Best Bank Invoice Template for Simple and Professional Billing

Managing financial transactions efficiently is crucial for maintaining smooth operations, whether for small businesses or large corporations. A well-structured document for payments not only ensures clarity between parties but also helps keep accurate records for future reference. When these documents are standardized and easy to customize, they save time and improve organization.

Having a predefined structure allows you to focus on the essential details of each transaction without reinventing the wheel each time. By using a flexible system, you can streamline the billing process and ensure consistency across all communications with clients and partners.

These documents typically include key information such as amounts, due dates, payment methods, and contact details. The right approach makes it easier for both you and your clients to stay on track with financial matters. In this guide, we’ll explore the importance of creating and using efficient, customizable tools to simplify your business’s payment documentation.

Bank Invoice Template Overview

For any business, the process of requesting payment from clients needs to be both clear and professional. By using a structured document, companies can ensure that all necessary information is included, making transactions smoother for both parties. These documents serve as a formal request for payment and provide a standard format that can be easily adapted to meet specific needs.

Using a consistent format allows businesses to manage financial communications more effectively. With the right document, you can easily track payments, avoid errors, and maintain an organized record of transactions. A well-organized payment request also enhances the company’s professional image and fosters trust with clients.

Such tools are designed for simplicity and flexibility, making them easy to adjust for different business models. Whether for one-time payments or recurring transactions, these systems allow businesses to maintain clarity while ensuring that all critical data is included in each request.

What is a Bank Invoice Template?

A payment request document is a formal method used by businesses to ask for compensation in exchange for goods or services. This document is designed to provide clear, organized information about the transaction, ensuring that both the recipient and the sender understand the terms and conditions. It typically includes details like the total amount due, payment terms, and the business’s contact information.

Such a document is structured in a way that makes it easy to replicate for multiple transactions, saving time and reducing the risk of errors. By using a standardized format, companies can ensure consistency, simplify the billing process, and ensure that all necessary information is included every time a payment is requested.

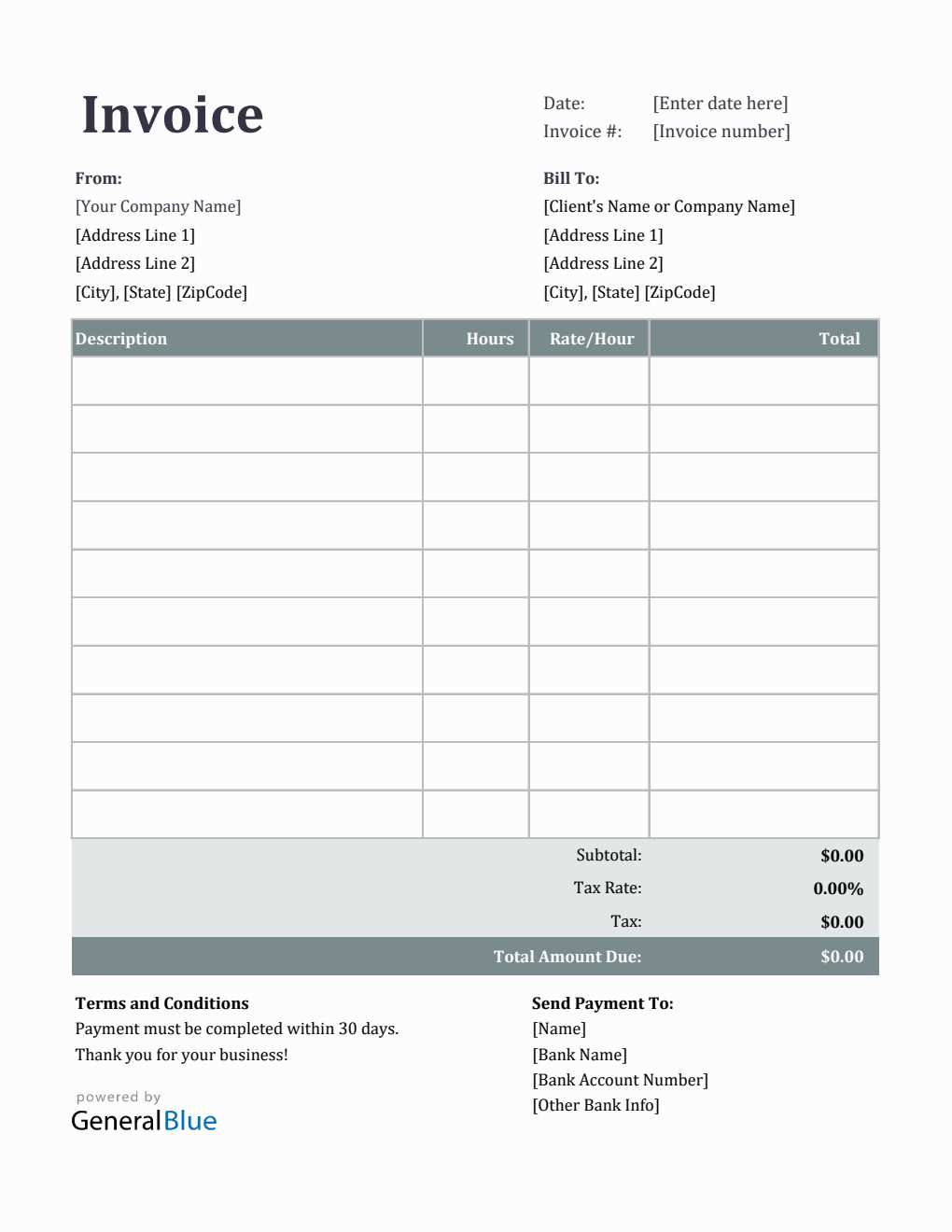

| Section | Description |

|---|---|

| Business Details | Name, address, and contact information of the company sending the payment request. |

| Client Information | Name and contact details of the client or customer being billed. |

| Payment Amount | The total amount due for the goods or services provided. |

| Payment Terms | Information about when the payment is due and acceptable payment methods. |

| Unique Reference | A reference number or code to identify the specific transaction or request. |

By including these critical sections, businesses can ensure that each payment request is clear, accurate, and professional. The document serves not only as a request but also as a record for future reference, making it a vital tool in financial management.

