion.

Essential Elements of a Payment Request

The following components are vital for creating an effective and professional payment request message:

| Component | Description |

|---|---|

| Subject Line | Clear and concise; briefly state the purpose of the message (e.g., “Payment Due for Recent Services”). |

| Salutation | Address the recipient by name to add a personal touch and ensure the message is received as intended. |

| Details of the Charge | Provide a detailed breakdown of the amounts owed, including descriptions of the goods or services provided, dates, and individual costs. |

| Due Date | Clearly specify the date by which the payment should be made. If applicable, mention any penalties for late payments. |

| Payment Instructions | Provide clear instructions on how to make the payment, including any accepted methods (e.g., bank transfer, credit card, etc.). |

| Contact Information | Include your contact details, in case the recipient has any questions or issues regarding the payment. |

| Closing | End the message politely with a thank you, expressing appreciation for the client’s business and their prompt attention to the request. |

Formatting and Presentation

The way the information is presented can greatly impact how easy it is for the recipient to understand the payment request. A clean, simple layout with clearly defined sections ensures that the necessary information is easy to find and follow. By following these guidelines, you create a message that is both profess

How to Format Your Invoice Email Properly

Formatting your payment request correctly is essential for ensuring the message is both clear and professional. A well-structured message allows the recipient to easily digest the information, making it more likely that they will respond promptly and without confusion. Proper formatting helps create a positive impression and makes the process smoother for both you and your client.

Here are key guidelines to ensure your communication is formatted effectively:

- Use a Clear Subject Line: The subject should immediately convey the purpose of the message, such as “Payment Request for Recent Project” or “Amount Due for Services Rendered.”

- Include a Personalized Greeting: Address the recipient by name, which helps build rapport and makes the message feel more tailored and professional.

- Keep Paragraphs Short: Use concise and well-organized paragraphs to break up the content, making it easier for the reader to follow. Avoid long blocks of text.

- Highlight Key Details: Use bullet points or bold text to highlight important information such as the amount due, payment due date, and payment methods. This draws attention to the most critical elements.

- Maintain a Professional Tone: While it’s important to be clear, it’s equally important to keep the tone professional, polite, and courteous. This ensures your message is taken seriously.

- Use Simple Language: Avoid jargon or overly complex terms. The clearer and simpler the language, the easier it will be for the recipient to understand your request.

- Include Clear Instructions: Ensure that the payment methods and instructions are easy to follow, with all necessary details for making the payment.

- Close Politely: End the message with a courteous closing, thanking the recipient for their attention and expressing appreciation for their business.

By following these formatting tips, you’ll create a payment request that is not only professional but also easy for the recipient to act on. Clear structure and presentation help ensure that your request is understood and responded to without unnecessary delays.

Choosing the Right Tone for Clients

When requesting payment, the tone you use in your communication is crucial. The way you express yourself can greatly impact how your message is received and how quickly you will get a response. Striking the right balance between professionalism and friendliness is key to maintaining positive relationships with your clients while ensuring that your payment request is taken seriously.

Here are some tips for choosing the right tone when reaching out to clients:

- Be Polite and Respectful: Always maintain a courteous tone, regardless of the situation. Even if the payment is overdue, being respectful helps preserve the relationship and ensures a positive interaction.

- Stay Professional: Use professional language, especially when discussing financial matters. Avoid slang or overly casual expressions, as they may undermine the seriousness of the request.

- Be Friendly but Not Overly Familiar: A friendly approach can help put clients at ease, but it’s important not to cross boundaries. Keep the tone warm, but maintain a level of professionalism that aligns with the business context.

- Adjust Based on Relationship: Tailor your tone depending on how well you know the client. For long-term or repeat clients, a more relaxed tone might be appropriate, whereas new clients or formal partnerships may require a more formal approach.

- Avoid Aggressive or Demanding Language: Refrain from using phrases that could come across as rude or demanding. Instead of saying “Pay now” or “You must,” consider phrasing it more politely, like “We kindly ask for payment by…”

- Show Appreciation: Always thank your client for their business and their attention to the request. A simple “Thank you for your prompt attention to this matter” can go a long way in fostering goodwill.

By selecting the appropriate tone for your payment requests, you help foster a cooperative atmosphere, making it more likely that the client will respond promptly and positively. Whether you’re sending a gentle reminder or a more formal request, the tone sets the stage for successful communication and payment processing.

Customizing the Subject Line Effectively

The subject line is the first thing a recipient sees, and it plays a crucial role in determining whether your message will be opened promptly or ignored. A well-crafted subject line grabs attention, conveys the purpose of the communication, and encourages the recipient to read further. By personalizing and customizing the subject line, you increase the likelihood of your message being prioritized and acted upon quickly.

Here are some tips for creating an effective subject line:

- Be Clear and Direct: The subject line should immediately communicate the purpose of the message. For example, “Payment Request for Services Rendered” or “Amount Due for Recent Project” clearly outlines the purpose without any ambiguity.

- Include Relevant Details: Mention the most important information, such as the amount owed or the due date, to make the subject more compelling. For example, “Payment Due by [Date] for [Service/Project Name].”

