Download Free Bathroom Remodel Invoice Template for Contractors and Homeowners

When undertaking a home renovation project, clear and professional financial documentation is essential. Whether you’re a contractor handling a large-scale job or a homeowner managing a smaller update, ensuring that payments are recorded accurately and efficiently can save time and prevent misunderstandings. Having a well-organized billing structure helps establish trust and transparency between both parties involved.

Proper documentation includes detailing work completed, materials used, and any additional charges that may apply. With the right format, managing payments and keeping track of expenses becomes a straightforward task, reducing the likelihood of disputes. A streamlined approach not only makes the process more efficient but also gives a polished and professional appearance to any project.

By using a pre-designed structure, you can quickly fill in the necessary information and avoid missing critical details. This can be particularly helpful for businesses looking to maintain consistency across multiple projects, ensuring that all the relevant terms are covered in a clear and concise manner. An accurate record also serves as protection should any questions arise later on.

Why You Need a Home Renovation Billing Document

Accurate financial documentation is a cornerstone of any home improvement project. When it comes to managing costs and ensuring that both parties are on the same page, a well-structured record of work completed and payments due is essential. This document serves as proof of the services provided and is a key reference for both the service provider and the homeowner throughout the payment process.

Clarity and Transparency

One of the main reasons to have a structured financial record is to provide clarity. By detailing each task performed, materials used, and total charges, it removes any ambiguity about the scope of work and cost expectations. Both parties are able to reference a clear and organized summary, which minimizes the risk of misunderstandings and disputes.

Legal Protection and Record Keeping

Another important reason for using a formal record is the legal protection it offers. In the event of any disagreements or the need for future reference, having a detailed statement of work can help protect both the contractor and homeowner. It serves as a formal agreement that outlines the terms, payment schedules, and conditions, making it easier to resolve any issues that may arise later on.

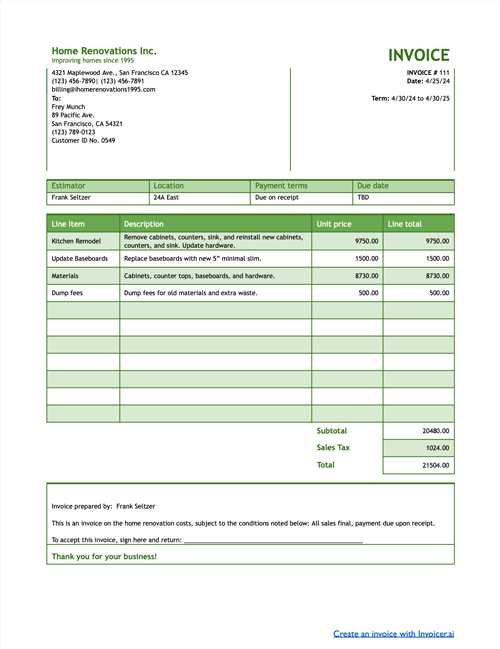

Key Elements of a Home Renovation Billing Statement

For any renovation project, an effective billing document includes several essential components to ensure clear communication between the contractor and the homeowner. These elements not only help in tracking costs but also provide a professional and transparent record of the work completed. A well-organized statement offers both the client and the service provider a reference point for payment and project details.

At a minimum, the document should include the project details, including a breakdown of the work performed, materials used, and the corresponding costs. Payment terms, deadlines, and any applicable taxes or additional fees must also be clearly stated. This clarity helps prevent disputes and ensures that both parties have the same understanding of the financial obligations.

Additionally, including a unique identification number for each document and the contact details of both parties provides further organization and ease of reference. A comprehensive and detailed billing document establishes professionalism and can protect all parties involved in case of future issues or audits.

How to Create a Renovation Billing Statement

Creating an effective financial document for a home improvement project involves organizing all relevant details in a clear and concise manner. The goal is to provide both the client and the service provider with an accurate record of work completed, materials used, and the corresponding costs. A well-prepared billing statement can make the payment process smoother and help avoid potential misunderstandings between the parties involved.