Key Features of Bank Invoice Templates

When creating a document for requesting payment, certain features make it more effective, clear, and professional. These essential elements ensure that all relevant information is included, helping businesses communicate payment details to clients in an organized way. A well-structured payment request not only facilitates smoother transactions but also promotes trust and transparency between the two parties.

Clarity and Simplicity are critical for any financial document. It should be easy to read, with clear headings and sections that guide both the sender and recipient through the information. This helps prevent misunderstandings and errors in payment details.

Customizability is another important feature. The ability to adapt the document to suit different business needs, payment methods, or specific client requirements ensures versatility. Whether it’s for one-time services or ongoing contracts, the structure should be flexible enough to handle various types of transactions.

Consistency across all requests helps create a uniform approach to billing, making it easier for businesses to manage and track payments. Having a set structure for each document reduces the risk of omitting critical details, ensuring that nothing is overlooked.

Inclusion of Key Information is essential. This includes the payment amount, due date, contact information, and payment terms, all of which must be presented clearly to avoid confusion. An organized, professional layout ensures that all necessary details are easy to find.

Professional Appearance helps businesses maintain a positive image. A well-designed document reflects the professionalism of the company, boosting credibility and fostering trust with clients.

Why Use a Bank Invoice Template?

Using a structured payment document simplifies the billing process and helps businesses maintain clear and consistent financial records. Instead of creating a new layout for every transaction, a pre-designed format ensures that each request includes the essential details, saving time and minimizing errors. This streamlined approach benefits both businesses and their clients by making payments quicker and more transparent.

Time Efficiency

One of the main reasons to use a standardized format is the time saved on document creation. Rather than starting from scratch for every client, a reusable structure allows businesses to focus on the details of the transaction rather than formatting. This leads to faster processing of payments.

- Quickly input payment details

- Eliminate the need to design each document from the ground up

- Reuse for multiple clients or transactions

Improved Accuracy

A consistent layout ensures that all relevant information is included each time, reducing the chances of overlooking crucial details such as payment deadlines, client contact information, or the total amount due. This minimizes the risk of disputes or delayed payments due to missing information.

- Standard sections for client, payment amount, and terms

- Prevents accidental omission of important data

- Helps keep records organized and consistent

By using a ready-made structure, businesses can enhance professionalism, avoid costly mistakes, and keep financial communications clear and reliable. This makes the entire billing process more efficient for both the company and its customers.

How to Customize Your Bank Invoice

Customizing your payment request document is essential to reflect your business’s unique needs and branding. A personalized format allows you to tailor the document to suit different client requirements, payment methods, or specific business practices. By adjusting the layout and content, you can make the document more relevant and efficient for your purposes.

Adjusting Basic Information

The first step in customization is ensuring that all your essential details are included and easy to find. Start with your company’s name, address, and contact information at the top of the document. Then, add client information such as their name and address. These details create the framework for each document and help maintain consistency across transactions.

Adding Payment Terms and Methods

Each business has different payment terms, so it’s important to specify these clearly in the document. Include the payment due date, acceptable methods of payment, and any late fees or early payment discounts. This information ensures both you and the client are on the same page regarding how and when the payment should be made.

| Field | Customizable Options |

|---|---|

| Company Name | Include full legal name, logo, or brand elements |

| Client Information | Customize to include company details, contact names, and billing addresses |

| Payment Terms | Adjust due date, payment methods, and discounts/penalties |

| Payment Amount | Specify quantity, rate, and total amount due |

| Reference Number | Include unique invoice or transaction number for tracking purposes |

Once these sections are adjusted to your business’s needs, you can also personalize the design, such as font styles, colors, and layout. A consistent style across all your documents not only makes them easier to recognize but also strengthens your professional image.

Top Benefits of Using Templates

Using a predefined structure for creating payment requests offers several significant advantages. These benefits not only improve efficiency but also help businesses maintain consistency, accuracy, and professionalism in their financial communications. By utilizing a standard format, companies can simplify the billing process while ensuring that key information is always included and presented clearly.

Time-Saving is one of the primary benefits of using a reusable structure. Rather than starting from scratch each time, businesses can quickly input transaction details into an existing layout, dramatically reducing the time spent on creating each document.

Consistency is another important advantage. By using the same format for every request, businesses can maintain a uniform look and feel across all their financial communications. This helps create a professional, organized image and ensures that all essential information is consistently included in each document.

Reduced Errors are inevitable when creating documents manually, especially when dealing with numerous transactions. A predefined structure helps minimize the risk of mistakes, such as missing data or formatting inconsistencies, which could lead to delays in payment or misunderstandings with clients.

Customization does not have to be sacrificed when using a ready-made format. Many layouts offer flexibility, allowing businesses to adjust the design, payment terms, and other essential details to suit specific client needs or business requirements. This makes it easy to maintain a personalized approach without losing the efficiency of a standardized process.

Free vs Paid Bank Invoice Templates

When choosing a structured layout for creating payment requests, businesses often face the decision of whether to use a free or a paid option. Each choice comes with its own set of advantages and trade-offs. While free layouts can be an appealing option for small businesses or startups, paid versions may offer additional features and customization options that could better meet the needs of larger organizations or more complex financial transactions.

Free Options often provide basic functionality, which can be enough for businesses with simple billing needs. These formats are readily available, easy to use, and cost nothing, making them an ideal starting point for businesses that are just getting started or only require occasional billing. However, they may have limitations in terms of design flexibility, features, or support.

Paid Versions, on the other hand, often come with more advanced features, such as professional designs, automatic calculations, or integration with accounting software. These options typically allow for greater customization, allowing businesses to tailor the document to their exact needs. They also usually come with customer support, ensuring that any issues can be addressed quickly and efficiently.

While free formats are great for basic purposes, businesses that need greater functionality, branding options, or more comprehensive support might find that investing in a paid version offers long-term benefits, especially when it comes to maintaining a consistent and professional image across all client communications. Ultimately, the choice depends on your business’s specific needs and budget.

Choosing the Right Template for Your Business

When selecting a document layout for payment requests, it’s essential to find one that aligns with your business needs, brand identity, and the complexity of your transactions. The right choice will streamline the billing process, ensure accuracy, and help maintain a professional image with clients. Different businesses require different features, so understanding your specific requirements will help you make the best decision.