- Personalize When Possible: If you know the recipient well, use their name or reference specific details to make the subject line feel more tailored. For instance, “John, Payment Reminder for [Project Name].”

- Keep It Short: Aim for brevity while still being clear. A concise subject line increases the chances of it being read quickly, especially on mobile devices. Try to keep it under 10 words.

- Maintain Professionalism: Avoid using all caps or overly aggressive language, as this can come across as rude or demanding. Instead, use a polite and neutral tone, such as “Friendly Reminder” or “Follow-up on Payment Due.”

- Use Action-Oriented Language: Encourage action with verbs like “Request,” “Reminder,” or “Due.” For example, “Action Required: Payment Due for [Service].”

A well-crafted subject line ensures your message stands out and conveys the importance of the request. By making it clear, personal, and to the point, you increase the chances of receiving a timely response and avoid your message being overlooked in a crowded inbox.

Common Mistakes in Billing Emails

When sending a payment request, there are several common pitfalls that can undermine the effectiveness of the message and damage client relationships. Small mistakes, such as missing details or unclear instructions, can cause delays or confusion, making it harder for the recipient to process the payment. Being aware of these frequent errors can help ensure your request is clear, professional, and more likely to result in timely payment.

Common Mistakes to Avoid

- Vague Subject Lines: The subject line should clearly state the purpose of the message. Using generic subject lines like “Important Information” or “Reminder” can confuse recipients, and they may overlook the message.

- Missing Payment Details: Failing to provide a detailed breakdown of the amount due, including the specific services or products billed, can lead to confusion. Be sure to include the date of the service, the amount, and a clear description.

- Unclear Payment Instructions: Without clear payment instructions, clients may be unsure how to proceed. Always provide detailed information about how to make the payment, including accepted payment methods, bank account details, or online payment links.

- Not Including a Due Date: A payment request without a due date can leave the recipient uncertain about when the payment is expected. Always specify when the payment should be made to avoid unnecessary delays.

- Overly Formal or Aggressive Tone: Using a harsh or overly formal tone can alienate clients. It’s important to strike a balance between professionalism and politeness to ensure the message is well-received.

- Spelling and Grammar Errors: Mistakes in grammar or spelling can undermine the professionalism of your request. Always proofread your message before sending to ensure it is clear and error-free.

How to Avoid These Mistakes

By carefully reviewing your payment requests before sending them, you can avoid these common mistakes and improve the chances of receiving prompt payment. Clear, concise, and professional communication is the key to a positive client experience and timely transaction processing.

