Free Basic Invoice Template Download for Easy Billing

Managing financial transactions efficiently is crucial for any business. One of the most effective ways to ensure accuracy and professionalism in your financial dealings is by using structured documents to request payment. These tools help you maintain consistency, reduce errors, and save time on administrative tasks, allowing you to focus on growing your company.

For many entrepreneurs, the challenge lies in finding easy-to-use, customizable forms that can meet the specific needs of their operations. Having access to pre-designed formats can streamline the process and ensure that all necessary details are included. Whether you’re a freelancer or a small business owner, using an organized structure for payment requests is key to establishing trust with clients and improving cash flow.

By utilizing such resources, you can avoid the complexity of creating billing documents from scratch and ensure your requests are clear and professional. These tools are readily available and offer great flexibility, making them a perfect solution for businesses of any size.

Free Invoice Templates for Small Businesses

For small business owners, managing payments efficiently is a fundamental part of maintaining a healthy cash flow. Having the right tools to create well-organized billing documents can save valuable time and help avoid errors. Instead of spending hours drafting new forms from scratch, many entrepreneurs turn to pre-designed resources that make invoicing a breeze. These ready-to-use options simplify the process, ensuring consistency across every transaction.

One of the biggest advantages of using these tools is the ability to quickly customize them to fit your specific needs. From adding your business logo to adjusting payment terms, customizable options give you control while still maintaining a professional appearance. Furthermore, these resources are designed to meet the unique demands of small businesses, whether you’re a consultant, freelancer, or retail store owner.

Why Small Businesses Benefit from Pre-Made Resources

Time is often a small business owner’s most valuable asset. By using ready-made forms, you can focus on your core activities while ensuring your clients receive clear and accurate payment requests. These resources are designed to be user-friendly, making them ideal for entrepreneurs who may not have extensive accounting experience. With just a few clicks, you can create a polished document that aligns with your business needs and client expectations.

How to Make the Most of Billing Documents

Even with the perfect form, it’s important to include all the necessary details. Ensure that your billing statements contain key information such as client names, services provided, due dates, and payment instructions. This level of clarity will not only help prevent disputes but also make it easier for clients to process their payments on time. Using organized resources can give you the confidence that every transaction is professionally handled.

Why Use a Simple Billing Document?

Using a structured format for payment requests is an efficient way to ensure clarity and professionalism in your financial transactions. A well-organized document can make the entire billing process faster and more accurate, reducing the risk of misunderstandings with clients. Whether you’re a freelancer, contractor, or small business owner, having a reliable system in place for creating and managing payment requests can save you time and effort.

By adopting a straightforward, pre-arranged format, you eliminate the need to create a new document from scratch each time. This not only speeds up your workflow but also ensures consistency in your communication with clients. Clear, easy-to-read statements also help maintain a professional image, which can strengthen relationships with your customers and enhance trust.

Key Benefits of Using a Pre-Designed Structure

One of the primary advantages of using a structured billing document is simplicity. Pre-made formats are designed to include all the necessary fields, such as contact details, services provided, payment terms, and due dates. This saves you from having to remember or manually add these critical elements every time you send a request for payment. With everything laid out clearly, both you and your clients can avoid unnecessary confusion.

Improving Efficiency and Reducing Errors

Another major benefit is the reduction of human error. With a standard structure, the risk of omitting important details or making formatting mistakes is minimized. This ensures that your clients have all the information they need to process payments quickly and accurately, helping you to maintain a smooth and efficient cash flow.

Benefits of Free Billing Documents

Having access to pre-designed resources for creating payment requests offers numerous advantages for small business owners, freelancers, and contractors. These resources streamline the process of generating accurate and professional-looking billing statements, saving both time and effort. Instead of starting from scratch, you can simply customize the existing structure to fit your needs, ensuring that every transaction is handled efficiently and correctly.

One of the key benefits of using these ready-made resources is cost-effectiveness. Many options are available at no cost, making them ideal for businesses with limited budgets. You can access professional-grade documents without needing to invest in expensive software or hiring an accountant. This allows you to allocate your resources elsewhere while still maintaining high standards in your billing practices.

Time-Saving Advantages

Time is a valuable commodity for business owners, especially when handling multiple clients or projects. With pre-designed resources, you eliminate the need to create billing statements from scratch each time, speeding up the invoicing process. Customizing these documents only takes a few minutes, leaving you more time to focus on your core business operations.

Professionalism and Accuracy

Even when working on a tight schedule, it’s crucial to maintain a professional image. These pre-made resources ensure that your payment requests are clear, organized, and error-free. With consistent formatting and essential details included, you reduce the chances of confusion or disputes, making it easier for clients to understand and process their payments promptly.

How to Obtain a Billing Document

Getting a well-structured billing document is a quick and simple process that can be done in just a few steps. Whether you’re a small business owner or a freelancer, there are plenty of online resources where you can easily access ready-made forms that meet your needs. Here’s how you can find and acquire a document that will help you manage your payment requests with ease.

- Start by researching trusted websites that offer professional billing formats for various business needs.

- Choose a platform that provides a variety of customizable options so you can pick the one that best fits your requirements.

- Look for resources that allow you to modify fields such as payment terms, contact information, and itemized services.

Once you’ve found the right resource, the process is simple. Most sites allow you to quickly access the documents, often in a format that is compatible with popular office software or PDF viewers.

Steps to Get the Right Document

- Search for a reliable provider online.

- Browse available options and choose the one that suits your business type.

- Click on the download link or button to save the document to your device.

- Open the document and begin editing it with your specific information, such as your business name, client details, and services provided.

- Save the modified document and send it to your client via email or other communication methods.

After these steps, you’ll have a customized, professional document ready for use in your business dealings. It’s a simple and effective way to keep your invoicing process organized and efficient.