For instance, small businesses or freelancers may not need advanced features like automatic calculations or extensive customization, while larger companies might need more sophisticated functionality to handle high volumes of transactions. Factors such as the type of services offered, payment methods, and the frequency of billing should all influence your decision.

| Factor | Small Business/Freelancers | Larger Businesses/Enterprises |

|---|---|---|

| Complexity of Transactions | Simple, one-time payments | Recurring payments, multiple clients |

| Customization Needs | Minimal customization required | High customization, branded design needed |

| Payment Methods | Basic methods (cash, bank transfer) | Multiple payment options (credit cards, online systems) |

| Volume of Transactions | Low volume | High volume, automated processes |

By considering these factors, businesses

Common Mistakes to Avoid in Invoices

Even with a well-structured payment document, it’s easy to overlook critical details that can lead to confusion, delays, or even payment disputes. Ensuring that all essential information is accurate and clear is vital to maintaining a professional image and fostering strong client relationships. Here are some of the most common mistakes businesses should avoid when creating payment requests.

- Missing or Incorrect Contact Information: Always double-check the contact details for both your business and the client. Incorrect information can cause delays or make it difficult for clients to reach out for inquiries.

- Omitting Payment Terms: Clear payment terms help avoid confusion about when and how payments should be made. Always include the due date, payment methods, and any penalties for late payments.

- Not Including a Unique Reference Number: Every document should have a unique reference number to help both you and your client track and manage the transaction. This makes future correspondence and record-keeping much easier.

- Incorrect Amounts or Calculations: Double-check all numbers for accuracy, including taxes, discounts, and total amounts. Errors in amounts can cause frustration for clients and lead to delays in payment.

- Lack of Clear Descriptions: Always provide detailed descriptions of the goods or services provided. A vague or unclear description could lead to misunderstandings or disputes over the charges.

- Failure to Include Company Details: Ensure your business’s name, address, and registration number (if applicable) are clearly listed. This adds legitimacy and professionalism to your request.

Avoiding these common mistakes ensures that your financial documents are professional, accurate, and efficient. By taking the time to review each section carefully, you can improve communication with clients and reduce the chances of errors that might delay payments.

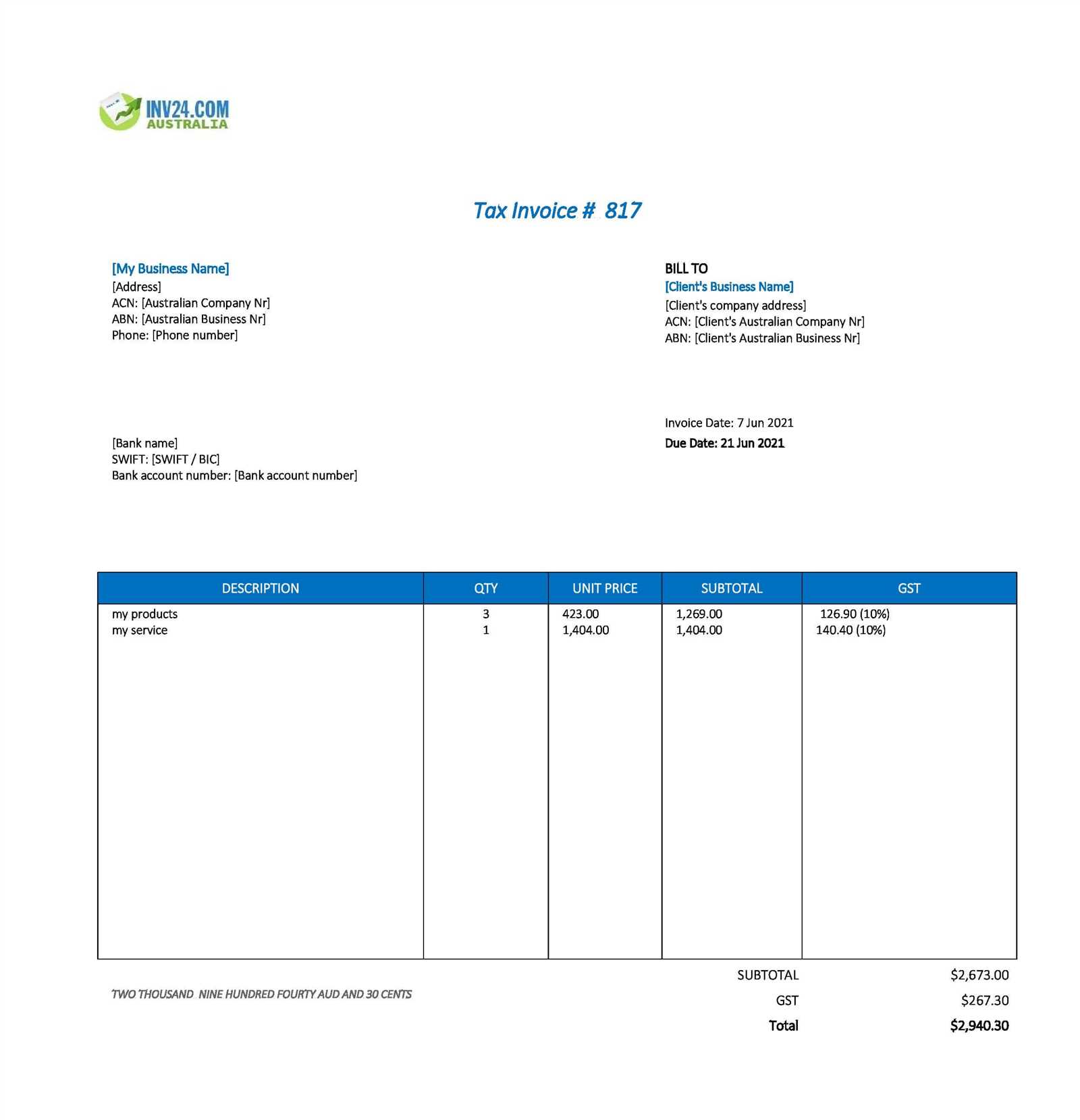

Essential Information to Include in a Bank Invoice

To ensure that your payment request is clear, professional, and legally sound, it’s crucial to include all necessary details. Each section of the document should provide the recipient with essential information about the transaction, including who is being billed, what they are being billed for, how much they owe, and when payment is due. This not only helps with timely payments but also keeps the communication transparent and professional.

