Customizable Bakery Invoice Template Excel for Efficient Billing

Managing financial transactions can be a challenging aspect of running a small food-related business. Whether you’re selling cakes, pastries, or any other handmade goods, ensuring smooth billing and accurate record-keeping is crucial for both your cash flow and customer satisfaction.

Streamlining the process with a well-organized document can save time and reduce errors. With the right tools, you can easily create professional and clear records that reflect the details of each sale, making it easier to track payments and monitor your business’s performance.

Customized billing sheets not only help you stay organized but also allow you to maintain consistency in your transactions, ensuring that all the necessary information is included for both you and your clients. Whether you’re a seasoned entrepreneur or just starting out, implementing an efficient system can lead to smoother operations and a more professional image.

How to Use Bakery Invoice Template in Excel

Creating professional financial documents for your food business is essential to ensure accuracy and efficiency. A well-structured record allows you to easily track sales, monitor outstanding payments, and maintain a clear overview of your operations. The key to achieving this is by using a properly formatted spreadsheet that automates calculations and organizes all the necessary details in one place.

Step-by-Step Guide to Using a Financial Sheet

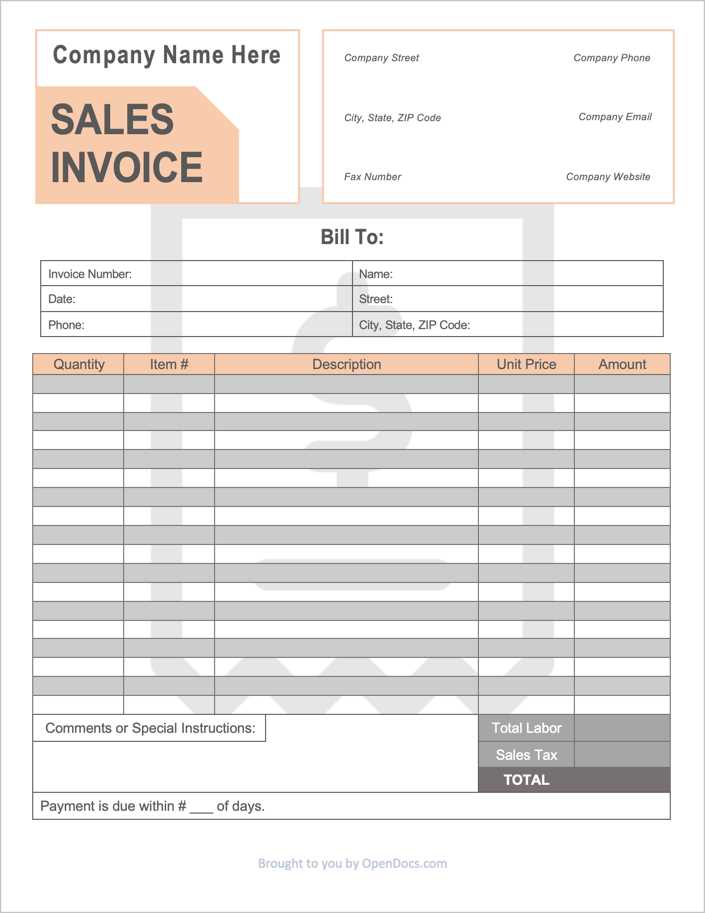

To begin, you’ll need to input all the relevant details, such as customer information, product descriptions, quantities, and pricing. Once these fields are filled, the document will automatically calculate totals, taxes, and discounts, minimizing the chance for errors. Here is a simple breakdown of what to include:

| Field | Description |

|---|---|

| Customer Name | Enter the name of the individual or business making the purchase. |

| Item Description | List the products or services sold, including quantities and sizes. |

| Unit Price | Specify the cost of each item sold. |

| Total Amount | The system will calculate this based on quantities and unit prices. |

| Tax Rate | Apply the applicable tax rate to the total amount. |

| Payment Status | Indicate whether the payment has been made, is pending, or overdue. |

Customizing the Document for Your Needs

Once you’ve set up the basic structure, you can customize the document to suit your specific requirements. You may wish to add fields for discount codes, shipping costs, or other charges related to your business. Additionally, you can personalize the design to match your brand’s look, ensuring that your records align with your overall business identity. By regularly updating your system, you’ll maintain accurate financial records while saving valuable time.

Benefits of Excel for Bakery Invoices

Using a spreadsheet software to manage your billing and financial records provides significant advantages in terms of efficiency, accuracy, and flexibility. This powerful tool simplifies the process of tracking payments, calculating totals, and organizing customer information, all while offering an intuitive interface that reduces the chances of errors. For small business owners in the food industry, particularly those offering custom products, this approach can make a huge difference in maintaining organized and clear records.

Here are some key benefits of using a spreadsheet program for managing your business documents:

- Automated Calculations: Complex math such as taxes, discounts, and totals are calculated automatically, reducing the chance of manual errors.

- Customizability: You can easily modify the layout to fit your business needs, adding or removing fields as necessary.

- Time Efficiency: Templates and pre-set formulas save time, allowing you to focus on your core business activities.

- Data Organization: All customer and transaction data can be stored in one place, making it easy to retrieve past records when needed.

- Cost-Effective: The software is often included as part of office suites, meaning you don’t need to invest in additional tools or platforms.

- Easy Integration: It’s simple to integrate data from other sources, such as your sales records, which can improve your workflow.