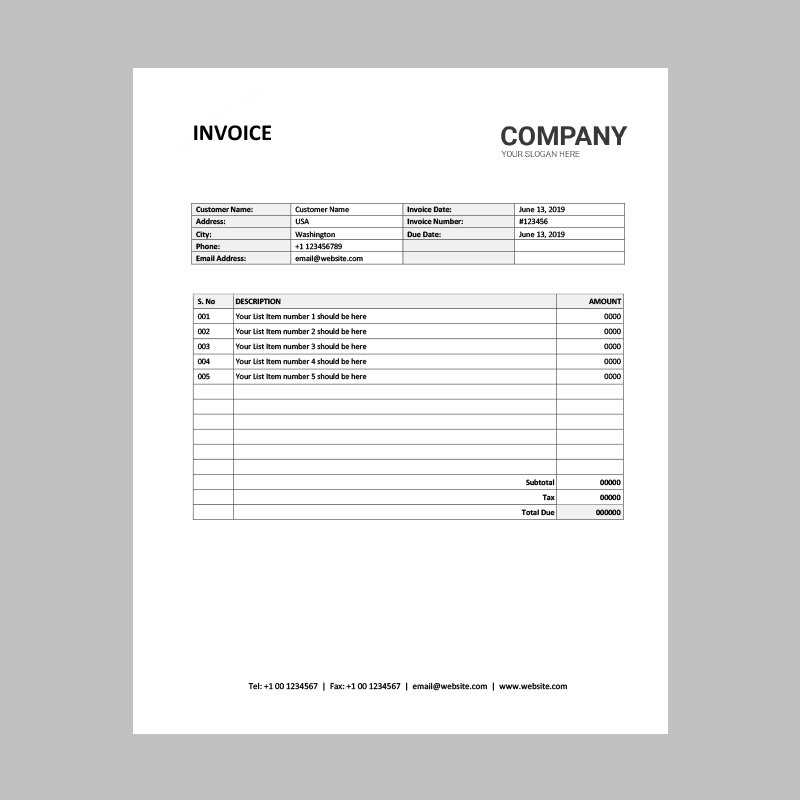

Choosing the Right Format for Your Needs

Selecting the appropriate document structure for your billing process is essential for streamlining your financial operations. The right choice depends on the nature of your business, the type of services you offer, and how you communicate with clients. Whether you are managing recurring payments or one-time projects, it’s important to find a solution that suits your specific requirements and helps maintain professionalism in every transaction.

For freelancers, contractors, and small business owners, there are various factors to consider when selecting a billing document. These include the level of detail needed, the payment terms, and the ability to customize the format for different clients. A simple, clear structure that includes all necessary elements–such as service descriptions, amounts, and due dates–will help ensure that your clients understand the charges and can process payments quickly.

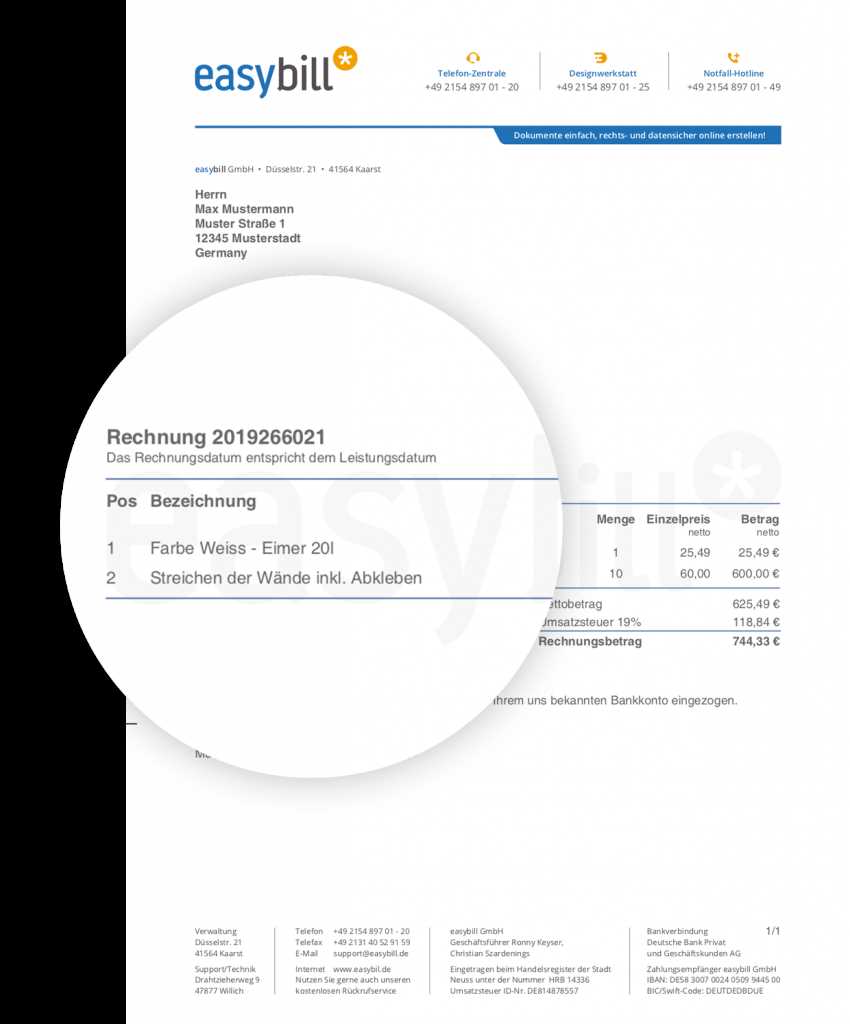

If your business offers different types of services or products, you may need a more customizable format. For example, some resources allow you to add line items or specify discounts, making them ideal for businesses with varied offerings. If you’re working with international clients, choosing a document that supports multiple currencies and languages may also be beneficial.

Customizing Your Billing Document

Personalizing your billing document is essential for making it reflect your business’s identity and ensuring it meets your specific needs. Customization allows you to add unique elements such as your business logo, payment terms, and specific services, making your document professional and tailored to each transaction. By adjusting the structure and content, you can create a clear, organized request for payment that resonates with clients and helps streamline the invoicing process.

