Bill Invoice Template for Easy and Professional Invoicing

Managing financial transactions smoothly is a critical aspect of any successful business operation. One essential task is ensuring that payment requests are clear, professional, and easy to understand. Having a structured system in place for generating payment requests can save time, reduce errors, and help maintain good relationships with clients.

Creating a consistent format for all your payment-related documents can streamline this process. Whether you’re a freelancer, a small business owner, or part of a larger company, using standardized forms can help you track outstanding payments and ensure that you never miss a step when requesting compensation. A well-designed document also reflects positively on your professionalism and attention to detail.

In this guide, we will explore various customizable options for building your own payment request formats, offering tips on how to make them both functional and visually appealing. You’ll learn how to simplify this process while keeping all essential details intact to guarantee smooth financial transactions.

Bill Invoice Template Overview

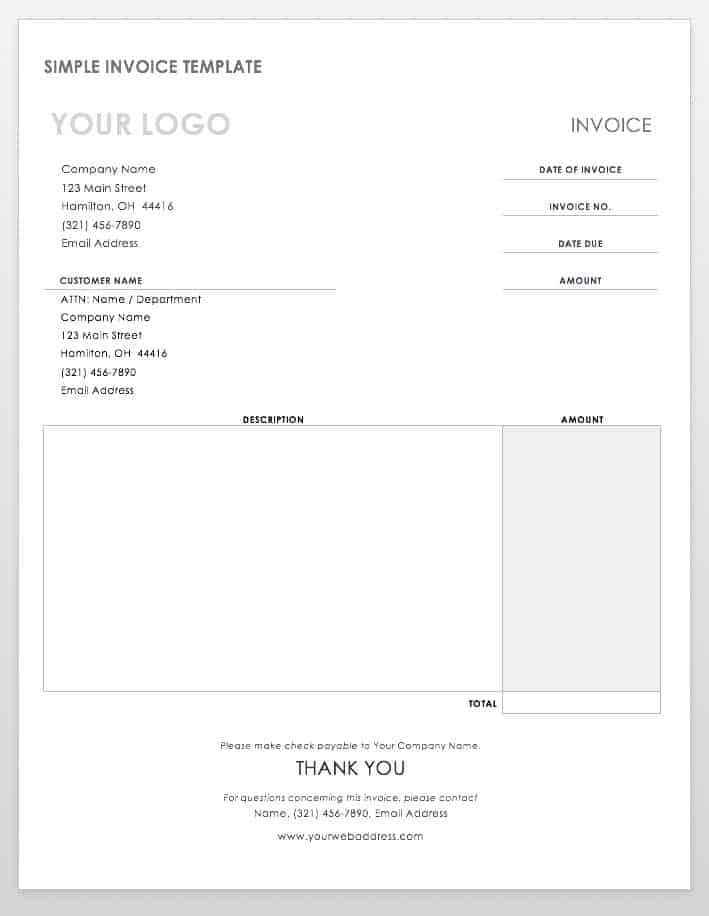

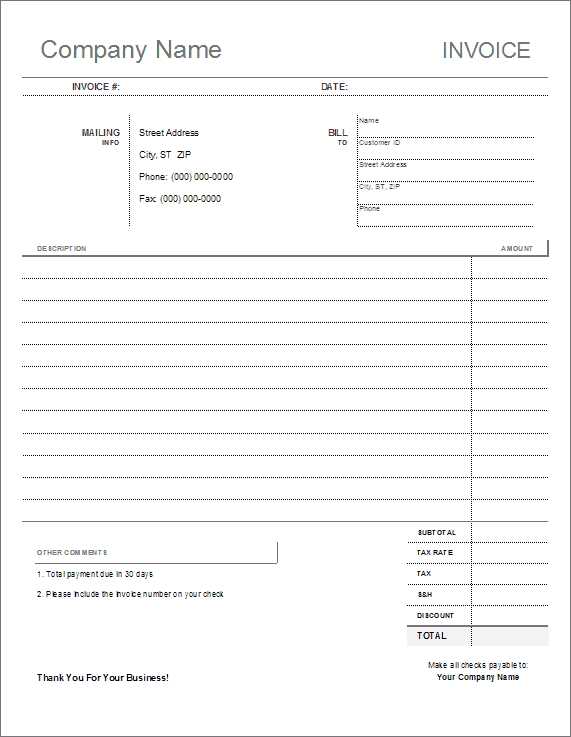

For any business, having a clear and structured document to request payment is essential. These documents serve as a formal means to communicate the amount owed, the services or goods provided, and the terms of payment. A well-organized form ensures that both parties are on the same page and can prevent misunderstandings or delays in transactions.

There are several types of forms available, each offering different levels of detail and customization. Some are simple, with just the basics of payment information, while others include more advanced features such as tax calculations, discounts, and payment tracking. Choosing the right document depends on the complexity of your business operations and the needs of your clients.

Importance of a Professional Layout

One of the key benefits of using a structured payment request is its professional appearance. A clean, well-laid-out document builds trust and reinforces your credibility as a business. Clear headings, organized sections, and easy-to-read fonts contribute to a better user experience for the recipient, making it more likely that payments will be processed quickly and without confusion.

Customizability and Flexibility

Customization is another important aspect to consider. Many businesses require specific fields and formats depending on the industry or region. The ability to modify these documents to suit your particular needs can help streamline your administrative processes and make the task of generating payment requests much easier. Whether you’re invoicing for a one-time service or recurring work, having a flexible system in place will save valuable time and effort.