For small food businesses, having a reliable and customizable way to manage financial records is essential. With its versatile features and user-friendly interface, using a spreadsheet program can help streamline your day-to-day operations, making it a valuable tool for managing financial documents efficiently.

Creating Custom Bakery Invoices in Excel

Designing personalized financial documents tailored to your business needs is a simple yet powerful way to keep operations organized and professional. By creating your own records from scratch, you have the flexibility to include all necessary information and ensure consistency in every transaction. Customization allows you to adapt the format to reflect your business style, add special instructions, or include specific charges relevant to your products.

To begin the process, focus on the key elements that should be present in each document:

- Customer Information: Include spaces for the client’s name, address, and contact details.

- Product Details: List each item sold along with quantities, unit prices, and descriptions.

- Pricing: Specify any discounts, additional charges, or delivery fees to accurately reflect the total amount due.

- Payment Terms: Add a section for payment due dates, accepted methods, and any payment conditions.

- Branding: Customize the document’s appearance by adding your business logo, colors, and fonts to align with your brand’s identity.

Personalizing your financial documents in this way ensures that all critical information is easy to find and clearly presented. It also helps establish a professional image, fostering trust with clients and promoting transparency in your business dealings. The more intuitive and organized your records are, the more efficient your workflow will become, ultimately supporting your long-term success.

Step-by-Step Guide to Bakery Invoice Creation

Creating a well-organized financial document for each transaction is an essential part of managing your business effectively. Following a clear process ensures that you include all necessary details, maintain consistency across records, and reduce the chances of errors. This guide will walk you through the key steps to create a professional billing statement, tailored to your business needs.

Step 1: Set Up the Document Structure

The first step is to create a blank sheet or file where all the necessary fields will be included. Focus on the structure that will make your document easy to read and use. Begin by adding a title at the top, such as “Transaction Record” or “Billing Statement.” Then, create sections for customer information, transaction details, and payment terms.

Step 2: Add Customer and Transaction Information

Include essential fields to collect all relevant customer and order information:

- Customer Name: Include the full name or company name of the customer.

- Address and Contact: Add the customer’s address, phone number, and email for future reference.

- Order Description: List all items or services provided, with quantities and unit prices.

- Total Amount: Calculate the total amount based on the number of items and their respective prices.

- Tax and Discounts: Apply any relevant taxes or discounts based on your local regulations or business promotions.

Step 3: Specify Payment Terms

Make it clear when the payment is due, what methods are accepted, and any late fees that may apply. Include fields like:

- Payment Due Date: Specify when the payment should be made.

- Payment Methods: Indicate the accepted payment methods (cash, bank transfer, online payment, etc.).

- Late Payment Fees: Outline any additional charges for late payments, if applicable.

Step 4: Final Review and Customization

After filling in all the necessary information, review the document for accuracy and ensure it looks professional. You may want to add your company’s logo, select appropriate fonts, and apply a color scheme that matches your branding. A clean and visually appealing layout can enhance your business image and ensure that your clients are impressed by your attention to detail.

Step 5: Save and Send the Document

Once you’re satisfied with the document, save it in a convenient format for sharing, such as PDF. This format ensures that the document retains its formatting across different devices and platforms. You can then send it to your customer via email, or print it out if necessary.

By following these steps, you’ll be able to efficiently create customized billing records that are clear, accurate, and professional, helping to streamline your business operations and maintain positive relationships with clients.

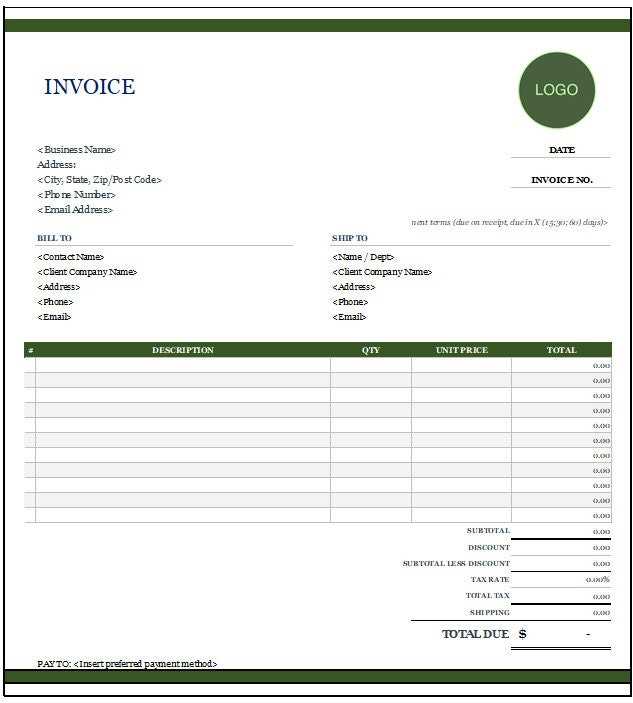

Key Features of a Bakery Invoice Template

When creating financial records for your business, certain features are essential to ensure clarity, accuracy, and ease of use. A well-structured document not only helps with organization but also ensures that all necessary information is included for both the seller and the buyer. By utilizing the right features, you can streamline your workflow and maintain professionalism with every transaction.

Essential Fields for a Comprehensive Record

The most important aspect of any financial document is the inclusion of all required details. Key fields that should be present in every record include:

- Customer Information: Name, address, and contact details for proper identification.