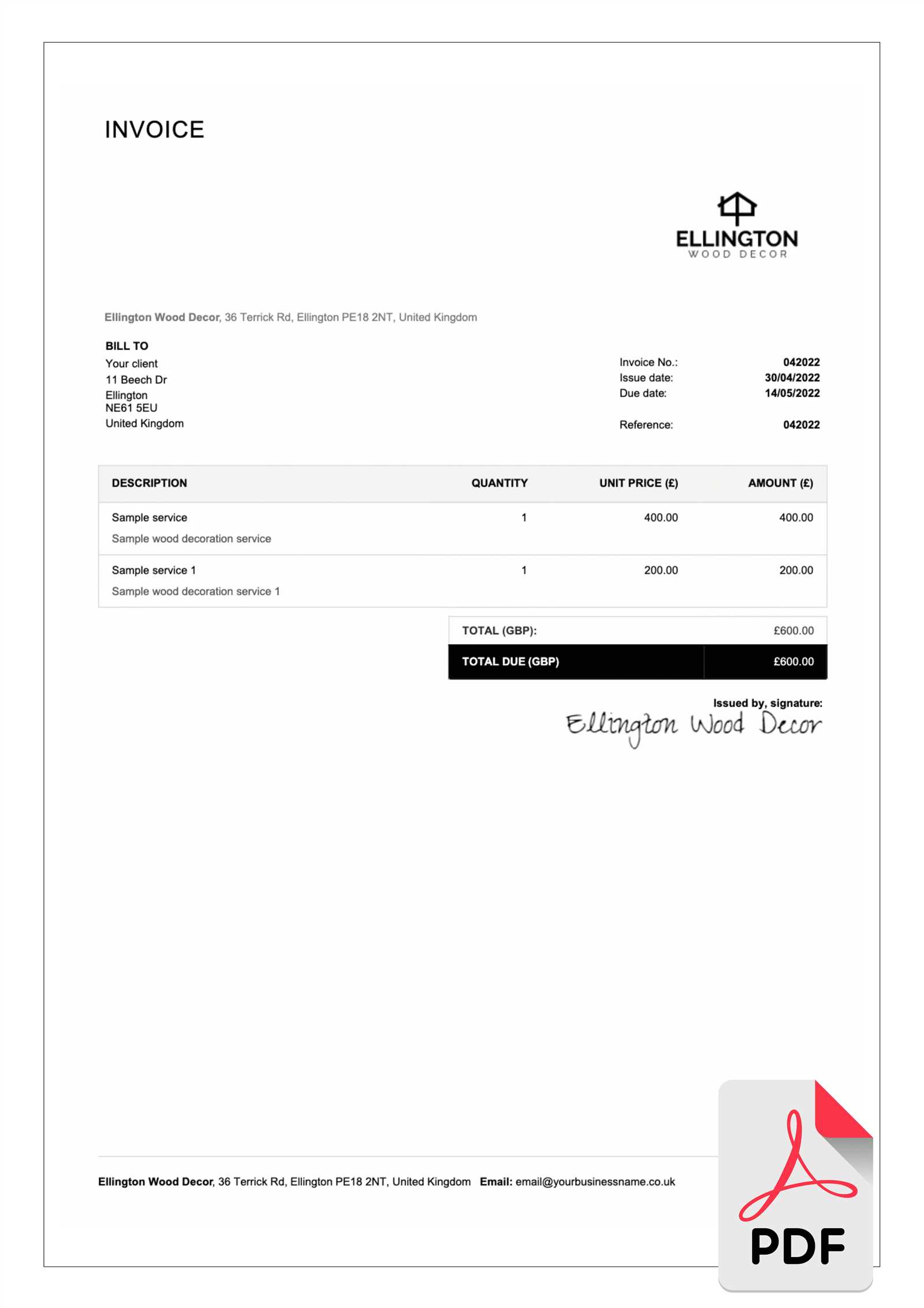

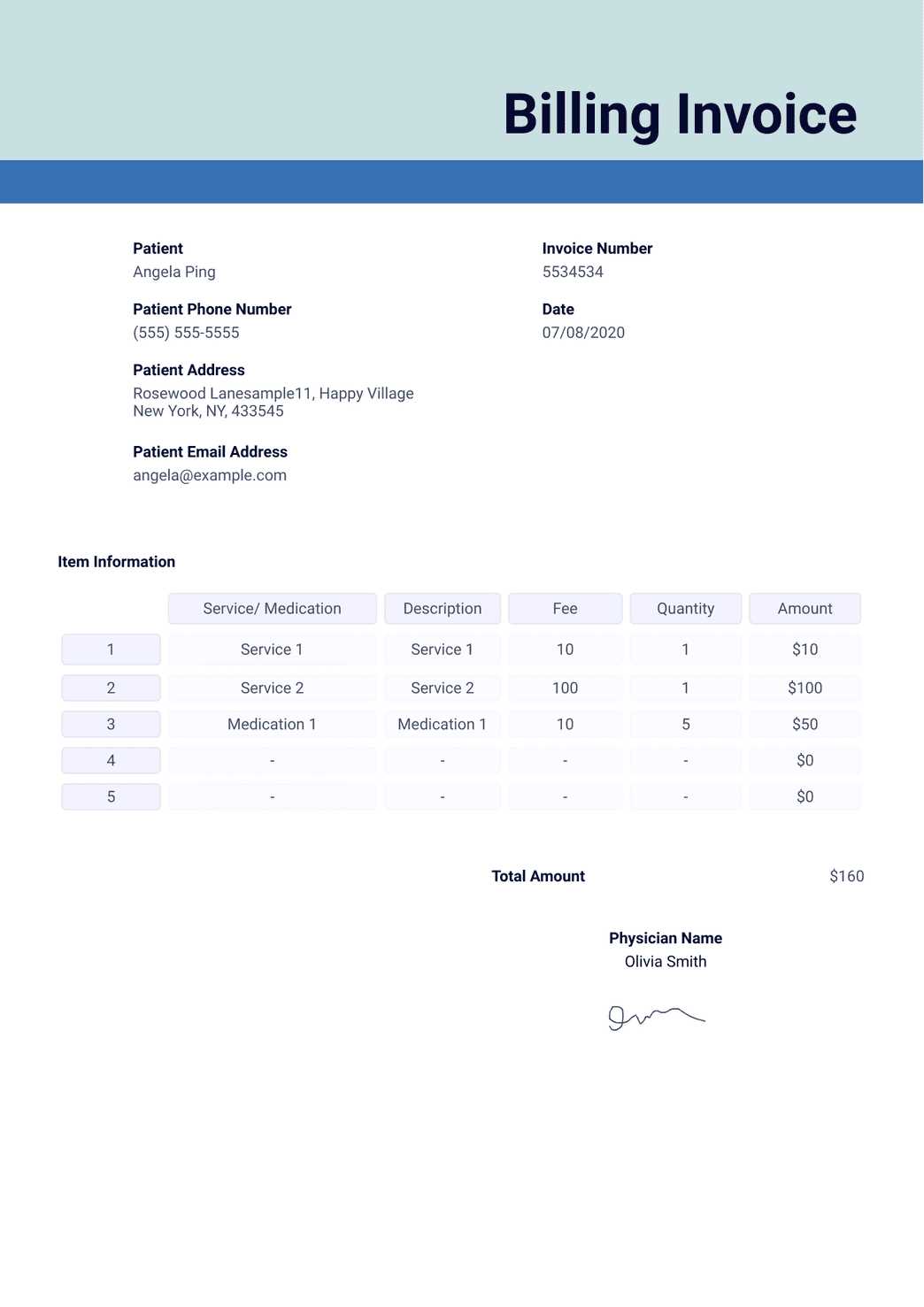

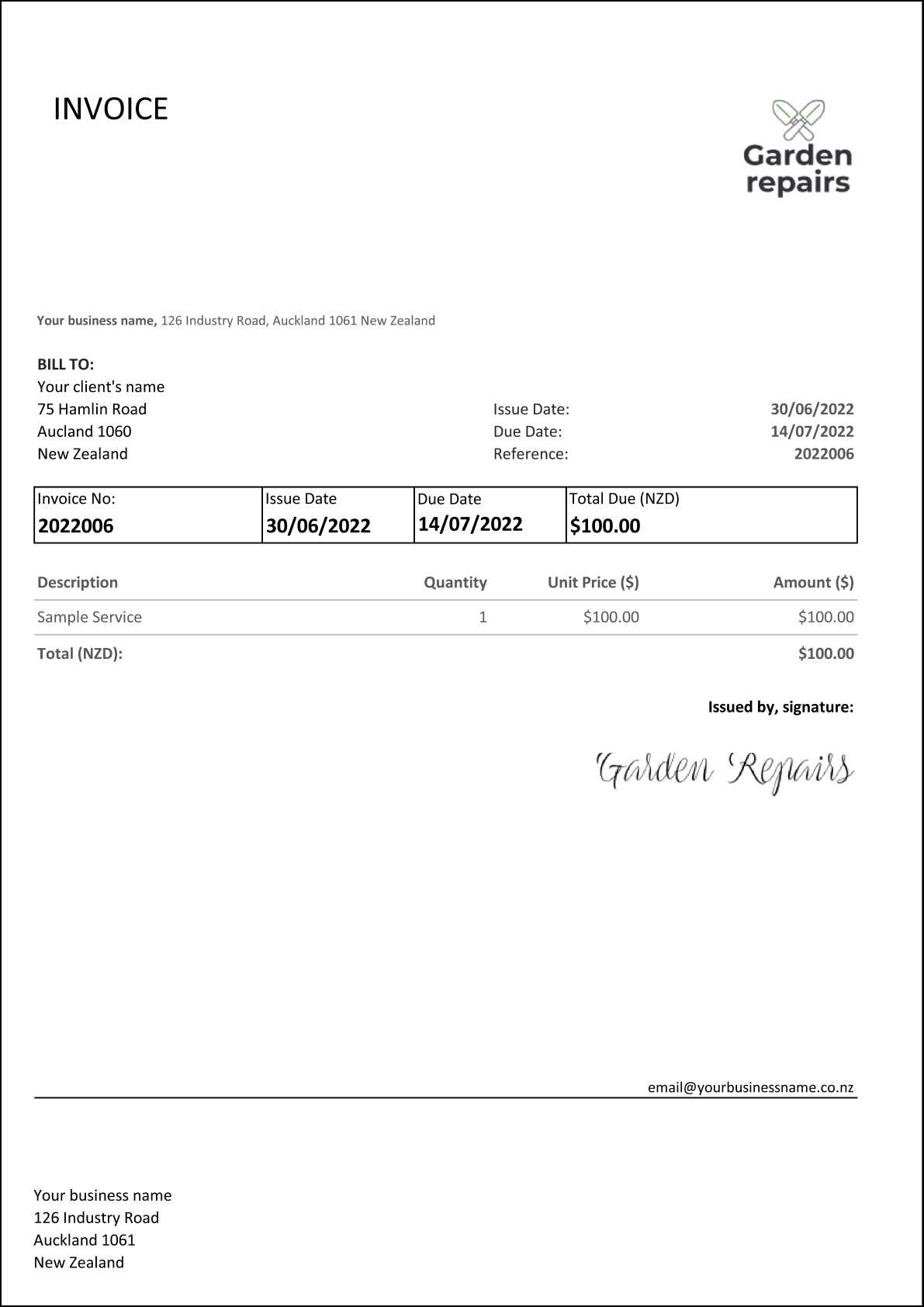

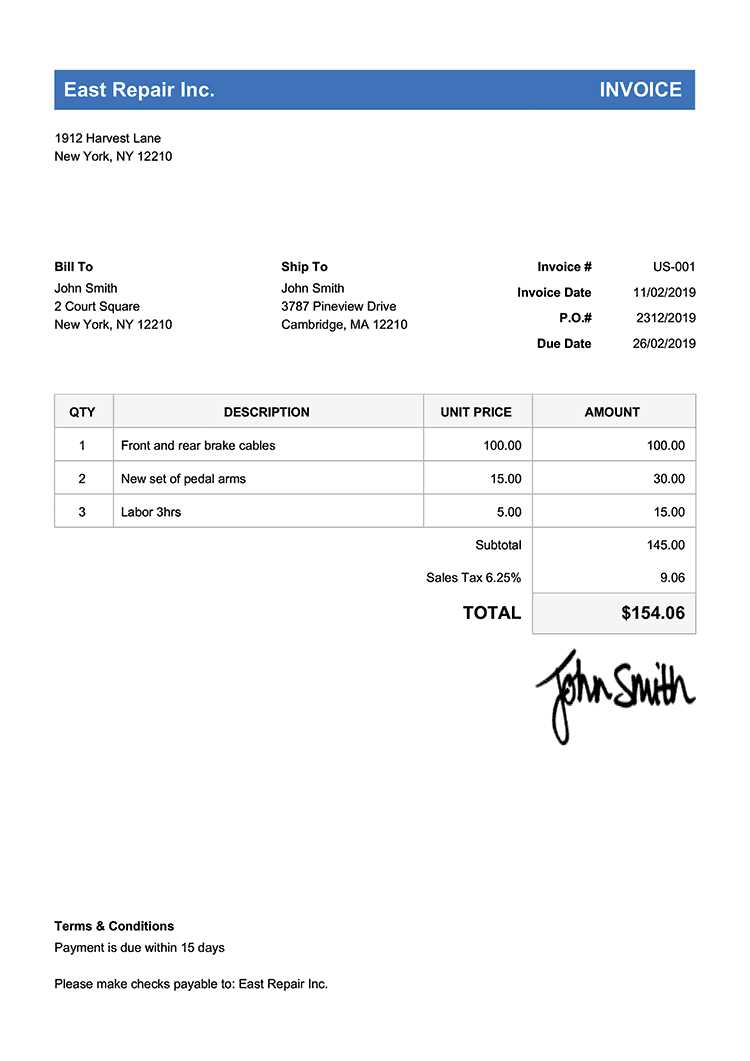

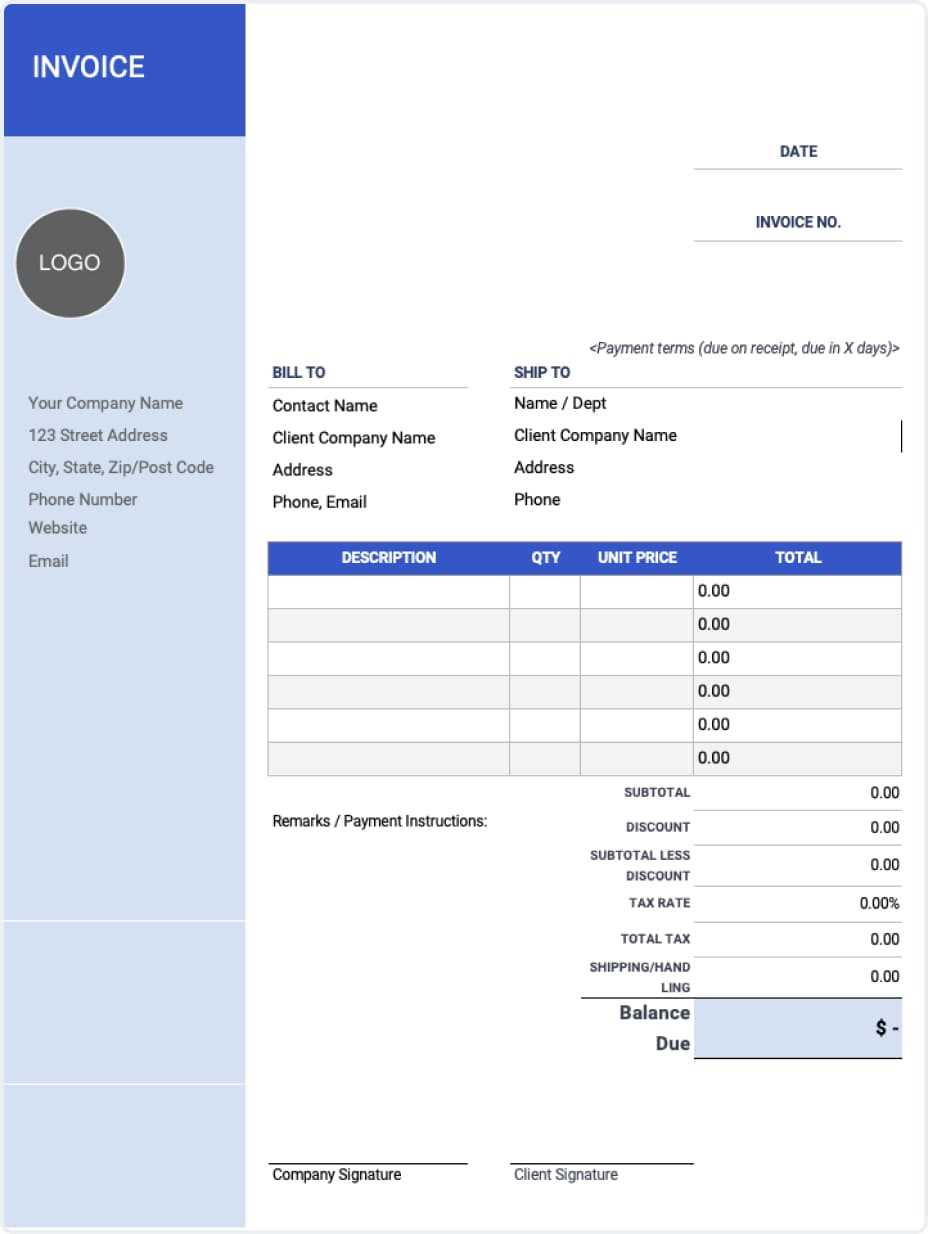

Most tools offer several customization options, from simple text fields to more advanced features like adding itemized lists or integrating payment methods. It’s important to focus on clarity and professionalism while ensuring the document captures all necessary details. Here’s an example of how you can structure your document with customizable fields:

| Item | Description | Quantity | Price | Total |

|---|---|---|---|---|

| Service 1 | Consulting | 1 | $100 | $100 |

| Service 2 | Design | 2 | $50 | $100 |

| Total Due | $200 | |||