- Business Details: Your company’s name, address, phone number, and email. This allows the client to know exactly who is sending the request and how they can get in touch with you if needed.

- Client Information: The name, address, and contact details of the person or business being billed. This ensures that the correct recipient receives the payment request.

- Unique Reference Number: A unique identifier for the transaction. This could be an invoice or order number, which makes it easier for both parties to track the payment and resolve any future queries.

- Description of Products or Services: A detailed breakdown of the goods or services provided. This should include quantities, prices, and any relevant dates (e.g., service periods or delivery dates) to avoid confusion.

- Total Amount Due: Clearly list the total amount the client owes, including taxes, shipping, discounts, or any other charges that apply. Make sure the amounts are clearly separated and easy to read.

- Payment Terms: Specify when the payment is due, the acceptable payment methods (e.g., bank transfer, credit card), and any late fees or penalties for overdue payments.

- Payment Instructions: Provide clear instructions on how and where the payment should be made. This can include bank account details, payment platform links, or other relevant instructions.

Including these essential elements in your document ensures that all necessary information is provided upfront, reducing the chances of delays or misunderstandings. A well-constructed payment request not only helps get paid on time but also improves your professional reputation.

How to Save Time with Bank Templates

Utilizing a pre-designed layout for creating payment requests can significantly reduce the time spent on generating documents for each transaction. Instead of starting from scratch, businesses can take advantage of ready-made formats that allow for quick customization and immediate use. This approach streamlines the entire process, from filling in client details to calculating totals, making it easier to manage large volumes of requests without sacrificing accuracy or professionalism.

By having a consistent structure in place, you eliminate the need for repeated formatting and organization for each new request. Simply input the necessary information–such as the client’s name, the services provided, and the payment terms–into the pre-built fields. This reduces the likelihood of mistakes and ensures that all key details are included every time.

Moreover, many pre-designed formats come with built-in features, such as automatic calculations for totals, taxes, and discounts. This not only speeds up the process but also minimizes human error, ensuring that the amounts are always accurate and up-to-date. With these automated features, businesses can quickly generate a professional document without having to manually calculate each item or fee.

Using these structured formats also helps businesses maintain a consistent look across all their financial communications. The uniformity of a standard layout contributes to a professional image, and it’s easier to track past transactions when the format remains the same. Whether you’re sending out a single payment request or dozens, this method saves time and increases efficiency.

Popular Formats for Bank Invoice Templates

When selecting a layout for generating payment requests, businesses can choose from various formats depending on their specific needs, design preferences, and the complexity of the transaction. Each format offers unique advantages, such as ease of use, adaptability, or enhanced functionality. Whether you prefer a simple, clean design or a more detailed and structured format, understanding the most common options can help you choose the one that best suits your business.

