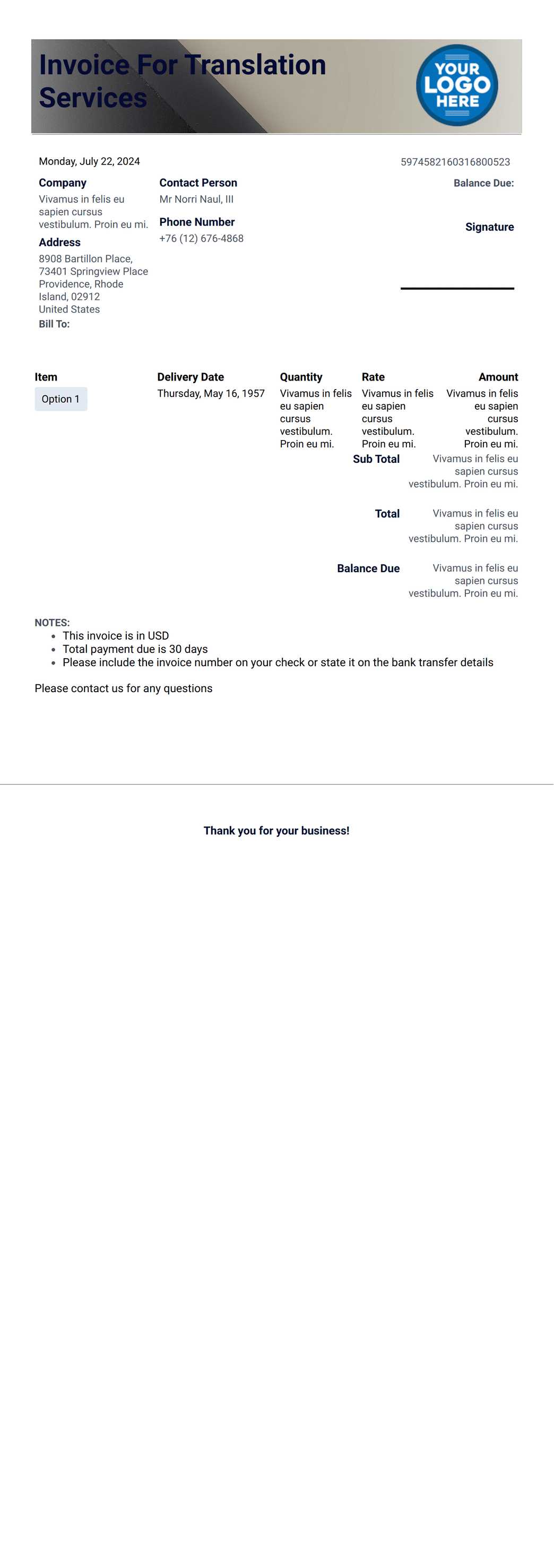

Download Free Basic Invoice Template for Easy Billing

Managing client payments efficiently is crucial for any business, whether you’re a freelancer or running a larger operation. Having the right document to request payment ensures professionalism, accuracy, and helps avoid misunderstandings. With the right structure, sending requests for payment becomes a smooth, organized process.

One of the easiest ways to enhance your billing routine is by using a well-organized document format. This not only saves time but also eliminates common errors, allowing you to focus on growing your business. The right layout can help present all necessary details in a clear and concise manner, reducing the chances of disputes and delays in payment.

By choosing a customizable format, you gain the flexibility to adapt the structure to your specific needs, from personal projects to larger business transactions. Whether you’re invoicing for services rendered or products sold, using a consistent and straightforward method can significantly improve cash flow management and financial tracking.

Simple Billing Document Available for Use

Having a standardized document to request payments can significantly simplify your financial operations. A well-organized format ensures you capture all essential details like amounts, services, and payment terms, reducing confusion for both you and your clients. With the right structure, you can create clear and professional requests, speeding up the payment process and improving client relations.

