How to Use a Bill to Invoice Template for Efficient Billing

Efficiently managing transactions is crucial for businesses of all sizes. Whether you’re a freelancer or a growing company, having a structured system to request payments from clients is essential. A well-organized billing document can streamline your workflow, reduce errors, and maintain a professional image.

Having a ready-made structure for creating payment requests ensures that you include all necessary details and adhere to best practices. It eliminates confusion for both you and your clients, ensuring timely payments and clear communication.

Customization is also key. A flexible structure allows you to adjust the document to your specific needs, such as adding taxes, discounts, or various payment terms. Whether you are billing for services, products, or projects, this approach simplifies the entire process.

Understanding Billing Document Structures

In any business, having a structured format for requesting payments is fundamental. This ensures that all necessary information is clearly presented, preventing misunderstandings and speeding up the payment process. A clear and professional payment request allows both the service provider and the client to stay aligned on the terms of the transaction.

Why Structure Matters

When designing a payment document, consistency is key. A well-organized format not only highlights essential details like the amount due and payment due date but also reflects your professionalism. Using a predefined structure can save time and reduce the chances of omitting crucial information.

Essential Components of a Payment Document

Each document should include key sections such as the recipient’s information, payment breakdown, and due date. Including these elements in a logical order makes the document easier to read and ensures that nothing is overlooked. The flexibility to adapt these components to specific needs, like adjusting payment terms or adding discounts, also provides added value.

Why You Need a Structured Payment Request Format

Having a predefined format for payment requests is essential for ensuring clarity and consistency in every transaction. It simplifies the process, minimizes errors, and helps maintain a professional image when dealing with clients. A well-organized structure ensures that both parties are on the same page and that no important information is overlooked.

Benefits of Using a Structured Format

- Consistency: Using the same format for every payment request ensures uniformity across all transactions, which can help build trust with clients.

- Time-saving: Pre-made formats allow for quicker document creation, so you can focus on other aspects of your business.

- Professionalism: A well-organized document reflects positively on your business and improves your clients’ perception of you.

How a Set Format Helps You Stay Organized

A structured approach reduces the risk of mistakes, like forgetting key details or miscalculating amounts. With a set layout, you can easily keep track of all your requests and monitor the status of payments. Over time, this system helps streamline your administrative processes and makes it easier to handle multiple transactions simultaneously.

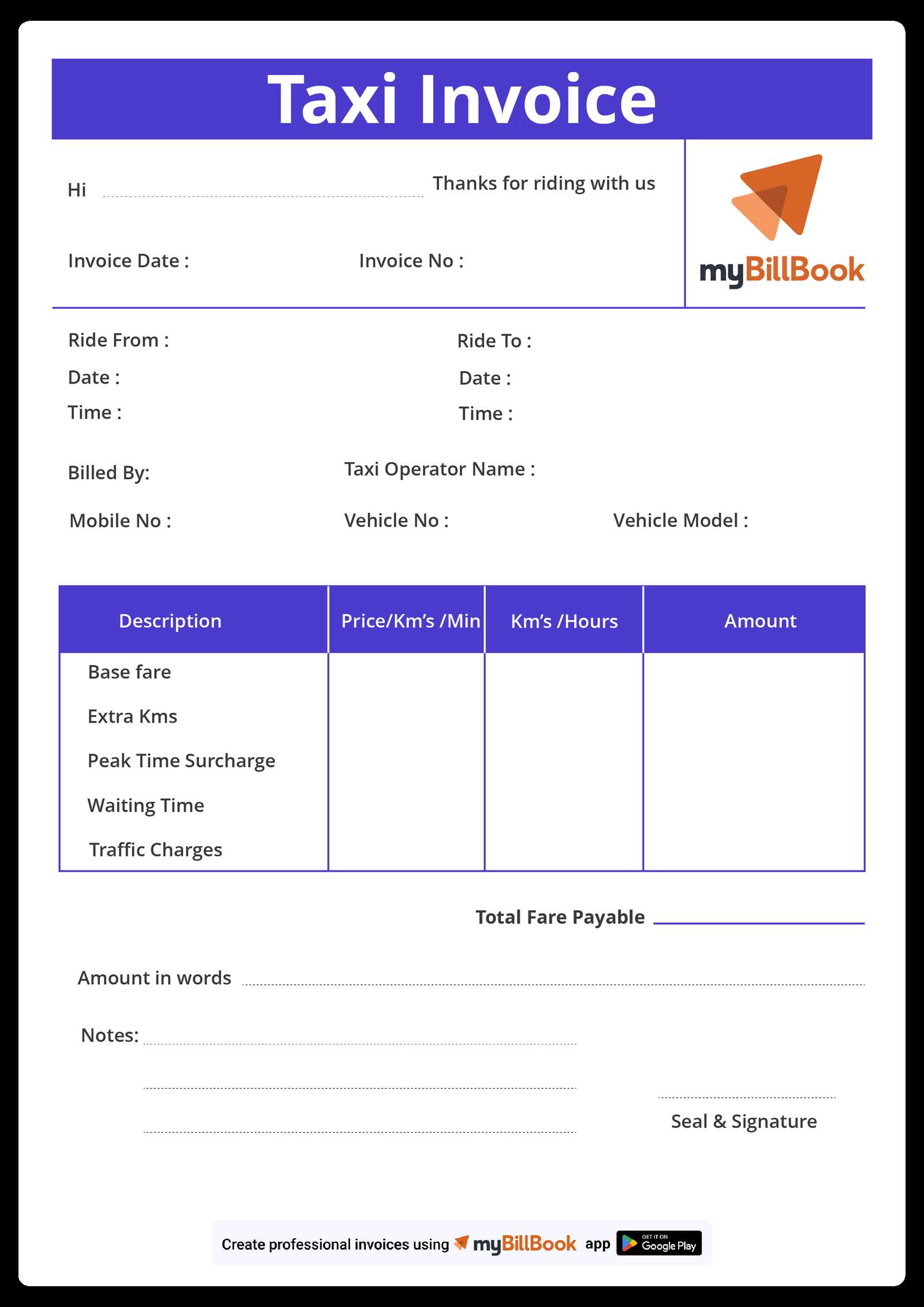

Key Elements of a Billing Document Structure

For a payment request to be effective, it must include specific details that ensure both clarity and accuracy. These elements help to clearly communicate the terms of the transaction, making it easier for both parties to understand and follow through with the payment process. Without these essential components, a request can become confusing and lead to delays or misunderstandings.