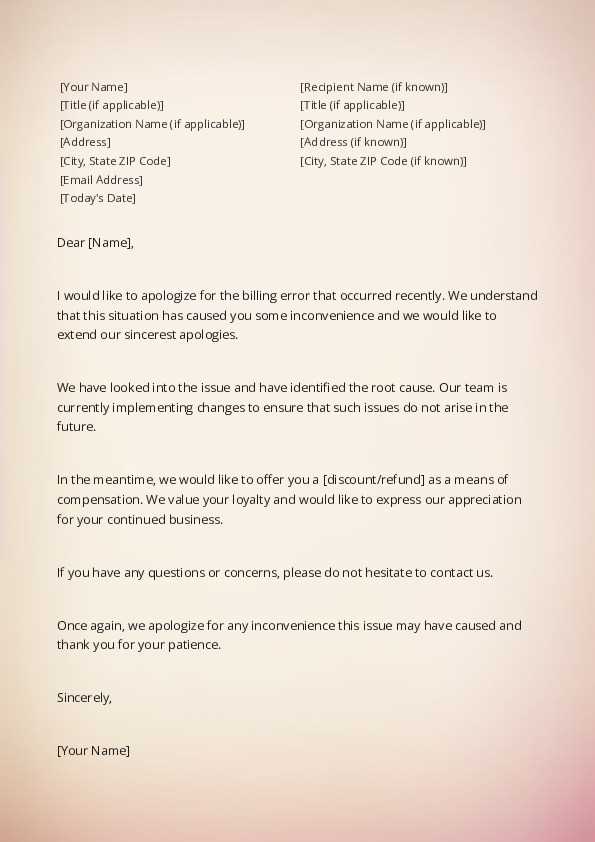

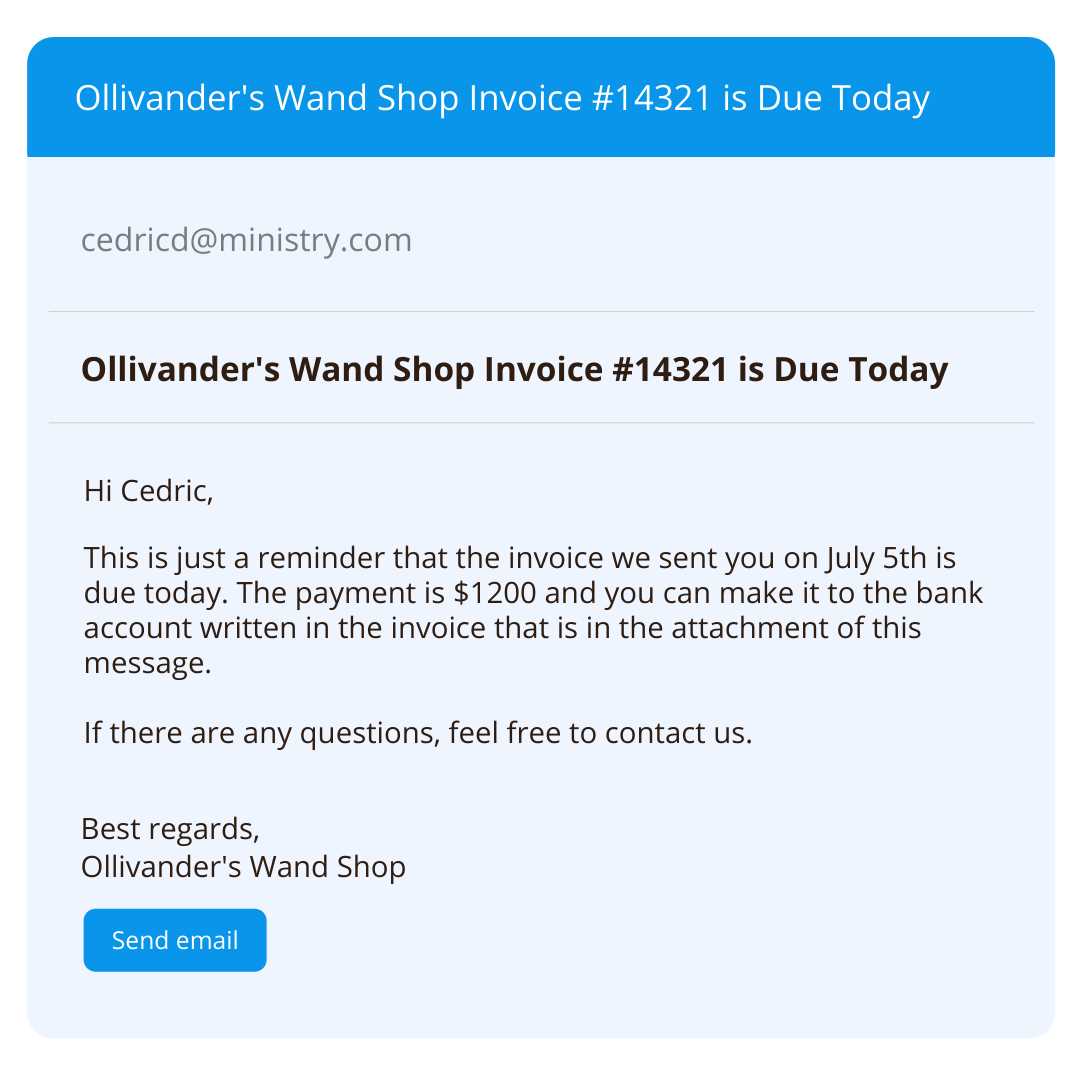

How to Handle Payment Reminders

Following up on overdue payments is an essential part of maintaining cash flow, but it’s important to approach reminders with care. A well-crafted reminder not only encourages timely payment but also helps preserve a positive relationship with your clients. It’s crucial to be polite, clear, and professional, ensuring that your message prompts action without causing any unnecessary tension.

Tips for Effective Payment Reminders

When sending a reminder for an outstanding payment, consider these best practices to ensure your message is well-received and effective:

- Send a Polite Reminder First: Start with a friendly, non-confrontational tone. A gentle reminder is more likely to prompt a response and keep the relationship on good terms.

- Be Clear and Concise: Include the necessary details such as the amount due, due date, and payment methods. The recipient should not have to search for important information.

- Allow a Grace Period: If the payment is only slightly overdue, offer a little extra time before the reminder gets more assertive. A simple “I just wanted to check in” can be enough.

- Be Firm but Respectful: If the payment is significantly overdue, express the importance of settling the balance, but do so in a way that doesn’t sound threatening. For example, “We would appreciate it if the payment could be processed by [date].”

- Provide Easy Payment Options: Ensure that the client has all the necessary information to complete the transaction. This can include bank account details, payment links, or other instructions.

- Offer a Payment Plan if Necessary: If the client is experiencing financial difficulty, consider offering a payment plan or an extension to ease the situation.

- Follow Up Regularly: If there’s still no response after the first reminder, a second or third follow-up may be needed. Each reminder should escalate in urgency, but always remain polite and professional.

Escalating Payment Requests

If the initial reminder doesn’t result in payment, follow-up reminders should gradually increase in urgency. However, even in more assertive messages, it’s crucial to maintain respect and professionalism. You may also want to consider contacting the client through other channels, such as phone calls or direct messages, if email reminders continue to be ignored.

By handling payment reminders in a professional and thoughtful manner, you can encourage clients to fulfill their obligations without damaging your business relationship. Clear communication, combined with persistence, can ensure that overdue payments are addressed promptly.