There are numerous resources offering customizable formats that cater to various industries and needs. These options allow you to adapt the layout and content according to your specific requirements. Whether you are working as a freelancer, running a small business, or handling larger transactions, a properly formatted document can make all the difference in keeping things running smoothly.

Many online platforms provide these resources at no cost, enabling you to access professional-grade documents without any financial commitment. By using these resources, you can ensure that your billing system is not only accurate but also consistent, making it easier to track payments and manage financial records over time.

Why You Need an Invoice Template

Having a standardized document to request payments is essential for maintaining professionalism and consistency in your business transactions. Without a clear structure, there is a higher risk of errors, confusion, or missed details that could delay payments or lead to disputes. A well-organized form ensures that all the necessary information is included, making it easier for your clients to understand what they owe and why.

Using a consistent format helps streamline your billing process, saving time and reducing the likelihood of mistakes. When you have a template ready to go, all you need to do is fill in the relevant details, rather than starting from scratch each time. This efficiency can be especially valuable when managing multiple clients or projects, as it keeps everything orderly and easily accessible.

Additionally, having a professional document shows clients that you are organized and serious about your business. It builds trust and can help you establish a positive reputation. By presenting a clear and accurate request for payment, you not only ensure prompt payment but also create a smoother overall experience for both parties.

Benefits of Using a Free Invoice Template

Utilizing a pre-designed document to request payments offers numerous advantages for businesses of all sizes. By relying on an established format, you can save valuable time and avoid common mistakes that can occur when creating documents from scratch. Here are several key benefits:

- Time Efficiency: A ready-made structure allows you to focus on filling in specific details, instead of spending time organizing the document layout.

- Consistency: Using the same format for every transaction ensures a uniform and professional appearance across all your requests for payment.

- Cost Savings: Many high-quality resources are available at no cost, which eliminates the need for expensive software or services.

- Customization: Most formats can be easily adjusted to suit the needs of different industries, whether you’re invoicing for products, services, or projects.

- Accuracy: With essential fields and sections already in place, the chance of missing key information, like payment terms or due dates, is significantly reduced.

- Improved Professionalism: A well-structured document enhances your business’s credibility and presents a polished image to clients.

Incorporating these resources into your workflow not only simplifies the process but also supports better financial management and faster payment collection. This approach ensures a smoother experience for both you and your clients.

How to Customize Your Invoice Template

Adapting a pre-made document to meet your specific needs is an essential step to ensure that your billing system is both efficient and professional. Customization allows you to tailor the layout, content, and design elements, ensuring that all required details are included and presented clearly. Here’s how you can personalize your payment request document to reflect your business identity and requirements.

Adjusting the Layout and Design

One of the first steps in customizing your document is adjusting its layout to match your preferences or business style. Many pre-designed options allow you to modify fonts, colors, and spacing. This helps align the document with your brand and gives a more personalized touch. You can choose to highlight specific sections, such as the total amount or payment terms, to make them stand out.

Adding Specific Details

It’s important to ensure that all relevant details are included, such as your company name, contact information, payment terms, and itemized descriptions of the services or products provided. Depending on your business model, you may also want to include additional fields, such as project numbers, tax IDs, or purchase order references. Tailoring these details guarantees clarity for your clients, which can prevent delays or misunderstandings.

Tip: Make sure your contact details and business name are easy to find, typically at the top of the document. This ensures that your clients can reach you with any questions quickly.

Once you’ve made these adjustments, the document will not only serve its primary purpose but also present a consistent and professional image, building trust with your clients and enhancing your business credibility.

Best Tools for Editing Invoice Templates

Editing your billing document is made easier with the right set of tools. Whether you’re looking for a simple, user-friendly editor or a more feature-rich platform to handle complex needs, there are various options available. These tools allow you to quickly modify the structure, add custom fields, and ensure that all your necessary details are included. Here are some of the best options for adjusting your billing documents:

- Microsoft Word: A widely used tool that provides flexibility in editing, formatting, and customizing documents. Word offers easy-to-use features for personalizing layouts and adding any necessary fields or text.

