Best QuickBooks Invoice Templates for Streamlined Billing

Efficient management of financial transactions is crucial for any business. One of the most essential aspects of this process is creating accurate and professional payment documents. Customizable solutions can help streamline this task, ensuring that each bill reflects the necessary details without unnecessary complexity.

By utilizing ready-made designs, businesses can save valuable time while maintaining consistency and professionalism. These pre-structured formats allow for quick adjustments, making them an ideal choice for companies looking to simplify their financial workflows. Personalization and automation are key factors in reducing manual effort and improving overall efficiency.

Whether you are handling one-off payments or recurring transactions, choosing the right setup can have a significant impact on your administrative load. The right approach to billing not only enhances productivity but also helps maintain positive client relationships through clear and concise documentation.

Best QuickBooks Invoice Templates

Choosing the right structure for your payment documents can significantly improve the efficiency of your financial processes. With the right design, you can streamline the creation of payment records, ensuring both accuracy and professionalism in each transaction. Pre-made options are available that cater to different business needs, offering flexibility and ease of use.

Types of Templates to Consider

There are several varieties of document designs that you can use to suit your specific business needs. Each offers distinct features that can help automate and simplify your billing process:

- Simple Designs: Ideal for businesses that need a straightforward, no-frills approach to billing. These designs are easy to customize and quick to generate.

- Professional Layouts: These formats often include additional sections, such as payment terms or service descriptions, making them perfect for formal business environments.

- Customizable Solutions: For businesses that require flexibility, these designs allow for extensive personalization, from color schemes to layout adjustments.

Key Features to Look For

When selecting a design, it’s important to focus on features that will help improve your workflow and client interactions:

- Ease of Use: Look for structures that are easy to customize and navigate, allowing for quick creation without technical expertise.

- Client-Focused Elements: Features like clear payment terms, due dates, and contact information ensure that clients have all the information they need.

- Compatibility: Ensure that your chosen format is compatible with your accounting software or can be easily exported to other platforms.

Choosing the Right Template for Your Business

Selecting the appropriate design for your billing documents is a key decision in simplifying financial processes. The right structure can help you maintain consistency, ensure accuracy, and save valuable time in your administrative tasks. It’s important to consider several factors that align with your business needs, size, and industry type to make the best choice.

Customization options are critical in this decision. The ability to modify elements such as layout, colors, and fields will allow you to match the design with your company’s branding and ensure that all necessary details are included. For businesses with more specific needs, a more tailored approach may be required to accommodate specialized information.

Another important consideration is automation. Choose a design that integrates well with your existing financial systems, allowing for smooth data entry and easy tracking of transactions. Automating parts of the billing process, such as recurring charges or reminders, can greatly reduce manual effort and the risk of human error.

Lastly, the level of professionalism required for your documents is also essential. If you deal with high-value transactions or corporate clients, opting for a more formal and polished design may be necessary to reflect your business’s image and build trust with clients.

Customizing QuickBooks Invoices for Efficiency

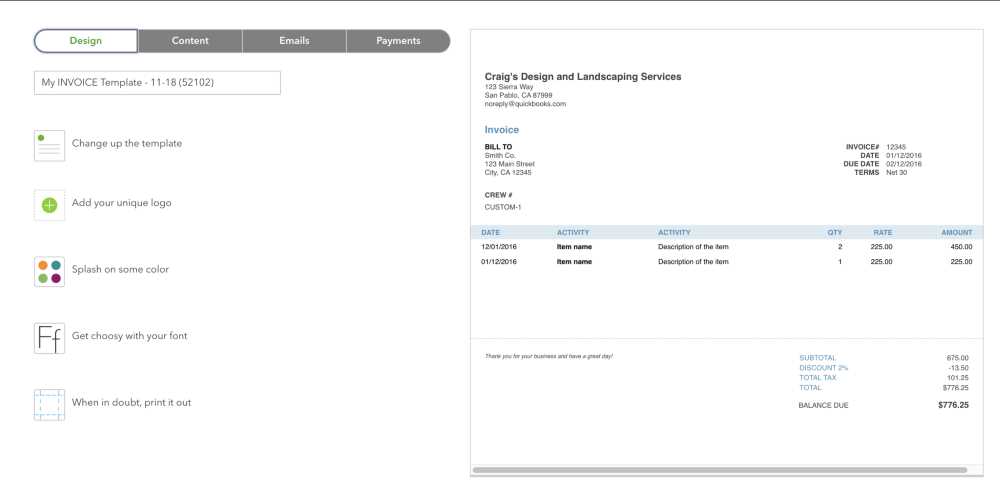

Tailoring your billing documents to fit the specific needs of your business can significantly improve operational efficiency. Customization allows you to create a streamlined process that saves time and reduces the risk of errors. By adjusting the design and content, you can ensure that every document reflects your brand and contains all necessary information for smooth financial transactions.