Why Use a Bill Invoice Template

Creating consistent and professional payment requests is a key part of maintaining a successful business. Without a standardized document, important details can be overlooked or misunderstood, leading to delays or confusion. Using a pre-designed format simplifies the process, ensuring that all necessary information is included and presented in a clear, organized way.

Moreover, automating this process through a reusable form can save significant time, allowing you to focus on other important tasks. By having a reliable structure in place, you can quickly generate accurate requests with minimal effort, reducing the risk of errors and increasing the likelihood of timely payments.

Streamlined Workflow

Utilizing a consistent format for all payment requests allows businesses to streamline their administrative tasks. Instead of spending time creating a new document for each transaction, you can simply fill in the required details and send it off. This efficiency can be especially beneficial for small businesses and freelancers who need to manage multiple payments regularly.

Professional Appearance

A standardized document gives your business a polished and trustworthy image. Clients appreciate clear and well-structured communications, and a neat, professional request reinforces your credibility. A good document not only reflects well on your business but also improves client relationships by demonstrating that you are organized and attentive to detail.

Benefits of Customizable Invoice Templates

Having the ability to personalize your payment request forms offers a wide range of advantages. Customizable documents allow businesses to tailor their communications to suit specific needs, ensuring that every detail is aligned with company branding, legal requirements, and client expectations. This flexibility helps to maintain consistency and professionalism across all transactions.

Furthermore, customization can improve efficiency by enabling businesses to add necessary fields, such as tax rates, discounts, or payment terms, without having to manually input this information each time. With a form that adapts to various scenarios, businesses can save time and reduce errors, ensuring that every request is accurate and meets both legal and business standards.