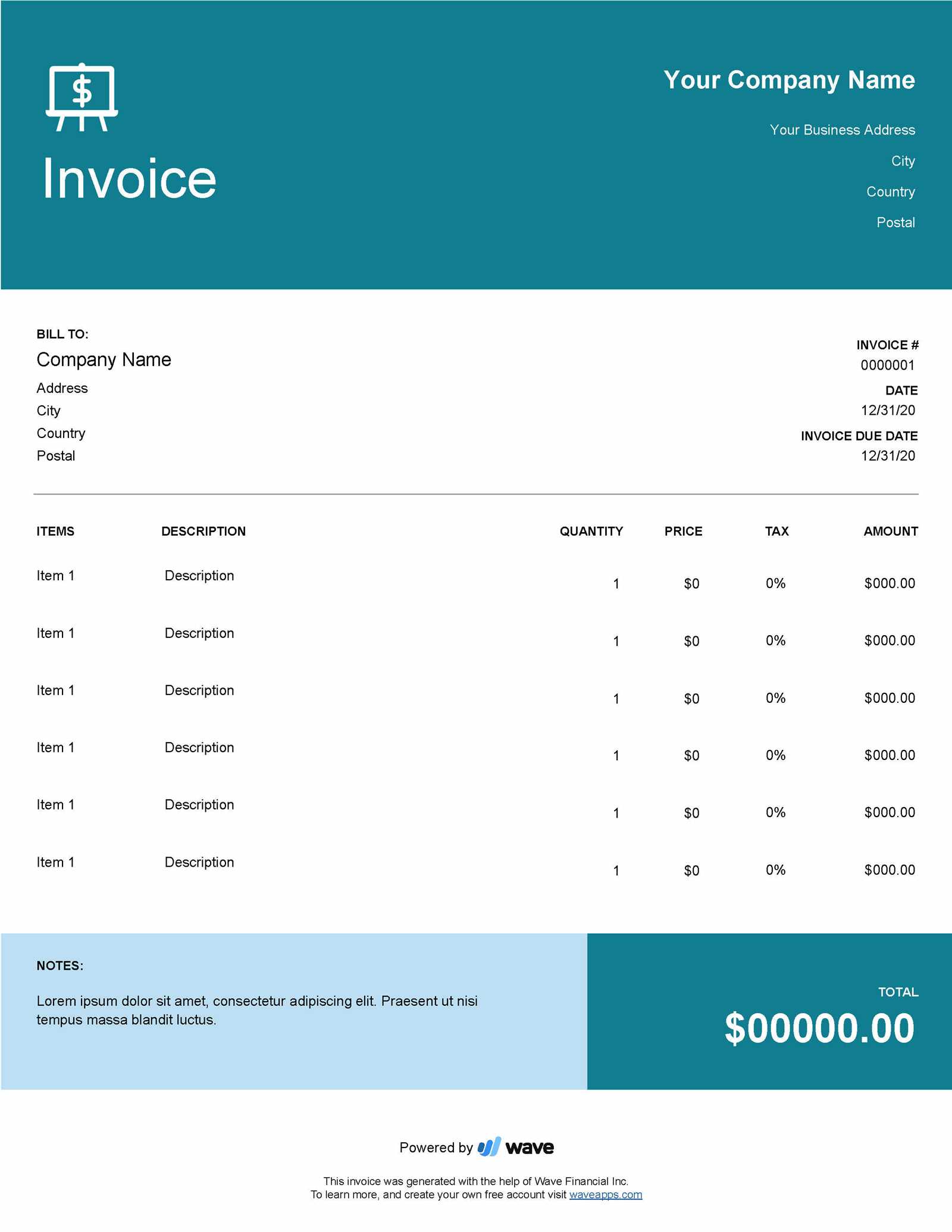

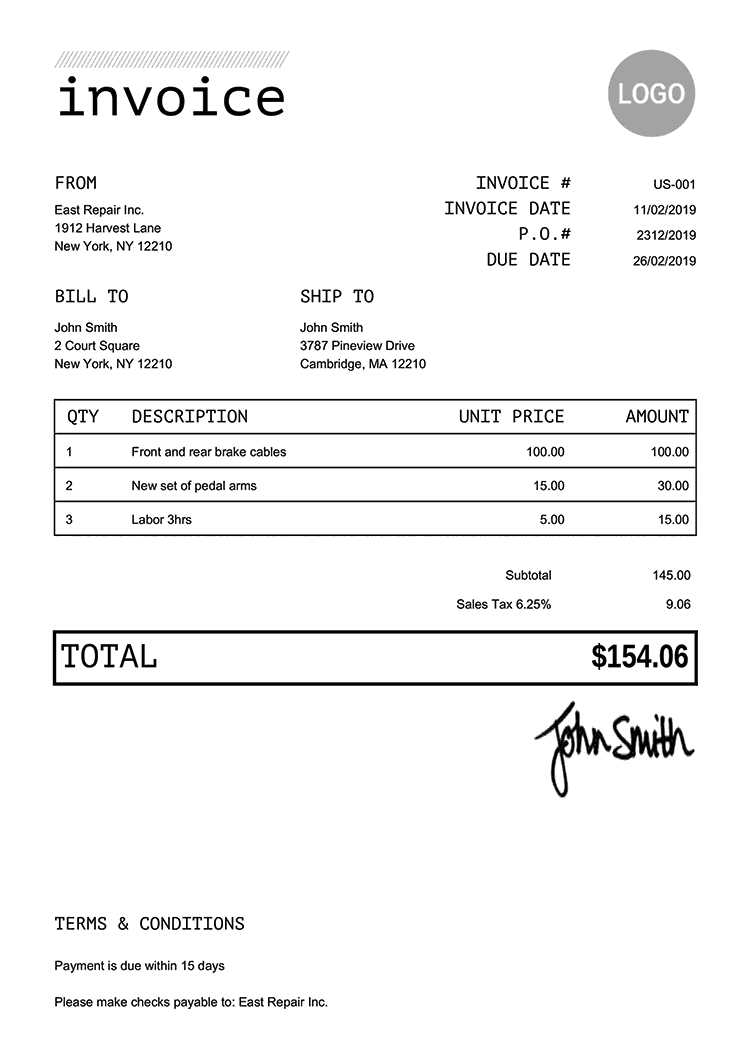

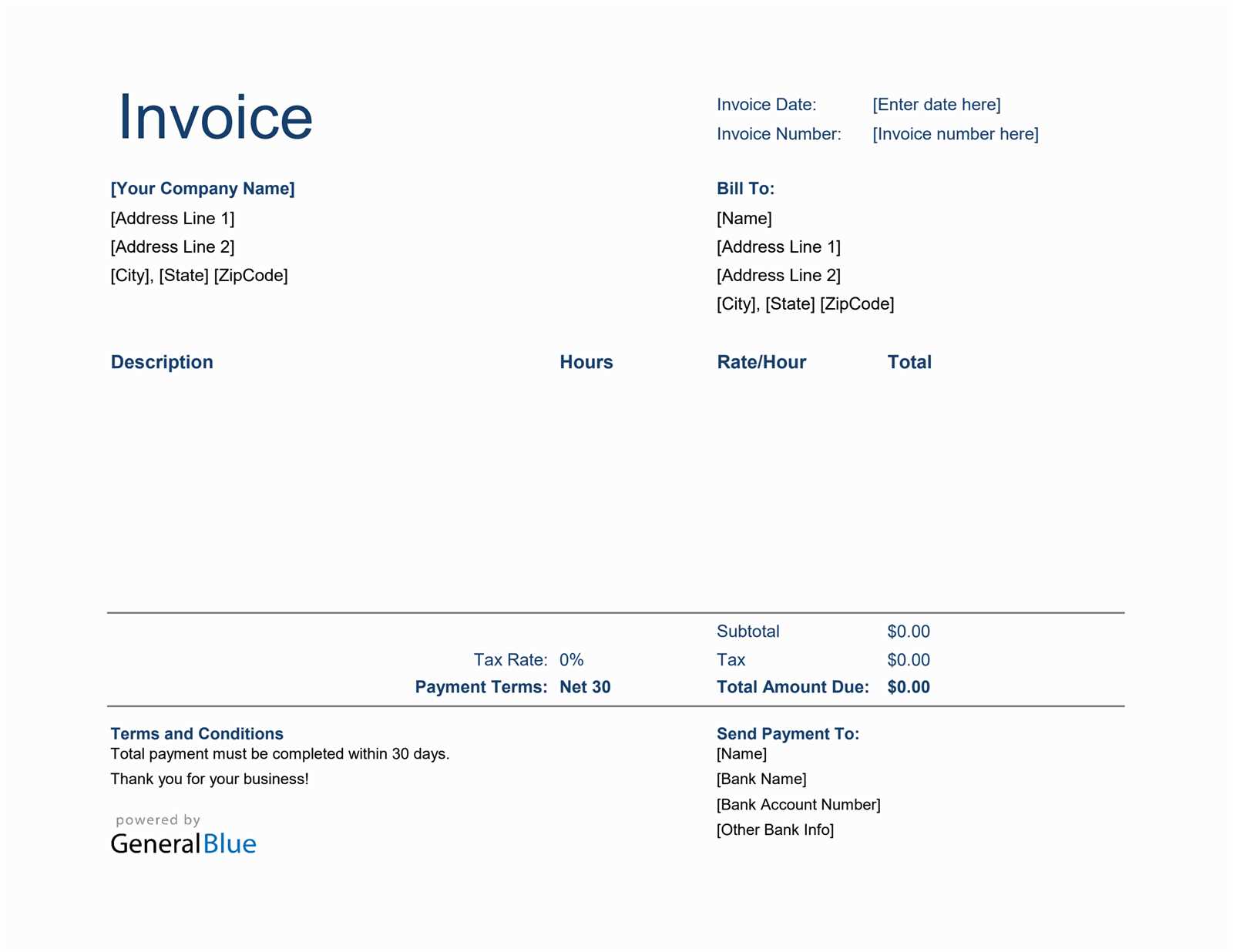

Basic Layouts

Basic formats are ideal for small businesses or freelancers who only need to generate simple payment requests. These layouts are often minimalistic, with essential sections such as client information, description of services, total amount, and payment terms. They are quick to fill out and easy to understand, making them suitable for businesses with straightforward transactions.