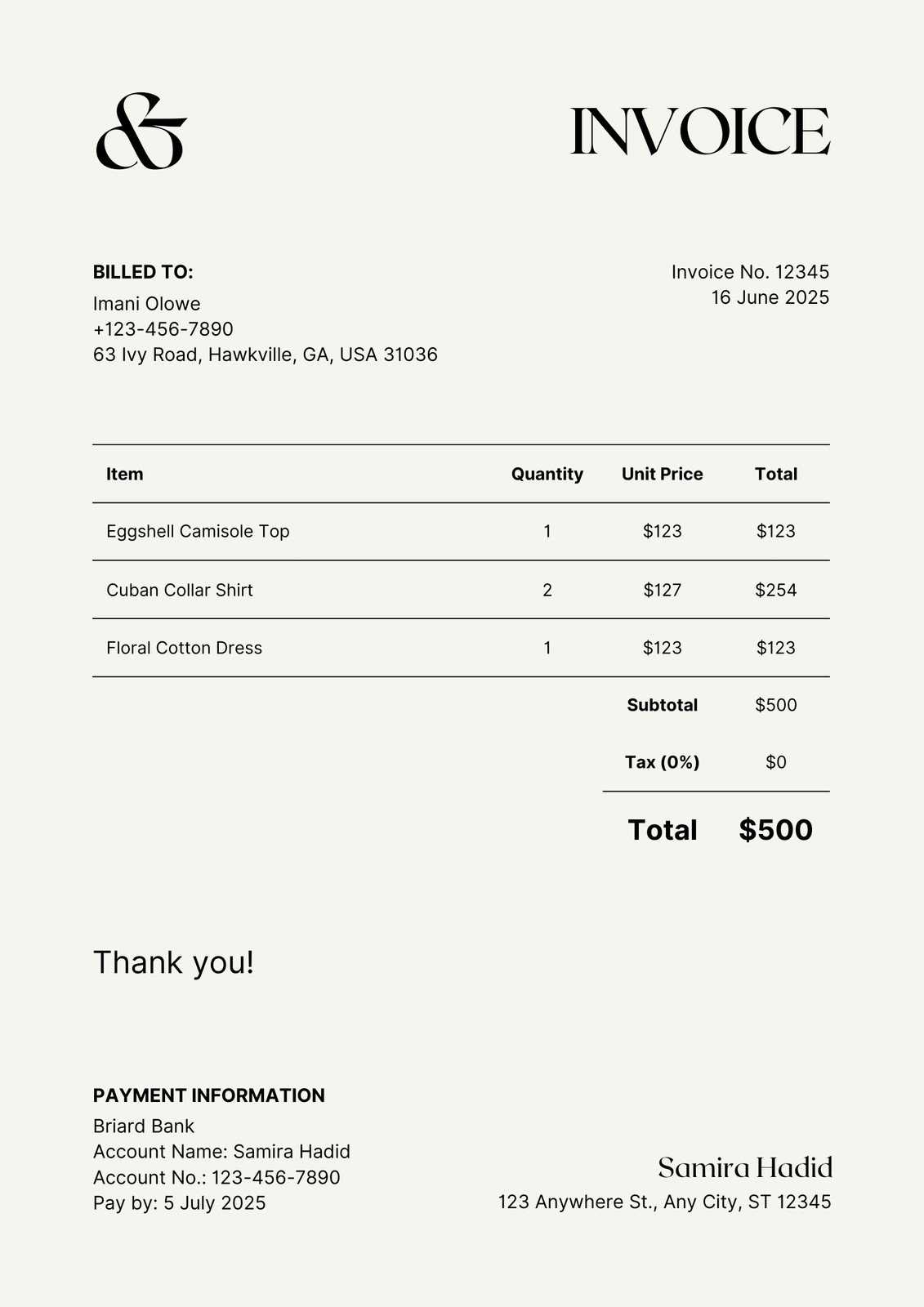

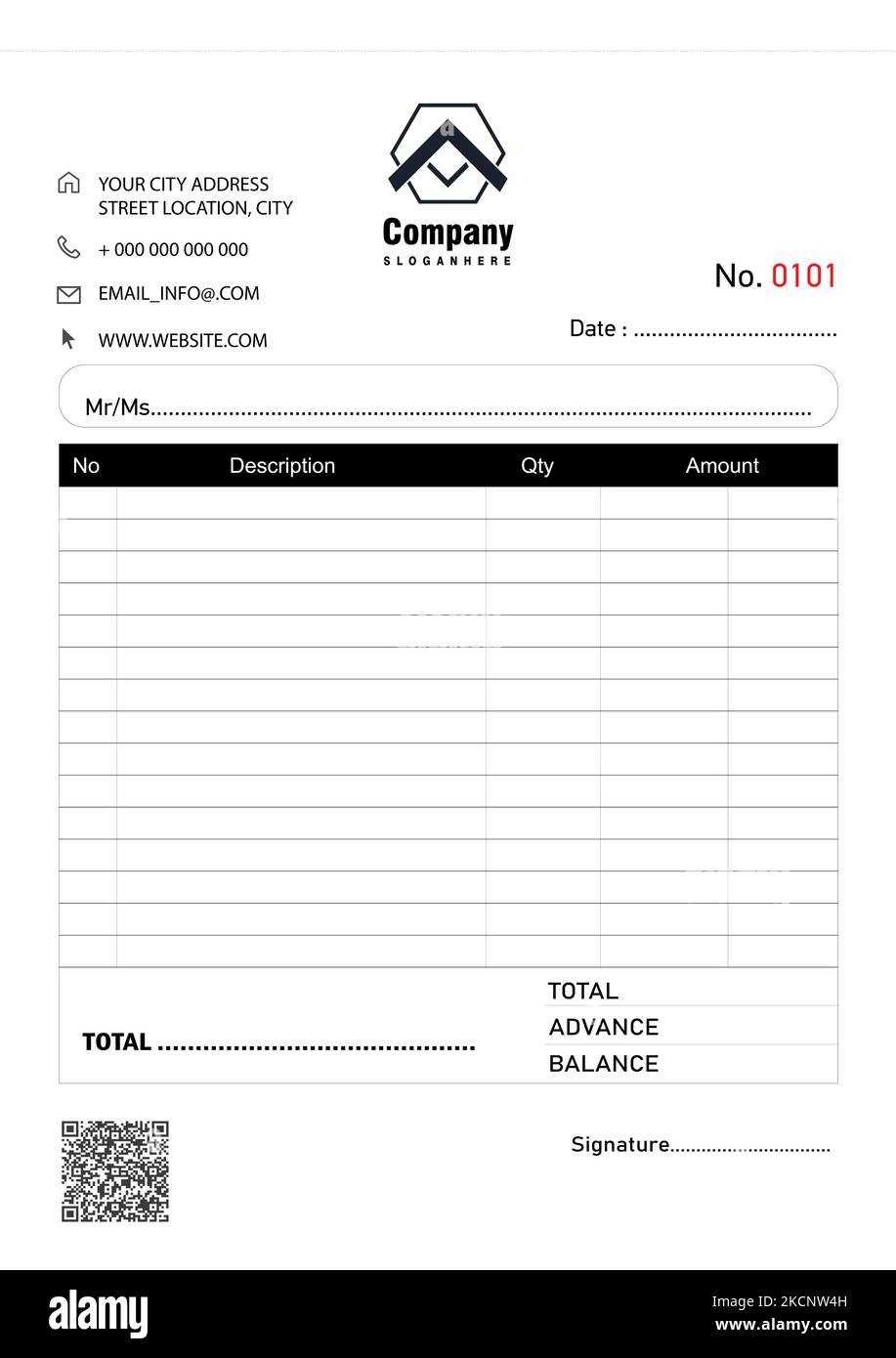

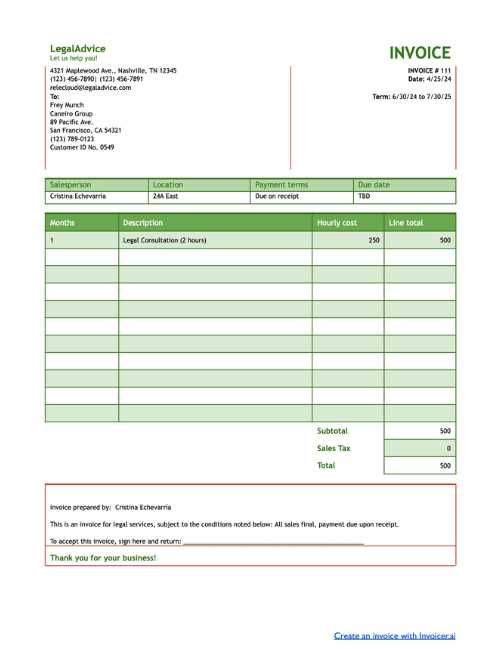

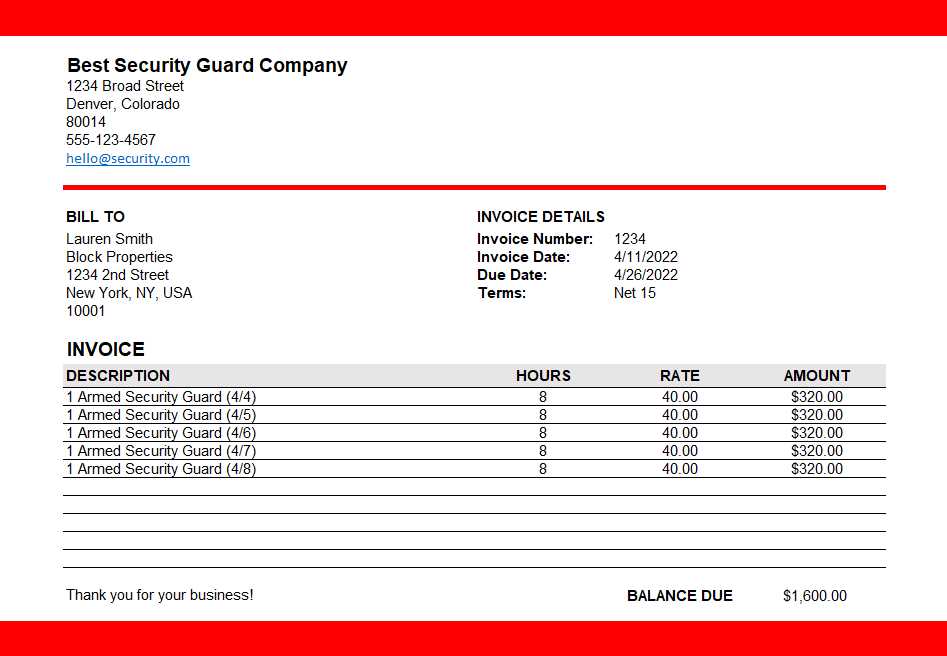

Essential Information to Include

- Recipient’s Details: Always include the name, address, and contact information of the person or company receiving the payment. This ensures clarity and avoids errors in processing.

- Payment Breakdown: Clearly outline the products or services being paid for, including individual amounts, taxes, and any discounts applied. This transparency helps build trust.

- Due Date: Specifying the exact date by which payment is expected eliminates any ambiguity regarding when the transaction should be completed.

Additional Features for a Comprehensive Document

- Payment Terms: Include any terms or conditions for late fees, early discounts, or payment methods to avoid confusion later.

- Unique Reference Number: Adding a unique identifier helps track payments and simplifies any future reference to the document.

- Company Branding: Including your logo and business information not only personalizes the document but also reinforces your brand identity.