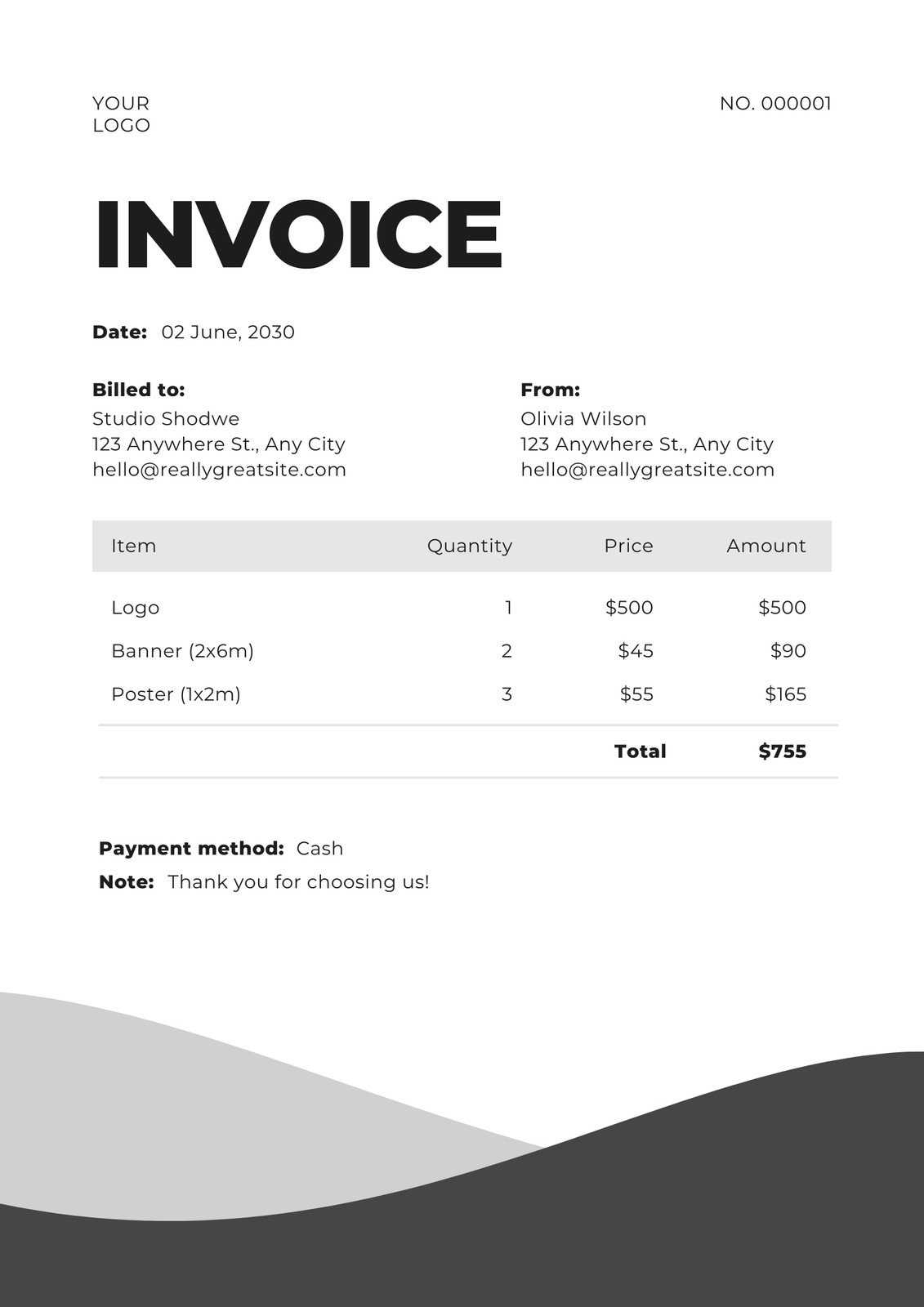

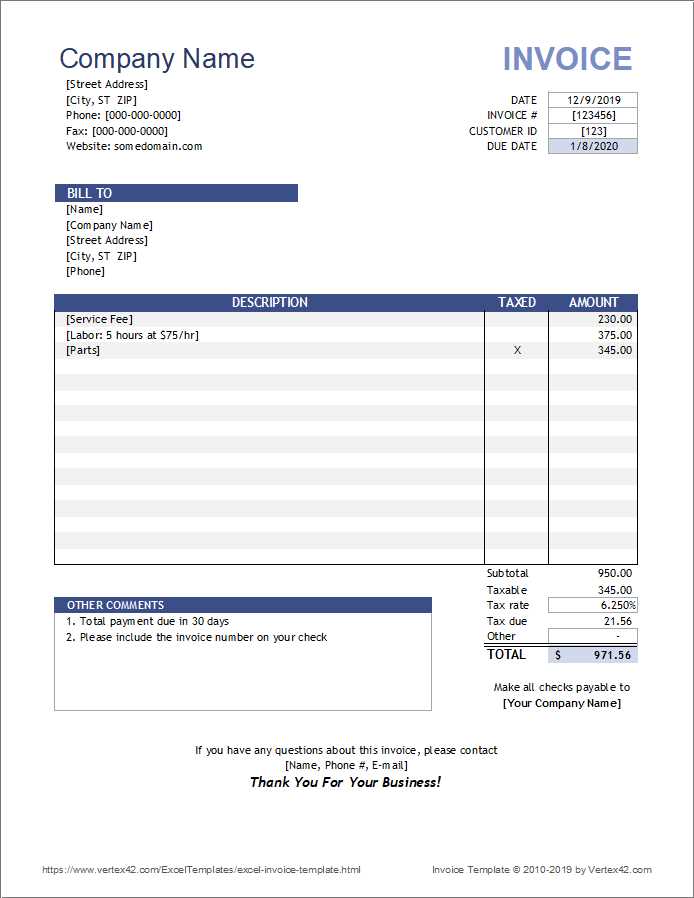

How to Create a Professional Bill

Creating a well-organized and professional payment request is essential for maintaining positive business relationships and ensuring timely payments. The key to an effective document lies in its clarity, structure, and accuracy. By following a few simple guidelines, you can craft a payment request that not only looks professional but also helps to avoid any confusion or disputes with clients.

Include Essential Information

Start by ensuring that all necessary details are included. This should consist of basic information like the date, payment amount, and a clear description of the products or services provided. Additionally, include payment terms, such as the due date and any penalties for late payments. This transparency will make it easier for clients to understand the payment request and act accordingly.

Maintain a Clean and Simple Layout

The design of your document plays a significant role in its effectiveness. Keep the layout clean and easy to read, using clear headings and sections to organize the information logically. Use a professional font and make sure that important details, like the total amount due, stand out. A well-designed document is not only easier for your clients to understand, but it also helps reinforce your business’s professionalism and attention to detail.