- Order Description: Clear breakdown of items or services sold, with quantities and prices.

- Amount Due: Total price calculated from item costs, including any applicable taxes or discounts.

- Payment Terms: Clear guidelines on payment methods, deadlines, and any late fees.

Additional Features for Customization

Beyond the basic fields, adding customizable elements can elevate the professionalism and usefulness of your financial documents:

- Branding: Incorporate your company logo, color scheme, and other design elements that align with your business identity.

- Automated Calculations: Use formulas to automatically calculate totals, taxes, and discounts, minimizing the risk of human error.

- Clear Layout: Ensure the document is easy to read by organizing information logically, using headings, borders, and spacing.

- Tracking and Management: Include a section for tracking payment status, such as “Paid”, “Pending”, or “Overdue”, to manage accounts effectively.

By including these key features in your financial records, you ensure that every transaction is accurately documented and professionally presented. Whether you are sending invoices to clients or keeping internal records, a well-designed document can enhance the overall efficiency and reliability of your business operations.

How to Track Payments with Excel Invoices

Efficiently tracking payments is essential for maintaining a healthy cash flow and ensuring that your business stays on top of its financial obligations. By organizing payment information in a spreadsheet, you can easily monitor which transactions are paid, which are pending, and which are overdue. This process not only improves your financial management but also reduces the risk of missed payments or disputes with clients.

Setting Up Payment Tracking Fields

The first step is to incorporate specific fields within your financial records to track the status of each transaction. Below are the key fields you should include:

- Payment Status: A column where you can mark whether a transaction is “Paid,” “Pending,” or “Overdue.”

- Payment Date: Record the date when the payment was made. This helps in managing due dates and reconciling payments.

- Amount Paid: Keep track of the exact amount that has been paid for each transaction, ensuring that it matches the total amount due.

- Balance Due: Automatically calculate the remaining balance by subtracting the amount paid from the total amount due.

- Payment Method: Include details of how the payment was made, whether via bank transfer, cash, credit card, or another method.

Automating Payment Tracking

One of the key advantages of using a spreadsheet is the ability to automate calculations and updates. With simple formulas, you can easily manage the status of each transaction:

- Automatic Balance Calculation: Subtract the payment amount from the total due to automatically update the balance remaining.

- Conditional Formatting: Use color coding to highlight overdue payments or mark fully paid transactions in green, making it easy to spot any issues at a glance.

- Payment Due Alerts: Set up a reminder system to flag upcoming payment due dates, ensuring that you follow up with clients on time.

By setting up these fields and automating the process, you can effortlessly track payments, stay on top of your financial records, and ensure that nothing falls through the cracks. An organized system for payment tracking is essential for maintaining a smooth, professional, and transparent business operation.

Best Excel Formulas for Bakery Invoices

Using formulas in your financial documents can significantly simplify the process of calculating totals, taxes, discounts, and balances. These automated calculations reduce the risk of errors and save you time, especially when managing multiple transactions. Below are some of the most useful formulas that can help streamline your billing and payment tracking process.

Key Formulas for Simplified Calculations

These basic formulas will allow you to automate common calculations in your financial records:

- SUM Formula: Adds up values in a selected range of cells, making it ideal for calculating the total cost of items.

=SUM(B2:B10)

=B2*C2

=SUM(B2:B10)-D2

This subtracts the discount (cell D2) from the total cost.

=E2*0.10

This calculates a 10% tax on the subtotal (cell E2).

=E2+F2

Advanced Formulas for Payment Tracking

Once you have your basic calculations in place, there are advanced formulas to help you track payments and balances:

- Balance Due: To automatically calculate the balance due after a payment, subtract the payment amount from the total amount.

=G2-H2

This formula subtracts the payment (cell H2) from the total (cell G2) to show the remaining balance.

=IF(H2=G2, "Paid", "Pending")

This formula checks if the payment amount (cell H2) equals the tota

Customizing Invoice Layout for Bakery Business

Creating a visually appealing and functional layout for your financial records can significantly enhance the professional appearance of your business. A well-organized design not only ensures that all necessary details are easy to find but also helps you stand out to your clients. Customizing the layout to suit the unique needs of your business allows for a more streamlined workflow and a polished presentation of your transactions.

Key Elements to Include in the Layout

When designing your document, consider the following key elements to ensure your financial records are both comprehensive and easy to navigate:

- Company Branding: Add your logo, business name, and contact information at the top to ensure clients easily identify your brand. This helps create a professional image and ensures your records are aligned with your company’s identity.

- Clear Title: The title of the document should be prominent and indicate the purpose of the document, such as “Transaction Record” or “Sales Receipt.”

- Customer Information: Include sections for customer details such as name, address, phone number, and email. This makes it easy to reference and ensures you have all contact information in one place.

- Itemized List: A detailed breakdown of products or services provided should be displayed clearly, including quantity, description, unit price, and total cost per item. This makes it easier for both you and your client to verify the transaction.

- Pricing and Total Amount: Make sure the total price is clearly highlighted, showing the subtotal, any discounts or additional charges, tax rates, and the final amount due.

- Payment Information: Include sections for payment methods, due dates, and terms, ensuring that both parties understand the payment expectations.

Design Tips for a Professional Look

Once you have all the necessary elements in place, consider the following design tips to enhance the layout:

- Consistent Font Style: Choose a professional and easy-to-read font, such as Arial or Calibri, and keep the font size consistent throughout the document for a clean and organized look.

