How to Use a Bed and Breakfast Invoice Template for Efficient Billing

Running a small guest accommodation requires efficient management of finances, and one of the most crucial aspects of this is ensuring accurate billing. A well-structured financial document not only helps in tracking payments but also reflects professionalism and fosters trust with guests. Crafting such documents manually can be time-consuming, but having a pre-designed format can simplify this process significantly.

In this guide, we’ll explore how to create a clear and organized record of charges for your services. From adding guest details to ensuring proper tax calculations, every section plays a vital role in maintaining transparency. Whether you’re a newcomer or have been in the hospitality business for years, using a structured approach for financial documentation can save you both time and effort.

Learn how to streamline your billing system by choosing the right design, incorporating essential elements, and avoiding common errors that could affect your revenue management. With the right tools and knowledge, managing payments and providing guests with clear, professional statements becomes a hassle-free task.

What is a Billing Document for Small Lodging Services

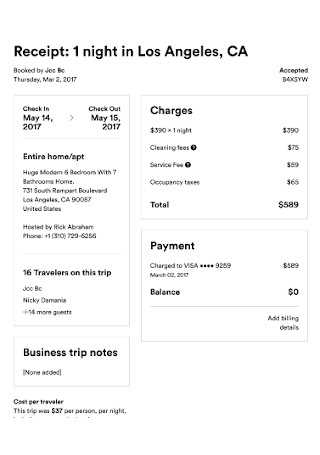

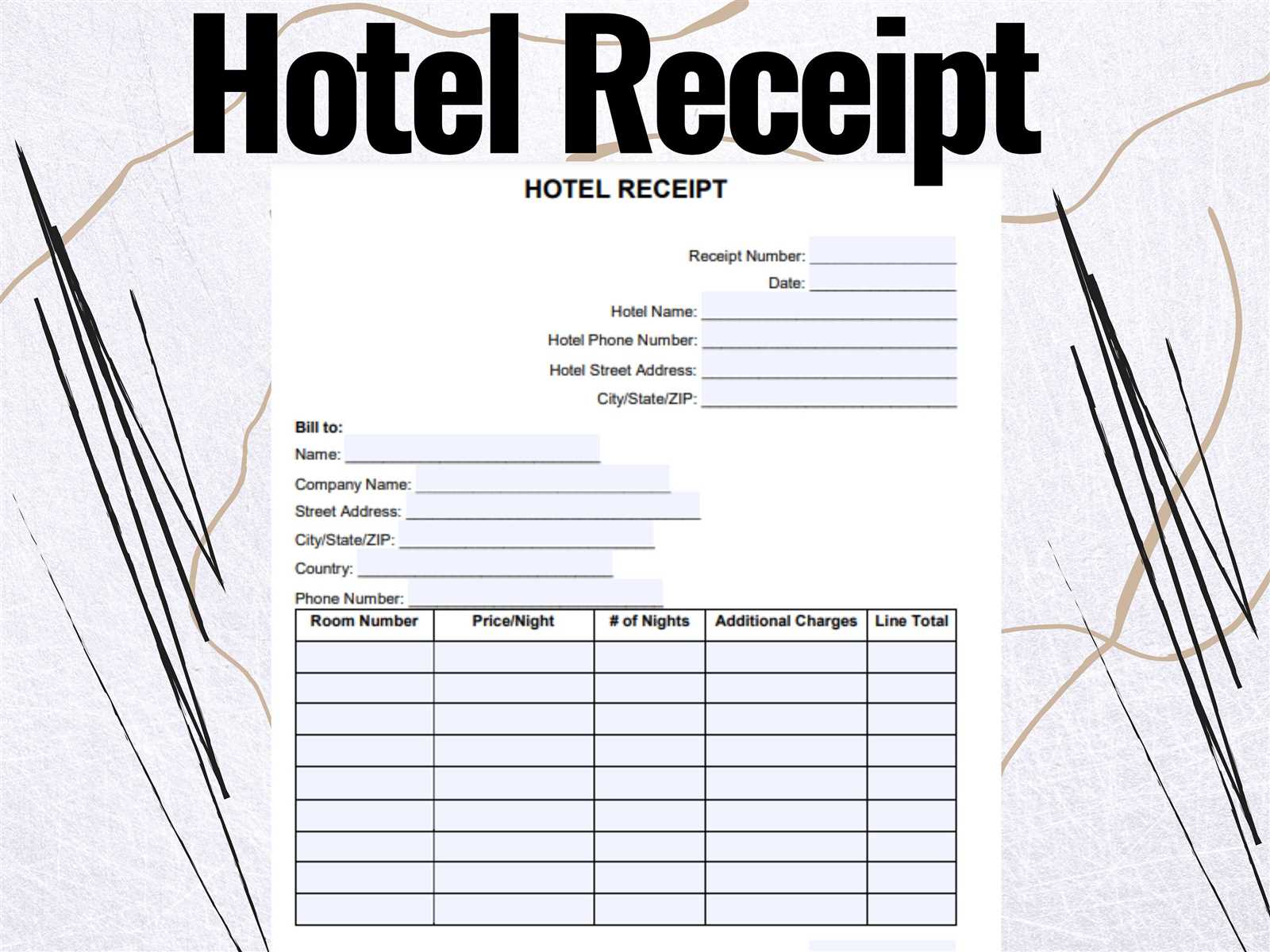

A well-structured document for tracking guest charges is essential for any small accommodation service. This financial record serves as an official summary of the stay, listing all fees and taxes, and providing both the guest and the business with a clear overview of the transaction. Such a document not only simplifies the payment process but also helps maintain professionalism and accuracy in financial dealings.

Typically, these documents include guest information, dates of stay, itemized charges, applicable taxes, and payment details. They are used for record-keeping, legal purposes, and as a formal request for payment. By using a consistent format, small lodging businesses can ensure that each transaction is documented correctly, minimizing errors and confusion.

Below is an example of a basic structure for such a financial record:

| Item | Description | Amount |

|---|---|---|

| Room Charge | Cost per night for a single room | $100 |

| Additional Services | Late check-out fee | $20 |

| Taxes | Applicable local tax rate | $12 |

| Total | Grand total for the stay | $132 |

This type of document not only ensures transparency between the host and the guest but also serves as a crucial tool for bookkeeping and financial planning.

Benefits of Using an Invoice Format

Utilizing a pre-designed format for documenting payments offers numerous advantages, particularly for small lodging businesses. By implementing a consistent, ready-made structure, hosts can streamline their financial processes, reduce errors, and save valuable time. Rather than starting from scratch with each new guest, having a standardized record ensures all necessary details are included and clearly presented.

One of the key benefits is improved organization. With a set structure in place, managing multiple transactions becomes more efficient. You can quickly access records, track payments, and ensure accuracy without having to manually create new documents each time. This level of consistency also enhances professionalism, as guests receive clear, well-organized statements that outline all charges transparently.

Another significant advantage is time savings. A customizable structure allows for quick updates, whether you need to change guest details, adjust pricing, or include special services. Instead of spending time formatting each document, you can focus on other aspects of your business, knowing that your financial records are both accurate and professional.

