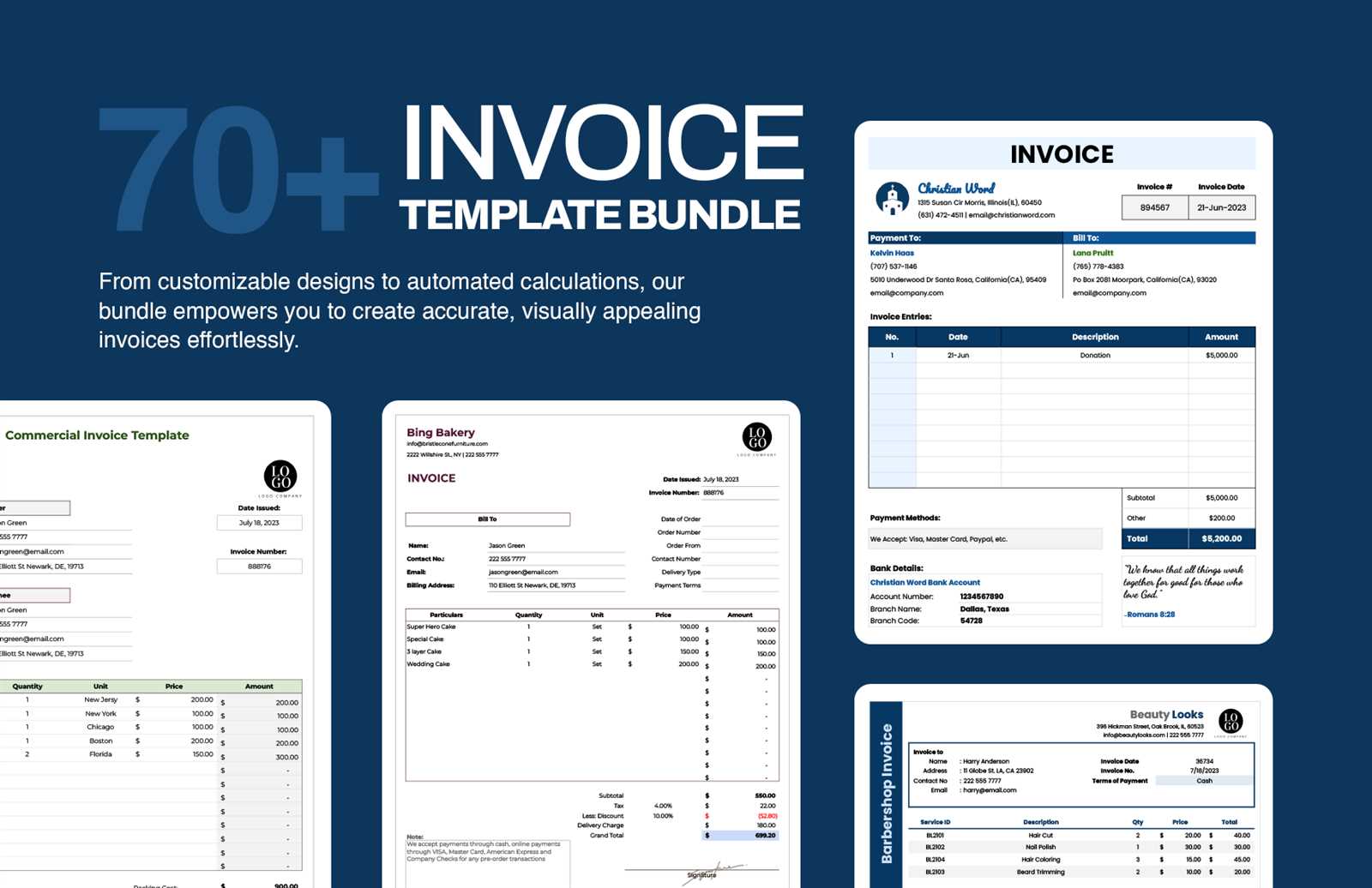

Baking Invoice Template for Easy and Professional Billing

Running a successful food business requires attention to detail, especially when it comes to financial transactions. One essential aspect of managing orders and payments is having a clear and structured document that outlines what services or products have been provided, the costs associated with them, and the terms of payment. This document not only ensures transparency but also helps maintain professionalism and organization in your operations.

For small food businesses, using a pre-designed structure for these documents can save both time and effort. Customizable formats allow you to quickly generate accurate statements, ensuring that no critical information is overlooked. With the right setup, you can easily manage your billing and improve cash flow by reducing errors and delays in payments.

Whether you’re an entrepreneur or running an established shop, using a well-organized billing structure will help your business stay on track. The ease of customizing such documents allows you to focus on what matters most: delivering quality products to your customers. Additionally, it offers the flexibility to reflect your brand’s personality and professionalism, making every transaction clear and straightforward.