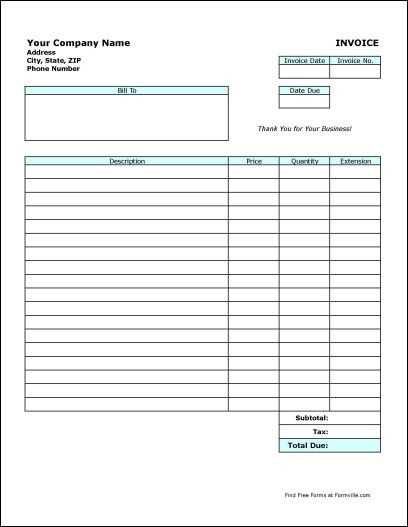

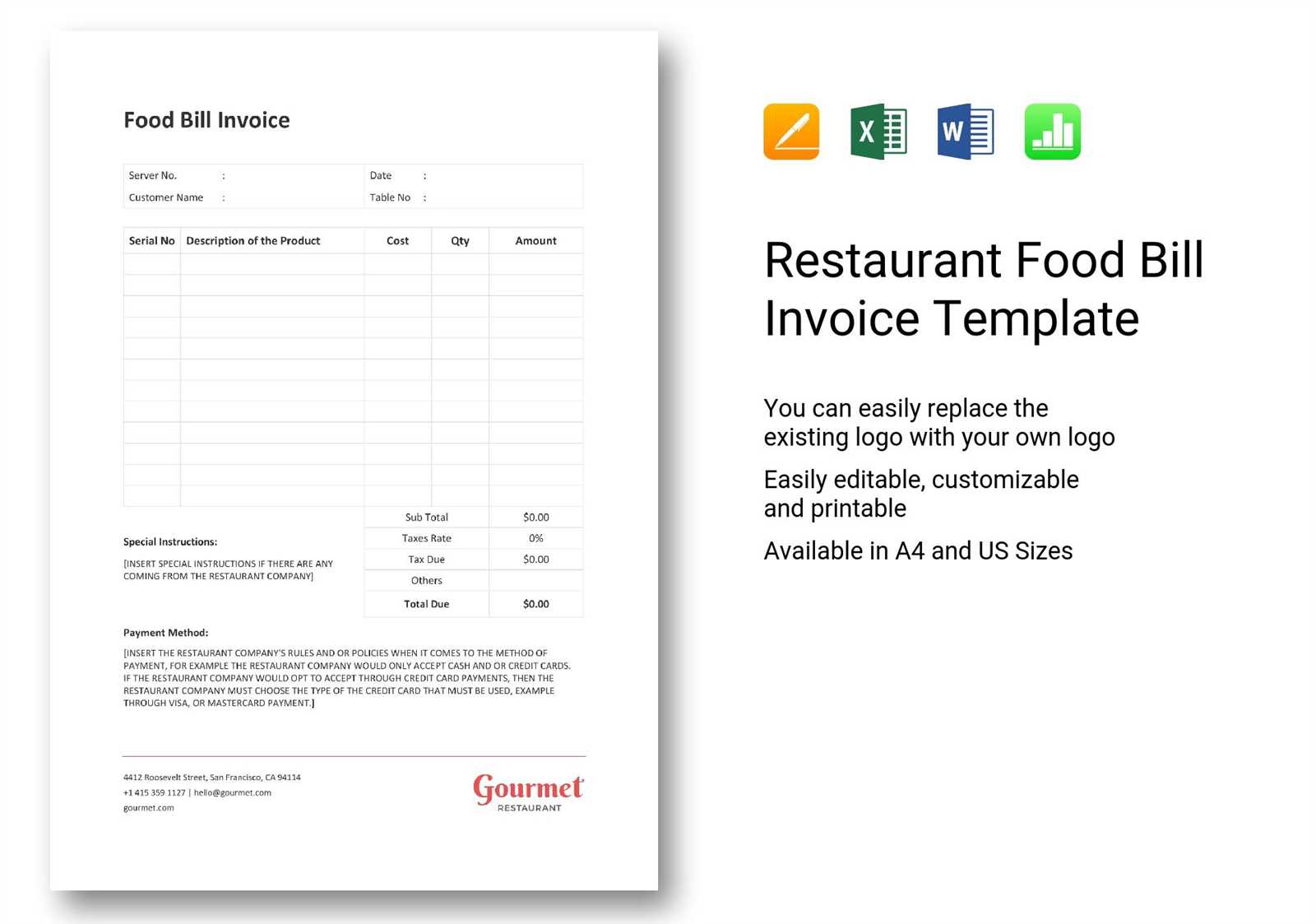

How to Customize Your Payment Request Format

Adapting a payment request structure to fit your specific business needs can significantly improve efficiency and professionalism. Customizing your document ensures that it aligns with your brand, includes all necessary details, and makes it easier for clients to understand. Personalization can also help you better track and manage payments over time.

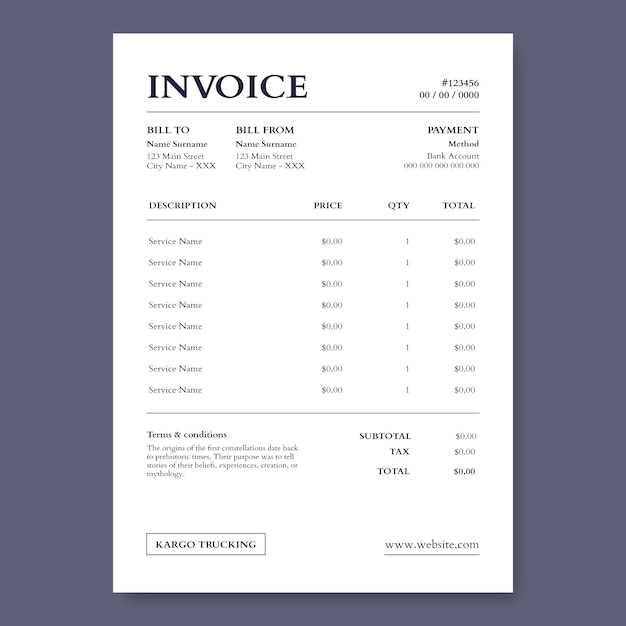

Adjusting Layout and Design

One of the first steps in customization is altering the layout to match your company’s visual style. You can modify the colors, fonts, and overall appearance to ensure consistency with your branding. Adding your company logo and contact details makes the document more personal and recognizable.

Including Additional Information

Beyond basic information, you can include additional fields that suit your business needs. For instance, you might want to add sections for discounts, payment methods, or terms and conditions. These personalized elements can help clarify payment expectations and improve communication with clients.

Advantages of Using Pre-Made Formats

Opting for ready-made structures for payment requests offers several key benefits. These pre-designed formats are crafted to streamline the process, saving you valuable time and effort. By using a professional layout, you ensure that all necessary details are included and clearly presented, which improves accuracy and minimizes the risk of errors.

Time Efficiency

- Quick Setup: Ready-to-use designs allow you to start issuing payment requests immediately, eliminating the need to build a format from scratch.

- Consistency: A standardized format ensures that every document looks professional and follows the same structure, making it easier for clients to process payments.

- Less Decision-Making: With pre-set fields and sections, you don’t have to worry about what to include or how to organize the information.

Improved Accuracy and Professionalism

- Clear Communication: These formats help clearly display essential information, such as amounts due, payment terms, and due dates, reducing misunderstandings.

- Professional Presentation: Using a pre-made structure ensures that your requests always look polished and organized, which enhances your credibility with clients.

Best Practices for Requesting Payments from Clients

Ensuring that your payment requests are clear, timely, and professionally presented is essential for maintaining healthy cash flow and client relationships. By following a few simple guidelines, you can make the process smoother for both you and your clients. These best practices will help you get paid promptly while also fostering trust and transparency.