- Use of Borders and Lines: Use subtle borders or lines to separate different sections of the document, such as the customer information, itemized list, and total. This will make your document easier to navigate and more visually appealing.

- Color Scheme: If you want to include color, use your brand colors sparingly. Highlight important sections, such as the total amount due or payment due date, with a contrasting color to make them stand out.

- White Space: Don’t overcrowd the document. Allow enough white space around text and numbers to make the information easy to read and ensure the document doesn’t appear cluttered.

By following these layout customization tips, you’ll be able to create a professional, clear, and visually appealing financial document that reflects your business’s professionalism. A customized design not only makes transactions easier to understand but also enhances your business’s credibility and reputation.

How to Include Taxes in Bakery Invoices

When managing transactions for your business, it’s essential to account for taxes to ensure compliance with local laws and provide clarity to your customers. Including taxes in your financial documents not only ensures that your business operates legally but also helps in maintaining transparency with your clients. This section will guide you on how to properly incorporate tax calculations into your records, making sure that every charge is accurately reflected.

Steps for Including Taxes in Financial Records

Here’s how you can easily calculate and include taxes in your documents:

- Determine the Tax Rate: Find out the applicable sales tax rate for your location or business. Tax rates vary depending on the region, so be sure to check local regulations.

- Apply the Tax Rate: Multiply the total cost of the goods or services by the tax rate to get the tax amount.

- Calculate the Total: Add the tax amount to the original total cost to get the final price that your customer owes.

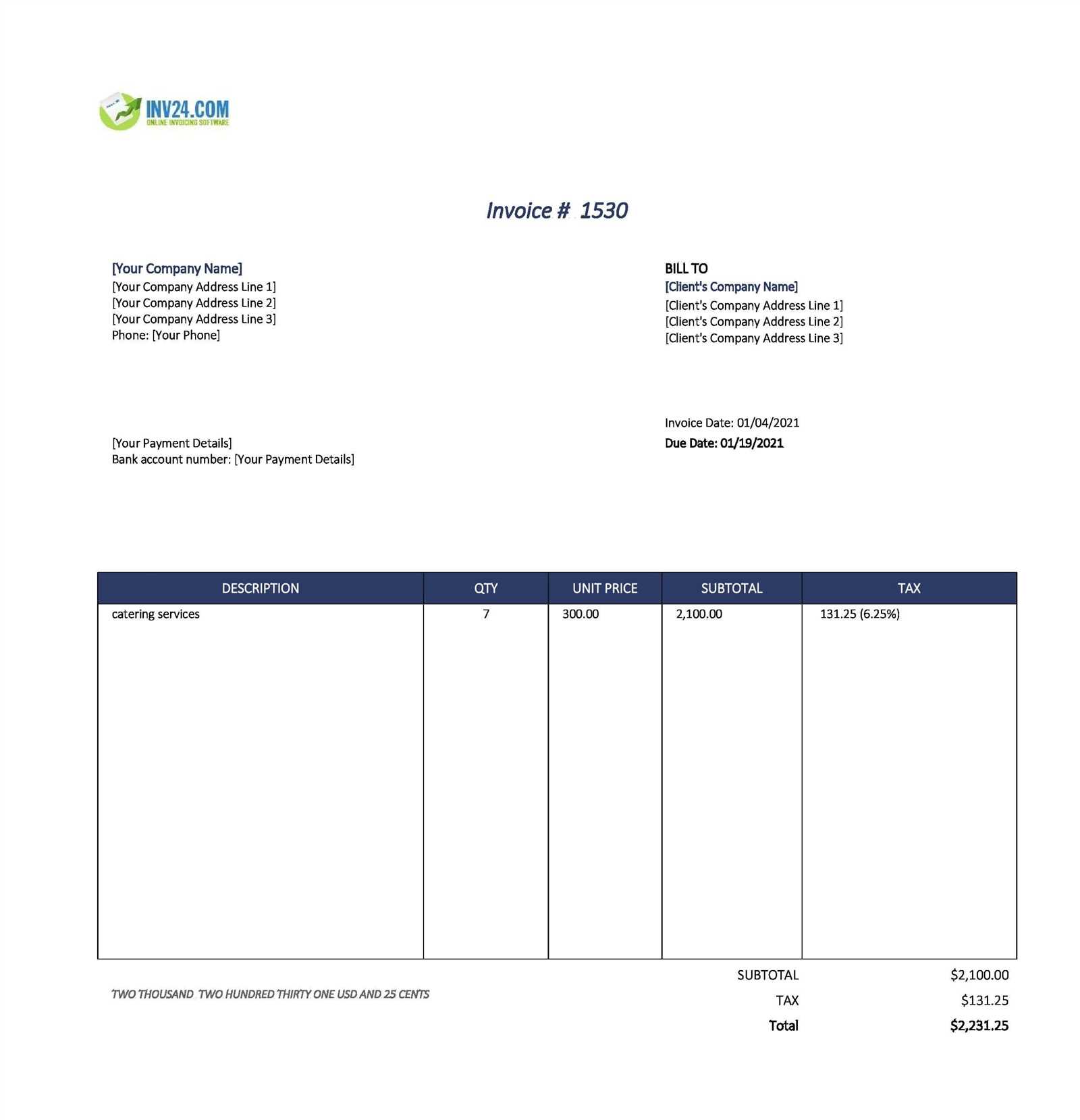

Example of Tax Calculation in a Financial Record

Below is an example showing how to include taxes in your document using a simple table format:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $5.00 | $10.00 |

| Product B | 3 | $7.00 | $21.00 |

| Subtotal | $31.00 | ||

| Sales Tax (10%) | $3.10 | ||

| Total Amount | $34.10 |

In this example, the subtotal of the products is $31.00. A 10% tax is applied, which amounts to $3.10. The final total

Invoice Templates for Different Bakery Orders

Every business order comes with its own set of requirements, whether it’s a small custom cake order or a large bulk supply for a corporate event. The format and layout of your billing documents should reflect these differences to make the transaction process more efficient. By adjusting the structure of your financial records, you can ensure that each order is properly documented and that the client receives clear and accurate details.