Key Customization Options

When personalizing your billing format, there are several elements you can adjust to better suit your workflow:

| Customization Option | Benefits |

|---|---|

| Company Branding | Incorporate your logo and brand colors to create a professional and consistent image. |

| Payment Terms | Set default payment terms to ensure clarity and consistency across all documents. |

| Item Descriptions | Customize descriptions for products or services to ensure full transparency with clients. |

| Automated Reminders | Set automatic notifications for overdue payments to improve cash flow. |

Improving Workflow Efficiency

Beyond simple adjustments, consider integrating automation tools to further enhance your billing workflow. Automating recurring payments or invoice generation can drastically reduce the time spent on manual tasks. This allows you to focus on more strategic aspects of your business while maintaining smooth operations in the background.

Benefits of Using QuickBooks Invoice Templates

Utilizing pre-designed formats for billing offers numerous advantages that can help businesses save time and increase accuracy. These structured solutions are designed to streamline the creation of payment records, ensuring that every document is consistent and professional. By relying on these options, businesses can focus more on growth while minimizing administrative workload.

| Benefit | Description |

|---|---|

| Time Savings | Ready-made designs eliminate the need to create documents from scratch, allowing for faster processing. |

| Consistency | Using standardized formats ensures uniformity across all payment records, improving professionalism and clarity. |

| Customization | Pre-built solutions can be easily tailored to suit specific business needs, making them flexible and adaptable. |

| Reduced Errors | Templates help prevent common mistakes by providing clear sections for all necessary information. |

| Automation | Many formats integrate with accounting systems, enabling automated billing processes and recurring payments. |

Top Features to Look for in Templates

When selecting a pre-designed solution for your business’s billing needs, it’s essential to focus on the features that will enhance both functionality and efficiency. The right features can make a significant difference in how easily you can customize documents, manage data, and maintain consistency across your transactions. By considering these key attributes, you can choose a format that best supports your workflow.

Essential Features for Optimal Functionality

The following features are crucial when evaluating options for financial documentation:

| Feature | Importance |

|---|---|

| Easy Customization | The ability to adjust text, layout, and sections ensures that the design fits your branding and business needs. |

| Clear Data Fields | Clearly labeled sections for amounts, descriptions, dates, and payment terms prevent confusion and errors. |

| Professional Appearance | A polished design enhances your business’s image and fosters trust with clients. |

| Automated Features | Automation for recurring charges and payment reminders reduces manual effort and improves consistency. |

| Cross-Platform Compatibility | Ensure that the chosen format works seamlessly with your accounting software or can be easily exported in various file formats. |

Advanced Features for Enhanced Efficiency

For businesses seeking more comprehensive solutions, consider advanced functionalities that offer greater control over billing processes:

| Advanced Feature | Benefit |

|---|---|

| Multi-Currency Support | Essential for businesses dealing with international clients, allowing for easy currency conversions. |

| Client-Specific Modifications | Ability to create custom designs or pricing structures for individual customers or projects. |

| Analytics Integration | Integrating data tracking features helps with monitoring payment history and identifying trends. |

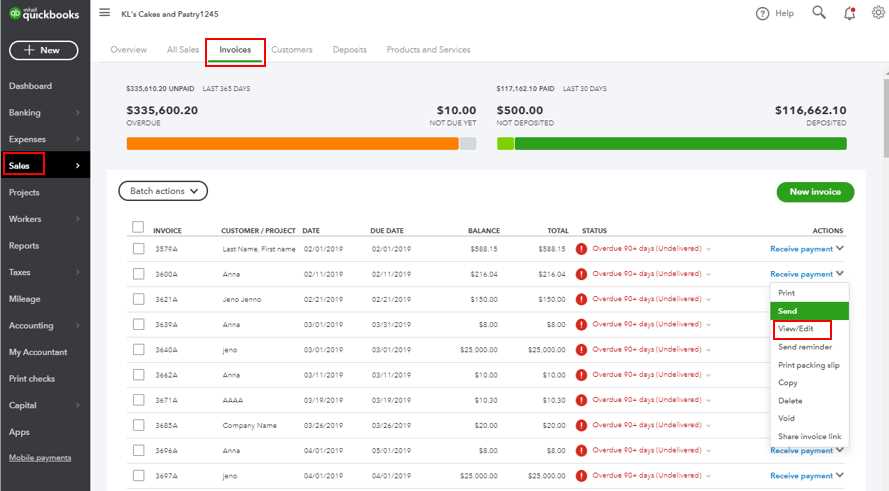

How to Edit and Save Templates in QuickBooks

Modifying pre-designed billing documents to meet the specific needs of your business is a simple process that can save time and ensure consistency. By adjusting various elements of the design, you can create professional and personalized records for each transaction. Once the changes are made, saving the document for future use ensures that you can reuse it whenever necessary, streamlining the workflow.