Essential Features of a Baking Invoice

To ensure smooth transactions and effective communication with clients, it’s crucial to include specific details in the document you use for billing purposes. A well-structured statement not only outlines the services or products provided but also provides clarity on payment expectations. The following key components are essential for creating a professional and comprehensive billing record.

Key Elements to Include

- Business Information: Your name, address, and contact details, ensuring clients can easily reach you for any inquiries.

- Client Details: Full name, address, and contact information of the customer to ensure correct delivery and communication.

- Unique Reference Number: A distinct identifier for the transaction, making it easier to track and reference in future communications.

- Clear Description of Services/Products: A detailed list of what was provided, including quantities, types, and unit prices, if applicable.

- Total Amount Due: A clearly stated total, including applicable taxes, discounts, and any additional fees.

- Payment Terms: A section specifying the due date for payment, preferred methods of payment, and any late fee policies.

Optional but Helpful Additions

- Logo or Branding: Adding your logo or any business branding can give the document a more professional appearance.

- Notes Section: A space for adding custom messages, special offers, or reminders to your clients.

- Discounts or Special Pricing: If offering promotions or custom pricing, clearly state these adjustments for transparency.

By including these elements in your billing document, you ensure that your transactions are clear, professional, and easily manageable for both you and your customers.

How to Customize Your Baking Invoice

Creating a personalized billing document for your business is an essential step in maintaining a professional image while simplifying your financial processes. Customizing this document allows you to reflect your brand, tailor it to your specific needs, and ensure that all required information is clearly presented. Here’s how you can make your billing record uniquely suited to your business.

Step 1: Choose the Right Layout

Select a layout that suits your business style and makes it easy for clients to understand the details. Consider the following when choosing your format:

- Clean and Simple Design: A well-organized layout with clearly defined sections helps avoid confusion.

- Professional Branding: Add your logo, color scheme, and font style to align with your business’s visual identity.

- Easy-to-Read Fonts: Use legible fonts and a good font size to ensure all text is easily readable.

Step 2: Adjust Content for Your Needs

Customizing the content of your document ensures it includes the necessary details for both you and your clients. These are some essential content adjustments:

- Business Information: Include your company name, address, phone number, and website, as well as any additional details like tax ID if required.

- Client Information: Ensure that you have a dedicated space for the client’s name, contact information, and billing address.

- Payment Terms and Conditions: Adjust payment instructions to match your preferred methods, due dates, and penalties for late payments.

- Product/Service Descriptions: Customize the list of services or products to include detailed descriptions, quantities, unit prices, and total costs.

Step 3: Add Optional Features

Depending on your business and client preferences, consider adding optional elements that enhance the document’s functionality:

- Discounts or Offers: If applicable, include any discounts or special deals, making sure to show the adjusted total.

- Personalized Notes: Leave a section for custom messages, such as a thank-you note, reminders for future orders, or special instructions.

- Payment Links: For a more modern approach, you can add clickable payment links or QR codes for easy online payments.

Why Use a Billing Document Structure for Bakeries

For any food-related business, especially those in the food production and sales industry, having a clear and consistent way to document transactions is essential. Using a pre-designed structure for billing helps ensure accuracy, professionalism, and timely payments. By standardizing the process, you not only streamline operations but also reduce the risk of errors and miscommunications with clients.

Streamlining Operations

- Time Efficiency: A ready-made structure allows you to generate documents quickly, saving time that can be better spent on production and customer service.

- Consistency: With a set format, every document looks the same, maintaining consistency and professionalism across all transactions.

- Reduced Errors: Pre-filled sections and automated calculations reduce the risk of mistakes, ensuring accurate billing every time.

Professionalism and Clarity

- Clear Communication: A well-organized document makes it easier for your clients to understand what they are being charged for, avoiding confusion or disputes.

- Brand Image: Using a customized structure reflects your commitment to quality and attention to detail, reinforcing your brand identity.

- Legal Protection: A formal record of every transaction provides documentation in case of any future disagreements or inquiries, offering peace of mind for both you and your clients.

By adopting a standardized approach for documenting your sales, you can enhance both the operational efficiency and reputation of your business, ensuring a smooth and professional experience for your customers.

Key Elements in a Bakery Invoice

A well-structured billing document should clearly outline all essential details regarding the transaction. By including the right components, you can ensure transparency and avoid misunderstandings between you and your clients. This section will guide you through the key elements to include in every bill, making sure your records are complete and professional.

Mandatory Details for Clarity

- Seller’s Information: This section should include your business name, address, and contact details. It helps the client know where to reach you if necessary.

- Client’s Information: The recipient’s full name, company (if applicable), address, and contact details should be included to avoid confusion and ensure proper delivery.

- Unique Identifier: Each document should have a distinct number or reference code, making it easier to track and reference in future communications.

- Product/Service Description: List every item provided, including quantities, unit prices, and a brief description to ensure the client understands what they are being charged for.

- Payment Terms: Clearly define when the payment is due, what payment methods are accepted, and any penalties for late payment. This section ensures both parties are on the same page regarding financial expectations.