Custom Orders vs. Bulk Orders

When dealing with varying types of orders, it’s important to customize your document to suit the specific needs of the transaction. Here’s how you can approach different types of orders:

- Custom Orders: These often involve personalized items such as cakes with custom decorations or specialty orders for events. Your document should highlight key details such as the customization request, specific designs, flavors, and any additional charges for special requests. Make sure to include sections for design notes or instructions and an area for deposit payment if applicable.

- Bulk Orders: Large orders for events like weddings or corporate functions usually consist of multiple items. The document should provide an itemized list of products, including quantity, unit price, and total cost. It’s also helpful to add a section for delivery details and timelines, as well as any bulk discount applied to the order.

Adjusting the Layout for Different Orders

While the basic fields remain the same, the layout of your billing document should adapt to suit the specifics of each type of order:

- Custom Orders: Consider including a section for design specifics, including notes about flavors, colors, or other unique features. A space for deposit payments and the final balance should be clearly marked.

- Bulk Orders: Create a detailed table listing each item, including quantities and prices. This helps your customer easily verify the order. Additionally, include a section for any discounts or special pricing for large orders.

By customizing your financial documents for different types of transactions, you can streamline the process, improve customer satisfaction, and maintain professional records for every order. Whether it’s a custom cake for a birthday or a large batch for an event, the right structure ensures that both you and your client are on the same page.

How to Manage Multiple Invoices in Excel

Managing multiple financial records can quickly become overwhelming, especially if you are processing a large number of transactions regularly. By organizing your documents in a structured and systematic way, you can easily keep track of payments, monitor due dates, and ensure that no entries are missed. Using a spreadsheet for this purpose allows you to manage multiple records efficiently and reduces the chances of errors or confusion.

Organizing Financial Records for Multiple Transactions

To effectively manage several records at once, you must first organize them in a way that allows you to quickly locate and update information. Here are some tips to get started:

- Create a Master Sheet: Use one central sheet to track all of your transactions. This will serve as your main overview, listing each transaction’s details such as the client name, date, amount due, payment status, and due date.

- Use Separate Sheets for Different Time Periods: Organize records by month or quarter. This will make it easier to search for past transactions or create reports for specific periods.

- Label Columns Clearly: Each column should be clearly labeled to indicate the type of information it contains, such as “Client Name”, “Date”, “Amount Due”, and “Amount Paid”. This makes it easier to review or update individual records quickly.

Automating and Tracking Payments

Once your records are organized, automation can significantly ease the process of managing payments. Here’s how to do that:

- Use Conditional Formatting: Highlight overdue payments or partially paid transactions with different colors. This visual cue helps you quickly spot which entries require immediate attention.

- Calculate Remaining Balances: Set up automatic calculations to determine the balance due by subtracting the payment received from the total amount. You can use a simple formula like

=TotalAmount - PaidAmount. - Use Filters for Easy Searching: Apply filters to each column, allowing you to sort records by payment status, date, or client. This makes it easy to find specific records, whether you need to follow up on overdue payments or create reports.

- Link Payments to Individual Transactions: For more accurate tracking, link each payment to the corresponding transaction. This way, you can easily see which payments have been applied and which are still pending.

By applying these strategies and utilizing the features of a spreadsheet, you can efficiently manage multiple records at once. This method not only saves you time but also ensures that you can easily track every transaction and maintain accurate financial data for your business.

Tips for Professional Bakery Invoices

Creating a professional and polished financial document can help your business leave a lasting impression on clients. A well-structured bill not only ensures clarity and accuracy, but also enhances your brand’s image. By following certain best practices, you can create records that are both efficient and visually appealing, ensuring that every transaction is documented properly and professionally.

Essential Elements of a Professional Financial Record

To ensure your documents reflect professionalism and clarity, make sure to include the following elements:

- Clear Business Information: Always include your business name, logo, and contact details at the top of the document. This helps clients easily identify the source of the transaction and provides them with necessary contact information in case of follow-up.

- Client Details: Ensure that the customer’s information is accurate, including their name, address, and contact information. This is important for accurate record-keeping and serves as a reference if any issues arise later.

- Detailed Itemization: Break down each product or service provided in a clear and organized list. This should include the quantity, description, unit price, and total amount. Transparency in itemization helps to avoid misunderstandings.

- Accurate Total Amount: Clearly highlight the total amount due. Include any applicable discounts, taxes, and extra charges to ensure your client knows exactly what they are paying for.

- Payment Terms: Specify the terms of payment, such as due dates, accepted payment methods, and any late fees. This ensures both you and your client have a clear understanding of the financial expectations.