The following steps outline how to edit and save your financial document structure effectively:

| Step | Action |

|---|---|

| Step 1 | Navigate to the section where your document designs are stored within your software. |

| Step 2 | Select the format you want to modify, then click “Edit” to enter the customization mode. |

| Step 3 | Adjust the content, layout, and style to meet your business’s specific requirements. This may include adding logos, adjusting text fields, or updating payment terms. |

| Step 4 | Once edits are complete, click “Save” to store the updated version for future use. You may also choose to save it with a new name if creating a new version. |

| Step 5 | If you need to apply this format to future documents, simply select it from your saved list whenever creating new records. |

By following these steps, you ensure that each document remains consistent with your business needs while saving time on each transaction.

Free vs Paid QuickBooks Invoice Templates

When choosing a pre-designed billing document for your business, you have two primary options: free or paid designs. Each option offers its own set of benefits and limitations. Deciding which route to take depends on the specific needs of your business and the level of customization, professionalism, and functionality required.

Free designs are an excellent starting point for small businesses or those just beginning to digitize their financial processes. They provide a basic structure that allows for quick setup without any upfront cost. However, these free options often come with limited features and less flexibility for customization. On the other hand, paid designs typically offer more advanced options, better support, and higher-quality designs, making them suitable for businesses looking for a more professional appearance and specific functionality.

Advantages of Free Designs

- No cost: The biggest advantage is that they come at no charge, making them ideal for businesses on a budget.

- Simple setup: Free designs are usually easy to access and use, requiring minimal setup and customization.

- Basic functionality: Suitable for businesses with straightforward billing needs and minimal customization requirements.

Advantages of Paid Designs

- Advanced features: Paid designs often come with additional features, such as automated payment reminders and recurring billing options.

- Better customization: More flexibility to match your business’s branding, with options to modify layouts, colors, and more.

- Professional appearance: These designs typically look more polished and can help enhance your business’s image.

- Support: Paid options often include customer support, ensuring you can get assistance when needed.

Choosing between free and paid options ultimately depends on the specific requirements of your business, such as the level of professionalism, features, and customization needed for your billing documents.

Creating Professional Invoices with Templates

Designing high-quality billing documents is essential for maintaining professionalism and ensuring clarity in transactions. Using pre-designed structures allows businesses to create polished and consistent records quickly, without the need for complex design work. By leveraging these customizable options, you can streamline your billing process while presenting a clean, organized, and professional image to your clients.

To create a professional document, it’s important to focus on a few key aspects. A well-organized layout that clearly separates sections such as client details, itemized costs, and payment instructions is crucial. Additionally, incorporating your business logo and brand colors can enhance your business identity. Choosing the right document format that suits your workflow and client needs ensures that the final product meets both functional and aesthetic standards.

By using these solutions, you can generate visually appealing and efficient payment records that help build trust with your clients and create a positive impression of your business.

How to Automate Invoice Creation in QuickBooks

Automating the process of generating billing documents can save valuable time and reduce the risk of errors. By setting up automated workflows, businesses can ensure that all financial records are consistently created and sent without manual input, allowing for more focus on growth and client relations. Automation tools within accounting software can streamline recurring tasks and improve efficiency in the billing process.

To automate your billing process effectively, it is important to set up recurring profiles for clients, define payment terms, and schedule automatic document generation. Once configured, the system will automatically create and send out the records based on pre-set parameters, ensuring timely payments and reducing administrative overhead.

Steps to Automate Document Creation

- Step 1: Create recurring profiles for customers with their payment terms and billing frequency.

- Step 2: Set up templates with required fields that can auto-populate for each transaction.

- Step 3: Choose an automation schedule (daily, weekly, monthly) that fits your billing cycle.

- Step 4: Enable automatic notifications and reminders to send the completed records to clients.

- Step 5: Monitor and adjust the system periodically to ensure accuracy and address any changes in the client’s billing requirements.

By following these steps, businesses can create a seamless and automated billing workflow that saves time and ensures accuracy in every transaction.

Template Compatibility with Your Business

Choosing the right document design is essential for ensuring that your business operations align seamlessly with your financial record-keeping processes. The document structures you use must fit with your company’s needs, industry standards, and the software tools you are utilizing. Compatibility ensures that billing records are generated efficiently and meet both operational and client-facing expectations.

