Basic Invoice Template for Open Office Free and Easy to Use

For any business, having a streamlined method to generate and manage payment requests is essential. A well-structured document ensures clarity and professionalism, fostering better relationships with clients and enhancing financial organization. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, the ability to quickly produce accurate and customizable billing paperwork is invaluable.

Free tools provide an accessible and efficient solution for creating these essential documents. By using simple yet versatile formats, users can easily adapt and modify their layouts according to specific needs, saving both time and effort. These resources are especially helpful for those who prefer not to invest in costly software while still needing polished, reliable results.

With a few basic steps, anyone can create a professional-looking document that suits their business model, with the flexibility to add personalized details, payment terms, and itemized lists. This guide will help you take full advantage of the available tools and make the most of your billing process.

Why Choose Open Office for Invoices

When it comes to managing financial documents, efficiency and flexibility are key. Many businesses are looking for tools that not only offer ease of use but also save on unnecessary costs. Open-source software stands out as a popular choice for those who want to create professional documents without the need for expensive programs. For billing, this option is particularly advantageous, as it provides a wide range of features that can cater to both simple and more complex requirements.

Here are several reasons why this free software is an excellent option for managing your billing paperwork:

- Cost-effective: The primary benefit is that it’s free. There are no licensing fees or subscription costs, which makes it ideal for freelancers, startups, and small businesses.

- Cross-platform compatibility: This software works on multiple operating systems, such as Windows, macOS, and Linux, ensuring that you can easily access and create documents on any device.

- Easy customization: With a variety of pre-designed formats available, you can easily adapt them to suit your needs, adding specific items, adjusting layouts, and personalizing the content.

- Wide range of features: In addition to basic document creation, you can include advanced functionalities such as automated calculations, customizable fields, and integrated templates for other business tasks.

- Open-source and flexible: Being open-source, the software is continuously updated by a community of developers. It also allows for modifications and extensions according to individual needs.

By choosing this solution, you gain access to a robust toolset that helps you produce clear and consistent payment records, track financial data, and present your business in a professional light–all without the burden of additional costs or complex systems.

Getting Started with Billing Document Templates

Creating professional payment requests doesn’t have to be complicated. With the right tools, you can quickly generate a polished document that meets all your needs. Whether you’re billing for services rendered or products sold, having a structured framework allows you to maintain consistency and accuracy across all transactions. The key is to start with a design that’s easy to modify, enabling you to focus on the essential details without worrying about formatting.