In this example, each row represents an individual service or product, and columns can be easily modified to fit your business. By adjusting the values, you ensure that all charges are properly calculated and communicated, leading to more efficient payment processing. Customizing the format not only ensures accuracy but also reinforces your branding and professionalism with every interaction.

Billing Document Formats Available

There are various formats available for creating payment requests, each offering unique features that cater to different business needs. The right format can make it easier to manage your transactions, ensuring that you can easily adapt to the tools you use and communicate clearly with your clients. Whether you’re working with spreadsheets, PDFs, or word processors, selecting the most suitable structure will help you streamline your invoicing process.

Some of the most popular options include:

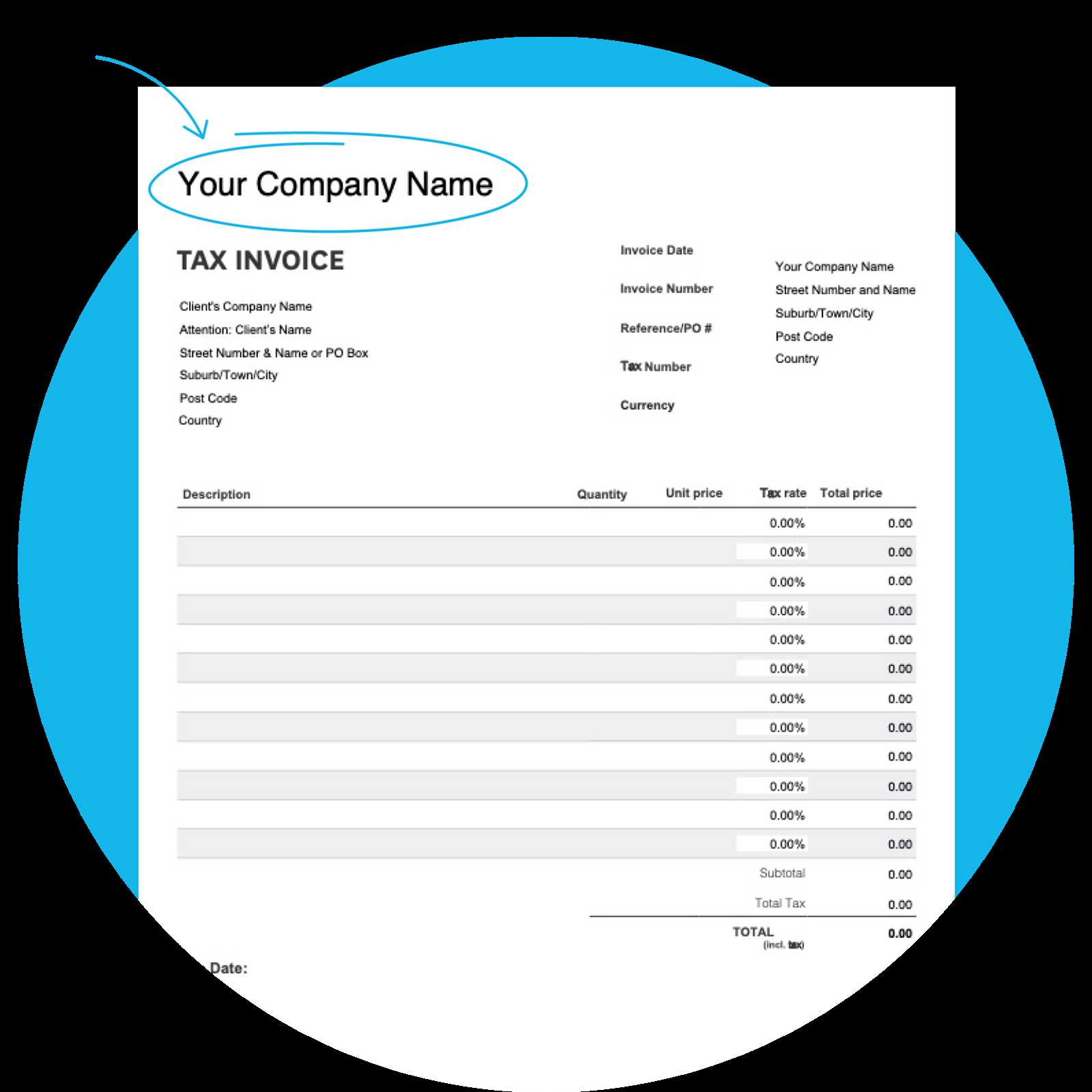

- Spreadsheet Formats (Excel, Google Sheets) – These are ideal for businesses that need to track multiple transactions and perform calculations. With built-in formulas, these formats can automatically calculate totals, taxes, and discounts, saving you time and reducing errors.

- PDF Files – PDFs offer a universally accepted, easy-to-read format that ensures your document looks the same across all devices. This is a great option for businesses that need to send static, finalized payment requests to clients.

- Word Processor Documents (Word, Google Docs) – If you prefer more flexibility in design, word processors allow for easy customization. You can create a document with text, images, and tables, which is useful for adding detailed descriptions or personal branding.