Step 1: Include Project Information

Start by clearly stating the scope of work, including a description of the tasks completed, the materials used, and the corresponding costs. This helps the client understand what they are paying for and gives them a detailed breakdown of charges. For transparency, include any additional services or extra charges that may apply during the project. Providing a precise itemization of these aspects builds trust and keeps both parties informed.

Step 2: Outline Payment Terms

Next, clearly define the payment terms in your document. Specify the total amount due, payment deadlines, and any payment schedules (e.g., deposit, final payment). If there are penalties for late payments or any discounts for early settlement, be sure to include those details as well. Having a clear payment structure ensures that both parties understand their financial commitments and deadlines, reducing the risk of confusion later on.

Benefits of Using a Structured Billing Document

Utilizing a pre-designed structure for financial records in home improvement projects offers numerous advantages. It simplifies the process of creating detailed, professional-looking documents, reducing the time and effort spent on each task. This streamlined approach not only enhances efficiency but also ensures consistency across various projects, creating a sense of reliability and organization.

Time-Saving Efficiency

One of the major benefits of using a pre-made structure is the time saved in creating detailed financial records. By using a consistent format, you can quickly fill in the relevant details without having to start from scratch each time. This allows contractors and homeowners to focus on other important aspects of the project. Key advantages include:

- Quickly generate accurate records with minimal effort

- Avoid mistakes from manual formatting or inconsistent styles

- Reduce administrative workload significantly

Professionalism and Consistency

Another key benefit is the ability to maintain a professional image. A structured document gives your financial records a polished look, increasing confidence among clients. Consistency in billing also helps establish a trustworthy reputation. By using a uniform format, clients know exactly what to expect each time. Some of the benefits are:

- Clear, organized presentation of charges

- Reinforced professional image with every project

- Enhanced customer satisfaction with well-documented costs

Essential Information for Home Renovation Billing Statements

To ensure accurate and professional documentation for any home improvement project, certain key details must always be included in the financial records. These elements provide clarity, prevent confusion, and ensure that both the contractor and homeowner are on the same page when it comes to costs and payments. Properly organized information helps establish trust and provides a solid reference in case of future inquiries.

Project Details and Itemization

The first section of a well-organized financial statement should detail the work performed. This includes a clear description of the tasks completed, materials used, and labor hours, all itemized with their corresponding costs. By breaking down the charges, both parties can easily understand what they are being charged for. Itemization also helps identify any additional costs that may have arisen during the project.

Payment Terms and Deadlines

Equally important is outlining the payment schedule and any applicable terms. Be sure to specify the total amount due, the due dates for payments, and any penalties for late payments. If payments are to be made in installments, clarify the amounts due at each stage. Clear payment terms reduce the risk of delays and misunderstandings, helping ensure a smooth financial transaction between both parties.

