Download Basic Invoice Template for Effortless Invoicing

Managing financial transactions is a key part of running any business, and having a clear and organized way to request payments can save both time and effort. Whether you’re a freelancer, small business owner, or entrepreneur, using pre-designed documents to formalize your charges helps maintain professionalism and ensures accuracy in your records.

Creating these documents from scratch can be time-consuming, but there are easy-to-use solutions available. These ready-made forms allow you to quickly input the necessary information and provide a polished and consistent appearance. The right format can also simplify tracking payments and managing your finances more efficiently.

In this guide, you’ll discover how you can access such tools and the advantages they offer. From customizable layouts to user-friendly features, they help you stay organized and focused on growing your business, without the hassle of starting from the ground up each time you need to issue a request for payment.

Why Use a Simple Billing Form

Having a ready-made document to request payments brings clarity and structure to your financial transactions. It ensures that every necessary detail is included, making the process smoother for both you and your clients. Rather than spending time designing a new document for every sale, using an easily adaptable format saves you valuable hours while maintaining a professional appearance.

Key Benefits of Using a Pre-Designed Billing Document

- Consistency: Using a set layout for all your financial requests helps you present a unified brand image and keeps your records organized.

- Accuracy: A structured format ensures that no important details are overlooked, reducing the chances of errors in the payment process.

- Time-Saving: By utilizing an existing document, you can focus on more important tasks, rather than creating new forms from scratch every time.

How Pre-Made Documents Improve Efficiency

- Faster Payment Processing: Clients can quickly understand the charges and terms, leading to quicker responses and payments.

- Easy Customization: Most formats are editable, allowing you to adjust them to suit your specific needs without the hassle of redesigning.

- Better Record Keeping: Standardizing your forms makes it easier to keep track of past transactions for future reference or tax purposes.

Benefits of Downloading a Billing Document

Using a pre-designed financial form brings numerous advantages to anyone managing payments. It eliminates the need to start from scratch, offering you a convenient and quick way to request payment while ensuring a professional, consistent approach. Whether you’re handling one-off projects or managing recurring transactions, these readily available resources can streamline your business operations.

Time Efficiency and Convenience

- Instant Access: Once you have the file, you can instantly fill it out and send it to your clients without delay, allowing you to focus on your core business activities.

- Ready-to-Use: There’s no need to spend time formatting or organizing information. The structure is already in place, making it easier to use right away.

- Customizable: Pre-made forms can be easily adjusted to suit your needs, from adding specific details to changing the overall design, providing flexibility without extra work.

Professionalism and Organization

- Consistency: By using the same structure for each transaction, you maintain a consistent and organized way of handling requests for payment.

- Clear Communication: A well-structured document ensures that your clients fully understand the payment terms, due dates, and amounts owed, which can lead to fewer misunderstandings.

- Improved Tracking: Storing these forms in an organized system makes it easier to track payments, which is essential for financial planning and tax reporting.