- Google Docs: A free, cloud-based solution that allows you to collaborate and make edits from anywhere. It’s perfect for simple adjustments and offers the benefit of automatic cloud storage.

- Canva: Known for its design features, Canva offers great templates and customization options for creating visually appealing and professional documents. It’s especially useful for users looking to create branded materials.

- Excel or Google Sheets: Ideal for more complex billing, these tools allow you to create itemized lists and include calculations for taxes, totals, and discounts. They are also beneficial for keeping track of multiple clients or projects.

- Zoho Invoice: A dedicated invoicing platform that offers pre-built formats and the ability to create, edit, and send documents directly. Zoho also allows for automation, making the process quicker for businesses with frequent transactions.

- FreshBooks: A popular online accounting tool that provides customizable billing documents along with features for tracking payments, managing clients, and more.

By choosing the right editing tool, you can ensure your billing process is efficient, professional, and tailored to your business’s specific needs.

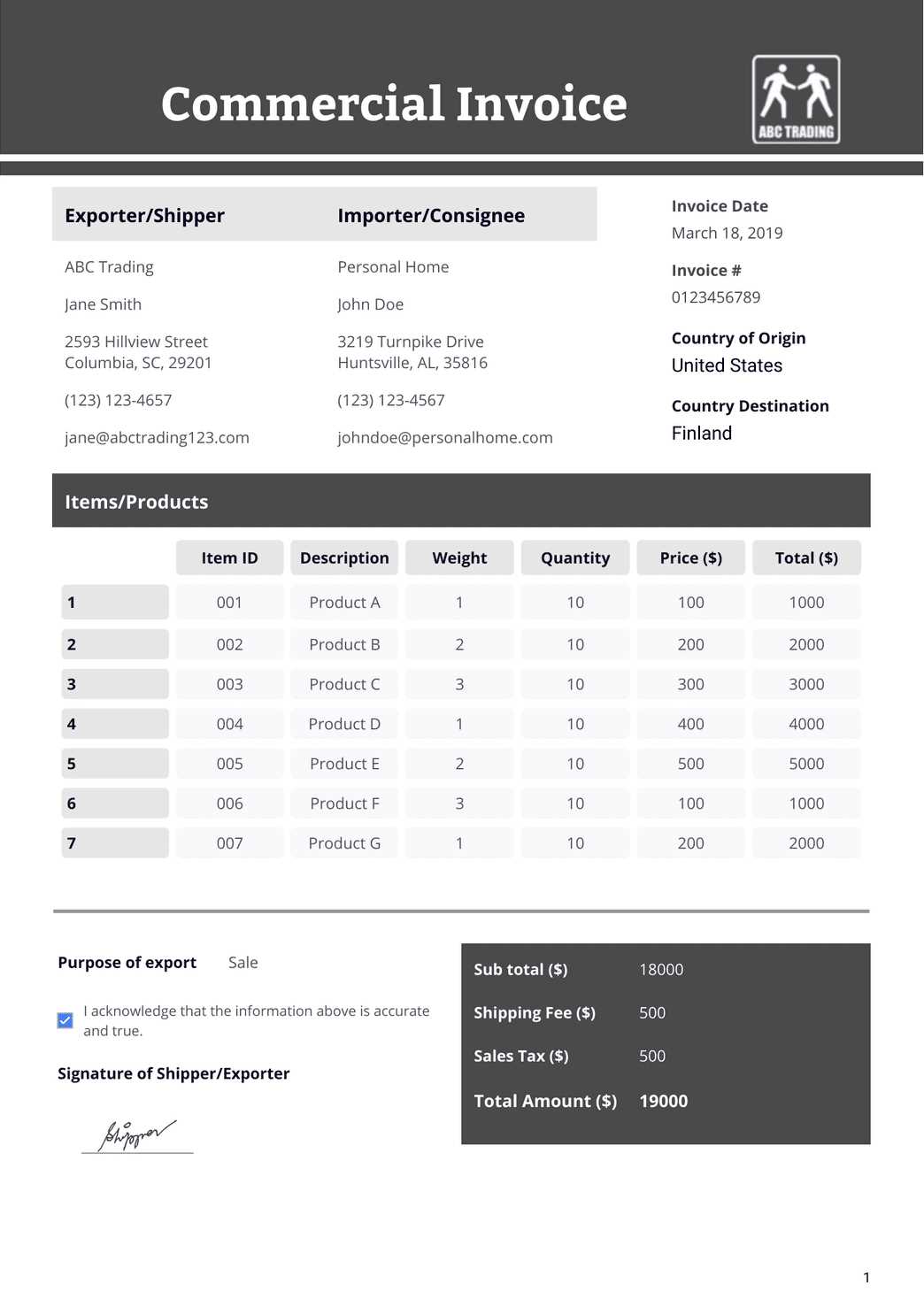

Key Information to Include on an Invoice

When creating a document to request payment, it’s essential to include all necessary details to ensure clarity and avoid confusion. A well-organized request not only helps your clients understand what they owe but also ensures that you receive timely payments. Here are the key elements that should be present in every billing document:

- Your Business Details: Include your company name, address, phone number, and email. This information helps clients reach you with any questions or concerns.

- Client Information: Clearly state the client’s name or business name, along with their address and contact details. This ensures the document is correctly attributed to the right party.

- Document Number: Assign a unique reference number to each document. This helps both you and your client keep track of payments and past transactions.

- Issue Date and Due Date: The issue date shows when the request was sent, while the due date specifies when payment should be made. This helps avoid any confusion about payment timelines.

- Description of Goods/Services: Provide a clear breakdown of the products or services rendered, including quantities, rates, and any relevant details about the work performed.