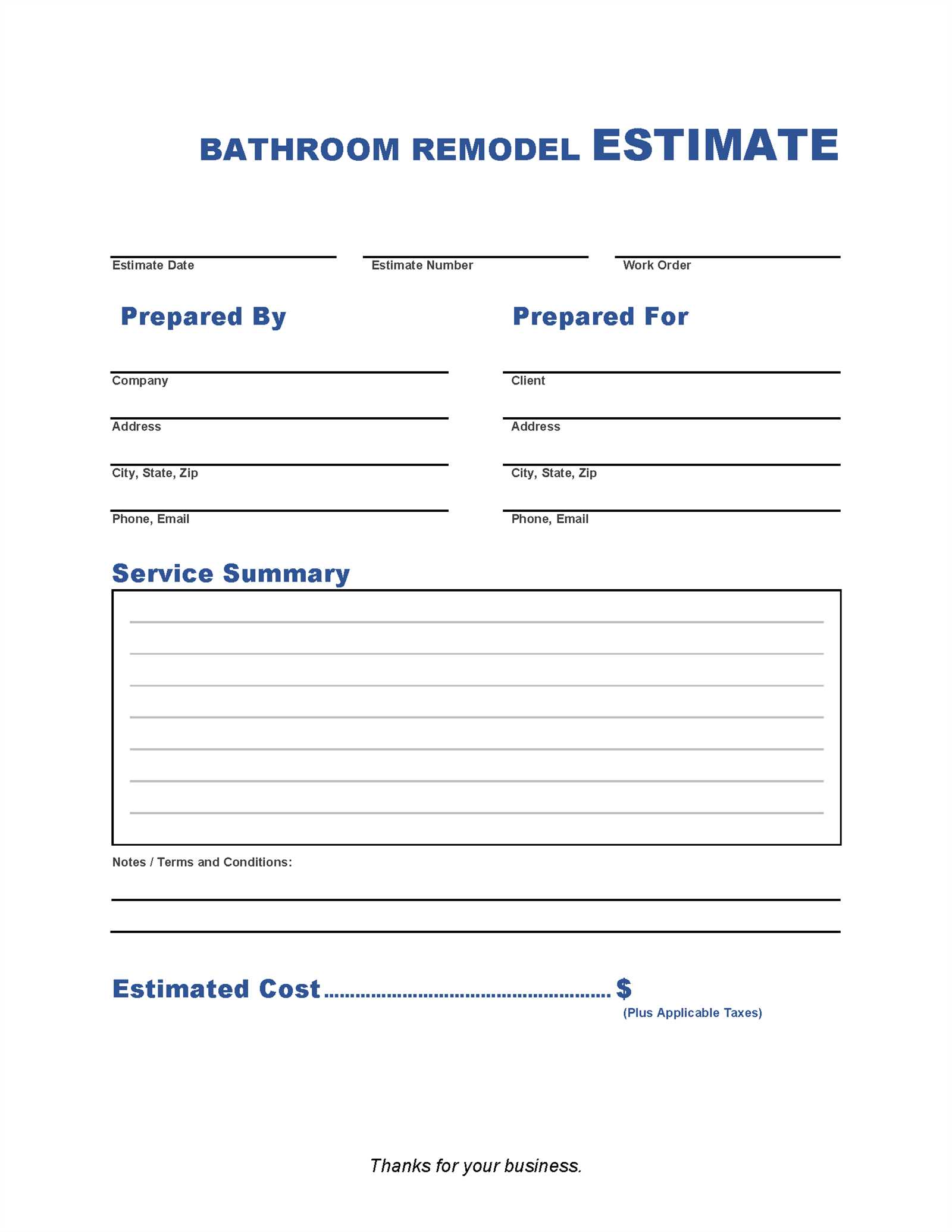

How to Customize Your Billing Document

Customizing your financial record for a home improvement project ensures it fits your specific needs and project details. By adjusting the structure and design, you can make the document more relevant to the particular work you’ve completed and present it in a professional manner. A personalized billing statement helps ensure all necessary details are included while maintaining consistency across different projects.

Step 1: Adjust the Layout

The first step in customization is to modify the layout according to your preferences. A clean, organized design makes the document easier to read and ensures that both parties can quickly find relevant information. Key layout elements to consider include:

- Company or personal branding (logo, contact information)

- Clear section headings for different categories (work performed, materials used, payment terms)

- A consistent and simple font that enhances readability

Step 2: Add Specific Project Details

Ensure the document includes all pertinent details unique to the project. This might include job-specific descriptions, individual charges, or additional fees. Tailoring the content allows you to provide a more accurate breakdown of services, which adds transparency and helps prevent confusion. Make sure to include:

- A breakdown of all labor and materials costs

- Special terms, such as warranties or guarantees

- Customized payment schedules or milestones for larger projects

Common Mistakes in Home Renovation Billing Documents

When creating financial records for home improvement projects, it’s easy to overlook certain details, which can lead to confusion, delays, or even disputes. Even a small mistake in documentation can cause frustration for both the contractor and the client. Understanding the most common errors and how to avoid them is crucial for ensuring a smooth payment process and maintaining professionalism throughout the project.

Incomplete or Vague Descriptions

One of the most frequent mistakes is providing incomplete or vague descriptions of the work completed. When the details are unclear, the client may not fully understand what they are being charged for. Be specific about the tasks performed, materials used, and labor costs. A detailed breakdown helps build trust and ensures both parties are on the same page. Avoid general phrases like “work

Tips for Accurate Billing in Home Renovations

Ensuring accuracy in financial records for any home improvement project is essential for maintaining professionalism and building trust with clients. Small errors can lead to misunderstandings, delayed payments, or even disputes. By following a few simple tips, you can make the billing process more precise and transparent, helping to avoid common pitfalls and ensure smooth transactions.