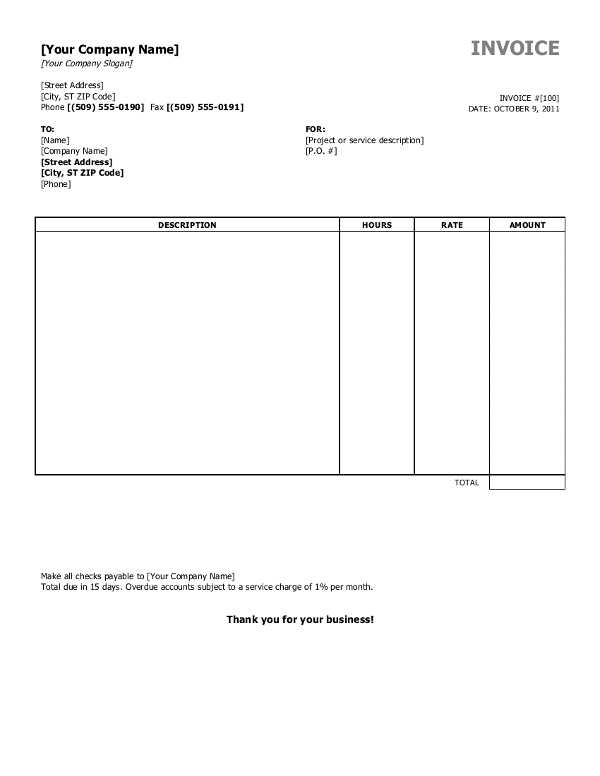

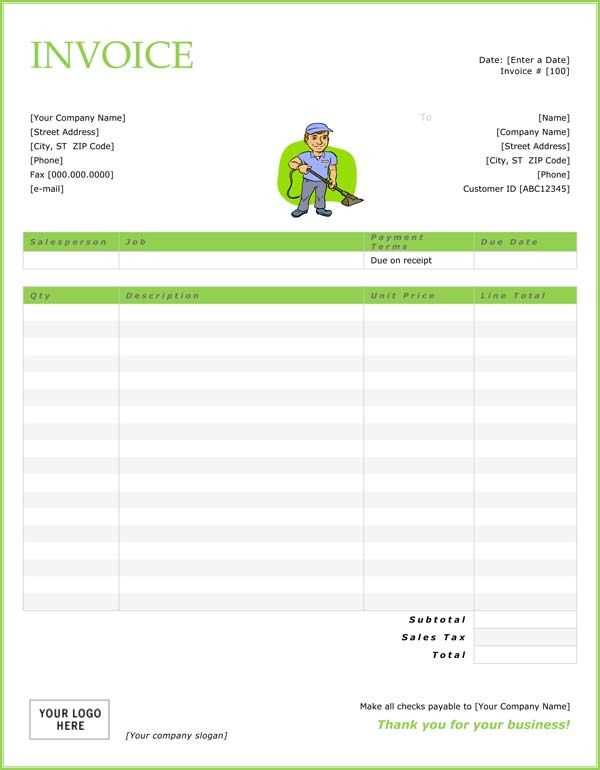

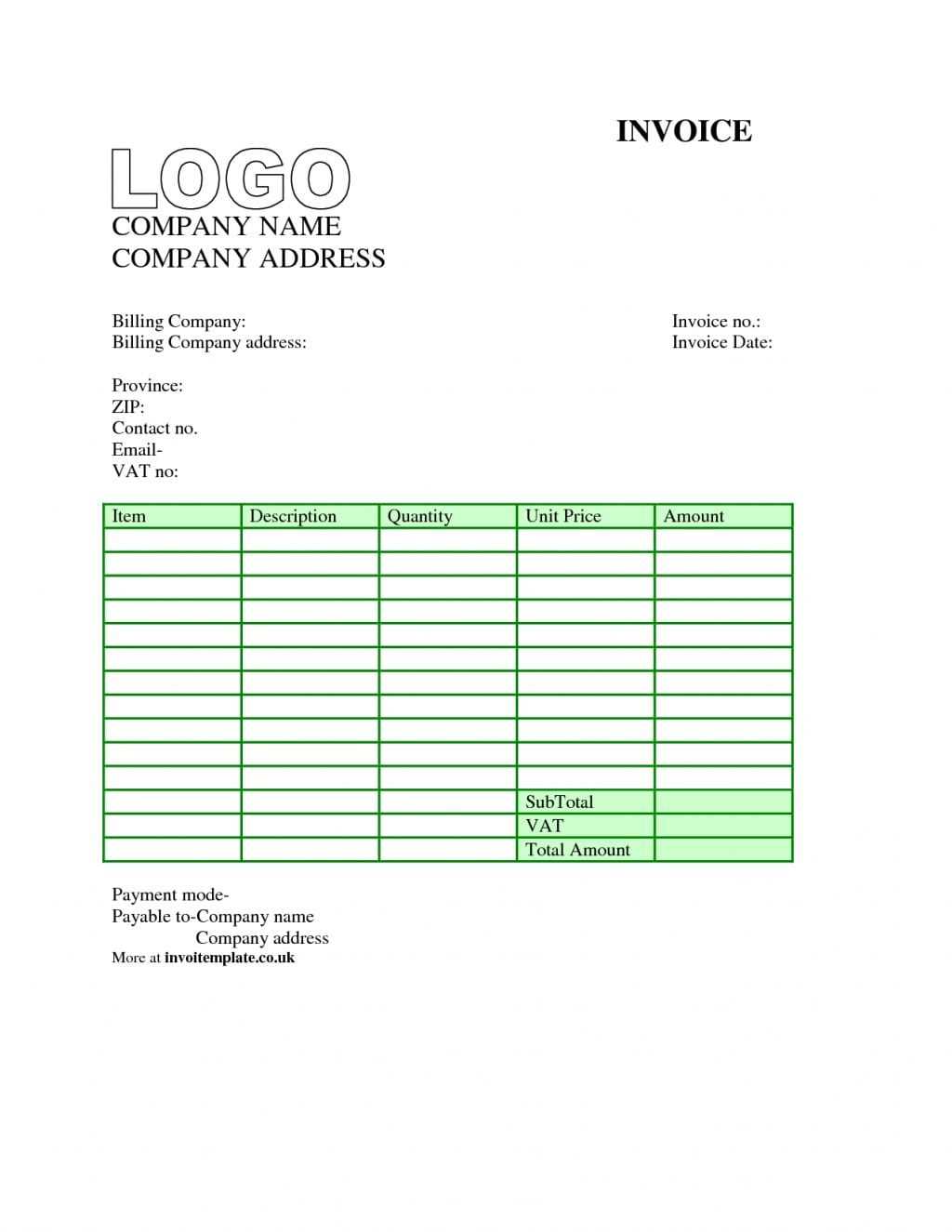

To begin, simply choose a layout that aligns with your business style and requirements. Most programs offer various pre-built designs that can be customized, allowing you to add your branding, adjust text, and include specific payment information. Once you select a format, input your business details, such as your name or company name, address, and contact information. Be sure to also include fields for the client’s information, the transaction date, and an itemized list of goods or services provided.

After customizing the layout, save the document for future use. Most programs will allow you to store your work as a reusable file, so you can easily generate similar documents whenever needed, saving both time and effort in the long run. With this approach, managing financial records becomes a seamless part of your workflow, helping you stay organized and professional in all business dealings.