How to Customize Your Billing Document

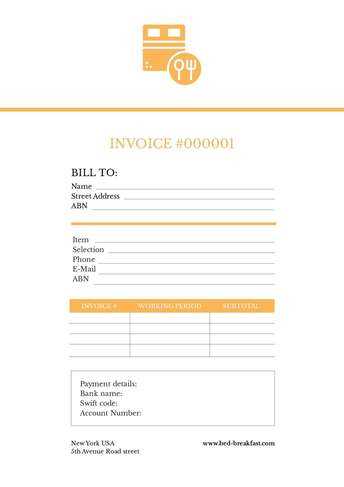

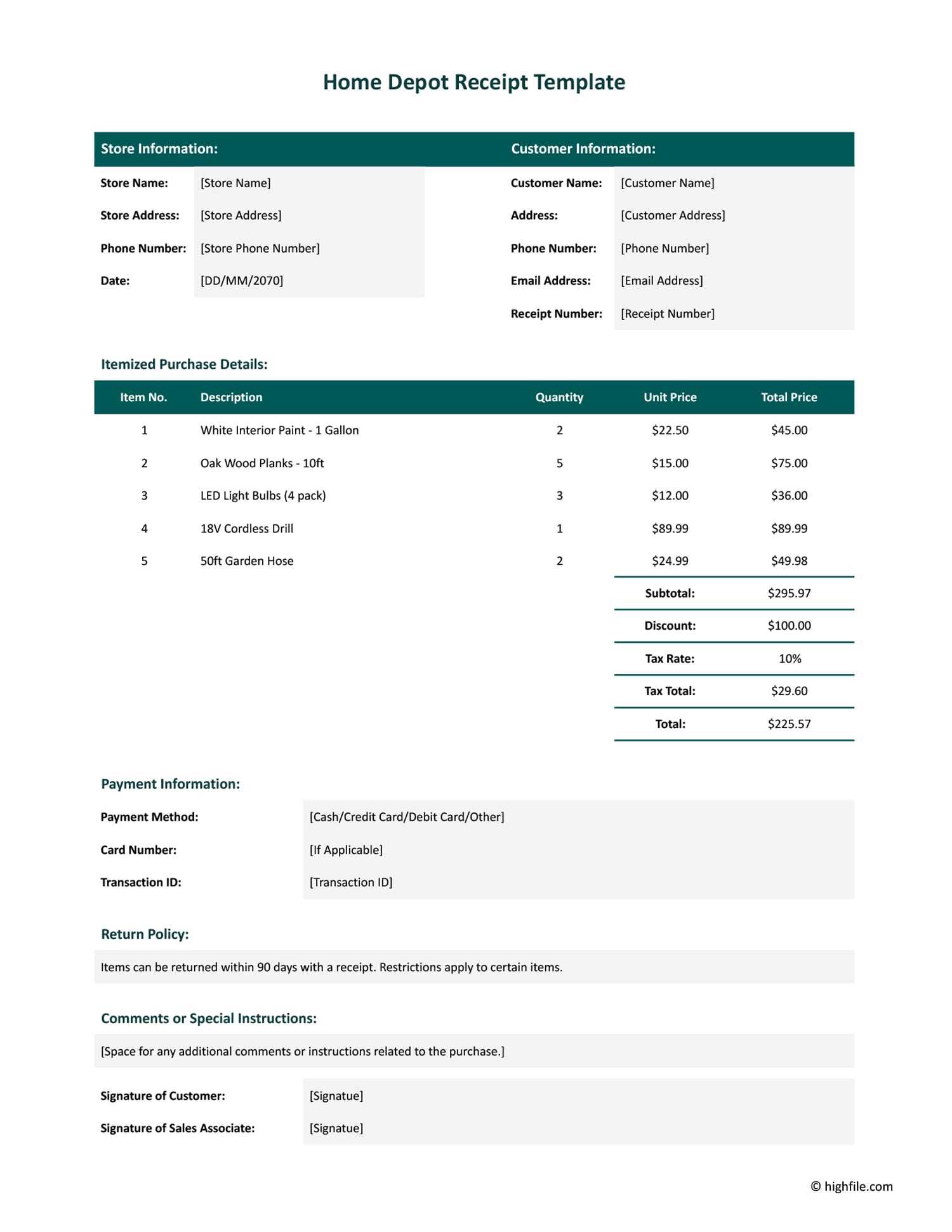

Personalizing a billing document for your small accommodation service can make the process more efficient and aligned with your brand. Customization allows you to adjust the layout, content, and features of the document, ensuring that it meets your specific needs and preferences. Whether you’re adding a logo, adjusting the pricing structure, or including additional services, a tailored document reflects both professionalism and attention to detail.

Here are some key elements to customize:

- Header Information: Include your business name, contact details, and logo. This will give the document a professional look and help clients easily reach you if needed.

- Guest Information: Ensure each record has the guest’s full name, contact information, and the dates of their stay. This helps avoid confusion and ensures accuracy.

- Itemized Charges: List all charges separately, including room rate, additional services, taxes, and fees. Adjust the categories as necessary based on your offerings.

- Payment Details: Include payment methods, due dates, and any applicable terms, such as early payment discounts or late fees.

Additionally, it’s important to ensure that the layout is easy to read and professionally designed. You can change fonts, colors, and spacing to match your branding and create a visually appealing document.

Once the document is customized, you can save it as a reusable file, ensuring you only need to update specific details for each new guest or transaction. This flexibility saves time and reduces errors while maintaining consistency in your billing process.