1. Double-Check All Calculations

One of the most important aspects of accurate billing is ensuring that all calculations are correct. Whether it’s the cost of materials, labor hours, or additional services, every detail should be verified before finalizing the document. To avoid errors:

- Use a calculator or software to ensure numbers are accurate

- Cross-check unit prices and quantities for each material

- Ensure that labor rates and hours worked match the agreement

2. Provide Clear and Detailed Descriptions

Ambiguous or incomplete descriptions can lead to confusion. Always be specific about what services were provided, what materials were used, and how much time was spent on each task. This transparency helps the client understand exactly what they are paying for and reduces the risk of disputes later on. Key points to consider include:

- Detail each service performed with specific terms

- List materials used, including type, quantity, and cost

- Include labor charges with the number of hours worked

How to Organize Your Billing Details

Proper organization of billing details is crucial for maintaining clarity and ensuring that both you and your client are on the same page throughout the financial transaction. A well-structured document not only improves readability but also helps prevent misunderstandings and discrepancies. By following a clear organizational format, you can keep track of all charges while presenting a professional and detailed financial summary.

1. Start with Basic Information

At the top of the document, include essential contact details and project-specific information. This serves as the foundation for your record and ensures that both parties know who to contact for clarification or further inquiries. Key details to include are:

- Your name or business name and contact information

- Client’s name and contact details

- Project title or reference number

- Invoice number and date

2. Break Down the Work and Costs

Next, organize the charges into clear, understandable categories. Each section should outline specific tasks, materials, and labor associated with the project. Organizing the details in this manner allows the client to easily review what they are paying for. Consider breaking the details down into:

- Work performed: Provide a description of each task completed

- Materials used: List the materials, quantities, and individual costs

- Labor costs: Detail the hours worked and hourly rate

- Additional charges: Include any extra fees, taxes, or discounts

3. Clarify Payment Terms and Deadlines

Clearly outline payment terms and deadlines to ensure both parties are aligned on expectations. This section should cover:

- Total amount due

- Payment methods accepted

- Due date and any installment plans if applicable

- Late fees or penalties for overdue payments

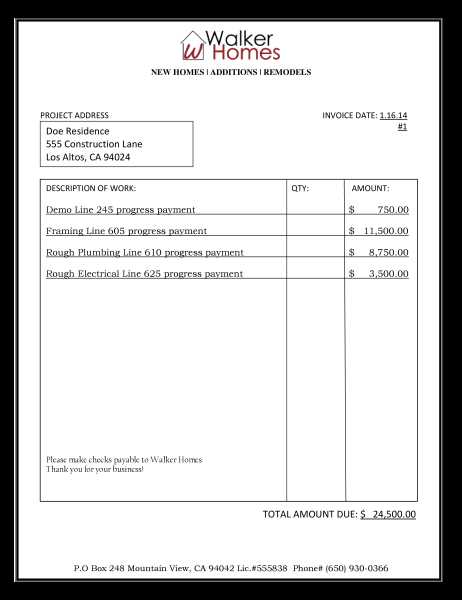

What to Include in Payment Terms

Clearly defined payment terms are essential for ensuring that both parties involved in a home improvement project have the same understanding of financial expectations. Properly outlining these terms can help avoid confusion, delays, and disputes. When drafting the payment section of your financial document, it’s important to include specific details regarding when and how payments are to be made, as well as any penalties or incentives related to the payment process.

1. Total Amount Due

Start by specifying the total amount the client is expected to pay for the work completed. This includes all costs, such as labor, materials, and any additional services. The total should be clear and easily identifiable to avoid any confusion. Ensure that the client understands the full scope of charges before agreeing to the payment terms.

2. Payment Schedule

For larger projects, it’s important to outline a payment schedule. If payments are to be made in installments, specify the amount due at each stage and when the payment is expected. This can be based on project milestones or specific dates. For example:

- Deposit due before work begins

- Progress payment due upon completion of certain tasks

- Final payment due upon project completion

3. Accepted Payment Methods

Clearly state the methods of payment you accept, whether it be bank transfers, checks, credit cards, or online payments. Providing multiple payment options can help facilitate quicker transactions and ensure the client can pay in the most convenient way.