Additional Details to Enhance Professionalism

- Discounts and Promotions: If there are any special offers, include them in this section, showing how the final amount is adjusted.

- Taxes and Fees: Ensure that any applicable taxes are clearly itemized, along with additional charges such as delivery or packaging fees, if relevant.

- Thank You Note: A personalized message at the end of the document can go a long way in building positive relationships with clients.

By including these essential components in your billing documents, you create a transparent and professional experience for your customers while keeping your business organized and efficient.

Benefits of Professional Invoicing for Bakers

Using a professional billing method brings several advantages to food businesses, particularly in the context of managing transactions efficiently and establishing trust with clients. A well-structured approach to documenting payments not only improves your business’s financial processes but also enhances your reputation and streamlines communication. Below are some key benefits of adopting professional billing practices for your bakery business.

Improved Financial Management

- Clear Record Keeping: A professional approach ensures that every transaction is documented accurately, making it easier to track revenue and expenses.

- Efficient Payment Tracking: You can easily monitor outstanding payments and set reminders, helping to reduce delays and improve cash flow.

- Automated Calculations: Using a structured system reduces the risk of human error in calculating totals, taxes, and discounts, ensuring accuracy every time.

Enhanced Professionalism and Customer Trust

- Consistency: By using the same format for all your billing records, you present a uniform and professional image that clients can rely on.

- Transparency: Clear, itemized statements show your clients exactly what they are paying for, reducing misunderstandings and disputes.

- Increased Credibility: A well-designed and detailed document reflects your attention to detail, which builds trust and strengthens relationships with your clients.

Adopting professional billing practices offers significant advantages, from more efficient financial tracking to improved client relationships. By presenting your business in a polished and organized way, you not only simplify your workflow but also create a positive experience for your customers, which can contribute to long-term success.