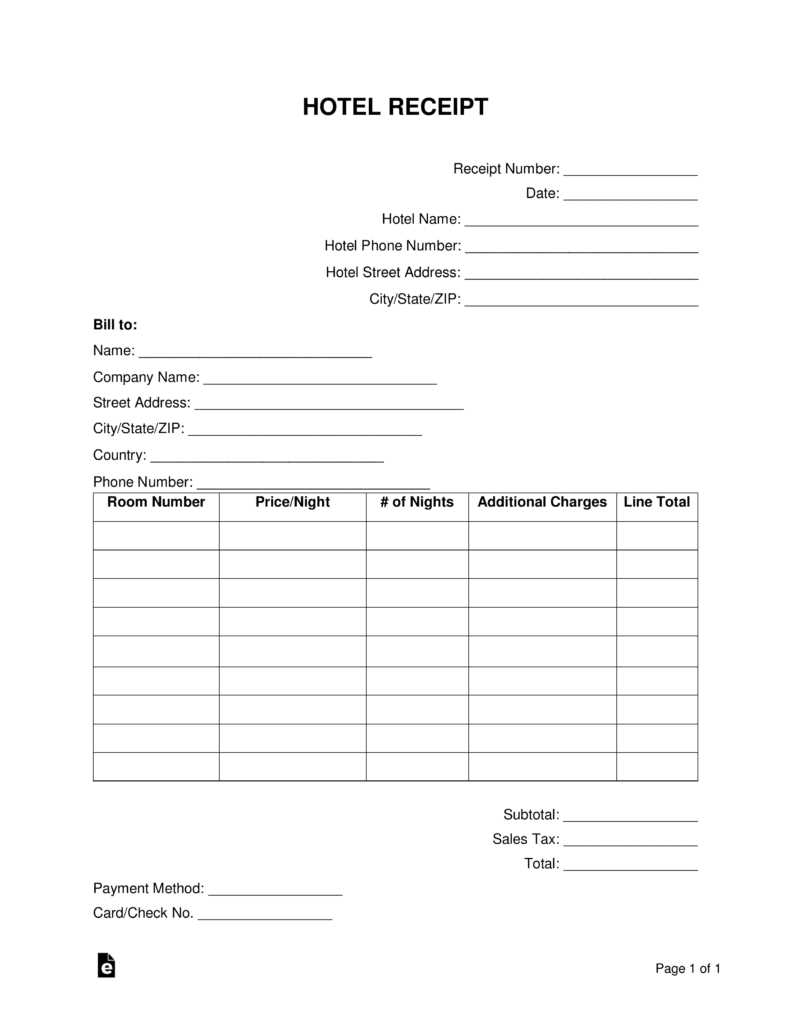

Essential Information for Lodging Billing Documents

For a billing record to be clear, accurate, and professional, it needs to contain specific details that both the guest and the host can reference easily. Including the right information ensures transparency and helps avoid misunderstandings about charges. The following elements are crucial when creating a financial record for guests at a small lodging establishment.

Guest and Stay Details

The first section should include the guest’s full name, contact details, and the dates of their stay. This basic information allows you to easily identify each transaction and ensures the record is specific to that guest. Additionally, you may include any special requests or notes related to the guest’s stay, such as early check-in or late check-out times.

Itemized Charges and Fees

Next, you need to list all services provided and the associated costs. Each charge should be broken down into individual items, such as room rates, additional services, taxes, and any extra fees (e.g., cleaning, late check-out). This breakdown helps avoid confusion and gives the guest a clear understanding of what they are being billed for.

Some important items to include are:

- Room Rate: The nightly cost or total stay rate, depending on how your pricing structure works.

- Additional Services: Charges for extras like meals, transportation, or special accommodations.

- Taxes: Local or national tax percentages and the total tax amount added to the charges.

- Discounts: Any applicable discounts, such as for early booking or long stays.

By clearly outlining these charges, you ensure that both parties understand the financial terms of the stay and reduce the likelihood of disputes.

