Billable Hours Invoice Template for Accurate Client Billing

Managing client payments for services rendered can often be a challenging task for freelancers, contractors, and businesses alike. Having an organized system in place is essential to ensure accurate and timely compensation for your work. One effective way to streamline this process is by using a structured document that outlines the work completed, the time spent, and the corresponding rates.

By utilizing a clear and professional method for tracking and requesting payment, you can avoid confusion and ensure that clients are charged fairly. This approach not only enhances the client experience but also helps you maintain financial clarity and avoid costly errors.

In this guide, we’ll explore the benefits of using a well-structured billing form, how to customize it for your specific needs, and the key elements that should always be included. Whether you’re a seasoned professional or just starting, having the right tools can significantly improve your business operations.

Billable Hours Invoice Template Overview

Efficiently tracking and requesting payment for services is crucial for any business or professional offering time-based work. A well-structured document helps to ensure transparency, clarity, and consistency in client transactions. This tool allows you to itemize the services provided, the time invested, and the corresponding fees, creating a clear record for both parties.

Such a document serves as a practical solution to streamline the billing process, ensuring that all relevant details are captured and communicated effectively. It simplifies financial management and eliminates the need for manual calculations, reducing the risk of errors. By using a comprehensive and user-friendly format, professionals can focus on their work while the payment process runs smoothly.

In this section, we will delve into the key components of this essential business document and explore how it can be adapted to suit various industries and types of services. From setting hourly rates to structuring the layout, understanding the full potential of this tool is vital for maintaining a smooth and professional billing workflow.

Why Use a Billable Hours Template

Having a clear and organized system for tracking the time and services provided ensures smooth business operations and reduces the chance of errors. Using a structured document simplifies the process of charging clients and helps both parties stay on the same page regarding compensation for work performed. By implementing a professional format, you can avoid confusion and ensure accurate billing every time.

Such a document provides several key advantages, including easy customization to match your specific needs, faster processing of payments, and a reduction in administrative tasks. It also helps maintain consistency in how services are recorded and billed, improving client trust and satisfaction. Whether you’re working with multiple clients or handling diverse projects, this tool offers a convenient way to stay organized and ensure timely compensation.

In the following section, we will explore how this tool can save you time, reduce potential disputes, and improve your overall financial management. Whether you’re an independent contractor or a small business owner, adopting this system can streamline your operations and enhance your professional image.