Legal Considerations in Invoice Emails

When requesting payment for goods or services, it’s important to ensure that your communication complies with legal requirements. A well-crafted payment request not only conveys the necessary details but also protects both parties by clearly outlining the terms and conditions of the transaction. Failing to include legally required information can lead to disputes or delays in payment. Understanding the legal aspects of these communications helps safeguard your business and maintains professionalism.

Here are some key legal considerations to keep in mind when sending payment requests:

- Clear Terms and Conditions: Ensure that the payment terms, including the amount, due date, and accepted methods of payment, are clearly stated. This prevents any misunderstandings and provides a clear reference in case of a dispute.

- Accurate Information: Provide accurate details of the goods or services rendered, including descriptions, quantities, and agreed-upon prices. If your communication contains errors, it could potentially lead to legal complications.

- Late Payment Penalties: If you intend to charge interest or penalties for late payments, make sure these terms are specified beforehand in your agreement. Clearly state the penalty rate and the time period in which payment must be received to avoid extra charges.

- Legal Language: Use precise legal language to avoid ambiguity. Phrases like “payment is due upon receipt” or “payment must be made by [date]” are important for clarity and legal enforceability.

- Comply with Local Laws: Be aware of the legal requirements and regulations in your jurisdiction, as payment laws may vary by country or state. This includes understanding tax regulations, such as sales tax or VAT, and ensuring they are included where applicable.

- Confidentiality and Privacy: Ensure that you handle any personal or financial information with care, adhering to privacy laws such as GDPR (in Europe) or CCPA (in California). Always secure sensitive information and avoid sharing it unnecessarily in the communication.

- Dispute Resolution: It’s also helpful to outline the process for resolving disputes, including who to contact for clarification or issues, and whether legal action will be taken if payment is not made within a specified time frame.

By taking these legal aspects into account, you can avoid common pitfalls and ensure that your payment requests are not only effective but also compliant with relevant regulations. This provides both you and your clients with a clear understanding of expectations and protections.

How to Send Invoices Electronically

Sending payment requests electronically has become the standard for businesses looking to streamline their operations and improve efficiency. This method allows for faster delivery, easier tracking, and better record-keeping compared to traditional paper methods. Whether you’re sending a formal payment request or a simple reminder, understanding how to effectively send digital requests ensures they are professional, secure, and well-received.

Choosing the Right Method

There are several ways to send electronic payment requests, each with its advantages and considerations:

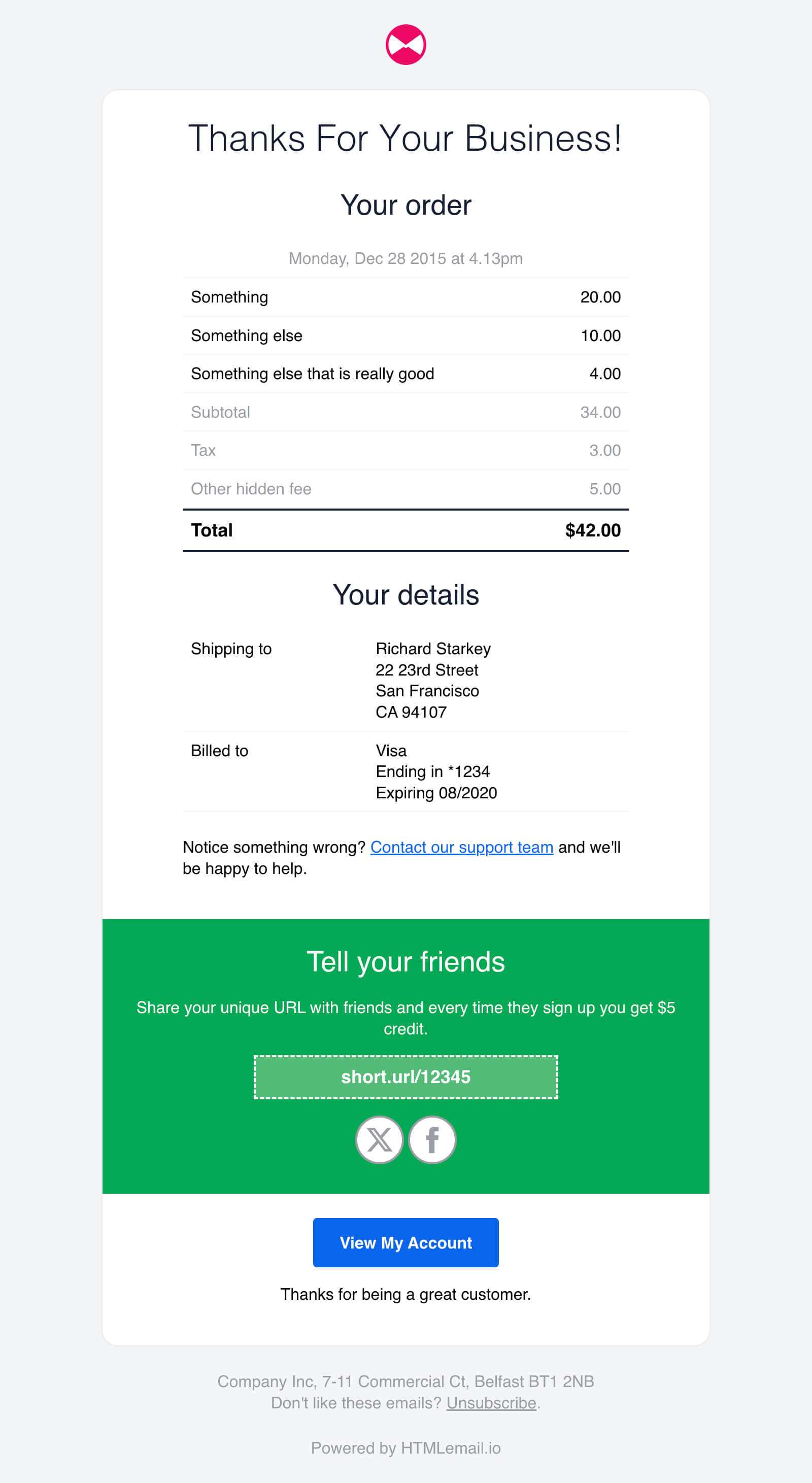

- PDF Attachments: One of the most common and secure ways to send payment requests is by attaching a PDF document. PDFs preserve the format and layout of the request, ensuring that the recipient sees the document exactly as intended. Be sure to protect sensitive data with a password if necessary.

- Online Payment Platforms: Platforms like PayPal, Stripe, or other online payment gateways allow you to send a link to the payment request. These platforms often include automated reminders and make the payment process more seamless for the recipient.

- Accounting Software: Many businesses use accounting tools like QuickBooks or Xero, which allow you to create, send, and track payment requests directly through the software. These platforms also often include features to manage due dates, taxes, and payment history.

- Direct Bank Transfers: Some businesses may prefer to simply provide their banking details in the message, allowing the client to transfer funds directly. While this method is straightforward, it lacks some of the automated tracking benefits of more sophisticated options.

Best Practices for Sending Digital Payment Requests

When sending a digital payment request, certain practices help ensure the process is professional, secure, and efficient:

- Include Clear Payment Details: Always provide a detailed breakdown of the services or products being billed, the total amount due, and the due date. Make it easy for the recipient to understand what they are paying for and when.

- Choose a Professional Subject Line: A clear and professional subject line helps ensure that your request is noticed and prioritized. For example, “Payment Request for [Service/Project Name]” is more effective than a vague “Invoice from [Company Name].”

- Confirm the Recipient’s Contact Information: Double-check that the recipient’s contact information is correct, including the email address or platform username. Incorrect contact details can delay the payment process.