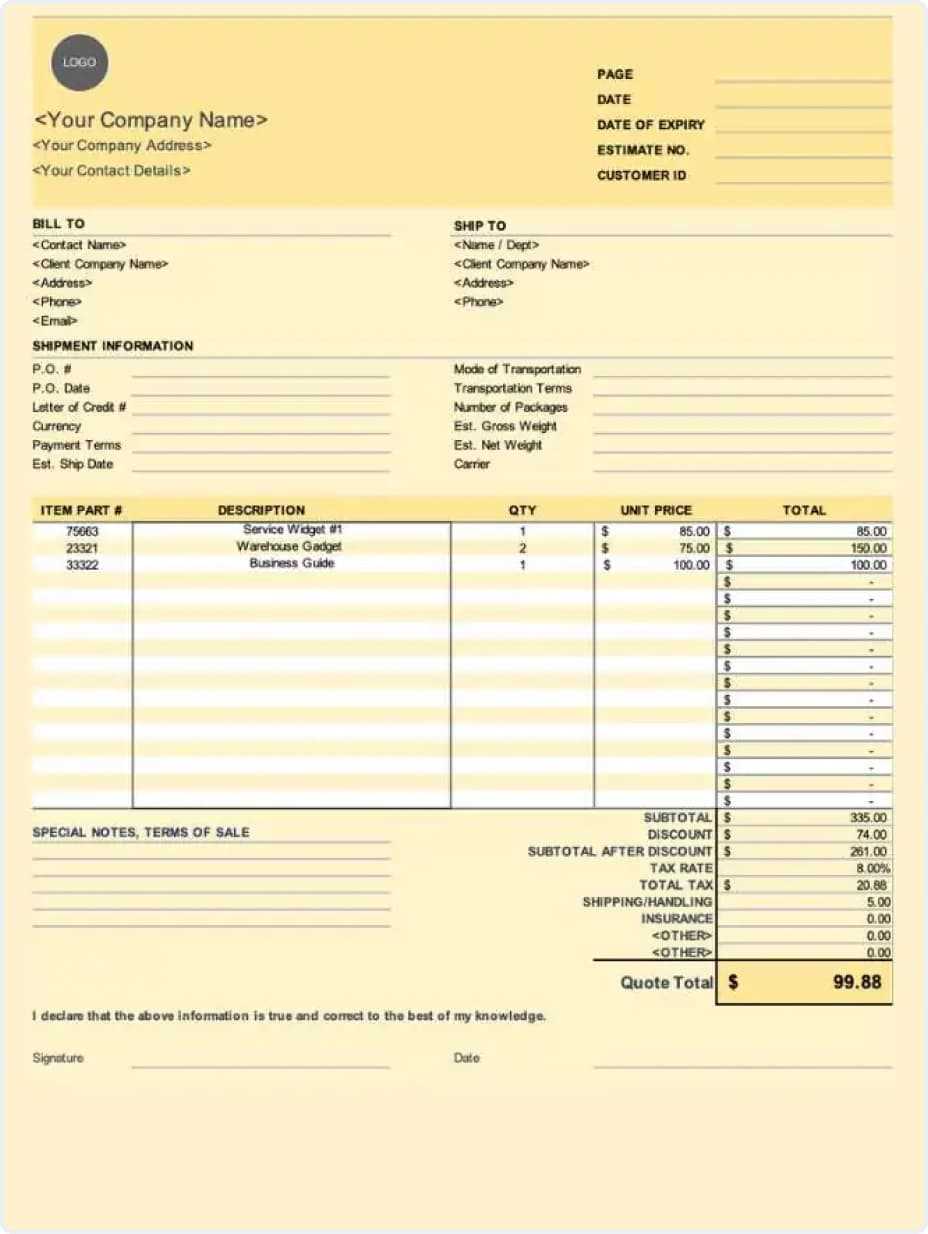

Top Features of Bill Invoice Templates

When creating payment request forms, it is important to incorporate features that improve both functionality and user experience. A well-designed form should not only capture essential information but also offer added features that enhance the clarity and efficiency of the payment process. Below are some of the key attributes that make a payment request document truly effective.

Key Features

| Feature | Description |

|---|---|

| Customizable Layout | Allows businesses to modify the document to fit their unique branding and requirements. |

| Clear Sections | Organizes information into easy-to-read sections like contact details, payment breakdown, and due dates. |

| Automatic Calculations | Includes fields for auto-calculating totals, taxes, and discounts to minimize errors. |

| Payment Terms | Clearly outlines payment instructions, due dates, and any late fees, helping avoid misunderstandings. |

| Professional Design | Ensures a polished look that reflects positively on the business’s professionalism and reliability. |

Common Mistakes to Avoid in Invoicing

When creating payment requests, even small errors can lead to confusion, delays, or disputes with clients. To ensure smooth financial transactions, it’s important to avoid common mistakes that can undermine professionalism or create unnecessary issues. Below are some frequent pitfalls and how to prevent them when preparing your payment documents.

Top Mistakes to Watch Out For

| Mistake | Why It Happens | How to Avoid It |

|---|---|---|

| Missing Contact Information | Incomplete or incorrect contact details can delay communication and payment processing. | Always include both your and the client’s full contact details, such as name, address, and email. |

| Incorrect Payment Amount | Math errors or omitting details like taxes or discounts can lead to confusion. | Double-check the math and ensure all discounts, taxes, and fees are properly accounted for. |

| Unclear Payment Terms | Lack of clear instructions regarding payment deadlines or late fees may result in delayed payments. | Clearly specify payment due dates, late fees, and preferred payment methods. |

| Overcomplicating the Design | A cluttered, difficult-to-read form can confuse clients and slow down the payment process. | Keep the design simple, with organized sections and easy-to-read fonts for quick reference. |

| Failure to Follow Up | Neglecting to follow up on overdue payments can result in lost revenue and strained client relationships. | Set reminders and contact clients promptly if payment is not received by the agreed-upon date. |