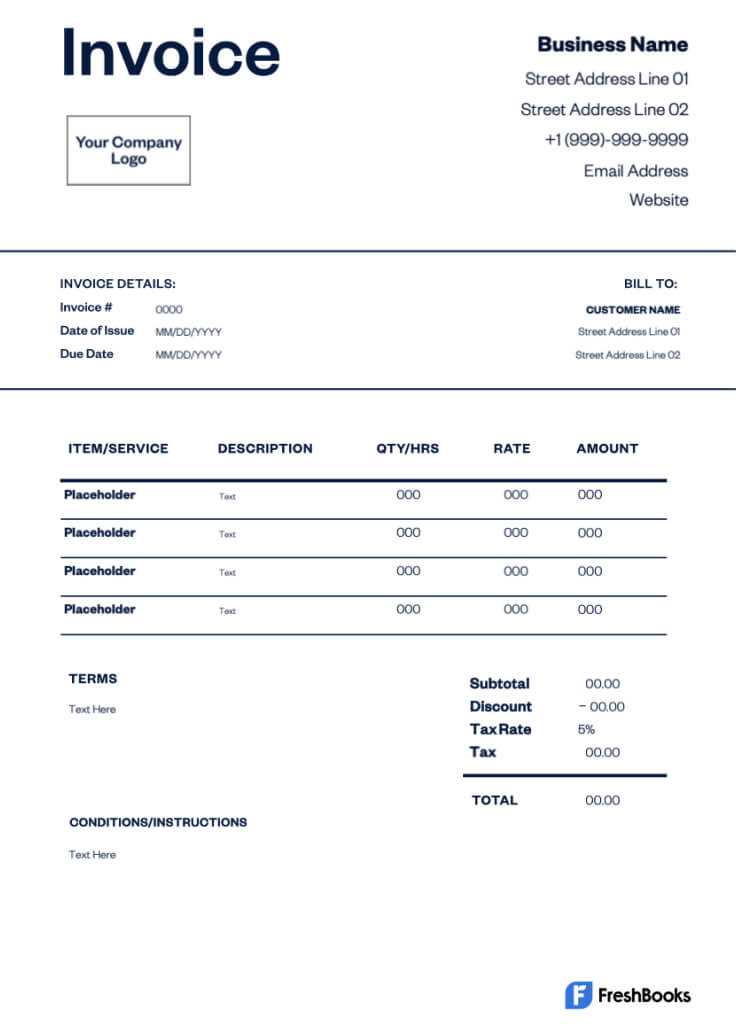

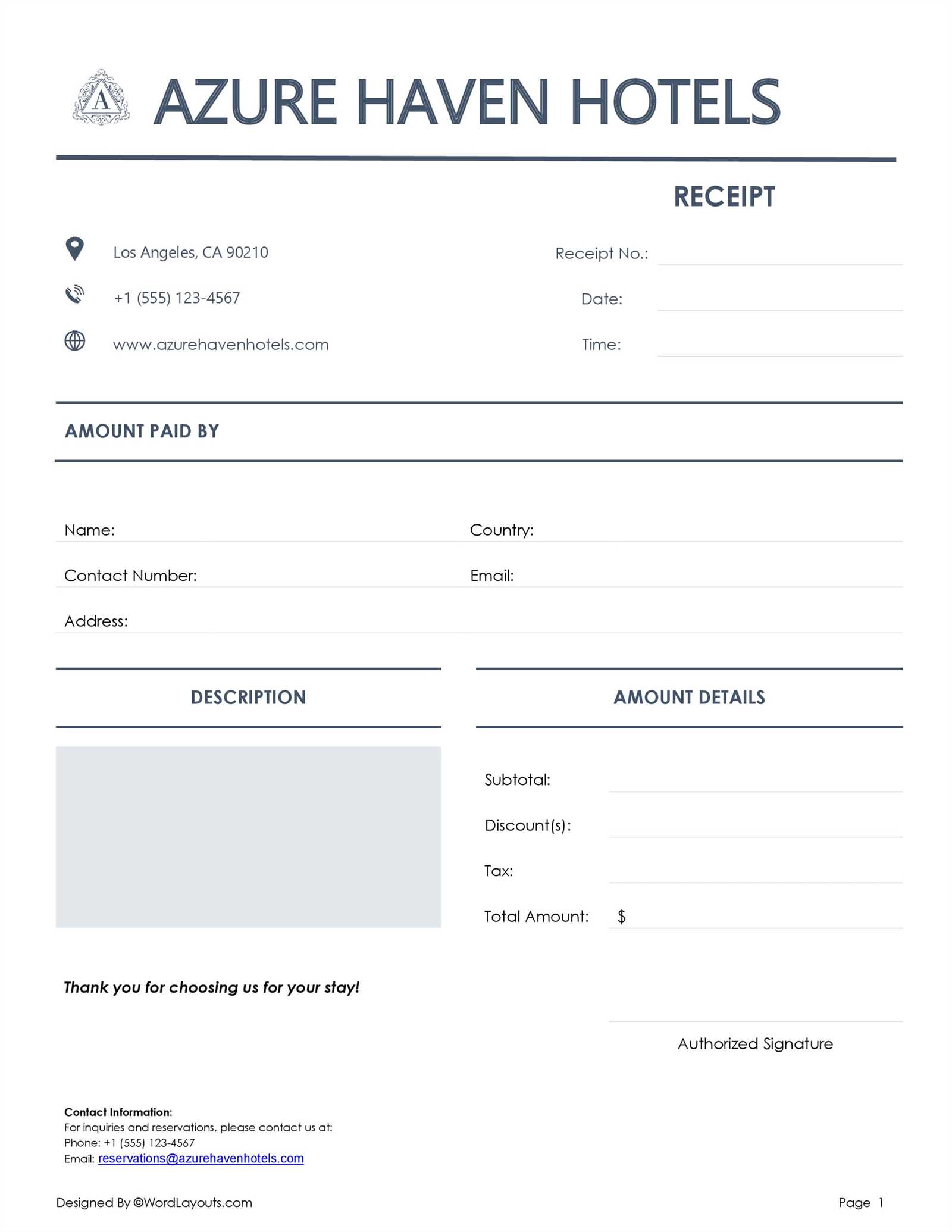

Choosing the Right Format for Your Business

Selecting the right format for your billing documents is essential for ensuring consistency, accuracy, and professionalism in your financial processes. With various options available, it is important to choose one that aligns with the needs of your small lodging business, whether you’re offering simple room rates or a variety of additional services. The right choice can save you time, improve guest satisfaction, and help streamline your operations.

Here are a few key factors to consider when choosing a format:

- Ease of Use: Look for a format that is simple to fill out and doesn’t require complex software. An intuitive design helps you quickly add or adjust guest information, charges, and dates.

- Customization Options: A flexible format allows you to easily modify the document to fit your specific needs. You should be able to add or remove fields, adjust pricing structures, and incorporate your branding, such as a logo and color scheme.

- Clarity: The format should be clear and easy to read, both for you and your guests. A well-organized layout with distinct sections for guest details, services, and payment terms will minimize confusion and enhance professionalism.

- Compatibility: Ensure the format is compatible with the tools you use, whether it’s a word processor, spreadsheet software, or an accounting program. This will allow for quick updates and easy record-keeping.

When selecting a format, make sure it suits your business model and addresses the unique needs of your clientele. A customized, easy-to-use billing document can greatly enhance the experience for both you and your guests.

How to Include Tax Information Correctly

Incorporating tax details accurately in your financial documents is essential for compliance and transparency. Tax rates vary depending on location, service type, and applicable laws, making it crucial to include the correct information. Ensuring that taxes are calculated and presented clearly not only prevents legal issues but also helps build trust with your guests.