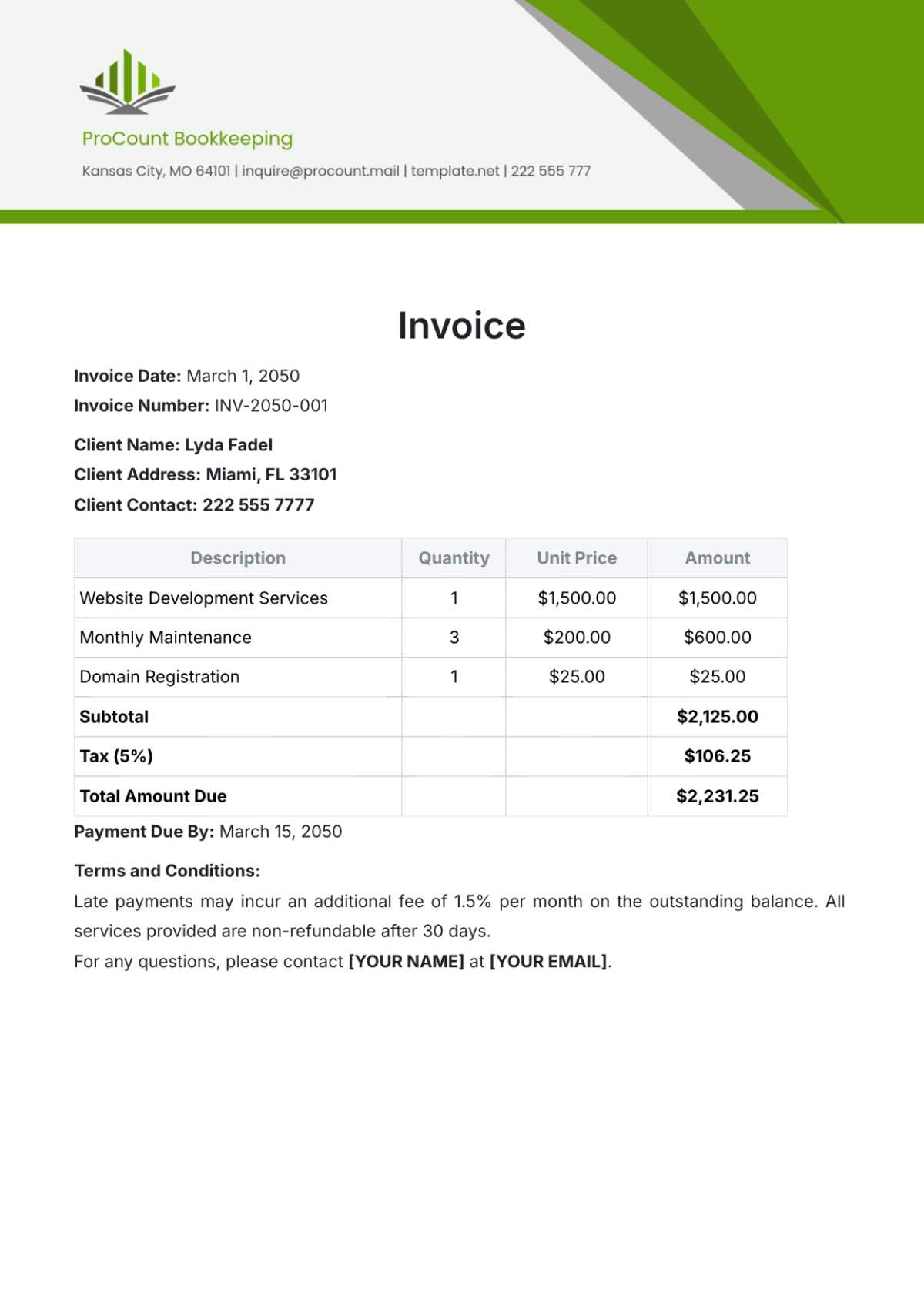

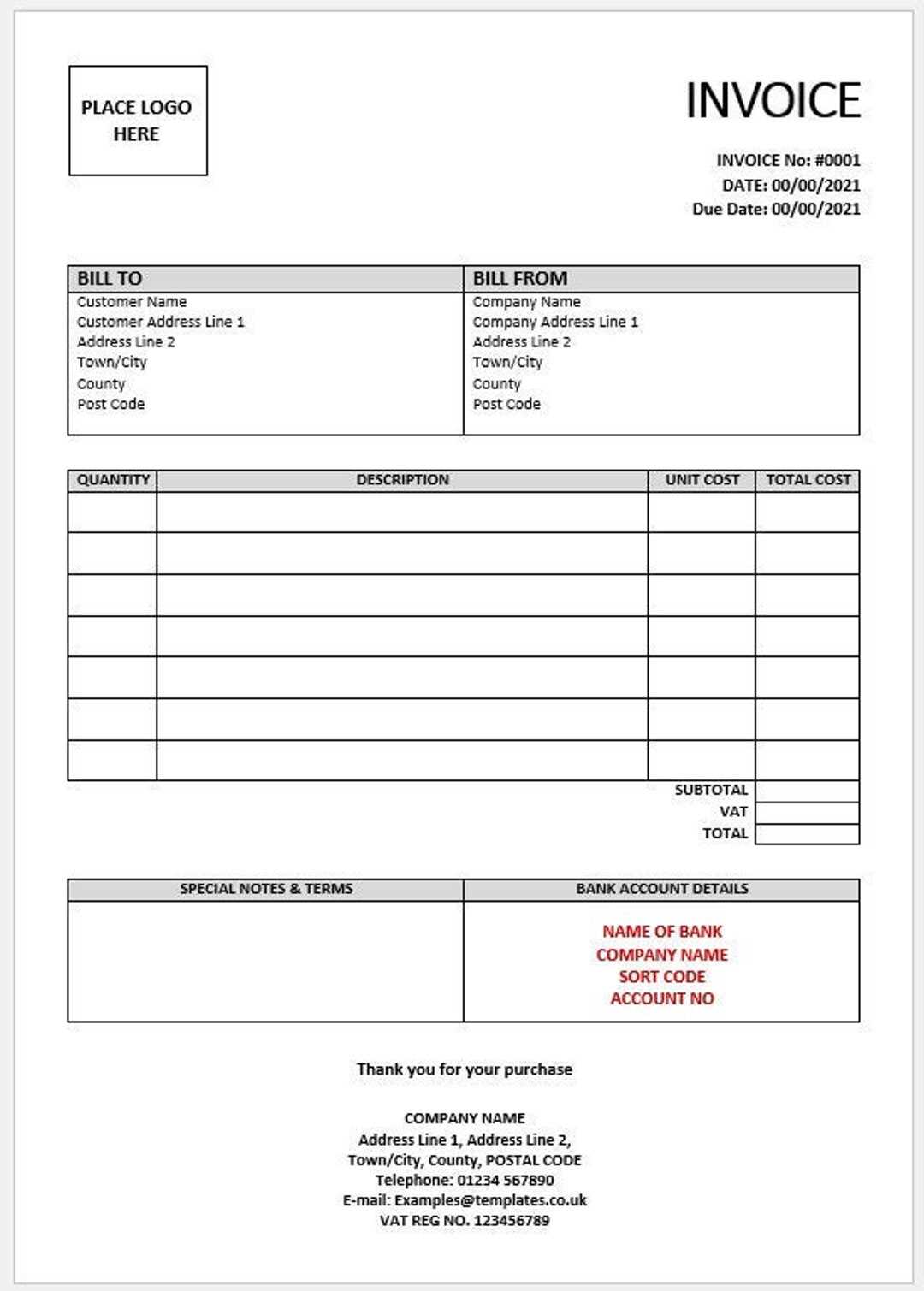

Advanced Layouts

For larger businesses or those with more complex billing needs, advanced formats may be a better option. These layouts often include additional features, such as multiple sections for itemized billing, automatic calculations, or integration with accounting software. They allow for greater customization and can accommodate a variety of payment methods, services, or pricing structures.

| Format | Description | Best For |

|---|---|---|

| Simple Layout | Basic structure with essential fields for quick payment requests | Small businesses, freelancers, one-time services |

| Itemized Layout | Detailed breakdown of services or products with line-item pricing | Businesses with multiple products or services, recurring billing |

| Professional Design | Visually appealing layout with brand elements and custom colors | Companies focusing on brand image, high-value clients |

| Automated Layout | Includes calculations, tax inclusion, and automated totals | Large businesses, businesses with complex pricing models |

By choosing the right format, businesses can not only streamline their billing process but also ensure

How to Format Your Bank Invoice Properly

Proper formatting is essential when creating a payment request document. A well-organized structure not only helps ensure clarity but also demonstrates professionalism and efficiency to your clients. Whether you’re using a simple or detailed layout, it’s important to pay attention to the alignment, hierarchy of information, and presentation. Here are some key steps to properly format your payment request document.

1. Use Clear Section Headings: Begin with a title that clearly identifies the purpose of the document, such as “Payment Request” or “Statement of Account.” This will immediately inform the recipient of the document’s purpose.