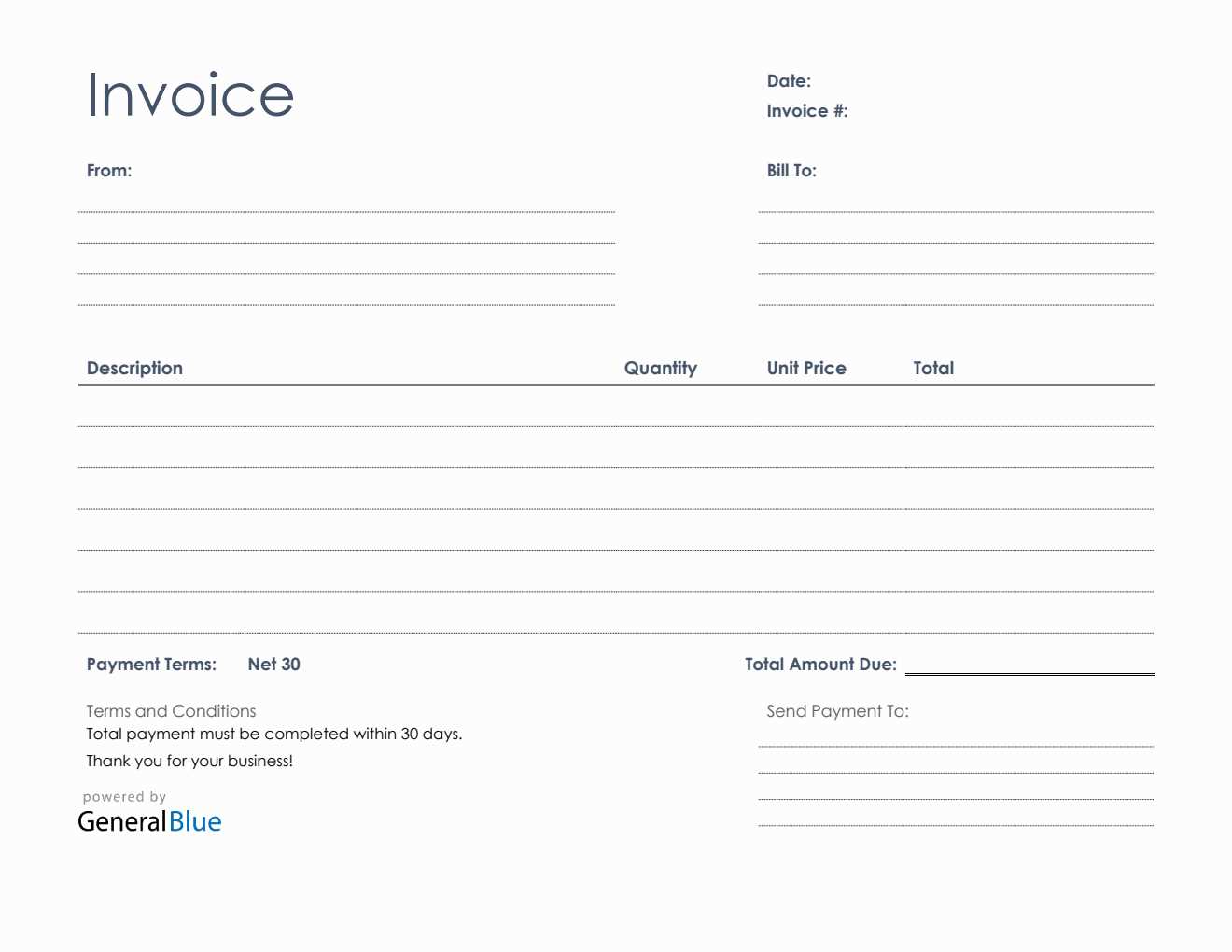

Free Bill Invoice Templates Online

Accessing ready-made forms online can significantly simplify the process of creating professional payment requests. Many platforms offer free, customizable documents that can be easily adapted to suit the specific needs of your business. These resources help save time, reduce the risk of errors, and ensure your requests look polished and are legally compliant.

Where to Find Free Resources

There are numerous websites that provide free access to customizable payment request forms. These online platforms allow you to download pre-designed documents in a variety of formats, such as Word, Excel, or PDF. Once downloaded, you can easily edit the fields to include your specific details, including your business name, services, payment terms, and client information.

Advantages of Using Free Forms

Cost-effectiveness is one of the biggest advantages of using free resources. For small businesses and freelancers, avoiding the cost of premium software or professional design services is a great way to keep expenses low. Additionally, many free platforms offer user-friendly interfaces, making it simple for anyone to create a professional-looking document with minimal effort.

Another benefit is the variety of designs available. Whether you need a simple, minimalistic format or something more detailed with advanced features like tax calculations, free online resources often have a wide range of options to choose from. This variety allows you to pick a layout that best fits your industry and personal preferences.

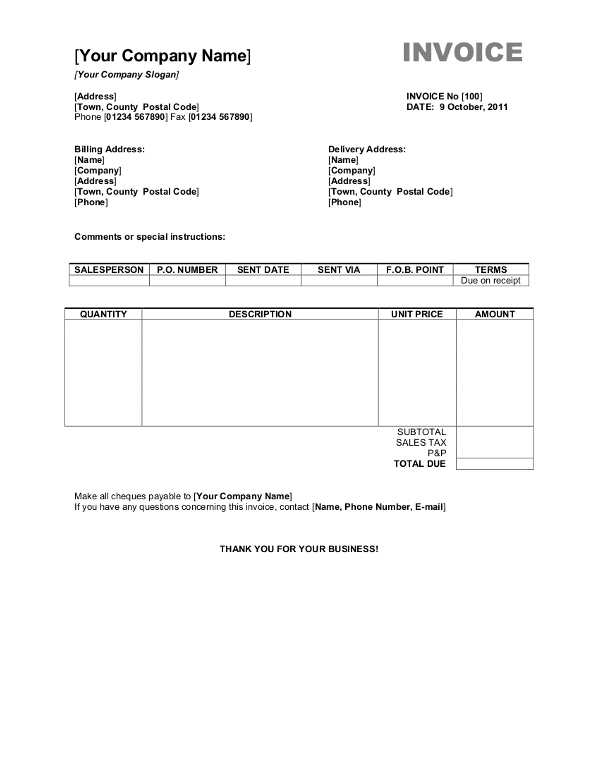

How to Edit a Bill Invoice Template

Customizing a pre-designed payment request form is a straightforward process that allows businesses to tailor the document to meet their unique needs. Whether you are adjusting details like client information, payment terms, or adding specific items and services, the ability to edit these forms ensures that each request is accurate and professional. Here’s a guide to editing these documents effectively.

Step-by-Step Editing Process

| Step | Description |

|---|---|

| Download the Document | Start by downloading the form in the format that suits you, such as Word, Excel, or PDF. Ensure you have the necessary software to edit the document. |

| Edit Client Information | Replace default placeholder text with your client’s contact details, including name, address, and email. Ensure accuracy to avoid payment issues. |

| Update Payment Details | Modify the amount due, payment terms, and any discounts or taxes that apply. Double-check that the calculations are correct. |

| Adjust Branding | Customize the document’s layout by adding your company’s logo, colors, and font styles to match your branding. |

| Review and Save | Carefully review the entire document for any errors or missing information. Save your edited version and keep a copy for your records. |

Editing a payment request form is simple and quick. With just a few updates, you can create a professional and customized document that reflects your business’s identity and ensures clarity for your clients.