Key Steps to Include Tax Information

To ensure you’re including tax information properly, follow these key steps:

- Identify Applicable Tax Rates: Different regions have different tax rates for lodging services, so make sure you know the local, state, or national taxes that apply to your charges. You may need to apply separate tax rates for services like food, room charges, and additional amenities.

- Show Separate Tax Amounts: It’s best to display the tax separately from the main charges. This provides clarity and avoids confusion for the guest. Make sure the tax is listed as a distinct line item in the document.

- Include Total Tax Amount: After listing the applicable taxes, be sure to provide the total tax amount, showing the guest exactly how much tax is being added to their overall charges.

- Clearly State Tax Jurisdictions: If multiple taxes apply from different jurisdictions, make sure each tax type is identified clearly. For example, you might have a city tax and a state tax, and each should be listed separately with its own rate.

Example of Correct Tax Information

Here’s how tax information could be presented:

- Room Charge: $100

- City Tax (8%): $8

- State Tax (5%): $5

- Total Tax: $13

- Total Due: $113

By following these guidelines, you can ensure that your guests clearly understand the taxes they are being charged and maintain compliance with tax laws.

Common Mistakes in Lodging Billing Documents

When preparing financial records for your guests, small errors can lead to confusion, disputes, or even financial loss. It’s important to be aware of common mistakes so that you can avoid them and ensure accurate, professional documents. From incorrect calculations to missing details, these small oversights can affect both the clarity of your billing process and your relationship with customers.

Common Errors to Avoid

Here are some of the most frequent mistakes people make when preparing billing documents for their accommodations:

- Incorrect Tax Calculation: One of the most common mistakes is applying the wrong tax rate or failing to add taxes altogether. Always double-check local tax rates and make sure they are applied to the appropriate charges.

- Omitting Important Details: Missing guest information or stay dates can create confusion. Ensure that the guest’s full name, contact details, check-in and check-out dates are clearly included.

- Failure to Itemize Charges: Consolidating charges into one lump sum can leave guests unsure about what they are being charged for. Always list charges separately, such as room fees, additional services, taxes, and fees, so the total amount is clear.

- Not Including Payment Terms: If payment due dates, methods, or any applicable late fees aren’t clearly stated, guests may become confused about the expectations and deadlines. Be explicit about payment terms and deadlines.

- Unclear or Unreadable Formatting: A cluttered, poorly formatted document can be difficult for guests to understand. Keep your layout clean and professional, with clear headings, sections, and easy-to-read fonts.

How to Avoid These Mistakes

To minimize errors, make sure your documents are regularly reviewed for accuracy. Double-check all numbers, confirm tax rates, and ensure that all sections are completed properly. By developing a consistent and thorough approach to preparing your financial records, you’ll reduce the risk of errors and maintain professionalism in your transactions.

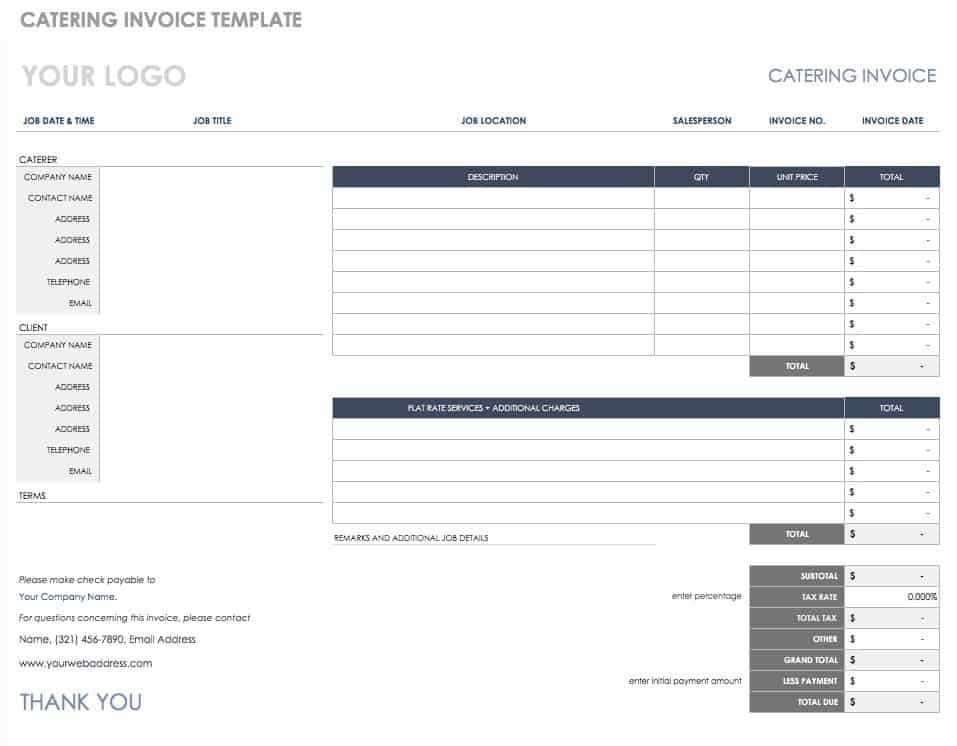

Design Tips for an Attractive Billing Document

The design of your financial record plays a significant role in how professional and clear your documents appear to guests. A well-designed document is not only easier to read but also reflects your business’s attention to detail and commitment to customer service. Creating an appealing and organized layout can enhance guest satisfaction and help build a positive reputation for your small lodging business.