How to Customize Your Invoice Template

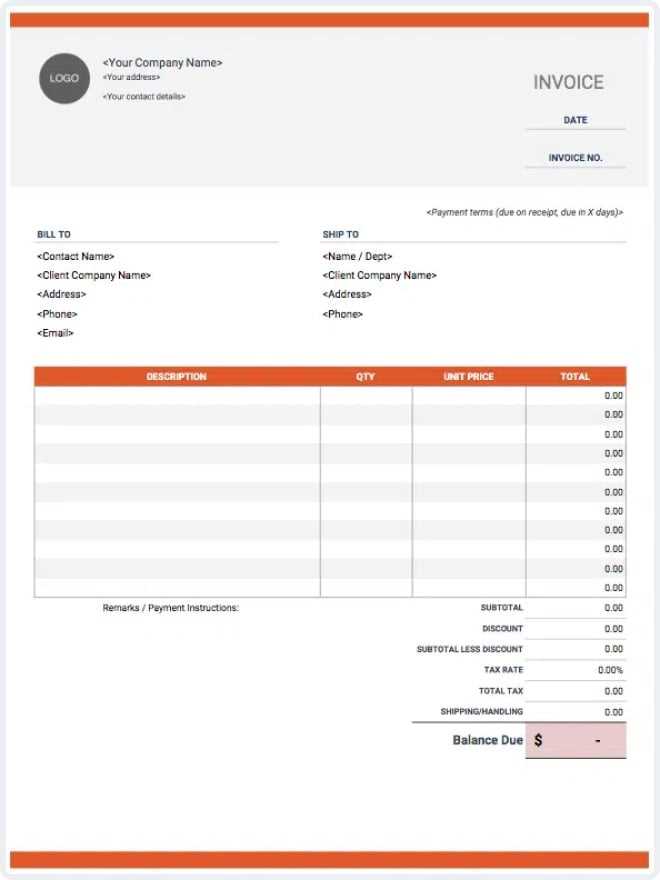

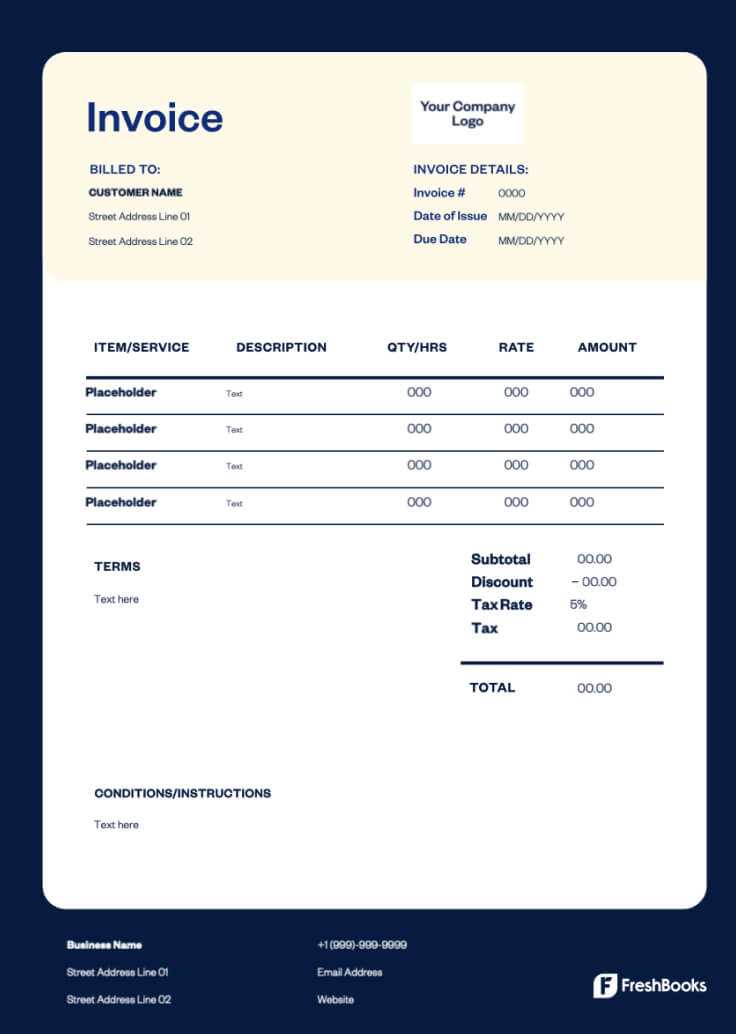

Personalizing a document for tracking work and requesting payment is essential to make sure it meets your specific needs and reflects your business style. Customizing this tool allows you to tailor the layout, language, and key fields to match the services you offer and how you work with clients. A well-crafted form helps present a professional image while ensuring accuracy in billing.

Start by adjusting basic details such as your business name, contact information, and logo. These elements help establish credibility and make the document instantly recognizable to your clients. Next, modify sections like service descriptions, rates, and time entries to reflect the nature of your work, whether it’s project-based or hourly. You can also include additional terms, such as payment methods, late fees, or tax information, to ensure all necessary conditions are clear.

Additionally, consider incorporating any industry-specific requirements or preferences. For instance, legal, consulting, or creative services may have unique formats for how work is recorded and charged. By ensuring the document is adaptable and comprehensive, you can avoid common issues and streamline the process of requesting payment for your work.