Each format serves different purposes, so it’s essential to choose the one that best aligns with how you manage your transactions and what your clients prefer. Additionally, consider the ease of sharing and editing the document, especially if you work with remote teams or need to send documents to clients across various platforms.

How to Fill Out a Billing Document

Completing a payment request document accurately is essential for ensuring timely payments and maintaining professional communication with your clients. A well-filled form clearly outlines the services or products provided, the amount owed, and other important details, minimizing the chances of misunderstandings or delays. The following steps will guide you through the process of filling out a billing document with all the necessary information.

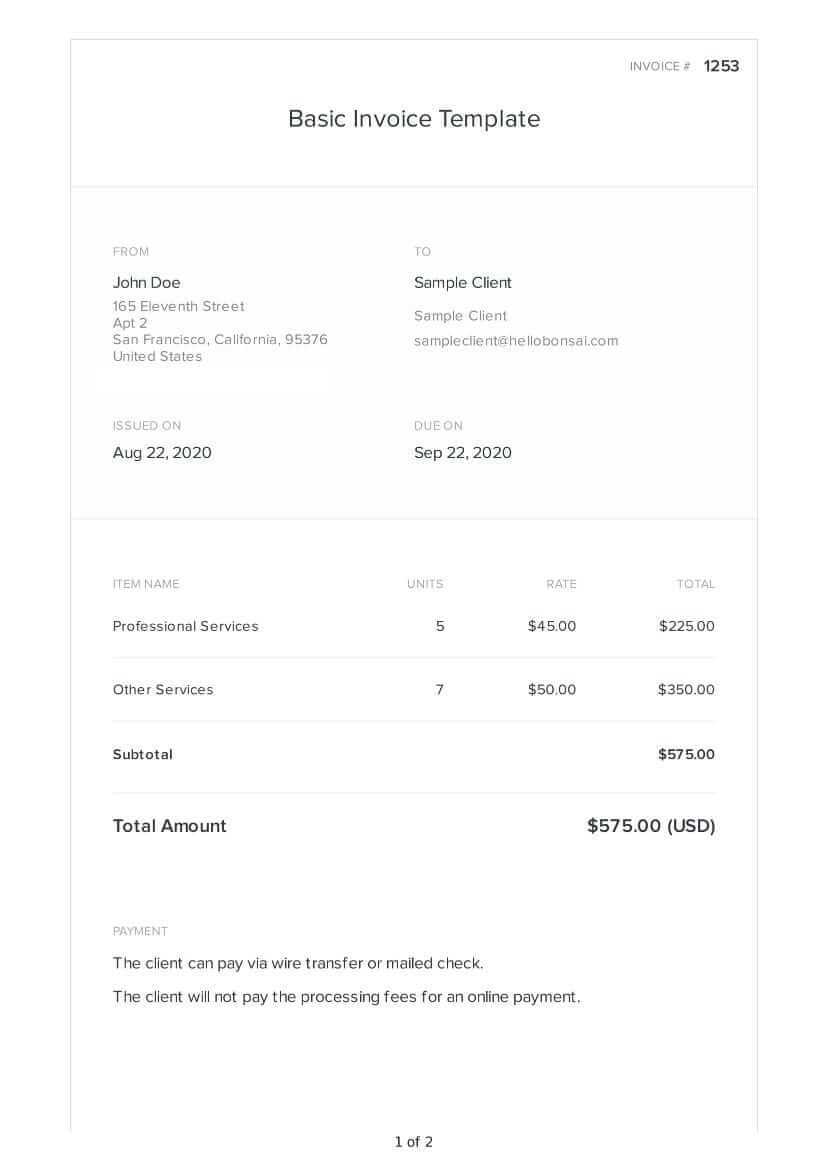

Step-by-Step Guide

- Enter Your Business Information: Start by adding your business name, address, phone number, and email. This ensures that your client can easily contact you if they have any questions or concerns.

- Include Client Information: Next, fill in your client’s name, company (if applicable), and their contact details. This will help you clearly identify the recipient and ensure the document reaches the right person.

- Assign an Invoice Number: Each request should have a unique identification number for tracking purposes. This will make it easier to reference past transactions and keep your records organized.

- Describe the Products or Services: List each item or service provided, along with a brief description and the corresponding unit price. For service-based businesses, make sure to outline the nature of the work done.

- Specify Quantity and Total Amount: For each item or service, include the quantity and calculate the total cost. If applicable, include any taxes or discounts.

- Set Payment Terms: Include the due date for payment and any terms, such as late fees or early payment discounts. This helps ensure that both parties are clear about the payment expectations.

- Provide Payment Instructions: Clearly state how your client can pay, whether it’s via bank transfer, credit card, PayPal, or another method. Including this information will make it easier for the client to process the payment without confusion.

Final Review

Before sending the completed document to your client, take a moment to review all the information for accuracy. Double-check the numbers, ensure the payment terms are clear, and confirm that contact details are correct. A well-organized and accurate billing document will foster trust and promote timely payments from your clients.

Key Elements of a Simple Billing Document

When creating a payment request, it’s essential to include certain elements that ensure clarity and accuracy. A well-structured document not only provides the necessary details for payment but also helps establish professionalism and transparency with your clients. Below are the key components that every effective billing document should have.

- Business Information: This includes the name, address, phone number, and email of the service provider. It’s important to make sure this is clearly visible at the top of the document for easy reference.

- Client Information: Include the client’s name, company name (if applicable), and contact details. This ensures that the document is addressed correctly and reaches the right recipient.

- Unique Identification Number: Assign a distinct number to each billing document for easy tracking and future reference. This helps both parties keep organized records of all transactions.

- Details of Goods or Services Provided: Clearly list each product or service provided, along with descriptions, quantities, and prices. This allows your client to easily understand the charges.

- Total Amount Due: Include a section that clearly shows the total amount due, including any applicable taxes or discounts. Make sure this is highlighted for easy visibility.

- Payment Terms: Specify the due date, any early payment discounts, or penalties for late payments. This sets clear expectations for when and how the payment should be made.

- Payment Instructions: Include the preferred payment methods, such as bank transfer, credit card, or PayPal. Providing clear payment instructions will help ensure the transaction is completed smoothly.

Incorporating these key elements into your payment request will help ensure that your document is clear, professional, and easy for your clients to understand and process.

Billing Documents for Different Industries

Every industry has its own unique needs when it comes to creating payment requests. From service-based businesses to product retailers, each sector requires different elements to be included in a financial document. Understanding the specific requirements of your field will help you choose the right structure and ensure that your billing process is both efficient and professional.

For example, businesses in creative industries may need to itemize each service or project in more detail, while a product-based business might focus on quantities, unit prices, and shipping costs. Here are some examples of how billing documents can differ across industries:

- Freelance and Consulting Services: These businesses often require detailed descriptions of services rendered, hourly rates, and any applicable project milestones. Clear payment terms and dates are critical for maintaining a smooth cash flow.

- Retail and E-commerce: For product-based businesses, the focus will be on listing each item sold, including quantities, individual prices, and the total amount for each line. Additionally, shipping fees and taxes should be calculated and included in the total due.

