Best Free Invoice Templates for Small Business and Freelance Use

Efficient billing is an essential part of any business operation, whether you’re a freelancer or a small company owner. The ability to send professional and accurate bills ensures smooth financial transactions and helps build trust with clients. With the right tools, managing payments can be streamlined, saving you time and effort.

Many entrepreneurs and businesses look for easy-to-use, customizable options that meet their specific needs. Instead of creating invoices from scratch, using pre-designed solutions can be an effective way to ensure consistency and professionalism across all your transactions. These ready-to-use formats are often available in various styles, allowing you to choose the one that best aligns with your brand or the nature of your services.

With numerous options available online, finding high-quality, no-cost solutions can help you focus more on growing your business rather than spending excessive time on administrative tasks. Whether you’re dealing with a few clients or a larger customer base, having a reliable, adaptable tool can significantly improve the billing process.

Top Billing Solutions for Your Business

Finding a reliable, customizable tool for managing billing can make a significant difference in how efficiently a business operates. Using professionally designed formats helps maintain accuracy and consistency, whether you’re working with one client or many. There are several online resources offering a variety of options to choose from, each designed to streamline the process and fit specific business needs.

Here are some of the most popular and effective options available for entrepreneurs, freelancers, and small business owners:

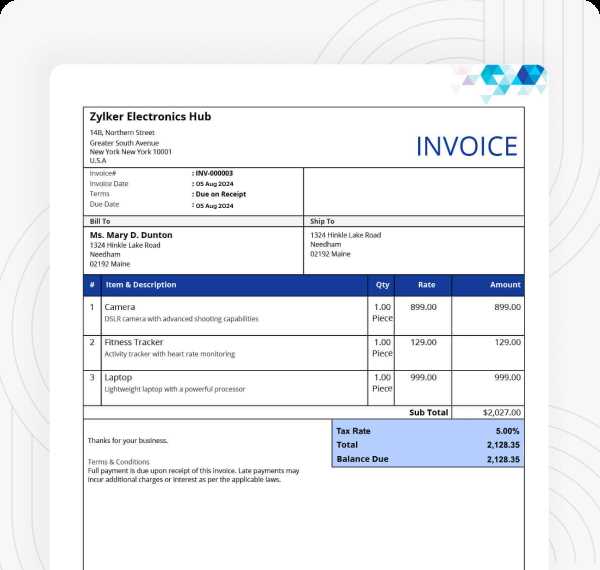

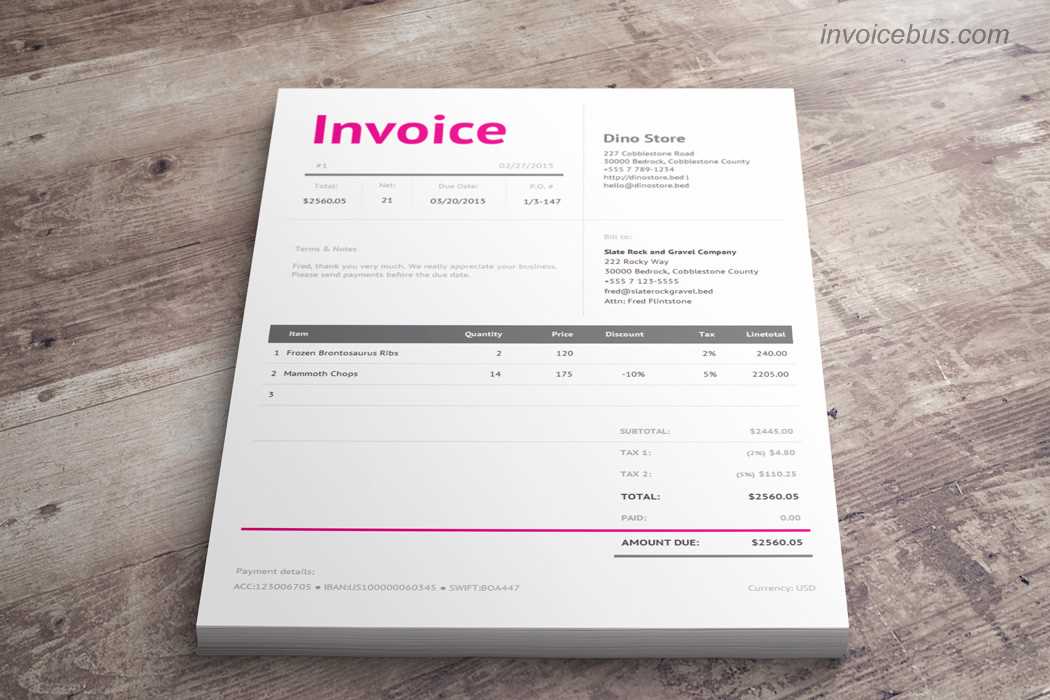

| Format | Best For | Features |

|---|---|---|

| Simple Bill | Freelancers | Easy-to-fill, clean design, customizable sections for services and payment details |

| Professional Statement | Small Businesses | Detailed breakdowns, room for taxes and discounts, integrates client branding |

| Minimalist Template | Creative Professionals | Modern, simple design, emphasis on services with minimalist aesthetic |

| Service Contract | Consultants | Includes space for contract terms, payment schedules, and client agreements |

| Comprehensive Bill | Product-Based Businesses | Detailed itemized list, room for taxes, shipping costs, and other fees |

Each of these options is available for download or direct use online, offering a variety of features to fit the specific needs of your business. Customizing them to match your brand identity or adjusting them for different services can ensure that your financial communications remain professional and organized.

Why Use Free Billing Solutions

Managing payment requests and financial records efficiently is crucial for maintaining smooth business operations. Using pre-designed documents to handle these tasks can save time, reduce errors, and ensure consistency in your financial communications. The simplicity and accessibility of ready-to-use options make them an ideal choice for small business owners, freelancers, and entrepreneurs who need reliable tools without the hassle of designing them from scratch.

Here are several key reasons why using such solutions can benefit your business:

- Time-Saving: Pre-designed formats eliminate the need to create new documents from scratch, allowing you to focus on core business activities.

- Professional Appearance: Ready-made designs ensure that your payment requests look polished and credible, which is important for building trust with clients.

- Consistency: Using standardized formats guarantees that every bill or receipt you send maintains a uniform structure and appearance, reinforcing your brand’s professionalism.

- Customization: Many options can be easily modified to match your specific needs, allowing you to tailor them with your branding, services, or payment terms.

- Cost-Effective: Many options are available at no cost, allowing businesses to manage their financial transactions without spending on expensive software or hiring designers.

By choosing the right solution, you can simplify the billing process and ensure that your financial records are accurate and well-organized, all while maintaining a professional image.

Top Features of Free Billing Solutions

When choosing a ready-made document for managing your payment requests, it’s essential to consider the key features that make them functional and adaptable to different business needs. These features not only ensure accuracy but also improve the overall experience for both business owners and clients. Whether you are a freelancer or a small business owner, the right set of tools can help streamline your billing process.

Here are some of the most important characteristics to look for:

- Customizable Layout: The ability to adjust fields such as client information, services, and payment terms allows for a more personalized approach, fitting the needs of your specific business model.

- Clear Itemization: Detailed sections for listing products or services, quantities, and unit prices ensure transparency and clarity in all financial transactions.

- Tax and Discount Calculation: Built-in fields to automatically calculate taxes, discounts, and additional charges save time and reduce manual errors.

- Payment Terms Section: Including payment due dates, methods, and any late fees makes it easier to communicate expectations and avoid confusion.

- Professional Design: A clean, modern layout that is easy to read enhances the overall presentation and helps build a strong brand image.

- Compatibility: Most ready-made documents are compatible with various file formats such as Word, Excel, or PDF, making it easy to send them electronically or print them out when needed.

- Multi-Currency and Language Support: For international clients, many solutions include the option to change currencies and languages, making them versatile for global business dealings.

By selecting a tool with these essential features, you can simplify the billing process, maintain professionalism, and ensure your financial documentation is accurate and comprehensive.

How to Customize a Billing Document

Customizing a pre-designed billing document is a simple and effective way to make it align with your business needs and branding. Whether you need to adjust text fields, add specific details, or change the layout, tailoring a ready-made document can ensure that it meets both your functional requirements and professional standards. This process allows you to create a personalized, polished financial tool without the need for complex software or graphic design skills.