Key Steps for Successful Payment Requests

- Send Requests Promptly: Issue your payment requests as soon as the service or product has been delivered. Waiting too long can delay payment and may create confusion about the terms.

- Clearly State Payment Terms: Always specify the due date, late fees, and acceptable payment methods. This prevents misunderstandings and sets clear expectations.

- Ensure Accuracy: Double-check all details before sending, including amounts, taxes, and any discounts. Errors can delay payments and damage your credibility.

Maintaining a Professional Tone

- Use Clear Language: Avoid jargon or complex terms that could confuse clients. Keep the document simple and easy to understand.

- Follow Up Politely: If payments are delayed, send a polite reminder. This can be an effective way to encourage clients to settle their accounts without damaging your relationship.

Common Mistakes to Avoid in Payment Requests

When preparing documents to request payment, it’s important to avoid common pitfalls that can lead to confusion, delays, or even loss of trust with clients. Small errors in formatting, missing details, or unclear terms can create unnecessary complications. By being mindful of these mistakes, you can ensure that your requests are always accurate and professional.

Frequent Errors in Payment Requests

- Incorrect or Missing Payment Details: Always double-check amounts, taxes, and payment methods to ensure accuracy. Missing or incorrect information can lead to confusion and payment delays.

- Lack of Clear Payment Terms: Failing to specify the due date, late fees, or acceptable payment methods can lead to misunderstandings and missed payments.

- Omitting Contact Information: Ensure that your business details, including your phone number and email address, are clearly listed in case the client needs to reach out for clarification.

Presentation Issues to Watch Out For

- Unorganized Layout: A cluttered or disorganized document can be difficult to read. Keep the layout clean, with a logical flow of information, to make it easier for the client to process.

- Overcomplicating the Language: Avoid using jargon or overly complex terms. The request should be simple, clear, and easy for the client to understand.

How to Generate Payment Requests Quickly

Generating payment requests efficiently is essential for maintaining smooth cash flow in your business. By using streamlined processes and tools, you can create professional documents in less time, allowing you to focus on other important tasks. With the right approach, you can minimize the time spent on administrative work while ensuring that your clients receive accurate and timely requests.