- Payment Amount: Clearly state the total amount due, breaking it down by individual items or services if necessary. Ensure that taxes, discounts, or additional charges are also listed.

- Payment Terms: Specify how you expect to be paid (e.g., bank transfer, credit card, PayPal) and include any relevant payment terms, such as late fees or early payment discounts.

- Tax Information: If applicable, include the relevant tax details, such as VAT or sales tax, to ensure compliance with local regulations.

By ensuring these key details are included, you not only present a professional image but also make it easier for your clients to understand their obligations, which can help speed up the payment process.

Common Invoice Mistakes to Avoid

Even with a structured format, errors in billing documents can cause delays in payment and create unnecessary confusion for both you and your clients. It’s crucial to pay attention to the details to ensure that your requests are clear and accurate. Below are some common mistakes to watch out for when preparing your payment requests:

- Missing Contact Information: Failing to include your business name, address, or contact details can make it difficult for clients to reach out for clarification or resolve issues. Always ensure your details are clearly displayed.

- Incorrect Client Information: Double-check the client’s name, address, and contact information. Errors in this section can delay payment or cause the document to be overlooked.

- Unclear Payment Terms: Be specific about payment deadlines, methods, and any applicable late fees. Vague terms may result in misunderstandings or delayed payments.

- Overlooking Taxes or Discounts: If applicable, ensure that any taxes or discounts are clearly stated and calculated correctly. Omitting this information can lead to confusion and disputes over the final amount due.

- Wrong or Missing Dates: Always include the issue date and due date. Missing or incorrect dates can cause confusion about when payment is expected, leading to delays.

- Inaccurate Amounts: Double-check the amounts for each item or service, as well as the final total. Mistakes in calculations or the omission of charges can create mistrust and delay payment.

- Not Using a Unique Reference Number: Each payment request should have its own unique identifier. Failing to include a reference number can lead to difficulties in tracking payments and reconciling accounts.