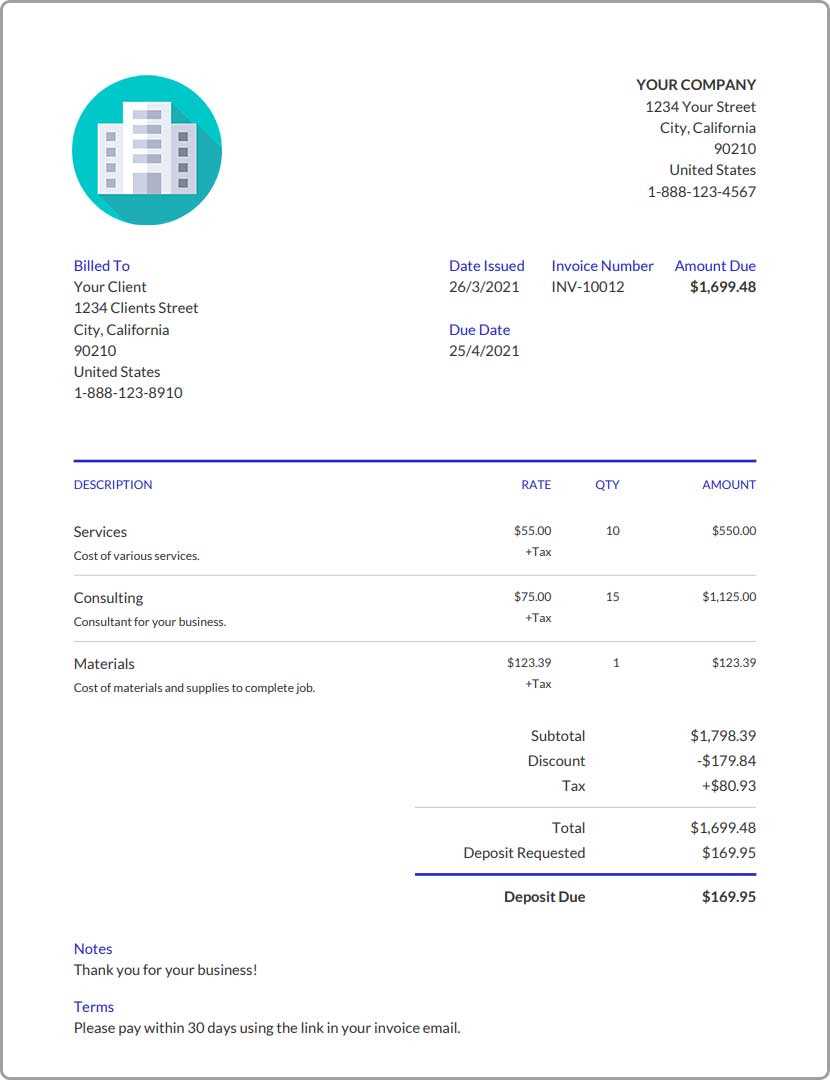

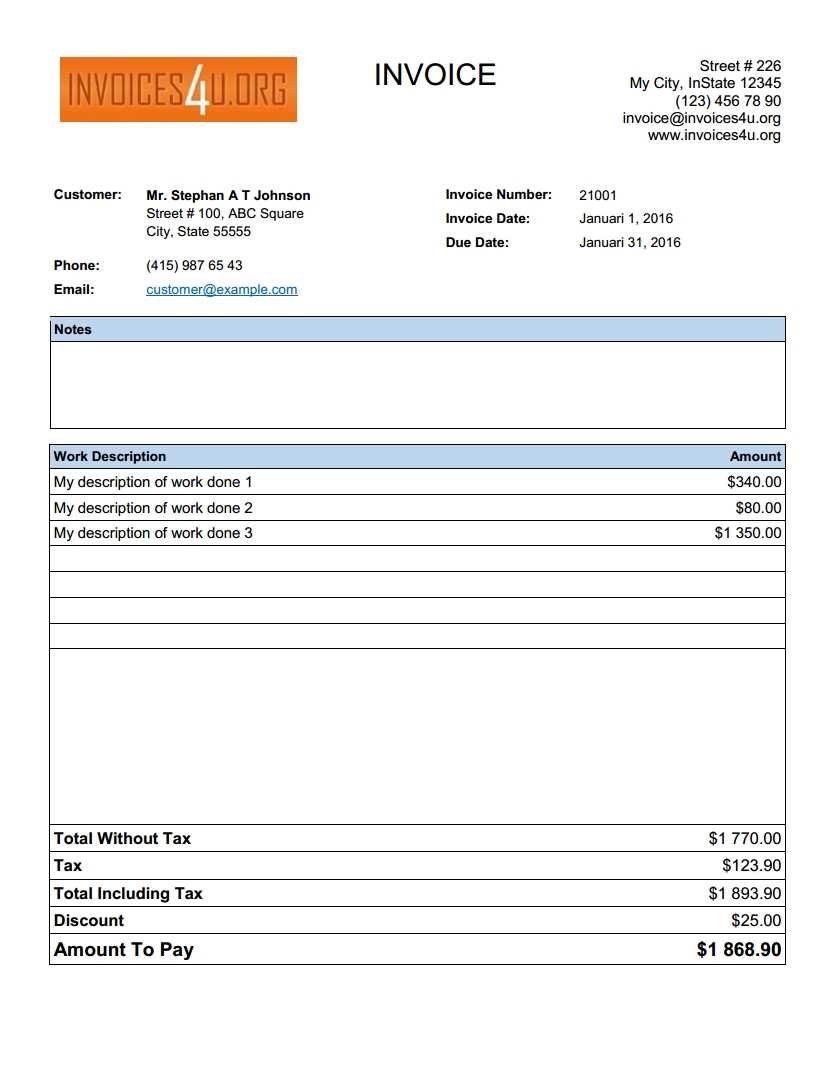

Key Features of a Simple Billing Document

When creating a document for requesting payment, it’s essential to include specific details that ensure clarity and professionalism. A well-structured document not only helps communicate the value of your services or products but also serves as a formal record of the transaction. Including the right elements will make it easier for your clients to understand the charges and process the payment promptly.

Some of the most important components of a straightforward billing record are:

- Business Information: Include your company or personal name, address, and contact details, making it clear who is issuing the document.

- Client Information: The recipient’s name, address, and contact details must be listed, ensuring that the payment is directed to the right party.

- Unique Reference Number: A unique identifier for each document helps in tracking and managing multiple requests easily.

- Transaction Date: Clearly indicate when the goods or services were provided to maintain transparency.

- Description of Goods or Services: Provide an itemized list of what is being billed, including quantities, unit prices, and any applicable discounts.

- Payment Terms: Include details on payment deadlines, accepted methods, and any late fees or interest charges that may apply.

- Total Amount Due: The final amount should be clearly displayed, with all relevant taxes or charges included.

Including these key details will ensure that your billing process runs smoothly and professionally. Having a standardized structure will also make it easier for clients to process payments quickly, helping you maintain a positive and efficient business relationship.

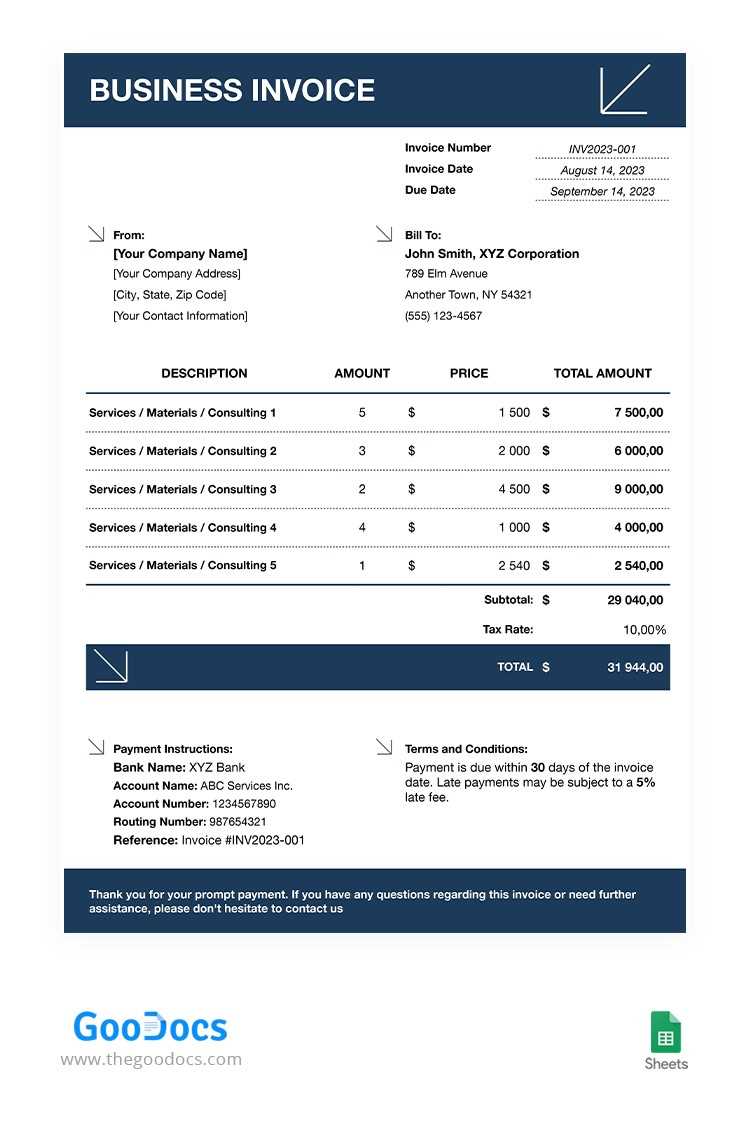

How to Customize Your Document

Tailoring a payment request document to suit your business needs is a simple yet important step in creating a professional image. Customizing the layout ensures that the document reflects your brand while meeting the specific requirements of each transaction. Whether you’re adjusting the design, adding new fields, or changing the structure, the process is quick and allows you to create documents that are both functional and visually appealing.

Adjusting the Layout

One of the first things to do is modify the general layout to match your style. You can move sections around, change fonts, or adjust text sizes. The goal is to make sure the document looks clean and organized, while still providing all the necessary details. Here are some common adjustments:

- Positioning of Business Information: Make sure your company name and contact details are clearly visible at the top, so clients can easily reach you.

- Customizing the Header: Add your logo or change the heading text to better reflect your branding.

- Adjusting Column Widths: Modify the space given to descriptions, quantities, and prices to ensure that everything fits neatly without looking cluttered.

Adding New Fields

As your business grows, you may need to include more details in your payment requests. The flexibility of most programs allows you to add additional fields as required. For example:

| Field Name | Description |

|---|---|

| Purchase Order Number | Incorporate a reference number to help clients track their orders. |

| Tax ID Number | Add your tax identification number for tax-related documentation. |

| Payment Instructions | Provide more detailed information on how clients should make payments. |

Once you have made these changes, it’s important to save your custom design as a reusable document. This way, you can generate similar records with minimal adjustments for each new transaction.