Adjusting the Layout

One of the first things to consider when customizing is the overall structure. You may want to rearrange sections to prioritize certain details such as client information, payment terms, or services provided. For example, you can move the payment due date to a more prominent place or add a section for additional notes at the bottom. Make sure that the layout flows logically and keeps the document easy to read.

Branding and Aesthetics

Another key element to focus on is incorporating your brand identity. This can be done by adding your company logo, choosing colors that match your branding, or selecting fonts that reflect the tone of your business. The more cohesive the look, the more professional your document will appear. Customizing the color scheme and typography can go a long way in making your financial communications stand out.

By making these adjustments, you can ensure that your billing documents are not only functional but also reflect your business’s unique identity and professionalism.

Where to Find Free Billing Solutions

There are many online platforms that offer ready-made financial documents designed to simplify the billing process. Whether you’re looking for a simple format or a more detailed, professional layout, numerous resources are available to help you save time and reduce the complexity of managing payments. The key is to find a reliable source that provides quality options tailored to your business needs.

Popular Websites Offering Ready-to-Use Documents

Several websites specialize in providing customizable financial documents at no cost. These sites often feature a range of styles, from basic to more sophisticated, allowing you to choose the one that best suits your preferences. Some platforms even allow you to download documents in different file formats such as Word, Excel, or PDF, offering flexibility in how you manage and distribute them. A few well-known sites include:

- Template.net – A large collection of downloadable formats for various business needs.

- Microsoft Office Templates – A variety of professional formats that integrate seamlessly with Microsoft Word and Excel.

- Canva – Provides easy-to-edit, visually appealing designs that can be personalized online.

Additional Resources for Customization

In addition to dedicated template websites, some platforms such as Google Docs and Google Sheets also offer free documents that can be easily customized and shared. Many of these options are cloud-based, making it easy to access and edit your documents from anywhere, and they often come with collaboration features, making it simple to work with clients or team members.

By exploring these resources, you can quickly find the right solution to meet your business needs, while keeping costs to a minimum and ensuring your documents remain professional and organized.

Benefits of Using Digital Billing Solutions

Switching to electronic billing offers a variety of advantages that can enhance the efficiency and professionalism of your business operations. Unlike paper-based methods, digital systems provide faster processing, better organization, and the convenience of managing financial transactions from virtually anywhere. These benefits make digital records an ideal solution for modern businesses looking to streamline their payment processes.

Here are some of the key advantages of using electronic billing systems:

- Speed and Efficiency: Digital billing can be created, sent, and processed within minutes, reducing delays associated with traditional paper-based systems.

- Reduced Costs: Eliminating the need for paper, ink, and postage can significantly lower overhead costs, especially for businesses that issue numerous documents regularly.

- Easy Tracking and Organization: Electronic records can be stored, sorted, and accessed with just a few clicks, making it easier to stay organized and locate specific transactions when needed.

- Improved Accuracy: Many digital systems include automatic calculations, reducing the chances of human error and ensuring that payment amounts, taxes, and discounts are calculated correctly.

- Faster Payments: Electronic documents can be linked directly to payment gateways, allowing clients to make payments quickly and efficiently, reducing waiting times for both parties.

- Environmentally Friendly: By reducing the need for paper, electronic records contribute to a more sustainable, eco-friendly business model.

Incorporating digital solutions into your billing process not only helps with day-to-day operations but also positions your business as more modern, organized, and ready to meet the needs of the digital age.

Billing Solutions for Freelancers

For freelancers, having a clear and professional way to request payments is essential to maintaining a successful business. Using a structured, easy-to-edit billing document can save time, reduce mistakes, and ensure that clients understand exactly what they’re being charged for. Whether you’re offering consulting services, design work, or writing, a customizable financial record allows you to present your work in a polished manner while keeping track of your earnings.

Freelancers benefit from using these documents because they provide a simple way to:

- Clearly Detail Services: Break down the work completed, including rates, hours worked, or project milestones, so clients can easily see what they’re paying for.

- Maintain Consistency: Using a pre-designed layout helps maintain a consistent look across all transactions, reinforcing your brand and professionalism.

- Include Payment Terms: Clearly define payment deadlines, late fees, and accepted methods, helping to avoid confusion and ensuring timely payments.

- Track Work Across Clients: Keep an organized record of your services and payments, making it easier to manage multiple clients and monitor your cash flow.