Legal Requirements for Bill Invoices

When preparing payment requests, it is essential to ensure that all necessary legal information is included to comply with local regulations and tax laws. These documents serve as a legal record of a transaction and can be used for tax filing, accounting purposes, and resolving disputes. Failing to meet the required legal standards can lead to fines or delays in payments.

Key Legal Information to Include

To meet legal requirements, the document should contain the following key details:

- Business Name and Address: Both the sender’s and recipient’s full business names and contact details should be clearly stated.

- Tax Identification Number: Include your tax ID number or VAT number, if applicable, to ensure proper tax reporting.

- Unique Identification Number: Each document should have a unique number for reference, ensuring traceability and preventing confusion.

- Description of Goods or Services: Provide a clear, detailed description of the goods or services provided, along with their cost.

- Terms of Payment: Clearly state the payment due date, accepted payment methods, and any applicable late fees.

Compliance with Tax Regulations

Depending on your location, certain tax laws may require you to list specific tax rates or include certain wording on your payment requests. It is important to familiarize yourself with the tax rules in your jurisdiction to ensure full compliance. For example, in many countries, businesses are required to display applicable value-added tax (VAT) rates and mention any tax-exempt status when applicable.

Best Practices for Sending Invoices

Sending payment requests promptly and professionally is key to maintaining smooth business operations. The way you send these documents not only affects the payment speed but also influences your relationship with clients. By following best practices, you can ensure timely payments and avoid misunderstandings.

Key Steps for Efficiently Sending Payment Requests

- Send Promptly: As soon as a service is completed or a product is delivered, send the payment request. Delaying the process can result in missed payments or client forgetfulness.

- Use the Right Format: Choose an appropriate method of sending your payment requests, whether by email, mail, or an online payment platform. Ensure the format is accessible to the client, whether it’s a PDF, Word document, or a link to an online platform.

- Ensure Clarity: The request should be easy to understand, with all necessary information clearly laid out. Avoid unnecessary jargon and use straightforward language to minimize confusion.

- Confirm Receipt: After sending a payment request, follow up with the client to confirm that it was received. This step ensures that there are no issues with delivery or understanding.

- Set Clear Deadlines: Clearly state the payment due date and any late fees that may apply. This helps set expectations and encourages timely payments.

Maintain Professionalism

- Personalize the Communication: Even if the form is standardized, include a personal message when sending it to show that you value the relationship and provide any necessary context.

- Use a Professional Email Address: Always send payment requests from your business email account rather than a personal email to maintain professionalism and increase credibility.

- Track Your Documents: If sending electronically, consider using tracking services that confirm the document has been opened. For physical mail, using registered or tracked post can offer peace of mind.

By adopting these best practices, you can streamline the process of sending payment requests, improve client communication, and increase the likelihood of receiving timely payments.