By avoiding these common mistakes, you can streamline your billing process, maintain professionalism, and reduce the risk of payment delays. Taking a little extra time to ensure accuracy will pay off in smoother transactions and stronger client relationships.

How to Save Time with Templates

Streamlining your billing process can significantly reduce the time spent on administrative tasks, allowing you to focus on more important aspects of your business. By using a pre-designed structure, you can quickly create professional payment requests without having to start from scratch each time. Here’s how utilizing a structured document can save you time:

- Pre-set Fields: Many formats come with predefined fields for essential details such as client information, item descriptions, and payment terms. This eliminates the need to repeatedly enter the same information, speeding up the process.

- Faster Data Entry: With a consistent layout, you only need to fill in the unique details for each transaction, rather than reformatting the document every time. This cuts down on the time spent creating new documents from the ground up.

- Reusable Structure: Once you’ve customized the layout to suit your needs, you can reuse it for all future billing requests. This ensures consistency and makes the process even faster over time as you become familiar with the format.

- Automatic Calculations: Some tools or software allow you to include automated calculations for totals, taxes, and discounts. This reduces manual work and minimizes the chance of errors, further speeding up the process.

- Consistency and Accuracy: By using the same format for every document, you reduce the likelihood of mistakes, ensuring that the information is always complete and correct. This prevents time spent fixing errors or following up with clients.

With the right approach, using a structured document can cut the time spent on creating payment requests by a significant margin. This efficiency allows you to focus on growing your business while ensuring that payments are handled smoothly and promptly.

Simple and Professional Invoice Layouts

A clean and well-organized structure is key to creating an effective payment request. A simple layout allows you to present all the necessary details without overwhelming your client with unnecessary information. At the same time, it’s important to maintain a professional look that reflects your business’s brand and values. Here are some tips on how to design a straightforward yet polished document:

Essential Elements for a Clean Layout

When designing your document, focus on the following elements to keep the layout clean and easy to read:

- Clear Section Headings: Use bold headings to separate different parts of the document, such as contact details, payment terms, and a list of products or services. This makes it easier for your client to navigate.

- Ample White Space: Avoid overcrowding the page. Include enough space between sections to make the document visually appealing and less cluttered.

- Consistent Fonts and Sizes: Stick to one or two fonts and make sure they are easy to read. Use larger text for headings and smaller text for details, ensuring that the most important information stands out.

- Itemized Lists: Break down the services or products you are charging for into a neat, itemized list with quantities, descriptions, and prices. This helps clients understand exactly what they are paying for.

Maintaining a Professional Look

While simplicity is key, it’s also important to add subtle touches that convey professionalism:

- Brand Colors and Logo: Incorporate your business’s logo and color scheme to personalize the document and reinforce your brand identity.

- Minimalist Design: Stick to a minimalist approach with just the essentials. Avoid overusing bold colors, graphics, or fancy fonts that may detract from the main content.

- Alignment and Consistency: Ensure all elements are properly aligned and consistent throughout the document. A well-aligned layout looks more polished and is easier for your client to read.

By focusing on simplicity and professionalism, you can create documents that are both functional and visually appealing, helping to build trust with your clients and making your billing process smoother and more efficient.

Choosing the Right Format for Invoices

Selecting the appropriate format for your payment requests is crucial for ensuring clarity, professionalism, and ease of use. The structure you choose can affect how quickly and efficiently your clients process payments. Whether you are working with a few clients or handling large volumes, it’s important to select a format that fits your specific needs and business requirements. Here’s what to consider when choosing the right structure:

Key Factors to Consider

- Client Preferences: Some clients may prefer receiving a physical document, while others may opt for a digital version. Understanding your client’s preferred method of receiving documents can guide your format choice.

- Complexity of Services: If you offer a wide range of services or products, a more detailed layout that allows for itemized lists and clear descriptions may be necessary. For simpler transactions, a more minimal format may be sufficient.