Essential Elements of an Invoice Template

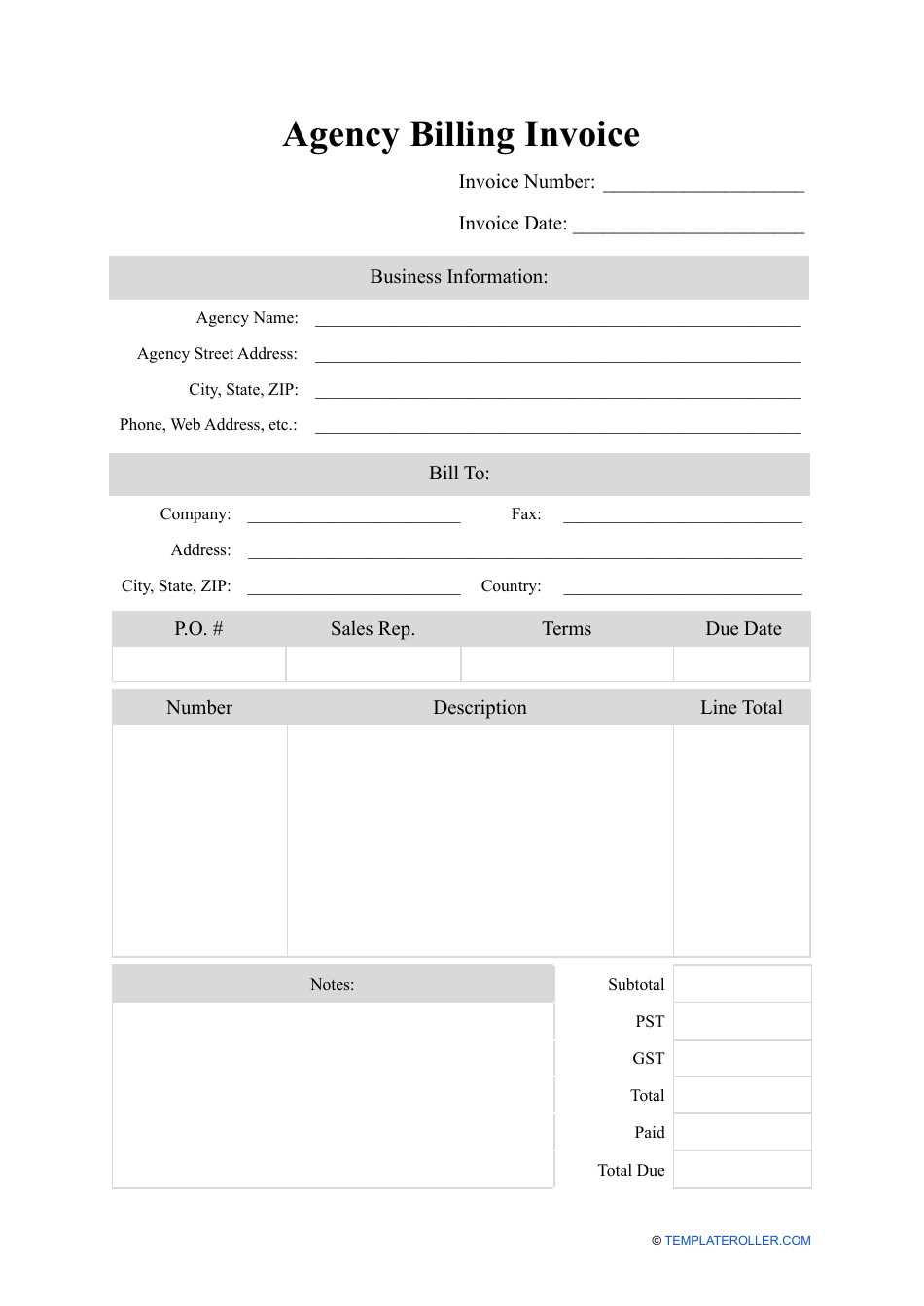

To ensure accurate billing and smooth transactions, certain key components must be included in any document used to request payment for services. These elements help maintain professionalism, clarity, and transparency between you and your clients. Understanding these essential parts allows you to create a comprehensive, easy-to-read record of the work completed and the amount due.

Client Information

Always include the client’s full name, company name (if applicable), and contact details. This ensures that the document is properly addressed and easy for both parties to reference. Accurate client information is crucial for maintaining communication and preventing any payment delays.

Service Details and Charges

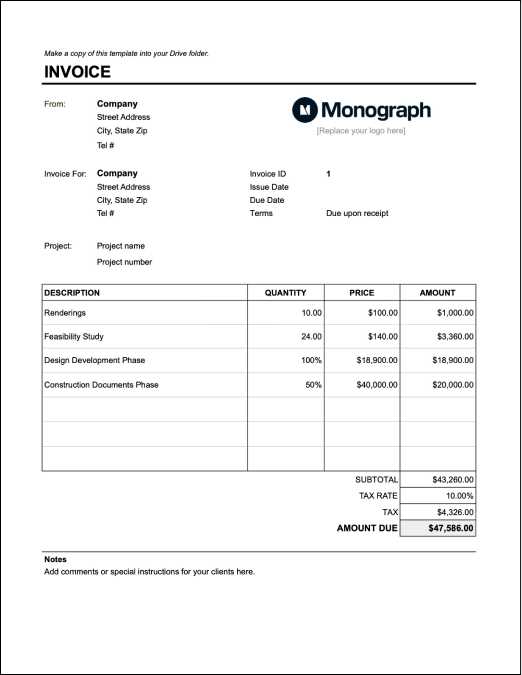

Clearly itemize the services provided, including descriptions, time spent, and applicable rates. This section allows clients to understand exactly what they are being charged for and helps avoid confusion over the work completed. Here’s a simple example of how to structure this section:

| Service Description | Quantity | Rate | Total |

|---|---|---|---|

| Consultation Session | 2 hours | $100/hour | $200 |

| Project Review | 3 hours | $80/hour | $240 |

| Total | $440 | ||

By clearly presenting these details in an easy-to-follow format, you ensure the client understands the breakdown of costs and can verify the information quickly. This transparency is crucial for building trust and encouraging timely payment.