Best Practices for Layout and Design

How your financial documents are presented plays a huge role in their professionalism. Consider the following design tips to make your records stand out:

- Consistent Branding: Use your brand colors and fonts consistently throughout the document. This helps reinforce your company’s identity and ensures that your document aligns with your brand’s aesthetic.

- Clear Sections and Layout: Divide your document into clear sections–such as billing information, itemized list, and payment details–using bold headings and ample spacing. A clean layout makes the information easier to read and understand.

- Readable Fonts and Sizes: Choose legible fonts, such as Arial or Times New Roman, with a font size that’s easy to read. Avoid using too many different fonts or colors, as it can distract from the content.

- Incorporate Professional Design Elements: Using lines, borders, or shaded backgrounds for specific sections can make your document appear more polished. However, ensure these elements are subtle and do not clutter the page.

By following these tips, you can create financial records that not only look professional but also contribute to better business organization and client trust. A well-crafted

Common Mistakes in Bakery Invoice Creation

Creating accurate financial records is essential for maintaining a smooth operation and ensuring transparent transactions. However, even small errors can lead to misunderstandings with clients and complicate your financial management. In this section, we’ll explore some of the most common mistakes made when preparing billing documents, and how to avoid them to ensure your records are clear, accurate, and professional.

Missing or Incorrect Details

One of the most common errors in financial documentation is failing to include or incorrectly entering key details. These mistakes can lead to confusion and delay in payment. Here are some of the most frequent issues:

- Incorrect Client Information: Ensure that the customer’s name, address, and contact information are accurate. Small typos or missing details can lead to miscommunication or delayed payments.

- Missing Item Descriptions: Always provide clear and concise descriptions of the products or services sold. Failing to do so can make it difficult for clients to verify what they’re being charged for.

- Omitting Payment Terms: Make sure that the due date and payment methods are clearly stated. Omitting this information can cause confusion and lead to payment delays.

Mathematical Errors and Miscalculations

Another frequent mistake is not double-checking the calculations in your records. Even small errors in totaling the amount due can cause serious problems. Some common mistakes in this category include:

- Incorrect Tax Calculations: Ensure that you apply the correct tax rate and calculate taxes properly. Mistakes in tax calculations can lead to legal issues or customer dissatisfaction.

- Misleading Discounts: If a discount is applied, make sure it’s clearly indicated and calculated correctly. Incorrectly applied discounts can confuse clients and may result in undercharging or overcharging.

- Inaccurate Total Amount: Always verify that the final total reflects all charges, taxes, and discounts. A mismatch between the subtotal and total can undermine your credibility.

Unprofessional Layout or Design

The visual presentation of your financial documents is just as important as the information they contain. A poorly designed document can make the information difficult to read or understand. Avoid these layout mistakes:

- Cluttered Layout: A messy, overcrowded design can make it hard for your clients to review the details of the transaction. Ensure that there’s enough white sp

How to Send Bakery Invoices to Clients

Sending accurate and timely financial records to clients is essential for maintaining a professional relationship and ensuring prompt payments. Whether you are sending the documents electronically or through traditional mail, it’s important to choose the right method and format for each client. Below are several strategies to send your billing documents effectively and efficiently.

Methods for Sending Financial Documents

There are various ways to send your financial documents, each with its own benefits. Here are the most common methods:

- Email: This is the quickest and most cost-effective method for delivering your records. Sending the documents as a PDF attachment ensures that they are easily accessible, printable, and professional-looking. Be sure to include a clear subject line, such as “Payment Request for [Client Name] – [Date of Transaction],” and a brief message in the body explaining the document attached.

- Online Payment Platforms: Many businesses use online invoicing tools or platforms that allow clients to view and pay their balance directly. This method is convenient for clients and offers the added benefit of tracking payment statuses in real-time.

- Postal Mail: For clients who prefer physical documents, mailing your records can still be a valid option. Ensure that your documents are properly printed and neatly packaged, and consider using a tracked service to confirm delivery.

Formatting and Organizing Financial Records

Regardless of the method, your documents should be organized in a professional and easy-to-read format. Here are some best practices for preparing your billing documents for sending:

- Use Clear, Concise Language: Keep your explanations short and to the point. Include all necessary details, such as the products or services provided, total cost, payment methods, and due date.

- Make the Document Readable: Use a simple, clean layout. Make sure there is adequate spacing between sections and that the font size is legible. Avoid using too many colors or fonts that could distract from the content.

- Attach or Include Tracking Information: If you are sending records via mail or an online platform, make sure to provide tracking details to help clients track the document’s delivery status. This ensures transparency and accountability for both parties.

Follow-Up and Payment Reminders

Sending the document is only the first step. Afterward, it’s important to follow up on unpaid balances and maintain clear communication. Here’s how to handle follow-ups effectively:

- Set Reminders: Set a reminder to follow up a few days before the payment due date. This can be done via email or phone call, politely reminding the client of the upcoming payment.

- Late Payment Notices: If the payment is not received on time, send a gentle reminder email, including the original document and a note about any late fees or charges that may apply. Be courteous b

Ensuring Accuracy in Bakery Billing

Accurate billing is crucial for maintaining trust and smooth operations within any business. Errors in financial documents can lead to misunderstandings, payment delays, or even customer dissatisfaction. To ensure that your records are precise, it’s essential to adopt practices that minimize mistakes and guarantee clarity in every transaction.