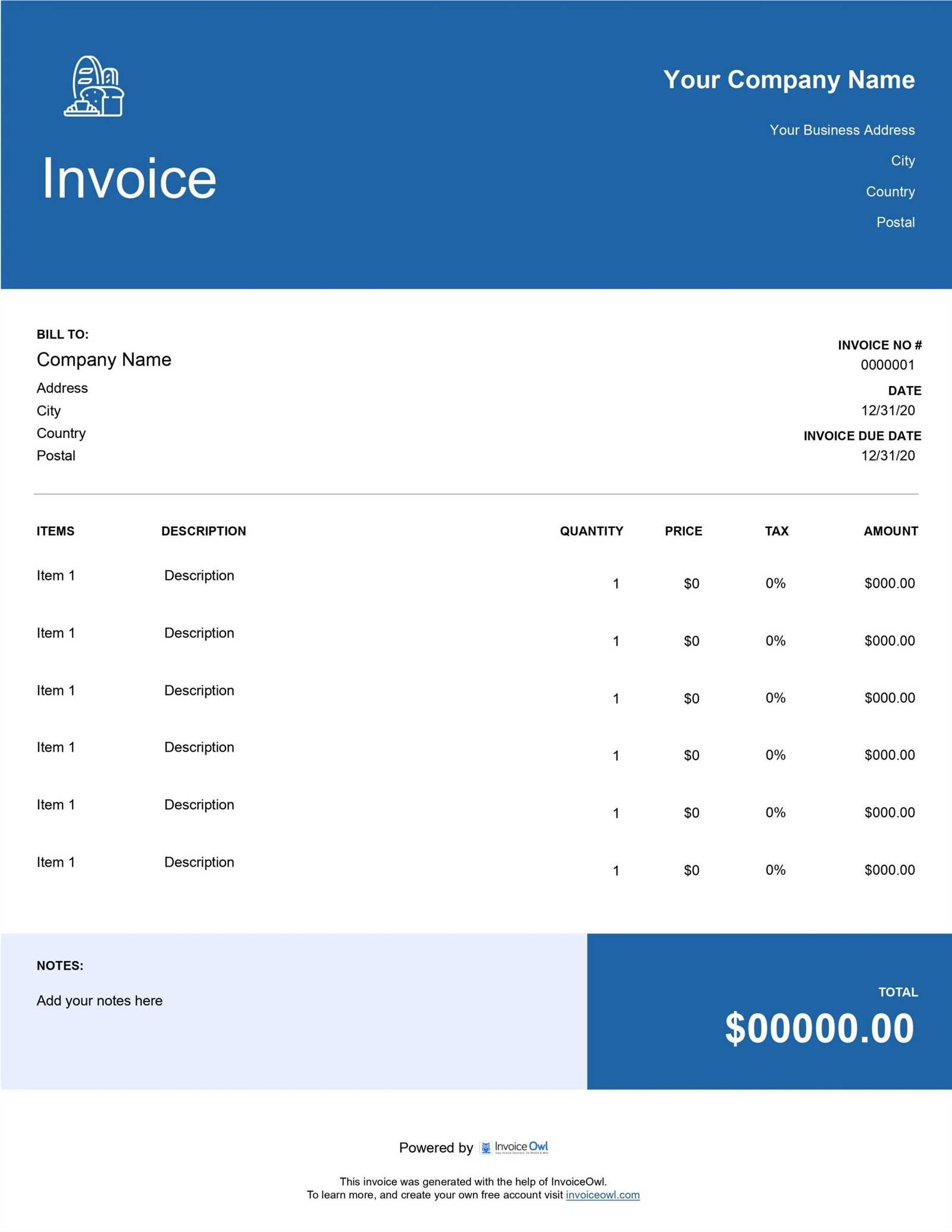

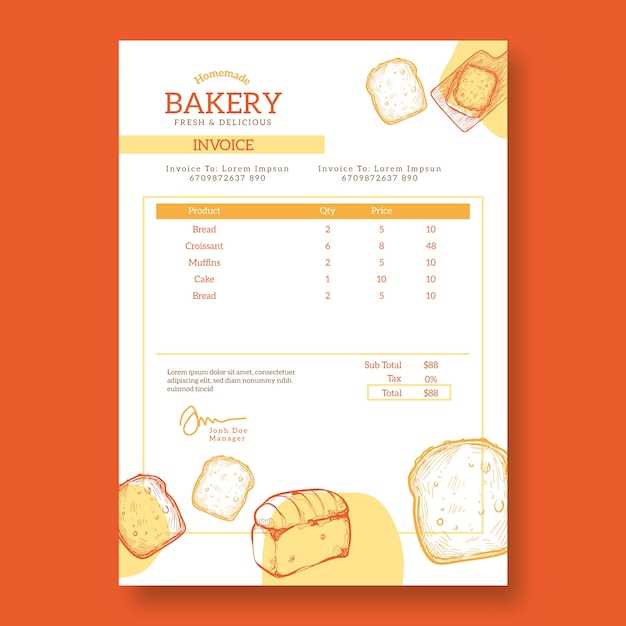

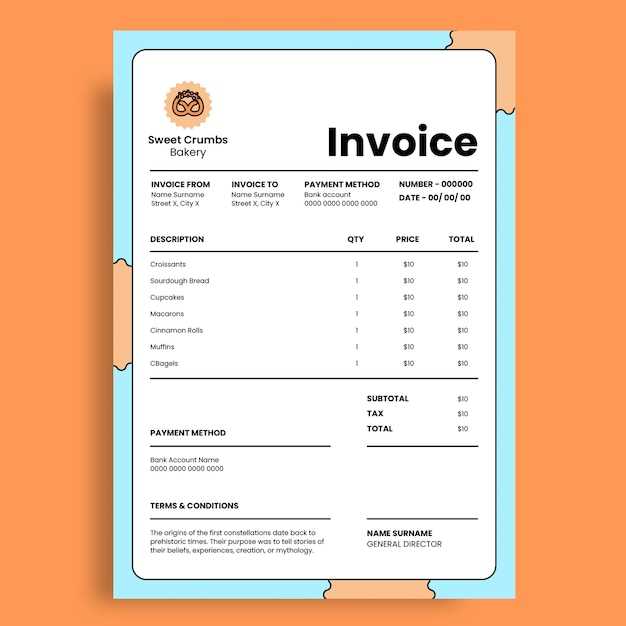

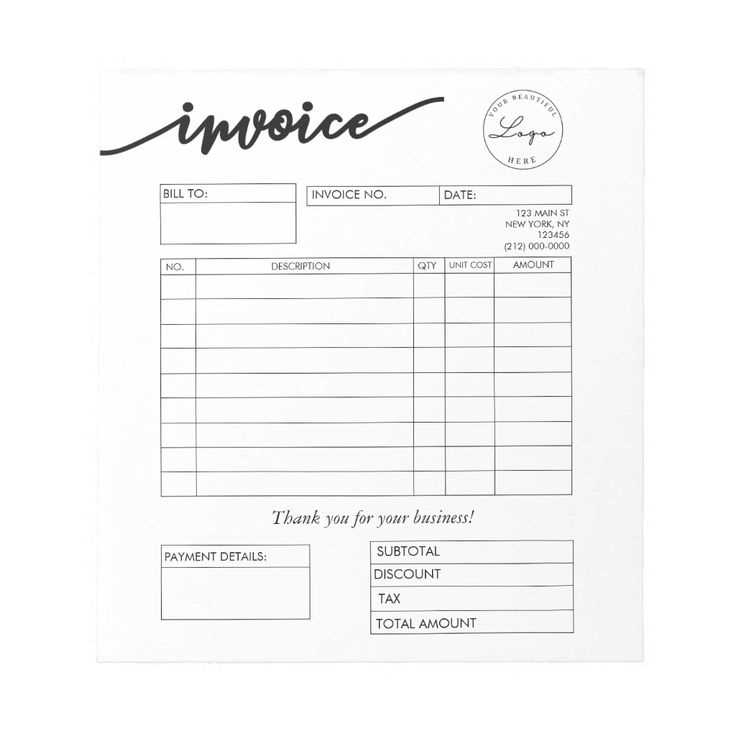

Free Billing Documents You Can Use

If you’re looking to save time and ensure that your transactions are documented professionally, using a free, pre-designed format can be a great solution. These ready-made files help you get started quickly and ensure that you include all necessary information for a smooth payment process. Below are a few options you can use to create customized records for your business at no cost.