4. Late Fees or Penalties

It’s crucial to include any late fees or penalties for overdue payments. Be sure to specify the percentage or flat fee that will be charged if the client fails to make the payment by the agreed deadline. This helps incentivize timely payment and protects you in case of delays. For example:

- A 2% late fee applied for every week the payment is overdue

- A fixed penalty charge if the payment is not received within 30 days

5. Early Payment Discounts

If you wish to offer a discount for early payments, outline this clearly as well. Offering a small incentive can motivate clients to pay ahead of schedule. For instance:

- 5% discount if the payment is made within 7 days

Clearly outlined payment terms protect both parties and help ensure a smooth financial transaction for your project.

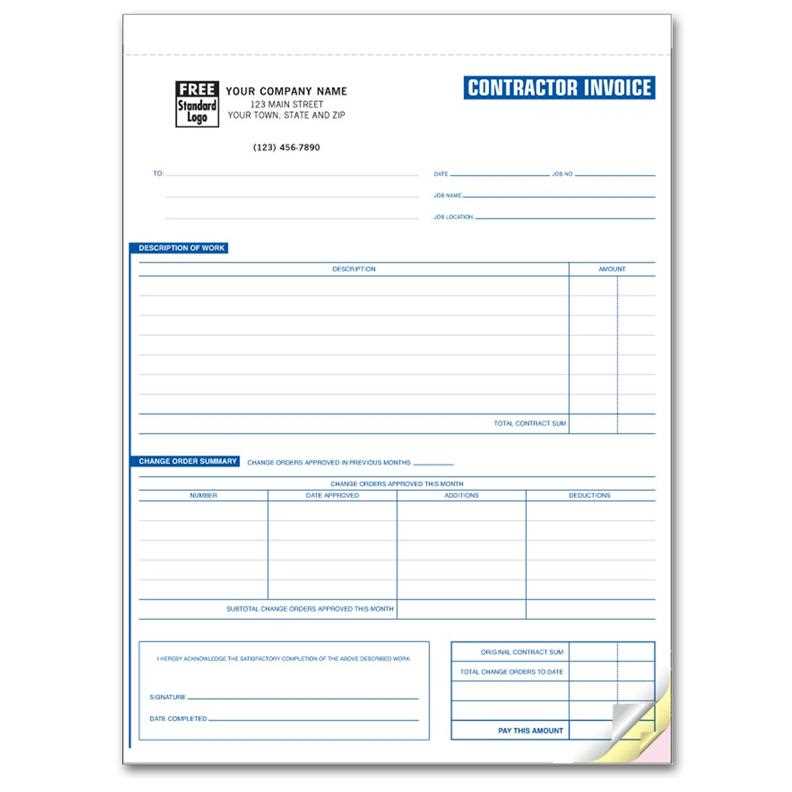

Billing Documents for Contractors vs Homeowners

When it comes to creating financial records for home improvement projects, contractors and homeowners often have different needs and expectations. While both require clear and organized documentation, the details they need to track and the way they present the information can differ. Contractors may need to focus more on services rendered, labor hours, and materials used, while homeowners might be more concerned with understanding the cost breakdown and payment terms. Below is a comparison of the key elements typically included in financial documents for contractors and homeowners.

| Aspect | Contractors | Homeowners |

|---|---|---|

| Client Information | Includes contractor business details, project reference number | Includes homeowner’s name, address, and contact info |

| Work Description | Detailed list of services provided, tasks completed, labor hours | Clear, simplified explanation of work done for easy understanding |

| Material Breakdown | Includes all materials purchased with quantities and costs | Describes materials and their individual costs for transparency |

| Payment Schedule | Clear milestones, payment installments, progress payments | Clear total amount, payment due date, possible discounts or penalties |

| Additional Charges | Lists any additional costs for extras or unforeseen circumstances | May list any extra fees or adjustments to the original agreement |

| Terms & Conditions | Includes contractor policies, late fees, warranty information | Lists payment deadlines, late fees, and any special terms |