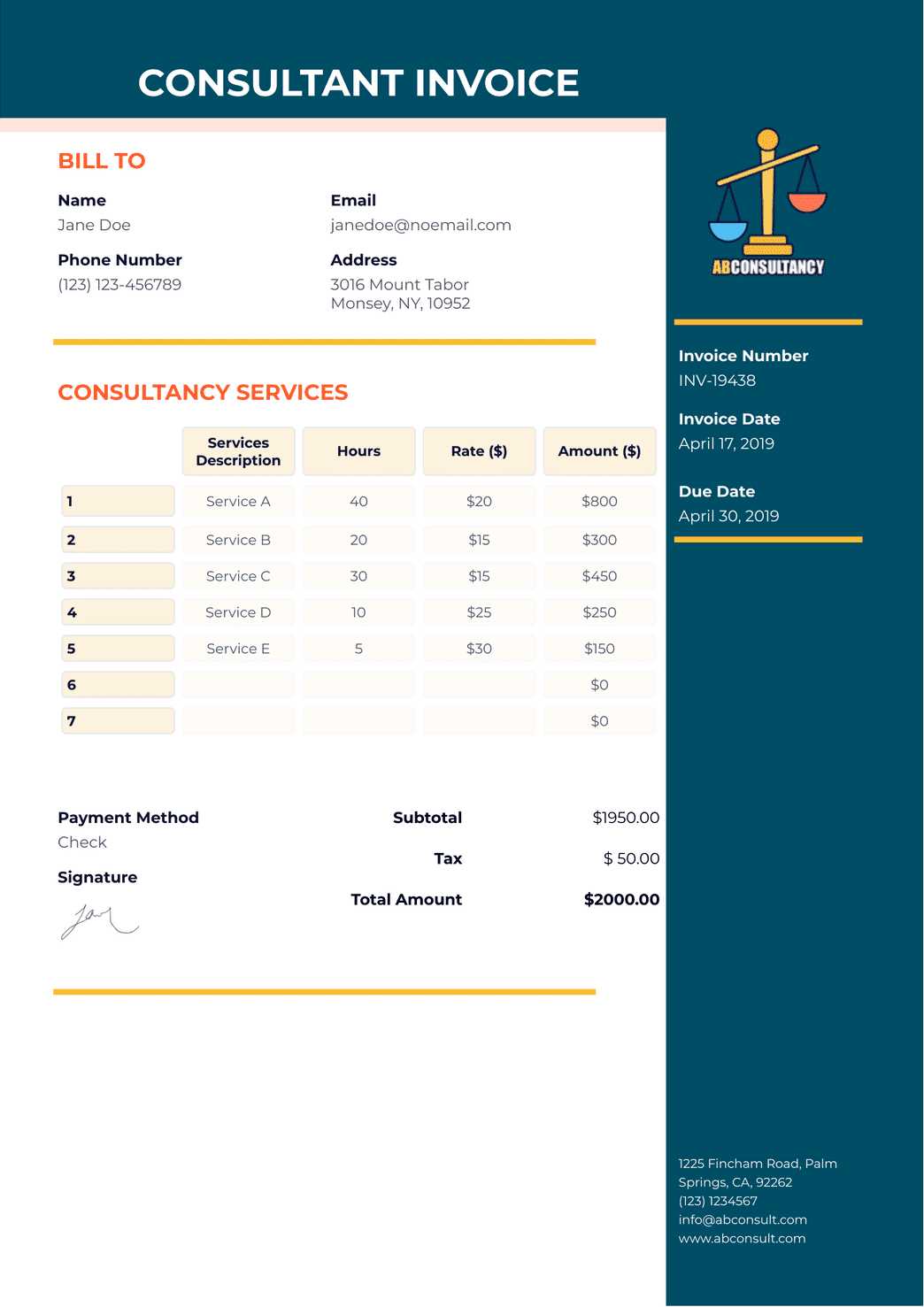

Invoice Template for Small Businesses

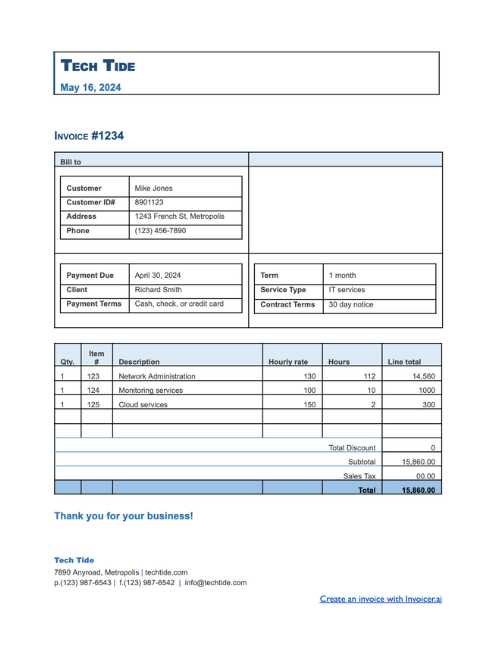

For small businesses, creating a professional and organized payment request form is crucial to ensure smooth financial transactions and maintain a positive relationship with clients. A well-designed document helps clearly communicate the terms of the agreement, reducing the likelihood of confusion or delayed payments. Below is an example of a simple yet effective format that small businesses can use to manage their transactions.

Essential Components of a Payment Request

| Component | Description |

|---|---|

| Business Information | Include your business name, address, phone number, and email. This ensures clients can easily reach you for inquiries or clarification. |

| Client Information | Provide the client’s name, business name (if applicable), and contact details. Accurate information helps prevent errors when sending the request. |

| Payment Breakdown | Clearly list the products or services provided, including quantities and unit prices. This breakdown gives clients a clear understanding of what they are being charged for. |

| Due Date | Set a clear due date for the payment, and if applicable, mention any late fees or interest for overdue payments. |

| Payment Methods | List all accepted payment methods (e.g., bank transfer, credit card, PayPal), making it easier for the client to pay you promptly. |

For small businesses, using a clean and professional format not only helps keep finances organized but also improves trust and credibility with clients. A well-structured document demonstrates attention to detail and professionalism, making it easier for clients to process payments on time.

How to Automate Your Invoicing Process

Streamlining your payment request system can save valuable time and reduce errors. Automation allows you to generate and send documents with minimal manual input, ensuring consistency and efficiency in your business operations. By integrating automation tools into your workflow, you can focus on growing your business while ensuring clients receive accurate and timely payment requests.

Steps to Automate Your Payment Requests

| Step | Description |

|---|---|

| Choose Automation Software | Select an online tool or software that can generate and send payment requests automatically. Many platforms offer features like templates, recurring billing, and integration with accounting systems. |

| Set Up Client Profiles | Create client profiles within the automation software. Include essential details like client contact information, payment terms, and billing preferences to streamline the process. |

| Schedule Recurring Requests | If you offer subscription-based services, set up recurring payment requests to be sent automatically at specified intervals (e.g., monthly, quarterly). |

| Customize Request Forms | Customize your payment request forms with the necessary fields, such as item descriptions, quantities, and rates, so that they are automatically populated when you create a new document. |

| Automate Payment Reminders | Set up automatic reminders for clients who have not made a payment by the due date. This reduces the need for manual follow-up and ensures timely payments. |

Benefits of Automation

Automation can greatly improve the speed and accuracy of your payment requests. By reducing human error and minimizing the need for repetitive tasks, you can ensure that your documents are always accurate and sent on time. Additionally, automating your billing system helps maintain consistency, creating a professional and efficient payment process for both you and your clients.