| Document Type | Features | Where to Find |

|---|---|---|

| Basic Billing Record | Simple format with essential fields like product descriptions, quantities, and prices | Google Docs, Microsoft Office |

| Detailed Payment Breakdown | Includes itemized breakdowns for large orders, taxes, and discounts | Template websites, Etsy |

| Online Customizable Form | Fully editable with a user-friendly interface, allowing easy customization for your business | Free online template platforms (e.g., Canva, Invoice Generator) |

| Minimalist Design | Simple and sleek design focusing on clarity and essential information | Template websites, Google Sheets |

These pre-made options are not only free but also customizable, meaning you can adjust them to suit your unique business needs. Whether you’re looking for a basic format or something more detailed, these resources provide a range of designs to help keep your financial records organized and professional.

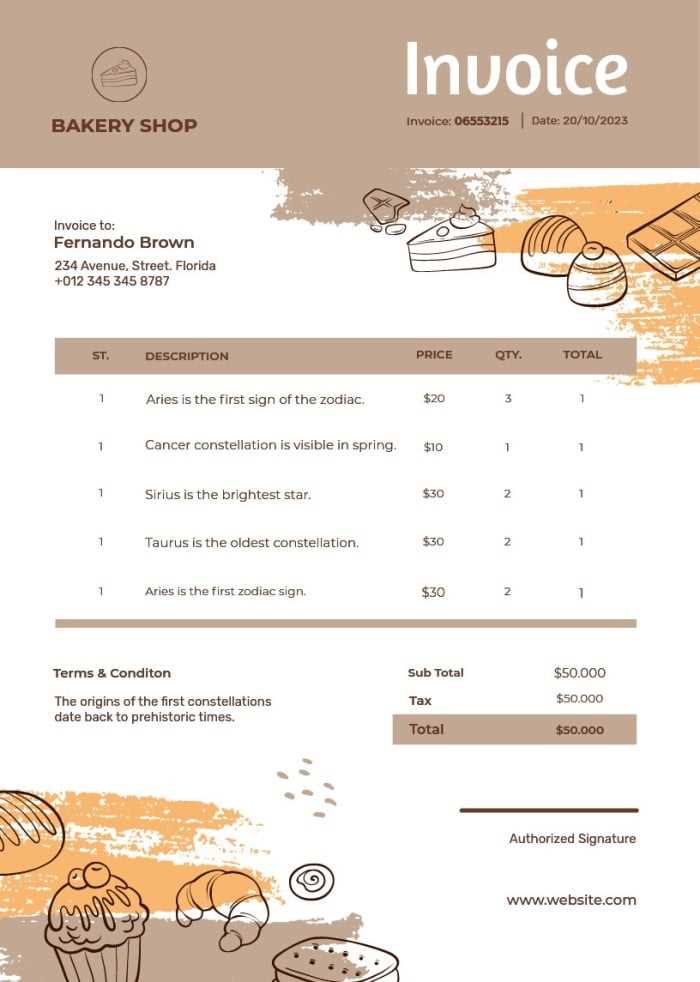

Choosing the Right Format for Bakery Invoices

Selecting the right structure for documenting payments and orders is crucial to ensure smooth transactions and maintain professionalism. The format you choose should be clear, easy to read, and tailored to the specific needs of your business. A well-chosen design not only helps in organizing your financial records but also presents your brand in the best light to your clients.

Consider these factors when choosing the best format:

- Business Size: If you operate a small bakery with fewer transactions, a simple, minimalist design might be enough. For larger businesses with complex orders, consider a more detailed structure with itemized costs and additional fields for customization.

- Client Expectations: Think about your customers’ needs. If your clients require detailed breakdowns of orders (e.g., catering or large event orders), a more thorough format with clear sections for quantities, pricing, and services will be necessary.

- Brand Identity: The design should reflect your business’s brand. A modern, clean look might suit a trendy bakery, while a more rustic or vintage style could work for a traditional bakery. Choose a layout that complements your branding.

- Ease of Use: Select a structure that is easy for you to fill out and update, as well as user-friendly for your clients to understand. Automation features like auto-calculation for totals can save you time.

Key Formats to Consider:

- Simple Document: Ideal for small operations or occasional orders, this format includes the essential fields–client details, item descriptions, and total amounts.

- Itemized Breakdown: Perfect for larger orders, this format gives you space to list each item separately, including quantities, prices, and any discounts or special offers.