As you can see, while both parties share some common aspects in their financial records, the content and focus can vary. Contractors generally need to provide a more detailed breakdown of

Ensuring Clear Communication with Your Billing Document

Effective communication is vital when it comes to financial documentation for home improvement projects. A well-organized and transparent document not only helps prevent misunderstandings but also builds trust between the contractor and the client. By presenting clear and concise details, you ensure that both parties have a mutual understanding of the services provided, costs involved, and payment terms. Below is an overview of how to structure your document for maximum clarity and communication.

| Key Element | How to Ensure Clarity |

|---|---|

| Work Description | Use precise, easy-to-understand language to explain each task completed, avoiding vague terms. |

| Material Costs | Provide a detailed breakdown of materials used, including quantities and unit prices, to ensure full transparency. |

| Payment Terms | Clearly state the total amount due, payment schedule, and any penalties for late payments to avoid confusion. |

| Additional Charges | List any extra costs or adjustments with a brief explanation of why they were incurred, so the client understands. |

| Contact Information | Include both contractor and client contact details for quick resolution of any questions or issues. |

By paying attention to these key areas, you can ensure that your financial document clearly conveys all necessary information. This not only helps maintain professionalism but also contributes to smoother project completion and payment processing.

How to Handle Partial Payments on Renovation Projects

When working on a home improvement project, it’s common to arrange partial payments throughout the course of the work. This approach can help manage cash flow for contractors and provide homeowners with a sense of security that payment is tied to completed milestones. However, managing partial payments requires clear agreements and documentation to avoid confusion. Understanding how to handle these payments ensures both parties are on the same page and the project progresses smoothly.

1. Establish Payment Milestones

Before beginning the project, agree on specific milestones that will trigger payments. These milestones should be tied to tangible deliverables or stages in the work, such as the completion of a particular task or phase. Clearly outline these stages in your contract and billing documents, such as:

- Initial deposit before work begins

- Payment due after completion of preliminary tasks (e.g., demolition, groundwork)

- Progress payments at defined intervals based on work completed

- Final payment due upon project completion and inspection

2. Document Each Payment

For each partial payment, provide a clear breakdown of the work completed and the amount due. This ensures that both the contractor and homeowner have an accurate record of payments made and the remaining balance. When documenting partial payments:

- Reference the specific milestone or work phase associated with each payment

- Include the amount paid, the remaining balance, and any future payment dates

- Keep track of payments and receipts in an organized manner for both parties

3. Include Payment Terms and Conditions

Clearly define the payment terms in the agreement to avoid any confusion regarding due dates, penalties, or late fees. Outline the following conditions:

- Due date for each payment, aligned with project milestones

- Late fee charges if payments are delayed beyond the agreed-upon date

- Consequences if a payment is missed, such as work stoppage until payment is received

Handling partial payments with clarity and consistency helps ensure that both parties are satisfied and that the project can move forward without financial disputes. Always keep communication open, and make sure that all agreements are documented in writing to protect both the contractor and the homeowner.

Tracking Renovation Costs with Billing Documents

Accurate tracking of project expenses is critical for managing home improvement costs and ensuring that both contractors and clients are on the same page regarding financial expectations. By organizing and detailing expenses through clear billing records, you can effectively monitor project spending, adjust budgets, and identify any potential issues early. Tracking costs properly also helps with future planning and can serve as a valuable reference for similar projects.

1. Break Down Costs by Category

To ensure clear tracking, it is essential to separate costs into relevant categories. This not only makes it easier to follow the spending but also allows you to identify areas where costs can be adjusted or optimized. The main categories to include are:

- Labor Costs: Include the cost of worker hours, subcontractor fees, and any related expenses.

- Materials and Supplies: List all items purchased, including quantities and unit prices.

- Equipment Rental: If any equipment is rented for the job, document the cost and duration of the rental.

- Permits and Fees: Include any necessary legal permits or inspection fees related to the project.

- Miscellaneous Expenses: Account for any unforeseen costs or additional services required throughout the project.