- Legal Requirements: Different regions or industries may have specific legal requirements regarding what must be included on a payment request, such as tax identification numbers or VAT details. Be sure your chosen format accommodates these regulations.

- Frequency of Use: If you issue these documents regularly, it’s important to choose a format that’s easy to modify and reuse. A simple, flexible structure that can be quickly updated and customized will save time in the long run.

Common Format Options

- Word Processing Documents: These are flexible and easy to customize, allowing you to adjust fonts, layouts, and sections as needed. Ideal for small businesses or freelancers who need a straightforward solution.

- Spreadsheets: Tools like Excel or Google Sheets are great for businesses that need to manage multiple clients or track payments. They allow for automatic calculations and detailed itemization.

- Accounting Software: If you are running a larger operation, using specialized software for managing billing can be a good option. These platforms often offer customizable templates, automation, and features for tracking and reporting payments.

- PDF Forms: For a more formal and fixed layout, PDF files are a great choice. They can be customized but remain consistent for all transactions, ensuring that each document looks the same regardless of where it is opened.

By considering these factors, you can select the format that best meets your needs while ensuring your payment requests are clear, professional, and easy for your clients to process.

Free Invoice Templates for Different Industries

When creating a payment request, it’s essential to choose a layout that suits the specific needs of your industry. Different sectors may require unique fields, terminology, or formats to ensure that all necessary details are captured accurately. Below, we explore various industries and the specific requirements that should be considered when selecting a format for your billing documents.

Industry-Specific Features

Each sector has its own requirements when it comes to billing documents. Here’s a look at some of the key fields that are typically included in requests for payment across different industries:

| Industry | Key Features |

|---|---|

| Freelance/Consulting | Hourly rates, project breakdown, payment terms, payment method options |

| Retail | Product descriptions, quantities, unit prices, total cost, sales tax |

| Construction | Project milestones, material costs, labor charges, job site details, permits and taxes |

| Professional Services | Service descriptions, consultation hours, hourly rates, special fees, licensing details |

| Manufacturing | Item numbers, bulk order quantities, pricing tiers, shipping details, production timelines |

Choosing the Right Format for Your Industry

Once you identify the features you need for your industry, selecting a structured layout becomes easier. Whether you’re working in consulting, retail, or another field, customizing a billing document to reflect the specifics of your business can help enhance accuracy and professionalism. Industry-specific formats not only ensure you’re covering all required information, but they also streamline the payment process and foster trust with your clients.

By choosing an appropriate format that addresses the unique requirements of your industry, you can ensure that your billing process is smooth, efficient, and professional.

How to Create Recurring Invoices

For businesses that offer subscription-based services or ongoing contracts, generating regular payment requests can become a time-consuming task. Setting up a recurring billing process can save significant time and ensure that clients are billed consistently. A recurring billing structure allows you to automatically generate payment requests on a specified schedule, such as weekly, monthly, or yearly. Here’s how you can create a system for recurring transactions:

Step-by-Step Guide

Creating recurring billing requests requires a few key steps to ensure accuracy and efficiency:

- Define the Billing Frequency: Decide how often the payments should be made–whether it’s weekly, monthly, or yearly. It’s important to clarify this with your clients at the outset to avoid confusion.

- Set Up a Payment Schedule: Establish a clear payment schedule and ensure your clients are aware of the dates when they will be billed. This helps prevent late payments and sets expectations for both parties.

- Determine the Amount: Set the amount to be charged on a recurring basis. If the amount varies depending on usage or services, make sure to account for fluctuations and provide clear explanations to your client.

- Use Automation Tools: Many accounting or invoicing software platforms offer automated billing features that generate requests at specified intervals. Utilizing these tools ensures that you don’t miss a billing cycle and reduces manual effort.

- Include Clear Terms and Conditions: Ensure that the terms for the recurring charges, including cancellation policies, payment methods, and late fees, are clearly outlined. This minimizes the risk of disputes or misunderstandings later on.