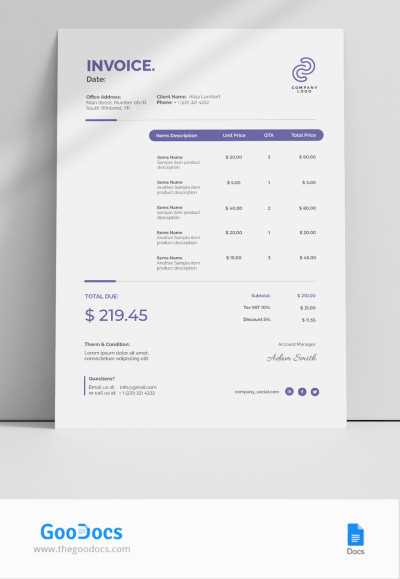

Best Practices for Document Design

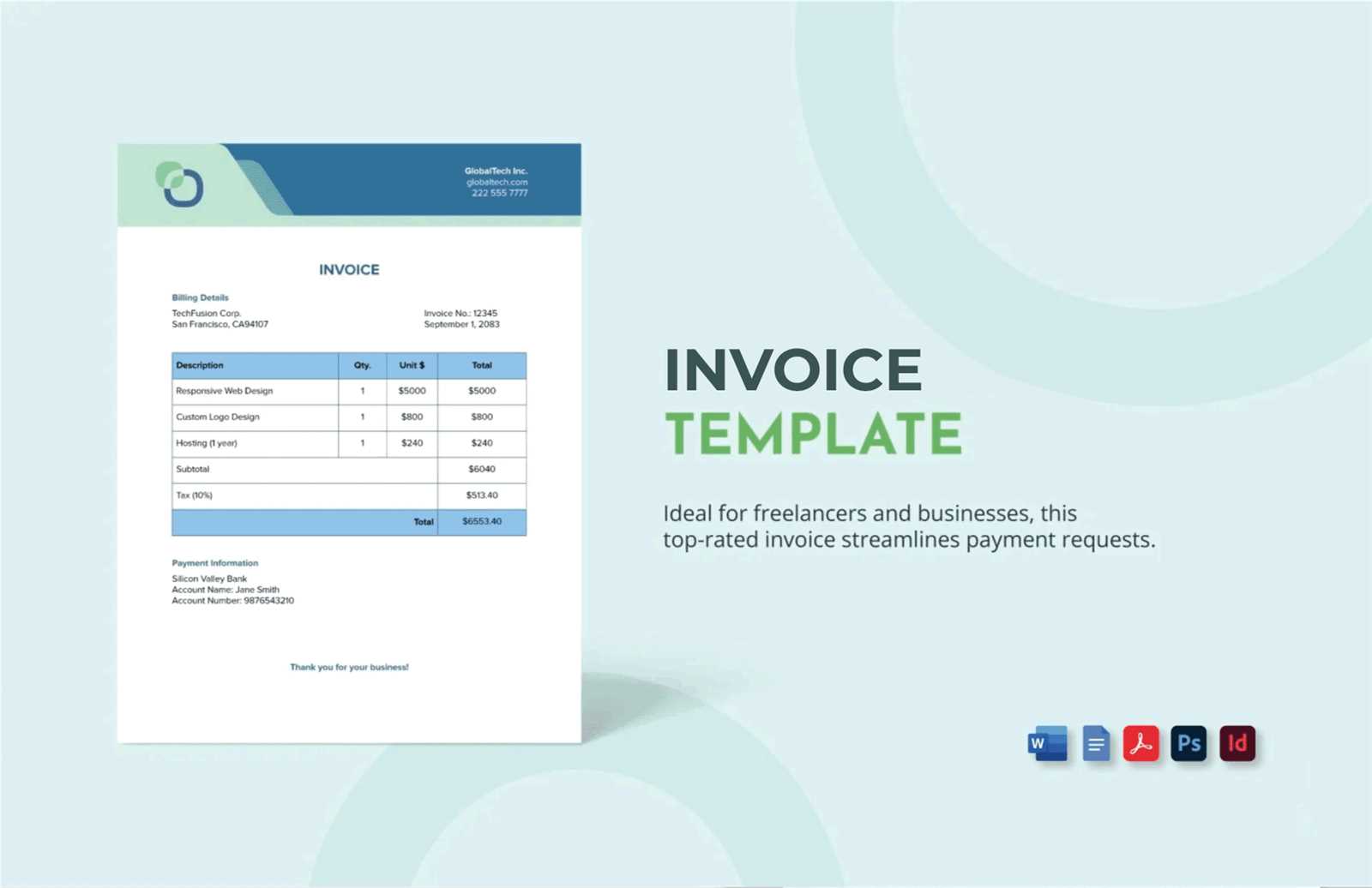

Creating well-organized and visually appealing payment documents not only helps ensure clarity but also enhances your professional image. The design plays a key role in how easily your clients can understand the details of the transaction and make payments on time. Following a few best practices can improve the readability and overall effectiveness of your documents, making them easier to process and more likely to be taken seriously.

Here are some essential tips for designing clean and efficient billing documents:

- Keep It Simple: Avoid clutter by using clear, concise language and enough white space between sections. A simple layout makes the document easier to read and navigate.

- Highlight Key Information: Ensure that important details like total amounts, due dates, and payment terms are easy to find. Use bold text or larger font sizes to draw attention to these elements.

- Use Consistent Branding: Include your logo, business name, and color scheme to maintain consistency with your brand. This helps create a professional look and reinforces your identity.

- Organize Data Clearly: Use tables to present items, quantities, and prices. A well-structured table makes it easier for your client to quickly understand the charges.

- Ensure Readability: Choose fonts that are easy to read, such as sans-serif fonts like Arial or Helvetica. Avoid overly decorative fonts that may be difficult to decipher.

- Include Essential Details: Always include key elements like business and client information, itemized list of services or products, payment terms, and a clear total amount due.

- Make It Mobile-Friendly: Consider how your document will appear on different devices. Ensure that the layout remains clear and legible when viewed on mobile phones or tablets.

By following these best practices, you’ll create documents that are not only functional but also represent your business in a professional and organized manner. Clear, consistent, and well-designed records lead to faster payments and stronger client relationships.

Common Mistakes to Avoid in Payment Documents

While creating a payment request, it’s easy to overlook important details that could lead to confusion or delays in processing. Even small errors can impact your relationship with clients and hinder timely payments. By being aware of the most common mistakes, you can ensure your documents are professional, clear, and error-free, helping to foster trust and streamline the payment process.

Missing or Incorrect Information

One of the most frequent issues is incomplete or incorrect information. Failing to include essential details can cause delays or misunderstandings. Some common mistakes in this category are:

- Incorrect Client Details: Always double-check that the recipient’s name, address, and contact information are accurate.

- Omitting Payment Terms: Not clearly stating payment deadlines or accepted payment methods can lead to confusion.

- Wrong Calculations: Ensure that all amounts, taxes, and totals are calculated correctly, and double-check for any rounding errors.