- Online Forms: These are highly customizable and can be filled out quickly. They also allow clients to make payments directly through the document, which is convenient for both parties.

Choosing the appropriate format for your payment records will help you maintain professionalism, ensure accurate billing, and provide a positive experience for your clients. Make sure it aligns with your business operations and client expectations to maximize efficiency and satisfaction.

Common Mistakes to Avoid in Invoices

When creating a billing document for your business, even small errors can lead to confusion, delays in payment, or damage to your professional image. Avoiding common mistakes can help you maintain clear communication with your clients, ensure timely payments, and present a more professional appearance. Below are some frequent errors that you should steer clear of when preparing payment records.

- Missing Contact Information: Always include both your business details and your client’s information. Failing to do so can cause confusion, especially if there are any questions or disputes regarding the transaction.

- Unclear Item Descriptions: Each product or service provided should be described in detail. Ambiguous terms can lead to misunderstandings, particularly if there are discrepancies in what was agreed upon and what was delivered.

- Incorrect Pricing or Totals: Double-check all calculations before sending out your record. Even a small mistake in pricing or a missing discount can create confusion and delay payments.

- Lack of Payment Terms: Always include clear payment instructions, including due dates, accepted methods, and any penalties for late payment. Without these terms, clients may not understand when or how to pay, which can lead to delays.

- Forgetting to Include Taxes or Additional Charges: If taxes, shipping, or handling fees are applicable, ensure they are clearly itemized. Overlooking these details can cause clients to question the final amount due.

- Inconsistent Formatting: A professional and consistent layout makes your records easier to read and look more polished. Avoid using multiple fonts or inconsistent spacing, as this can make the document appear unorganized and unprofessional.

- Not Using a Unique Identifier: Each payment document should have a unique reference number for easy tracking. Without this, it can be difficult to refer back to previous transactions, especially in case of any follow-up or questions.

By being aware of these common mistakes and taking steps to avoid them, you can ensure that your payment records are accurate, professional, and clear. This not only helps with smoother financial transactions but also contributes to maintaining strong relationships with your clients.

How to Add Payment Terms to Invoices

Payment terms are a critical part of any financial document, as they clearly define the expectations between you and your clients regarding the timing and method of payment. By outlining these terms, you can avoid misunderstandings and ensure that both parties are aware of their responsibilities. This section will guide you through the process of adding clear and effective payment conditions to your documents.

Key Elements to Include in Payment Terms

- Due Date: Specify when the payment is expected. This could be a fixed date or a number of days after the transaction (e.g., “Net 30” means payment is due 30 days after the transaction).

- Accepted Payment Methods: Clearly state the payment methods you accept (e.g., credit cards, bank transfers, checks, online payment platforms). This helps avoid confusion for clients.

- Late Payment Penalties: Outline any fees or interest charges that will apply if the payment is not made by the specified due date. This incentivizes timely payments.

- Early Payment Discounts: If you offer discounts for early payments, include the terms for these discounts. For example, “2% discount if paid within 10 days.” This encourages quicker payments.

Where to Place Payment Terms in Your Document

- At the Top or Bottom: Payment terms can be included at the top or bottom of the document. The key is to make them easily visible so your clients can reference them quickly.

- Near the Total Amount: Another effective placement is next to the total amount due, as this ensures that the payment conditions are directly associated with the amount the client needs to pay.

- Separate Section: For clarity, you might want to dedicate a section specifically to payment terms, especially if your terms are complex or if you have different conditions for different types of orders.

Adding clear and concise payment terms to your documents helps set the right expectations and ensures that your clients know exactly what is expected of them. This not only helps in securing timely payments but also fosters better communication and professionalism in your business transactions.

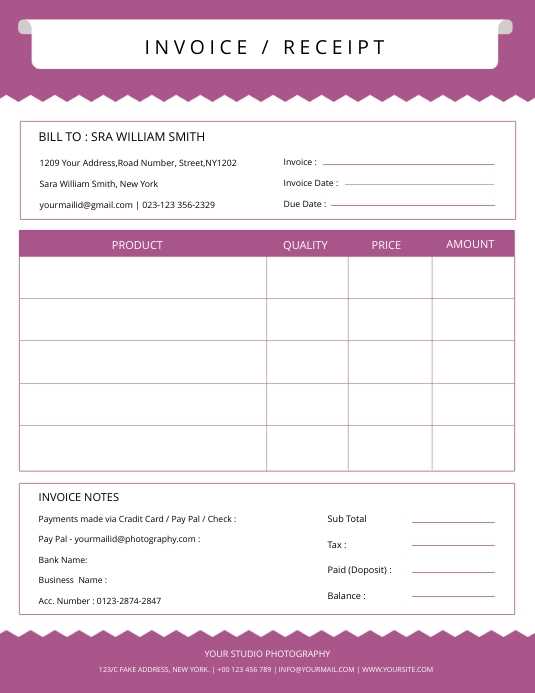

Design Tips for a Clean Invoice Layout

A well-designed billing document not only looks professional but also ensures that important information is easy to find. A clean, organized layout helps prevent confusion and makes the payment process smoother for both you and your clients. Here are some design tips to help you create a clear and effective billing record.