- Customize for Each Project: Easily adjust the layout, fields, or design elements to suit the specifics of each project or client relationship.

For independent contractors, using a well-designed, easy-to-manage document can not only make billing easier but also project a more professional image, helping you build long-term client relationships.

Billing Solutions for Small Businesses

For small business owners, having a streamlined and professional method for requesting payments is crucial for maintaining healthy cash flow and ensuring timely payments. Whether you offer products or services, using a well-structured document helps provide clarity to clients while reducing administrative burdens. A customized, easily manageable billing solution can save time and foster positive relationships with customers.

Why Small Businesses Need Customized Billing Documents

Small businesses often operate with limited resources, making efficiency essential. Using a tailored document for each transaction allows you to maintain professionalism without the need for expensive software or time-consuming manual record-keeping. A good solution offers:

- Clear Payment Breakdown: Detail each item or service sold, along with their prices, to ensure clients understand the charges and can easily review them.

- Consistency in Branding: Incorporate your logo, company name, and color scheme to create a unified, professional look across all communication.

- Flexible Payment Terms: Include sections for payment due dates, accepted methods, and any late fees to make sure clients are aware of expectations and deadlines.

- Tax and Discount Integration: Built-in fields for taxes, discounts, and additional fees can save time and prevent mistakes.

Additional Features for Small Business Efficiency

Along with basic billing needs, some businesses may require extra features to simplify their process further. For instance:

- Recurring Billing: For businesses with subscription-based services, having a recurring billing option helps automate the process, ensuring no missed payments.

- Multi-Currency Support: If your business serves international clients, having the ability to switch currencies quickly can be an important time-saver.

- Expense Tracking: Including sections for tracking business expenses directly within the document can help you stay organized and reduce the need for separate accounting systems.

By using a well-designed, customizable solution, small businesses can maintain professional billing practices without investing in complex or costly systems, making it easier to focus on growth and customer satisfaction.

Customizable Billing Solutions for Different Industries

Every industry has unique needs when it comes to managing payments and maintaining financial records. A one-size-fits-all approach may not be effective for businesses across diverse sectors, as each requires specific fields, layouts, and details. Whether you’re in construction, consulting, retail, or any other field, using a specialized document can help ensure that your payment requests meet industry standards while also providing the clarity and professionalism your clients expect.

Here are some industry-specific options for businesses that need customized billing solutions:

- Construction and Contracting: For businesses in construction, including sections for labor hours, materials, and project milestones is essential. A detailed breakdown ensures transparency and helps manage long-term projects effectively.

- Consulting and Coaching: Consultants often charge based on hourly rates or project-based fees. A clean, professional layout that allows for detailed service descriptions and time tracking is crucial for maintaining clear agreements with clients.

- Retail and E-Commerce: Retail businesses need to itemize products, quantities, and prices. A well-organized structure that tracks sales tax, shipping fees, and any discounts applied makes it easier to manage customer purchases.

- Creative Services (Design, Photography, etc.): For creative professionals, it’s important to have a template that highlights the scope of work, project timelines, and usage rights. Clear payment terms for various deliverables can also help avoid confusion.

- Health and Wellness: Personal trainers, massage therapists, and health consultants often charge per session or package. A straightforward document that reflects session dates, rates, and total amounts is useful for maintaining accurate financial records.

- Education and Tutoring: Tutors and educators can benefit from templates that track hours, subjects taught, and payment rates. A simple layout with space for lesson details and payment schedules helps keep things organized.

Choosing the right format tailored to your industry’s requirements not only saves time but also ensures you meet client expectations and maintain a professional image. Customizing these documents with relevant fields helps keep your financial communications clear, efficient, and aligned with the specific nature of your work.

How to Save Time with Billing Documents

For any business owner or freelancer, efficiency is key to managing operations effectively. When it comes to handling payment requests, using pre-designed formats can significantly reduce the time spent on administrative tasks. Instead of starting from scratch each time you need to create a financial document, using ready-made options allows you to focus on the work that truly matters while ensuring consistency and accuracy.

Streamlining the Process

By adopting a pre-structured document, you eliminate the need to recreate the same sections every time. Here are some ways in which using these solutions can save you time:

- Pre-set Fields: Many formats come with standardized fields for client information, services provided, and payment terms, allowing you to quickly fill in the relevant details rather than creating each section manually.