Overcomplicated Design

Another mistake is using a complex design that makes the document harder to read. A cluttered layout can distract from important details and make the document look unprofessional. Some design errors to avoid include:

- Too Many Fonts or Colors: Overuse of different fonts or colors can create visual chaos. Stick to one or two easy-to-read fonts and a simple color scheme.

- Lack of Structure: Without clear headings, sections, or a well-organized table, the client might struggle to quickly find key information.

- Unnecessary Information: Avoid including irrelevant details that don’t contribute to the transaction, as they may distract from the important points.

By focusing on clear, accurate, and simple designs, you can avoid these common mistakes and create documents that are both professional and easy to process.

How to Save and Share Your Payment Document

Once you have created a payment request, it’s important to save it properly and share it with your clients in an efficient way. Choosing the right format for saving and the most reliable method for sharing ensures that your document remains intact and can be easily accessed by the recipient. Whether you need to send it via email or print it for physical delivery, understanding how to handle your file properly will streamline the entire process.

Saving Your Document

When saving your document, it’s essential to choose a format that preserves its structure and makes it easy to share. Most programs allow you to save your file in various formats, including:

| File Format | Advantages |

|---|---|

| Ensures that the document’s layout and design remain intact across all devices. Ideal for sending to clients via email. | |

| ODT | Allows easy editing if you need to make changes to the document before sending it. Useful for ongoing or multiple transactions with the same client. |

| XLS | Great for documents that require calculations, such as itemized lists with changing amounts or quantities. |

After choosing the appropriate format, save the document in a dedicated folder with a clear naming convention to make future access easier, such as using the client’s name and the date for quick reference.

Sharing Your Document

Once the document is saved, sharing it with your client is the next step. You can send your payment request via:

- Email: Attach the saved file (usually as a PDF) to your email and include a brief message explaining the details. Ensure that the file size is not too large to avoid email delivery issues.

- Cloud Storage: If the file is too large or you want to provide access to multiple documents, uploading it to a cloud storage service like Google Drive or Dropbox can make sharing easier and more secure.

- Printed Copy: For clients who prefer physical documents, you can print the file and send it via postal mail or deliver it in person. Make sure to use a professional printer to maintain the quality of the document.

By following these steps, you ensure that your payment requests are accessible, professional, and easy to process for your clients, leading to smoother transactions and better relationships.

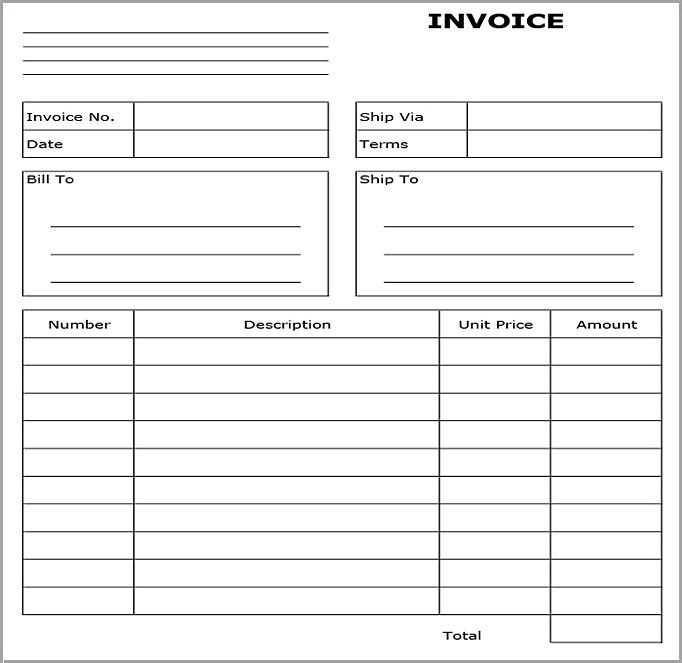

Understanding Billing Document Formatting Options

Choosing the right format for your payment request is essential for ensuring that the document is clear, professional, and easy to understand. Proper formatting helps to highlight key information such as the total amount due, payment terms, and itemized charges. With the right approach, you can create a well-organized document that not only looks appealing but also facilitates a smooth transaction process.

There are several formatting options available when creating a payment document, each designed to address different needs. Understanding how to use these options effectively can make a significant difference in how your client receives and processes your request.

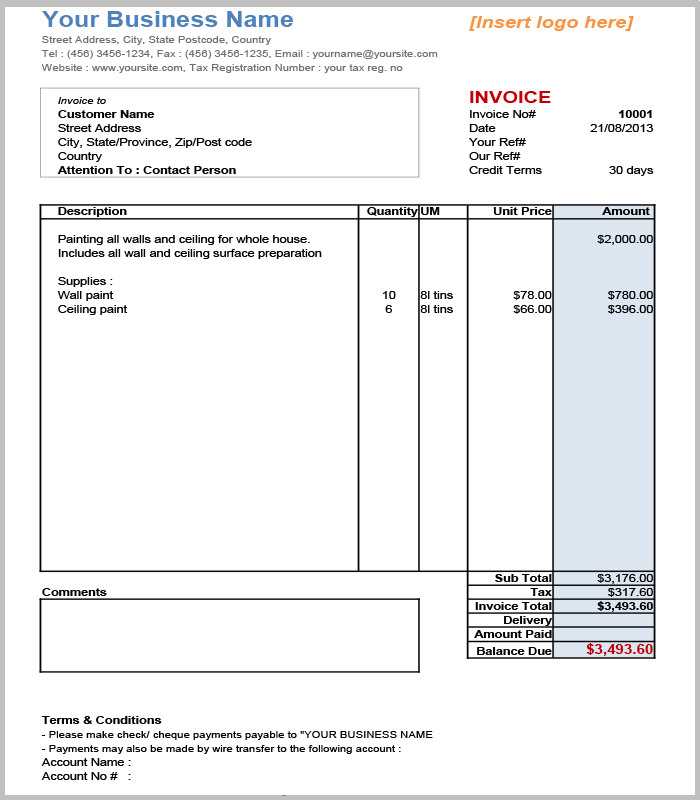

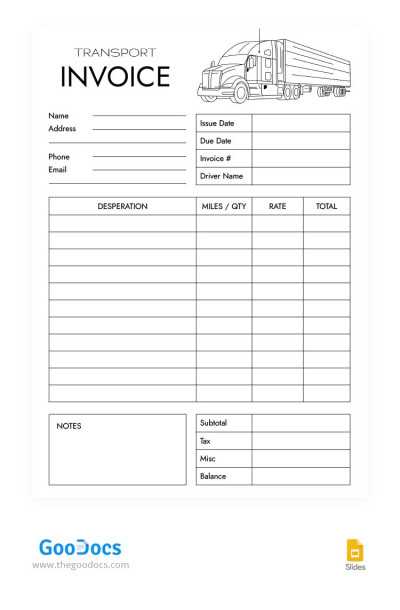

- Document Layout: The layout refers to the overall structure of your document. Most payment requests follow a standard format, with sections for business and client details, itemized descriptions, totals, and payment terms. Using a clear layout ensures that information is easy to locate and understand.