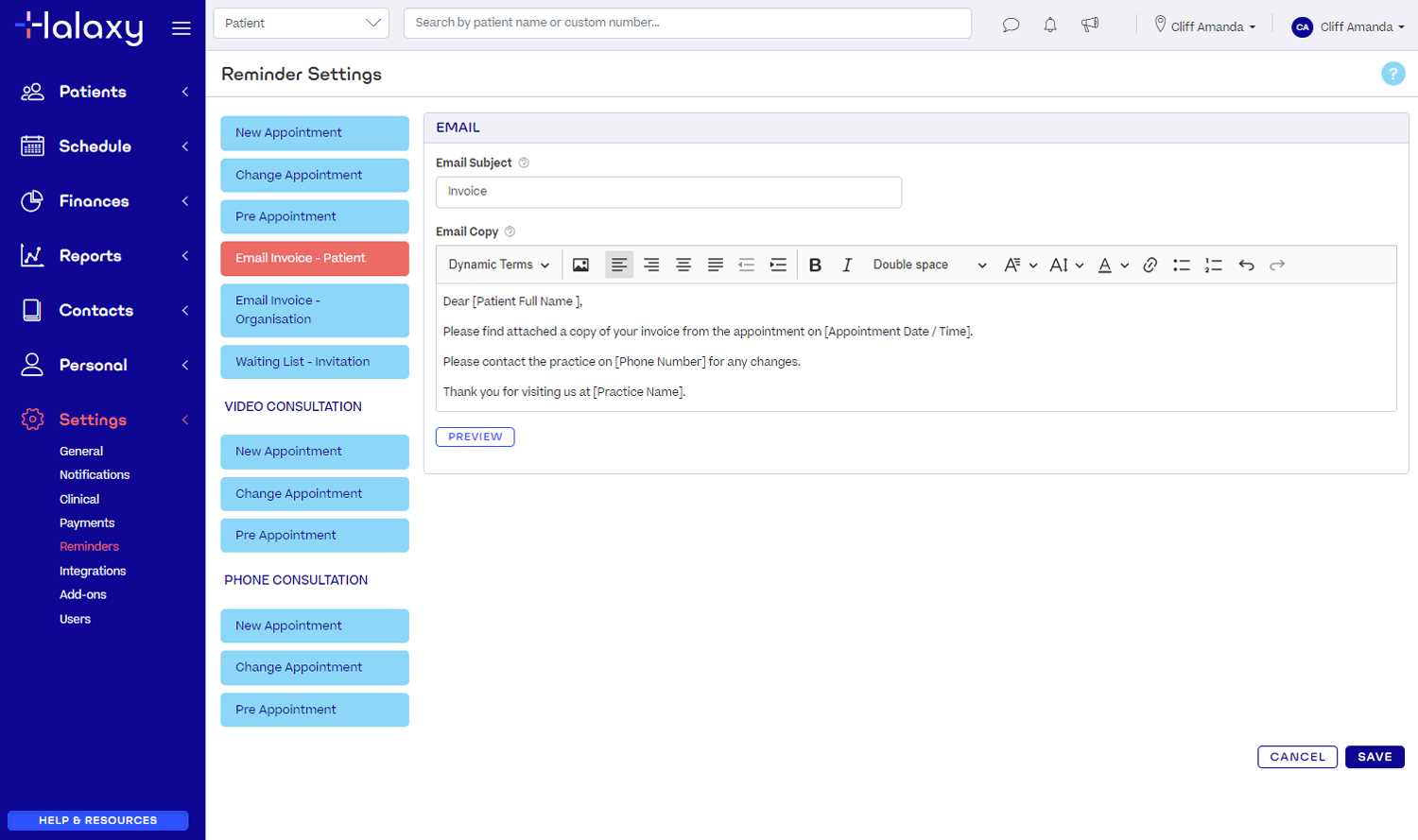

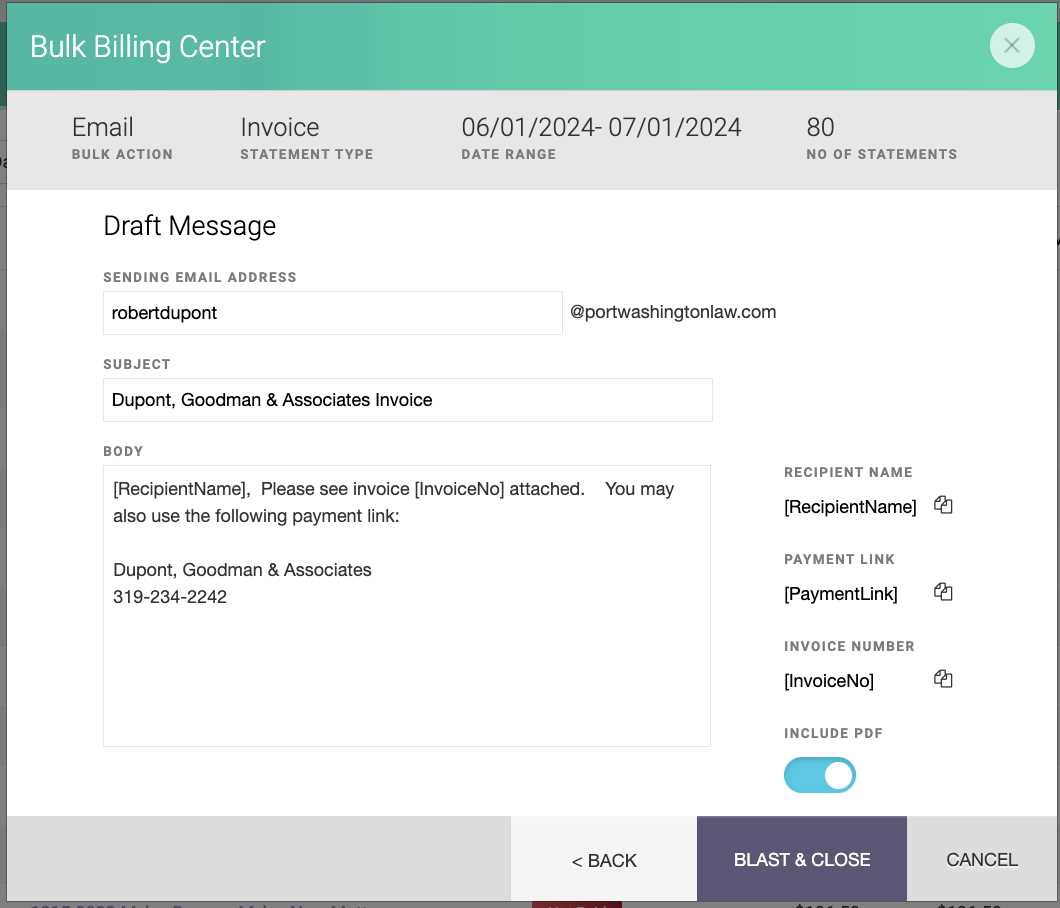

Automating Invoice Email Processes

Automating payment requests can significantly enhance the efficiency of your business operations, freeing up time and reducing the risk of errors. By streamlining routine tasks, you can ensure that requests are sent promptly, consistently, and with minimal effort on your part. Automated processes can also help maintain a professional approach, ensuring your clients receive timely reminders and follow-ups without requiring manual input for each transaction.