Tracking Billable Hours for Accuracy

Accurate tracking of time spent on tasks is essential to ensure that clients are charged fairly and that you are compensated properly for your work. Without a clear system in place, it becomes easy to overlook small tasks or miscalculate the time invested, leading to potential disputes or financial loss. A reliable method for recording the work completed can save both time and effort in the long run.

One of the most effective ways to track time is by using a consistent approach, whether through digital tools, spreadsheets, or manual logs. Each entry should include detailed information about the work performed, the time spent, and any relevant notes to clarify the task. This not only helps you keep an accurate record but also provides transparency for your clients, making it easier for them to understand the charges on their statement.

Additionally, consider breaking down larger projects into smaller, more manageable tasks to ensure precision in tracking. Using time-tracking software can also automate the process, providing real-time data that reduces the chances of human error. The key is consistency–by recording your work in a structured manner, you ensure that your billing reflects the true value of your time.

Tips for Calculating Billable Hours

Accurately calculating the time spent on tasks is crucial for ensuring fair compensation for the work you provide. Without a clear method for measuring the time invested, it’s easy to make mistakes that can lead to undercharging or disputes with clients. By adopting a systematic approach, you can improve the precision of your billing and ensure that every minute of work is accounted for.

One important tip is to break down your tasks into smaller segments. This approach not only helps in tracking specific activities more accurately but also makes it easier to determine the exact amount of time spent on each task. Be sure to round up or down based on your billing policy, whether it’s to the nearest 15 minutes or a different increment, to avoid confusion.

Using a timer or time-tracking software is another effective way to ensure precision. These tools can automatically log your work, making it easier to monitor the time spent without distractions. It also reduces the risk of forgetting to record time during busy work periods. Finally, always factor in breaks or interruptions to give a true reflection of productive time, ensuring your calculations are as accurate as possible.

How to Format Your Invoice Professionally

Presenting a well-organized document to clients is essential for maintaining a professional image and ensuring timely payments. The format of your billing statement plays a significant role in how your services are perceived and how efficiently the payment process is handled. A clean, easy-to-read layout helps both you and your clients review the details quickly and accurately.

To ensure your document is formatted professionally, consider the following key elements:

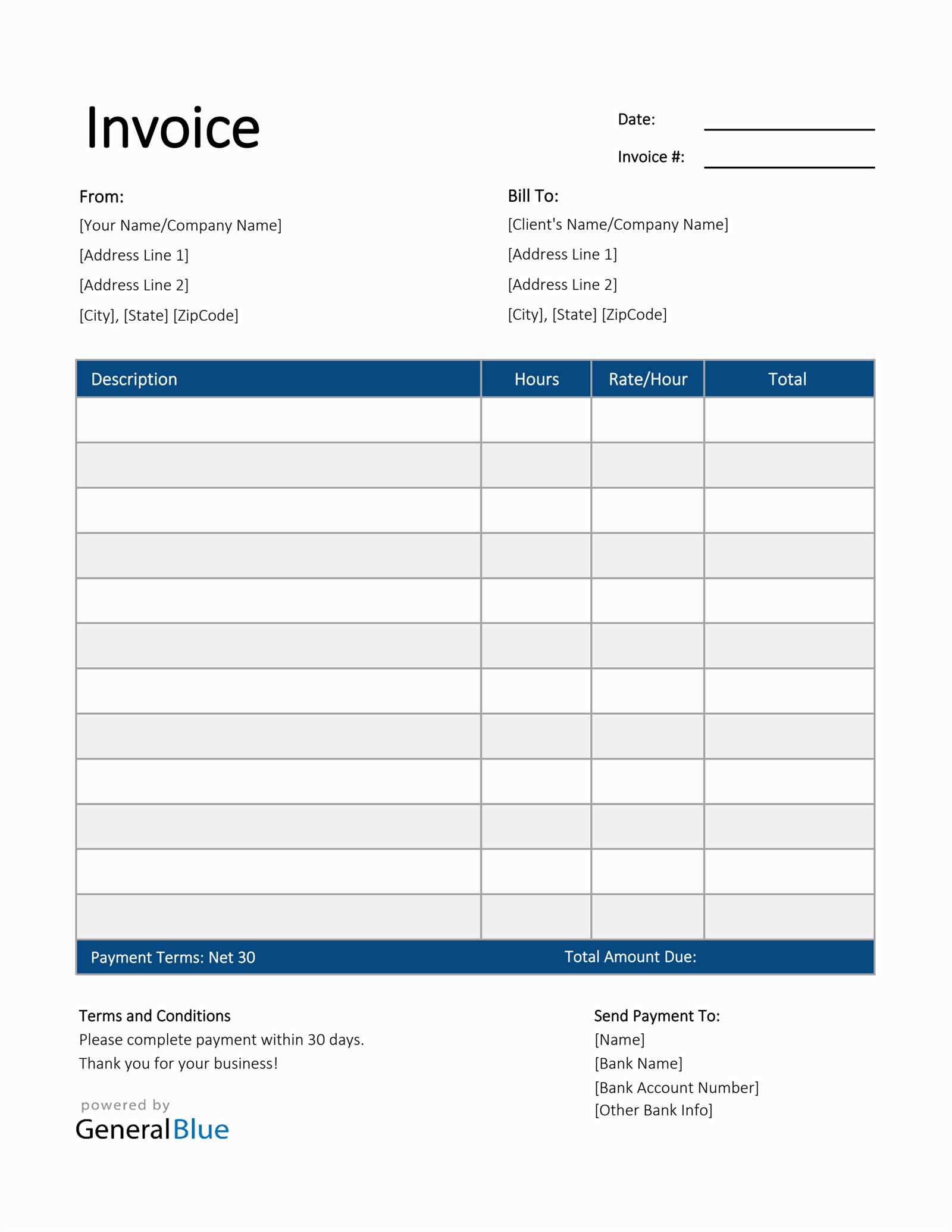

- Clear Header: Include your business name, logo, and contact information at the top for easy recognition.

- Client Information: Ensure the client’s name, company, and contact details are clearly displayed.

- Itemized Breakdown: List each service or task separately, with clear descriptions, time spent, and rates. This transparency helps avoid misunderstandings.

- Payment Terms: Clearly state the due date and any payment conditions, such as late fees or discounts for early payment.

- Totals and Summary: Make sure the total amount due is easy to find, typically at the bottom of the document.

By following these guidelines, you can create a billing statement that is both professional and functional. Consistency in the format across all documents ensures your clients know exactly what to expect, contributing to positive relationships and smoother financial transactions.

Automating Your Invoice Creation Process

Streamlining the process of creating billing documents can save significant time and reduce the risk of errors. By automating key aspects of the creation process, you can ensure consistency, accuracy, and efficiency while freeing up more time to focus on your work. There are several tools and methods available that can help speed up this process and make your workflow more seamless.

Benefits of Automation

- Time Savings: Automating repetitive tasks allows you to generate new documents quickly without manually entering data each time.

- Consistency: Automated systems help maintain a uniform format, reducing the chance of missing key details or making formatting errors.

- Accuracy: Automation reduces the risk of human error, ensuring that calculations for services rendered and rates are correct.

- Convenience: Many automated systems allow for cloud storage, making it easy to access and manage your documents from anywhere.

How to Automate the Process

- Use Billing Software: Many software solutions offer pre-built templates and automatic calculations, allowing you to input data once and generate documents instantly.

- Integrate Time Tracking Tools: Time tracking tools can automatically log work details and sync them with your billing software, reducing manual data entry.

- Set Up Recurring Invoices: For regular clients, set up recurring billing schedules to automatically generate and send documents on a set basis.

- Use Cloud Services: Cloud-based solutions offer automatic syncing across devices, ensuring all your records are updated and accessible at any time.

By embracing automation, you can simplify the billing process, avoid unnecessary delays, and improve client satisfaction by delivering accurate and timely payment requests. The more automated your process, the more efficient and professional your business will appear to clients.

Common Mistakes to Avoid in Billing

Even the smallest mistakes in the billing process can lead to confusion, delayed payments, or even strained client relationships. It’s essential to be aware of the common errors that can occur when preparing payment requests and take steps to avoid them. By doing so, you ensure that your financial documents are clear, professional, and accurate.

- Incorrect Service Descriptions: Failing to clearly outline the work performed can lead to misunderstandings. Always provide detailed descriptions of the tasks completed to avoid confusion.

- Inaccurate Time Entries: Mistakes in logging time can result in incorrect charges. Be diligent about tracking your time and double-checking any entries before sending the final document.

- Omitting Payment Terms: Not specifying payment terms, such as due dates, late fees, or discounts, can cause delays. Always include clear payment instructions and deadlines.

- Forgetting to Include Taxes: Failing to calculate and add relevant taxes can result in undercharging. Ensure all applicable taxes are correctly added to your total amount due.

- Vague or Missing Contact Information: Not including your business details or the client’s contact information can cause confusion and hinder payment processing. Always include full contact information for both parties.

- Using an Unprofessional Format: A cluttered or unorganized document can make it difficult for clients to read or understand. Use a clean, well-structured layout that highlights key details such as service descriptions and amounts.