- Text Alignment: Proper alignment helps to organize the document and make it more readable. For example, aligning monetary values to the right helps clients quickly locate prices and totals. Left-aligning descriptions and items creates a clean, easy-to-follow flow.

- Font and Size: Choose fonts that are easy to read, such as Arial or Times New Roman, and use a font size that ensures clarity. Headings should be slightly larger to stand out, while the body text can be smaller but still legible.

- Tables for Itemization: A well-structured table can help break down services or products, making the charges easy to follow. Use columns for descriptions, quantities, unit prices, and totals to make the payment breakdown clear and professional.

- Whitespace: Proper use of whitespace can greatly enhance the readability of your document. Avoid overcrowding sections or using too much text in one area. Ensure that there’s enough space between different sections so the document doesn’t feel too cluttered.

- Bold and Italics: Use bold text for headings or key figures such as totals, and italics for secondary information like payment instructions or terms. This helps draw attention to important parts of the document.

By experimenting with these formatting options, you can create a well-organized and visually appealing document that communicates your message effectively and professionally, ensuring that your clients have all the information they need to make timely payments.

Why Open Office Is a Free Solution

For small businesses, freelancers, or individuals just starting out, finding a cost-effective solution to create professional documents is essential. While there are many paid software options available, some free alternatives offer the same functionality without the financial burden. One of the most popular free tools is open-source software, which provides a range of powerful features for document creation, all without any upfront costs or licensing fees.

Open-source software is developed and maintained by a community of volunteers, and it is freely available to anyone who wants to use it. Unlike proprietary programs that often come with high price tags or recurring subscription fees, this solution allows users to access and utilize advanced features at no cost. It provides a great way for individuals or businesses to maintain their budgets while still benefiting from a fully functional tool for creating various types of business documents.

What makes open-source tools even more appealing is that they are typically customizable, with a wide range of add-ons and plug-ins available. Users can tailor the software to meet their specific needs, and since it’s open for modification, it can be continuously improved by the community. Furthermore, as a free solution, it removes the financial barriers that might otherwise prevent people from accessing quality document creation tools, making it an ideal choice for anyone looking to keep costs low while still producing professional results.

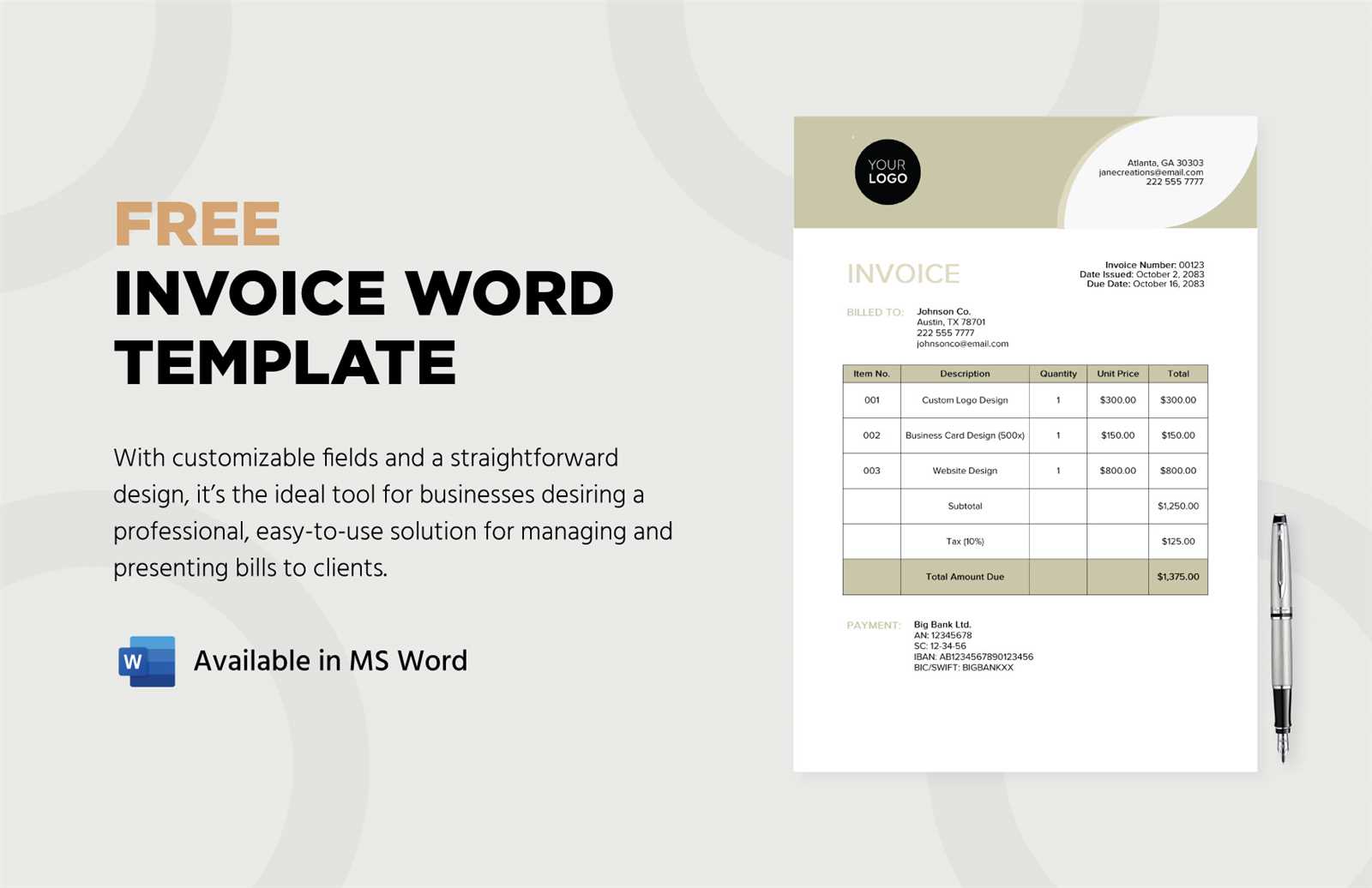

Creating Professional Billing Documents Without Software Costs

For freelancers and small business owners, managing finances can become complicated, but creating a professional payment request doesn’t have to come with high software costs. There are free tools and methods available that allow you to create polished, accurate, and formal documents for your clients, all without the need for expensive programs or subscriptions. By utilizing free alternatives, you can focus on your business without breaking your budget.

Here are several ways you can generate well-designed payment documents without investing in paid software:

- Using Free Software: Open-source programs offer comprehensive features for creating business documents at no cost. These programs allow you to design custom forms, add itemized lists, and include all essential details like terms and totals. Examples include LibreOffice and other open-source solutions that are freely available online.

- Online Invoice Generators: Several websites offer free invoice creation tools. These online platforms often come with pre-designed templates that can be quickly customized to include your branding, client details, and specific services. While some may have premium features, many offer sufficient functionality at no cost.