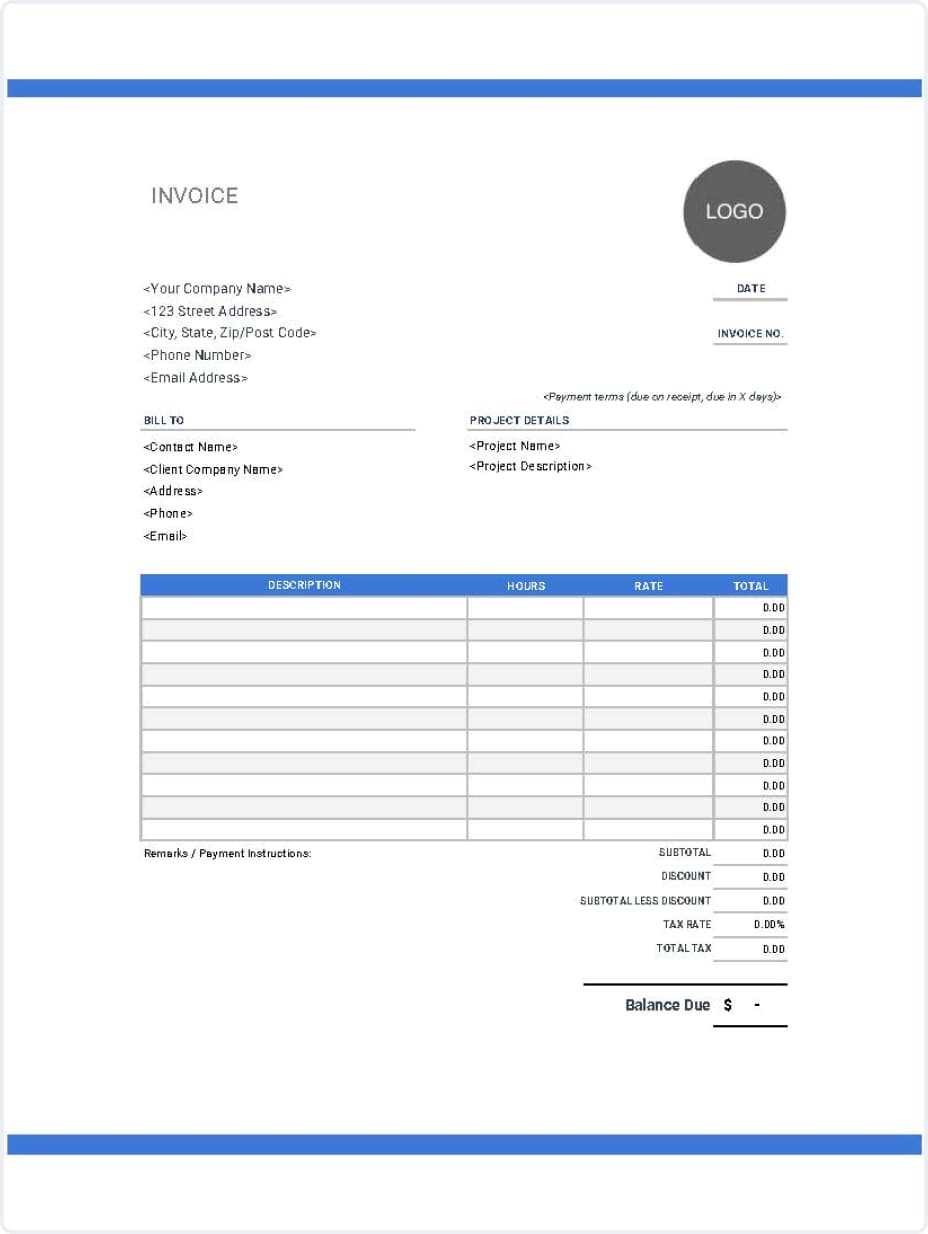

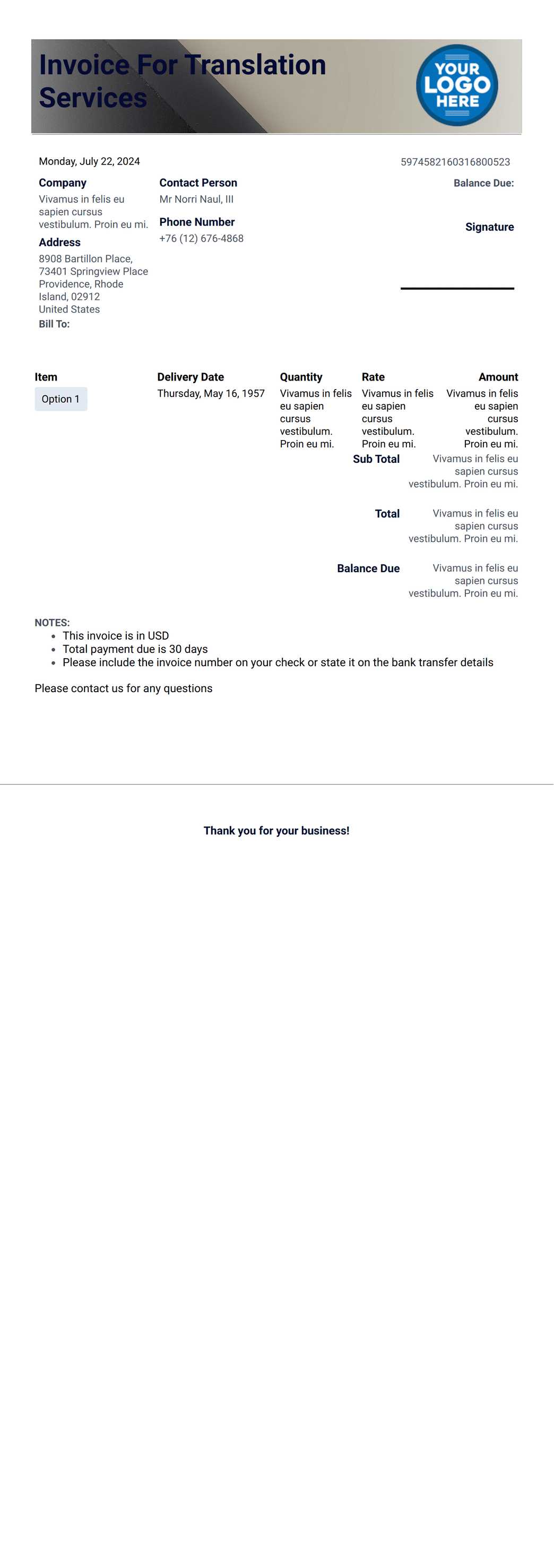

Using Pre-Designed Formats

One of the quickest ways to generate payment requests is by using pre-designed formats. These ready-to-use structures allow you to simply fill in the necessary information, such as amounts and due dates, without the need for formatting. Many tools offer customizable fields, making it easy to adjust the layout to suit your business needs.

Automating the Process

Automating the creation of payment requests can significantly reduce the time spent on this task. Accounting software and online tools often have features that allow you to create and send documents with just a few clicks. By linking your customer data and transaction details, these tools can automatically populate payment requests, ensuring accuracy and speed.

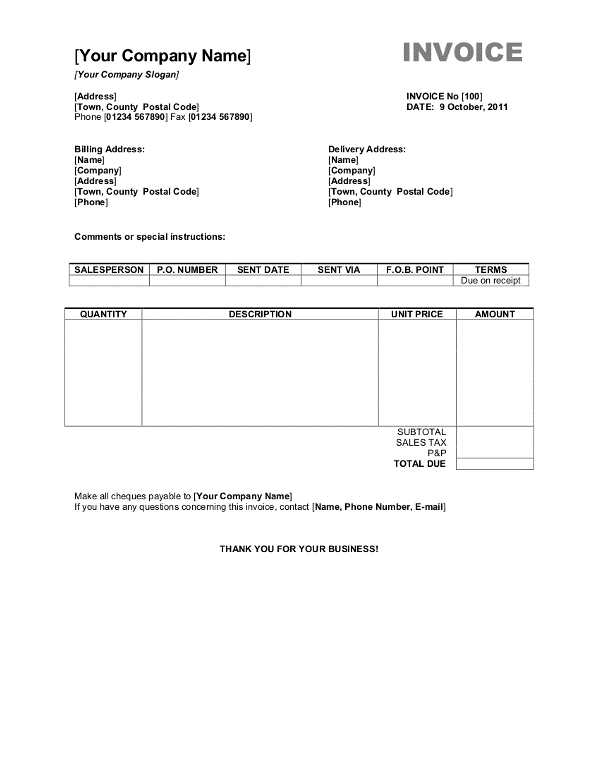

Choosing the Right Format for Your Business

Selecting the appropriate structure for payment requests is essential to ensure efficiency, clarity, and professionalism. The format you choose should align with your business needs, branding, and the type of clients you work with. With many options available, it’s important to consider how each format can serve both your operational requirements and client expectations.

Factors to Consider When Choosing a Format

- Industry Relevance: Different industries may have specific requirements for payment documentation. For instance, freelancers might need simpler formats, while larger businesses may require more detailed layouts.

- Ease of Use: Choose a format that is easy to fill out and modify. Complicated structures can slow down the process and lead to errors, while a user-friendly design ensures accuracy and efficiency.

- Brand Alignment: The format should reflect your company’s branding and visual identity. Customizing colors, fonts, and logos creates a consistent professional appearance and strengthens your brand recognition.

Customizing for Specific Needs

- Client Preferences: Consider whether your clients prefer a minimalist approach or need more detailed information on the document. Some clients may require breakdowns of services or payment terms clearly outlined.

- Automation Capabilities: If you need to issue multiple payment requests regularly, consider formats that integrate with your accounting software. Automation can save time and reduce the risk of human error.

Managing Multiple Client Payment Requests Efficiently

Handling multiple payment requests from different clients can become overwhelming without the right organization and tools in place. Streamlining the process of creating, tracking, and sending documents ensures that you can manage all transactions smoothly and avoid confusion. By using effective methods, you can maintain control over your accounts receivable while keeping clients satisfied.

Effective Organization and Tracking

- Centralized System: Use a centralized tool or software to track all payment requests in one place. This helps you stay organized and avoid losing track of any outstanding amounts.

- Clear Categorization: Categorize payment requests by client, date, or due date. This makes it easier to prioritize and follow up on overdue payments without overlooking any accounts.

- Automated Reminders: Set up automated reminders for upcoming and overdue payments. These notifications can save you time and ensure that clients are consistently reminded of their outstanding balances.

Optimizing Your Workflow

- Batch Processing: Instead of handling each payment request individually, batch process them. This allows you to create and send multiple documents at once, saving time and reducing repetitive tasks.