When selecting a pre-designed format, it is important to evaluate how well it integrates with your existing systems. Whether you are using accounting software, spreadsheets, or other business management tools, the design should be easy to customize and compatible with the data inputs required. The goal is to simplify workflows, enhance communication with clients, and ensure smooth processing of transactions.

Factors to Consider for Compatibility

- Integration with Existing Systems: The format should easily integrate with your business software or platforms for automatic data entry and reporting.

- Customization Options: Ensure that the document can be tailored to include your business logo, colors, and other branding elements.

- Data Fields: Look for a design that allows for the inclusion of necessary client details, payment terms, and itemized lists.

- Ease of Use: Choose a format that is intuitive and easy to work with, ensuring quick adaptation by your team.

Ensuring Long-Term Flexibility

- Scalability: The design should allow room for future expansion, such as adding more products, services, or clients as your business grows.

- Adaptability to Industry Standards: Your document structure should be suitable for your specific industry regulations, such as tax codes, client payment preferences, and legal requirements.

By carefully considering these factors, you can ensure that the chosen design will not only streamline your internal processes but also present your business in a professional manner to your clients.

Improving Cash Flow with Invoice Templates

Effective management of your financial processes plays a crucial role in maintaining healthy cash flow for your business. One key aspect is ensuring that your billing documents are clear, professional, and sent promptly. By using structured, pre-designed formats, you can streamline the payment process, reduce delays, and encourage quicker payments from clients. This contributes to maintaining a steady cash flow and prevents disruptions in your operations.

Automating and standardizing the billing process not only saves time but also ensures that all necessary details are captured accurately and consistently. With clear payment terms, due dates, and instructions, your clients will have no confusion about when and how to pay, reducing the likelihood of late payments. Additionally, creating documents that are easy to read and understand can help reinforce your professionalism and build trust with your clients.

How Standardized Billing Helps Cash Flow

- Faster Payment Processing: Pre-designed formats help ensure that all relevant information is included, allowing clients to process payments quickly without needing clarification.

- Clear Payment Terms: Clearly stated due dates and payment instructions help reduce confusion and increase the likelihood of timely payments.

- Minimized Errors: Automated, consistent formats minimize human errors, which can lead to delays and missed payments.

- Professional Appearance: A polished, well-structured document improves the perception of your business, which can lead to better client relationships and quicker settlements.

Encouraging Prompt Payments

- Timely Reminders: Many pre-designed formats come with built-in reminders, helping you to follow up with clients before payments become overdue.

- Recurring Billing Options: Setting up recurring schedules can help ensure regular, predictable payments, improving your cash flow management.

By using standardized formats for your financial documents, you can enhance the efficiency of your billing system and help improve your business’s cash flow. Consistency in the payment process not only accelerates revenue collection but also fosters strong, trustworthy relationships with clients.

Saving Time with Invoice Solutions

Efficiency is key in running a successful business, and automating routine tasks is one of the most effective ways to save time. Streamlining the process of generating and sending billing documents can help businesses focus more on core activities and less on administrative work. Using pre-designed structures or software solutions for creating these documents simplifies the process, reduces manual entry, and minimizes the risk of errors.

By relying on automated tools and templates, businesses can speed up the creation, customization, and delivery of financial records. Once the setup is complete, sending out multiple records becomes a matter of a few clicks, eliminating the need for manual data input each time. This allows employees to focus on higher-value tasks and improves overall workflow efficiency.

Time-Saving Features to Consider

- Automated Data Entry: Pre-filled fields that auto-populate with customer details and transaction information speed up the document creation process.

- Recurring Billing: Set up automatic billing schedules for repeat clients, reducing the need to manually create documents each cycle.

- Quick Customization: The ability to quickly modify elements like pricing, due dates, and item descriptions helps create tailored records with minimal effort.

- Batch Processing: Tools that allow you to create and send multiple documents at once save time, especially for businesses with a large client base.

Maximizing Efficiency with Integration

- Integration with Accounting Software: Syncing with other business systems, like accounting platforms or CRM software, helps eliminate duplicate data entry and ensures consistency.

- Cloud-Based Accessibility: Accessing your documents from anywhere allows for faster adjustments and quick sending, whether you’re in the office or on the go.

By leveraging automated solutions and integrations, businesses can significantly reduce the time spent on administrative tasks related to billing, improving both productivity and accuracy.

Tracking Payments Using Billing Solutions

Maintaining control over payments is crucial for the financial health of any business. By utilizing organized and structured formats for billing documents, businesses can more easily track payment statuses, identify outstanding balances, and follow up on overdue accounts. This streamlines financial management, improves cash flow, and reduces the chances of missed payments or inaccuracies.