2. Maintain Consistent Alignment: All the information should be neatly aligned, with business and client details placed at the top, followed by transaction-related sections. Aligning data like amounts and dates makes the document easier to read and helps prevent errors.

3. Organize the Information Logically: Start with your company’s name and contact information at the top, followed by the client’s details. Include a unique reference number, date, and description of the products or services. Finally, present the amount due and payment instructions in a clear, logical order. This order helps the recipient quickly find the information they need.

4. Use Simple and Professional Fonts: The font should be clear and legible. Avoid using overly decorative or hard-to-read fonts. A simple sans-serif font like Arial or Helvetica is ideal for professional documents.

5. Include a Payment Summary Table: For detailed documents, use a table to list the items, quantities, individual prices, taxes, and total amounts. Tables help break up information and make it more digestible.

6. Include Payment Terms and Instructions: Make sure your terms are easy to find and understand. Clearly state the due date, available payment methods, and any penalties for late payments.

By following these basic guidelines, you can ensure that your document is both professionally formatted and easy to understand. Proper formatting not only makes a great impression but also helps speed up the payment process and minimize misunderstandings.

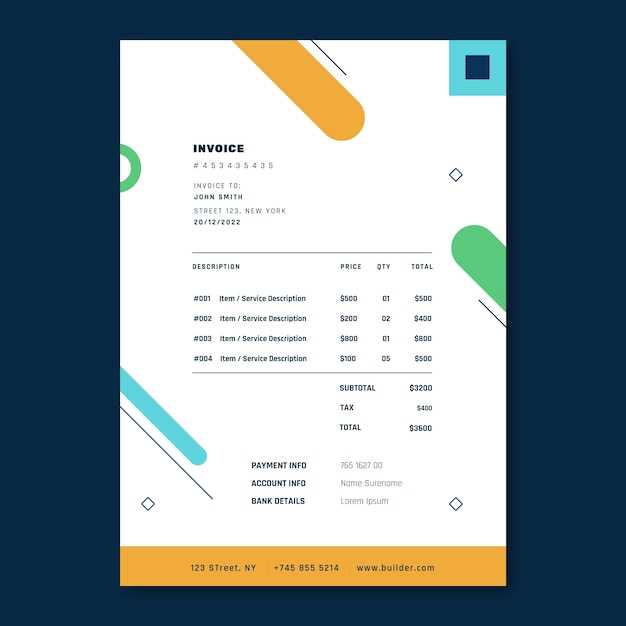

Tips for Professional Invoice Design

A well-designed payment request can greatly impact your business’s professionalism and client satisfaction. A clean, organized layout not only ensures that all necessary details are included but also makes it easier for your clients to understand and process the request. Here are some essential tips to elevate the design of your payment documents and create a lasting impression.