Key Strategies for Accurate Billing

To prevent common mistakes, consider implementing these strategies:

- Double-Check Item Descriptions: Always ensure that each item listed is clearly described with accurate details, such as the type of product, quantity, and price per unit. Inaccurate or vague descriptions can lead to confusion and disputes.

- Verify Prices and Discounts: Confirm that the prices for each item match what was agreed upon with the client, and that any discounts or promotions are applied correctly. Mistakes in pricing can lead to undercharging or overcharging your customers.

- Check for Mathematical Accuracy: Before finalizing the document, always double-check your calculations, including subtotals, taxes, and the final total. Simple arithmetic errors can have a significant impact on the overall amount owed.

Best Practices for Maintaining Accuracy

Maintaining accuracy is not just about verifying individual details; it’s also about having the right systems in place to prevent errors. Here are a few best practices:

- Use Automation: Implement automated systems that calculate totals, taxes, and discounts. This reduces the risk of human error and saves time when preparing multiple documents.

- Implement Review Procedures: Always have a second set of eyes review each document before sending it to clients. A colleague or supervisor may spot mistakes that you missed.

- Standardize Document Formats: Using a consistent format for all your records can help ensure that all necessary details are included and clearly presented. Consistency reduces the chance of omitting important information.

By adopting these strategies, you can significantly improve the accuracy of your financial documents. This will not only ensure timely payments but also enhance the professionalism of your business, building stronger and more trusting relationships with your clients.