With the right setup, tracking incoming payments becomes straightforward. Custom fields and automated processes allow businesses to record the status of each transaction, from initial creation to full payment. This ensures that you always know which invoices are paid, partially paid, or still due, helping to keep finances on track and enabling efficient follow-ups when necessary.

Key Features for Tracking Payments

- Payment Status Indicators: Clear markers indicating whether a document has been paid, partially paid, or is overdue help quickly assess the situation.

- Payment History: Maintaining a detailed record of all previous payments allows businesses to track a client’s payment history, ensuring timely follow-ups when needed.

- Due Date Alerts: Automated reminders and due date tracking help businesses stay on top of upcoming payments and prevent delays.

- Client Payment Methods: Offering a variety of payment options and tracking which method was used helps streamline the accounting process.

Efficient Follow-Up and Reporting

- Automated Reminders: Setting up automatic payment reminders for clients ensures timely payments and reduces the need for manual intervention.

- Reports and Insights: Access to detailed reports on payment statuses, outstanding balances, and payment trends allows for more informed business decisions.

By implementing organized billing structures and automated payment tracking systems, businesses can effectively monitor their cash flow, ensuring that all payments are processed efficiently and accurately.

Setting Up Recurring Invoices in Billing Solutions

Automating billing for recurring transactions can save businesses significant time and reduce the chance of errors. By setting up recurring billing cycles, you can ensure that clients are billed consistently without needing to manually create and send documents each time. This streamlines the process, improves cash flow, and allows businesses to focus on other essential activities.

When you set up automated billing, you create a system that generates and sends invoices automatically on a set schedule, whether it’s weekly, monthly, or annually. This helps maintain regularity and ensures that payments are collected promptly. Once configured, the system will handle everything from generating the billing document to sending it to clients, allowing for a smooth and efficient transaction process.

Steps to Set Up Recurring Billing

- Choose Your Frequency: Determine how often the billing should occur–whether it’s on a monthly, quarterly, or annual basis.

- Enter Customer Details: Ensure that client information, including payment terms and amounts, are pre-entered to save time on each cycle.

- Define Recurring Charges: Specify which services or products will be billed regularly, along with their prices and descriptions.

- Set Up Payment Methods: Choose the payment methods you accept for these recurring transactions, such as credit cards, bank transfers, or online payment platforms.

Managing and Adjusting Recurring Billing

- Monitor Payment Status: Keep track of when each billing cycle is processed and check if any payments are overdue.

- Make Adjustments Easily: Edit or update billing details like pricing, services, or customer information at any time without interrupting the recurring cycle.

By setting up and managing recurring billing cycles, businesses can ensure predictable income streams and save valuable time on repetitive tasks, improving overall efficiency and client satisfaction.

Integrating Invoice Designs with Online Billing Systems

Integrating billing document designs with an online financial platform offers businesses an efficient way to streamline their invoicing processes. By syncing customizable document layouts with an online accounting system, businesses can enhance their workflow, ensure consistency, and reduce manual effort in managing customer transactions. This integration allows for the seamless creation, customization, and tracking of financial documents while ensuring they align with your company’s branding and operational needs.

When integrating document formats with your online system, it’s important to ensure compatibility, enabling automated data entry and minimizing the risk of errors. Once integrated, invoices can be automatically generated, updated, and sent to clients, saving time and maintaining a professional appearance with every transaction.

Steps to Integrate Billing Formats

- Choose the Right Financial Platform: Select an online system that supports customizable billing solutions and allows for easy integration of your preferred design formats.

- Upload Your Document Design: Upload your pre-designed billing documents or choose from available options that fit your business’s needs. Ensure that the layout is aligned with your branding guidelines.

- Link Customer Information: Ensure that your client details, such as name, address, payment terms, and service descriptions, are automatically pulled from the system to reduce manual data entry.

- Enable Automation: Set up automatic invoicing schedules based on your business cycle. This could include recurring payments or one-time charges, depending on your needs.

Managing and Customizing Integrated Billing Documents

- Update Layouts Easily: Make any necessary adjustments to the design or structure of your billing documents to better reflect your business’s brand and style.

- Monitor Payment Status: Use the online system to track payment status in real-time, ensuring you are aware of overdue amounts and reducing the chances of missed payments.

By effectively integrating customized billing formats with an online accounting solution, businesses can automate their invoicing processes, ensuring accuracy, consistency, and a more streamlined financial workflow. This approach not only improves operational efficiency but also enhances client satisfaction through timely and professional communication.