By avoiding these common billing mistakes, you can maintain a professional image, streamline the payment process, and ensure that you are paid accurately and on time for your services.

Benefits of Using Digital Templates

Utilizing digital tools for creating financial documents can offer numerous advantages, enhancing both efficiency and accuracy. Digital solutions allow for greater flexibility, organization, and consistency, while reducing the time spent on manual processes. By embracing these tools, businesses can streamline their administrative tasks and present a more professional image to clients.

Key Advantages of Digital Solutions

- Time Efficiency: Pre-designed digital files save you time by eliminating the need to start from scratch with each new document. Templates can be quickly modified and reused, reducing repetitive tasks.

- Accuracy: Automated calculations reduce the risk of human error, ensuring that figures, totals, and rates are accurate every time.

- Consistency: Digital tools allow you to maintain a consistent format across all your documents, improving professionalism and helping clients easily recognize your brand.

- Accessibility: Cloud-based templates can be accessed from any device with an internet connection, providing flexibility and ensuring that your documents are always at your fingertips.

- Customization: Digital tools often offer easy customization options, allowing you to adapt templates to suit specific client needs or projects without starting from scratch.

Improved Workflow and Organization

- Reduced Paperwork: Digital documents eliminate the need for physical paperwork, helping you save space and reduce clutter in your office.

- Environmentally Friendly: Going digital is an eco-friendly option, reducing paper consumption and contributing to sustainability efforts.

- Security: Digital files can be securely stored and backed up, reducing the risk of losing important records due to physical damage or misplacement.

By switching to digital solutions, you can enjoy these benefits and more, making your administrative tasks easier and allowing you to focus on delivering quality services to your clients.

Invoice Template for Freelancers and Contractors

For freelancers and independent contractors, creating professional payment requests is essential to maintaining a positive business relationship with clients. A well-structured document not only ensures prompt payments but also helps establish credibility and trust. Customizing such documents for your specific needs can save time and increase efficiency when it comes to financial record-keeping.

Key Features for Freelancers and Contractors

When designing a payment request for freelance work or contract services, there are certain elements to keep in mind to ensure it meets both professional standards and the client’s expectations:

- Clear Service Descriptions: Provide a concise and detailed breakdown of the work performed, ensuring transparency and reducing the risk of disputes.

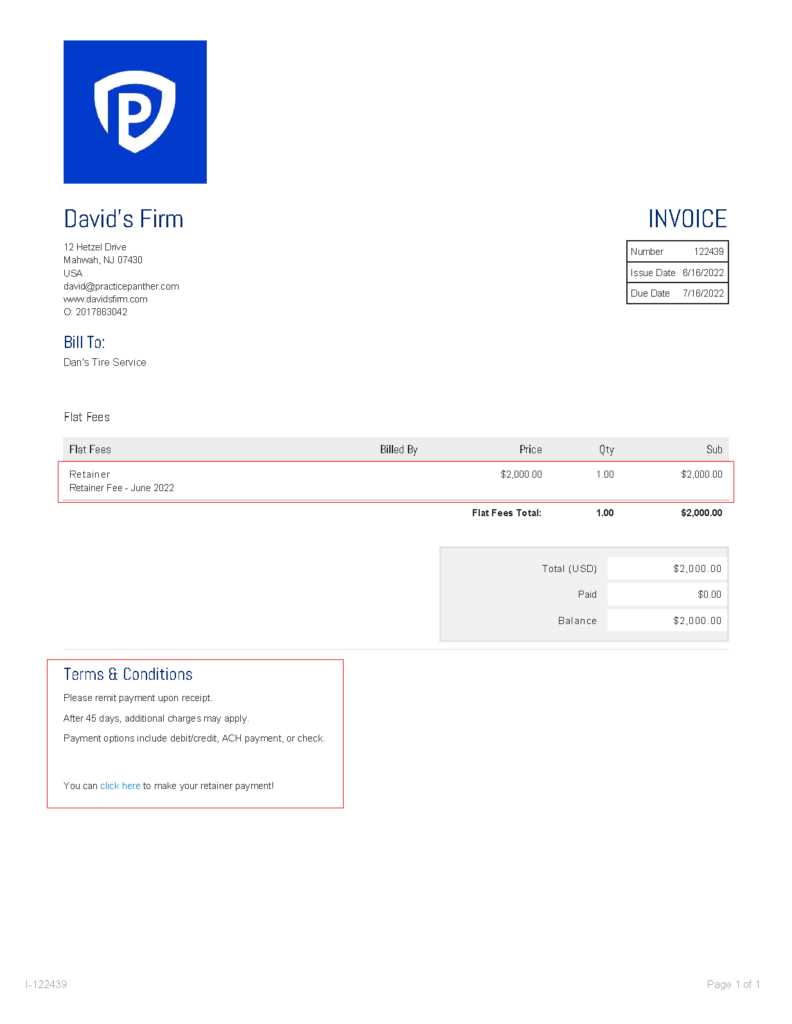

- Hourly Rate or Flat Fee: Clearly indicate the method of payment, whether it’s an hourly rate, flat fee, or project-based pricing.