- Template Use for Quick Customization: Customize pre-built structures that you can quickly modify for different clients. This minimizes the time spent on creating each request while ensuring consistency across all communications.

- Regular Monitoring: Check the status of payments regularly to avoid bottlenecks. Stay proactive in following up with clients who haven’t responded or completed payments.

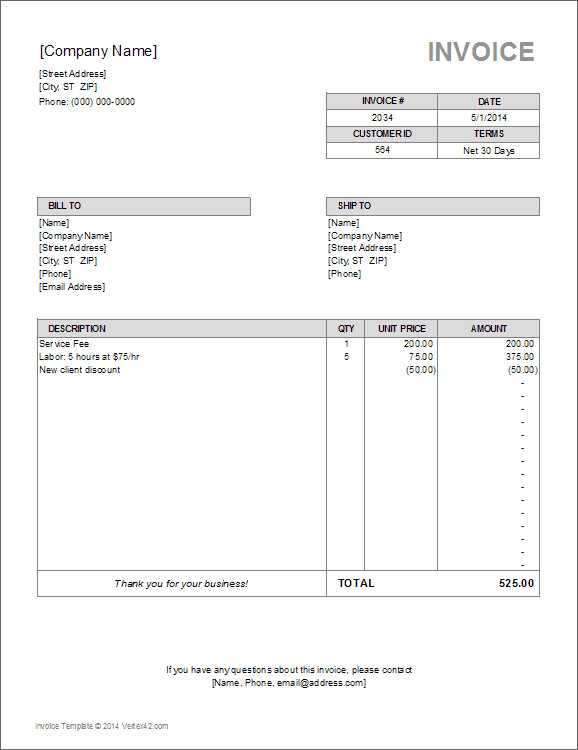

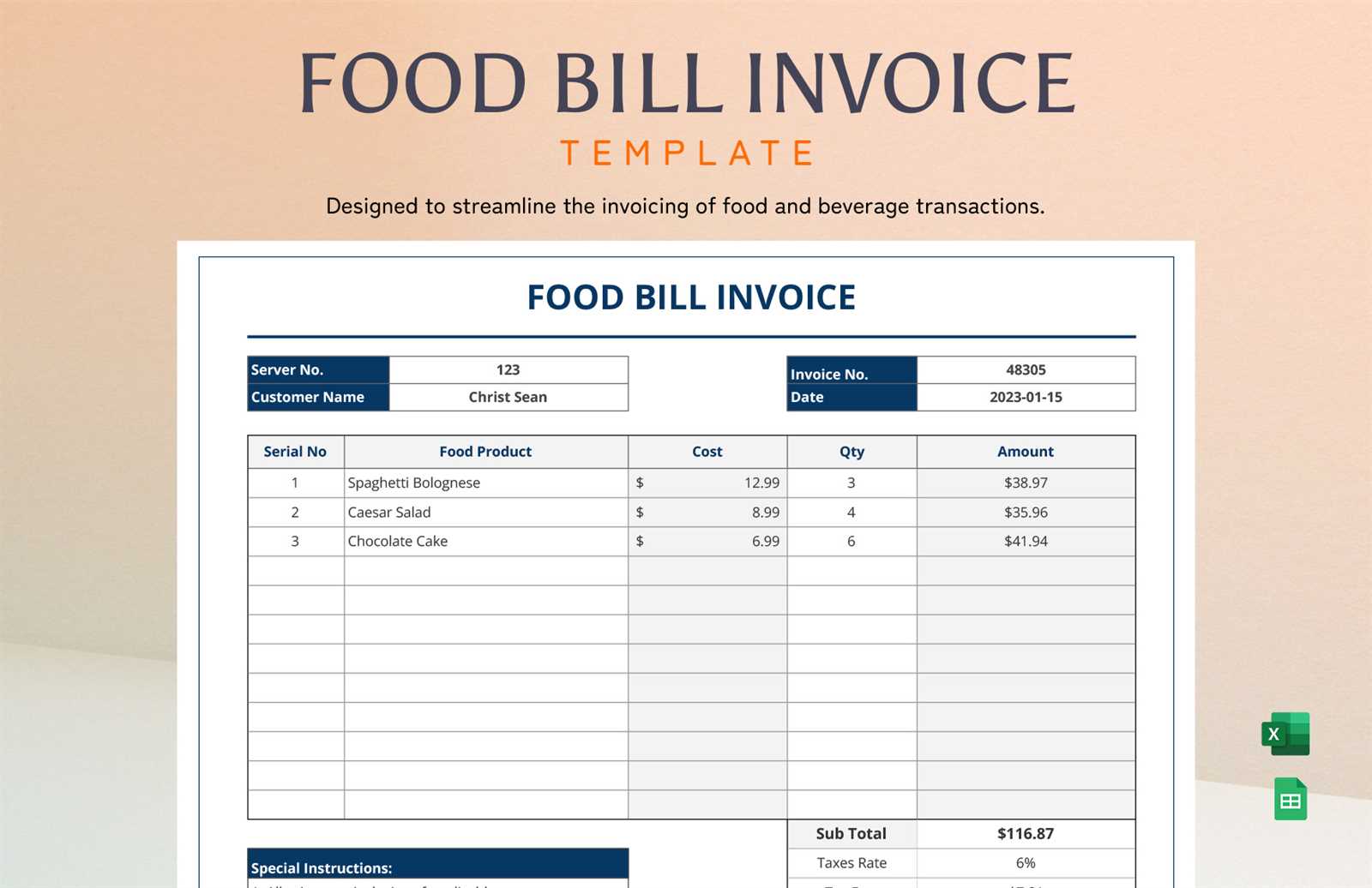

How to Include Taxes and Discounts

When preparing payment requests, it’s important to clearly outline the applicable taxes and discounts to avoid confusion and ensure transparency. Properly adding these elements not only helps you comply with local regulations but also provides your clients with a clear breakdown of their charges. Knowing how to incorporate these adjustments into your documents is key to maintaining accurate and professional records.

Including Taxes in Payment Requests

Taxes are often a necessary component of any financial transaction. When adding taxes to your payment requests, ensure that the rate and type of tax are clearly specified. This allows clients to understand the total amount they owe and prevents misunderstandings about the breakdown of costs.

- Specify Tax Rate: Include the applicable tax rate for each item or service. For example, a sales tax of 10% should be listed alongside the respective item.

- Itemized Breakdown: Clearly itemize the total amount charged for each product or service and then list the tax applied to each, followed by the total tax.