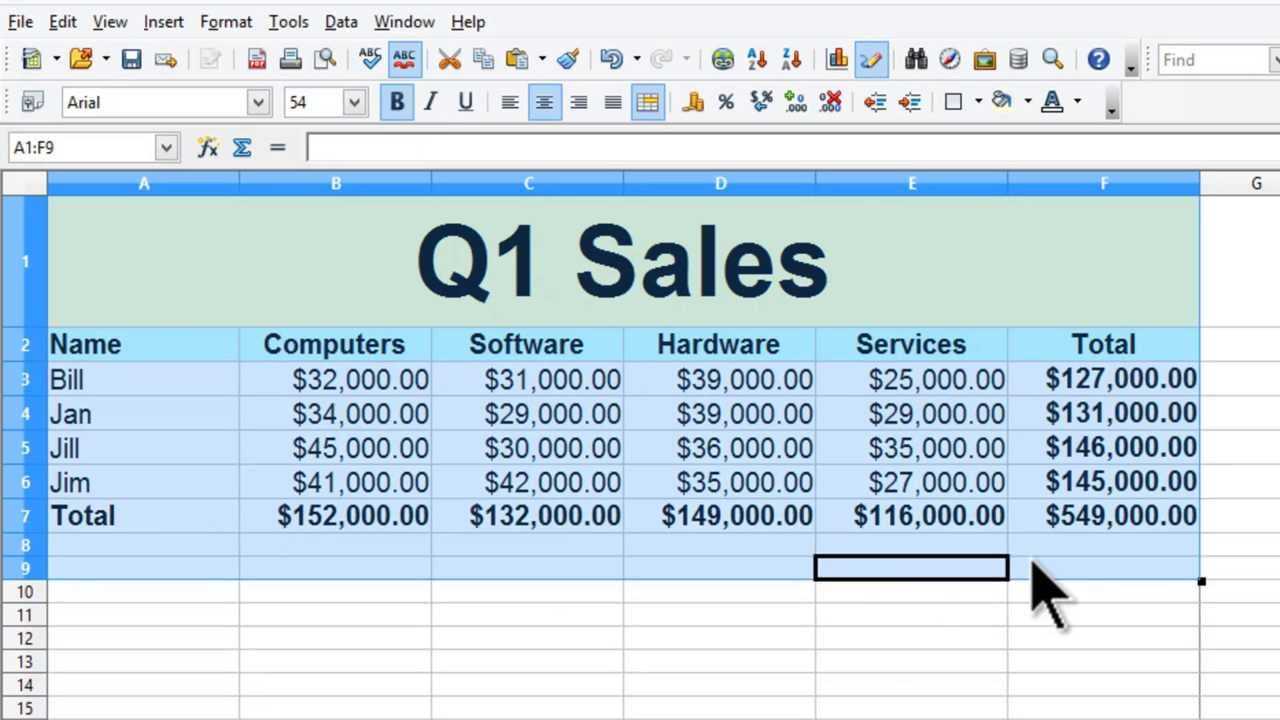

- Spreadsheet Programs: Using programs like Google Sheets or LibreOffice Calc, you can build custom layouts from scratch or use a simple grid structure to create a functional billing document. With these tools, you can manually input prices, quantities, and other essential data, and easily calculate totals using built-in formulas.

- Document Editing Tools: Even basic word processors like Google Docs or LibreOffice Writer can be used to create formal documents. You can start with a blank page and design your layout using tables and text formatting. The added benefit is that these programs are free and widely available.

- Template Downloads: Many free websites provide downloadable files for generating invoices. These documents are often compatible with free office suites and can be customized to your specific needs. Simply download, fill in your business and client details, and save them in the appropriate format.

By leveraging these no-cost tools, you can create and manage your payment documents efficiently while maintaining a professional image, all without incurring additional software expenses. This approach not only helps keep overhead low but also allows you to focus your resources on other important aspects of your business.

Steps to Add Your Business Details

Including your business information in a payment document is a vital part of the process. It ensures that your clients know how to contact you, how to send payments, and it adds a layer of professionalism to your paperwork. Whether you are creating a custom document or modifying an existing design, properly displaying your business details is essential for building trust and maintaining clear communication.

Here’s a step-by-step guide to ensure your business details are correctly included in the document:

- Position Your Information at the Top: Your business name, logo, and contact details should be placed at the top of the document. This makes it easy for clients to see your identity and reach out if needed.

- Include Your Address and Contact Information: Add your physical address, phone number, and email address. This is particularly important for clients who may need to contact you regarding any issues or queries related to the payment.

- Display Your Business Number or Tax ID: If applicable, include your business registration number or tax ID for clients who may need this information for accounting or tax purposes.

- Add Payment Details: Provide your payment methods or bank account details. This section should be clear, making it easy for your client to send the payment without confusion.

- Designate a Contact Person: If possible, list a specific person in your company whom the client can contact for any inquiries regarding the document.

To help visualize this, here’s an example of how to structure your business details in a document:

| Business Information | Example |

|---|---|

| Business Name | XYZ Consulting |

| Business Address | 1234 Elm St, Suite 100, Cityville, State 12345 |

| Phone Number | (123) 456-7890 |

| Email Address | [email protected] |

| Tax ID Number | 123-45-6789 |

| Payment Methods | Bank Transfer, PayPal, Credit Card |

By following these steps, you ensure that your payment document includes all the necessary business details, making it clear, professional, and easy for your clients to make payments and contact you when needed.

Tracking Payments with Billing Document Templates

Tracking payments is a crucial part of managing your business finances. A well-organized payment request not only ensures that you can clearly communicate the amount due to your clients but also provides a systematic way to monitor when payments are made. By using a structured format, you can easily record payments and keep track of outstanding balances, helping you maintain accurate financial records.

Here are several ways to efficiently track payments using a well-designed document format:

- Payment Due Date: Clearly displaying the due date on your documents ensures that both you and your client are on the same page. This helps you keep track of when to follow up on outstanding payments.

- Record Payment Status: Include a section in your document where you can update the payment status–whether it’s “Paid,” “Pending,” or “Overdue.” This will help you track the progress of each payment in real time.

- Unique Invoice Numbers: Assigning a unique number to each payment request allows you to easily reference and track each transaction. You can use this number to record payments in your financial records and make it easier to follow up on any missing payments.

- Partial Payments: If a client makes a partial payment, record the amount received and update the outstanding balance. This ensures that the amount left to be paid is always clear.

- Payment Method: Include a section for the client to specify the payment method used (e.g., bank transfer, credit card, cash). This can help you track which methods are most commonly used and make future transactions smoother.

- Due Balance: Always provide a running total of the amount owed, including any applied discounts or credits. Keeping this figure updated will make it easier to reconcile payments and identify any discrepancies quickly.

By incorporating these tracking features into your documents, you create a simple yet effective system for managing your payments. This not only helps you stay on top of finances but also ensures a smooth and transparent process for both you and your clients.