Benefits of Automation

There are numerous advantages to automating the process of sending payment requests and reminders:

- Time Efficiency: Automation eliminates the need for manual creation and sending of each payment request, saving valuable time that can be used for other aspects of your business.

- Consistency: Automated systems ensure that payment requests are sent on time and follow the same professional format every time, which improves your clients’ experience.

- Reduced Human Error: By using pre-designed templates and automation, you reduce the risk of missing key details or making errors in calculations that could delay payment or cause confusion.

- Improved Cash Flow: Sending payment reminders automatically increases the likelihood of timely payments. The system can also track overdue payments and escalate reminders when necessary.

- Customizable Alerts: Many automation tools allow you to set specific rules, such as when to send a reminder or escalate a payment issue. This helps you stay on top of your receivables without needing to manually monitor every transaction.

Tools for Automating Payment Requests

Several tools and software solutions are available to help automate the process of sending payment requests:

- Accounting Software: Many accounting platforms, such as QuickBooks, Xero, and FreshBooks, offer automation features that allow you to create and send payment requests automatically based on your billing cycles.

- Payment Gateways: Online payment platforms like PayPal and Stripe can automate reminders and send payment links directly to clients. These platforms often integrate with your accounting software for seamless operations.

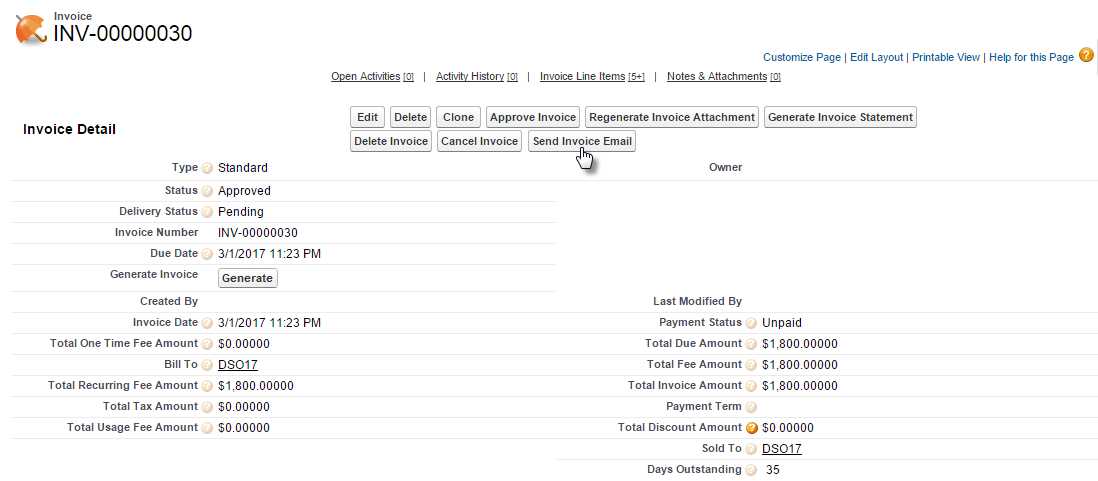

- Customer Relationship Management (CRM) Systems: CRMs like Salesforce or Zoho allow you to set up automated workflows that trigger payment reminders or follow-ups based on predefined actions and dates.

- Custom Automated Solutions: For businesses with more complex needs, custom automation can be built using tools like Zapier or Integromat, which allow you to connect various apps and set up automatic triggers for payment requests.

By implementing automation in your payment request process, you can not only save time but also improve the overall client experience and ensure that payments are processed more quickly. A well-oiled automation system enables you to focus on growing your business while ensuring your finances are in order.

Using Templates for Consistency

Maintaining consistency in business communications is crucial, especially when requesting payments. By using pre-designed structures for these requests, you ensure that every message follows the same professional format and includes all necessary details. This consistency not only helps build trust with clients but also improves operational efficiency, as you can quickly generate and send payment requests without reinventing the wheel each time.

Why Consistency Matters

Consistency in communication is key to presenting your business as organized and reliable. When all payment requests follow a similar structure, clients know exactly what to expect, making the process smoother for both parties. Additionally, consistency helps prevent the omission of important details, reducing the risk of confusion and delayed payments.

- Professional Image: A uniform style for all payment requests enhances your brand’s professionalism and fosters client trust.

- Efficiency: Templates allow for quick generation of payment requests, saving time and ensuring no crucial details are left out.

- Clarity: A standard format makes it easy for clients to understand the payment terms and requirements at a glance, improving communication.

- Reduced Errors: Templates reduce the likelihood of mistakes that can arise from drafting a new request each time, such as forgetting essential payment information or miscalculating amounts.

How to Create Effective Templates

To ensure your payment requests are both consistent and effective, consider the following tips when creating templates:

- Include Essential Information: Every template should have key elements, such as the amount due, payment due date, and any applicable payment instructions. Additionally, always include your business contact information for easy reference.

- Clear and Concise Language: Use simple, direct language that avoids confusion. Make sure the message is polite but firm, specifying the action needed from the recipient.