- Local Regulations: Ensure the tax rate used aligns with the local laws and tax regulations of your jurisdiction.

Applying Discounts to Payment Requests

Discounts are a great way to incentivize early payment or reward loyal customers. When applying discounts, make sure they are properly calculated and presented, so clients can clearly see the reduction in their final amount.

- Clearly Mention Discount Terms: Specify the conditions of the discount, such as “10% off for payments made within 7 days.”

- Subtract Discount from Total: Deduct the discount from the total amount and clearly show the new amount after the discount is applied.

- Include Discount Code (if applicable): If you’re offering a promo code or special deal, ensure the code is visible on the request so the client knows how to claim the discount.

Legal Considerations in Payment Requests

When preparing financial documents for clients, it’s crucial to be aware of the legal requirements surrounding the process. Ensuring compliance with relevant laws not only helps protect your business but also builds trust with your clients. Understanding the key legal aspects can help you avoid disputes, late payments, and potential legal issues.

Essential Legal Elements to Include

- Correct Business Information: Include your full legal business name, address, and contact details. This ensures the document is legitimate and traceable.

- Accurate Payment Terms: Clearly outline the payment due date, accepted payment methods, and any applicable late fees. This helps set expectations and minimizes confusion.

- Tax Identification Number: Depending on your jurisdiction, it may be required to include your tax ID number for proper documentation.

Compliance with Local Laws

- Tax Regulations: Ensure that the applicable tax rates are correctly applied and compliant with local tax laws. This includes sales tax, VAT, or other region-specific charges.

- Consumer Protection Laws: Some regions have specific rules regarding payment requests, including rules for cancellation, refunds, or returns. Be aware of these laws to avoid potential legal issues.

- Data Protection: Personal data included in payment requests should be handled in compliance with data protection laws, such as GDPR in the European Union or similar regulations in other jurisdictions.

Setting Payment Terms in Your Payment Request

Defining clear and fair payment terms is essential for ensuring smooth financial transactions with clients. By specifying the expectations upfront, you avoid misunderstandings and reduce the likelihood of delayed or missed payments. Properly setting payment terms helps maintain a professional relationship and ensures that both parties are on the same page regarding deadlines, methods, and penalties for late payments.

It’s important to be clear about the due date, accepted payment methods, and any applicable fees or discounts. Clear payment terms can also include early payment incentives or penalties for overdue amounts. Having these terms in writing not only protects your business but also helps clients manage their cash flow and plan their payments accordingly.

Tracking Payments with Payment Request Documents

Effectively tracking payments is an essential part of managing finances for any business. Keeping a clear record of transactions allows you to monitor outstanding amounts, confirm receipts, and follow up on overdue payments. With the right approach, you can easily track payments and ensure that all financial obligations are met on time.

Organizing Payment Records

To keep track of payments, it is important to use a system that allows you to record all incoming funds clearly. You should include key details such as the payment date, amount, and payment method in your documents. This helps you easily match each payment with the correct client and service provided.

- Include a Payment Status: Mark whether a payment is pending, completed, or overdue. This gives both you and the client a clear understanding of where the transaction stands.

- Track Multiple Payments: If a client is making partial payments, make sure to document each installment and the remaining balance due.

- Automatic Reminders: Use a system that automatically generates reminders or notifications for overdue payments to streamline follow-up communications.

Using Digital Tools for Tracking

Digital platforms and software can simplify the process of tracking payments. Many tools allow you to generate and send payment documents automatically, track payment status in real-time, and integrate with your accounting system to update records automatically. Using such tools can save you time and reduce the likelihood of errors.

- Payment Tracking Software: Consider using tools that provide invoicing, payment status updates, and even payment integration.

- Accounting Platforms: Many accounting platforms can sync with your payment request documents, allowing for seamless tracking and recordkeeping.

Free vs Paid Payment Request Documents

When choosing a document format for managing transactions, businesses often face the decision between free and paid options. Both have their advantages and limitations, and understanding these differences can help you decide which option suits your needs. Free options are widely accessible and may work for simple requirements, but paid solutions often offer additional features and customization for a more professional experience.

Advantages of Free Documents

Free formats are a great option for small businesses or freelancers who need a quick and easy solution without significant investment. These options typically offer basic features, such as the ability to input client information and payment details. Here are some key benefits:

- No initial cost: Free options are ideal if you’re just starting and need to minimize upfront costs.

- Simple to use: These formats are often straightforward, requiring little to no learning curve.

- Accessibility: Free tools are widely available and can be found online or integrated into other software.

Advantages of Paid Documents

While free formats may suffice for basic needs, paid versions often provide enhanced functionality that makes them worth the investment. Paid options tend to offer more customization, better organization, and integrations with other business tools. Here are some reasons to consider upgrading:

- Customization: Paid formats often allow for greater flexibility in design, allowing you to incorporate your branding and adjust layouts.

- Advanced features: These options often include features like automated reminders, tax calculations, and integration with accounting software.

- Better support: Paid options typically come with customer support, making it easier to resolve issues quickly.

Tools for Creating Professional Payment Documents

For businesses that need to maintain a professional appearance and streamline their payment collection process, the right tools are essential. Whether you’re a freelancer or managing a larger company, using the appropriate software can help you create clear, organized, and customized payment documents. These tools range from simple online services to comprehensive business solutions, providing flexibility and efficiency.

Online Platforms for Quick Document Creation

Online platforms are a popular choice for generating payment requests quickly and efficiently. They offer easy-to-use interfaces and often come with pre-designed layouts. Many of these services are free or offer basic features at no cost, while premium features are available through paid plans. Here are some popular options:

- Wave: A free accounting software that offers easy creation and management of payment documents for small businesses.

- Zoho Invoice: A comprehensive tool that offers both free and paid plans, with customizable layouts and integration with other business tools.

- PayPal: A widely-used payment platform with basic features to generate and send payment requests directly to clients.

Advanced Software for Full Customization

For businesses with more complex needs or those that require high levels of customization, advanced software may be the best choice. These tools typically offer advanced features such as automated payment reminders, tracking, and integrations with accounting systems. Some popular choices include:

- QuickBooks: A full accounting suite that includes payment document creation, bookkeeping, and tax management for small to medium-sized businesses.

- FreshBooks: An invoicing and accounting software that allows businesses to customize their payment documents, track expenses, and manage clients.

- Microsoft Excel or Google Sheets: While not specifically designed for payment documents, these spreadsheet programs allow for full customization and are widely used by those familiar with spreadsheet software.