Benefits of Recurring Billing

By automating recurring payment requests, you can streamline your business processes and ensure timely payments. Key benefits include:

- Improved Cash Flow: Regular, automated billing helps ensure a consistent stream of income, improving cash flow and financial stability.

- Less Time Spent on Administrative Tasks: Automating the process means you no longer need to manually create new payment requests every billing period.

- Better Client Experience: Clients appreciate the convenience of automated payments and clear, predictable billing cycles, enhancing their overall experience.

Setting up a recurring billing system not only saves time but also ensures that you can focus on growing your business without worrying about missed payments or administrative overhead.

Invoice Templates for Freelancers and Contractors

For freelancers and independent contractors, creating clear and professional billing documents is essential to maintaining a successful business relationship. Whether you’re working on short-term projects or long-term contracts, having a consistent structure for your payment requests helps ensure timely payments and reduces the chances of confusion. Below are key features and considerations that should be included in any billing structure for freelance work or contract-based jobs.

Essential Elements for Freelance Billing

When designing a payment request, freelancers and contractors need to account for specific factors related to their services. Here are some of the key components that should be present in these types o

How to Invoice International Clients

Billing international clients comes with its own set of considerations that differ from local transactions. Whether you’re working across borders or serving customers in multiple countries, it’s important to account for various factors such as currency, taxes, and payment methods. Ensuring clarity in your payment requests can help prevent delays and misunderstandings, while also demonstrating professionalism. Below are some key points to consider when creating billing documents for clients from different countries.

First, you need to clearly specify the currency in which the payment is due. This is especially important when working with clients from countries with different monetary systems. You should also include any international taxes or fees that apply based on local regulations, such as VAT or GST. If applicable, always verify whether your client’s country has specific tax rates or exemptions that need to be reflected in the payment request.

Next, make sure to include all necessary international payment details. Many clients abroad prefer using services like PayPal, wire transfers, or other cross-border payment platforms. Ensure that your payment methods are clearly outlined and that any additional fees for international transactions are accounted for. It’s also a good idea to be transparent about who covers those fees–whether it’s you or your client.

Finally, when dealing with international clients, it’s crucial to consider the timeline for payment. Currency exchange rates may affect the exact amount received, and payment processing times can be longer than domestic transfers. Be clear about your payment due dates and allow for flexibility when necessary, especially if there are time zone differences that may impact prompt payment.

By carefully considering these details and making your payment requests as clear as possible, you can ensure smooth and efficient transactions with international clients, avoiding confusion and strengthening your global business relationships.

Security Tips for Sending Invoices

Sending billing documents securely is essential to protect both your business and your clients from potential fraud or data breaches. Whether you’re emailing a payment request or using a third-party platform, safeguarding sensitive information should always be a top priority. Below are several practical steps you can take to enhance the security of your payment requests and ensure that they are transmitted safely.

Best Practices for Sending Billing Requests Securely

- Use Encrypted Communication: Always use encrypted email or file-sharing services to send payment requests. Many email providers offer secure options, and third-party platforms like Dropbox or Google Drive allow for encrypted document sharing.

- Enable Two-Factor Authentication: For any platform or service you use to send documents or receive payments, enable two-factor authentication (2FA). This adds an extra layer of security and helps protect your accounts from unauthorized access.

- Use Password Protection: Consider password-protecting your payment request documents, especially if they contain sensitive financial information. Share the password through a separate communication channel, like a phone call or text message.

- Verify Email Addresses: Before sending payment requests, always double-check the recipient’s email address. Phishing attacks often involve fraudsters posing as legitimate clients, so verifying the contact details can prevent errors.

Additional Steps to Enhance Security

- Avoid Sending Sensitive Data in Plain Text: Never send sensitive details such as bank account numbers, credit card information, or personal identification numbers (PINs) in unencrypted email messages. If needed, use secure communication channels.