- Keep the Layout Simple and Organized: Avoid cluttering your document with unnecessary elements. Use a clean structure with well-defined sections, such as client information, transaction details, and total amount due. This simplicity makes it easier for your clients to find the information they need quickly.

- Use Your Branding: Incorporate your company’s logo, colors, and fonts to make the document feel cohesive with your overall brand. This reinforces your business’s identity and adds a professional touch to your communications.

- Choose Readable Fonts: Use clear and easy-to-read fonts for all text. Sans-serif fonts like Arial or Helvetica work best for professional documents. Avoid decorative fonts that may be difficult to read or look out of place in a formal setting.

- Ensure Proper Hierarchy: Use bold text or larger font sizes to highlight the most important elements, such as the document title, amounts, and payment due date. This visual hierarchy guides the reader’s eyes and makes the key details stand out.

- Incorporate a Payment Summary Table: For clarity, use a table to organize itemized services, quantities, prices, taxes, and totals. This breaks down the information in a way that is easy to follow, minimizing errors or confusion.

- Leave Room for Notes or Terms: Make sure to include a space for payment terms, instructions, or any additional notes. This area should be clearly separated from the rest of the document to ensure it’s easy to find.

- Use Professional Colors: Stick to neutral, professional colors like navy, gray, or black for text. Use accent colors sparingly to highlight important information such as the total amount due, but avoid using too many different colors, as this can look unprofessional.

- Ensure Consistency: Maintain a consistent design across all your financial documents. Whether it’s the layout, font choices, or color scheme, consistency builds trust with your clients and reinforces your brand’s identity.

By following these design tips, you can create a payment document that not only looks professional but also ensures clarity and improves communication with your clients. A polished design helps establish credibility and can contribute to a

Bank Invoice Template for Small Businesses

For small businesses, managing payments efficiently is essential to maintaining cash flow and keeping operations running smoothly. One of the most effective ways to streamline this process is by using a structured payment document that ensures consistency and professionalism in every transaction. A well-designed payment document not only helps small businesses present a professional image but also reduces the risk of errors and misunderstandings.

Small businesses often need a format that is simple yet functional, balancing clarity and essential details. Whether you’re offering services or selling products, your document should cover the basics–like who the payment is from, what is being charged, how much is due, and when it should be paid–while being easy to create and modify for each client.

- Simple and Clear Layout: Keep the structure straightforward, with distinct sections for client information, services rendered, payment amount, and terms. A clear layout reduces confusion and ensures that both you and your client are on the same page.

- Quick Customization: A good payment document for small businesses should be easily customizable, allowing you to quickly adjust fields for new transactions. Pre-designed fields for client names, services, and pricing make this process faster, saving you valuable time.

- Professional Branding: Even as a small business, it’s important to maintain a professional image. Including your business name, logo, and contact details on every document helps establish credibility and reinforces your brand.

- Accurate Payment Details: Always ensure that the document includes all necessary payment instructions, such as due dates, accepted payment methods, and any applicable taxes or fees. Clear payment terms are essential to avoid confusion and ensure prompt payment.

- Itemized List: If you’re billing for multiple items or services, make sure to include a detailed list. This helps the client understand exactly what they are paying for and can prevent disputes over charges.

- Space for Notes or Special Instructions: Including a section for additional notes, such as delivery information or special discounts, adds a personal touch to the document and ensures that all relevant details are communicated.

By using an efficient and well-structured payment request, small businesses can improve both their internal processes and client relationships. Having a clear and professional format not only makes the billing process easier but also helps ensure that payments are received on time, contributing to smoother cash flow management.

Security Features in Bank Invoice Templates

When creating payment documents, security is a key concern for both businesses and clients. Ensuring that the information is protected against fraud, tampering, and unauthorized access is essential. A well-designed payment document should incorporate various security features that help safeguard sensitive details and build trust with clients.

Common Security Features

There are several built-in security features that can be included in payment documents to prevent unauthorized changes or data theft. Some of the most common security measures focus on document integrity, encryption, and authentication. By utilizing these features, businesses can ensure that their payment requests are secure and trustworthy.

- Watermarking: Adding a watermark to the document can deter unauthorized copying or modification. This feature makes it obvious if the document has been tampered with, as the watermark will be altered or removed.

- Unique Identification Numbers: Including a unique reference or serial number for each document helps track and verify the authenticity of each payment request. This makes it easier to identify specific requests and prevents confusion with duplicates.

- Digital Signatures: Digital signatures ensure that the payment document has not been altered after it was created. These can also verify the identity of the sender, adding an extra layer of security and legitimacy to the document.

- Password Protection: Some advanced formats offer password protection to prevent unauthorized access to the document. This can be particularly useful for sensitive or confidential financial transactions.

Best Practices for Securing Payment Documents

In addition to using built-in security features, businesses should also follow best practices when sending or storing payment documents to further enhance protection.

- Encrypt the Document: Always encrypt documents before sending them via email or storing them online. Encryption ensures that even if the document is intercepted, it remains unreadable without the correct decryption key.

- Use Secure Payment Gateways: If the document includes payment instructions or links, ensure that they are connected to a secure, trusted payment gateway. This ensures that any financial transactions are protected from hacking attempts.

- Limit Access to Documents: Only authorized personnel should have access to sensitive payment documents. Restricting access ensures that confidential information is not exposed to unauthorized individuals.

| Security Feature | Descrip

Automating Invoicing with Bank TemplatesAutomating your payment document process can save valuable time and reduce the likelihood of human error. With the right tools, you can streamline the creation, sending, and tracking of your payment requests. Automation allows businesses to focus on core operations while ensuring that every client receives a consistent, professional document with minimal effort. Benefits of AutomationBy automating your payment document process, you can experience numerous benefits that enhance both efficiency and accuracy. These include:

How to Automate Your Payment RequestsTo take advantage of automation, you can use various tools and software that offer built-in templates for payment requests. These solutions allow you to customize the design and content of your documents while automating the sending process. Here are the main steps for automating your payment process:

|

|---|