- Payment Terms: Specify due dates, payment methods, and any late fees to avoid confusion and ensure timely payment.

- Business and Client Information: Include your business name, contact details, and your client’s information for a professional touch.

- Tax Information: Add applicable tax rates if necessary, ensuring compliance with local tax laws and regulations.

How to Tailor Your Payment Request

Each client may have unique needs, so tailoring your documents accordingly is important. You can adjust the design and contents to reflect the specific nature of the work and any additional requirements:

- Customize for Project Type: For long-term projects, you might want to create milestone-based payment requests, while for one-time services, a simple summary of work done is sufficient.

- Include Additional Notes: If there were any specific agreements, discounts, or considerations, include those in a notes section for transparency.

- Adjust Frequency: For recurring work, set up automatic generation of documents based on your predetermined schedule, such as weekly or monthly payments.

By using a structured, customizable document format, freelancers and contractors can save time on administrative tasks, maintain professional relationships, and ensure timely payments for ser

How to Add Taxes to Your Bill

When preparing a payment request for your services, it’s important to ensure that taxes are correctly included. Adding taxes not only ensures compliance with local regulations but also helps avoid issues with undercharging. Understanding how to calculate and display taxes accurately will help you maintain professionalism and transparency with your clients.

Understanding Tax Rates

Before adding taxes, you need to understand the applicable tax rates based on your location and the nature of the service provided. Different regions and services may have different tax rates. It’s essential to research the correct tax percentage to apply to your total amount due.

- Sales Tax: This is the most common tax applied to goods and services, and it varies by region.

- Value Added Tax (VAT): In some countries, VAT is applied instead of sales tax and is often calculated based on the value added at each stage of production or service provision.

- Service Tax: In some jurisdictions, specific services are subject to a special tax, and this needs to be applied on top of the cost of the work provided.

How to Calculate and Add Taxes

Once you know the tax rate, you can calculate the tax amount based on your total charges. Here’s a simple formula to follow:

- Calculate Tax: Multiply the subtotal of your services by the tax rate. For example, if your subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Add to Total: Once the tax amount is calculated, add it to the subtotal to get the final amount due. In this example, the total would be $500 + $50 = $550.

Be sure to clearly label the tax amount and show it as a separate line item in your document to ensure transparency. This helps your client understand how the total is calculated and ensures there are no surprises when it comes to payment.

Setting Payment Terms in the Template

When preparing a request for payment, one of the most important aspects is establishing clear payment terms. This not only ensures that both parties understand the expectations but also helps prevent delays in payments. By clearly outlining when and how payments are due, you can avoid confusion and build a professional relationship with your clients.

Types of Payment Terms

There are several types of payment terms that can be applied depending on the nature of your work and the agreement with the client:

- Net 30: This is one of the most common terms, where payment is due 30 days after the service is completed or the payment request is issued.

- Net 15: Some businesses prefer shorter payment terms, where the payment is due within 15 days of completion.

- Due on Receipt: In this case, the payment is expected immediately upon receiving the payment request, commonly used for smaller projects or clients.

- Installments: For larger projects, you might set up a payment plan with installments, where the total amount is divided into agreed-upon payments over time.

How to Set Clear Payment Expectations

To ensure clarity, always state the payment terms explicitly in your request. Here are some key things to include:

- Payment Due Date: Clearly state the date by which the payment should be made to avoid confusion.

- Late Fees: If applicable, include details about late fees, such as a percentage of the total amount for every week the payment is delayed.

- Accepted Payment Methods: Specify the methods you accept for payment, such as bank transfers, credit cards, or online payment platforms.

- Currency: Make sure to specify the currency of payment, especially if dealing with international clients.

By setting clear payment terms, you ensure a smooth and predictable process for both you and your clients, allowing you to focus on your work without worrying about delayed payments.

Managing Multiple Clients with One Template

When managing multiple clients, it’s crucial to have an efficient system for organizing and presenting your payment requests. Using a single structure for all your clients helps maintain consistency, saves time, and reduces errors. However, it’s also important to customize certain sections for each client to meet their specific needs while maintaining a streamlined approach.