- Automatic Calculations: With built-in calculations for taxes, discounts, and totals, you can avoid the time-consuming task of manually adding these details each time you generate a new document.

- Easy Customization: Templates often offer customizable sections that allow you to add specific details without altering the entire structure. Whether it’s adjusting a rate or adding a new service, modifications can be made in minutes.

- Consistent Design: The design elements are already set up, so you don’t have to worry about layout or visual appeal every time you need to create a new document. This ensures that all your records maintain a cohesive and professional appearance.

Faster Client Communication

Time isn’t just saved during the creation process–using pre-made formats can also streamline the way you communicate with clients. With the document ready to go, you can send payment requests instantly, reducing delays in the billing cycle. This not only speeds up cash flow but also improves your professionalism, as clients will appreciate the clarity and consistency of your financial communications.

By incorporating ready-to-use documents into your workflow, you can cut down on administrative time and focus more on growing your business and serving your clients.

Common Mistakes to Avoid in Billing Documents

Creating a clear and accurate billing document is essential for maintaining good business relationships and ensuring timely payments. However, there are several common errors that many business owners and freelancers make when preparing these documents. Avoiding these mistakes can help ensure that your records are professional, accurate, and effective in securing payment without confusion.

Here are some of the most common mistakes to watch out for when preparing billing records:

- Incorrect Client Information: Always double-check the client’s name, address, and contact details before sending. Inaccurate information can cause confusion and delay payment.

- Missing or Incorrect Payment Terms: Clearly state the payment due date, methods accepted, and any late fees. Omitting or misstating these terms can lead to misunderstandings and delayed payments.

- Failure to Itemize Services or Products: Not breaking down the individual services or items provided can create confusion for clients. Ensure every charge is listed clearly, including quantities, unit prices, and any discounts applied.

- Omitting Tax Details: If taxes are applicable, make sure to include the exact tax rates and amounts in the document. Leaving out tax information can lead to discrepancies and potential legal issues.

- Not Including an Invoice Number: Every document should have a unique identifier to help both you and your client keep track of payments and ensure there is no confusion about the billing history.

- Unclear Payment Instructions: Be specific about how and where payments should be made. If you’re accepting payments via bank transfer, credit card, or other methods, provide all the necessary details to avoid delays.

- Failure to Proofread: Simple typos or errors in amounts can undermine your professionalism and lead to misunderstandings. Always take a moment to review the document before sending it out.

By carefully avoiding these common mistakes, you can ensure that your billing process runs smoothly, that your clients receive clear information, and that you’re paid promptly for your work. A professional, accurate record will reflect well on your business and build trust with your clients.

How to Choose the Right Billing Document Format

Choosing the appropriate format for your billing documents is crucial to ensure that they meet your business’s needs and reflect your professionalism. With various styles and layouts available, it’s important to consider factors like your industry, the complexity of the services you offer, and the preferences of your clients. Selecting the right structure will save you time, improve communication, and streamline the payment process.

Key Factors to Consider

When deciding on the best format, keep the following factors in mind:

- Industry Needs: Different industries require different levels of detail. For instance, freelancers may only need basic fields, while businesses in construction or consulting might need more comprehensive breakdowns for labor, materials, or project milestones.

- Design and Branding: Choose a layout that matches your business’s aesthetic. A professional, clean design with your branding elements (such as logo, color scheme, etc.) will help reinforce your company’s image.

- Ease of Use: Select a format that is easy to fill out and customize. Overly complex designs can slow down your workflow, so choose a document that’s simple to adapt to different client needs.

- Payment Methods: Ensure that the chosen format allows you to clearly specify accepted payment methods, terms, and any necessary details for easy transaction processing.

Understanding Different Layouts

Here’s a quick comparison of different layout options to help you select the one best suited to your business:

| Layout Type | Description | Best For |

|---|---|---|

| Simple Layout | Basic design with essential fields like client details, services, and totals. | Freelancers, Small Service Providers |

| Itemized Layout | Detailed breakdown of services, quantities, and individual pricing. | Retail, E-Commerce, Consulting |

| Customizable Layout | Highly flexible, allowing you to add various sections as needed. | Businesses with diverse offerings, Project-Based Work |

| Professional Corporate Layout | Elegant design with a formal tone, incorporating company branding. | Larger Companies, Agencies |

By understanding the specific needs of your business and the preferences of your clients, you can make an informed decision when choosing the right format for your financial records. A well-chosen layout ensures clarity, reduces confusion, and helps build stronger client relationships.