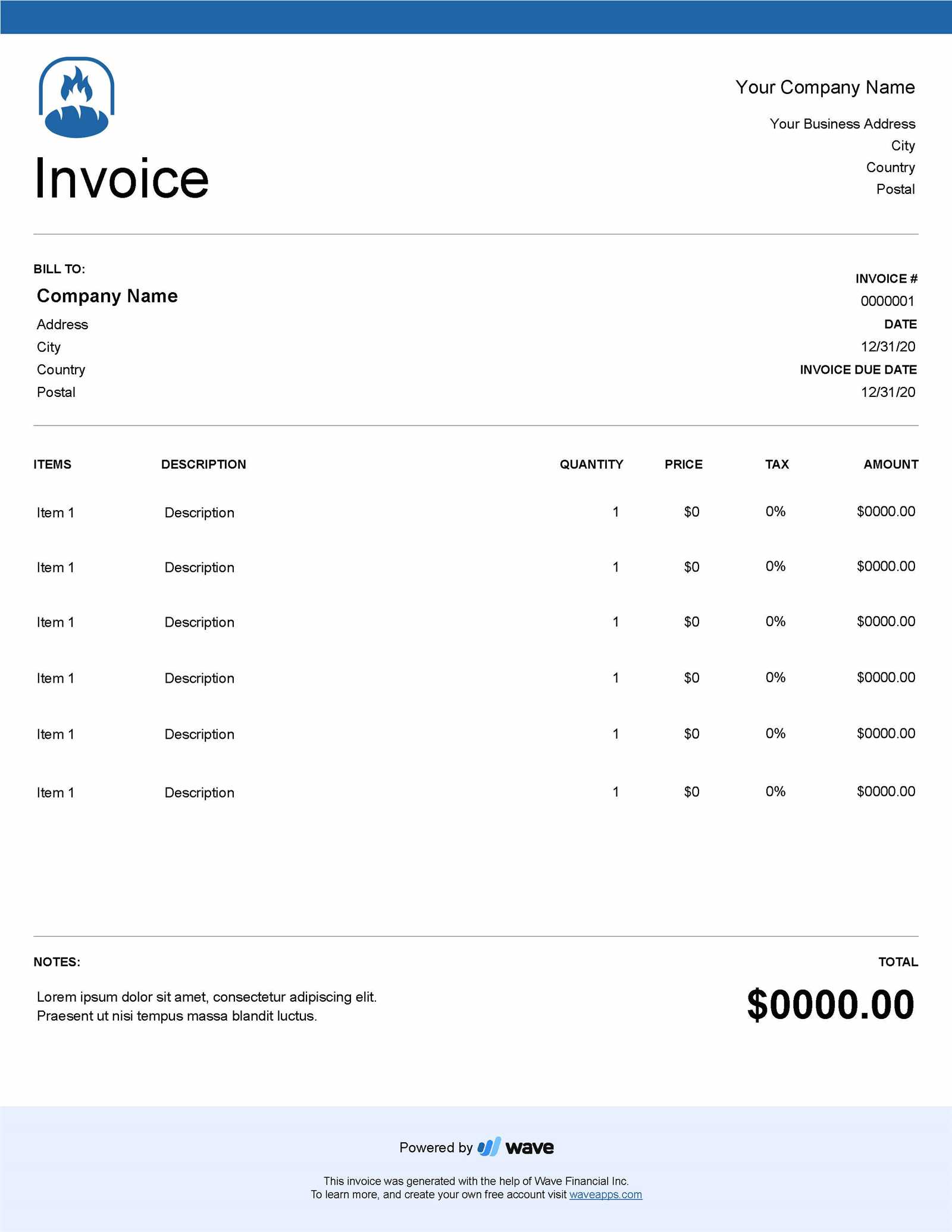

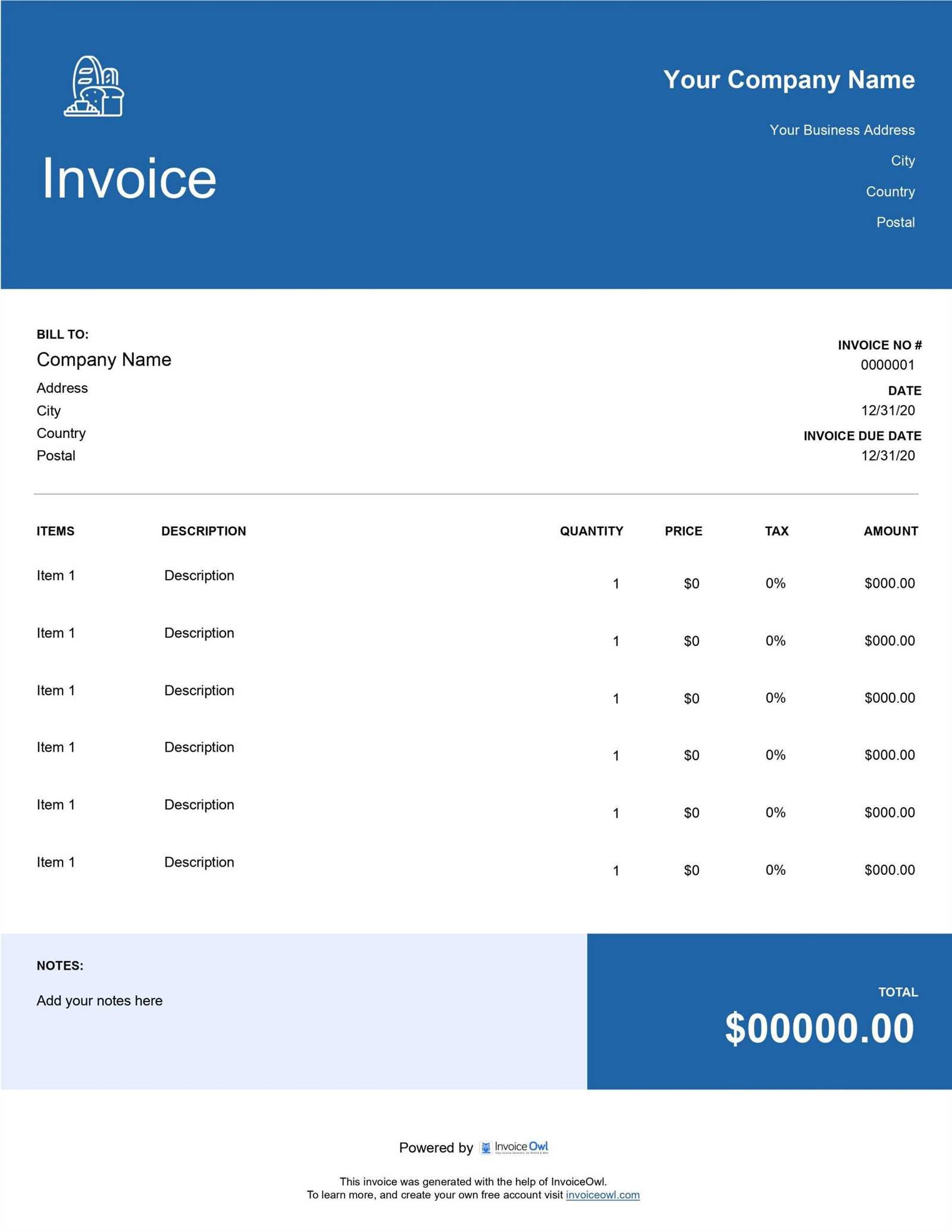

Free Resources for Bakery Invoice Templates

Creating well-organized financial documents doesn’t have to be expensive. There are numerous free resources available online that can help you design professional-looking records for your business. These resources offer ready-to-use documents, customizable layouts, and easy-to-fill formats, making it simple to generate accurate and clear billing records without the need for expensive software or complicated tools.

Top Free Tools for Creating Financial Records

Here are some of the most popular free resources that can help you create effective and professional financial documents:

- Google Sheets: A free, web-based tool that allows you to create and edit spreadsheets in real-time. Google Sheets offers several built-in templates for billing records that can be easily customized to meet your needs.

- Microsoft Office Templates: Microsoft offers a range of free document templates through its website. These templates are easy to download and can be customized with your business details to create polished financial documents.

- Canva: Known for its user-friendly design tools, Canva offers free customizable templates for various types of business documents, including billing records. You can easily drag and drop elements to personalize the design to your liking.

- Zoho Invoice: While this is primarily an invoicing software, Zoho offers a free plan with customizable document templates that can be tailored to suit your business’s branding and needs.

- Invoice Generator: A simple and intuitive tool that allows you to create free financial documents online. You can add client details, item descriptions, and totals, and then download the final document as a PDF.

Benefits of Using Free Resources

Utilizing free tools for creating your business’s billing records comes with several advantages:

- Cost-Effective: Free resources allow you to create professional records without investing in expensive software or hiring a designer.

- Time-Saving: Ready-made templates save time as you don’t need to create documents from scratch. Most tools allow for easy customization, making it quick to input your business and client details.

- Convenience: Many of these tools are cloud-based, allowing you to access your documents from anywhere and on any device. This flexibility can be invaluable for businesses on the go.

- Customization: Despite being free, many of these tools offer a high level of customization. You can adjust colors, fonts, and layouts to align with your business’s branding.

By using these free resources, you can streamline y