How to Customize Your Billing Form

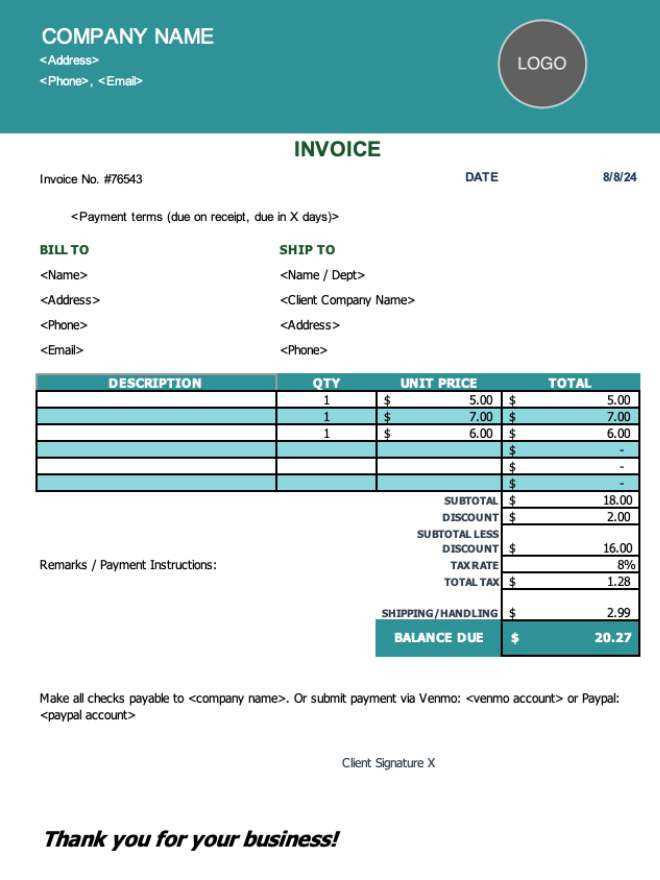

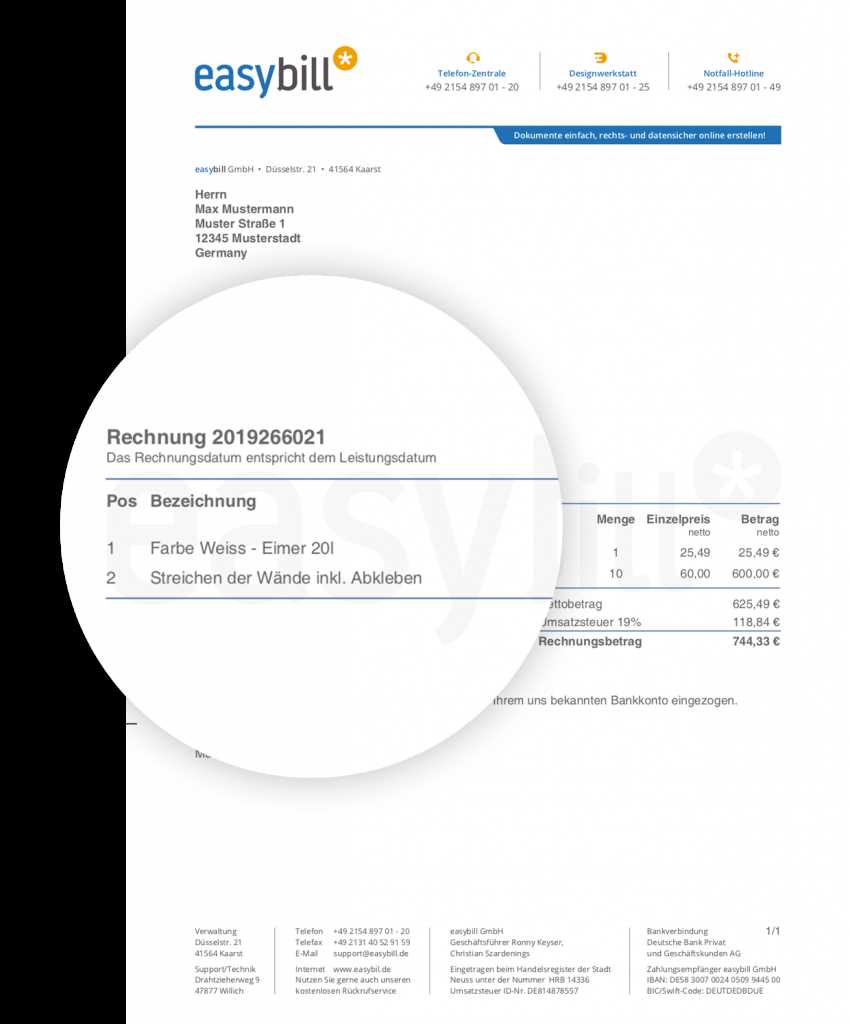

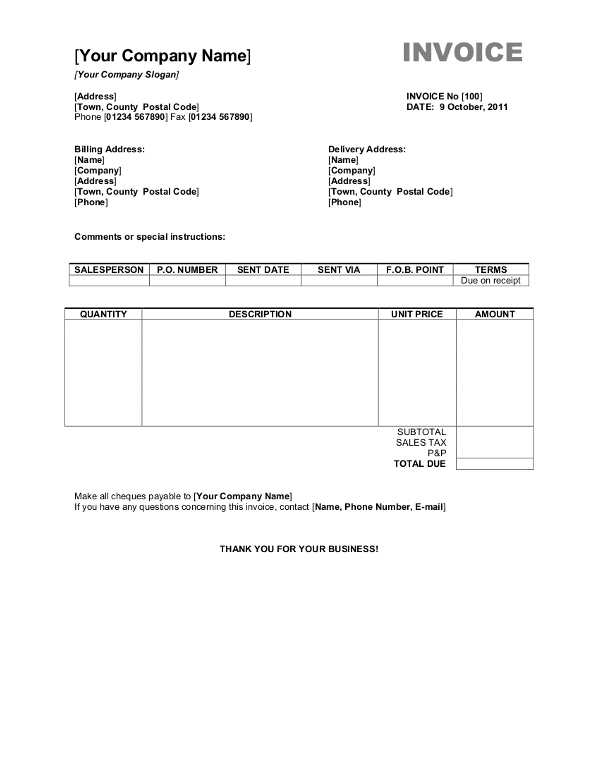

One of the advantages of using a pre-designed financial form is the ability to personalize it to meet your specific needs. Customizing the document ensures that it aligns with your branding and includes all the necessary information for both you and your clients. Whether you need to adjust the layout, add specific fields, or modify the design, most ready-made forms are simple to update and tailor for your business.

Steps to Personalize Your Financial Form

- Insert Your Logo: Adding your business logo gives the form a professional touch and reinforces your brand identity.

- Modify Text Fields: Edit the pre-filled areas to match your service details, such as product names, pricing, payment terms, and any additional charges.

- Change Fonts and Colors: Adjust the font style and color scheme to align with your brand’s look, creating a cohesive and attractive appearance.

- Include Your Business Information: Ensure that your contact details, payment instructions, and terms are clearly stated on the form for easy reference.

- Adjust Layout: Rearrange the sections to emphasize important information, such as the due date, total amount, or a breakdown of services provided.