Using Open Office for Multiple Billing Documents

Managing multiple payment requests can become overwhelming, especially when you’re handling a large number of clients or transactions. Using the right tools can help streamline this process, making it easier to generate, organize, and track several documents at once. Free software solutions offer the flexibility and functionality to efficiently handle multiple billing documents without incurring any additional costs.

With the right setup, you can quickly create a batch of payment requests, apply consistent formatting, and update information across various documents with minimal effort. This process allows you to focus on your work, rather than spend excessive time creating individual documents from scratch.

Batch Creation and Customization

When you need to create multiple payment documents, it’s essential to use a solution that allows batch creation. By using customizable designs and saving them as templates, you can easily modify details such as client information, amounts, and dates. This eliminates the need to start from scratch each time, saving valuable time and ensuring consistency.

Efficient Tracking and Updates

As you create and manage several payment documents, it’s also important to track their status. You can use the same software to keep a record of when payments are due, received, or overdue. Most programs allow you to update multiple documents at once or even create a central file to monitor progress. This way, you won’t need to search through numerous documents manually to find outstanding balances or payment status.

By taking advantage of the features offered by free software, you can easily manage and organize multiple billing documents, ensuring that each one is accurate and up-to-date. This approach saves time and minimizes the risk of errors, giving you more control over your financial management processes.

How to Handle Tax Calculations on Billing Documents

Calculating taxes correctly is a crucial part of creating a professional payment document. Whether you’re required to charge sales tax or need to apply value-added tax (VAT), ensuring that these calculations are accurate is important for both your business and your clients. Including taxes in a clear and organized manner helps maintain transparency and ensures compliance with local tax regulations.

There are different methods to calculate taxes depending on your location and the types of goods or services you offer. However, regardless of the specific tax rates, the general process involves determining the applicable tax rate, applying it to the taxable amount, and clearly showing the tax on your payment document. Here’s how you can handle tax calculations effectively:

Step-by-Step Guide to Tax Calculation

To make tax calculations easier, follow these steps:

- Determine the Tax Rate: Research the current tax rates that apply to your products or services. This could include local, state, or federal taxes, depending on your location.

- Calculate the Taxable Amount: Identify the portion of the total amount that is taxable. Some services may be exempt from tax, so ensure you apply the tax only to the relevant charges.

- Apply the Tax Rate: Multiply the taxable amount by the appropriate tax rate to calculate the total tax owed.

- Include the Tax on the Document: Clearly list the tax amount as a separate line item on the payment document, with the total amount due including tax at the bottom.

Example of Tax Calculation

Here’s an example of how a typical tax calculation might look in a billing document:

| Item Description | Unit Price | Quantity | Subtotal |

|---|---|---|---|

| Consulting Service | $100.00 | 2 | $200.00 |

| Software License | $50.00 | 1 | $50.00 |

| Total Before Tax | $250.00 | ||

| Sales Tax (8%) | $20.00 | ||

| Total Due | $270.00 | ||

By following these steps and clearly showing the tax calculation in your document, you ensure that your clients understand the breakdown of costs and that your tax obligations are met correctly.

Tips for Managing Billing Document Versions

Keeping track of multiple versions of your billing documents is essential for maintaining organization and ensuring accuracy. Whether you are issuing revised documents due to client requests, updating pricing, or making corrections, version control helps prevent confusion and ensures that both you and your clients are referring to the correct file. It’s crucial to implement a system that allows easy access to previous versions while keeping your most current records up to date.

Managing different versions can seem complex, but with a few best practices in place, you can keep things streamlined and organized. Here are some helpful tips:

1. Use Clear Version Numbering

When creating revised documents, always use a clear versioning system. This will allow both you and your clients to easily identify the most recent version of a document. A simple way to do this is by appending the version number or the date of the revision to the document’s filename. For example:

- Invoice_12345_v1

- Invoice_12345_v2_2024-11-05

- Invoice_12345_final_2024-11-06

This method reduces the risk of sending an outdated or incorrect document to a client and makes it easy to track changes over time.

2. Keep Detailed Notes on Changes

Whenever you make a revision, it’s important to note the changes you’ve made. Whether it’s a minor update to quantities, a correction to a total, or a change in payment terms, documenting these adjustments will help you stay organized and prevent mistakes in the future. You can create a change log within your financial management system or include a brief note at the top of the document itself that outlines the changes made.

For instance, you might include a statement like:

Version 2 – Updated total amount and added discount for early payment.

This way, you will always know why a particular version exists and what changes were made between versions, improving transparency and accountability.

3. Use Cloud Storage for Easy Access

Storing all versions of your documents in cloud storage ensures that you always have access to your files, no matter where you are. This also helps you avoid confusion if you ever need to revisit or reference a previous version. Cloud services such as Google Drive, Dropbox, or OneDrive provide version history functionality, allowing you to restore previous versions of documents with ease.

By using cloud storage, you can maintain a secure, organized, and easily accessible system for managing your billing records. This is especially helpful for businesses with multiple team members who need to collaborate or access files remotely.

With these simple tips, managing billing document versions can become a straightforward and efficient process. Version control helps keep your records clear and accurate, making it easier to follow up on payments, address client concerns, and maintain financial organization.

Improving Efficiency with Open Office Billing Documents

Enhancing your workflow when creating payment requests can save both time and effort, especially if you deal with multiple clients or projects. A well-organized approach to generating and managing documents allows you to streamline repetitive tasks, minimize errors, and ensure that each transaction is handled smoothly. By using an intuitive and accessible software solution, you can significantly improve the overall efficiency of your billing process.

Here are some effective strategies to improve your efficiency when working with billing documents:

1. Automate Common Fields

Using pre-built formats, you can set up common fields such as client names, contact information, and payment terms to automatically fill in. This reduces the need for manual entry, ensuring consistency and saving you time. Once the initial details are entered, many software options allow you to duplicate documents with minimal adjustments, speeding up the process for future requests.

2. Streamline Calculations

Having built-in functions to automatically calculate totals, taxes, and discounts ensures accuracy and eliminates the possibility of mistakes. You can set up formulas to handle arithmetic calculations, making it easier to generate error-free documents every time. This is especially useful when managing complex or recurring payments.

3. Maintain a Consistent Layout

By using a standardized design for all your payment documents, you ensure that all your records are professional, organized, and easy to read. This also helps clients quickly recognize important details, such as the amount due and payment deadlines. A clean, consistent layout reduces confusion and enhances the overall professionalism of your business.

4. Use Templates for Multiple Documents

If you generate many similar documents, creating and saving a template can dramatically increase your productivity. Rather than designing each document from scratch, templates allow you to quickly reuse the same structure with just a few modifications. This consistency speeds up the document creation process and helps you maintain a professional image across all client interactions.

By implementing these strategies and taking full advantage of available tools, you can significantly improve the efficiency of your payment processing, reduce manual work, and focus more on other critical aspects of your business. Simple automation and consistent practices can make a significant difference in how quickly and accurately you handle billing tasks.