2. Track Payments and Adjustments

Regularly updating billing records with partial payments and adjustments ensures that you always have an accurate picture of the remaining balance. When tracking payments:

- Update the amount due after each payment is made, reflecting both partial payments and any additional costs incurred.

- Include the date each payment is received and provide receipts or proof of payment.

- Ensure that any credits or discounts are clearly reflected in the updated balance.

By maintaining detailed billing records, you can keep track of the financial health of the project and avoid any unexpected cost overruns. This also provides transparency for your clients and builds trust through open financial communication.

Why a Professional Billing Document Matters

Creating a professional financial record for any project is essential for maintaining trust, ensuring clarity, and streamlining the payment process. A well-crafted document not only reflects the quality of the work completed but also sets the tone for how the client perceives the business. When financial records are clear, accurate, and organized, they reduce the potential for misunderstandings and payment delays, making the entire process smoother for both the contractor and the client.

1. Establishes Credibility

Using a professional billing document signals to clients that you are serious, organized, and detail-oriented. It shows that you have a structured approach to handling finances, which can increase trust and confidence in your business. When clients receive a clear and polished document, they are more likely to feel that they are working with a reputable professional.

2. Ensures Clear Communication

A well-structured document communicates the necessary details clearly–such as services rendered, costs, and payment schedules–leaving little room for confusion. This clarity ensures that both parties are aligned on what has been done and what is owed, reducing the chances of disputes or missed payments. A professionally presented document also helps avoid ambiguous terms, making it easier for clients to understand their financial obligations.

Ultimately, investing time and effort into creating a polished billing document helps foster positive relationships with clients and ensures a smooth financial transaction from start to finish. By maintaining a high standard of professionalism in your records, you set yourself apart from competitors and build a strong foundation for repeat business.

How to Save Time with Billing Document Templates

Managing the financial side of home improvement projects can be time-consuming, especially when you have to create detailed records for each client. However, by using pre-designed billing formats, you can streamline the process and save significant amounts of time. These ready-made documents allow you to quickly input project details, reducing the need to start from scratch each time and enabling you to focus on completing your work.

1. Faster Document Creation

Using a standardized document format speeds up the process of generating financial records. With essential fields already pre-filled–such as client information, task descriptions, and pricing structures–you only need to adjust the specifics for each new project. This eliminates the need to design a new layout or worry about formatting every time you prepare a document.

2. Consistency and Accuracy

Templates help ensure consistency across all of your financial documents. By using the same structure for every project, you reduce the likelihood of missing important details or making errors. Consistency also fosters professionalism and builds trust with your clients, as they know what to expect every time they receive a record of services and costs.

In addition, templates allow for quicker adjustments to reflect any changes in pricing or project scope. By simply modifying a few key areas, you can generate an accurate and up-to-date document without starting from scratch each time. This ensures both speed and precision, helping you stay on top of your workload and meet deadlines with ease.

Legal Considerations in Renovation Billing Documents

When creating financial records for home improvement projects, it’s essential to ensure that they comply with legal requirements. Proper documentation not only protects both the contractor and the client but also helps avoid potential disputes or legal issues. Understanding the legal aspects of these documents can safeguard your business and promote a smooth payment process.

1. Clear Terms and Conditions

One of the most important legal aspects of a financial record is the inclusion of clear terms and conditions. This section should outline:

- Payment Due Dates: Clearly state when payments are expected to be made, whether it’s upon completion or in installments.

- Late Fees: Specify any penalties for delayed payments, including the rate and terms of enforcement.

- Work Deliverables: Detail the specific tasks or services that are being provided, so there is no ambiguity about what the client is paying for.

2. Compliance with Local Regulations

Each region or country may have specific laws regarding billing practices and financial documentation. It’s crucial to comply with these rules to avoid legal issues. Some key points to consider include:

- Tax Compliance: Ensure that your document reflects the correct tax rates and includes tax numbers where applicable.

- Licensing Information: If your business requires a license, include the relevant licensing details to establish your legitimacy.

- Dispute Resolution: Outline any procedures for resolving disputes, whether through arbitration, mediation, or small claims court, to protect both parties’ interests.

By paying attention to these legal considerations, you not only make your business more professional but also help protect both yourself and your clients from unnecessary legal complications.