- Personalization Options: While templates are designed for consistency, allow room for customization to address specific client needs or situations. This might include adding custom notes or adjusting the payment terms based on individual agreements.

- Branding: Ensure that your template reflects your company’s branding with consistent use of logos, colors, and font styles. This adds a professional touch and reinforces your brand identity.

- Automation Compatibility: For businesses using automation tools, make sure your template can be easily integrated into your chosen software. This will allow you to send requests on schedule and track progress efficiently.

By adopting templates, you streamline your payment processes and reduce the chances of errors while enhancing the overall professionalism of your communication. Templates provide a solid foundation for consistent, efficient, and clear payment requests, ensuring both you and your clients stay organized.

Tracking and Managing Invoice Emails

Efficiently managing payment requests is crucial for maintaining smooth business operations. Tracking these communications ensures you don’t lose sight of overdue payments and helps you stay on top of your financial records. By implementing a system to monitor when requests are sent, opened, and paid, you can minimize delays, reduce errors, and maintain strong relationships with your clients.

Why Tracking is Essential

Monitoring the progress of your payment requests provides numerous benefits for your business:

- Timely Follow-Ups: Tracking allows you to send timely reminders to clients who haven’t responded or paid, reducing the chances of delayed payments.

- Clear Financial Records: A tracking system ensures you have accurate records of which requests have been sent and which are still pending. This makes managing your accounts easier and more transparent.

- Dispute Resolution: If there are any disputes regarding payments, having a clear record of when and how payment requests were sent can help resolve issues quickly and fairly.

- Client Communication: By tracking requests, you can tailor your communication with clients based on their payment status, keeping them informed and reducing confusion.

Methods for Tracking and Managing Payment Requests

There are various tools and strategies you can use to track and manage your payment requests effectively:

- Accounting Software: Many modern accounting platforms like QuickBooks, FreshBooks, or Xero provide built-in features for tracking payment requests. These tools allow you to view the status of sent requests, track payments, and automate reminders.

- CRM Systems: Customer Relationship Management (CRM) platforms can help you track communication history with clients, including payment requests. They allow you to set reminders, follow up automatically, and even generate reports on payment status.

- Payment Processing Tools: If you use third-party payment processors like PayPal or Stripe, they often come with tracking features. These tools can tell you when a payment request has been opened and when the payment was completed.

- Manual Tracking: For smaller businesses or those not using specialized software, a simple spreadsheet can be used to track payment requests manually. You can list dates sent, amounts, client names, and payment statuses to stay organized.

- Automated Follow-Ups: Set up automated reminders for clients who have not paid by the due date. These reminders can be sent at scheduled intervals (e.g., after 7 days, 14 days) to keep payment requests top of mind for clients.

By utilizing these tracking methods, you can ensure that no payment request slips through the cracks. The ability to monitor when requests are received and payments are made enhances your financial management, allows for proactive follow-ups, and improves cash flow.

How to Improve Client Payment Response

Timely responses to payment requests are essential for maintaining healthy cash flow and a positive client relationship. To increase the likelihood of prompt payments, it is important to create a seamless and professional process that encourages clients to act quickly. From clear communication to offering multiple payment options, several strategies can help improve the chances of getting paid on time.

Strategies for Encouraging Timely Payments

There are several effective ways to boost the chances of a quick payment response from clients:

- Clear Payment Terms: Ensure your payment terms are easy to understand. Specify the due date, payment methods accepted, and any penalties for late payments. When clients know exactly what is expected, they are more likely to act promptly.

- Send Reminders: Sending gentle reminders before and after the due date can significantly improve the response rate. Automated systems can help you send these reminders without having to manually follow up with every client.

- Make Payment Easy: Offering multiple ways to pay, such as credit cards, bank transfers, or online payment platforms, makes it easier for clients to settle their accounts quickly. The simpler the process, the faster they will pay.

- Early Payment Discounts: Offering small discounts or incentives for early payment can motivate clients to pay ahead of schedule. This approach can be particularly effective for recurring customers or large accounts.

- Clear and Professional Messaging: A well-structured and professional payment request gives a sense of urgency and seriousness. Ensure that your communication is polite but firm, and that all relevant details (such as payment amounts and due dates) are clearly stated.

Building Positive Relationships to Encourage Prompt Payments

Building strong, positive relationships with your clients can have a long-term impact on their responsiveness to payment requests:

- Maintain Good Communication: Regular and open communication throughout the course of your project or service helps establish trust. When clients feel informed and valued, they are more likely to prioritize your payment request.

- Be Transparent: If there are any issues with the payment process, address them upfront and offer solutions. Transparency helps avoid misunderstandings and shows your commitment to resolving problems.

- Set Realistic Expectations: Be realistic about your payment terms and deadlines. When clients understand that you are flexible but professional, they are more likely to respond positively to your payment requests.

- Follow Up Professionally: If a payment is overdue, send a polite follow-up. Be persistent but respectful, and always approach clients in a way that preserves the relationship. A professional tone helps maintain goodwill and encourages prompt payments.

By adopting these strategies, you can improve the likelihood of re