Billing Software vs Manual Creation

When it comes to managing financial documents, businesses often face the decision between using specialized software or manually creating each record. Both options offer their own set of advantages and challenges, depending on the nature of the business and the scale of operations. While software solutions can automate and streamline the process, manual creation allows for complete customization and control. Understanding the differences between these two approaches is key to choosing the most efficient method for your needs.

Advantages of Using Billing Software

Billing software is designed to make the process of generating financial documents faster and more efficient. Here are some of the key benefits:

- Speed and Automation: Software can automatically populate fields, calculate totals, and apply taxes, significantly reducing the time spent on each document.

- Customization and Templates: Many software tools offer customizable formats and predefined designs, allowing businesses to create documents that match their branding and specific requirements.

- Data Storage and Tracking: Billing software often includes storage features, making it easier to track past transactions and keep an organized record of your financial activities.

- Integration with Payment Systems: Some software can integrate directly with payment gateways, making it easier for clients to pay their bills online and for businesses to track payments automatically.

Advantages of Manual Creation

For those who prefer a more hands-on approach or operate on a smaller scale, manually creating each document can still be an effective option. Some advantages of manual creation include:

- Complete Control: Manual creation gives you full control over the design and content of each document, allowing for complete customization without relying on software templates.

- No Learning Curve: For small businesses or individuals who don’t need advanced features, manually creating records can be straightforward, without the need for training or understanding complex software.

- Cost-Effective: If you have only a few transactions each month, creating documents manually may be the most economical choice, as it doesn’t require investing in paid software.

- Flexibility: Manual creation allows for flexibility in terms of structure, layout, and the inclusion of non-standard information that may not be supported by software.

While software solutions offer convenience and scalability, manual creation can still be a viable option for businesses with fewer financial records or those that require more control over document details. The right approach depends on the volume of work and the specific needs of your business.

Legal Considerations for Billing Documents

When creating financial records for your business, it’s essential to ensure that they comply with legal requirements. These documents not only serve as proof of transactions but can also be used in case of disputes or audits. Failing to include certain necessary elements or misinterpreting local regulations can lead to confusion, delayed payments, or even legal issues. Understanding the legal aspects of billing is key to protecting your business and maintaining transparent and fair relationships with clients.

Key Legal Elements to Include

There are several critical pieces of information that must appear on every billing document to ensure that it is legally valid and enforceable:

- Complete Contact Information: Both the business’s and the client’s full names, addresses, and contact details should be included to clearly identify all parties involved in the transaction.

- Unique Document Number: Each billing document should have a unique reference number to track the document and prevent confusion in case of disputes or future referencing.

- Clear Description of Services or Goods: A detailed description of the work performed or products sold, including the quantity, pricing, and any agreed-upon terms, is essential for clarity and to avoid disputes over the scope of the agreement.

- Payment Terms: Clearly specify the due date, accepted payment methods, and any late payment penalties. This ensures both parties understand the terms under which payment is expected.

- Applicable Taxes: Include all necessary tax information, including the tax rate and total tax amount. This is particularly important in regions where VAT or sales tax is applicable.

Jurisdiction and Legal Compliance

It’s also crucial to be aware of the specific legal requirements that may vary depending on the location of your business or the client. Different countries and regions may have unique rules regarding taxes, late payment fees, or required disclosures. Familiarizing yourself with these requirements can prevent errors and ensure that your billing practices are legally sound. For example:

- Local Tax Laws: Different jurisdictions may have specific tax rates or exemptions, so it’s important to apply the correct tax rate for your area and include any mandatory tax codes or registration numbers.

- Late Fees and Interest: Many regions allow businesses to charge interest on overdue payments, but the rate must comply with local laws. Be sure to include this information if applicable, and make sure it aligns with legal standards.

- Contractual Requirements: In some industries or for certain types of transactions, specific clauses must be included on billing documents, such as payment schedules, delivery terms, or refund policies.