Additional Customization Tips

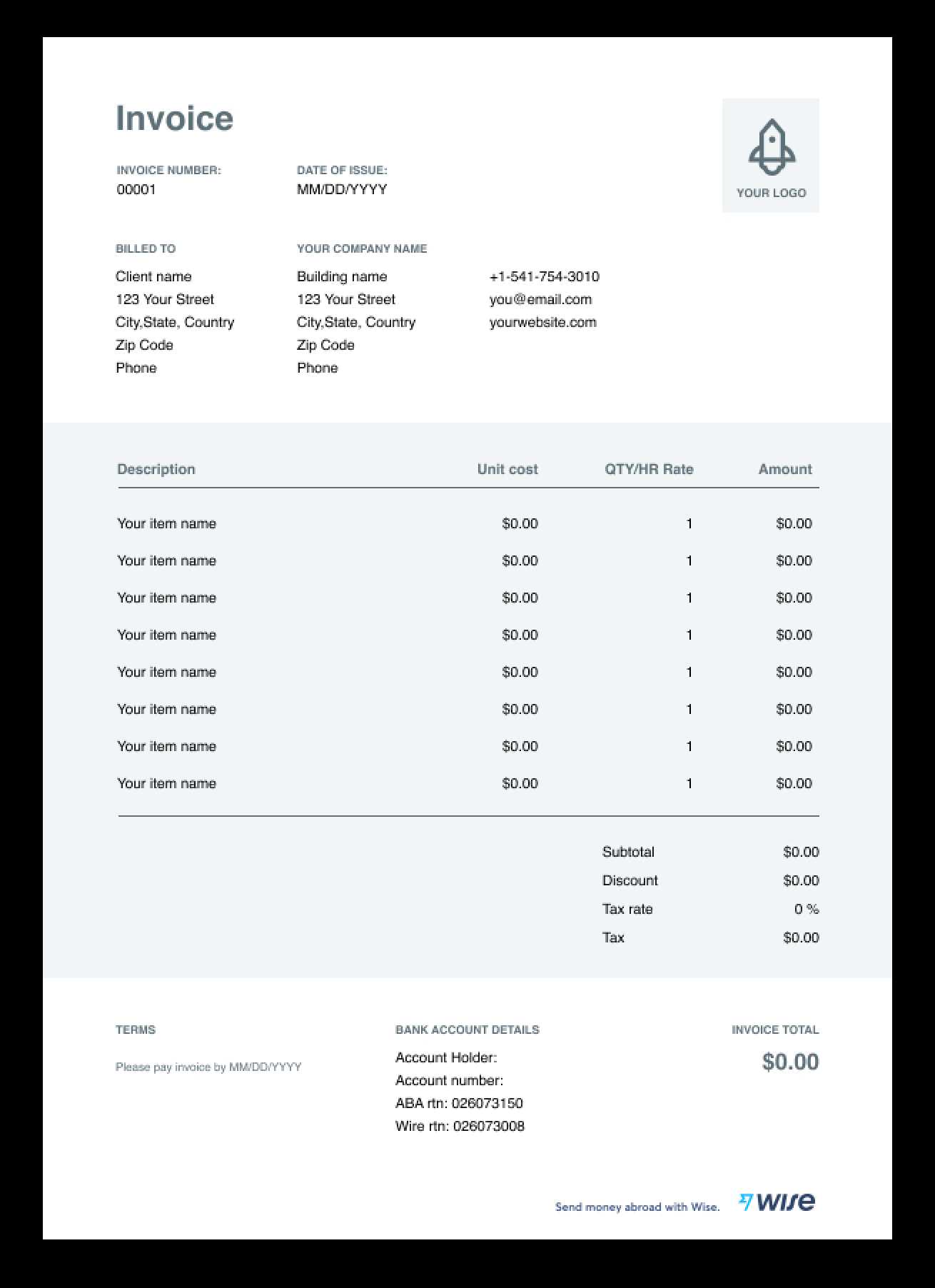

- Payment Methods: Add various payment options if you offer more than one method (e.g., credit card, bank transfer, PayPal).

- Custom Fields: Include specific fields that might be relevant for your industry, such as project codes, purchase order numbers, or client IDs.

- Discounts and Tax Calculations: If applicable, ensure your document includes sections for discounts, tax rates, or other price adjustments to make the total amount clear.

With these simple steps, you can create a customized financial document that fits your business perfectly, enhances your professional image, and ensures a smooth billing process.

Where to Find Free Billing Forms

For anyone looking to streamline their payment requests, there are many resources available online offering free, ready-to-use documents. These resources make it easy to access a variety of formats suited to different business needs. Whether you need a simple form or something more detailed, there are platforms that provide customizable options at no cost, helping you save both time and money.

Top Resources for Free Billing Forms

| Resource | Features | Link | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Google Docs | Easy customization with Google Drive, multiple design options | docs.google.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Microsoft Office Templates | Wide range of designs for different business needs, editable in Word or Excel | templates.office.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