Use Simple and Consistent Formatting

- Stick to One or Two Fonts: Choose a legible font and use it consistently throughout your document. Too many font styles can make the document look cluttered and unprofessional.

- Align Information Properly: Ensure that all text is aligned properly–like centering headers and aligning amounts to the right. This makes your document easier to read and looks more organized.

- Utilize White Space: Don’t overcrowd the page with too much information. White space around sections helps to make the document less intimidating and more user-friendly.

Organize Information Logically

- Clear Section Headings: Break the document into distinct sections (e.g., client details, order details, totals) with bold or larger headings. This allows clients to quickly find what they need.

- Itemized List: Use bullet points or tables to list products or services. An itemized list makes it easier for clients to review each charge, reducing confusion and disputes.

- Highlight Key Information: Make the total amount due, payment due date, and any important terms stand out by using bold text or a larger font size.

Make the Document Scannable

- Use Tables for Structure: Organize complex information like prices, quantities, and totals in a clean, easy-to-read table format. This helps break down the data into digestible pieces.

- Limit Colors: Stick to a simple color palette to enhance readability. Use color sparingly for headings or important sections like the total amount due, but avoid overwhelming the reader with too many colors.

By following these design tips, you can create a billing document that is not only professional and aesthetically pleasing but also functional and easy to navigate. A clean layout will leave a lasting impression and make financial transactions more straightforward for your clients.

Automating Your Bakery Billing Process

Streamlining your payment processing system can save valuable time and reduce human error, allowing you to focus more on growing your business. Automating your billing tasks helps ensure that records are accurate, payments are tracked efficiently, and clients receive their documents promptly. This section explores various ways to automate the payment documentation process for your bakery business.

Benefits of Automation

- Time-Saving: Automating repetitive tasks such as generating billing documents or sending reminders frees up time for other essential business operations.

- Reduced Errors: By using automated tools, you eliminate the chance of manual errors in calculations, client information, or payment tracking.

- Improved Cash Flow: Automation ensures that invoices are sent on time and follow-ups are consistent, increasing the likelihood of prompt payments.

- Professional Appearance: Automated systems often offer customizable, polished document formats that help maintain a consistent and professional look across all transactions.

Tools and Solutions for Automation

- Online Billing Platforms: Many cloud-based tools like QuickBooks, FreshBooks, or Zoho allow for automatic creation and delivery of payment documents. These platforms also offer features like recurring billing and payment tracking.

- Integrated POS Systems: Some point-of-sale systems have built-in features for generating and sending payment records automatically after each sale. This can be particularly useful for bakeries with a high volume of small transactions.

- Automated Reminders: Setting up automatic reminders for overdue payments helps keep clients accountable and reduces the need for follow-up emails or calls.

- Customizable Email Templates: Automating the email delivery of your payment records ensures timely communication with clients while maintaining a professional tone and appearance in every message.

By implementing automated solutions, you can significantly reduce the time spent on manual tasks, improve accuracy, and maintain a smooth billing process. Automation not only boosts efficiency but also enhances the client experience, helping to establish trust and reliability in your business.

Tracking Payments with Invoice Templates

Keeping track of payments is a vital part of managing a business’s cash flow and ensuring that financial transactions are properly recorded. Using a well-structured billing document allows you to monitor when payments are made and identify any outstanding balances. This section will show you how to effectively track payments using a standardized format that can help you stay organized and ensure timely follow-ups on overdue amounts.

Essential Payment Tracking Features

- Unique Reference Numbers: Assigning a unique identifier to each document allows you to track individual transactions easily and ensures accurate records for future reference.

- Payment Status: Clearly indicate whether a payment is “Paid,” “Pending,” or “Overdue.” This helps you quickly assess the status of any outstanding balances.

- Due Date: Including a clear due date makes it easier to track when payments are expected and follow up on overdue amounts.

- Partial Payments: If a client makes a partial payment, it’s important to record this on the document to ensure the remaining balance is clearly visible.

Example of a Payment Tracking System

| Reference Number | Client Name | Amount Due | Amount Paid | Status | Due Date |

|---|---|---|---|---|---|

| #1001 | John Doe | $250.00 | $250.00 | Paid | 10/10/2024 |

| #1002 | Jane Smith | $180.00 | $90.00 | Partial | 15/10/2024 |

| #1003 | Mike Johnson | $300.00 | $0.00 | Overdue | 05/10/2024 |

By incorporating payment tracking features into your billing documents, you can ensure that all financial transactions are clearly documented and easily accessible. This helps you stay organized, reduces confusion, and ensures that payments are tracked in a timely and efficient manner.