By ensuring that your billing records are legally compliant, you can protect your business from potential disputes, avoid costly fines, and establish trust with your clients. Proper documentati

How to Add Branding to Billing Documents

Incorporating branding into your financial records is a great way to reinforce your company’s identity and maintain professionalism. Adding your brand’s visual elements to these documents not only makes them look more polished but also helps to create a consistent experience for your clients. Whether it’s through logos, color schemes, or typography, branding enhances your business’s recognition and establishes trust with clients.

Key Branding Elements to Include

There are several key components that you can integrate into your financial records to reflect your brand’s personality:

- Logo: Including your company logo at the top of the document is the most straightforward way to add branding. It immediately signals the document’s source and reinforces your brand identity.

- Company Colors: Use your brand’s color scheme for headings, borders, or background accents. This ensures that the document reflects your company’s visual style and makes it instantly recognizable.

- Typography: Choose fonts that align with your company’s branding guidelines. Consistent use of specific fonts can help maintain a cohesive look across all communication, from emails to billing records.

- Contact Information: Include your website, phone number, and social media handles in a prominent place, ensuring clients have easy access to more of your company’s touchpoints.

- Brand Messaging: Consider adding a tagline or a brief note reflecting your company’s values or mission, especially if your business focuses on customer service or environmental sustainability. This helps to further personalize the document.

How to Integrate These Elements

Now that you know what elements to include, here’s how to seamlessly integrate them into your financial documents:

- Choose a Layout with Flexibility: Select a document layout that allows for easy customization. Many tools offer templates that you can modify by adding your logo, adjusting fonts, and changing colors.

- Consistency Across Documents: Make sure that all your billing records, contracts, and other official communications use the same branding elements. This creates a professional, cohesive image for your business.

- Keep It Simple: While it’s important to add branding, be mindful not to clutter the document. The focus should remain on the payment details and terms, so keep design elements balanced and simple.

By thoughtfully incorporating your branding into your financial documents, you enhance the professional image of your business and create a more personalized experience for your clients. Consistent branding also strengthens customer trust and makes your business stand out in a competitive market.

How to Track Payments Using Billing Documents

Managing payments effectively is a critical aspect of running a business. One way to streamline the payment process and ensure clarity is by using well-organized financial records. These records not only provide a clear breakdown of the services or products provided but also help track the status of payments, making it easier to follow up on overdue amounts and maintain healthy cash flow. By utilizing the right structure, you can easily monitor outstanding payments and avoid missed or delayed transactions.

Key Payment Tracking Elements

To effectively track payments through your financial records, include the following key elements:

- Payment Due Date: Clearly state the due date for payment. This serves as a reference for both parties and helps in tracking whether payments are made on time.

- Payment Status: Include a column or field to note the current status of the payment–whether it is “Paid,” “Pending,” or “Overdue.” This makes it easy to quickly assess which transactions need attention.

- Amount Paid: Track partial or full payments by including an area to record the exact amount paid. This is particularly useful for clients who make installment payments or partial settlements.

- Payment Method: Record how the payment was made, such as via bank transfer, credit card, or check. This helps to reconcile payments and avoid confusion.

- Transaction Reference: Include a field for a payment reference number or transaction ID, which helps to match payments with the corresponding records in your bank or payment system.

Creating a Payment Tracking Table

By organizing this information in a clear table format, you can easily monitor payments. Below is an example of a simple table layout to help track payments:

| Document Number | Due Date | Amount Due | Amount Paid | Payment Status | Payment Method | Transaction Reference | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 00123 | 10/15/2024 | $500.00 | $500.00 | Paid | Bank Transfer | TXN123456 | ||||||||||||||||||||||

| 00124 | 10/30/2024 | $350.00 | $0.00 | Pending |

| Billing Cycle | Service/Item | Amount Due | Payment Status | Payment Date | Transaction Reference |

|---|---|---|---|---|---|

| October 2024 | Monthly Subscription | $50.00 | Paid | 10/01/2024 | TXN987654 |

| November 2024 | Monthly Subscription | $50.00 | Pending | 11/01/2024 | Pending |

| December 2024 | Monthly Subscription | $50.00 | Pending | 12/01/2024 | Pending |

This table structure allows you to track the payment cycle and payment status for each recurring charge. Using this appro