Creating a Template for Recurring Billing

Setting up a consistent and reliable process for managing periodic payments can save time and reduce administrative effort. Whether you’re running a subscription-based service or have regular clients, creating a system for automatic payment requests helps maintain cash flow and ensures clients are billed accurately and on time. A well-organized format for recurring charges provides clarity and builds trust with your clients.

To create an efficient system for recurring payments, you need to set up a document that can be easily customized for each cycle while maintaining consistency in format and content. This document should include key details like payment frequency, amount, services provided, and terms of payment. By using an automated system or a reusable structure, businesses can send these requests on schedule with minimal manual intervention.

Incorporating recurring billing into your workflow not only improves your operational efficiency but also enhances the client experience, reducing the risk of payment delays and maintaining a steady stream of revenue.

Bill Invoice Template for Freelancers

For freelancers, maintaining a professional approach to managing payments is essential for establishing trust with clients and ensuring timely compensation. A well-structured document that outlines the work completed, payment due, and terms of payment can make the billing process much smoother. Creating an effective payment request form helps avoid confusion and provides both you and your clients with clear documentation of the transaction.

Key Components of a Freelancer Payment Request

- Freelancer’s Contact Information: Include your name, business name (if applicable), email, and phone number to ensure the client can easily reach you for any clarifications.

- Client’s Information: Clearly list the client’s name, company name (if applicable), and contact details to avoid any confusion about the recipient.

- Project or Service Description: Provide a detailed breakdown of the services provided, including hours worked, hourly rate, or project milestones completed, along with the associated costs.

- Payment Terms: Specify the due date for the payment, accepted payment methods (e.g., bank transfer, PayPal, etc.), and any applicable late fees.

- Unique Identification Number: Assign a unique number to each payment request for better tracking and record-keeping.

- Tax Information: If relevant, include any applicable tax details, such as VAT, to ensure compliance with tax regulations.

Benefits of a Professional Payment Request for Freelancers

- Clear Communication: Using a consistent format helps you communicate your fees and terms more clearly, which can reduce the likelihood of disputes.

- Improved Cash Flow: By maintaining an organized system for sending requests, freelancers can ensure they receive payments on time, helping with financial planning and cash flow management.

- Streamlined Record-Keeping: A structured format makes it easier to track payments and maintain accurate financial records for tax and accounting purposes.

Creating a well-organized and clear payment request document helps establish a professional image, encourages timely payments, and reduces administrative effort for freelancers.

Understanding Invoice Terms and Conditions

When preparing a payment request, it is essential to include clear terms and conditions that outline the expectations for both parties involved. These terms define the legal framework of the transaction, specifying payment deadlines, accepted payment methods, and any penalties for late payments. By setting these terms upfront, both the sender and recipient can avoid confusion and potential disputes regarding the financial agreement.

Common Terms to Include

Here are some key terms typically included in a payment request to ensure transparency and legal compliance:

- Payment Due Date: This specifies the exact date by which the recipient must settle the payment. It ensures both parties are aligned on the timing of the transaction.

- Late Payment Fees: To incentivize timely payments, businesses often include a clause outlining the additional fees that will be charged if the payment is delayed. This helps encourage prompt action from clients.

- Accepted Payment Methods: Clearly listing the methods by which payment can be made (e.g., bank transfer, credit card, online payment systems) prevents any confusion about the available options.

- Refund Policy: If applicable, include a statement on your refund or return policy, specifying under what circumstances a refund is granted.

- Discounts: Some businesses offer early payment discounts. If this is the case, mention the discount percentage and the payment window within which the client can take advantage of it.

Why Terms and Conditions Are Important

Having well-defined terms and conditions not only protects your business legally but also builds trust with your clients. By clearly stating your expectations, both parties can agree on the rules from the outset, which minimizes misunderstandings and ensures smoother financial transactions. Clear terms also make it easier to enforce payment agreements if issues arise, providing a strong foundation for professional interactions.

How to Organize Your Invoices Efficiently

Maintaining an organized system for managing payment requests is critical for any business. By keeping track of financial documents in an efficient manner, you can ensure timely payments, avoid errors, and simplify tax preparation. Implementing an organized approach will save you time and reduce stress, allowing you to focus on growing your business.

Best Practices for Organizing Payment Requests

- Use a Digital Filing System: Storing documents electronically in folders is much more efficient than relying on physical copies. Cloud storage solutions like Google Drive or Dropbox offer easy access and backup options for your records.

- Label and Categorize: Create specific folders or categories based on client names, services, or billing periods. This will allow you to quickly retrieve any payment request when needed.

- Number Each Request: Assign a unique reference number to each document. This numbering system will help you track and differentiate between various requests, making it easier to follow up and resolve any disputes.

- Set Up Regular Reviews: Schedule weekly or monthly reviews of your records to ensure all payments have been made, and that no documents are missing or overlooked.

- Automate Where Possible: Use software that automatically generates and stores your documents, so you don’t have to manually input information or create new documents from scratch for each client.

Benefits of an Organized System

- Reduced Errors: With a well-structured system, the chances of missing or incorrectly charging clients decrease significantly.

- Improved Efficiency: You can quickly locate documents, process payments, and respond to queries without wasting time searching through disorganized files.

- Easier Tax Preparation: An organized system ensures you have all the necessary records when it’s time to prepare your taxes, simplifying the process and reducing stress.

By taking the time to set up an efficient system for organizing your financial documents, you can streamline your workflow and ensure that your business operates smoothly and professionally.