How to Include Discounts and Taxes

When preparing a payment document, it’s important to clearly show any applicable discounts and taxes so that your clients can easily understand the final amount due. Properly including these elements not only ensures transparency but also helps avoid disputes. In this section, we’ll discuss the best practices for incorporating discounts and taxes into your records, making sure the calculations are clear and accurate.

Including Discounts

- Flat Discount: If you offer a flat discount (e.g., 10% off the total), ensure that it is clearly indicated on the document. Specify the original price, the discount amount, and the final price after the discount is applied.

- Conditional Discounts: Sometimes discounts are offered based on specific conditions, such as early payment or bulk purchases. If applicable, include the terms of the discount and the exact amount the client is saving.

- Highlighting the Discount: Make the discount stand out by placing it in a separate row or section. This draws attention to the savings, making it easier for your client to understand the adjusted amount.

Including Taxes

- Itemized Taxes: If taxes apply to your products or services, list them separately on the document. Break them down by type (e.g., sales tax, VAT) and include the applicable rate for each.

- Tax Calculations: Always show the tax amount for each item or service, and calculate the total tax at the end of the document. This ensures that clients can easily verify the amount of tax they are being charged.

- Tax-inclusive Pricing: If your prices are inclusive of taxes, make this clear to avoid confusion. Specify that the price includes all applicable taxes, and include the tax breakdown separately so clients can see how much tax is included.

Clearly showing discounts and taxes in your financial documents helps create transparency and trust with your clients. By following these guidelines, you can ensure that your clients understand the pricing structure and any savings or additional charges they are receiving. This approach helps to avoid confusion and promotes smoother financial transactions.

Saving Time with Digital Invoice Templates

Switching to a digital method for generating billing documents can significantly streamline your workflow and reduce the time spent on manual tasks. By using digital tools, you can automate repetitive processes, minimize errors, and quickly send documents to clients. This section explores how digital systems can help save valuable time and enhance your overall efficiency when managing payments.

Key Time-Saving Features of Digital Billing Systems

- Automated Document Creation: Digital systems allow you to generate billing records quickly by using pre-built formats. This eliminates the need to create each document from scratch, saving you time on every transaction.

- Pre-filled Client Information: Once client details are entered into the system, they can be automatically populated into new documents. This reduces the time spent on data entry and ensures consistency across all records.

- Instant Delivery: With digital tools, you can instantly send payment records to clients via email or direct online links. This eliminates the need for printing, mailing, or waiting for physical delivery.

- Easy Edits and Updates: If changes are needed, digital documents can be quickly updated and sent without starting over. This flexibility saves time and reduces frustration when adjustments are required.

Example of Digital Billing Process

| Step | Action | Time Saved |

|---|---|---|

| 1. Create New Document | Automatically fill in client details and product/service information. | Minutes per document |

| 2. Review and Edit | Quickly adjust amounts, add discounts, or update dates. | Seconds per edit |

| 3. Send to Client | Instantly email the document or generate a link for download. | Minutes per transaction |

By switching to a digital system, you can reduce the amount of time spent on administrative tasks, which can be better spent focusing on core business operations. Automating routine aspects of your payment management not only speeds up the process but also reduces the risk of errors, ensuring a smoother workflow overall.

How to Create a Baking Invoice from Scratch

Creating a billing document from scratch may seem challenging, but with the right approach, it can be a simple and efficient process. By including the necessary details and organizing the information properly, you can produce clear and professional records for your transactions. This section will guide you through the steps of creating a billing document from the ground up, ensuring that all essential elements are covered.

Step-by-Step Guide to Creating a Billing Document

- Start with Basic Information: At the top of your document, include your business name, address, phone number, and email. Similarly, list your client’s details, such as name, address, and contact information.

- Assign a Unique Reference Number: Create a unique identifier for each record. This could be a sequential number or a customized code to help you track the transaction more easily.

- Include Date and Due Date: Clearly state the date the document is being generated and the payment due date. This helps set expectations for when payment should be made.

- Detail the Products or Services: List each item or service provided, along with its individual price, quantity, and total cost. Be as specific as possible to ensure the client knows exactly what they are being charged for.

- Calculate the Total Amount: Add up all the charges, including any applicable taxes or discounts. Provide a clear breakdown to show the final amount due, making sure it’s easy for your client to understand.

Formatting Your Document

- Use a Clean Layout: Organize the information in a clear, logical format. Use headings to separate sections, such as client details, transaction details, and payment instructions.

- Highlight Key Information: Make the total amount due and payment due date stand out using bold or larger font sizes. This will ensure your client knows exactly what they need to pay and by when.

- Provide Payment Instructions: Include clear instructions on how the client can make the payment. This could include bank details, online payment links, or alternative methods, depending on your business setup.

By following these steps, you can create a clear and effective billing document from scratch. Whether you’re a small business or a large operation, having a well-organized record helps ensure smoother transactions and improved financial management.