Customizing for Each Client

Even though you are using one general structure, certain elements will need to be adjusted for each client. Here are a few key areas to personalize:

- Client Information: Ensure that the name, address, and contact details are correct for each client. This ensures your communication is professional and accurate.

- Service Details: While the format can stay the same, each request should include specific details about the services provided, along with the associated costs and dates.

- Payment Terms: Tailor the payment terms to fit each client’s preferences, whether they require specific due dates or installment options.

Using Digital Tools for Efficiency

Digital tools and platforms can greatly enhance your ability to manage multiple clients with a single structure. Many software options allow you to create reusable forms where you can input client-specific details automatically, reducing the time spent on manual entries. Some benefits of using digital tools include:

- Quick Edits: Easily update and modify client information without having to redesign the entire structure.

- Consistency: Maintain a uniform look and feel across all your requests, which reinforces professionalism.

- Tracking: Track which requests have been sent, paid, or are overdue, making it easier to follow up and manage multiple clients at once.

By managing multiple clients through a single, customizable structure, you can improve efficiency, reduce errors, and maintain a high standard of professionalism, all while keeping your workflow organized and streamlined.

Invoice Template for Legal and Consulting Services

When providing professional services in fields like law or consulting, it’s essential to have a clear and detailed way to request payment for your work. For these industries, the structure of the payment request needs to be comprehensive and transparent, ensuring that clients understand the charges and the scope of services rendered. An organized and professional format will not only streamline the payment process but also reinforce trust and credibility with your clients.

Key Elements for Legal and Consulting Services

Legal and consulting services often involve a variety of tasks that need to be clearly documented. Here are some essential sections to include in your request for payment:

- Service Description: Clearly outline the tasks completed, whether it’s legal advice, consulting sessions, or research. The more specific you are, the less likely it is that clients will have questions later.

- Hourly Rates or Project Fees: Depending on the nature of your work, specify whether you charge by the hour or provide a flat rate for a project. Ensure that all fees are calculated correctly and are easy to understand.

- Dates and Time Period: For services rendered over a period, include the dates the work was performed, or the timeline of the project. This helps avoid confusion and provides clarity.

Professional Appearance and Clarity

In legal and consulting services, your requests for payment are not just financial documents; they reflect your professionalism. Using a clear and organized layout ensures that clients have all the information they need at a glance. Some helpful tips to keep in mind:

- Simple Layout: Keep the structure clean and easy to read. Avoid over-complicating the format, and use clear headings and bullet points to break down information.

- Include Contact Information: Ensure that both your contact details and the client’s information are correct and easy to find. This makes it easier for clients to reach out if they have questions.

- Clear Payment Terms: Specify your payment terms, such as due dates and accepted payment methods. Clients appreciate clear expectations for when and how payments are to be made.

By maintaining a professional and well-structured document, you can enhance the payment process for legal and consulting services, ensuring both you and your clients have a clear understanding of the work completed and the terms of payment.

Exporting and Sharing Your Completed Invoice

Once you’ve finished preparing a payment request, it’s crucial to share it with your client in a professional and efficient manner. Exporting the document in the right format and ensuring it’s easy to send can help maintain a smooth transaction process. Whether you’re working with individuals or large organizations, proper sharing methods can speed up the payment cycle and reduce the chance of misunderstandings.

Choosing the Right File Format

The first step in sharing your completed document is to decide on the format. Different file types offer various advantages, so it’s important to select one that suits both you and your client’s preferences. Some commonly used formats include:

- PDF: The most common format for sharing professional documents. PDFs preserve the layout and are easily accessible across different devices.

- Word Documents: If your client prefers to make edits or comments, a Word document might be a better choice. However, it’s not always the best for final versions due to potential formatting changes.

- Excel Spreadsheets: If your request includes detailed breakdowns or multiple calculations, sharing a spreadsheet can allow for better transparency and flexibility.

Methods for Sharing the Document

Once the document is in the right format, you need to send it securely and efficiently. Here are a few reliable methods for sharing your finalized request for payment:

- Email: The most common and simple method. Attach the file to your email and provide any additional notes if necessary. Make sure to use a professional tone and a clear subject line to avoid it being overlooked.

- Cloud Storage: If the file is too large for email or if you want to share multiple documents, cloud storage platforms like Google Drive, Dropbox, or OneDrive provide an easy solution. You can send a link to the client for secure access.

- Payment Platforms: Some online platforms offer direct uploading and sharing of payment-related documents. If you’re using a platform like PayPal, QuickBooks, or FreshBooks, the sharing process is integrated within the platform.

By choosing the appropriate file format and sharing method, you can ensure that your payment request reaches your client efficiently and in a way that suits their preferences. Clear and acc