Here are some design tips to make your financial documents more attractive and effective:

- Use a Clean and Simple Layout: Avoid clutter. A clear, organized structure helps guests understand the charges quickly. Keep important information like guest details, services, and totals in separate sections, and use spacing to make the document easier to scan.

- Incorporate Your Branding: Include your logo, business name, and brand colors to create a cohesive look. This reinforces your brand identity and adds a professional touch to the document.

- Choose Readable Fonts: Select easy-to-read fonts for all text. Stick to two or three complementary fonts–one for headings and another for the body text. Avoid using overly decorative or small fonts that may make the document hard to read.

- Highlight Key Information: Use bold or larger font sizes for important details like the total amount due, payment terms, or due dates. This helps guests easily identify critical information at a glance.

- Incorporate Subtle Design Elements: You can add borders, shading, or light background patterns to give the document a polished appearance. However, keep it subtle–too much decoration can distract from the essential details.

- Ensure Consistent Alignment: Align text and numbers properly, particularly when it comes to charges and totals. Consistency in alignment improves the overall readability and structure of the document.

By applying these design principles, you can create financial records that are not only functional but also visually appealing, ultimately contributing to a positive guest experience and reinforcing the professionalism of your business.

How to Add Payment Terms on Billing Documents

Including clear payment terms in your financial records is essential to avoid confusion and ensure timely payments. Well-defined terms set expectations for your guests, outlining when and how payment should be made, as well as any penalties for late payment. By providing these details upfront, you reduce the risk of misunderstandings and maintain a smooth transaction process.

Here’s how to properly add payment terms to your billing documents:

- Specify Payment Due Date: Clearly state when the payment is expected. For example, you could include terms such as “Payment due within 30 days of check-out” or “Full payment required upon check-in.” Ensure the due date is prominently placed to avoid any confusion.

- Indicate Accepted Payment Methods: List the methods of payment you accept, such as credit cards, bank transfers, or cash. This ensures that guests know their options and can make arrangements ahead of time.

- Late Payment Penalties: If you charge interest or a fee for late payments, include this information in your terms. Be clear about how much will be charged and when it will apply, for example, “A late fee of $10 will be added for payments received after 30 days.” This helps incentivize timely payments.

- Discounts for Early Payment: If you offer any discounts for early payment, make sure to specify this in the terms. For example, “A 5% discount will apply if payment is made within 10 days of check-out.” This encourages quicker settlement of bills.

- Clarify Currency and Amount: Ensure that the total due is listed in the correct currency and that all charges are specified clearly. If the amount is subject to change (e.g., if exchange rates fluctuate), mention this as well.

By adding these elements to your billing documents, you ensure that guests are fully informed about payment expectations, making the process smoother for both parties. Clear payment terms help improve cash flow, reduce disputes, and maintain a professional standard for your business.

Best Practices for Sending Billing Documents

Sending financial records promptly and professionally is crucial for maintaining good relations with your guests and ensuring timely payments. The way you deliver these documents can have a significant impact on how your business is perceived and can also influence payment speed. Following best practices in communication and delivery helps reduce errors and delays, while also enhancing your reputation for professionalism.

Here are some key best practices to follow when sending billing documents:

- Send Documents Promptly: Aim to send the document as soon as possible after the guest checks out. This reduces the time between the service provided and the payment expected, encouraging quicker settlement of the bill.

- Use Clear Communication: Accompany the document with a brief, polite message that reminds the guest of the payment due and provides any necessary instructions for payment. Be clear about the due date and payment methods.

- Double-Check for Accuracy: Before sending the document, carefully review all details to ensure accuracy. Verify guest information, dates, charges, and tax calculations. Mistakes can lead to confusion and delays in payment.

- Offer Multiple Payment Methods: Make it easy for guests to pay by offering a variety of payment options, such as credit cards, bank transfers, or online payment systems. The more options you provide, the more likely you are to receive timely payments.

- Follow Up If Necessary: If the payment due date has passed, send a polite reminder. A gentle follow-up email can encourage guests to take care of their outstanding balances without creating any tension.