- Construction and Contracting: Contractors typically need to include more comprehensive details, such as labor costs, material expenses, and project timelines. Progress payments, based on completed work or project phases, are also often included in these documents.

- Healthcare and Medical Services: Healthcare providers must account for medical services rendered, treatments provided, and any associated equipment or medications. Insurance details or co-pays may also be incorporated into these billing documents.

Each of these industries requires different formats to properly communicate the nature of the transaction. Customizing your billing form to meet industry standards can help ensure clarity, improve client satisfaction, and reduce the likelihood of payment delays.

Top Websites for Free Billing Document Access

Finding reliable online resources to obtain well-designed billing formats is essential for streamlining your business transactions. Many websites offer a range of customizable, professional-grade options at no cost, making it easier for small business owners, freelancers, and entrepreneurs to maintain organized financial records. These platforms allow you to choose from a variety of styles and layouts, ensuring you find the perfect match for your business needs.

Here are some of the top websites where you can access high-quality, ready-to-use billing documents:

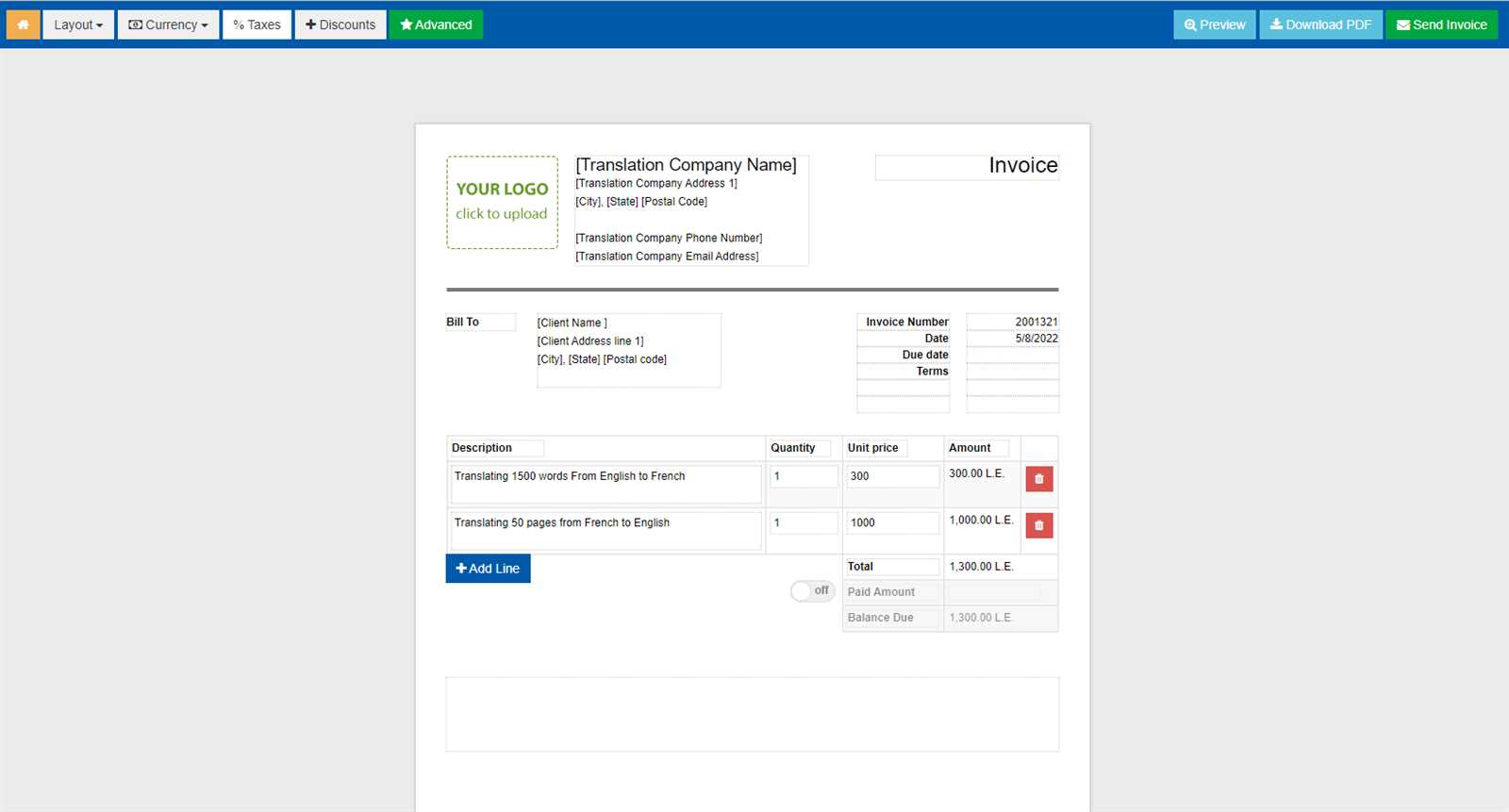

- Invoice Generator: A simple and easy-to-use tool that allows you to create professional billing documents quickly. You can customize the layout, add company details, and adjust the items listed. Once finished, you can instantly save or print the document.

- Zoho Invoice: Zoho offers a customizable billing tool with a range of templates for different industries. Their platform also includes features like payment tracking and integration with accounting software, making it a comprehensive choice for business owners.

- Wave: Known for its user-friendly interface, Wave provides a free invoicing tool that includes various styles and formats. It’s particularly useful for small businesses, as it also offers features like accounting and expense tracking.

- Invoice Simple: This platform allows you to create quick and professional billing documents with minimal effort. It includes options for adding payment terms, discounts, and taxes, and you can export the documents as PDFs.

- Invoicely: Invoicely provides a range of customizable billing formats suitable for freelancers and small businesses. The platform offers basic features for free, with additional functionality available through paid plans.

By using these platforms, you can quickly create detailed and professional payment requests tailored to your business needs, all without the need for expensive software or complicated setups. Each site offers a variety of options to ensure you have the tools necessary to maintain smooth financial operations.

How to Save Time with Billing Documents

Using pre-designed payment request forms can significantly reduce the time spent on administrative tasks, allowing you to focus more on running your business. Instead of manually creating a new document for each transaction, you can utilize ready-made structures that only require minimal customization. This streamlined approach not only saves time but also reduces the likelihood of errors, helping ensure that your financial processes remain smooth and efficient.

Here are a few ways that utilizing structured documents can help you save valuable time:

- Pre-filled Fields: Many platforms provide pre-filled sections such as your business name, logo, and contact details. These details are automatically included every time you create a new payment request, eliminating the need to re-enter the same information.

- Quick Customization: With a standardized format, you can quickly fill in specific details such as item descriptions, quantities, and prices. This speeds up the process of generating billing documents, allowing you to focus on other tasks.

- Consistent Formatting: When using a consistent structure, there’s no need to worry about formatting errors. These ready-to-use forms are designed to look professional every time, saving you the effort of adjusting margins, fonts, or layouts.

- Automation Features: Some platforms offer automated features, such as calculating totals, taxes, and discounts, reducing the time spent on manual calculations and ensuring accuracy.