- Regularly Update Security Software: Ensure that your computer, email service, and any financial software you use are equipped with the latest security updates and anti-malware tools to protect against threats.

- Monitor Payment Status: Keep track of any payments received or overdue. By staying proactive, you can quickly spot any inconsistencies or fraudulent activity.

By implementing these security practices, you reduce the risk of compromising your financial information and ensure that your payment requests are safe from potential threats. Always prioritize security to protect both your business and your clients’ sensitive data.

Where to Download Free Invoice Templates

If you’re looking for a simple and convenient way to create professional billing documents without starting from scratch, there are numerous online resources that offer customizable layouts at no cost. These platforms provide templates that can be tailored to your specific needs, saving you time and effort while maintaining a polished appearance for your business communications. Below, we explore some of the best places where you can access these templates.

Top Websites for Getting Professional Billing Documents

- Microsoft Office Templates: Microsoft offers a wide selection of billing document layouts that can be customized for various industries. You can easily access these templates through Word or Excel, and they are perfect for those who are familiar with the Microsoft Office suite.

- Google Docs and Sheets: Google provides a range of pre-made layouts for billing documents that can be used and edited online. These templates can be saved in your Google Drive and accessed from anywhere, making them convenient for freelancers and small business owners on the go.

- Canva: Canva offers a variety of visually appealing and customizable invoice designs. Their user-friendly platform allows you to create professional documents even if you don’t have graphic design skills. The templates are easily downloadable in various formats.

- Zoho: Zoho provides a selection of simple, customizable layouts for billing documents. These are available as part of their suite of business tools and are designed to streamline your administrative tasks.

- Template.net: Template.net offers numerous customizable options for billing documents across a range of industries, from consulting to construction. The templates are easy to download and personalize for your business needs.

Things to Keep in Mind When Choosing a Resource

- Customization Options: Ensure the resource you choose offers sufficient flexibility to customize fields, logos, and text to suit your business style and needs.

- Format Compatibility: Check that the downloaded files are compatible with your preferred software (e.g., Word, Excel, PDF, etc.) to avoid any issues with editing or printing.

- Ease of Use: Look for platforms that provide an intuitive, easy-to-use interface, especially if you’re not familiar with graphic design or advanced formatting tools.

With these resources, you can quickly generate professional-looking billing documents without any cost. Whether you need a simple layout or a more elaborate design, there’s a solution that f

How to Use Invoice Templates for Better Cash Flow

Effectively managing your cash flow is crucial for maintaining the financial health of your business. One of the key aspects of ensuring a steady cash inflow is ensuring that your payment requests are clear, timely, and professional. By using structured, ready-made formats for these documents, you can streamline the billing process and avoid common mistakes that can delay payments. Below are some strategies on how to leverage these formats to improve your cash flow management.

First, consistency is key. Using a standardized structure for all your payment requests helps clients quickly identify the necessary details, such as the amount owed, payment terms, and due dates. The more straightforward your documents are, the less likely there will be confusion or delays in processing. With a consistent design, clients will know exactly what to expect every time you send a request, which can lead to faster payments.

Second, integrating payment terms that incentivize quick payments can have a positive impact on your cash flow. By clearly stating discounts for early payments or penalties for overdue amounts in your documents, you can encourage timely settlements. Additionally, having your payment details prominently displayed makes it easier for clients to complete transactions without unnecessary delays.

Finally, regularly reviewing and updating your payment requests ensures that they align with your current business needs. As your business grows, your services, pricing structure, and payment terms may change. Using customizable formats makes it easier to adapt and adjust these details quickly, helping you maintain efficiency while staying on top of your cash flow.

By following these tips and utilizing structured formats for payment requests, you can reduce errors, minimize delays, and improve your cash flow management. Timely payments mean you can reinvest in your business, pay employees and contractors on time, and keep your operations running smoothly.