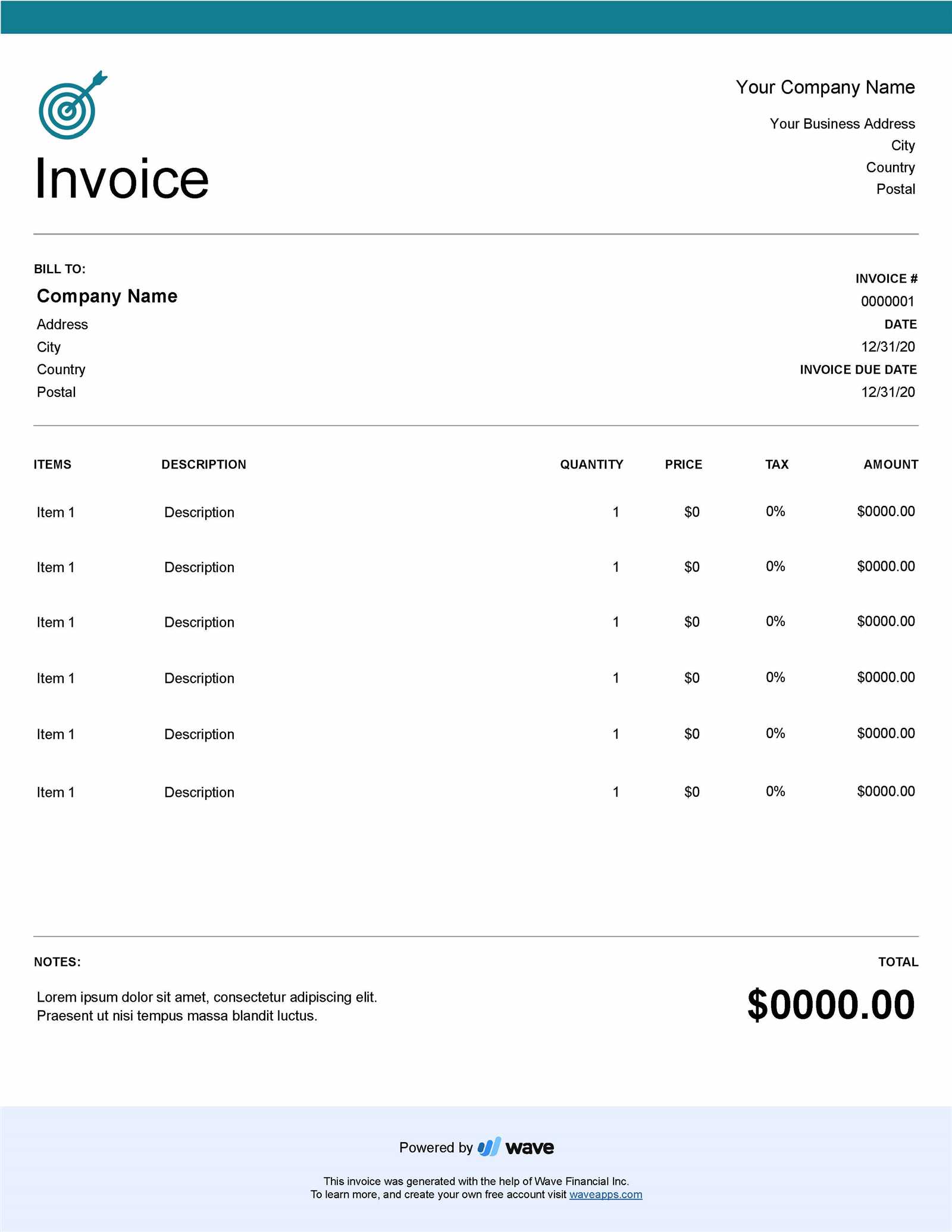

| Wave Accounting | Free invoicing software with pre-built forms, easy to use | waveapps.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zoho Invoice | Customizable templates with online payment options, free for small businesses | zoho.com/invoice | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Invoice Generator | Quick and

Essential Features of a Good Billing Document

A well-structured document for requesting payment should include several key elements that make it clear, professional, and easy to understand. Whether you’re sending this to a client or vendor, the document must communicate all necessary information, ensure transparency, and be straightforward to fill out and process. These essential features not only help avoid errors but also create a professional impression for your business. Key Elements of a Clear Payment Request

Formatting and Design TipsIn addition to the essential information, a good document should be well-organized, easy to read, and visually appealing. Clear headings, logical structure, and a clean layout can make a big difference in how your request is received. Keep the font legible and use enough spacing to ensure that each section stands out. By incorporating these essential features into your billing form, you create a document that not only serves its purpose effectively but also e Understanding Billing Document FormatsWhen creating a payment request, choosing the right format is crucial for clarity and ease of use. Different formats offer various benefits depending on your needs, whether you’re working with a small project, a large contract, or recurring payments. Understanding the strengths of each format helps you select the best option for your business operations. There are several common formats available, each designed to cater to specific business requirements. From simple designs to more comprehensive layouts, the format you choose will depend on the complexity of the transaction, the tools you have available, and how you want to present the information. Common Document Formats

Choosing the Right Format

The choice of format depends on factors such as the volume of transactions, the complexity of the information, and your personal preferences. Excel and online forms are great for businesses with frequent and detailed billing needs, while Word and PDF documents are well-suited for one-time or simpler requests. Regardless of your choice, the key is to select a format that fits your workflow and helps ensure that both you and your clients can easily process the document. How to Edit a Simple Billing DocumentOnce you’ve chosen the right payment request form for your business, the next step is to personalize it with your specific details. Customizing your document ensures it reflects your business style and provides all the necessary information for the client. Editing a pre-made form is often quick and simple, whether you’re using a word processor, spreadsheet, or online tool. Steps to Edit Your Payment Request

Formatting Tips for Clear Communication

|