By adopting this approach, you can improve the efficiency of your invoicing process, minimize the risk of mistakes, and ultimately save yourself a great deal of time and effort in the long run. With everything streamlined, you’ll have more time to focus on growing your business.

Common Mistakes When Using Billing Documents

While using pre-designed forms can simplify the payment request process, there are common mistakes that businesses often make, which can lead to delays or confusion with clients. Understanding these pitfalls can help ensure that your billing documents are accurate and professional. It’s important to pay attention to details and make sure all the necessary information is properly filled out before sending any documents.

Typical Errors to Avoid

- Missing or Incorrect Contact Information: One of the most common mistakes is forgetting to include the correct contact details, either for your business or the client. This can lead to miscommunication and delays in payment processing.

- Not Including a Clear Payment Due Date: Without a specific due date, clients may not prioritize payment. Always make sure to set a clear, unambiguous date for payment to avoid confusion.

- Not Double-Checking Calculations: Even though many forms have automated features for calculations, it’s still important to review the total amount due, taxes, and discounts. Errors in numbers can lead to financial discrepancies.

- Omitting Payment Methods or Instructions: If payment instructions are unclear or missing, your client might delay payment simply because they are unsure of how to proceed. Always include detailed payment options and methods.

- Not Customizing the Document: Using a generic form without adding specific details about the products or services provided can make your document look unprofessional. Customizing the form to reflect the transaction ensures clarity and demonstrates attention to detail.

How to Avoid These Mistakes

To prevent these issues, always review your payment requests before sending them. Double-check the client’s contact details, the payment terms, and the amounts. Ensure that the document includes all necessary information, such as payment instructions and the due date. A quick review can save you time and avoid unnecessary confusion, leading to quicker and smoother transactions.

Billing Documents for Freelancers and Contractors

Freelancers and contractors often face unique challenges when it comes to managing payments. Unlike traditional employees, they typically work on a project-by-project basis and may have varying payment terms depending on the nature of the work. Having a professional and organized document for each transaction is crucial for maintaining clarity and ensuring timely payments. With the right structure, freelancers and contractors can present clear, detailed accounts of services provided, payment terms, and deadlines.

Key Features for Freelance and Contracting Billing

- Hourly Rates or Project-Based Payments: Freelancers and contractors should specify whether the charges are based on hours worked or the completion of a project. It’s important to include a breakdown of hours or milestones, especially for long-term contracts.

- Clear Payment Terms: Clear terms about payment schedules, such as deposits or payment upon completion, should be included. Specifying the due date and any late fees ensures that both parties are aware of expectations.

- Detailed Descriptions of Work: Providing detailed descriptions of the services rendered is essential, especially if the work is complex or involves multiple stages. This clarity helps clients understand exactly what they’re paying for.

- Expense Reimbursement: If the freelancer or contractor has incurred expenses on behalf of the client, these should be clearly itemized. This includes travel costs, materials, or other out-of-pocket expenses.

Customizing for Different Types of Work

Depending on the nature of the work, the billing document may need additional customization. For example, a designer may want to include design concepts or mockups, while a contractor may include detailed labor costs, material fees, and project phases. Customizing the document to suit the specific type of freelance or contract work not only helps with transparency but also enhances professionalism.

By using an organized structure, freelancers and contractors can avoid misunderstandings with clients and ensure timely payment, leading to more efficient and successful working relationships.

How to Send Billing Documents Professionally

Sending payment requests professionally is key to maintaining a positive relationship with clients and ensuring timely payments. The way you present your financial documents speaks volumes about your business practices and attention to detail. A well-crafted document, combined with a professional delivery method, enhances your credibility and helps avoid delays or misunderstandings.

Steps to Sending Payment Requests Professionally

- Ensure Accuracy: Double-check all the details before sending your payment request. Verify that all services or products are correctly listed, quantities and prices are accurate, and that your payment terms are clearly defined. An error can lead to confusion or delay.

- Use Professional Language: The tone of your payment request should be polite, concise, and clear. Avoid informal language, and ensure that the terms of the agreement (such as payment due dates and any penalties) are unambiguous.

- Choose the Right Format: Sending documents in a universally accepted format, such as PDF, is important. PDFs ensure that your payment request will appear professional and maintain its formatting, regardless of the recipient’s software.

- Send via Appropriate Channels: While email is a common and efficient method, be sure to use a professional email address (preferably one associated with your business). If you’re sending a hard copy, use a formal envelope and ensure the document is neatly presented.

- Follow Up: If payment isn’t received by the due date, it’s important to send a polite reminder. Ensure your follow-up communication remains professional and courteous, restating the details of the original payment request and any applicable late fees.

Maintaining Consistency

It’s essential to use a consistent approach when sending payment requests. This includes using a standard format for all documents, setting the same payment terms, and following a clear process for how and when payment requests are sent. Consistency not only improves your efficiency but also builds trust with your clients, who will come to expect the same level of professionalism from every transaction.

By following these steps and maintaining a professional approach, you can ensure that your payment processes run smoothly and your business maintains a strong reputation for reliability and organization.

How to Track Payments Using Templates

Keeping track of payments is a crucial part of managing finances for any business. Using well-structured documents not only helps you create clear and professional payment requests but also makes it easier to monitor incoming payments. By including key information such as payment dates, amounts due, and statuses, you can maintain an organized record of transactions and avoid confusion or delays in payments.

Key Information for Payment Tracking

When creating a payment request document, it’s important to include the following information to track payments effectively:

- Payment Due Date: Clearly list the due date to establish when payment should be received. This helps both you and your clients stay on schedule.

- Amount Due: Specify the total amount due for the services or goods provided. This will be important for reference when reconciling payments.

- Payment Method: Include options for how payments can be made, such as bank transfer, credit card, or online payment system.

- Payment Status: This section helps you track whether the payment is pending, partially paid, or fully paid. It’s essential for managing outstanding invoices.

Tracking Payments with a Simple Payment Log

One of the most efficient ways to track payments is to maintain a payment log or spreadsheet. You can set it up manually or use available tools that allow for easy tracking. Here’s an example of a basic table that can be included in your document or used as a separate log:

| Invoice Number | Client Name | Amount Due | Due Date | Payment Status | Payment Date | Amount Paid |

|---|---|---|---|---|---|---|

| 001 | John Doe | $500 | 12/15/2024 | Paid | 12/10/2024 | $500 |

| 002 | Jane Smith | $300

Improving Business Cash Flow with Billing DocumentsEffective cash flow management is vital for any business to thrive. A key part of this process involves ensuring timely payments from clients. One of the most effective tools for improving cash flow is using well-organized and clear payment requests. By streamlining your billing process and setting clear terms, you can accelerate payments, minimize delays, and keep your finances in good shape. Why Proper Billing Matters for Cash FlowWhen payment requests are clear, detailed, and professionally presented, clients are more likely to process them promptly. Well-structured documents help avoid confusion about payment terms, reduce back-and-forth communication, and demonstrate professionalism. Here’s how proper billing can directly impact cash flow:

Best Practices for Maintaining Steady Cash FlowTo further improve cash flow, businesses should consider a few best practices in their payment request process:

|