Below is an example of how a billing document might look in a simple format:

| Item | Description | Amount |

|---|---|---|

| Room Charge | Cost for a single room, per night | $100 |

| Additional Services | Late check-out fee | $20 |

| Taxes | Applicable local tax rate | $12 |

| Total | Grand total for the stay | $132 |

By following these best practices, you ensure that your billing process is smooth, efficient, and professional. This can lead to faster payments, better relationships with guests, and fewer misunderstandings.

Tracking Payments with Billing Documents

Efficiently tracking payments is crucial for maintaining smooth financial operations and ensuring timely settlements. By using structured financial records, you can easily monitor outstanding balances, record received payments, and keep track of overdue amounts. This process not only helps with accurate accounting but also improves cash flow management for your business.

Here’s how you can track payments effectively using a clear, organized format:

- Include Payment Status: Always mark whether a payment has been received, is pending, or is overdue. This simple addition helps you quickly see the current status of each transaction.

- Provide a Payment History: For each guest, include a section that tracks payments made and any outstanding amounts. This history can be updated regularly to reflect the most accurate status of a guest’s balance.

- Use Payment Reference Numbers: Assign unique reference numbers to each transaction. This allows you to match payments with specific billing records, especially if payments are made through different channels (e.g., bank transfers, credit cards).

- Record Payment Dates: Ensure that the payment date is noted on your documents. This helps you monitor deadlines and follow up on overdue payments effectively.

Here is an example of how payment tracking might look within a simple document:

| Item | Description | Amount | Payment Status | Payment Date | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Room Charge | Cost for a single room, per night | $100 | Paid | October 1, 2024 | ||||||||||||||||||||||||||||||||||||||||||

| Additional Services | Late check-out fee | $20 | Pending | – | ||||||||||||||||||||||||||||||||||||||||||

| Taxes | Applicable local tax rate | $12 | Paid | October 1, 2024 | ||||||||||||||||||||||||||||||||||||||||||

| Total | Grand total for the stay

How to Handle Refunds on Billing DocumentsRefunds are an inevitable part of running a business that deals with customer payments. Whether it’s due to cancellations, overpayments, or other reasons, handling refunds correctly is crucial for maintaining good customer relations and accurate financial records. It’s important to ensure that all refunded amounts are clearly documented in your records to prevent confusion and to maintain transparency with your guests. When issuing refunds, make sure to follow these best practices:

Here is an example of how a refund can be documented within a billing document:

By carefully documenting refunds, you help ensure clarity for both your business and your guests. It also makes it easier to track financial changes and maintain accurate records for accounting and tax purposes. Integrating Payment Methods into Your Billing DocumentsIntegrating various payment options into your financial records provides your guests with the flexibility to pay through their preferred channels. By clearly outlining accepted methods, you make the payment process easier, faster, and more efficient, reducing any potential delays. Clear instructions and options for payment within your billing documents can significantly enhance customer experience and encourage quicker settlements. Here are a few strategies to effectively incorporate payment methods into your financial records:

By incorporating these practices, you create a seamless payment experience for your guests and ensure that payments are processed efficiently. Offering multiple payment options within your billing documents makes it easier for guests to pay on time, which can ultimately improve your cash flow and reduce administrative work. How to Keep Billing Records Organized

Staying organized with your financial records is crucial for effective management, accurate accounting, and efficient follow-ups. Properly keeping track of each transaction, payment status, and related details ensures that you can quickly retrieve information when needed, and it also simplifies tax filing and audit processes. Developing a clear and structured method for organizing your records can save you time and reduce errors. Here are some tips to help you keep your records well-organized:

By implementing these methods, you can create a well-organized system that simplifies your financial management. Keeping your records organized not only saves time and reduces stress but also ensures that your business runs smoothly and remains compliant with tax regulations. Automating Billing for EfficiencyAutomating the billing process can significantly enhance operational efficiency, reduce human error, and save valuable time. By streamlining the creation and delivery of financial documents, businesses can focus more on customer satisfaction and less on administrative tasks. Automation tools enable you to generate, send, and track payments with minimal manual input, improving both accuracy and speed. Here are several key benefits and methods for automating your billing process: Benefits of Automation

How to Implement Automation

By automating your billing processes, you can reduce administrative workload, improve accuracy, and enhance the overall efficiency of your business. This system not only saves you time but also fosters stronger customer relationships by offering a streamlined and professional payment experience. Legal Considerations for Billing Documents

When creating financial records for your business, it’s essential to comply with local laws and regulations to avoid legal complications. Properly documenting all transactions not only ensures transparency but also helps protect your business in case of disputes or audits. There are various legal aspects to consider, from including the necessary details to adhering to tax regulations. Being aware of these legal requirements will help you maintain professionalism and stay compliant. Here are some key legal considerations to keep in mind when preparing your billing records:

Below is an example of how some of the key legal information should be presented on your billing documents:

By ensuring that you meet these legal requirements, you will create a solid foundation for your business’s financial operations and safeguard against potential issues down the line. Keeping accurate, legal records is not only a best practice but a crucial step in protecting your business and its reputation. |